A Special Insight Announcement November 2016 Insight All-Hands Exhibit 99.1

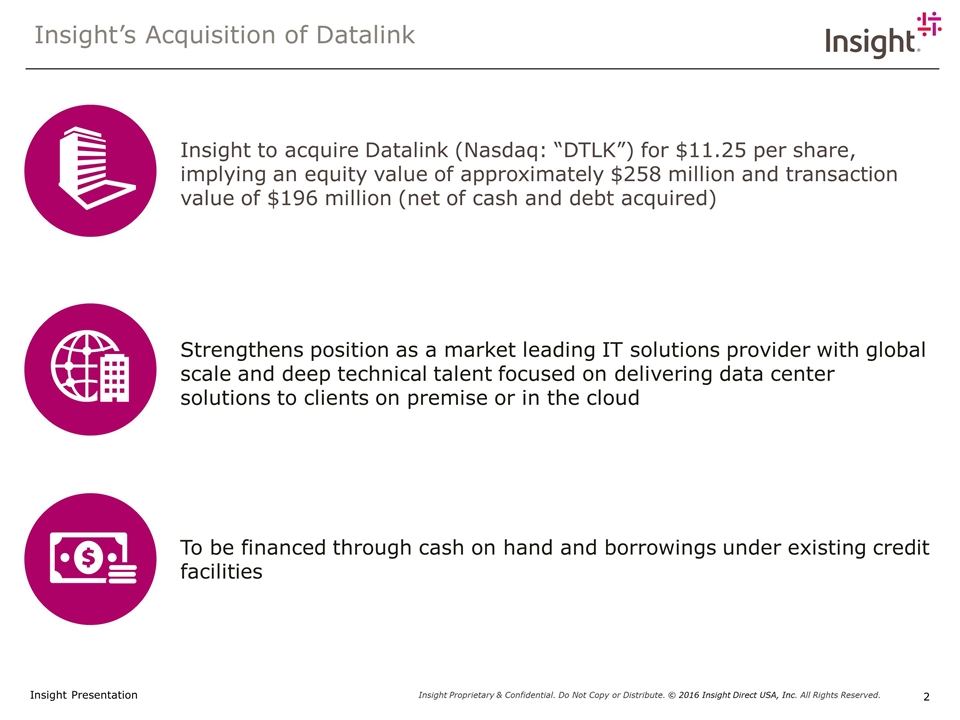

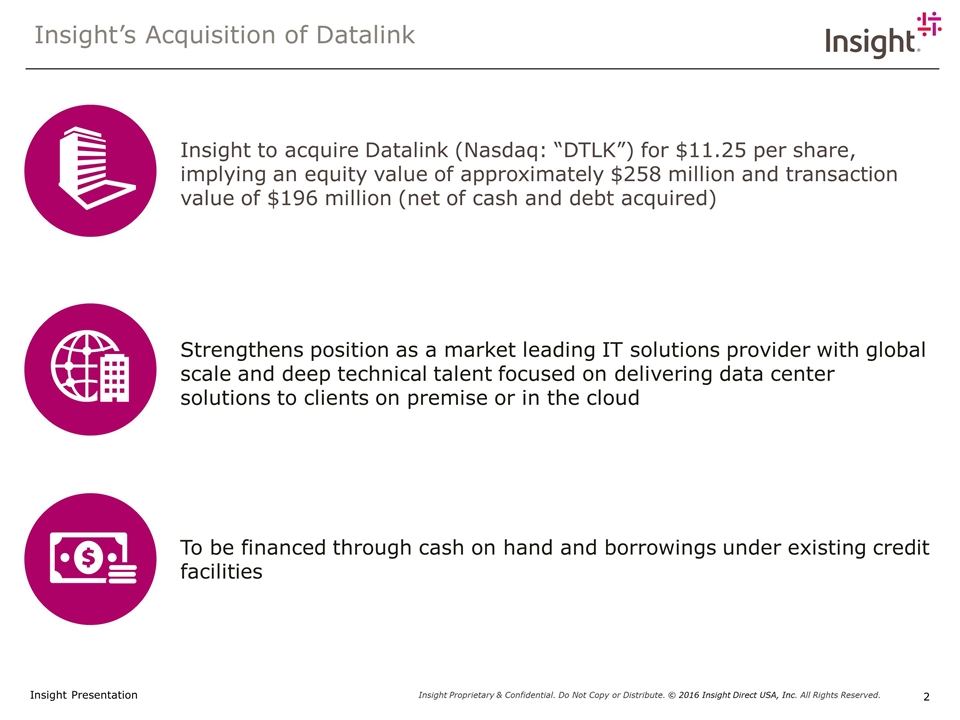

Insight’s Acquisition of Datalink Insight to acquire Datalink (Nasdaq: “DTLK”) for $11.25 per share, implying an equity value of approximately $258 million and transaction value of $196 million (net of cash and debt acquired) Strengthens position as a market leading IT solutions provider with global scale and deep technical talent focused on delivering data center solutions to clients on premise or in the cloud To be financed through cash on hand and borrowings under existing credit facilities

Increases addressable market opportunity in high growth data center categories Enhances our go-to-market with solutions-led approach Expands our services capabilities, particularly in the data center and around next generation technologies Drives scale and growth by adding complementary capabilities, partner relationships and clients in key U.S. markets Leverages our best-in-class digital marketing engine to bring scalable solutions to the mid-market Consistency of culture, values and vision across the organizations Accretive to gross margins with increased services sales and higher growth, higher margin product categories Insight and Datalink: Strategic & Compelling Acquisition

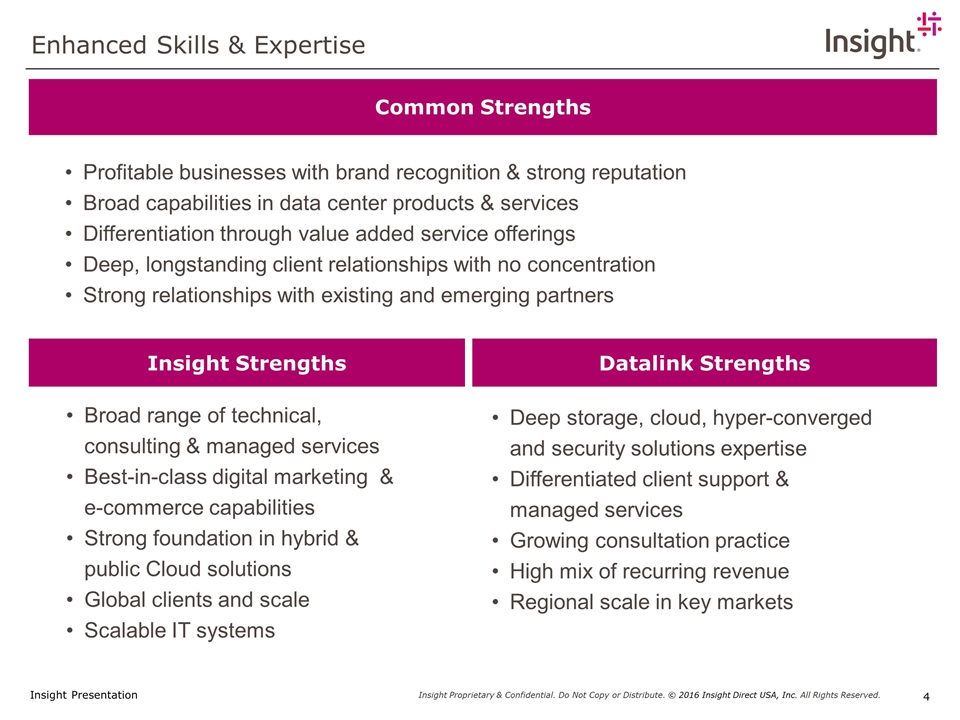

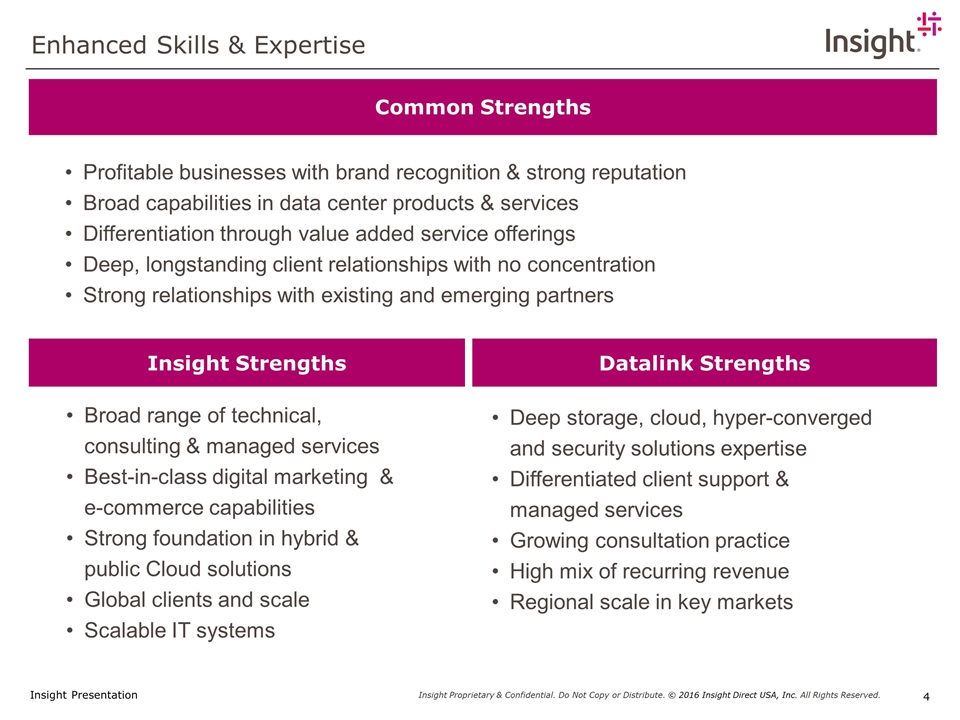

Enhanced Skills & Expertise Common Strengths Broad range of technical, consulting & managed services Best-in-class digital marketing & e-commerce capabilities Strong foundation in hybrid & public Cloud solutions Global clients and scale Scalable IT systems Insight Strengths Deep storage, cloud, hyper-converged and security solutions expertise Differentiated client support & managed services Growing consultation practice High mix of recurring revenue Regional scale in key markets Datalink Strengths Profitable businesses with brand recognition & strong reputation Broad capabilities in data center products & services Differentiation through value added service offerings Deep, longstanding client relationships with no concentration Strong relationships with existing and emerging partners

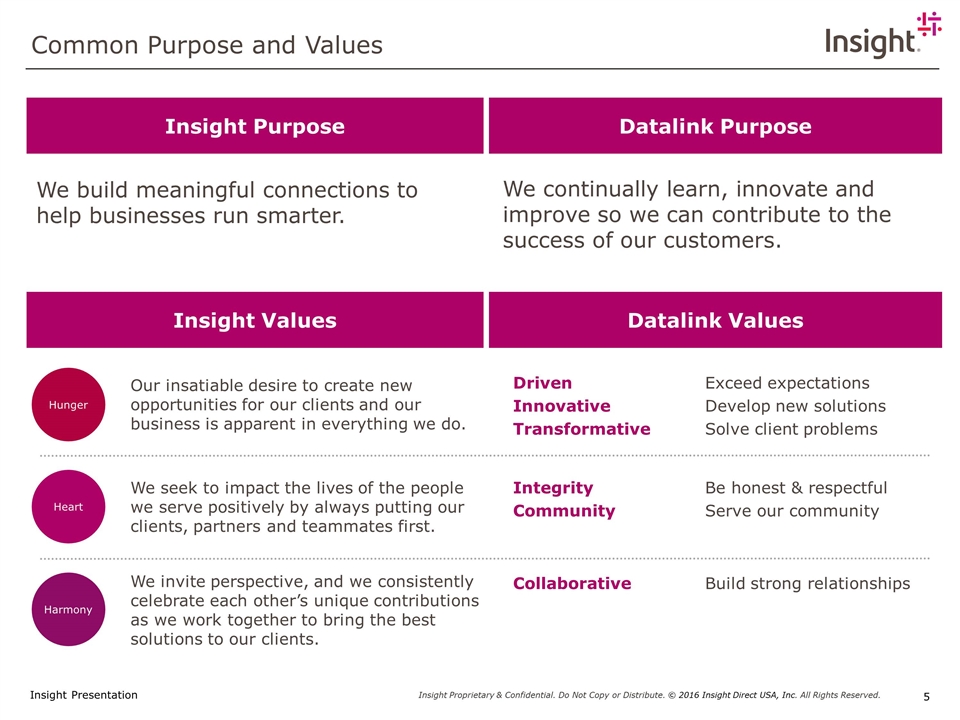

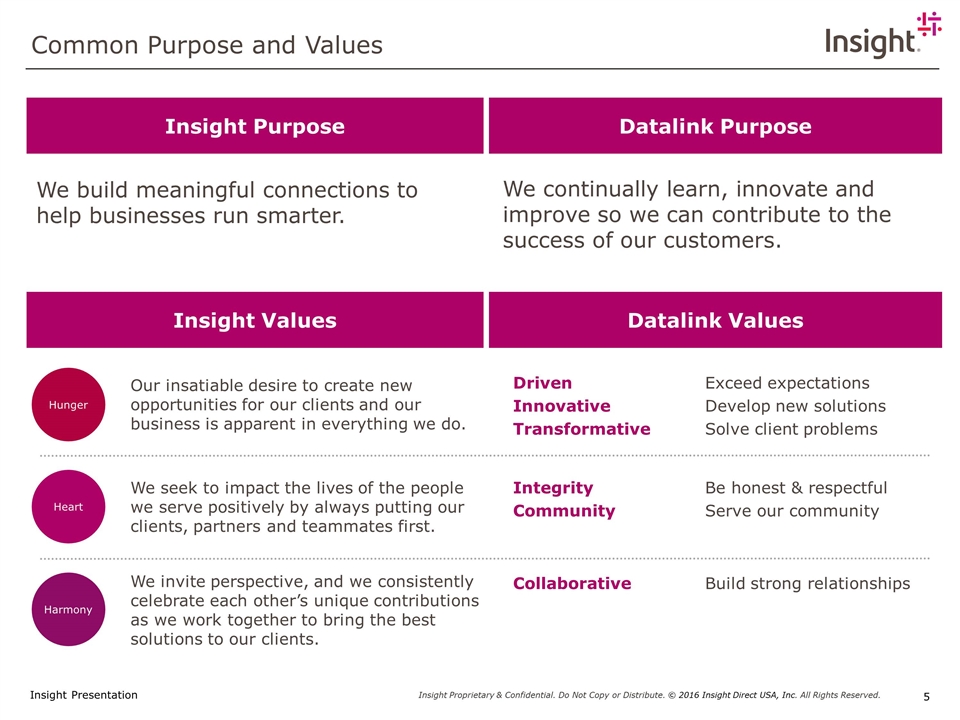

Common Purpose and Values We build meaningful connections to help businesses run smarter. We continually learn, innovate and improve so we can contribute to the success of our customers. Insight Purpose Datalink Purpose We invite perspective, and we consistently celebrate each other’s unique contributions as we work together to bring the best solutions to our clients. Collaborative Build strong relationships Insight Values Datalink Values Hunger Heart Harmony We seek to impact the lives of the people we serve positively by always putting our clients, partners and teammates first. Our insatiable desire to create new opportunities for our clients and our business is apparent in everything we do. Driven Exceed expectations InnovativeDevelop new solutions Transformative Solve client problems Integrity Be honest & respectful CommunityServe our community

Get to Know Datalink Who is Datalink?

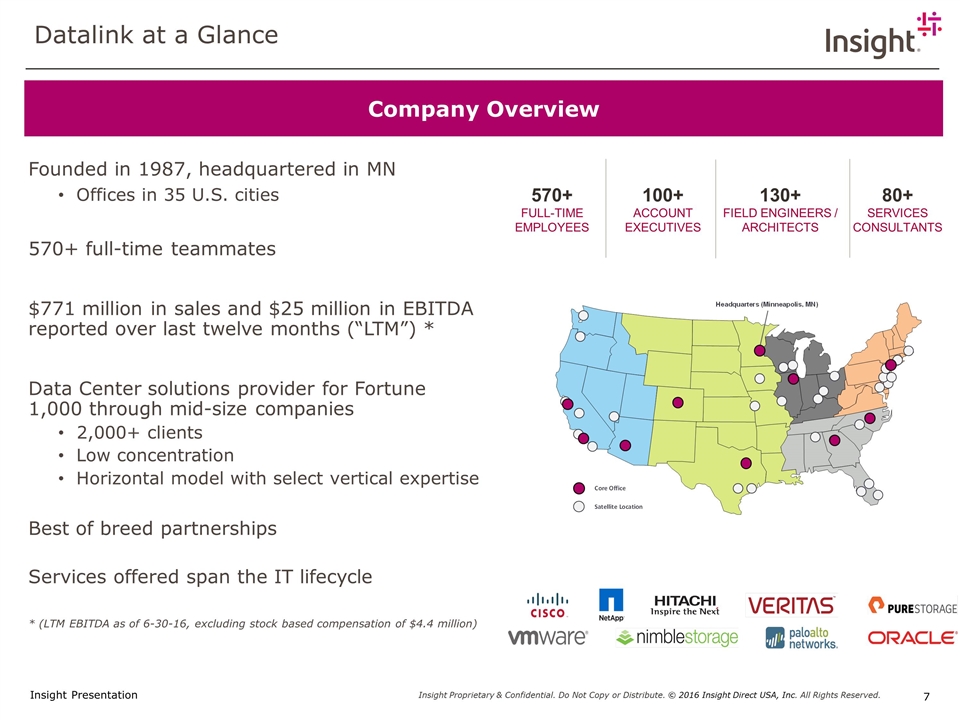

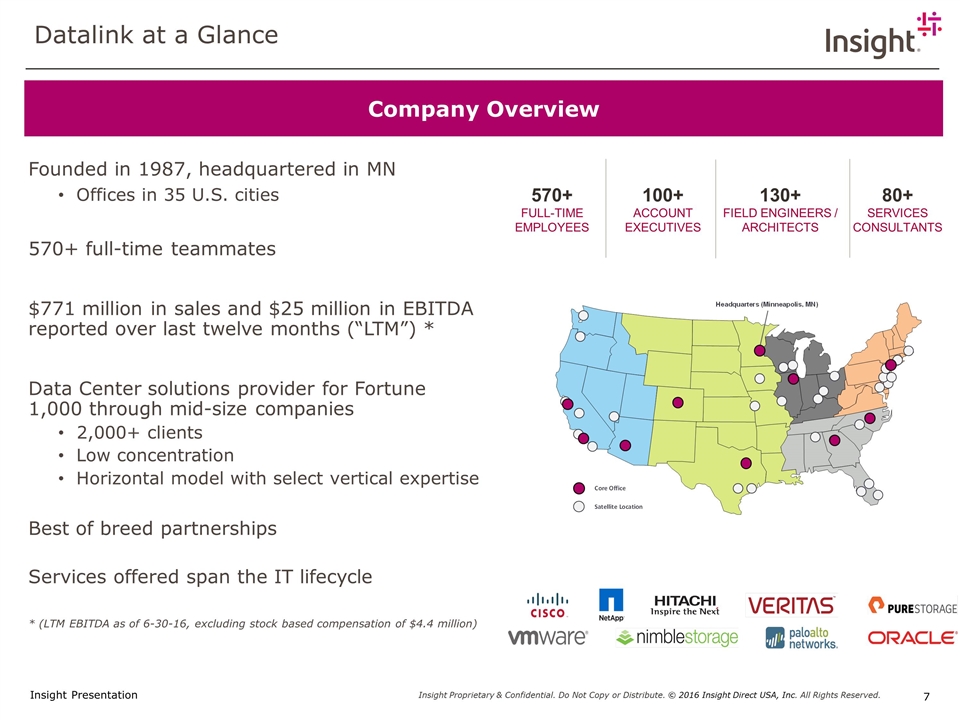

Datalink at a Glance Founded in 1987, headquartered in MN Offices in 35 U.S. cities 570+ full-time teammates $771 million in sales and $25 million in EBITDA reported over last twelve months (“LTM”) * Data Center solutions provider for Fortune 1,000 through mid-size companies 2,000+ clients Low concentration Horizontal model with select vertical expertise Best of breed partnerships Services offered span the IT lifecycle * (LTM EBITDA as of 6-30-16, excluding stock based compensation of $4.4 million) Company Overview 130+ Field Engineers / Architects 100+ Account Executives 80+ Services Consultants 570+ Full-Time Employees

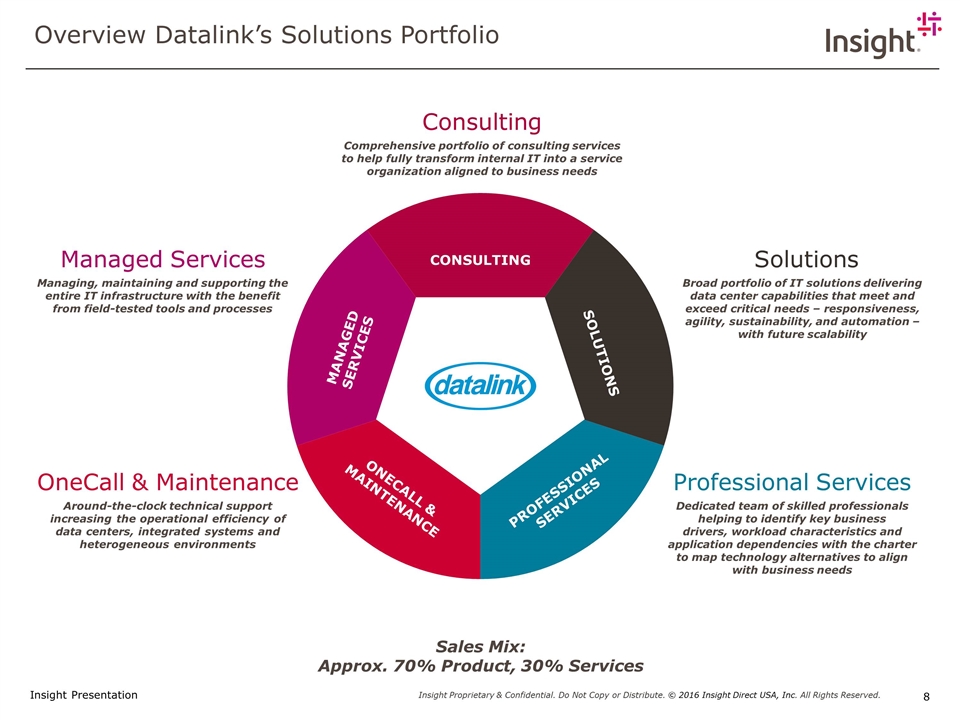

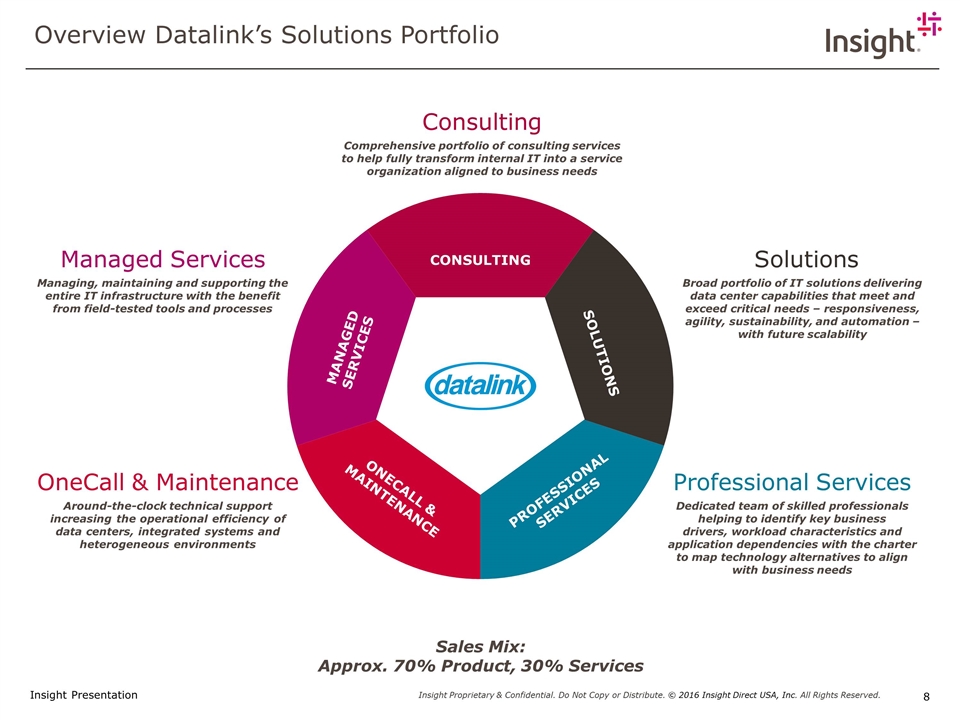

Overview Datalink’s Solutions Portfolio CONSULTING SOLUTIONS PROFESSIONAL SERVICES ONECALL & MAINTENANCE MANAGED SERVICES Consulting Comprehensive portfolio of consulting services to help fully transform internal IT into a service organization aligned to business needs Professional Services Dedicated team of skilled professionals helping to identify key business drivers, workload characteristics and application dependencies with the charter to map technology alternatives to align with business needs Solutions Broad portfolio of IT solutions delivering data center capabilities that meet and exceed critical needs – responsiveness, agility, sustainability, and automation – with future scalability OneCall & Maintenance Around-the-clock technical support increasing the operational efficiency of data centers, integrated systems and heterogeneous environments Managed Services Managing, maintaining and supporting the entire IT infrastructure with the benefit from field-tested tools and processes Sales Mix: Approx. 70% Product, 30% Services

Leadership Who’s running things?

Leadership Who’s running things? Shawn O’Grady retains day-to-day management of Datalink, reporting to Steve Dodenhoff. Together, they will shape the future of our joint organization.

Timeline Now and post-close

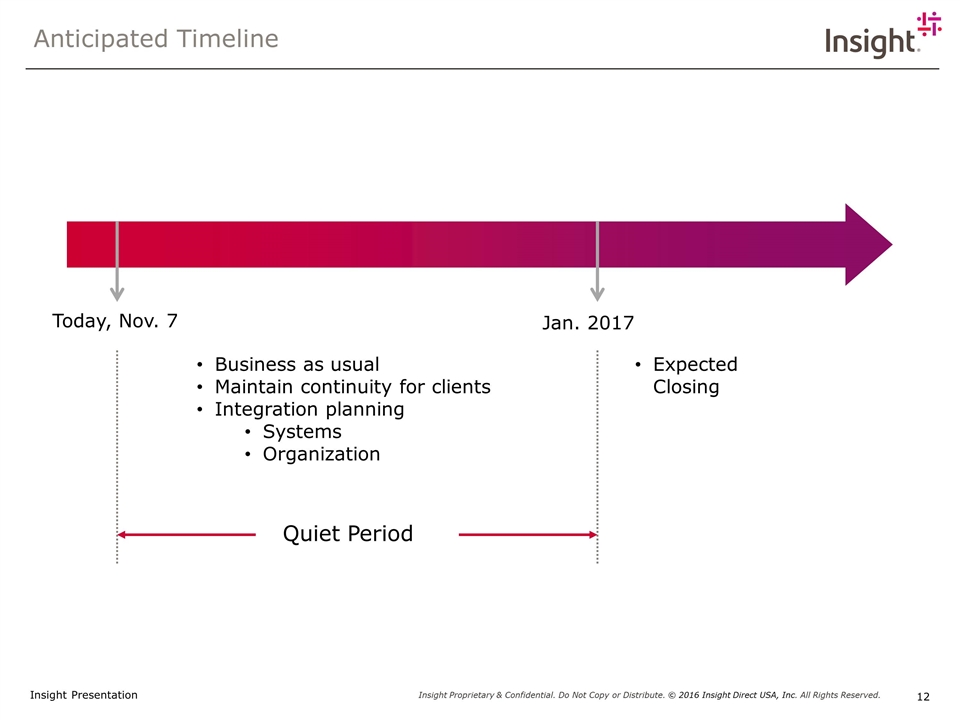

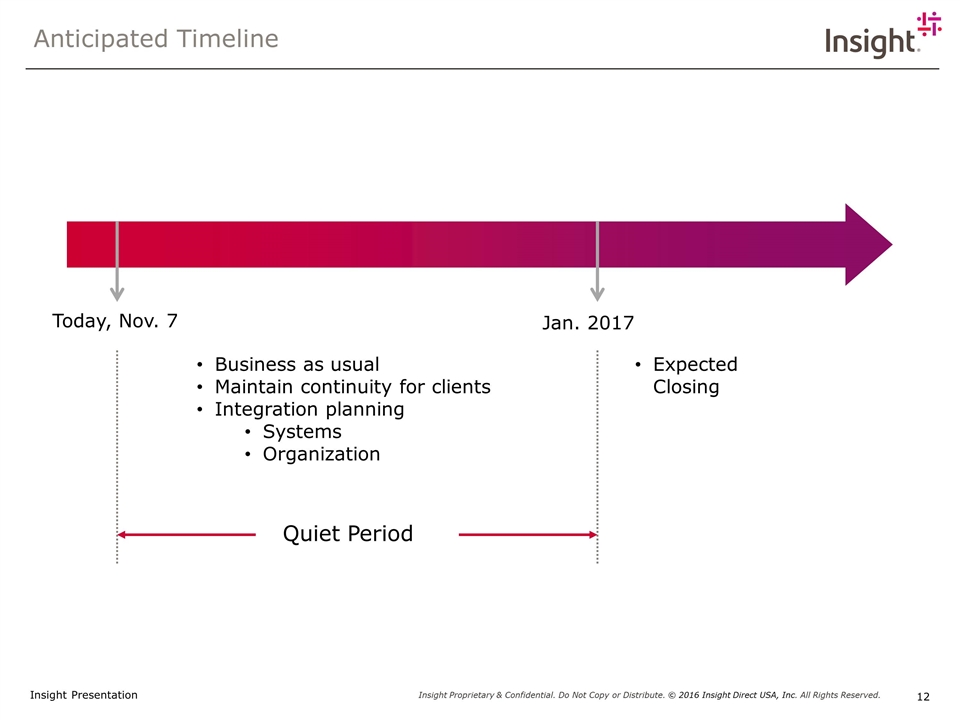

Anticipated Timeline Today, Nov. 7 Jan. 2017 Business as usual Maintain continuity for clients Integration planning Systems Organization Expected Closing Quiet Period

Priorities in the Transition Next steps

Goals for this Merger Key priorities Be as transparent as possible (given regulatory limitations) with all Insight and Datalink teammates about forthcoming events. Ensure the core of both organizations remains focused and continue to compete vigorously in the marketplace during the time before closing. After closing, unite our client experiences and leverage Datalink to drive growth, preserving and enhancing the Datalink data center solutions platform. Create the right alignment of the combined companies to maximize the opportunities to deliver Intelligent Technology Solutions™ to our newly combined client base.

What to Expect Reminders for ALL teammates Do operate in the ordinary course. This means Insight and Datalink will continue to operate completely separately. Do not reach out or contact Datalink teammates. Do not schedule introductory meetings or “meet and greets.” Do not share competitive information at all. Do not proactively connect via LinkedIn or other social media. Do initiate social media connections after the transaction closes.

Important Information Rule 14a-12 Legends Cautionary Note Regarding Forward-Looking Statements Certain statements contained in this communication may constitute “forward-looking statements.” Forward-looking statements can usually be identified by the use of words such as “aim,” “anticipate,” “believe,” “continue,” “could,” “estimate,” “evolve,” “expect,” “forecast,” “intend,” “looking ahead,” “may,” “opinion,” “plan,” “possible,” “potential,” “project,” “should,” “will” and other expressions which indicate future events or trends. These forward-looking statements are based upon certain expectations and assumptions and are subject to risks and uncertainties. Actual results could differ materially from those anticipated as a result of various factors, including the following: Datalink’s shareholders may not approve the transaction; conditions to the closing of the transaction, including receipt of required regulatory approvals, may not be satisfied; the transaction may involve unexpected costs, liabilities or delays; the parties may be unable to achieve expected synergies and operating efficiencies in the merger within the expected time frames or at all and to successfully integrate Datalink’s operations into those of Insight; such integration may be more difficult, time consuming or costly than expected; revenues following the transaction may be lower than expected; operating costs, customer loss and business disruption (including, without limitation, difficulties in maintaining relationships with employees, customers, clients or suppliers) may be greater than expected following the transaction; uncertainties surrounding the transaction; the outcome of any legal proceedings related to the transaction; Datalink and/or Insight may be adversely affected by other economic, business, and/or competitive factors; risks that the pending transaction disrupts current plans and operations; the retention of key employees of Datalink; other risks to consummation of the transaction, including circumstances that could give rise to the termination of the merger agreement and the risk that the transaction will not be consummated within the expected time period or at all; and the other risks described from time to time in Datalink’s and Insight’s reports filed with the Securities and Exchange Commission (the “SEC”) under the heading “Risk Factors,” including each company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, subsequent Quarterly Reports on Form 10-Q and in other of Datalink’s and Insight’s filings with the SEC. All forward-looking statements are qualified by, and should be considered in conjunction with, such cautionary statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which such statements were made. Except as required by applicable law, neither Insight nor Datalink undertakes any obligation to update forward-looking statements to reflect events or circumstances arising after such date. Additional Information and Where to Find It In connection with the transaction, Datalink intends to file relevant materials with the SEC, including a proxy statement on Schedule 14A. Following the filing of the definitive proxy statement with the SEC, Datalink will mail the definitive proxy statement and a proxy card to each shareholder entitled to vote at the special meeting relating to the transaction. Datalink shareholders are urged to carefully read these materials (and any amendments or supplements) and any other relevant documents that Datalink files with the SEC when they become available because they will contain important information. The definitive proxy statement, the preliminary proxy statement and other relevant materials in connection with the transaction (when they become available), and any other documents filed by Datalink with the SEC, may be obtained free of charge at the SEC’s website (http://www.sec.gov), at Datalink’s investor website (http://www.datalink.com/Investor-Information), or by writing or calling Datalink at Datalink Corporation, 10050 Crosstown Circle, Suite 500, Eden Prairie, Minnesota 55344 or by (952) 944-3462. Participants in the Solicitation Datalink and its directors and executive officers, and Insight and its directors and officers, may be deemed to be participants in the solicitation of proxies from Datalink’s stockholders with respect to the transaction. Information about Datalink’s directors and executive officers and their ownership of Datalink’s common stock is set forth in Datalink’s proxy statement on Schedule 14A filed with the SEC on April 15, 2016. To the extent that holdings of Datalink’s securities have changed since the amounts printed in Datalink’s proxy statement, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Information regarding the identity of the participants in the proxy solicitation, and their direct or indirect interests in the transaction, by security holdings or otherwise, will be set forth in the proxy statement and other materials to be filed with SEC in connection with the transaction. Information about the directors and executive officers of Insight is set forth in the proxy statement for Insight’s 2016 Annual Meeting of Stockholders, which was filed with the SEC on April 5, 2016.