UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

October 29, 2020

Commission File Number 001-15244

CREDIT SUISSE GROUP AG

(Translation of registrant’s name into English)

Paradeplatz 8, 8001 Zurich, Switzerland (Address of principal executive office)

Commission File Number 001-33434

CREDIT SUISSE AG

(Translation of registrant’s name into English)

Paradeplatz 8, 8001 Zurich, Switzerland (Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F  Form 40-F

Form 40-F

Form 40-F

Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

This report includes the media release and the slides for the presentation to investors in connection with the 3Q20 results.

Media Release Zurich, October 29, 2020 |  |

Third quarter 2020 financial results

Strong business growth and continued capital generation

Key financial highlights:

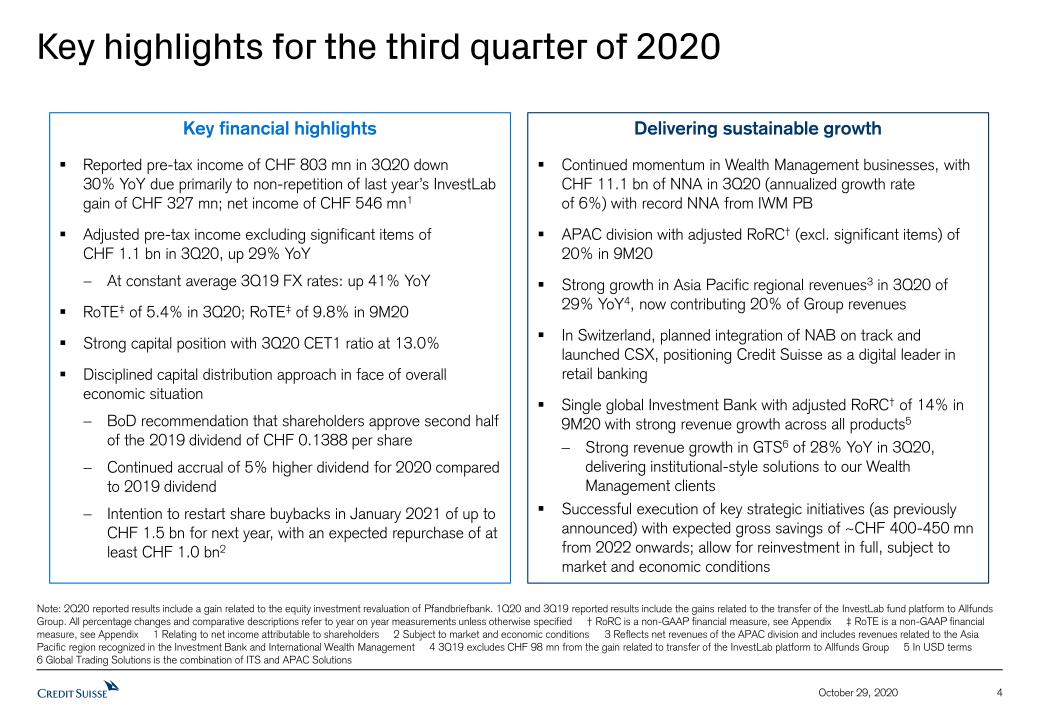

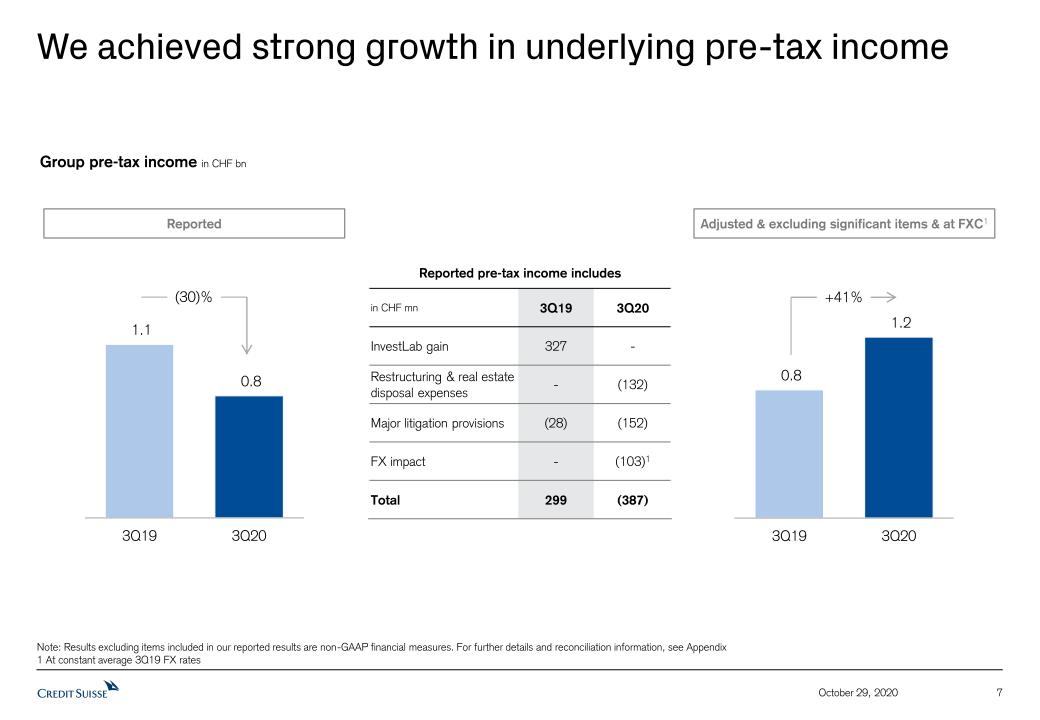

| - | 3Q20 reported results: PTI of CHF 803 million, down 30% year on year due primarily to non-repetition of last year’s InvestLab gain of CHF 327 million |

| - | Reported results for 3Q20 include restructuring expenses of CHF 107 million, major litigation provisions of CHF 152 million and a net adverse impact on our PTI of CHF 103 million from foreign exchange moves, primarily from USD weakness |

| o | 3Q20 adjusted results excluding the InvestLab gain, at constant foreign exchange rates*: PTI of CHF 1.2 billion, up 41% year on year, net revenues of CHF 5.5 billion, up 11% |

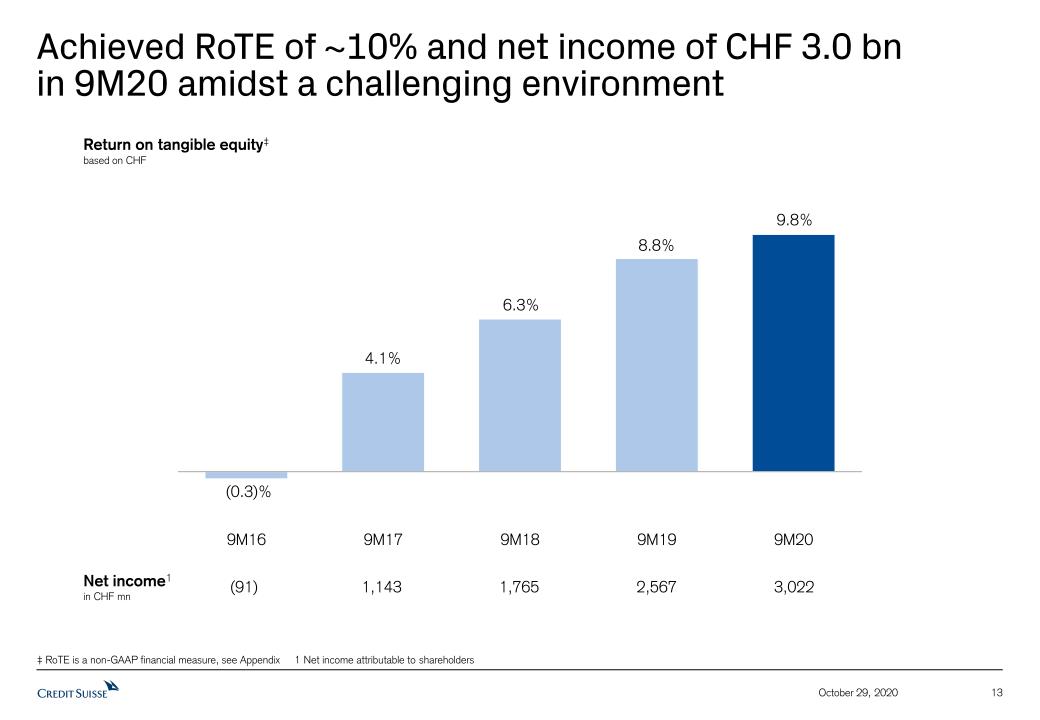

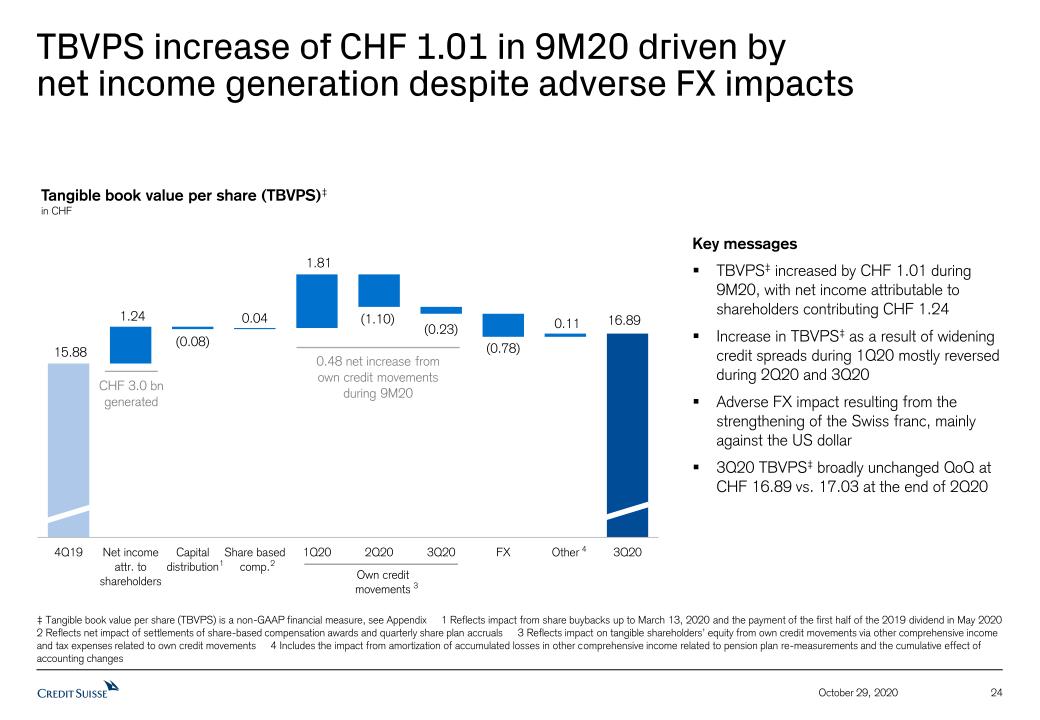

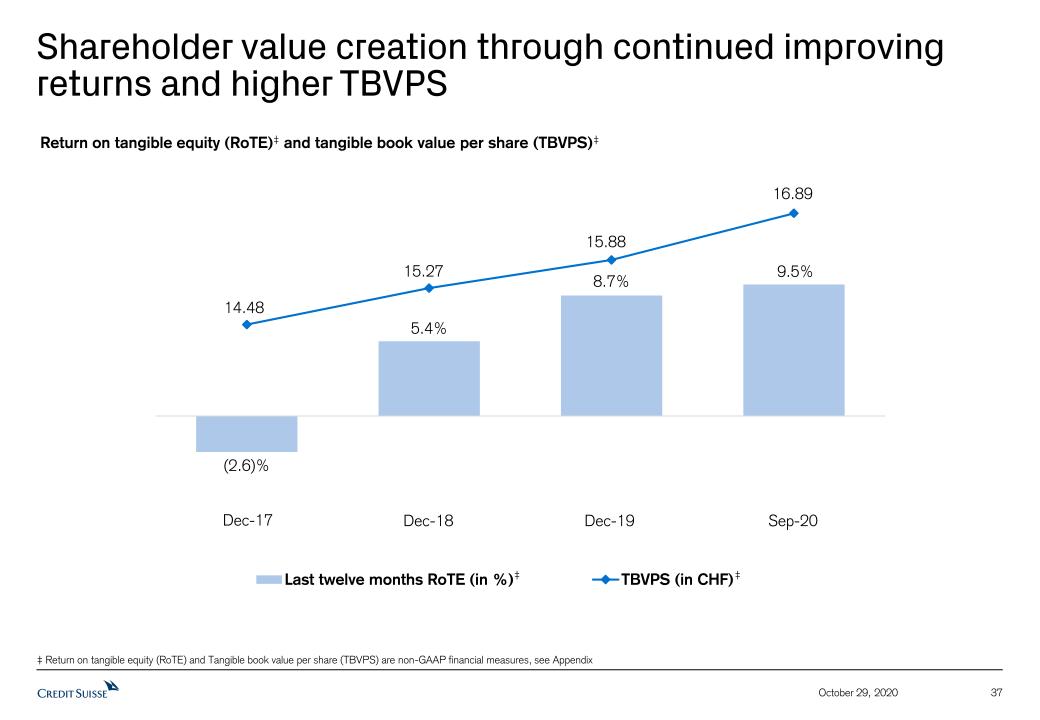

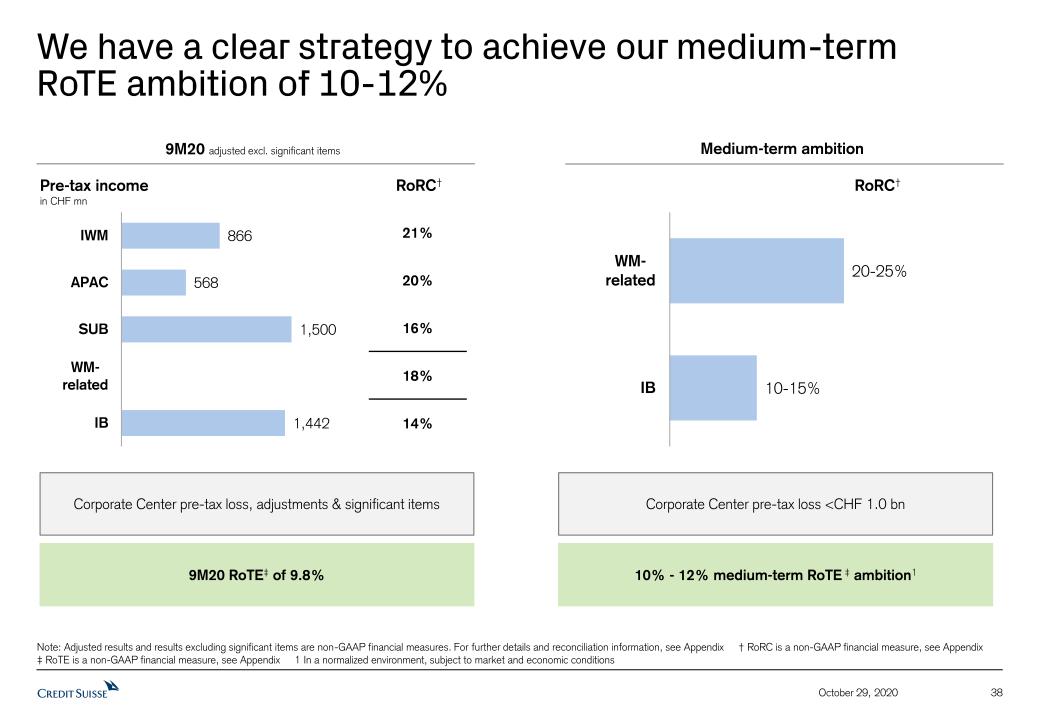

| - | 9M20 Return on Tangible Equity (RoTE) of 9.8% |

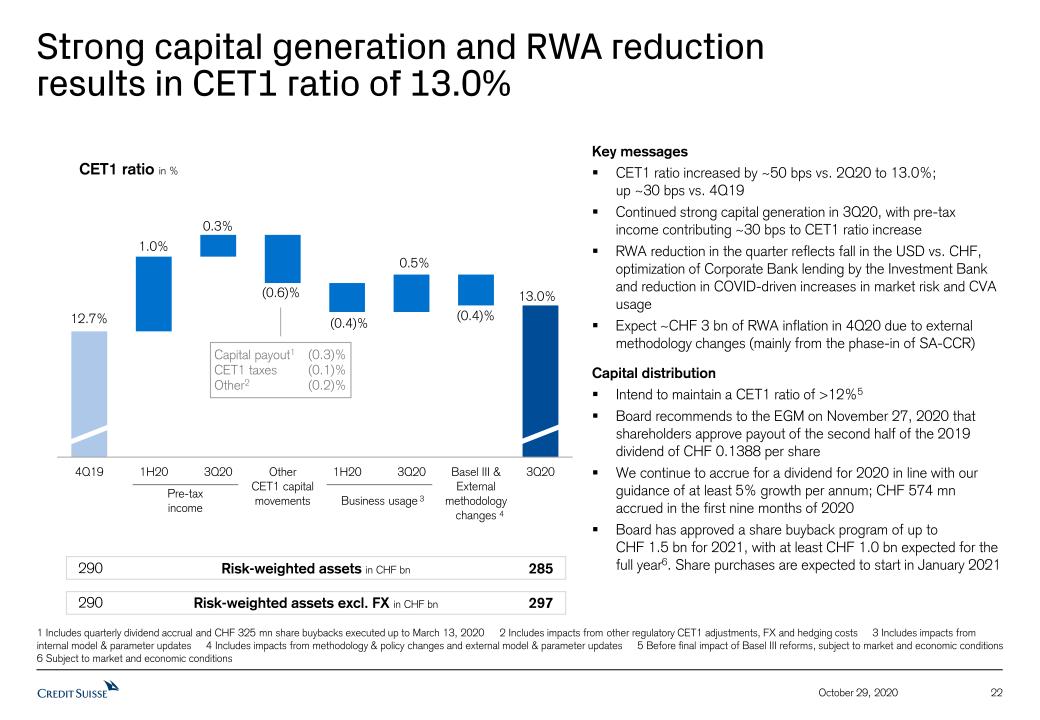

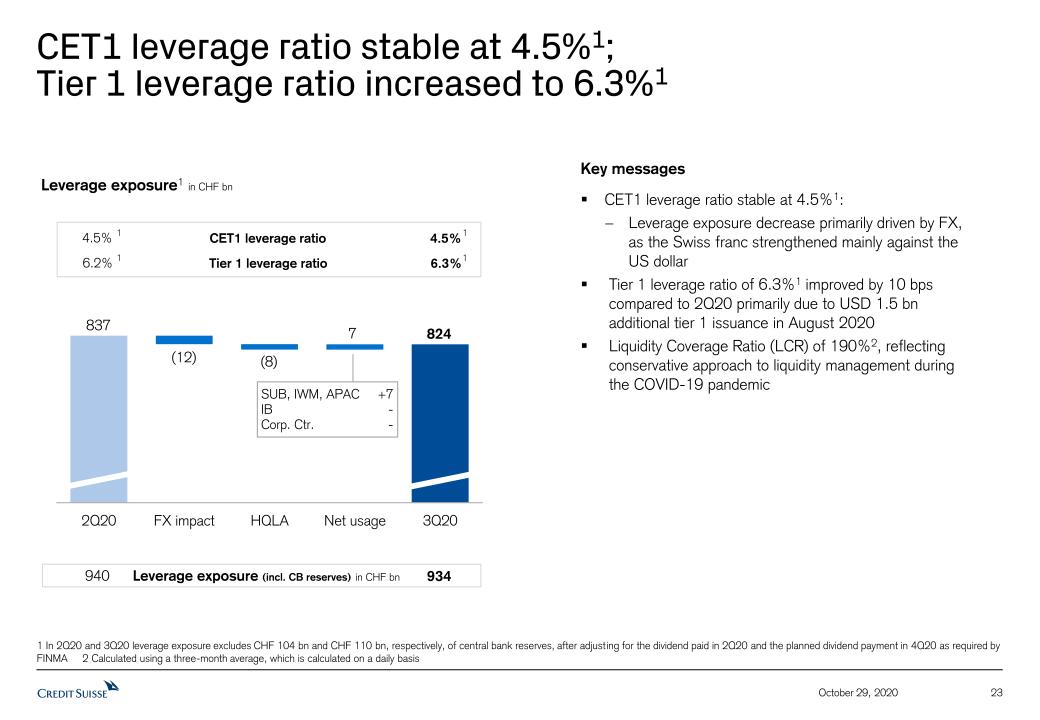

| - | Strong capital position with CET1 ratio of 13.0% in 3Q20, up from 12.5% in 2Q20; Tier 1 leverage ratio of 6.3%1 in 3Q20, up from 6.2%1 in 2Q20 |

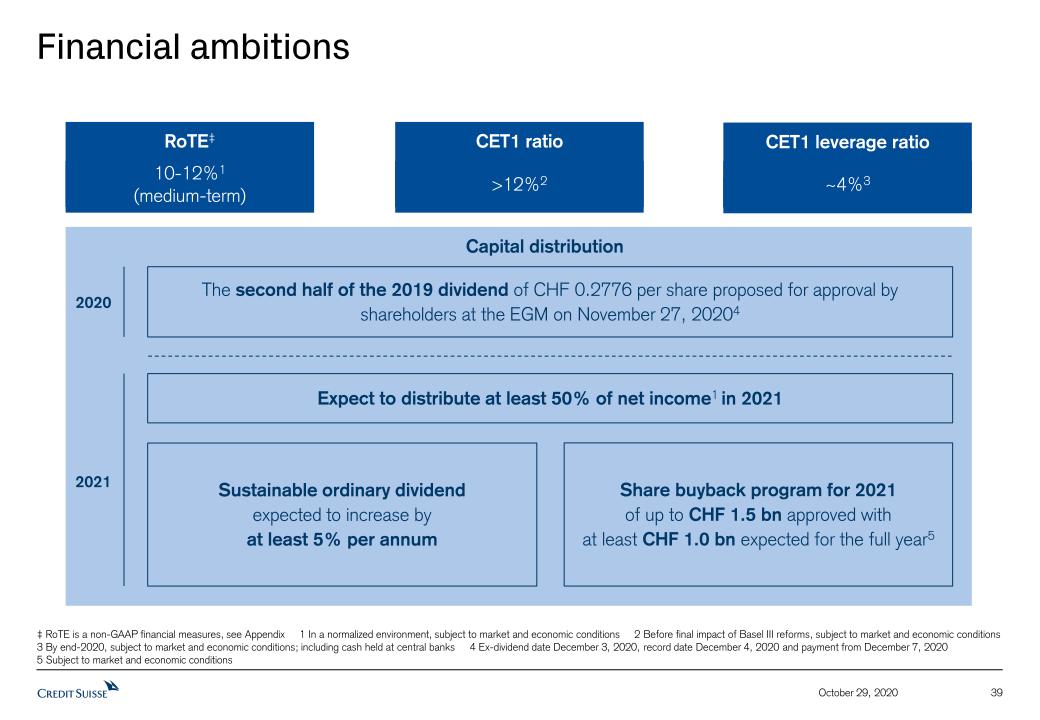

| - | Committed to deliver to shareholders: |

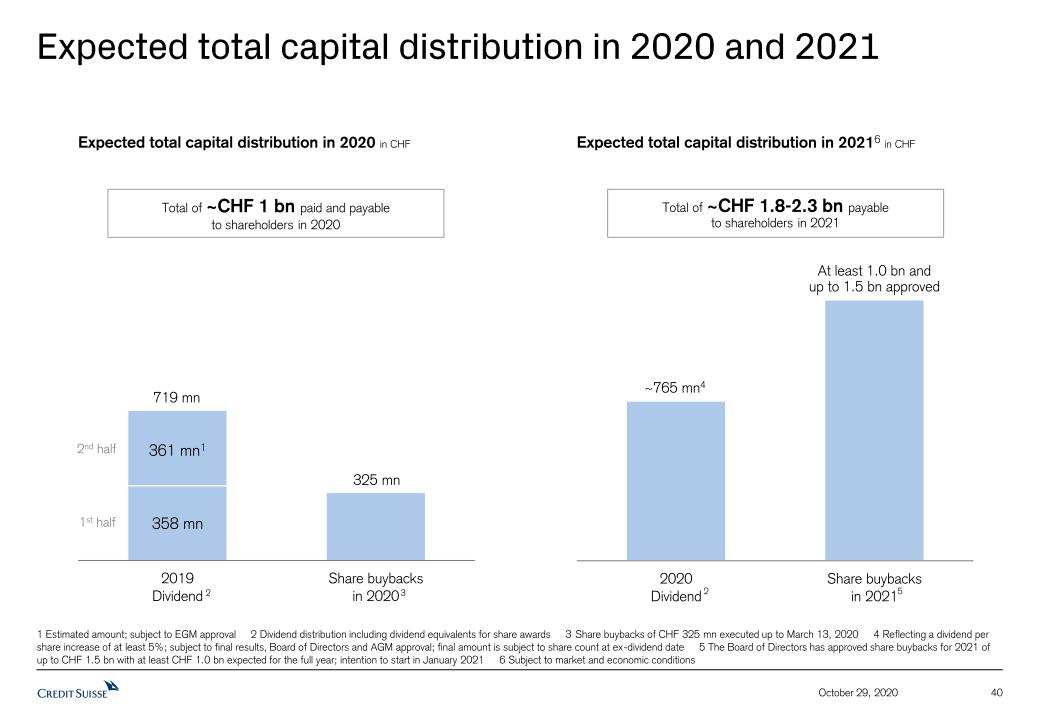

| o | Board of Directors recommends shareholders to approve second half of 2019 dividend of CHF 0.1388 per share at forthcoming Extraordinary General Meeting (EGM) on November 27, 2020 |

| o | Continued accrual of 5% higher dividend for 2020 compared to 2019 dividend |

| o | Intention to restart share buybacks in January 2021, with a 2021 share buyback program of up to CHF 1.5 billion and an expected repurchase of at least CHF 1.0 billion next year2 |

Key strategic highlights, delivering sustainable growth:

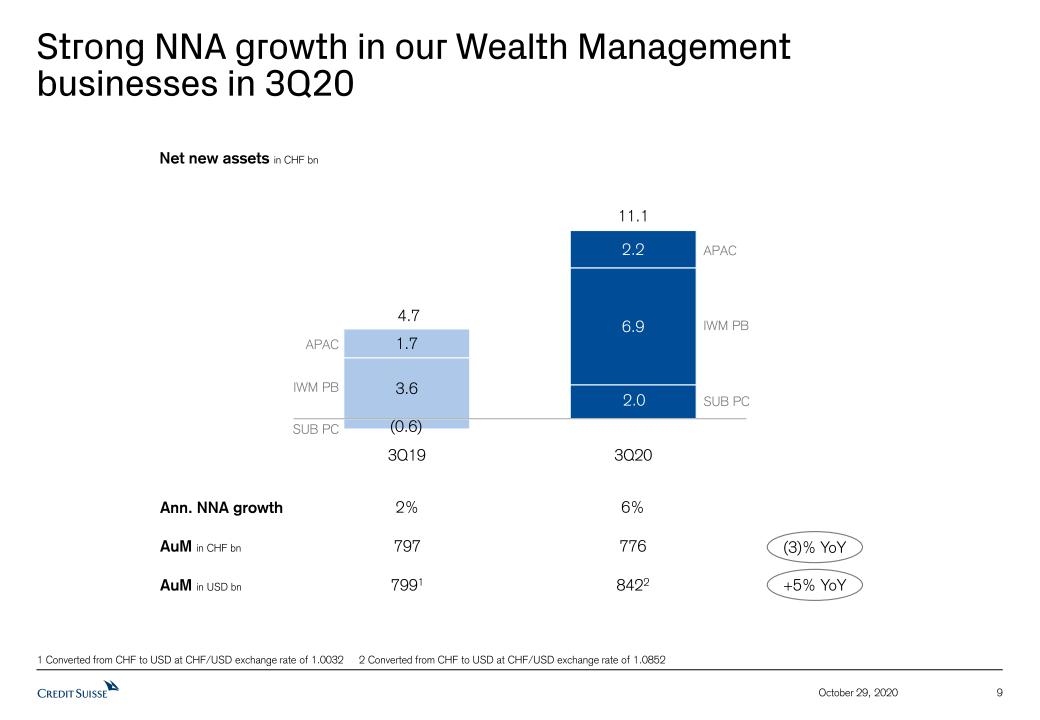

| - | Continued momentum in Wealth Management businesses, with CHF 11.1 billion of Net New Assets (NNA) in 3Q20, including record NNA from IWM PB; total NNA of CHF 18.0 billion; total Assets under Management of CHF 1.5 trillion at the end of 3Q20 |

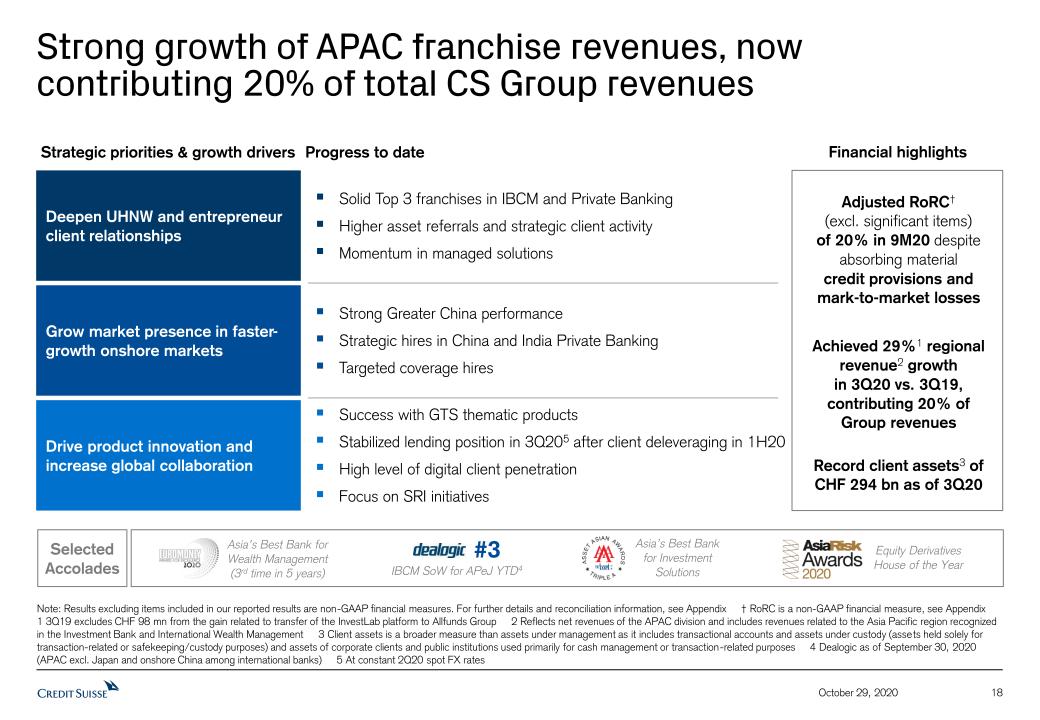

| - | APAC division delivered adjusted Return on Regulatory Capital (RoRC), excluding significant items*, of 20% in 9M20; across divisions, in 3Q20 the Asia Pacific region delivered strong year on year growth in regional revenues3 of 29%4 excluding the InvestLab gain*, now contributing 20% of total 3Q20 Group revenues |

| - | In Switzerland, planned integration of Neue Aargauer Bank on track and launched CSX, positioning Credit Suisse as a digital leader in retail banking |

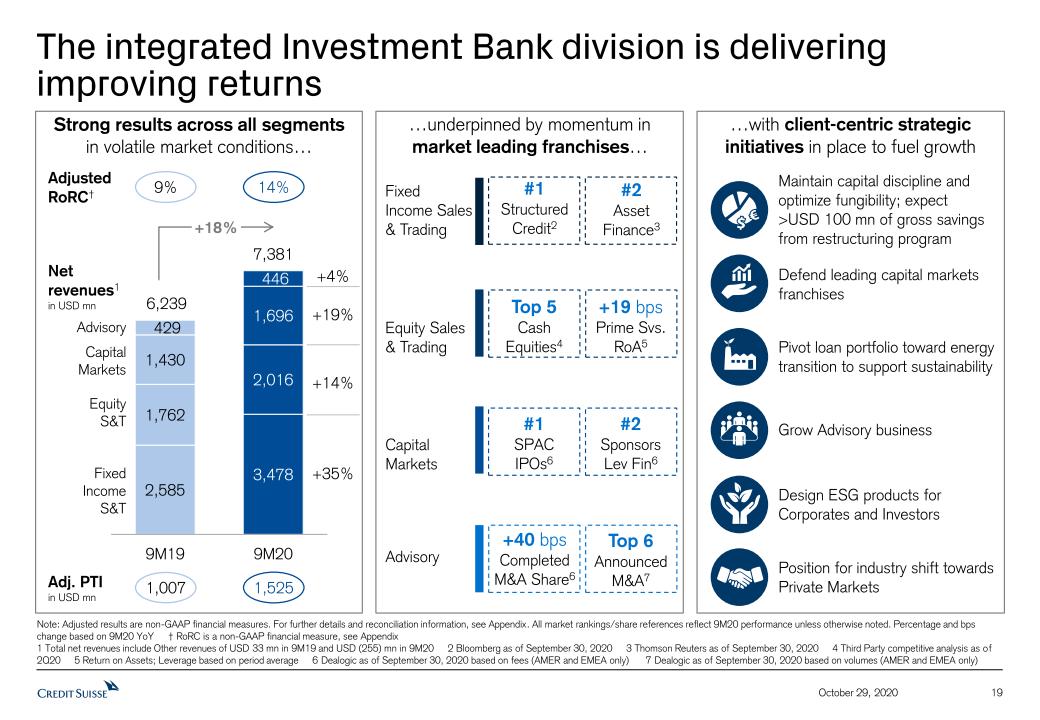

| - | Single global Investment Bank with adjusted* RoRC of 14% in 9M20 with strong revenue growth across fixed income sales and trading, equity sales and trading and capital markets |

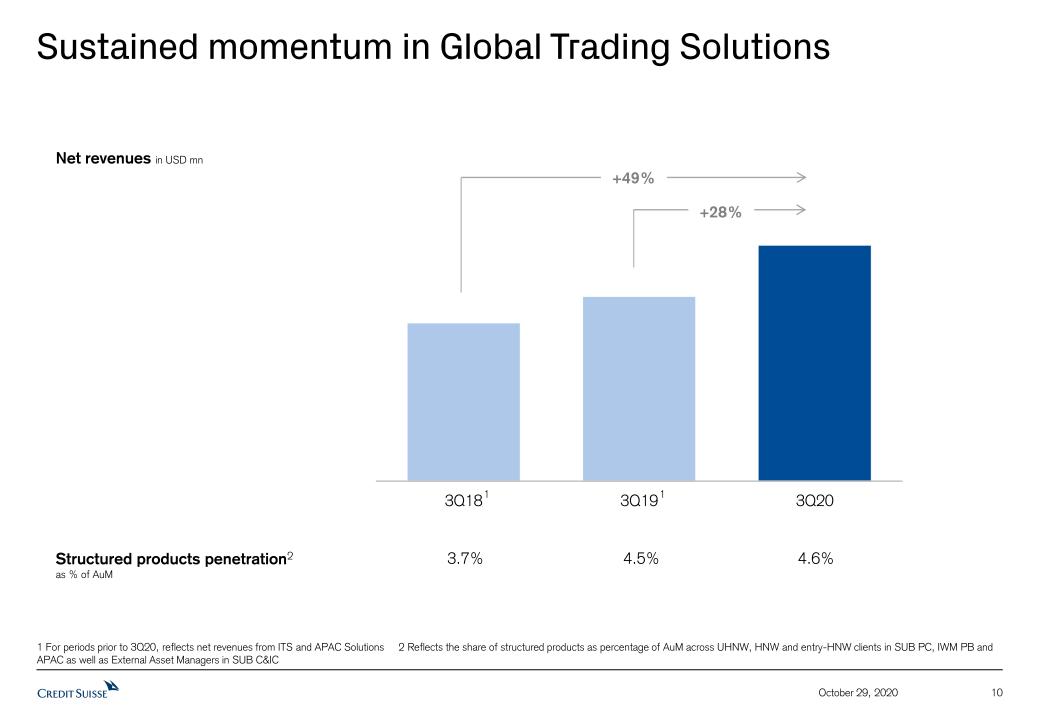

| o | Strong year on year revenue growth in Global Trading Solutions (GTS) of 28%5 in 3Q20, delivering institutional-style solutions to our wealth management clients |

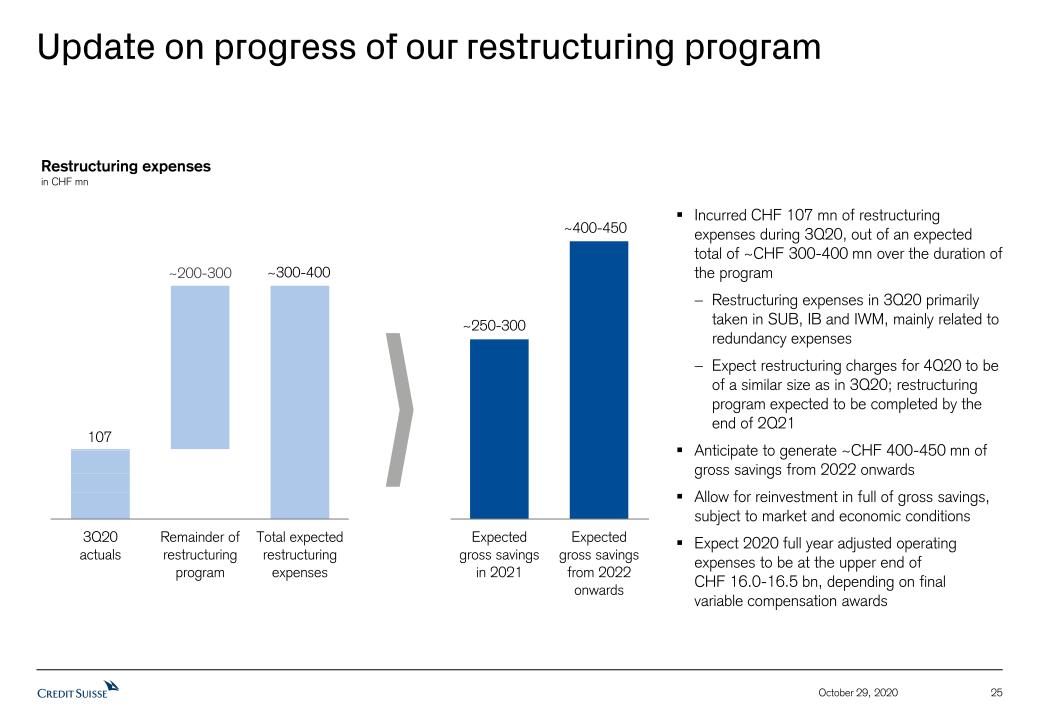

| - | Successful execution of key strategic initiatives as previously announced with expected gross savings of approximately CHF 400 million to CHF 450 million from 2022 onwards; allow for reinvestment in full, subject to market and economic conditions |

Page 1

Media Release Zurich, October 29, 2020 |  |

Thomas Gottstein, Chief Executive Officer of Credit Suisse Group AG, commented: “Despite the COVID-19 pandemic and significant foreign exchange headwinds due to the strong Swiss franc, our performance in the first nine months of this year has been strong, delivering a 5% growth in net revenues year on year, and a pre-tax income of CHF 3.6 billion, up 1%. On an adjusted basis and excluding significant items*, pre-tax income was up 10% year on year. Net income attributable to shareholders for the first nine months was CHF 3.0 billion, resulting in an RoTE of 9.8%. We have once again proven the strength of our diversified business and we are confident that the refinements that we announced over the summer will provide further momentum as we complete the restructuring measures. With a strong CET1 ratio of 13.0%, we are well positioned to drive further balance sheet growth. We are pleased that we are proposing the payout of the second tranche of our 2019 dividend and that we continue to accrue a 5% higher 2020 dividend for our shareholders. Furthermore, we intend to resume our share buyback program in January 2021 with a target repurchase of up to CHF 1.5 billion of shares and a minimum of at least CHF 1.0 billion2 for the full year. The year to date has been an uncertain one, and although challenges lie ahead, I want to take this opportunity to thank all our employees for their continued dedication in delivering the best of Credit Suisse to our clients.” |

Reported results

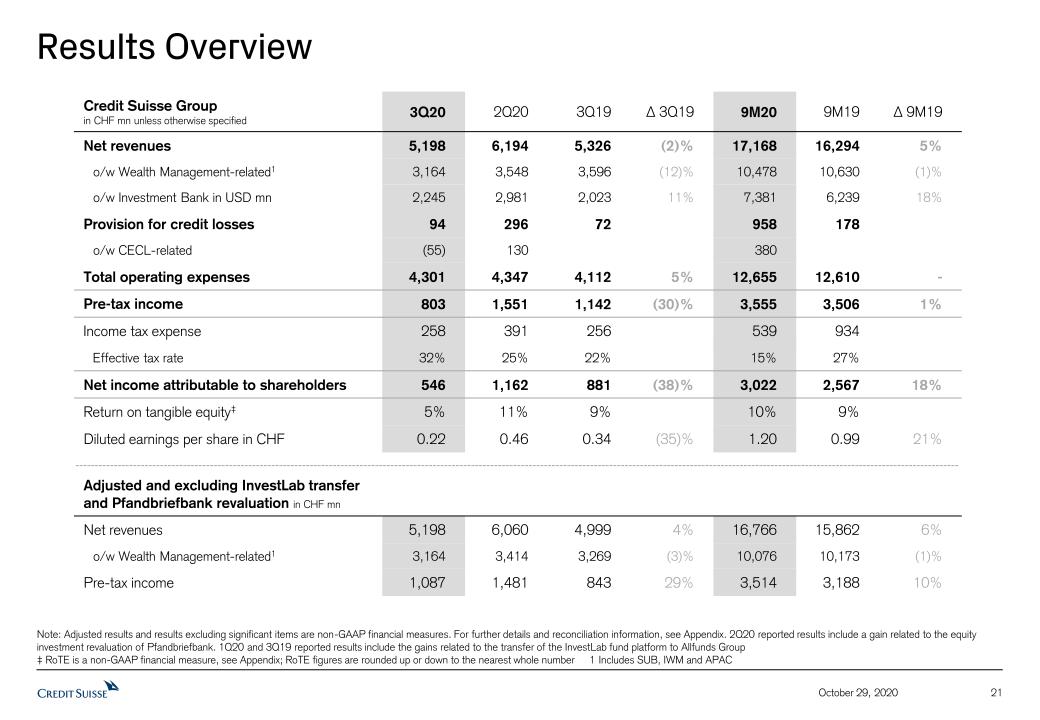

Credit Suisse Group (in CHF million) | 3Q20 | 2Q20 | 3Q19 | ∆3Q19 | 9M20 | 9M19 | ∆9M19 | |

| Net revenues | 5,198 | 6,194 | 5,326 | (2)% | 17,168 | 16,294 | 5% | |

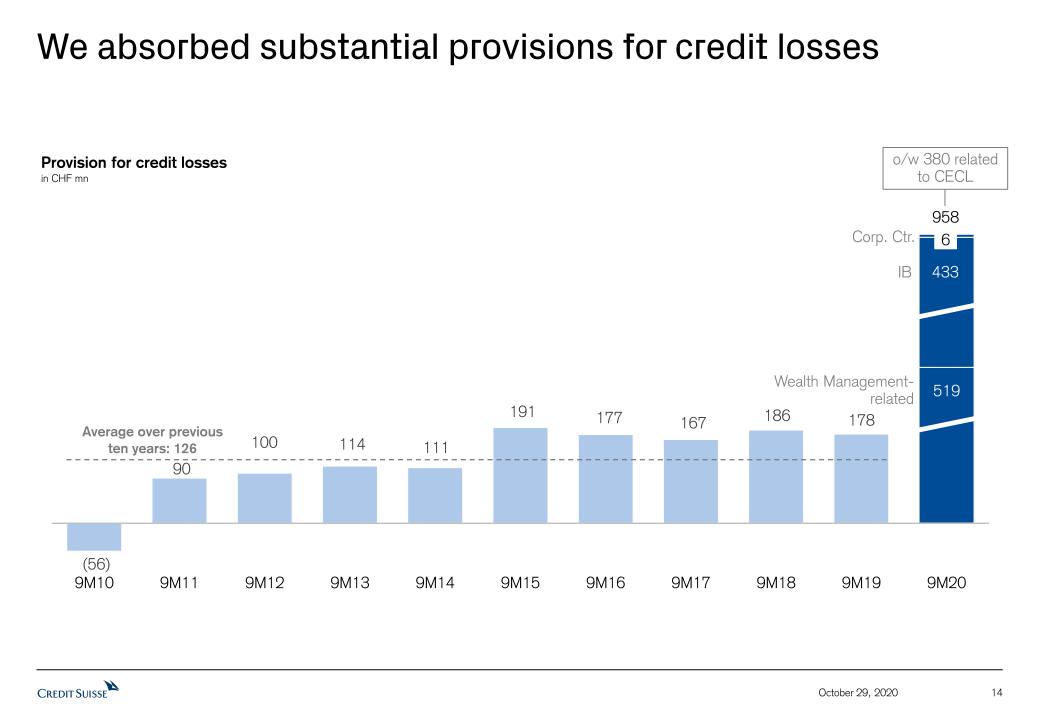

| Provision for credit losses | 94 | 296 | 72 | - | 958 | 178 | - | |

| Total operating expenses | 4,301 | 4,347 | 4,112 | 5% | 12,655 | 12,610 | 0% | |

| Pre-tax income | 803 | 1,551 | 1,142 | (30)% | 3,555 | 3,506 | 1% | |

| Net income attributable to shareholders | 546 | 1,162 | 881 | (38)% | 3,022 | 2,567 | 18% | |

| Return on tangible equity (%) | 5.4 | 11.0 | 9.0 | - | 9.8 | 8.8 | - | |

| CET1 ratio (%) | 13.0 | 12.5 | 12.4 | - | 13.0 | 12.4 | - | |

CET1 leverage ratio (%)6 | 4.5 | 4.5 | 4.1 | - | 4.5 | 4.1 | - | |

Tier 1 leverage ratio (%)1 | 6.3 | 6.2 | 5.5 | - | 6.3 | 5.5 | - | |

Adjusted results, excluding significant items*

Credit Suisse Group (in CHF million) | 3Q20 | 2Q20 | 3Q19 | ∆3Q19 | 9M20 | 9M19 | ∆9M19 | |

| Net revenues | 5,198 | 6,060 | 4,999 | 4% | 16,766 | 15,862 | 6% | |

| Total operating expenses | 4,017 | 4,283 | 4,084 | (2)% | 12,294 | 12,496 | (2)% | |

| Pre-tax income | 1,087 | 1,481 | 843 | 29% | 3,514 | 3,188 | 10% |

Page 2

Media Release Zurich, October 29, 2020 |  |

SUMMARY

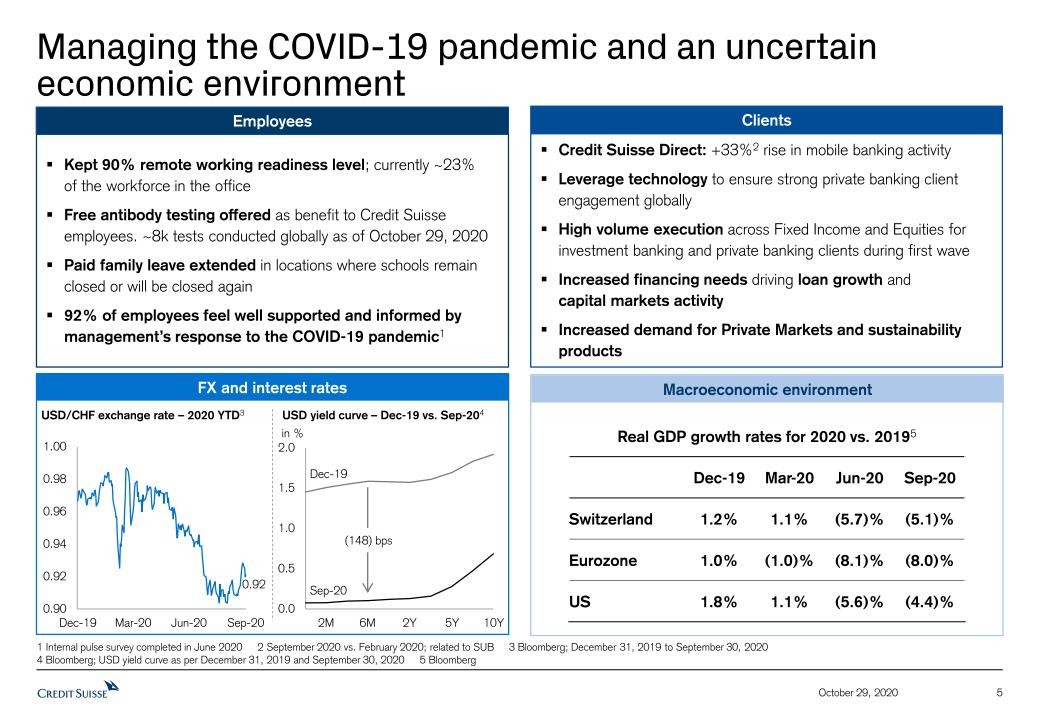

Despite the continued impact of the COVID-19 pandemic, Credit Suisse delivered a strong underlying performance.

On a reported basis, 3Q20 pre-tax income of CHF 803 million was down 30% year on year, while net income attributable to shareholders decreased by 38% to CHF 546 million, in part because 3Q19 included a gain of CHF 327 million related to the transfer of the InvestLab fund platform to Allfunds Group. Net revenues of CHF 5.2 billion were down 2% year on year, while total operating expenses of CHF 4.3 billion were up 5%, driven by restructuring expenses of CHF 107 million and major litigation provisions of CHF 152 million. In 9M20, pre-tax income was CHF 3.6 billion, up 1% year on year, and net income attributable to shareholders was CHF 3 billion, up 18%. Net revenues were CHF 17.2 billion, up 5% year on year, while total operating expenses of CHF 12.7 billion remained flat.

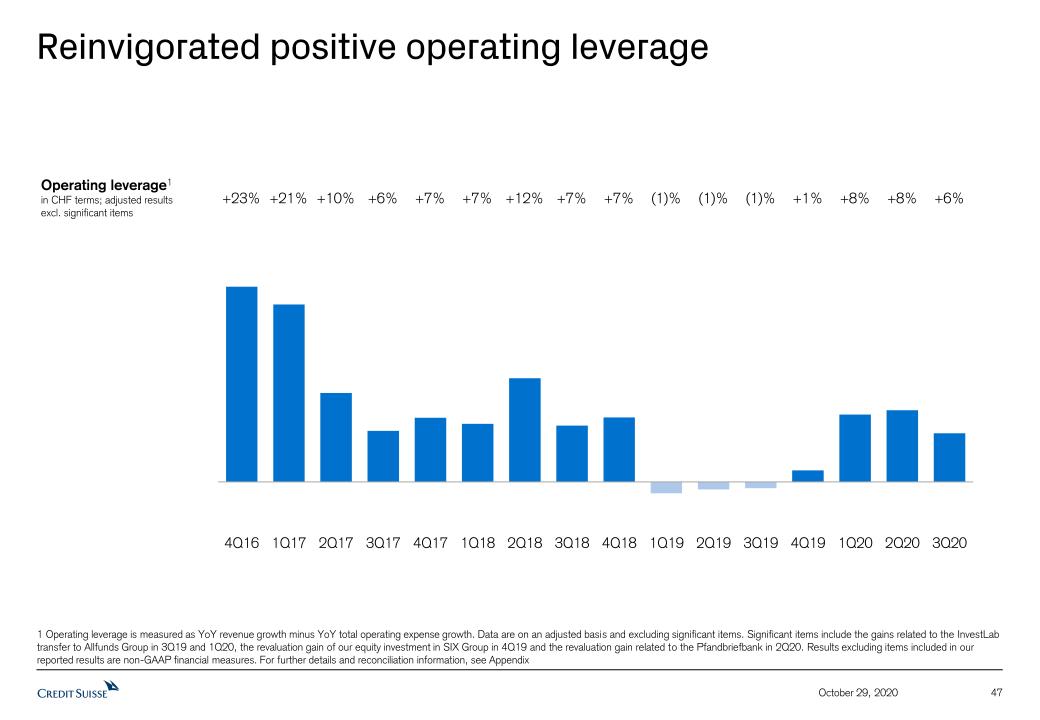

On an adjusted basis, 3Q20 pre-tax income, excluding significant items*, was CHF 1.1 billion, up 29% year on year. We delivered continued positive operating leverage, with adjusted net revenues, excluding significant items*, of CHF 5.2 billion, up 4% year on year, and adjusted* total operating expenses of CHF 4.0 billion, down 2%. In 9M20, adjusted pre-tax income, excluding significant items*, was CHF 3.5 billion, up 10% year on year, driven by higher adjusted net revenues, excluding significant items*, of CHF 16.8 billion, up 6%, and lower adjusted* total operating expenses of CHF 12.3 billion, down 2%.

Our RoTE for 9M20 was 9.8%.

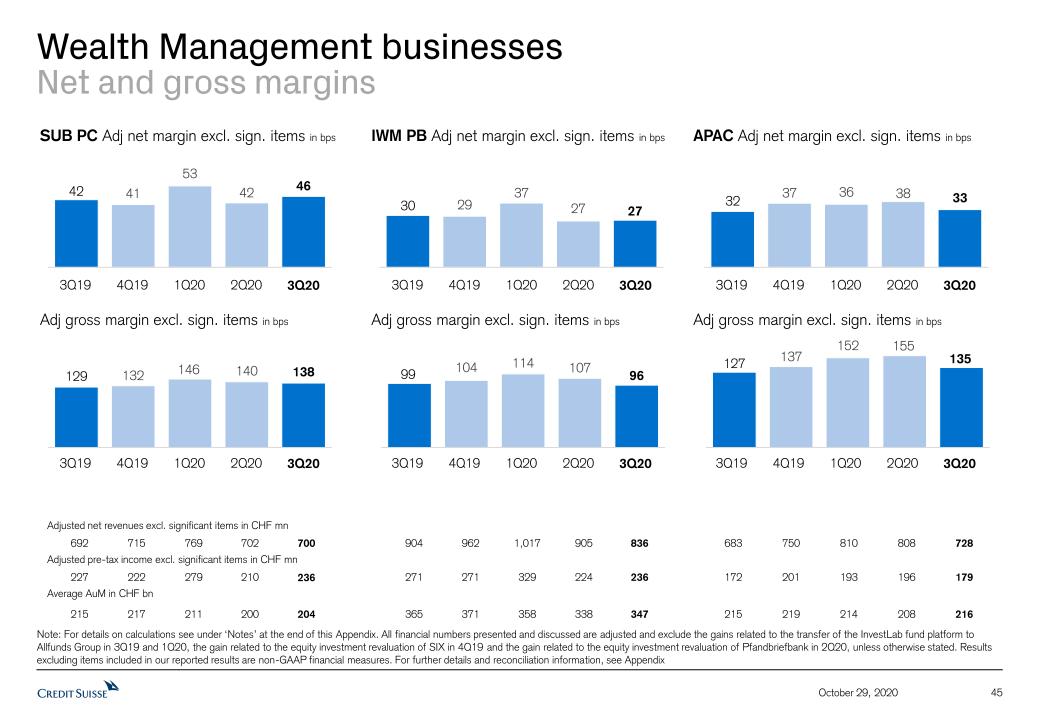

Our Wealth Management businesses recorded continued underlying momentum in 3Q20. On a reported basis, 3Q20 total Wealth Management net revenues of CHF 2.3 billion were down 10% year on year, with strong transaction-based revenues, up 18%, being more than offset by lower recurring commissions and fees, down 9% and lower net interest income, down 8%. In 9M20, total Wealth Management net revenues of CHF 7.4 billion were flat year on year, with strong transaction-based revenues, up 11%, lower recurring commissions and fees, down 6%, and flat net interest income. At constant foreign exchange rates, 3Q20 total Wealth Management adjusted net revenues, excluding significant items*, of CHF 2.4 billion were up 5% year on year, with significantly stronger transaction-based revenues, up 27%, and slightly lower recurring commission and fees as well as lower net interest income, down 3% and down 4%, respectively. In 9M20, total Wealth Management adjusted net revenues excluding significant items, at constant foreign exchange rates*, of CHF 7.6 billion were up 6% year on year, with strong transaction-based revenues, up 17%, stable recurring commissions and fees, and slightly higher net interest income, up 3%.

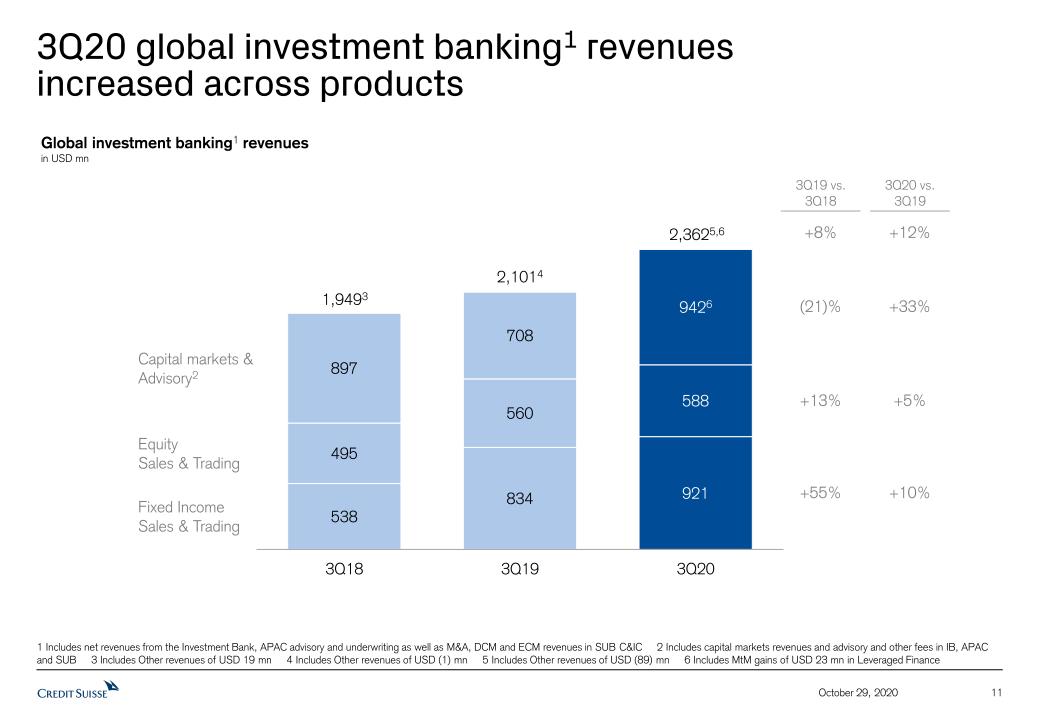

In 3Q20 we continued to deliver a strong performance in our global investment banking businesses. Global investment banking revenues of USD 2.4 billion were up 12% year on year, with Fixed Income Sales & Trading up 10%, Equity Sales & Trading up 5%, and Capital Markets & Advisory7 up 33%. In 9M20, our global investment banking revenues significantly increased to USD 7.8 billion, up 20% year on year, benefitting from a strong performance across products: Fixed Income Sales & Trading was up 35%, Equity Sales & Trading was up 14%, and Capital Markets & Advisory7 was up 19%. In GTS, our internal joint venture of our four divisions delivering institutional-style solutions to our wealth management clients, we recorded strong revenue growth, with 3Q20 revenues up 28% year on year5.

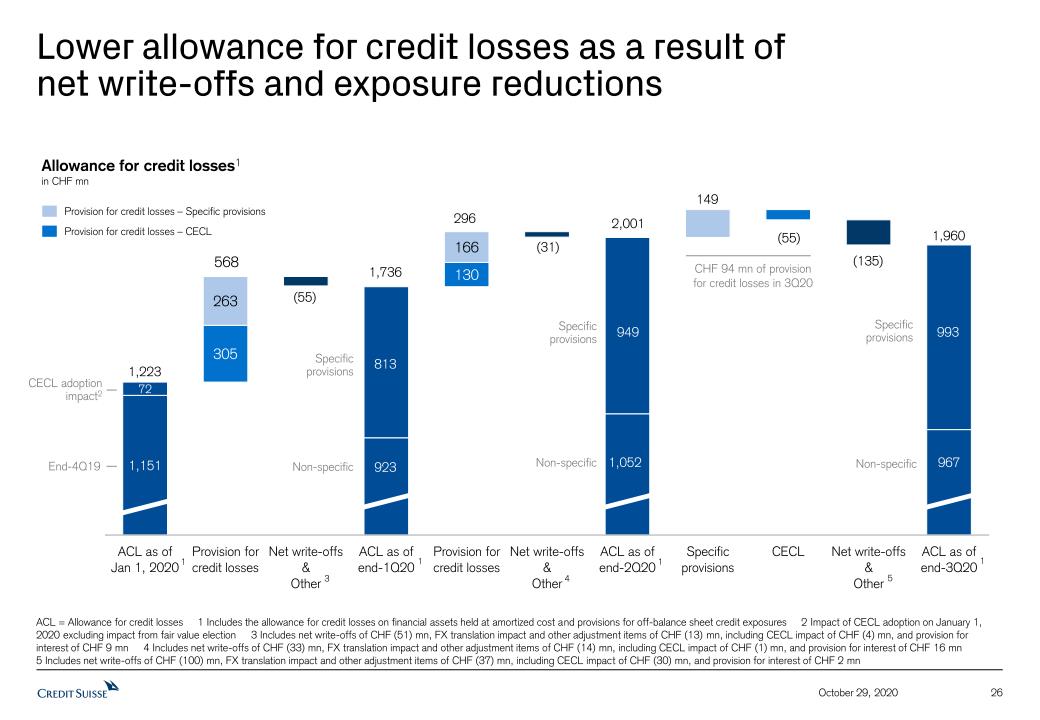

In 3Q20, we recorded CHF 94 million provision for credit losses, compared to CHF 296 million in 2Q20. In 9M20, we recorded CHF 958 million provision for credit losses, compared to a ten-year average of CHF 126 million for the period from 9M10 to 9M19.

Page 3

Media Release Zurich, October 29, 2020 |  |

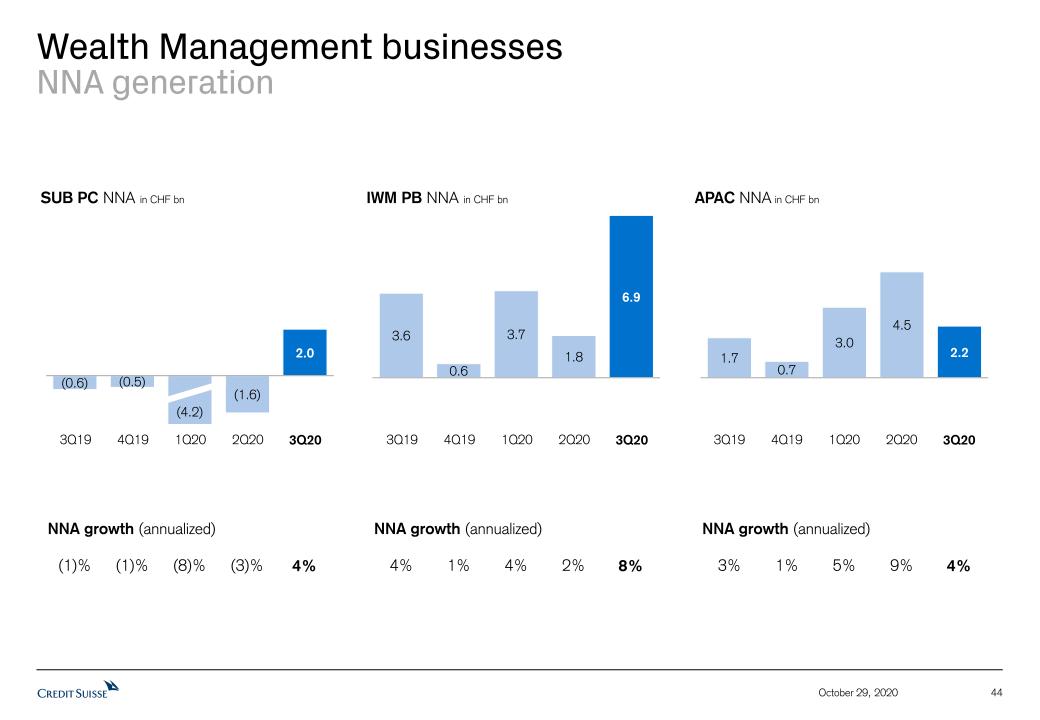

We recorded strong NNA of CHF 18.0 billion across our businesses in 3Q20, with CHF 5.5 billion in SUB, CHF 11.9 billion in IWM and CHF 2.2 billion in APAC; Wealth Management businesses delivered continued momentum, with CHF 11.1 billion of NNA, representing a 6% annualized growth rate, including record NNA from IWM PB. Our AuM at the end of 3Q20 increased to CHF 1.5 trillion, up from CHF 1.4 trillion at the end of 2Q20, with positive market movements and NNA offsetting significant negative foreign exchange-related effects. Total NNA for 9M20 were CHF 33.6 billion, with CHF 6.1 billion in SUB, CHF 21.6 billion in IWM and CHF 9.7 billion in APAC; NNA in our Wealth Management businesses were CHF 18.3 billion.

As a result of our resilient and diversified business model, we continued to further generate capital. Our capital position at the end of 3Q20 remained strong, with a CET1 ratio of 13.0% compared to 12.5% at the end of 2Q20. Our Tier 1 leverage ratio was 6.3%1 at the end of 3Q20, up from 6.2%1 at the end of 2Q20.

OUTLOOK As we move through the fourth quarter and look ahead to 2021, we are focusing on ensuring that we continue to deliver outstanding products and services to our clients, supporting them through the persisting COVID-19 pandemic and the resultant economic challenges. We would expect this environment to continue to result in elevated levels of transactional and trading activity, across both our wealth management and investment banking businesses, as our clients respond to the macroeconomic uncertainties. Furthermore, the interest rate environment should continue to support higher levels of financing demand, and we would expect higher loan growth to help Credit Suisse to offset the pressure from lower interest rates. While the path of the pandemic remains uncertain, we have a significant CECL buffer on our balance sheet; and we expect to continue to benefit further from our focus on the resilient Swiss economy. With the CET1 capital ratio at 13%, we now believe that it is appropriate to pay our shareholders the second half of the 2019 dividend, to continue to accrue for our 2020 dividend payment and to resume the share buyback program next January2. |

DISTRIBUTION OF 2019 DIVIDENDS AND EXTRAORDINARY GENERAL MEETING (EGM)

In view of the financial results until the end of the third quarter 2020, the Board of Directors now proposes a second distribution of dividends in the amount of the first distribution of dividends of CHF 0.1388 gross per registered share, to distribute the full dividend amount of CHF 0.2776 gross per share as originally proposed to shareholders for the financial year 2019. To this end, the Board of Directors calls an EGM on November 27, 2020.

The EGM will be held in accordance with the requirements of the Ordinance of the Swiss Federal Council regarding measures on combatting COVID-19, and without the personal attendance of shareholders. Shareholders are requested to vote in advance by giving a power of attorney and voting instructions to the independent proxy. The respective deadline is November 24, 2020. Credit Suisse invites shareholders to join the EGM through webcast on www.credit-suisse.com/egm.

The voting results will also be published on www.credit-suisse.com/egm shortly after the EGM.

Page 4

Media Release Zurich, October 29, 2020 |  |

The Agenda for the 2020 EGM, published by the Board of Directors of Credit Suisse Group AG, includes a proposal for a second distribution of dividends, as stated above, of which 50% will be paid out of capital contribution reserves and 50% out of retained earnings, from December 7, 2020.

SHARE BUYBACK PROGRAM AND 2021 TOTAL CAPITAL DISTRIBUTION

The Board of Directors has approved a share buyback program of up to CHF 1.5 billion in 2021, with at least CHF 1.0 billion expected for the full year, subject to market and economic conditions. Share repurchases are expected to start in January 2021. For the full year 2021, we expect a total capital distribution2 to our shareholders of approximately CHF 1.8 billion to 2.3 billion, through the expected share buyback program and an anticipated 2020 dividend of approximately CHF 765 million8.

CHANGES TO THE BOARD OF DIRECTORS PROPOSED FOR THE ANNUAL GENERAL MEETING OF APRIL 30, 2021

The Board of Directors of Credit Suisse Group AG is proposing Clare Brady and Blythe Masters for election as new non-executive members of the Board of Directors at the Annual General Meeting to be held on April 30, 2021.

Clare Brady is the former Director of Internal Audit at the International Monetary Fund and is currently a member of the Audit and Risk Commission of the International Federation of Red Cross and Red Crescent Societies (IFRC), Switzerland, and non-executive Director of Fidelity Asian Values, PLC, UK. Former roles include Vice President and Auditor General of the World Bank Group, Managing Director and Head of Group Audit in the UK and Singapore for Deutsche Bank, Head of Internal Audit at the Bank of England and Global Head of Internal Audit at Barclays Capital. Clare Brady is a UK citizen.

Blythe Masters is a former executive at J.P. Morgan Chase where she held various key roles over 27 years, including Chief Financial Officer of the Investment Bank, Head of Credit Policy and Global Credit Portfolio, Head of Corporate & Investment Bank Regulatory Affairs and Head of Global Commodities, before joining Digital Asset Holdings, a financial technology firm, where she was CEO until 2018. She is currently a board member at A.P. Moller - Maersk and board and audit committee chair at Phunware, an enterprise mobile platform. Blythe Masters is a UK citizen.

Regarding the nominations of Clare Brady and Blythe Masters, Urs Rohner, Chairman of the Board of Credit Suisse Group, commented: “I am extremely pleased that Clare Brady and Blythe Masters are nominated for election as new Board members. Clare is a seasoned and recognized professional with extensive experience in audit, compliance and risk management at various banks and international financial institutions. Blythe is a hugely experienced financial services and technology executive with an excellent track record and deep knowledge and understanding of corporate and investment banking, as well as the complex regulatory environment, in which this business operates. Thanks to their experience and expertise, they will ideally complement the existing strengths of the Board of Directors.”

From the current members of the Board, Joaquin J. Ribeiro, John Tiner and Urs Rohner will not stand for re-election at the Annual General Meeting in 2021. All other members of the Board of Directors will stand for re-election for a further term of office of one year. As previously stated, the Chairman’s succession process is well underway, and a successor will be announced before the end of the year.

Page 5

Media Release Zurich, October 29, 2020 |  |

DETAILED DIVISIONAL SUMMARIES

Swiss Universal Bank (SUB)

Reported results

SUB (in CHF million) | 3Q20 | 2Q20 | 3Q19 | ∆3Q19 | 9M20 | 9M19 | ∆9M19 | |

| Net revenues | 1,294 | 1,474 | 1,380 | (6)% | 4,222 | 4,171 | 1% | |

| Provision for credit losses | 52 | 28 | 28 | - | 204 | 66 | - | |

| Total operating expenses | 812 | 790 | 783 | 4% | 2,401 | 2,399 | 0% | |

| Pre-tax income | 430 | 656 | 569 | (24)% | 1,617 | 1,706 | (5)% | |

| Cost/income ratio (%) | 63 | 54 | 57 | - | 57 | 58 | - |

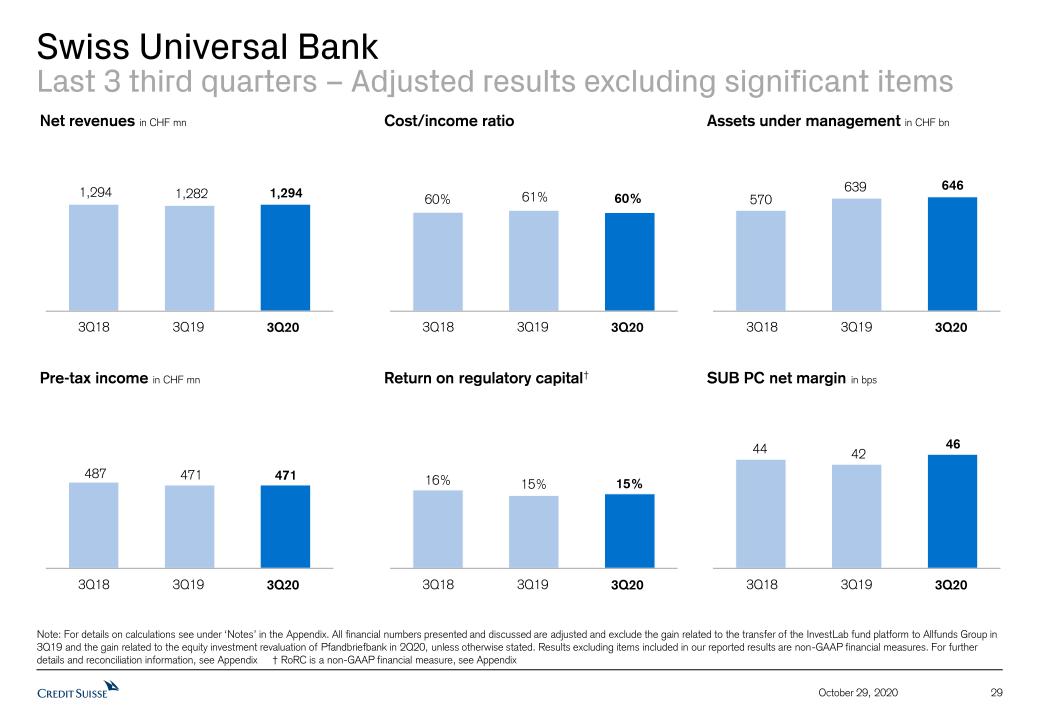

Adjusted results, excluding significant items*

SUB (in CHF million) | 3Q20 | 2Q20 | 3Q19 | ∆3Q19 | 9M20 | 9M19 | ∆9M19 | |

| Net revenues | 1,294 | 1,340 | 1,282 | 1% | 4,063 | 3,956 | 3% | |

| Provision for credit losses | 52 | 28 | 28 | - | 204 | 66 | - | |

| Total operating expenses | 771 | 790 | 783 | (2)% | 2,359 | 2,386 | (1)% | |

| Pre-tax income | 471 | 522 | 471 | 0% | 1,500 | 1,504 | 0% | |

| Cost/income ratio (%) | 60 | 59 | 61 | - | 58 | 60 | - |

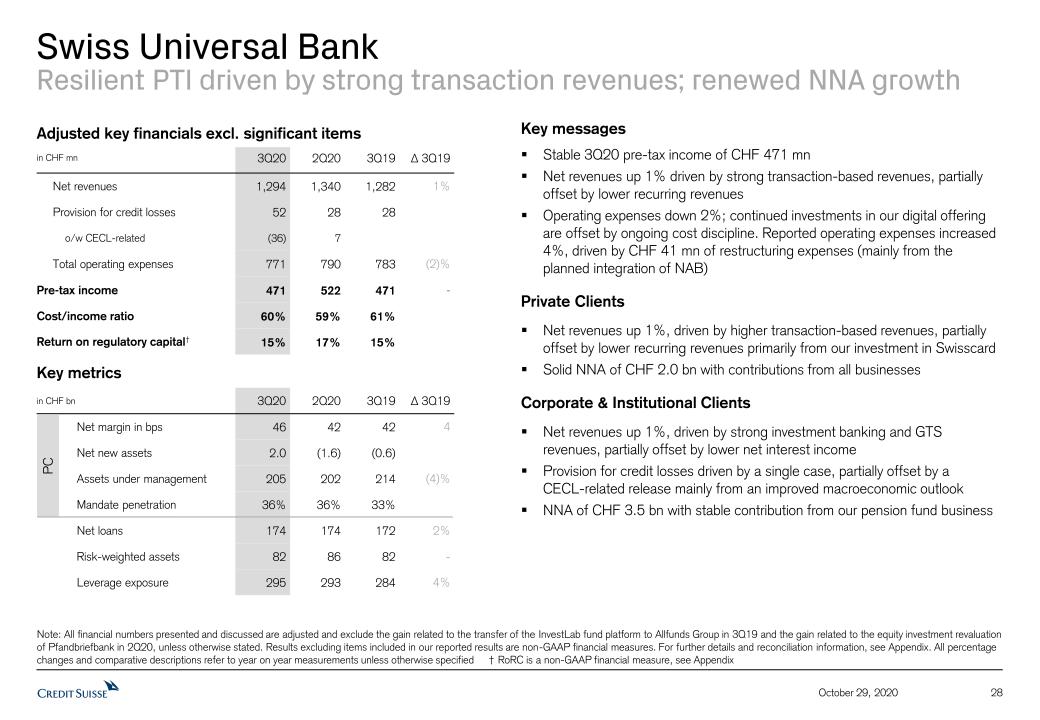

SUB recorded adjusted pre-tax income, excluding significant items*, in 3Q20 of CHF 471 million, stable year on year, illustrating the resilient performance of the division. Adjusted net revenues, excluding significant items*, of CHF 1.3 billion were stable year on year, driven by strong transaction-based revenues, partially offset by lower recurring commissions and fees. Adjusted* total operating expenses were slightly lower year on year; our ongoing cost discipline allowed for continued investments in our digital offering. Reported total operating expenses included CHF 41 million in restructuring expenses, mainly from the planned integration of Neue Aargauer Bank. The adjusted cost/income ratio, excluding significant items*, was 60%, slightly lower than in 3Q19. In SUB, we recorded provision for credit losses of CHF 52 million, driven by a single case within our Corporate & Institutional Clients segment, partially offset by a CECL-related release from improved macroeconomic factors. SUB recorded NNA of CHF 5.5 billion and client assets of CHF 791 billion, with AuM of CHF 646 billion and custody assets of CHF 145 billion.

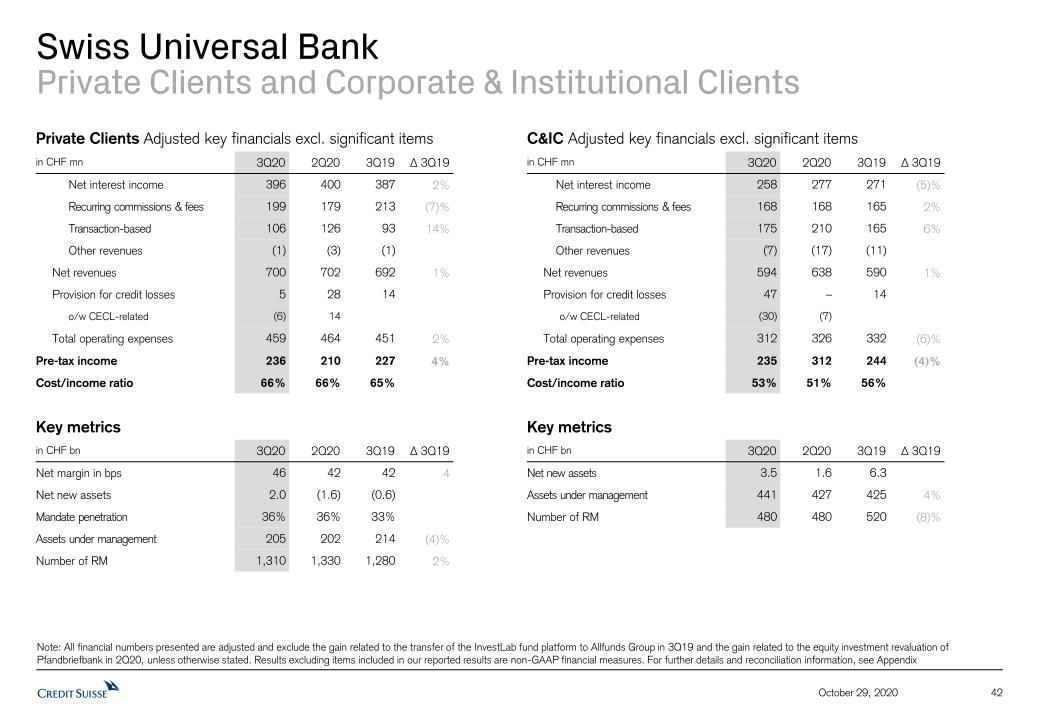

Private Clients recorded adjusted pre-tax income, excluding significant items*, of CHF 236 million in 3Q20, up 4% year on year. Adjusted net revenues, excluding significant items*, increased by 1% year on year, driven by higher transactional revenues, partially offset by lower recurring commissions and fees primarily from our investment in Swisscard. AuM of CHF 205 billion increased by 2% compared to 2Q20. We generated solid NNA of CHF 2.0 billion in the quarter, reflecting contributions from across our Private Clients businesses.

Corporate & Institutional Clients generated adjusted pre-tax income, excluding significant items*, of CHF 235 million in 3Q20, down 4% year on year, while adjusted net revenues, excluding significant items*, increased by 1%. Strong transactional revenues from our Swiss investment banking business and GTS, our collaboration with International Wealth Management, Asia Pacific and our newly formed Investment

Page 6

Media Release Zurich, October 29, 2020 |  |

Bank, helped offset lower net interest income. AuM increased by 3% to CHF 441 billion compared to 2Q20. NNA of CHF 3.5 billion reflected stable contribution from our pension fund business.

International Wealth Management (IWM)

Reported results

IWM (in CHF million) | 3Q20 | 2Q20 | 3Q19 | ∆3Q19 | 9M20 | 9M19 | ∆9M19 | |

| Net revenues | 1,142 | 1,266 | 1,435 | (20)% | 3,885 | 4,180 | (7)% | |

| Provision for credit losses | 12 | 34 | 14 | - | 85 | 32 | - | |

| Total operating expenses | 915 | 892 | 906 | 1% | 2,736 | 2,713 | 1% | |

| Pre-tax income | 215 | 340 | 515 | (58)% | 1,064 | 1,435 | (26)% | |

| Cost/income ratio (%) | 80 | 70 | 63 | - | 70 | 65 | - |

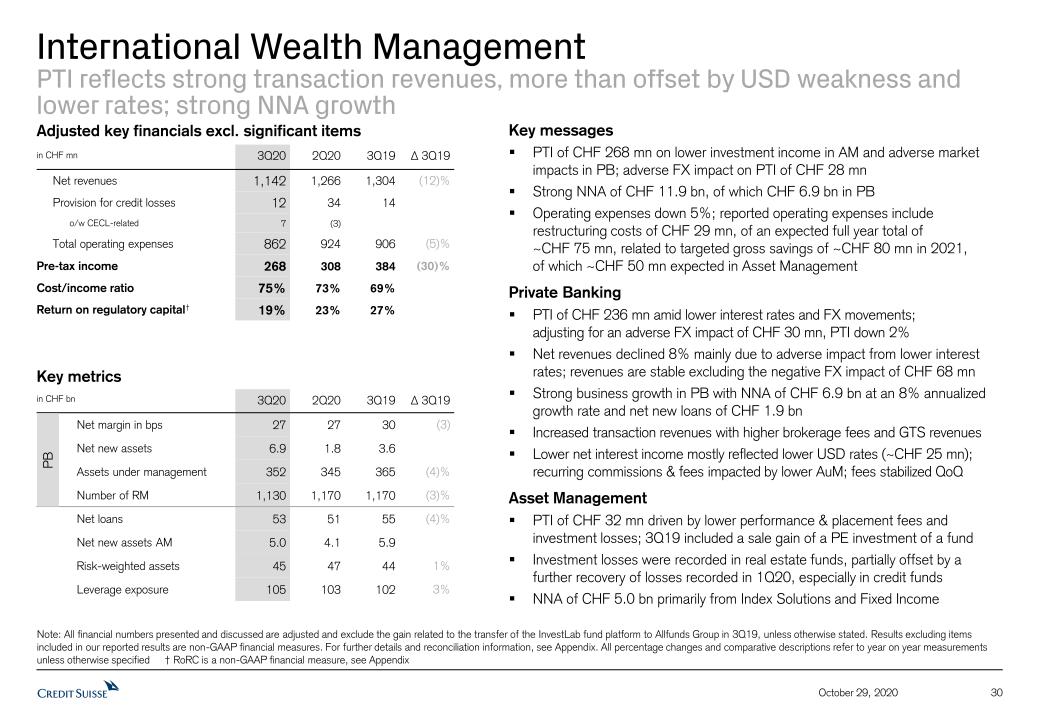

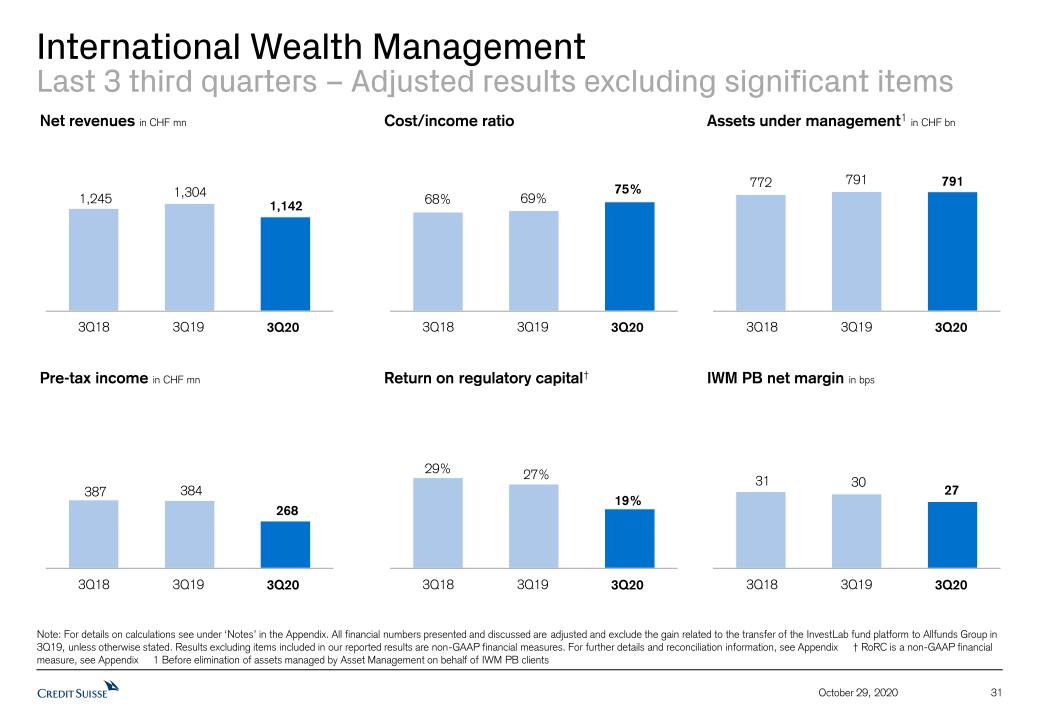

Adjusted results, excluding significant items*

IWM (in CHF million) | 3Q20 | 2Q20 | 3Q19 | ∆3Q19 | 9M20 | 9M19 | ∆9M19 | |

| Net revenues | 1,142 | 1,266 | 1,304 | (12)% | 3,667 | 4,036 | (9)% | |

| Provision for credit losses | 12 | 34 | 14 | - | 85 | 32 | - | |

| Total operating expenses | 862 | 924 | 906 | (5)% | 2,716 | 2,728 | 0% | |

| Pre-tax income | 268 | 308 | 384 | (30)% | 866 | 1,276 | (32)% | |

| Cost/income ratio (%) | 75 | 73 | 69 | - | 74 | 68 | - |

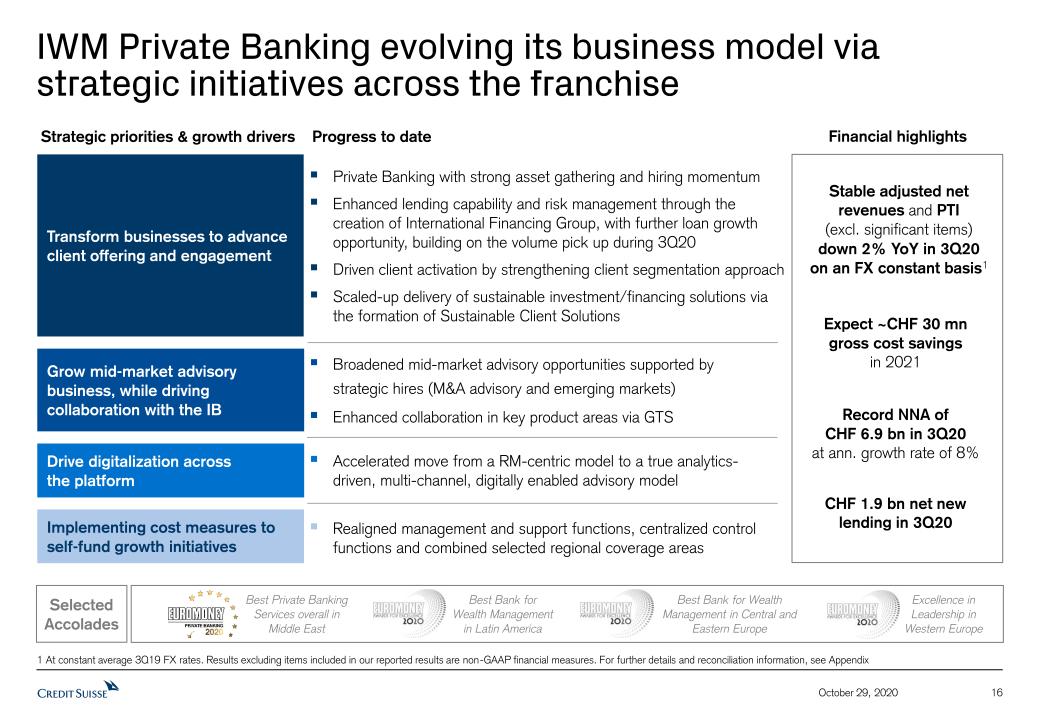

IWM’s results in 3Q20 continued to be supported by strong transaction revenues, offset by market impact and restructuring costs. Adjusted pre-tax income, excluding significant items*, was down 30% year on year at CHF 268 million, reflecting lower investment income as well as adverse foreign exchange and interest rate movements. Adjusted net revenues, excluding significant items*, were CHF 1.1 billion, down 12% year on year. Adjusted* total operating expenses of CHF 862 million were down 5% year on year; reported total operating expenses included restructuring expenses of CHF 29 million of an expected total of approximately CHF 75 million, related to our ambition of generating gross savings of approximately CHF 80 million in 2021. Asset gathering momentum was strong with NNA of CHF 11.9 billion. IWM recorded client assets of CHF 880 billion, with AuM9 of CHF 791 billion and custody assets of CHF 89 billion.

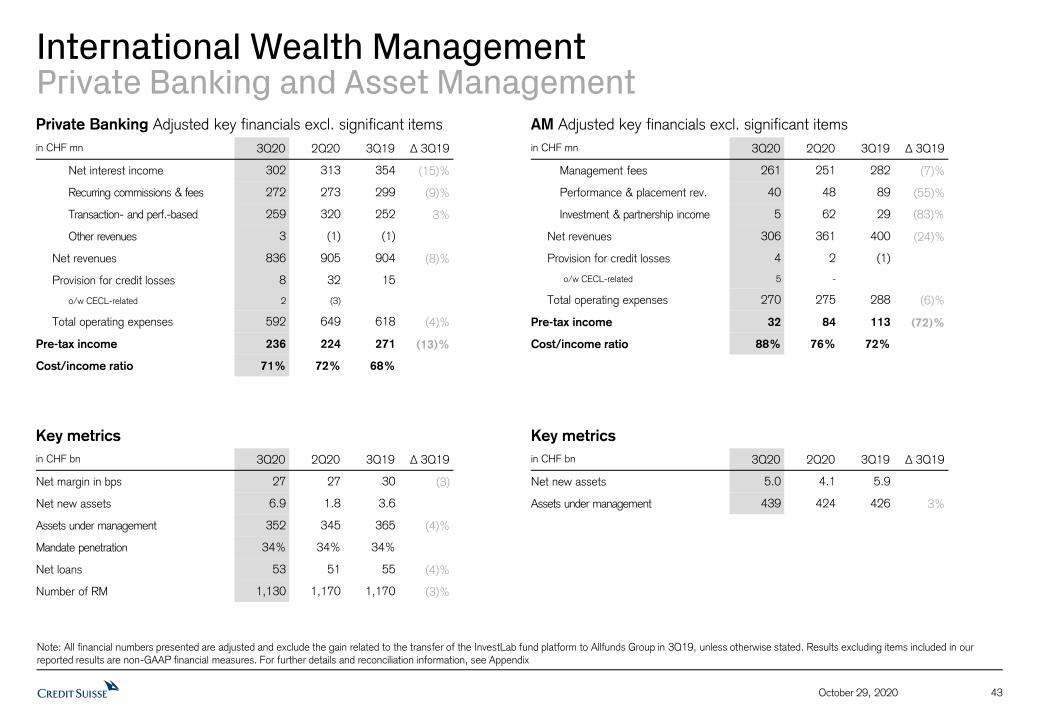

Private Banking recorded adjusted pre-tax income, excluding significant items*, of CHF 236 million in 3Q20, down 13% year on year, amid lower interest rates and foreign exchange impacts. NNA of CHF 6.9 billion demonstrated strong business growth at an annualized growth rate of 8%, with inflows across Europe and emerging markets. In addition, net new loans amounted to CHF 1.9 billion, reversing the deleveraging experienced in 1Q20. Adjusted net revenues, excluding significant items*, of CHF 836 million were down 8% year on year, benefitting from increased transaction-based revenues with higher brokerage fees and GTS revenues; however, lower net interest income in part reflected the impact of reductions in US dollar interest rates, while recurring commissions and fees were also negatively impacted by foreign exchange movements. Adjusted* total operating expenses were down 4% year on year; reported total operating expenses included restructuring expenses of CHF 16 million.

Page 7

Media Release Zurich, October 29, 2020 |  |

Asset Management’s adjusted pre-tax income, excluding significant items*, in 3Q20 was down 72% year on year at CHF 32 million amid investment losses and lower performance and placement fees as 3Q19 included a sale gain of a private equity investment of a fund. Investment losses were recorded in real estate funds, partially offset by a further recovery, especially in credit funds, of losses recorded in 1Q20. In addition, placement fees were lower with delayed market fundraising activity. Adjusted* total operating expenses were down 6% year on year; reported total operating expenses included restructuring expenses of CHF 13 million. NNA amounted to CHF 5.0 billion, driven by Index Solutions and Fixed Income.

Asia Pacific (APAC)

Reported results

APAC (in CHF million) | 3Q20 | 2Q20 | 3Q19 | ∆3Q19 | 9M20 | 9M19 | ∆9M19 | |

| Net revenues | 728 | 808 | 781 | (7)% | 2,371 | 2,279 | 4% | |

| Provision for credit losses | 45 | 86 | 20 | - | 230 | 41 | - | |

| Total operating expenses | 506 | 526 | 491 | 3% | 1,550 | 1,517 | 2% | |

| Pre-tax income | 177 | 196 | 270 | (34)% | 591 | 721 | (18)% | |

| Cost/income ratio (%) | 70 | 65 | 63 | - | 65 | 67 | - |

Adjusted results, excluding significant items*

APAC (in CHF million) | 3Q20 | 2Q20 | 3Q19 | ∆3Q19 | 9M20 | 9M19 | ∆9M19 | |

| Net revenues | 728 | 808 | 683 | 7% | 2,346 | 2,181 | 8% | |

| Provision for credit losses | 45 | 86 | 20 | - | 230 | 41 | - | |

| Total operating expenses | 504 | 526 | 491 | 3% | 1,548 | 1,517 | 2% | |

| Pre-tax income | 179 | 196 | 172 | 4% | 568 | 623 | (9)% | |

| Cost/income ratio (%) | 69 | 65 | 72 | - | 66 | 70 | - |

APAC recorded adjusted pre-tax income, excluding significant items*, in 3Q20 of CHF 179 million, up 4% year on year, despite negative foreign exchange impacts of CHF 21 million. Adjusted net revenues, excluding significant items*, of CHF 728 million were up 7% year on year, despite an adverse foreign exchange impact of CHF 58 million. Adjusted* total operating expenses increased 3% year on year, mainly from higher variable compensation reflecting improved performance. APAC delivered an adjusted return on regulatory capital, excluding significant items*, of 20% and an adjusted cost/income ratio, excluding significant items*, of 69%. We recorded lower provision for credit losses of CHF 45 million, compared to the CHF 86 million recorded in 2Q20, mainly related to a single case.

Transaction-based net revenues were particularly strong and up 32% year on year in 3Q20, driven by strong client activity and higher revenues from GTS as a result of strong APAC performance and increased cross-divisional collaboration as well as increased equity capital markets activity, partially offset by lower financing revenues. Net interest income was down 12% year on year from lower deposit income and credit volumes, which were negatively impacted by client deleveraging in 1H20. Recurring commissions & fees were also down, 11% year on year, mainly reflecting lower investment product management and banking services fees.

Page 8

Media Release Zurich, October 29, 2020 |  |

In 3Q20, we reported regional revenues3 of CHF 1 billion in Asia Pacific, up 29%4 year on year, excluding the InvestLab gain*, and representing 20% of Credit Suisse Group revenues.

In 3Q20, APAC gathered NNA of CHF 2.2 billion and achieved record client assets of CHF 294 billion, with AuM of CHF 219 billion and custody assets of CHF 75 billion. APAC client assets represent 30% of Wealth Management client assets. APAC advisory, underwriting and financing maintained a top 3 ranking in terms of share of wallet10 in the first nine months of 2020.

Credit Suisse was named Asia’s Best Bank for Wealth Management by Euromoney; Asia’s Private Bank of the Year, Equity Derivatives House of the Year and Credit Derivatives House of the Year by Asia Risk; Asia’s Best Bank for Investment Solutions, Best Bank for Investment Solutions, Equity and Best Bank for Investment Solutions, Credit by The Asset; and Best House, Asian Equities by Structured Retail Products.

Investment Bank (IB)

Reported results

IB (in USD million) | 3Q20 | 2Q20 | 3Q19 | ∆3Q19 | 9M20 | 9M19 | ∆9M19 | |

| Net revenues | 2,245 | 2,981 | 2,023 | 11% | 7,381 | 6,239 | 18% | |

| Provision for credit losses | (16) | 148 | 19 | - | 447 | 36 | - | |

| Total operating expenses | 1,856 | 1,882 | 1,694 | 10% | 5,492 | 5,227 | 5% | |

| Pre-tax income/loss | 405 | 951 | 310 | 31% | 1,442 | 976 | 48% | |

| Cost/income ratio (%) | 83 | 63 | 84 | - | 74 | 84 | - |

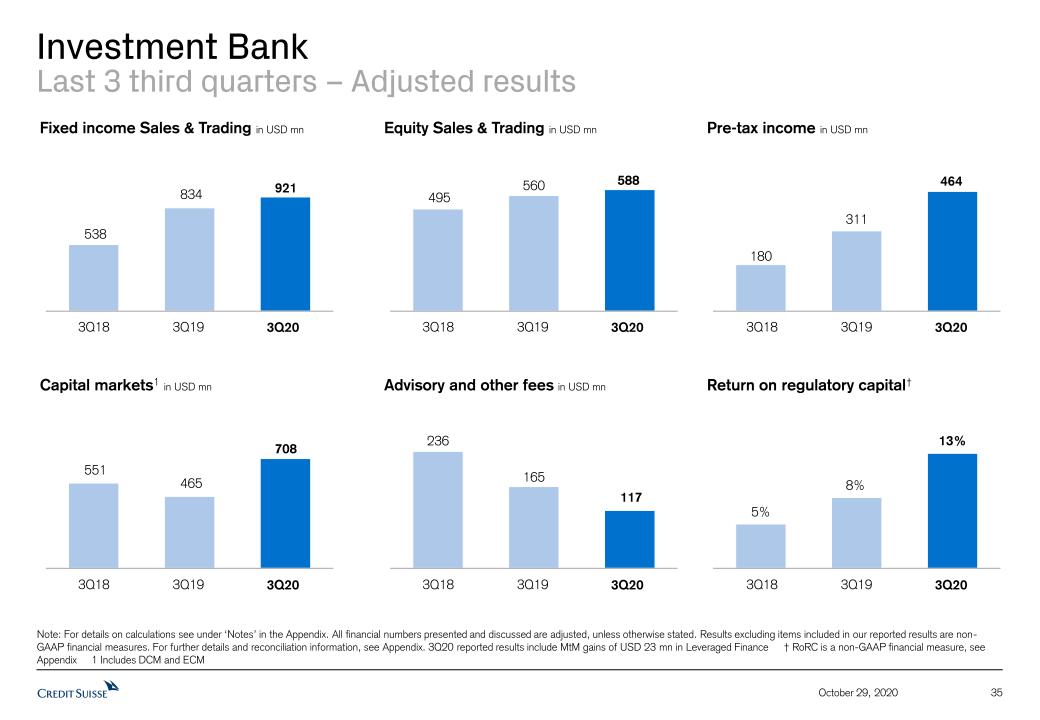

Adjusted results*

IB (in USD million) | 3Q20 | 2Q20 | 3Q19 | ∆3Q19 | 9M20 | 9M19 | ∆9M19 | |

| Net revenues | 2,245 | 2,981 | 2,023 | 11% | 7,381 | 6,239 | 18% | |

| Provision for credit losses | (16) | 148 | 19 | - | 447 | 36 | - | |

| Total operating expenses | 1,797 | 1,854 | 1,693 | 6% | 5,409 | 5,196 | 4% | |

| Pre-tax income/loss | 464 | 979 | 311 | 49% | 1,525 | 1,007 | 51% | |

| Cost/income ratio (%) | 80 | 62 | 84 | - | 73 | 83 | - |

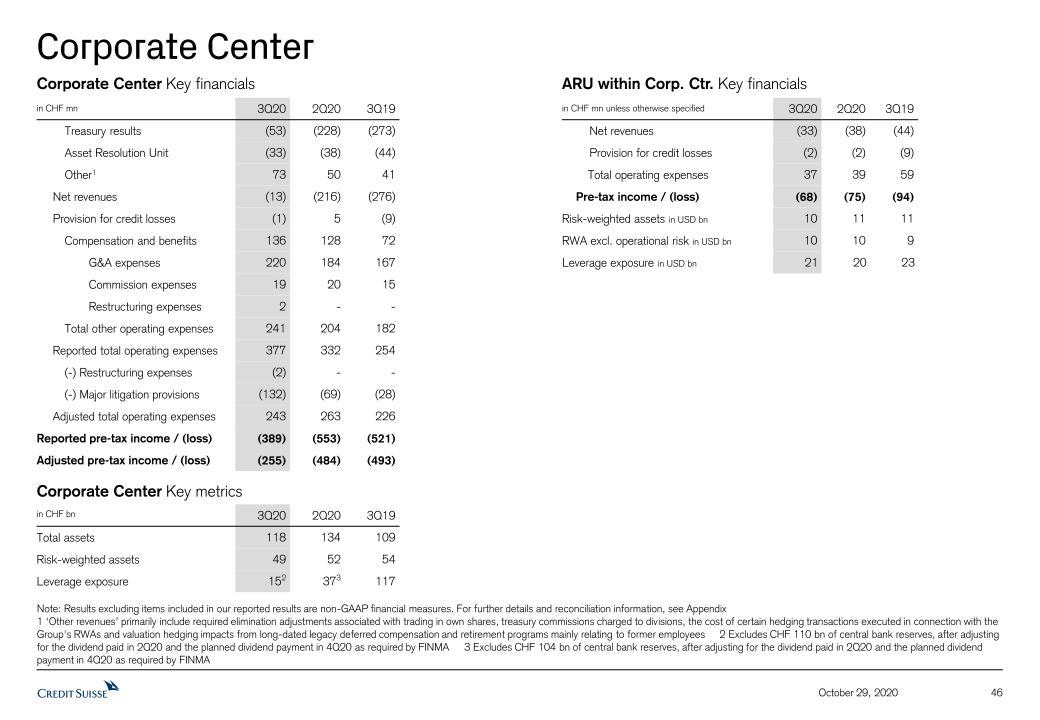

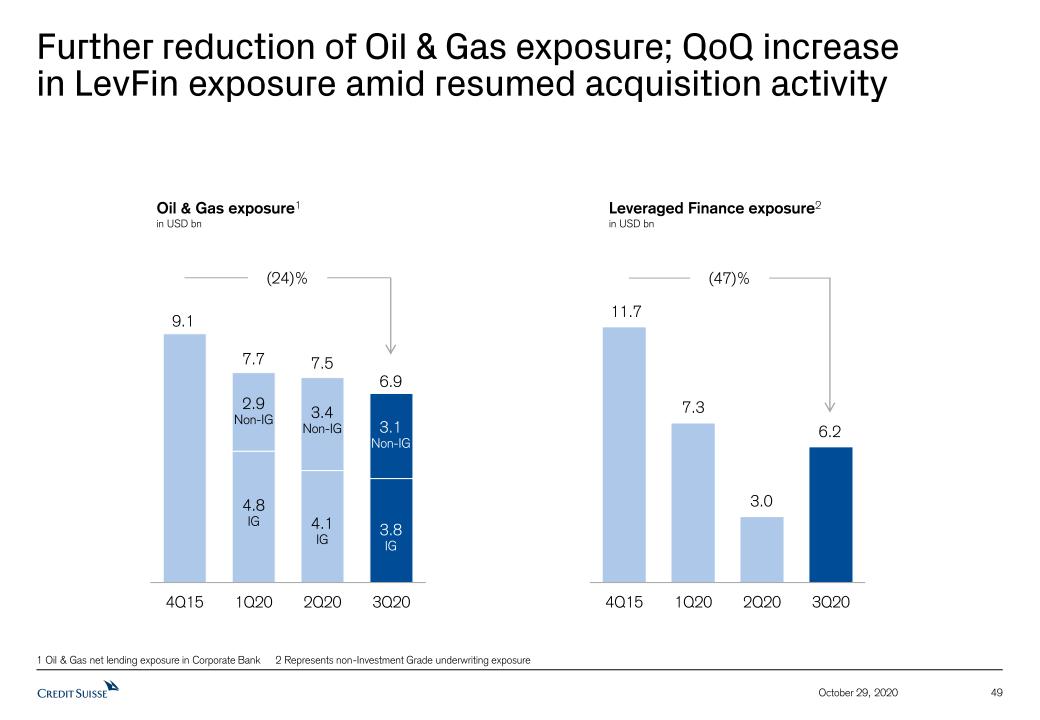

IB achieved adjusted* pre-tax income of USD 464 million in 3Q20, up 49% year on year, with an adjusted* return on regulatory capital of 13%, highlighting the strength of our diversified client franchise. Net revenues of USD 2.2 billion increased 11% year on year due to constructive market conditions and higher client activity, particularly in Asia. Adjusted* total operating expenses increased 6% year on year, primarily reflecting higher variable compensation accruals. Reported operating expenses included restructuring costs of USD 36 million. Additionally, provision for credit losses declined compared to 2Q20 due to a release of credit provisions of USD 16 million, reflecting a release of CECL reserves driven by exposure reductions in the Corporate Bank.

Page 9

Media Release Zurich, October 29, 2020 |  |

Fixed income sales and trading revenues of USD 921 million in 3Q20 increased 10% year on year, driven by higher client activity in our securitized products, emerging markets and macro franchises.

Equity sales and trading revenues of USD 588 million in 3Q20 increased 5% year on year, reflecting higher activity in equity derivatives, global share gains11 in cash equities and increased revenues in prime services, particularly in Asia.

Our GTS business delivered strong results in 3Q20 reflecting increased collaboration and continued momentum with our wealth management, institutional and corporate clients.

Capital Markets revenues of USD 708 million in 3Q20 increased 52% year on year, driven by strong performance in equity capital markets as well as higher debt capital markets revenues. Equity capital markets revenues more than doubled due to significantly higher IPO activity resulting in a number 2 ranking12 in IPOs in 3Q20. In addition, debt capital markets revenues increased year on year, driven by higher investment grade activity and slightly higher leveraged finance revenues.

Advisory revenues of USD 117 million in 3Q20 decreased 29% year on year, driven by fewer M&A deal completions.

COVID-19 AND OUR ONGOING COMMITMENT TO OUR EMPLOYEES

Credit Suisse is committed to equality, diversity and inclusion for all our employees and to cultivating a culture where all employees feel that they belong and can thrive. We are now building on those commitments to ensure that our workforce truly reflects society with a broader, more resilient team and that we deliver higher quality services to our clients.

Our new mandates with regards to diversity and inclusion are:

| - | Further expand our existing targets for gender globally, and ensure action to drive our culture of inclusion for all employees in all locations in which we operate |

| - | Set a new target to double our Black Talent senior headcount while increasing our overall Black Talent representation by 50% by 2024 |

| - | Further embed D&I in to the bank’s culture and into the business strategies of our divisions and functions |

| - | Full engagement from the Board of Directors, Executive Board and senior leadership of all business divisions and functions, including anti-bias and inclusive leadership training for all employees |

| - | Extending D&I stakeholder management beyond employees, to clients, investors, public policy, community and suppliers |

| - | Further increase our D&I budget to support our efforts globally |

As COVID-19 continues to impact our business and the way we work and live, our priority continues to be focused on the welfare and health of our employees and their families. We are immensely grateful to each and every one of our colleagues for their ongoing commitment and dedication during this challenging period. As we continue to face uncertainty heading into the winter months, we remain committed to supporting our employees as well as our clients and the communities in which we operate. We continue to fully support our employees who are working remotely, as well as those who choose to come into our offices. During the third quarter, 77% of employees were working from home on average. We pursued our initiative to explore new ways of working, with Switzerland being the first trial market of a

Page 10

Media Release Zurich, October 29, 2020 |  |

broader study. While the results of that program are not yet ready, what is clear is that agile working will become a viable option for our employees going forward.

We continued to roll out voluntary, free antibody testing to Credit Suisse employees in Switzerland and to our offices globally. Since the launch of the program, we have had more than 8,300 employees tested. We have also extended our paid family leave offer to employees, indefinitely, in locations where schools remain closed or where they will be closed again.

In terms of supporting our clients through the pandemic, we continued to leverage technology to ensure strong private banking client engagement globally. We also saw a high volume of execution across our Equities and Fixed Income businesses for investment banking and private banking clients as our employees remained close to and dedicated to serving the needs of our clients. Additionally, Credit Suisse hosted a number of notable virtual events for clients, including our signature Global Women’s Financial Forum, building on its strong regional event programs and engagement by introducing a virtual Global Summit under the theme "The Power of Transformation" from September 29 – October 1, 2020.

We continue to have an open and active dialogue with the Swiss government around the best way to support the Swiss economy and businesses, which is in line with our active participation in the design and execution of the up to CHF 20 billion SME COVID-19 financing program sponsored by the Swiss government, earlier this year.

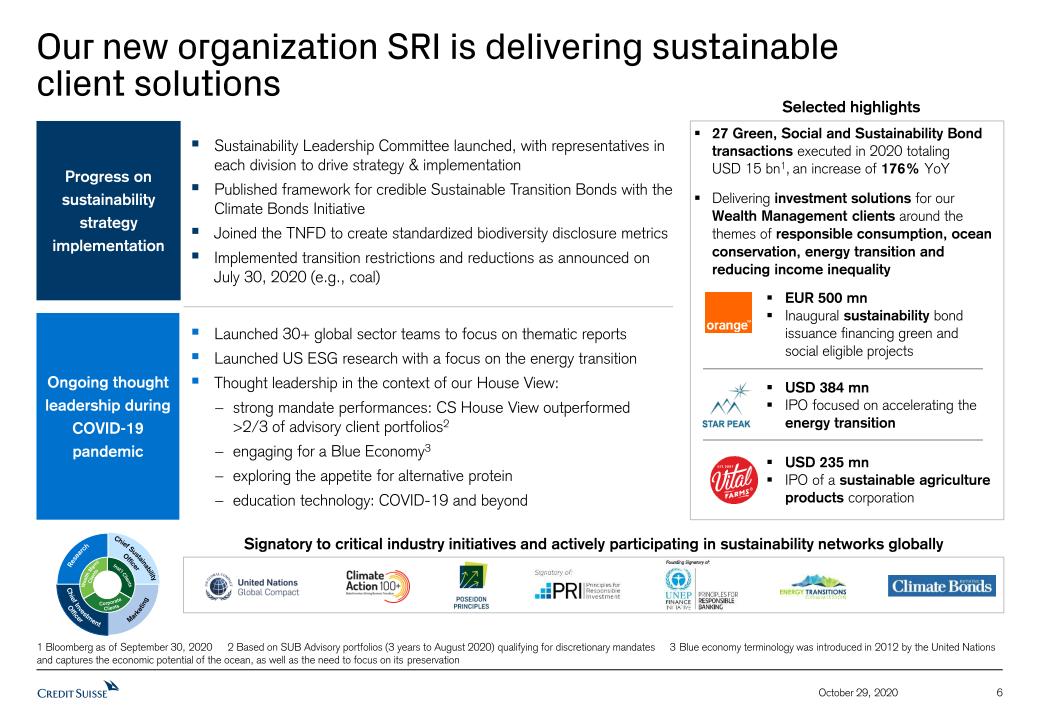

ONGOING COMMITMENT TO SOCIETY AND SUSTAINABILITY

Credit Suisse continued its sustainability related initiatives in 3Q20. In August, the bank established the new Sustainability, Research & Investment Solutions (SRI) function at the Executive Board level to accelerate and embed our sustainability efforts throughout all client segments. On the back of this announcement, Credit Suisse committed to invest at least CHF 300 billion of sustainable financing over the next ten years and introduced further financing restrictions on thermal coal extraction, coal power generation, and oil & gas projects in the Arctic region, to further align its business with the objectives of the Paris Agreement on climate change.

In the context of the fifth anniversary of the UN Sustainable Development Goals (SDGs), Credit Suisse published six case studies on its contribution to the UN SDGs. The case studies provide an overview of Credit Suisse’s activities relating to SDG 4 (Quality education), SDG 5 (Gender equality), SDG 7 (Affordable and clean energy), SDG 8 (Decent work and economic growth), SDG 11 (Sustainable cities and communities) and SDG 15 (Life on land).

Along with the Climate Bonds Initiative, the bank published the “Financing Credible Transitions” paper, a document which presents a framework for defining ambitious and credible transition pathways for companies that will collectively reduce global emissions and help to deliver the goals of the Paris Agreement.

In partnership with the Yacht Club de Monaco, the bank launched the Monaco Superyacht Eco Association (SEA) Index measuring the carbon impact of yacht design. The aspiration is that the index will evolve over time into a global industry standard providing a transparent ecological rating for all large yachts.

Page 11

Media Release Zurich, October 29, 2020 |  |

Credit Suisse also enhanced its platform for relationship managers, the Product Buffet, by introducing additional sustainability-related product classifications with a more differentiated methodology that is in line with our Credit Suisse Sustainable Investing Framework.

We co-hosted a virtual panel alongside Dynamo and IBM for Climate Week NYC titled: "Cleantech, Collaboration, and Climate Action: Driving the Clean Energy Transition through COVID-19".

Furthermore, in 3Q20 Credit Suisse joined a number of prestigious networks and taskforces aimed at further sustainability efforts in the global economy as well as improving governance around sustainability issues; these included the Task Force on Nature-related Financial Disclosures, Climate Action 100+, as well as the International Corporate Governance Network.

Finally, Credit Suisse was named as a winner in the 2020 Corporate Philanthropy Awards by the Triangle Business Journal (Raleigh) in the United States and, in EMEA, has supported the Fair Education Alliance Scaling Awards. The 17 winners will collectively make a significant contribution to systemic change to end educational inequality and deepen their impact and scale to the areas of greatest need. In addition to financial support, Credit Suisse was able to provide significant skills-based / capacity building volunteering to the Fair Education Alliance to support the awards process.

Page 12

Media Release Zurich, October 29, 2020 |  |

CONTACT DETAILS

Kinner Lakhani, Investor Relations, Credit Suisse Tel: +41 44 333 71 49 Email: investor.relations@credit-suisse.com |

James Quinn, Corporate Communications, Credit Suisse Tel: +41 844 33 88 44 E-mail: media.relations@credit-suisse.com |

The Financial Report and Presentation Slides for 3Q20 are available to download from 7:00 CET today at: https://www.credit-suisse.com/results |

PRESENTATION OF 3Q20 RESULTS – THURSDAY, OCTOBER 29, 2020

| Event | Analyst Call | Media Call |

| Time | 08:15 Zurich 07:15 London 03:15 New York | 10:30 Zurich 09:30 London 05:30 New York |

| Language | English | English |

| Access | Switzerland: +41 44 580 48 67 Europe: +44 203 057 6528 US: +1 866 276 8933 Reference: Credit Suisse Analysts and Investors Call Conference ID: 9896195 Please dial in 10 minutes before the start of the call Webcast link here. | Switzerland: +41 44 580 48 67 Europe: +44 203 057 6528 US: +1 866 276 8933 Reference: Credit Suisse Media Call Conference ID: 2484283 Please dial in 10 minutes before the start of the call Webcast link here. |

| Q&A Session | Following the presentation, you will have the opportunity to ask the speakers questions | Following the presentation, you will have the opportunity to ask the speakers questions |

| Playback | Replay available approximately one hour after the event Switzerland: +41 44 580 40 26 Europe: +44 333 300 9785 US: +1 917 677 7532 Conference ID: 9896195 | Replay available approximately one hour after the event Switzerland: +41 44 580 40 26 Europe: +44 333 300 9785 US: +1 917 677 7532 Conference ID: 2484283 |

Page 13

Media Release Zurich, October 29, 2020 |  |

* Refers to adjusted results, results excluding significant items and results on a constant foreign exchange rate basis as applicable. Results excluding items included in our reported results are non-GAAP financial measures. For a reconciliation to the most directly comparable US GAAP measures, see the Appendix of this Media Release.

Footnotes

1 In 3Q20 and 2Q20 leverage exposure excludes CHF 110 billion and CHF 104 billion, respectively, of central bank reserves, after adjusting for the dividend paid in 2Q20 and the planned dividend payment in 4Q20 as required by FINMA. Including cash held at central banks, our Tier 1 leverage ratio would have been 5.6% for 3Q20 and 5.5% for 2Q20.

2 Subject to market and economic conditions

3 Reflects net revenues of the APAC division and includes revenues related to the Asia Pacific region recognized in the Investment Bank and International Wealth Management

4 Excluding a gain of CHF 98 million related to the transfer of InvestLab in 3Q19

5 For periods prior to 3Q20, reflects net revenues from ITS and APAC Solutions

6 In 3Q20 and 2Q20 leverage exposure excludes CHF 110 billion and CHF 104 billion, respectively, of central bank reserves, after adjusting for the dividend paid in 2Q20 and the planned dividend payment in 4Q20 as required by FINMA. Including cash held at central banks, our CET1 leverage ratio would have been 4.0% for both 3Q20 and 2Q20

7 Includes capital markets revenues and advisory and other fees within global investment banking

8 Reflecting a dividend per share increase of at least 5%; subject to final results, Board of Directors and AGM approval; final amount is subject to share count at ex-dividend date. Dividend distribution including dividend equivalents for share awards

9 Before elimination of assets managed by Asset Management on behalf of IWM PB clients

10 Source: Dealogic for the period ending September 30, 2020 (APAC excluding Japan and China onshore among international banks)

11 Based on third party competitive analysis as of 2Q20

12 Source: Dealogic for the period ending September 30, 2020 (Americas and EMEA only)

Abbreviations

AGM – Annual General Meeting; APAC – Asia Pacific; AuM – assets under management; BCBS – Basel Committee on Banking Supervision; BIS – Bank for International Settlements; CECL – US GAAP accounting standard for current expected credit losses; CEO – Chief Executive Officer; CET1 – common equity tier 1; CHF – Swiss francs; C&IC – Corporate & Institutional Clients; D&I – Diversity & Inclusion; DCM – Debt Capital Markets; ECM – Equity Capital Markets; EGM – Extraordinary General Meeting; EMEA – Europe, Middle East, Africa; FINMA – Swiss Financial Market Supervisory Authority FINMA; FX – Foreign Exchange; GAAP – Generally accepted accounting principles; GTS – Global Trading Solutions; IB – Investment Bank; IPO – Initial Public Offering; ITS – International Trading Solutions; IWM – International Wealth Management; NAB– Neue Aargauer Bank; M&A – Mergers & Acquisitions; NNA – net new assets; PB – Private Banking; PC – Private Clients; PTI – Pre-Tax Income; RoRC – Return on Regulatory Capital; RoTE – Return on Tangible Equity; RWA – risk weighted assets; SEA – Superyacht Eco Association; SEC – U.S. Securities and Exchange Commission; SDG – Sustainable Development Goals; SME – Small and Medium Enterprises; SRI – Sustainability, Research & Investment Solutions; SUB – Swiss Universal Bank; UK – United Kingdom; UN – United Nations; US – United States; USD – US dollar.

Important information

This document contains select information from the full 3Q20 Financial Report and 3Q20 Results Presentation slides that Credit Suisse believes is of particular interest to media professionals. The complete 3Q20 Financial Report and 3Q20 Results Presentation slides, which have been distributed simultaneously, contain more comprehensive information about our results and operations for the reporting quarter, as well as important information about our reporting methodology and some of the terms used in these documents. The complete 3Q20 Financial Report and 3Q20 Results Presentation slides are not incorporated by reference into this document.

We may not achieve all of the expected benefits of our strategic initiatives. Factors beyond our control, including but not limited to the market and economic conditions (including macroeconomic and other challenges and uncertainties, for example, resulting from the COVID-19 pandemic), changes in laws, rules or regulations and other challenges discussed in our public filings, could limit our ability to achieve some or all of the expected benefits of these initiatives.

In particular, the terms “Estimate”, “Illustrative”, “Ambition”, “Objective”, “Outlook” and “Goal” are not intended to be viewed as targets or projections, nor are they considered to be Key Performance Indicators. All such estimates, illustrations, ambitions, objectives, outlooks and goals are subject to a large number of inherent risks, assumptions and uncertainties, many of which are completely outside of our control. These risks, assumptions and uncertainties include, but are not limited to, general market conditions, market volatility, interest rate volatility and levels, global and regional economic conditions, challenges and uncertainties resulting from the COVID-19 pandemic, political uncertainty, changes in tax policies, regulatory changes, changes in levels of client activity as a result of any of the foregoing and other factors. Accordingly, this information should not be relied on for any purpose. We do not intend to update these estimates, illustrations, ambitions, objectives, outlooks or goals.

Page 14

Media Release Zurich, October 29, 2020 |  |

In preparing this document, management has made estimates and assumptions that affect the numbers presented. Actual results may differ. Annualized numbers do not take into account variations in operating results, seasonality and other factors and may not be indicative of actual, full-year results. Figures throughout this document may also be subject to rounding adjustments. All opinions and views constitute judgments as of the date of writing without regard to the date on which the reader may receive or access the information. This information is subject to change at any time without notice and we do not intend to update this information.

Return on tangible equity, a non-GAAP financial measure, is calculated as annualized net income attributable to shareholders divided by average tangible shareholders’ equity. Tangible shareholder’s equity, a non-GAAP financial measure, is calculated by deducting goodwill and other intangible assets from total shareholders’ equity as presented in our balance sheet. Management believes that return on tangible equity is meaningful as it is a measure used and relied upon by industry analysts and investors to assess valuations and capital adequacy. For end-3Q20, tangible shareholders’ equity excluded goodwill of CHF 4,577 million and other intangible assets of CHF 256 million from total shareholders’ equity of CHF 45,740 million as presented in our balance sheet.

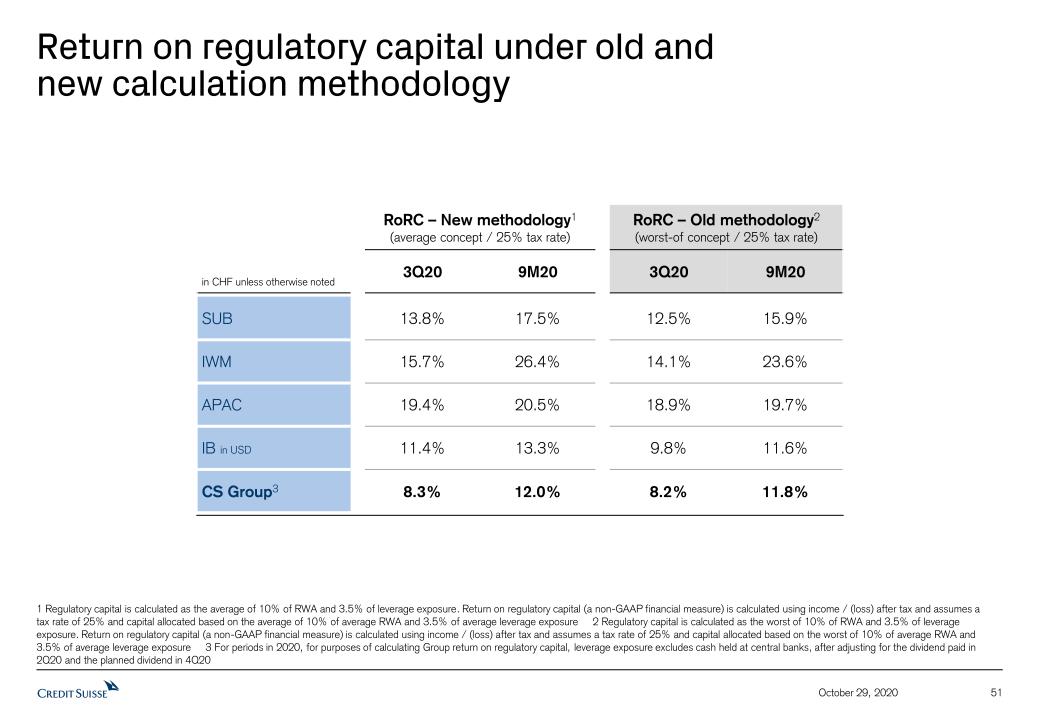

Prior to 3Q20, regulatory capital was calculated as the worst of 10% of RWA and 3.5% of leverage exposure, and return on regulatory capital (a non-GAAP financial measure) was calculated using income / (loss) after tax and assumed a tax rate of 30%. In 3Q20, we updated our calculation approach, following which regulatory capital is calculated as the average of 10% of RWA and 3.5% of leverage exposure, and return on regulatory capital (a non-GAAP financial measure) is calculated using income / (loss) after tax and assumes a tax rate of 30% for periods prior to 2020 and 25% from 2020 onward. For periods in 2020, for purposes of calculating Group return on regulatory capital, leverage exposure excludes cash held at central banks, after adjusting for the dividend paid in 2Q20 and the planned dividend in 4Q20. For the Investment Bank division, return on regulatory capital is based on US dollar denominated numbers. Adjusted return on regulatory capital is calculated using adjusted results, applying the same methodology to calculate return on regulatory capital.

Foreign exchange impact is calculated by converting the CHF amount of net revenues, provision for credit losses and operating expenses for 2020 back to the original currency on a monthly basis at the respective spot foreign exchange rate. The respective amounts are then converted back to CHF applying the average 2019 foreign exchange rate from the period against which the foreign exchange impact is measured. Average foreign exchange rates apply a straight line average of monthly foreign exchange rates for major currencies.

Client assets is a broader measure than assets under management as it includes transactional accounts and assets under custody (assets held solely for transaction-related or safekeeping/custody purposes) and assets of corporate clients and public institutions used primarily for cash management or transaction-related purposes.

Credit Suisse is subject to the Basel III framework, as implemented in Switzerland, as well as Swiss legislation and regulations for systemically important banks, which include capital, liquidity, leverage and large exposure requirements and rules for emergency plans designed to maintain systemically relevant functions in the event of threatened insolvency. Credit Suisse has adopted the Bank for International Settlements (BIS) leverage ratio framework, as issued by the Basel Committee on Banking Supervision (BCBS) and implemented in Switzerland by the Swiss Financial Market Supervisory Authority FINMA (FINMA).

Unless otherwise noted, all CET1 ratio, Tier-1 leverage ratio, risk-weighted assets and leverage exposure figures in this document are as of the end of the respective period and on a “look-through” basis.

Unless otherwise noted, leverage exposure is based on the BIS leverage ratio framework and consists of period-end balance sheet assets and prescribed regulatory adjustments. The tier 1 leverage ratio and CET1 leverage ratio are calculated as BIS tier 1 capital and CET1 capital, respectively, divided by period end leverage exposure. Swiss leverage ratios are measured on the same period-end basis as the leverage exposure for the BIS leverage ratio. Unless otherwise noted, for periods in 2020, leverage exposure excludes cash held at central banks, after adjusting for the dividend paid in 2Q20 and the planned dividend in 4Q20.

Generic references to profit and costs in this document refer to pre-tax income and operating expenses, respectively. References to Wealth Management mean SUB PC, IWM PB and APAC or their combined results. References to Wealth Management-related mean SUB, IWM and APAC or their combined results. References to global investment banking mean the Investment Bank, APAC advisory and underwriting as well as M&A, DCM and ECM in SUB C&IC. References to Global Trading Solutions, prior to 3Q20, mean the combination of ITS and APAC Solutions.

Investors and others should note that we announce material information (including quarterly earnings releases and financial reports) to the investing public using press releases, SEC and Swiss ad hoc filings, our website and public conference calls and webcasts. We intend to also use our Twitter account @creditsuisse (https://twitter.com/creditsuisse) to excerpt key messages from our public disclosures, including earnings releases. We may retweet such messages through certain of our regional Twitter accounts, including @csschweiz (https://twitter.com/csschweiz) and @csapac (https://twitter.com/csapac). Investors and others should take care to consider such abbreviated messages in the context of the disclosures from which they are excerpted. The information we post on these Twitter accounts is not a part of this document.

Page 15

Media Release Zurich, October 29, 2020 |  |

Information referenced in this document, whether via website links or otherwise, is not incorporated into this document.

Certain material in this document has been prepared by Credit Suisse on the basis of publicly available information, internally developed data and other third-party sources believed to be reliable. Credit Suisse has not sought to independently verify information obtained from public and third-party sources and makes no representations or warranties as to accuracy, completeness or reliability of such information.

In various tables, use of “–” indicates not meaningful or not applicable.

The English language version of this document is the controlling version.

Page 16

| Appendix |  |

| Key metrics | |||||||||||||||||

| in / end of | % change | in / end of | % change | ||||||||||||||

| 3Q20 | 2Q20 | 3Q19 | QoQ | YoY | 9M20 | 9M19 | YoY | ||||||||||

| Credit Suisse Group results (CHF million) | |||||||||||||||||

| Net revenues | 5,198 | 6,194 | 5,326 | (16) | (2) | 17,168 | 16,294 | 5 | |||||||||

| Provision for credit losses | 94 | 296 | 72 | (68) | 31 | 958 | 178 | 438 | |||||||||

| Compensation and benefits | 2,441 | 2,594 | 2,383 | (6) | 2 | 7,351 | 7,446 | (1) | |||||||||

| General and administrative expenses | 1,458 | 1,440 | 1,404 | 1 | 4 | 4,244 | 4,212 | 1 | |||||||||

| Commission expenses | 295 | 313 | 325 | (6) | (9) | 953 | 952 | 0 | |||||||||

| Restructuring expenses | 107 | – | – | – | – | 107 | – | – | |||||||||

| Total other operating expenses | 1,860 | 1,753 | 1,729 | 6 | 8 | 5,304 | 5,164 | 3 | |||||||||

| Total operating expenses | 4,301 | 4,347 | 4,112 | (1) | 5 | 12,655 | 12,610 | 0 | |||||||||

| Income before taxes | 803 | 1,551 | 1,142 | (48) | (30) | 3,555 | 3,506 | 1 | |||||||||

| Net income attributable to shareholders | 546 | 1,162 | 881 | (53) | (38) | 3,022 | 2,567 | 18 | |||||||||

| Statement of operations metrics (%) | |||||||||||||||||

| Return on regulatory capital | 8.3 | 15.5 | 10.4 | – | – | 12.0 | 10.8 | – | |||||||||

| Balance sheet statistics (CHF million) | |||||||||||||||||

| Total assets | 821,296 | 828,480 | 795,920 | (1) | 3 | 821,296 | 795,920 | 3 | |||||||||

| Risk-weighted assets | 285,216 | 299,293 | 302,121 | (5) | (6) | 285,216 | 302,121 | (6) | |||||||||

| Leverage exposure | 824,420 | 836,755 | 921,411 | (1) | (11) | 824,420 | 921,411 | (11) | |||||||||

| Assets under management and net new assets (CHF billion) | |||||||||||||||||

| Assets under management | 1,478.3 | 1,443.4 | 1,476.9 | 2.4 | 0.1 | 1,478.3 | 1,476.9 | 0.1 | |||||||||

| Net new assets | 18.0 | 9.8 | 11.9 | 83.7 | 51.3 | 33.6 | 69.4 | (51.6) | |||||||||

| Basel III regulatory capital and leverage statistics (%) | |||||||||||||||||

| CET1 ratio | 13.0 | 12.5 | 12.4 | – | – | 13.0 | 12.4 | – | |||||||||

| CET1 leverage ratio | 4.5 | 4.5 | 4.1 | – | – | 4.5 | 4.1 | – | |||||||||

| Tier 1 leverage ratio | 6.3 | 6.2 | 5.5 | – | – | 6.3 | 5.5 | – | |||||||||

Page A-1

| Appendix |  |

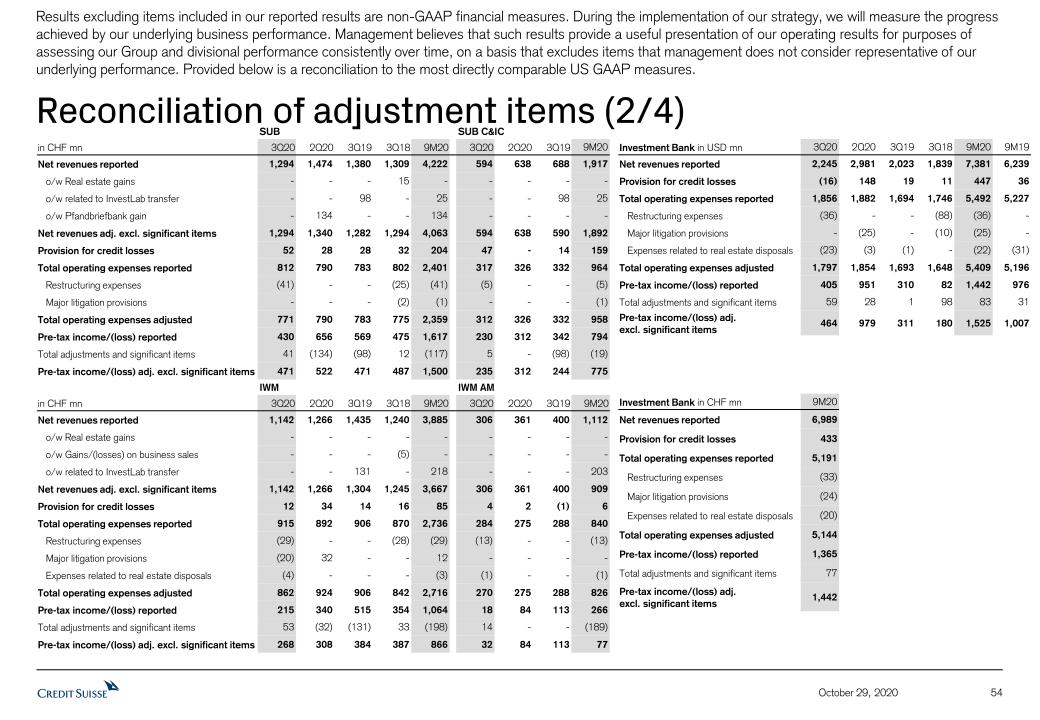

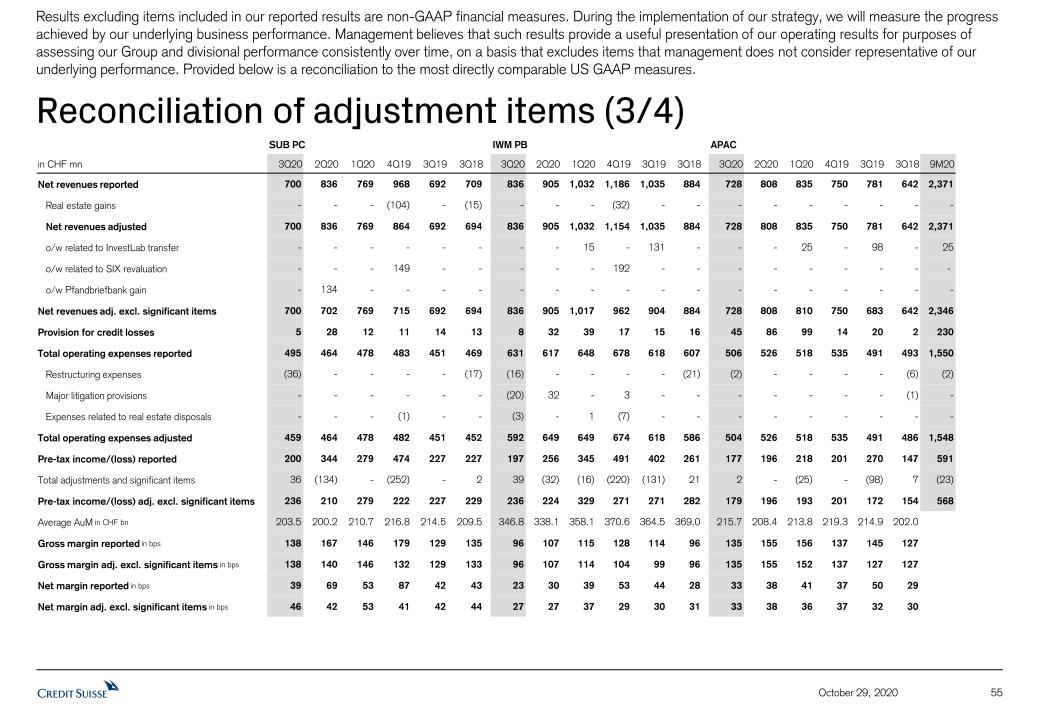

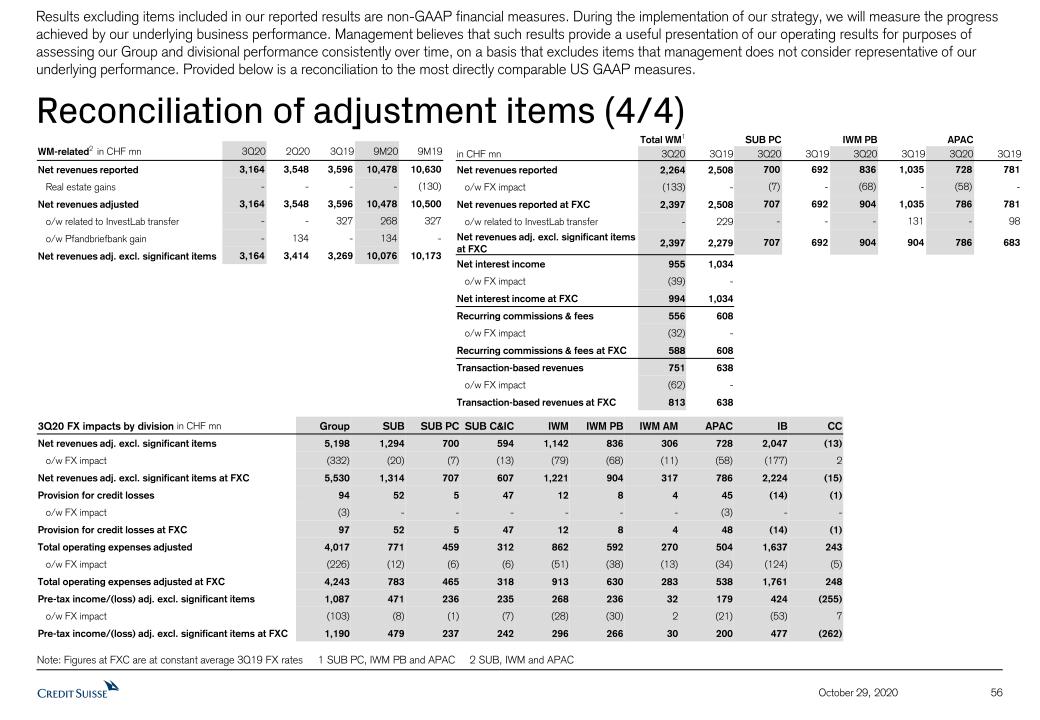

Results excluding items included in our reported results are non-GAAP financial measures. During the implementation of our strategy, we will measure the progress achieved by our underlying business performance. Management believes that such results provide a useful presentation of our operating results for purposes of assessing our Group and divisional performance consistently over time, on a basis that excludes items that management does not consider representative of our underlying performance. Provided below is a reconciliation to the most directly comparable US GAAP measures.

| Reconciliation of adjustment items | |||||||||||||||||||

| Group | |||||||||||||||||||

| in | 3Q20 | 2Q20 | 3Q19 | 9M20 | 9M19 | ||||||||||||||

| Adjusted results excluding signficant items (CHF million) | |||||||||||||||||||

| Net revenues | 5,198 | 6,194 | 5,326 | 17,168 | 16,294 | ||||||||||||||

| of which real estate gains | 0 | 0 | 0 | 0 | (105) | ||||||||||||||

| of which gain related to InvestLab transfer | 0 | 0 | (327) | (268) | (327) | ||||||||||||||

| of which Pfandbriefbank gain | 0 | (134) | 0 | (134) | 0 | ||||||||||||||

| Adjusted net revenues excluding significant items | 5,198 | 6,060 | 4,999 | 16,766 | 15,862 | ||||||||||||||

| Provision for credit losses | 94 | 296 | 72 | 958 | 178 | ||||||||||||||

| Total operating expenses | 4,301 | 4,347 | 4,112 | 12,655 | 12,610 | ||||||||||||||

| Restructuring expenses | (107) | – | – | (107) | – | ||||||||||||||

| Major litigation provisions | (152) | (61) | (28) | (231) | (63) | ||||||||||||||

| Expenses related to real estate disposals | (25) | (3) | 0 | (23) | (51) | ||||||||||||||

| Adjusted total operating expenses | 4,017 | 4,283 | 4,084 | 12,294 | 12,496 | ||||||||||||||

| Income before taxes | 803 | 1,551 | 1,142 | 3,555 | 3,506 | ||||||||||||||

| Total adjustments and significant items | 284 | 64 | (299) | 93 | (318) | ||||||||||||||

| Adjusted income before taxes excluding significant items | 1,087 | 1,615 | 843 | 3,648 | 3,188 | ||||||||||||||

| Group | |||||

| in | 3Q20 | 3Q19 | |||

| Adjusted results excluding significant items and FX impact (CHF million) | |||||

| Adjusted net revenues | 5,198 | 5,326 | |||

| of which gain related to InvestLab transfer | 0 | (327) | |||

| of which FX impact | 332 | – | |||

| Adjusted net revenues excluding FX impact | 5,530 | 4,999 | |||

| Adjusted income before taxes | 1,087 | 843 | |||

| of which FX impact | 103 | – | |||

| Adjusted income before taxes excluding significant items and FX impact | 1,190 | 843 | |||

Page A-2

| Appendix |  |

| Swiss Universal Bank | |||||||||||||||||

| in / end of | % change | in / end of | % change | ||||||||||||||

| 3Q20 | 2Q20 | 3Q19 | QoQ | YoY | 9M20 | 9M19 | YoY | ||||||||||

| Results (CHF million) | |||||||||||||||||

| Net revenues | 1,294 | 1,474 | 1,380 | (12) | (6) | 4,222 | 4,171 | 1 | |||||||||

| of which Private Clients | 700 | 836 | 692 | (16) | 1 | 2,305 | 2,218 | 4 | |||||||||

| of which Corporate & Institutional Clients | 594 | 638 | 688 | (7) | (14) | 1,917 | 1,953 | (2) | |||||||||

| Provision for credit losses | 52 | 28 | 28 | 86 | 86 | 204 | 66 | 209 | |||||||||

| Total operating expenses | 812 | 790 | 783 | 3 | 4 | 2,401 | 2,399 | 0 | |||||||||

| Income before taxes | 430 | 656 | 569 | (34) | (24) | 1,617 | 1,706 | (5) | |||||||||

| of which Private Clients | 200 | 344 | 227 | (42) | (12) | 823 | 808 | 2 | |||||||||

| of which Corporate & Institutional Clients | 230 | 312 | 342 | (26) | (33) | 794 | 898 | (12) | |||||||||

| Metrics (%) | |||||||||||||||||

| Return on regulatory capital | 13.8 | 21.2 | 17.8 | – | – | 17.5 | 17.9 | – | |||||||||

| Cost/income ratio | 62.8 | 53.6 | 56.7 | – | – | 56.9 | 57.5 | – | |||||||||

| Private Clients | |||||||||||||||||

| Assets under management (CHF billion) | 205.0 | 201.8 | 214.2 | 1.6 | (4.3) | 205.0 | 214.2 | (4.3) | |||||||||

| Net new assets (CHF billion) | 2.0 | (1.6) | (0.6) | – | – | (3.8) | 3.9 | – | |||||||||

| Gross margin (annualized) (bp) | 138 | 167 | 129 | – | – | 150 | 140 | – | |||||||||

| Net margin (annualized) (bp) | 39 | 69 | 42 | – | – | 54 | 51 | – | |||||||||

| Corporate & Institutional Clients | |||||||||||||||||

| Assets under management (CHF billion) | 441.0 | 427.4 | 424.6 | 3.2 | 3.9 | 441.0 | 424.6 | 3.9 | |||||||||

| Net new assets (CHF billion) | 3.5 | 1.6 | 6.3 | – | – | 9.9 | 42.8 | – | |||||||||

| Reconciliation of adjustment items | |||||||||||||||||||

| Swiss Universal Bank | |||||||||||||||||||

| in | 3Q20 | 2Q20 | 3Q19 | 9M20 | 9M19 | ||||||||||||||

| Adjusted results excluding signficant items (CHF million) | |||||||||||||||||||

| Net revenues | 1,294 | 1,474 | 1,380 | 4,222 | 4,171 | ||||||||||||||

| of which real estate gains | 0 | 0 | 0 | 0 | (117) | ||||||||||||||

| of which gain related to InvestLab transfer | 0 | 0 | (98) | (25) | (98) | ||||||||||||||

| of which Pfandbriefbank gain | 0 | (134) | 0 | (134) | 0 | ||||||||||||||

| Adjusted net revenues excluding significant items | 1,294 | 1,340 | 1,282 | 4,063 | 3,956 | ||||||||||||||

| Provision for credit losses | 52 | 28 | 28 | 204 | 66 | ||||||||||||||

| Total operating expenses | 812 | 790 | 783 | 2,401 | 2,399 | ||||||||||||||

| Restructuring expenses | (41) | – | – | (41) | – | ||||||||||||||

| Major litigation provisions | 0 | 0 | 0 | (1) | (3) | ||||||||||||||

| Expenses related to real estate disposals | 0 | 0 | 0 | 0 | (10) | ||||||||||||||

| Adjusted total operating expenses | 771 | 790 | 783 | 2,359 | 2,386 | ||||||||||||||

| Income before taxes | 430 | 656 | 569 | 1,617 | 1,706 | ||||||||||||||

| Total adjustments and significant items | 41 | (134) | (98) | (117) | (202) | ||||||||||||||

| Adjusted income before taxes excluding significant items | 471 | 522 | 471 | 1,500 | 1,504 | ||||||||||||||

Page A-3

| Appendix |  |

| Reconciliation of adjustment items | |||||||||

Swiss Universal Bank – Private Clients | Swiss Universal Bank – Corporate & Institutional Clients | ||||||||

| in | 3Q20 | 3Q19 | 3Q20 | 3Q19 | |||||

| Adjusted results excluding signficant items (CHF million) | |||||||||

| Net revenues | 700 | 692 | 594 | 688 | |||||

| of which gain related to InvestLab transfer | 0 | 0 | 0 | (98) | |||||

| Adjusted net revenues excluding significant items | 700 | 692 | 594 | 590 | |||||

| Provision for credit losses | 5 | 14 | 47 | 14 | |||||

| Total operating expenses | 495 | 451 | 317 | 332 | |||||

| Restructuring expenses | (36) | – | (5) | – | |||||

| Adjusted total operating expenses | 459 | 451 | 312 | 332 | |||||

| Income before taxes | 200 | 227 | 230 | 342 | |||||

| Total adjustments and significant items | 36 | 0 | 5 | (98) | |||||

| Adjusted income before taxes excluding significant items | 236 | 227 | 235 | 244 | |||||

Page A-4

| Appendix |  |

| International Wealth Management | |||||||||||||||||

| in / end of | % change | in / end of | % change | ||||||||||||||

| 3Q20 | 2Q20 | 3Q19 | QoQ | YoY | 9M20 | 9M19 | YoY | ||||||||||

| Results (CHF million) | |||||||||||||||||

| Net revenues | 1,142 | 1,266 | 1,435 | (10) | (20) | 3,885 | 4,180 | (7) | |||||||||

| of which Private Banking | 836 | 905 | 1,035 | (8) | (19) | 2,773 | 2,995 | (7) | |||||||||

| of which Asset Management | 306 | 361 | 400 | (15) | (24) | 1,112 | 1,185 | (6) | |||||||||

| Provision for credit losses | 12 | 34 | 14 | (65) | (14) | 85 | 32 | 166 | |||||||||

| Total operating expenses | 915 | 892 | 906 | 3 | 1 | 2,736 | 2,713 | 1 | |||||||||

| Income before taxes | 215 | 340 | 515 | (37) | (58) | 1,064 | 1,435 | (26) | |||||||||

| of which Private Banking | 197 | 256 | 402 | (23) | (51) | 798 | 1,095 | (27) | |||||||||

| of which Asset Management | 18 | 84 | 113 | (79) | (84) | 266 | 340 | (22) | |||||||||

| Metrics (%) | |||||||||||||||||

| Return on regulatory capital | 15.7 | 25.1 | 36.5 | – | – | 26.4 | 34.6 | – | |||||||||

| Cost/income ratio | 80.1 | 70.5 | 63.1 | – | – | 70.4 | 64.9 | – | |||||||||

| Private Banking | |||||||||||||||||

| Assets under management (CHF billion) | 352.0 | 344.5 | 365.2 | 2.2 | (3.6) | 352.0 | 365.2 | (3.6) | |||||||||

| Net new assets (CHF billion) | 6.9 | 1.8 | 3.6 | – | – | 12.4 | 10.4 | – | |||||||||

| Gross margin (annualized) (bp) | 96 | 107 | 114 | – | – | 106 | 110 | – | |||||||||

| Net margin (annualized) (bp) | 23 | 30 | 44 | – | – | 31 | 40 | – | |||||||||

| Asset Management | |||||||||||||||||

| Assets under management (CHF billion) | 438.5 | 423.8 | 426.0 | 3.5 | 2.9 | 438.5 | 426.0 | 2.9 | |||||||||

| Net new assets (CHF billion) | 5.0 | 4.1 | 5.9 | – | – | 9.2 | 14.0 | – | |||||||||

| Reconciliation of adjustment items | |||||||||||

| International Wealth Management | |||||||||||

| in | 3Q20 | 2Q20 | 3Q19 | 9M20 | 9M19 | ||||||

| Adjusted results excluding signficant items (CHF million) | |||||||||||

| Net revenues | 1,142 | 1,266 | 1,435 | 3,885 | 4,180 | ||||||

| of which real estate gains | 0 | 0 | 0 | 0 | (13) | ||||||

| of which gain related to InvestLab transfer | 0 | 0 | (131) | (218) | (131) | ||||||

| Adjusted net revenues excluding significant items | 1,142 | 1,266 | 1,304 | 3,667 | 4,036 | ||||||

| Provision for credit losses | 12 | 34 | 14 | 85 | 32 | ||||||

| Total operating expenses | 915 | 892 | 906 | 2,736 | 2,713 | ||||||

| Restructuring expenses | (29) | – | – | (29) | – | ||||||

| Major litigation provisions | (20) | 32 | 0 | 12 | 27 | ||||||

| Expenses related to real estate disposals | (4) | 0 | 0 | (3) | (12) | ||||||

| Adjusted total operating expenses | 862 | 924 | 906 | 2,716 | 2,728 | ||||||

| Income before taxes | 215 | 340 | 515 | 1,064 | 1,435 | ||||||

| Total adjustments and significant items | 53 | (32) | (131) | (198) | (159) | ||||||

| Adjusted income before taxes income excluding significant items | 268 | 308 | 384 | 866 | 1,276 | ||||||

Page A-5

| Appendix |  |

| Reconciliation of adjustment items | |||||||||

| International Wealth Management – Private Banking | International Wealth Management – Asset Management | ||||||||

| in | 3Q20 | 3Q19 | 3Q20 | 3Q19 | |||||

| Adjusted results excluding signficant items (CHF million) | |||||||||

| Net revenues | 836 | 1,035 | 306 | 400 | |||||

| of which gain related to InvestLab transfer | 0 | (131) | 0 | 0 | |||||

| Adjusted net revenues excluding significant items | 836 | 904 | 306 | 400 | |||||

| Provision for credit losses | 8 | 15 | 4 | (1) | |||||

| Total operating expenses | 631 | 618 | 284 | 288 | |||||

| Restructuring expenses | (16) | – | (13) | – | |||||

| Major litigation provisions | (20) | 0 | 0 | 0 | |||||

| Expenses related to real estate disposals | (3) | 0 | (1) | 0 | |||||

| Adjusted total operating expenses | 592 | 618 | 270 | 288 | |||||

| Income before taxes | 197 | 402 | 18 | 113 | |||||

| Total adjustments and significant items | 39 | (131) | 14 | 0 | |||||

| Adjusted income before taxes income excluding significant items | 236 | 271 | 32 | 113 | |||||

| Reconciliation of adjustment items | |||||||||||||||||

| Wealth Management | |||||||||||||||||

| in | 3Q20 | 3Q19 | 9M20 | 9M19 | |||||||||||||

| Adjusted net revenues excluding significant items and FX impact (CHF million) | |||||||||||||||||

| Net revenues | 2'264 | 2'508 | 7'449 | 7'492 | |||||||||||||

| of which real estate gains | 0 | 0 | 0 | (130) | |||||||||||||

| of which gain related to InvestLab transfer | 0 | (229) | (40) | (229) | |||||||||||||

| of which Pfandbriefbank gain | 0 | 0 | (134) | 0 | |||||||||||||

| of which FX impact | 133 | 0 | 315 | 0 | |||||||||||||

| Adjusted net revenues excluding significant items and FX impact | 2,397 | 2,279 | 7,590 | 7,133 | |||||||||||||

| Net interest income | 955 | 1'034 | 3'002 | 3'005 | |||||||||||||

| of which FX impact | 39 | 0 | 92 | 0 | |||||||||||||

| Net interest income excluding FX impact | 994 | 1,034 | 3,094 | 3,005 | |||||||||||||

| Recurring commissions and fees | 556 | 608 | 1'680 | 1'784 | |||||||||||||

| of which FX impact | 32 | 0 | 83 | 0 | |||||||||||||

| Recurring commissions and fees excluding FX impact | 588 | 608 | 1,763 | 1,784 | |||||||||||||

| Transaction-based revenues | 751 | 638 | 2'599 | 2'346 | |||||||||||||

| of which FX impact | 62 | 0 | 138 | 0 | |||||||||||||

| Transaction-based revenues excluding FX impact | 813 | 638 | 2,737 | 2,346 | |||||||||||||

Page A-6

| Appendix |  |

| Asia Pacific | |||||||||||||||||

| in / end of | % change | in / end of | % change | ||||||||||||||

| 3Q20 | 2Q20 | 3Q19 | QoQ | YoY | 9M20 | 9M19 | YoY | ||||||||||

| Results (CHF million) | |||||||||||||||||

| Net revenues | 728 | 808 | 781 | (10) | (7) | 2,371 | 2,279 | 4 | |||||||||

| Provision for credit losses | 45 | 86 | 20 | (48) | 125 | 230 | 41 | 461 | |||||||||

| Total operating expenses | 506 | 526 | 491 | (4) | 3 | 1,550 | 1,517 | 2 | |||||||||

| 177 | 196 | 270 | (10) | (34) | 721 | – | |||||||||||

| Metrics (%) | |||||||||||||||||

| Return on regulatory capital | 19.4 | 20.0 | 24.6 | – | – | 20.5 | 22.2 | – | |||||||||

| Cost/income ratio | 69.5 | 65.1 | 62.9 | – | – | 65.4 | 66.6 | – | |||||||||

| Assets under management (CHF billion) | 218.5 | 215.8 | 217.1 | 1.3 | 0.6 | 218.5 | 217.1 | 0.6 | |||||||||

| Net new assets (CHF billion) | 2.2 | 4.5 | 1.7 | – | – | 9.7 | 8.0 | – | |||||||||

| Gross margin (annualized) (bp) | 135 | 155 | 145 | – | – | 149 | 142 | – | |||||||||

| Net margin (annualized) (bp) | 33 | 38 | 50 | – | – | 37 | 45 | – | |||||||||

| Reconciliation of adjustment items | |||||||||||

| Asia Pacific | |||||||||||

| in | 3Q20 | 2Q20 | 3Q19 | 9M20 | 9M19 | ||||||

| Adjusted results excluding significant items (CHF million) | |||||||||||

| Net revenues | 728 | 808 | 781 | 2,371 | 2,279 | ||||||

| of which gain related to InvestLab transfer | 0 | 0 | (98) | (25) | 0 | ||||||

| Adjusted net revenues excluding significant items | 728 | 808 | 683 | 2,346 | 2,279 | ||||||

| Provision for credit losses | 45 | 86 | 20 | 230 | 41 | ||||||

| Total operating expenses | 506 | 526 | 491 | 1,550 | 1,517 | ||||||

| Restructuring expenses | (2) | – | – | (2) | – | ||||||

| Adjusted total operating expenses | 504 | 526 | 491 | 1,548 | 1,517 | ||||||

| Income before taxes | 177 | 196 | 270 | 591 | 721 | ||||||

| Total adjustments and significant items | 2 | 0 | (98) | (23) | 0 | ||||||

| Adjusted income before taxes excluding significant items | 179 | 196 | 172 | 568 | 721 | ||||||

Page A-7

| Appendix |  |

| Investment Bank | |||||||||||||||||

| in / end of | % change | in / end of | % change | ||||||||||||||

| 3Q20 | 2Q20 | 3Q19 | QoQ | YoY | 9M20 | 9M19 | YoY | ||||||||||

| Results (CHF million) | |||||||||||||||||

| Net revenues | 2,047 | 2,862 | 2,006 | (28) | 2 | 6,989 | 6,214 | 12 | |||||||||

| Provision for credit losses | (14) | 143 | 19 | – | – | 433 | 37 | – | |||||||||

| Total operating expenses | 1,691 | 1,807 | 1,678 | (6) | 1 | 5,191 | 5,206 | 0 | |||||||||

| Income before taxes | 370 | 912 | 309 | (59) | 20 | 1,365 | 971 | 41 | |||||||||

| Metrics (%) | |||||||||||||||||

| Return on regulatory capital | 11.4 | 25.8 | 8.5 | – | – | 13.3 | 9.0 | – | |||||||||

| Cost/income ratio | 82.6 | 63.1 | 83.6 | – | – | 74.3 | 83.8 | – | |||||||||

| Reconciliation of adjustment items | |||||||||||||||||||

| Investment Bank | |||||||||||||||||||

| in | 3Q20 | 2Q20 | 3Q19 | 9M20 | 9M19 | ||||||||||||||

| Adjusted results (USD million) | |||||||||||||||||||

| Net revenues | 2,245 | 2,981 | 2,023 | 7,381 | 6,239 | ||||||||||||||

| Provision for credit losses | (16) | 148 | 19 | 447 | 36 | ||||||||||||||

| Total operating expenses | 1,856 | 1,882 | 1,694 | 5,492 | 5,227 | ||||||||||||||

| Restructuring expenses | (36) | – | – | (36) | – | ||||||||||||||

| Major litigation provisions | 0 | (25) | 0 | (25) | 0 | ||||||||||||||

| Expenses related to real estate disposals | (23) | (3) | (1) | (22) | (31) | ||||||||||||||

| Adjusted total operating expenses | 1,797 | 1,854 | 1,693 | 5,409 | 5,196 | ||||||||||||||

| Income before taxes | 405 | 951 | 310 | 1,442 | 976 | ||||||||||||||

| Total adjustments | 59 | 28 | 1 | 83 | 31 | ||||||||||||||

| Adjusted income before taxes | 464 | 979 | 311 | 1,525 | 1,007 | ||||||||||||||

| Global investment banking revenues | |||||||||

| in | 3Q20 | 3Q19 | 9M20 | 9M19 | |||||

| Global investment banking revenues (USD million) | |||||||||

| Fixed income sales and trading | 921 | 834 | 3,478 | 2,585 | |||||

| Equity sales and trading | 588 | 560 | 2,016 | 1,762 | |||||

| Capital markets | 782 | 511 | 1,960 | 1,581 | |||||

| Advisory and other fees | 160 | 197 | 573 | 540 | |||||

| Other revenues | (89) | (1) | (255) | 33 | |||||

| Global investment banking revenues | 2,362 | 2,101 | 7,772 | 6,501 | |||||

Page A-8

| Appendix |  |

Cautionary statement regarding forward-looking information

This document contains statements that constitute forward-looking statements. In addition, in the future we, and others on our behalf, may make statements that constitute forward-looking statements. Such forward-looking statements may include, without limitation, statements relating to the following:

■ our plans, targets or goals;

■ our future economic performance or prospects;

■ the potential effect on our future performance of certain contingencies; and

■ assumptions underlying any such statements.

Words such as “believes,” “anticipates,” “expects,” “intends” and “plans” and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. We do not intend to update these forward-looking statements.

By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, and risks exist that predictions, forecasts, projections and other outcomes described or implied in forward-looking statements will not be achieved. We caution you that a number of important factors could cause results to differ materially from the plans, targets, goals, expectations, estimates and intentions expressed in such forward-looking statements. These factors include:

■ the ability to maintain sufficient liquidity and access capital markets;

■ market volatility and interest rate fluctuations and developments affecting interest rate levels, including the persistence of a low or negative interest rate environment;

■ the strength of the global economy in general and the strength of the economies of the countries in which we conduct our operations, in particular the risk of negative impacts of COVID-19 on the global economy and financial markets and the risk of continued slow economic recovery or downturn in the EU, the US or other developed countries or in emerging markets in 2020 and beyond;

■ the emergence of widespread health emergencies, infectious diseases or pandemics, such as COVID-19, and the actions that may be taken by governmental authorities to contain the outbreak or to counter its impact on our business;

■ potential risks and uncertainties relating to the severity of impacts from COVID-19 and the duration of the pandemic, including potential material adverse effects on our business, financial condition and results of operations;

■ the direct and indirect impacts of deterioration or slow recovery in residential and commercial real estate markets;

■ adverse rating actions by credit rating agencies in respect of us, sovereign issuers, structured credit products or other credit-related exposures;

■ the ability to achieve our strategic goals, including those related to our targets, ambitions and financial goals;

■ the ability of counterparties to meet their obligations to us and the adequacy of our allowance for credit losses;

■ the effects of, and changes in, fiscal, monetary, exchange rate, trade and tax policies, as well as currency fluctuations;

■ political, social and environmental developments, including war, civil unrest or terrorist activity and climate change;

■ the ability to appropriately address social, environmental and sustainability concerns that may arise from our business activities;

■ the effects of, and the uncertainty arising from, the UK’s withdrawal from the EU;

■ the possibility of foreign exchange controls, expropriation, nationalization or confiscation of assets in countries in which we conduct our operations;

■ operational factors such as systems failure, human error, or the failure to implement procedures properly;

■ the risk of cyber attacks, information or security breaches or technology failures on our business or operations;

■ the adverse resolution of litigation, regulatory proceedings and other contingencies;

■ actions taken by regulators with respect to our business and practices and possible resulting changes to our business organization, practices and policies in countries in which we conduct our operations;

■ the effects of changes in laws, regulations or accounting or tax standards, policies or practices in countries in which we conduct our operations;

■ the expected discontinuation of LIBOR and other interbank offered rates and the transition to alternative reference rates;

■ the potential effects of changes in our legal entity structure;

■ competition or changes in our competitive position in geographic and business areas in which we conduct our operations;

■ the ability to retain and recruit qualified personnel;

■ the ability to maintain our reputation and promote our brand;

■ the ability to increase market share and control expenses;

■ technological changes instituted by us, our counterparties or competitors;

■ the timely development and acceptance of our new products and services and the perceived overall value of these products and services by users;