Fiscal Q2 2019 Investor Update August 12, 2019 Exhibit 99.2

Safe Harbor Statement This presentation contains statements about School Specialty’s future financial condition, results of operations, equity value, expectations, plans, or prospects, including information under the heading “Fiscal 2019 Full Year Guidance”, “Peak Season Update – H2 2019 Outlook”, and the information regarding our Fiscal 2019 financial and performance and business objectives outlook, that constitute forward-looking statements. Forward-looking statements also include those preceded or followed by the words "anticipates," "believes," "could," "estimates," "expects," "intends," "may," "plans," "projects," "should," "targets" and/or similar expressions. These forward-looking statements are based on School Specialty's current estimates and assumptions as of the date of the information presented and as such, involve uncertainty and risk. Forward-looking statements are not guarantees of future performance, and actual results may differ materially from those contemplated by the forward-looking statements because of a number of factors, including the factors described in Item 1A of School Specialty's Report on Form 10-K for the fiscal year ended December 29, 2018, which factors are incorporated herein by reference. Other risks and uncertainties include, but are not limited to, the following: failure to comply with restrictive covenants under our credit facilities and other debt instruments; material adverse effects on our operating flexibility resulting from our debt levels; volatile or uncertain economic conditions; inability to timely respond to the needs of our clients; our ability to refinance our currently maturing debt; declining school budgets; cyberattack or improper disclosure or loss of sensitive or confidential company, employee or client data; increasing competition in our science curriculum products; and other factors that may be disclosed from time to time in our SEC filings or otherwise. Any forward-looking statement in this presentation speaks only as of the date in which it is made. Except to the extent required under the federal securities laws, School Specialty does not intend to update or revise the forward-looking statements.

Q2 2019 – Key Takeaways Core Business Stable; Move Away From Low-Margin Business and Isolated Headwinds Affect Top-Line Exceptionally Strong Operational Performance Road to Success in Second Half & Beyond Traction with large U.S. districts remains strong; Q2 2019 revenue top-line softness due to Supplies weakness within smaller districts and non-district customers. Overall Supplies revenue and outlook remains healthy. Pricing actions and improved margin discipline aiding in margin expansion, the impact of which to be realized primarily in H2 2019. Science Curriculum recovery slower than expected; targeting 2H growth and expecting a more pronounced recovery in 2020. Strongest operating metrics in years; fulfillment centers are current and delivering on-time, accurate and damage free orders. Expect to leverage excellent operational performance and customer service levels to boost post-peak re-order rates in 2H. Aggressive SG&A management continues to be evident; favorable SG&A margin trend is expected to continue in H2 2019 Working capital has normalized as expected, providing FCF to accelerate debt paydown in 3Q and 4Q 2019. Driven by favorable margin trends and aggressive SG&A management, guiding to the low-end of our Adjusted EBITDA guidance range Full-year impact of pricing actions, continued SG&A management and recovery in the Science Curriculum business point to continued bottom-line improvement in 2020.

2019 Key Priorities & Objectives Drive Organic Revenue Growth Cost Efficiency & Process Excellence Build Long-Term Growth Momentum Boost Free Cash Flow Leverage team-sell model and customer segmentation strategy to drive growth. Strengthen relationships at the District Administration & School Board Level. Capitalize on supplier consolidation trends as Districts seek to streamline procurement activities. Benefit from increased funding directed toward STEM/STEAM, Early Childhood and Learning Environment modernization efforts. Strategically invest in Learning Environment pipeline to support its strong, multi-year projected growth. Launch new high-margin supplemental curriculum products in ELA, Math and Science. Convert growing Science Curriculum opportunities outside of California. Continue to deepen customer relationships and broaden account penetration across categories. Continue to benefit from process excellence initiatives designed to lower costs and create scalability. Realize transportation-cost savings from renegotiation of key transport agreements and other supply chain initiatives. Leverage reduced order-cycle times and improved fill-rates to enhance customer experience and drive strong follow-on orders post peak season. On track for 2019 net working capital normalization. On-time complete shipments and enhanced e-commerce integration to shorten collection cycles. Continue to expect modest reduction in capital expenditures in 2019. Stronger cash flows expected to reduce overall leverage.

Q2 2019 Revenue Overview Q2 2019 revenue was $160.6M, a decline of 5.1% as compared to the previous year. The main drivers were as follows: Distribution segment revenue of $150.1M, a decline of 3.6% as compared to the previous year. Supplies revenue softness and continued headwinds in the Agendas category were key drivers of the decline YoY. The weakness in Agendas is due to challenges associated with the transition to a new technology platform to support the sale and production of Agendas. Supplies Revenue of $77.0M, down 4.1% as compared to the previous year. Large school districts posting solid growth YoY offset by weakness in small-to-medium sized districts, Canada and non-district accounts. The weakness in small district and non-district accounts, we believe, is partly attributable to our poor operating performance in 2018; we have deployed multiple sales and marketing initiatives in an effort to reactivate this segment of the customer base. Weakness in Canada can be attributed to education budget cuts and increased local competition in certain provinces. Furniture Revenue of $53.6M, up 2.3% as compared to the previous year. Strong demand was partially offset by our strategic decision to be more selective when considering the pursuit of low margin opportunities in certain markets. Instruction & Intervention (“I&I”) Revenue of $14.1M, down 2.0% as compared to the previous year, reflecting soft demand for our Triumph Learning (Coach) product line and non-proprietary instructional support materials and manipulatives. Pipeline of opportunities for SPIRE and Wordly Wise remains solid, with modest YoY growth expected in these anchor products. Success Coach launch on track for Q3, representing the first major new product release in several years. AV Tech Revenue of $4.2M, up 2.9% as compared to the previous year; category performance up low single digit YoY and modestly better than historical trends. Better alignment with Furniture (Learning Environment) sales process is beginning to gain traction. Science Curriculum segment revenue of $10.5M, a decline of 22.2% as compared to the previous year, reflecting the result of weaker than expected performance of FOSS in several large open territory opportunities and timing shifts with the California adoption. Overall yield from the California adoption appears to still be intact. Our 2019 plan assumed approximately half of the California spend would occur in 2019, with the balance being spent in 2020. However, due to slower than expected adoption we now expect approximately a quarter of the California spend to occur in 2019, with the balance being spent in 2020 / 2021.

Q2 2019 Gross Profit Overview Q2 2019 gross profit was $52.7M, down $6.1M or 10.3% as compared to the previous year, representing a gross margin of 32.8%, contracting 190 bps YoY. YoY spread in gross margin continues to narrow positively (from a 220 bps YoY decline in Q1 2019 to a 190 bps decline in Q2 2019). Margin trends at the product category level in late Q2 / early Q3 support gross margin expansion in 2H 2019 as our pricing actions and efforts to improve margin discipline within bids, contracts and major projects take hold. The main drivers of gross profit were as follows: Distribution Segment gross profit of $46.8M, down $3.5M or 7.0% as compared to the previous year, representing a gross margin of 31.2%, 110 bps below prior year. Q2 2019 Distribution segment gross margins was negatively impacted by both product mix (-30 bps) and increased customer rebates and allowances (-30 bps). Pricing actions taken in fiscal 2018 and early fiscal 2019 have begun to positively impact gross margins over the past three quarters. We expect the impact of pricing actions to be more pronounced in 2H 2019 and result in positive YoY gross margin variances. Science Curriculum Segment gross profit of $5.9M, down $2.5M or 30.2% as compared to the previous year, representing a gross margin of 55.7%, decreasing 640 bps YoY. Factors resulting in YoY margin contraction were: increased product costs associated with smaller runs of printed materials, higher than expected training and material costs, and lower shipping and handling revenues. Expect gross margin expansion in H2 2019, based upon higher volumes and margins, to be consistent with 2H 2018.

Structural Improvements Leading to Improved YoY Gross Margin Profile Pricing actions and the re-pricing of material bids / contracts gradually materialized in the 1H of the year. The full impact of pricing changes becomes most evident in the peak-season. Lower gross margins are expected during the “peak-season,” driven primarily by product mix. Pricing actions beginning in mid-2018 have substantially offset the seasonal decline; YoY favorability emerged in late Q2 and has been sustained in early Q3. Pricing actions include: More effective assortment review to optimize SKU list prices and published discount prices. Improved bid/quote process and analytics. Structured discount programs to be more in-line with the strategic value of the customer / opportunity. Supplies Weekly Booked GM Expect YoY gross margin favorability in 2H 2019 for both Supplies and Furniture to be meaningful.

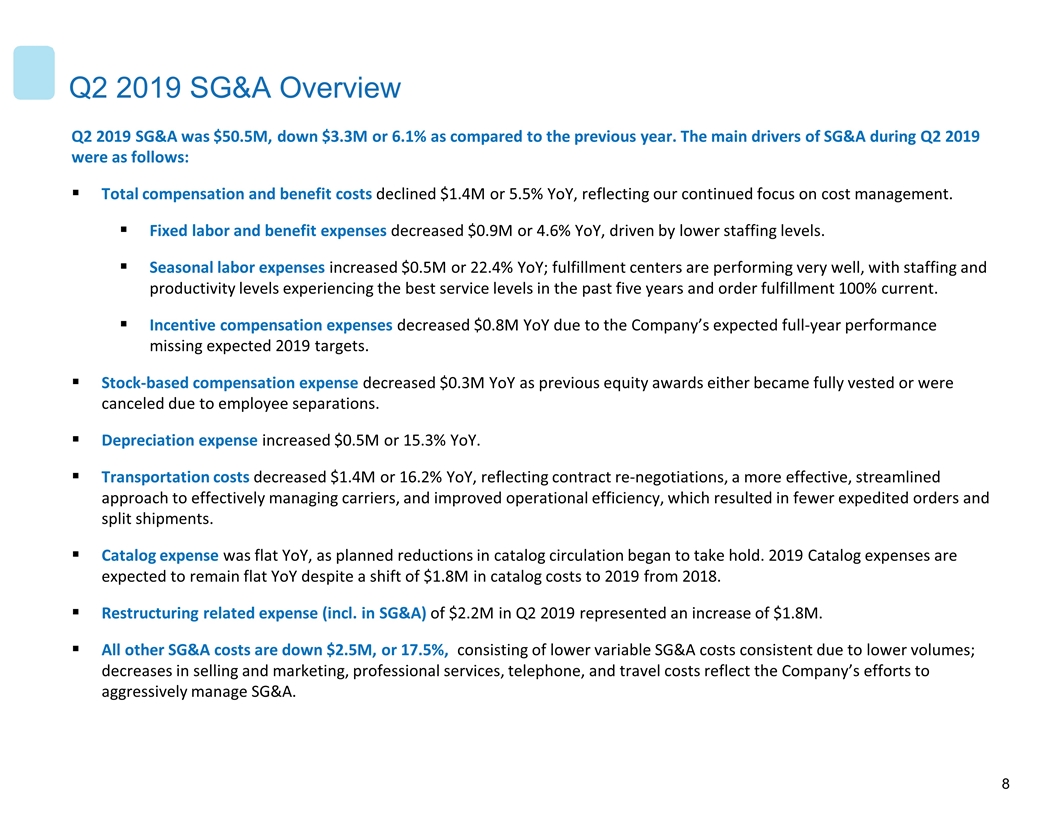

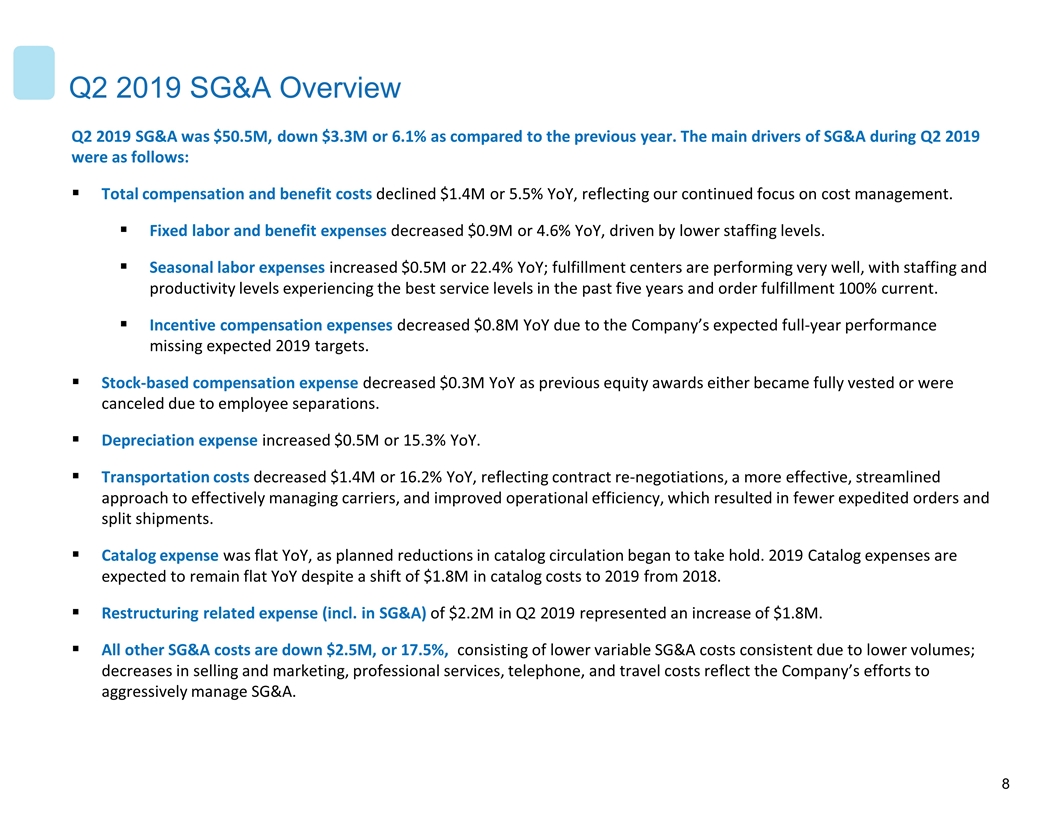

Q2 2019 SG&A Overview Q2 2019 SG&A was $50.5M, down $3.3M or 6.1% as compared to the previous year. The main drivers of SG&A during Q2 2019 were as follows: Total compensation and benefit costs declined $1.4M or 5.5% YoY, reflecting our continued focus on cost management. Fixed labor and benefit expenses decreased $0.9M or 4.6% YoY, driven by lower staffing levels. Seasonal labor expenses increased $0.5M or 22.4% YoY; fulfillment centers are performing very well, with staffing and productivity levels experiencing the best service levels in the past five years and order fulfillment 100% current. Incentive compensation expenses decreased $0.8M YoY due to the Company’s expected full-year performance missing expected 2019 targets. Stock-based compensation expense decreased $0.3M YoY as previous equity awards either became fully vested or were canceled due to employee separations. Depreciation expense increased $0.5M or 15.3% YoY. Transportation costs decreased $1.4M or 16.2% YoY, reflecting contract re-negotiations, a more effective, streamlined approach to effectively managing carriers, and improved operational efficiency, which resulted in fewer expedited orders and split shipments. Catalog expense was flat YoY, as planned reductions in catalog circulation began to take hold. 2019 Catalog expenses are expected to remain flat YoY despite a shift of $1.8M in catalog costs to 2019 from 2018. Restructuring related expense (incl. in SG&A) of $2.2M in Q2 2019 represented an increase of $1.8M. All other SG&A costs are down $2.5M, or 17.5%, consisting of lower variable SG&A costs consistent due to lower volumes; decreases in selling and marketing, professional services, telephone, and travel costs reflect the Company’s efforts to aggressively manage SG&A.

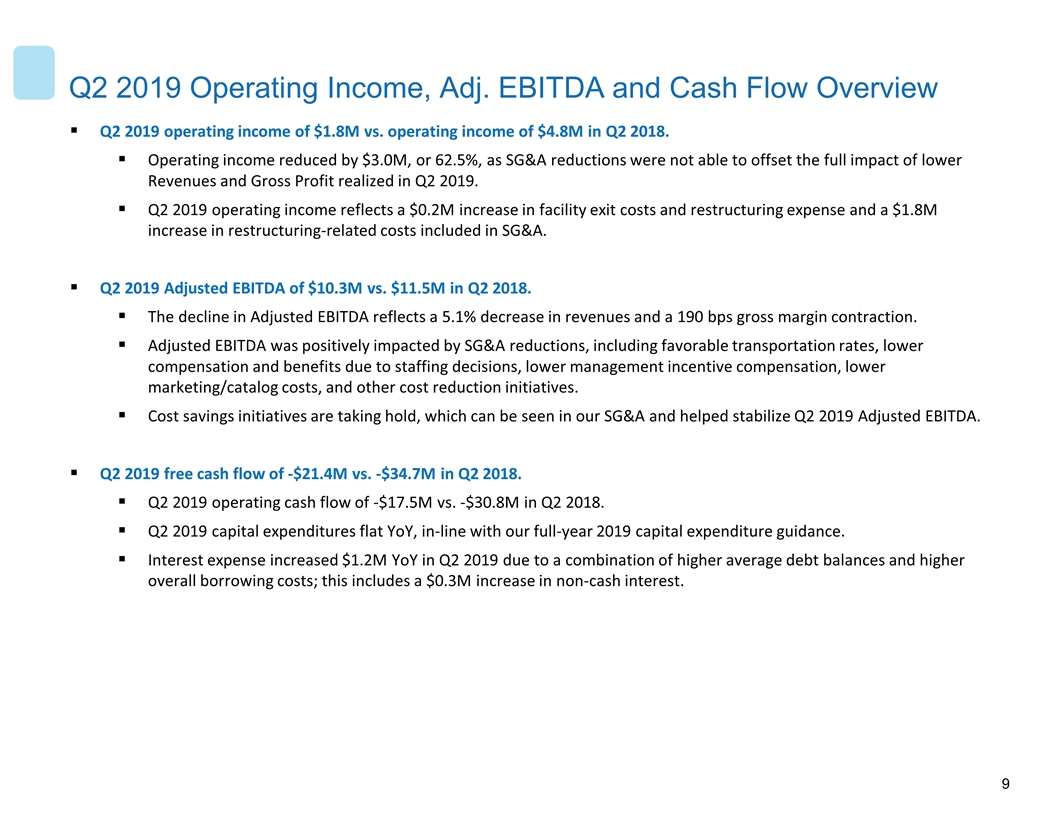

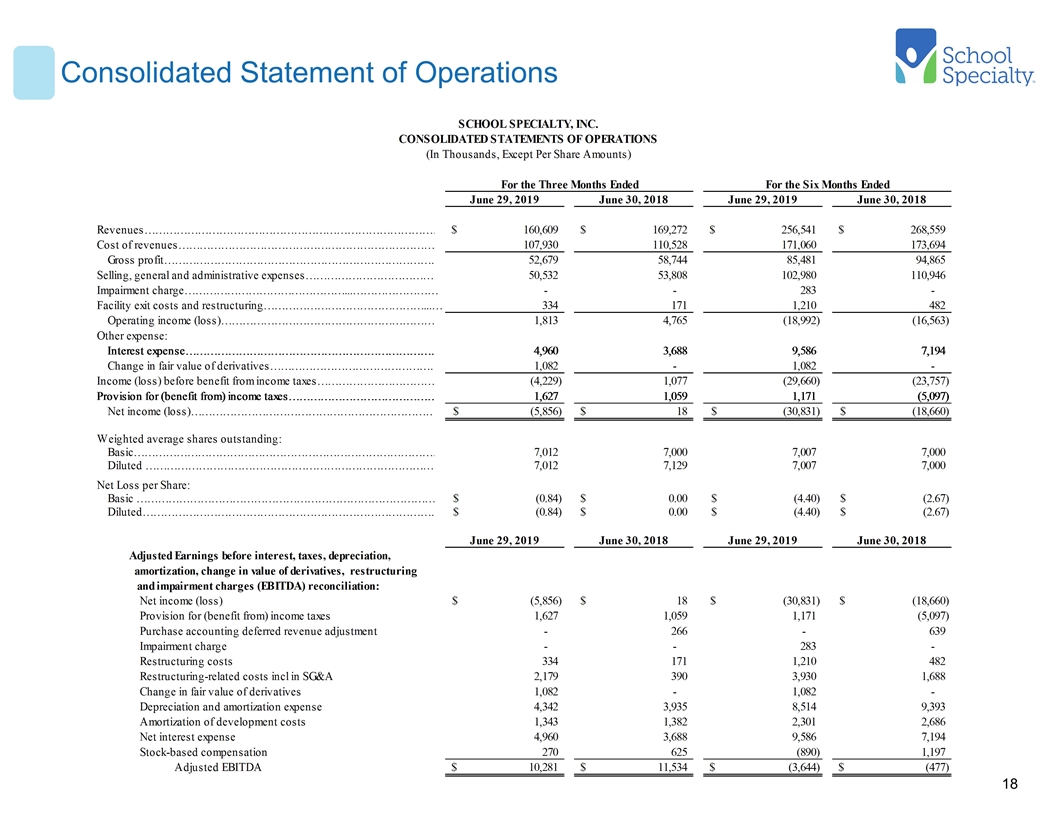

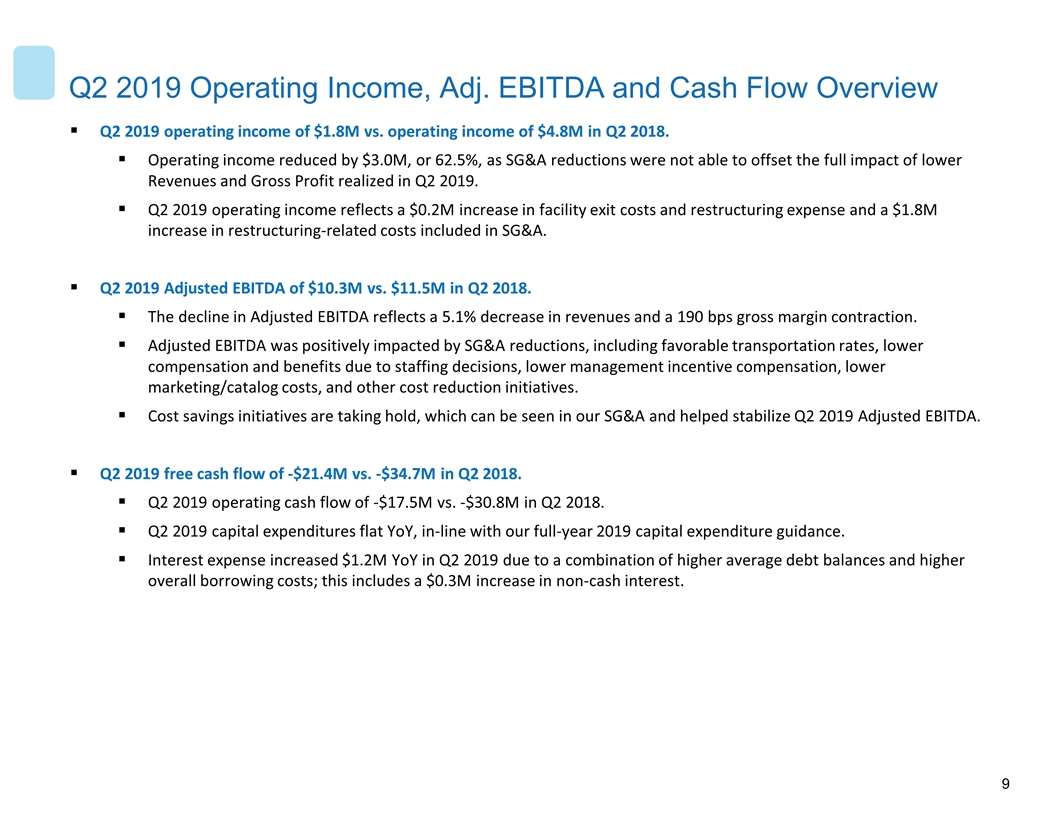

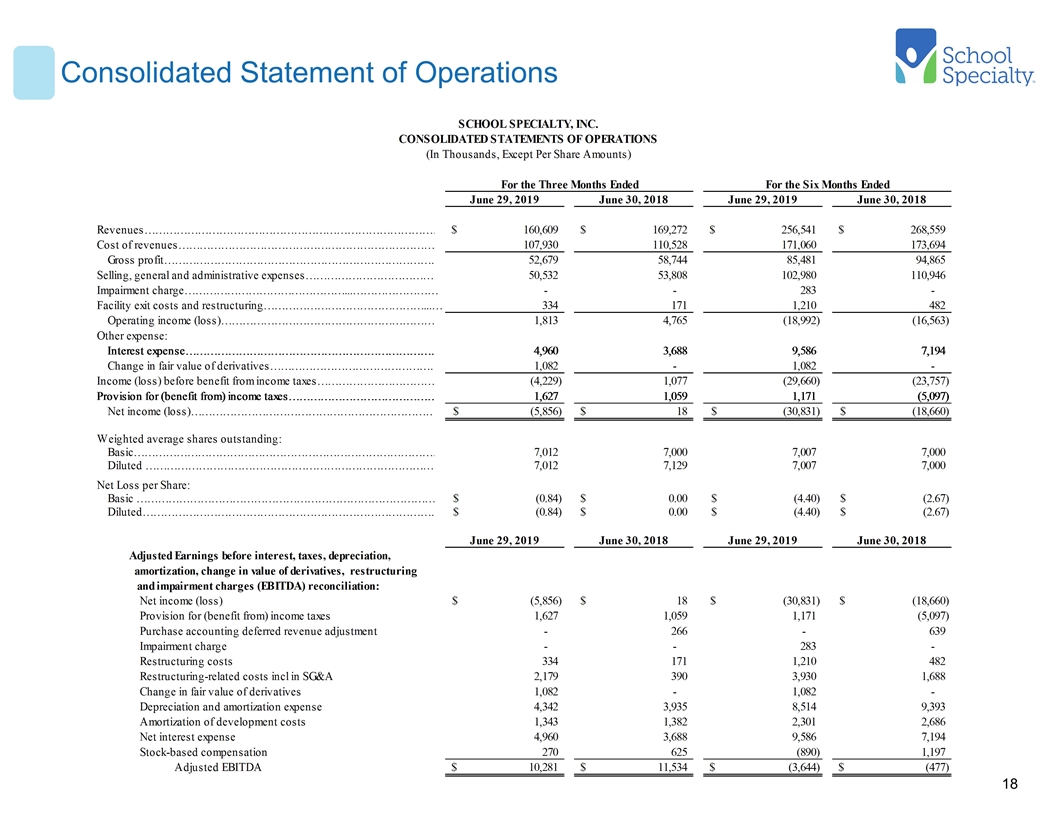

Q2 2019 Operating Income, Adj. EBITDA and Cash Flow Overview Q2 2019 operating income of $1.8M vs. operating income of $4.8M in Q2 2018. Operating income reduced by $3.0M, or 62.5%, as SG&A reductions were not able to offset the full impact of lower Revenues and Gross Profit realized in Q2 2019. Q2 2019 operating income reflects a $0.2M increase in facility exit costs and restructuring expense and a $1.8M increase in restructuring-related costs included in SG&A. Q2 2019 Adjusted EBITDA of $10.3M vs. $11.5M in Q2 2018. The decline in Adjusted EBITDA reflects a 5.1% decrease in revenues and a 190 bps gross margin contraction. Adjusted EBITDA was positively impacted by SG&A reductions, including favorable transportation rates, lower compensation and benefits due to staffing decisions, lower management incentive compensation, lower marketing/catalog costs, and other cost reduction initiatives. Cost savings initiatives are taking hold, which can be seen in our SG&A and helped stabilize Q2 2019 Adjusted EBITDA. Q2 2019 free cash flow of -$21.4M vs. -$34.7M in Q2 2018. Q2 2019 operating cash flow of -$17.5M vs. -$30.8M in Q2 2018. Q2 2019 capital expenditures flat YoY, in-line with our full-year 2019 capital expenditure guidance. Interest expense increased $1.2M YoY in Q2 2019 due to a combination of higher average debt balances and higher overall borrowing costs; this includes a $0.3M increase in non-cash interest.

Financial Update

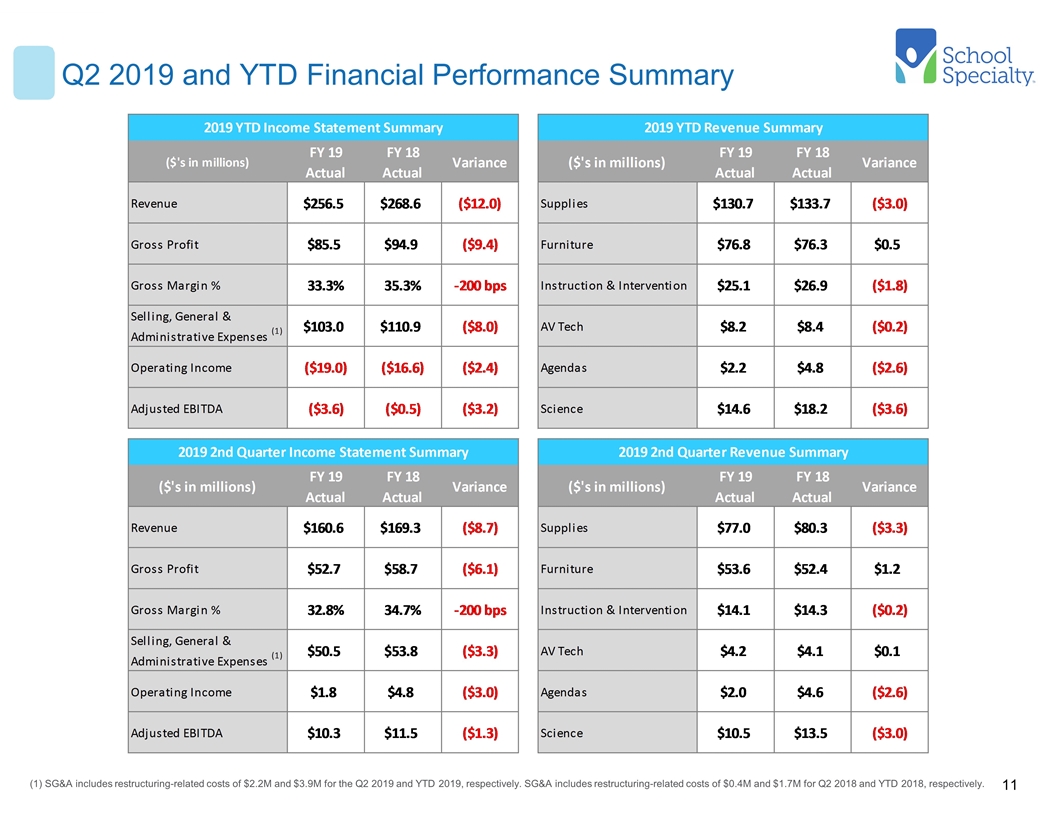

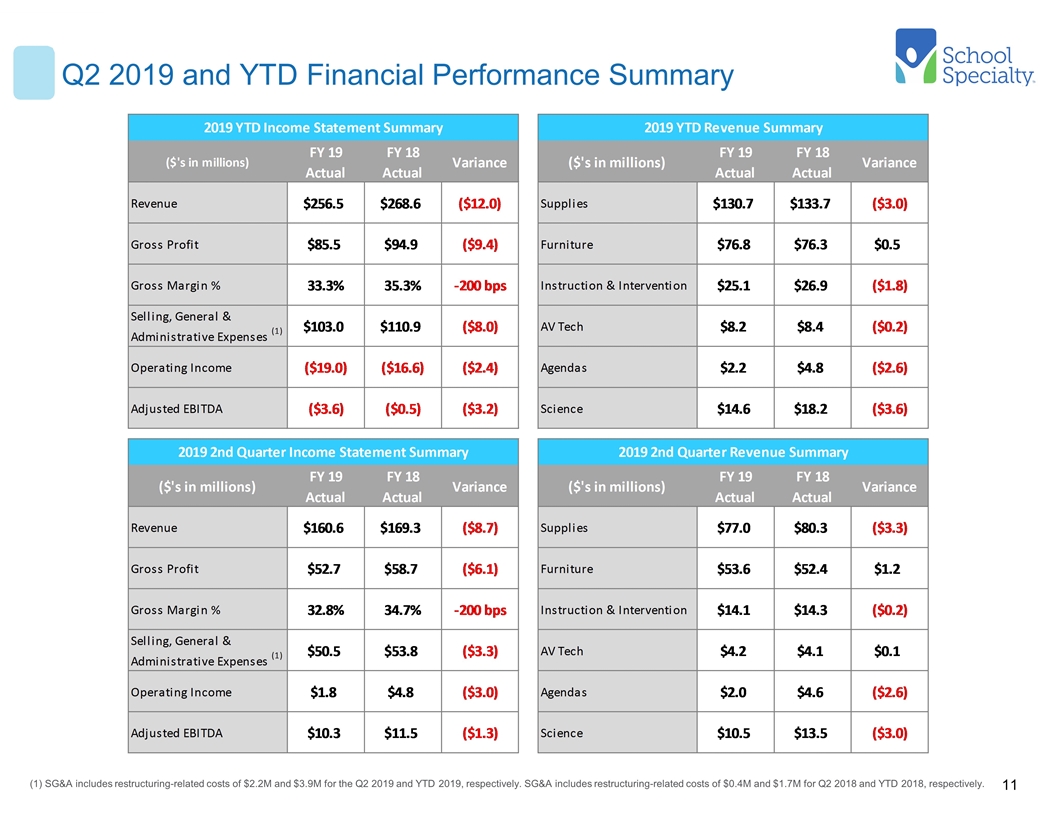

Q2 2019 and YTD Financial Performance Summary ($’s in millions) (1) SG&A includes restructuring-related costs of $2.2M and $3.9M for the Q2 2019 and YTD 2019, respectively. SG&A includes restructuring-related costs of $0.4M and $1.7M for Q2 2018 and YTD 2018, respectively.

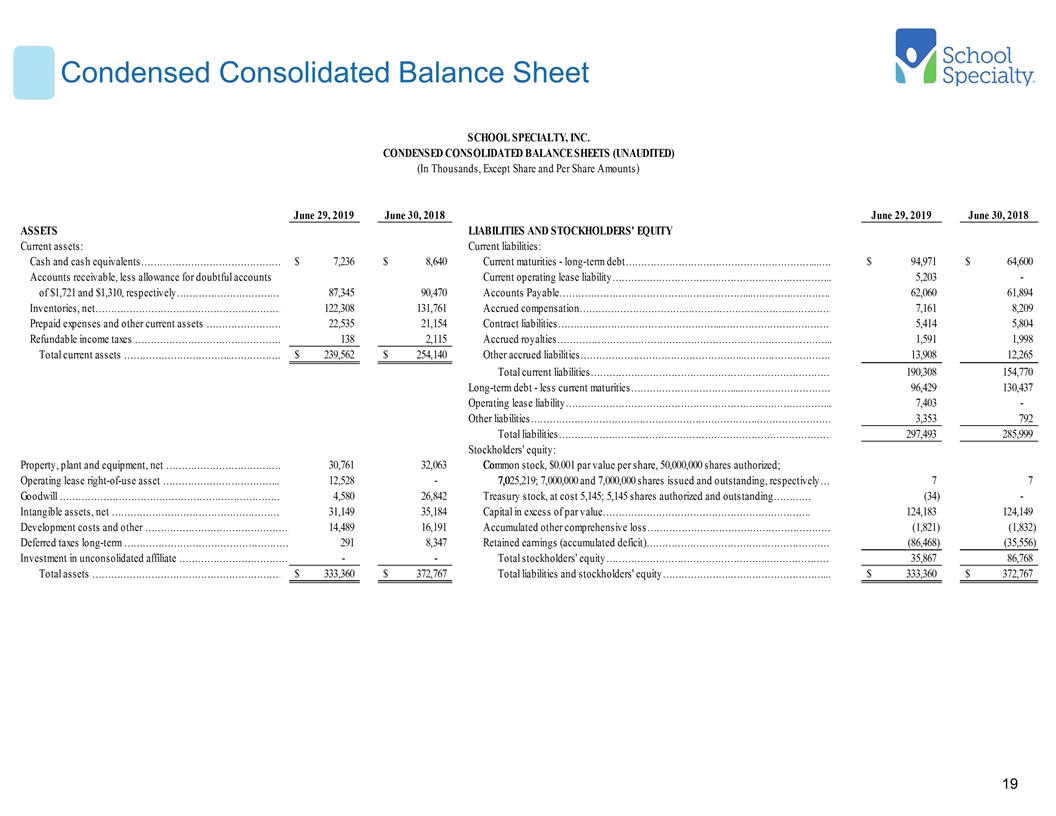

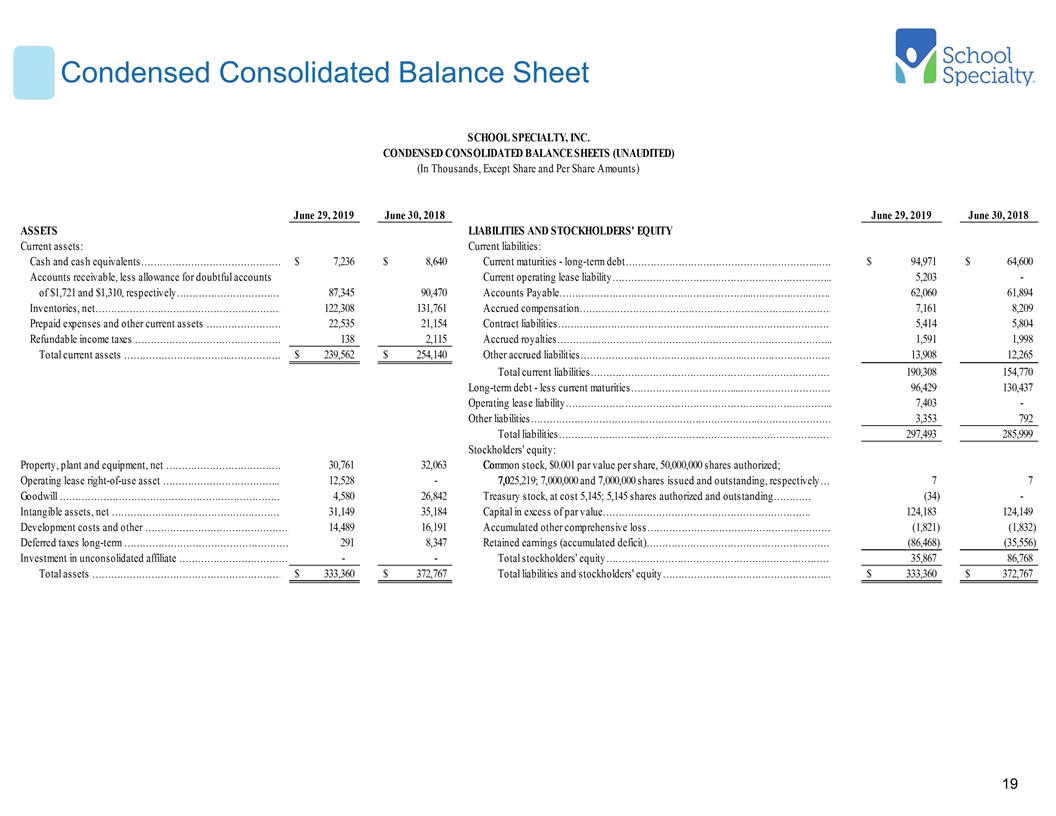

Working Capital Analytics / Other Cash Flow Drivers Working capital balances have returned to historic levels. Accounts Receivable down by $3.2M due to volume. The impact of PY FC issues on A/R balances contributed approximately $10.0M of incremental collections in 2019. Inventory decrease of $9.5M is related to a combination of lower volume and transition of Agenda production-related activities to a third party. Trailing-twelve-months capex of $12.0M at end of Q2 2019 is expected to continue to trend downward. Product development investment in line with plan; spending decrease vs. TTM FY18 Q2 is related to 2017/2018 spend in anticipation of 2019 FOSS California adoption. Trailing-twelve-month cash interest increased by $2.7M due to a combination of increases in average debt outstanding and higher borrowing costs associated with increases to both LIBOR and applicable margins. Note: Net Working Capital excludes cash, currently maturing long-term debt and current lease liabilities.

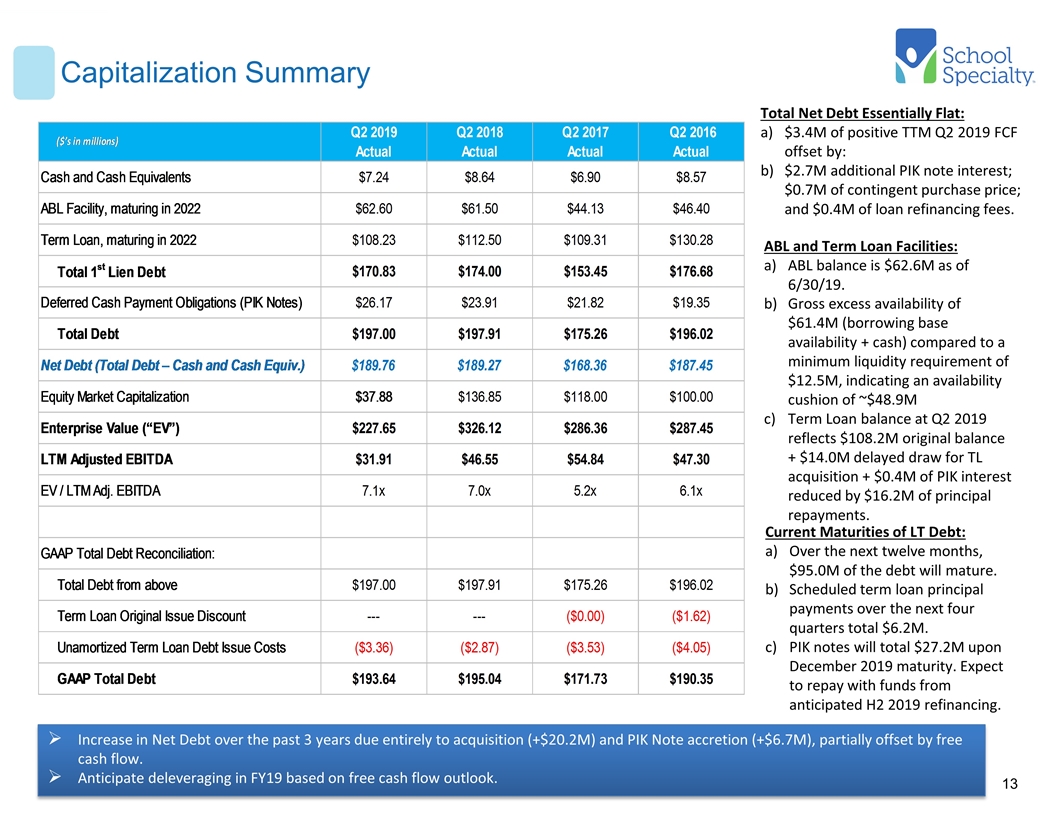

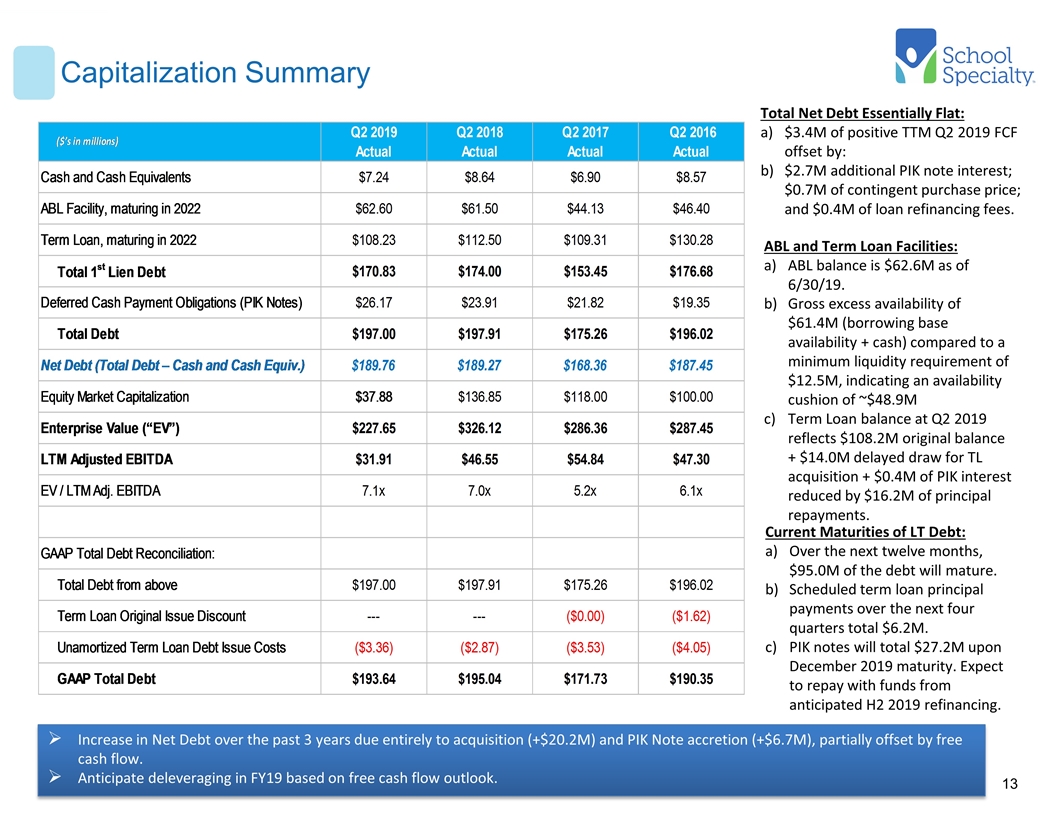

Capitalization Summary Increase in Net Debt over the past 3 years due entirely to acquisition (+$20.2M) and PIK Note accretion (+$6.7M), partially offset by free cash flow. Anticipate deleveraging in FY19 based on free cash flow outlook. Total Net Debt Essentially Flat: $3.4M of positive TTM Q2 2019 FCF offset by: $2.7M additional PIK note interest; $0.7M of contingent purchase price; and $0.4M of loan refinancing fees. ABL and Term Loan Facilities: ABL balance is $62.6M as of 6/30/19. Gross excess availability of $61.4M (borrowing base availability + cash) compared to a minimum liquidity requirement of $12.5M, indicating an availability cushion of ~$48.9M Term Loan balance at Q2 2019 reflects $108.2M original balance + $14.0M delayed draw for TL acquisition + $0.4M of PIK interest reduced by $16.2M of principal repayments. Current Maturities of LT Debt: Over the next twelve months, $95.0M of the debt will mature. Scheduled term loan principal payments over the next four quarters total $6.2M. PIK notes will total $27.2M upon December 2019 maturity. Expect to repay with funds from anticipated H2 2019 refinancing.

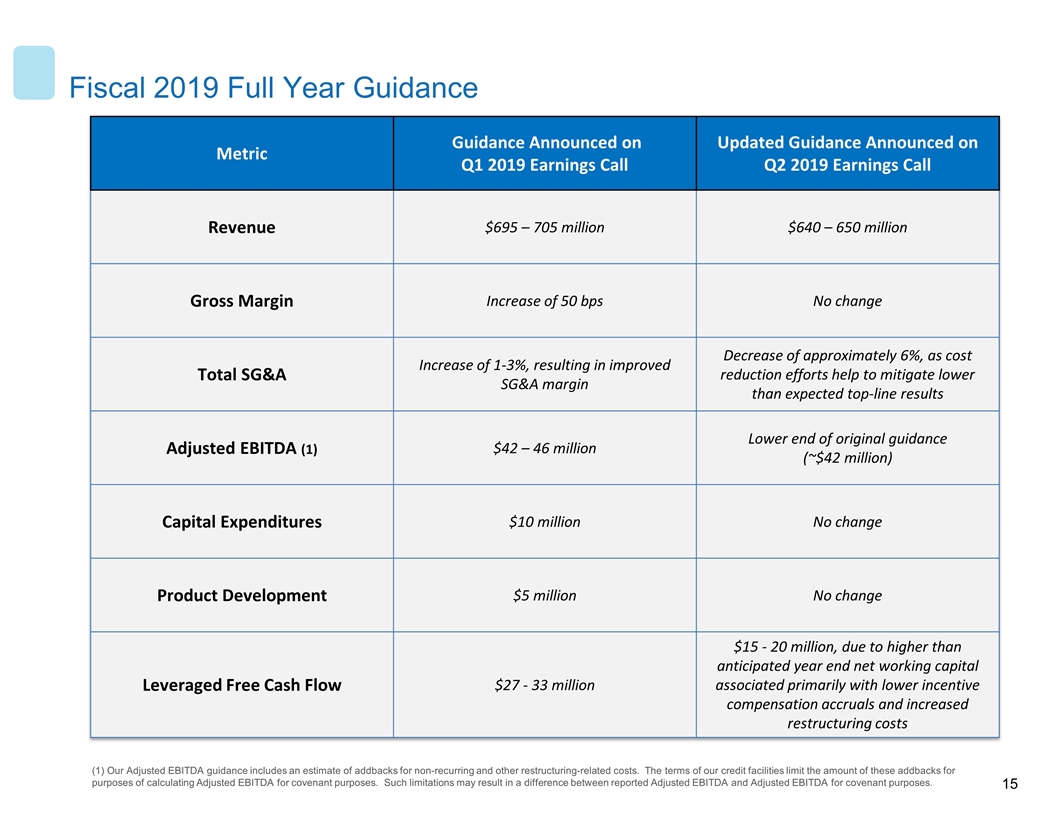

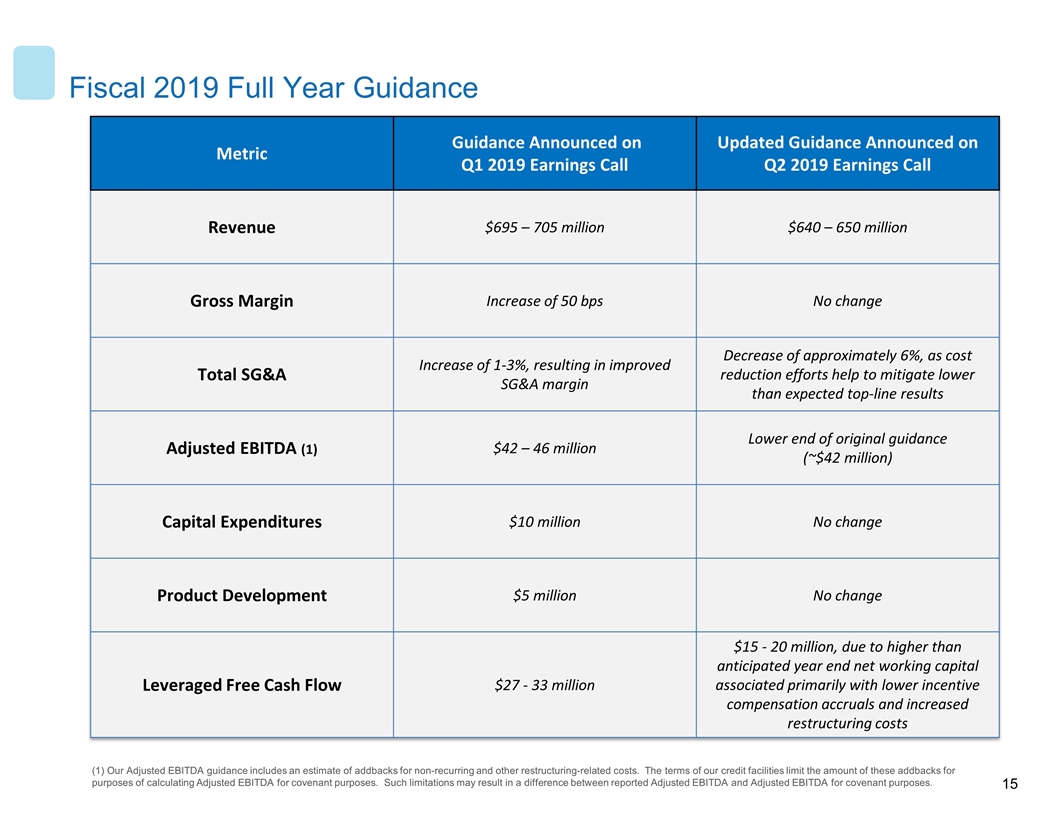

Guidance Update

Fiscal 2019 Full Year Guidance Metric Guidance Announced on Q1 2019 Earnings Call Updated Guidance Announced on Q2 2019 Earnings Call Revenue $695 – 705 million $640 – 650 million Gross Margin Increase of 50 bps No change Total SG&A Increase of 1-3%, resulting in improved SG&A margin Decrease of approximately 6%, as cost reduction efforts help to mitigate lower than expected top-line results Adjusted EBITDA (1) $42 – 46 million Lower end of original guidance (~$42 million) Capital Expenditures $10 million No change Product Development $5 million No change Leveraged Free Cash Flow $27 - 33 million $15 - 20 million, due to higher than anticipated year end net working capital associated primarily with lower incentive compensation accruals and increased restructuring costs (1) Our Adjusted EBITDA guidance includes an estimate of addbacks for non-recurring and other restructuring-related costs. The terms of our credit facilities limit the amount of these addbacks for purposes of calculating Adjusted EBITDA for covenant purposes. Such limitations may result in a difference between reported Adjusted EBITDA and Adjusted EBITDA for covenant purposes.

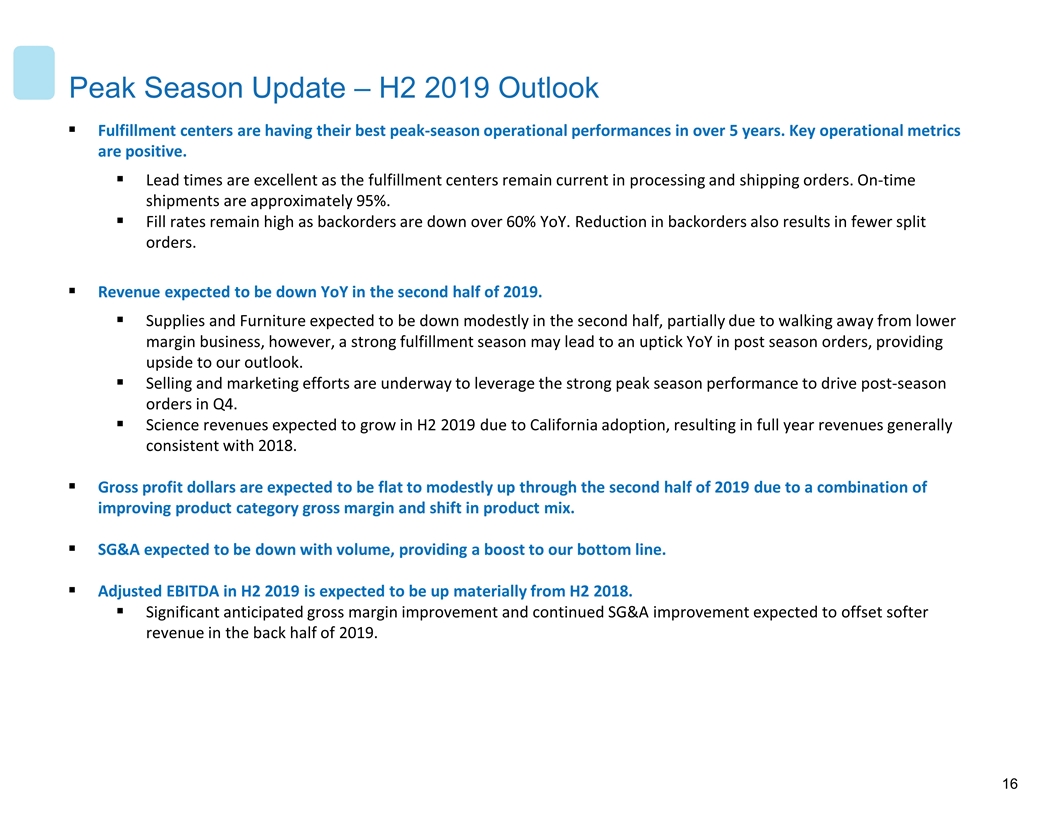

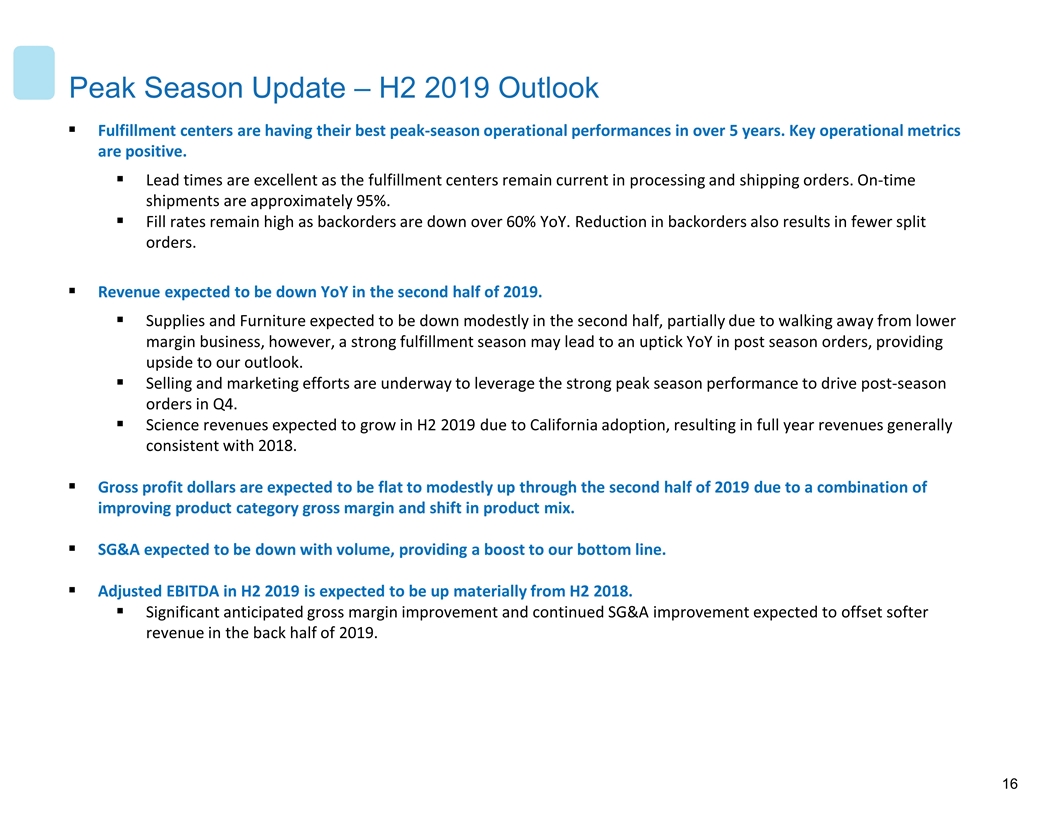

Peak Season Update – H2 2019 Outlook Fulfillment centers are having their best peak-season operational performances in over 5 years. Key operational metrics are positive. Lead times are excellent as the fulfillment centers remain current in processing and shipping orders. On-time shipments are approximately 95%. Fill rates remain high as backorders are down over 60% YoY. Reduction in backorders also results in fewer split orders. Revenue expected to be down YoY in the second half of 2019. Supplies and Furniture expected to be down modestly in the second half, partially due to walking away from lower margin business, however, a strong fulfillment season may lead to an uptick YoY in post season orders, providing upside to our outlook. Selling and marketing efforts are underway to leverage the strong peak season performance to drive post-season orders in Q4. Science revenues expected to grow in H2 2019 due to California adoption, resulting in full year revenues generally consistent with 2018. Gross profit dollars are expected to be flat to modestly up through the second half of 2019 due to a combination of improving product category gross margin and shift in product mix. SG&A expected to be down with volume, providing a boost to our bottom line. Adjusted EBITDA in H2 2019 is expected to be up materially from H2 2018. Significant anticipated gross margin improvement and continued SG&A improvement expected to offset softer revenue in the back half of 2019.

Appendix

Consolidated Statement of Operations

Condensed Consolidated Balance Sheet

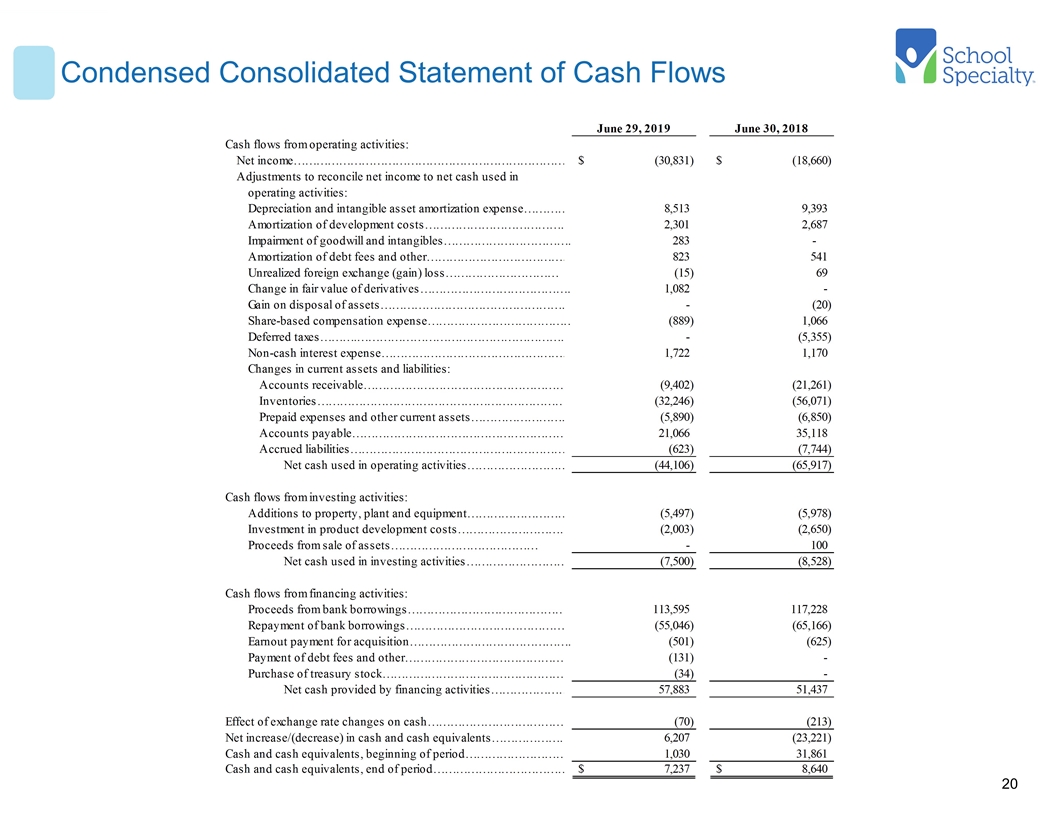

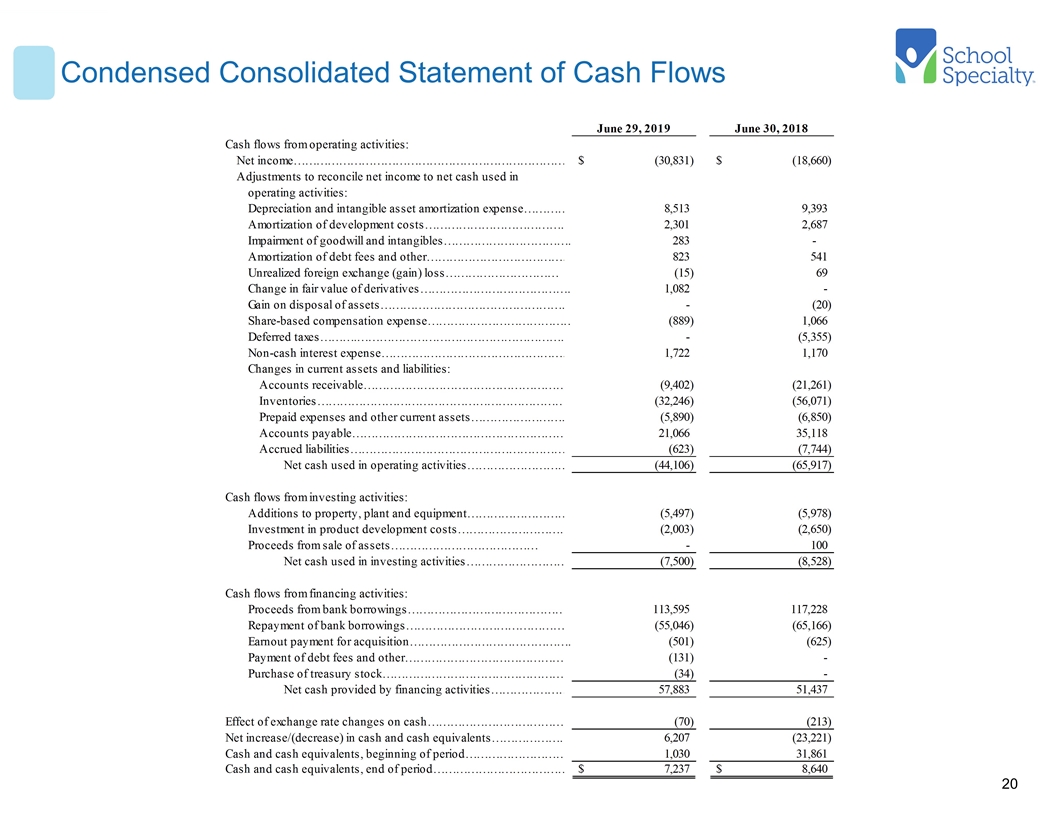

Condensed Consolidated Statement of Cash Flows

Q2 2019 SG&A Review SG&A Comments Q2 2019 SG&A down $3.3M or 6.1%, driven by favorable transportation rates and aggressive management of both fixed and variable personnel costs. Continued focus on managing SG&A expenses in Q2 2019 contributed to a decline in SG&A as a percentage of revenue. As a percentage of revenue, total Q2 2019 SG&A of 31.4% is down 40 bps from Q2 2018. Adjusting for D&A, stock-based compensation, FX (gain) loss, and restructuring-related expenses, all other operating SG&A decreased by 10.5%. Renegotiated freight contracts have resulted in YoY decreases in transportation costs in Q2 2019. We expect rest of year transportation costs to be favorable vs. PY. Catalog rationalization efforts continued with a decrease of $0.1M in Q2 2019; with a YTD increase of $0.4M, rationalization efforts have offset the majority of a $1.8M shift in catalog production between 2018 and 2019 with a decrease of $0.1M in Q2 2019; marketing spend transitioning to digital media. Reductions in incentive compensation are primarily attributable to H1 2019 performance. Company anticipates further cost reductions from process excellence initiatives, as well as greater efficiencies related to the completion of IT projects in process.

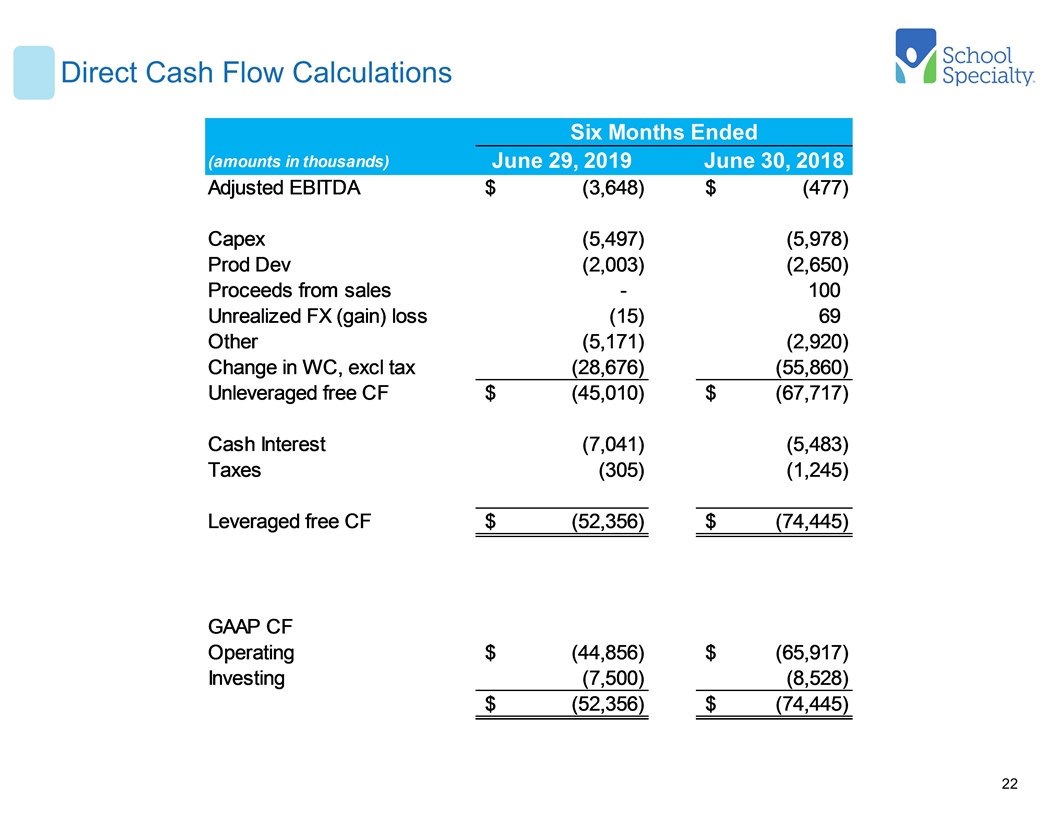

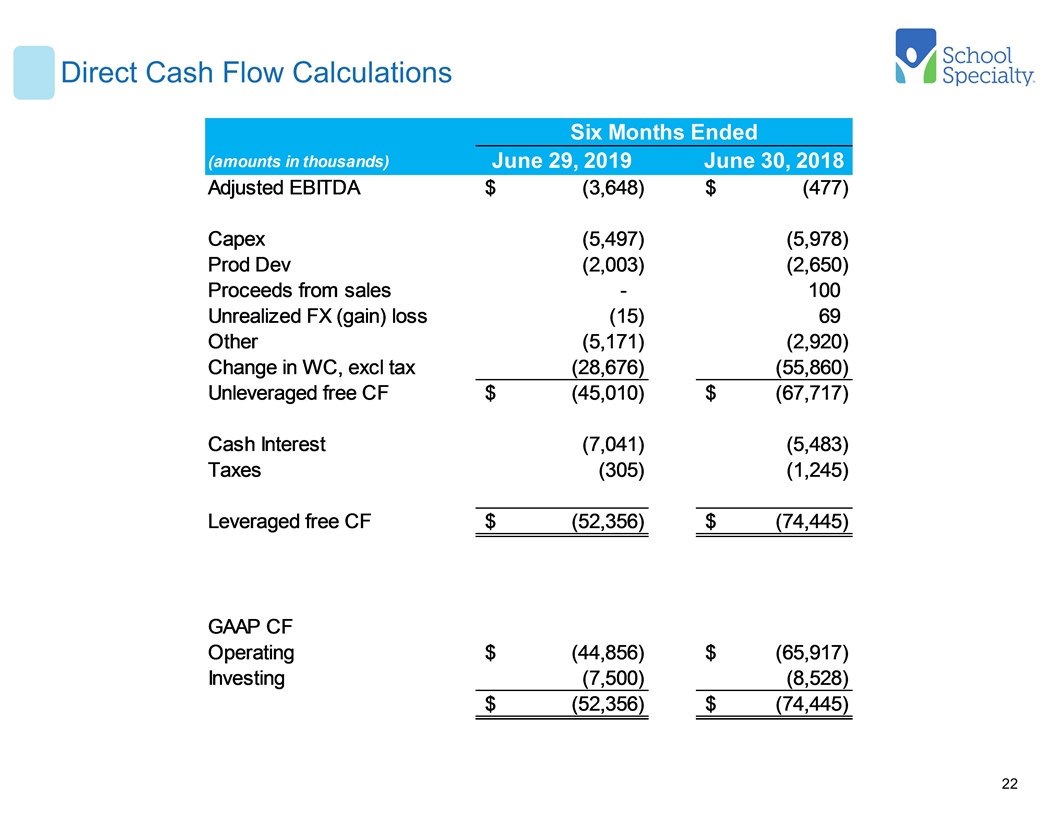

Direct Cash Flow Calculations

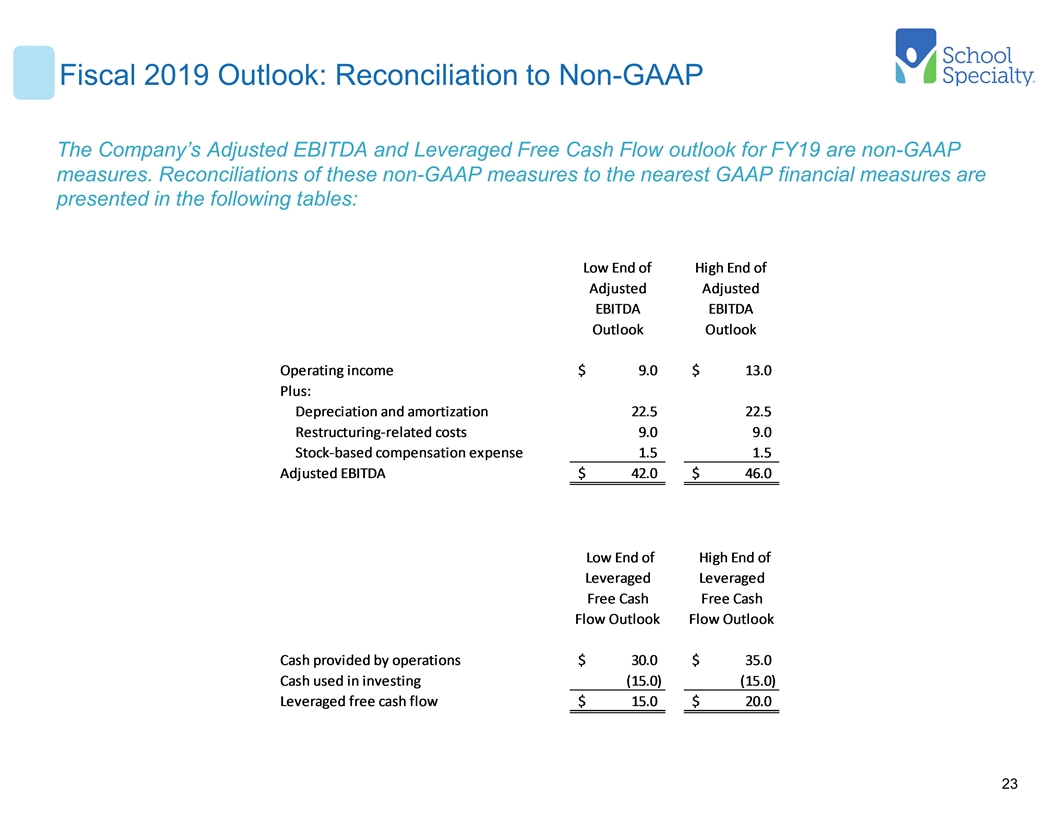

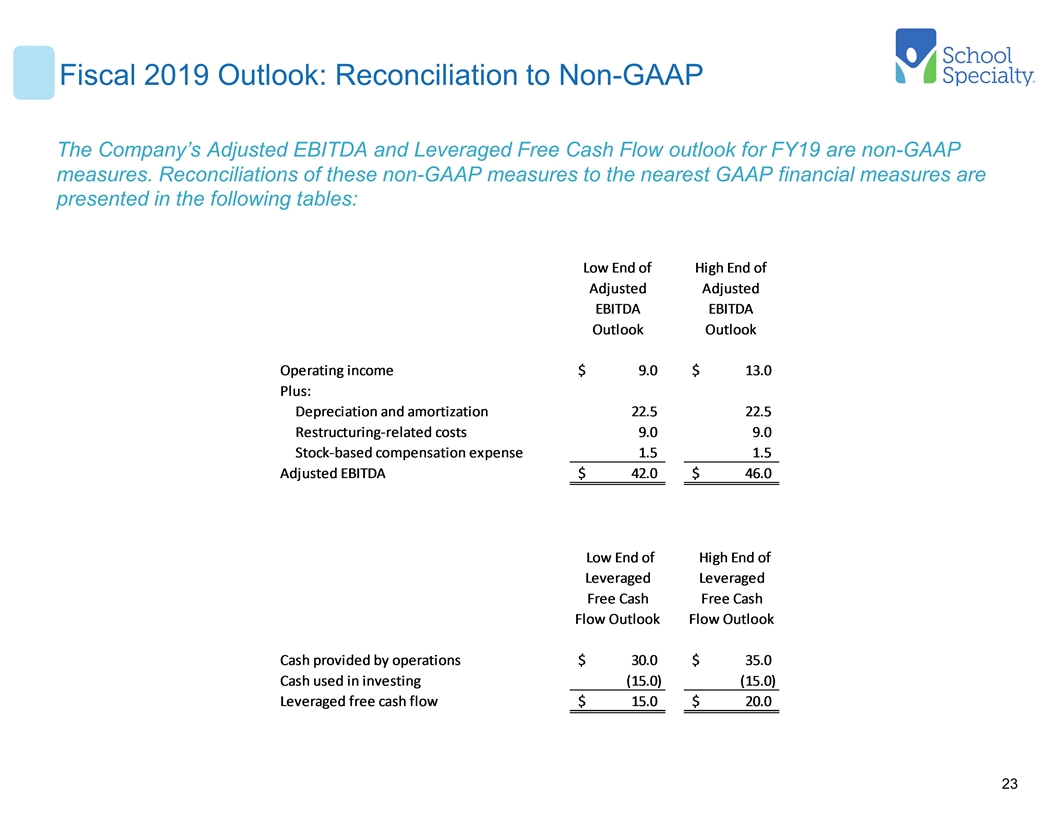

Fiscal 2019 Outlook: Reconciliation to Non-GAAP The Company’s Adjusted EBITDA and Leveraged Free Cash Flow outlook for FY19 are non-GAAP measures. Reconciliations of these non-GAAP measures to the nearest GAAP financial measures are presented in the following tables:

Non-GAAP Financial Information Non-GAAP Financial Information This update includes references to Adjusted EBITDA, Leveraged/Unleveraged Free Cash Flow, and Total Debt, each of which is a non-GAAP financial measure. Adjusted EBITDA represents net income (loss) adjusted for: provision for (benefit from) income taxes; restructuring costs; restructuring-related costs included in SG&A; purchase accounting deferred revenue adjustment; impairment charges; changes in fair value of derivatives; depreciation and amortization expense; amortization of development costs; net interest expense; and stock-based compensation. Unleveraged Free Cash Flow represents Adjusted EBITDA adjusted for: capital expenditures; product development expenditures; proceeds from sales; unrealized foreign exchange gains and losses; other; and changes in working capital. Leveraged Free Cash Flow is Unleveraged Free Cash Flow adjusted for Cash Interest and Cash Taxes. Total Debt represents the cash repayment obligations associated with the Company’s borrowings excluding unamortized term loan debt issuance costs and term loan original issue discount. The Company considers Adjusted EBITDA a relevant supplemental measure of its financial performance and Leveraged and Unleveraged Free Cash Flow relevant supplemental measures of liquidity. The Company believes these non-GAAP financial results provide useful supplemental information for investors regarding trends and performance of our ongoing operations and are useful for YOY comparisons of such results. We also use these non-GAAP financial measures in making operational and financial decisions and in establishing operational goals. The Company assesses its operating performance using both GAAP operating income and non-GAAP Adjusted EBITDA in order to better isolate the impact of certain, material items that may not be comparable between periods. The Company believes that Leveraged/Unleveraged Free Cash Flow provides a meaningful measure of its ability to generate cash and improve liquidity. In addition, the Company believes it provides investors a useful basis for assessing the Company’s ability to fund both its operating activities and reinvestments into the business, as well as service its debt, including debt repayments. The Company considers Total Debt a meaningful measure of the future cash obligations of the Company which is useful in assessing future liquidity needs. In summary, we believe that providing these non-GAAP financial measures to investors, as a supplement to GAAP financial measures, helps investors to (i) evaluate our operating and financial performance and future prospects, (ii) compare financial results across accounting periods, (iii) better understand the long-term performance of our core business, and (iv) evaluate trends in our business, all consistent with how management evaluates such performance and trends. Adjusted EBITDA does not represent, and should not be considered, an alternative to net income or operating income as determined by GAAP, and our calculation may not be comparable to similarly titled measures reported by other companies. Leveraged/Unleveraged Free Cash Flow does not represent, and should not be considered, an alternative to cash flow from operations. Total Debt should not be considered an alternative to Total Debt as determined under GAAP. A reconciliation of: (i) Adjusted EBITDA to GAAP net income (loss) for the three and six-months ended June 29, 2019 and June 30, 2018 and projected Fiscal 2019 Adjusted EBITDA to projected Fiscal 2019 operating income; (ii) Leveraged/Unleveraged Free Cash Flow to Adjusted EBITDA for the six-months ended June 29, 2019 and June 30, 2018 and projected Fiscal 2019 Leveraged Free Cash Flow to projected Fiscal 2019 Cash Provided by Operations less Cash Used in Investing; and (iii) Total Debt to GAAP Total Debt as of June 29, 2019, June 30, 2018, July 1, 2017 and June 25, 2016 is included in this Fiscal 2019 Q2 Investor Update dated August 12, 2019.