SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE SECURITIES

EXCHANGE ACT OF 1934 (AMENDMENT NO. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

¨ Preliminary Proxy Statement | | ¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x Definitive Proxy Statement | | |

| |

¨ Definitive Additional Materials | | |

|

¨ Soliciting Material Pursuant to sec. 240.14a-12 |

Omega Protein Corporation

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(l) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

April 25, 2005

To Our Stockholders:

You are cordially invited to attend the 2005 Annual Meeting of Stockholders of Omega Protein Corporation, to be held on Thursday, June 16, 2005, at 9:00 a.m., local time, at The Drake Hotel, 140 East Walton Place, Chicago, Illinois 60611. A notice of the meeting, proxy statement and form of proxy are enclosed with this letter.

At the meeting, we will report on the progress of the Company, comment on matters of interest and respond to your questions. A copy of the Company’s Annual Report to Stockholders for the fiscal year ended December 31, 2004 accompanies this mailing.

Stockholders can vote their shares by proxy by marking their votes on the proxy card or by attending the meeting in person.

It is important that your shares be represented at the meeting. Even if you plan to attend the meeting, we hope that you will read the enclosed Proxy Statement and the voting instructions on the enclosed proxy card and then vote by completing, signing, dating and mailing the proxy card in the enclosed, postage pre-paid envelope.You may vote your shares in person if you attend the Annual Meeting, thereby canceling any proxy previously given. If your shares are not registered in your own name and you would like to attend the meeting, please ask the broker, trust, bank or other nominee that holds the shares to provide you with evidence of your share ownership.

We appreciate your continued interest in the Company.

|

Sincerely, |

|

Joseph L. von Rosenberg III President and Chief Executive Officer |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 16, 2005

TO THE STOCKHOLDERS OF OMEGA PROTEIN CORPORATION:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Omega Protein Corporation (the “Company”) will be held at at The Drake Hotel, 140 East Walton Place, Chicago, Illinois 60611 on Thursday, June 16, 2005 at 9:00 a.m., local time, for the following purposes:

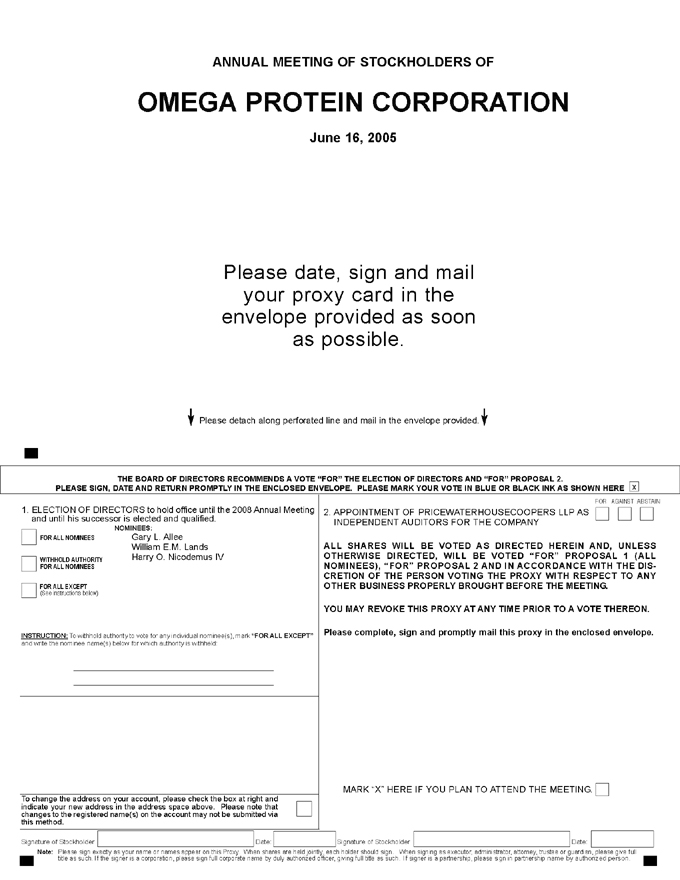

| | 1. | To elect three Class I directors for a term of three years and until their successors are duly elected and qualified; |

| | 2. | To ratify the appointment of PricewaterhouseCoopers LLP as independent certified public accountants for the Company’s fiscal year ending December 31, 2005; and |

| | 3. | To transact such other business as may properly come before the meeting or any postponements or adjournments thereof. |

The Board of Directors has fixed the close of business on April 18, 2005 as the record date for determining the stockholders entitled to notice of, and to vote at, the meeting and at any postponement or adjournment thereof. A list of such stockholders will be available during normal business hours at the offices of the Company for inspection at least ten days prior to the Annual Meeting.

You are cordially invited to attend this meeting.

By order of the Board of Directors

|

|

JOHN D. HELD Senior Vice President, General Counsel and Secretary |

Houston, Texas

April 25, 2005

OMEGA PROTEIN CORPORATION

1717 St. James Place

Suite 550

Houston, Texas 77056

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

JUNE 16, 2005

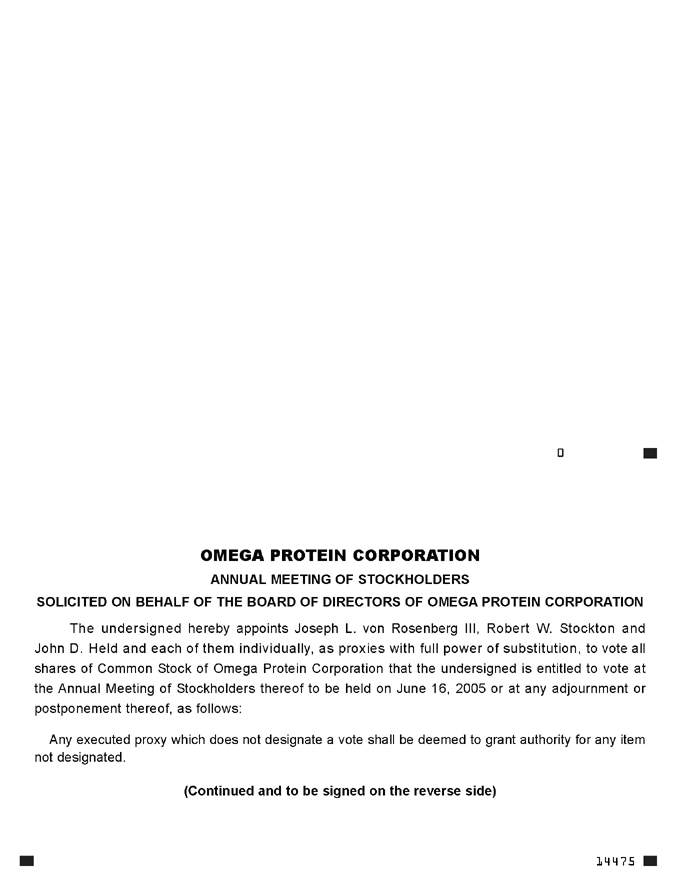

General Information

This statement (the “Proxy Statement”) is being furnished in connection with the solicitation of proxies by the Board of Directors of Omega Protein Corporation (“Omega” or the “Company”) for use at the Annual Meeting of Stockholders of the Company to be held at at The Drake Hotel, 140 East Walton Place, Chicago, Illinois 60611 on June 16, 2005 at 9:00 a.m., local time, and at any postponement or adjournment thereof (the “Annual Meeting”). The Annual Meeting is being held for the purposes set forth in this Proxy Statement. This Proxy Statement and the enclosed form of proxy (the “Proxy Card”) are first being mailed on or about April 25, 2005.

Proxy Card

The shares represented by any Proxy Card which is properly executed and received by the Company prior to or at the Annual Meeting (each, a “Conforming Proxy”) will be voted in accordance with the specifications made thereon. Conforming Proxies that are properly signed and returned but on which no specifications have been made by the stockholder will be voted in favor of the proposals described in the Proxy Statement. The Board of Directors is not aware of any matters that are expected to come before the Annual Meeting other than those described in the Proxy Statement. However, if any other matters are properly brought before the Annual Meeting, the persons named in the Proxy Card will vote the shares represented by each Conforming Proxy on those matters as instructed by the Board of Directors, or in the absence of express instructions from the Board of Directors, in accordance with their own best judgment. A stockholder who has executed and delivered a Conforming Proxy may revoke that Conforming Proxy at any time before it is voted by (i) executing a new proxy with a later date and delivering the new proxy to the Secretary of the Company, (ii) voting in person at the Annual Meeting, or (iii) giving record of written notice of the revocation to the Secretary of the Company prior to the Annual Meeting.

Quorum and Other Matters

The presence at the Annual Meeting, in person or by proxy, of the holders of a majority of the outstanding shares of the Company’s common stock, par value $0.01 per share (“Common Stock”), is necessary and sufficient to constitute a quorum. Shares of Common Stock represented by Conforming Proxies will be counted as present at the Annual Meeting for purposes of determining a quorum, without regard to whether the proxy is marked as casting a vote or abstaining. Shares of Common Stock represented by conforming proxies that are voted on at least one matter coming before the Annual Meeting will also be counted as present for purposes of determining a quorum, even if the beneficial owner’s discretion has been withheld (a “broker non-vote”) for voting on some or all other matters.

Directors will be elected by a favorable vote of a plurality of the shares of Common Stock present, in person or by proxy, at the Annual Meeting and entitled to vote. Accordingly, abstentions and broker non-votes will not affect the outcome of the election of directors.

All other matters to come before the Annual Meeting require the approval of a majority of the shares of Common Stock present, in person or by proxy, at the Annual Meeting and entitled to vote. Therefore, abstentions

1

will have the same effect as votes against the proposals on such matters. Broker non-votes, however, will be deemed shares not present to vote on such matters, and therefore will not count as votes for or against the proposals, and will not be included in calculating the number of votes necessary for approval of such matters.

Solicitation of Proxies

This solicitation of proxies is being made by the Board of Directors of the Company and all expenses of this solicitation will be borne by the Company. The Company expects to reimburse brokerage houses, banks and other fiduciaries for reasonable expenses of forwarding proxy materials to beneficial owners.

VOTING SECURITIES AND SECURITY OWNERSHIP

OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The outstanding voting securities of the Company consist entirely of shares of Common Stock. Each share of Common Stock entitles its owner to one vote upon each matter to come before the Annual Meeting. Only stockholders of record at the close of business on April 18, 2005 (the “Record Date”) will be entitled to vote at the Annual Meeting and at any postponement or adjournment thereof. At the close of business on such date, the Company had outstanding 24,964,609 shares of Common Stock.

Security Ownership of Certain Beneficial Owners

To the Company’s knowledge, the following persons are the only persons who are beneficial owners of more than five percent of the Company’s Common Stock based on the number of shares outstanding on December 31, 2004:

| | | | | |

Name and Address of Beneficial Owner

| | Amount and Nature of

Beneficial Ownership(1)

| | Percent

of

Class(1)

| |

Malcolm I. Glazer(2) c/o Zapata Corporation 100 Meridian Centre, Suite 350 Rochester, New York 14618 | | 14,501,000 | | 58.4 | % |

| | |

Zapata Corporation(2) 100 Meridian Centre, Suite 350 Rochester, New York 14618 | | 14,510,000 | | 58.4 | % |

| | |

Royce & Associates, LLC(3) 1414 Avenue of the Americas New York, New York 10019 | | 2,112,300 | | 8.5 | % |

| | |

Dimensional Fund Advisors, Inc.(4) 1299 Ocean Avenue, 11th Floor Santa Monica, California 90401 | | 1,785,250 | | 7.2 | % |

| | |

Kennedy Capital Management, Inc.(5) 10829 Olive Boulevard St. Louis, Missouri 63141 | | 1,430,250 | | 5.8 | % |

| (1) | For purposes of computing the percentage of outstanding shares held by each person or group of persons named above, any security which such person or persons has the right to acquire within 60 days after December 31, 2004 is deemed to be outstanding, but is not deemed to be outstanding in computing the percentage ownership of any other person. |

2

| (2) | Based on the Form 10-K for the year ended December 31, 2004 filed with the Securities and Exchange Commission (“SEC”) by Zapata Corporation (“Zapata”), Malcolm I. Glazer beneficially owns 51.3% of outstanding common stock of Zapata. By virtue of such ownership, Mr. Glazer may be deemed to beneficially own the 14,501,000 shares of Common Stock of the Company owned by Zapata. Mr. Glazer disclaims beneficial ownership of such Company shares. |

| (3) | Based on a Schedule 13G dated February 1, 2005 filed with the SEC by Royce & Associates, LLC., showing sole voting and dispositive power over 2,112,300 shares. |

| (4) | Based on a Schedule 13G/A dated February 9, 2005 filed with the SEC by Dimensional Fund Advisors Inc., showing sole voting and dispositive power over 1,785,250 shares |

| (5) | Based on a Schedule 13G dated February 15, 2005 filed with the SEC by Kennedy Capital Management, showing sole voting power over 1,371,145 shares and sole dispositive power over 1,430,250 shares. |

Security Ownership of Directors and Executive Officers

The following table sets forth the number of shares of Common Stock of the Company and common stock of Zapata beneficially owned as of December 31, 2004 by each of the Company’s directors and executive officers, including each of the Named Executive Officers set forth in the Summary Compensation Table, and by all directors and executive officers as a group. Unless otherwise noted, each of the named persons and members of the group has sole voting and investment power with respect to the shares shown.

| | | | | | | | | | | |

Name of Beneficial Owner

| | Shares of the Company’s

Common

Stock(1)

| | | Percent of

the

Company’s

Common

Stock(2)

| | | Shares of

Zapata Common

Stock

| | | % of Zapata

Common Stock

|

Joseph L. von Rosenberg III | | 1,590,700 | | | 6.0 | % | | 0 | | | — |

Robert W. Stockton | | 1,318,000 | | | 5.0 | % | | 0 | | | — |

Avram A. Glazer | | 568,200 | (3) | | 2.2 | % | | 17,159 | (4) | | * |

John D. Held | | 225,000 | | | * | | | 0 | | | — |

Michael E. Wilson | | 135,000 | | | * | | | 0 | | | — |

Clark A. Haner | | 86,666 | | | * | | | 0 | | | — |

J. Scott Herbert | | 71,000 | | | * | | | 0 | | | — |

Albert A. Riley | | 60,700 | | | * | | | 0 | | | — |

Thomas R. Wittmann | | 46,333 | | | * | | | 0 | | | — |

Kenneth Robichau | | 35,833 | | | * | | | 0 | | | * |

Gary L. Allee | | 103,348 | | | * | | | 0 | | | — |

William E. M. Lands | | 74,500 | (5) | | * | | | 0 | | | — |

Paul M. Kearns | | 44,200 | | | * | | | 0 | | | — |

Harry O. Nicodemus IV | | 24,200 | | | * | | | 0 | | | — |

Darcie S. Glazer | | 0 | (6) | | — | | | 14,125 | (7) | | * |

All directors and executive officers as a group, including those persons named above (15 total) | | 4,383,680 | | | 15.0 | % | | 31,284 | | | * |

| * | Represents ownership of less than 1.0%. |

| (1) | Includes 1,571,200; 1,312,000; 568,200; 225,000; 135,000; 86,666; 71,000; 60,700; 46,333; 30,833; 64,200; 64,200; 44,200; 24,200; 0; and 4,303,732 shares of Common Stock subject to stock options exercisable on December 31, 2004 or within 60 days thereafter held by, respectively, Messrs. von Rosenberg, Stockton, A. Glazer, Held, Wilson, Haner, Herbert, Riley, Wittmann, Robichau, Allee, Lands, Kearns, Nicodemus, Ms. D. Glazer, and all directors and executive officers as a group. |

| (2) | For purposes of computing the percentage of outstanding shares held by each person or group of persons named above, any security which such person or persons has the right to acquire within 60 days after December 31, 2004 is deemed to be outstanding, but is not deemed to be outstanding in computing the percentage ownership of any other person. |

3

| (3) | Does not include 14,501,000 shares that are held by the Malcolm I. Glazer Family Limited Partnership or Zapata, with respect to which Avram A. Glazer disclaims any beneficial ownership. |

| (4) | Includes 13,459 shares of Zapata common stock subject to stock options held by Avram A. Glazer, based on Zapata’s Proxy Statement dated September 21, 2004. |

| (5) | Includes 2,000 shares of Common Stock owned by a trust established for the benefit of Dr. Lands’ grandchildren. Dr. Lands disclaims beneficial ownership of such shares. |

| (6) | Does not include 14,501,000 shares of Common Stock that are held by the Malcolm I. Glazer Family Limited Partnership or Zapata, with respect to which Darcie S. Glazer disclaims any beneficial ownership. |

| (7) | Includes 14,125 shares of Zapata common stock subject to options held by Darcie S. Glazer, based on Zapata’s Proxy Statement dated September 21, 2004. |

Because Zapata holds more than a majority of the Company’s outstanding Common Stock, Zapata has the power to approve matters submitted for consideration at the Annual Meeting without regard to the votes of the other stockholders. The Company understands that Zapata intends to votefor the election of the proposed Nominees for the Board of Directors andfor the ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent auditors. There are no agreements between the Company and Zapata with respect to the election of directors or the officers of the Company or with respect to other matters that may come before the Annual Meeting.

4

PROPOSAL 1

ELECTION OF DIRECTORS

The Company’s Articles of Incorporation divide the Board of Directors into three classes designated as Class I, Class II and Class III. Each class of directors is elected to serve a three-year term. The Board presently consists of seven directors, three in Class I, two in Class II and two in Class III, whose terms expire at the 2005, 2006 and 2007 Annual Meetings, respectively, and until their successors are duly elected and qualified.

The Class I directors are Dr. Gary L. Allee, Dr. William E. M. Lands and Harry O. Nicodemus IV, and their terms expire at the 2005 Annual Meeting, or as soon thereafter as their successors are elected and qualified. Each of Dr. Allee, Dr. Lands and Mr. Nicodemus has been nominated by the Board of Directors to be elected by the holders of the Common Stock to serve an additional three-year term as a Class I Director. Each of Dr. Allee, Dr. Lands and Mr. Nicodemus has consented to be named in this Proxy Statement and to serve as a director if elected.

The Company’s Articles of Incorporation provide that the Board of Directors shall consist of no more non-U.S. citizens than a minority of the number necessary to constitute a quorum of the Board of Directors. Each of the Company’s directors is a citizen of the United States except for Paul M. Kearns who is a citizen of the United Kingdom.

Proxies representing shares of Common Stock held on the Record Date that are returned duly executed will be voted, unless otherwise specified, in favor of the nominees for the Class I directors named below. The nominees have consented to serve if elected, but should either nominee be unavailable to serve (which event is not anticipated) the persons named in the proxy intend to vote for such substitute nominee or nominees as the Board of Directors may recommend.

Vote Required.Each nominee shall be elected by a plurality of the votes cast in the election by the holders of the Common Stock represented and entitled to vote at the Annual Meeting, assuming the existence of a quorum.

Class I Nominees—To Serve A Three-Year Term Expiring at the 2008 Annual Stockholders Meeting

GARY L. ALLEE, age 60, has been a director of the Company since May 1998. For more than the past five years, Dr. Allee has been Professor of Swine Nutrition at the University of Missouri. Dr. Allee has also served as President and as a member of the Board of Directors of the Midwest Section of the American Society of Animal Science. Dr. Allee has B.S. and M.S. degrees in Animal Husbandry and Swine Nutrition from the University of Missouri and a Ph.D. in Nutritional Sciences from the University of Illinois.

WILLIAM E. M. LANDS, age 74, has been a director of the Company since May 1998. In February 2002, Dr. Lands retired as Senior Scientific Advisor to the Director of the National Institute on Alcohol Abuse and Alcoholism, a position he assumed after serving as head of the Department of Biological Chemistry at the University of Illinois Medical Center. Dr. Lands has a B.S. degree in Chemistry from the University of Michigan and a Ph.D. in Biological Chemistry from the University of Illinois.

HARRY O. NICODEMUS IV, age 57, has been a director of the Company since April 2004. Mr. Nicodemus has served since November 2003 as Vice President, Chief Financial Officer, Chief Accounting Officer, Secretary, and Chief Compliance Officer of Equus Capital Management Corporation, a financial advisor for Equus II Incorporated which is a publicly-traded business development company with investments in privately owned businesses and venture capital firms. From October 1999 to December 2002, Mr. Nicodemus was Vice President and Chief Accounting Officer of US Liquids, Inc., a national provider of liquid waste management services. Prior thereto, Mr. Nicodemus held senior financial and accounting positions with various public companies and also practiced accounting with a national accounting firm. Mr. Nicodemus is a certified public accountant.

5

THE BOARD RECOMMENDS A VOTEFOR THE ELECTION OF EACH CLASS I NOMINEE AS A DIRECTOR.

Continuing Directors

Biographical and other information with respect to all members of the Board of Directors whose current terms will continue after the Annual Meeting is set forth below:

Class II Directors—Current Term Expires at the 2006 Annual Stockholders Meeting

AVRAM A. GLAZER, age 43, has been Chairman of the Board of the Company since January 1998. He also has served as Chairman of the Board of Zapata since March 2002, and as President and Chief Executive Officer of Zapata since 1995. For more than the past five years, he has been employed by, and has worked on behalf of, Malcolm I. Glazer and a number of entities owned and controlled by Malcolm I. Glazer, including First Allied Corporation. Mr. Glazer served as Vice President of First Allied Corporation from 1985 through 1995. He also serves as a director, President and Chief Executive Officer of Zap.Com Corporation (a public shell company which until December 2000 was an internet advertising and e-commerce network company) and as a director of Safety Components International, Inc. (an automotive air bag fabric and cushions manufacturer). Avram A. Glazer is the brother of Darcie S. Glazer and the son of Malcolm I. Glazer.

DARCIE S. GLAZER, age 36, has been a director of the Company since April 2002. For more than the past five years, she has been employed by, and has worked on behalf of, Malcolm I. Glazer and a number of entities owned and controlled by Malcolm I. Glazer, including First Allied Corporation. Ms. Glazer serves as the Executive Vice President of First Allied Corporation. Ms. Glazer served as an investment analyst for Zapata from 1996 to February 2001. Darcie S. Glazer is the sister of Avram A. Glazer and the daughter of Malcolm I. Glazer.

Class III Directors—Current Term Expires at the 2007 Annual Stockholders Meeting

JOSEPH L. VON ROSENBERG III, age 46, has been President and Chief Executive Officer and a director of the Company since July 1997.

PAUL M. KEARNS, age 41, has been a director of the Company since June 2001. Mr. Kearns is Director—Marine at Price Forbes Ltd., a London-based insurance brokerage firm which is the successor to Prentis, Donegan & Partners, Ltd, an insurance brokerage firm which Mr. Kearns co-founded in 1993. Mr. Kearns has more than 20 years of experience in the global risk management and insurance industries. Mr. Kearns is a citizen of the United Kingdom.

Board of Directors and Board Committees

The Company’s Board of Directors has seven directors and has established the Audit, Compensation, Scientific and Corporate Governance Committees as its standing committees. The Board of Directors does not have a nominating committee or executive committee or any committees performing similar functions.

The Board of Directors has adopted Corporate Governance Guidelines to assist the Board in the exercise of its responsibilities. These Guidelines reflect the Board’s commitment to monitor the effectiveness of policy and decision making both at the Board and management level, with a view to enhancing stockholder value over the long term. The Guidelines are posted on the Company’s website atwww.omegaproteininc.com.

During 2004, the Board of Directors met two times, the Audit Committee met six times, the Compensation Committee met three times and took action by written consent on one occasion, the Scientific Committee did not meet, and the Corporate Governance Committee met one time. Each director, except for Avram A. Glazer and Darcie S. Glazer, during the period for which he or she was a director in 2004, attended at least 75% of the aggregate of the total number of meetings of the Board of Directors and the total number of meetings held by all committees of the Board on which such director served.

6

Audit Committee. The Audit Committee consists of Mr. Nicodemus (Chairman), Dr. Allee, and Dr. Lands, each of whom the Board of Directors has determined to be “independent” under the definition set forth in the NYSE listing standards, and under the standards set for audit committee members by the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and under the definition of “independent director” established by the Board. The Board of Directors has determined that Mr. Nicodemus is an “audit committee financial expert” as that term is used in applicable SEC regulations.

The Audit Committee reviews the adequacy of the Company’s internal control systems and financial reporting procedures, reviews the general scope of the annual audit and reviews and monitors the performance of non-audit services by the Company’s independent public accountants. The Audit Committee also meets with the independent auditors and with appropriate financial personnel of the Company regarding these matters. The Audit Committee also appoints the Company’s independent auditors. The independent auditors may periodically meet alone with the Audit Committee and have unrestricted access to the Audit Committee. The Audit Committee operates under a written charter which is posted on the Company’s website atwww.omegaproteininc.com.

Compensation Committee. The Compensation Committee consists of Mr. Kearns (Chairman) and Dr. Allee, each of whom the Board of Directors has determined to be “independent” under the definition set forth in the NYSE listing standards, and under the definition of “independent director” established by the Board. The Compensation Committee determines the compensation (both salary and performance incentive compensation) to be paid to the Chief Executive Officer and certain other officers of the Company, and makes grants of long-term incentive awards. The Compensation Committee operates under a written charter which is posted on the Company’s website atwww.omegaproteininc.com.

Scientific Committee. The Scientific Committee consists of Dr. Lands (Chairman) and Dr. Allee, each of whom the Board of Directors has determined to be “independent” under the definition set forth in the NYSE listing standards, and under the definition of “independent director” established by the Board. The Scientific Committee keeps the Board of Directors and Company management apprised of scientific matters and developments that are relevant to the Company’s industry. The Scientific Committee operates under a written charter which is posted on the Company’s website atwww.omegaproteininc.com.

Corporate Governance Committee.The Corporate Governance Committee consists of Mr. Nicodemus (Chairman) and Mr. Kearns, each of whom the Board of Directors has determined to be “independent” under the definition set forth in the NYSE listing standards, and under the definition of “independent director” established by the Board. The Corporate Governance Committee reviews and reports to the Board on a periodic basis on corporate governance matters, periodically reviews and assesses the effectiveness of the Board’s Corporate Governance Guidelines and recommends proposed revisions to those Guidelines to the Board. The Corporate Governance Committee operates under a written charter which is posted on the Company’s website atwww.omegaproteininc.com.

Nominating Committee. The Company does not currently have, nor has it had in the past, a standing nominating committee or committee performing similar functions, and consequently, does not have a nominating committee charter. Pursuant to Section 303A of the NYSE Listed Company Manual, the Company is not required to have a nominating committee because the Company is a “controlled company” due to the fact that more than 50% of the voting power of the Company’s equity securities is held by Zapata. Nominations for directors are considered by the entire Board of Directors, and when performing this function, the Board operates under its Corporate Governance Guidelines. These Guidelines are posted at the Company’s websiteat www.omegaproteininc.com.

The Board has not formally established procedures to be followed by stockholders submitting recommendations for candidates for the Board, nor has it established a formal process for identifying candidates for directors. The Board considers individuals who have distinguished records for leadership and success in their area of activity and who will make meaningful contributions to the Board. The Board selects nominees for

7

director on the basis of broad experience, character, integrity, ability to make independent analytical inquiries, as well as their understanding of the Company’s business environment. The Company does not pay fees to any third party to identify or evaluate or assist in identifying or evaluating director candidates.

The Company’s Bylaws provide that nominations for the election of directors may be made upon timely notice given by a stockholder. A timely notice must be made in writing, and physically received by the Secretary of the Company, not later than the close of business on the 60th calendar day, nor earlier than the close of business on the 90th calendar day, before the first anniversary of the preceding year’s annual meeting (except that, in the event that the date of the annual meeting is more than 30 calendar days before, or more than 60 calendar days after, such anniversary date, notice by the stockholder to be timely must be so delivered not earlier than the close of business on the 90th calendar day before such annual meeting and not later than the close of business on the later of the 60th calendar day before such annual meeting or the 10th calendar day following the day on which public announcement of a meeting date is first made by the Company). The stockholder notice must contain: (i) the name and address of the nominee for director, (ii) the name and address, as they appear on the books of the Company, of the stockholder proposing the nomination, (iii) the class and number of shares of the stock of the Company that are beneficially owned by the stockholder, and (iv) any material interest of the stockholder in the nomination. This notice provision does not apply to Zapata or its affiliates so long as Zapata owns at least a majority of the outstanding Common Stock.

Independent Directors. The Board of Directors has determined that all members of the Board, other than Joseph L. von Rosenberg III, Avram A. Glazer and Darcie S. Glazer, are “independent” under the definition set forth in the NYSE listing standards, and under the definition of independence established by the Board. In addition, the Board of Directors has determined that all members of the Company’s Audit Committee, in addition to meeting the above standards, also meet the criteria for independence for audit committee members which are set out in the Exchange Act. See “Director Independence.” The Board does not have a policy on the number or percentage of independent directors who shall constitute the Board. Pursuant to Section 303A of the NYSE Listed Company Manual, the Company is not required to have a majority of independent directors on the Board (although it currently does so) because the Company is a “controlled company” due to the fact that more than 50% of the voting power of the Company’s equity securities is held by Zapata.

Stockholder Communications. The Board of Directors maintains a process for stockholders to communicate with the Board or any Board member. Stockholders who desire to communicate with the Board should send any communication to the Company’s Corporate Secretary, c/o Omega Protein Corporation, 1717 St. James Place, Suite 550, Houston, Texas 77056. Any such communication must state the number of shares of Common Stock beneficially owned by the stockholder making the communication. The Corporate Secretary will forward such communication to the full Board of Directors or to any individual director or directors to whom the communication is directed unless the communication is threatening or illegal, uses inappropriate expletive language or is similarly inappropriate, in which case the Corporate Secretary has the authority to discard the communication or take appropriate legal action regarding the communication.

Director Attendance at Annual Meetings. The Board does not have a policy requiring that all directors attend Company annual meetings of stockholders, but it encourages all directors to do so. The 2004 Annual Meeting of Stockholders was attended by Dr. Allee, Dr. Lands, Mr. Kearns and Mr. von Rosenberg.

Presiding Director for Board Executive Sessions. The Company schedules regular executive sessions in which directors meet without management present. The Board has elected Dr. Gary Allee to be the Presiding Director at all Board executive sessions. Stockholders may communicate with the Presiding Director in the same manner described above under “—Stockholder Communications.”

8

EXECUTIVE OFFICERS

The following sets forth certain information with respect to the executive officers of the Company as of the date of this Proxy Statement.

| | | | |

Name

| | Age

| | Position

|

Joseph L. von Rosenberg III | | 46 | | President, Chief Executive Officer and Director |

Robert W. Stockton | | 54 | | Executive Vice President and Chief Financial Officer |

John D. Held | | 42 | | Senior Vice President, General Counsel and Secretary |

Thomas R. Wittmann | | 55 | | Vice President—Operations |

Richard W. Weis | | 47 | | Vice President—Business Development |

J. Scott Herbert | | 39 | | Vice President—Agriproducts |

Albert A. Riley | | 56 | | Vice President—Refined Oils |

Michael E. Wilson | | 54 | | Vice President—Marine Operations and President of Omega Shipyard, Inc. |

Clark A. Haner | | 48 | | Vice President—Administration and Controller |

Kenneth Robichau | | 52 | | Vice President—Tax and Director of Internal Audit |

JOSEPH L. VON ROSENBERG has served as President and Chief Executive Officer and a director of the Company since July 1997.

ROBERT W. STOCKTON has served as Executive Vice President and Chief Financial Officer of the Company since July 1997. Mr. Stockton also served as Secretary of the Company from January 2000 to September 2002. Mr. Stockton is a certified public accountant.

JOHN D. HELD has served as the Company’s General Counsel since March 2000, as Vice President of the Company from April 2002 to September 2002, and as Senior Vice President and Secretary since September 2002. Mr. Held also served as a consultant to the Company from December 1999 to February 2000. Prior thereto, Mr. Held held senior legal positions with two other publicly traded companies and also practiced law for several years with a large law firm in Houston, Texas.

THOMAS R. WITTMANN has served as Vice President—Operations since October 2002. Prior thereto, Mr. Wittmann served as the General Manager of the Company’s Abbeville, Louisiana facility since 1997 and served in various other Company positions since 1985.

RICHARD W. WEIS has served as Vice President—Business Development since January 2005. From May 2002 until January 2004, Mr. Weis served as Vice President—Business Development for Flavors of North America, Inc., a manufacturer of flavors for the food and beverage industries. From 1993 through 2000, Mr. Weis was President of Alex Fries, Inc., a Land O’Lakes, Inc. subsidiary that produced flavor systems for the food and beverage industries. Mr. Weis also served as Vice President and Chief Operating Officer of Alex Fries, Inc. from 1987 to 1993.

J. SCOTT HERBERT has served as Vice President—Agriproducts of the Company since September 2002. Prior thereto, Mr. Herbert served as Vice President—Feed Ingredient Marketing of the Company’s principal subsidiary, Omega Protein, Inc., since March 1998, and as Director of Fish Meal Sales and in various other sales capacities with the Company since 1992.

ALBERT A. RILEY has served as Vice President—Refined Oils of the Company since September 2002. Prior thereto, Mr. Riley served as Vice President—Refined Oils of the Company’s principal subsidiary, Omega

9

Protein, Inc., since May 2000 and as Business Development Manager—Industrial Oils of Omega Protein, Inc. from September 1999 to April 2000. From July 1999 to September 1999, Mr. Riley served as a consultant to the Company. Prior thereto, Mr. Riley was a financial planner with Lincoln Financial.

MICHAEL E. WILSON has served as President of the Company’s wholly-owned subsidiary, Omega Shipyard, Inc., since June 1997. Since July 1998, he has also served as the Company’s Vice President—Marine Operations and, prior thereto, served as the Company’s Coordinator of Marine Engineering and Maintenance. Mr. Wilson joined the Company in 1985 and served in various operating capacities until 1996.

CLARK A. HANER has served as Vice President—Administration and Controller of the Company since December 1999. From September 1997 to December 1999, Mr. Haner served as the Company’s Controller and Assistant Treasurer and prior thereto, served as the Company’s Accounting Manager. Mr. Haner joined the Company in September 1995.

KENNETH ROBICHAU has served as Vice President—Tax since September 1998 (in a part-time capacity until September 2002) and as Director of Internal Audit since September 2002. From March 1998 until September 1998, Mr. Robichau also worked in a part-time capacity as a tax consultant for the Company. Prior to March 1998, Mr. Robichau served as Vice President—Tax and Treasurer of Zapata.

EXECUTIVE COMPENSATION

��

Summary Compensation Table

The following table sets forth the compensation paid in 2004 and the two prior fiscal years to the Company’s Chief Executive Officer and its other four most highly compensated executive officers with annual 2004 compensation in excess of $100,000, (collectively, the “Named Executive Officers”).

| | | | | | | | | | | | |

| | | Fiscal Year

| | | | | | Long-Term Compensation(1)

|

| | | | Annual Compensation

| | Other Annual Compensation(2)

| | Stock

Option

Awards (# of options)

| | All Other

Compensation(3)

|

Name and Principal Position

| | | Salary

| | Bonus

| | | |

Joseph L. von Rosenberg III President and Chief Executive Officer | | 2002

2003

2004 | | $380,000

$425,000

$425,000 | | $325,000

$325,000

$400,000 | | —

—

— | | 0

0

0 | | $8,300

$8,450

$8,650 |

| | | | | | |

Robert W. Stockton Executive Vice President and Chief Financial Officer | | 2002

2003

2004 | | $245,000

$271,000

$271,000 | | $175,000

$175,000

$220,000 | | —

—

— | | 0

0

0 | | $8,690

$8,690

$8,890 |

| | | | | | |

John D. Held Senior Vice President, General Counsel and Secretary | | 2002

2003

2004 | | $210,000

$245,000

$245,000 | | $125,000

$125,000

$200,000 | | —

—

— | | 0

0

300,000 | | $8,300

$8,300

$8,500 |

| | | | | | |

J. Scott Herbert Vice President—Agriproducts | | 2002

2003

2004 | | $110,000

$116,000

$116,000 | | $37,185

$30,000

$58,200 | | —

—

— | | 0

0

0 | | $6,145

$6,075

$7,207 |

| | | | | | |

Thomas R. Wittmann Vice President—Operations | | 2002

2003

2004 | | $94,240

$112,000

$123,333 | | $17,500

$30,000

$20,000 | | —

—

— | | 100,000

0

0 | | $4,818

$6,078

$6,476 |

| (1) | Columns for Restricted Stock Awards and Long-Term Incentive Plan payouts have been omitted because the Company has not made any such awards in 2002, 2003 or 2004. |

| (2) | Amounts exclude perquisites and other personal benefits that did not exceed the lesser of $50,000 or 10% of the total annual salary and bonus reported for each Named Executive Officer. |

10

| (3) | The reported amounts represent (i) insurance premiums paid by the Company on the employee’s behalf, and (ii) Company matching contributions to the employee’s 401(k) plan account. In 2004, these amounts for insurance premiums and Company matching 401(k) contributions were, respectively, for Mr. von Rosenberg: $450 and $8,200; for Mr. Stockton: $690 and $8,200; for Mr. Held: $300 and $8,200; for Mr. Herbert: $134 and $7,073; and for Mr. Wittmann: $686 and $5,790. |

Option Grants In Last Fiscal Year

The following table provides information regarding all grants of stock options to the Named Executive Officers during 2004:

| | | | | | | | | | | | | | | | | |

Name

| | Number of

Securities

Underlying

Options

Granted (1)

| | | Percentage

Of Total

Options

Granted to

Employees

in 2004 (3)

| | | Exercise

Price

($/Share)

| | Expiration

Date

| | Potentially Realizable Percent of

Value at Assumed Annual Rate

of Stock Price Appreciation of

Option Terms (1)

|

| | | | | | 5%

| | 10%

|

Joseph L. von Rosenberg III | | 0 | | | 0 | | | | N/A | | N/A | | | N/A | | | N/A |

Robert W. Stockton | | 0 | | | 0 | | | | N/A | | N/A | | | N/A | | | N/A |

John D. Held | | 300,000 | (2) | | 70 | %(3) | | $ | 10.58 | | 05/28/14 | | $ | 1,996,112 | | $ | 5,058,539 |

J. Scott Herbert | | 0 | | | 0 | | | | N/A | | N/A | | | N/A | | | N/A |

Thomas R. Wittmann | | 0 | | | 0 | | | | N/A | | N/A | | | N/A | | | N/A |

| (1) | These amounts represent assumed rates of appreciation for the market value of the Company’s common stock, based on the exercise price on the date of grant, from the date of grant until the end of the option period at rates arbitrarily set by the SEC. These amounts are not intended to forecast possible future appreciation in the Company’s common stock, and any actual gains on exercise of options will be dependent on the future performance of the Company’s common stock. |

| (2) | All options vest and are exercisable in one-third increments on each of the first, second and third years, respectively, after the date of grant. The exercise price of all options is the fair market value of the Company’s Common Stock on the date of the grant, as defined by the Company’s 2000 Long-Term Incentive Plan. |

| (3) | Represents the percentage of all options granted in 2004 to employees and independent directors under the Company’s 2000 Long-Term Incentive Plan. |

Aggregated Option Exercises and Fiscal Year-End Option Values

The following table shows the stock option exercises by the Named Executive Officers during 2004. In addition, this table includes the number of exercisable and unexercisable stock options on the Company’s Common Stock held by each of the Named Executive Officers as of December 31, 2004. The Company has never granted any stock appreciation rights or restricted stock awards. None of the persons named below hold any stock options relating to Zapata’s common stock.

| | | | | | | | | |

Name

| | Shares

Acquired

On Exercise

| | | Value

Realized ($)

| | Number of

Securities

Underlying Unexercised

Options at December 31,

2004

Exercisable/

Unexercisable

| | Value of

Unexercised In-the-Money(1) Options at December 31, 2004

Exercisable/

Unexercisable

|

Joseph L. von Rosenberg III | | 92,000 | (2) | | $614,436 | | 1,571,200/0 | | $5,733,480/0 |

Robert W. Stockton | | 8,000 | (2) | | $54,970 | | 1,312,000/0 | | $5,083,720/0 |

John D. Held | | 100,000 | (2) | | $653,775 | | 225,000/300,000 | | $1,264,500/0 |

J. Scott Herbert | | 19,000 | | | $126,965 | | 71,000/0 | | $215,450/0 |

Thomas R. Wittmann | | 48,333 | | | $209,468 | | 31,334/33,333 | | $80,670/$146,665 |

11

| (1) | “In-the-Money” options are stock options which had an exercise price less than the closing market price of the Common Stock at December 31, 2004, which was $8.60 as reported by the New York Stock Exchange. |

| (2) | Each of these stock option exercises was a pre-programmed sale pursuant to a Rule10b-5(1) sales plan with an unaffiliated broker. All sales were made automatically and without discretion by the stock option holder. |

Equity Compensation Plan Information

The following table shows equity compensation plan information as of December 31, 2004:

| | | | | | | |

| | | (a)

| | (b)

| | (c)

|

Plan Category

| | Number of

Securities to be Issued

upon

Exercise of

Outstanding

Options,

Warrants

and Rights (in thousands)

| | Weighted- average Exercise Price of

Outstanding

Options,

Warrants and Rights

| | Number of Securities

Remaining

Available for Future

Issuance

Under Equity

Compensation Plans

(Excluding

Securities

Reflected in

Column(a))

(in thousands)

|

Equity compensation plans approved by security holders | | 4,960 | | $ | 7.13 | | 383 |

Equity compensation plans not approved by security holders | | 0 | | | N/A | | 0 |

| | |

| |

|

| |

|

Total | | 4,960 | | $ | 7.13 | | 383 |

Employment and Severance Agreements

Joseph L. von Rosenberg III, the Company’s President and Chief Executive Officer, Robert W. Stockton, the Company’s Executive Vice President and Chief Financial Officer, and John D. Held, the Company’s Senior Vice President, General Counsel and Secretary, each has an employment agreement with the Company that provides for a rolling three-year term, and provides that, in the event of termination of the executive’s employment for death, disability or for Cause (as defined in the agreement), or if the executive voluntarily terminates his employment other than for Good Reason (as defined in the agreement), the Company will pay the executive’s base salary through the termination date. Each agreement also provides that, in the event of a termination of employment (i) by the executive for Good Reason (as defined in the agreement), (ii) by the Company without Cause (as defined in the agreement), or (iii) by the executive, other than because of death or disability, within one year after a Change of Control of the Company (as defined in the agreement), the Company will pay the Executive a lump-sum severance payment equal to 2.99 times the executive’s “base amount” (as defined by Section 280G(b)(3) and 280G(d) of the Internal Revenue Code) and will provide 18 months of health care and life insurance benefits under existing Company plans (36 months in the event of a termination within one year after a Change of Control.)

Each agreement contains restrictions on the executive’s use of any Company confidential information. Each agreement also provides that the executive will assign to the Company all worldwide rights in any intellectual property that he develops which relates to the business, products or services of the Company. During the term of his agreement, and for the three years following the termination of his agreement, the executive may not engage, directly or indirectly, in any business or enterprise which is in competition with the Company anywhere in the world, induce any Company employee to leave his or her employment with the Company, or solicit any distributor or customer to amend its business relationship with the Company. The agreements also provide for the gross-up for any Change in Control excise taxes, if applicable, and the advancement and reimbursement of the executive’s costs and expenses in conjunction with any disputes relating to the agreement.

12

Mr. Herbert, the Company’s Vice President—Agriproducts, has a Change of Control Agreement with the Company pursuant to which he is entitled to receive a severance of twelve months continuation of his base salary in the event of both a Change of Control of the Company (as defined in the agreement) and a termination of his employment by the Company other than for Cause (as defined in the agreement) within a two year period after that Change of Control.

Mr. Wittmann, the Company’s Vice President—Operations, has an Employment Agreement with the Company pursuant to which he is entitled to receive a severance of twelve months continuation of his base salary in the event of a termination of his employment by the Company other than for Cause (as defined in the agreement), or a severance of twenty-four months continuation of his base salary in the event of a termination of his employment by the Company other than for Cause (as defined in the agreement) which occurs within two years after a Change of Control of the Company (as defined in the agreement). The agreement contains restrictions on the executive’s use of any Company confidential information and also provides that the executive may not accept employment or render assistance to primary competitors of the Company for a three-year period after the date of termination.

Retirement Plans

The Company maintains a defined benefit plan for its employees (the “Pension Plan”). The table below shows the estimated annual benefits payable on retirement under the Pension Plan to persons in the specified compensation and years of service classifications. The retirement benefits shown are based on the following assumptions: retirement at age 65, payments of a single-life annuity to the employee (although a participant can select other methods of calculating benefits) to be received under the Company’s Pension Plan using current average Social Security wage base amounts, and not subject to any deduction for Social Security or other offset amounts. The retirement benefits listed include both Salary and Bonus as set forth in the Summary Compensation Table. A participant’s benefit is based on the average monthly earnings for the consecutive five year period during which the participant had his or her highest level of earnings. With certain exceptions, the Internal Revenue Code of 1986, as amended (the “Code”), restricts to an aggregate amount of $160,000 (subject to cost of living adjustments) the annual pension that may be paid by an employer from a plan which is qualified under the Code. The Code also limits the covered compensation that may be used to determine benefits to $200,000 (subject to cost of living adjustments).

Pension Plan Table

| | | | | | | | | | | | | | | |

| | | Years of Service

|

Covered Compensation(1)

| | 15

| | 20

| | 25

| | 30

| | 35

|

$120,000 | | $ | 16,730 | | $ | 22,307 | | $ | 27,883 | | $ | 33,460 | | $ | 39,037 |

$130,000 | | $ | 18,380 | | $ | 24,507 | | $ | 30,333 | | $ | 36,760 | | $ | 42,887 |

$140,000 | | $ | 20,030 | | $ | 26,707 | | $ | 33,383 | | $ | 40,060 | | $ | 46,737 |

$150,000 | | $ | 21,680 | | $ | 28,907 | | $ | 36,133 | | $ | 43,360 | | $ | 50,587 |

$160,000 | | $ | 23,330 | | $ | 31,107 | | $ | 38,883 | | $ | 46,660 | | $ | 54,437 |

$170,000 and higher | | $ | 24,980 | | $ | 33,307 | | $ | 41,633 | | $ | 49,960 | | $ | 58,287 |

| (1) | Represents the highest average annual earnings during five consecutive calendar years of service. |

As of December 31, 2004, the approximate years of credited service (rounded to the nearest whole year) under the Pension Plan for the Named Executive Officers were as follows: Mr. von Rosenberg—9, Mr. Stockton—5, Mr. Held—2, Mr. Herbert—10 and Mr. Wittmann—17.

The Company’s Pension Plan has been frozen since 2002 so that all employees on the date of the freeze, including the above Named Executive Officers, no longer accrue years of service and new employees after the date of the freeze are not eligible to participate in the Pension Plan.

13

COMPENSATION OF DIRECTORS

Directors who are employees of the Company or Zapata or its affiliates are not paid any fees or additional compensation for services rendered as members of the Board of Directors or any committee thereof. Directors who are not employees of the Company or Zapata or its affiliates (“Non-Employee Directors”) receive an annual retainer fee of $20,000 that is paid in four equal quarterly installments. The Presiding Director for the Board’s executive sessions receives an annual retainer of $2,500 that is paid in four equal quarterly installments. Each member of the Audit Committee, Compensation Committee and Corporate Governance Committee receives an annual retainer fee of $2,500 that is paid in four equal quarterly installments for each committee on which he serves. Each Non-Employee Director also receives a fee of $2,000 for each Board meeting attended, either in person or telephonically, and a fee of $1,000 for each Audit Committee, Compensation Committee or Corporate Governance meeting attended, either in person or telephonically. Members of the Scientific Committee receive an annual retainer fee of $1,000 that is paid in four quarterly installments and do not receive any meeting fees.

Pursuant to the Company’s 2000 Long-Term Incentive Plan (the “Plan”), upon joining the Board, each Non-Employee Director, other than the initial Chairman of the Board, is granted options to purchase 14,200 shares of Common Stock at fair market value on the date of grant. Pursuant to such Plan, the initial Chairman of the Board, upon being elected, received stock options to purchase 568,200 shares of Common Stock at fair market value on the date of the grant ($12.75 per share). In addition, on each date of the regular Annual Meeting of Stockholders of the Company, each Non-Employee Director also receives stock options under the Plan to purchase 10,000 shares of Common Stock at fair market value on the date of the grant. All stock options granted to directors under the Plan vest six months and one day after the date of grant.

The Plan also allows Non-Employee Directors to elect to take all or a portion of their annual retainer fees and meeting and per diem fees in Common Stock in lieu of cash. On or before the last day of each calendar quarter (each, an “Election Date”), a Non-Employee Director may elect to receive a percentage (the “Elected Percentage”) of such fees during the quarterly period immediately following such Election Date (the “Service Period”) in shares of Common Stock. The number of shares to be received will be determined on the first business day of the month immediately following the completion of the Service Period by multiplying the amount of the director’s fees for such Service Period by his Elected Percentage and dividing that result by the Fair Market Value per share on such date. In 2004, Dr. Allee elected to take a percentage of his 2004 annual retainer fees, meeting fees and per diem fees in Common Stock in lieu of cash. As a result of such election, Dr. Allee purchased 1,144 shares of Common Stock in lieu of receiving $8,500 in cash.

14

COMPENSATION COMMITTEE REPORT ON

EXECUTIVE COMPENSATION FOR THE YEAR 2004

The Compensation Committee of the Board of Directors (the “Committee”) is composed of Paul M. Kearns (Chairman) and Dr. Gary L. Allee. The Committee determines the compensation (both salary and performance incentive compensation) to be paid to the Chief Executive Officer (the “CEO”) and certain other officers of the Company and makes grants of long-term incentive awards. The goal of the Company’s executive compensation program is to attract, retain and encourage the development of highly-qualified and experienced executives who are key to the success of the Company. In addition, the equity-based compensation portion of the program is intended to align the interests of these executives with the interests of the Company’s stockholders.

The key elements of the Company’s executive compensation program are base salary, annual performance incentive awards and long-term incentive awards. The Committee’s policies with respect to each of these three components are discussed below.

Base Salary. The Committee reviews and establishes the base salaries of the CEO and certain other officers on an annual basis. In establishing base salaries, the Committee considers the importance of the particular executive position and the skills required for that position, the individual’s qualifications and experience, as well as the Committee’s own subjective assessment of the individual’s performance. The Committee may also consider generally prevailing market rates for similarly based positions and does so with a compensation philosophy that executive base salary compensation should generally be between the 50th and 75th percentile of the market base salary for the respective position. The Committee does not use any mechanical formulations or weighting of any of the factors it considers.

Performance Incentive Awards. The Committee reviews performance incentives (generally in the form of cash bonuses) for the CEO and certain other officers on an annual basis. These incentives generally are determined at the Committee’s discretion, taking into account Company performance, the importance of the position, and the Committee’s subjective assessment of the executive’s performance. The Committee also takes into account the CEO’s evaluation of the performance of other officers. The Committee does not use any mechanical formulations or weighting of any of the factors it considers.

Long-Term Incentive Awards. In an effort to align the long-term interests of the Company’s management and stockholders, the Committee may make awards under the Company’s 2000 Long-Term Incentive Plan. Under the Long-Term Incentive Plan, the Committee may award non-qualified or incentive stock options, stock appreciation rights, restricted stock or cash awards. The Committee believes that the Long-Term Incentive Plan enables the Company to attract and retain highly-qualified and experienced managers and other key personnel. Under the Long-Term Incentive Plan, the Committee is responsible for establishing who receives awards, the terms of the awards, and the requisite conditions and the size of the awards. In making its determinations, the Committee considers the CEO’s recommendations regarding awards, the person’s position and level of responsibility, the Committee’s subjective assessment of the individual’s performance, as well as the amount of awards previously made to that person.

The Committee granted non-qualified stock options under the 2000 Long-Term Incentive Plan to one officer in 2004.

CEO Compensation. The Committee left Mr. von Rosenberg’s base salary for 2004 unchanged from his base salary for 2003. The Committee’s bases for compensation of the CEO are derived from the same considerations discussed above under “—Base Salary,” “—Performance Incentive Awards” and “—Long-Term Incentive Awards”. The Committee believes that the base salary level established for Mr. von Rosenberg reflects his expertise in the Company’s industry and recognizes his continuing leadership of the Company.

The Committee awarded Mr. von Rosenberg a bonus in 2004 of $400,000. The Committee noted that, at the time of the granting of the bonus, the Company’s stock price had increased by more than 100% over the prior

15

one-year period, and the Company’s market capitalization had increased by more than $100 million. The Committee granted this bonus to acknowledge Mr. von Rosenberg’s multi-year efforts in refocusing the Company away from a traditional agriproducts business and towards a food ingredients business emphasizing healthy foods for human consumption. The Committee also considered Company performance and certain management changes implemented by Mr. von Rosenberg that resulted in better performance in several areas. The bonus was also intended to provide an incentive for future performance.

The Committee made no grants of stock option awards or any other form of equity compensation or long-term incentive award to Mr. von Rosenberg in 2004.

Section 162(m) of the Internal Revenue Code of 1986 places a limit of $1,000,000 per person on the amount of compensation that may be deducted by the Company in any one fiscal year with respect to the CEO and each of the other four most highly compensated individuals who are executive officers as of the end of the fiscal year. This deduction limitation, however, does not apply to certain “performance based” compensation. The Committee intends that the Company’s compensation plans should qualify for full deductibility in accordance with Section 162(m).

Respectfully submitted,

Paul M. Kearns (Chairman)

Dr. Gary L. Allee

COMPENSATION COMMITTEE INTERLOCKS

AND INSIDER PARTICIPATION

During 2004, the Compensation Committee consisted of Mr. Kearns (Chairman) and Dr. Allee. Neither Mr. Kearns nor Dr. Allee had any relationships or transactions with the Company or its subsidiaries required to be disclosed pursuant to Item 402(j) of Regulation S-K under the Exchange Act.

DIRECTOR INDEPENDENCE

The Board of Directors has determined that all members of the Board of Directors, other than Joseph L. von Rosenberg, Avram Glazer, and Darcie Glazer, are “independent” under the definition set forth in the NYSE listing standards, and under the definition of independence established by the Board of Directors. In addition, the Board of Directors has determined that all members of the Company’s Audit Committee, in addition to meeting the above standards, also meet the criteria for independence for audit committee members which are set out in the Exchange Act.

The Board of Directors determines whether each Director is independent based upon all relevant facts and circumstances appropriate for consideration in the judgment of the Board. In the context of this review, the Board has adopted a definition of Independent Director which includes the NYSE definition of Independent Director. The Company’s definition of Independent Director is set forth in full below:

| | (a) | No director qualifies as “independent” unless the Board affirmatively determines that the director has no material relationship with the Company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company). The Company will disclose these determinations annually in its proxy statement. |

| | (i) | A director who is an employee, or whose immediate family is an executive officer, of the Company is not independent until three years after the end of such employment relationship. |

16

| | (ii) | A director who receives, or whose immediate family member receives, more than $100,000 per year in direct compensation from the Company, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided that such compensation is not contingent in any way on continued service), is not independent until three years after he or she ceases to receive more than $100,000 per year in such compensation. |

| | (iii) | A director who is affiliated with or employed by, or whose immediate family member is affiliated with or employed in a professional capacity by, a present or former internal or external auditor of the Company, is not “independent” until three years after the end or the affiliation or the employment or auditing relationship. |

| | (iv) | A director who is employed, or whose immediate family member is employed, as an executive officer of another company where any of the Company’s present executives serve on that company’s executive compensation committee, is not “independent” until three years after the end of such service or the employment relationship. |

| | (v) | A director who is an executive officer or an employee, or whose immediate family member is an executive officer, of a company that makes payments to, or receives payments from, the Company for property or services in an amount which, in any single fiscal year, exceeds the greater of $1 million, or 2% of such other company’s consolidated gross revenues, is not “independent” until three years after falling below such threshold. Both the payments and the consolidated gross revenues to be measured shall be those reported in the last completed fiscal year. |

| | (vi) | A director who is a control person or director, or the immediate family member of a control person or director, of an entity that is the beneficial owner of 25% of the outstanding shares of common stock of the Company is not independent until three years after the end of such control or director relationship. |

17

STOCK PERFORMANCE GRAPH

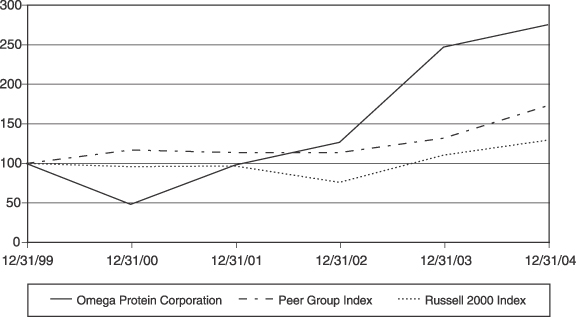

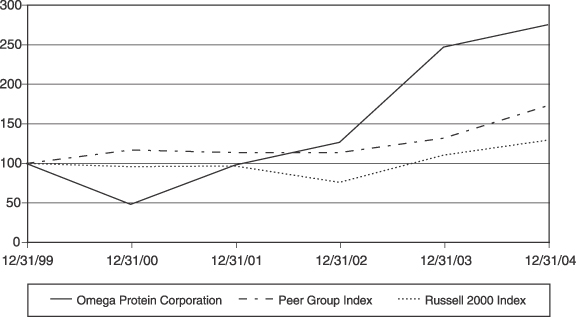

The following performance graph compares the Company’s cumulative total stockholder return on its Common Stock with the cumulative total return on (i) the Russell 2000 Index, and (ii) a peer group stock index (the “Peer Group Index”) which consists of three publicly traded companies in the agriproducts industry. The companies that comprise the Peer Group Index are Archer Daniels Midland Company, ConAgra, Inc. and Tyson Foods, Inc.

The cumulative total return computations set forth in the Performance Graph assume the investment of $100 in the Company’s Common Stock, the Russell 2000 Index, and the Peer Group Index on December 31, 1999. Any dividends are assumed to be reinvested.

| | | | | | | | | | | | | | | | | |

| | | 12/31/99

| | | 12/31/00

| | 12/31/01

| | 12/31/02

| | 12/31/03

| | 12/31/04

|

Omega Protein Corporation | | $ | 100.00 | * | | $ | 48.00 | | $ | 97.60 | | $ | 126.40 | | 247.40 | | 275.20 |

Peer Group Index | | $ | 100.00 | * | | $ | 116.77 | | $ | 113.68 | | $ | 113.38 | | 131.96 | | 172.89 |

Russell 2000 | | $ | 100.00 | * | | $ | 95.68 | | $ | 96.66 | | $ | 110.19 | | 131.78 | | 129.47 |

| * | $100 invested on December 31, 1999 including reinvestment of dividends |

The Performance Graph and related description shall not be deemed incorporated by reference by any general statement incorporating by reference the Proxy Statement into any filing under the Securities Act of 1933, as amended (the “Securities Act”) or under the Exchange Act, except to the extent that the Company specifically incorporates this information by reference and shall not otherwise be deemed filed with the SEC.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Prior to the Company’s initial public offering in April 1998 (the “Initial Public Offering”), Zapata advanced funds to the Company from time to time. During fiscal year 1997, Zapata forgave the repayment of $41.9 million of intercompany indebtedness owed to Zapata by the Company and the Company recorded this amount as contributed capital. After forgiving such indebtedness, Zapata advanced $28.1 million to the Company to meet the cash requirements for certain acquisitions and $5.2 million, primarily for payment of the Company’s income

18

taxes. As of December 31, 1997, Zapata had no outstanding guarantees of Company indebtedness and the Company owed Zapata approximately $33.3 million of intercompany debt. The intercompany balance attributable to the acquisition financing discussed above accrued interest at a rate equal to Zapata’s cost of funds, which was approximately 8.5%; the balance of the Company’s indebtedness to Zapata did not bear any interest. Pursuant to the Separation Agreement described below, the Company utilized a portion of the net proceeds from the Initial Public Offering to repay all of the $33.3 million it owed to Zapata.

Prior to the Initial Public Offering, Zapata provided the Company with certain administrative services, including treasury and tax services, which were billed at their approximate costs to Zapata. The costs of these services were directly charged and/or allocated based on the estimated percentage of time that employees spent working on the other party’s matters as a percentage of total time worked.

In connection with the Initial Public Offering, the Company and Zapata entered into a number of agreements for the purpose of defining their continuing relationship. These agreements were negotiated in the context of a parent-subsidiary relationship and, therefore, were not the result of arms-length negotiations.

Separation Agreement. The Separation Agreement served as the master agreement for the Company’s separation from Zapata. Pursuant to the Separation Agreement, the Company and Zapata entered into a Sublease Agreement, Registration Rights Agreement, Tax Indemnity Agreement and Administrative Services Agreement. The Separation Agreement also required the Company to repay the $33.3 million of intercompany indebtedness owed by the Company to Zapata contemporaneously with the consummation of the Initial Public Offering.

The Separation Agreement also prohibited Zapata from engaging in the harvesting of menhaden or the production or marketing of fish meal, fish oil or fish solubles anywhere in the United States for a period of five years from the date of the Separation Agreement, which period ended in April 2003. Under the Separation Agreement, Zapata and the Company and its subsidiaries agreed to indemnify each other with respect to any future losses that might arise from the Initial Public Offering as a result of any untrue statement or alleged untrue statement in any Initial Public Offering document or the omission or alleged omission to state a material fact in any Initial Public Offering document (i) in the Company’s case, except to the extent such statement was based on information provided by Zapata and (ii) in Zapata’s case, only to the extent such statement was based on information supplied by Zapata.

Registration Rights Agreement. Under the Registration Rights Agreement, the Company granted to Zapata certain rights (the “Registration Rights”) with respect to the registration under the Securities Act of 1933, as amended (the “Securities Act”), of shares of Common Stock owned by Zapata at the closing of the Initial Public Offering (the “Registrable Securities”). Pursuant to the Registration Rights Agreement, Zapata may require the Company, on not more than three occasions after Zapata no longer owns a majority of the voting power of the outstanding capital stock of the Company, to file a registration statement under the Securities Act covering the registration of the Registrable Securities, including in connection with an offering by Zapata of its securities that are exchangeable for the Registrable Securities (the “Demand Registration Rights”). Zapata’s Demand Registration Rights are subject to certain limitations, including that any such registration cover a number of Registrable Securities having a fair market value of at least $50 million at the time of the request for registration and that the Company may be able to temporarily defer a demand registration to the extent it conflicts with another public offering of securities by the Company or would require the Company to disclose certain material non-public information. Zapata will also be able to require the Company to include Registrable Securities owned by Zapata in a registration by the Company of its securities (the “Piggyback Registration Rights”), subject to certain conditions, including the ability of the underwriters for the offering to limit or exclude Registrable Securities therefrom.

The Company and Zapata will share equally the out-of-pocket fees and expenses of the Company associated with a demand registration and Zapata will pay its pro rata share of underwriting discounts, commissions and related expenses (the “Selling Expenses”). The Company will pay all expenses associated with a piggyback registration, except that Zapata will pay its pro rata share of the Selling Expenses. The Registration Rights

19

Agreement contains certain indemnification and contribution provisions (i) by Zapata for the benefit of the Company and related persons, as well as any potential underwriter and (ii) by the Company for the benefit of Zapata and related persons, as well as any potential underwriter. Zapata’s Demand Registration Rights will terminate on the date that Zapata owns, on a fully converted or exercised basis with respect to such securities held by Zapata, Registrable Securities representing less than 10% of the then issued and outstanding voting stock of the Company. Zapata’s Piggyback Registration Rights will terminate at such time as it is able to sell all of its Registrable Securities pursuant to Rule 144 under the Securities Act within a three month period. Zapata also may transfer its Registration Rights to any transferee from it of Registrable Securities that represent, on a fully converted or exercised basis with respect to the Registrable Securities transferred, at least 20% of the then issued and outstanding voting stock of the Company at the time of transfer; provided, however, that any such transferee will be limited to (i) two demand registrations if the transfer conveys less than a majority but more than 30% of the then issued and outstanding voting stock of the Company and (ii) one demand registration if the transfer conveys 30% or less of the then issued and outstanding voting stock of the Company.

Tax Indemnity Agreement. Prior to the Initial Public Offering, the Company was a member of Zapata’s affiliated group and filed its tax returns on a consolidated basis with such group. As a result of the Initial Public Offering, the Company is no longer a member of the Zapata affiliated group. The Tax Indemnity Agreement defines the respective rights and obligations of the Company and Zapata relating to federal, state and other taxes for periods before and after the Initial Public Offering. Pursuant to the Tax Indemnity Agreement, Zapata is responsible for paying all federal income taxes relating to taxable periods ending before and including the date on which the Company is no longer a member of Zapata’s affiliated group. Under the Tax Indemnity Agreement, the Company is responsible for all taxes of the Company with respect to taxable periods beginning after the date on which the Company was no longer a member of Zapata’s affiliated group. The Company is entitled to any refunds (or reductions in tax liability) attributable to any carry back of the Company’s post-Initial Public Offering tax attributes (i.e., net operating losses) realized by the Company after it was no longer a member of Zapata’s affiliated group. Any other refunds arising from the reduction in tax liability involving the Zapata affiliated group while the Company was a member of such group, including but not limited to, taxable periods ending before or including such date (with the exception of any refunds arising from a reduction in tax liability attributable to the Company), belong to Zapata.

Administrative Services Agreements. Under the Administrative Services Agreement, the Company is required to provide Zapata with administrative services upon reasonable request of Zapata. Zapata pays the Company for these services at the Company’s estimated cost of providing these services. This agreement continues until Zapata terminates it on five days advance written notice or the Company terminates it after Zapata fails to cure a breach of the agreement within thirty days after the Company provides written notice to Zapata of the breach. The Company invoiced Zapata $11,600 under this agreement in 2004. As of December 31, 2004, Zapata’s outstanding balance under this agreement to the Company was $105,000.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires the Company’s executive officers and directors, and persons who beneficially own more than ten percent of the Company’s Common Stock, to file reports of their beneficial ownership (Forms 3, 4, and 5, and any amendment thereto) with the SEC and the New York Stock Exchange. Executive officers, directors, and greater-than-ten percent holders are required to furnish the Company with copies of the forms that they file.

To the Company’s knowledge, all filings applicable to its executive officers, directors, greater-than-ten percent beneficial owners and other persons subject to Section 16 of the Exchange Act were timely filed in 2004, except for one Form 4 for John D. Held reporting a pre-programmed option exercise for 1,000 shares under a Rule 10b5-1 plan that was filed one day late, one Form 4 for Dr. Gary Allee reporting a pre-programmed sale of 10,000 shares under a Rule 10b5-1 plan that was filed three days late, and one Form 4 for J. Scott Herbert reporting a sale of 50 shares that was filed six months late.

20

PROPOSAL 2

RATIFICATION OF INDEPENDENT AUDITORS

The Audit Committee of the Board of Directors has selected the firm of PricewaterhouseCoopers LLP, which firm has served as the Company’s independent auditor for the past five fiscal years, to conduct an audit, in accordance with generally accepted auditing standards, of the Company’s financial statements for the fiscal year ending December 31, 2005. The Company expects representatives of PricewaterhouseCoopers LLP to be present at the Annual Meeting to respond to appropriate questions and to make a statement, if they so desire. This selection is being submitted for ratification at the meeting.

Audit and Non-Audit Fees

Aggregate fees for professional services rendered for the Company by PricewaterhouseCoopers LLP for the fiscal years ended December 31, 2004 and 2003 are set forth below.

| | | | |

| | | 2004

| | 2003

|

Audit Fees | | $454,500 | | $153,100 |

Audit-Related Fees | | $47,400 | | $128,190 |

Tax Fees | | $11,850 | | $32,255 |

All Other Fees | | 0 | | 0 |

| | |

| |

|

Total | | $513,750 | | $313,545 |

None of the services described above were approved by the Audit Committee under thede minimus exception provided by Rule 2-01(c)(7)(i)(C) under Regulation S-X.

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditors