Filed by CoStar Group, Inc.

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Matterport, Inc.

Commission File No.: 001-39790

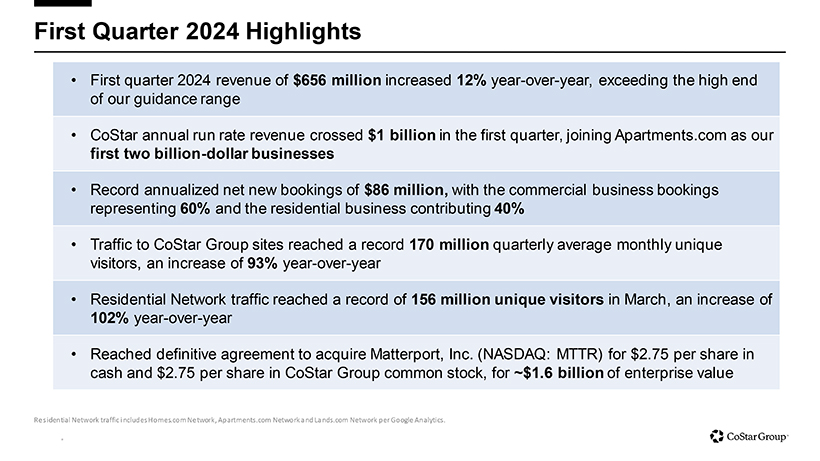

This filing relates to the proposed transaction between CoStar Group, Inc., a Delaware corporation (“CoStar”), and Matterport, Inc., a Delaware corporation (“Matterport”), pursuant to the terms of that certain Agreement and Plan of Merger and Reorganization, dated as of April 21, 2024, by and among CoStar, Matterport, Matrix Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of CoStar (“Merger Sub I”) and Matrix Merger Sub II LLC, a Delaware limited liability company and a wholly owned subsidiary of CoStar (“Merger Sub II”).

Forward-Looking Statements

This communication may include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act. All statements other than statements of historical fact, including statements regarding the proposed acquisition of Matterport, the expected timetable for completing the transaction, future financial and operating results, benefits and synergies of the transaction, future opportunities for the combined businesses and any other statements regarding events or developments that we believe or anticipate will or may occur in the future, may be “forward-looking statements” for purposes of federal and state securities laws. These forward-looking statements, involve a number of risks and uncertainties that could significantly affect the financial or operating results of CoStar, Matterport or the combined company. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “will,” and variations of such words and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. CoStar can give no assurance that its expectations will be attained and, therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. For example, these forward-looking statements could be affected by factors including, without limitation, risks associated with the ability to consummate the proposed transaction and the timing of the closing of the proposed transaction; the ability to successfully integrate operations and employees; the ability to realize anticipated benefits and synergies of the proposed mergers as rapidly or to the extent anticipated by financial analysts or investors; the potential impact of announcement of the proposed mergers or consummation of the proposed transaction on business relationships, including with employees, customers, suppliers and competitors; unfavorable outcomes of any legal proceedings that have been or may be instituted against CoStar or Matterport; the ability to retain key personnel; costs, fees, expenses and charges related to the proposed transaction; general adverse economic conditions; and those additional risks and factors discussed in reports filed with the Securities and Exchange Commission (the “SEC”) by CoStar and Matterport. Moreover, other risks and uncertainties of which CoStar or Matterport are not currently aware may also affect each of the companies’ forward-looking statements and may cause actual results and the timing of events to differ materially from those anticipated. The forward-looking statements made in this communication are made only as of the date hereof or as of the dates indicated in the forward-looking statements, even if they are subsequently made available by CoStar or Matterport on their respective websites or otherwise. Neither CoStar nor Matterport undertakes any obligation to update or supplement any forward-looking statements to reflect actual results, new information, future events, changes in its expectations or other circumstances that exist after the date as of which the forward-looking statements were made.

Additional Information and Where to Find It

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed transaction, CoStar intends to file with the SEC a registration statement on Form S-4 that will include a proxy statement of Matterport that also constitutes a prospectus of CoStar and other documents regarding the proposed transaction. The definitive proxy statement/prospectus will be delivered to stockholders of Matterport.

Investors and security holders will be able to obtain free copies of the registration statement, the proxy statement/prospectus (when available) and other relevant documents filed by CoStar and Matterport with the SEC through the website maintained by the SEC at www.sec.gov. Copies of the documents filed by CoStar with the SEC will also be available on CoStar’s website at https://costargroup.com, and copies of the documents filed by Matterport with the SEC are available on Matterport’s website at https://matterport.com.