A Special Announcement November 7, 2016 Datalink All-Hands Exhibit 99.2

Insight’s Acquisition of Datalink Insight to acquire Datalink (Nasdaq: “DTLK”) for $11.25 per share, implying an equity value of approximately $258 million and transaction value of $196 million (net of cash and debt acquired) Strengthens position as a market leading IT solutions provider with global scale and deep technical talent focused on delivering data center solutions to clients on premise or in the cloud To be financed through cash on hand and borrowings under existing credit facilities

Insight and Datalink: Strategic Rationale A significant, strategic and powerful combination that supports Insight’s strategy. Increases addressable market opportunity in high growth data center categories Enhances our go-to-market with solutions-led approach Expands our services capabilities, particularly in the data center and around next generation technologies Drives scale and growth by adding complementary capabilities, partner relationships and clients in key U.S. markets Leverages our best-in-class digital marketing engine to bring scalable solutions to the mid-market Consistency of culture, values and vision across the organizations Accretive to gross margins with increased services sales and higher growth, higher margin product categories

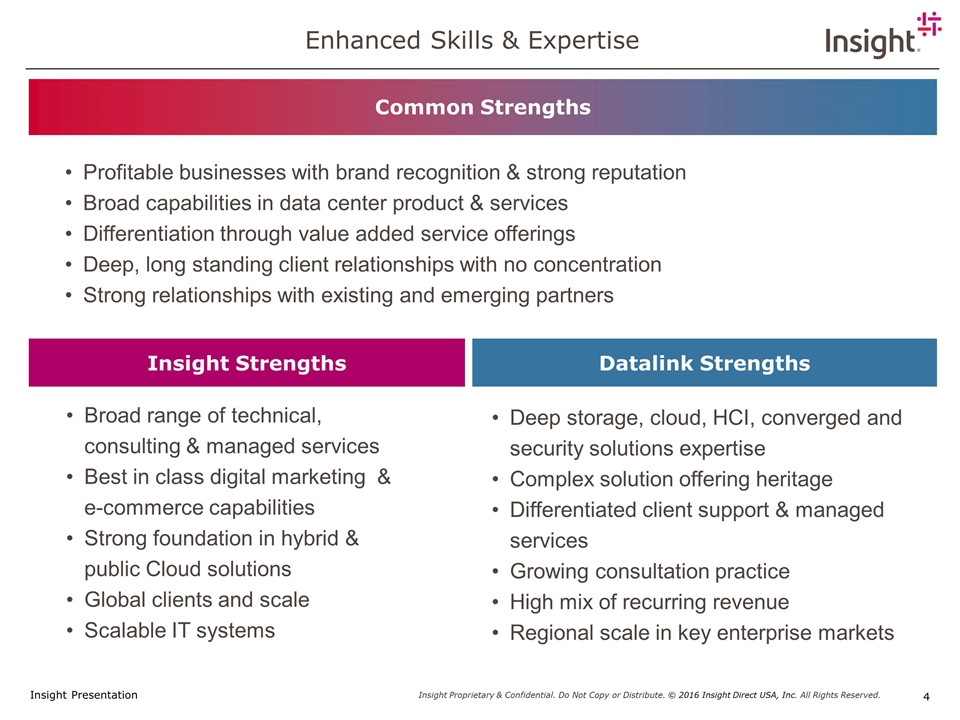

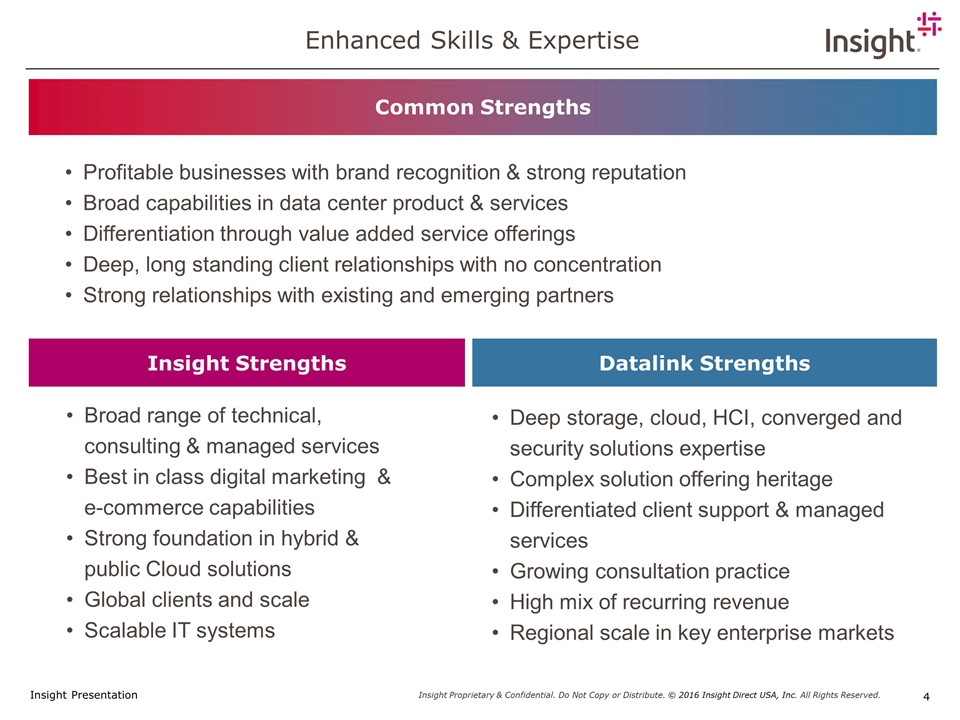

Enhanced Skills & Expertise Common Strengths Broad range of technical, consulting & managed services Best in class digital marketing & e-commerce capabilities Strong foundation in hybrid & public Cloud solutions Global clients and scale Scalable IT systems Insight Strengths Deep storage, cloud, HCI, converged and security solutions expertise Complex solution offering heritage Differentiated client support & managed services Growing consultation practice High mix of recurring revenue Regional scale in key enterprise markets Datalink Strengths Profitable businesses with brand recognition & strong reputation Broad capabilities in data center product & services Differentiation through value added service offerings Deep, long standing client relationships with no concentration Strong relationships with existing and emerging partners

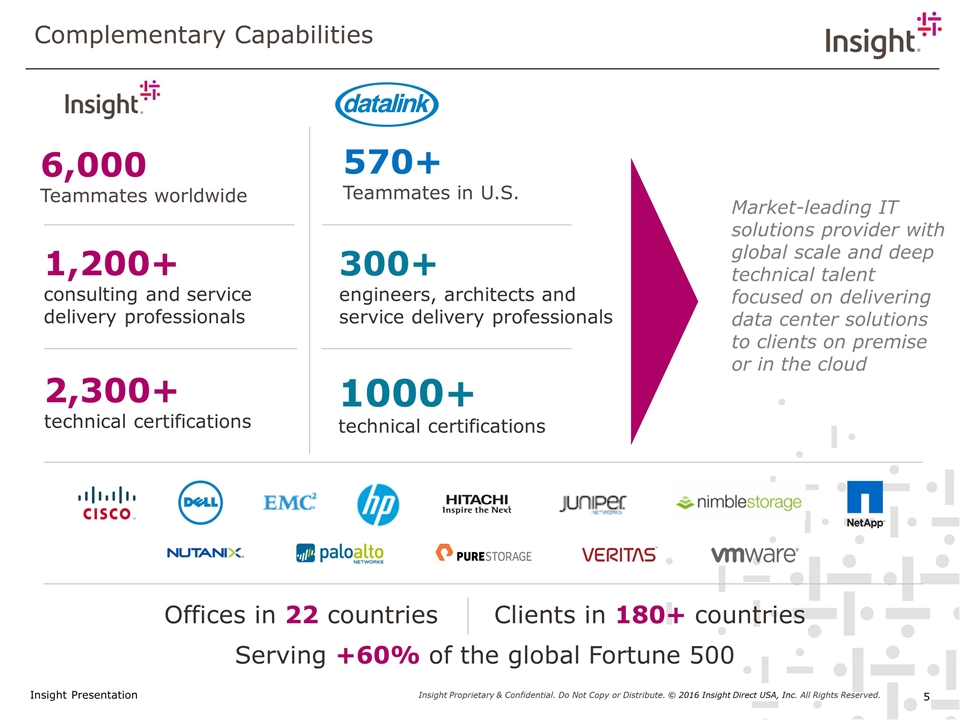

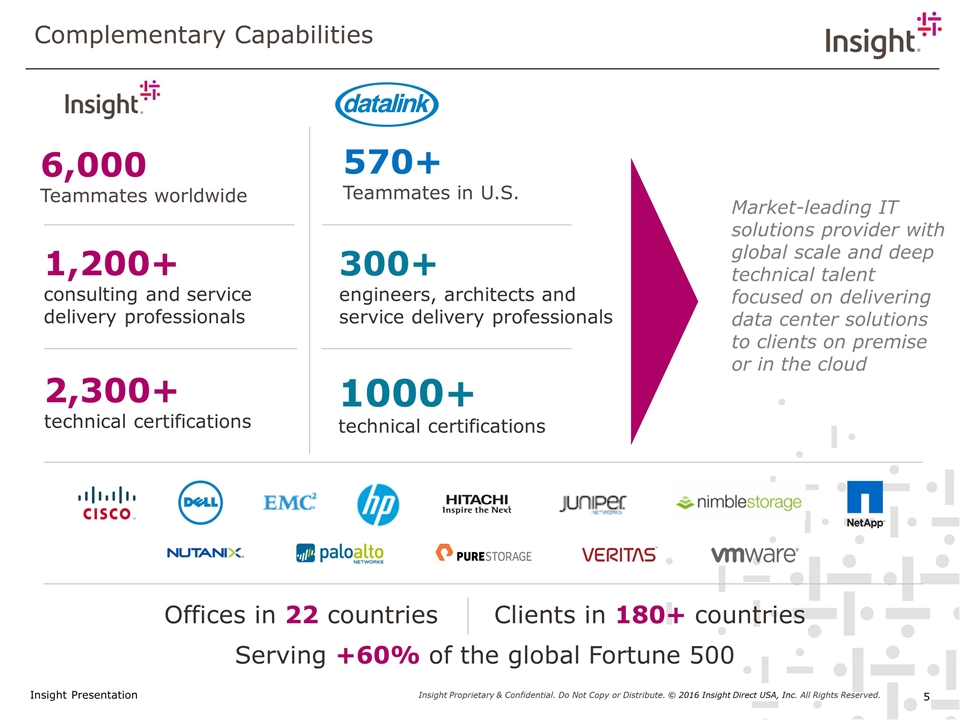

6,000 Teammates worldwide Complementary Capabilities 570+ Teammates in U.S. Market-leading IT solutions provider with global scale and deep technical talent focused on delivering data center solutions to clients on premise or in the cloud 2,300+ technical certifications 1,200+ consulting and service delivery professionals Offices in 22 countriesClients in 180+ countries Serving +60% of the global Fortune 500 1000+ technical certifications 300+ engineers, architects and service delivery professionals

Get to Know Us Who is Insight?

Insight Purpose Video

Common Purpose and Values We build meaningful connections to help businesses run smarter. We continually learn, innovate, and improve so we can contribute to the success of our customers. Insight Purpose Datalink Purpose We invite perspective, and we consistently celebrate each other’s unique contributions as we work together to bring the best solutions to our clients. Collaborative Build strong relationships Insight Values Datalink Values Hunger Heart Harmony We seek to impact the lives of the people we serve positively by always putting our clients, partners and teammates first. Our insatiable desire to create new opportunities for our clients and our business is apparent in everything we do. Driven Exceed expectations InnovativeDevelop new solutions Transformative Solve client problems Integrity Be honest & respectful CommunityServe our community

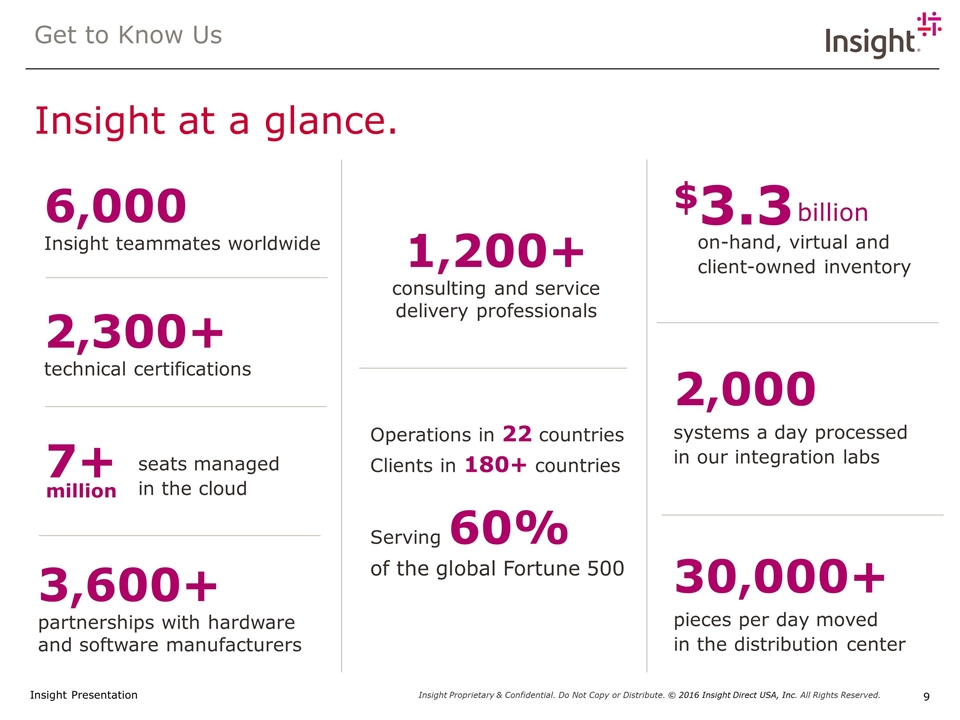

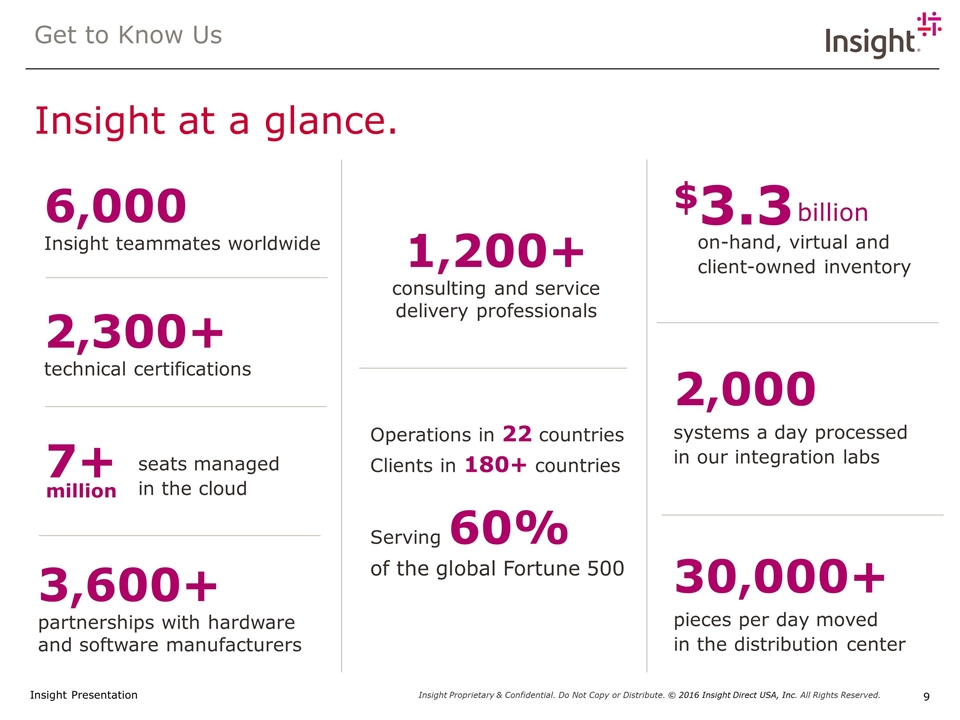

Get to Know Us Insight at a glance. 6,000 Insight teammates worldwide 2,300+ technical certifications 7+ million seats managed in the cloud 3,600+ partnerships with hardware and software manufacturers $3.3 billion on-hand, virtual and client-owned inventory 2,000 systems a day processed in our integration labs 30,000+ pieces per day moved in the distribution center 1,200+ consulting and service delivery professionals Operations in 22 countries Clients in 180+ countries Serving 60% of the global Fortune 500

Get to know us. You need a unique solution. We offer a diverse portfolio of hardware, software and services. Solutions Software and hardware Data center and virtualization Mobility Networking Security Office productivity Communications and collaboration Cloud Services Strategy and assessment Financing and leasing Design architecture Implementation Integration Maintenance Management Refresh

Leadership Who’s running things?

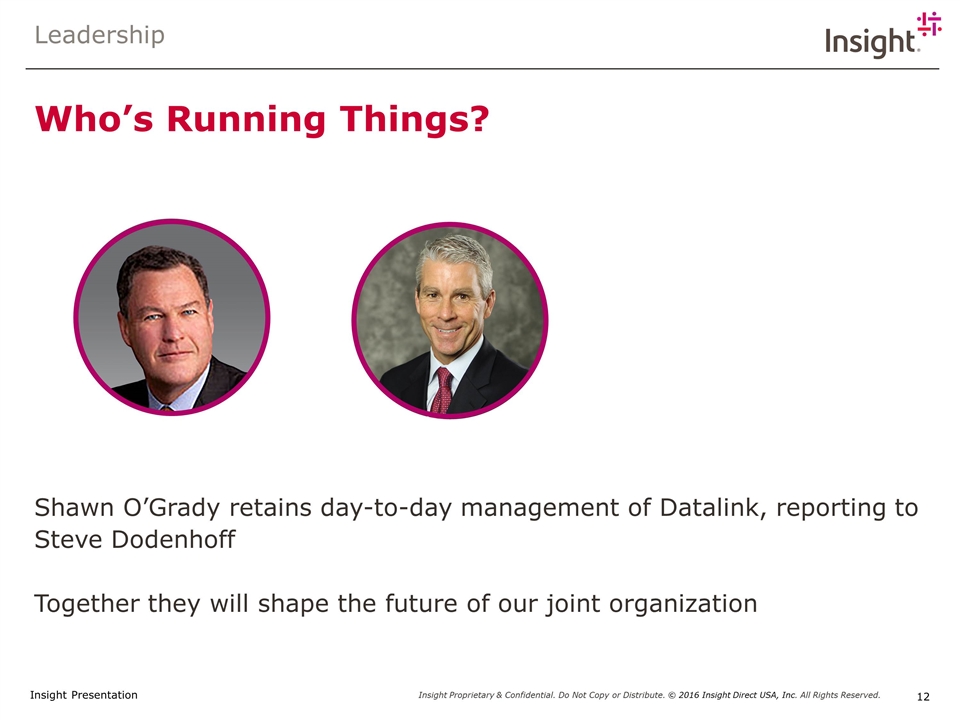

Leadership Who’s Running Things? Shawn O’Grady retains day-to-day management of Datalink, reporting to Steve Dodenhoff Together they will shape the future of our joint organization

All about Initial details

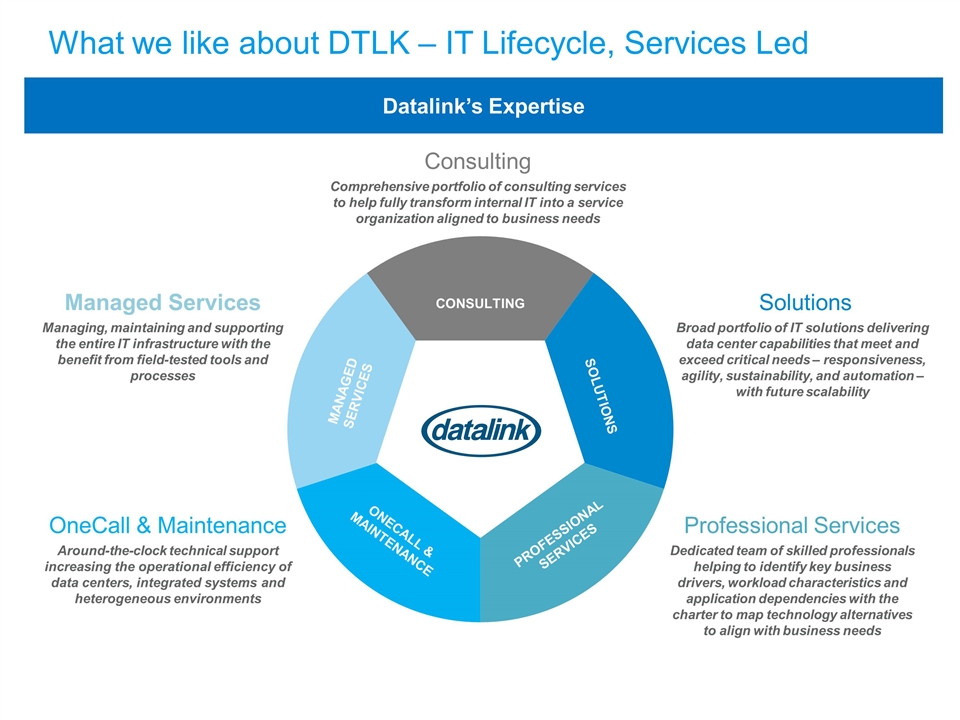

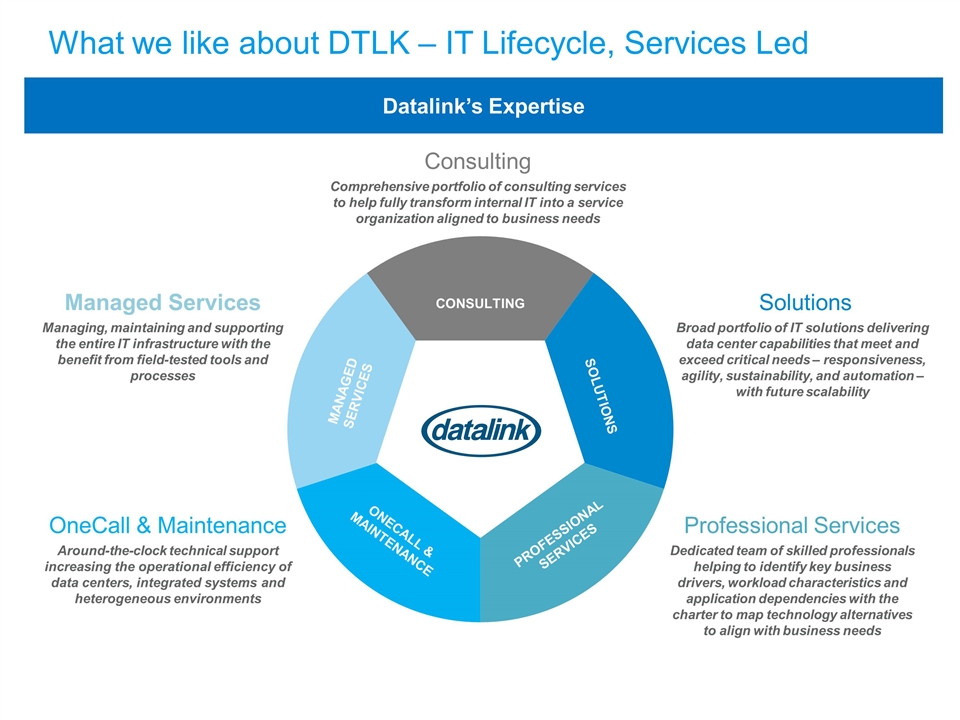

What we like about DTLK – IT Lifecycle, Services Led CONSULTING SOLUTIONS PROFESSIONAL SERVICES ONECALL & MAINTENANCE MANAGED SERVICES Consulting Comprehensive portfolio of consulting services to help fully transform internal IT into a service organization aligned to business needs Professional Services Dedicated team of skilled professionals helping to identify key business drivers, workload characteristics and application dependencies with the charter to map technology alternatives to align with business needs Solutions Broad portfolio of IT solutions delivering data center capabilities that meet and exceed critical needs – responsiveness, agility, sustainability, and automation – with future scalability OneCall & Maintenance Around-the-clock technical support increasing the operational efficiency of data centers, integrated systems and heterogeneous environments Managed Services Managing, maintaining and supporting the entire IT infrastructure with the benefit from field-tested tools and processes Datalink’s Expertise

Datalink Value Congratulations on building a successful enterprise business in this dynamic IT market Take stock in the accomplishments to get to this deal Datalink’s value recognized! Strategy, capabilities, portfolio, partnerships, success Datalink, an Insight Company After today: Business as usual - back to doing what we do well, with more opportunity ahead

All About You Your Position: It is business as usual until the transaction closes. We’ll be working with Datalink leadership on the integration plan and will be proactive in communicating our integration plan after the transaction closes. Your Benefits: You can expect to maintain your existing benefits plan through 2017. You’ll be integrated into Insight’s plans effective January 1, 2018 (more information to come). Your Tenure: You’ll keep your seniority based on your original date of employment with Datalink, which impacts vacation allocation, 401(k) vesting and service recognition. Your Location: You will not be required to relocate. If, however, you are open to relocating, more opportunities may present themselves after the transaction closes. Note: You’ll be receiving a comprehensive FAQ following today’s presentation.

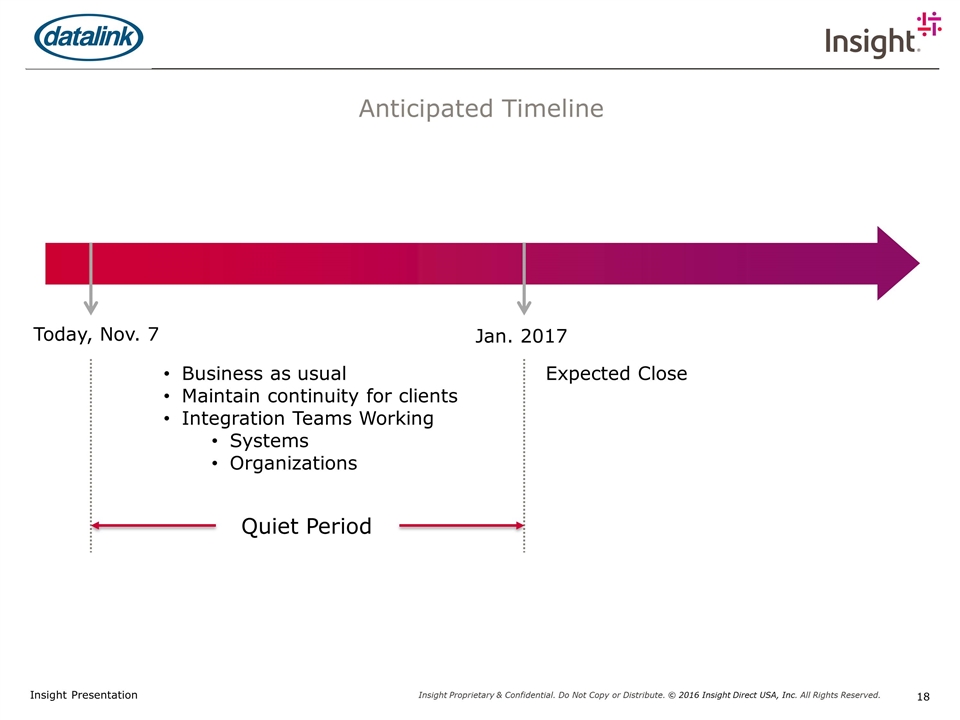

Timeline Now and post-close.

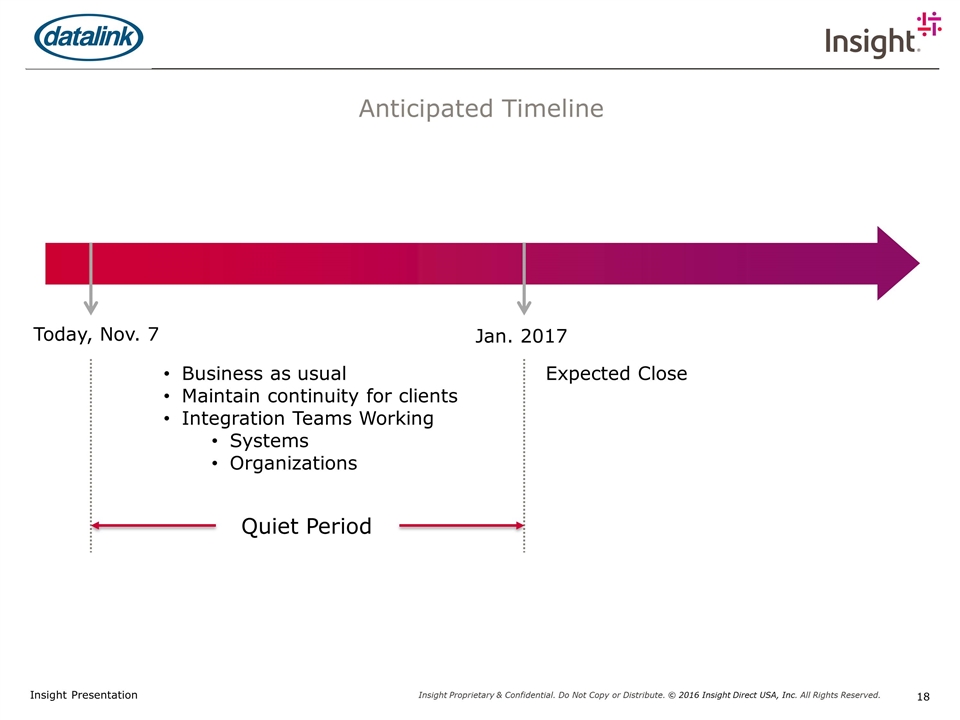

Anticipated Timeline Today, Nov. 7 Jan. 2017 Business as usual Maintain continuity for clients Integration Teams Working Systems Organizations Expected Close Quiet Period

Priorities in the Transition

Goals for this Merger Key Priorities Be as transparent as able (given regulatory limitations) with all Insight and Datalink teammates about forthcoming events. Ensure the core of both organizations remain focused and continue to compete vigorously in the marketplace during the time before closing. After closing, unite our client experiences and leverage Datalink to drive growth, preserving and enhancing the Datalink Data Center solutions platform. Create the right alignment of the combined companies to maximize the opportunities to deliver Intelligent Technology Solutions™ to our newly combined client base.

What to Expect Reminders for ALL Teammates Do operate in the ordinary course. This means Insight and Datalink will continue to operate completely separately. Do not reach out or contact Insight teammates. Do not schedule introductory meetings or “meet and greets.” Do not share competitive information at all. Do not proactively connect via LinkedIn or other social media. Do initiate social media connections after the transaction closes.

Important Information Cautionary Statement Regarding Forward-Looking Statements Certain statements contained in this communication may constitute “forward-looking statements”. Actual results could differ materially from those projected or forecast in the forward-looking statements. The factors that could cause actual results to differ materially include the following: the risk that the parties may be unable to achieve expected synergies and operating efficiencies in the merger within the expected time frames or at all and to successfully integrate Datalink’s operations into those of Insight; such integration may be more difficult, time consuming or costly than expected; revenues following the transaction may be lower than expected; operating costs, customer loss and business disruption (including, without limitation, difficulties in maintaining relationships with employees, customers, clients or suppliers) may be greater than expected following the transaction; the retention of certain key employees of Datalink; uncertainties as to the timing of the transaction; the possibility that the conditions to the completion of the transaction may not be satisfied; and the other factors discussed in “Risk Factors” in each of Insight’s and Datalink’s Annual Report on Form 10-K for the most recently ended fiscal year and other filings with the SEC, which are available at http://www.sec.gov. Insight assumes no obligation to update the information in this communication, except as otherwise required by law. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof. Additional Information and Where to Find It This communication may be deemed to be solicitation material in respect of the proposed acquisition of Datalink by Insight. In connection with the proposed acquisition, Insight and Datalink intend to file relevant materials with the SEC, including a preliminary proxy statement on Schedule 14A. Promptly after filing its definitive proxy statement with the SEC, Datalink will mail the definitive proxy statement and a proxy card to each stockholder entitled to vote at the special meeting relating to the transaction. STOCKHOLDERS OF Datalink ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING Datalink’S PROXY STATEMENT, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain the documents free of charge at the SEC’s web site, http://www.sec.gov, and Datalink stockholders will receive information at an appropriate time on how to obtain transaction-related documents free of charge from Datalink. Such documents are not currently available. Participants in Solicitation Insight and its directors and executive officers, and Datalink and its directors and executive officers, may be deemed to be participants in the solicitation of proxies from the holders of Datalink common stock in respect of the proposed transaction. Information about the directors and executive officers of Insight is set forth in the proxy statement for Insight’s 2016 Annual Meeting of Stockholders, which was filed with the SEC on April 5, 2016. Information about the directors and executive officers of Datalink is set forth in the proxy statement for Datalink’s 2016 Annual Meeting of Stockholders, which was filed with the SEC on April 15, 2016. Investors may obtain additional information regarding the interest of such participants by reading the proxy statement regarding the acquisition when it becomes available.