31 December 2023 Pillar 3 Report |

UBS Group | Introduction and basis for preparation

11

Category

Definition of risk

Regulatory risk exposure

Risk-weighted assets

II. Counterparty credit risk

Counterparty credit

risk (CCR)

CCR is the risk that a counterparty for over-

the-counter (OTC) derivatives, exchange-

traded derivatives (ETDs) or securities

financing transactions (SFTs) will default

before the final settlement of a transaction

and cause a loss to the firm if the transaction

has a positive economic value at the time of

default.

Refer to section 6, Counterparty credit risk.

We primarily use internal models to measure

CCR exposures to third parties. All internal

models are approved by FINMA.

–

For OTC derivatives and ETDs

,

we apply the

effective expected positive exposure (EEPE)

and stressed expected positive exposure

(SEPE) as defined in the Basel

III framework.

–

For SFTs

, we apply the close-out period

approach.

In certain instances where risk models are not

available:

–

Exposure on OTC derivatives and ETDs

calculated considering the net positive

replacement values and potential future

exposure.

–

Exposure for SFTs

Accounting Standards carrying amount, net

of

collateral mitigation.

We apply two approaches to measure CCR RWA.

–

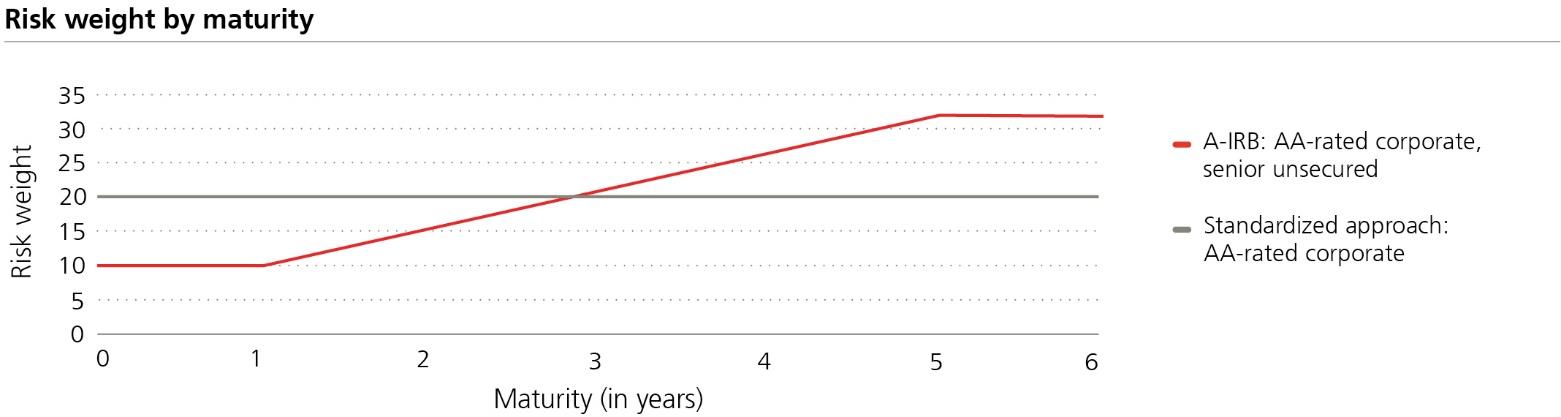

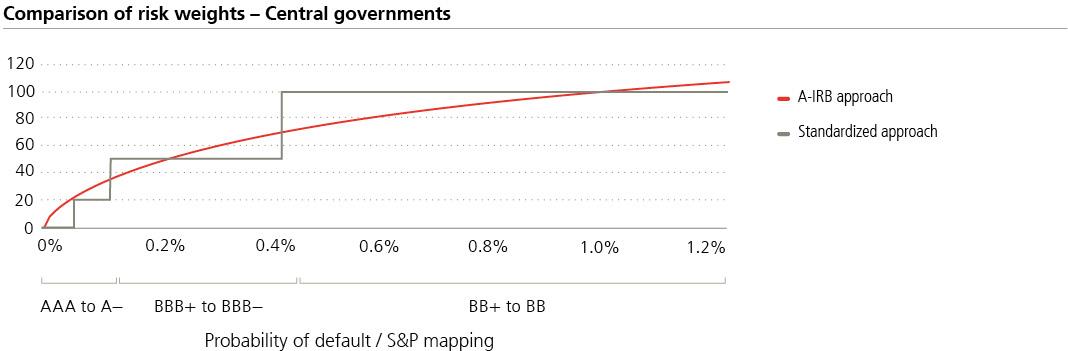

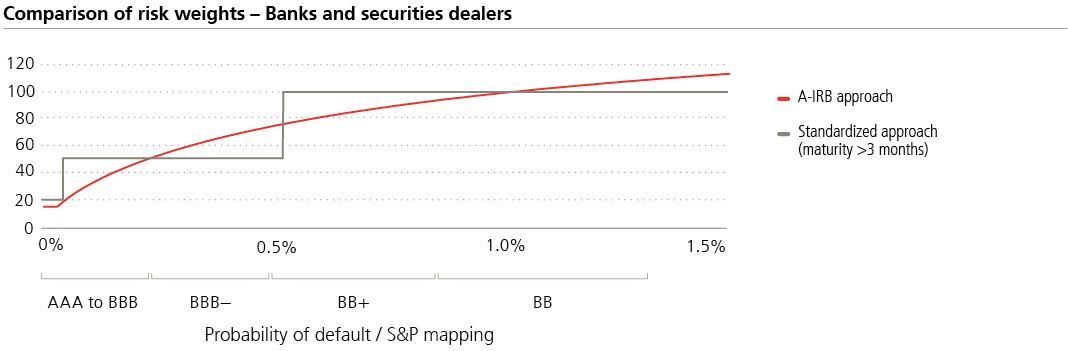

Advanced internal ratings-based (A-IRB)

approach

, applied for the majority of our

businesses. Counterparty risk weights are

determined by reference to internal counterparty

ratings and LGD estimates.

–

Standardized approach (SA),

generally based on

external ratings for a sub-set of our credit

portfolio, where internal measures are not

available.

We apply an additional credit valuation adjustment

(CVA) capital charge to hold capital against the risk

of mark-to-market losses associated with the

deterioration of counterparty credit quality.

Settlement risk

Settlement risk is the risk of loss resulting from

transactions that involve exchange of value

(e.g., security versus cash) where we must

deliver without first being able to determine

with certainty that we will receive the

countervalue.

Refer to section 3, Overview of risk-weighted

assets.

The IFRS Accounting Standards carrying

amount is the basis for measuring settlement

risk exposure.

We measure settlement risk RWA through the

application of prescribed regulatory risk weights to

the settlement risk exposure.

III. Securitization exposures in the banking book

Securitization

exposures in the

banking book

Exposures arising from traditional and

synthetic securitizations held in our banking

Refer to section 8, Securitizations.

The IFRS Accounting Standards carrying

amount after eligible regulatory credit risk

mitigation and credit conversion factor is the

basis for measuring securitization exposure.

For synthetic securitization transactions, the

exposure is equal to the fair value of the net

long or short securitization position.

Consistent with the BCBS, we apply the FINMA-

defined hierarchy of approaches for banking book

securitizations to measure RWA.

–

Internal ratings-based approach (SEC-IRBA)

,

considering the advanced IRB risk weights, if the

securitized pool largely consists of IRB positions

and internal ratings are available.

–

External ratings-based approach (SEC-ERBA)

, if

the IRB approach cannot be applied, risk weights

are applied based on external ratings, provided

that we are able to demonstrate our expertise in

critically reviewing and challenging the external

–

Standardized approach (SEC-SA) or 1,250% risk

weight factor,

if none of the aforementioned

approaches can be applied, we would apply the

standardized approach where the delinquency

status of a significant portion of the underlying

exposure can be determined or a risk weight of

1,250%.

For re-securitization exposures we apply either the

standardized approach or a risk weight factor of

1,250%.