SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE SECURITIES

EXCHANGE ACT OF 1934 (AMENDMENT N0. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

¨ Preliminary Proxy Statement | | ¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x Definitive Proxy Statement | | |

| |

¨ Definitive Additional Materials | | |

|

¨ Soliciting Material Pursuant to sec. 240.14a-11(c) or sec. 240.14a-12 |

Omega Protein Corporation

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(l) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

April 29, 2004

To Our Stockholders:

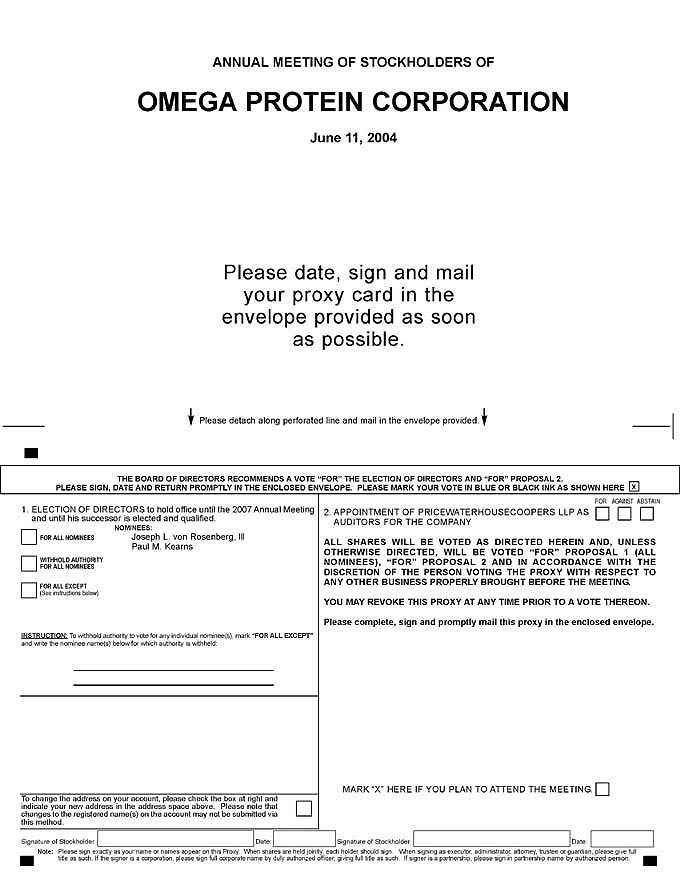

You are cordially invited to attend the 2004 Annual Meeting of Stockholders of Omega Protein Corporation, to be held on Friday, June 11, 2004, at 9:00 a.m., local time, at The Drake Hotel, 140 East Walton Place, Chicago, Illinois 60611. A notice of the meeting, proxy statement and form of proxy are enclosed with this letter.

At the meeting, we will report on the progress of the Company, comment on matters of interest and respond to your questions. A copy of the Company’s Annual Report to Stockholders for the fiscal year ended December 31, 2003 accompanies this mailing.

Stockholders can vote their shares by proxy by marking their votes on the proxy card or by attending the meeting in person.

It is important that your shares be represented at the meeting. Even if you plan to attend the meeting, we hope that you will read the enclosed Proxy Statement and the voting instructions on the enclosed proxy card and then vote by completing, signing, dating and mailing the proxy card in the enclosed, postage pre-paid envelope. You may vote your shares in person if you attend the Annual Meeting, thereby canceling any proxy previously given. If your shares are not registered in your own name and you would like to attend the meeting, please ask the broker, trust, bank or other nominee that holds the shares to provide you with evidence of your share ownership.

We appreciate your continued interest in the Company.

|

| Sincerely, |

|

|

Joseph L. von Rosenberg III President and Chief Executive Officer |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 11, 2004

TO THE STOCKHOLDERS OF OMEGA PROTEIN CORPORATION:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Omega Protein Corporation (the “Company”) will be held at The Drake Hotel, 140 East Walton Place, Chicago, Illinois 60611 on Friday, June 11, 2004 at 9:00 a.m., local time, for the following purposes:

| | 1. | To elect two Class III directors for a term of three years and until their successors are duly elected and qualified; |

| | 2. | To ratify the appointment of PricewaterhouseCoopers LLP as independent certified public accountants for the Company’s fiscal year ending December 31, 2004; and |

| | 3. | To transact such other business as may properly come before the meeting or any postponements or adjournments thereof. |

The Board of Directors has fixed the close of business on April 23, 2004 as the record date for determining the stockholders entitled to notice of, and to vote at, the meeting and at any postponement or adjournment thereof. A list of such stockholders will be available during normal business hours at the offices of the Company for inspection at least ten days prior to the Annual Meeting.

You are cordially invited to attend this meeting.

By order of the Board of Directors

|

|

|

JOHN D. HELD Senior Vice President, General Counsel and Secretary |

Houston, Texas

April 29, 2004

OMEGA PROTEIN CORPORATION

1717 St. James Place

Suite 550

Houston, Texas 77056

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

JUNE 11, 2004

General Information

This statement (the “Proxy Statement”) is being furnished in connection with the solicitation of proxies by the Board of Directors of Omega Protein Corporation (“Omega” or the “Company”) for use at the Annual Meeting of Stockholders of the Company to be held at The Drake Hotel, 140 East Walton Place, Chicago, Illinois 60611 on June 11, 2004 at 9:00 a.m., local time, and at any postponement or adjournment thereof (the “Annual Meeting”). The Annual Meeting is being held for the purposes set forth in this Proxy Statement. This Proxy Statement and the enclosed form of proxy (the “Proxy Card”) are first being mailed on or about April 29, 2004.

Proxy Card

The shares represented by any Proxy Card which is properly executed and received by the Company prior to or at the Annual Meeting (each, a “Conforming Proxy”) will be voted in accordance with the specifications made thereon. Conforming Proxies that are properly signed and returned but on which no specifications have been made by the stockholder will be voted in favor of the proposals described in the Proxy Statement. The Board of Directors is not aware of any matters that are expected to come before the Annual Meeting other than those described in the Proxy Statement. However, if any other matters are properly brought before the Annual Meeting, the persons named in the Proxy Card will vote the shares represented by each Conforming Proxy on those matters as instructed by the Board of Directors, or in the absence of express instructions from the Board of Directors, in accordance with their own best judgment. A stockholder who has executed and delivered a Conforming Proxy may revoke that Conforming Proxy at any time before it is voted by (i) executing a new proxy with a later date and delivering the new proxy to the Secretary of the Company, (ii) voting in person at the Annual Meeting, or (iii) giving record of written notice of the revocation to the Secretary of the Company prior to the Annual Meeting.

Quorum and Other Matters

The presence at the Annual Meeting, in person or by proxy, of the holders of a majority of the outstanding shares of the Company’s common stock, par value $0.01 per share (“Common Stock”), is necessary and sufficient to constitute a quorum. Shares of Common Stock represented by Conforming Proxies will be counted as present at the Annual Meeting for purposes of determining a quorum, without regard to whether the proxy is marked as casting a vote or abstaining. Shares of Common Stock held by nominees that are voted on at least one matter coming before the Annual Meeting will also be counted as present for purposes of determining a quorum, even if the beneficial owner’s discretion has been withheld (a “broker non-vote”) for voting on some or all other matters.

Directors will be elected by a favorable vote of a plurality of the shares of Common Stock present, in person or by proxy, at the Annual Meeting and entitled to vote. Accordingly, abstentions and broker non-votes will not affect the outcome of the election of directors.

All other matters to come before the Annual Meeting require the approval of a majority of the shares of Common Stock present, in person or by proxy, at the Annual Meeting and entitled to vote.

Therefore, abstentions will have the same effect as votes against the proposals on such matters. Broker non-votes, however, will be deemed shares not present to vote on such matters, and therefore will not count as votes for or against the proposals, and will not be included in calculating the number of votes necessary for approval of such matters.

Solicitation of Proxies

This solicitation of proxies is being made by the Board of Directors of the Company and all expenses of this solicitation will be borne by the Company. The Company expects to reimburse brokerage houses, banks and other fiduciaries for reasonable expenses of forwarding proxy materials to beneficial owners.

VOTING SECURITIES AND SECURITY OWNERSHIP

OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The outstanding voting securities of the Company consist entirely of shares of Common Stock. Each share of Common Stock entitles its owner to one vote upon each matter to come before the Annual Meeting. Only stockholders of record at the close of business on April 23, 2004 (the “Record Date”) will be entitled to vote at the Annual Meeting and at any postponement or adjournment thereof. At the close of business on such date, the Company had outstanding 24,414,427 shares of Common Stock.

Security Ownership of Certain Beneficial Owners

To the Company’s knowledge, the following persons are the only persons who are beneficial owners of more than five percent of the Company’s Common Stock based on the number of shares outstanding on December 31, 2003:

| | | | | |

Name and Address of Beneficial Owner

| | Amount and Nature of Beneficial Ownership(1)

| | Percent

of Class(1)

| |

Malcolm I. Glazer(2) c/o Zapata Corporation 100 Meridian Centre, Suite 350 Rochester, New York 14618 | | 14,501,000 | | 59.46 | % |

| | |

Zapata Corporation(2) 100 Meridian Centre, Suite 350 Rochester, New York 14618 | | 14,501,000 | | 59.46 | % |

| | |

Dimensional Fund Advisors, Inc.(3) 1299 Ocean Avenue, 11th Floor Santa Monica, California 90401 | | 1,583,200 | | 6.49 | % |

| | |

Wellington Management Company, LLP(4) 75 State St. Boston, Massachusetts 02109 | | 1,234,200 | | 5.06 | % |

| (1) | For purposes of computing the percentage of outstanding shares held by each person or group of persons named above, any security which such person or persons has the right to acquire within 60 days after December 31, 2003 is deemed to be outstanding, but is not deemed to be outstanding in computing the percentage ownership of any other person. |

| (2) | Based on the Form 10K/A Amendment No. 1 for the year ended December 31, 2003 filed with the Securities and Exchange Commission (“SEC”) by Zapata Corporation (“Zapata”), Malcolm I. Glazer beneficially owns 47.2% of outstanding common stock of Zapata. By virtue of such ownership, Mr. Glazer |

2

| | may be deemed to beneficially own the 14,501,000 shares of Common Stock of the Company owned by Zapata. Mr. Glazer disclaims beneficial ownership of such Company shares. |

| (3) | Based on a Schedule 13G/A dated February 6, 2004 filed with the SEC by Dimensional Fund Advisors Inc. |

| (4) | Based on a Schedule 13G/A dated February 13, 2004 filed with the SEC by the Wellington Management Company, LLP reporting shared voting power over 1,170,200 shares and shared dispositive power over 1,234,200 shares. |

Security Ownership of Directors and Executive Officers

The following table sets forth the number of shares of Common Stock of the Company and common stock of Zapata beneficially owned as of December 31, 2003 by each of the Company’s directors and executive officers, including each of the Named Executive Officers set forth in the Summary Compensation Table, and by all directors and executive officers, including the Named Executive Officers, as a group. Unless otherwise noted, each of the named persons and members of the group has sole voting and investment power with respect to the shares shown.

| | | | | | | | | | | |

Name of Beneficial Owner

| | Shares of

the

Company’s

Common Stock(1)

| | | Percent of

the

Company’s

Common

Stock(2)

| | | Shares

of

Zapata Common Stock

| | | % of Zapata

Common Stock

|

Joseph L. von Rosenberg III | | 1,682,700 | | | 6.5 | % | | 0 | | | — |

Robert W. Stockton | | 1,326,000 | | | 5.2 | % | | 0 | | | — |

Avram A. Glazer | | 568,200 | (3) | | 2.3 | % | | 17,159 | (4) | | * |

John D. Held | | 325,000 | | | 1.3 | % | | 0 | | | — |

Michael E. Wilson | | 161,000 | | | * | | | 0 | | | — |

Albert A. Riley | | 100,000 | | | * | | | 0 | | | — |

J. Scott Herbert | | 90,050 | | | * | | | 0 | | | — |

Clark A. Haner | | 73,333 | | | * | | | 0 | | | — |

Thomas R. Wittmann | | 46,333 | | | * | | | 0 | | | — |

Kenneth Robichau | | 24,166 | | | * | | | 310 | | | * |

Captain Warner Allen Ketnor | | 10,000 | | | * | | | 0 | | | — |

Gary L. Allee | | 126,564 | | | * | | | 0 | | | — |

William E. M. Lands | | 94,500 | (5) | | * | | | 0 | | | — |

Paul M. Kearns | | 34,200 | | | * | | | 0 | | | — |

Darcie S. Glazer | | 0 | (6) | | * | | | 14,125 | (7) | | * |

Harry O. Nicodemus IV | | 0 | | | * | | | 0 | | | — |

All directors and executive officers, including Named Executive Officers, as a group, including those persons named above (16 total) | | 4,662,046 | | | 16.1 | % | | 31,594 | | | * |

| * | Represents ownership of less than 1.0%. |

| (1) | Includes 1,663,200; 1,320,000; 568,200; 325,000;160,000; 100,000; 90,000; 73,333; 46,333; 19,166; 10,000; 54,200; 54,200; 34,200; 0; 0 and 4,517,832 shares of Common Stock subject to options exercisable on December 31, 2003 or within 60 days thereafter held by Messrs. von Rosenberg, Stockton, A. Glazer, Held, Wilson, Riley, Herbert, Haner, Wittmann, Robichau, Ketnor, Allee, Lands, Kearns, Ms. D. Glazer, Mr. Nicodemus and all directors and executive officers, including Named Executive Officers, as a group, including those persons named in the above table, respectively. |

| (2) | For purposes of computing the percentage of outstanding shares held by each person or group of persons named above, any security which such person or persons has the right to acquire within 60 days after December 31, 2003 is deemed to be outstanding, but is not deemed to be outstanding in computing the percentage ownership of any other person. |

| (3) | Does not include 14,501,000 shares that are held by the Malcolm I. Glazer Family Limited Partnership or Zapata, with respect to which Avram A. Glazer disclaims any beneficial ownership. |

3

| (4) | Includes 13,459 shares of Zapata common stock subject to stock options held by Avram A. Glazer, based on Zapata’s Form 10K/A Amendment No. 1 for the year ended December 31, 2003. |

| (5) | Includes 2,000 shares of Common Stock owned by a trust established for the benefit of Dr. Lands’ grandchildren. Dr. Lands disclaims beneficial ownership of such shares. |

| (6) | Does not include 14,501,000 shares of Common Stock that are held by the Malcolm I. Glazer Family Limited Partnership or Zapata, with respect to which Darcie S. Glazer disclaims any beneficial ownership. |

| (7) | Includes 14,125 shares of Zapata common stock subject to options held by Darcie S. Glazer, based on Zapata’s Form 10K/A Amendment No. 1 for the year ended December 31, 2003. |

Because Zapata holds more than a majority of the Company’s outstanding Common Stock, Zapata has the power to approve matters submitted for consideration at the Annual Meeting without regard to the votes of the other stockholders. The Company understands that Zapata intends to votefor the election of the proposed Nominees for the Board of Directors andfor the ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent auditors. There are no agreements between the Company and Zapata with respect to the election of directors or the officers of the Company or with respect to other matters that may come before the Annual Meeting.

Changes in Control

Zapata has stated in its Form 10-K for the year ended December 31, 2003 that it continues to explore ways to enhance Zapata stockholder value through its 59% ownership of the Company and that possible transactions may include a sale, merger or another significant strategic transaction involving the Company, as well as purchases of Common Stock through the open market or private transactions.

4

PROPOSAL 1

ELECTION OF DIRECTORS

The Company’s Articles of Incorporation divide the Board of Directors into three classes designated as Class I, Class II and Class III. Each class of directors is elected to serve a three-year term. The Board presently consists of seven directors, three in Class I, two in Class II and two in Class III, whose terms expire at the 2005, 2006 and 2004 Annual Meetings, respectively, and until their successors are duly elected and qualified.

The Class III directors are Joseph L. von Rosenberg and Paul M. Kearns, and their terms expire at the 2004 Annual Meeting, or as soon thereafter as their successors are elected and qualified. Each of Mr. von Rosenberg and Mr. Kearns has been nominated by the Board of Directors to be elected by the holders of the Common Stock to serve an additional three-year term as a Class III Director. Each of Mr. von Rosenberg and Mr. Kearns has consented to be named in this Proxy Statement and to serve as a director if elected.

The Company’s Articles of Incorporation provide that the Board of Directors shall consist of no more non-U.S. citizens than a minority of the number necessary to constitute a quorum of the Board of Directors. Each of the Company’s directors is a citizen of the United States except for Mr. Kearns who is a citizen of the United Kingdom.

Proxies representing shares of Common Stock held on the Record Date that are returned duly executed will be voted, unless otherwise specified, in favor of the nominees for the Class III directors named below. The nominees have consented to serve if elected, but should either nominee be unavailable to serve (which event is not anticipated) the persons named in the proxy intend to vote for such substitute nominee or nominees as the Board of Directors may recommend.

Vote Required.Each nominee shall be elected by a plurality of the votes cast in the election by the holders of the Common Stock represented and entitled to vote at the Annual Meeting, assuming the existence of a quorum.

Class III Directors—To Serve a Three-Year Term Expiring at the 2007 Annual Stockholders Meeting

JOSEPH L. VON ROSENBERG III, age 45, has been President and Chief Executive Officer and a director of the Company since July 1997.

PAUL M. KEARNS, age 40, has been a director of the Company since June 2001. Mr. Kearns is a director of Prentis, Donegan & Partners, Ltd., a London-based insurance brokerage firm which he co-founded in 1993. Mr. Kearns has more than 20 years of experience in the global risk management and insurance industries. Mr. Kearns is a citizen of the United Kingdom.

THE BOARD RECOMMENDS A VOTEFOR THE ELECTION OF EACH CLASS III NOMINEE AS A DIRECTOR.

Continuing Directors

Biographical and other information with respect to all members of the Board of Directors whose current terms will continue after the Annual Meeting is set forth below:

Class I Nominees—Current Term Expires at the 2005 Annual Stockholders Meeting

GARY L. ALLEE, age 59, has been a director of the Company since May 1998. For more than the past five years, Dr. Allee has been Professor of Swine Nutrition at the University of Missouri. Dr. Allee has also served as President and as a member of the Board of Directors of the Midwest Section of the American Society of Animal

5

Science. Dr. Allee has B.S. and M.S. degrees in Animal Husbandry and Swine Nutrition from the University of Missouri and a Ph.D. in Nutritional Sciences from the University of Illinois.

WILLIAM E. M. LANDS, age 73, has been a director of the Company since May 1998. In February 2002, Dr. Lands retired as Senior Scientific Advisor to the Director of the National Institute on Alcohol Abuse and Alcoholism, a position he assumed after serving as head of the Department of Biological Chemistry at the University of Illinois Medical Center. Dr. Lands has a B.S. degree in Chemistry from the University of Michigan and a Ph.D. in Biological Chemistry from the University of Illinois.

HARRY O. NICODEMUS IV, age 56, has been a director of the Company since April 2004. Mr. Nicodemus has served since November 2003 as Vice President, Chief Financial Officer, Chief Accounting Officer, Secretary, and Compliance Officer of Equus Capital Management Corporation, a financial advisor for Equus II Incorporated which is a publicly-traded business development company with investments in privately owned businesses and venture capital firms. From October 1999 to December 2002, Mr. Nicodemus was Vice President and Chief Accounting Officer of US Liquids, Inc., a national provider of liquid waste management services. From February 1997 until August 1999, Mr. Nicodemus was the Chief Financial Officer of American Residential Services, Inc., a residential and commercial heating, air conditioning, plumbing and electrical services company. Mr. Nicodemus is a certified public accountant.

Class II Directors—Current Term Expires at the 2006 Annual Stockholders Meeting

AVRAM A. GLAZER, age 42, has been Chairman of the Board of the Company since January 1998. He also has served as Chairman of the Board of Zapata since March 2002, and as President and Chief Executive Officer of Zapata since 1995. For more than the past five years, he has been employed by, and has worked on behalf of, Malcolm I. Glazer and a number of entities owned and controlled by Malcolm I. Glazer, including First Allied Corporation. Mr. Glazer served as Vice President of First Allied Corporation from 1985 through 1995. He also serves as a director, President and Chief Executive Officer of Zap.Com Corporation (a public shell company which until December 2000 was an internet advertising and e-commerce network company) and as a director of Safety Components International, Inc. (an automotive air bag fabric and cushions manufacturer). Avram A. Glazer is the brother of Darcie S. Glazer and the son of Malcolm I. Glazer.

DARCIE S. GLAZER, age 35, has been a director of the Company since April 2002. For more than the past five years, she has been employed by, and has worked on behalf of, Malcolm I. Glazer and a number of entities owned and controlled by Malcolm I. Glazer, including First Allied Corporation. Ms. Glazer serves as the Executive Vice President of First Allied Corporation. Ms. Glazer served as an investment analyst for Zapata from 1996 to February 2001. Darcie S. Glazer is the sister of Avram A. Glazer and the daughter of Malcolm I. Glazer.

Board of Directors and Board Committees

The Company’s Board of Directors has seven directors and has established the Audit, Compensation, Scientific and Corporate Governance Committees as its standing committees. The Board of Directors does not have a nominating committee or executive committee or any committees performing similar functions.

The Board of Directors has adopted Corporate Governance Guidelines to assist the Board in the exercise of its responsibilities. These Guidelines reflect the Board’s commitment to monitor the effectiveness of policy and decision making both at the Board and management level, with a view to enhancing stockholder value over the long term. The Guidelines are posted on the Company’s website atwww.omegaproteininc.com.

During 2003, the Board of Directors met seven times, the Audit Committee met six times and took action by unanimous written consent on two occasions, the Compensation Committee met four times, and the Scientific Committee met once. The Corporate Governance Committee did not exist in 2003. Each director, except for

6

Avram A. Glazer and Darcie S. Glazer, during the period for which he or she was a director in 2003, attended at least 75% of the aggregate of the total number of meetings of the Board of Directors and the total number of meetings held by all committees of the Board on which such director served.

Audit Committee. The Audit Committee consists of Mr. Nicodemus (Chairman), Dr. Allee, and Dr. Lands, each of whom the Board of Directors has determined to be “independent” as defined by the NYSE listing standards, the standards set for Audit Committee members by the Securities Exchange Act of 1934, as amended by the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley Act”), as well as the definition of “independent director” established by the Board. See “Director Independence.” (Prior to April 2004, the Audit Committee consisted of Dr. Allee (Chairman), Dr. Lands and Mr. Kearns.) The Board of Directors has determined that Mr. Nicodemus is an “audit committee financial expert” as that term is used in applicable SEC regulations.

The Audit Committee reviews the adequacy of the Company’s internal control systems and financial reporting procedures, reviews the general scope of the annual audit and reviews and monitors the performance of non-audit services by the Company’s independent public accountants. The Audit Committee also meets with the independent auditors and with appropriate financial personnel of the Company regarding these matters. The Audit Committee also appoints the Company’s independent auditors. The independent auditors may periodically meet alone with the Audit Committee and have unrestricted access to the Audit Committee. The Audit Committee operates under a written charter which is posted on the Company’s website atwww.omegaproteininc.com.

Compensation Committee. The Compensation Committee consists of Mr. Kearns (Chairman) and Dr. Allee, each of whom the Board of Directors has determined to be “independent” as defined by the NYSE listing standards, as well as the definition of “independent director” established by the Board. See “Director Independence.” The Compensation Committee determines the compensation (both salary and performance incentive compensation) to be paid to the Chief Executive Officer and certain other officers of the Company, and makes grants of long-term incentive awards. The Compensation Committee operates under a written charter which is posted on the Company’s website atwww.omegaproteininc.com.

Scientific Committee. The Scientific Committee consists of Dr. Lands (Chairman) and Dr. Allee. The Scientific Committee keeps the Board of Directors and Company management apprised of scientific matters and developments that are relevant to the Company’s industry. The Scientific Committee operates under a written charter which is posted on the Company’s website atwww.omegaproteininc.com.

Corporate Governance Committee.The Corporate Governance Committee consists of Mr. Nicodemus (Chairman) and Mr. Kearns. The Corporate Governance Committee reviews and reports to the Board on a periodic basis on corporate governance matters, periodically reviews and assesses the effectiveness of the Board’s Corporate Governance Guidelines and recommends proposed revisions to those Guidelines to the Board. The Corporate Governance Committee operates under a written charter which is posted on the Company’s website atwww.omegaproteininc.com.

Nominating Committee. The Company does not currently have, nor has it had in the past, a standing nominating committee or committee performing similar functions. Pursuant to Section 303A of the NYSE Listed Company Manual, the Company is not required to have a nominating committee because the Company is a “controlled company” due to the fact that more than 50% of the voting power of the Company’s equity securities is held by Zapata. Nominations for directors are considered by the entire Board of Directors, and when performing this function, the Board operates under its Corporate Governance Guidelines. These Guidelines are posted at the Company’s websiteat www.omegaproteininc.com.

The Board has not formally established procedures to be followed by stockholders submitting recommendations for candidates for the Board, nor has it established a formal process for identifying candidates for directors. The Board considers individuals who have distinguished records for leadership and success in their

7

area of activity and who will make meaningful contributions to the Board. The Board selects nominees for director on the basis of broad experience, character, integrity, ability to make independent analytical inquiries, as well as their understanding of the Company’s business environment. The Company does not pay fees to any third party to identify or evaluate or assist in identifying or evaluating director candidates.

The Company’s Bylaws provide that nominations for the election of directors may be made upon timely notice given by a stockholder. A timely notice must be made in writing, and physically received by the Secretary of the Company, not later than the close of business on the 60th calendar day, nor earlier than the close of business on the 90th calendar day, before the first anniversary of the preceding year’s annual meeting (except that, in the event that the date of the annual meeting is more than 30 calendar days before, or more than 60 calendar days after, such anniversary date, notice by the stockholder to be timely must be so delivered not earlier than the close of business on the 90th calendar day before such annual meeting and not later than the close of business on the later of the 60th calendar day before such annual meeting or the 10th calendar day following the day on which public announcement of a meeting date is first made by the Company). The stockholder notice must contain: (i) the name and address of the nominee for director, (ii) the name and address, as they appear on the books of the Company, of the stockholder proposing the nomination, (iii) the class and number of shares of the stock of the Company that are beneficially owned by the stockholder, and (iv) any material interest of the stockholder in the nomination. This notice provision does not apply to Zapata or its affiliates so long as Zapata owns at least a majority of the outstanding Common Stock.

Independent Directors. The Board of Directors has determined that all members of the Board, other than Joseph L. von Rosenberg III, Avram A. Glazer and Darcie S. Glazer, are “independent” with the meaning of the rules of the NYSE, as well as the definition of independence established by the Board. See “Director Independence.” The Board does not have a policy on the number of percentage or independent directors who shall constitute the Board. Pursuant to Section 303A of the NYSE Listed Company Manual, the Company is not required to have a majority of independent directors on the Board (although it currently does so) because the Company is a “controlled company” due to the fact that more than 50% of the voting power of the Company’s equity securities is held by Zapata.

Stockholder Communications. The Board of Directors maintains a process for stockholders to communicate with the Board or any Board member. Stockholders who desire to communicate with the Board should send any communication to the Company’s Corporate Secretary, c/o Omega Protein Corporation, 1717 St. James Place, Suite 550, Houston, Texas 77056. Any such communication must state the number of shares of Common Stock beneficially owned by the stockholder making the communication. The Corporate Secretary will forward such communication to the full Board of Directors or to any individual director or directors to whom the communication is directed unless the communication is threatening or illegal, uses inappropriate expletive language or is similarly inappropriate, in which case the Corporate Secretary has the authority to discard the communication or take appropriate legal action regarding the communication.

Director Attendance at Annual Meetings. The Board does not have a policy requiring that all directors attend Company annual meetings of stockholders, but it encourages all directors to do so. The 2003 Annual Meeting of Stockholders was attended by Dr. Allee, Dr. Lands and Mr. von Rosenberg.

Presiding Director for Board Executive Sessions. The Company schedules regular executive sessions in which directors meet without management present. The Board has elected Dr. Gary Allee to be the Presiding Director at all Board executive sessions. Stockholders may communicate with the Presiding Director in the same manner described above under “—Stockholder Communications.”

8

EXECUTIVE OFFICERS

The following sets forth certain information with respect to the executive officers of the Company as of the date of this Proxy Statement.

| | | | |

Name

| | Age

| | Position

|

Joseph L. von Rosenberg III | | 45 | | President, Chief Executive Officer and Director |

Robert W. Stockton | | 53 | | Executive Vice President and Chief Financial Officer |

John D. Held | | 41 | | Senior Vice President, General Counsel and Secretary |

Clark A. Haner | | 47 | | Vice President—Administration and Controller |

Thomas R. Wittmann | | 54 | | Vice President—Operations |

J. Scott Herbert | | 38 | | Vice President—Agriproducts |

Albert A. Riley | | 55 | | Vice President—Refined Oils |

Michael E. Wilson | | 53 | | Vice President—Marine Operations and President of Omega Shipyard, Inc. |

Kenneth Robichau | | 51 | | Vice President—Tax and Director of Internal Audit |

JOSEPH L. VON ROSENBERG has been President and Chief Executive Officer and a director of the Company since July 1997.

ROBERT W. STOCKTON has served as Executive Vice President and Chief Financial Officer of the Company since July 1997. Mr. Stockton also served as Secretary of the Company from January 2000 to September 2002. Mr. Stockton is a certified public accountant.

JOHN D. HELD has served as the Company’s General Counsel since March 2000, as Vice President of the Company from April 2002 to September 2002, and as Senior Vice President and Secretary since September 2002. Mr. Held also served as a consultant to the Company from December 1999 to February 2000. From March 1996 until October 1999, Mr. Held was Senior Vice President, General Counsel and Secretary of American Residential Services, Inc., a residential and commercial heating, air conditioning, plumbing and electrical services company. Prior thereto, Mr. Held practiced law with a large firm in Houston, Texas.

CLARK A. HANER has served as Vice President—Administration and Controller of the Company since December 1999. From September 1997 to December 1999, Mr. Haner served as the Company’s Controller and Assistant Treasurer and prior thereto, served as the Company’s Accounting Manager. Mr. Haner joined the Company in September 1995.

THOMAS R. WITTMANN has served as Vice President—Operations since October 2002. Prior thereto, Mr. Wittmann served as the General Manager of the Company’s Abbeville, Louisiana facility since 1997 and served in various other Company positions since 1985.

J. SCOTT HERBERT has served as Vice President—Agriproducts of the Company since September 2002. Prior thereto, Mr. Herbert served as Vice President—Feed Ingredient Marketing of the Company’s principal subsidiary, Omega Protein, Inc., since March 1998, and as Director of Fish Meal Sales and in various other sales capacities with the Company since 1992.

ALBERT A. RILEY has served as Vice President—Refined Oils of the Company since September 2002. Prior thereto, Mr. Riley served as Vice President—Refined Oils of the Company’s principal subsidiary, Omega Protein, Inc., since May 2000 and as Business Development Manager—Industrial Oils of Omega Protein, Inc.

9

from September 1999 to April 2000. From July 1999 to September 1999, Mr. Riley served as a consultant to the Company. Prior thereto, Mr. Riley was a financial planner with Lincoln Financial.

MICHAEL E. WILSON is President of the Company’s wholly-owned subsidiary, Omega Shipyard, Inc., a position he has held since June 1997. Since July 1998, he has also served as the Company’s Vice President—Marine Operations and, prior thereto, served as the Company’s Coordinator of Marine Engineering and Maintenance. Mr. Wilson joined the Company in 1985 and served in various operating capacities until 1996.

KENNETH ROBICHAU has served as Vice President—Tax since September 1998 (in a part-time capacity until September 2002) and as Director of Internal Audit since September 2002. From March 1998 until September 1998, Mr. Robichau also worked in a part-time capacity as a tax consultant for the Company. Prior to March 1998, Mr. Robichau served as Vice President—Tax and Treasurer of Zapata.

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth the compensation paid in 2003 and the two prior fiscal years to the Company’s Chief Executive Officer and its other four most highly compensated executive officers with annual 2003 compensation in excess of $100,000, as well as one other employee who would otherwise be included in the five most highly compensated employees but for the fact that he is not an executive officer (collectively, the “Named Executive Officers”).

| | | | | | | | | | | | |

| | | Fiscal Year

| | Annual Compensation

| | Long-Term Compensation(1)

|

| | | | | Other Annual Compensation(2)

| | Stock Option Awards (# of options)

| | All Other Compensation(3)

|

Name and Principal Position

| | | Salary

| | Bonus

| | | |

Joseph L. von Rosenberg III President and Chief Executive Officer | | 2001

2002

2003 | | $290,000

$380,000

$425,000 | | 0

$325,000

$325,000 | | —

—

— | | 0

0

0 | | $ 300

$8,300

$8,450 |

| | | | | | |

Robert W. Stockton Executive Vice President and Chief Financial Officer | | 2001

2002

2003 | | $205,000

$245,000

$271,000 | | 0 $175,000

$175,000 | | —

—

— | | 0

0

0 | | $ 690

$8,690

$8,690 |

| | | | | | |

John D. Held Senior Vice President, General Counsel and Secretary | | 2001

2002

2003 | | $150,000

$210,000

$245,000 | | 0

$125,000

$125,000 | | —

—

— | | 0

0

0 | | $ 189

$8,300

$8,300 |

| | | | | | |

Clark A. Haner Vice President—Administration and Controller | | 2001

2002

2003 | | $ 90,000

$108,000

$118,000 | | $ 15,000

$ 20,000

$ 30,000 | | —

—

— | | 0

40,000

0 | | $ 162

$5,325

$6,158 |

| | | | | | |

J. Scott Herbert Vice President—Agriproducts | | 2001

2002

2003 | | $103,000

$110,000

$116,000 | | $ 26,085

$ 37,185

$ 30,000 | | —

—

— | | 76,000

0

0 | | $ 112

$6,145

$6,075 |

| | | | | | |

Warren Allen Ketnor Captain, F/V Sandy Point | | 2001

2002

2003 | | $ 64,007

$ 80,448

$ 98,221 | | $ 36,316

$ 39,309

$ 55,508 | | —

—

— | | 0

0

0 | | 0

$ 148

$ 193 |

| (1) | Columns for Restricted Stock Awards and Long-Term Incentive Plan payouts have been omitted because the Company has not made any such awards in 2001, 2002 or 2003. |

10

| (2) | Amounts exclude perquisites and other personal benefits that did not exceed the lesser of $50,000 or 10% of the total annual salary and bonus reported for each Named Executive Officer. |

| (3) | The reported amounts represent (i) insurance premiums paid by the Company on the Named Executive Officer’s behalf, and (ii) Company matching contributions to the Named Executive Officer’s Company 401(k) plan account. In 2003, these amounts for insurance premiums and Company matching 401(k) contributions were, respectively, for Mr. von Rosenberg: $450 and $8,000; for Mr. Stockton: $690 and $8,000; for Mr. Held: $300 and $8,000; for Mr. Haner: $229 and $5,929; for Mr. Herbert: $134 and $5,941; and for Mr. Ketnor: $193 and $0. |

Option Grants In Last Fiscal Year

No stock option grants were made to any Named Executive Officer in 2003.

Aggregated Option Exercises and Fiscal Year-End Option Values

The following table shows the stock option exercises by the Named Executive Officers during 2003. In addition, this table includes the number of exercisable and unexercisable stock options on the Company’s Common Stock held by each of the Named Executive Officers as of December 31, 2003. The Company has never granted any stock appreciation rights or restricted stock awards. None of the persons named below hold any stock options relating to Zapata’s common stock.

| | | | | | | | | | |

Name

| | Shares

Acquired On Exercise

| | Value

Realized ($)

| | Number of

Securities

Underlying Unexercised

Options at December

31, 2003

Exercisable/

Unexercisable

| | Value of

Unexercised In-the-Money(1) Options at December 31, 2003

Exercisable/ Unexercisable

|

Joseph L. von Rosenberg III | | 0 | | | 0 | | 1,663,200/0 | | $ | 5,462,100/$0 |

Robert W. Stockton | | 0 | | | 0 | | 1,320,000/0 | | $ | 3,468,000/$0 |

John D. Held | | 0 | | | 0 | | 325,000/0 | | $ | 1,644,500/$0 |

Clark A. Haner | | 0 | | | 0 | | 73,333/26,667 | | $ | 215,732/$93,868 |

J. Scott Herbert | | 50,000 | | $ | 172,821 | | 56,666/33,334 | | $ | 149,723/$153,777 |

Warren Allen Ketnor | | 0 | | | 0 | | 10,000/0 | | $ | 42,200/$0 |

| (1) | “In-the-Money” options are stock options which had an exercise price less than the closing market price of the Common Stock at December 31, 2003, which was $7.72 as reported by the New York Stock Exchange. |

Equity Compensation Plan Information

The following table shows equity compensation plan information as of December 31, 2003:

| | | | | | | |

| | | (a)

| | (b)

| | (c)

|

Plan Category

| | Number of

Securities to be Issued

upon

Exercise of

Outstanding

Options,

Warrants and Rights (in thousands)

| | Weighted-

average Exercise Price of

Outstanding

Options,

Warrants and Rights

| | Number of Securities Remaining Available for Future

Issuance

Under Equity

Compensation Plans

(Excluding

Securities

Reflected in

Column(a)) (in thousands)

|

Equity compensation plans approved by security holders | | 5,134 | | $ | 6.62 | | 550 |

Equity compensation plans not approved by security holders | | 0 | | | N/A | | 0 |

| | |

| |

|

| |

|

Total | | 5,134 | | $ | 6.62 | | 550 |

11

Employment and Severance Agreements

Messrs. von Rosenberg and Stockton each has an Employment Agreement with the Company pursuant to which the Company has agreed to provide for base salaries that are subject to review at least annually, provided that they may not be decreased without the executive’s consent. The employment agreements provide for a severance payment equal to 2.99 times the executive’s “base amount” (as defined by Section 280G(b)(3) and (d) of the Internal Revenue Code) in the event of a termination of employment (i) by the executive for Good Reason (as defined in the respective employment agreement), (ii) by the Company without Cause (as defined in the respective employment agreement), or (iii) following any Change in Control of the Company (as defined in the respective employment agreement). The agreements provide for rolling three year terms.

Mr. Held has a Change of Control and Severance Agreement with the Company pursuant to which Mr. Held is entitled to receive a severance payment in the event of termination of his employment other than for Cause (as defined in the Agreement). Prior to a Change in Control of the Company (as defined in the Agreement), the severance payment is equal to the continuation of the executive’s annual base salary for an 18-month period after termination. After a Change of Control of the Company, the severance payment is equal to 2.99 times the executive’s annual base salary and most recent cash bonus, if any.

Mr. Herbert has a Change of Control Agreement with the Company pursuant to which Mr. Herbert is entitled to a severance payment in the event of both a Change of Control of the Company (as defined in the agreement) and a termination other than for Cause (as defined in the agreement) within a two year period after a Change of Control. The severance payment is equal to one times the executive’s annual base salary in effect prior to the termination of employment.

Mr. Ketnor has an Employment Agreement with the Company which is similar in form to the employment agreement for all captains of the Company’s fishing vessels. The agreement’s term is for one year and expires on December 31, 2004. The agreement provides for a base salary, and bonuses based on individual vessel fish catch, aggregate team fish catch, and years of service with the Company, as well as discretionary bonuses. The agreement does not provide for any severance payments based on termination of employment.

Retirement Plans

The Company maintains a defined benefit plan for its employees (the “Pension Plan”). The table below shows the estimated annual benefits payable on retirement under the Pension Plan to persons in the specified compensation and years of service classifications. The retirement benefits shown are based on the following assumptions: retirement at age 65, payments of a single-life annuity to the employee (although a participant can select other methods of calculating benefits) to be received under the Company’s Pension Plan using current average Social Security wage base amounts, and not subject to any deduction for Social Security or other offset amounts. The retirement benefits listed include both Salary and Bonus as set forth in the Summary Compensation Table. A participant’s benefit is based on the average monthly earnings for the consecutive five year period during which the participant had his or her highest level of earnings. With certain exceptions, the Internal Revenue Code of 1986, as amended (the “Code”), restricts to an aggregate amount of $160,000 (subject to cost of living adjustments) the annual pension that may be paid by an employer from a plan which is qualified under the Code. The Code also limits the covered compensation that may be used to determine benefits to $200,000 (subject to cost of living adjustments).

12

Pension Plan Table

| | | | | | | | | | | | | | | |

| | | Years of Service

|

Covered Compensation(1)

| | 15

| | 20

| | 25

| | 30

| | 35

|

$120,000 | | $ | 16,730 | | $ | 22,307 | | $ | 27,883 | | $ | 33,460 | | $ | 39,037 |

$130,000 | | $ | 18,380 | | $ | 24,507 | | $ | 30,333 | | $ | 36,760 | | $ | 42,887 |

$140,000 | | $ | 20,030 | | $ | 26,707 | | $ | 33,383 | | $ | 40,060 | | $ | 46,737 |

$150,000 | | $ | 21,680 | | $ | 28,907 | | $ | 36,133 | | $ | 43,360 | | $ | 50,587 |

$160,000 | | $ | 23,330 | | $ | 31,107 | | $ | 38,883 | | $ | 46,660 | | $ | 54,437 |

$170,000 and higher | | $ | 24,980 | | $ | 33,307 | | $ | 41,633 | | $ | 49,960 | | $ | 58,287 |

| (1) | Represents the highest average annual earnings during five consecutive calendar years of service. |

As of December 31, 2003, the approximate years of credited service (rounded to the nearest whole year) under the Pension Plan for the Named Executive Officers were as follows: Mr. von Rosenberg—8, Mr. Stockton—5, Mr. Held—2, Mr. Haner—7, Mr. Herbert—10 and Mr. Ketnor—5.

The Company’s Pension Plan has been frozen since 2002 so that all employees on the date of the freeze, including the above Named Executive Officers, no longer accrue years of service and new employees after the date of the freeze are not eligible to participate in the Pension Plan.

COMPENSATION OF DIRECTORS

Directors who are employees of the Company or Zapata or its affiliates are not paid any fees or additional compensation for services rendered as members of the Board of Directors or any committee thereof. Directors who are not employees of the Company or Zapata or its affiliates (“Non-Employee Directors”) receive an annual retainer fee of $20,000 that is paid in four equal quarterly installments. The Presiding Director for the Board’s executive sessions receives an annual retainer of $2,500 that is paid in four equal quarterly installments. Each member of the Audit Committee, Compensation Committee and Corporate Governance Committee receives an annual retainer fee of $2,500 that is paid in four equal quarterly installments for each committee on which he serves. Each Non-Employee Director also receives a fee of $2,000 for each Board meeting attended, either in person or telephonically, and a fee of $1,000 for each Audit Committee, Compensation Committee or Corporate Governance meeting attended, either in person or telephonically. Effective February 1, 2003, members of the Scientific Committee receive an annual retainer fee of $1,000 that is paid in four quarterly installments and do not receive any meeting fees. (Prior to February 1, 2003, the Scientific Committee members received $500 for each day of service related to Scientific Committee activities.)

Pursuant to the Company’s 2000 Long-Term Incentive Plan (the “Plan”), upon joining the Board, each Non-Employee Director, other than the initial Chairman of the Board, is granted options to purchase 14,200 shares of Common Stock at fair market value on the date of grant. Pursuant to such Plan, the initial Chairman of the Board, upon being elected, received stock options to purchase 568,200 shares of Common Stock at fair market value on the date of the grant ($12.75 per share). In addition, on each date of the regular Annual Meeting of Stockholders of the Company, each Non-Employee Director also receives stock options under the Plan to purchase 10,000 shares of Common Stock at fair market value on the date of the grant. All stock options granted to directors under the Plan vest six months and one day after the date of grant.

The Plan also allows Non-Employee Directors to elect to take all or a portion of their annual retainer fees and meeting and per diem fees in Common Stock in lieu of cash. On or before the last day of each calendar quarter (each, an “Election Date”), a Non-Employee Director may elect to receive a percentage (the “Elected Percentage”) of such fees during the quarterly period immediately following such Election Date (the “Service Period”) in shares of Common Stock. The number of shares to be received will be determined on the first

13

business day of the month immediately following the completion of the Service Period by multiplying the amount of the director’s fees for such Service Period by his Elected Percentage and dividing that result by the Fair Market Value per share on such date. In 2003, Dr. Allee elected to take 100% of his annual retainer fees, meeting fees and per diem fees for all 2003 Service Periods in Common Stock in lieu of cash, and Dr. Lands elected to take a portion of his annual retainer fees, meeting fees and per diem fees for his 2003 Service Periods in Common Stock in lieu of cash. As a result of such elections, Dr. Allee received 7,895 shares of Common Stock in lieu of $47,971 in cash and Dr. Lands received $31,625 in cash and 1,708 shares of Common stock in lieu of $9,792 in cash.

14

COMPENSATION COMMITTEE REPORT ON

EXECUTIVE COMPENSATION FOR THE YEAR 2003

The Compensation Committee of the Board of Directors (the “Committee”) is composed of Paul M. Kearns (Chairman) and Dr. Gary L. Allee. The Compensation Committee determines the compensation (both salary and performance incentive compensation) to be paid to the Chief Executive Officer (the “CEO”) and certain other officers of the Company and makes grants of long-term incentive awards. The goal of the Company’s executive compensation program is to attract, retain and encourage the development of highly-qualified and experienced executives who are key to the success of the Company. In addition, the equity-based compensation portion of the program is intended to align the interests of these executives with the interests of those executives with the interests of the Company’s stockholders.

The key elements of the Company’s executive compensation program are base salary, annual performance incentive awards and long-term incentive awards. The Committee’s policies with respect to each of these three components are discussed below.

Base Salary.The Committee reviews and establishes the base salaries of the CEO and certain other officers on an annual basis. In establishing base salaries, the Committee considers the importance of the particular executive position and the skills required for that position, the individual’s qualifications and experience, as well as the Committee’s own subjective assessment of the individual’s performance. The Committee may also consider generally prevailing market rates for similarly based positions and does so with a compensation philosophy that executive based salary compensation should generally be between the 50th and 75th percentile of the market base salary for the respective position. The Committee does not use any mechanical formulations or weighting of any of the factors it considers.

Performance Incentive Awards.The Committee reviews performance incentives (generally in the form of cash bonuses) for the CEO and certain other officers on an annual basis. These incentives generally are determined at the Committee’s discretion, taking into account Company performance, the importance of the position, and the Committee’s subjective assessment of the executive’s performance. The Committee also takes into account the CEO’s evaluation of the performance of other officers. The Committee does not use any mechanical formulations or weighting of any of the factors it considers.

Long-Term Incentive Awards.In an effort to align the long-term interests of the Company’s management and stockholders, the Committee may make awards under the Company’s 2000 Long-Term Incentive Plan. Under the Long-Term Incentive Plan, the Committee may award non-qualified or incentive stock options, stock appreciation rights, restricted stock or cash awards. The Committee believes that the Long-Term Incentive Plan enables the Company to attract and retain highly-qualified and experienced managers and other key personnel. Under the Long-Term Incentive Plan, the Committee is responsible for establishing who receives awards, the terms of the awards, and the requisite conditions and the size of the awards. In making its determinations, the Committee considers the CEO’s recommendations regarding awards, the person’s position and level of responsibility, the Committee’s subjective assessment of the individual’s performance, as well as the amount of awards previously made to that person.

The Committee did not award any stock options to officers in 2003.

CEO Compensation.The Committee’s basis for compensation of the CEO is derived from the same considerations discussed above. In determining Mr. von Rosenberg’s base salary for 2003, the Committee also considered a report prepared by an independent executive compensation consulting firm. The Committee increased Mr. von Rosenberg’s base salary for 2003 from $380,000 to $425, 000. This base salary was within the third quartile (50% to 75%) for the CEO position for similarly situated companies. The Committee believes that the base salary level established for Mr. von Rosenberg reflects his expertise in the Company’s industry and recognizes his continuing leadership of the Company.

15

The Committee awarded Mr. von Rosenberg a bonus in 2003 of $325,000. The Committee granted this bonus to acknowledge Mr. von Rosenberg’s contribution to significant multi-year Company operational and sales strategy objectives, as well as to provide an incentive for future performance.

The Committee made no grants of stock option awards or any other form of equity compensation or long-term incentive award to Mr. von Rosenberg in 2003.

Section 162(m) of the Internal Revenue Code of 1986 places a limit of $1,000,000 per person on the amount of compensation that may be deducted by the Company in any one fiscal year with respect to the CEO and each of the other four most highly compensated individuals who are executive officers as of the end of the fiscal year. This deduction limitation, however, does not apply to certain “performance based” compensation. The Committee intends that the Company’s compensation plans should qualify for full deductibility in accordance with Section 162(m).

Respectfully submitted,

Paul M. Kearns (Chairman)

Dr. Gary L. Allee

COMPENSATION COMMITTEE INTERLOCKS

AND INSIDER PARTICIPATION

During 2003, the Compensation Committee consisted of Mr. Kearns (Chairman) and Dr. Allee. Neither Mr. Kearns nor Dr. Allee had any relationships or transactions with the Company or its subsidiaries required to be disclosed pursuant to Item 402(j) of Regulation S-K under the Exchange Act of 1934.

DIRECTOR INDEPENDENCE

The Board of Directors has determined that all members of the Board of Directors, other than Joseph L. von Rosenberg, Avram Glazer, and Darcie Glazer, are “independent” with the meaning of the rules of the NYSE, as well as the definition of independence established by the Board of Directors.

The Board of Directors determines whether each Director is independent based upon all relevant facts and circumstances appropriate for consideration in the judgment of the Board. In the context of this review, the Board has adopted a definition of Independent Director which includes the NYSE definition of Independent Director. The Company’s definition of Independent Director is set forth in full below:

| | (a) | No director qualifies as “independent” unless the Board affirmatively determines that the director has no material relationship with the Company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company). The Company will disclose these determinations annually in its proxy statement. |

| | (i) | A director who is an employee, or whose immediate family is an executive officer, of the Company is not independent until three years after the end of such employment relationship. |

| | (ii) | A director who receives, or whose immediate family member receives, more than $100,000 per year in direct compensation from the Company, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided that such compensation is not contingent in any way on continued service), is not independent until three years after he or she ceases to receive more than $100,000 per year in such compensation. |

16

| | (iii) | A director who is affiliated with or employed by, or whose immediate family member is affiliated with or employed in a professional capacity by, a present or former internal or external auditor of the Company, is not “independent” until three years after the end or the affiliation or the employment or auditing relationship. |

| | (iv) | A director who is employed, or whose immediate family member is employed, as an executive officer of another company where any of the Company’s present executives serve on that company’s executive compensation committee, is not “independent” until three years after the end of such service or the employment relationship. |

| | (v) | A director who is an executive officer or an employee, or whose immediate family member is an executive officer, of a company that makes payments to, or receives payments from, the Company for property or services in an amount which, in any single fiscal year, exceeds the greater of $1 million, or 2% of such other company’s consolidated gross revenues, is not “independent” until three years after falling below such threshold. Both the payments and the consolidated gross revenues to be measured shall be those reported in the last completed fiscal year. |

| | (vi) | A director who is a control person or director, or the immediate family member of a control person or director, of an entity that is the beneficial owner of 25% of the outstanding shares of common stock of the Company is not independent until three years after the end of such control or director relationship. |

17

STOCK PERFORMANCE GRAPH

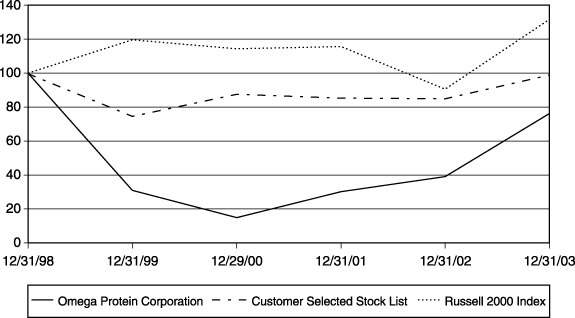

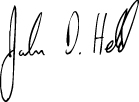

The following performance graph compares the Company’s cumulative total stockholder return on its Common Stock with the cumulative total return on (i) the Russell 2000 Index, and (ii) a peer group stock index (the “Peer Group Index”) which consists of three publicly traded companies in the same industry or line-of-business as the Company. The companies that comprise the Peer Group Index are Archer Daniels Midland Company, ConAgra, Inc. and Tyson Foods, Inc.

The cumulative total return computations set forth in the Performance Graph assume the investment of $100 in the Company’s Common Stock, the Russell 2000 Index, and the Peer Group Index on December 31, 1998. Any dividends are assumed to be reinvested.

| | | | | | | | | | | | | | | | | | |

| | | 12/31/98

| | 12/31/99

| | 12/31/00

| | 12/31/01

| | 12/31/02

| | 12/31/03

|

Omega Protein Corporation | | $ | 100 | | $ | 30.86 | | $ | 14.81 | | $ | 30.12 | | $ | 39.01 | | $ | 76.25 |

Peer Group Index | | $ | 100 | | $ | 74.98 | | $ | 87.86 | | $ | 85.58 | | $ | 85.29 | | $ | 99.29 |

Russell 2000 | | $ | 100 | | $ | 119.59 | | $ | 114.43 | | $ | 115.60 | | $ | 90.65 | | $ | 131.78 |

| * | $100 INVESTED ON December 31, 1998 INCLUDING REINVESTMENT OF DIVIDENDS |

The Performance Graph and related description shall not be deemed incorporated by reference by any general statement incorporating by reference the Proxy Statement into any filing under the Securities Act of 1933 or under the Securities Exchange Act of 1934, except to the extent that the Company specifically incorporates this information by reference and shall not otherwise be deemed filed with the SEC.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Prior to the Company’s initial public offering in April 1998 (the “Initial Public Offering”), Zapata advanced funds to the Company from time to time. During fiscal year 1997, Zapata forgave the repayment of $41.9 million of intercompany indebtedness owed to Zapata by the Company and the Company recorded this amount as contributed capital. After forgiving such indebtedness, Zapata advanced $28.1 million to the Company to meet

18

the cash requirements for certain acquisitions and $5.2 million, primarily for payment of the Company’s income taxes. As of December 31, 1997, Zapata had no outstanding guarantees of Company indebtedness and the Company owed Zapata approximately $33.3 million of intercompany debt. The intercompany balance attributable to the acquisition financing discussed above accrued interest at a rate equal to Zapata’s cost of funds, which was approximately 8.5%; the balance of the Company’s indebtedness to Zapata did not bear any interest. Pursuant to the Separation Agreement described below, the Company utilized a portion of the net proceeds from the Initial Public Offering to repay all of the $33.3 million it owed to Zapata.

Prior to the Initial Public Offering, Zapata provided the Company with certain administrative services, including treasury and tax services, which were billed at their approximate costs to Zapata. The costs of these services were directly charged and/or allocated based on the estimated percentage of time that employees spent working on the other party’s matters as a percentage of total time worked.

In connection with the Initial Public Offering, the Company and Zapata entered into a number of agreements for the purpose of defining their continuing relationship. These agreements were negotiated in the context of a parent-subsidiary relationship and, therefore, were not the result of arms-length negotiations.

Separation Agreement. The Separation Agreement served as the master agreement for the Company’s separation from Zapata. Pursuant to the Separation Agreement, the Company and Zapata entered into a Sublease Agreement, Registration Rights Agreement, Tax Indemnity Agreement and Administrative Services Agreement. The Separation Agreement also required the Company to repay the $33.3 million of intercompany indebtedness owed by the Company to Zapata contemporaneously with the consummation of the Initial Public Offering.

The Separation Agreement also prohibited Zapata from engaging in the harvesting of menhaden or the production or marketing of fish meal, fish oil or fish solubles anywhere in the United States for a period of five years from the date of the Separation Agreement, which period ended in April 2003. Under the Separation Agreement, Zapata and the Company and its subsidiaries agreed to indemnify each other with respect to any future losses that might arise from the Initial Public Offering as a result of any untrue statement or alleged untrue statement in any Initial Public Offering document or the omission or alleged omission to state a material fact in any Initial Public Offering document (i) in the Company’s case, except to the extent such statement was based on information provided by Zapata and (ii) in Zapata’s case, only to the extent such statement was based on information supplied by Zapata.

Sublease Agreement. Pursuant to a Sublease Agreement, the Company subleased from Zapata its principal corporate offices in Houston, Texas until May 30, 2003. In May 2003, the Company directly assumed Zapata’s obligations under the Sublease Agreement with the third party landlord and terminated the Sublease Agreement with Zapata. The lease obligations assumed by the Company were identical to its sublease obligations to Zapata, and the transaction had no material effect on the Company. The annual rent paid by the Company through May 2003 to Zapata under this Sublease Agreement was $43,235. The Company believes that this sublease cost was equal to or lower than prevailing market rates.

Registration Rights Agreement. Under the Registration Rights Agreement, the Company granted to Zapata certain rights (the “Registration Rights”) with respect to the registration under the Securities Act of 1933, as amended (the “Securities Act”), of shares of Common Stock owned by Zapata at the closing of the Initial Public Offering (the “Registrable Securities”). Pursuant to the Registration Rights Agreement, Zapata may require the Company, on not more than three occasions after Zapata no longer owns a majority of the voting power of the outstanding capital stock of the Company, to file a registration statement under the Securities Act covering the registration of the Registrable Securities, including in connection with an offering by Zapata of its securities that are exchangeable for the Registrable Securities (the “Demand Registration Rights”). Zapata’s Demand Registration Rights are subject to certain limitations, including that any such registration cover a number of Registrable Securities having a fair market value of at least $50 million at the time of the request for registration and that the Company may be able to temporarily defer a demand registration to the extent it conflicts with

19

another public offering of securities by the Company or would require the Company to disclose certain material non-public information. Zapata will also be able to require the Company to include Registrable Securities owned by Zapata in a registration by the Company of its securities (the “Piggyback Registration Rights”), subject to certain conditions, including the ability of the underwriters for the offering to limit or exclude Registrable Securities therefrom.

The Company and Zapata will share equally the out-of-pocket fees and expenses of the Company associated with a demand registration and Zapata will pay its pro rata share of underwriting discounts, commissions and related expenses (the “Selling Expenses”). The Company will pay all expenses associated with a piggyback registration, except that Zapata will pay its pro rata share of the Selling Expenses. The Registration Rights Agreement contains certain indemnification and contribution provisions (i) by Zapata for the benefit of the Company and related persons, as well as any potential underwriter and (ii) by the Company for the benefit of Zapata and related persons, as well as any potential underwriter. Zapata’s Demand Registration Rights will terminate on the date that Zapata owns, on a fully converted or exercised basis with respect to such securities held by Zapata, Registrable Securities representing less than 10% of the then issued and outstanding voting stock of the Company. Zapata’s Piggyback Registration Rights will terminate at such time as it is able to sell all of its Registrable Securities pursuant to Rule 144 under the Securities Act within a three month period. Zapata also may transfer its Registration Rights to any transferee from it of Registrable Securities that represent, on a fully converted or exercised basis with respect to the Registrable Securities transferred, at least 20% of the then issued and outstanding voting stock of the Company at the time of transfer; provided, however, that any such transferee will be limited to (i) two demand registrations if the transfer conveys less than a majority but more than 30% of the then issued and outstanding voting stock of the Company and (ii) one demand registration if the transfer conveys 30% or less of the then issued and outstanding voting stock of the Company.

Tax Indemnity Agreement. Prior to the Initial Public Offering, the Company was a member of Zapata’s affiliated group and filed its tax returns on a consolidated basis with such group. As a result of the Initial Public Offering, the Company is no longer a member of the Zapata affiliated group. The Tax Indemnity Agreement defines the respective rights and obligations of the Company and Zapata relating to federal, state and other taxes for periods before and after the Initial Public Offering. Pursuant to the Tax Indemnity Agreement, Zapata is responsible for paying all federal income taxes relating to taxable periods ending before and including the date on which the Company is no longer a member of Zapata’s affiliated group. Under the Tax Indemnity Agreement, the Company is responsible for all taxes of the Company with respect to taxable periods beginning after the date on which the Company was no longer a member of Zapata’s affiliated group. The Company is entitled to any refunds (or reductions in tax liability) attributable to any carry back of the Company’s post-Initial Public Offering tax attributes (i.e., net operating losses) realized by the Company after it was no longer a member of Zapata’s affiliated group. Any other refunds arising from the reduction in tax liability involving the Zapata affiliated group while the Company was a member of such group, including but not limited to, taxable periods ending before or including such date (with the exception of any refunds arising from a reduction in tax liability attributable to the Company), belong to Zapata.

Administrative Services Agreements. Under the Administrative Services Agreement, the Company is required to provide Zapata with administrative services upon reasonable request of Zapata. Zapata pays the Company for these services at the Company’s estimated cost of providing these services. This agreement continues until Zapata terminates it on five days advance written notice or the Company terminates it after Zapata fails to cure a breach of the agreement within thirty days after the Company provides written notice to Zapata of the breach. The Company invoiced Zapata $122,400 under this agreement in 2003, of which $107,900 was outstanding on December 31, 2003.

20

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s executive officers and directors, and persons who beneficially own more than ten percent of the Company’s Common Stock, to file reports of their beneficial ownership (Forms 3, 4, and 5, and any amendment thereto) with the SEC and the New York Stock Exchange. Executive officers, directors, and greater-than-ten percent holders are required to furnish the Company with copies of the forms that they file.

To the Company’s knowledge, all filings applicable to its executive officers, directors, greater-than-ten percent beneficial owners and other persons subject to Section 16 of the Exchange Act were timely filed in 2003.

21

PROPOSAL 2

RATIFICATION OF INDEPENDENT AUDITORS

The Audit Committee of the Board of Directors has selected the firm of PricewaterhouseCoopers LLP, which firm has served as the Company’s independent auditor for the past five fiscal years, to conduct an audit, in accordance with generally accepted auditing standards, of the Company’s financial statements for the fiscal year ending December 31, 2004. The Company expects representatives of PricewaterhouseCoopers LLP to be present at the Annual Meeting to respond to appropriate questions and to make a statement, if they so desire. This selection is being submitted for ratification at the meeting.

Audit and Non-Audit Fees

Aggregate fees for professional services rendered for the Company by PricewaterhouseCoopers LLP for the fiscal years ended December 31, 2003 and 2002 are set forth below.

| | | | | | |

| | | 2003

| | 2002

|

Audit Fees | | $ | 153,100 | | $ | 143,601 |

Audit-Related Fees | | $ | 128,190 | | $ | 85,536 |

Tax Fees | | $ | 32,255 | | $ | 19,400 |

All Other Fees | | | 0 | | | 0 |

| | |

|

| |

|

|

Total | | $ | 313,545 | | $ | 248,537 |

None of the services described above was approved by the Audit Committee under thede minimus exception provided by Rule 2-01(c)(7)(i)(C) under Regulation S-X.

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditors

The Audit Committee pre-approves all audit and non-audit services provided by the independent auditors prior to the engagement of the independent auditors with respect to such services. The Audit Committee may delegate pre-approval authority to one or more of its members. The member or members to whom such authority is delegated must report any pre-approval decisions to the Audit Committee at its next scheduled meeting.

22

REPORT OF THE AUDIT COMMITTEE

The Audit Committee of the Board of Directors is composed of three independent directors and operates under a written charter adopted by the Audit Committee and the Board of Directors. The full text of the Audit Committee’s charter may be viewed at the Company’s website,www.omegaproteininc.com.

All three of the Audit Committee members are independent and financially literate as determined by the Board under applicable standards set by the NYSE, the Sarbanes-Oxley Act and the Board. In addition, the Board has determined that Mr. Nicodemus is an “audit committee financial expert” as defined under SEC regulations.

The Audit Committee’s report for 2003 is set forth below:

In connection with the December 31, 2003 financial statements of the Company, the Audit Committee: (i) reviewed and discussed the audited financial statements with management, (ii) discussed with the independent auditors the matters required by Statement on Auditing Standards No. 90, (iii) received the written disclosures and letter from the independent auditors required by Independence Standards Board Standard No. 1 and discussed with the independent auditor the independent auditor’s independence, and (iv) considered the compatibility of any non-audit services provided by the independent auditor with the auditor’s independence. Based upon these reviews and discussions, the Audit Committee has recommended to the Board of Directors that the Company’s audited financial statements be included in the Securities and Exchange Commission Annual Report on Form 10-K for the fiscal year ended December 31, 2003.

Dated February 16, 2004

AUDIT COMMITTEE

Gary L. Allee (Chairman)

Paul M. Kearns

William Lands

After the date of the above report, the Board of Directors reconstituted the Audit Committee with the following members: Harry O. Nicodemus (Chairman), Dr. Gary Allee and Dr. William Lands.

The Audit Committee Report shall not be deemed incorporated by reference by any general statement incorporating by reference the Proxy Statement into any filing under the Securities Act of 1933 or under the Securities Exchange Act of 1934, except to the extent that the Company specifically incorporates this information by reference, and it shall not otherwise be deemed filed with the Securities and Exchange Commission.

Vote Required. The affirmative vote of the holders of a majority of the shares of Common Stock present in person or represented by proxy at the meeting and entitled to vote is required for such ratification. If not ratified, the Audit Committee will reconsider the selection of the independent auditors although it will not be required to select different independent auditors for the Company.

THE BOARD OF DIRECTORS AND THE AUDIT COMMITTEE EACH RECOMMENDS THAT STOCKHOLDERS VOTEFOR RATIFICATION OF PRICEWATERHOUSECOOPERS LLP AS INDEPENDENT AUDITORS FOR THE COMPANY.

23

OTHER MATTERS

The Board of Directors is not presently aware of any matters to be presented at the Annual Meeting other than the election of directors, and the ratification of PricewaterhouseCoopers LLP as the Company’s independent auditors. If, however, other matters are properly brought before the Annual Meeting, the enclosed Proxy Card and gives discretionary authority to the persons named therein to act in accordance with their best judgment on such matters.

STOCKHOLDER PROPOSALS FOR 2005 ANNUAL MEETING