UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| x | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

AVANEX CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To Be Held on , 2008

To Our Stockholders:

Notice is hereby given that a Special Meeting of Stockholders (the “Special Meeting”) of Avanex Corporation, a Delaware corporation (“Avanex”), will be held on , 2008, at : .m., local time, at Avanex’s corporate headquarters, 40919 Encyclopedia Circle, Fremont, California 94538, for the following purposes:

| | 1. | To approve amendments to Avanex’s Amended and Restated Certificate of Incorporation which would effect a reverse stock split, pursuant to which any whole number of outstanding shares of Avanex’s common stock between and including ten and fifteen would be combined into one share of such stock, pursuant to which the total number of shares of Common Stock that Avanex is authorized to issue would be correspondingly reduced, and pursuant to which the total number of shares of Preferred Stock that Avanex is authorized to issue would be reduced to 2,000,000, and to authorize the Board of Directors to select and file one such amendment which would effect the reverse stock split within such range; and |

| | 2. | To transact such other business as may properly come before the Special Meeting or any adjournment or postponement thereof. |

These items of business are more fully described in the Proxy Statement accompanying this Notice of Special Meeting.

Only holders of record of Avanex’s common stock at the close of business on , 2008, the record date, are entitled to vote on the matters listed in this Notice of Special Meeting.

All stockholders are cordially invited to attend the Special Meeting in person. However, to ensure your representation at the Special Meeting, please vote as soon as possible using one of the following methods: (1) by using the Internet as instructed on the enclosed proxy card, (2) by telephone as instructed on the enclosed proxy card, or (3) by mail by completing, signing, dating and returning the enclosed proxy card in the enclosed postage-prepaid envelope. For further details, please see the section entitled “Voting” on page 2 of the accompanying Proxy Statement. Any stockholder attending the Special Meeting may vote in person even if he or she has voted using the Internet, telephone or proxy card.

By Order of the Board of Directors

of Avanex Corporation

/s/ Jo S. Major, Jr.

Jo S. Major, Jr.

President, Chief Executive Officer and

Chairman of the Board of Directors

Fremont, California

, 2008

WHETHER OR NOT YOU PLAN TO ATTEND THE SPECIAL MEETING, PLEASE VOTE BY TELEPHONE OR BY USING THE INTERNET AS INSTRUCTED ON THE ENCLOSED PROXY CARD OR COMPLETE, SIGN, DATE, AND RETURN THE ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE IN THE ENCLOSED ENVELOPE.

TABLE OF CONTENTS

AVANEX CORPORATION

PROXY STATEMENT

FOR THE

SPECIAL MEETING OF STOCKHOLDERS

PROCEDURAL MATTERS

General

This Proxy Statement is being furnished to the holders of common stock, par value $0.001 per share (the “Common Stock”), of Avanex Corporation, a Delaware corporation (“Avanex” or the “Company”), in connection with the solicitation of proxies by the Board of Directors of Avanex for use at the Special Meeting of Stockholders (the “Special Meeting”) to be held on , 2008, at : .m., local time, and at any adjournment or postponement thereof, for the purpose of considering and acting upon the matters set forth herein. The Special Meeting will be held at Avanex’s corporate headquarters, 40919 Encyclopedia Circle, Fremont, California 94538. The telephone number at that location is (510) 897-4188.

This Proxy Statement and the accompanying proxy card are first being mailed on or about , 2008, to all stockholders entitled to vote at the Special Meeting.

Stockholders Entitled to Vote; Record Date

Only holders of record of the Company’s Common Stock at the close of business on , 2008 (the “Record Date”), are entitled to notice of and to vote at the Special Meeting. Such stockholders are entitled to cast one vote for each share of Common Stock held as of the Record Date on all matters properly submitted for the vote of stockholders at the Special Meeting. As of the Record Date, there were shares of Common Stock outstanding and entitled to vote at the Special Meeting. No shares of preferred stock were outstanding. For information regarding security ownership by management and by the beneficial owners of more than five percent of the Company’s Common Stock, see “Security Ownership of Certain Beneficial Owners and Management” beginning on page 11.

Quorum; Required Vote

The presence of the holders of a majority of the shares of Common Stock entitled to vote generally at the Special Meeting is necessary to constitute a quorum at the Special Meeting. Such stockholders are counted as present at the Special Meeting if they (1) are present in person at the Special Meeting or (2) have properly submitted a proxy card or voted by telephone or by using the Internet. Under the General Corporation Law of the State of Delaware, an abstaining vote and a broker “non-vote” are counted as present and entitled to vote and are, therefore, included for purposes of determining whether a quorum is present at the Special Meeting. A broker “non-vote” occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that proposal and has not received instructions on how to vote from the beneficial owner.

The affirmative vote of a majority of the shares outstanding and entitled to vote as of the Record Date is required to approve amendments to the Company’s Amended and Restated Certificate of Incorporation (the “Certificate”) which would effect a reverse stock split within a range from ten and fifteen and to authorize the Company’s Board of Directors to select and file one such amendment which would effect the reverse stock split within such range (Proposal One). Abstentions are deemed to be “votes cast,” and have the same effect as a vote against the proposal. However, broker non-votes are not deemed to be votes cast, and therefore are not included in the tabulation of the voting results on the proposal.

1

Voting

Voting by Proxy Card. All shares entitled to vote and represented by properly executed proxy cards received prior to the Special Meeting, and not revoked, will be voted at the Special Meeting in accordance with the instructions indicated on those proxy cards. If no instructions are indicated on a properly executed proxy card, the shares represented by that proxy card will be voted as recommended by the Board of Directors. If any other matters are properly presented for consideration at the Special Meeting, including, among other things, consideration of a motion to adjourn the Special Meeting to another time or place (including, without limitation, for the purpose of soliciting additional proxies), the persons named in the enclosed proxy card and acting thereunder will have discretion to vote on those matters in accordance with their best judgment. The Company does not currently anticipate that any other matters will be raised at the Special Meeting.

Voting by Telephone or the Internet. If you are a registered stockholder, you may vote your shares by calling the toll-free number indicated on the enclosed proxy card and following the recorded instructions or by accessing the website indicated on the enclosed proxy card and following the instructions provided. If your shares are registered in the name of a bank or brokerage firm, you may be eligible to vote your shares electronically over the Internet or by telephone. A large number of banks and brokerage firms are participating in the Broadridge Financial Solutions online program. This program provides eligible stockholders who receive a paper copy of the proxy statement the opportunity to vote via the Internet or by telephone. If your bank or brokerage firm is participating in Broadridge’s program, your voting form will provide instructions. If your voting form does not reference Internet or telephone information, please complete and return the paper proxy card in the self-addressed postage paid envelope provided. When a stockholder votes via the Internet or by telephone, his or her vote is recorded immediately. Avanex encourages its stockholders to vote using these methods whenever possible.

Voting by Attending the Meeting. A stockholder may vote his or her shares in person at the Special Meeting. A stockholder planning to attend the Special Meeting should bring proof of identification for entrance to the Special Meeting. If a stockholder attends the Special Meeting, he or she may submit his or her vote in person, and any previous votes that were submitted by the stockholder, whether by Internet, telephone or mail, will be superseded by the vote that such stockholder casts at the Special Meeting.

Changing Vote; Revocability of Proxies. If a stockholder has voted by telephone, over the Internet or by returning a proxy card, such stockholder may change his or her vote before the Special Meeting.

A stockholder who has voted by telephone or over the Internet may later change his or her vote by making a timely and valid telephone or Internet vote, as the case may be, or by following the procedures in the following paragraph.

A stockholder may revoke any proxy given pursuant to this solicitation at any time before it is voted by: (1) filing with the Secretary of the Company, at or before the taking of the vote at the Special Meeting, a written notice of revocation or a duly executed proxy card, in either case dated later than the prior proxy relating to the same shares, or (2) attending the Special Meeting and voting in person (although attendance at the Special Meeting will not by itself revoke a proxy). Any written notice of revocation or subsequent proxy card must be received by the Secretary of the Company prior to the taking of the vote at the Special Meeting. Such written notice of revocation or subsequent proxy card should be hand delivered to the Secretary of the Company or should be sent to Avanex Corporation, 40919 Encyclopedia Circle, Fremont, California 94538, Attention: Corporate Secretary.

Expenses of Solicitation

Avanex will bear all expenses of this solicitation, including the cost of preparing and mailing this solicitation material. The Company may reimburse brokerage firms, custodians, nominees, fiduciaries, and other persons representing beneficial owners of Common Stock for their reasonable expenses in forwarding solicitation material to such beneficial owners. Directors, officers and employees of the Company may also solicit proxies in person or by telephone, letter, electronic mail, telegram, facsimile or other means of communication. Such

2

directors, officers and employees will not be additionally compensated, but they may be reimbursed for reasonable out-of-pocket expenses in connection with such solicitation. The Company has retained the services of Morrow & Co., LLC, a professional proxy solicitation firm, to assist in the solicitation of proxies. Avanex will pay Morrow approximately $6,000 for its services, in addition to reimbursement of its out-of-pocket expenses.

Procedure for Submitting Stockholder Proposals

Requirements for Stockholder Proposals to be Considered for Inclusion in the Company’s Proxy Materials. Stockholders may present proper proposals for inclusion in the Company’s proxy statement and for consideration at the annual meeting of its stockholders to be held in 2008 by submitting their proposals in writing to the Secretary of the Company in a timely manner. In order to be included in the Company’s proxy materials for the 2008 annual meeting of stockholders, stockholder proposals must be received by the Secretary of the Company no later than the Notice Deadline (as defined below), and must otherwise comply with the requirements of Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Requirements for Stockholder Proposals to be Brought Before an Annual Meeting. In addition, the Company’s Bylaws establish an advance notice procedure for stockholders who wish to present certain matters before an annual meeting of stockholders. In general, nominations for the election of directors may be made by (1) the Board of Directors, (2) the Corporate Governance and Nominating Committee or (3) any stockholder entitled to vote who has delivered written notice to the Secretary of the Company no later than the Notice Deadline, which notice must contain specified information concerning the nominees and concerning the stockholder proposing such nominations. If a stockholder wishes only to recommend a candidate for consideration by the Corporate Governance and Nominating Committee as a potential nominee for the Company’s Board of Directors, such recommendations must be received by June 30 of the year in which the recommended candidate will be considered for nomination. Stockholder recommendations for candidates to the Board of Directors must be directed in writing to Avanex Corporation, 40919 Encyclopedia Circle, Fremont, California 94538, Attention: Corporate Secretary, and must include the candidate’s name, home and business contact information, detailed biographical data and qualifications, information regarding any relationships between the candidate and the Company within the last three years and evidence of the nominating person’s ownership of Company stock. Such recommendations must also include a statement from the recommending stockholder in support of the candidate, particularly within the context of the criteria for membership on the Board of Directors, including issues of character, judgment, diversity, age, independence, expertise, corporate experience, other commitments and the like, personal references, and an indication of the candidate’s willingness to serve.

The Company’s Bylaws also provide that the only business that may be conducted at an annual meeting is business that is (1) specified in the notice of meeting given by or at the direction of the Board of Directors, (2) properly brought before the meeting by or at the direction of the Board of Directors, or (3) properly brought before the meeting by a stockholder who has delivered written notice to the Secretary of the Company no later than the Notice Deadline, which notice must contain specified information concerning the matters to be brought before such meeting and concerning the stockholder proposing such matters.

The “Notice Deadline” is defined as that date which is 120 days prior to the one-year anniversary of the date on which the Company first mailed its proxy materials for the previous year’s annual meeting of stockholders. As a result, the Notice Deadline for the 2008 annual stockholder meeting is June 16, 2008.

If a stockholder who has notified the Company of his or her intention to present a proposal at an annual meeting does not appear to present his or her proposal at such meeting, or does not send a representative who is qualified under Delaware law to present the proposal on his or her behalf, the Company need not present the proposal for vote at such meeting.

A copy of the full text of the Bylaw provisions discussed above may be obtained by writing to the Secretary of the Company. All notices of proposals by stockholders, whether or not included in the Company’s proxy materials, should be sent to Avanex Corporation, 40919 Encyclopedia Circle, Fremont, California 94538, Attention: Corporate Secretary.

3

PROPOSAL ONE

TO APPROVE AMENDMENTS TO AVANEX’S AMENDED AND RESTATED CERTIFICATE OF INCORPORATION WHICH WOULD EFFECT A REVERSE STOCK SPLIT, PURSUANT TO WHICH ANY WHOLE NUMBER OF OUTSTANDING SHARES OF AVANEX’S COMMON STOCK BETWEEN AND INCLUDING TEN AND FIFTEEN WOULD BE COMBINED INTO ONE SHARE OF SUCH STOCK, PURSUANT TO WHICH THE TOTAL NUMBER OF SHARES OF COMMON STOCK THAT AVANEX IS AUTHORIZED TO ISSUE WOULD BE CORRESPONDINGLY REDUCED, AND PURSUANT TO WHICH THE TOTAL NUMBER OF SHARES OF PREFERRED STOCK THAT AVANEX IS AUTHORIZED TO ISSUE WOULD BE REDUCED TO 2,000,000, AND TO AUTHORIZE THE COMPANY’S BOARD OF DIRECTORS TO SELECT AND FILE ONE SUCH AMENDMENT WHICH WOULD EFFECT THE REVERSE STOCK SPLIT WITHIN SUCH RANGE

Overview

Our Board of Directors has unanimously approved proposed amendments to the Certificate which would effect a reverse stock split of all outstanding shares of Common Stock at an exchange ratio ranging from one-for-ten to one-for-fifteen, would reduce the total number of shares of Common Stock that Avanex is authorized to issue by a corresponding amount and would reduce the total number of shares of Preferred Stock that Avanex is authorized to issue to 2,000,000. The Board of Directors has declared such proposed amendments to be advisable and has recommended that these proposed amendments be presented to the stockholders for approval. You are now being asked to vote upon these amendments to the Certificate which would effect a reverse stock split whereby a number of outstanding shares of Common Stock between and including ten and fifteen would be combined into one share of Common Stock, the total number of shares of Common Stock that Avanex is authorized to issue would be reduced by a corresponding amount, and the total number of shares of Preferred Stock that Avanex is authorized to issue would be reduced to 2,000,000. The actions taken in connection with the reverse stock split would reduce the number of outstanding and the total number of authorized shares of Common Stock as well as the total number of authorized shares of Preferred Stock.

Upon receiving stockholder approval, the Board of Directors will have the sole discretion pursuant to Section 242(c) of the Delaware General Corporation Law to elect, as it determines to be in the best interests of the Company and its stockholders, whether or not to effect a reverse stock split, and if so, the number of shares of Common Stock between and including ten and fifteen which will be combined into one share of Common Stock, to effect the corresponding reduction in the total number of shares of Common Stock that Avanex is authorized to issue, and to effect the reduction in the total number of shares of Preferred Stock that Avanex is authorized to issue to 2,000,000, at any time before the annual meeting of stockholders in 2009. The Board of Directors believes that stockholder approval of these amendments granting the Board of Directors this discretion, rather than approval of a specified exchange ratio, provides the Board of Directors with maximum flexibility to react to then-current market conditions and, therefore, is in the best interests of the Company and its stockholders.

The text of the form of proposed amendments to the Certificate is attached hereto asAppendix A. By approving these amendments, stockholders will approve a series of amendments to the Certificate pursuant to which any whole number of outstanding shares between and including ten and fifteen would be combined into one share of Common Stock, pursuant to which the total number of shares of Common Stock that Avanex is authorized to issue would be correspondingly reduced, and pursuant to which the total number of shares of Preferred Stock that Avanex is authorized to issue would be reduced to 2,000,000, and authorize the Board of Directors to file only one such amendment, as determined by the Board of Directors in the manner described herein, and to abandon each amendment not selected by the Board of Directors. The Board of Directors may also elect not to undertake any reverse split, any corresponding reduction in the total number of authorized shares of Common Stock and the reduction in the total number of authorized shares of Preferred Stock to 2,000,000.

If approved by the stockholders, and following such stockholder approval the Board of Directors determines that effecting a reverse stock split, effecting a corresponding reduction in the total number of authorized shares of

4

Common Stock, and effecting a reduction in the total number of authorized shares of Preferred Stock to 2,000,000 is in the best interests of the Company and its stockholders, the reverse stock split, the corresponding reduction in the total number of authorized shares of Common Stock, and the reduction in the total number of authorized shares of Preferred Stock to 2,000,000 will become effective upon filing one such amendment with the Secretary of State of the State of Delaware. The amendment filed thereby will contain the number of shares selected by the Board of Directors within the limits set forth in this proposal to be combined into one share of Common Stock, the corresponding reduction in the total number of authorized shares of Common Stock, and the reduction in the total number of authorized shares of Preferred Stock to 2,000,000.

If, following stockholder approval, the Board of Directors elects to effect a reverse stock split, a corresponding reduction in the total number of authorized shares of Common Stock, and a reduction in the total number of authorized shares of Preferred Stock to 2,000,000, the number of issued and outstanding shares of Common Stock would be reduced in accordance with an exchange ratio determined by the Board of Directors within the limits set forth in this proposal, the total number of shares of Common Stock that Avanex is authorized to issue would be reduced by a corresponding amount, and the total number of authorized shares of Preferred Stock would be reduced to 2,000,000. Except for adjustments that may result from the treatment of fractional shares as described below, each stockholder will hold the same percentage of the outstanding Common Stock immediately following the reverse stock split as such stockholder held immediately prior to the reverse stock split. The par value of the Common Stock would remain unchanged at $0.001 per share.

Reasons for the Reverse Stock Split

The Board of Directors believes that a reverse stock split and corresponding reduction in the total number of authorized shares of Common Stock may be desirable for a number of reasons. First, the Board of Directors believes that a reverse stock split and corresponding reduction in the total number of authorized shares of Common Stock could improve the marketability and liquidity of the Common Stock. Second, the Board of Directors believes that a reverse stock split may enable the Company to meet the continued listing rules of the Nasdaq Global Market.

Potential Increased Investor Interest. The Board of Directors believes that the increased market price of the Common Stock expected as a result of implementing a reverse stock split and corresponding reduction in the total number of authorized shares of Common Stock will improve the marketability and liquidity of the Common Stock and will encourage interest and trading in the Common Stock. Many brokerage houses and institutional investors have internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers. In addition, some of those policies and practices may function to make the processing of trades in low-priced stocks economically unattractive to brokers. Moreover, because brokers’ commissions on low-priced stocks generally represent a higher percentage of the stock price than commissions on higher-priced stocks, the current average price per share of Common Stock can result in individual stockholders paying transaction costs representing a higher percentage of their total share value than would be the case if the share price were substantially higher. Although it should be noted that the liquidity of the Common Stock may be harmed by the proposed reverse split given the reduced number of shares that would be outstanding after the reverse stock split, the Board of Directors is hopeful that the anticipated higher market price will reduce, to some extent, the negative effects on the liquidity and marketability of the Common Stock inherent in some of the policies and practices of institutional investors and brokerage houses described above.

Nasdaq Listing. On March 5, 2008, Avanex received a letter from the Listing Qualifications Department of The Nasdaq Stock Market LLC informing it that for the previous thirty consecutive trading days, the bid price of the Company’s Common Stock had closed below the minimum $1.00 per share requirement for continued listing set forth in Marketplace Rule 4450(a)(5), and that, in accordance with Marketplace Rule 4450(e)(2), the Company was being provided 180 calendar days, or until September 2, 2008, to regain compliance with the minimum $1.00 per share bid price requirement. Compliance will be achieved if the bid price of the Common

5

Stock closes at or above $1.00 per share for a minimum of ten consecutive trading days prior to September 2, 2008 (or such longer period of time as may be required by Nasdaq, in its discretion). Avanex believes that approval of this Proposal One would significantly reduce Avanex’s risk of not meeting the continued listing standard by providing Avanex with the ability to increase the share price of the Common Stock above $1.00 per share by effecting the amendment so approved.

Preferred Stock. The Board of Directors believes that, with a reduction in the total number of authorized shares of Common Stock as contemplated herein, the total number of authorized shares of Preferred Stock can also be adjusted from 10,000,000 to 2,000,000 so as to eliminate unneeded authorized shares of Preferred Stock.

The Board of Directors does not intend for this transaction to be the first step in a series of plans or proposals of a “going private transaction” within the meaning of Rule 13e-3 of the Exchange Act.

The Reverse Stock Split May Not Result in an Increase in the Per Share Price of the Common Stock; There Are Other Risks Associated With the Reverse Stock Split

The Board of Directors expects that a reverse stock split of the Common Stock will increase the market price of the Common Stock. However, the Company cannot be certain whether the reverse stock split would increase the trading price for the Common Stock. The history of similar stock split combinations for companies in like circumstances is varied. There is no assurance that:

| | • | | the trading price per share of Common Stock after the reverse stock split would rise in proportion to the reduction in the number of pre-split shares of Common Stock outstanding before the reverse stock split; |

| | • | | the reverse stock split would result in a per share price that would attract brokers and investors who do not trade in lower priced stocks; and |

| | • | | the market price per post-split share would either exceed or remain in excess of the $1.00 minimum bid price as required by Nasdaq or that the Company would otherwise meet the requirements of Nasdaq for continued inclusion for trading on Nasdaq. |

The market price of the Common Stock would also be based on Avanex’s performance and other factors, some of which are unrelated to the number of shares outstanding. If the reverse stock split is consummated and the trading price of the Common Stock declines, the percentage decline as an absolute number and as a percentage of the Company’s overall market capitalization may be greater than would occur in the absence of the reverse stock split. Furthermore, the liquidity of the Common Stock could be adversely affected by the reduced number of shares that would be outstanding after the reverse stock split.

Board Discretion to Implement the Reverse Stock Split

If the reverse stock split, the corresponding reduction in the total number of authorized shares of Common Stock, and the reduction in the total number of authorized shares of Preferred Stock to 2,000,000 are approved by the stockholders, such amendment will be effected, if at all, only upon a determination by the Board of Directors that a reverse stock split (with an exchange ratio determined by the Board of Directors as described above), a corresponding reduction in the total number of authorized shares of Common Stock, and a reduction in the total number of authorized shares of Preferred Stock to 2,000,000 are in the best interests of the Company and its stockholders. Such determination shall be based upon certain factors, including existing and expected marketability and liquidity of the Common Stock, meeting the listing requirements for the Nasdaq Global Market, prevailing market conditions and the likely effect on the market price of the Common Stock. Notwithstanding approval by the stockholders of the reverse stock split, the corresponding reduction in the total number of authorized shares of Common Stock, and the reduction in the total number of authorized shares of Preferred Stock to 2,000,000, the Board of Directors may, in its sole discretion, abandon all of the proposed amendments and determine prior to the effectiveness of any filing with the Secretary of State of the State of

6

Delaware not to effect the reverse stock split, the corresponding reduction in the total number of authorized shares of Common Stock, and the reduction in the total number of authorized shares of Preferred Stock to 2,000,000 prior to the annual meeting of stockholders in 2009, as permitted under Section 242(c) of the Delaware General Corporation Law. If the Board of Directors fails to implement any of the reverse stock splits, the corresponding reductions in the total number of authorized shares of Common Stock, and the reduction in the total number of authorized shares of Preferred Stock to 2,000,000 prior to the annual meeting of stockholders in 2009, stockholder approval again would be required prior to implementing any reverse stock split, corresponding reduction in the total number of authorized shares of Common Stock, and reduction in the total number of authorized shares of Preferred Stock to 2,000,000.

Principal Effects of the Reverse Stock Split

After the effective date of the proposed reverse stock split and corresponding reduction in the total number of authorized shares of Common Stock, each stockholder will own a reduced number of shares of Common Stock. However, the proposed reverse stock split will affect all stockholders uniformly and will not affect any stockholder’s percentage ownership interest in the Company (except to the extent that the reverse split would result in any of the stockholders owning a fractional share as described below). Proportionate voting rights and other rights and preferences of the holders of Common Stock will not be affected by the proposed reverse stock split (except to the extent that the reverse split would result in any stockholders owning a fractional share as described below). For example, a holder of 2% of the voting power of the outstanding shares of Common Stock immediately prior to the reverse stock split would continue to hold approximately 2% of the voting power of the outstanding shares of Common Stock immediately after the reverse stock split. The number of stockholders of record also will not be affected by the proposed reverse stock split (except to the extent that the reverse split would result in any stockholders owning only a fractional share as described below).

The following table contains approximate information relating to the Common Stock under each of the proposed amendments based on share information as of May 1, 2008 (in thousands):

| | | | | | | | | | | | | | |

| | | Pre

Reverse

Split | | 1-for-10 | | 1-for-11 | | 1-for-12 | | 1-for-13 | | 1-for-14 | | 1-for-15 |

Authorized | | 450,000 | | 45,000 | | 40,909 | | 37,500 | | 34,615 | | 32,142 | | 30,000 |

Outstanding | | 229,731 | | 22,973 | | 20,885 | | 19,144 | | 17,672 | | 16,409 | | 15,315 |

Reserved for future issuance pursuant to outstanding stock options and restricted stock units | | 17,424 | | 1,742 | | 1,584 | | 1,452 | | 1,340 | | 1,245 | | 1,162 |

Reserved for future issuance pursuant to outstanding warrants | | 10,098 | | 1,010 | | 918 | | 842 | | 777 | | 721 | | 673 |

Reserved for future issuance pursuant to employee benefit plans | | 24,124 | | 2,412 | | 2,193 | | 2,010 | | 1,856 | | 1,723 | | 1,608 |

The proposed reverse stock split will also reduce the number of shares of Common Stock available for issuance under the Company’s 1998 Stock Plan, 1999 Director Option Plan, 1999 Employee Stock Purchase Plan and Officer and Director Share Purchase Plan, in proportion to the exchange ratio selected by the Board of Directors within the limits set forth in this proposal. The Company also has certain outstanding stock options to purchase shares of Common Stock and certain outstanding unvested Restricted Stock Units (“RSUs”). Under the terms of the outstanding stock options and the outstanding unvested RSUs, the proposed reverse stock split will effect a reduction in the number of shares subject to such outstanding options or unvested RSUs proportional to the ratio of the reverse stock split and will effect a proportionate increase in the exercise price of such outstanding stock options. In connection with the proposed reverse stock split, the number of shares of Common Stock issuable upon exercise of outstanding stock options or vesting of outstanding unvested RSUs will be rounded to the nearest whole share and no cash payment will be made in respect of such rounding.

7

Under the terms of the Company’s outstanding warrants, the proposed reverse stock split would also result in a proportionate increase in the exercise price of the warrants, as well as a proportionate decrease in the number of shares issuable to the holders thereof upon exercise of the warrants.

If the proposed reverse stock split is implemented, it will increase the number of stockholders of the Company who own “odd lots” of less than 100 shares of Common Stock. Brokerage commission and other costs of transactions in odd lots are generally higher than the costs of transactions of more than 100 shares of Common Stock.

The Common Stock is currently registered under Section 12(b) of the Exchange Act, and the Company is subject to the periodic reporting and other requirements of the Exchange Act. The proposed reverse stock split will not affect the registration of the Common Stock under the Exchange Act. If the proposed reverse stock split is implemented, the Common Stock will continue to be reported on the Nasdaq Global Market under the symbol “AVNX” (although Nasdaq would likely add the letter “D” to the end of the trading symbol for a period of 20 trading days to indicate that the reverse stock split has occurred).

If the proposed reverse stock split is implemented which would effect a reverse stock split of all outstanding shares of Common Stock at an exchange ratio ranging from one-for-ten to one-for-fifteen and which would reduce the total number of shares of Common Stock that Avanex is authorized to issue by a corresponding amount, the reduction in the total number of shares of Preferred Stock that Avanex is authorized to issue to 2,000,000 would be effected regardless of the particular reverse stock-split exchange ratio that was determined by the Board of Directors within the limits set forth in this proposal.

Effective Date

The proposed reverse stock split, the corresponding reduction in the total number of authorized shares of Common Stock, and the reduction in the total number of authorized shares of Preferred Stock to 2,000,000 would become effective as of 5:00 p.m. Eastern time on the date of filing of a certificate of amendment to the Certificate with the office of the Secretary of State of the State of Delaware. On the effective date, shares of Common Stock issued and outstanding immediately prior thereto will be combined and converted, automatically and without any action on the part of the stockholders, into new shares of Common Stock in accordance with the reverse stock split ratio determined by the Board of Directors within the limits set forth in this proposal, the total number of shares of Common Stock that Avanex is authorized to issue will be reduced by a corresponding amount, and the total number of shares of Preferred Stock that Avanex is authorized to issue will be reduced by 2,000,000.

Treatment of Fractional Shares

No scrip or fractional shares would be issued if, as a result of the reverse stock split, a registered stockholder would otherwise become entitled to a fractional share. Instead, the Company would pay to the registered stockholder, in cash, the value of any fractional share interest arising from the reverse stock split. The cash payment would equal the fraction to which the stockholder would otherwise be entitled multiplied by the closing sales price of the Common Stock as reported on the Nasdaq Global Market, as of the effective date. No transaction costs would be assessed to stockholders for the cash payment. Stockholders would not be entitled to receive interest for the period of time between the effective date of the reverse stock split and the date payment is made for their fractional shares.

If you do not hold sufficient shares of pre-split Common Stock to receive at least one post-split share of Common Stock and you want to hold the Common Stock after the reverse stock split, you may do so by taking either of the following actions far enough in advance so that it is completed before the reverse stock split is effected:

| | • | | purchase a sufficient number of shares of Common Stock so that you would hold at least that number of shares of Common Stock in your account prior to the implementation of the reverse stock split that would entitle you to receive at least one share of Common Stock on a post-split basis; or |

8

| | • | | if applicable, consolidate your accounts so that you hold at least that number of shares of Common Stock in one account prior to the reverse stock split that would entitle you to at least one share of Common Stock on a post-split basis. Common Stock held in registered form (that is, shares held by you in your own name on the Company’s share register maintained by its transfer agent) and Common Stock held in “street name” (that is, shares held by you through a bank, broker or other nominee) for the same investor would be considered held in separate accounts and would not be aggregated when implementing the reverse stock split. Also, shares of Common Stock held in registered form but in separate accounts by the same investor would not be aggregated when implementing the reverse stock split. |

After the reverse stock split, then current stockholders would have no further interest in the Company with respect to their fractional shares. A person otherwise entitled to a fractional share interest would not have any voting, dividend or other rights in respect of their fractional interest except to receive the cash payment as described above. Such cash payments would reduce the number of post-split stockholders to the extent that there are stockholders holding fewer than that number of pre-split shares within the exchange ratio that is determined by the Board of Directors as described above. Reducing the number of post-split stockholders, however, is not the purpose for this Proposal One.

Stockholders should be aware that, under the escheat laws of the various jurisdictions where stockholders reside, where Avanex is domiciled and where the funds for fractional shares would be deposited, sums due to stockholders in payment for fractional shares that are not timely claimed after the effective time may be required to be paid to the designated agent for each such jurisdiction. Thereafter, stockholders otherwise entitled to receive such funds may have to seek to obtain them directly from the state to which they were paid.

Effect on Non-registered Stockholder

Non-registered stockholders holding Common Stock through a bank, broker or other nominee should note that such banks, brokers or other nominees may have different procedures for processing the consolidation than those that would be put in place by the Company for registered stockholders, and their procedures may result, for example, in differences in the precise cash amounts being paid by such nominees in lieu of a fractional share. If you hold your shares with such a bank, broker or other nominee and if you have questions in this regard, you are encouraged to contact your nominee.

Exchange of Stock Certificates

As soon as practicable after the effective date, stockholders will be notified that the reverse split has been effected. The Company’s transfer agent will act as “exchange agent” for purposes of implementing the exchange of stock certificates. Holders of pre-reverse split shares will be asked to surrender to the exchange agent certificates representing pre-reverse split shares in exchange for certificates representing post-reverse split shares and payment in lieu of fractional shares (if any) in accordance with the procedures to be set forth in a letter of transmittal to be sent by the Company. No new certificates and no payments in lieu of fractional shares will be issued to a stockholder until such stockholder has surrendered such stockholder’s outstanding certificate(s) together with the properly completed and executed letter of transmittal to the exchange agent.

STOCKHOLDERS SHOULD NOT DESTROY ANY PRE-SPLIT STOCK CERTIFICATE AND SHOULD NOT SUBMIT ANY CERTIFICATES UNTIL THEY ARE REQUESTED TO DO SO.

Accounting Consequences

The par value per share of Common Stock would remain unchanged at $0.001 per share after the reverse stock split. As a result, on the effective date of the reverse split, the stated capital on the Company’s balance sheet attributable to the Common Stock will be reduced proportionally, based on the exchange ratio of the reverse stock split, from its present amount, and the additional paid-in capital account shall be credited with the

9

amount by which the stated capital is reduced. The per share Common Stock net income or loss and net book value will be increased because there will be fewer shares of Common Stock outstanding. The Company does not anticipate that any other accounting consequences would arise as a result of the reverse stock split.

No Appraisal Rights

Our stockholders are not entitled to dissenters’ or appraisal rights under either Delaware or California corporate law, respectively, with respect to the proposed amendments to the Certificate to effect the reverse split, and Avanex will not independently provide the stockholders with any such right.

Material Federal U.S. Income Tax Consequence of the Reverse Stock Split

The following is a summary of certain material federal income tax consequences of the reverse stock split to the holders of the Common Stock and does not purport to be a complete discussion of all of the possible federal income tax consequences of the reverse stock split and is included for general information only. Further, it does not address any state, local or foreign income or other tax consequences. Also, it does not address the tax consequences that may be applicable to particular holders in light of their individual circumstances or to holders that are subject to special tax rules, such as banks, insurance companies, regulated investment companies, personal holding companies, foreign entities, nonresident alien individuals, broker-dealers and tax-exempt entities. The discussion is based on the provisions of the United States federal income tax law as of the date hereof, which is subject to change retroactively as well as prospectively. This summary also assumes that the pre-split shares were, and the post-split shares would be, held as a “capital asset,” as defined in the Internal Revenue Code of 1986, as amended (i.e., generally, property held for investment). The tax treatment of a stockholder may vary depending upon the particular facts and circumstances of such stockholder. Each stockholder is urged to consult with such stockholder’s own tax advisor with respect to the tax consequences of the reverse stock split.

No gain or loss should be recognized by a stockholder upon such stockholder’s exchange of pre-split shares for post-split shares pursuant to the reverse stock split, other than with respect to the cash payments for fractional shares (as discussed below). The aggregate tax basis of the post-split shares received in the reverse stock split (including any fraction of a post-split share deemed to have been received) would be the same as the stockholder’s aggregate tax basis in the pre-split shares exchanged therefor. The stockholder’s holding period for the post-split shares would include the period during which the stockholder held the pre-split shares surrendered in the reverse stock split. In general, stockholders who receive cash upon redemption of their fractional share interests in the post-split shares as a result of the reverse stock split will recognize gain or loss based on their adjusted basis in the fractional share interests redeemed.

Our view regarding the tax consequence of the reverse stock split is not binding on the Internal Revenue Service or the courts. Accordingly, each stockholder should consult with his or her own tax advisor with respect to all of the potential tax consequences to him or her of the reverse stock split.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THIS PROPOSAL.

10

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information concerning the beneficial ownership of Avanex’s Common Stock, as of May 1, 2008, for the following: (1) each person or entity who is known by the Company to own beneficially more than 5% of the outstanding shares of the Company’s Common Stock; (2) each of the Company’s non-employee directors; (3) each of the executive officers named in the Summary Compensation Table on page 22 of the Company’s proxy statement for its 2007 Annual Meeting of Stockholders filed with the SEC on October 16, 2007; and (4) all directors and executive officers of the Company as a group.

| | | | | |

Name | | Common

Stock

Beneficially

Owned(1) | | Percentage

Beneficially

Owned(2) | |

Pirelli & C. SpA(3) | | 28,295,868 | | 12.31 | % |

Via Gaetano Negri, 10 Milan Italy | | | | | |

| | |

Trivium Capital Management, LLC(4) | | 27,431,900 | | 11.93 | % |

600 Lexington Avenue, 23rd Floor New York, NY 10022 | | | | | |

| | |

Jo S. Major, Jr.(5) | | 2,225,517 | | * | |

Vinton Cerf(6) | | 188,057 | | * | |

Greg Dougherty(7) | | 134,162 | | * | |

Joel A. Smith III(8) | | 160,875 | | * | |

Paul G. Smith (9) | | 328,732 | | * | |

Susan Wang(10) | | 176,642 | | * | |

Dennis Wolf | | — | | * | |

Yves LeMaitre(11) | | 7,716 | | * | |

Brad Kolb(12) | | 304,863 | | * | |

Marla Sanchez(13) | | 425,731 | | * | |

Cal Hoagland(14) | | — | | * | |

Anthony Riley(15) | | 116,040 | | * | |

All directors and executive officers as a group (12 persons)(16) | | 5,705,954 | | 2.44 | % |

| * | Less than one percent of the outstanding Common Stock. |

| (1) | The number and percentage of shares beneficially owned are determined in accordance with Rule 13d-3 of the Exchange Act, and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rule, beneficial ownership includes any shares over which the individual or entity has voting power or investment power and any shares of Common Stock that the individual has the right to acquire within 60 days of May 1, 2008, through the exercise of any stock option or other right. Unless otherwise indicated in the footnotes, each person or entity has sole voting and investment power (or shares such powers with his or her spouse) with respect to the shares shown as beneficially owned. |

| (2) | The total number of shares of Common Stock outstanding as of May 1, 2008 was 229,888,496. |

| (3) | As indicated in the Schedule 13G jointly filed by Pirelli & C. SpA (“Pirelli”) and by Pirelli Finance (Luxembourg) SA (“Pirelli Finance”) pursuant to the Exchange Act on November 8, 2007, which may not be current as of May 1, 2008. Each of Pirelli and Pirelli Finance may be deemed to beneficially own an aggregate of 28,295,868 shares. Pirelli Finance is a wholly-owned subsidiary of Perilli with principal business offices at 35 boulevard du Prince, L-1724 Luxemboug, Luxembourg. |

| (4) | As indicated in the Schedule 13G/A jointly filed by Trivium Capital Management, LLC and by Trivium Offshore Fund Ltd. pursuant to the Exchange Act on February 14, 2008, which may not be current as of |

11

| | May 1, 2008. Trivium Offshore Fund Ltd. has voting and dispositive power over 22,693,007 shares and principal business offices at c/o Citco Fund Services (Bermuda) Limited, Washington Mall West, 2nd Floor, 7 Reid Street, Hamilton HM11, Bermuda. |

| (5) | Represents 761,408 shares held by Dr. Major and 1,464,109 shares issuable pursuant to options exercisable and restricted stock units scheduled to vest within 60 days of May 1, 2008. |

| (6) | Represents 35,557 shares held by Dr. Cerf and 152,500 shares issuable pursuant to options exercisable and restricted stock units scheduled to vest within 60 days of May 1, 2008. |

| (7) | Represents 64,162 shares held by Mr. Dougherty and 70,000 shares issuable pursuant to options exercisable and restricted stock units scheduled to vest within 60 days of May 1, 2008. |

| (8) | Represents 40,000 shares held by Mr. J. Smith individually, 8,375 shares held by his spouse and 112,500 shares issuable pursuant to options exercisable and restricted stock units scheduled to vest within 60 days of May 1, 2008. |

| (9) | Represents 328,732 shares held by Mr. P. Smith. |

| (10) | Represents 66,642 shares held by Ms. Wang and 110,000 shares issuable pursuant to options exercisable and restricted stock units scheduled to vest within 60 days of May 1, 2008. |

| (11) | Mr. LeMaitre resigned as the Company’s Senior Vice President and Chief Marketing Officer, effective November 9, 2007. The last Form 5 was filed on November 9, 2007, thus the beneficial ownership may not be current as of May 1, 2008. |

| (12) | Represents 34,493 shares held by Mr. Kolb and 270,370 shares issuable pursuant to options exercisable and restricted stock units scheduled to vest within 60 days of May 1, 2008. |

| (13) | Represents 221,816 shares held by Ms. Sanchez and 203,915 shares issuable pursuant to options exercisable and restricted stock units scheduled to vest within 60 days of May 1, 2008. |

| (14) | Mr. Hoagland ceased to be the Company’s Senior Vice President and Chief Financial Officer on October 27, 2006. The last Form 4 was filed on October 3, 2006, thus the beneficial ownership may not be current as of May 1, 2008. |

| (15) | Mr. Riley resigned as Vice President of Finance in May 2007, effective June 30, 2007. The last Form 5 was filed on August 14, 2007, thus the beneficial ownership may not be current as of May 1, 2008. |

| (16) | Includes 4,058,315 shares issuable upon the exercise of options exercisable and restricted stock units scheduled to vest within 60 days of May 1, 2008. |

12

OTHER MATTERS

The Board of Directors does not know of any other matter to be presented at the Special Meeting. If any additional matters are properly presented at the Special Meeting, the persons named on the enclosed proxy card will have discretion to vote the shares of Common Stock they represent in accordance with their own judgment on such matters.

It is important that your shares be represented at the Special Meeting, regardless of the number of shares that you hold. We urge you to vote by telephone or by using the Internet as instructed on the enclosed proxy card or execute and return, at your earliest convenience, the enclosed proxy card in the envelope that has also been enclosed.

|

| THE BOARD OF DIRECTORS |

|

| Vinton Cerf |

| Greg Dougherty |

| Jo S. Major, Jr. |

| Joel A. Smith III |

| Paul G. Smith |

| Susan Wang |

| Dennis Wolf |

Fremont, California

May 16, 2008

13

APPENDIX A

FORM OF CERTIFICATE OF AMENDMENT

CERTIFICATE OF AMENDMENT

TO THE AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

OF AVANEX CORPORATION

A Delaware Corporation

Avanex Corporation, a corporation organized and existing under the laws of the State of Delaware (the “Corporation”), hereby certifies that:

A: The name of this Corporation is Avanex Corporation.

B: The date of filing of this Corporation’s original Certificate of Incorporation with the Secretary of State of Delaware was December 1, 1999.

C: Pursuant to Section 242 of the Delaware General Corporation Law, this Certificate of Amendment hereby amends the provisions of the Corporation’s Amended and Restated Certificate of Incorporation by deleting the first paragraph of Article Fourth and substituting therefor a new first paragraph to read in its entirety as follows:

FOURTH: This Corporation is authorized to issue two classes of shares to be designated, respectively, Common Stock and Preferred Stock. The total number of shares of Common Stock that this Corporation is authorized to issue is[ ]* with a par value of $0.001 per share, and the total number of shares of Preferred Stock that this Corporation is authorized to issue is 2,000,000, with a par value of $0.001 per share. Effective as of 5:00 p.m., Eastern time, on the date this Certificate of Amendment to the Amended and Restated Certificate of Incorporation is filed with the Secretary of State of the State of Delaware, each[ten (10) to fifteen (15)]* shares of the Corporation’s Common Stock, par value $0.001 per share, issued and outstanding shall, automatically and without any action on the part of the respective holders thereof, be combined and converted into one (1) share of Common Stock, par value $0.001 per share, of the Corporation. No fractional shares shall be issued and, in lieu thereof, any holder of less than one (1) share of Common Stock shall be entitled to receive cash for such holder’s fractional share based upon the closing sales price of the Corporation’s Common Stock as reported on the Nasdaq Global Market, as of the date this Certificate of Amendment is filed with the Secretary of State of the State of Delaware.

D: This Certificate of Amendment to the Amended and Restated Certificate of Incorporation has been duly adopted by the stockholders of the Corporation in accordance with the provisions of Section 242 of the Delaware General Corporation Law.

IN WITNESS WHEREOF, Avanex Corporation has caused this Certificate of Amendment to the Amended and Restated Certificate of Incorporation to be signed by Jo S. Major, Jr. its President and Chief Executive Officer, this day of , .

|

| AVANEX CORPORATION |

|

|

| Jo S. Major, Jr. |

| President and Chief Executive Officer |

| * | These amendments approve the combination of any whole number of shares of Common Stock between and including ten (10) and fifteen (15) into one (1) share of Common Stock and a corresponding reduction in the total number of shares of Common Stock that Avanex is authorized to issue. By these amendments, the |

A-1

| | stockholders would approve each of the six amendments proposed by the Board of Directors. The Certificate of Amendment filed with the Secretary of State of the State of Delaware will include only that amendment determined by the Board of Directors to be in the best interests of the Corporation and its stockholders. The other five proposed amendments will be abandoned pursuant to Section 242(c) of the Delaware General Corporation Law. The Board of Directors may also elect not to do any reverse split and corresponding reduction in the total number of shares of Common Stock that Avanex is authorized to issue, in which case all six proposed amendments will be abandoned. In accordance with the resolutions to be adopted by the stockholders, the Board of Directors will not implement any amendment providing for a different split ratio. |

A-2

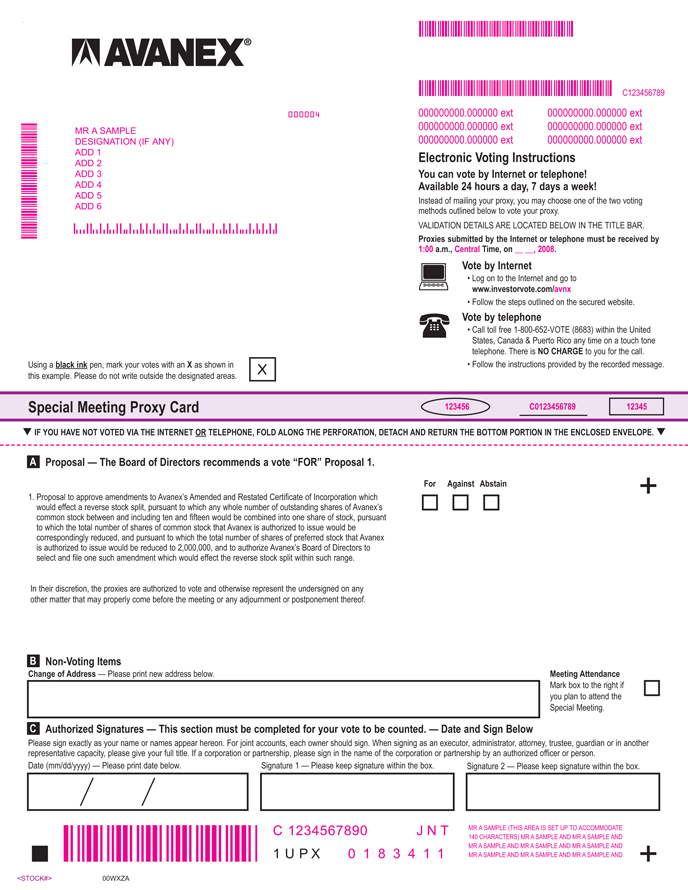

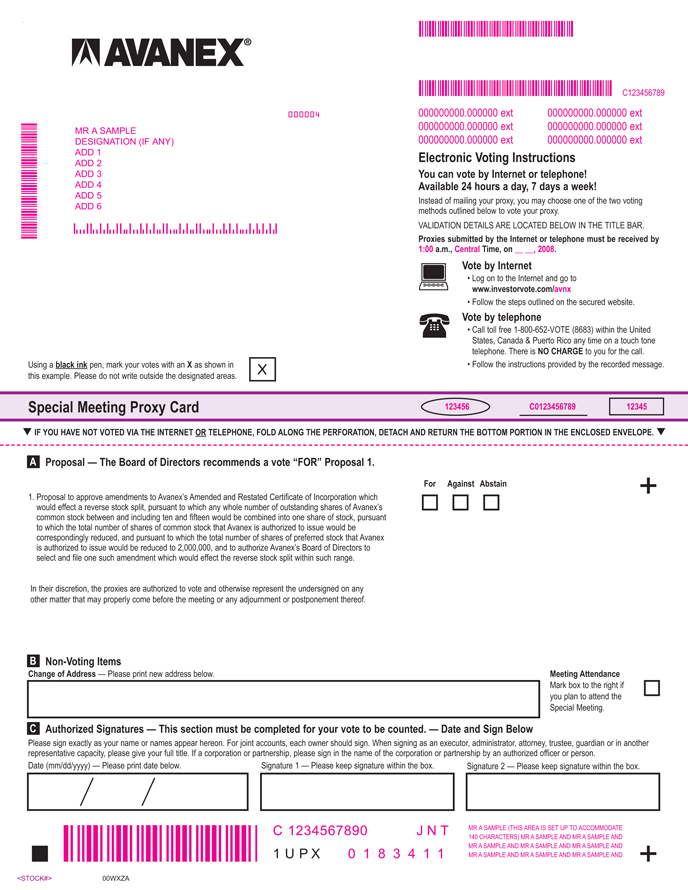

AVANEX <STOCK#> 000000000.000000 ext 000000000.000000 ext 000000000.000000 ext 000000000.000000 ext 000000000.000000 ext 000000000.000000 ext 000004 MR A SAMPLE DESIGNATION (IF ANY) ADD 1 ADD 2 ADD 3 ADD 4 ADD 5 ADD 6 123456 C0123456789 12345 0 1 8 3 4 1 1 MR A SAMPLE (THIS AREA IS SET UP TO ACCOMMODATE 140 CHARACTERS) MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND C 1234567890 J N T C123456789 Using a black ink pen, mark your votes with an X as shown in this example. Please do not write outside the designated areas. X 00WXZA 1 U PX + Special Meeting Proxy Card . Authorized Signatures — This section must be completed for your vote to be counted. — Date and Sign Below C Please sign exactly as your name or names appear hereon. For joint accounts, each owner should sign. When signing as an executor, administrator, attorney, trustee, guardian or in another representative capacity, please give your full title. If a corporation or partnership, please sign in the name of the corporation or partnership by an authorized officer or person. Signature 1 — Please keep signature within the box. Signature 2 — Please keep signature within the box. Date (mm/dd/yyyy) — Please print date below. + B Non-Voting Items A Proposal — The Board of Directors recommends a vote “FOR” Proposal 1. For Against Abstain 1. Proposal to approve amendments to Avanex’s Amended and Restated Certificate of Incorporation which would effect a reverse stock split, pursuant to which any whole number of outstanding shares of Avanex’s common stock between and including ten and fifteen would be combined into one share of stock, pursuant to which the total number of shares of common stock that Avanex is authorized to issue would be correspondingly reduced, and pursuant to which the total number of shares of preferred stock that Avanex is authorized to issue would be reduced to 2,000,000, and to authorize Avanex’s Board of Directors to select and file one such amendment which would effect the reverse stock split within such range. In their discretion, the proxies are authorized to vote and otherwise represent the undersigned on any other matter that may properly come before the meeting or any adjournment or postponement thereof. Meeting Attendance Mark box to the right if you plan to attend the Special Meeting. Change of Address — Please print new address below. IF YOU HAVE NOT VOTED VIA THE INTERNET OR TELEPHONE, FOLD ALONG THE PERFORATION, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE. Electronic Voting Instructions You can vote by Internet or telephone! Available 24 hours a day, 7 days a week! Instead of mailing your proxy, you may choose one of the two voting methods outlined below to vote your proxy. VALIDATION DETAILS ARE LOCATED BELOW IN THE TITLE BAR. Proxies submitted by the Internet or telephone must be received by 1:00 a.m., Central Time, on , 2008. Vote by Internet • Log on to the Internet and go to www.investorvote.com/avnx • Follow the steps outlined on the secured website. Vote by telephone • Call toll free 1-800-652-VOTE (8683) within the United States, Canada & Puerto Rico any time on a touch tone telephone. There is NO CHARGE to you for the call. • Follow the instructions provided by the recorded message.

. AVANEX Proxy — Avanex Corporation PROXY FOR SPECIAL MEETING OF STOCKHOLDERS , 2008 PROXY SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS The undersigned hereby appoints Jo S. Major, Jr. and Marla Sanchez and each of them as attorneys and proxies of the undersigned, with full power of substitution, to vote all shares of Avanex Corporation which the undersigned may be entitled to vote at the Special Meeting of Stockholders of Avanex Corporation to be held at Avanex’s corporate headquarters, 40919 Encyclopedia Circle, Fremont, California 94538, telephone (510) 897-4188, on , , 2008 at : .m. (local time) and at any and all postponements, continuations and adjournments thereof, with all powers that the undersigned would possess if personally present, upon and in respect of the matters listed on the reverse side and in accordance with the specified instructions, with discretionary authority as to any and all other matters that may properly come before the meeting. Unless a contrary direction is indicated, this Proxy will be voted “FOR” the Proposal on the reverse side hereof, as more specifically described in the Proxy Statement. If specific instructions are indicated, this Proxy will be voted in accordance therewith. Please sign, date and return this proxy card promptly using the enclosed envelope. CONTINUED AND TO BE SIGNED ON REVERSE SIDE SEE REVERSE SIDE SEE REVERSE SIDE IF YOU HAVE NOT VOTED VIA THE INTERNET OR TELEPHONE, FOLD ALONG THE PERFORATION, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE.