UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14(a)-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Section 240.14a-12 |

SCHOOL SPECIALTY, INC.

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

THIS FILING CONSISTS OF A POWERPOINT PRESENTATION PROVIDED ON MAY 31, 2005, BY MR. DAVID VANDER ZANDEN, THE COMPANY’S PRESIDENT AND CHIEF EXECUTIVE OFFICER, TO THE COMPANY’S EMPLOYEES REGARDING THE PROPOSED MERGER.

SCHOOL SPECIALTY, INC.

W6316 Design Drive

Greenville, WI 54942

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

February 22, 2006

To the Shareholders of School Specialty, Inc.:

The 2005 Annual Meeting of Shareholders of School Specialty, Inc. will be held at School Specialty’s headquarters, located at W6316 Design Drive, Greenville, Wisconsin, on Wednesday, February 22, 2006 at 8:30 a.m. Central Time for the following purposes:

| | (1) | To elect one director to serve until the 2008 Annual Meeting of Shareholders as a Class I director; |

| | (2) | To ratify the appointment of Deloitte & Touche LLP as School Specialty’s independent registered public accounting firm for fiscal 2006; and |

(3) To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement.

Shareholders of record at the close of business on January 4, 2006 are entitled to receive notice of and to vote at the Annual Meeting.

All shareholders are cordially invited to attend the Annual Meeting in person. However, whether or not you expect to attend the Annual Meeting in person, you are urged to vote by completing and returning the enclosed proxy card, or by telephone or internet by following the instructions on the proxy card. Your prompt voting by proxy will help ensure a quorum. If you vote by proxy and then decide to attend the Annual Meeting to vote your shares in person, you may still do so. Your proxy is revocable in accordance with the procedures set forth in this Proxy Statement.

|

By Order of the Board of Directors |

|

| |

| Joseph F. Franzoi IV,Secretary |

January 25, 2006

SCHOOL SPECIALTY, INC.

W6316 Design Drive

Greenville, Wisconsin 54942

January 25, 2006

Proxy Statement

Unless the context requires otherwise, all references to “School Specialty,” “we” or “our” refer to School Specialty, Inc. and its subsidiaries. Our fiscal year ends on the last Saturday of April each year. In this proxy statement, we refer to fiscal years by reference to the calendar year in which they end (e.g., the fiscal year ended April 30, 2005 is referred to as “fiscal 2005”).

This Proxy Statement is furnished by the Board of Directors of School Specialty for the solicitation of proxies from the holders of our common stock, $0.001 par value (the “Common Stock”), in connection with the Annual Meeting of Shareholders to be held at School Specialty’s headquarters, located at W6316 Design Drive, Greenville, Wisconsin, on Wednesday, February 22, 2006 at 8:30 a.m. Central Time, and at any adjournment or postponement thereof (the “Annual Meeting”). It is expected that the Notice of Annual Meeting of Shareholders, this Proxy Statement and the enclosed proxy card, together with our Annual Report on Form 10-K for fiscal 2005, will be mailed to shareholders starting on or about January 25, 2006.

Shareholders can ensure that their shares are voted at the Annual Meeting by signing, dating and returning the enclosed proxy card in the envelope provided or by calling the toll-free telephone number listed on the proxy card. If you submit a signed proxy card or vote by telephone, you may still attend the Annual Meeting and vote in person. Any shareholder giving a proxy may revoke it before it is voted by submitting to School Specialty’s Secretary a written revocation or by submitting another proxy by telephone or mail that is received later. You will not revoke a proxy merely by attending the Annual Meeting unless you file a written notice of revocation of the proxy with School Specialty’s Secretary at any time prior to voting.

Proxies will be voted as specified by the shareholders. Where specific choices are not indicated, proxies will be voted as follows:

| | • | | FOR the election of the individual nominated to serve as a Class I director, and |

| | • | | FOR ratification of the appointment of the independent registered public accounting firm. |

The Board of Directors knows of no other matters to be presented for shareholder action at the Annual Meeting. If any other matters properly come before the Annual Meeting, the persons named as proxies will vote on the same in their discretion.

The expense of printing and mailing proxy materials, including expenses involved in forwarding materials to beneficial owners of Common Stock held in the name of another person, will be paid by School Specialty. No solicitation, other than by mail, is currently planned, except that officers or employees of School Specialty may solicit the return of proxies from certain shareholders by telephone or other electronic means.

Only shareholders of record at the close of business on January 4, 2006 (the “Record Date”) are entitled to receive notice of and to vote the shares of Common Stock registered in their name at the Annual Meeting. As of the Record Date, we had 22,896,892 shares of Common Stock outstanding. Each share of Common Stock entitles its holder to cast one vote on each matter to be voted upon at the Annual Meeting.

Under Wisconsin law and School Specialty’s by-laws, the presence of a quorum is required to conduct business at the Annual Meeting. A quorum is defined as the presence, either in person or by proxy, of a majority of the total outstanding shares of Common Stock entitled to vote at the Annual Meeting. The shares represented at the Annual Meeting by proxies that are marked, with respect to the election of directors, “withhold authority” or, with respect to any other proposals, “abstain,” will be counted as shares present for the purpose of determining whether a quorum is present. Broker non-votes (i.e., proxies from brokers or nominees indicating that such persons have not received instructions from beneficial owners to vote shares as to a matter with respect to which the brokers or nominees do not have discretionary power to vote) will also be counted as shares present for purposes of determining a quorum.

With respect to the vote required to approve the various proposals at the Annual Meeting, the following rules apply:

| | • | | The director will be elected by the affirmative vote of a plurality of the shares of Common Stock present, either in person or by proxy, at the Annual Meeting and entitled to vote. In the election of a director, votes may be cast in favor or withheld. Votes that are withheld and broker non-votes will have no effect on the outcome of such election. |

| | • | | Ratification of the appointment of the independent registered public accounting firm requires that the votes cast in favor of ratification exceed the votes cast opposing the ratification. Abstentions and broker non-votes will therefore have no effect on the approval of this proposal. |

2

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS

The following table sets forth certain information as of January 4, 2006 (unless otherwise specified) regarding the beneficial ownership of shares of Common Stock by each of our directors, the executive officers named in the summary compensation table (the “Named Officers”), all of our directors and executive officers as a group and each person believed by us to be a beneficial owner of more than 5% of the outstanding Common Stock. Except as otherwise indicated, the business address of each of the following is W6316 Design Drive, Greenville, Wisconsin 54942.

| | | | | |

Name and Address of Beneficial Owner

| | Amount and Nature of Beneficial Ownership

| | Percent of Outstanding Shares (8)

| |

David J. Vander Zanden (1) | | 446,019 | | 1.9 | % |

Mary M. Kabacinski (1) | | 129,717 | | | * |

Stephen R. Christiansen (1) | | 56,250 | | | * |

Jonathan J. Ledecky (1) | | 942,703 | | 4.0 | % |

Leo C. McKenna (1) | | 56,239 | | | * |

Rochelle Lamm (1) | | 23,500 | | | * |

Terry L. Lay | | 3,000 | | | * |

All executive officers and directors as a group (7 persons) (1) | | 1,657,428 | | 6.8 | % |

EARNEST Partners, LLC (2)

75 Fourteenth Street, Suite 2300

Atlanta, Georgia 30309 | | 2,348,947 | | 10.3 | % |

MSD Capital, L.P. (3) MSD SBI, L.P.

645 Fifth Avenue, 21st Floor

New York, NY 10022 | | 1,951,100 | | 8.5 | % |

Neuberger Berman, Inc. (4) Neuberger Berman, LLC Neuberger Berman Management Inc. Neuberger Berman Genesis Fund

605 Third Avenue

New York, New York 10158 | | 1,850,383 | | 8.1 | % |

T. Rowe Price Associates, Inc. (5) T. Rowe Price New Horizons Fund, Inc.

100 East Pratt Street

Baltimore, Maryland 21202 | | 1,815,676 | | 7.9 | % |

Artisan Partners Limited Partnership (6) Artisan Investment Corporation Andrew A. Ziegler Carlene Murphy Ziegler

875 East Wisconsin Avenue, Suite 800

Milwaukee, Wisconsin 53202 | | 1,310,900 | | 5.7 | % |

Capital Research and Management Company (7) SMALLCAP World Fund, Inc.

333 South Hope Street

Los Angeles, California 90071 | | 1,292,900 | | 5.6 | % |

Skyline Asset Management, L.P. (8)

311 South Wacker Drive, Suite 4500

Chicago, Illinois 60606 | | 1,186,163 | | 5.2 | % |

| * | Less than 1% of the outstanding Common Stock. |

3

| (1) | Share amounts include options granted under our 1998 and 2002 Stock Incentive Plans which are currently exercisable, or exercisable within 60 days after the Record Date, in the amount of 396,019 for Mr. Vander Zanden, 113,560 for Ms. Kabacinski, 56,250 for Mr. Christiansen, 942,579 for Mr. Ledecky, 50,000 for Mr. McKenna, 23,500 for Ms. Lamm, 3,000 for Mr. Lay and 1,019,079 for all executive officers and directors as a group. |

| (2) | EARNEST Partners, LLC filed a Schedule 13G with the Securities and Exchange Commission (the “SEC”) reporting that it had, as of May 31, 2005, sole voting power over 892,005 shares of Common Stock, shared voting power over 764,542 shares of Common Stock and the sole dispositive power over 2,348,947 shares of Common Stock. |

| (3) | MSD Capital, L.P. and MSD SBI, L.P. have jointly filed a Schedule 13D with the SEC reporting that they had, as of October 26, 2005, shared voting and dispositive power over 1,951,100 shares of Common Stock. |

| (4) | Neuberger Berman, Inc., Neuberger Berman, LLC, Neuberger Berman Management Inc. and Neuberger Berman Genesis Fund have jointly filed an amended Schedule 13G with the SEC reporting that as of December 31, 2004, Neuberger Berman, Inc., Neuberger Berman, LLC and Neuberger Berman Management Inc. each had sole voting power over 16,445 shares of Common Stock, shared voting power over 1,447,838 shares of Common Stock and shared dispositive power over 1,850,383 shares of Common Stock. Also, Neuberger Berman Genesis Fund had shared voting and dispositive power over 1,411,138 shares of Common Stock. |

| (5) | T. Rowe Price Associates, Inc. and T. Rowe Price New Horizons Fund, Inc. have jointly filed an amended Schedule 13G with the SEC reporting that they had, as of February 11, 2005, sole voting power over 301,900 and 1,500,000 shares, respectively, of Common Stock and T. Rowe Price Associates, Inc. had sole dispositive power over 1,815,676 shares of Common Stock. |

| (6) | Artisan Partners Limited Partnership, Artisan Investment Corporation, Andrew A. Ziegler and Carlene Murphy Ziegler have jointly filed an amended Schedule 13G with the SEC, reporting that they had, as of December 31, 2004, shared voting and dispositive power over 1,310,900 shares of Common Stock. |

| (7) | Capital Research and Management Company and SMALLCAP World Fund, Inc. have jointly filed an amended Schedule 13G with the SEC reporting that, as of December 31, 2004, SMALLCAP World Fund, Inc. had sole voting power over 1,210,000 shares of Common Stock and Capital Research and Management Company had sole dispositive power over 1,292,900 shares of Common Stock. |

| (8) | Skyline Asset Management, L.P. filed an amended Schedule 13G with the SEC reporting that is had, as of December 31, 2003, shared voting power over 1,062,759 shares of Common Stock and shared dispositive power over 1,186,163 shares of Common Stock. |

| (9) | Based on 22,896,892 shares of Common Stock outstanding as of the Record Date. |

4

PROPOSAL ONE: ELECTION OF DIRECTOR

School Specialty’s Board of Directors currently consists of five members. The Board of Directors has determined that the majority of the current directors are independent under the listing standards of the National Association of Securities Dealers, Inc. (“NASD”). Our independent directors include Rochelle Lamm, Terry L. Lay, Jonathan J. Ledecky and Leo C. McKenna. Directors are divided into three classes, designated as Class I, Class II and Class III, with staggered terms of three years each. The term of office of the director in Class I expires at the Annual Meeting. The Board of Directors proposes that the nominee described below, who is currently serving as a Class I director, and who is standing for re-election, be elected as a Class I director for a new term of three years ending at the 2008 Annual Meeting and until his successor is duly elected and qualified.

The nominee has indicated a willingness to serve as a director, but if he should decline or be unable to act as a director, the persons named in the proxy will vote for the election of another person or persons as the Board of Directors recommends.

The Board of Directors unanimously recommends that shareholders vote “for” the election of the nominee to serve as a director.

NOMINEE FOR DIRECTOR – CLASS I

| | |

| Name and Age of Director | | |

| |

Jonathan J. Ledecky

Age 47 | | Mr. Ledecky has served as a director of School Specialty since June 1998 and was an employee of School Specialty from June 1998 to June 2000. He is currently President, Secretary and Director of Endeavor Acquisition Corp., a publicly-traded Special Purpose Acquisition Corporation formed in June 2005. He is also currently Chairman of the Ledecky Foundation, a philanthropic organization, and Chairman of Ironbound Partners Fund LLC, a private investment management fund. He founded Building One Services Corporation (formerly Consolidation Capital Corporation) in February 1997 and served as its Chairman until March 2000. Mr. Ledecky founded U.S. Office Products in October 1994, served as its Chairman of the Board until June 1998 and served as its Chief Executive Officer until November 1997. Mr. Ledecky was a Trustee of George Washington University and served as a Commissioner on the National Commission on Entrepreneurship. He is a director of the Washington Educational Television Association (WETA). Prior to 1994, Mr. Ledecky held various executive levels positions, primarily with investment management companies. Mr. Ledecky is a graduate of Harvard College and Harvard Business School. |

5

CONTINUING DIRECTORS – CLASS II

(term expiring 2006)

| | |

| Name and Age of Director | | |

| |

David J. Vander Zanden

Age 51 | | Mr. Vander Zanden became President and Chief Executive Officer of School Specialty in September 2002, after serving as Interim Chief Executive Officer since March 2002. Mr. Vander Zanden served as President and Chief Operating Officer from March 1998 to March 2002. From 1992 to March 1998, he served as President of Ariens Company, a manufacturer of outdoor lawn and garden equipment. Mr. Vander Zanden has served as a director of School Specialty since June 1998. |

| |

Rochelle Lamm

Age 57 | | Ms. Lamm has served as a director of School Specialty since June 1998. Ms. Lamm is the Chairman of Rochelle Lamm & Associates, LLC. Her organization provides sales, marketing and professional development services to broker dealers, mutual fund and insurance companies and banks. From 1999 through 2005, Ms. Lamm was Chairman & Chief Executive Officer of Precision Marketing Partners, LLC and The Academy of Financial Services Studies, LLC, Convergent Retirement Plan Services, LLC and NFC Continuing Education Services, LLC. Ms. Lamm was associated with The Strong Funds organization from 1995 to February 1998 as President of Strong Advisory Services and Strong Retirement Plan Services. Prior to that time, she was President and the chief operating officer of AAL Capital Management Corporation, manager of The AAL Mutual Funds. |

CONTINUING DIRECTORS – CLASS III

(term expiring 2007)

| | |

| Name and Age of Director | | |

| |

Leo C. McKenna

Age 72 | | Mr. McKenna has served as a director of School Specialty since June 1998. In September 2002 Mr. McKenna was appointed as non-executive Chairman of the Board. Mr. McKenna is a self-employed financial consultant. He is a director and a member of the Executive Committee of the Boston and New York Life Insurance Company, a subsidiary of Boston Mutual Life Insurance Company. Mr. McKenna is a director and member of the John Brown Cook Foundation, a foundation established to support organizations that promote the American way of life, and an overseer to the Catholic Student Center at Dartmouth College. |

6

| | |

Terry L. Lay

Age 58 | | Mr. Lay has served as a director of School Specialty since June 2004. He retired from VF Corporation in June 2005 having served as its Vice President and Chairman – Global Jeanswear Coalition. Previously, he served as Vice President and Chairman – Outdoor and International Jeanswear Coalitions. In October 2000, Mr. Lay was named Vice President Global Processes for VF Corporation in addition to his role as Chairman of VF’s International Jeanswear Coalition, which he has held since March 1999. He previously served as President of the Lee Apparel Company. Mr. Lay has been active in many organizations, and formerly served on the board of directors of the American Apparel and Footwear Association. |

CORPORATE GOVERNANCE

The Board of Directors has standing Compensation, Executive Performance Compensation and Audit Committees. The Board of Directors held ten meetings in fiscal 2005. Each director attended at least 75% of the meetings of the Board of Directors and meetings of committees on which each served, if any, in fiscal 2005.

The Board of Directors does not have a Nominating Committee because it believes that the nomination of directors is the responsibility of all of School Specialty’s independent directors. Therefore, in accordance with NASD requirements, the independent directors, including Ms. Lamm, Mr. Lay, Mr. Ledecky and Mr. McKenna, are responsible for approving director nominations. School Specialty’s Corporate Governance Principles set forth the authority and responsibilities of the independent directors with respect to director nominations. In connection with the selection and nomination process, the independent directors review the desired experience, skills and other qualities of potential candidates to assure the appropriate Board composition, taking into account the current Board members and the specific needs of School Specialty and the Board. The Board will generally look for individuals who have displayed high ethical standards, integrity, sound business judgment and a willingness to devote adequate time to Board duties. This process is designed to ensure that the Board includes members with diverse backgrounds, skills and experience, including appropriate financial and other expertise relevant to School Specialty’s business.

The independent directors will consider candidates nominated by shareholders of School Specialty in accordance with the procedures set forth in School Specialty’s by-laws. Under School Specialty’s by-laws, nominations other than those made at the discretion of the Board of Directors or a person appointed by the Board of Directors must be made pursuant to a timely notice in proper written form to the Secretary of School Specialty. To be timely, a shareholder’s request to nominate a person for director at an annual meeting of shareholders, together with the written consent of such person to serve as a director, must be received by the Secretary of School Specialty at School Specialty’s principal office not less than 60 nor more than 90 days prior to the anniversary date of the annual meeting of shareholders in the immediately preceding year. To be in proper written form, the notice must contain certain information concerning the nominee and the shareholder submitting the nomination. Candidates nominated by shareholders of School Specialty in accordance with these procedures will be evaluated by the independent directors on the same basis as other nominees.

School Specialty does not have a policy regarding board members’ attendance at the annual meeting of shareholders; however, all but one of the members of the Board of Directors attended the 2004 annual meeting of shareholders.

7

The Compensation Committee is responsible for reviewing and approving the strategy and design of School Specialty’s compensation systems, making recommendations to the Board of Directors with respect to incentive compensation and equity-based plans, reviewing the compensation of our directors and Chief Executive Officer and reviewing and approving the salaries and incentive compensation of key officers. The members of the Compensation Committee are Mr. Lay (Chairman), Mr. McKenna and Mr. Ledecky, each of whom is “independent” within the meaning of the NASD listing standards. Mr. Lay was appointed to the Compensation Committee to replace Jerome Pool, who was an “independent” director of School Specialty and Chairman of the Compensation Committee during fiscal 2005 and until his death in June 2005. Mr. Ledecky was appointed to the Compensation Committee in January 2006. The Compensation Committee held four meetings in fiscal 2005.

The Board of Directors appointed the Executive Performance Compensation Committee as a sub-committee of the Compensation Committee to approve certain matters related to performance-based compensation when required by Section 162(m) of the Internal Revenue Code of 1986, as amended. The Executive Performance Compensation Committee is also responsible for administering our 1998 and 2002 Stock Incentive Plans. The members of the Executive Performance Compensation Committee are Mr. Lay (Chairman) and Mr. Ledecky. Mr. Lay was appointed to the Executive Compensation Performance Committee to replace Mr. Pool, who was the sole member during fiscal 2005. Mr. Ledecky ws appointed to the Executive Performance Compensation Committee in January 2006. The Executive Performance Compensation Committee held four meetings in fiscal 2005.

The Audit Committee is responsible for oversight of School Specialty’s accounting and financial reporting processes and the audit of School Specialty’s financial statements. The members of the Audit Committee are Mr. McKenna (Chairman), Mr. Lay and Mr. Ledecky, each of whom is “independent” within the meaning of the NASD listing standards. Mr. McKenna has been deemed by the Board of Directors to be an “audit committee financial expert” for purposes of the SEC’s rules. Mr. Ledecky was appointed to the Audit Committee in January 2006 to replace Jerome Pool, who was an “independent” director of School Specialty and member of the Audit Committee during fiscal 2005 and until his death in June 2005. The Audit Committee has adopted, and the Board of Directors has approved, a charter for the Audit Committee, a copy of which was attached to School Specialty’s proxy statement issued in connection with the 2003 Annual Meeting of Shareholders. The Audit Committee held five meetings in fiscal 2005.

Shareholders wishing to communicate with members of the Board of Directors may direct correspondence to such individuals c/o Assistant Secretary, W6316 Design Drive, Greenville, Wisconsin 54942. The Assistant Secretary will regularly forward such communications to the appropriate board member(s).

Certain documents relating to corporate governance matters are available on School Specialty’s web site at www.schoolspecialty.com. These documents include the following:

| | • | | Corporate Governance Principles, which includes the charters of the Audit Committee, the Qualified Legal Compliance Committee and the Compensation Committee; and |

| | • | | Code of Business Conduct/Ethics, which contains a confidential employee hotline number that employees may use to report suspected code violations. All employees of School Specialty have been made aware of the availability of the hotline. |

8

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires School Specialty’s directors and officers, among others, to file reports with the SEC disclosing their ownership, and changes in their ownership, of stock in School Specialty. Copies of these reports must also be furnished to School Specialty. Based solely on a review of these copies, School Specialty believes that all filing requirements were complied with on a timely basis during fiscal 2005.

9

EXECUTIVE COMPENSATION

Summary Compensation Information. The following table sets forth the compensation paid by us for services rendered during fiscal years 2005, 2004 and 2003 to the Named Officers.

Summary Compensation Table

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | Long Term Compensation Awards

| | | |

| | | | | Annual Compensation

| | | School Specialty Securities Underlying Options (#)

| | All Other Compensation ($)

| |

Name and Principal Position

| | Year

| | Salary ($)

| | Bonus

($)(1)

| | | Other Annual Compensation

| | | |

David J. Vander Zanden

President and Chief Executive Officer | | 2005

2004

2003 | | $

| 492,191

453,769

392,885 | | $

| 25,000

98,221

98,226 | (4)

| | $

| 13,062

15,165

11,169 | (5)

| | —

—

50,000 | | $

| 24,667

24,016

23,193 | (6)

|

| | | | | | |

Mary M. Kabacinski

Executive Vice President and

Chief Financial Officer | | 2005

2004

2003 | | $

| 268,077

246,154

221,923 | | $

| 20,000

55,481

55,481 | (4)

| |

| —

—

— |

| | —

—

— | | $

| 4,982

4,331

3,508 | (7)

|

| | | | | | |

Stephen R. Christiansen (2)

Executive Vice President, Specialty Companies | | 2005

2004

2003 | | $

| 257,692

237,692

103,846 | |

$ | —

—

75,000 |

| |

| —

—

— |

| | —

—

75,000 | | $

| 4,982

5,400

60,500 | (7)

|

| | | | | | |

A. Brent Pulsipher (3)

Executive Vice President of Corporate Technology | | 2005

2004

2003 | | $

| 218,077

208,462

198,538 | | $

| 64,592

63,738

73,662 |

| |

$ | —

—

19,216 |

| | —

—

— | | $

| 4,982

4,331

3,850 | (7)

|

| (1) | Consists of amounts awarded under School Specialty’s Executive Incentive Plan. Amounts paid in fiscal 2005, fiscal 2004 and fiscal 2003 to Mr. Pulsipher were guaranteed under his employment agreement. The amount paid in fiscal 2003 to Mr. Christiansen was guaranteed under his employment agreement. |

| (2) | Mr. Christiansen was first employed by School Specialty in November 2002. |

| (3) | Mr. Pulsipher voluntarily terminated his employment with School Specialty effective August 5, 2005. |

| (4) | Represents a bonus granted to Mr. Vander Zanden and Ms. Kabacinski in fiscal 2006 for service to School Specialty during fiscal 2005. |

| (5) | Represents tax gross-up payment related to term life insurance premium. |

| (6) | Represents $19,685 paid by School Specialty for the term life insurance premium and contributions by School Specialty under our 401(k) plan of $4,982. |

| (7) | Represents contributions by School Specialty under our 401(k) plan. |

10

Option Grants.No options to acquire School Specialty Common Stock were granted to the Named Officers during fiscal 2005.

Option Exercises. The following table provides information regarding options to acquire School Specialty Common Stock exercised during fiscal 2005 and options held at fiscal year end by the Named Officers.

Aggregated Option/SAR Exercises in Last Fiscal Year and

Fiscal Year End Option/SAR Values

| | | | | | | | | | | | | | | |

Name

| | Shares

Acquired on

Exercise (#)

| | Value Realized ($)

| | Number of Securities

Underlying Unexercised

Options/SARs at FY-End (#)

| | Value of Unexercised In-the-Money Options/SARs at FY-End ($) (1)

|

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

David J. Vander Zanden | | — | | | — | | 383,519 | | 25,000 | | $ | 7,869,096 | | $ | 325,250 |

Mary M. Kabacinski | | — | | | — | | 109,310 | | 6,250 | | | 2,272,757 | | | 64,750 |

Stephen R. Christiansen | | — | | | — | | 37,500 | | 37,500 | | | 487,875 | | | 487,875 |

A. Brent Pulsipher | | 18,750 | | $ | 339,838 | | — | | — | | | — | | | — |

| (1) | For valuation purposes, an April 29, 2005 market price of $37.11 per share was used. |

Equity Compensation Plan Information

The following table sets forth certain information as of April 30, 2005 about shares of our common stock outstanding and available for issuance under our equity compensation plans, the Amended and Restated School Specialty, Inc. 1998 Stock Incentive Plan (the “1998 Plan”) and the 2002 Stock Incentive Plan (the “2002 Plan”). Under the 1998 Plan and 2002 Plan, we may grant stock options and other awards from time to time to employees, consultants, advisors and independent contractors of School Specialty and its subsidiaries, as well as non-employee directors and officers of School Specialty. The 1998 Plan was approved by shareholders on August 29, 2000 and the 2002 Plan was approved by shareholders on August 27, 2002.

| | | | | | | |

Plan Category

| | Number of

Shares to be

Issued Upon

Exercise of

Outstanding

Options

| | Weighted-Average

Exercise Price of

Outstanding

Options

| | Number of Shares

Remaining Available for

Future Issuance Under

Equity Compensation

Plans (Excluding Shares

Reflected in the First

Column)

|

Equity compensation plans approved by shareholders (1) | | 2,628,370 | | $ | 21.38 | | 1,646,858 |

Equity compensation plans not approved by shareholders (2) | | N/A | | | N/A | | N/A |

Total | | 2,628,370 | | $ | 21.38 | | 1,646,858 |

| (1) | Grants for shares of our common stock under the 1998 Plan are limited to 20% of the outstanding shares of School Specialty stock at the time of grant. As the number of outstanding shares of School Specialty stock increases or decreases, the maximum number of shares that may be issued under the 1998 Plan increases and decreases. As of April 30, 2005, there were 22,851,225 shares of School Specialty common stock outstanding. Grants for shares of our common stock under the 2002 Plan are limited to 1,500,000 shares. |

11

| (2) | School Specialty does not maintain any equity compensation plans that have not been approved by shareholders. |

NON-EMPLOYEE DIRECTOR COMPENSATION

Non-employee directors are granted options under our stock incentive plans to purchase 15,000 shares of Common Stock upon their initial election as members of the Board of Directors and 5,000 shares of Common Stock for each additional year of service. These options are granted at an exercise price equal to the fair market value on the date of grant and have three year vesting schedules.

Non-employee directors are currently paid an annual retainer of $30,000 plus $1,000 for each additional special meeting and committee meeting attended and are reimbursed for all out-of-pocket expenses related to their service as directors. The non-executive chairman is paid an additional annual retainer of $40,000 and non-employee director committee chairmen are paid annual retainers of $2,500.

Beginning on March 14, 2005, each member of the special committee of independent and “disinterested” directors established to consider a merger transaction, which was subsequently terminated by mutual agreement of the parties, received a fee in the amount of $1,000 per meeting or for any day (other than a day on which a meeting of the special committee was held) on which he or she devoted a meaningful portion of his or her day to the affairs of the special committee as consideration for his or her service on the special committee. Receipt of this compensation was not contingent on the special committee’s approval of the merger agreement. Each member’s out-of-pocket expenses were also reimbursed.

EMPLOYMENT CONTRACTS AND RELATED MATTERS

We have entered into employment agreements with each Named Officer.

We entered into an employment agreement with David J. Vander Zanden, President and Chief Executive Officer of School Specialty, on November 5, 2002. The agreement has an initial term of three years, and automatically renews for additional three year terms following the first year of the initial term or any renewal term unless either party gives notice of non-renewal. The agreement provides for an annual base salary of at least $425,000 and participation in a performance-based incentive compensation plan. The agreement contains a confidentiality provision that is triggered upon the termination of Mr. Vander Zanden’s employment and runs for a period of two years. The agreement provides Mr. Vander Zanden the right to terminate his employment upon a change of control of School Specialty. In the event Mr. Vander Zanden’s employment is terminated due to his death or disability or upon a change of control, School Specialty is required to pay to him his base salary for the balance of the then remaining term of the agreement. The agreement contains a non-compete provision that applies during Mr. Vander Zanden’s employment and runs for a period of two years following termination of employment or the length of time he receives base salary payments, whichever is longer. On November 5, 2002, the Board of Directors of School Specialty approved an Executive Term Life Insurance Plan (the “Plan”) for Mr. Vander Zanden. The Plan provides for $20 million of term life insurance coverage on the life of Mr. Vander Zanden. The

12

Plan, with premiums paid by School Specialty, provides coverage under two separate policies. The first policy provides for $10 million of coverage, with School Specialty designated as the beneficiary. The second policy provides for $10 million of coverage, with beneficiaries designated by Mr. Vander Zanden. The second policy is in addition to Mr. Vander Zanden’s compensation as provided for as part of his employment agreement.

We entered into an employment agreement with Mary M. Kabacinski, Executive Vice President and Chief Financial Officer of School Specialty, on September 3, 1999. The agreement has an initial term of two years, with automatic two year extensions following the first year of the initial term or any renewal term unless either party gives notice of non-renewal. The agreement provides for an annual base salary of at least $175,000 and participation in a performance-based incentive compensation plan. The agreement provides Ms. Kabacinski with the right to terminate her employment upon a change of control of School Specialty. The agreement contains a confidentiality provision that is triggered upon the termination of Ms. Kabacinski’s employment and runs for a period of two years. In the event Ms. Kabacinski’s employment is terminated due to her death, disability or upon a change of control, School Specialty is required to pay Ms. Kabacinski her base salary for the balance of the then remaining term of the agreement. The agreement contains a non-compete provision that applies during Ms. Kabacinski’s employment and runs for a period of 18 months following termination of employment.

We entered into an employment agreement with Stephen R. Christiansen, Executive Vice President of the Specialty Companies, on November 5, 2002. The agreement has an initial term of two years, with automatic one year extensions unless either party gives notice of non-renewal. The agreement provides for an annual base salary of at least $225,000 and participation in a performance-based incentive compensation plan. The agreement contains confidentiality, non-solicitation and non-compete provisions that apply during Mr. Christiansen’s employment and runs for a period of 24 months following termination of employment.

We entered into an employment agreement with A. Brent Pulsipher, Executive Vice President of Corporate Technology of School Specialty, on March 26, 2001. The agreement was subsequently amended on September 11, 2002, effective June 1, 2002, and on June 3, 2004, effective April 25, 2004. The agreement had an initial term of three years, with automatic one year extensions unless either party gives notice of non-renewal. The agreement, as amended, provided for annual total cash compensation of at least $272,200 as an annual minimum amount. The agreement provided Mr. Pulsipher with the right to terminate his employment upon a change of control of School Specialty. The agreement contained confidentiality, non-solicitation and non-compete provisions that applied during Mr. Pulsipher’s employment and runs for a period of two years following termination of employment.

On July 20, 2005, we entered into a separation agreement with Mr. Pulsipher related to Mr. Pulsipher’s voluntary termination of employment effective August 5, 2005. Under the terms of the separation agreement, we agreed to pay Mr. Pulsipher (1) all of his wages and unused time off due him as of the retirement date, subject to deductions for appropriate tax withholdings, and (2) his annualized salary and guaranteed bonus of $272,000 over a twelve month period commencing after the retirement date. Mr. Pulsipher will retain all of his vested rights under the Company’s 401(K) plan, COBRA benefit rights and stock option plan and will receive benefits in accordance with the terms of those plans. In consideration for these benefits, Mr. Pulsipher agreed to release the Company and its affiliates from any claims arising on or before the date of the separation agreement and to abide by the post-employment obligations set forth in his employment agreement.

13

COMPENSATION COMMITTEE REPORT

School Specialty’s Executive Compensation Program is designed to attract and retain highly competent executives, to provide incentives for achieving and exceeding School Specialty’s short-term and long-term financial goals, and to align the financial objectives of our executives with the enhancement of shareholder value.

The Compensation Committee consists of Mr. Lay (Chairman), Mr. McKenna and Mr. Ledecky. Mr. Lay was appointed to the Compensation Committee to replace Mr. Pool, who was Chairman of the Compensation Committee during fiscal 2005 and until his death in June 2005. Mr. Ledecky was appointed to the Compensation Committee in January 2006. The Compensation Committee is responsible for reviewing and, if appropriate, approving the compensation of our President and Chief Executive Officer, Mr. Vander Zanden, and the recommendations of Mr. Vander Zanden concerning the compensation levels of our other executive officers. The Executive Performance Compensation Committee consists of Mr. Lay (Chairman) and Mr. Ledecky. Mr. Lay was appointed to the Executive Performance Compensation Committee to replace Mr. Pool, who was the sole member in 2005. Mr. Ledecky was appointed to the Executive Performance Compensation Committee in January 2006. The Executive Performance Compensation Committee administers our 1998 and 2002 Stock Incentive Plans, with responsibility for determining the awards to be made under such plans.

The Compensation and the Executive Performance Compensation Committees review compensation programs for executive officers in June of each year and more frequently as appropriate. Because certain matters related to compensation are approved by the Executive Performance Compensation Committee, that committee joins in this report of the Compensation Committee.

Overview. The compensation structure for our executive officers consists in general of three principal components: base salary, annual cash bonus and periodic grants of stock options. Base salary determinations are an important ingredient in attracting and retaining quality personnel in a competitive market. Base salaries are set at levels based generally on subjective factors, including the individual’s level of responsibility, experience and past performance record. In addition, a significant portion of compensation is directly related to and contingent upon objective performance criteria established on an annual basis. Accordingly, our executives participate in annual cash bonus arrangements based in part on objective formulas tied to the individual’s profit center and/or School Specialty as a whole. Finally, to ensure that executive officers hold equity positions in School Specialty, which we think is important, stock options are granted to executives to enable them to hold equity interests at more meaningful levels than they could through alternative methods.

Base Salary. The base salary of Mr. Vander Zanden was established by his employment agreement and is reviewed annually by the Compensation Committee which makes recommendations on changes to the Board of Directors for approval. In November 2002, the Committee recommended an annual base salary of at least $425,000 for Mr. Vander Zanden in recognition of his expanded role as Chief Executive Officer. Executive salaries for officers other than the President and Chief Executive Officer are recommended to the Compensation Committee for review and approval prior to submission to the Board of Directors for approval.

Cash Bonus. For corporate executives, the current incentive compensation plan permits such persons to receive up to 100% of their base compensation in cash bonus and is tied in part to the performance goals established on an annual basis by the Board of Directors and in part to discretionary performance criteria. The Committee believes that the plan provides important incentives to executives thereby benefiting not only the executive but School Specialty as well. The Committee granted bonuses

14

of $25,000 and $20,000 to Mr. Vander Zanden and Ms. Kabacinski, respectively, in fiscal 2006 for their service to School Specialty during fiscal 2005.

Equity Based Compensation. Under our 1998 and 2002 Stock Incentive Plans, the Executive Performance Compensation Committee determines the stock option awards to be made to executive officers and others. With respect to our President and Chief Executive Officer, the Executive Performance Compensation Committee bases its determination upon performance goals as well as existing overall compensation. With respect to other executives, the Executive Performance Compensation Committee bases its determinations on recommendations made by management.

Section 162(m) of the Internal Revenue Code of 1986, as amended, generally disallows a tax deduction to public corporations for compensation over $1 million for any fiscal year paid to the corporation’s chief executive officer and other highly compensated executive officers whose compensation is required to be reported in this Proxy Statement as of the end of any fiscal year. However, Section 162(m) also provides that qualifying performance-based compensation will not be subject to the deduction limit if certain requirements are met. In making compensation decisions, it is the Compensation Committee’s current intention to recommend plans and awards which will meet the requirements for deductibility for tax purposes under Section 162(m) and has established the Executive Performance Compensation Committee to assist in that regard. Because of uncertainties as to the application and interpretation of Section 162(m), no assurance can be given that the compensation paid to our most highly compensated officers will be deductible for federal income tax purposes, notwithstanding School Specialty’s efforts to satisfy such section. In addition, School Specialty may pay compensation that does not satisfy these requirements for deduction if it is deemed advisable for business reasons.

| | |

The Compensation Committee: | | The Executive Performance Compensation Committee: |

| |

Terry L. Lay (Chairman) | | Terry L. Lay (Chairman) |

Leo C. McKenna | | Jonathan J. Ledecky |

Jonathan J. Ledecky | | |

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

Mr. Lay has never been, and Mr. Pool never was, an officer of our company or any of our subsidiaries, and none of our executive officers has served on the compensation committee or the board of directors of any company of which any of our directors is an executive officer. Mr. McKenna is a former non-employee officer and director of a predecessor company of School Specialty that was acquired by U.S. Office Products in 1996. Mr. Ledecky was an employee of School Specialty from June 1998 to June 2000.

AUDIT COMMITTEE REPORT

In accordance with its written charter, the Audit Committee oversees all accounting and financial reporting processes and the audit of our financial statements. The Audit Committee assists the Board of Directors in fulfilling its responsibility to our shareholders, the investment community and governmental agencies relating to the quality and integrity of our financial statements and the qualifications, independence and performance of our independent registered public accounting firm. During fiscal 2005, the Audit Committee met five times, and the Audit Committee chair, the designated representative of the Audit Committee, discussed the interim financial information contained in each of our quarterly reports on Form 10-Q with the Chief Financial Officer and independent registered public accounting firm prior to their filing with the SEC.

15

In July 2005, the Audit Committee appointed Deloitte & Touche LLP (“Deloitte”) to serve as our independent registered public accounting firm for fiscal 2006.

Independent Registered Public Accounting Firm Independence and Fiscal 2005 Audit.In discharging its duties, the Audit Committee obtained from Deloitte, our independent registered public accounting firm for the 2005 audit, a formal written statement describing all relationships between Deloitte and us that might bear on Deloitte’s independence consistent with Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees.” In addition, the Audit Committee discussed with Deloitte any relationships that may impact their objectivity and independence and satisfied itself as to Deloitte’s independence. The Audit Committee also independently discussed the quality and adequacy of our internal controls with management and Deloitte. The Audit Committee reviewed with Deloitte its audit plans, audit scope and identification of audit risks.

The Audit Committee discussed and reviewed with Deloitte all communications required by generally accepted auditing standards, including those described in Statement on Auditing Standards No. 61, as amended, “Communication with Audit Committees” and, with and without management present, discussed and reviewed the results of Deloitte’s examination of the financial statements. The Audit Committee also discussed with management and Deloitte the objectives and scope of the internal audit process and the results of the internal audit examinations.

Fiscal 2005 Financial Statements and Recommendations of the Committee.The Audit Committee separately reviewed and discussed our audited financial statements and management’s discussion and analysis of financial condition and results operations (“MD&A”) as of and for the fiscal year ended April 30, 2005 with management and Deloitte. Management has the responsibility for the preparation of our financial statements and the independent registered public accounting firm has the responsibility for the examination of those statements.

Based on the above-mentioned review, and discussions with management and Deloitte, the Audit Committee recommended to the Board of Directors that our audited financial statements and MD&A be included in our annual report on Form 10-K for the fiscal year ended April 30, 2005 for filing with the SEC.

Fees Paid to Deloitte & Touche LLP. The aggregate fees billed for professional services by Deloitte during fiscal 2005 and fiscal 2004 were approximately:

| | | | | | |

Type of Fees

| | Fiscal 2005

| | Fiscal 2004

|

Audit Fees | | $ | 617,800 | | $ | 257,500 |

Audit-Related Fees | | | 41,100 | | | 242,100 |

Tax Fees | | | 377,000 | | | 359,300 |

| | |

|

| |

|

|

Total | | $ | 1,035,900 | | $ | 858,900 |

| | |

|

| |

|

|

In the above table, “audit fees” are fees School Specialty paid Deloitte for professional services for the audit of School Specialty’s consolidated financial statements included in Form 10-K and review of financial statements included in Forms 10-Q, or for services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements. “Audit-related fees” are fees billed by Deloitte for assurance and related services that are reasonably related to the performance of the audit or review of School Specialty’s financial statements. Audit-related services for fiscal 2005 included post-closing accounting services related to one acquisition and a benefit plan audit. Audit-related services for fiscal 2004 included post-closing accounting services related to two acquired operations, preparation of comfort letters in connection with the filing of School Specialty’s Registration Statement on Form S-3 in connection with the offering of its 3.75% Convertible Subordinated Notes Due 2023 and benefit plan

16

audits. “Tax fees” are fees for tax compliance, tax advice, and tax planning. Tax-related services for fiscal 2005 and fiscal 2004 included tax return preparation and consulting. There were no “other fees” paid in fiscal 2005 or fiscal 2004.

The Audit Committee pre-approves all audit and non-audit work, including tax compliance and tax consulting, performed by Deloitte. However, the Audit Committee has delegated the approval of one category of non-audit services, post-closing accounting services related to School Specialty’s future acquisitions and dispositions, to the Chairman in the event it is not administratively expedient for the full Audit Committee to approve and authorize such services. In such case, the Chairman is required to make a report to the full Audit Committee at its next meeting. All audit and non-audit services provided by Deloitte during fiscal 2005 were pre-approved by the Audit Committee.

|

| The Audit Committee: |

|

Leo C. McKenna (Chairman) |

Terry L. Lay |

Jonathan J. Ledecky |

17

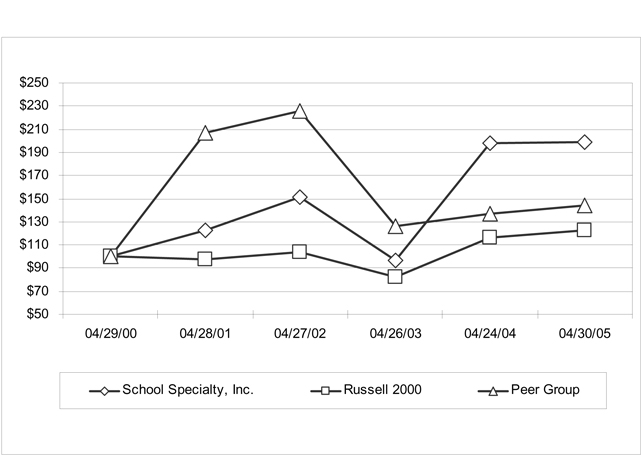

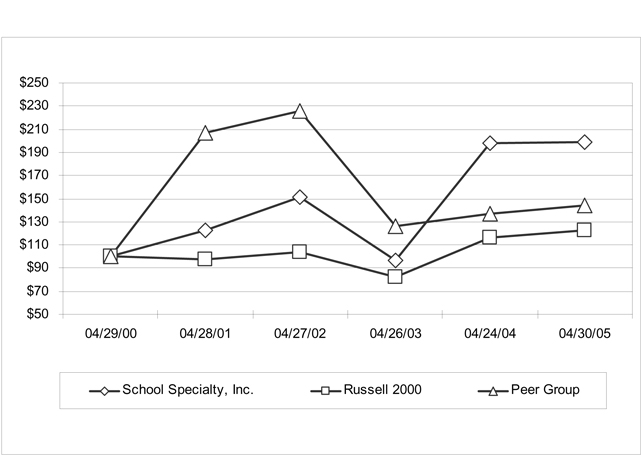

PERFORMANCE GRAPH

The following graph compares the total shareholder return on our Common Stock since April 29, 2000 with that of the Russell 2000 Stock Market Index and a peer group index constructed by us. The companies included in our peer group index are: Renaissance Learning, Inc. (RLRN), Scholastic Corporation (SCHL), The Aristotle Corporation (ARTL) and Excelligence Learning Corporation (LRNS).

The total return calculations set forth below assume $100 invested on April 29, 2000, with reinvestment of any dividends into additional shares of the same class of securities at the frequency with which dividends were paid on such securities through April 30, 2005. The stock price performance shown in the graph below should not be considered indicative of potential future stock price performance.

| | | | | | | | | | | | | | | | | | |

| | | April 29, 2000

| | April 28, 2001

| | April 27, 2002

| | April 26, 2003

| | April 24, 2004

| | April 30, 2005

|

School Specialty, Inc. | | $ | 100.00 | | $ | 122.28 | | $ | 151.69 | | $ | 96.19 | | $ | 197.64 | | $ | 199.19 |

Russell 2000 Index | | $ | 100.00 | | $ | 97.14 | | $ | 103.72 | | $ | 82.18 | | $ | 116.71 | | $ | 122.21 |

Peer Group | | $ | 100.00 | | $ | 206.55 | | $ | 225.39 | | $ | 126.58 | | $ | 137.33 | | $ | 144.55 |

18

PROPOSAL TWO: RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Upon recommendation of the Audit Committee and subject to ratification by the shareholders at the Annual Meeting, the Audit Committee has appointed Deloitte & Touche LLP (“Deloitte”), an independent registered public accounting firm, to audit the consolidated financial statements of School Specialty for the fiscal year ending April 29, 2006. Deloitte audited the financial statements of School Specialty for the fiscal year ended April 30, 2005. Representatives of Deloitte will be present at the Annual Meeting to make any statement they may desire and to respond to appropriate questions from shareholders.

If shareholders do not ratify the appointment of Deloitte, the selection of our independent registered public accounting firm will be reconsidered by the Audit Committee.

The Board of Directors unanimously recommends a vote FOR ratification of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal 2006.

OTHER MATTERS

Although management is not aware of any other matters that may come before the Annual Meeting, if any such matters should be presented, the persons named in the enclosed proxy card intend to vote in accordance with their best judgment.

19

SUBMISSION OF SHAREHOLDER PROPOSALS

In accordance with our By-Laws, nominations, other than by or at the direction of the Board of Directors, of candidates for election as directors at the 2006 Annual Meeting of Shareholders must be submitted to us no earlier than May 26, 2006 and no later than June 25, 2006. Any other shareholder proposed business to be brought before the 2006 Annual Meeting of Shareholders must be submitted to us no later than March 22, 2006. Shareholder proposed nominations and other shareholder proposed business must be made in accordance with our By-Laws which provide, among other things, that shareholder proposed nominations must be accompanied by certain information concerning the nominee and the shareholder submitting the nomination, and that shareholder proposed business must be accompanied by certain information concerning the proposal and the shareholder submitting the proposal. To be considered for inclusion in the proxy statement solicited by the Board of Directors, shareholder proposals for consideration at the 2006 Annual Meeting of Shareholders of School Specialty must be received by us at our principal executive offices, W6316 Design Drive, Greenville, Wisconsin, 54942 on or before March 22, 2006. Proposals should be directed to Ms. Karen A. Riching, Assistant Secretary. To avoid disputes as to the date of receipt, it is suggested that any shareholder proposal be submitted by certified mail, return receipt requested.

Shareholders may obtain a copy of our Annual Report on Form 10-K for fiscal 2005 at no cost by writing to Ms. Karen A. Riching, Assistant Secretary, School Specialty, Inc., W6316 Design Drive, Greenville, Wisconsin, 54942.

| | |

By Order of the Board of Directors, |

|

| |

| Joseph F. Franzoi IV,Secretary |

20

ANNUAL MEETING OF SHAREHOLDERS OF

SCHOOL SPECIALTY, INC.

February 22, 2006

Please date, sign and mail

your proxy card in the

envelope provided as soon

as possible.

¯ Please detach along perforated line and mail in the envelope provided.¯

PLEASE SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE. PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HEREx

| | | | | | | | | | |

1. ELECTION OF DIRECTOR: (To serve until the 2008 Annual Meeting and until his successor is elected and qualified.) | | | | FOR | | AGAINST | | ABSTAIN |

| | 2. RATIFY DELOITTE & TOUCHE LLP AS SCHOOL SPECIALTY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR FISCAL 2006. | | ¨ | | ¨ | | ¨ |

| | | NOMINEE: | | | | | | | |

¨ FOR THE NOMINEE | | Jonathan J. Ledecky | | | | | | | |

| | |

¨ WITHHOLD AUTHORITY FOR THE NOMINEE | | | | 3. IN THEIR DISCRETION, THE PROXIES ARE AUTHORIZED TO VOTE UPON SUCH OTHER BUSINESS AS MAY PROPERLY COME BEFORE THE MEETING (AND ANY ADJOURNMENT OR POSTPONEMENT THEREOF). |

| | |

| | | | | Number of shares __________ |

| | | | | | |

| To change the address on your account, please check the box at right and indicate your new address in the address space above. Please note that changes to the registered name(s) on the account may not be submitted via this method. | | ¨ | | |

| | | | | | | | | | | | | | |

| Signature of Shareholder | | | | Date: | | | | Signature of Shareholder | | | | Date: | | |

| | Note: | Please sign your proxy card exactly as your name or names appear hereon. When shares are held by joint tenants, both should sign. When signing as attorney, executor, administrator, trustee or guardian, please give your full title, as such. If a corporation, please sign in full corporate name by the president or other authorized officer, giving full title, as such. If a partnership, please sign in partnership name by an authorized person and state your title. |

SCHOOL SPECIALTY, INC.

This Proxy is Solicited on Behalf of the Board of Directors

The undersigned appoints David J. Vander Zanden and Mary M. Kabacinski, and each of them, as proxies, each with the power to appoint his or her substitute, and authorizes each of them to represent and to vote as designated on the reverse side, all of the shares of stock of School Specialty, Inc. held of record by the undersigned on January 4, 2006 at the 2005 Annual Meeting of Shareholders of School Specialty, Inc. to be held on February 22, 2006 and at any adjournment or postponement thereof.

This proxy, when properly executed, will be voted in the manner directed herein by the undersigned shareholder. If no direction is indicated, this proxy will be voted “FOR” the election of the individual nominated to serve as a Class I director and “FOR” the ratification of the appointment of the independent registered public accounting firm, each of which is being proposed by School Specialty, Inc.

(Continued and to be signed on the reverse side.)