UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-00121

| Name of Registrant: | Vanguard Wellington Fund |

| Address of Registrant: | P.O. Box 2600 |

| | Valley Forge, PA 19482 |

| Name and address of agent for service: | John E. Schadl, Esquire |

| | P.O. Box 876 |

| | Valley Forge, PA 19482 |

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: November 30

Date of reporting period: December 1, 2023—November 30, 2024

Item 1: Reports to Shareholders.

TABLE OF CONTENTS

Vanguard U.S. Minimum Volatility ETF

ETF Shares (VFMV) CBOE BZX Exchange, Inc.

Annual Shareholder Report | November 30, 2024

This annual shareholder report contains important information about Vanguard U.S. Minimum Volatility ETF (the "Fund") for the period of December 1, 2023, to November 30, 2024. You can find additional information about the Fund at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature. You can also request this information by contacting us at 800-662-7447.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Share Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| ETF Shares | $15 | 0.13% |

|---|

How did the Fund perform during the reporting period?

For the 12 months ended November 30, 2024, the Fund underperformed its expense-free benchmark, the Russell 3000 Index.

U.S. economic growth hovered around 3% on a year-over-year basis for the period, quelling recession fears. Consumer price inflation trended lower, falling below 3% in July, and the Federal Reserve began to ease monetary policy with cuts to short-term interest rates in September and November. Against this positive macroeconomic backdrop, U.S. stocks posted very strong gains.

The Fund lagged its benchmark in seven of 11 industry sectors. Subpar stock selection in information technology, financials, and industrials hurt most. Strong selection in energy and health care, as well as an underweight to materials, which lagged the overall market, helped performance.

The Fund seeks to build a portfolio of stocks with lower volatility than the broad U.S. equity market. The Fund’s average volatility for the 12 months was nearly 20% less than that of its benchmark.

The absolute returns of the Fund and the market during the fiscal year were remarkable. The Fund’s benchmark returned far less during the past decade, which was a good one for stocks. As such, long-term shareholders should expect periods of lower performance.

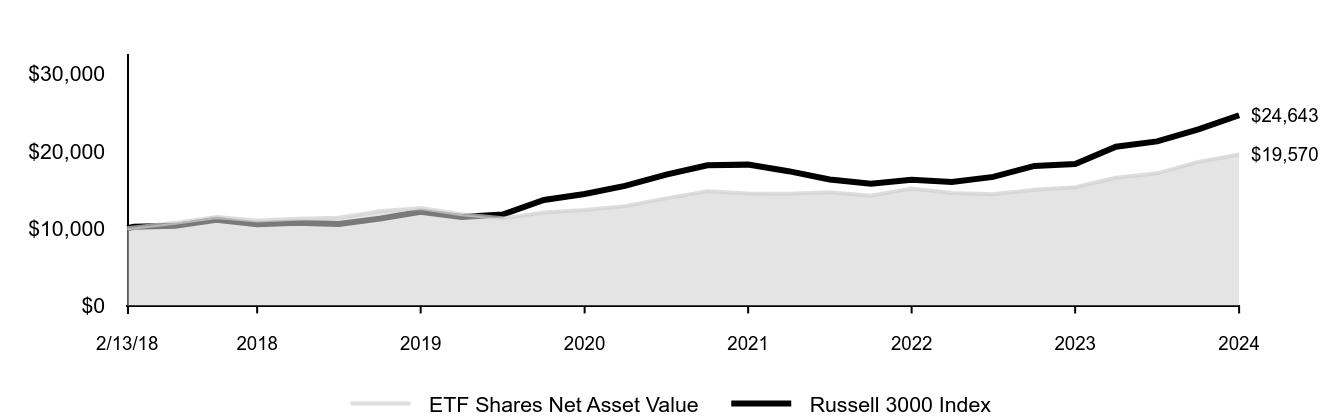

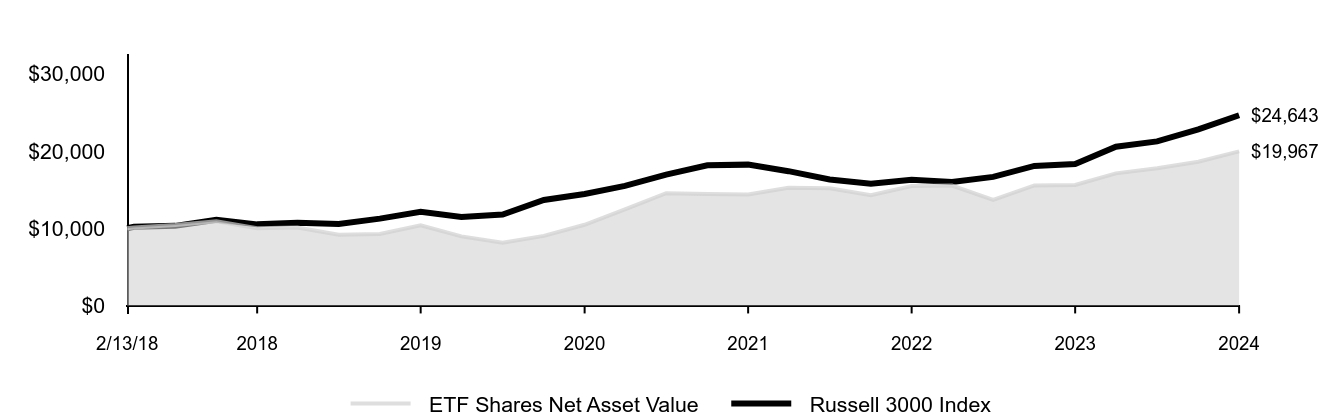

How did the Fund perform since inception?

Keep in mind that the Fund's past performance does not indicate how the Fund will perform in the future. Updated performance information is available on our website at vanguard.com/performance or by calling Vanguard toll-free at 800-662-7447. The graph and returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

Cumulative Performance: February 13, 2018, Through November 30, 2024

Initial Investment of $10,000

| ETF Shares Net Asset Value | Russell 3000 Index |

|---|

| 2/13/18 | $10,000 | $10,000 |

|---|

| 2/28/18 | $10,111 | $10,194 |

|---|

| 5/31/18 | $10,699 | $10,310 |

|---|

| 8/31/18 | $11,464 | $11,098 |

|---|

| 11/30/18 | $11,007 | $10,504 |

|---|

| 2/28/19 | $11,238 | $10,708 |

|---|

| 5/31/19 | $11,354 | $10,567 |

|---|

| 8/31/19 | $12,212 | $11,244 |

|---|

| 11/30/19 | $12,613 | $12,132 |

|---|

| 2/29/20 | $11,817 | $11,447 |

|---|

| 5/31/20 | $11,282 | $11,779 |

|---|

| 8/31/20 | $12,027 | $13,655 |

|---|

| 11/30/20 | $12,362 | $14,440 |

|---|

| 2/28/21 | $12,865 | $15,492 |

|---|

| 5/31/21 | $13,871 | $16,951 |

|---|

| 8/31/21 | $14,785 | $18,166 |

|---|

| 11/30/21 | $14,491 | $18,243 |

|---|

| 2/28/22 | $14,458 | $17,396 |

|---|

| 5/31/22 | $14,670 | $16,327 |

|---|

| 8/31/22 | $14,223 | $15,754 |

|---|

| 11/30/22 | $15,138 | $16,272 |

|---|

| 2/28/23 | $14,582 | $15,992 |

|---|

| 5/31/23 | $14,419 | $16,659 |

|---|

| 8/31/23 | $14,986 | $18,078 |

|---|

| 11/30/23 | $15,308 | $18,324 |

|---|

| 2/29/24 | $16,537 | $20,566 |

|---|

| 5/31/24 | $17,117 | $21,254 |

|---|

| 8/31/24 | $18,594 | $22,805 |

|---|

| 11/30/24 | $19,570 | $24,643 |

|---|

Average Annual Total Returns

| | 1 Year | 5 Years | Since Inception 2/13/18 |

|---|

| ETF Shares Net Asset Value | 27.84% | 9.18% | 10.39% |

|---|

| ETF Shares Market Price | 27.84% | 9.18% | 10.39% |

|---|

| Russell 3000 Index | 34.49% | 15.23% | 14.19% |

|---|

This table reflects the Fund's investments, including short-term investments, derivatives and other assets and liabilities.

Portfolio Composition % of Net Assets

(as of November 30, 2024)

| Basic Materials | 1.5% | |

| Consumer Discretionary | 11.8% | |

| Consumer Staples | 11.4% | |

| Energy | 4.6% | |

| Financials | 10.6% | |

| Health Care | 11.8% | |

| Industrials | 6.9% | |

| Real Estate | 1.4% | |

| Technology | 22.6% | |

| Telecommunications | 8.1% | |

| Utilities | 8.8% | |

| Other Assets and Liabilities—Net | 0.5% | |

Fund Statistics

(as of November 30, 2024)

| Fund Net Assets (in millions) | $153 |

|---|

| Number of Portfolio Holdings | 165 |

|---|

| Portfolio Turnover Rate | 39% |

|---|

| Total Investment Advisory Fees (in thousands) | $25 |

|---|

Where can I find additional information about the Fund?

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information is available at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature.

Connect with Vanguard® • vanguard.com

Fund Information • 800-662-7447

Direct Investor Account Services • 800-662-2739

Text Telephone for People Who Are Deaf or Hard of Hearing •

800-749-7273

© 2024 The Vanguard Group, Inc.

All rights reserved.

Vanguard Marketing Corporation, Distributor.

AR4419

Vanguard U.S. Momentum Factor ETF

ETF Shares (VFMO) CBOE BZX Exchange, Inc.

Annual Shareholder Report | November 30, 2024

This annual shareholder report contains important information about Vanguard U.S. Momentum Factor ETF (the "Fund") for the period of December 1, 2023, to November 30, 2024. You can find additional information about the Fund at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature. You can also request this information by contacting us at 800-662-7447.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Share Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| ETF Shares | $16 | 0.13% |

|---|

How did the Fund perform during the reporting period?

For the 12 months ended November 30, 2024, the Fund outperformed its expense-free benchmark, the Russell 3000 Index.

U.S. economic growth hovered around 3% on a year-over-year basis for the period, quelling recession fears. Consumer price inflation trended lower, falling below 3% in July, and the Federal Reserve began to ease monetary policy with cuts to short-term interest rates in September and November. Against this positive macroeconomic backdrop, U.S. stocks posted very strong gains.

The Fund outpaced its benchmark in eight of 11 industry sectors. Stock selection in industrials, information technology, and health care contributed most. An overweight to energy, which lagged the overall market, detracted most.

The Fund seeks long-term capital appreciation by investing in stocks with relatively strong recent performance.

The returns of the Fund and the market during the fiscal year were remarkable. The Fund’s benchmark returned far less during the past decade, which was a good one for stocks. As such, long-term shareholders should expect periods of lower performance.

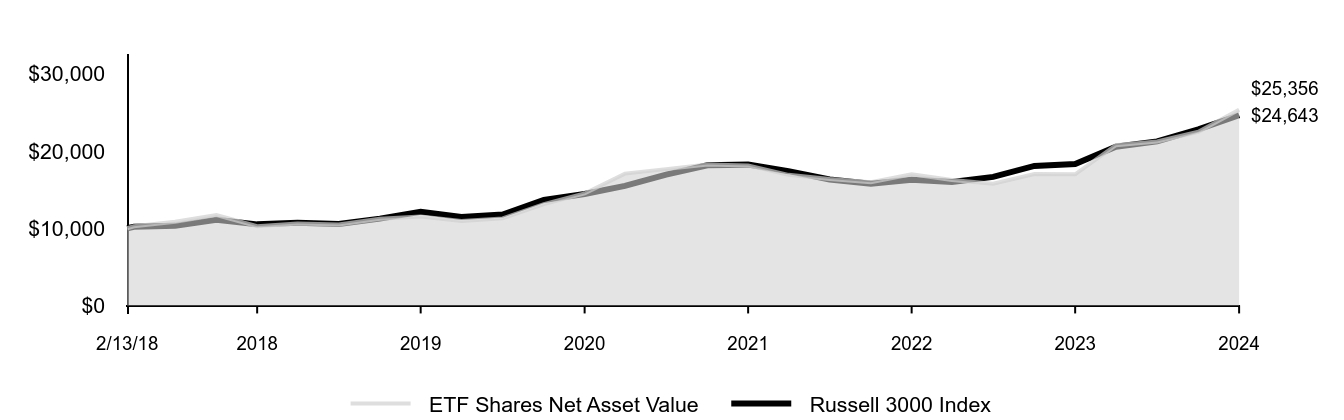

How did the Fund perform since inception?

Keep in mind that the Fund's past performance does not indicate how the Fund will perform in the future. Updated performance information is available on our website at vanguard.com/performance or by calling Vanguard toll-free at 800-662-7447. The graph and returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

Cumulative Performance: February 13, 2018, Through November 30, 2024

Initial Investment of $10,000

| ETF Shares Net Asset Value | Russell 3000 Index |

|---|

| 2/13/18 | $10,000 | $10,000 |

|---|

| 2/28/18 | $10,252 | $10,194 |

|---|

| 5/31/18 | $10,835 | $10,310 |

|---|

| 8/31/18 | $11,720 | $11,098 |

|---|

| 11/30/18 | $10,267 | $10,504 |

|---|

| 2/28/19 | $10,616 | $10,708 |

|---|

| 5/31/19 | $10,490 | $10,567 |

|---|

| 8/31/19 | $11,222 | $11,244 |

|---|

| 11/30/19 | $11,525 | $12,132 |

|---|

| 2/29/20 | $10,936 | $11,447 |

|---|

| 5/31/20 | $11,277 | $11,779 |

|---|

| 8/31/20 | $13,121 | $13,655 |

|---|

| 11/30/20 | $14,511 | $14,440 |

|---|

| 2/28/21 | $17,083 | $15,492 |

|---|

| 5/31/21 | $17,661 | $16,951 |

|---|

| 8/31/21 | $18,259 | $18,166 |

|---|

| 11/30/21 | $18,140 | $18,243 |

|---|

| 2/28/22 | $16,918 | $17,396 |

|---|

| 5/31/22 | $16,377 | $16,327 |

|---|

| 8/31/22 | $15,959 | $15,754 |

|---|

| 11/30/22 | $17,002 | $16,272 |

|---|

| 2/28/23 | $16,245 | $15,992 |

|---|

| 5/31/23 | $15,761 | $16,659 |

|---|

| 8/31/23 | $17,032 | $18,078 |

|---|

| 11/30/23 | $16,991 | $18,324 |

|---|

| 2/29/24 | $20,758 | $20,566 |

|---|

| 5/31/24 | $21,238 | $21,254 |

|---|

| 8/31/24 | $22,496 | $22,805 |

|---|

| 11/30/24 | $25,356 | $24,643 |

|---|

Average Annual Total Returns

| | 1 Year | 5 Years | Since Inception 2/13/18 |

|---|

| ETF Shares Net Asset Value | 49.23% | 17.08% | 14.68% |

|---|

| ETF Shares Market Price | 49.14% | 17.08% | 14.67% |

|---|

| Russell 3000 Index | 34.49% | 15.23% | 14.19% |

|---|

This table reflects the Fund's investments, including short-term investments, derivatives and other assets and liabilities.

Portfolio Composition % of Net Assets

(as of November 30, 2024)

| Basic Materials | 3.0% | |

| Consumer Discretionary | 12.5% | |

| Consumer Staples | 4.0% | |

| Energy | 3.5% | |

| Financials | 21.2% | |

| Health Care | 17.4% | |

| Industrials | 21.0% | |

| Real Estate | 1.0% | |

| Technology | 11.9% | |

| Telecommunications | 3.7% | |

| Utilities | 0.5% | |

| Other Assets and Liabilities—Net | 0.3% | |

Fund Statistics

(as of November 30, 2024)

| Fund Net Assets (in millions) | $919 |

|---|

| Number of Portfolio Holdings | 707 |

|---|

| Portfolio Turnover Rate | 77% |

|---|

| Total Investment Advisory Fees (in thousands) | $151 |

|---|

Where can I find additional information about the Fund?

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information is available at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature.

Connect with Vanguard® • vanguard.com

Fund Information • 800-662-7447

Direct Investor Account Services • 800-662-2739

Text Telephone for People Who Are Deaf or Hard of Hearing •

800-749-7273

© 2024 The Vanguard Group, Inc.

All rights reserved.

Vanguard Marketing Corporation, Distributor.

AR4418

Vanguard U.S. Multifactor Fund

Annual Shareholder Report | November 30, 2024

This annual shareholder report contains important information about Vanguard U.S. Multifactor Fund (the "Fund") for the period of December 1, 2023, to November 30, 2024. You can find additional information about the Fund at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature. You can also request this information by contacting us at 800-662-7447. The report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Share Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Admiral Shares | $21 | 0.18% |

|---|

How did the Fund perform during the reporting period?

For the 12 months ended November 30, 2024, the Fund outperformed its benchmark, the Russell 3000 Index.

U.S. economic growth hovered around 3% on a year-over-year-basis for the period, quelling recession fears. Consumer price inflation trended lower, falling below 3% in July, and the Federal Reserve began to ease monetary policy with cuts to short-term interest rates in September and November. Against this positive macroeconomic backdrop, U.S. stocks posted very strong gains.

Six of the Fund’s 11 industry sectors positively impacted relative performance. Financials contributed the most, owing to both strong selection and an overweight allocation. Selection in industrials, consumer discretionary, and consumer staples also boosted results.

Energy detracted most from relative performance, due to both selection and an overweight allocation. Information technology also lagged, owing to both selection and an underweight allocation.

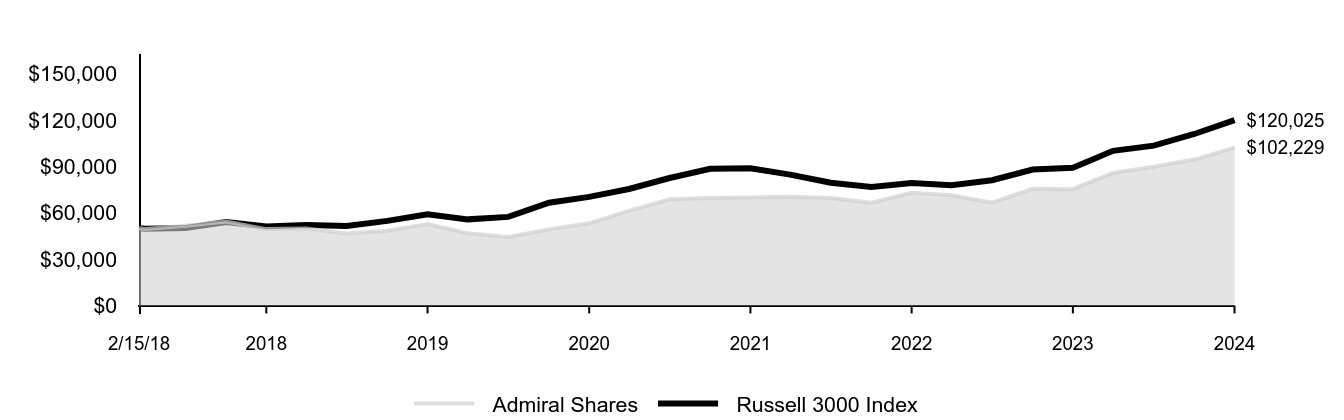

How did the Fund perform since inception?

Keep in mind that the Fund's past performance does not indicate how the Fund will perform in the future. Updated performance information is available on our website at vanguard.com/performance or by calling Vanguard toll-free at 800-662-7447. The graph and returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

Cumulative Performance: February 15, 2018, Through November 30, 2024

Initial Investment of $50,000

| Admiral Shares | Russell 3000 Index |

|---|

| 2/15/18 | $50,000 | $50,000 |

|---|

| 2/28/18 | $49,460 | $49,649 |

|---|

| 5/31/18 | $51,640 | $50,216 |

|---|

| 8/31/18 | $54,358 | $54,056 |

|---|

| 11/30/18 | $49,446 | $51,163 |

|---|

| 2/28/19 | $49,899 | $52,156 |

|---|

| 5/31/19 | $46,619 | $51,469 |

|---|

| 8/31/19 | $48,352 | $54,764 |

|---|

| 11/30/19 | $52,681 | $59,088 |

|---|

| 2/29/20 | $46,697 | $55,756 |

|---|

| 5/31/20 | $44,362 | $57,370 |

|---|

| 8/31/20 | $49,278 | $66,506 |

|---|

| 11/30/20 | $53,192 | $70,329 |

|---|

| 2/28/21 | $61,252 | $75,453 |

|---|

| 5/31/21 | $68,804 | $82,562 |

|---|

| 8/31/21 | $69,526 | $88,481 |

|---|

| 11/30/21 | $69,892 | $88,853 |

|---|

| 2/28/22 | $70,336 | $84,729 |

|---|

| 5/31/22 | $69,582 | $79,520 |

|---|

| 8/31/22 | $66,529 | $76,729 |

|---|

| 11/30/22 | $72,989 | $79,255 |

|---|

| 2/28/23 | $71,358 | $77,889 |

|---|

| 5/31/23 | $66,606 | $81,138 |

|---|

| 8/31/23 | $75,556 | $88,052 |

|---|

| 11/30/23 | $75,315 | $89,248 |

|---|

| 2/29/24 | $85,873 | $100,167 |

|---|

| 5/31/24 | $89,851 | $103,518 |

|---|

| 8/31/24 | $94,482 | $111,073 |

|---|

| 11/30/24 | $102,229 | $120,025 |

|---|

Average Annual Total Returns

| | 1 Year | 5 Years | Since Inception 2/15/18 |

|---|

| Admiral Shares | 35.74% | 14.18% | 11.11% |

|---|

| Russell 3000 Index | 34.49% | 15.23% | 13.77% |

|---|

This table reflects the Fund's investments, including short-term investments, derivatives and other assets and liabilities.

Portfolio Composition % of Net Assets

(as of November 30, 2024)

| Basic Materials | 2.6% | |

| Consumer Discretionary | 17.1% | |

| Consumer Staples | 8.0% | |

| Energy | 5.9% | |

| Financials | 26.6% | |

| Health Care | 10.0% | |

| Industrials | 17.1% | |

| Real Estate | 0.4% | |

| Technology | 8.5% | |

| Telecommunications | 3.0% | |

| Utilities | 0.0% | |

| Other Assets and Liabilities—Net | 0.8% | |

Fund Statistics

(as of November 30, 2024)

| Fund Net Assets (in millions) | $169 |

|---|

| Number of Portfolio Holdings | 572 |

|---|

| Portfolio Turnover Rate | 56% |

|---|

| Total Investment Advisory Fees (in thousands) | $25 |

|---|

How has the Fund changed?

The Fund added as a principal risk "management of certain similar funds."

This is a summary of certain changes to the Fund since November 30, 2023. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by March 31, 2025 at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature or upon request at 800-662-7447.

Where can I find additional information about the Fund?

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information is available at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature.

Connect with Vanguard® • vanguard.com

Fund Information • 800-662-7447

Direct Investor Account Services • 800-662-2739

Text Telephone for People Who Are Deaf or Hard of Hearing •

800-749-7273

© 2024 The Vanguard Group, Inc.

All rights reserved.

Vanguard Marketing Corporation, Distributor.

AR516

Vanguard U.S. Quality Factor ETF

ETF Shares (VFQY) CBOE BZX Exchange, Inc.

Annual Shareholder Report | November 30, 2024

This annual shareholder report contains important information about Vanguard U.S. Quality Factor ETF (the "Fund") for the period of December 1, 2023, to November 30, 2024. You can find additional information about the Fund at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature. You can also request this information by contacting us at 800-662-7447.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Share Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| ETF Shares | $15 | 0.13% |

|---|

How did the Fund perform during the reporting period?

For the 12 months ended November 30, 2024, the Fund underperformed its benchmark, the Russell 3000 Index.

U.S. economic growth hovered around 3% on a year-over-year basis for the period, quelling recession fears. Consumer price inflation trended lower, falling below 3% in July, and the Federal Reserve began to ease monetary policy with cuts to short-term interest rates in September and November. Against this positive macroeconomic backdrop, U.S. stocks posted very strong gains.

The Fund seeks to provide long-term capital appreciation by investing in stocks with strong operation, earning, and balance sheet quality, as determined by the advisor.

Only five of the 11 industry sectors contributed to relative performance. The greatest detractors included stock selection in the information technology, consumer discretionary, and consumer staples sectors. An overweight allocation to consumer staples and an underweight to communication services also detracted. The greatest contributor was selection among financial stocks.

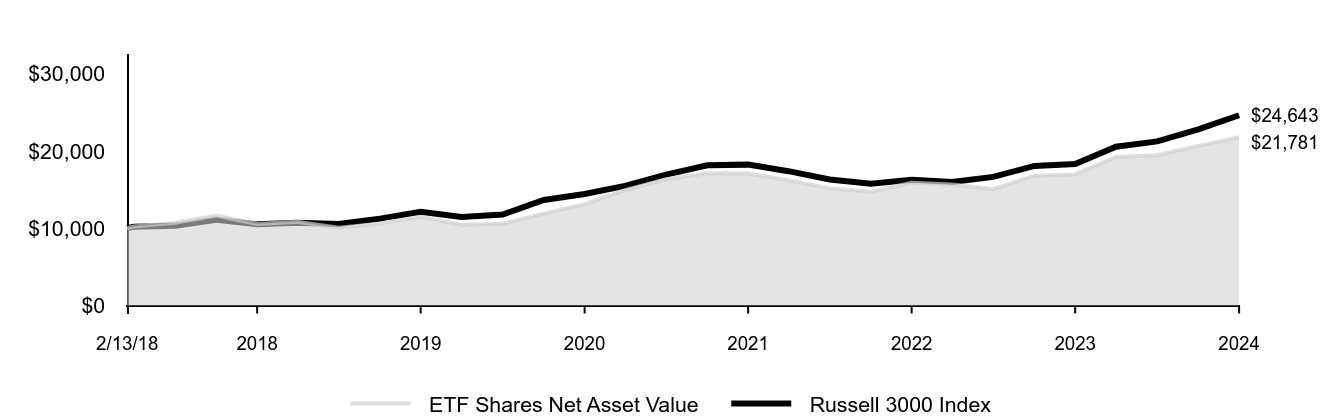

How did the Fund perform since inception?

Keep in mind that the Fund's past performance does not indicate how the Fund will perform in the future. Updated performance information is available on our website at vanguard.com/performance or by calling Vanguard toll-free at 800-662-7447. The graph and returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

Cumulative Performance: February 13, 2018, Through November 30, 2024

Initial Investment of $10,000

| ETF Shares Net Asset Value | Russell 3000 Index |

|---|

| 2/13/18 | $10,000 | $10,000 |

|---|

| 2/28/18 | $10,227 | $10,194 |

|---|

| 5/31/18 | $10,717 | $10,310 |

|---|

| 8/31/18 | $11,647 | $11,098 |

|---|

| 11/30/18 | $10,552 | $10,504 |

|---|

| 2/28/19 | $10,850 | $10,708 |

|---|

| 5/31/19 | $10,080 | $10,567 |

|---|

| 8/31/19 | $10,598 | $11,244 |

|---|

| 11/30/19 | $11,475 | $12,132 |

|---|

| 2/29/20 | $10,445 | $11,447 |

|---|

| 5/31/20 | $10,574 | $11,779 |

|---|

| 8/31/20 | $11,899 | $13,655 |

|---|

| 11/30/20 | $13,115 | $14,440 |

|---|

| 2/28/21 | $14,921 | $15,492 |

|---|

| 5/31/21 | $16,358 | $16,951 |

|---|

| 8/31/21 | $17,134 | $18,166 |

|---|

| 11/30/21 | $17,105 | $18,243 |

|---|

| 2/28/22 | $16,209 | $17,396 |

|---|

| 5/31/22 | $15,166 | $16,327 |

|---|

| 8/31/22 | $14,731 | $15,754 |

|---|

| 11/30/22 | $15,883 | $16,272 |

|---|

| 2/28/23 | $15,675 | $15,992 |

|---|

| 5/31/23 | $15,064 | $16,659 |

|---|

| 8/31/23 | $16,807 | $18,078 |

|---|

| 11/30/23 | $16,970 | $18,324 |

|---|

| 2/29/24 | $19,226 | $20,566 |

|---|

| 5/31/24 | $19,453 | $21,254 |

|---|

| 8/31/24 | $20,671 | $22,805 |

|---|

| 11/30/24 | $21,781 | $24,643 |

|---|

Average Annual Total Returns

| | 1 Year | 5 Years | Since Inception 2/13/18 |

|---|

| ETF Shares Net Asset Value | 28.35% | 13.67% | 12.14% |

|---|

| ETF Shares Market Price | 28.35% | 13.68% | 12.15% |

|---|

| Russell 3000 Index | 34.49% | 15.23% | 14.19% |

|---|

This table reflects the Fund's investments, including short-term investments, derivatives and other assets and liabilities.

Portfolio Composition % of Net Assets

(as of November 30, 2024)

| Basic Materials | 3.2% | |

| Consumer Discretionary | 22.2% | |

| Consumer Staples | 8.2% | |

| Energy | 3.3% | |

| Financials | 13.1% | |

| Health Care | 9.9% | |

| Industrials | 22.1% | |

| Technology | 17.1% | |

| Telecommunications | 0.6% | |

| Other Assets and Liabilities—Net | 0.3% | |

Fund Statistics

(as of November 30, 2024)

| Fund Net Assets (in millions) | $438 |

|---|

| Number of Portfolio Holdings | 385 |

|---|

| Portfolio Turnover Rate | 44% |

|---|

| Total Investment Advisory Fees (in thousands) | $94 |

|---|

Where can I find additional information about the Fund?

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information is available at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature.

Connect with Vanguard® • vanguard.com

Fund Information • 800-662-7447

Direct Investor Account Services • 800-662-2739

Text Telephone for People Who Are Deaf or Hard of Hearing •

800-749-7273

© 2024 The Vanguard Group, Inc.

All rights reserved.

Vanguard Marketing Corporation, Distributor.

AR4417

Vanguard U.S. Value Factor ETF

ETF Shares (VFVA) CBOE BZX Exchange, Inc.

Annual Shareholder Report | November 30, 2024

This annual shareholder report contains important information about Vanguard U.S. Value Factor ETF (the "Fund") for the period of December 1, 2023, to November 30, 2024. You can find additional information about the Fund at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature. You can also request this information by contacting us at 800-662-7447.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Share Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| ETF Shares | $15 | 0.13% |

|---|

How did the Fund perform during the reporting period?

For the 12 months ended November 30, 2024, the Fund underperformed its benchmark, the Russell 3000 Index.

U.S. economic growth hovered around 3% on a year-over-year basis for the period, quelling recession fears. Consumer price inflation trended lower, falling below 3% in July, and the Federal Reserve began to ease monetary policy with cuts to short-term interest rates in September and November. Against this positive macroeconomic backdrop, U.S. stocks posted very strong gains.

In recent years, value stocks have underperformed their growth counterparts. This period was no exception. Seven of 11 industry sectors detracted from relative results.

Energy—particularly stock selection and, to a lesser extent, an overweight position in the sector—was the portfolio’s greatest detractor. A combination of stock selection and an underweight position in information technology was another large detractor. Materials and communication services also lagged. By far, the greatest overall contributor was financials, due to a combination of stock selection and allocation decisions.

How did the Fund perform since inception?

Keep in mind that the Fund's past performance does not indicate how the Fund will perform in the future. Updated performance information is available on our website at vanguard.com/performance or by calling Vanguard toll-free at 800-662-7447. The graph and returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

Cumulative Performance: February 13, 2018, Through November 30, 2024

Initial Investment of $10,000

| ETF Shares Net Asset Value | Russell 3000 Index |

|---|

| 2/13/18 | $10,000 | $10,000 |

|---|

| 2/28/18 | $10,109 | $10,194 |

|---|

| 5/31/18 | $10,412 | $10,310 |

|---|

| 8/31/18 | $10,897 | $11,098 |

|---|

| 11/30/18 | $9,992 | $10,504 |

|---|

| 2/28/19 | $10,097 | $10,708 |

|---|

| 5/31/19 | $9,165 | $10,567 |

|---|

| 8/31/19 | $9,268 | $11,244 |

|---|

| 11/30/19 | $10,375 | $12,132 |

|---|

| 2/29/20 | $8,948 | $11,447 |

|---|

| 5/31/20 | $8,109 | $11,779 |

|---|

| 8/31/20 | $9,009 | $13,655 |

|---|

| 11/30/20 | $10,448 | $14,440 |

|---|

| 2/28/21 | $12,445 | $15,492 |

|---|

| 5/31/21 | $14,545 | $16,951 |

|---|

| 8/31/21 | $14,432 | $18,166 |

|---|

| 11/30/21 | $14,367 | $18,243 |

|---|

| 2/28/22 | $15,235 | $17,396 |

|---|

| 5/31/22 | $15,191 | $16,327 |

|---|

| 8/31/22 | $14,266 | $15,754 |

|---|

| 11/30/22 | $15,464 | $16,272 |

|---|

| 2/28/23 | $15,534 | $15,992 |

|---|

| 5/31/23 | $13,679 | $16,659 |

|---|

| 8/31/23 | $15,554 | $18,078 |

|---|

| 11/30/23 | $15,614 | $18,324 |

|---|

| 2/29/24 | $17,110 | $20,566 |

|---|

| 5/31/24 | $17,781 | $21,254 |

|---|

| 8/31/24 | $18,619 | $22,805 |

|---|

| 11/30/24 | $19,967 | $24,643 |

|---|

Average Annual Total Returns

| | 1 Year | 5 Years | Since Inception 2/13/18 |

|---|

| ETF Shares Net Asset Value | 27.88% | 13.99% | 10.71% |

|---|

| ETF Shares Market Price | 27.93% | 13.98% | 10.72% |

|---|

| Russell 3000 Index | 34.49% | 15.23% | 14.19% |

|---|

This table reflects the Fund's investments, including short-term investments, derivatives and other assets and liabilities.

Portfolio Composition % of Net Assets

(as of November 30, 2024)

| Basic Materials | 5.3% | |

| Consumer Discretionary | 15.0% | |

| Consumer Staples | 6.4% | |

| Energy | 13.6% | |

| Financials | 26.3% | |

| Health Care | 8.1% | |

| Industrials | 15.1% | |

| Real Estate | 0.6% | |

| Technology | 5.8% | |

| Telecommunications | 3.4% | |

| Utilities | 0.1% | |

| Other Assets and Liabilities—Net | 0.3% | |

Fund Statistics

(as of November 30, 2024)

| Fund Net Assets (in millions) | $841 |

|---|

| Number of Portfolio Holdings | 644 |

|---|

| Portfolio Turnover Rate | 39% |

|---|

| Total Investment Advisory Fees (in thousands) | $198 |

|---|

Where can I find additional information about the Fund?

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information is available at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature.

Connect with Vanguard® • vanguard.com

Fund Information • 800-662-7447

Direct Investor Account Services • 800-662-2739

Text Telephone for People Who Are Deaf or Hard of Hearing •

800-749-7273

© 2024 The Vanguard Group, Inc.

All rights reserved.

Vanguard Marketing Corporation, Distributor.

AR4416

Vanguard U.S. Multifactor ETF

ETF Shares (VFMF) CBOE BZX Exchange, Inc.

Annual Shareholder Report | November 30, 2024

This annual shareholder report contains important information about Vanguard U.S. Multifactor ETF (the "Fund") for the period of December 1, 2023, to November 30, 2024. You can find additional information about the Fund at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature. You can also request this information by contacting us at 800-662-7447. The report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Share Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| ETF Shares | $21 | 0.18% |

|---|

How did the Fund perform during the reporting period?

For the 12 months ended November 30, 2024, the Fund performed in line with its benchmark, the Russell 3000 Index.

U.S. economic growth hovered around 3% on a year-over-year-basis for the period, quelling recession fears. Consumer price inflation trended lower, falling below 3% in July, and the Federal Reserve began to ease monetary policy with cuts to short-term interest rates in September and November. Against this positive macroeconomic backdrop, U.S. stocks posted very strong gains.

Six of the Fund’s 11 industry sectors positively impacted relative performance. Selection in industrials, financials, and consumer discretionary especially contributed, as did an overweight allocation to financials.

Information technology detracted the most from relative performance, due to both selection and an underweight allocation. Energy lagged as well, owing to both selection and an overweight allocation.

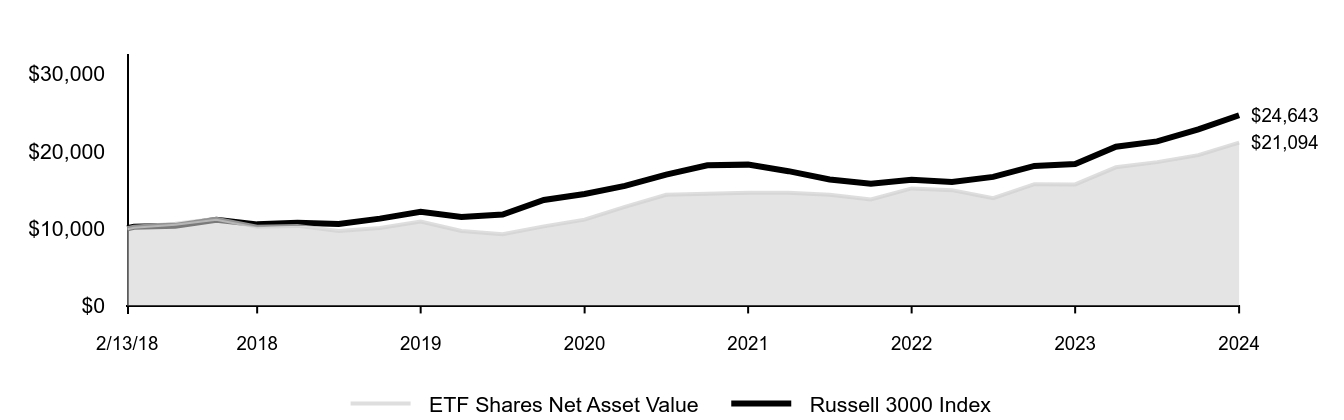

How did the Fund perform since inception?

Keep in mind that the Fund's past performance does not indicate how the Fund will perform in the future. Updated performance information is available on our website at vanguard.com/performance or by calling Vanguard toll-free at 800-662-7447. The graph and returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

Cumulative Performance: February 13, 2018, Through November 30, 2024

Initial Investment of $10,000

| ETF Shares Net Asset Value | Russell 3000 Index |

|---|

| 2/13/18 | $10,000 | $10,000 |

|---|

| 2/28/18 | $10,183 | $10,194 |

|---|

| 5/31/18 | $10,585 | $10,310 |

|---|

| 8/31/18 | $11,223 | $11,098 |

|---|

| 11/30/18 | $10,203 | $10,504 |

|---|

| 2/28/19 | $10,306 | $10,708 |

|---|

| 5/31/19 | $9,635 | $10,567 |

|---|

| 8/31/19 | $10,029 | $11,244 |

|---|

| 11/30/19 | $10,862 | $12,132 |

|---|

| 2/29/20 | $9,652 | $11,447 |

|---|

| 5/31/20 | $9,217 | $11,779 |

|---|

| 8/31/20 | $10,242 | $13,655 |

|---|

| 11/30/20 | $11,117 | $14,440 |

|---|

| 2/28/21 | $12,773 | $15,492 |

|---|

| 5/31/21 | $14,338 | $16,951 |

|---|

| 8/31/21 | $14,486 | $18,166 |

|---|

| 11/30/21 | $14,612 | $18,243 |

|---|

| 2/28/22 | $14,596 | $17,396 |

|---|

| 5/31/22 | $14,350 | $16,327 |

|---|

| 8/31/22 | $13,739 | $15,754 |

|---|

| 11/30/22 | $15,158 | $16,272 |

|---|

| 2/28/23 | $14,937 | $15,992 |

|---|

| 5/31/23 | $13,905 | $16,659 |

|---|

| 8/31/23 | $15,706 | $18,078 |

|---|

| 11/30/23 | $15,676 | $18,324 |

|---|

| 2/29/24 | $17,898 | $20,566 |

|---|

| 5/31/24 | $18,565 | $21,254 |

|---|

| 8/31/24 | $19,477 | $22,805 |

|---|

| 11/30/24 | $21,094 | $24,643 |

|---|

Average Annual Total Returns

| | 1 Year | 5 Years | Since Inception 2/13/18 |

|---|

| ETF Shares Net Asset Value | 34.57% | 14.20% | 11.61% |

|---|

| ETF Shares Market Price | 34.57% | 14.20% | 11.62% |

|---|

| Russell 3000 Index | 34.49% | 15.23% | 14.19% |

|---|

This table reflects the Fund's investments, including short-term investments, derivatives and other assets and liabilities.

Portfolio Composition % of Net Assets

(as of November 30, 2024)

| Basic Materials | 2.9% | |

| Consumer Discretionary | 17.1% | |

| Consumer Staples | 7.0% | |

| Energy | 5.1% | |

| Financials | 26.9% | |

| Health Care | 10.8% | |

| Industrials | 17.6% | |

| Real Estate | 0.4% | |

| Technology | 8.6% | |

| Telecommunications | 3.3% | |

| Other Assets and Liabilities—Net | 0.3% | |

Fund Statistics

(as of November 30, 2024)

| Fund Net Assets (in millions) | $333 |

|---|

| Number of Portfolio Holdings | 512 |

|---|

| Portfolio Turnover Rate | 50% |

|---|

| Total Investment Advisory Fees (in thousands) | $74 |

|---|

How has the Fund changed?

The Fund added as a principal risk "management of certain similar funds."

This is a summary of certain changes to the Fund since November 30, 2023. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by March 31, 2025 at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature or upon request at 800-662-7447.

Where can I find additional information about the Fund?

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information is available at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature.

Connect with Vanguard® • vanguard.com

Fund Information • 800-662-7447

Direct Investor Account Services • 800-662-2739

Text Telephone for People Who Are Deaf or Hard of Hearing •

800-749-7273

© 2024 The Vanguard Group, Inc.

All rights reserved.

Vanguard Marketing Corporation, Distributor.

AR4421

Vanguard Short-Term Tax-Exempt Bond ETF

ETF Shares (VTES) NYSE Arca

Annual Shareholder Report | November 30, 2024

This annual shareholder report contains important information about Vanguard Short-Term Tax-Exempt Bond ETF (the "Fund") for the period of December 1, 2023, to November 30, 2024. You can find additional information about the Fund at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature. You can also request this information by contacting us at 800-662-7447. The report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Share Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| ETF Shares | $7 | 0.07% |

|---|

How did the Fund perform during the reporting period?

For the 12 months ended November 30, 2024, the Fund performed in line with its benchmark, the S&P 0–7 Year National AMT-Free Municipal Bond Index.

U.S. economic growth hovered around 3% on a year-over-year basis for the period, quelling recession fears. Consumer price inflation trended lower, falling below 3% in July, and the Federal Reserve began to cut short-term interest rates in September. The pivot in monetary policy contributed to strong gains for U.S. investment-grade bonds.

The muni bond market performed well for the period, but it lagged the taxable U.S. bond market.

Revenue bonds in the broad muni market returned more than their general obligation counterparts. By credit quality, munis on the bottom rung of the investment-grade credit ladder outperformed their higher-rated counterparts. By maturity, longer-dated muni bonds posted the strongest gains.

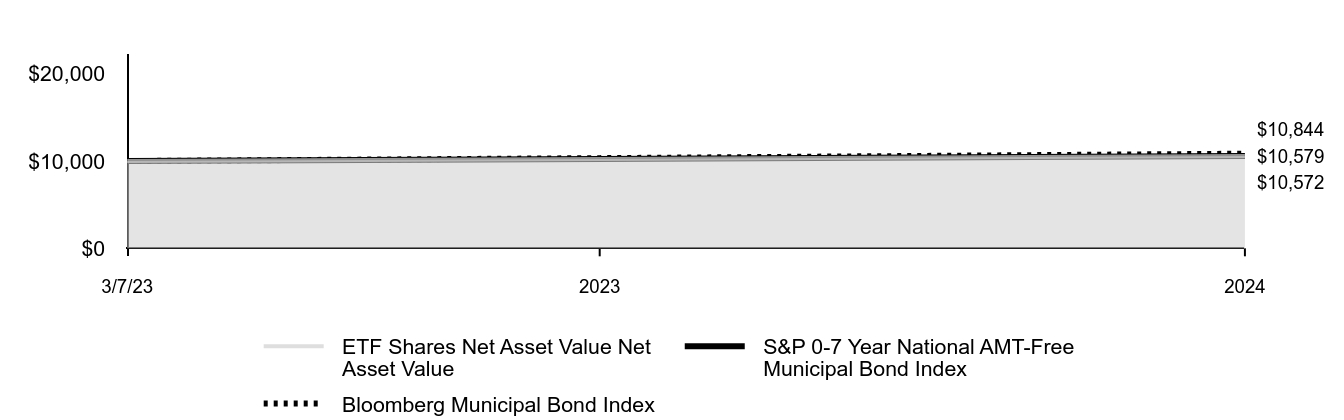

How did the Fund perform since inception?

Keep in mind that the Fund's past performance does not indicate how the Fund will perform in the future. Updated performance information is available on our website at vanguard.com/performance or by calling Vanguard toll-free at 800-662-7447. The graph and returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

Cumulative Performance: March 7, 2023, Through November 30, 2024

Initial Investment of $10,000

| ETF Shares Net Asset Value Net Asset Value | S&P 0-7 Year National AMT-Free Municipal Bond Index | Bloomberg Municipal Bond Index |

|---|

| 3/7/23 | $10,000 | $10,000 | $10,000 |

|---|

| 2023 | $10,238 | $10,240 | $10,335 |

|---|

| 2024 | $10,572 | $10,579 | $10,844 |

|---|

Average Annual Total Returns

| | 1 Year | Since Inception 3/7/23 |

|---|

| ETF Shares Net Asset Value | 3.26% | 3.26% |

|---|

| ETF Shares Market Price | 3.50% | 3.32% |

|---|

| S&P 0-7 Year National AMT-Free Municipal Bond Index | 3.30% | 3.30% |

|---|

Bloomberg Municipal Bond IndexFootnote Reference* | 4.93% | 4.78% |

|---|

| Footnote | Description |

Footnote* | The Fund added a broad-based benchmark to reflect new regulatory requirements. The Bloomberg Municipal Bond Index is considered broadly representative of the overall securities market applicable to the Fund. |

This table reflects the Fund's investments, including short-term investments and other assets and liabilities.

Distribution by Stated Maturity % of Net Assets

(as of November 30, 2024)

| Less than 1 Year | 16.8% |

| 1 to 3 Years | 29.1% |

| 3 to 5 Years | 25.7% |

| 5 to 10 Years | 25.5% |

| 10 to 20 Years | 0.4% |

| 20 to 30 Years | 1.6% |

| Greater than 30 Years | 0.2% |

| Other Assets and Liabilities—Net | 0.7% |

Fund Statistics

(as of November 30, 2024)

| Fund Net Assets (in millions) | $561 |

|---|

| Number of Portfolio Holdings | 2,338 |

|---|

| Portfolio Turnover Rate | 21% |

|---|

| Total Investment Advisory Fees (in thousands) | $8 |

|---|

How has the Fund changed?

The Fund's principal investment strategy was modified to add that the Fund may become nondiversified under the Investment Company Act of 1940 solely as a result of an index rebalance or market movement. The Fund added nondiversification risk as a principal risk.

This is a summary of certain changes to the Fund since November 30, 2023. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by March 31, 2025 at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature or upon request at 800-662-7447.

Where can I find additional information about the Fund?

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information is available at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature.

Connect with Vanguard® • vanguard.com

Fund Information • 800-662-7447

Direct Investor Account Services • 800-662-2739

Text Telephone for People Who Are Deaf or Hard of Hearing •

800-749-7273

© 2024 The Vanguard Group, Inc.

All rights reserved.

Vanguard Marketing Corporation, Distributor.

ARV014

Item 2: Code of Ethics.

The Registrant has adopted a code of ethics that applies to the Registrant’s principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions. The Code of Ethics was amended during the reporting period covered by this report to make certain technical, non-material changes.

Item 3: Audit Committee Financial Expert.

All members of the Audit Committee have been determined by the Registrant’s Board of Trustees to be Audit Committee Financial Experts and to be independent: F. Joseph Loughrey, Mark Loughridge, Sarah Bloom Raskin, and Peter F. Volanakis.

Item 4: Principal Accountant Fees and Services.

Includes fees billed in connection with services to the Registrant only.

| | | Fiscal Year Ended

November 30,

2024 | | | Fiscal Year Ended

November 30,

2023 | |

| (a) Audit Fees. | | $ | 253,000 | | | $ | 230,000 | |

| (b) Audit-Related Fees. | | | 0 | | | | 0 | |

| (c) Tax Fees. | | | 0 | | | | 0 | |

| (d) All Other Fees. | | | 0 | | | | 0 | |

| Total. | | $ | 253,000 | | | $ | 230,000 | |

| (e) | (1) Pre-Approval Policies. The audit committee is responsible for pre-approving all audit and non-audit services provided by PwC to: (i) the Vanguard funds; and (ii) Vanguard, or any entity controlled by Vanguard that provides ongoing services to the Vanguard funds. All services provided to Vanguard entities by the independent auditor, whether or not they are subject to preapproval, must be disclosed to the audit committee. The audit committee chair may preapprove any permissible audit and non-audit services as long as any preapproval is brought to the attention of the full audit committee at the next scheduled meeting. |

| | |

| | (2) No percentage of the principal accountant’s fees or services were approved pursuant to the waiver provision of paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. |

(f) For the most recent fiscal year, over 50% of the hours worked under the principal accountant’s engagement were not performed by persons other than full-time, permanent employees of the principal accountant.

(g) Aggregate Non-Audit Fees.

Includes fees billed for non-audit services provided to the Registrant, other registered investment companies in the Vanguard complex, The Vanguard Group, Inc., and Vanguard Marketing Corporation.

| | | Fiscal Year Ended

November 30,

2024 | | | Fiscal Year Ended

November 30,

2023 | |

| Non-audit fees to the Registrant only, listed as (b) through (d) above. | | $ | 0 | | | $ | 0 | |

| | | | | | | | | |

| Non-audit Fees to other registered investment companies in the Vanguard complex, The Vanguard Group, Inc., and Vanguard Marketing Corporation. | | | | | | | | |

| Audit-Related Fees. | | $ | 3,802,420 | | | $ | 3,295,934 | |

| Tax Fees. | | $ | 1,960,472 | | | $ | 1,678,928 | |

| All Other Fees. | | $ | 293,000 | | | $ | 25,000 | |

| Total. | | $ | 6,055,892 | | | $ | 4,999,862 | |

(h) For the most recent fiscal year, the Audit Committee has determined that the provision of all non-audit services was consistent with maintaining the principal accountant’s independence.

Item 5: Audit Committee of Listed Registrants.

The Registrant is a listed issuer as defined in rule 10A-3 under the Securities Exchange Act of 1934 (“Exchange Act”). The Registrant has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. The Registrant’s audit committee members are: F. Joseph Loughrey, Mark Loughridge, Sarah Bloom Raskin, and Peter F. Volanakis.

Item 6: Investments.

Not applicable. The complete schedule of investments is included in the financial statements filed under Item 7 of this Form.

Item 7: Financial Statements and Financial Highlights for Open-End Management Investment Companies.

Financial Statements

For the year ended November 30, 2024

Vanguard U.S. Factor ETFs

| Vanguard U.S. Minimum Volatility ETF |

| Vanguard U.S. Momentum Factor ETF |

| Vanguard U.S. Multifactor ETF |

| Vanguard U.S. Quality Factor ETF |

| Vanguard U.S. Value Factor ETF |

Contents

U.S. Minimum Volatility ETF

| 1 |

U.S. Momentum Factor ETF

| 12 |

U.S. Multifactor ETF

| 31 |

U.S. Quality Factor ETF

| 47 |

U.S. Value Factor ETF

| 61 |

Report of Independent Registered Public Accounting Firm

| 79 |

Tax information

| 80 |

| | |

U.S. Minimum Volatility ETF

Schedule of Investments

As of November 30, 2024

The fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The fund’s Form N-PORT reports are available on the SEC’s website at www.sec.gov.

| | | Shares | Market

Value•

($000) |

| Common Stocks (99.5%) |

| Basic Materials (1.5%) |

| | Linde plc | 4,865 | 2,243 |

| Consumer Discretionary (11.8%) |

| | TJX Cos. Inc. | 16,680 | 2,097 |

| | Murphy USA Inc. | 3,180 | 1,742 |

| * | O'Reilly Automotive Inc. | 1,354 | 1,683 |

| | Walmart Inc. | 17,607 | 1,629 |

| * | Stride Inc. | 14,823 | 1,584 |

| * | Spotify Technology SA | 3,309 | 1,578 |

| | Electronic Arts Inc. | 9,516 | 1,557 |

| * | TKO Group Holdings Inc. | 10,408 | 1,436 |

| | McDonald's Corp. | 3,594 | 1,064 |

| | eBay Inc. | 10,489 | 664 |

| * | QuinStreet Inc. | 23,390 | 533 |

| * | AutoZone Inc. | 150 | 475 |

| | Fox Corp. Class B | 10,567 | 473 |

| | Marcus Corp. | 15,310 | 347 |

| * | Grand Canyon Education Inc. | 1,631 | 268 |

| * | Ollie's Bargain Outlet Holdings Inc. | 1,825 | 181 |

| * | Laureate Education Inc. | 8,847 | 168 |

| | Rollins Inc. | 3,002 | 151 |

| * | Liberty Media Corp.-Liberty Formula One Class A | 1,424 | 115 |

| * | Atlanta Braves Holdings Inc. Class C | 2,752 | 111 |

| * | Atlanta Braves Holdings Inc. Class A | 2,421 | 102 |

| | New York Times Co. Class A | 1,823 | 99 |

| | | | 18,057 |

| Consumer Staples (11.4%) |

| | Procter & Gamble Co. | 12,866 | 2,306 |

| | Cencora Inc. | 9,084 | 2,285 |

| | McKesson Corp. | 3,596 | 2,260 |

| | General Mills Inc. | 33,989 | 2,252 |

| | Church & Dwight Co. Inc. | 20,415 | 2,248 |

| | Coca-Cola Co. | 34,370 | 2,203 |

| | Colgate-Palmolive Co. | 13,982 | 1,351 |

| | Flowers Foods Inc. | 22,518 | 509 |

| | Hershey Co. | 2,612 | 460 |

| | Mondelez International Inc. Class A | 5,258 | 342 |

| * | Pilgrim's Pride Corp. | 6,526 | 337 |

| | Ingredion Inc. | 2,278 | 336 |

| | Fresh Del Monte Produce Inc. | 7,150 | 241 |

| | J & J Snack Foods Corp. | 1,071 | 186 |

| | John B Sanfilippo & Son Inc. | 1,396 | 121 |

| | PepsiCo Inc. | 363 | 59 |

| | Altria Group Inc. | 565 | 33 |

| | | | 17,529 |

| Energy (4.6%) |

| | Kinder Morgan Inc. | 82,011 | 2,318 |

| | Exxon Mobil Corp. | 17,930 | 2,115 |

| | DTE Midstream LLC | 7,127 | 756 |

| | Williams Cos. Inc. | 11,088 | 649 |

| | Chevron Corp. | 3,478 | 563 |

| * | First Solar Inc. | 1,660 | 331 |

| | ONEOK Inc. | 2,514 | 286 |

| | | | 7,018 |

| Financials (10.6%) |

| | CME Group Inc. | 9,501 | 2,261 |

| | Progressive Corp. | 8,047 | 2,164 |

| | Cboe Global Markets Inc. | 8,911 | 1,923 |

U.S. Minimum Volatility ETF

| | | Shares | Market

Value•

($000) |

| | Willis Towers Watson plc | 5,045 | 1,625 |

| * | Clearwater Analytics Holdings Inc. Class A | 42,573 | 1,321 |

| * | Berkshire Hathaway Inc. Class B | 1,991 | 962 |

| | Commerce Bancshares Inc. | 12,927 | 953 |

| | White Mountains Insurance Group Ltd. | 438 | 880 |

| | Marsh & McLennan Cos. Inc. | 3,410 | 795 |

| | Travelers Cos. Inc. | 2,225 | 592 |

| | Safety Insurance Group Inc. | 6,560 | 563 |

| | Arthur J Gallagher & Co. | 1,738 | 543 |

| | RLI Corp. | 2,688 | 473 |

| | First Financial Corp. | 5,065 | 247 |

| | Tradeweb Markets Inc. Class A | 1,402 | 190 |

| | Intercontinental Exchange Inc. | 813 | 131 |

| | Chubb Ltd. | 347 | 100 |

| | Unum Group | 1,291 | 99 |

| | JPMorgan Chase & Co. | 311 | 78 |

| | Donegal Group Inc. Class A | 4,595 | 76 |

| | Peoples Bancorp of North Carolina Inc. | 2,148 | 69 |

| | CNA Financial Corp. | 1,023 | 52 |

| * | California BanCorp | 2,857 | 51 |

| | Employers Holdings Inc. | 921 | 49 |

| * | Columbia Financial Inc. | 1,735 | 32 |

| | First Financial Northwest Inc. | 1,402 | 32 |

| | | | 16,261 |

| Health Care (11.8%) |

| | Abbott Laboratories | 19,259 | 2,287 |

| | Johnson & Johnson | 14,527 | 2,252 |

| | Merck & Co. Inc. | 17,038 | 1,732 |

| * | Boston Scientific Corp. | 15,969 | 1,448 |

| | HealthStream Inc. | 40,365 | 1,336 |

| | Gilead Sciences Inc. | 13,676 | 1,266 |

| | Cardinal Health Inc. | 9,572 | 1,170 |

| | Chemed Corp. | 1,880 | 1,076 |

| | UnitedHealth Group Inc. | 1,751 | 1,069 |

| | AbbVie Inc. | 5,192 | 950 |

| | Pfizer Inc. | 35,487 | 930 |

| * | Prestige Consumer Healthcare Inc. | 7,938 | 673 |

| * | Hologic Inc. | 6,065 | 482 |

| | Eli Lilly & Co. | 506 | 402 |

| * | Exelixis Inc. | 10,973 | 400 |

| * | Regeneron Pharmaceuticals Inc. | 413 | 310 |

| | Bristol-Myers Squibb Co. | 2,918 | 173 |

| * | Vertex Pharmaceuticals Inc. | 77 | 36 |

| | Cigna Group | 91 | 31 |

| | | | 18,023 |

| Industrials (6.9%) |

| | Lockheed Martin Corp. | 3,746 | 1,983 |

| | RTX Corp. | 13,869 | 1,690 |

| | Northrop Grumman Corp. | 3,078 | 1,507 |

| | General Dynamics Corp. | 5,203 | 1,478 |

| * | Kirby Corp. | 9,792 | 1,239 |

| | Matson Inc. | 4,363 | 668 |

| * | FTI Consulting Inc. | 2,927 | 593 |

| | Visa Inc. Class A | 1,755 | 553 |

| | AptarGroup Inc. | 2,179 | 377 |

| | Accenture plc Class A | 789 | 286 |

| | Mastercard Inc. Class A | 265 | 141 |

| | Cass Information Systems Inc. | 2,305 | 103 |

| | | | 10,618 |

| Real Estate (1.4%) |

| | Agree Realty Corp. | 11,475 | 881 |

| | CareTrust REIT Inc. | 29,199 | 870 |

| | Realty Income Corp. | 7,926 | 459 |

| | | | 2,210 |

| Technology (22.6%) |

| * | MACOM Technology Solutions Holdings Inc. | 17,970 | 2,387 |

| | Analog Devices Inc. | 10,395 | 2,267 |

| * | Tyler Technologies Inc. | 3,532 | 2,222 |

U.S. Minimum Volatility ETF

| | | Shares | Market

Value•

($000) |

| | International Business Machines Corp. | 9,483 | 2,156 |

| * | CommVault Systems Inc. | 12,452 | 2,137 |

| | Texas Instruments Inc. | 10,626 | 2,136 |

| | Amdocs Ltd. | 23,722 | 2,057 |

| | NetApp Inc. | 15,343 | 1,882 |

| | Roper Technologies Inc. | 3,303 | 1,871 |

| | Apple Inc. | 5,974 | 1,418 |

| | Microsoft Corp. | 3,181 | 1,347 |

| | HP Inc. | 36,973 | 1,310 |

| | Dolby Laboratories Inc. Class A | 14,107 | 1,105 |

| | Alphabet Inc. Class C | 5,585 | 952 |

| * | Blackbaud Inc. | 10,779 | 905 |

| | Alphabet Inc. Class A | 5,339 | 902 |

| * | GoDaddy Inc. Class A | 4,045 | 799 |

| | Broadcom Inc. | 4,650 | 754 |

| * | Cirrus Logic Inc. | 7,083 | 740 |

| * | Yelp Inc. | 17,941 | 686 |

| | Skyworks Solutions Inc. | 7,548 | 661 |

| | Meta Platforms Inc. Class A | 1,136 | 652 |

| * | CCC Intelligent Solutions Holdings Inc. | 45,918 | 579 |

| | NVE Corp. | 7,243 | 560 |

| * | Vertex Inc. Class A | 8,809 | 478 |

| | Microchip Technology Inc. | 6,865 | 468 |

| * | N-able Inc. | 24,087 | 251 |

| | Hackett Group Inc. | 7,531 | 236 |

| | Sapiens International Corp. NV | 5,350 | 146 |

| * | Grindr Inc. | 7,149 | 108 |

| * | Veeco Instruments Inc. | 3,774 | 105 |

| * | Impinj Inc. | 543 | 104 |

| | Cognizant Technology Solutions Corp. Class A | 1,143 | 92 |

| | KLA Corp. | 121 | 78 |

| | PC Connection Inc. | 917 | 67 |

| | Applied Materials Inc. | 316 | 55 |

| | | | 34,673 |

| Telecommunications (8.1%) |

| | T-Mobile US Inc. | 9,280 | 2,291 |

| | AT&T Inc. | 98,101 | 2,272 |

| | InterDigital Inc. | 10,342 | 2,027 |

| | Cisco Systems Inc. | 31,852 | 1,886 |

| | IDT Corp. Class B | 35,221 | 1,819 |

| | Verizon Communications Inc. | 28,311 | 1,255 |

| | Motorola Solutions Inc. | 1,129 | 564 |

| | Spok Holdings Inc. | 13,524 | 222 |

| | | | 12,336 |

| Utilities (8.8%) |

| | Consolidated Edison Inc. | 22,457 | 2,259 |

| | Duke Energy Corp. | 18,419 | 2,156 |

| | Southern Co. | 23,529 | 2,097 |

| | Republic Services Inc. | 8,255 | 1,802 |

| | Waste Management Inc. | 7,079 | 1,615 |

| | MGE Energy Inc. | 13,519 | 1,410 |

| | FirstEnergy Corp. | 26,407 | 1,124 |

| | WEC Energy Group Inc. | 7,593 | 767 |

| | Ameren Corp. | 3,065 | 289 |

| | CMS Energy Corp. | 527 | 37 |

| | | | 13,556 |

| Total Common Stocks (Cost $125,093) | 152,524 |

U.S. Minimum Volatility ETF

| | | Shares | Market

Value•

($000) |

| Temporary Cash Investments (0.3%) |

| Money Market Fund (0.3%) |

| 1 | Vanguard Market Liquidity Fund, 4.651% (Cost $423) | 4,229 | 423 |

| Total Investments (99.8%) (Cost $125,516) | 152,947 |

| Other Assets and Liabilities—Net (0.2%) | 267 |

| Net Assets (100%) | 153,214 |

| Cost is in $000. |

| • | See Note A in Notes to Financial Statements. |

| * | Non-income-producing security. |

| 1 | Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield. |

| | REIT—Real Estate Investment Trust. |

Derivative Financial Instruments Outstanding as of Period End

| Futures Contracts |

| | | | ($000) |

| | Expiration | Number of

Long (Short)

Contracts | Notional

Amount | Value and

Unrealized

Appreciation

(Depreciation) |

| Long Futures Contracts | | | | |

| E-mini S&P 500 Index | December 2024 | 1 | 302 | 4 |

| Micro E-mini S&P 500 Index | December 2024 | 6 | 182 | 2 |

| | | | | 6 |

See accompanying Notes, which are an integral part of the Financial Statements.

U.S. Minimum Volatility ETF

Statement of Assets and Liabilities

|

| ($000s, except shares, footnotes, and per-share amounts) | Amount |

| Assets | |

| Investments in Securities, at Value | |

| Unaffiliated Issuers (Cost $125,093) | 152,524 |

| Affiliated Issuers (Cost $423) | 423 |

| Total Investments in Securities | 152,947 |

| Investment in Vanguard | 4 |

| Cash Collateral Pledged—Futures Contracts | 24 |

| Receivables for Accrued Income | 246 |

| Variation Margin Receivable—Futures Contracts | 3 |

| Total Assets | 153,224 |

| Liabilities | |

| Payables for Investment Securities Purchased | 2 |

| Payables to Vanguard | 8 |

| Total Liabilities | 10 |

| Net Assets | 153,214 |

| At November 30, 2024, net assets consisted of: | |

| | |

| Paid-in Capital | 136,500 |

| Total Distributable Earnings (Loss) | 16,714 |

| Net Assets | 153,214 |

| |

| Net Assets | |

Applicable to 1,200,000 outstanding $.001 par value shares of

beneficial interest (unlimited authorization) | 153,214 |

| Net Asset Value Per Share | $127.68 |

See accompanying Notes, which are an integral part of the Financial Statements.

U.S. Minimum Volatility ETF

|

| | Year Ended

November 30, 2024 |

| | ($000) |

| Investment Income | |

| Income | |

| Dividends1 | 1,952 |

| Interest2 | 26 |

| Securities Lending—Net | — |

| Total Income | 1,978 |

| Expenses | |

| The Vanguard Group—Note B | |

| Investment Advisory Services | 25 |

| Management and Administrative | 41 |

| Marketing and Distribution | 5 |

| Auditing Fees | 31 |

| Shareholders’ Reports and Proxy Fees | 30 |

| Trustees’ Fees and Expenses | — |

| Professional Services | 15 |

| Total Expenses | 147 |

| Net Investment Income | 1,831 |

| Realized Net Gain (Loss) | |

| Investment Securities Sold2,3 | 4,339 |

| Futures Contracts | 82 |

| Realized Net Gain (Loss) | 4,421 |

| Change in Unrealized Appreciation (Depreciation) | |

| Investment Securities2 | 22,028 |

| Futures Contracts | 1 |

| Change in Unrealized Appreciation (Depreciation) | 22,029 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 28,281 |

| 1 | Dividends are net of foreign withholding taxes of $1,000. |

| 2 | Interest income, realized net gain (loss), capital gain distributions received, and change in unrealized appreciation (depreciation) from an affiliated company of the fund were $21,000, less than $1,000, less than $1,000, and ($1,000), respectively. Purchases and sales are for temporary cash investment purposes. |

| 3 | Includes $4,969,000 of net gain (loss) resulting from in-kind redemptions. |

See accompanying Notes, which are an integral part of the Financial Statements.

U.S. Minimum Volatility ETF

Statement of Changes in Net Assets

|

| | Year Ended November 30, |

| | 2024

($000) | 2023

($000) |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net Investment Income | 1,831 | 2,090 |

| Realized Net Gain (Loss) | 4,421 | 639 |

| Change in Unrealized Appreciation (Depreciation) | 22,029 | (1,777) |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 28,281 | 952 |

| Distributions | | |

| Total Distributions | (1,762) | (2,061) |

| Capital Share Transactions | | |

| Issued | 51,009 | 31,343 |

| Issued in Lieu of Cash Distributions | — | — |

| Redeemed | (17,707) | (17,629) |

| Net Increase (Decrease) from Capital Share Transactions | 33,302 | 13,714 |

| Total Increase (Decrease) | 59,821 | 12,605 |

| Net Assets | | |

| Beginning of Period | 93,393 | 80,788 |

| End of Period | 153,214 | 93,393 |

See accompanying Notes, which are an integral part of the Financial Statements.

U.S. Minimum Volatility ETF

For a Share Outstanding

Throughout Each Period | Year Ended November 30, |

| 2024 | 2023 | 2022 | 2021 | 2020 |

| Net Asset Value, Beginning of Period | $101.51 | $102.91 | $100.28 | $87.08 | $91.10 |

| Investment Operations | | | | | |

| Net Investment Income1 | 1.838 | 2.373 | 2.160 | 1.374 | 1.779 |

| Net Realized and Unrealized Gain (Loss) on Investments | 26.142 | (1.354) | 2.231 | 13.497 | (3.776) |

| Total from Investment Operations | 27.980 | 1.019 | 4.391 | 14.871 | (1.997) |

| Distributions | | | | | |

| Dividends from Net Investment Income | (1.810) | (2.419) | (1.761) | (1.671) | (2.023) |

| Distributions from Realized Capital Gains | — | — | — | — | — |

| Total Distributions | (1.810) | (2.419) | (1.761) | (1.671) | (2.023) |

| Net Asset Value, End of Period | $127.68 | $101.51 | $102.91 | $100.28 | $87.08 |

| Total Return | 27.84% | 1.13% | 4.46% | 17.22% | -1.99% |

| Ratios/Supplemental Data | | | | | |

| Net Assets, End of Period (Millions) | $153 | $93 | $81 | $47 | $57 |

| Ratio of Total Expenses to Average Net Assets | 0.13% | 0.13%2 | 0.13% | 0.13% | 0.13% |

| Ratio of Net Investment Income to Average Net Assets | 1.61% | 2.40% | 2.18% | 1.43% | 2.14% |

| Portfolio Turnover Rate3 | 39% | 26% | 32% | 46% | 83% |

| 1 | Calculated based on average shares outstanding. |

| 2 | The ratio of expenses to average net assets for the period net of reduction from custody fee offset arrangements was 0.13%. |

| 3 | Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares, including ETF Creation Units. |

See accompanying Notes, which are an integral part of the Financial Statements.

U.S. Minimum Volatility ETF

Notes to Financial Statements

Vanguard U.S. Minimum Volatility ETF is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. ETF Shares are listed for trading on Cboe BZX Exchange, Inc.; they can be purchased and sold through a broker.

| A. | The following significant accounting policies conform to generally accepted accounting principles for U.S. investment companies. The fund consistently follows such policies in preparing its financial statements. |

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued by methods deemed by the valuation designee to represent fair value and subject to oversight by the board of trustees. Investments in Vanguard Market Liquidity Fund are valued at that fund's net asset value.

2. Futures Contracts: The fund uses index futures contracts to a limited extent, with the objective of maintaining full exposure to the stock market while maintaining liquidity. The fund may purchase or sell futures contracts to achieve a desired level of investment, whether to accommodate portfolio turnover or cash flows from capital share transactions. The primary risks associated with the use of futures contracts are imperfect correlation between changes in market values of stocks held by the fund and the prices of futures contracts, and the possibility of an illiquid market. Counterparty risk involving futures is mitigated because a regulated clearinghouse is the counterparty instead of the clearing broker. To further mitigate counterparty risk, the fund trades futures contracts on an exchange, monitors the financial strength of its clearing brokers and clearinghouse, and has entered into clearing agreements with its clearing brokers. The clearinghouse imposes initial margin requirements to secure the fund’s performance and requires daily settlement of variation margin representing changes in the market value of each contract. Any securities pledged as initial margin for open contracts are noted in the Schedule of Investments.

Futures contracts are valued at their quoted daily settlement prices. The notional amounts of the contracts are not recorded in the Statement of Assets and Liabilities. Fluctuations in the value of the contracts are recorded in the Statement of Assets and Liabilities as an asset (liability) and in the Statement of Operations as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as realized gains (losses) on futures contracts.

During the year ended November 30, 2024, the fund’s average investments in long and short futures contracts represented less than 1% and 0% of net assets, respectively, based on the average of the notional amounts at each quarter-end during the period.

3. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute virtually all of its taxable income. The fund’s tax returns are open to examination by the relevant tax authorities until expiration of the applicable statute of limitations, which is generally three years after the filing of the tax return. Management has analyzed the fund’s tax positions taken for all open federal and state income tax years, and has concluded that no provision for income tax is required in the fund’s financial statements.

4. Distributions: Distributions to shareholders are recorded on the ex-dividend date. Distributions are determined on a tax basis at the fiscal year-end and may differ from net investment income and realized capital gains for financial reporting purposes.

5. Securities Lending: To earn additional income, the fund lends its securities to qualified institutional borrowers. Security loans are subject to termination by the fund at any time, and are required to be secured at all times by collateral in an amount at least equal to the market value of securities loaned. Daily market fluctuations could cause the value of loaned securities to be more or less than the value of the collateral received. When this occurs, the collateral is adjusted and settled before the opening of the market on the next business day. The fund further mitigates its counterparty risk by entering into securities lending transactions only with a diverse group of prequalified counterparties, monitoring their financial strength, and entering into master securities lending agreements with its counterparties. The master securities lending agreements provide that, in the event of a counterparty’s default (including bankruptcy), the fund may terminate any loans with that borrower, determine the net amount owed, and sell or retain the collateral up to the net amount owed to the fund; however, such actions may be subject to legal proceedings. While collateral mitigates counterparty risk, in the event of a default, the fund may experience delays and costs in recovering the securities loaned. The fund invests cash collateral received in Vanguard Market Liquidity Fund, and records a liability in the Statement of Assets and Liabilities for the return of the collateral, during the period the securities are on loan. Collateral investments in Vanguard Market Liquidity Fund are subject to market appreciation or depreciation. Securities lending income represents fees charged to borrowers plus income earned on invested cash collateral, less expenses associated with the loan. During the term of the loan, the fund is entitled to all distributions made on or in respect of the loaned securities.

6. Credit Facilities and Interfund Lending Program: The fund and certain other funds managed by The Vanguard Group ("Vanguard") participate in a $4.3 billion committed credit facility provided by a syndicate of lenders pursuant to a credit agreement and an uncommitted credit facility provided by Vanguard. Both facilities may be renewed annually. Each fund is individually liable for its borrowings, if any, under the credit facilities. Borrowings may be utilized for temporary or emergency purposes and are subject to the fund’s regulatory and contractual borrowing restrictions. With respect to the committed credit facility, the participating funds are charged administrative fees and an annual commitment fee of 0.10% of the undrawn committed amount of the facility, which are allocated to the funds based on a method approved by the fund’s board of trustees and included in Management and Administrative expenses on the fund’s Statement of Operations. Any borrowings under either facility bear interest at an agreed-upon spread plus the higher of the federal funds effective rate, the overnight bank funding rate, or the Daily Simple Secured Overnight Financing Rate inclusive of an additional agreed-upon spread. However, borrowings under the uncommitted credit facility may bear interest based upon an alternate rate agreed to by the fund and Vanguard.

In accordance with an exemptive order (the “Order”) from the SEC, the fund may participate in a joint lending and borrowing program that allows registered open-end Vanguard funds to borrow money from and lend money to each other for temporary or emergency purposes (the “Interfund Lending Program”), subject to compliance with the terms and conditions of the Order, and to the extent permitted by the fund’s investment objective and investment policies. Interfund loans and borrowings normally extend overnight but can have a maximum duration of seven days. Loans may be

U.S. Minimum Volatility ETF

called on one business day’s notice. The interest rate to be charged is governed by the conditions of the Order and internal procedures adopted by the board of trustees. The board of trustees is responsible for overseeing the Interfund Lending Program.

For the year ended November 30, 2024, the fund did not utilize the credit facilities or the Interfund Lending Program.

7. Other: Dividend income is recorded on the ex-dividend date. Non-cash dividends included in income, if any, are recorded at the fair value of the securities received. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

| B. | In accordance with the terms of a Funds' Service Agreement (the “FSA”) between Vanguard and the fund, Vanguard furnishes to the fund investment advisory, corporate management, administrative, marketing, and distribution services at Vanguard’s cost of operations (as defined by the FSA). These costs of operations are allocated to the fund based on methods and guidelines approved by the board of trustees and are generally settled twice a month. |

Upon the request of Vanguard, the fund may invest up to 0.40% of its net assets as capital in Vanguard. At November 30, 2024, the fund had contributed to Vanguard capital in the amount of $4,000, representing less than 0.01% of the fund’s net assets and less than 0.01% of Vanguard’s capital received pursuant to the FSA. The fund’s trustees and officers are also directors and employees, respectively, of Vanguard.

| C. | Various inputs may be used to determine the value of the fund’s investments and derivatives. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities. |

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments). Any investments and derivatives valued with significant unobservable inputs are noted on the Schedule of Investments.

At November 30, 2024, 100% of the market value of the fund’s investments and derivatives was determined based on Level 1 inputs.

| D. | Permanent differences between book-basis and tax-basis components of net assets are reclassified among capital accounts in the financial statements to reflect their tax character. These reclassifications have no effect on net assets or net asset value per share. As of period end, permanent differences primarily attributable to the accounting for in-kind redemptions were reclassified between the following accounts: |

| | Amount

($000) |

| Paid-in Capital | 4,969 |

| Total Distributable Earnings (Loss) | (4,969) |

Temporary differences between book-basis and tax-basis components of total distributable earnings (loss) arise when certain items of income, gain, or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse at some time in the future. The differences are primarily related to capital loss carryforwards; the deferral of losses from wash sales; and the recognition of unrealized gains or losses from certain derivative contracts. As of period end, the tax-basis components of total distributable earnings (loss) are detailed in the table as follows:

| | Amount

($000) |

| Undistributed Ordinary Income | 477 |

| Undistributed Long-Term Gains | — |

| Net Unrealized Gains (Losses) | 27,431 |

| Capital Loss Carryforwards | (11,194) |

| Qualified Late-Year Losses | — |

| Other Temporary Differences | — |

| Total | 16,714 |

The tax character of distributions paid was as follows:

| | Year Ended November 30, |

| | 2024

Amount

($000) | 2023

Amount

($000) |

| Ordinary Income* | 1,762 | 2,061 |

| Long-Term Capital Gains | — | — |

| Total | 1,762 | 2,061 |

| * | Includes short-term capital gains, if any. |

U.S. Minimum Volatility ETF

As of November 30, 2024, gross unrealized appreciation and depreciation for investments and derivatives based on cost for U.S. federal income tax purposes were as follows:

| | Amount

($000) |

| Tax Cost | 125,516 |

| Gross Unrealized Appreciation | 28,397 |

| Gross Unrealized Depreciation | (966) |

| Net Unrealized Appreciation (Depreciation) | 27,431 |

| E. | During the year ended November 30, 2024, the fund purchased $93,536,000 of investment securities and sold $44,750,000 of investment securities, other than temporary cash investments. In addition, the fund purchased and sold investment securities of $0 and $15,409,000, respectively, in connection with in-kind purchases and redemptions of the fund's capital shares. |

The fund purchased securities from and sold securities to other Vanguard funds or accounts managed by Vanguard or its affiliates, in accordance with procedures adopted by the board of trustees in compliance with Rule 17a-7 of the Investment Company Act of 1940. For the year ended November 30, 2024, such purchases were $1,741,000 and sales were $600,000, resulting in net realized loss of $177,000; these amounts, other than temporary cash investments, are included in the purchases and sales of investment securities noted above.

| F. | Capital shares issued and redeemed were: |

| | Year Ended November 30, |

| | 2024

Shares

(000) | 2023

Shares

(000) |

| Issued | 440 | 315 |

| Issued in Lieu of Cash Distributions | — | — |

| Redeemed | (160) | (180) |

| Net Increase (Decrease) in Shares Outstanding | 280 | 135 |

| G. | Significant market disruptions, such as those caused by pandemics, natural or environmental disasters, war, acts of terrorism, or other events, can adversely affect local and global markets and normal market operations. Any such disruptions could have an adverse impact on the value of the fund’s investments and fund performance. |

To the extent the fund’s investment portfolio reflects concentration in a particular market, industry, sector, country or asset class, the fund may be adversely affected by the performance of these concentrations and may be subject to increased price volatility and other risks.

The use of derivatives may expose the fund to various risks. Derivatives can be highly volatile, and any initial investment is generally small relative to the notional amount so that transactions may be leveraged in terms of market exposure. A relatively small market movement may have a potentially larger impact on derivatives than on standard securities. Leveraged derivatives positions can, therefore, increase volatility. Additional information regarding the fund’s use of derivative(s) and the specific risks associated is described under significant accounting policies.

At November 30, 2024, one shareholder was a record or beneficial owner of 39% of the fund’s net assets. If this shareholder were to redeem its investment in the fund, the redemption might result in an increase in the fund’s expense ratio, cause the fund to incur higher transaction costs, or lead to the realization of taxable capital gains.

| H. | Management has determined that no events or transactions occurred subsequent to November 30, 2024, that would require recognition or disclosure in these financial statements. |

Schedule of Investments

As of November 30, 2024

The fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The fund’s Form N-PORT reports are available on the SEC’s website at www.sec.gov.

| | | Shares | Market

Value•

($000) |

| Common Stocks (99.7%) |

| Basic Materials (3.0%) |