UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2011

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

000-50327

(Commission File Number)

iPass Inc.

(Exact name of Registrant as specified in its charter)

| | |

| Delaware | | 93-1214598 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

3800 Bridge Parkway

Redwood Shores, California 94065

(Address of principal executive offices, including zip code)

(650) 232-4100

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232 405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files. Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | x |

| | | |

| Non-accelerated filer | | ¨ (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The number of shares outstanding of the Registrant’s Common Stock, $0.001 par value, as of October 31, 2011 was 58,969,492.

IPASS INC.

FORM 10-Q

FOR THE QUARTERLY PERIOD ENDED SEPTEMBER 30, 2011

TABLE OF CONTENTS

2

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements (Unaudited)

IPASS INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

| | | | | | | | |

| | | September 30,

2011 | | | December 31,

2010 | |

| | | (Unaudited, in thousands) | |

| ASSETS | | | | | | | | |

Current assets: | | | | | | | | |

Cash and cash equivalents | | $ | 26,297 | | | $ | 30,746 | |

Accounts receivable, net of allowance for doubtful accounts of $1,628 and $1,757, respectively | | | 22,196 | | | | 24,034 | |

Prepaid expenses and other current assets | | | 6,191 | | | | 6,630 | |

| | | | | | | | |

Total current assets | | | 54,684 | | | | 61,410 | |

| | | | | | | | |

Property and equipment, net | | | 3,782 | | | | 4,264 | |

Intangible assets, net | | | 229 | | | | 408 | |

Other assets | | | 7,133 | | | | 7,900 | |

| | | | | | | | |

Total assets | | $ | 65,828 | | | $ | 73,982 | |

| | | | | | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | | |

Current liabilities: | | | | | | | | |

Accounts payable | | $ | 10,608 | | | $ | 13,552 | |

Accrued liabilities | | | 11,023 | | | | 15,333 | |

Deferred revenue, short-term | | | 4,137 | | | | 4,119 | |

| | | | | | | | |

Total current liabilities | | | 25,768 | | | | 33,004 | |

| | | | | | | | |

Deferred revenue, long-term | | | 3,006 | | | | 2,435 | |

Other long-term liabilities | | | 514 | | | | 721 | |

| | | | | | | | |

Total liabilities | | | 29,288 | | | | 36,160 | |

| | | | | | | | |

Commitments and contingencies (Note 8) | | | | | | | | |

Stockholders’ equity: | | | | | | | | |

Common stock | | | 59 | | | | 58 | |

Additional paid-in capital | | | 209,047 | | | | 206,992 | |

Accumulated deficit | | | (172,566 | ) | | | (169,228 | ) |

| | | | | | | | |

Total stockholders’ equity | | | 36,540 | | | | 37,822 | |

| | | | | | | | |

Total liabilities and stockholders’ equity | | $ | 65,828 | | | $ | 73,982 | |

| | | | | | | | |

See Accompanying Notes to Condensed Consolidated Financial Statements

3

IPASS INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | | Nine Months Ended

September 30, | |

| | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

| | | (Unaudited, in thousands, except share and per share amounts) | |

Revenues | | $ | 34,411 | | | $ | 38,058 | | | $ | 106,326 | | | $ | 117,519 | |

Cost of revenues and operating expenses: | | | | | | | | | | | | | | | | |

Network access costs | | | 15,647 | | | | 17,338 | | | | 50,249 | | | | 54,605 | |

Network operations | | | 5,427 | | | | 6,544 | | | | 16,845 | | | | 20,872 | |

Research and development | | | 3,715 | | | | 3,566 | | | | 10,843 | | | | 10,210 | |

Sales and marketing | | | 5,350 | | | | 5,916 | | | | 16,053 | | | | 18,314 | |

General and administrative | | | 5,092 | | | | 5,793 | | | | 15,120 | | | | 16,824 | |

Restructuring charges (benefit) and related adjustments | | | (7 | ) | | | 179 | | | | (162 | ) | | | 466 | |

Amortization of intangible assets | | | 60 | | | | 76 | | | | 179 | | | | 363 | |

| | | | | | | | | | | | | | | | |

Total cost of revenue and operating expenses | | | 35,284 | | | | 39,412 | | | | 109,127 | | | | 121,654 | |

| | | | | | | | | | | | | | | | |

Operating loss | | | (873 | ) | | | (1,354 | ) | | | (2,801 | ) | | | (4,135 | ) |

Interest income | | | 5 | | | | 22 | | | | 104 | | | | 59 | |

Foreign exchange gains (losses) and other income (expenses), net | | | 66 | | | | (478 | ) | | | (395 | ) | | | 140 | |

| | | | | | | | | | | | | | | | |

Loss before income taxes | | | (802 | ) | | | (1,810 | ) | | | (3,092 | ) | | | (3,936 | ) |

Provision for (benefit from) income taxes | | | 1 | | | | 96 | | | | 246 | | | | (87 | ) |

| | | | | | | | | | | | | | | | |

Net loss | | $ | (803 | ) | | $ | (1,906 | ) | | $ | (3,338 | ) | | $ | (3,849 | ) |

| | | | | | | | | | | | | | | | |

Net loss per share: | | | | | | | | | | | | | | | | |

Basic and diluted | | $ | (0.01 | ) | | $ | (0.03 | ) | | $ | (0.06 | ) | | $ | (0.07 | ) |

Number of shares used in per share calculations: | | | | | | | | | | | | | | | | |

Basic and diluted | | | 58,776,585 | | | | 57,615,067 | | | | 58,346,859 | | | | 58,930,806 | |

See Accompanying Notes to Condensed Consolidated Financial Statements

4

IPASS INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | | | | | | | |

| | | Nine Months Ended

September 30, | |

| | | 2011 | | | 2010 | |

| | | (Unaudited, in thousands) | |

Cash flows from operating activities: | | | | | | | | |

Net loss | | $ | (3,338 | ) | | $ | (3,849 | ) |

Adjustments to reconcile net loss to net cash provided by (used in) operating activities: | | | | | | | | |

Stock-based compensation | | | 1,348 | | | | 1,245 | |

Amortization of intangible assets | | | 179 | | | | 363 | |

Depreciation, amortization and accretion | | | 1,731 | | | | 2,536 | |

Loss on disposal of property and equipment | | | 87 | | | | 3 | |

Provision for doubtful accounts | | | 369 | | | | 1,060 | |

Change in sales tax liability estimation | | | (395 | ) | | | — | |

Changes in operating assets and liabilities: | | | | | | | | |

Accounts receivable | | | 1,469 | | | | 2,359 | |

Prepaid expenses and other current assets | | | 439 | | | | (484 | ) |

Other assets | | | 481 | | | | 410 | |

Accounts payable | | | (3,027 | ) | | | (1,720 | ) |

Accrued liabilities | | | (3,915 | ) | | | (434 | ) |

Deferred revenues | | | 589 | | | | (527 | ) |

Other liabilities | | | (207 | ) | | | (67 | ) |

| | | | | | | | |

Net cash provided by (used in) operating activities | | | (4,190 | ) | | | 895 | |

| | | | | | | | |

Cash flows from investing activities: | | | | | | | | |

Maturities of short-term investments | | | — | | | | 3,778 | |

Purchases of property and equipment | | | (1,253 | ) | | | (2,950 | ) |

Change in restricted cash pledged for letter of credit | | | 286 | | | | (678 | ) |

| | | | | | | | |

Net cash provided by (used in) investing activities | | | (967 | ) | | | 150 | |

| | | | | | | | |

Cash flows from financing activities: | | | | | | | | |

Proceeds from issuance of common stock | | | 708 | | | | 223 | |

Cash used in repurchase of common stock | | | — | | | | (5,127 | ) |

| | | | | | | | |

Net cash provided by (used in) financing activities | | | 708 | | | | (4,904 | ) |

| | | | | | | | |

Net decrease in cash and cash equivalents | | | (4,449 | ) | | | (3,859 | ) |

Cash and cash equivalents at beginning of period | | | 30,746 | | | | 37,973 | |

| | | | | | | | |

Cash and cash equivalents at end of period | | $ | 26,297 | | | $ | 34,114 | |

| | | | | | | | |

Supplemental disclosures of cash flow information: | | | | | | | | |

Net cash paid (refunded) for taxes | | $ | 490 | | | | (906 | ) |

Accrued amounts for acquisition of property and equipment | | | 206 | | | | 48 | |

See Accompanying Notes to Condensed Consolidated Financial Statements

5

IPASS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Note 1. Basis of Presentation

The condensed consolidated financial statements include the accounts of iPass Inc. (the “Company”) and its wholly owned subsidiaries. The condensed consolidated financial statements that accompany these notes have been prepared in accordance with U.S. generally accepted accounting principles or GAAP consistent in all material respects with those applied in the Company’s Annual Report on Form 10-K for the year ended December 31, 2010. The December 31, 2010 Condensed Consolidated Balance Sheets were derived from audited financial statements, but does not include all disclosures required by generally accepted accounting principles. The interim financial information is unaudited, but reflects all normal adjustments that are, in the opinion of management, necessary to provide a fair statement of results for the interim period presented. This interim financial information should be read in conjunction with the Consolidated Financial Statements and the Notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2010. The results of operations for the three months and nine months ended September 30, 2011 are not necessarily indicative of the operating results for the full fiscal year or any future periods.

The preparation of the condensed consolidated financial statements in conformity with GAAP requires management to make estimates and judgments that affect the amounts reported in the condensed consolidated financial statements and accompanying notes. Actual results that the Company experiences may differ materially from those estimates. Estimates are used for, but not limited to the valuation of accounts receivables, inventories, intangible assets, other long-lived assets, network access costs, stock-based compensation, legal contingencies, income taxes, sales tax liabilities, and restructuring charges.

Note 2. Fair Value

Fair value is the price that would be received from selling an asset or paid to transfer a liability in an orderly transaction in the principal or most advantageous market between market participants at the measurement date. When determining the fair value measurements for assets and liabilities required or permitted to be recorded at fair value, the Company considers assumptions that market participants would use when pricing the asset or liability.

Fair Value Hierarchy

The three levels of inputs that may be used to measure fair value are as follows:

| | • | | Level 1 – Quoted prices in active markets for identical assets or liabilities; |

| | • | | Level 2 – Inputs other than Level 1 either directly or indirectly, such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities; and |

| | • | | Level 3 – Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities. |

The fair values of these financial assets (excluding cash) and nonfinancial liabilities were determined using the following inputs at September 30, 2011:

| | | | | | | | | | | | | | | | |

| | | Fair Value Measurements at September 30, 2011 Using | |

| | | Total | | | Quoted

Prices in

Active

Markets for

Identical

Assets

(Level 1) | | | Significant

Other

Inputs

(Level 2) | | | Significant

Unobservable

Inputs

(Level 3) | |

| | | (in thousands) | |

Financial assets: | | | | | | | | | | | | | | | | |

Money market funds(1) | | $ | 19,146 | | | $ | 19,146 | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

Total financial assets | | $ | 19,146 | | | $ | 19,146 | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

Nonfinancial liabilities: | | | | | | | | | | | | | | | | |

Lease liabilities incurred in connection with the restructuring plan(2) | | $ | 823 | | | $ | — | | | $ | — | | | $ | 823 | |

| | | | | | | | | | | | | | | | |

Total nonfinancial liabilities | | $ | 823 | | | $ | — | | | $ | — | | | $ | 823 | |

| | | | | | | | | | | | | | | | |

6

| (1) | Held in cash and cash equivalents and restricted cash on the Company’s condensed consolidated balance sheets. |

| (2) | Lease liabilities are recorded at fair value and are included as liabilities in the Company’s condensed consolidated balance sheets. The lease liability was recorded in connection with the lease abandonment plans implemented in the first and fourth quarter of 2009 (see Note 7 for further discussion of the restructuring plans). Management made assumptions in determining the fair value of the lease liability. Inputs to the present value technique to determine fair value included inputs, such as the future rent payment schedule, the discount rate and sublease income based on the executed sublease agreement through the end of the lease term. |

There were no transfers between Levels 1, 2, and 3 between December 31, 2010 and September 30, 2011.

The carrying amounts of accounts receivable, prepaid expenses and other assets, accounts payable and accrued liabilities, closely approximate fair value as of September 30, 2011 and December 31, 2010.

Note 3. Property and Equipment, net

Property and equipment, net, consisted of the following:

| | | | | | | | |

| | | September 30, 2011 | | | December 31, 2010 | |

| | | (in thousands) | |

Equipment | | $ | 16,158 | | | $ | 17,847 | |

Furniture and fixtures | | | 3,015 | | | | 3,032 | |

Computer software | | | 8,357 | | | | 8,772 | |

Leasehold improvements | | | 2,396 | | | | 2,534 | |

| | | | | | | | |

| | | 29,926 | | | | 32,185 | |

Less: Accumulated depreciation and amortization | | | (26,144 | ) | | | (27,921 | ) |

| | | | | | | | |

Property and equipment, net | | $ | 3,782 | | | $ | 4,264 | |

| | | | | | | | |

Note 4. Intangible Assets, net

The following tables set forth the carrying amount of intangible assets that will continue to be amortized:

| | | | | | | | | | | | | | | | |

| | | September 30, 2011 | |

| | | Amortization

Life | | | Gross Carrying

Amount | | | Accumulated

Amortization | | | Net Carrying

Amount | |

| | | | | | (in thousands) | |

Existing technology | | | 4-8 yrs | | | $ | 5,375 | | | $ | (5,278 | ) | | $ | 97 | |

Patent and core technology | | | 4-8 yrs | | | | 2,800 | | | | (2,668 | ) | | | 132 | |

| | | | | | | | | | | | | | | | |

| | | | | | $ | 8,175 | | | $ | (7,946 | ) | | $ | 229 | |

| | | | | | | | | | | | | | | | |

| |

| | | December 31, 2010 | |

| | | Amortization

Life | | | Gross Carrying

Amount | | | Accumulated

Amortization | | | Net Carrying

Amount | |

| | | | | | (in thousands) | |

Existing technology | | | 4-8 yrs | | | $ | 5,375 | | | $ | (5,202 | ) | | $ | 173 | |

Patent and core technology | | | 4-8 yrs | | | | 2,800 | | | | (2,565 | ) | | | 235 | |

| | | | | | | | | | | | | | | | |

| | | | | | $ | 8,175 | | | $ | (7,767 | ) | | $ | 408 | |

| | | | | | | | | | | | | | | | |

Amortization of intangible assets was approximately $0.1 million for the three months ended September 30, 2011 and 2010, and approximately $0.2 million and $0.4 million for the nine months ended September 30, 2011 and 2010, respectively.

7

Scheduled amortization of the remaining intangible assets is as follows:

| | | | |

Year | | (in thousands) | |

Remaining 2011 | | $ | 60 | |

2012 | | | 169 | |

| | | | |

| | $ | 229 | |

| | | | |

Note 5. Other Assets

Other assets consisted of the following:

| | | | | | | | |

| | | September 30, 2011 | | | December 31, 2010 | |

| | | (in thousands) | |

Prepaid lease obligations | | $ | 525 | | | $ | 732 | |

Deferred installation costs | | | 2,606 | | | | 2,288 | |

Deposits | | | 868 | | | | 1,291 | |

Long-term deferred tax asset, net | | | 351 | | | | 351 | |

Restricted cash | | | 2,754 | | | | 3,040 | |

Other long-term assets | | | 29 | | | | 198 | |

| | | | | | | | |

| | $ | 7,133 | | | $ | 7,900 | |

| | | | | | | | |

Note 6. Accrued Liabilities

Accrued liabilities consisted of the following:

| | | | | | | | |

| | | September 30, 2011 | | | December 31, 2010 | |

| | | (in thousands) | |

Accrued incremental sales tax liabilities (1) | | $ | 1,532 | | | $ | 2,918 | |

Accrued restructuring liabilities – current (2) | | | 309 | | | | 962 | |

Accrued network access costs | | | 2,460 | | | | 2,617 | |

Accrued bonus, commissions and other employee benefits (3) | | | 3,618 | | | | 4,325 | |

Amounts due to customers | | | 997 | | | | 1,844 | |

Other accrued liabilities | | | 2,107 | | | | 2,667 | |

| | | | | | | | |

| | $ | 11,023 | | | $ | 15,333 | |

| | | | | | | | |

| (1) | See Note 8. Commitments and Contingencies |

| (2) | See Note 7. Accrued Restructuring |

| (3) | As of September 30, 2011, approximately $0.5 million was included in accrued bonus, commissions and other employee benefits for termination payments related to the approved elimination of certain positions, primarily in sales and marketing, to be completed in the fourth quarter of 2011. Total estimated termination payments incurred during the three months ended September 30, 2011 for this approved elimination of positions was approximately $0.6 million, of which approximately $0.4 million was recorded in sales and marketing and approximately $0.1 million in each of research and development expenses and general and administrative expenses. |

Note 7. Accrued Restructuring

In the first quarter of 2009, the Company announced a restructuring plan (the “Q1 2009 Plan”) in order to reduce operating costs and focus resources on key strategic priorities which resulted in a workforce reduction of 68 positions across all functional areas and abandonment of certain facilities.

In the fourth quarter of 2009, the Company announced a restructuring plan (the “Q4 2009 Plan”) to align the cost structure and improve operating efficiencies which resulted in a workforce reduction of 78 positions, abandonment of certain additional facilities and termination of a contract obligation.

The Q1 2009 and Q4 2009 Plans were completed during 2010.

8

The following is a summary of restructuring activities of the Q1 2009 and Q4 2009 Plans for the three and nine months ended September 30, 2011:

| | | | | | | | | | | | |

| For the Three Months Ended September 30, 2011 | | Q1 2009

Excess

Facility Costs | | | Q4 2009

Excess

Facility Costs | | | Total

Restructuring

Costs | |

| | | (in thousands) | |

| | | | | | | | | | | | |

Balance as of June 30, 2011 | | $ | 987 | | | $ | 16 | | | $ | 1,003 | |

Restructuring charges (benefits) and related adjustments | | | (7 | ) | | | — | | | | (7 | ) |

Payments | | | (168 | ) | | | (5 | ) | | | (173 | ) |

| | | | | | | | | | | | |

Balance as of September 30, 2011 | | $ | 812 | | | | 11 | | | | 823 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| For the Nine Months Ended September 30, 2011 | | Q1 2009

Excess

Facility Costs | | | Q4 2009

Excess

Facility Costs | | | Total

Restructuring

Costs | |

| | | (in thousands) | |

| | | | | | | | | | | | |

Balance as of December 31, 2010 | | $ | 1,185 | | | $ | 456 | | | $ | 1,641 | |

Restructuring charges (benefits) and related adjustments | | | 5 | | | | (167 | ) | | | (162 | ) |

Payments | | | (378 | ) | | | (278 | ) | | | (656 | ) |

| | | | | | | | | | | | |

Balance as of September 30, 2011 | | $ | 812 | | | | 11 | | | | 823 | |

| | | | | | | | | | | | |

As of September 30, 2011, the Company classified approximately $0.3 million of restructuring liability in accrued liabilities and the remaining $0.5 million in long-term liabilities based on the Company’s expectation that the remaining lease payments for the abandoned facilities will be paid through April 2015 (net of sublease income). Net restructuring charges for the Q1 2009 Plan includes an adjustment for sublease income related to the new sublease agreement that the Company executed in the second quarter of 2011 for unused space. Net restructuring charges for the Q4 2009 Plan includes an adjustment of previously recorded facility exit costs as a result of negotiating a favorable termination and lease surrender agreement.

Note 8. Commitments and Contingencies

The Company leases facilities under operating leases that expire at various dates through April 2015. Certain leases are cancellable prior to lease expiration dates. Future minimum lease payments under these operating leases, including payments on leases accounted for under the Company’s restructuring plans, as of September 30, 2011, are as follows:

| | | | |

Year | | (in thousands) | |

Remaining 2011 | | $ | 738 | |

2012 | | | 2,133 | |

2013 | | | 1,752 | |

2014 | | | 1,810 | |

2015 | | | 610 | |

| | | | |

| | $ | 7,043 | |

| | | | |

The table above includes approximately $0.8 million in facility lease obligations which are included in accrued restructuring liabilities.

The Company has contracts with certain network service and mobile data providers which have minimum purchase commitments that expire on various dates through April 2013. Future minimum purchase commitments under all agreements are as follows:

| | | | |

Year | | (in thousands) | |

Remaining 2011 | | $ | 1,016 | |

2012 | | | 1,624 | |

2013 | | | 31 | |

| | | | |

| | $ | 2,671 | |

| | | | |

At September 30, 2011, the Company had no material commitments for capital expenditures.

9

Sales Tax Liabilities

The Company’s sales and use tax filings are subject to customary audits by authorities in the jurisdictions where it conducts business in the United States which may result in assessments of additional taxes. During fiscal year 2009, the Company determined that additional sales taxes were probable of being assessed for multiple states as a result of the preliminary findings specific to a sales and use tax audit that had been initiated in the same year. As a result, the Company estimated an incremental sales tax liability in fiscal year 2009 of $5.0 million, including interest and penalties of $1.5 million. During fiscal year 2010, this liability was reduced to $2.9 million through sales tax payments, settlements with certain state tax authorities and revised estimates. During the nine months ended September 30, 2011 the liability was reduced further to $1.5 million as a result of payments and revised estimates.

Legal Proceedings

The Company is involved in legal proceedings and claims arising in the ordinary course of business. While there can be no assurances as to the ultimate outcome of any litigation involving the Company, management does not believe any such pending legal proceeding or claim will result in a judgment or settlement that would have a material adverse effect on the Company’s financial position, results of operations or cash flows.

In the ordinary course of business, the Company may provide indemnifications of varying scope and terms to customers, business partners, and other parties with respect to certain matters, including, but not limited to, losses arising out of our breach of such agreements, services to be provided by the Company, or from intellectual property infringement claims made by third-parties. Certain indemnification agreements may not be subject to maximum loss clauses. If the potential loss from any indemnification claim is considered probable and the amount or the range of the loss can be estimated, the Company accrues a liability for the estimated loss. To date, claims under such indemnification provisions have not been significant.

Note 9. Net Loss Per Common Share

Basic net income per share is computed by dividing net income available to common shareholders by the weighted daily average number of common shares outstanding during the period. Participating securities are included in the weighted daily average number of shares outstanding in the computation of basic net income per share but are excluded in the computation of basic net loss per share. Diluted net income per share is computed by dividing net income available to common shareholders by the weighted daily average number of common shares outstanding plus potentially dilutive common shares outstanding during the period from the issuance of stock options and awards using the treasury stock method. Participating securities are included in the weighted daily average number of shares outstanding used in the calculation of diluted net income per share but are excluded from the calculation of diluted net loss per share. As the Company was in a net loss position for all periods presented, basic and diluted net loss per share are equal to each other as the weighted average number of shares used to compute diluted net loss per share excludes anti-dilutive securities, including participating securities.

The following table sets forth the computation of basic and diluted net loss per share:

| | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | | Nine Months Ended

September 30, | |

| | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

| | | (in thousands, except share and per share amounts) | |

Numerator: | | | | | | | | | | | | | | | | |

Net loss | | $ | (803 | ) | | $ | (1,906 | ) | | $ | (3,338 | ) | | $ | (3,849 | ) |

| | | | | | | | | | | | | | | | |

Denominator: | | | | | | | | | | | | | | | | |

Denominator for basic and diluted net loss per common share – weighted average shares outstanding | | | 58,776,585 | | | | 57,615,067 | | | | 58,346,859 | | | | 58,930,806 | |

Basic and diluted net loss per common share | | $ | (0.01 | ) | | $ | (0.03 | ) | | $ | (0.06 | ) | | $ | (0.07 | ) |

The following weighted average potential shares of common stock have been excluded from the computation of diluted net loss per share because the effect of including these shares would have been anti-dilutive:

| | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | | Nine Months Ended

September 30, | |

| | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

Options to purchase common stock | | | 9,699,990 | | | | 10,525,050 | | | | 8,566,836 | | | | 9,962,112 | |

Unvested restricted stock awards, considered participating securities | | | 1,051,090 | | | | 928,970 | | | | 972,537 | | | | 877,798 | |

| | | | | | | | | | | | | | | | |

Total | | | 10,751,080 | | | | 11,454,020 | | | | 9,539,373 | | | | 10,839,910 | |

| | | | | | | | | | | | | | | | |

10

Note 10. Segment and Geographical Information

The Company’s two reportable operating segments are: Enterprise Mobility Services (referred to as “EMS”) and Managed Network Services (referred to as “MNS”).

The Company’s Chief Operating Decision Maker (the “CODM”) has been identified as the Company’s President and Chief Executive Officer. The CODM allocates resources to and assesses the performance of each operating segment using information about its revenue and operating income or loss.

The Enterprise Mobility Services segment includes services that help enterprises and carriers manage the networks, connections and devices used by their mobile workforce and subscribers. The Managed Network Services segment involves enterprise branch and retail office connectivity.

The Company evaluates performance and allocates resources based on segment profit or loss from operations before income taxes, not including amortization of intangibles, restructuring and state taxes, penalties and interest. The accounting policies of the reportable segments are substantially the same as those the Company uses for consolidated financial statements. All direct costs are allocated to the respective segments. In addition to direct costs, each segment has indirect costs. Indirect costs that are allocated to each segment include certain costs of facilities, certain employee benefits and payroll tax costs, and certain additional shared services, costs in management, finance, legal, human resources, and information technology. Indirect costs are allocated based on headcount, salaries and segment revenue contribution. Total operating costs allocated to the reportable segments for the three months ended September 30, 2011 and 2010 were $35.5 million and $39.1 million, respectively, and were $110.1 million and $120.5 million for the nine months ended September 30, 2011 and 2010, respectively. The Company does not allocate to its reportable segments amortization of intangibles, restructuring and any associated adjustments related to restructuring actions, or state tax, penalties and interest. By definition, segment operating income also excludes interest income, foreign exchange gains and losses, and income taxes.

Revenue and operating loss for each reportable segment for the three and nine months ended September 30, 2011 and 2010 were as follows:

| | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30 | | | Nine Months Ended

September 30 | |

| | | (in thousands) | |

| | | Net Revenue | | | Total

Segment

Operating

Loss | | | Net Revenue | | | Total

Segment

Operating

Loss | |

2011 | | | | | | | | | | | | | | | | |

Enterprise Mobility Services | | $ | 26,905 | | | $ | (893 | ) | | $ | 84,294 | | | $ | (2,487 | ) |

Managed Network Services | | | 7,506 | | | | (210 | ) | | | 22,032 | | | | (1,324 | ) |

| | | | | | | | | | | | | | | | |

Total Segments | | $ | 34,411 | | | $ | (1,103 | ) | | $ | 106,326 | | | $ | (3,811 | ) |

| | | | | | | | | | | | | | | | |

2010 | | | | | | | | | | | | | | | | |

Enterprise Mobility Services | | $ | 31,227 | | | $ | (430 | ) | | $ | 97,199 | | | $ | (1,864 | ) |

Managed Network Services | | | 6,831 | | | | (577 | ) | | | 20,320 | | | | (1,140 | ) |

| | | | | | | | | | | | | | | | |

Total Segments | | $ | 38,058 | | | $ | (1,007 | ) | | $ | 117,519 | | | $ | (3,004 | ) |

| | | | | | | | | | | | | | | | |

Substantially all of the Company’s long-lived assets are located in the United States. The CODM does not evaluate operating segments using discrete asset information. Accordingly, no segment assets have been reported.

There were no material intersegment sales or transfers for the three and nine months ended September 30, 2011 and 2010, to arrive at net revenue. Depreciation for the EMS segment for the three months ended September 30, 2011 and 2010 was $0.5 million and $0.7 million, respectively, and for the nine months ended September 30, 2011 and 2010 was $1.6 million and $2.3 million, respectively. Depreciation for the MNS segment for the three months ended September 30, 2011 and 2010 was less than $0.1 million, and for the nine months ended September 30, 2011 and 2010 was $0.1 million and $0.2 million, respectively.

11

Reconciliations of total segment operating loss to the Company consolidated operating loss from continuing operations before income taxes for the three and nine months ended September 30, 2011 and 2010 are as follows:

| | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | | Nine Months Ended

September 30, | |

| | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

| | | (in thousands) | |

Total segment operating loss | | $ | (1,103 | ) | | $ | (1,007 | ) | | $ | (3,811 | ) | | $ | (3,004 | ) |

Amortization of intangibles | | | (60 | ) | | | (76 | ) | | | (179 | ) | | | (363 | ) |

Restructuring | | | 7 | | | | (179 | ) | | | 162 | | | | (466 | ) |

State tax, penalties and interest | | | 283 | | | | (92 | ) | | | 1,027 | | | | (302 | ) |

| | | | | | | | | | | | | | | | |

Total loss from operations | | | (873 | ) | | | (1,354 | ) | | | (2,801 | ) | | | (4,135 | ) |

| | | | | | | | | | | | | | | | |

Interest income | | | 5 | | | | 22 | | | | 104 | | | | 59 | |

Foreign exchange gains (losses) and other income (expenses), net | | | 66 | | | | (478 | ) | | | (395 | ) | | | 140 | |

| | | | | | | | | | | | | | | | |

Total loss from continuing operations before income taxes | | $ | (802 | ) | | $ | (1,810 | ) | | $ | (3,092 | ) | | $ | (3,936 | ) |

| | | | | | | | | | | | | | | | |

The following table presents total Company revenue summarized by country or by geographical region for the periods indicated:

| | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | | Nine Months Ended

September 30, | |

| | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

United States | | | 58 | % | | | 62 | % | | | 59 | % | | | 62 | % |

EMEA | | | 32 | % | | | 28 | % | | | 32 | % | | | 29 | % |

Asia Pacific | | | 9 | % | | | 7 | % | | | 9 | % | | | 7 | % |

Rest of World | | | 1 | % | | | 3 | % | | | — | | | | 2 | % |

No individual customer represented 10% or more of total revenue for the three and nine months ended September 30, 2011 and 2010. No individual country, except for the United States, accounted for 10% or more of total revenues for the periods presented.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Our Management’s Discussion and Analysis of Financial Condition and Results of Operations or MD&A is provided in addition to the accompanying condensed consolidated financial statements and notes to assist readers in understanding our results of operations, financial condition, and cash flows. The following discussion and analysis should be read in conjunction with the condensed consolidated financial statements and notes thereto included in Item 1 of this Quarterly Report on Form 10-Q and with the MD&A in Part II, Item 7 of our Annual Report on Form 10-K for the period ended December 31, 2010.

This MD&A is organized as follows:

| | |

| Overview | | Discussion of our business |

| |

| Key Corporate Objectives | | Our overall strategy and goals |

| |

| Significant Trends and Events | | Operating, financial and other material highlights affecting the Company |

| |

| Key Operating Metrics | | Discussion of key metrics and measures that we use to evaluate our operating performance |

| |

Critical Accounting Policies and Estimates | | Accounting policies and estimates that we believe are most important to understanding the assumptions and judgments incorporated in our reported financial results and Forecasts |

| |

| Results of Operations | | An analysis of our financial results for the three months and nine months ended September 30, 2011 |

| |

Liquidity and Capital Resources | | An analysis of changes in our balance sheets and cash flows, and discussion of our financial condition |

The various sections of this MD&A contain forward-looking statements regarding future events and our future results that are based on current expectations, estimates, forecasts, and projections about the industries in which we operate and the beliefs and assumptions of our management. Words such as “expects,” “will,” “anticipates,” “targets,” “goals,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” variations of such words, and similar expressions are intended to identify such forward-looking statements. In addition, any statements which refer to projections of our future financial performance, our anticipated growth and trends in our business, and other characterizations of future events or circumstances, are forward-looking statements. Readers are cautioned that these forward-looking statements are only predictions and are subject to risks, uncertainties, and assumptions that are difficult to predict. Therefore, actual results may differ materially and adversely from those expressed in any forward-looking statements. Also see “Risk Factors” in Part I, Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2010 for factors that may cause actual results to be different from those expressed in these forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and except as required by law, we undertake no obligation to revise or update publicly any forward-looking statements for any reason.

12

Overview

We provide cloud-based mobility management and network connectivity services to large and multi-national enterprise customers and telecommunication carriers, enabling them to control cost while managing the compliance and security needs of their global employees and subscribers. The iPass mission is to deliver mobility services to enhance the productivity of workers as they move between and among office sites, home and remote locations. Our mobility services consist of enterprise mobility services and carrier Wi-Fi mobility services.

Our global enterprise mobility services consist of our Open Mobile services, our legacy Mobile Office offering, and our Network Services. Our Open Mobile services are based on our Open Mobile Platform, which is a cloud-based services delivery system that gives the enterprise insight and control over definition and management of their mobility services. Our Mobile Office product has been our historic enterprise mobility offering, providing unified global connectivity, connectivity management and device management. Our enterprise mobility services also includes the iPass Mobile Network, which consists of more than 650,000 global venues including Wi-Fi, Hotel Ethernet and Inflight Wi-Fi hotspots, broadband connection technologies such as 3G, as well as narrowband access technologies, such as modem dial-up, which we collectively refer to as our Network Services. The iPass Mobile Network is composed of contractual relationships and technical integrations with approximately 305 fixed and mobile telecommunications carriers, Internet service providers and other network service providers around the globe.

Our carrier Wi-Fi mobility services consist of our new Wi-Fi offload, roaming and exchange services that leverage our Open Mobile platform and networking expertise, unique Wi-Fi authentication infrastructure and transaction settlement capabilities to provide global telecommunication carriers with a data offload and international Wi-Fi roaming functionality. Although revenues generated from our carrier Wi-Fi mobility services have been immaterial to-date, we believe that this is a significant opportunity that will drive our prospective business. We believe that there is resurgent demand for Wi-Fi which has evolved into an essential service for network operators due to device proliferation, soaring mobile broadband data volumes and congested cellular networks. We believe that carriers will look to differentiate their consumer offerings to meet the accelerating demand for data services on smartphones and tablet devices. We have recently launched the iPass Open Mobile Exchange (referred to as “OMX”), which is a carrier-grade platform for service providers to extend and enhance core mobility and Internet offerings by integrating Wi-Fi with 3G and 4G, allowing providers to seamlessly connect customers and subscribers to preferred Wi-Fi networks, including free Wi-Fi. The platform incorporates the iPass Mobile Network with our authentication and transaction settlements infrastructure, which we believe allows providers to introduce new services to capture the rapidly growing Wi-Fi enabled devices market.

We also provide managed network services to enterprise customers, connecting the enterprise’s branch offices, retail locations and teleworkers. The MNS value proposition is a significant price-for-performance value over traditional or legacy private networking services. Our managed network solutions are used by enterprises in a range of industries.

Our business is reported under two segments: Enterprise Mobility Services (referred to as “EMS”) and Managed Network Services (referred to as “MNS”). Our enterprise mobility services and carrier Wi-Fi mobility services business are reported under the EMS segment.

We were incorporated in California in July 1996 and reincorporated in Delaware in June 2000. Our corporate headquarters is located in Redwood Shores, California.

Key Corporate Objectives

Our corporate objectives include the following, which we view as important to driving our business.

| | • | | Migrate Existing Enterprise Customers and Add New Customers to the Open Mobile Platform – We believe that our portfolio of mobility management platform services and continued enhancement of our existing mobile network services are key to driving the migration of existing enterprise customers and partners to, and acquiring new customers on, our Open Mobile Platform. We continue to sign enterprise customer contracts for our Open Mobile Platform and we currently have more than 235 enterprise customers who have signed agreements for our Open Mobile platform of which 80 were signed during the third quarter of 2011. |

| | • | | Increase the Use of Our Services – We intend to increase the usage of our services, as well as the frequency-of-use, by our customers by creating an easy and seamless end-user experience, expanding our mobile network footprint and executing on our commitment to customer satisfaction. We have continued to develop and roll-out expanded feature sets of our Open Mobile Platform (see below) and we have expanded the size and reach of our global Wi-Fi network footprint to more than 650,000 locations worldwide. |

13

| | • | | Leverage our Technology Expertise and Unique Assets to Capitalize on the Wi-Fi Roaming and Offload Opportunity– We are leveraging our global authentication infrastructure and Wi-Fi transaction settlements capabilities to provide compelling functionality around 3G and 4G Wi-Fi offload, international roaming, Wi-Fi exchange services and other related opportunities. Our iPass OMX service that was launched in July 2011 provides these services to our telecommunication carrier and service provider partners to help them address their network infrastructure costs and introduce new offerings to generate revenue. |

| | • | | Continue to Develop the Open Mobile Platform – We continue to enhance and develop our cloud-based Open Mobile Platform with innovative features, functionality and services in order to provide a leading and value-added integrated mobility offering for enterprise customers and our telecommunication carrier and service provider partners. We recently released Open Mobile 2.0 that provides mobile users with useful information regarding their current connection status and usage meters detailing their mobile usage (Wi-Fi and cellular data). Open Mobile 2.0 also provides several enhancements designed to make it even easier for users to get connected without compromising security for the enterprise, including ensuring that laptops meet security policies as soon as users connect, providing organizations with additional options for controlling mobile broadband, and providing users an easy way to connect to cloud-based applications without having to enter a username or password. |

For a detailed discussion regarding certain of our corporate objectives, see the section entitled “Our Strategy” under “Item 1A. Business” included in our Annual Report on Form 10-K for the year ended December 31, 2010.

Significant Trends and Events

The following describes significant trends and events that impacted our financial condition, results of operations, and the direction of our business during the third quarter of 2011.

Continued Progress with iPass Open Mobile Enterprise

We have continued to increase the number of enterprise customers signed on to our Open Mobile Platform since the third quarter of 2010. During the third quarter of 2011, we signed 80 enterprise customers to the iPass Open Mobile Platform and experienced a meaningful increase in the number of users of our new platform. The number of active Open Mobile Monetized users has continued to increase from approximately 7,000 as of March 31, 2011 to approximately 12,000 as of June 30, 2011 to approximately 24,000 as of September 30, 2011. Additional user metrics highlighting users for which iPass is being paid but that have not yet been fully deployed by their enterprises is being provided and shows additional traction in the growth of the Open Mobile Platform. See “Key Operating Metrics” below for a full discussion of additional user metrics being provided. Also during the quarter, iPass made meaningful progress in product development and released the new Open Mobile 2.0.

Strong Early Win with iPass Open Mobile Exchange

We recently launched iPass OMX, which is a carrier-grade platform for service providers to extend and enhance core mobility and Internet offerings by integrating Wi-Fi with 3G and 4G, allowing them to seamlessly connect customers and subscribers to preferred Wi-Fi networks, including free Wi-Fi. The platform incorporates the iPass Mobile Network with a unique authentication and transaction settlements infrastructure, and allows service providers to introduce new services to capture the rapidly growing Wi-Fi enabled devices market. By enabling operators to provide an integrated approach to mobility, iPass OMX positions them to participate in the second wave of Wi-Fi. With this new platform launch, we believe we will provide multiple service and revenue opportunities to network operators.

Recently, China Mobile selected iPass to provide the foundation for their new data roaming service and to serve as a hub for their carrier partners to gain access to China’s largest Wi-Fi footprint. iPass OMX has already been adopted by Deutsche Telekom as part of its Wi-Fi Mobilize service, a new network services exchange for in-country and international roaming services, which can help Deutsche Telekom and its numerous carrier partners across the globe to address the accelerating demand for data services on smartphone and tablet devices using Wi-Fi. During the third quarter of 2011, revenue generated from iPass OMX was immaterial.

Continued Decline in Legacy Dial-up, Minimum Commitment, and 3G Network Revenue

For the nine months ended September 30, 2011, we experienced a continued and anticipated decline in revenue from dial-up network services of approximately $3.2 million or 51% compared to the same period in 2010. This trend was primarily due to our customers’ continued migration from dial-up connections to faster broadband technologies. We expect the trend of declining dial-up revenue to continue during the remainder of 2011. For the nine months ended September 30, 2011 revenue from dial-up network services comprised less than 3% of our total revenue.

We have customers that have signed contracts with us that contain network minimum commitment revenue. Revenue derived from minimum network commitments has declined as these legacy contracts have come up for renewal and customers have committed to lower dollar amounts on a prospective basis. We have seen a decline in network minimum commitment revenue due, in part, to these new arrangements. At the same time, with these renegotiated arrangements, we have often been able to secure longer contract terms, higher marginal pricing and/or commitments for our customers to migrate to our Open Mobile Platform. We continue to see a decrease in the number of customers that have contracts with minimum network commitments. Network minimum commitment revenue decreased $3.6 million or 28% for the nine months ended September 30, 2011 compared to the same period in 2010. We believe that this decline in network minimum commitment revenue will continue for the foreseeable future. For the nine months ended September 30, 2011 network minimum commitment revenue comprised approximately 9% of our total revenue.

14

We are focused on providing value-add enterprise mobility and carrier Wi-Fi exchange and related services and do not believe that reselling 3G network services are core to this value proposition. We experienced a decline in 3G network revenue of $1.4 million or 9% for the nine months ended September 30, 2011 compared to the same period in 2010. We anticipate that 3G network revenue will continue to decline over time as we move away from focusing our efforts on 3G network sales and look to continue to grow our platform revenue and Wi-Fi services. For the nine months ended September 30, 2011 3G network revenue comprised approximately 13% of our total revenue.

Key Operating Metrics

Described below are key metrics that we use to evaluate our operating performance and our success in transforming our business and driving future growth.

Average Monthly Monetized Users

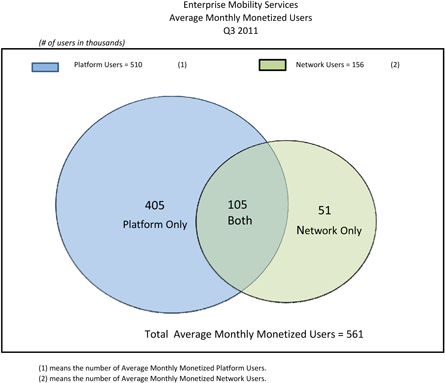

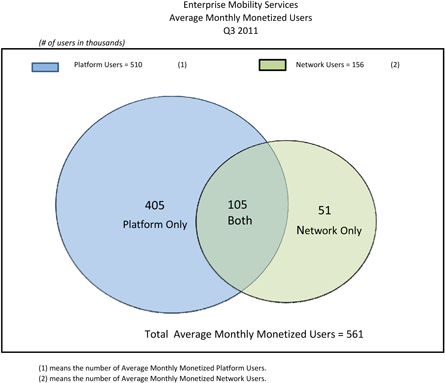

Since the fourth quarter of 2009, we have presented Average Monthly Monetized Users (referred to as “AMMU”) as a key metric that we use to track and evaluate the operating performance of our EMS business. The AMMU metric is based on the number of active users of our network and platform services; as such, there is some overlap for users that may be active users of both our network and platform services in a given month. Network users are billed for their use of our Wi-Fi, dial-up or 3G network services. Platform users are billed for their use of our legacy iPassConnect (“iPC”) client or our Open Mobile client. As such, the AMMU metric is indicative of the adoption and active use of our services, and corresponds to our results of operations.

AMMU is defined as the average number of monthly users over a given quarter for which a fee was billed by us to an EMS customer for the use of our network and platform services. The following diagram and table reflects the relationship between the AMMU of our network and platform services for the third quarter of 2011:

15

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | | Nine Months Ended

September 30, | |

| | | 2011 | | 2010 | | | % Change | | 2011 | | 2010 | | % Change | |

| | | (in thousands, except percentages) | |

Average Number of Monthly Monetized Users | | 561 | | | 621 | | | | (9.7 | %) | | 587 | | 654 | | | (10.2 | %) |

Network | | 156 | | | 192 | | | | (18.8 | %) | | 170 | | 204 | | | (16.7 | %) |

Platform | | 510 | | | 552 | | | | (7.6 | %) | | 534 | | 583 | | | (8.4 | %) |

The AMMU of our network services decreased for the three and nine months ended September 30, 2011, compared to the same period in 2010, primarily due to the decline in dial-up and Wi-Fi users. The decrease in dial-up users was due to the anticipated erosion of our dial-up customer base as they migrated to faster technologies. The decrease in Wi-Fi users is due to increased availability of free Wi-Fi internet access in the United States and the observed migration in customer usage patterns from laptops to smartphones and tablets worldwide.

The AMMU of our platform services decreased for the three and nine months ended September 30, 2011, compared to the same period in 2010 was primarily due to the decline in users at customers with legacy iPC pricing plans where we are paid an annual business fee as well as the attrition of legacy iPC client users which to date has outpaced the growth we have been experiencing in our Open Mobile platform users. We continue to sign an increasing number of enterprise customer contracts for our Open Mobile platform; however, we have witnessed long lead times in customer Open Mobile deployments as our ability to control large enterprise program deployments is limited since they are typically tied closely to enterprise hardware and operating system refreshes and other IT initiatives.

Open Mobile Monetized Users

As noted, the AMMU metric is based on active enterprise users, that is, users to whom iPass platforms (both legacy iPC and Open Mobile) have been deployed by their enterprise and set up with their user credentials. As iPass continues to drive forward with its Open Mobile platform and pricing models with its enterprise customers continue to evolve to include deployed user models, for example, we have found it helpful to track both the Open Mobile active users (as reflected in AMMU) as well as to track those Open Mobile users for which enterprise customers are paying iPass for the Open Mobile platform but who have not yet deployed the Open Mobile offering to their mobile workers. iPass refers to this second type of monetized user as “paying, undeployed” and is now reporting these metrics in order to provide additional visibility into the adoption of the Open Mobile platform and the monetization of users that iPass is realizing on its Open Mobile platform.

These metrics are defined as follows:

| | (i) | Open Mobile Monetized Users – Active. Represents the number of Open Mobile users who were billed Open Mobile platform fees and who have used or deployed Open Mobile (e.g., this is synonymous with the definition of our AMMU metric). |

| | (ii) | Open Mobile Monetized Users – Paying, Undeployed. A new metric that represents the number of Open Mobile users at enterprise customers for which Open Mobile platform fees were billed for the period but that have not yet used Open Mobile or had Open Mobile fully-deployed on a device. |

| | (iii) | Open Mobile Monetized Users – Gross. Is the sum of both Active and Paying, Undeployed Open Mobile monetized users. |

The table below reflects the number of Open Mobile Monetized Users for the following months:

| | | | | | | | | | | | |

| Open Mobile Monetized Users: | | September 30, 2011 | | | June 30, 2011 | | | March 31, 2011 | |

| | | (in thousands) | |

Active | | | 24 | | | | 12 | | | | 7 | |

Paying, Undeployed | | | 113 | | | | 36 | | | | 12 | |

| | | | | | | | | | | | |

Gross | | | 137 | | | | 48 | | | | 19 | |

| | | | | | | | | | | | |

Open Mobile Monetized Users are presented as a period-end metric as this provides increased visibility into the traction we are experiencing with enterprise customers on our new Open Mobile platform and allows us to measure the progress and performance of the business over time. We have not presented the number of Open Mobile Monetized Users prior to the current year as these numbers are not significant.

16

Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization or Adjusted EBITDA

Adjusted EBITDA is used by our management as a measure of operating efficiency, financial performance and as a benchmark against our peers and competitors. In addition, we also use this metric to determine a portion of our incentive compensation payouts. Management also believes that Adjusted EBITDA is useful to investors because it is frequently used by securities analysts, investors and other interested parties to understand our performance excluding the impact of items which may obscure trends in our core operating performance. Furthermore, the use of Adjusted EBITDA facilitates comparisons with other companies in our industry which may use similar financial measures to supplement their GAAP results. We adjust for these excluded items because we believe that, in general, these items possess one or more of the following characteristics: their magnitude and timing is largely outside of our control; they are unrelated to the ongoing operation of the business in the ordinary course; they are unusual or infrequent and we do not expect them to occur in the ordinary course of business; or they are non-operational, or non-cash expenses involving stock option grants. Adjusted EBITDA is not a measure determined in accordance with accounting principles generally accepted in the United States or GAAP and should not be considered a substitute for operating income, operating performance, net income or any other measure determined in accordance with GAAP. Adjusted EBITDA should not be considered in isolation or as a substitute for measures of performance prepared in accordance with GAAP.

We defined Adjusted EBITDA as net loss adjusted for interest income; income taxes; depreciation and amortization; stock-based compensation; restructuring charges; certain state sales and federal tax charges, and one-time non-recurring discrete items. The following table reconciles Adjusted EBITDA to GAAP net loss (in thousands):

| | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | | Nine Months Ended

September 30, | |

| | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

| | | (in thousands) | |

Adjusted EBITDA | | | (272 | ) | | | (332 | ) | | | (1,348 | ) | | | 736 | |

Interest income | | | 5 | | | | 22 | | | | 104 | | | | 59 | |

Income tax (expense) benefit | | | (1 | ) | | | (96 | ) | | | (246 | ) | | | 87 | |

Depreciation of property and equipment | | | (531 | ) | | | (764 | ) | | | (1,731 | ) | | | (2,515 | ) |

Amortization of intangible assets | | | (60 | ) | | | (76 | ) | | | (179 | ) | | | (363 | ) |

Stock-based compensation | | | (392 | ) | | | (389 | ) | | | (1,348 | ) | | | (1,245 | ) |

Restructuring (charges) benefits and related adjustments | | | 7 | | | | (179 | ) | | | 162 | | | | (466 | ) |

Certain state sales and federal tax items and other discrete items | | | 441 | | | | (92 | ) | | | 1,248 | | | | (142 | ) |

| | | | | | | | | | | | | | | | |

Net loss | | | (803 | ) | | | (1,906 | ) | | | (3,338 | ) | | | (3,849 | ) |

| | | | | | | | | | | | | | | | |

Adjusted EBITDA loss decreased by less than $0.1 million for the three months ended September 30, 2011 compared to the same period in 2010 primarily due to a $3.6 million net decrease in revenues mainly from lower network dial-up, minimum commitment, and 3G revenues that were anticipated. The revenue decrease was offset by lower network access costs of approximately $1.7 million and lower operating expenses of approximately $2.0 million (net of adjustments for excluded items).

Adjusted EBITDA loss increased by approximately $2.1 million for the nine months ended September 30, 2011 compared to the same period in 2010 primarily due to a $11.2 million net decrease in revenues mainly from lower network dial-up, minimum commitment, and 3G revenues as anticipated. These unfavorable decreases were partially offset by lower network access costs of approximately $4.4 million and lower operating expenses of approximately $4.7 million (net of adjustments for excluded items). (See “Results of Operations” for further discussions on the factors affecting Adjusted EBITDA).

Network Gross Margin

We use network gross margin as a metric to assist us in assessing the profitability of our various network services. Our overall network gross margin percentage is defined as (total EMS network revenue plus MNS revenue less total network access costs divided by total EMS network revenue plus MNS revenue).

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | | | Nine Months Ended September 30, | |

| | | 2011 | | | 2010 | | | Change | | | 2011 | | | 2010 | | | Change | |

Total Network Gross Margin | | | 45.0 | % | | | 46.4 | % | | | (1.4 | %) | | | 44.1 | % | | | 46.1 | % | | | (2.0 | %) |

The decline in network gross margin was in large part driven by the continued erosion of our higher-margin dial-up network revenue and network minimum commitment revenue that contributed approximately 3% and 4%, respectively, to the decline for the three and nine month comparative periods. The erosion in our dial-up revenue is due to the continued migration of customers to alternative faster connectivity technologies while the decline in network minimum commitment revenue is due to terminations and customers renewing their agreements at lower commit levels. These decreases were offset in part by an increase in MNS margin contribution of approximately 2% and 1%, respectively, for the three and nine months ended September 30, 2011 compared to the same periods in 2010. The increase in MNS margin contribution was due to a growth in customer base and our efforts in renegotiating network access costs. In addition, although Wi-Fi margin contribution decreased by less than 1% for the three month comparative periods, there was a 1% increase in Wi-Fi margin contribution for the nine month comparative periods that further offset the decline in dial-up and minimum commitment margin.

17

Critical Accounting Policies and Estimates

Our discussion and analysis of our financial condition and results of operations is based upon our condensed consolidated financial statements which have been prepared in accordance with GAAP. The preparation of these condensed consolidated financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. The methods, estimates, and judgments that we use in applying our accounting policies have a significant impact on the results that we report in our condensed consolidated financial statements. Some of our accounting policies require us to make difficult and subjective judgments, often as a result of the need to make estimates regarding matters that are inherently uncertain. We base our estimates and judgments on our historical experience, knowledge of current conditions and our belief of what could occur in the future considering available information, including assumptions that are believed to be reasonable under the circumstances. By their nature, these estimates and judgments are subject to an inherent degree of uncertainty and actual results could differ materially from the amounts reported based on these policies. We evaluate our estimates on an ongoing basis. Our most critical accounting estimates include those related to revenue recognition, income taxes, incremental sales tax liability, network access costs, stock-based compensation and allowance for doubtful accounts.

There have been no significant changes in our critical accounting policies and estimates during the three and nine months ended September 30, 2011 as compared to the critical accounting policies and estimates disclosed in Management’s Discussion and Analysis of Financial Condition and Results of Operations included in our Annual Report on Form 10-K for the year ended December 31, 2010.

Results of Operations

From a broad perspective, we are reporting and analyzing revenue and operations under two primary operating segments: EMS and MNS. In determining segment operating income or loss, the items that are not allocated to these segments include amortization of intangibles, restructuring, incremental sales tax costs, penalties and interest.

Sources of Revenue

Within our enterprise mobility services, we present revenue from three areas: (i) platform revenue, (ii) network revenue, and (iii) other EMS fees and revenue. Platform revenue consists of revenues derived from the following services: Open Mobile Platform fees, iPC fees and other client/platform related fees. Network revenue consists of revenue primarily from the sale of access to our network of Wi-Fi hotspots, hotel Ethernet, and mobile broadband services such as 3G and narrowband access technologies such as modem dial-up. Network revenues are derived primarily from two types of fee structures: usage-based, which is based on actual network usage, and a fixed-rate per user per month fee structure. Network revenue also includes minimum commitment shortfall revenue. Other fees include device management fees, professional services and other mobility-related fees and services. We present revenue from Wi-Fi mobility services under enterprise mobility services revenue.

Our MNS revenues are derived from the delivery and management of wide area networking services offered to enterprise customers primarily through our iPass Branch and Retail IP VPN, and managed broadband services. These revenues are based on committed monthly contracts in which each recurring end point fee is bundled with certain other upfront non-recurring fees including equipment, installation, management set up, and shipping. Each end point is a physical network site.

| | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | | Nine Months Ended

September 30, | |

| Enterprise Mobility Services Segment | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

| | | (in thousands, except percentages) | |

Enterprise Mobility Services Revenue: | | $ | 26,905 | | | $ | 31,227 | | | $ | 84,294 | | | $ | 97,199 | |

Network Revenue | | | 20,937 | | | | 25,532 | | | | 67,817 | | | | 80,992 | |

Platform Revenue | | | 5,005 | | | | 4,277 | | | | 13,993 | | | | 11,829 | |

Other EMS Fees and Revenue | | | 963 | | | | 1,418 | | | | 2,484 | | | | 4,378 | |

| | | | |

EMS revenue as a percentage of total revenue | | | 78.2 | % | | | 82.1 | % | | | 79.3 | % | | | 82.7 | % |

Dollar Change | | | (4,322 | ) | | | | | | | (12,905 | ) | | | | |

Percentage change | | | (13.8 | )% | | | | | | | (13.3 | )% | | | | |

| | | | |

Operating loss | | | (893 | ) | | | (430 | ) | | | (2,487 | ) | | | (1,864 | ) |

Dollar Change | | | 463 | | | | | | | | 623 | | | | | |

Percentage change | | | 107.7 | % | | | | | | | 33.4 | % | | | | |

18

Network Revenue

The decline in EMS network revenue was due to a decline in Wi-Fi revenue, and the anticipated decline in dial-up, minimum commitment and 3G revenues. The decline in Wi-Fi revenue was due to lower usage as a result of increased availability of free Wi-Fi internet access in the United States and the observed migration in customer usage patterns from laptops to smartphones and tablets worldwide. The anticipated decline in dial-up revenue was due to the continued erosion in our dial-up base as customers migrated to alternative faster connectivity technologies. The continued and anticipated decline in minimum commitment revenue was due to customers contracting to lower dollar commit levels on a prospective basis. The decline in 3G revenues was a result of lower usage levels due to continued and anticipated customer terminations as we move away from focusing our efforts on 3G network sales and look to continue to grow our platform revenue and Wi-Fi services. Our decision in the second quarter of 2011 to discontinue sales of new 3G services provided by a certain carrier also contributed to the decrease in 3G revenues starting in the third quarter of 2011.

For the three months ended September 30, 2011 compared to the same period in 2010, network revenue decreased $4.6 million or 18.0% primarily due to the decline in Wi-Fi revenue of $2.0 million and the anticipated decline in minimum commitment, dial-up and 3G revenues of $0.8 million, $0.9 million, and $1.0 million, respectively.

For the nine months ended September 30, 2011 compared to the same period in 2010, network revenue decreased $13.2 million or 16.3% primarily due to the decline in Wi-Fi revenue of $5.0 million and the anticipated decline in minimum commitment, dial-up and 3G revenues of $3.6 million, $3.2 million, and $1.4 million, respectively.

Platform Revenue

For the three months ended September 30, 2011, compared to the same period in 2010, platform revenue increased by $0.7 million or 17.0% due to increased fees generated by carrier and enterprise Open Mobile customers of $1.7 million offset in part by a decrease in iPC fees of $0.7 million, and lower legacy annual business fees and other platform fees of $0.3 million.

For the nine months ended September 30, 2011, compared to the same period in 2010, platform revenue increased by $2.2 million or 18.3% due to increased fees generated by carrier and enterprise Open Mobile customers of $4.7 million offset in part by a decrease in iPC fees of $1.5 million, and lower legacy annual business fees and other platform fees of $1.0 million.

Other EMS Fees and Revenue

For the three and nine months ended September 30, 2011 compared to the same period in 2010, the decrease in other EMS fees and revenue of $0.5 million or 32.1%, and $1.9 million or 43.3%, respectively, was primarily due to the decrease in device management fees and other fees, license and subscription fees.

Operating Loss

For the three and nine months ended September 30, 2011 compared to the same periods in 2010, the increase in EMS operating loss was primarily due to lower EMS revenues of $4.3 million and $12.9 million, respectively; partially offset by a corresponding reduction in network access costs of $2.2 million and $6.4 million, respectively and lower operating expenses of $1.7 million and $5.8 million, respectively, due to our ongoing cost management efforts that include ongoing headcount reductions.

| | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | | Nine Months Ended

September 30, | |

| Managed Network Services Segment | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

| | | (in thousands, except percentages) | |

Managed Network Services Revenue | | $ | 7,506 | | | $ | 6,831 | | | $ | 22,032 | | | $ | 20,320 | |

| | | | |

MNS revenue as a percentage of total revenue | | | 21.8 | % | | | 17.9 | % | | | 20.7 | % | | | 17.3 | % |

Dollar Change | | | 675 | | | | | | | | 1,712 | | | | | |

Percentage change | | | 9.9 | % | | | | | | | 8.4 | % | | | | |

| | | | |

Operating loss | | | (210 | ) | | | (577 | ) | | | (1,324 | ) | | | (1,140 | ) |

Dollar Change | | | (367 | ) | | | | | | | 184 | | | | | |

Percentage change | | | (63.6 | %) | | | | | | | 16.1 | % | | | | |

MNS Revenue

The increase in MNS revenue for the three and nine months ended September 30, 2011 compared to the same periods in 2010, was primarily due to an increase in revenue of $1.2 million and $3.7 million, respectively, resulting from growth in our Branch/Retail customer base and related management fees. These increases were partially offset by a decrease in Home/Office product revenue of $0.5 million and $1.9 million, respectively, for these periods.

19

Operating loss

For the three months ended September 30, 2011 compared to the same period in 2010, the decrease in MNS operating loss was primarily due to lower operating expenses of $0.2 million due to lower commission payouts and savings from past headcount reduction, and the increase in gross profit of approximately $0.2 million as a result of network access costs that increased at a lower rate compared to the increase in revenue due to the favorable renegotiation of certain supplier contracts.

For the nine months ended September 30, 2011 compared to the same periods in 2010, the increase in MNS operating loss was primarily due to the decrease in gross profit of approximately $0.4 million as a result of the shift in product mix from Home/Office to lower margin Branch/Retail, partially offset by lower operating expenses of $0.2 million due to lower commission payouts and savings from past headcount reductions.

Q4 2011 Outlook

We expect total revenue in the fourth quarter of 2011 to be consistent with the third quarter of 2011 primarily due to increases in Wi-Fi, platform, and MNS revenues, offset by anticipated decreases in dial-up, minimum commitment and 3G network revenues. We expect Adjusted EBITDA loss to decline in the fourth quarter primarily driven by lower operating expenses.

Operating Expenses

Network Access Costs

Network access costs (referred to as “NAC”) consist of charges for network access which we pay to our network service providers.

| | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | | Nine Months Ended

September 30, | |

| | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

| | | (in thousands, except percentages) | |

Network access costs | | $ | 15,647 | | | $ | 17,338 | | | $ | 50,249 | | | $ | 54,605 | |

As a percent of total revenue | | | 45.5 | % | | | 45.6 | % | | | 47.3 | % | | | 46.5 | % |

Dollar change | | $ | (1,691 | ) | | | | | | $ | (4,356 | ) | | | | |

Percentage change | | | (9.8 | )% | | | | | | | (8.0 | )% | | | | |

The decrease in network access costs for the three and nine months ended September 30, 2011, compared to the same periods in 2010, was primarily due to a combination of lower Wi-Fi, 3G and dial-up network usage that decreased EMS network access costs by $2.2 million and $6.4 million, respectively. These decreases were partially offset by an increase in MNS network access costs for the three and nine months ended September 30, 2011, compared to the same periods in 2010, of $0.5 million and $2.1 million, respectively. The increase in MNS network access costs was due to the increase in revenue and a continued shift in the product mix from Home/Office to Branch/Retail. Branch/Retail generally has higher incremental deployment costs and higher connection charges.

Network Operations

Network operations expenses consist of compensation and benefits for our network engineering, customer support and network access quality personnel, outside consultants, transaction center fees, network equipment depreciation, costs of 3G data cards and allocated overhead costs.

| | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | | Nine Months Ended

September 30, | |

| | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

| | | (in thousands, except percentages) | |

Network operations expenses | | $ | 5,427 | | | $ | 6,544 | | | $ | 16,845 | | | $ | 20,872 | |

As a percent of total revenue | | | 15.8 | % | | | 17.2 | % | | | 15.8 | % | | | 17.8 | % |

Dollar | | $ | (1,117 | ) | | | | | | $ | (4,027 | ) | | | | |

Percentage change | | | (17.1 | )% | | | | | | | (19.3 | )% | | | | |

The decrease in network operations expenses for the three and nine months ended September 30, 2011 compared to the same periods in 2010, was primarily due to our ongoing cost management efforts, including ongoing headcount reductions, efficiencies achieved in our network footprint and related technology infrastructure, and lower shipments of 3G mobile data cards as sales efforts focus on platform revenue and Wi-Fi services, with 3G network sales de-emphasized.

For the three and nine months ended September 30, 2011 compared to the same periods in 2010, headcount-related expenses decreased $0.5 million and $1.4 million, respectively, infrastructure expenses decreased $0.4 million and $1.2 million, respectively, and 3G mobile data cards subsidized expenses decreased $0.2 million and $1.3 million, respectively.

20

Research and Development

Research and development expenses consist of compensation and benefits for our research and development personnel, consulting, and allocated overhead costs.

| | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | | Nine Months Ended

September 30, | |

| | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

| | | (in thousands, except percentages) | |

Research and development expenses | | $ | 3,715 | | | $ | 3,566 | | | $ | 10,843 | | | $ | 10,210 | |

As a percent of total revenue | | | 10.8 | % | | | 9.4 | % | | | 10.2 | % | | | 8.7 | % |

Dollar change | | $ | 149 | | | | | | | $ | 633 | | | | | |

Percentage change | | | 4.2 | % | | | | | | | 6.2 | % | | | | |

Research and development expenses increased for the three and nine months ended September 30, 2011 compared to the same periods in 2010, mainly to support the ongoing development efforts of our Open Mobile platform and our new Open Mobile Exchange platform.

Sales and Marketing

Sales and marketing expenses consist of compensation, benefits, advertising and promotion costs, and allocated overhead costs.

| | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | | Nine Months Ended