UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-01766

| |

| Name of Registrant: | Vanguard Wellesley Income Fund |

| Address of Registrant: | P.O. Box 2600 |

| | Valley Forge, PA 19482 |

| |

| Name and address of agent for service: | Anne E. Robinson, Esquire |

| | P.O. Box 876 |

| | Valley Forge, PA 19482 |

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: September 30 Date of reporting period: October 1, 2017 – September 30, 2018

Item 1: Reports to Shareholders

Vanguard’s Principles for Investing Success

We want to give you the best chance of investment success. These principles, grounded in Vanguard’s research and experience, can put you on the right path.

Goals. Create clear, appropriate investment goals.

Balance. Develop a suitable asset allocation using broadly diversified funds. Cost. Minimize cost.

Discipline. Maintain perspective and long-term discipline.

A single theme unites these principles: Focus on the things you can control.

We believe there is no wiser course for any investor.

| |

| Contents | |

| Your Fund’s Performance at a Glance. | 1 |

| CEO’s Perspective. | 3 |

| Advisor’s Report. | 5 |

| Fund Profile. | 9 |

| Performance Summary. | 11 |

| Financial Statements. | 13 |

| Your Fund’s After-Tax Returns. | 35 |

| About Your Fund’s Expenses. | 36 |

| Trustees Approve Advisory Arrangement. | 38 |

| Glossary. | 40 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

Your Fund’s Performance at a Glance

• Vanguard Wellesley Income Fund returned 3.28% for Investor Shares and 3.38% for Admiral Shares for the 12 months ended September 30, 2018. It outperformed its benchmark, the Wellesley Income Composite Index, as well as the average return for its mixed-asset target allocation conservative fund peers.

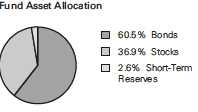

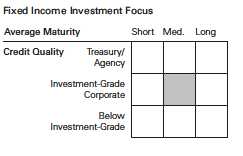

• The fund allocates 60% to 65% of its assets to investment-grade bonds. The fixed income portfolio’s absolute returns were negative but surpassed those of its benchmark, the Bloomberg Barclays U.S. Credit A or Better Bond Index (–1.31%). The advisor’s security selection within industrial bonds, as well as the portfolio’s duration stance and its yield-curve positioning, drove much of the outperformance.

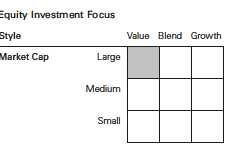

• The fund’s stock portfolio, which represents 35% to 40% of its assets, trailed its benchmark, the FTSE High Dividend Yield Index (+10.75%). The advisor’s selections within consumer staples and energy detracted most from relative performance, while sector allocations were generally positive.

| |

| Total Returns: Fiscal Year Ended September 30, 2018 | |

| | Total |

| | Returns |

| Vanguard Wellesley Income Fund | |

| Investor Shares | 3.28% |

| Admiral™ Shares | 3.38 |

| Wellesley Income Composite Index | 2.84 |

| Mixed-Asset Target Allocation Conservative Funds Average | 2.51 |

For a benchmark description, see the Glossary.

Mixed-Asset Target Allocation Conservative Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company.

Admiral Shares carry lower expenses and are available to investors who meet certain account-balance requirements.

| |

| Total Returns: Ten Years Ended September 30, 2018 | |

| | Average |

| | Annual Return |

| Wellesley Income Fund Investor Shares | 7.91% |

| Wellesley Income Composite Index | 7.58 |

| Mixed-Asset Target Allocation Conservative Funds Average | 5.19 |

| For a benchmark description, see the Glossary. | |

Mixed-Asset Target Allocation Conservative Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company.

The figures shown represent past performance, which is not a guarantee of future results. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost.

1

| | | |

| Expense Ratios | | | |

| Your Fund Compared With Its Peer Group | | | |

| | Investor | Admiral | Peer Group |

| | Shares | Shares | Average |

| Wellesley Income Fund | 0.22% | 0.15% | 0.76% |

The fund expense ratios shown are from the prospectus dated January 26, 2018, and represent estimated costs for the current fiscal year. For the fiscal year ended September 30, 2018, the fund’s expense ratios were 0.23% for Investor Shares and 0.16% for Admiral Shares. The peer-group expense ratio is derived from data provided by Lipper, a Thomson Reuters Company, and captures information through year-end 2017.

Peer group: Mixed-Asset Target Allocation Conservative Funds.

2

CEO’s Perspective

Tim Buckley

President and Chief Executive Officer

Dear Shareholder,

Over the years, I’ve found that prudent investors exhibit a common trait: discipline. No matter how the markets move or what new investing fad hits the headlines, those who stay focused on their goals and tune out the noise are set up for long-term success.

The prime gateway to investing is saving, and you don’t usually become a saver without a healthy dose of discipline. Savers make the decision to sock away part of their income, which means spending less and delaying gratification, no matter how difficult that may be.

Of course, disciplined investing extends beyond diligent saving. The financial markets, in the short term especially, are unpredictable; I have yet to meet the investor who can time them perfectly. It takes discipline to resist the urge to go all-in when markets are frothy or to retreat when things look bleak.

Staying put with your investments is one strategy for handling volatility. Another, rebalancing, requires even more discipline because it means steering your money away from strong performers and toward poorer performers.

Patience—a form of discipline—is also the friend of long-term investors. Higher returns are the potential reward for weathering the market’s turbulence and uncertainty.

3

We have been enjoying one of the longest bull markets in history, but it won’t continue forever. Prepare yourself now for how you will react when volatility comes back. Don’t panic. Don’t chase returns or look for answers outside the asset classes you trust. And be sure to rebalance periodically, even when there’s turmoil.

Whether you’re a master of self-control, get a boost from technology, or work with a professional advisor, know that discipline

is necessary to get the most out of your investment portfolio. And know that Vanguard is with you for the entire ride.

Thank you for your continued loyalty.

Mortimer J. Buckley

President and Chief Executive Officer

October 18, 2018

| | | |

| Market Barometer | | | |

| | | Average Annual Total Returns |

| | Periods Ended September 30, 2018 |

| | One Year | Three Years | Five Years |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 17.76% | 17.07% | 13.67% |

| Russell 2000 Index (Small-caps) | 15.24 | 17.12 | 11.07 |

| Russell 3000 Index (Broad U.S. market) | 17.58 | 17.07 | 13.46 |

| FTSE All-World ex US Index (International) | 2.13 | 10.18 | 4.51 |

| |

| Bonds | | | |

| Bloomberg Barclays U.S. Aggregate Bond Index | | | |

| (Broad taxable market) | -1.22% | 1.31% | 2.16% |

| Bloomberg Barclays Municipal Bond Index | | | |

| (Broad tax-exempt market) | 0.35 | 2.24 | 3.54 |

| FTSE Three-Month U. S. Treasury Bill Index | 1.57 | 0.80 | 0.48 |

| |

| CPI | | | |

| Consumer Price Index | 2.28% | 1.99% | 1.52% |

4

Advisor’s Report

For the 12 months ended September 30, 2018, Vanguard Wellesley Income Fund returned 3.28% for Investor Shares and 3.38% for the lower-cost Admiral Shares. The composite benchmark, which is weighted 65% Bloomberg Barclays U.S. Credit A or Better Bond Index and 35% FTSE High Dividend Yield Index, returned 2.84%.

The investment environment

The global economy ended 2017 on a strong note, supported by low unemployment rates, high consumer and business confidence, and optimism around tax-law changes. Healthy corporate and economic fundamentals boosted the U.S. equity market. The U.S. Federal Reserve raised interest rates in December and projected at least three more increases in 2018. Shorter-term U.S. Treasury yields rose in anticipation of tax cuts and Fed balance-sheet contraction, but the 30-year yield fell amid a weak inflation outlook.

In February, the U.S. equity markets declined for the first time since late 2015. The sharp correction appeared to be the result of investor concern about inflation and global trade. President Trump imposed tariffs on steel and aluminum and announced further plans to impose tariffs on billions of dollars of goods from China. Treasury yields dipped temporarily in response to trade-war concerns and adverse regulation in the technology sector. As expected, the Fed raised interest rates in March.

By midyear, U.S. equity markets had rebounded, boosted by the positive effects of tax cuts and greater capital expenditures. Nevertheless, we remained wary of the modest acceleration in inflation, slowly rising interest rates, and deceleration in housing affordability. Energy prices rose, which was good news for producers but weighed on consumer sentiment. Fears of a global trade war mounted as President Trump levied additional tariffs on Chinese imports and threatened to impose tariffs on European auto manufacturers. Greater inflationary pressures balanced higher political uncertainty. U.S. investment-grade corporate bonds posted negative excess returns as credit spreads widened. The Fed increased rates again in June, as expected.

As of this writing, the U.S. stock market was in the longest bull market in its history. More than 80% of domestic public companies reported exceeding their most recent earnings forecasts. The Fed presented an upbeat assessment of the economy, downplaying the effects of trade tensions and raising rates for the third time in 2018. U.S. investment-grade corporate credit experienced a mixed third quarter, responding favorably to a strong U.S. economy but also pressured by mounting trade concerns.

For the 12 months, the Standard & Poor’s 500 Index returned 17.91%, the MSCI World Index returned 11.84%, and the MSCI EAFE Index returned 2.74%. Within

5

the United States, growth continued to outperform value, as the Russell 1000 Growth Index returned 26.30% and the Russell 1000 Value Index returned 9.45%. The fund’s equity benchmark, the FTSE High Dividend Yield Index, returned 10.75%.

On the fixed income side, the Bloomberg Barclays U.S. Aggregate Bond Index returned –1.22%. The higher-quality corporate bond market experienced slightly weaker performance, returning –1.31% as measured by the Bloomberg Barclays U.S. Credit A or Better Bond Index. The yield of the 10-year U.S. Treasury note closed at 3.06%, up from 2.33% 12 months earlier.

The fund’s successes

The fixed income portfolio outperformed the Bloomberg Barclays U.S. Credit A or Better Bond Index, helped by security selection and duration and yield-curve positioning. Our selection within investment-grade corporate bonds, particularly industrials, drove positive relative performance. Our security selection among taxable municipal bonds and out-of-benchmark allocation to asset-backed securities also helped returns. Our short duration posture remained beneficial.

Within the equity portfolio, our overweight allocations to energy and health care and our underweight allocation to industrials contributed to performance. Security

selection among industrials, health care, and information technology also boosted returns. Among individual stocks, our decision to sell out of General Electric, which tumbled more than 30% during the period, was the strongest relative contributor. Our positions in Union-Pacific and Cisco Systems, as well as our avoidance of AT&T, also helped.

The fund’s shortfalls

The fixed income portfolio outperformed its benchmark but produced negative absolute returns. This was not attributable to any particular positioning or security selection but rather to challenges in the broader corporate credit markets as short-term Treasury yields rose, credit spreads widened, and investors grew concerned about global trade.

The stock portfolio underperformed its equity benchmark, pulled down by security selection in consumer staples and energy. Our underweighting of the strong-performing information technology sector weighed on returns. Our holdings in Philip Morris International and British American Tobacco detracted, as did our decision not to own benchmark constituent Boeing. We also eliminated Microsoft at the end of March because of insufficient yield and because the stock reached our target price. Microsoft continued to appreciate after that, which hurt our relative performance, but the index ultimately dropped the company in June.

6

The fund’s positioning

Broadly speaking, global economic fundamentals continue to look healthy, and we’re seeing strong signs of prosperity translate to corporate performance. Central banks are unwinding accommodative monetary policies, and we anticipate a measured approach to rate normalization. Inflation pressure remains muted for now, but we are watching carefully for any deterioration in data, particularly with unemployment levels in the U.S. at historic lows, as wage growth pressure could push up inflation.

A key topic that remains top of mind is the potential escalation of trade tensions between the United States and the rest of the world. Although there’s been some progress, the overall situation remains in flux and it’s tough to draw definitive conclusions at this stage. The main questions on investors’ minds are how much this could damage global economic growth and whether we’re headed toward an all-out trade war. While the direct cost of trade restrictions announced so far is low, should the situation deteriorate, trade retaliation and the effects of disruption to the global supply chain and inflation could cause financial conditions to tighten meaningfully.

In the fixed income portfolio, we are underweight in duration across the U.S. yield curve, particularly the short end, as we expect the Fed to continue to raise short-term interest rates. While we are

underweight in corporate credit relative to the all-credit benchmark, we expect our significant positioning there to benefit from the continued tailwinds from tax reform, deregulation, and fiscal stimulus.

Overall, we feel valuations largely reflect a comfort with synchronized global economic growth and stable credit fundamentals. On an industry basis, the fixed income portfolio maintains an out-of-benchmark allocation to U.S. government bonds, namely Treasury bills. We believe government yields will continue to rise in response to both an increase in Treasury borrowing and a reduction in the Fed’s asset purchases. Within corporate credit, we are overweight utilities and favor financials because of their attractive valuations and high credit quality. We also have a small out-of-benchmark allocation to securitized sectors such as asset-backed securities and mortgages, given their favorable valuations compared with other areas of corporate credit.

On the equity side, solid fundamentals remain in place. Job growth has driven the unemployment rate below 4%, and the strong employment backdrop supported robust retail sales through the summer and has kept consumer confidence near all-time highs. Tax cuts boosted consumer spending and corporate earnings growth, leading to strong business confidence and high levels of capital spending. Inflation ticked up modestly to 2.4%, but it remains near the Fed’s targeted level.

7

Outside the United States, a weaker macroeconomic backdrop contributed to softer equity markets. In response to the announced tariffs, which may result in increased inflationary pressure and manufacturing dislocations, we are monitoring supply chain impacts in the technology, industrial, and consumer sectors. We are also mindful of the overall impact the tariffs may have on global economic growth.

During the period, the equity portfolio’s net buys were largest within health care and telecommunication services; its net sales were largest within industrials and consumer discretionary. Although we believe that fundamentals within the United States remain constructive in the near term, we did reduce our cyclical exposure over the course of 2018. This reduction was primarily the result of our bottom-up security selection process, but the shift also aligns with our desire to provide the equity portfolio with some downside protection as we move further along in the economic cycle.

We ended the period most overweight in the health care, energy, and utilities sectors and most underweight in consumer discretionary, industrials, and information technology. Notable purchases within the equity portfolio include Comcast, Medtronic, Crown Castle International, Travelers, and Schlumberger. Notable eliminations include VF, Marathon Petroleum, and Altria. We also trimmed our position in Wells Fargo meaningfully because of company-specific risks associated with the multiple investigations into company practices.

John C. Keogh

Senior Managing Director and

Fixed Income Portfolio Manager

Michael E. Stack, CFA

Senior Managing Director and

Fixed Income Portfolio Manager

Loren L. Moran, CFA

Managing Director and

Fixed Income Portfolio Manager

W. Michael Reckmeyer, III, CFA

Senior Managing Director and

Equity Portfolio Manager

Wellington Management Company llp

October 10, 2018

8

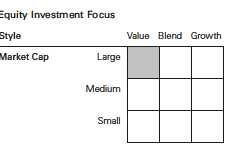

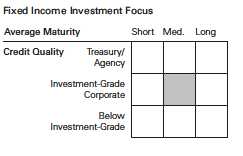

Wellesley Income Fund

Fund Profile

As of September 30, 2018

Share-Class Characteristics

| | | | |

| | | Investor | Admiral |

| | | Shares | Shares |

| Ticker Symbol | | VWINX | VWIAX |

| Expense Ratio1 | | 0.22% | 0.15% |

| 30-Day SEC Yield | | 3.27% | 3.34% |

| |

| Equity and Portfolio Characteristics | |

| | | | FTSE High | DJ |

| | | | Dividend | U.S. Total |

| | | | Yield | Market |

| | | Fund | Index | FA Index |

| Number of Stocks | | 72 | 399 | 3,825 |

| Median Market Cap $115.2B | $105.8B | $73.9B |

| Price/Earnings Ratio | | 16.6x | 16.8x | 21.0x |

| Price/Book Ratio | | 2.5x | 2.5x | 3.1x |

| Return on Equity | | 13.3% | 15.4% | 14.9% |

| Earnings Growth Rate | 2.6% | 3.4% | 8.5% |

| Dividend Yield | | 3.0% | 3.1% | 1.7% |

| Foreign Holdings | | 5.9% | 0.0% | 0.0% |

| Turnover Rate | | 36% | — | — |

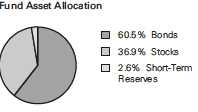

| Short-Term Reserves | 2.6% | — | — |

| |

| Fixed Income Characteristics | |

| | | Bloomberg | |

| | | | Barclays | Bloomberg |

| | | | Credit | Barclays |

| | | A or Better | Aggregate |

| | | Fund | Index Bond Index |

| Number of Bonds | | 1,033 | 3,264 | 10,112 |

| Yield to Maturity | | | | |

| (before expenses) | | 3.7% | 3.7% | 3.5% |

| Average Coupon | | 3.5% | 3.5% | 3.2% |

| Average Duration | 6.4 years | 6.7 years | 6.0 years |

| Average Effective | | | | |

| Maturity | 9.3 years | 9.7 years | 8.4 years |

| | | |

| Total Fund Volatility Measures | | |

| | | | DJ |

| | Wellesley | U.S. Total |

| | Composite | | Market |

| | Index | | FA Index |

| R-Squared | 0.97 | | 0.52 |

| Beta | 1.05 | | 0.32 |

| These measures show the degree and timing of the fund’s |

| fluctuations compared with the indexes over 36 months. | |

| |

| Ten Largest Stocks (% of equity portfolio) |

| JPMorgan Chase & Co. | Diversified Banks | 4.6% |

| Johnson & Johnson | Pharmaceuticals | 3.5 |

| Cisco Systems Inc. | Communications | |

| | Equipment | | 3.4 |

| Pfizer Inc. | Pharmaceuticals | 3.4 |

| Verizon Communications Integrated | | |

| Inc. | Telecommunication | |

| | Services | | 3.4 |

| Suncor Energy Inc. | Integrated Oil & Gas | 2.5 |

| Philip Morris | | | |

| International Inc. | Tobacco | | 2.5 |

| Chevron Corp. | Integrated Oil & Gas | 2.5 |

| Eli Lilly & Co. | Pharmaceuticals | 2.4 |

| Exxon Mobil Corp. | Integrated Oil & Gas | 2.2 |

| Top Ten | | | 30.4% |

| Top Ten as % of Total Net Assets | | 11.4% |

| The holdings listed exclude any temporary cash investments and equity index products. |

1 The expense ratios shown are from the prospectus dated January 26, 2018, and represent estimated costs for the current fiscal year. For the fiscal year ended September 30, 2018, the expense ratios were 0.23% for Investor Shares and 0.16% for Admiral Shares.

9

Wellesley Income Fund

| |

| Sector Diversification (% of equity exposure) |

| | Fund |

| Consumer Discretionary | 4.6% |

| Consumer Staples | 12.4 |

| Energy | 13.1 |

| Financials | 14.6 |

| Health Care | 18.1 |

| Industrials | 8.3 |

| Information Technology | 9.7 |

| Materials | 4.5 |

| Real Estate | 1.4 |

| Telecommunication Services | 4.2 |

| Utilities | 9.1 |

Sector categories are based on the Global Industry Classification Standard (“GICS”), except for the “Other” category (if applicable), which includes securities that have not been provided a GICS classification as of the effective reporting period.

| |

| Sector Diversification (% of fixed income | |

| portfolio) | |

| Asset-Backed | 3.8% |

| Commercial Mortgage-Backed | 0.6 |

| Finance | 29.5 |

| Foreign | 5.3 |

| Government Mortgage-Backed | 1.8 |

| Industrial | 33.4 |

| Treasury/Agency | 12.5 |

| Utilities | 8.2 |

| Other | 4.9 |

The agency and mortgage-backed securities sectors may include issues from government-sponsored enterprises; such issues are generally not backed by the full faith and credit of the U.S. government.

| |

| Distribution by Credit Quality (% of fixed | |

| income portfolio) | |

| U.S. Government | 14.6% |

| Aaa | 7.3 |

| Aa | 14.2 |

| A | 44.2 |

| Baa | 19.6 |

| Ba | 0.1 |

Credit-quality ratings are obtained from Barclays and are from Moody's, Fitch, and S&P. When ratings from all three agencies are used, the median rating is shown. When ratings from two of the agencies are used, the lower rating for each issue is shown. "Not Rated" is used to classify securities for which a rating is not available. Not rated securities include a fund's investment in Vanguard Market Liquidity Fund or Vanguard Municipal Cash Management Fund, each of which invests in high-quality money market instruments and may serve as a cash management vehicle for the Vanguard funds, trusts, and accounts. For more information about these ratings, see the Glossary entry for Credit Quality.

10

Wellesley Income Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

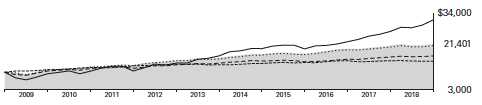

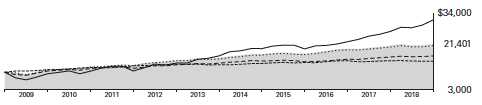

Cumulative Performance: September 30, 2008, Through September 30, 2018

Initial Investment of $10,000

| | | | |

| | Average Annual Total Returns | |

| | Periods Ended September 30, 2018 | |

| |

| | | | | Final Value |

| | One | Five | Ten | of a $10,000 |

| | Year | Years | Years | Investment |

| |

| Wellesley Income Fund*Investor | | | | |

| Shares | 3.28% | 6.26% | 7.91% | $21,401 |

| |

| Wellesley Income Composite Index | 2.84 | 6.21 | 7.58 | 20,764 |

| |

| Mixed-Asset Target Allocation | | | | |

| Conservative Funds Average | 2.51 | 3.96 | 5.19 | 16,579 |

| |

| Bloomberg Barclays U.S. Aggregate | | | | |

| Bond Index | -1.22 | 2.16 | 3.77 | 14,482 |

| Dow Jones U.S. Total Stock Market | | | | |

| Float Adjusted Index | 17.58 | 13.42 | 12.05 | 31,191 |

For a benchmark description, see the Glossary.

Mixed-Asset Target Allocation Conservative Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company.

| | | | |

| | | | | Final Value |

| | One | Five | Ten | of a $50,000 |

| | Year | Years | Years | Investment |

| Wellesley Income Fund Admiral Shares | 3.38% | 6.34% | 7.99% | $107,800 |

| Wellesley Income Composite Index | 2.84 | 6.21 | 7.58 | 103,819 |

| Bloomberg Barclays U.S. Aggregate | | | | |

| Bond Index | -1.22 | 2.16 | 3.77 | 72,412 |

| Dow Jones U.S. Total Stock Market | | | | |

| Float Adjusted Index | 17.58 | 13.42 | 12.05 | 155,955 |

See Financial Highlights for dividend and capital gains information.

11

Wellesley Income Fund

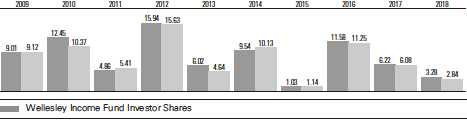

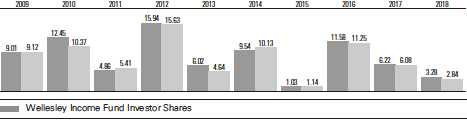

Fiscal-Year Total Returns (%): September 30, 2008, Through September 30, 2018

Wellesley Income Composite Index

For a benchmark description, see the Glossary.

12

Wellesley Income Fund

Financial Statements

Statement of Net Assets—Investments Summary

As of September 30, 2018

This Statement summarizes the fund’s holdings by asset type. Details are reported for each of the fund’s 50 largest individual holdings and for investments that, in total for any issuer, represent more than 1% of the fund’s net assets. The total value of smaller holdings is reported as a single amount within each category.

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the complete listing of the fund’s holdings is available electronically on vanguard.com and on the Securities and Exchange Commission’s website (sec.gov), or you can have it mailed to you without charge by calling 800-662-7447. For the first and third fiscal quarters, the fund files the lists with the SEC on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | | | | | |

| | | | | | Face | Market | Percentage |

| | | | | Maturity | Amount | Value • | of Net |

| | | | Coupon | Date | ($000) | ($000) | Assets |

| U. S. Government and Agency Obligations | | | | |

| U. S. Government Securities | | | | | |

| | United States Treasury Inflation | | | | | |

| | Indexed Bonds | | 0.750% | 7/15/28 | 328,600 | 324,893 | 0.6% |

| 1 | United States Treasury Note/Bond | 2.250% | 2/29/20 | 788,010 | 782,588 | 1.5% |

| 2 | United States Treasury Note/Bond | 2.125% | 12/31/22 | 520,400 | 503,570 | 1.0% |

| | United States Treasury Note/Bond | 2.250% | 3/31/20 | 337,000 | 334,526 | 0.6% |

| | United States Treasury Note/Bond | 3.375% | 5/15/44 | 322,125 | 332,040 | 0.6% |

| | United States Treasury Note/Bond | 2.250% | 11/15/27 | 302,780 | 283,429 | 0.5% |

| | United States Treasury Note/Bond | 1.625% | 6/30/20 | 280,795 | 275,224 | 0.5% |

| | United States Treasury | | | | | |

| | Note/Bond | 1.250%–3.625% | 2/15/20–5/15/48 | 975,212 | 943,912 | 1.8% |

| | U.S. Government Securities—Other † | | | 171,180 | 0.3% |

| | | | | | | 3,951,362 | 7.4% |

| |

| Agency Notes † | | | | | 22,989 | 0.0% |

| |

| Conventional Mortgage-Backed Securities | | | | |

| 3,4,5 Fannie Mae Pool | 2.500%–4.500% | 8/1/27–10/1/48 | 582,132 | 570,648 | 1.1% |

| | Conventional Mortgage-Backed Securities—Other † | | 3,195 | 0.0% |

| | | | | | | 573,843 | 1.1% |

| Nonconventional Mortgage-Backed Securities | | | |

| §,3,4 Fannie Mae REMICS 3.500%–4.000% 9/25/29–10/25/56 | 78,827 | 78,837 | 0.2% |

| | Nonconventional Mortgage-Backed Securities—Other † | | 119,564 | 0.2% |

| | | | | | | 198,401 | 0.4% |

| Total U.S. Government and Agency Obligations (Cost $4,813,971) | | 4,746,595 | 8.9% |

| §,6Asset-Backed/Commercial Mortgage-Backed Securities (Cost $1,220,639) † | 1,209,268 | 2.3% |

13

Wellesley Income Fund

| | | | | |

| | | | Face | Market | Percentage |

| | | Maturity | Amount | Value • | of Net |

| | Coupon | Date | ($000) | ($000) | Assets |

| Corporate Bonds | | | | | |

| Finance | | | | | |

| Banking | | | | | |

| Bank One Corp. | 7.750% | 7/15/25 | 25,000 | 29,553 | 0.1% |

| 4 Goldman Sachs Group | | | | | |

| Inc. | 2.625%– 6.250% | 2/25/21–10/21/45 | 591,235 | 594,597 | 1.1% |

| 4 JPMorgan Chase & Co. | 2.550%– 6.300% | 4/23/19–11/15/48 | 648,505 | 644,351 | 1.2% |

| 4 Morgan Stanley | 2.375%–7.300% | 1/24/19–1/27/45 | 567,155 | 572,616 | 1.1% |

| Wachovia Corp. | 6.605% | 10/1/25 | 15,000 | 16,674 | 0.0% |

| Wells Fargo & Co. | 2.150%–5.606% | 1/30/20–12/7/46 | 530,230 | 524,731 | 1.0% |

| 6 Banking—Other † | | | | 5,408,894 | 10.1% |

| Brokerage † | | | | 25,650 | 0.0% |

| Finance Companies † | | | | 197,282 | 0.4% |

| 6 Insurance † | | | | 1,203,903 | 2.3% |

| 6 Other Finance † | | | | 48,845 | 0.2% |

| 6 Real Estate Investment Trusts † | | | 167,959 | 0.3% |

| | | | | 9,435,055 | 17.8% |

| Industrial | | | | | |

| 6 Basic Industry † | | | | 74,712 | 0.1% |

| 6 Capital Goods † | | | | 837,477 | 1.6% |

| Communication | | | | | |

| Comcast Corp. | 2.350%–4.750% | 2/1/24–11/1/52 | 431,771 | 409,721 | 0.8% |

| 6 NBCUniversal Enterprise | | | | | |

| Inc. | 1.974% | 4/15/19 | 84,070 | 83,697 | 0.1% |

| NBCUniversal Media | | | | | |

| LLC | 4.375%–4.450% | 4/1/21–1/15/43 | 36,639 | 36,768 | 0.1% |

| Verizon Communications | | | | | |

| Inc. | 3.450%–5.012% | 3/15/21–3/15/55 | 282,461 | 283,622 | 0.5% |

| 6 Communication—Other † | | | | 711,830 | 1.3% |

| 6 Consumer Cyclical † | | | | 1,341,172 | 2.5% |

| Consumer Noncyclical | | | | | |

| Johnson & Johnson | 2.450%– 6.730% | 11/15/23–3/1/26 | 93,000 | 90,130 | 0.2% |

| Medtronic Inc. | 2.500%–4.375% | 3/15/20–3/15/35 | 178,634 | 178,324 | 0.3% |

| Pfizer Inc. | 3.000%–4.100% | 6/15/23–9/15/38 | 106,555 | 104,986 | 0.2% |

| Philip Morris | | | | | |

| International Inc. | 1.875%–4.875% | 3/26/20–11/10/44 | 175,695 | 170,024 | 0.3% |

| Wyeth LLC | 5.950% | 4/1/37 | 15,000 | 18,093 | 0.0% |

| 6 Consumer Noncyclical—Other † | | | 3,062,125 | 5.8% |

| Energy | | | | | |

| Chevron Corp. | 2.355%–3.191% | 12/5/22– 6/24/23 | 75,750 | 74,972 | 0.1% |

| Suncor Energy Inc. | 3.600%–5.950% | 12/1/24–12/1/34 | 32,505 | 34,196 | 0.1% |

| Texaco Capital Inc. | 8.625% | 4/1/32 | 25,000 | 34,868 | 0.1% |

| 6 Energy—Other † | | | | 917,747 | 1.7% |

| 6 Other Industrial † | | | | 159,298 | 0.3% |

| Technology | | | | | |

| Cisco Systems Inc. | 2.500% | 9/20/26 | 15,921 | 14,724 | 0.0% |

| 6 Technology—Other † | | | | 1,774,567 | 3.4% |

| 6 Transportation † | | | | 239,928 | 0.5% |

| | | | | 10,652,981 | 20.0% |

14

| | | |

| Wellesley Income Fund | | | |

| |

| |

| |

| | | Market | Percentage |

| | | Value• | of Net |

| | | ($000) | Assets |

| Utilities | | | |

| 6 Electric † | | 2,311,448 | 4.3% |

| 6 Natural Gas † | | 262,366 | 0.5% |

| Other Utility † | | 46,727 | 0.1% |

| | | 2,620,541 | 4.9% |

| Total Corporate Bonds (Cost $23,007,624) | | 22,708,577 | 42.7% |

| 6Sovereign Bonds (Cost $1,720,335) † | | 1,688,390 | 3.2% |

| Taxable Municipal Bonds (Cost $1,428,933) † | | 1,572,459 | 3.0% |

| |

| | Shares | | |

| Common Stocks | | | |

| Consumer Discretionary | | | |

| Comcast Corp. Class A | 11,662,133 | 412,956 | 0.8% |

| McDonald’s Corp. | 1,321,658 | 221,100 | 0.4% |

| Consumer Discretionary—Other † | | 286,374 | 0.5% |

| | | 920,430 | 1.7% |

| Consumer Staples | | | |

| Philip Morris International Inc. | 6,187,171 | 504,502 | 1.0% |

| Unilever NV | 7,149,302 | 397,144 | 0.8% |

| Coca-Cola Co. | 7,410,851 | 342,307 | 0.6% |

| Procter & Gamble Co. | 2,963,537 | 246,655 | 0.5% |

| PepsiCo Inc. | 2,034,338 | 227,439 | 0.4% |

| Consumer Staples—Other † | | 751,531 | 1.4% |

| | | 2,469,578 | 4.7% |

| Energy | | | |

| Suncor Energy Inc. | 13,052,243 | 504,991 | 1.0% |

| Chevron Corp. | 4,082,926 | 499,260 | 0.9% |

| Exxon Mobil Corp. | 5,260,011 | 447,206 | 0.8% |

| ^ TransCanada Corp. | 6,107,253 | 247,099 | 0.5% |

| Canadian Natural Resources Ltd. | 6,599,591 | 215,543 | 0.4% |

| Energy—Other † | | 703,360 | 1.3% |

| | | 2,617,459 | 4.9% |

| Financials | | | |

| JPMorgan Chase & Co. | 8,118,222 | 916,060 | 1.7% |

| Wells Fargo & Co. | 7,544,642 | 396,546 | 0.8% |

| MetLife Inc. | 7,804,253 | 364,615 | 0.7% |

| Financials—Other † | | 1,229,136 | 2.3% |

| | | 2,906,357 | 5.5% |

| Health Care | | | |

| Johnson & Johnson | 5,109,959 | 706,043 | 1.4% |

| Pfizer Inc. | 15,222,727 | 670,866 | 1.3% |

| Eli Lilly & Co. | 4,509,809 | 483,948 | 0.9% |

| Merck & Co. Inc. | 5,377,406 | 381,473 | 0.7% |

| Medtronic plc | 3,835,616 | 377,310 | 0.7% |

| Bristol-Myers Squibb Co. | 4,427,504 | 274,859 | 0.5% |

| Novartis AG | 3,189,761 | 274,570 | 0.5% |

| Koninklijke Philips NV | 4,719,831 | 215,139 | 0.4% |

| Roche Holding AG | 886,810 | 214,444 | 0.4% |

| | | 3,598,652 | 6.8% |

15

| | | | | |

| Wellesley Income Fund | | | | | |

| |

| |

| |

| | | | | Market | Percentage |

| | | | | Value• | of Net |

| | | | Shares | ($000) | Assets |

| Industrials | | | | | |

| Union Pacific Corp. | | | 2,008,628 | 327,065 | 0.6% |

| Eaton Corp. plc | | | 3,649,221 | 316,497 | 0.6% |

| Lockheed Martin Corp. | | | 896,270 | 310,074 | 0.6% |

| Caterpillar Inc. | | | 1,855,166 | 282,894 | 0.5% |

| 3M Co. | | | 1,050,759 | 221,405 | 0.4% |

| Industrials—Other † | | | | 192,431 | 0.4% |

| | | | | 1,650,366 | 3.1% |

| Information Technology | | | | | |

| Cisco Systems Inc. | | | 13,805,946 | 671,659 | 1.3% |

| Intel Corp. | | | 9,067,452 | 428,800 | 0.8% |

| Analog Devices Inc. | | | 3,951,328 | 365,340 | 0.7% |

| QUALCOMM Inc. | | | 3,245,326 | 233,761 | 0.4% |

| Information Technology—Other † | | | 232,608 | 0.4% |

| | | | | 1,932,168 | 3.6% |

| Materials | | | | | |

| DowDuPont Inc. | | | 6,932,472 | 445,827 | 0.8% |

| Materials—Other † | | | | 458,343 | 0.9% |

| | | | | 904,170 | 1.7% |

| Real Estate | | | | | |

| Crown Castle International Corp. | | 2,490,418 | 277,258 | 0.5% |

| |

| Telecommunication Services | | | | | |

| Verizon Communications Inc. | | | 12,535,730 | 669,282 | 1.3% |

| Telecommunication Services—Other † | | | 169,643 | 0.3% |

| | | | | 838,925 | 1.6% |

| Utilities | | | | | |

| Dominion Energy Inc. | | | 4,316,311 | 303,350 | 0.6% |

| NextEra Energy Inc. | | | 1,498,423 | 251,136 | 0.5% |

| Eversource Energy | | | 4,053,157 | 249,026 | 0.4% |

| Duke Energy Corp. | | | 2,787,844 | 223,083 | 0.4% |

| Sempra Energy | | | 1,847,207 | 210,120 | 0.4% |

| Utilities—Other † | | | | 576,344 | 1.1% |

| | | | | 1,813,059 | 3.4% |

| Total Common Stocks (Cost $14,461,074) | | | 19,928,422 | 37.5% |

| |

| | | Coupon | | | |

| Temporary Cash Investments | | | | | |

| Money Market Fund | | | | | |

| 7,8 Vanguard Market Liquidity Fund | 2.209% | 1,813,594 | 181,360 | 0.3% |

| |

| | | | Face | | |

| | | Maturity | Amount | | |

| | Coupon | Date | ($000) | | |

| Repurchase Agreements | | | | | |

| Bank of America Securities, LLC | | | | |

| (Dated 9/28/18, Repurchase | | | | | |

| Value $16,403,000, collateralized | | | | |

| by Federal Farm Credit Bank, | | | | |

| 2.480%, 10/19/29, with a value | | | | |

| of $16,728,000) | 2.270% | 10/1/18 | 16,400 | 16,400 | 0.0% |

16

Wellesley Income Fund

| | | | | |

| | | | Face | Market | Percentage |

| | | Maturity | Amount | Value • | of Net |

| | Coupon | Date | ($000) | ($000) | Assets |

| Deutsche Bank Securities, Inc. | | | | | |

| (Dated 9/28/18, Repurchase | | | | | |

| Value $10,302,000, collateralized | | | | | |

| by Federal Farm Credit Bank, | | | | | |

| 2.035%, 7/9/20, with a value | | | | | |

| of $10,506,000) | 2.250% | 10/1/18 | 10,300 | 10,300 | 0.0% |

| HSBC Bank USA (Dated 9/28/18, | | | | | |

| Repurchase Value $85,516,000, | | | | | |

| collateralized by U. S. Treasury | | | | | |

| Bill 0.000%, 11/1/18–11/8/18, | | | | | |

| and U.S. Treasury Note/Bond, | | | | | |

| 2.125%, 5/15/25, with a value | | | | | |

| of $87,210,000) | 2.230% | 10/1/18 | 85,500 | 85,500 | 0.2% |

| HSBC Bank USA (Dated 9/28/18, | | | | | |

| Repurchase Value $20,504,000, | | | | | |

| collateralized by Federal Home | | | | | |

| Loan Mortgage Corp., 3.000%– | | | | | |

| 6.000%, 1/1/23–9/1/48, and | | | | | |

| Federal National Mortgage Assn., | | | | | |

| 5.000%–5.500%, 3/1/33–3/1/41, | | | | | |

| with a value of $20,910,000) | 2.240% | 10/1/18 | 20,500 | 20,500 | 0.1% |

| JP Morgan Securities LLC | | | | | |

| (Dated 9/28/18, Repurchase | | | | | |

| Value $165,131,000, collateralized | | | | | |

| by U. S. Treasury Note/Bond, | | | | | |

| 1.625%, 5/15/26, with a value | | | | | |

| of $168,402,000) | 2.220% | 10/1/18 | 165,100 | 165,100 | 0.3% |

| Natixis (Dated 9/28/18, | | | | | |

| Repurchase Value $175,033,000, | | | | | |

| collateralized by U. S. Treasury | | | | | |

| Note/Bond, 1.500%–3.375%, | | | | | |

| 7/31/20–4/15/32, with a value | | | | | |

| of $178,500,000) | 2.230% | 10/1/18 | 175,000 | 175,000 | 0.3% |

| Nomura International plc | | | | | |

| (Dated 9/28/18, Repurchase | | | | | |

| Value $70,013,000, collateralized | | | | | |

| by U. S. Treasury Note/Bond, | | | | | |

| 1.625%–3.125%, 5/31/25– | | | | | |

| 11/15/41, with a value of | | | | | |

| $71,400,000) | 2.250% | 10/1/18 | 70,000 | 70,000 | 0.1% |

| RBC Capital Markets LLC | | | | | |

| (Dated 9/28/18, Repurchase | | | | | |

| Value $17,103,000, collateralized | | | | | |

| by Federal Home Loan Mortgage | | | | | |

| Corp., 4.000%, 9/1/48, and | | | | | |

| Federal National Mortgage Assn., | | | | | |

| 2.360%–3.040%, 12/1/22– | | | | | |

| 11/1/26, with a value of | | | | | |

| $17,443,000) | 2.230% | 10/1/18 | 17,100 | 17,100 | 0.1% |

17

Wellesley Income Fund

| | | | | |

| | | | Face | Market | Percentage |

| | | Maturity | Amount | Value • | of Net |

| | Coupon | Date | ($000) | ($000) | Assets |

| RBS Securities, Inc. | | | | | |

| (Dated 9/28/18, Repurchase | | | | |

| Value $272,351,000, collateralized | | | | |

| by U. S. Treasury Note/Bond | | | | |

| 3.375%, 11/15/19, with a value | | | | |

| of $277,746,000) | 2.240% | 10/1/18 | 272,300 | 272,300 | 0.5% |

| | | | | 832,200 | 1.6% |

| U. S. Government and Agency Obligations | | | | |

| United States Treasury | | | | | |

| Bill | 1.972%–1.973% | 10/25/18 | 198,100 | 197,824 | 0.4% |

| United States Treasury | | | | | |

| Bill | 2.545%–2.548% | 9/12/19 | 353,000 | 344,553 | 0.6% |

| | | | | 542,377 | 1.0% |

| Total Temporary Cash Investments (Cost $1,555,973) | | | 1,555,937 | 2.9% |

| Total Investments (Cost $48,208,549) | | | 53,409,648 | 100.5% |

| | |

| | Amount | |

| | ($000) | |

| Other Assets and Liabilities | | |

| Other Assets | | |

| Investment in Vanguard | 2,717 | |

| Receivables for Investment Securities Sold | 115,353 | |

| Receivables for Accrued Income | 312,724 | |

| Receivables for Capital Shares Issued | 20,426 | |

| Variation Margin Receivable—Futures Contracts | 1,149 | |

| Unrealized Appreciation—Forward Currency Contracts | 2,633 | |

| Other Assets | 10,952 | |

| Total Other Assets | 465,954 | 0.9% |

| Liabilities | | |

| Payables for Investment Securities Purchased | (455,792) | |

| Collateral for Securities on Loan | (181,351) | |

| Payables to Investment Advisor | (7,752) | |

| Payables for Capital Shares Redeemed | (33,809) | |

| Payables for Distributions | (1) | |

| Payables to Vanguard | (40,425) | |

| Variation Margin Payable—Futures Contracts | (454) | |

| Unrealized Depreciation—Forward Currency Contracts | (162) | |

| Other Liabilities | (1,874) | |

| Total Liabilities | (721,620) | (1.4%) |

| Net Assets | 53,153,982 | 100.0% |

18

Wellesley Income Fund

| |

| | Amount |

| | ($000) |

| Paid-in Capital | 45,936,605 |

| Undistributed Net Investment Income | 9,743 |

| Accumulated Net Realized Gains | 1,989,520 |

| Unrealized Appreciation (Depreciation) | |

| Investment Securities | 5,201,099 |

| Futures Contracts | 14,676 |

| Forward Currency Contracts | 2,471 |

| Foreign Currencies | (132) |

| Net Assets | 53,153,982 |

| |

| |

| Investor Shares—Net Assets | |

| Applicable to 469,044,106 outstanding $.001 par value shares of | |

| beneficial interest (unlimited authorization) | 12,397,630 |

| Net Asset Value Per Share—Investor Shares | $26.43 |

| |

| |

| Admiral Shares—Net Assets | |

| Applicable to 636,542,622 outstanding $.001 par value shares of | |

| beneficial interest (unlimited authorization) | 40,756,352 |

| Net Asset Value Per Share—Admiral Shares | $64.03 |

At September 30, 2018, net assets consisted of:

• See Note A in Notes to Financial Statements.

§ Security value determined using significant unobservable inputs.

^ Includes partial security positions on loan to broker-dealers. The total value of securities on loan is $172,277,000.

† Represents the aggregate value, by category, of securities that are not among the 50 largest holdings and, in total for any issuer, represent 1% or less of net assets.

1 Securities with a value of $808,000 have been segregated as collateral for certain open To Be Announced (TBA) transactions. 2 Securities with a value of $13,720,000 have been segregated as initial margin for open futures contracts.

3 The issuer was placed under federal conservatorship in September 2008; since that time, its daily operations have been managed by the Federal Housing Finance Agency and it receives capital from the U.S. Treasury, as needed to maintain a positive net worth, in exchange for senior preferred stock.

4 The average or expected maturity is shorter than the final maturity shown because of the possibility of interim principal payments and prepayments or the possibility of the issue being called.

5 Includes securities purchased on a when-issued or delayed-delivery basis for which the fund has not taken delivery as of September 30, 2018.

6 Certain of the fund’s securities are exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be sold in transactions exempt from registration, normally to qualified institutional buyers. At September 30, 2018, the aggregate value of these securities was $5,980,511,000, representing 11.3% of net assets.

7 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield.

8 Includes $181,351,000 of collateral received for securities on loan.

REMICS—Real Estate Mortgage Investment Conduits.

19

Wellesley Income Fund

| | | | |

| Derivative Financial Instruments Outstanding as of Period End | | |

| Futures Contracts | | | | |

| | | | | ($000) |

| | | | | Value and |

| | | Number of | | Unrealized |

| | | Long (Short) | Notional | Appreciation |

| | Expiration | Contracts | Amount | (Depreciation) |

| Long Futures Contracts | | | | |

| 5-Year U.S. Treasury Note | December 2018 | 9,060 | 1,019,038 | (7,299) |

| |

| Short Futures Contracts | | | | |

| 2-Year U.S. Treasury Note | December 2018 | (4,437) | (935,029) | 2,487 |

| 10-Year U.S. Treasury Note | December 2018 | (7,861) | (933,739) | 9,179 |

| Ultra Long U.S. Treasury Bond | December 2018 | (1,902) | (293,443) | 10,309 |

| | | | | 21,975 |

| | | | | 14,676 |

| | | | | | |

| Forward Currency Contracts | | | | | | |

| | | | | | | Unrealized |

| | Contract | | | | | Appreciation |

| | | | Contract Amount (000) | |

| | Settlement | | | | | (Depreciation) |

| Counterparty | Date | | Receive | | Deliver | ($000) |

| J.P. Morgan Chase Bank, N.A. | 1/9/19 | USD | 163,834 | JPY | 18,440,450 | 106 |

| Citibank, N.A. | 10/29/18 | USD | 82,886 | JPY | 9,150,000 | 2,180 |

| J.P. Morgan Chase Bank, N.A. | 10/29/18 | USD | 41,050 | JPY | 4,627,000 | 238 |

| Citibank, N.A. | 10/22/18 | USD | 37,725 | CAD | 48,700 | 2 |

| UBS AG | 10/10/18 | USD | 25,750 | CAD | 33,460 | (161) |

| Citibank, N.A. | 10/22/18 | USD | 18,860 | CAD | 24,350 | (1) |

| Citibank, N.A. | 10/19/18 | USD | 18,834 | CAD | 24,300 | 12 |

| Goldman Sachs International | 10/16/18 | USD | 18,826 | CAD | 24,300 | 7 |

| Credit Suisse International | 10/17/18 | USD | 18,826 | CAD | 24,300 | 6 |

| Barclays Bank plc | 10/15/18 | USD | 18,824 | CAD | 24,300 | 5 |

| Goldman Sachs International | 10/15/18 | USD | 12,942 | JPY | 1,460,000 | 77 |

| | | | | | | 2,471 |

| CAD—Canadian dollar. | | | | | | |

| JPY—Japanese yen. | | | | | | |

| USD—U.S. dollar. | | | | | | |

At September 30, 2018, a counterparty had deposited in a segregated account securities with a value of $1,825,000 in connection with open forward currency contracts.

See accompanying Notes, which are an integral part of the Financial Statements.

20

| |

| Wellesley Income Fund | |

| |

| |

| Statement of Operations | |

| |

| | Year Ended |

| | September 30, 2018 |

| | ($000) |

| Investment Income | |

| Income | |

| Dividends1 | 616,713 |

| Interest | 1,098,088 |

| Securities Lending—Net | 1,446 |

| Total Income | 1,716,247 |

| Expenses | |

| Investment Advisory Fees—Note B | |

| Basic Fee | 29,260 |

| Performance Adjustment | 2,529 |

| The Vanguard Group—Note C | |

| Management and Administrative—Investor Shares | 19,949 |

| Management and Administrative—Admiral Shares | 37,800 |

| Marketing and Distribution—Investor Shares | 2,244 |

| Marketing and Distribution—Admiral Shares | 2,402 |

| Custodian Fees | 268 |

| Auditing Fees | 33 |

| Shareholders’ Reports and Proxy—Investor Shares | 348 |

| Shareholders’ Reports and Proxy—Admiral Shares | 442 |

| Trustees’ Fees and Expenses | 84 |

| Total Expenses | 95,359 |

| Net Investment Income | 1,620,888 |

| Realized Net Gain (Loss) | |

| Investment Securities Sold 2 | 2,382,165 |

| Futures Contracts | 80,739 |

| Forward Currency Contracts | (4,427) |

| Foreign Currencies | 5,313 |

| Realized Net Gain (Loss) | 2,463,790 |

| Change in Unrealized Appreciation (Depreciation) | |

| Investment Securities 2 | (2,323,374) |

| Futures Contracts | 4,797 |

| Forward Currency Contracts | (897) |

| Foreign Currencies | (844) |

| Change in Unrealized Appreciation (Depreciation) | (2,320,318) |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 1,764,360 |

1 Dividends are net of foreign withholding taxes of $13,872,000.

2 Realized net gain (loss) and change in unrealized appreciation (depreciation) from an affiliated company of the fund were ($54,000) and ($4,000), respectively. Purchases and sales are for temporary cash investment purposes.

See accompanying Notes, which are an integral part of the Financial Statements.

21

Wellesley Income Fund

Statement of Changes in Net Assets

| | |

| | Year Ended September 30, |

| | 2018 | 2017 |

| | ($000) | ($000) |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net Investment Income | 1,620,888 | 1,541,537 |

| Realized Net Gain (Loss) | 2,463,790 | 734,142 |

| Change in Unrealized Appreciation (Depreciation) | (2,320,318) | 888,957 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 1,764,360 | 3,164,636 |

| Distributions | | |

| Net Investment Income | | |

| Investor Shares | (389,576) | (420,839) |

| Admiral Shares | (1,236,857) | (1,142,767) |

| Realized Capital Gain1 | | |

| Investor Shares | (158,569) | (144,472) |

| Admiral Shares | (472,158) | (370,403) |

| Total Distributions | (2,257,160) | (2,078,481) |

| Capital Share Transactions | | |

| Investor Shares | (1,702,663) | (241,853) |

| Admiral Shares | 1,154,836 | 3,497,807 |

| Net Increase (Decrease) from Capital Share Transactions | (547,827) | 3,255,954 |

| Total Increase (Decrease) | (1,040,627) | 4,342,109 |

| Net Assets | | |

| Beginning of Period | 54,194,609 | 49,852,500 |

| End of Period2 | 53,153,982 | 54,194,609 |

| 1 Includes fiscal 2018 and 2017 short-term gain distributions totaling $50,213,000 and $18,019,000, respectively. Short-term gain |

| distributions are treated as ordinary income dividends for tax purposes. | | |

| 2 Net Assets—End of Period includes undistributed (overdistributed) net investment income of $9,743,000 and $1,334,000. |

See accompanying Notes, which are an integral part of the Financial Statements.

22

Wellesley Income Fund

Financial Highlights

| | | | | |

| Investor Shares | | | | | |

| |

| For a Share Outstanding | | | Year Ended September 30, |

| Throughout Each Period | 2018 | 2017 | 2016 | 2015 | 2014 |

| Net Asset Value, Beginning of Period | $26.66 | $26.13 | $24.71 | $25.65 | $24.82 |

| Investment Operations | | | | | |

| Net Investment Income | .7791 | .7691 | .761 | .760 | .811 |

| Net Realized and Unrealized Gain (Loss) | | | | | |

| on Investments | .086 | .810 | 2.014 | (.487) | 1.491 |

| Total from Investment Operations | .865 | 1.579 | 2.775 | .273 | 2.302 |

| Distributions | | | | | |

| Dividends from Net Investment Income | (.786) | (.780) | (.746) | (.761) | (.793) |

| Distributions from Realized Capital Gains | (.309) | (.269) | (.609) | (.452) | (.679) |

| Total Distributions | (1.095) | (1.049) | (1.355) | (1.213) | (1.472) |

| Net Asset Value, End of Period | $26.43 | $26.66 | $26.13 | $24.71 | $25.65 |

| |

| Total Return2 | 3.28% | 6.22% | 11.58% | 1.03% | 9.54% |

| |

| Ratios/Supplemental Data | | | | | |

| Net Assets, End of Period (Millions) | $12,398 | $14,220 | $14,175 | $11,617 | $11,830 |

| Ratio of Total Expenses to Average Net Assets3 | 0.23% | 0.22% | 0.22% | 0.23% | 0.25% |

| Ratio of Net Investment Income to | | | | | |

| Average Net Assets | 2.93% | 2.95% | 3.02% | 2.96% | 3.19% |

| Portfolio Turnover Rate4 | 36% | 22% | 31% | 59% | 109% |

1 Calculated based on average shares outstanding.

2 Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information

about any applicable account service fees.

3 Includes performance-based investment advisory fee increases (decreases) of 0.00%, (0.00%), 0.00%, 0.00%, and 0.01%.

4 Includes 4%, 1%, 15%, 18%, and 23% attributable to mortgage-dollar-roll activity.

See accompanying Notes, which are an integral part of the Financial Statements.

23

Wellesley Income Fund

Financial Highlights

| | | | | |

| Admiral Shares | | | | | |

| |

| For a Share Outstanding | | | Year Ended September 30, |

| Throughout Each Period | 2018 | 2017 | 2016 | 2015 | 2014 |

| Net Asset Value, Beginning of Period | $64.57 | $63.30 | $59.87 | $62.14 | $60.12 |

| Investment Operations | | | | | |

| Net Investment Income | 1. 9341 | 1.9081 | 1.887 | 1.884 | 2.010 |

| Net Realized and Unrealized Gain (Loss) | | | | | |

| on Investments | .226 | 1.945 | 4.868 | (1.171) | 3.623 |

| Total from Investment Operations | 2.160 | 3.853 | 6.755 | .713 | 5.633 |

| Distributions | | | | | |

| Dividends from Net Investment Income | (1.951) | (1.932) | (1.850) | (1.888) | (1.967) |

| Distributions from Realized Capital Gains | (.749) | (.651) | (1.475) | (1.095) | (1.646) |

| Total Distributions | (2.700) | (2.583) | (3.325) | (2.983) | (3.613) |

| Net Asset Value, End of Period | $64.03 | $64.57 | $63.30 | $59.87 | $62.14 |

| |

| Total Return2 | 3.38% | 6.27% | 11.64% | 1.11% | 9.64% |

| |

| Ratios/Supplemental Data | | | | | |

| Net Assets, End of Period (Millions) | $40,756 | $39,974 | $35,678 | $28,083 | $27,156 |

| Ratio of Total Expenses to Average Net Assets3 | 0.16% | 0.15% | 0.15% | 0.16% | 0.18% |

| Ratio of Net Investment Income to | | | | | |

| Average Net Assets | 3.00% | 3.02% | 3.09% | 3.03% | 3.26% |

| Portfolio Turnover Rate4 | 36% | 22% | 31% | 59% | 109% |

1 Calculated based on average shares outstanding.

2 Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable account service fees.

3 Includes performance-based investment advisory fee increases (decreases) of 0.00%, (0.00%), 0.00%, 0.00%, and 0.01%.

4 Includes 4%, 1%, 15%, 18%, and 23% attributable to mortgage-dollar-roll activity.

See accompanying Notes, which are an integral part of the Financial Statements

24

Wellesley Income Fund

Notes to Financial Statements

Vanguard Wellesley Income Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. Certain of the fund’s investments are in corporate debt instruments; the issuers’ abilities to meet their obligations may be affected by economic developments in their respective industries. The fund offers two classes of shares: Investor Shares and Admiral Shares. Investor Shares are available to any investor who meets the fund’s minimum purchase requirements. Admiral Shares are designed for investors who meet certain administrative, service, and account-size criteria.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. investment companies. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Bonds and temporary cash investments are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing services. Structured debt securities, including mortgages and asset-backed securities, are valued using the latest bid prices or using valuations based on a matrix system that considers such factors as issuer, tranche, nominal or option-adjusted spreads, weighted average coupon, weighted average maturity, credit enhancements, and collateral. Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value. Securities for which market quotations are not readily available, or whose values have been affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued at their fair values calculated according to procedures adopted by the board of trustees. These procedures include obtaining quotations from an independent pricing service, monitoring news to identify significant market-or security-specific events, and evaluating changes in the values of foreign market proxies (for example, ADRs, futures contracts, or exchange-traded funds), between the time the foreign markets close and the fund’s pricing time. When fair-value pricing is employed, the prices of securities used by a fund to calculate its net asset value may differ from quoted or published prices for the same securities.

2. Foreign Currency: Securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars using exchange rates obtained from an independent third party as of the fund’s pricing time on the valuation date. Realized gains (losses) and unrealized appreciation (depreciation) on investment securities include the effects of changes in exchange rates since the securities were purchased, combined with the effects of changes in security prices. Fluctuations in the value of other assets and liabilities resulting from changes in exchange rates are recorded as unrealized foreign currency gains (losses) until the assets or liabilities are settled in cash, at which time they are recorded as realized foreign currency gains (losses).

3. Futures Contracts: The fund uses futures contracts to invest in fixed income asset classes with greater efficiency and lower cost than is possible through direct investment, to add value when these instruments are attractively priced, or to adjust sensitivity to changes in interest rates. The primary risks associated with the use of futures contracts are imperfect correlation between changes

25

Wellesley Income Fund

in market values of bonds held by the fund and the prices of futures contracts, and the possibility of an illiquid market. Counterparty risk involving futures is mitigated because a regulated clearinghouse is the counterparty instead of the clearing broker. To further mitigate counterparty risk, the fund trades futures contracts on an exchange, monitors the financial strength of its clearing brokers and clearinghouse, and has entered into clearing agreements with its clearing brokers. The clearinghouse imposes initial margin requirements to secure the fund’s performance and requires daily settlement of variation margin representing changes in the market value of each contract. Any assets pledged as initial margin for open contracts are noted in the Statement of Net Assets.

Futures contracts are valued at their quoted daily settlement prices. The notional amounts of the contracts are not recorded in the Statement of Net Assets. Fluctuations in the value of the contracts are recorded in the Statement of Net Assets as an asset (liability) and in the Statement of Operations as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as realized futures gains (losses).

During the year ended September 30, 2018, the fund’s average investments in long and short futures contracts represented less than 1% and 3% of net assets, respectively, based on the average of the notional amounts at each quarter-end during the period.

4. Forward Currency Contracts: The fund enters into forward currency contracts to protect the value of securities and related receivables and payables against changes in future foreign exchange rates. The fund’s risks in using these contracts include movement in the values of the foreign currencies relative to the U.S. dollar and the ability of the counterparties to fulfill their obligations under the contracts. The fund mitigates its counterparty risk by entering into forward currency contracts only with a diverse group of prequalified counterparties, monitoring their financial strength, entering into master netting arrangements with its counterparties, and requiring its counterparties to transfer collateral as security for their performance. In the absence of a default, the collateral pledged or received by the fund cannot be repledged, resold, or rehypothecated.

The master netting arrangements provide that, in the event of a counterparty’s default (including bankruptcy), the fund may terminate the forward currency contracts, determine the net amount owed by either party in accordance with its master netting arrangements, and sell or retain any collateral held up to the net amount owed to the fund under the master netting arrangements. The forward currency contracts contain provisions whereby a counterparty may terminate open contracts if the fund’s net assets decline below a certain level, triggering a payment by the fund if the fund is in a net liability position at the time of the termination. The payment amount would be reduced by any collateral the fund has pledged. Any assets pledged as collateral for open contracts are noted in the Statement of Net Assets. The value of collateral received or pledged is compared daily to the value of the forward currency contracts exposure with each counterparty, and any difference, if in excess of a specified minimum transfer amount, is adjusted and settled within two business days.

Forward currency contracts are valued at their quoted daily prices obtained from an independent third party, adjusted for currency risk based on the expiration date of each contract. The notional amounts of the contracts are not recorded in the Statement of Net Assets. Fluctuations in the value of the contracts are recorded in the Statement of Net Assets as an asset (liability) and in the Statement of Operations as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as realized forward currency contract gains (losses).

26

Wellesley Income Fund

During the year ended September 30, 2018, the fund’s average investment in forward currency contracts represented 1% of net assets, based on the average of notional amounts at each quarter-end during the period.

5. To Be Announced (TBA) Transactions: A TBA transaction is an agreement to buy or sell mortgage-backed securities with agreed-upon characteristics (face amount, coupon, maturity) for settlement at a future date. The fund may be a seller of TBA transactions to reduce its exposure to the mortgage-backed securities market or in order to sell mortgage-backed securities it owns under delayed-delivery arrangements. When the fund is a buyer of TBA transactions, it maintains cash or short-term investments in an amount sufficient to meet the purchase price at the settlement date of the TBA transaction. The primary risk associated with TBA transactions is that a counterparty may default on its obligations. The fund mitigates its counterparty risk by, among other things, performing a credit analysis of counterparties, allocating transactions among numerous counterparties, and monitoring its exposure to each counterparty. The fund may also enter into a Master Securities Forward Transaction Agreement (MSFTA) with certain counterparties and require them to transfer collateral as security for their performance. In the absence of a default, the collateral pledged or received by the fund cannot be repledged, resold, or rehypothecated. Under an MSFTA, upon a counterparty default (including bankruptcy), the fund may terminate any TBA transactions with that counterparty, determine the net amount owed by either party in accordance with its master netting arrangements, and sell or retain any collateral held up to the net amount owed to the fund under the master netting arrangements.

6. Mortgage Dollar Rolls: The fund enters into mortgage-dollar-roll transactions, in which the fund sells mortgage-backed securities to a dealer and simultaneously agrees to purchase similar securities in the future at a predetermined price. The proceeds of the securities sold in mortgage-dollar-roll transactions are typically invested in high-quality short-term fixed income securities. The fund forgoes principal and interest paid on the securities sold, and is compensated by interest earned on the proceeds of the sale and by a lower price on the securities to be repurchased. The fund has also entered into mortgage-dollar-roll transactions in which the fund buys mortgage-backed securities from a dealer pursuant to a TBA transaction and simultaneously agrees to sell similar securities in the future at a predetermined price. The securities bought in mortgage-dollar-roll transactions are used to cover an open TBA sell position. The fund continues to earn interest on mortgage-backed security pools already held and receives a lower price on the securities to be sold in the future.

The fund accounts for mortgage-dollar-roll transactions as purchases and sales; as such, these transactions may increase the fund’s portfolio turnover rate. Amounts to be received or paid in connection with open mortgage dollar rolls are included in Receivables for Investment Securities Sold or Payables for Investment Securities Purchased in the Statement of Net Assets.

7. Repurchase Agreements: The fund enters into repurchase agreements with institutional counterparties. Securities pledged as collateral to the fund under repurchase agreements are held by a custodian bank until the agreements mature, and in the absence of a default, such collateral cannot be repledged, resold, or rehypothecated. Each agreement requires that the market value of the collateral be sufficient to cover payments of interest and principal. The fund further mitigates its counterparty risk by entering into repurchase agreements only with a diverse group of prequalified counterparties, monitoring their financial strength, and entering into master repurchase agreements with its counterparties. The master repurchase agreements provide that, in the event of a counterparty’s default (including bankruptcy), the fund may terminate any repurchase agreements

27

Wellesley Income Fund

with that counterparty, determine the net amount owed, and sell or retain the collateral up to the net amount owed to the fund. Such action may be subject to legal proceedings, which may delay or limit the disposition of collateral.

8. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Management has analyzed the fund’s tax positions taken for all open federal income tax years (September 30, 2015–2018), and has concluded that no provision for federal income tax is required in the fund’s financial statements.

9. Distributions: Distributions to shareholders are recorded on the ex-dividend date. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes.

10. Securities Lending: To earn additional income, the fund lends its securities to qualified institutional borrowers. Security loans are subject to termination by the fund at any time, and are required to be secured at all times by collateral in an amount at least equal to the market value of securities loaned. Daily market fluctuations could cause the value of loaned securities to be more or less than the value of the collateral received. When this occurs, the collateral is adjusted and settled before the opening of the market on the next business day. The fund further mitigates its counterparty risk by entering into securities lending transactions only with a diverse group of prequalified counterparties, monitoring their financial strength, and entering into master securities lending agreements with its counterparties. The master securities lending agreements provide that, in the event of a counterparty’s default (including bankruptcy), the fund may terminate any loans with that borrower, determine the net amount owed, and sell or retain the collateral up to the net amount owed to the fund; however, such actions may be subject to legal proceedings. While collateral mitigates counterparty risk, in the event of a default, the fund may experience delays and costs in recovering the securities loaned. The fund invests cash collateral received in Vanguard Market Liquidity Fund, and records a liability in the Statement of Net Assets for the return of the collateral, during the period the securities are on loan. Securities lending income represents fees charged to borrowers plus income earned on invested cash collateral, less expenses associated with the loan. During the term of the loan, the fund is entitled to all distributions made on or in respect of the loaned securities.

11. Credit Facility: The fund and certain other funds managed by The Vanguard Group (“Vanguard”) participate in a $3.1 billion committed credit facility provided by a syndicate of lenders pursuant to a credit agreement that may be renewed annually; each fund is individually liable for its borrowings, if any, under the credit facility. Borrowings may be utilized for temporary and emergency purposes, and are subject to the fund’s regulatory and contractual borrowing restrictions. The participating funds are charged administrative fees and an annual commitment fee of 0.10% of the undrawn amount of the facility; these fees are allocated to the funds based on a method approved by the fund’s board of trustees and included in Management and Administrative expenses on the fund’s Statement of Operations. Any borrowings under this facility bear interest at a rate based upon the higher of the one-month London Interbank Offered Rate, federal funds effective rate, or overnight bank funding rate plus an agreed-upon spread.

The fund had no borrowings outstanding at September 30, 2018, or at any time during the period then ended.

28

Wellesley Income Fund

12. Other: Dividend income is recorded on the ex-dividend date. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Premiums and discounts on debt securities purchased are amortized and accreted, respectively, to interest income over the lives of the respective securities. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

Each class of shares has equal rights as to assets and earnings, except that each class separately bears certain class-specific expenses related to maintenance of shareholder accounts (included in Management and Administrative expenses), shareholder reporting, and the proxy. Marketing and distribution expenses are allocated to each class of shares based on a method approved by the board of trustees. Income, other non-class-specific expenses, and gains and losses on investments are allocated to each class of shares based on its relative net assets.

B. Wellington Management Company LLP provides investment advisory services to the fund for a fee calculated at an annual percentage rate of average net assets. The basic fee is subject to quarterly adjustments based on the fund’s performance for the preceding three years relative to a combined index comprising the Bloomberg Barclays U.S. Credit A or Better Bond Index and the FTSE High Dividend Yield Index. For the year ended September 30, 2018, the investment advisory fee represented an effective annual basic rate of 0.05% of the fund’s average net assets before an increase of $2,529,000 (0.00%) based on performance.

C. In accordance with the terms of a Funds’ Service Agreement (the “FSA”) between Vanguard and the fund, Vanguard furnishes to the fund corporate management, administrative, marketing, and distribution services at Vanguard’s cost of operations (as defined by the FSA). These costs of operations are allocated to the fund based on methods and guidelines approved by the board of trustees. Vanguard does not require reimbursement in the current period for certain costs of operations (such as deferred compensation/benefits and risk/insurance costs); the fund’s liability for these costs of operations is included in Payables to Vanguard on the Statement of Net Assets. All other costs of operations payable to Vanguard are generally settled twice a month.

Upon the request of Vanguard, the fund may invest up to 0.40% of its net assets as capital in Vanguard. At September 30, 2018, the fund had contributed to Vanguard capital in the amount of $2,717,000, representing 0.01% of the fund’s net assets and 1.09% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and employees, respectively, of Vanguard.

D. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments). Any investments valued with significant unobservable inputs are noted on the Statement of Net Assets.

29

Wellesley Income Fund

The following table summarizes the market value of the fund’s investments as of September 30, 2018, based on the inputs used to value them:

| | | |

| | Level 1 | Level 2 | Level 3 |

| Investments | ($000) | ($000) | ($000) |

| U.S. Government and Agency Obligations | — | 4,702,665 | 43,930 |

| Asset-Backed/Commercial Mortgage-Backed Securities | — | 1,204,002 | 5,266 |

| Corporate Bonds | — | 22,708,577 | — |

| Sovereign Bonds | — | 1,688,390 | — |

| Taxable Municipal Bonds | — | 1,572,459 | — |

| Common Stocks | 18,629,861 | 1,298,561 | — |

| Temporary Cash Investments | 181,360 | 1,374,577 | — |

| Futures Contracts—Assets1 | 1,149 | — | — |

| Futures Contracts—Liabilities1 | (454) | — | — |

| Forward Currency Contracts—Assets | — | 2,633 | — |

| Forward Currency Contracts—Liabilities | — | (162) | — |

| Total | 18,811,916 | 34,551,702 | 49,196 |

| 1 Represents variation margin on the last day of the reporting period. | | | |

E. At September 30, 2018, the fair values of derivatives were reflected in the Statement of Net Assets as follows:

| | | |

| | Interest Rate | Currency | |

| | Contracts | Contracts | Total |

| Statement of Net Assets Caption | ($000) | ($000) | ($000) |

| Variation Margin Receivable—Futures Contracts | 1,149 | — | 1,149 |

| Unrealized Appreciation—Forward Currency Contracts | — | 2,633 | 2,633 |

| Total Assets | 1,149 | 2,633 | 3,782 |

| |

| Variation Margin Payable—Futures Contracts | (454) | — | (454) |

| Unrealized Depreciation—Forward Currency Contracts | — | (162) | (162) |

| Total Liabilities | (454) | (162) | (616) |

30

Wellesley Income Fund

Realized net gain (loss) and the change in unrealized appreciation (depreciation) on derivatives for the year ended September 30, 2018, were:

| | | |

| | Interest Rate | Currency | |

| | Contracts | Contracts | Total |

| Realized Net Gain (Loss) on Derivatives | ($000) | ($000) | ($000) |

| Futures Contracts | 80,739 | — | 80,739 |

| Forward Currency Contracts | — | (4,427) | (4,427) |

| Realized Net Gain (Loss) on Derivatives | 80,739 | (4,427) | 76,312 |

| |

| Change in Unrealized Appreciation (Depreciation) on Derivatives | | |

| Futures Contracts | 4,797 | — | 4,797 |

| Forward Currency Contracts | — | (897) | (897) |

| Change in Unrealized Appreciation (Depreciation) | | | |

| on Derivatives | 4,797 | (897) | 3,900 |

F. Permanent differences between book-basis and tax-basis components of net assets are reclassified among capital accounts in the financial statements to reflect their tax character. These reclassifications have no effect on net assets or net asset value per share. As of period end, the following permanent differences primarily attributable to the accounting for foreign currency transactions and distributions in connection with fund share redemptions were reclassified to the following accounts:

| |

| | Amount |

| | ($000) |

| Paid-in Capital | 211,701 |

| Undistributed (Overdistributed) Net Investment Income | 13,954 |

| Accumulated Net Realized Gains (Losses) | (225,655) |