Sustainability Report 2023

| Managing sustainability and climate risks

95

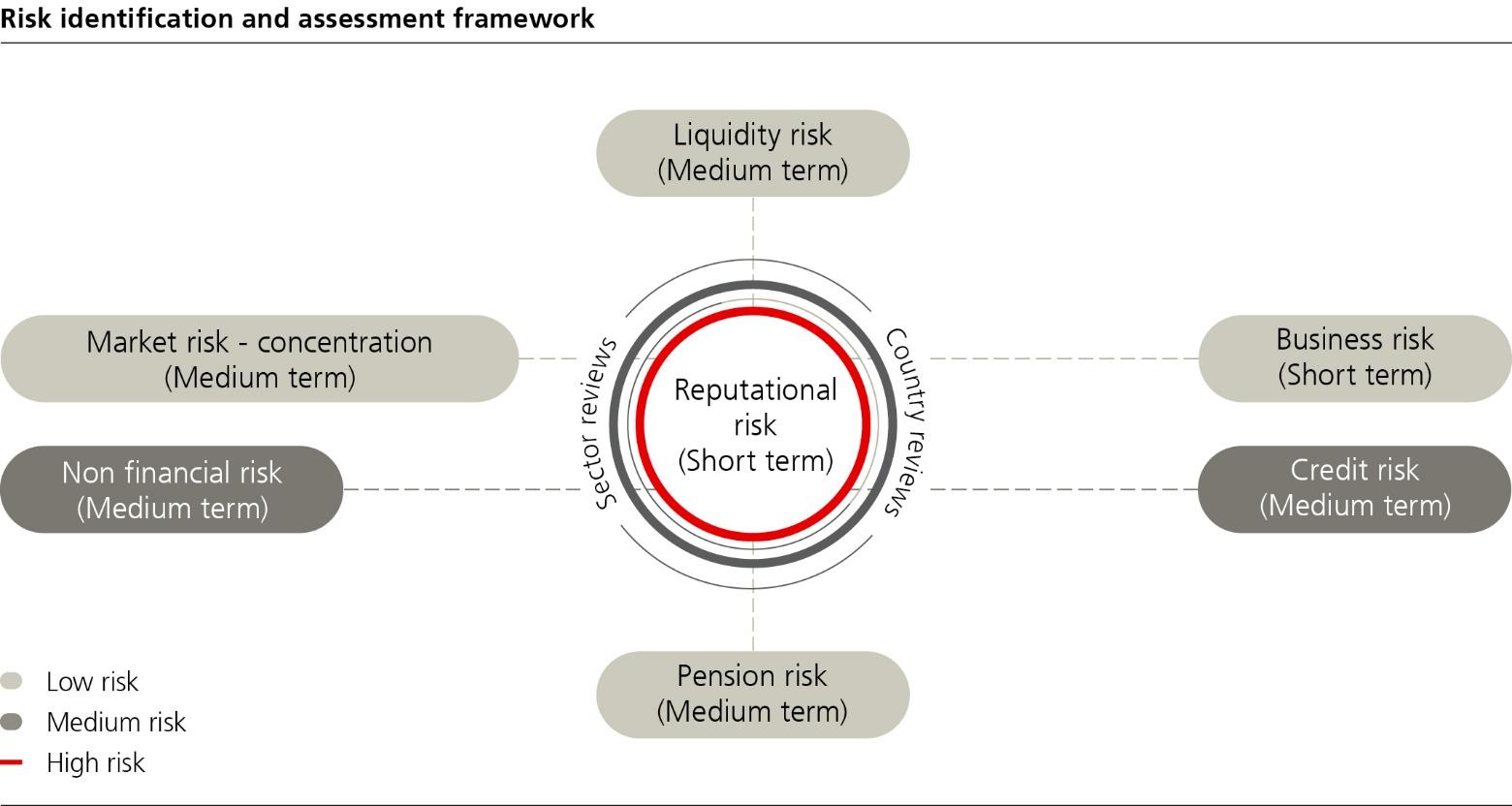

Market risk

(traded and

not traded)

Potential financial impacts to UBS from price

shifts and/or market volatility. A changing

physical environment (including climate

change) may affect the value of companies

reliant on the natural environment and/or

how the market perceives these companies.

The transition to a low-carbon economy

through climate policies, low-carbon

technologies, demand shifts and/or market

perception may also impact the value of

UBS’s positions and/or lead to a breakdown

in correlations between risk factors (e.g.,

prompting a change in market liquidity

and/or challenging assumptions in UBS’s

model).

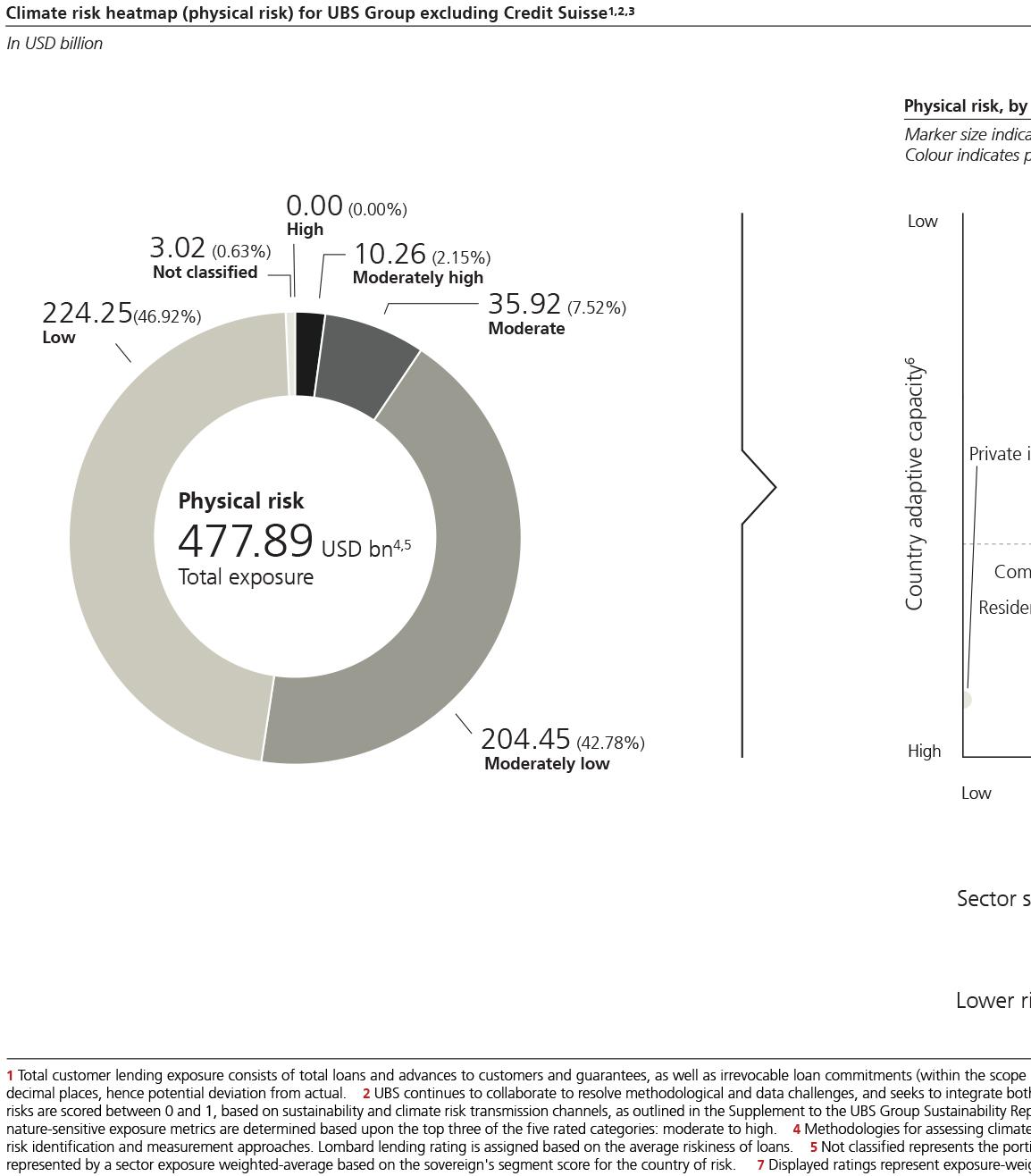

In 2023, we assessed the risk from planned portfolios,

in line with our multi-year SCR

Initiative, and established solutions for integrating

climate and nature-related risks into

our market risk management framework. Progress on integrating

climate and nature-

related risks into our market risk management

was incrementally driven by

enhancing

analytical capacity, automating

UBS sector-level heatmaps in our market

risk

monitoring systems, and establishing

a

quantitative risk appetite.

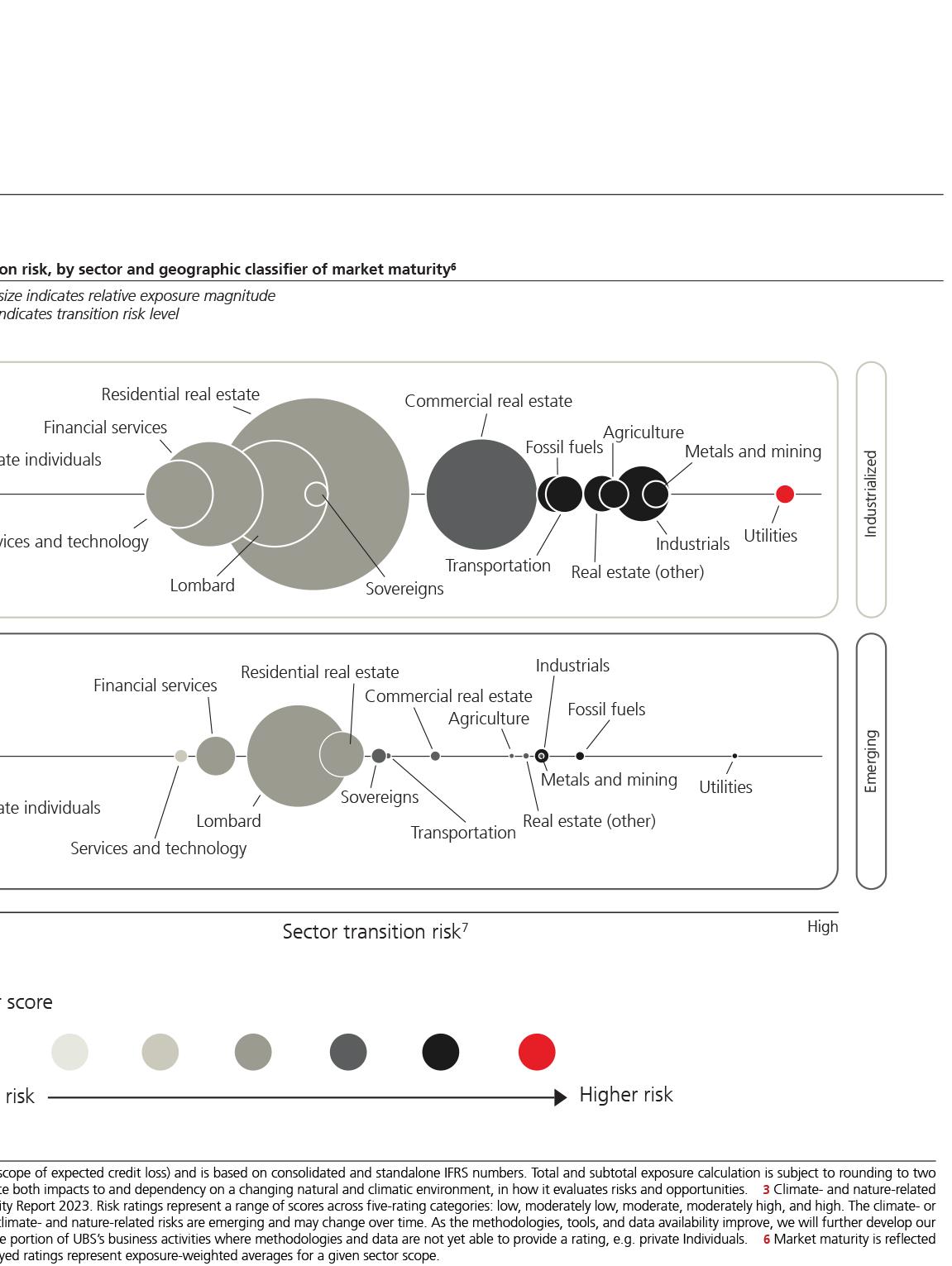

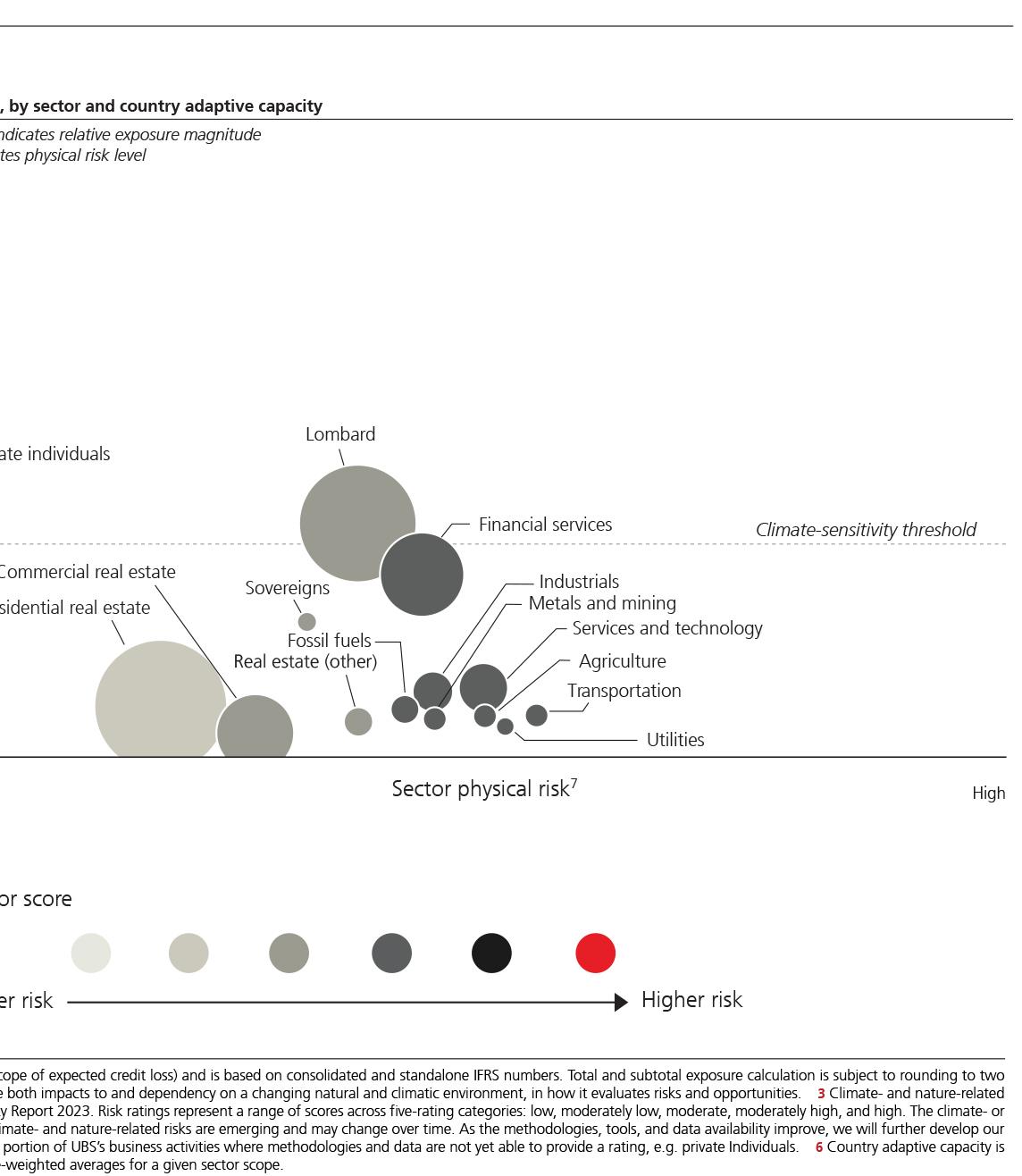

Enhancing analytical capacity:

Leveraging existing sector-level heatmap

methodologies and our in-house scenario development

capacity, we sought to

perform a loss-driven materiality assessment.

By linking the risk ratings with adverse-

scenario-driven shocks, UBS was able to further

examine the correlations between risk

factors and understand the short-term loss potentials

for climate. For the first time in

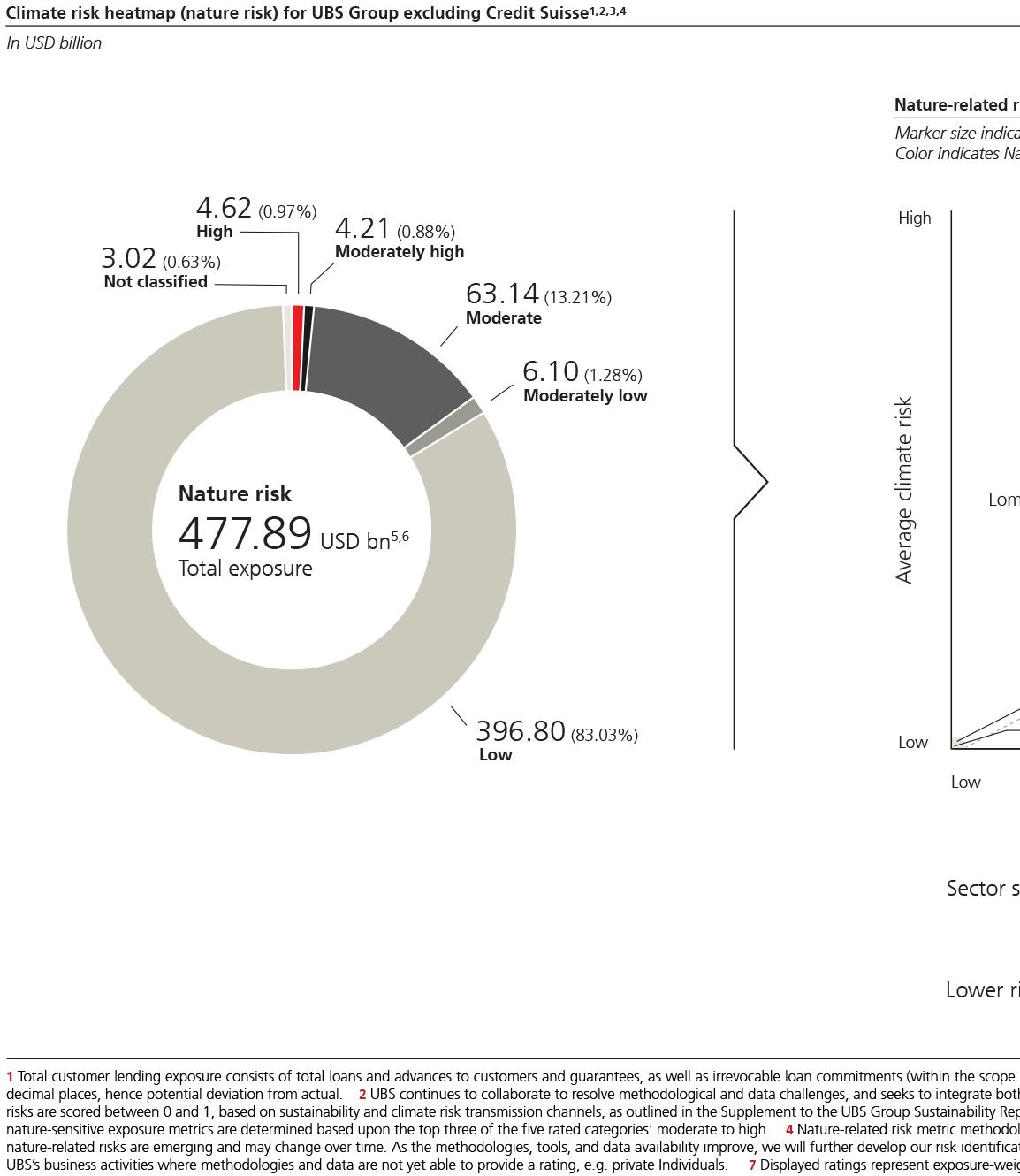

2023, UBS was also able to review nature risk sensitivities,

following the introduction

of a nature risk heatmap.

Automation:

Market risks systems allow daily monitoring,

reporting and control. By

integrating these with our centralized climate

sector-level heatmaps, we are able to

understand and react to drivers of climate impacts

on our portfolios through the use

of a quantitative risk appetite for relevant portfolios.

Quantitative risk appetite:

For the relevant portfolios, climate risk concentration

triggers were introduced in 2023 based on the sector-level

climate risk heatmaps.

The

solution allows for daily monitoring of positions

that are considered inherently

sensitive to climate risks, including an automated

breach escalation process along with

the market risk escalation path for concentration

limits, providing an opportunity for

remediation actions. The triggers cover credit delta

and equity delta aggregated in

accordance with the “sensitivity,” as defined through the UBS heatmapping

Looking ahead to 2024 and beyond

, UBS is building the capacity to be able to

further differentiate risks at the company/issuer level.

Through the new “climate risk

rating model”,

UBS will incorporate third-party data with

an automated model to be

able to further establish company-level performance

against inherent risks defined

through the sector-level heatmap. We have also started to adapt UBS in-house

long-

term scenarios to the specifics of short-term

market risk analytical requirements.

Further adaptation

and implementation of this short-term perspective

of UBS’s adverse

climate scenario is expected for 2024.

The capabilities and processes currently established and under

development are also

being planned for expansion to the UBS global

market risk portfolios in 2024.

Liquidity risk

The potential impact on liquidity adequacy is

driven by risks from a changing physical

climate, the transition to a low-carbon

economy, or impacts and/or dependencies

on our natural environment (e.g.,

biodiversity, clean water, fresh air). Climate

events have been proven to affect funding

conditions, and therefore liquidity buffers

across broader banks (BCBS). Climate-

related risks are considered as an additional

driver of liquidity risk. As such, they may

impact our liquidity adequacy directly or

indirectly through our ability to raise funds,

liquidate assets and/or our customers’

demand for liquidity. This could result in net

cash outflows or depletion of our liquidity

In 2023, UBS enhanced its analytical capability

to assess the impact of climate shocks

on the liquidity position of planned portfolios,

in line with the multi-year SCR Initiative.

For the first time in 2023, UBS was also

able to review nature risk sensitivities,

following the introduction of a nature risk heatmap. As

part of the SCR Initiative, the

2023 climate and environmental assessment is being

developed further for global

rollout in the coming years,

2024 and 2025. In addition, a dedicated

Treasury Risk

Control team, focusing on sustainability and climate

risks, was established in Q3 2023

to support this work. The integration

of identified material climate-related risks into

the internal liquidity risk management framework

will be an iterative process as we

continuously improve the methodology, along with improving the availability and

quality of required data in the industry, and enhanced analytics and insights over

time.

Non-financial

risk (NFR)

Non-financial impact on UBS (compliance,

operational risk and financial crime) from

inadequate or failed internal processes,

people and systems and/or externally

due to

physical climate events or stakeholder legal

action

In 2023, we continued to integrate climate

considerations into the existing NFR

management framework. Specific climate risk

driver scenarios were defined for impact

on the exposure to taxonomy NFR, documented in

a consolidated Root Cause Library

to assess the completeness of controls against known

transmission channels. By the

end of 2023, 14 out of 18 taxonomies were assessed

(with a target to complete

across residual taxonomies by mid-2024). We also started to develop

a roadmap to

integrate climate-related considerations

into operational risk regulatory/economic

capital determination for inclusion in the GCRG

NFR measurement model governance

process with selective calibration applied initially to

Suitability and Product Lifecycle.

Given current strong capitalization, related ESG risks were assessed

as sufficiently and

inherently captured in their respective standalone capital exposures, but

GCRG will

continue to build on its modelling capabilities

by enhancing and expanding the risk

identification and materiality assessment to be

performed quantitatively across

relevant NFR categories and account for material

climate-related model dynamics.

Reputational

risk

Risk of an unfavorable perception,

or a

decline in UBS’s reputation,

from the point

of view of clients, industries, shareholders,

regulators, employees or the general public,

which may lead to potential financial losses

and/or loss of market share.

Risk is considered across all business

activities, transactions, and decisions.

We assessed the design of the reputational risk framework

to be generally robust in

terms of roles and responsibilities, escalation requirements, and

review and approval

authorities for sustainability-related risks. The reputational

risk dashboard now

captures the key risk indicators on a quarterly

basis, including metrics for financial

crime prevention, sustainability and climate risks,

client complaints, new business and

›

Refer to the “Supplement to Managing sustainability and climate risks” section of the Supplement to the UBS

Group Sustainability Report 2023, available at

ubs.com/sustainability-reporting

, for more information about our

vision for integrating sustainability and climate risks