SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A)

OF THE SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

SCHOOL SPECIALTY, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

SCHOOL SPECIALTY, INC.

W6316 Design Drive

Greenville, WI 54942

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

August 24, 2004

To the Shareholders of School Specialty, Inc.:

The 2004 Annual Meeting of Shareholders of School Specialty, Inc. will be held at the Fox Cities Performing Arts Center, 400 West College Avenue, Appleton, Wisconsin, on Tuesday, August 24, 2004 at 10:00 a.m. Central Time for the following purposes:

| | (1) | | To elect two directors to serve until the 2007 Annual Meeting of Shareholders as Class III directors; |

| | (2) | | To ratify the appointment of Deloitte & Touche LLP as School Specialty’s independent registered public accounting firm for fiscal 2005; and |

| | (3) | | To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement. |

Shareholders of record at the close of business on July 6, 2004 are entitled to receive notice of and to vote at the Annual Meeting.

All shareholders are cordially invited to attend the Annual Meeting in person. However, whether or not you expect to attend the Annual Meeting in person, you are urged to vote by completing and returning the enclosed proxy card, or by telephone vote. Your prompt voting by proxy will help ensure a quorum. If you vote by proxy and then decide to attend the Annual Meeting to vote your shares in person, you may still do so. Your proxy is revocable in accordance with the procedures set forth in this Proxy Statement.

By Order of the Board of Directors

Joseph F. Franzoi IV,Secretary

July 20, 2004

SCHOOL SPECIALTY, INC.

W6316 Design Drive

Greenville, Wisconsin 54942

July 20, 2004

Proxy Statement

Unless the context requires otherwise, all references to “School Specialty,” “we” or “our” refer to School Specialty, Inc. and its subsidiaries. Our fiscal year ends on the last Saturday of April each year. In this proxy statement, we refer to fiscal years by reference to the calendar year in which they end (e.g., the fiscal year ended April 24, 2004 is referred to as “fiscal 2004”).

This Proxy Statement is furnished by the Board of Directors of School Specialty for the solicitation of proxies from the holders of our common stock, $0.001 par value (the “Common Stock”), in connection with the Annual Meeting of Shareholders to be held at the Fox Cities Performing Arts Center, 400 West College Avenue, Appleton, Wisconsin, on Tuesday, August 24, 2004 at 10:00 a.m. Central Time, and at any adjournment or postponement thereof (the “Annual Meeting”). It is expected that the Notice of Annual Meeting of Shareholders, this Proxy Statement and the enclosed proxy card, together with our Annual Report to Shareholders for fiscal 2004, will be mailed to shareholders starting on or about July 20, 2004.

Shareholders can ensure that their shares are voted at the Annual Meeting by signing, dating and returning the enclosed proxy card in the envelope provided or by calling the toll-free telephone number listed on the proxy card. If you submit a signed proxy card or vote by telephone, you may still attend the Annual Meeting and vote in person. Any shareholder giving a proxy may revoke it before it is voted by submitting to School Specialty’s Secretary a written revocation or by submitting another proxy by telephone or mail that is received later. You will not revoke a proxy merely by attending the Annual Meeting unless you file a written notice of revocation of the proxy with School Specialty’s Secretary at any time prior to voting.

Proxies will be voted as specified by the shareholders. Where specific choices are not indicated, proxies will be voted as follows:

| | • | | FOR the election of each of the individuals nominated to serve as Class III directors, and |

| | • | | FOR ratification of the appointment of the independent registered public accounting firm. |

The Board of Directors knows of no other matters to be presented for shareholder action at the Annual Meeting. If any other matters properly come before the Annual Meeting, the persons named as proxies will vote on the same in their discretion.

The expense of printing and mailing proxy materials, including expenses involved in forwarding materials to beneficial owners of Common Stock held in the name of another person, will be paid by School Specialty. No solicitation, other than by mail, is currently planned, except that officers or employees of School Specialty may solicit the return of proxies from certain shareholders by telephone or other electronic means.

Only shareholders of record at the close of business on July 6, 2004 (the “Record Date”) are entitled to receive notice of and to vote the shares of Common Stock registered in their name at the Annual Meeting. As of the Record Date, we had 19,102,023 shares of Common Stock outstanding. Each share of Common Stock entitles its holder to cast one vote on each matter to be voted upon at the Annual Meeting.

Under Wisconsin law and School Specialty’s By-Laws, the presence of a quorum is required to conduct business at the Annual Meeting. A quorum is defined as the presence, either in person or by proxy, of a majority of the total outstanding shares of Common Stock entitled to vote at the Annual Meeting. The shares represented at the Annual Meeting by proxies that are marked, with respect to the election of directors, “withhold authority” or, with respect to any other proposals, “abstain,” will be counted as shares present for the purpose of

determining whether a quorum is present. Broker non-votes (i.e., proxies from brokers or nominees indicating that such persons have not received instructions from beneficial owners to vote shares as to a matter with respect to which the brokers or nominees do not have discretionary power to vote) will also be counted as shares present for purposes of determining a quorum.

With respect to the vote required to approve the various proposals at the Annual Meeting, the following rules apply:

| | • | | Directors are elected by the affirmative vote of a plurality of the shares of Common Stock present, either in person or by proxy, at the Annual Meeting and entitled to vote. In other words, the two nominees who receive the largest number of votes will be elected as directors. In the election of directors, votes may be cast in favor or withheld. Votes that are withheld and broker non-votes will have no effect on the outcome of the election of directors. |

| | • | | Ratification of the appointment of the independent registered public accounting firm requires that the votes cast in favor of ratification exceed the votes cast opposing the ratification. Abstentions and broker non-votes will therefore have no effect on the approval of this proposal. |

2

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS

The following table sets forth certain information as of July 6, 2004 (unless otherwise specified) regarding the beneficial ownership of shares of Common Stock by each of our directors, the executive officers named in the summary compensation table (the “Named Officers”), all of our directors and executive officers as a group and each person believed by us to be a beneficial owner of more than 5% of the outstanding Common Stock. Except as otherwise indicated, the business address of each of the following is W6316 Design Drive, Greenville, Wisconsin 54942.

| | | | | |

Name and Address of Beneficial Owner

| | Amount and Nature of Beneficial Ownership

| | Percent of Outstanding Shares (9)

| |

David J. Vander Zanden (1) | | 421,019 | | 2.2 | % |

Mary M. Kabacinski (1) | | 117,217 | | * | |

Stephen R. Christiansen (1) | | 18,750 | | * | |

A. Brent Pulsipher | | — | | * | |

Jonathan J. Ledecky (1) | | 934,329 | | 4.7 | % |

Leo C. McKenna (1) | | 36,489 | | * | |

Rochelle Lamm (1) | | 15,422 | | * | |

Jerome M. Pool (1) | | 16,250 | | * | |

Terry L. Lay | | — | | * | |

All executive officers and directors as a group

(9 persons) (1) | | 1,559,476 | | 7.6 | % |

| | |

T. Rowe Price Associates, Inc. (2) T. Rowe Price New Horizons Fund, Inc.

100 East Pratt Street

Baltimore, Maryland 21202 | | 1,858,976 | | 9.7 | % |

| | |

Michael Lee-Chin (3) Portland Holdings, Inc. AIC Limited AIC Investment Services, Inc. AIC American Focused Fund AIC American Focused Corporate Class AIC American Focused Plus Fund

1375 Kerns Road

Burlington, Ontario, Canada L7R 4X8 | | 1,484,419 | | 7.8 | % |

| | |

Capital Research and Management Company (4) SMALLCAP World Fund, Inc.

333 South Hope Street

Los Angeles, California 90071 | | 1,467,900 | | 7.7 | % |

| | |

Morgan Stanley (5)

1585 Broadway

New York, New York 10036 | | 1,186,513 | | 6.2 | % |

| | |

Skyline Asset Management, L.P. (6)

311 South Wacker Drive, Suite 4500

Chicago, Illinois 60606 | | 1,186,163 | | 6.2 | % |

3

| | | | | |

Name and Address of Beneficial Owner

| | Amount and Nature of Beneficial Ownership

| | Percent of Outstanding Shares (9)

| |

Artisan Partners Limited Partnership (7) Artisan Investment Corporation Andrew A. Ziegler Carlene Murphy Ziegler

875 East Wisconsin Avenue, Suite 800

Milwaukee, Wisconsin 53202 | | 1,070,400 | | 5.6 | % |

| | |

Cramer Rosenthal McGlynn, LLC (8)

520 Madison Avenue

New York, New York 10022 | | 1,026,500 | | 5.4 | % |

| * | | Less than 1% of the outstanding Common Stock. |

| (1) | | Share amounts include options granted under our 1998 and 2002 Stock Incentive Plans which are currently exercisable, or exercisable within 60 days after the Record Date, in the amount of 371,019 for Mr. Vander Zanden, 103,060 for Ms. Kabacinski, 18,750 for Mr. Christiansen, 934,329 for Mr. Ledecky, 30,250 for Mr. McKenna, 15,250 for Ms. Lamm, 15,250 for Mr. Pool, and 1,487,908 for all executive officers and directors as a group. |

| (2) | | T. Rowe Price Associates, Inc. and T. Rowe Price New Horizons Fund, Inc. have jointly filed an amended Schedule 13G with the Securities and Exchange Commission (“SEC”) reporting that they had, as of February 13, 2004, sole voting power over 340,500 and 1,500,000 shares, respectively, of Common Stock and T. Rowe Price Associates, Inc. had sole dispositive power over 1,858,976 shares of Common Stock. |

| (3) | | Michael Lee-Chin, Portland Holdings, Inc., AIC Limited, AIC Investment Services, Inc., AIC American Focused Fund, AIC American Focused Corporate Class and AIC American Focused Plus Fund have jointly filed a Schedule13G with the SEC, reporting that as of February 11, 2004, Michael Lee-Chin, Portland Holdings, Inc., AIC Limited and AIC Investment Services, Inc. each had shared voting and dispositive power over 1,484,419 shares of Common Stock, respectively. Also, AIC American Focused Fund had shared voting and dispositive power over 1,235,638 shares of Common Stock, AIC American Focused Corporate Class had shared voting and dispositive power over 196,567 shares of Common Stock, and AIC American Focused Plus Fund had shared voting and dispositive power over 52,214 shares of Common Stock. |

| (4) | | Capital Research and Management Company and SMALLCAP World Fund, Inc. have jointly filed an amended Schedule 13G with the SEC reporting that, as of December 31, 2003, SMALLCAP World Fund, Inc. had sole voting power over 1,210,000 shares of Common Stock and Capital Research and Management Company had sole dispositive power over 1,467,900 shares of Common Stock. |

| (5) | | Morgan Stanley filed a Schedule 13G with the SEC reporting that it had, as of February 15, 2004, shared voting and dispositive power over 1,186,513 shares of Common Stock. |

| (6) | | Skyline Asset Management, L.P. filed an amended Schedule 13G with the SEC reporting that it had, as of December 31, 2003, shared voting power over 1,062,759 shares of Common Stock and shared dispositive power over 1,186,163 shares of Common Stock. |

| (7) | | Artisan Partners Limited Partnership, Artisan Investment Corporation, Andrew A. Ziegler and Carlene Murphy Ziegler have jointly filed a Schedule 13G with the SEC, reporting that they had, as of December 31, 2003, shared voting and dispositive power over 1,070,400 shares of Common Stock. |

| (8) | | Cramer Rosenthal McGlynn, LLC filed an amended Schedule 13G with the SEC reporting that it had, as of January 22, 2004, sole voting power over 529,600 shares of Common Stock, sole dispositive power over 561,100 shares of Common Stock and shared voting and dispositive power over 465,400 shares of Common Stock. |

| (9) | | Based on 19,102,023 shares of Common Stock outstanding as of the Record Date. |

4

PROPOSAL ONE: ELECTION OF DIRECTORS

School Specialty’s Board of Directors currently consists of six members. The Board of Directors has determined that the majority of the current directors are independent under the listing standards of the National Association of Securities Dealers, Inc. (“NASD”). Our independent directors include Rochelle Lamm, Terry L. Lay (who was appointed on June 15, 2004 to fill a vacancy on the Board), Jonathan J. Ledecky, Leo C. McKenna and Jerome M. Pool. Directors are divided into three classes, designated as Class I, Class II and Class III, with staggered terms of three years each. The term of office of directors in Class III expires at the Annual Meeting. The Board of Directors proposes that the nominees described below, who are currently serving as Class III directors, be elected as Class III directors for a new term of three years ending at the 2007 Annual Meeting and until their successors are duly elected and qualified. Mr. McKenna is standing for re-election. Mr. Lay was recommended to School Specialty’s Board of Directors as a nominee by a non-management director of School Specialty.

The nominees have indicated a willingness to serve as directors, but if either of them should decline or be unable to act as a director, the persons named in the proxy will vote for the election of another person or persons as the Board of Directors recommends.

The Board of Directors unanimously recommends that shareholders vote “for” the election of the nominees to serve as directors.

| | |

Name and Age of Director

| | NOMINEES FOR DIRECTOR—CLASS III |

Leo C. McKenna Age 70 | | Mr. McKenna has served as a director of School Specialty since June 1998. In September 2002 Mr. McKenna was appointed as non-executive Chairman of the Board. Mr. McKenna is a self-employed financial consultant. He is a director and a member of the Executive Committee of the Boston and New York Life Insurance Company, a subsidiary of Boston Mutual Life Insurance Company. Mr. McKenna is a director and member of the John Brown Cook Foundation, a foundation established to support organizations that promote the American way of life, and an overseer to the Catholic Student Center at Dartmouth College. |

| |

Terry L. Lay Age 56 | | Mr. Lay was appointed to the Board of Directors of School Specialty in June 2004. Mr. Lay currently serves as the Vice President and Chairman—Global Jeanswear Coalition for VF Corporation. Previously, he served as Vice President and Chairman—Outdoor and International Jeanswear Coalitions. In October 2000, Mr. Lay was named Vice President Global Processes for VF Corporation in addition to his role as Chairman of VF’s International Jeanswear Coalition, which he has held since March 1999. He previously served as President of the Lee Apparel Company. Mr. Lay has been active in many organizations, and is currently serving on the board of directors of the American Apparel and Footwear Association. |

| |

| | | CONTINUING DIRECTORS—CLASS I (term expiring 2005) |

| |

Jonathan J. Ledecky Age 46 | | Mr. Ledecky has served as a director of School Specialty since June 1998 and was an employee of School Specialty from June 1998 to June 2000. He is currently Chairman of the Ledecky Foundation, a philanthropic organization. He founded Building One Services |

5

| | |

Name and Age of Director

| | |

| | | Corporation (formerly Consolidation Capital Corporation) in February 1997 and served as its Chairman until March 2000. Mr. Ledecky was Vice Chairman of Lincoln Holdings, owner of Washington sports franchises in the NBA, NHL and WNBA, from July 1999 to July 2001. Mr. Ledecky founded U.S. Office Products in October 1994, served as its Chairman of the Board until June 1998 and served as its Chief Executive Officer until November 1997. Prior to 1994, Mr. Ledecky held various executive level positions, primarily with investment management companies. Mr. Ledecky is a graduate of Harvard College and Harvard Business School. |

| |

Jerome M. Pool Age 68 | | Mr. Pool was appointed to the Board of Directors of School Specialty in June 1999. Mr. Pool is a self-employed business advisor/consultant. He retired from Jantzen, Inc., a manufacturer of apparel, in 1992 having served as Chairman, President and Chief Executive Officer since 1983. Prior to 1983, Mr. Pool served in various sales and management positions with Jantzen. |

| |

| | | CONTINUING DIRECTORS—CLASS II (term expiring 2006) |

David J. Vander Zanden Age 49 | | Mr. Vander Zanden became President and Chief Executive Officer of School Specialty in September 2002, after serving as Interim Chief Executive Officer since March 2002. Mr. Vander Zanden served as President and Chief Operating Officer from March 1998 to March 2002. From 1992 to March 1998, he served as President of Ariens Company, a manufacturer of outdoor lawn and garden equipment. Mr. Vander Zanden has served as a director of School Specialty since June 1998. |

| |

Rochelle Lamm Age 56 | | Ms. Lamm has served as a director of School Specialty since June 1998. Ms. Lamm is Chairman and Chief Executive Officer of Precision Marketing Partners, LLC and The Academy of Financial Services Studies, LLC. Ms. Lamm was associated with Strong Advisory Services, a division of Strong Capital Management, Inc., as its President from 1995 to February 1998. Prior to that time, she was President and Chief Operating Officer of AAL Capital Management, a mutual fund manager. |

CORPORATE GOVERNANCE

The Board of Directors has standing Compensation, Executive Performance Compensation and Audit Committees. The Board of Directors held seven meetings in fiscal 2004. Each director attended at least 75% of the meetings of the Board of Directors and meetings of committees on which each served, if any, in fiscal 2004.

The Board of Directors does not have a Nominating Committee because it believes that the nomination of directors is the responsibility of all of School Specialty’s independent directors. Therefore, in accordance with NASD requirements, the independent directors, including Ms. Lamm, Mr. Lay, Mr. Ledecky, Mr. McKenna and Mr. Pool, are responsible for approving director nominations. School Specialty’s Corporate Governance Principles set forth the authority and responsibilities of the independent directors with respect to director nominations. In connection with the selection and nomination process, the independent directors review the

6

desired experience, skills and other qualities of potential candidates to assure the appropriate Board composition, taking into account the current Board members and the specific needs of School Specialty and the Board. The Board will generally look for individuals who have displayed high ethical standards, integrity, sound business judgment and a willingness to devote adequate time to Board duties. This process is designed to ensure that the Board includes members with diverse backgrounds, skills and experience, including appropriate financial and other expertise relevant to School Specialty’s business.

The independent directors will consider candidates nominated by shareholders of School Specialty in accordance with the procedures set forth in School Specialty’s by-laws. Under School Specialty’s by-laws, nominations other than those made at the discretion of the Board of Directors or a person appointed by the Board of Directors must be made pursuant to a timely notice in proper written form to the Secretary of School Specialty. To be timely, a shareholder’s request to nominate a person for director at an annual meeting of shareholders, together with the written consent of such person to serve as a director, must be received by the Secretary of School Specialty at School Specialty’s principal office not less than 60 nor more than 90 days prior to the anniversary date of the annual meeting of shareholders in the immediately preceding year. To be in proper written form, the notice must contain certain information concerning the nominee and the shareholder submitting the nomination. Candidates nominated by shareholders of School Specialty in accordance with these procedures will be evaluated by the independent directors on the same basis as other nominees.

School Specialty does not have a policy regarding board members’ attendance at the annual meeting of shareholders; however, all of the members of the Board of Directors attended the 2003 annual meeting of shareholders.

The Compensation Committee is responsible for reviewing and approving the strategy and design of School Specialty’s compensation systems, making recommendations to the Board of Directors with respect to incentive compensation and equity-based plans, reviewing the compensation of our directors and Chief Executive Officer and reviewing and approving the salaries and incentive compensation of key officers. The members of the Compensation Committee are Mr. Pool (Chairman) and Mr. McKenna, each of whom is “independent” within the meaning of the NASD listing standards. The Compensation Committee held five meetings in fiscal 2004.

The Board of Directors appointed the Executive Performance Compensation Committee as a sub-committee of the Compensation Committee to approve certain matters related to performance-based compensation when required by Section 162(m) of the Internal Revenue Code of 1986, as amended. The Executive Performance Compensation Committee is also responsible for administering our 1998 and 2002 Stock Incentive Plans. Mr. Pool is currently the sole member of the Executive Performance Compensation Committee. The Executive Performance Compensation Committee held five meetings in fiscal 2004.

The Audit Committee is responsible for oversight of School Specialty’s accounting and financial reporting processes and the audit of School Specialty’s financial statements. As a result of the recent resignation of Ms. Lamm from the Audit Committee, the Audit Committee currently consists of two members, including Mr. McKenna (Chairman) and Mr. Pool, each of whom is “independent” within the meaning of the NASD listing standards. Mr. McKenna has been deemed by the Board of Directors to be an “audit committee financial expert” for purposes of the SEC’s rules. The Board of Directors currently intends to appoint a new member to the Audit Committee at a meeting of the Board of Directors to be held on August 24, 2004. The Audit Committee has adopted, and the Board of Directors has approved, a charter for the Audit Committee, a copy of which was attached to School Specialty’s proxy statement issued in connection with the 2003 Annual Meeting of Shareholders. The Audit Committee held five meetings in fiscal 2004.

Shareholders wishing to communicate with members of the Board of Directors may direct correspondence to such individuals c/o Assistant Secretary, W6316 Design Drive, Greenville, Wisconsin 54942. The Assistant Secretary will regularly forward such communications to the appropriate board member(s).

7

Certain documents relating to corporate governance matters are available on School Specialty’s web site at www.schoolspecialty.com. These documents include the following:

| | • | | Corporate Governance Principles, which includes the charters of the Audit Committee, the Qualified Legal Compliance Committee and the Compensation Committee; and |

| | • | | Code of Conduct/Ethics. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires School Specialty’s directors and officers, among others, to file reports with the SEC disclosing their ownership, and changes in their ownership, of stock in School Specialty. Copies of these reports must also be furnished to School Specialty. Based solely on a review of these copies, School Specialty believes that all filing requirements were complied with on a timely basis during fiscal 2004.

8

EXECUTIVE COMPENSATION

Summary Compensation Information. The following table sets forth the compensation paid by us for services rendered during fiscal years 2004, 2003 and 2002 to the Named Officers.

Summary Compensation Table

| | | | | | | | | | | | | | | | | | | |

| | | | | | Long Term Compensation Awards

| | All Other Compensation ($)

| |

| | | | | Annual Compensation

| | | School Specialty Securities Underlying Options (#)

| |

Name and Principal Position

| | Year

| | Salary ($)

| | Bonus ($)(1)

| | | Other Annual Compensation

| | | |

David J. Vander Zanden (2) | | 2004 | | $ | 453,769 | | $ | 98,221 | (4) | | $ | 15,165 | (5) | | — | | $ | 24,016 | (6) |

President and Chief Executive | | 2003 | | | 392,885 | | | 98,226 | | | | 11,169 | | | 50,000 | | | 23,193 | |

Officer | | 2002 | | | 304,615 | | | 277,452 | | | | — | | | — | | | 2,391 | |

| | | | | | |

Mary M. Kabacinski | | 2004 | | $ | 246,154 | | $ | 55,481 | (4) | | | — | | | — | | $ | 4,331 | (7) |

Executive Vice President and | | 2003 | | | 221,923 | | | 55,481 | | | | — | | | — | | | 3,508 | |

Chief Financial Officer | | 2002 | | | 200,385 | | | 174,423 | | | | — | | | 25,000 | | | 2,391 | |

| | | | | | |

Stephen R. Christiansen (3) | | 2004 | | $ | 237,692 | | | — | | | | — | | | — | | $ | 5,400 | (7) |

Executive Vice President, | | 2003 | | | 103,846 | | $ | 75,000 | | | | — | | | 75,000 | | | 60,500 | |

Specialty Companies | | 2002 | | | — | | | — | | | | — | | | — | | | — | |

| | | | | | |

A. Brent Pulsipher | | 2004 | | $ | 208,462 | | $ | 63,738 | | | | — | | | — | | $ | 4,331 | (7) |

Executive Vice President of | | 2003 | | | 198,538 | | | 73,662 | | | $ | 19,216 | | | — | | | 3,850 | |

Corporate Technology | | 2002 | | | 190,500 | | | 142,875 | | | | — | | | — | | | 34,495 | |

| (1) | | Consists of amounts awarded under School Specialty’s Executive Incentive Plan. Amounts paid in fiscal 2004 and fiscal 2003 to Mr. Pulsipher were guaranteed under his employment agreement. The amount paid in fiscal 2003 to Mr. Christiansen was guaranteed under his employment agreement. No discretionary bonuses were paid to the Named Officers related to School Specialty’s fiscal 2004 performance. |

| (2) | | Mr. Vander Zanden was appointed President and Chief Executive Officer in September 2002 after serving as the Interim Chief Executive Officer since March 2002. |

| (3) | | Mr. Christiansen was first employed by School Specialty in November 2002. |

| (4) | | Represents a bonus granted to Mr. Vander Zanden and Ms. Kabacinski in fiscal 2004 for service to School Specialty during fiscal 2003. |

| (5) | | Represents tax gross-up payment related to term life insurance premium. |

| (6) | | Represents $19,685 paid by School Specialty for the term life insurance premium and contributions by School Specialty under our 401(k) plan of $4,331. |

| (7) | | Represents contributions by School Specialty under our 401(k) plan. |

9

Option Grants. No options to acquire School Specialty Common Stock were granted to the Named Officers during fiscal 2004.

Option Exercises. The following table provides information regarding options to acquire School Specialty Common Stock exercised during fiscal 2004 and options held at year end by the Named Officers.

Aggregated Option/SAR Exercises in Last Fiscal Year and

Fiscal Year End Option/SAR Values

| | | | | | | | | | | | | | | |

Name

| | Shares

Acquired on

Exercise (#)

| | Value Realized ($)

| | Number of Securities Underlying Unexercised Options/SARs at FY-End (#)

| | Value of Unexercised In-the-Money Options/SARs at FY-End ($) (1)

|

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

David J. Vander Zanden | | — | | | — | | 371,019 | | 37,500 | | $ | 7,598,875 | | $ | 477,000 |

| | | | | | |

Mary M. Kabacinski | | 4,140 | | $ | 88,834 | | 103,060 | | 12,500 | | | 2,178,119 | | | 125,875 |

| | | | | | |

Stephen R. Christiansen | | — | | | — | | 18,750 | | 56,250 | | | 238,500 | | | 715,500 |

| | | | | | |

A. Brent Pulsipher | | 56,250 | | | 627,328 | | — | | 18,750 | | | — | | | 310,688 |

| (1) | | For valuation purposes, an April 23, 2004 market price of $36.82 per share was used. |

Equity Compensation Plan Information

The following table sets forth certain information as of April 24, 2004 about shares of our common stock outstanding and available for issuance under our equity compensation plans, the Amended and Restated School Specialty, Inc. 1998 Stock Incentive Plan (the “1998 Plan”) and the 2002 Stock Incentive Plan (the “2002 Plan”). Under the 1998 Plan and 2002 Plan, we may grant stock options and other awards from time to time to employees, consultants, advisors and independent contractors of School Specialty and its subsidiaries, as well as non-employee directors and officers of School Specialty. The 1998 Plan was approved by shareholders on August 29, 2000 and the 2002 Plan was approved by shareholders on August 27, 2002.

| | | | | | | |

Plan category

| | Number of shares to be issued upon exercise of outstanding options

| | Weighted-average exercise price of outstanding options

| | Number of shares

remaining available

for future issuance

under equity

compensation plans

(excluding shares reflected in the first column)

|

Equity compensation plans approved by shareholders (1) | | 2,642,296 | | $ | 20.08 | | 1,107,094 |

Equity compensation plans not approved by shareholders (2) | | N/A | | | N/A | | N/A |

Total | | 2,642,296 | | $ | 20.08 | | 1,107,094 |

| (1) | | Grants for shares of our common stock under the 1998 Plan are limited to 20% of the outstanding shares of School Specialty stock at the time of grant. As the number of outstanding shares of School Specialty stock increases or decreases, the maximum number of shares that may be issued under the 1998 Plan increases and decreases. As of April 24, 2004, there were 19,069,987 shares of School Specialty common stock outstanding. Grants for shares of our common stock under the 2002 Plan are limited to 1,500,000 shares. |

| (2) | | School Specialty does not maintain any equity compensation plans that have not been approved by shareholders. |

10

NON-EMPLOYEE DIRECTOR COMPENSATION

Non-employee directors are granted options under our stock incentive plans to purchase 15,000 shares of Common Stock upon their initial election as members of the Board of Directors and 5,000 shares of Common Stock for each additional year of service. These options are granted at an exercise price equal to the fair market value on the date of grant and have three year vesting schedules.

Non-employee directors are currently paid an annual retainer of $30,000 plus $1,000 for each additional special meeting and committee meeting attended and are reimbursed for all out-of-pocket expenses related to their service as directors. The non-executive chairman is paid an additional annual retainer of $40,000 and non-employee director committee chairmen are paid annual retainers of $2,500.

EMPLOYMENT CONTRACTS AND RELATED MATTERS

We have entered into employment agreements with each Named Officer.

We entered into an employment agreement with David J. Vander Zanden, President and Chief Executive Officer of School Specialty, on November 5, 2002. The agreement has an initial term of three years, and automatically renews for additional three year terms following the first year of the initial term or any renewal term unless either party gives notice of non-renewal. The agreement provides for an annual base salary of at least $425,000 and participation in a performance-based incentive compensation plan. The agreement contains a confidentiality provision that is triggered upon the termination of Mr. Vander Zanden’s employment and runs for a period of two years. The agreement provides Mr. Vander Zanden the right to terminate his employment upon a change of control of School Specialty. In the event Mr. Vander Zanden’s employment is terminated due to his death or disability or upon a change of control, School Specialty is required to pay to him his base salary for the balance of the then remaining term of the agreement. The agreement contains a non-compete provision that applies during Mr. Vander Zanden’s employment and runs for a period of two years following termination of employment or the length of time he receives base salary payments, whichever is longer. On November 5, 2002, the Board of Directors of School Specialty approved an Executive Term Life Insurance Plan (the “Plan”) for Mr. Vander Zanden. The Plan provides for $20 million of term life insurance coverage on the life of Mr. Vander Zanden. The Plan, with premiums paid by School Specialty, provides coverage under two separate policies. The first policy provides for $10 million of coverage, with School Specialty designated as the beneficiary. The second policy provides for $10 million of coverage, with beneficiaries designated by Mr. Vander Zanden. The second policy is in addition to Mr. Vander Zanden’s compensation as provided for as part of his employment agreement.

We entered into an employment agreement with Mary M. Kabacinski, Executive Vice President and Chief Financial Officer of School Specialty, on September 3, 1999. The agreement has an initial term of two years, with automatic two year extensions following the first year of the initial term or any renewal term unless either party gives notice of non-renewal. The agreement provides for an annual base salary of at least $175,000 and participation in a performance-based incentive compensation plan. The agreement provides Ms. Kabacinski with the right to terminate her employment upon a change of control of School Specialty. The agreement contains a confidentiality provision that is triggered upon the termination of Ms. Kabacinski’s employment and runs for a period of two years. In the event Ms. Kabacinski’s employment is terminated due to her death, disability or upon a change of control, School Specialty is required to pay Ms. Kabacinski her base salary for the balance of the then remaining term of the agreement. The agreement contains a non-compete provision that applies during Ms. Kabacinski’s employment and runs for a period of 18 months following termination of employment.

We entered into an employment agreement with Stephen R. Christiansen, Executive Vice President of the Specialty Companies, on November 5, 2002. The agreement has an initial term of two years, with automatic one year extensions unless either party gives notice of non-renewal. The agreement provides for an annual base salary of at least $225,000 and participation in a performance-based incentive compensation plan. The agreement

11

contains confidentiality, non-solicitation and non-compete provisions that apply during Mr. Christiansen’s employment and runs for a period of 24 months following termination of employment.

We entered into an employment agreement with A. Brent Pulsipher, Executive Vice President of Corporate Technology of School Specialty, on March 26, 2001. The agreement was subsequently amended on September 11, 2002, effective June 1, 2002, and on June 3, 2004, effective April 25, 2004. The agreement has an initial term of three years, with automatic one year extensions unless either party gives notice of non-renewal. The agreement, as amended, provides for annual total cash compensation of at least $272,200 as an annual minimum amount. The agreement provides Mr. Pulsipher with the right to terminate his employment upon a change of control of School Specialty. The agreement contains confidentiality, non-solicitation and non-compete provisions that apply during Mr. Pulsipher’s employment and run for a period of two years following termination of employment. In the event Mr. Pulsipher’s employment is terminated due to his breach of or failure to perform his obligations under the agreement or by mutual agreement of the parties, School Specialty is required to pay Mr. Pulsipher his base salary for a period of 12 months. In the event Mr. Pulsipher elects to terminate employment upon a change of control, School Specialty is required to pay Mr. Pulsipher his base salary through the then remaining term of the agreement.

COMPENSATION COMMITTEE REPORT

School Specialty’s Executive Compensation Program is designed to attract and retain highly competent executives, to provide incentives for achieving and exceeding School Specialty’s short-term and long-term financial goals, and to align the financial objectives of our executives with the enhancement of shareholder value.

The Compensation Committee consists of Mr. Pool (Chairman) and Mr. McKenna. The Compensation Committee is responsible for reviewing and, if appropriate, approving the compensation of our President and Chief Executive Officer, Mr. Vander Zanden, and the recommendations of Mr. Vander Zanden concerning the compensation levels of our other executive officers. Mr. Pool is currently the sole member of the Executive Performance Compensation Committee. The Executive Performance Compensation Committee administers our 1998 and 2002 Stock Incentive Plans, with responsibility for determining the awards to be made under such plans.

The Compensation and the Executive Performance Compensation Committees review compensation programs for executive officers in June of each year and more frequently as appropriate. Because certain matters related to compensation are approved by the Executive Performance Compensation Committee, that committee joins in this report of the Compensation Committee.

Overview. The compensation structure for our executive officers consists in general of three principal components: base salary, annual cash bonus and periodic grants of stock options. Base salary determinations are an important ingredient in attracting and retaining quality personnel in a competitive market. Base salaries are set at levels based generally on subjective factors, including the individual’s level of responsibility, experience and past performance record. In addition, a significant portion of compensation is directly related to and contingent upon objective performance criteria established on an annual basis. Accordingly, our executives participate in annual cash bonus arrangements based in part on objective formulas tied to the individual’s profit center and/or School Specialty as a whole. Finally, to ensure that executive officers hold equity positions in School Specialty, which we think is important, stock options are granted to executives to enable them to hold equity interests at more meaningful levels than they could through alternative methods.

Base Salary. The base salary of Mr. Vander Zanden was established by his employment agreement and is reviewed annually by the Compensation Committee which makes recommendations on changes to the Board of Directors for approval. In November 2002, the Committee recommended an annual base salary of at least $425,000 for Mr. Vander Zanden in recognition of his expanded role as Chief Executive Officer. Executive

12

salaries for officers other than the President and Chief Executive Officer are recommended to the Compensation Committee for review and approval prior to submission to the Board of Directors for approval.

Cash Bonus. For corporate executives, the current incentive compensation plan permits such persons to receive up to 100% of their base compensation in cash bonus and is tied in part to the performance goals established on an annual basis by the Board of Directors and in part to discretionary performance criteria. The Committee believes that the plan provides important incentives to executives thereby benefiting not only the executive but School Specialty as well. The Committee did not approve a fiscal 2004 bonus for School Specialty’s corporate executive officers, including Mr. Vander Zanden, based on parameters of the incentive compensation plan. The Committee granted bonuses to Mr. Vander Zanden and Ms. Kabacinski in fiscal 2004 for service to School Specialty during fiscal 2003.

Equity Based Compensation. Under our 1998 and 2002 Stock Incentive Plans, the Executive Performance Compensation Committee determines the stock option awards to be made to executive officers and others. With respect to our President and Chief Executive Officer, the Executive Performance Compensation Committee bases its determination upon performance goals as well as existing overall compensation. With respect to other executives, the Executive Performance Compensation Committee bases its determinations on recommendations made by management.

Section 162(m) of the Internal Revenue Code of 1986, as amended, generally disallows a tax deduction to public corporations for compensation over $1 million for any fiscal year paid to the corporation’s chief executive officer and other highly compensated executive officers whose compensation is required to be reported in this Proxy Statement as of the end of any fiscal year. However, Section 162(m) also provides that qualifying performance-based compensation will not be subject to the deduction limit if certain requirements are met. In making compensation decisions, it is the Compensation Committee’s current intention to recommend plans and awards which will meet the requirements for deductibility for tax purposes under Section 162(m) and has established the Executive Performance Compensation Committee to assist in that regard. Because of uncertainties as to the application and interpretation of Section 162(m), no assurance can be given that the compensation paid to our most highly compensated officers will be deductible for federal income tax purposes, notwithstanding School Specialty’s efforts to satisfy such section. In addition, School Specialty may pay compensation that does not satisfy these requirements for deduction if it is deemed advisable for business reasons.

| | |

The Compensation Committee: | | The Executive Performance Compensation Committee: |

| |

| Jerome M. Pool (Chairman) | | Jerome M. Pool (Chairman) |

| Leo C. McKenna | | |

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

With the exception of Leo C. McKenna, no member of the Compensation Committee has ever been an officer of our company or any of our subsidiaries and none of our executive officers has served on the compensation committee or the board of directors of any company of which any of our directors is an executive officer. Mr. McKenna is a former non-employee officer and director of a predecessor company of School Specialty that was acquired by U.S. Office Products in 1996.

AUDIT COMMITTEE REPORT

In accordance with its written charter, the Audit Committee oversees all accounting and financial reporting processes and the audit of our financial statements. The Audit Committee assists the Board of Directors in fulfilling its responsibility to our shareholders, the investment community and governmental agencies relating to

13

the quality and integrity of our financial statements and the qualifications, independence and performance of our independent registered public accounting firm. During fiscal 2004, the Audit Committee met five times, and the Audit Committee chair, the designated representative of the Audit Committee, discussed the interim financial information contained in each of our quarterly reports on Form 10-Q with the Chief Financial Officer and independent registered public accounting firm prior to their filing with the SEC.

In June 2004, the Audit Committee appointed Deloitte & Touche LLP (“Deloitte”) to serve as our independent registered public accounting firm for fiscal 2005.

Independent Registered Public Accounting Firm Independence and Fiscal 2004 Audit. In discharging its duties, the Audit Committee obtained from Deloitte, our independent registered public accounting firm for the 2004 audit, a formal written statement describing all relationships between the independent registered public accounting firm and us that might bear on the independent registered public accounting firm’s independence consistent with Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees.” In addition, the Audit Committee discussed with the independent registered public accounting firm any relationships that may impact their objectivity and independence and satisfied itself as to the independent registered public accounting firm’s independence. The Audit Committee also independently discussed the quality and adequacy of our internal controls with management and the independent registered public accounting firm. The Audit Committee reviewed with the independent registered public accounting firm its audit plans, audit scope and identification of audit risks.

The Audit Committee discussed and reviewed with the independent registered public accounting firm all communications required by generally accepted auditing standards, including those described in Statement on Auditing Standards No. 61, as amended, “Communication with Audit Committees” and, with and without management present, discussed and reviewed the results of the independent registered public accounting firm’s examination of the financial statements. The Audit Committee also discussed with management and the independent registered public accounting firm the objectives and scope of the internal audit process and the results of the internal audit examinations.

Fiscal 2004 Financial Statements and Recommendations of the Committee. The Audit Committee separately reviewed and discussed our audited financial statements and management’s discussion and analysis of financial condition and results operations (“MD&A”) as of and for the fiscal year ended April 24, 2004 with management and the independent registered public accounting firm. Management has the responsibility for the preparation of our financial statements and the independent registered public accounting firm has the responsibility for the examination of those statements.

Based on the above-mentioned review, and discussions with management and the independent registered public accounting firm, the Audit Committee recommended to the Board of Directors that our audited financial statements and MD&A be included in our annual report on Form 10-K for the fiscal year ended April 24, 2004 for filing with the SEC.

Fees Paid to Deloitte & Touche LLP. The aggregate fees billed for professional services by Deloitte during fiscal 2004 and fiscal 2003 were approximately:

| | | | | | |

Type of Fees

| | Fiscal

2004

| | Fiscal

2003

|

Audit Fees | | $ | 257,500 | | $ | 226,000 |

Audit-Related Fees | | | 242,100 | | | 105,000 |

Tax Fees | | | 359,300 | | | 278,200 |

All Other Fees | | | — | | | 15,000 |

| | |

|

| |

|

|

Total | | $ | 858,900 | | $ | 624,200 |

| | |

|

| |

|

|

14

In the above table, “audit fees” are fees School Specialty paid Deloitte for professional services for the audit of School Specialty’s consolidated financial statements included in Form 10-K and review of financial statements included in Forms 10-Q, or for services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements. “Audit-related fees” are fees billed by Deloitte for assurance and related services that are reasonably related to the performance of the audit or review of School Specialty’s financial statements. Audit-related services for fiscal 2004 included post-closing accounting services related to two acquired operations, preparation of comfort letters in connection with the filing of School Specialty’s Registration Statement on Form S-3 in connection with the offering of its 3.75% Convertible Subordinated Notes Due 2023 and benefit plan audits. Audit-related services for fiscal 2003 included closing balance sheet audit of an acquired operation and benefit plan audits. “Tax fees” are fees for tax compliance, tax advice, and tax planning. Tax-related services for fiscal 2004 and fiscal 2003 included tax return preparation and consulting. “All other fees” are fees billed by Deloitte to School Specialty for any other services not included in the first three categories.

The Audit Committee pre-approves all audit and non-audit work performed by Deloitte. Pursuant to pre-approval policies and procedures adopted by the Audit Committee in fiscal 2004, the Audit Committee pre-approves all non-audit services, including tax compliance and tax consulting, to be performed by Deloitte. However, the Audit Committee has delegated the approval of one category of non-audit services, post-closing accounting services related to School Specialty’s future acquisitions and dispositions, to the Chairman in the event it is not administratively expedient for the full Audit Committee to approve and authorize such services. In such case, the Chairman is required to make a report to the full Audit Committee at its next meeting. All audit and non-audit services provided by Deloitte during fiscal 2004 were pre-approved by the Audit Committee.

The Audit Committee:

Leo C. McKenna (Chairman)

Jerome M. Pool

15

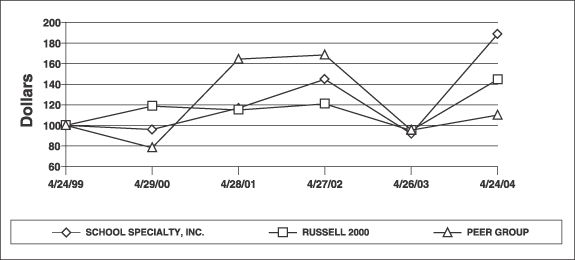

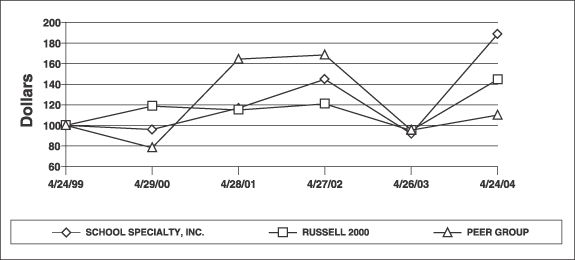

PERFORMANCE GRAPH

The following graph compares the total shareholder return on our Common Stock since April 24, 1999 with that of the Russell 2000 Stock Market Index and a peer group index constructed by us. The companies included in our peer group index are: Renaissance Learning, Inc. (RLRN), Scholastic Corporation (SCHL), The Aristotle Corporation (ARTL) and Excelligence Learning Corporation (LRNS).

The total return calculations set forth below assume $100 invested on April 24, 1999, with reinvestment of any dividends into additional shares of the same class of securities at the frequency with which dividends were paid on such securities through April 24, 2004. The stock price performance shown in the graph below should not be considered indicative of potential future stock price performance.

| | | | | | | | | | | | |

| | | April 24, 1999

| | April 29, 2000

| | April 28, 2001

| | April 27, 2002

| | April 26, 2003

| | April 24, 2004

|

School Specialty, Inc. | | $100.00 | | $ 95.91 | | $116.82 | | $144.92 | | $91.90 | | $188.82 |

Russell 2000 Index | | $100.00 | | $118.77 | | $115.05 | | $120.86 | | $95.05 | | $144.51 |

Peer Group | | $100.00 | | $ 78.27 | | $164.32 | | $168.54 | | $95.44 | | $109.99 |

PROPOSAL TWO: RATIFICATION OF INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

As previously disclosed, on June 11, 2002 we dismissed Arthur Andersen LLP (“Andersen”) as our independent auditors and appointed Deloitte & Touche LLP (“Deloitte”) as our new independent registered public accounting firm. The decision to change independent registered public accounting firms was recommended by the Audit Committee and approved by the Board of Directors. Andersen’s report on our financial statements for the fiscal year ended April 28, 2001 did not contain any adverse opinion, disclaimer of opinion or qualification or modification as to uncertainty, audit scope or accounting principles. During the fiscal years ended April 27, 2002 and April 28, 2001 and during the subsequent interim period through June 11, 2002, we had no disagreements with Andersen on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure. None of the reportable events described in Item 304(a)(l)(v) of Regulation S-K occurred during the fiscal years ended April 27, 2002 and April 28, 2001 and through June 11, 2002. During the fiscal years ended April 27, 2002 and April 28, 2001 and the subsequent interim period through June 11, 2002, School Specialty did not consult with Deloitte regarding any of the matters or events set forth in Item 304(a)(2)(i) and (ii) of Regulation S-K.

16

The Audit Committee has appointed Deloitte, an independent registered public accounting firm, to audit the consolidated financial statements of School Specialty for the fiscal year ending April 30, 2005. Deloitte audited the financial statements of School Specialty for the fiscal year ended April 24, 2004. Representatives of Deloitte will be present at the Annual Meeting to make any statement they may desire and to respond to appropriate questions from shareholders.

If shareholders do not ratify the appointment of Deloitte, the selection of our independent registered public accounting firm will be reconsidered by the Audit Committee.

The Board of Directors unanimously recommends a vote FOR ratification of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal 2005.

OTHER MATTERS

Although management is not aware of any other matters that may come before the Annual Meeting, if any such matters should be presented, the persons named in the enclosed proxy card intend to vote in accordance with their best judgment.

SUBMISSION OF SHAREHOLDER PROPOSALS

In accordance with our By-Laws, nominations, other than by or at the direction of the Board of Directors, of candidates for election as directors at the 2005 Annual Meeting of Shareholders must be submitted to us no earlier than May 26, 2005 and no later than June 25, 2005. Any other shareholder proposed business to be brought before the 2005 Annual Meeting of Shareholders must be submitted to us no later than March 22, 2005. Shareholder proposed nominations and other shareholder proposed business must be made in accordance with our By-Laws which provide, among other things, that shareholder proposed nominations must be accompanied by certain information concerning the nominee and the shareholder submitting the nomination, and that shareholder proposed business must be accompanied by certain information concerning the proposal and the shareholder submitting the proposal. To be considered for inclusion in the proxy statement solicited by the Board of Directors, shareholder proposals for consideration at the 2005 Annual Meeting of Shareholders of School Specialty must be received by us at our principal executive offices, W6316 Design Drive, Greenville, Wisconsin, 54942 on or before March 22, 2005. Proposals should be directed to Ms. Karen A. Riching, Assistant Secretary. To avoid disputes as to the date of receipt, it is suggested that any shareholder proposal be submitted by certified mail, return receipt requested.

Shareholders may obtain a copy of our Annual Report to Shareholders for fiscal 2004, which includes our Annual Report on Form 10-K, at no cost by writing to Ms. Karen A. Riching, Assistant Secretary, School Specialty, Inc., W6316 Design Drive, Greenville, Wisconsin, 54942.

By Order of the Board of Directors,

Joseph F. Franzoi IV,Secretary

17

PROXY CARD

SCHOOL SPECIALTY, INC.

This Proxy is Solicited on Behalf of the Board of Directors

The undersigned appoints David J. Vander Zanden and Mary M. Kabacinski, and each of them, as proxies, each with the power to appoint his or her substitute, and authorizes each of them to represent and to vote, as designated on the reverse side, all of the shares of stock of School Specialty, Inc. held of record by the undersigned on July 6, 2004 at the 2004 Annual Meeting of Shareholders of School Specialty, Inc. to be held on August 24, 2004 and at any adjournment or postponement thereof.

This proxy, when properly executed, will be voted in the manner directed herein by the undersigned shareholder. If no direction is indicated, this proxy will be voted “FOR” the election of each of the individuals nominated to serve as Class III directors and “FOR” the ratification of the appointment of the independent registered public accounting firm, each of which is being proposed by School Specialty, Inc.

ANNUAL MEETING OF SHAREHOLDERS OF

SCHOOL SPECIALTY, INC.

August 24, 2004

PROXY VOTING INSTRUCTIONS

MAIL—Date, sign and mail your proxy card in the envelope provided as soon as possible.

- OR -

TELEPHONE—Call toll-free 1-800-PROXIES

(1-800-776-9437) from any touch-tone telephone and follow the instructions. Have your proxy card available when you call.

COMPANY NUMBER

ACCOUNT NUMBER

You may enter your voting instructions at 1-800-PROXIES up until 11:59 PM Eastern Time the day before the cut-off or meeting date.

Please detach along perforated line and mail in the envelope provided IF you are not voting via telephone.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF DIRECTORS AND “FOR” PROPOSAL 2.

PLEASE SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE. PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HERE

1. ELECTION OF DIRECTORS: (To serve until the 2007 Annual Meeting and until their successors are elected and qualified)

FOR ALL NOMINEES

WITHHOLD AUTHORITY FOR ALL NOMINEES

FOR ALL EXCEPT

(See instructions below)

NOMINEES:

O Leo C. McKenna O Terry L. Lay

INSTRUCTION: To withhold authority to vote for any individual nominee(s), mark “FOR ALL EXCEPT” and fill in the circle next to each nominee you wish to withhold, as shown here:

To change the address on your account, please check the box at right and indicate your new address in the address space above. Please note that changes to the registered name(s) on the account may not be submitted via this method.

FOR AGAINST ABSTAIN

2. RATIFY DELOITTE & TOUCHE LLP AS SCHOOL SPECIALTY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR FISCAL 2005.

3. IN THEIR DISCRETION, THE PROXIES ARE AUTHORIZED TO VOTE UPON SUCH OTHER BUSINESS AS MAY PROPERLY COME BEFORE THE MEETING (AND ANY ADJOURNMENT OR POSTPONEMENT THEREOF).

No. of Shares

Signature of Shareholder Date: Signature of Shareholder Date:

Note: Please sign exactly as your name or names appear on this Proxy. When shares are held jointly, each holder should sign. When signing as executor, administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by duly authorized officer, giving full title as such. If signer is a partnership, please sign in partnership name by authorized person.