SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

| |

| ý | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2012

OR

|

| |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 1-34243

tw telecom inc.

(Exact name of Registrant as specified in its charter)

|

| | |

| | | |

| Delaware | | 84-1500624 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

| | |

10475 Park Meadows Drive Littleton, Colorado | | 80124 |

| (Address of principal executive offices) | | (Zip Code) |

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. |

| | | | | | |

| | | | | | | |

| Large accelerated filer | | ý | | Accelerated filer | | ¨ |

| | | | |

| Non-accelerated filer | | o (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

The number of shares outstanding of tw telecom inc.’s common stock as of October 31, 2012 was 151,354,943 shares.

INDEX TO FORM 10-Q

|

| | |

| | | |

| | | Page |

| |

| Item 1. | Financial Statements: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| |

| Item 1. | | |

| Item 1A. | | |

| Item 4. | | |

| Item 6. | | |

Part I. Financial Information

Item 1. Financial Statements

tw telecom inc.

CONDENSED CONSOLIDATED BALANCE SHEETS |

| | | | | | | | |

| | | September 30,

2012 | | December 31,

2011 |

| | | (unaudited) | | |

| | | (amounts in thousands, except per share amounts) |

| ASSETS | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 316,800 |

| | $ | 353,394 |

|

| Investments | | 142,597 |

| | 131,525 |

|

| Receivables, less allowances of $7,693 and $8,192, respectively | | 106,714 |

| | 96,182 |

|

| Prepaid expenses and other current assets | | 19,475 |

| | 17,340 |

|

| Deferred income taxes | | 65,008 |

| | 65,008 |

|

| Total current assets | | 650,594 |

| | 663,449 |

|

| Property, plant and equipment | | 4,186,321 |

| | 4,026,134 |

|

| Less accumulated depreciation | | (2,721,086 | ) | | (2,598,922 | ) |

| | | 1,465,235 |

| | 1,427,212 |

|

| Deferred income taxes | | 123,063 |

| | 162,535 |

|

| Goodwill | | 412,694 |

| | 412,694 |

|

| Intangible assets, net of accumulated amortization | | 19,362 |

| | 17,742 |

|

| Other assets, net | | 22,736 |

| | 24,594 |

|

| Total assets | | $ | 2,693,684 |

| | $ | 2,708,226 |

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 61,819 |

| | $ | 52,739 |

|

| Deferred revenue | | 44,413 |

| | 42,253 |

|

| Accrued taxes, franchise and other fees | | 65,975 |

| | 66,880 |

|

| Accrued interest | | 7,653 |

| | 13,934 |

|

| Accrued payroll and benefits | | 40,840 |

| | 44,284 |

|

| Accrued carrier costs | | 23,988 |

| | 32,760 |

|

| Current portion debt and capital lease obligations, net | | 369,404 |

| | 7,733 |

|

| Other current liabilities | | 29,227 |

| | 31,361 |

|

| Total current liabilities | | 643,319 |

| | 291,944 |

|

| Long-term debt and capital lease obligations, net | | 903,243 |

| | 1,352,820 |

|

| Long-term deferred revenue | | 24,031 |

| | 22,296 |

|

| Other long-term liabilities | | 36,840 |

| | 35,445 |

|

| Commitments and contingencies (Note 8) | |

|

| |

|

|

| Stockholders’ equity: | | | | |

| Preferred stock, $0.01 par value, 20,000 shares authorized, no shares issued and outstanding | | — |

| | — |

|

| Common stock, $0.01 par value, 439,800 shares authorized and 151,953 shares issued | | 1,520 |

| | 1,520 |

|

| Additional paid-in capital | | 1,836,144 |

| | 1,823,856 |

|

| Treasury stock, 682 and 2,909 shares, at cost, respectively | | (12,879 | ) | | (53,156 | ) |

| Accumulated deficit | | (738,598 | ) | | (766,518 | ) |

| Accumulated other comprehensive income | | 64 |

| | 19 |

|

| Total stockholders’ equity | | 1,086,251 |

| | 1,005,721 |

|

| Total liabilities and stockholders’ equity | | $ | 2,693,684 |

| | $ | 2,708,226 |

|

See accompanying notes to condensed consolidated financial statements.

tw telecom inc.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

|

| | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | | 2012 | | 2011 | | 2012 | | 2011 |

| | | (amounts in thousands, except per share amounts) |

| Revenue: | | | | | | | | |

| Data and Internet services | | $ | 189,164 |

| | $ | 164,670 |

| | $ | 548,495 |

| | $ | 475,025 |

|

| Voice services | | 91,052 |

| | 85,220 |

| | 271,681 |

| | 251,880 |

|

| Network services | | 81,261 |

| | 86,878 |

| | 249,074 |

| | 265,287 |

|

| Intercarrier compensation | | 7,457 |

| | 7,688 |

| | 23,112 |

| | 23,192 |

|

| Total revenue | | 368,934 |

| | 344,456 |

| | 1,092,362 |

| | 1,015,384 |

|

| Costs and expenses (a): | | | | | | | | |

| Operating (exclusive of depreciation, amortization and accretion shown separately below) | | 156,195 |

| | 144,161 |

| | 458,374 |

| | 425,141 |

|

| Selling, general and administrative | | 83,341 |

| | 82,085 |

| | 254,011 |

| | 241,684 |

|

| Depreciation, amortization and accretion | | 70,726 |

| | 70,940 |

| | 209,589 |

| | 210,757 |

|

| Total costs and expenses | | 310,262 |

| | 297,186 |

| | 921,974 |

| | 877,582 |

|

| Operating income | | 58,672 |

| | 47,270 |

| | 170,388 |

| | 137,802 |

|

| Interest expense | | (21,825 | ) | | (21,930 | ) | | (65,266 | ) | | (65,747 | ) |

| Debt extinguishment costs | | (77 | ) | | — |

| | (77 | ) | | — |

|

| Interest income | | 84 |

| | 126 |

| | 281 |

| | 443 |

|

| Income before income taxes | | 36,854 |

| | 25,466 |

| | 105,326 |

| | 72,498 |

|

| Income tax expense | | 15,885 |

| | 10,873 |

| | 45,706 |

| | 30,979 |

|

| Net income | | $ | 20,969 |

| | $ | 14,593 |

| | $ | 59,620 |

| | $ | 41,519 |

|

| Earnings per share: | | | | | | | | |

| Basic | | $ | 0.14 |

| | $ | 0.10 |

| | $ | 0.40 |

| | $ | 0.28 |

|

| Diluted | | $ | 0.14 |

| | $ | 0.10 |

| | $ | 0.39 |

| | $ | 0.27 |

|

| Weighted average shares outstanding: | | | | | | | | |

| Basic | | 147,973 |

| | 147,084 |

| | 147,481 |

| | 147,528 |

|

| Diluted | | 150,359 |

| | 148,999 |

| | 149,781 |

| | 149,734 |

|

(a) Includes non-cash stock-based employee compensation expense (Note 7):

|

| | | | | | | | | | | | | | | | |

| Operating | | $ | 473 |

| | $ | 565 |

| | $ | 1,428 |

| | $ | 1,737 |

|

| Selling, general and administrative | | $ | 6,667 |

| | $ | 6,248 |

| | $ | 20,889 |

| | $ | 19,357 |

|

See accompanying notes to condensed consolidated financial statements.

tw telecom inc.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited)

|

| | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | | 2012 | | 2011 | | 2012 | | 2011 |

| | | (amounts in thousands) |

| Net income | | $ | 20,969 |

| | $ | 14,593 |

| | $ | 59,620 |

| | $ | 41,519 |

|

| Other comprehensive income (loss), net of tax: | | | | | | | | |

| Unrealized gain on cash flow hedging activities | | — |

| | 10 |

| | — |

| | 1,023 |

|

| Unrealized gain (loss) on available-for-sale securities | | 105 |

| | (56 | ) | | 45 |

| | (12 | ) |

| Other comprehensive income (loss), net of tax | | 105 |

| | (46 | ) | | 45 |

| | 1,011 |

|

| Comprehensive income | | $ | 21,074 |

| | $ | 14,547 |

| | $ | 59,665 |

| | $ | 42,530 |

|

See accompanying notes to condensed consolidated financial statements.

tw telecom inc.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

|

| | | | | | | | |

| | | Nine Months Ended

September 30, |

| | | 2012 | | 2011 |

| | | (amounts in thousands) |

| Cash flows from operating activities: | | | | |

| Net income | | $ | 59,620 |

| | $ | 41,519 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

| Depreciation, amortization and accretion | | 209,589 |

| | 210,757 |

|

| Deferred income taxes | | 44,306 |

| | 29,783 |

|

| Stock-based compensation expense | | 22,317 |

| | 21,094 |

|

| Amortization of discount on debt and deferred debt issue costs and other | | 18,774 |

| | 17,374 |

|

| Changes in operating assets and liabilities: | | | | |

| Receivables, prepaid expenses and other assets | | (10,231 | ) | | (24,590 | ) |

| Accounts payable, deferred revenue and other liabilities | | (24,591 | ) | | (4,154 | ) |

| Net cash provided by operating activities | | 319,784 |

| | 291,783 |

|

| Cash flows from investing activities: | | | | |

| Capital expenditures | | (241,049 | ) | | (254,094 | ) |

| Purchases of investments | | (139,740 | ) | | (195,311 | ) |

| Proceeds from sale of investments | | 126,881 |

| | 182,725 |

|

| Proceeds from sale of assets and other investing activities, net | | 4,529 |

| | 3,876 |

|

| Net cash used in investing activities | | (249,379 | ) | | (262,804 | ) |

| Cash flows from financing activities: | | | | |

| Proceeds from issuance of common stock upon exercise of stock options | | 20,097 |

| | 15,460 |

|

| Taxes paid related to net share settlement of equity awards | | (9,962 | ) | | (6,416 | ) |

| Purchases of treasury stock | | (11,519 | ) | | (50,000 | ) |

| Excess tax benefits from stock-based compensation | | 1,216 |

| | — |

|

| Retirement of debt obligations | | (101,518 | ) | | — |

|

| Payment of debt and capital lease obligations | | (5,313 | ) | | (5,204 | ) |

| Net cash used in financing activities | | (106,999 | ) | | (46,160 | ) |

| Decrease in cash and cash equivalents | | (36,594 | ) | | (17,181 | ) |

| Cash and cash equivalents at beginning of period | | 353,394 |

| | 356,922 |

|

| Cash and cash equivalents at end of period | | $ | 316,800 |

| | $ | 339,741 |

|

| Supplemental disclosures of cash flow information: | | | | |

| Cash paid for interest | | $ | 53,859 |

| | $ | 57,596 |

|

| Cash paid for income taxes, net of refunds | | $ | 6,566 |

| | $ | 3,013 |

|

| Addition of capital lease obligation | | $ | 2,752 |

| | $ | 2,000 |

|

See accompanying notes to condensed consolidated financial statements.

tw telecom inc.

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS’ EQUITY

Nine months ended September 30, 2012

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Common Stock | | Treasury Stock | | Additional paid-in capital | | Accumulated deficit | | Accumulated other comprehensive (loss) income | | Total stockholders’ equity |

| | | Shares | | Amount | | Shares | | Amount | |

| | | (amounts in thousands) |

| Balance at December 31, 2011 | | 151,953 |

| | $ | 1,520 |

| | (2,909 | ) | | $ | (53,156 | ) | | $ | 1,823,856 |

| | $ | (766,518 | ) | | $ | 19 |

| | $ | 1,005,721 |

|

| Net income | | — |

| | — |

| | — |

| | — |

| | — |

| | 59,620 |

| | — |

| | 59,620 |

|

| Unrealized gain on available-for-sale securities, net of tax | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 45 |

| | 45 |

|

| Excess tax benefits (shortfalls) from stock-based compensation | | — |

| | — |

| | — |

| | — |

| | (68 | ) | | — |

| | — |

| | (68 | ) |

| Purchases of treasury stock | | — |

| | — |

| | (521 | ) | | (11,519 | ) | | — |

| | — |

| | — |

| | (11,519 | ) |

| Exercise of stock options net of withholdings to satisfy employee tax obligations upon vesting of stock awards | | — |

| | — |

| | 1,567 |

| | 28,712 |

| | (12,615 | ) | | (5,962 | ) | | — |

| | 10,135 |

|

| Stock-based compensation | | — |

| | — |

| | 1,181 |

| | 23,084 |

| | 24,971 |

| | (25,738 | ) | | — |

| | 22,317 |

|

| Balance at September 30, 2012 | | 151,953 |

| | $ | 1,520 |

| | (682 | ) | | $ | (12,879 | ) | | $ | 1,836,144 |

| | $ | (738,598 | ) | | $ | 64 |

| | $ | 1,086,251 |

|

See accompanying notes to condensed consolidated financial statements.

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

1. Organization and Summary of Significant Accounting Policies

Description of Business and Capital Structure

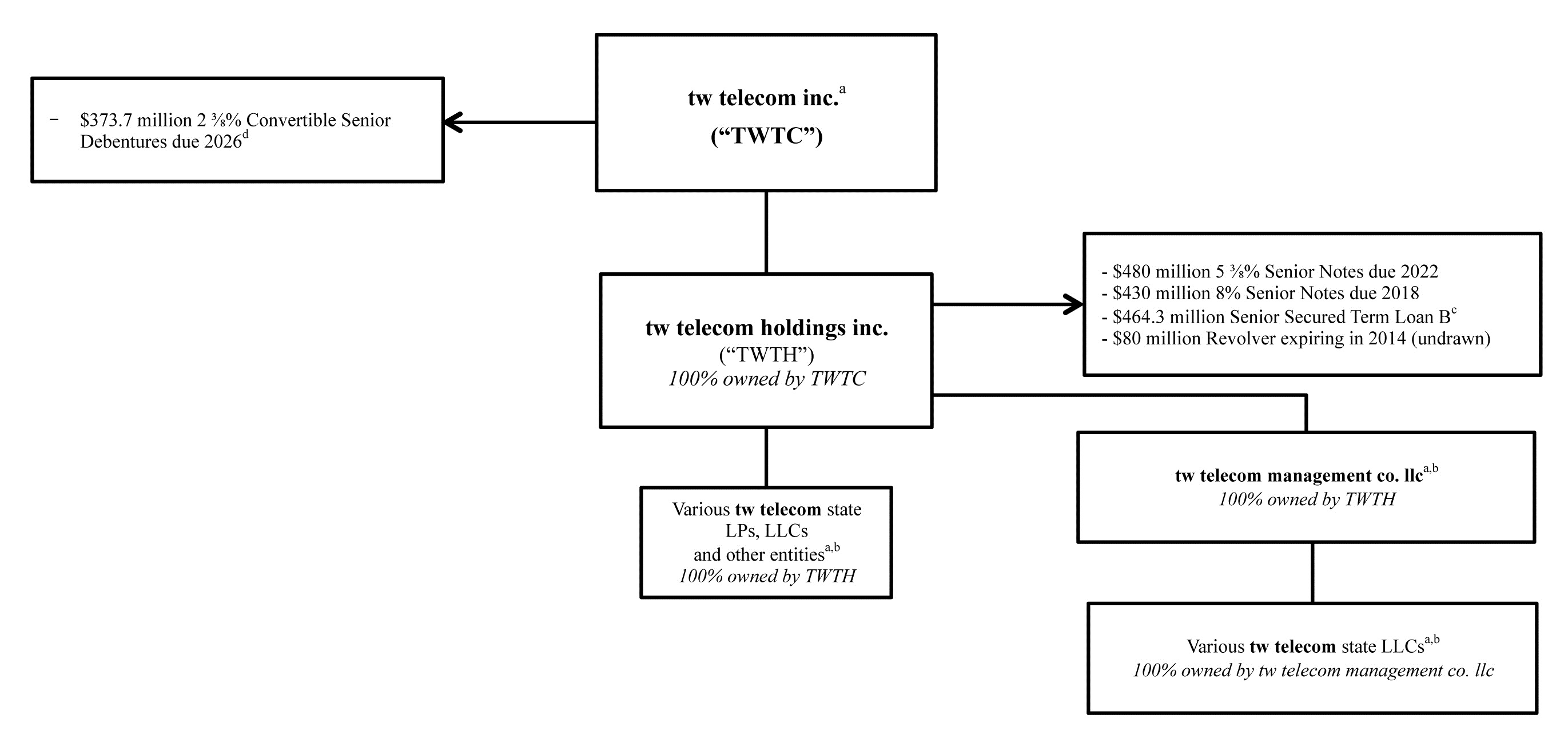

tw telecom inc. (together with its wholly-owned subsidiaries, the “Company”) is a leading national provider of managed network services, specializing in business Ethernet, data networking, converged, IP based virtual private network or "IP VPN", Internet access, voice, including voice over Internet Protocol or “VoIP”, and network security services to enterprise organizations, including public sector entities, and carriers throughout the United States, including their global locations.

The Company has one class of common stock outstanding with one vote per share. The Company also is authorized to issue shares of preferred stock. The Company’s Board of Directors has the authority to establish voting powers, preferences, and special rights for the preferred stock. No shares of preferred stock have been issued.

Basis of Presentation

The accompanying unaudited interim condensed consolidated financial statements have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”) for quarterly reports on Form 10-Q and do not include all of the information and note disclosures required by U.S. generally accepted accounting principles (“U.S. GAAP”) for complete financial statements. These condensed consolidated financial statements should therefore be read in conjunction with the consolidated financial statements and notes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2011 filed with the SEC. The accompanying unaudited interim condensed consolidated financial statements have been prepared in accordance with U.S. GAAP and include all adjustments of a normal, recurring nature that are, in the opinion of management, necessary to present fairly the financial position and results of operations for the interim periods presented. The results of operations for an interim period are not necessarily indicative of the results of operations for a full fiscal year.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

Recently Adopted Accounting Pronouncements

In June 2011, the Financial Accounting Standards Board (the “FASB”) issued an accounting standard update that eliminates the option to report other comprehensive income and its components in the statement of stockholders’ equity. Instead, an entity is required to present items of net income and other comprehensive income in one continuous statement or in two separate but consecutive statements. The standard is effective for fiscal years beginning after December 15, 2011. The Company adopted this accounting standard update in the three months ended March 31, 2012. This update affected presentation and disclosure, but did not affect the Company’s consolidated financial position, results of operations or cash flows.

In September 2011, the FASB issued an accounting standard update intended to simplify goodwill impairment testing. Entities have the option to perform a qualitative assessment on goodwill impairment to determine if a quantitative assessment is necessary. The accounting standard update is effective for fiscal years beginning after December 15, 2011. The Company adopted the new guidance effective January 1, 2012. This update affects testing steps only, and therefore adoption will not affect the Company’s consolidated financial position, results of operations or cash flows.

Revenue

The Company’s revenue is derived primarily from business communications services comprised of the following:

| |

| • | Data and Internet services include services that enable customers to connect their internal computer networks and to access external networks, including Internet access at high speeds using Ethernet protocol, metropolitan and wide-area business Ethernet and IP VPN solutions. |

| |

| • | Voice services include traditional and next generation voice capabilities, including voice services provided as stand alone and bundled services, long distance, toll free services and VoIP. |

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

| |

| • | Network services are point-to-point services that transmit voice, data and images using state-of-the-art fiber optics, and collocation services that provide secure space with controlled climate and power where customers can locate their equipment to connect to the Company’s network in facilities equipped for enterprise information technology environmental requirements. |

| |

| • | Converged services fully integrate a combination of certain communication applications including IP VPN, voice, Internet, security and managed router service into a single managed IP solution. The various components of converged services are classified into the pertinent service categories in the condensed consolidated statements of operations. |

The Company also generates revenue from intercarrier compensation. Intercarrier compensation is comprised of switched access services and reciprocal compensation. Switched access represents the compensation from another carrier for the delivery of traffic from a long distance carrier’s point of presence to an end-user’s premises provided through the Company’s switching facilities. The Federal Communications Commission ("FCC") and state public utility commissions regulate switched access rates in their respective jurisdictions. Reciprocal compensation represents compensation from local exchange carriers (“LECs”) for local exchange traffic originated on another LEC’s facilities and terminated on the Company’s facilities.

The Company’s customers include, among others, enterprise organizations in the financial services, technology and scientific, health care, distribution, manufacturing and professional services industries, public sector entities, system integrators and communications service providers, including incumbent local exchange carriers ("ILECs"), competitive local exchange carriers ("CLECs"), wireless communications companies and cable companies.

Revenue for network, data and Internet, and the majority of voice services is generally billed in advance on a monthly fixed rate basis and recognized over the period the services are provided. Revenue for the majority of intercarrier compensation and certain components of voice services, such as long distance, is generally billed on a transactional basis in arrears based on a customer’s actual usage; therefore, estimates are used to recognize revenue in the period earned.

The Company evaluates whether receivables are reasonably assured of collection based on certain factors, including the likelihood of billing being disputed by customers. If there is a billing dispute with a customer, revenue generally is not recognized until the dispute is resolved. The Company does not recognize revenue associated with contract termination charges until cash is received.

The Company classifies certain taxes and fees billed to customers and remitted to government authorities on a gross versus net basis in revenue and expense. In making this determination, the Company assesses, among other things, whether the Company is the primary obligor or principal taxpayer for the taxes and fees assessed in each jurisdiction where the Company does business. In jurisdictions where the Company determines that it is the principal taxpayer, the Company records the taxes and fees on a gross basis, including the taxes and fees in both revenue and expense. In jurisdictions where the Company determines that it is merely a collection agent for the government authority, the Company records the taxes on a net basis. The total amounts classified as revenue, primarily included in voice services, associated with such taxes and fees were approximately $19.3 million and $16.3 million for the three months ended September 30, 2012 and 2011, respectively, and approximately $58.8 million and $46.7 million for the nine months ended September 30, 2012 and 2011, respectively.

Significant Customers

The Company has substantial business relationships with a few large customers, including major telecommunications carriers. The Company’s 10 largest customers accounted for an aggregate of 19% of the Company’s total revenue in each of the nine months ended September 30, 2012 and 2011. No customer accounted for 10% or more of total revenue for the nine months ended September 30, 2012 or 2011. The Company’s largest customer (AT&T Inc., a carrier) represented 4% of the Company’s total revenue in each of the three and nine months ended September 30, 2012 and 2011.

2. Earnings per Common Share and Potential Common Share

Basic earnings per common share (“EPS”) is measured as the income allocated to common stockholders divided by the weighted average outstanding common shares for the period. Diluted EPS is similar to basic EPS but presents the dilutive effect on a per share basis of potential common shares (such as convertible securities and stock options) as if they had been converted to shares at the beginning of the period presented. Potential common shares that have an anti-dilutive effect (e.g., those that increase income per share) are excluded from diluted EPS.

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

The following is a reconciliation of the numerators and denominators used in the basic and diluted EPS computations:

|

| | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | | 2012 | | 2011 | | 2012 | | 2011 |

| | | (amounts in thousands, except per share amounts) |

| Numerator | | | | | | | | |

| Net income | | $ | 20,969 |

| | $ | 14,593 |

| | $ | 59,620 |

| | $ | 41,519 |

|

| Allocation of net income to unvested restricted stock awards | | (437 | ) | | (281 | ) | | (1,245 | ) | | (777 | ) |

| Net income allocated to common stockholders, basic | | $ | 20,532 |

| | $ | 14,312 |

| | $ | 58,375 |

| | $ | 40,742 |

|

| Net income allocated to common stockholders, diluted | | $ | 20,532 |

| | $ | 14,312 |

| | $ | 58,375 |

| | $ | 40,742 |

|

| Denominator | | | | | | | | |

| Basic weighted average shares outstanding | | 147,973 |

| | 147,084 |

| | 147,481 |

| | 147,528 |

|

| Dilutive potential common shares: | | | | | | | | |

| Stock options | | 1,763 |

| | 1,382 |

| | 1,633 |

| | 1,611 |

|

| Unvested restricted stock units | | 623 |

| | 533 |

| | 667 |

| | 595 |

|

| Diluted weighted average shares outstanding | | 150,359 |

| | 148,999 |

| | 149,781 |

| | 149,734 |

|

| Basic earnings per share | | $ | 0.14 |

| | $ | 0.10 |

| | $ | 0.40 |

| | $ | 0.28 |

|

| Diluted earnings per share | | $ | 0.14 |

| | $ | 0.10 |

| | $ | 0.39 |

| | $ | 0.27 |

|

Options to purchase shares of the Company’s common stock, restricted stock awards, restricted stock units to be settled in common stock upon vesting and shares of common stock subject to issuance upon conversion of the Company’s Convertible Senior Debentures due 2026 (“Convertible Debentures”), which were excluded from the computation of diluted weighted average shares outstanding because their inclusion would be anti-dilutive, totaled 23.2 million shares and 25.9 million shares for the three months ended September 30, 2012 and 2011, respectively, and 23.2 million shares and 26.1 million shares for the nine months ended September 30, 2012 and 2011, respectively.

3. Investments

The Company’s investments at September 30, 2012 and December 31, 2011 are summarized as follows:

|

| | | | | | | | |

| | | September 30,

2012 | | December 31,

2011 |

| | | (amounts in thousands) |

| Cash equivalents: | | | | |

| U.S. Treasury money market mutual funds | | $ | 224,803 |

| | $ | 291,746 |

|

| Commercial paper | | 18,797 |

| | 8,497 |

|

| Debt securities issued by the U.S. Treasury | | 5,000 |

| | — |

|

| Certificates of deposit | | 2,802 |

| | 5,201 |

|

| International government securities | | — |

| | 1,401 |

|

| Total cash equivalents | | 251,402 |

| | 306,845 |

|

| Investments: | | | | |

| Corporate debt securities | | 71,264 |

| | 99,132 |

|

| Debt securities issued by the U.S. Treasury | | 40,263 |

| | 3,008 |

|

| Debt securities issued by U.S. Government agencies | | 31,070 |

| | 27,885 |

|

| Commercial paper | | — |

| | 1,500 |

|

| Total investments | | 142,597 |

| | 131,525 |

|

| Total cash equivalents and investments | | $ | 393,999 |

| | $ | 438,370 |

|

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

At September 30, 2012 and December 31, 2011, the carrying values of investments included in cash and cash equivalents approximated fair value. The aggregate fair value of available-for-sale securities by major security type is included in Note 6. The amortized cost basis of the available-for-sale securities was not materially different from the aggregate fair value. The contractual maturities of the Company’s available-for-sale securities are all within one year.

Proceeds from the sale and maturity of available-for-sale securities were $20.8 million and $97.6 million during the three months ended September 30, 2012 and 2011, respectively, and $126.9 million and $182.7 million during the nine months ended September 30, 2012 and 2011, respectively. Gains and losses on investments are calculated using the specific identification method and are recognized during the period the investment is sold. The Company recognized no material unrealized or realized net gains or losses during the three and nine months ended September 30, 2012 and 2011.

4. Long-Term Debt and Capital Lease Obligations

The components of long-term debt and capital lease obligations at September 30, 2012 and December 31, 2011 were as follows:

|

| | | | | | | | |

| | | September 30,

2012 | | December 31,

2011 |

| | | (amounts in thousands) |

| Term Loan B - January 2013 tranche, due 2013 | | $ | — |

| | $ | 102,055 |

|

| Term Loan B - extended tranche, due 2016 | | 464,250 |

| | 467,946 |

|

| 8% Senior Notes, due 2018 | | 430,000 |

| | 430,000 |

|

23/8% Convertible Senior Debentures, due 2026 (1) | | 373,743 |

| | 373,744 |

|

| Capital lease obligations | | 17,917 |

| | 16,251 |

|

| Total obligations | | 1,285,910 |

| | 1,389,996 |

|

| Unamortized discounts | | (13,263 | ) | | (29,443 | ) |

| Current portion | | (369,404 | ) | | (7,733 | ) |

| Total long-term debt and capital lease obligations | | $ | 903,243 |

| | $ | 1,352,820 |

|

| |

| (1) | The Convertible Debentures are redeemable in whole or in part at the Company’s option at any time on or after April 6, 2013 at a redemption price equal to 100% of the principal amount of the debentures to be redeemed, plus accrued and unpaid interest. Holders of the Convertible Debentures have the option to require the Company to purchase all or part of the Convertible Debentures on April 1, 2013, April 1, 2016, or April 1, 2021, at 100% of the principal and unpaid interest, or at any time prior to April 1, 2026, to convert the debentures into shares of the Company’s common stock. Upon conversion, the Company will have the right to deliver, in lieu of shares of common stock, cash or a combination of cash and shares of common stock. |

Debt Retirement

In August 2012, the Company's wholly-owned subsidiary, tw telecom holdings inc. (“Holdings”), extinguished in full the $101.5 million tranche of its Term Loan B due January 2013 by utilizing cash and cash equivalents. A $0.1 million write off of deferred debt issuance costs related to the extinguishment has been classified as debt extinguishment costs in the accompanying condensed consolidated statements of operations for the three and nine months ended September 30, 2012.

Debt Offering

In October 2012, Holdings completed a private offering of $480 million principal amount 5 3/8% Senior Notes due 2022 (the "2022 Notes"), at an offering price of 100% of the principal amount. The Company plans to use the net proceeds of this offering to settle the conversion obligations for the Convertible Debentures to the extent holders elect to convert their Convertible Debentures and the Company elects to settle the conversion obligations in whole or in part in cash, or if the Company otherwise redeems the Convertible Debentures. See the discussion in Note 1 to the table above for the terms under which the Convertible Debentures may be settled or redeemed. Any net proceeds not used for these purposes would be used for general corporate purposes.

The 2022 Notes are unsecured obligations of Holdings and are guaranteed by the Company and substantially all of Holdings' subsidiaries. Interest is payable semi-annually on April 1 and October 1, commencing on April 1, 2013. The 2022 Notes are redeemable in whole or in part, at the Company's option at any time prior to October 1, 2017 at a price equal to 100% of the principal amount, plus accrued and unpaid interest, if any, liquidated damages, if any, plus a make-whole premium.

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

The 2022 Notes are also redeemable in whole or in part, at the Company's option at any time on or after October 1, 2017, 2018, 2019 and 2020 at redemption prices of 102.688%, 101.792%, 100.896% and 100%, respectively, of the principal amount, plus accrued and unpaid interest, if any, and liquidated damages, if any. In addition, any time prior to October 1, 2015, at the Company's option, the Company may redeem up to 35% of the aggregate principal amount of the 2022 Notes with net proceeds from one or more equity offerings by the Company at a redemption price of 105.375% of their principal amount, plus accrued and unpaid interest, if any, and liquidated damages, if any. Offering costs of $9.2 million related to the 2022 Notes were deferred and will be amortized to interest expense over the term of the 2022 Notes. The Company has agreed to file an exchange offer registration statement within 180 days of issuance of the 2022 Notes on October 2, 2012, or in certain circumstances, a shelf registration, to enable the holders of the 2022 Notes to exchange the unregistered 2022 Notes for notes registered under the Securities Act of 1933 with substantially identical terms.

As of September 30, 2012, tw telecom inc. and Holdings were in compliance with all of their debt covenants.

5. Derivative Instruments

Holdings’ variable rate Term Loan B due 2016 (the “Term Loan”) exposes the Company to variability in interest payments due to changes in interest rates. In order to mitigate interest rate fluctuations on the Term Loan, Holdings has in the past entered into derivative instruments, specifically interest rate swap agreements. The interest rate swap agreements effectively converted a portion of Holdings’ floating-rate debt to a fixed-rate for the term of the agreement, which reduces the impact of interest rate changes on future interest expense. Historically, the Company has designated its interest rate swap agreements as cash flow hedges. During the year ended December 31, 2011, the Company's remaining interest rate swap agreement expired.

If certain correlation and risk reduction criteria are met, the derivative is deemed to be highly effective in offsetting the changes in cash flows of the hedged item on a retrospective and prospective basis, and may be specifically designated as a hedge of exposure to changes in cash flow. For derivative instruments that are designated and qualify as a cash flow hedge, the effective portion of the gain or loss on the derivative instrument is reported as a component of other comprehensive income or loss. Amounts excluded from the assessment of hedge effectiveness, if any, as well as the ineffective portion of the gain or loss, are reported in results of operations immediately. The Company performs a quarterly assessment to determine whether each derivative instrument is highly effective in offsetting changes in cash flows of the hedged item. If the derivative instrument is determined to be not highly effective as a hedge, or if a derivative instrument ceases to be a highly effective hedge, hedge accounting is discontinued prospectively with respect to that derivative instrument.

There were no unrecognized losses for the interest rate swap agreement included in accumulated other comprehensive income at September 30, 2012 or December 31, 2011. The effect of the interest rate swap on the condensed consolidated statements of operations was as follows for the three and nine months ended September 30, 2012 and 2011:

|

| | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | | 2012 | | 2011 | | 2012 | | 2011 |

| | | (amounts in thousands) |

| Loss recognized in other comprehensive (loss) income (effective portion) | | $ | — |

| | $ | (10 | ) | | $ | — |

| | $ | (116 | ) |

| Loss reclassified from accumulated other comprehensive (loss) income into interest expense (effective portion) | | $ | — |

| | $ | (705 | ) | | $ | — |

| | $ | (2,070 | ) |

| Gain/(Loss) recognized in income (ineffective portion and amount excluded from effectiveness testing) | | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

|

6. Fair Value Measurements

Fair value, as defined by relevant accounting standards, is the price that would be received from selling an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. When determining the fair value measurements for assets and liabilities required to be recorded at fair value, the Company considers the principal or most advantageous market in which it would complete a transaction and considers assumptions that market participants would use when pricing the asset or liability, such as inherent risk, transfer restrictions and risk of nonperformance.

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

Fair Value Hierarchy

Relevant accounting standards set forth a fair value hierarchy that requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. A financial instrument’s categorization within the fair value hierarchy is based upon the lowest level of input that is significant to the fair value measurement. Relevant accounting standards establish three levels of inputs that may be used to measure fair value:

| |

| • | Level 1—Quoted prices in active markets for identical assets or liabilities. Level 1 assets that are measured at fair value on a recurring basis consist of the Company’s investment in U.S. Treasury money market mutual funds that are traded in an active market with sufficient volume and frequency of transactions, and are included as a component of cash and cash equivalents in the condensed consolidated balance sheets. |

| |

| • | Level 2—Observable inputs other than Level 1 prices such as quoted prices for similar assets or liabilities; quoted prices in markets with insufficient volume or infrequent transactions (less active markets); or model-derived valuations in which all significant inputs are observable or can be derived principally from or corroborated by observable market data for substantially the full term of the assets or liabilities. Level 2 assets that are measured at fair value on a recurring basis consist of the Company’s investments in certificates of deposit, commercial paper, corporate debt securities, international government securities, and debt securities issued by the U.S. Treasury and other U.S. government agencies using observable inputs in less active markets and are included as a component of cash equivalents and investments in the condensed consolidated balance sheets. Level 2 liabilities that are measured, but not carried, at fair value on a recurring basis include the Company’s long-term debt. Although the Company’s long-term debt has not been listed on any securities exchange or inter-dealer automated quotation system, the Company has estimated the fair value of its long-term debt based on indicative pricing published by certain investment banks. |

| |

| • | Level 3—Unobservable inputs to the valuation methodology that are significant to the measurement of fair value of assets or liabilities. The Company did not have any Level 3 assets or liabilities that were measured at fair value at September 30, 2012 and December 31, 2011. |

The following table reflects assets and liabilities that are measured and carried at fair value on a recurring basis at September 30, 2012 and December 31, 2011:

|

| | | | | | | | | | | | | | | | |

| | | Fair Value Measurements At September 30, 2012 | | Assets at Fair Value |

| | | Level 1 | | Level 2 | | Level 3 | |

| | | (amounts in thousands) |

| Assets | | | | | | | | |

| U.S. Treasury money market mutual funds | | $ | 224,803 |

| | $ | — |

| | $ | — |

| | $ | 224,803 |

|

| Commercial paper | | — |

| | 18,797 |

| | — |

| | 18,797 |

|

| Debt securities issued by the U.S. Treasury | | — |

| | 5,000 |

| | — |

| | 5,000 |

|

| Certificates of deposit | | — |

| | 2,802 |

| | — |

| | 2,802 |

|

| Investments included in cash and cash equivalents | | 224,803 |

| | 26,599 |

| | — |

| | 251,402 |

|

| Corporate debt securities | | — |

| | 71,264 |

| | — |

| | 71,264 |

|

| Debt securities issued by the U.S. Treasury | | — |

| | 40,263 |

| | — |

| | 40,263 |

|

| Debt securities issued by U.S. Government agencies | | — |

| | 31,070 |

| | — |

| | 31,070 |

|

| Short-term investments | | — |

| | 142,597 |

| | — |

| | 142,597 |

|

| Total assets | | $ | 224,803 |

| | $ | 169,196 |

| | $ | — |

| | $ | 393,999 |

|

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

|

| | | | | | | | | | | | | | | | |

| | | Fair Value Measurements At December 31, 2011 | | Assets at Fair Value |

| | | Level 1 | | Level 2 | | Level 3 | |

| | | (amounts in thousands) |

| Assets | | | | | | | | |

| U.S. Treasury money market mutual funds | | $ | 291,746 |

| | $ | — |

| | $ | — |

| | $ | 291,746 |

|

| Commercial paper | | — |

| | 8,497 |

| | — |

| | 8,497 |

|

| Certificates of deposit | | — |

| | 5,201 |

| | — |

| | 5,201 |

|

| International government securities | | — |

| | 1,401 |

| | — |

| | 1,401 |

|

| Investments included in cash and cash equivalents | | 291,746 |

| | 15,099 |

| | — |

| | 306,845 |

|

| Corporate debt securities | | — |

| | 99,132 |

| | — |

| | 99,132 |

|

| Debt securities issued by U.S. Government agencies | | — |

| | 27,885 |

| | — |

| | 27,885 |

|

| Debt securities issued by the U.S. Treasury | | — |

| | 3,008 |

| | — |

| | 3,008 |

|

| Commercial paper | | — |

| | 1,500 |

| | — |

| | 1,500 |

|

| Short-term investments | | — |

| | 131,525 |

| | — |

| | 131,525 |

|

| Total assets | | $ | 291,746 |

| | $ | 146,624 |

| | $ | — |

| | $ | 438,370 |

|

The following table summarizes the carrying amounts and estimated fair values of the Company’s long-term debt, including the current portion:

|

| | | | | | | | | | | | | | | | |

| | | September 30, 2012 | | December 31, 2011 |

| | | Carrying Value | | Fair Value Level 2 | | Carrying Value | | Fair Value Level 2 |

| | | (amounts in thousands) |

| Term Loan B - January 2013 tranche | | $ | — |

| | $ | — |

| | $ | 102,055 |

| | $ | 101,673 |

|

| Term Loan B - Extended tranche, due 2016 | | 464,250 |

| | 465,991 |

| | 467,946 |

| | 464,435 |

|

| 8% Senior Notes due 2018, net of discount | | 427,905 |

| | 473,000 |

| | 427,614 |

| | 460,100 |

|

23/8% Convertible Senior Debentures, net of discount | | 362,575 |

| | 531,182 |

| | 346,687 |

| | 444,288 |

|

| Total debt | | $ | 1,254,730 |

| | $ | 1,470,173 |

| | $ | 1,344,302 |

| | $ | 1,470,496 |

|

7. Stock-Based Compensation

During the nine months ended September 30, 2012, the Company granted restricted stock awards and restricted stock units with respect to 1.9 million shares and no stock options. As of September 30, 2012, the Company had 4.6 million restricted stock awards and restricted stock units that were unvested and 5.1 million options outstanding, of which 4.4 million were exercisable.

As of September 30, 2012, there was $61.1 million of total unrecognized compensation expense related to unvested restricted stock awards and restricted stock units, which is expected to be recognized over a weighted-average period of 2.4 years, and $2.3 million of total unrecognized compensation expense related to unvested stock options, which is expected to be recognized over a weighted-average period of 0.8 years.

8. Commitments and Contingencies

Management routinely reviews the Company’s exposure to liabilities incurred in the normal course of its business operations. Where a probable contingency exists and the amount can be reasonably estimated, the Company records the estimated liability. Considerable judgment is required in analyzing and recording such liabilities and actual results may vary from the estimates.

The Company’s pending legal proceedings are limited to litigation incidental to its business. In the opinion of management, the ultimate resolution of these matters will not have a material adverse effect on the Company’s financial statements.

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

9. Supplemental Guarantor Information

In March 2010, Holdings (“Issuer”) issued 8% Senior Notes due 2018 (the “2018 Notes”) with a principal amount of $430 million. The 2018 Notes are unsecured obligations of the Issuer and are guaranteed by tw telecom inc. (“Parent Guarantor”) and substantially all of the Issuer’s subsidiaries (“Combined Subsidiary Guarantors”). The guarantees are joint and several. A significant amount of the Issuer’s cash flow is generated by the Combined Subsidiary Guarantors. As a result, funds necessary to meet the Issuer’s debt service obligations are provided in large part by distributions or advances from the Combined Subsidiary Guarantors. The 2018 Notes are governed by an indenture that contains certain restrictive covenants. These restrictions affect, and in many respects significantly limit or prohibit, among other things, the ability of the Parent Guarantor, the Issuer and its subsidiaries to incur indebtedness, make prepayments of certain indebtedness, pay dividends, make investments, engage in transactions with stockholders and affiliates, issue capital stock of subsidiaries, create liens, sell assets, and engage in mergers and consolidations.

The following information sets forth the Company’s Condensed Consolidating Balance Sheets as of September 30, 2012 and December 31, 2011, Condensed Consolidating Statements of Operations for the three and nine months ended September 30, 2012 and 2011, Condensed Consolidating Statements of Comprehensive Income for the three and nine months ended September 30, 2012 and 2011, and Condensed Consolidating Statements of Cash Flows for the nine months ended September 30, 2012 and 2011.

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

tw telecom inc.

CONDENSED CONSOLIDATING BALANCE SHEET

September 30, 2012

(unaudited)

|

| | | | | | | | | | | | | | | | | | | | |

| | | Parent Guarantor | | Issuer | | Combined Subsidiary Guarantors | | Eliminations | | Consolidated |

| | | (amounts in thousands) |

| ASSETS | | | | | | | | | | |

| Current assets: | | | | | | | | | | |

| Cash and cash equivalents | | $ | 24,543 |

| | $ | 292,257 |

| | $ | — |

| | $ | — |

| | $ | 316,800 |

|

| Investments | | — |

| | 142,597 |

| | — |

| | — |

| | 142,597 |

|

| Receivables, net | | — |

| | — |

| | 106,714 |

| | — |

| | 106,714 |

|

| Prepaid expenses and other current assets | | — |

| | 11,906 |

| | 7,569 |

| | — |

| | 19,475 |

|

| Deferred income taxes | | — |

| | 64,988 |

| | 20 |

| | — |

| | 65,008 |

|

| Total current assets | | 24,543 |

| | 511,748 |

| | 114,303 |

| | — |

| | 650,594 |

|

| Property, plant and equipment, net | | — |

| | 49,554 |

| | 1,415,681 |

| | — |

| | 1,465,235 |

|

| Deferred income taxes | | — |

| | 122,578 |

| | 485 |

| | — |

| | 123,063 |

|

| Goodwill | | — |

| | — |

| | 412,694 |

| | — |

| | 412,694 |

|

| Intangible and other assets, net | | 549 |

| | 12,850 |

| | 28,699 |

| | — |

| | 42,098 |

|

| Total assets | | $ | 25,092 |

| | $ | 696,730 |

| | $ | 1,971,862 |

| | $ | — |

| | $ | 2,693,684 |

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | | | | |

| Current liabilities: | | | | | | | | | | |

| Accounts payable | | $ | — |

| | $ | 18,712 |

| | $ | 43,107 |

| | $ | — |

| | $ | 61,819 |

|

| Current portion debt and capital lease obligations, net | | 362,575 |

| | 5,461 |

| | 1,368 |

| | — |

| | 369,404 |

|

| Other current liabilities | | 4,438 |

| | 47,234 |

| | 160,424 |

| | — |

| | 212,096 |

|

| Intercompany payable (receivable) | | (1,856,023 | ) | | (540,628 | ) | | 2,396,651 |

| | — |

| | — |

|

| Total current liabilities | | (1,489,010 | ) | | (469,221 | ) | | 2,601,550 |

| | — |

| | 643,319 |

|

| Losses in subsidiary in excess of investment | | 427,883 |

| | 887,626 |

| | — |

| | (1,315,509 | ) | | — |

|

| Long-term debt and capital lease obligations, net | | — |

| | 887,732 |

| | 15,511 |

| | — |

| | 903,243 |

|

| Long-term deferred revenue | | — |

| | — |

| | 24,031 |

| | — |

| | 24,031 |

|

| Other long-term liabilities | | — |

| | 6,720 |

| | 30,120 |

| | — |

| | 36,840 |

|

| Stockholders’ equity (deficit) | | 1,086,219 |

| | (616,127 | ) | | (699,350 | ) | | 1,315,509 |

| | 1,086,251 |

|

| Total liabilities and stockholders’ equity | | $ | 25,092 |

| | $ | 696,730 |

| | $ | 1,971,862 |

| | $ | — |

| | $ | 2,693,684 |

|

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

tw telecom inc.

CONDENSED CONSOLIDATING BALANCE SHEET

December 31, 2011

|

| | | | | | | | | | | | | | | | | | | | |

| | | Parent Guarantor | | Issuer | | Combined Subsidiary Guarantors | | Eliminations | | Consolidated |

| | | (amounts in thousands) |

| ASSETS | | | | | | | | | | |

| Current assets: | | | | | | | | | | |

| Cash and cash equivalents | | $ | 24,543 |

| | $ | 328,851 |

| | $ | — |

| | $ | — |

| | $ | 353,394 |

|

| Investments | | — |

| | 131,525 |

| | — |

| | — |

| | 131,525 |

|

| Receivables, net | | — |

| | — |

| | 96,182 |

| | — |

| | 96,182 |

|

| Prepaid expenses and other current assets | | — |

| | 10,521 |

| | 6,819 |

| | — |

| | 17,340 |

|

| Deferred income taxes | | — |

| | 64,988 |

| | 20 |

| | — |

| | 65,008 |

|

| Total current assets | | 24,543 |

| | 535,885 |

| | 103,021 |

| | — |

| | 663,449 |

|

| Property, plant and equipment, net | | — |

| | 56,720 |

| | 1,370,492 |

| | — |

| | 1,427,212 |

|

| Deferred income taxes | | — |

| | 162,050 |

| | 485 |

| | — |

| | 162,535 |

|

| Goodwill | | — |

| | — |

| | 412,694 |

| | — |

| | 412,694 |

|

| Intangible and other assets, net | | 1,373 |

| | 13,287 |

| | 27,676 |

| | — |

| | 42,336 |

|

| Total assets | | $ | 25,916 |

| | $ | 767,942 |

| | $ | 1,914,368 |

| | $ | — |

| | $ | 2,708,226 |

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | | | | |

| Current liabilities: | | | | | | | | | | |

| Accounts payable | | $ | — |

| | $ | 9,649 |

| | $ | 43,090 |

| | $ | — |

| | $ | 52,739 |

|

| Current portion debt and capital lease obligations | | — |

| | 6,505 |

| | 1,228 |

| | — |

| | 7,733 |

|

| Other current liabilities | | 2,219 |

| | 57,028 |

| | 172,225 |

| | — |

| | 231,472 |

|

| Intercompany payable (receivable) | | (1,836,254 | ) | | (600,773 | ) | | 2,437,027 |

| | — |

| | — |

|

| Total current liabilities | | (1,834,035 | ) | | (527,591 | ) | | 2,653,570 |

| | — |

| | 291,944 |

|

| Losses in subsidiary in excess of investment | | 507,643 |

| | 971,457 |

| | — |

| | (1,479,100 | ) | | — |

|

| Long-term debt and capital lease obligations, net | | 346,687 |

| | 992,490 |

| | 13,643 |

| | — |

| | 1,352,820 |

|

| Long-term deferred revenue | | — |

| | — |

| | 22,296 |

| | — |

| | 22,296 |

|

| Other long-term liabilities | | — |

| | 7,310 |

| | 28,135 |

| | — |

| | 35,445 |

|

| Stockholders’ equity (deficit) | | 1,005,621 |

| | (675,724 | ) | | (803,276 | ) | | 1,479,100 |

| | 1,005,721 |

|

| Total liabilities and stockholders’ equity | | $ | 25,916 |

| | $ | 767,942 |

| | $ | 1,914,368 |

| | $ | — |

| | $ | 2,708,226 |

|

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

tw telecom inc.

CONDENSED CONSOLIDATING STATEMENT OF OPERATIONS

Three Months Ended September 30, 2012

(unaudited)

|

| | | | | | | | | | | | | | | | | | | | |

| | | Parent Guarantor | | Issuer | | Combined Subsidiary Guarantors | | Eliminations | | Consolidated |

| | | (amounts in thousands) |

| Total revenue | | $ | — |

| | $ | — |

| | $ | 368,934 |

| | $ | — |

| | $ | 368,934 |

|

| Costs and expenses: | | | | | | | | | | |

| Operating, selling, general and administrative | | — |

| | 55,911 |

| | 183,625 |

| | — |

| | 239,536 |

|

| Depreciation, amortization and accretion | | — |

| | 6,171 |

| | 64,555 |

| | — |

| | 70,726 |

|

| Corporate expense allocation | | — |

| | (62,082 | ) | | 62,082 |

| | — |

| | — |

|

| Total costs and expenses | | — |

| | — |

| | 310,262 |

| | — |

| | 310,262 |

|

| Operating income | | — |

| | — |

| | 58,672 |

| | — |

| | 58,672 |

|

| Interest expense, net | | (7,903 | ) | | (12,213 | ) | | (1,709 | ) | | — |

| | (21,825 | ) |

| Debt extinguishment costs | | — |

| | (77 | ) | | — |

| | | | (77 | ) |

| Interest expense allocation | | 7,903 |

| | 12,290 |

| | (20,109 | ) | | — |

| | 84 |

|

| Income before income taxes and equity in undistributed earnings of subsidiaries | | — |

| | — |

| | 36,854 |

| | — |

| | 36,854 |

|

| Income tax expense | | — |

| | 15,328 |

| | 557 |

| | — |

| | 15,885 |

|

| Net income (loss) before equity in undistributed earnings of subsidiaries | | — |

| | (15,328 | ) | | 36,297 |

| | — |

| | 20,969 |

|

| Equity in undistributed earnings of subsidiaries | | 20,969 |

| | 36,297 |

| | — |

| | (57,266 | ) | | — |

|

| Net income | | $ | 20,969 |

| | $ | 20,969 |

| | $ | 36,297 |

| | $ | (57,266 | ) | | $ | 20,969 |

|

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

tw telecom inc.

CONDENSED CONSOLIDATING STATEMENT OF OPERATIONS

Three Months Ended September 30, 2011

(unaudited)

|

| | | | | | | | | | | | | | | | | | | | |

| | | Parent Guarantor | | Issuer | | Combined Subsidiary Guarantors | | Eliminations | | Consolidated |

| | | (amounts in thousands) |

| Total revenue | | $ | — |

| | $ | — |

| | $ | 344,456 |

| | $ | — |

| | $ | 344,456 |

|

| Costs and expenses: | | | | | | | | | | |

| Operating, selling, general and administrative | | — |

| | 49,547 |

| | 176,699 |

| | — |

| | 226,246 |

|

| Depreciation, amortization and accretion | | — |

| | 5,660 |

| | 65,280 |

| | — |

| | 70,940 |

|

| Corporate expense allocation | | — |

| | (55,207 | ) | | 55,207 |

| | — |

| | — |

|

| Total costs and expenses | | — |

| | — |

| | 297,186 |

| | — |

| | 297,186 |

|

| Operating income | | — |

| | — |

| | 47,270 |

| | — |

| | 47,270 |

|

| Interest expense, net | | (7,464 | ) | | (11,768 | ) | | (2,572 | ) | | — |

| | (21,804 | ) |

| Interest expense allocation | | 7,464 |

| | 11,768 |

| | (19,232 | ) | | — |

| | — |

|

| Income before income taxes and equity in undistributed earnings of subsidiaries | | — |

| | — |

| | 25,466 |

| | — |

| | 25,466 |

|

| Income tax expense | | — |

| | 10,425 |

| | 448 |

| | — |

| | 10,873 |

|

| Net income (loss) before equity in undistributed earnings of subsidiaries | | — |

| | (10,425 | ) | | 25,018 |

| | — |

| | 14,593 |

|

| Equity in undistributed earnings of subsidiaries | | 14,593 |

| | 25,018 |

| | — |

| | (39,611 | ) | | — |

|

| Net income | | $ | 14,593 |

| | $ | 14,593 |

| | $ | 25,018 |

| | $ | (39,611 | ) | | $ | 14,593 |

|

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

tw telecom inc.

CONDENSED CONSOLIDATING STATEMENT OF OPERATIONS

Nine months ended September 30, 2012

(unaudited)

|

| | | | | | | | | | | | | | | | | | | | |

| | | Parent Guarantor | | Issuer | | Combined Subsidiary Guarantors | | Eliminations | | Consolidated |

| | | (amounts in thousands) |

| Total revenue | | $ | — |

| | $ | — |

| | $ | 1,092,362 |

| | $ | — |

| | $ | 1,092,362 |

|

| Costs and expenses: | | | | | | | | | | |

| Operating, selling, general and administrative | | — |

| | 161,337 |

| | 551,048 |

| | — |

| | 712,385 |

|

| Depreciation, amortization and accretion | | — |

| | 17,640 |

| | 191,949 |

| | — |

| | 209,589 |

|

| Corporate expense allocation | | — |

| | (178,977 | ) | | 178,977 |

| | — |

| | — |

|

| Total costs and expenses | | — |

| | — |

| | 921,974 |

| | — |

| | 921,974 |

|

| Operating income | | — |

| | — |

| | 170,388 |

| | — |

| | 170,388 |

|

| Interest expense, net | | (23,370 | ) | | (36,300 | ) | | (5,596 | ) | | — |

| | (65,266 | ) |

| Debt extinguishment costs | | — |

| | (77 | ) | | — |

| | — |

| | (77 | ) |

| Interest expense allocation | | 23,370 |

| | 36,377 |

| | (59,466 | ) | | — |

| | 281 |

|

| Income before income taxes and equity in undistributed earnings of subsidiaries | | — |

| | — |

| | 105,326 |

| | — |

| | 105,326 |

|

| Income tax expense | | — |

| | 44,305 |

| | 1,401 |

| | — |

| | 45,706 |

|

| Net income (loss) before equity in undistributed earnings of subsidiaries | | — |

| | (44,305 | ) | | 103,925 |

| | — |

| | 59,620 |

|

| Equity in undistributed earnings of subsidiaries | | 59,620 |

| | 103,925 |

| | — |

| | (163,545 | ) | | — |

|

| Net income | | $ | 59,620 |

| | $ | 59,620 |

| | $ | 103,925 |

| | $ | (163,545 | ) | | $ | 59,620 |

|

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

tw telecom inc.

CONDENSED CONSOLIDATING STATEMENT OF OPERATIONS

Nine months ended September 30, 2011

(unaudited)

|

| | | | | | | | | | | | | | | | | | | | |

| | | Parent Guarantor | | Issuer | | Combined Subsidiary Guarantors | | Eliminations | | Consolidated |

| | | (amounts in thousands) |

| Total revenue | | $ | — |

| | $ | — |

| | $ | 1,015,384 |

| | $ | — |

| | $ | 1,015,384 |

|

| Costs and expenses: | | | | | | | | | | |

| Operating, selling, general and administrative | | — |

| | 158,767 |

| | 508,058 |

| | — |

| | 666,825 |

|

| Depreciation, amortization and accretion | | — |

| | 16,163 |

| | 194,594 |

| | — |

| | 210,757 |

|

| Corporate expense allocation | | — |

| | (174,930 | ) | | 174,930 |

| | — |

| | — |

|

| Total costs and expenses | | — |

| | — |

| | 877,582 |

| | — |

| | 877,582 |

|

| Operating income | | — |

| | — |

| | 137,802 |

| | — |

| | 137,802 |

|

| Interest expense, net | | (22,080 | ) | | (33,049 | ) | | (10,175 | ) | | — |

| | (65,304 | ) |

| Interest expense allocation | | 22,080 |

| | 33,049 |

| | (55,129 | ) | | — |

| | — |

|

| Income before income taxes and equity in undistributed earnings of subsidiaries | | — |

| | — |

| | 72,498 |

| | — |

| | 72,498 |

|

| Income tax expense | | — |

| | 29,785 |

| | 1,194 |

| | — |

| | 30,979 |

|

| Net income (loss) before equity in undistributed earnings of subsidiaries | | — |

| | (29,785 | ) | | 71,304 |

| | — |

| | 41,519 |

|

| Equity in undistributed earnings of subsidiaries | | 41,519 |

| | 71,304 |

| | — |

| | (112,823 | ) | | — |

|

| Net income | | $ | 41,519 |

| | $ | 41,519 |

| | $ | 71,304 |

| | $ | (112,823 | ) | | $ | 41,519 |

|

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

tw telecom inc.

CONDENSED CONSOLIDATING STATEMENT OF COMPREHENSIVE INCOME

Three Months Ended September 30, 2012

(unaudited)

|

| | | | | | | | | | | | | | | | | | | | |

| | | Parent Guarantor | | Issuer | | Combined Subsidiary Guarantors | | Eliminations | | Consolidated |

| | | (amounts in thousands) |

| Net income | | $ | 20,969 |

| | $ | 20,969 |

| | $ | 36,297 |

| | $ | (57,266 | ) | | $ | 20,969 |

|

| Other comprehensive income, net of tax: | | | | | | | | | | |

| Unrealized gain on available-for-sale securities | | 105 |

| | 105 |

| | — |

| | (105 | ) | | 105 |

|

| Other comprehensive income, net of tax | | 105 |

| | 105 |

| | — |

| | (105 | ) | | 105 |

|

| Comprehensive income | | $ | 21,074 |

| | $ | 21,074 |

| | $ | 36,297 |

| | $ | (57,371 | ) | | $ | 21,074 |

|

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

tw telecom inc.

CONDENSED CONSOLIDATING STATEMENT OF COMPREHENSIVE INCOME

Three Months Ended September 30, 2011

(unaudited)

|

| | | | | | | | | | | | | | | | | | | | |

| | | Parent Guarantor | | Issuer | | Combined Subsidiary Guarantors | | Eliminations | | Consolidated |

| | | (amounts in thousands) |

| Net income | | $ | 14,593 |

| | $ | 14,593 |

| | $ | 25,018 |

| | $ | (39,611 | ) | | $ | 14,593 |

|

| Other comprehensive income (loss), net of tax: | | | | | | | | | | |

| Unrealized gain on cash flow hedging activities | | 10 |

| | 10 |

| | — |

| | (10 | ) | | 10 |

|

| Unrealized loss on available-for-sale securities | | (56 | ) | | (56 | ) | | — |

| | 56 |

| | (56 | ) |

| Other comprehensive loss, net of tax | | (46 | ) | | (46 | ) | | — |

| | 46 |

| | (46 | ) |

| Comprehensive income | | $ | 14,547 |

| | $ | 14,547 |

| | $ | 25,018 |

| | $ | (39,565 | ) | | $ | 14,547 |

|

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

tw telecom inc.

CONDENSED CONSOLIDATING STATEMENT OF COMPREHENSIVE INCOME

Nine months ended September 30, 2012

(unaudited)

|

| | | | | | | | | | | | | | | | | | | | |

| | | Parent Guarantor | | Issuer | | Combined Subsidiary Guarantors | | Eliminations | | Consolidated |

| | | (amounts in thousands) |

| Net income | | $ | 59,620 |

| | $ | 59,620 |

| | $ | 103,925 |

| | $ | (163,545 | ) | | $ | 59,620 |

|

| Other comprehensive income, net of tax: | | | | | | | | | | |

| Unrealized gain on available-for-sale securities | | 45 |

| | 45 |

| | — |

| | (45 | ) | | 45 |

|

| Other comprehensive income, net of tax | | 45 |

| | 45 |

| | — |

| | (45 | ) | | 45 |

|

| Comprehensive income | | $ | 59,665 |

| | $ | 59,665 |

| | $ | 103,925 |

| | $ | (163,590 | ) | | $ | 59,665 |

|

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

tw telecom inc.

CONDENSED CONSOLIDATING STATEMENT OF COMPREHENSIVE INCOME

Nine months ended September 30, 2011

(unaudited)

|

| | | | | | | | | | | | | | | | | | | | |

| | | Parent Guarantor | | Issuer | | Combined Subsidiary Guarantors | | Eliminations | | Consolidated |

| | | (amounts in thousands) |

| Net income | | $ | 41,519 |

| | $ | 41,519 |

| | $ | 71,304 |

| | $ | (112,823 | ) | | $ | 41,519 |

|

| Other comprehensive income (loss), net of tax: | | | | | | | | | | |

| Unrealized gain on cash flow hedging activities | | 1,023 |

| | 1,023 |

| | — |

| | (1,023 | ) | | 1,023 |

|

| Unrealized loss on available-for-sale securities | | (12 | ) | | (12 | ) | | — |

| | 12 |

| | (12 | ) |

| Other comprehensive income, net of tax | | 1,011 |

| | 1,011 |

| | — |

| | (1,011 | ) | | 1,011 |

|

| Comprehensive income | | $ | 42,530 |

| | $ | 42,530 |

| | $ | 71,304 |

| | $ | (113,834 | ) | | $ | 42,530 |

|

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

tw telecom inc.

CONDENSED CONSOLIDATING STATEMENT OF CASH FLOWS

Nine months ended September 30, 2012

(unaudited)

|

| | | | | | | | | | | | | | | | | | | | |

| | | Parent Guarantor | | Issuer | | Combined Subsidiary Guarantors | | Eliminations | | Consolidated |

| | | (amounts in thousands) |

| Cash flows from operating activities: | | | | | | | | | | |

| Net income | | $ | 59,620 |

| | $ | 59,620 |

| | $ | 103,925 |

| | $ | (163,545 | ) | | $ | 59,620 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | | | |

| Depreciation, amortization and accretion | | — |

| | 17,640 |

| | 191,949 |

| | — |

| | 209,589 |

|

| Deferred income taxes | | — |

| | 44,306 |

| | — |

| | — |

| | 44,306 |

|

| Stock-based compensation expense | | — |

| | — |

| | 22,317 |

| | — |

| | 22,317 |

|

| Amortization of discount on debt and deferred debt issue costs and other | | 16,713 |

| | 2,061 |

| | — |

| | — |

| | 18,774 |

|

| Intercompany and equity investment changes | | (77,167 | ) | | (23,686 | ) | | (62,692 | ) | | 163,545 |

| | — |

|

| Changes in operating assets and liabilities | | 2,219 |

| | (8,331 | ) | | (28,710 | ) | | — |

| | (34,822 | ) |

| Net cash provided by operating activities | | 1,385 |

| | 91,610 |

| | 226,789 |

| | — |

| | 319,784 |

|

| Cash flows from investing activities: | | | | | | | | | | |

| Capital expenditures | | — |

| | (11,942 | ) | | (229,107 | ) | | — |

| | (241,049 | ) |

| Purchases of investments | | — |

| | (139,740 | ) | | — |

| | — |

| | (139,740 | ) |

| Proceeds from sale of investments | | — |

| | 126,881 |

| | — |

| | — |

| | 126,881 |

|

| Proceeds from sale of assets and other investing activities, net | | — |

| | 1,470 |

| | 3,059 |

| | — |

| | 4,529 |

|

| Net cash used in investing activities | | — |

| | (23,331 | ) | | (226,048 | ) | | — |

| | (249,379 | ) |

| Cash flows from financing activities: | | | | | | | | | | |

| Net proceeds (tax withholdings) from issuance of common stock upon exercise of stock options and vesting of restricted stock awards and units | | 10,135 |

| | — |

| | — |

| | — |

| | 10,135 |

|

| Purchases of treasury stock | | (11,519 | ) | | — |

| | — |

| | — |

| | (11,519 | ) |

| Excess tax benefits from stock-based compensation | | — |

| | 1,216 |

| | — |

| | — |

| | 1,216 |

|

| Retirement of debt obligations | | — |

| | (101,518 | ) | | — |

| | — |

| | (101,518 | ) |

| Payment of debt and capital lease obligations | | (1 | ) | | (4,571 | ) | | (741 | ) | | — |

| | (5,313 | ) |

| Net cash used in financing activities | | (1,385 | ) | | (104,873 | ) | | (741 | ) | | — |

| | (106,999 | ) |

| Decrease in cash and cash equivalents | | — |

| | (36,594 | ) | | — |

| | — |

| | (36,594 | ) |

| Cash and cash equivalents at beginning of period | | 24,543 |

| | 328,851 |

| | — |

| | — |

| | 353,394 |

|

| Cash and cash equivalents at end of period | | $ | 24,543 |

| | $ | 292,257 |

| | $ | — |

| | $ | — |

| | $ | 316,800 |

|

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

tw telecom inc.

CONDENSED CONSOLIDATING STATEMENT OF CASH FLOWS

Nine months ended September 30, 2011

(unaudited)

|

| | | | | | | | | | | | | | | | | | | | |

| | | Parent Guarantor | | Issuer | | Combined Subsidiary Guarantors | | Eliminations | | Consolidated |

| | | (amounts in thousands) |

| Cash flows from operating activities: | | | | | | | | | | |

| Net income | | $ | 41,519 |

| | $ | 41,519 |

| | $ | 71,304 |

| | $ | (112,823 | ) | | $ | 41,519 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | | | |

| Depreciation, amortization and accretion | | — |

| | 16,163 |

| | 194,594 |

| | — |

| | 210,757 |

|

| Deferred income taxes | | — |

| | 29,783 |

| | — |

| | — |

| | 29,783 |

|

| Stock-based compensation expense | | — |

| | — |

| | 21,094 |

| | — |

| | 21,094 |

|

| Amortization of discount on debt and deferred debt issue costs and other | | 15,423 |

| | 1,951 |

| | — |

| | — |

| | 17,374 |

|

| Intercompany and equity investment changes | | (18,205 | ) | | (61,201 | ) | | (33,417 | ) | | 112,823 |

| | — |

|

| Changes in operating assets and liabilities | | 2,219 |

| | (2,315 | ) | | (28,648 | ) | | — |

| | (28,744 | ) |

| Net cash provided by operating activities | | 40,956 |

| | 25,900 |

| | 224,927 |

| | — |

| | 291,783 |

|

| Cash flows from investing activities: | | | | | | | | | | |

| Capital expenditures | | — |

| | (30,839 | ) | | (223,255 | ) | | — |

| | (254,094 | ) |

| Purchases of investments | | — |

| | (195,311 | ) | | — |

| | — |

| | (195,311 | ) |

| Proceeds from sale of investments | | — |

| | 182,725 |

| | — |

| | — |

| | 182,725 |

|

| Proceeds from sale of assets and other investing activities, net | | — |

| | 4,960 |

| | (1,084 | ) | | — |

| | 3,876 |

|

| Net cash used in investing activities | | — |

| | (38,465 | ) | | (224,339 | ) | | — |

| | (262,804 | ) |

| Cash flows from financing activities: | | | | | | | | | | |

| Net proceeds (tax withholdings) from issuance of common stock upon exercise of stock options and vesting of restricted stock awards and units | | 9,044 |

| | — |

| | — |

| | — |

| | 9,044 |

|

| Purchases of treasury stock | | (50,000 | ) | | — |

| | — |

| | — |

| | (50,000 | ) |

| Payment of debt and capital lease obligations | | — |

| | (4,616 | ) | | (588 | ) | | — |

| | (5,204 | ) |

| Net cash used in financing activities | | (40,956 | ) | | (4,616 | ) | | (588 | ) | | — |

| | (46,160 | ) |

| Decrease in cash and cash equivalents | | — |

| | (17,181 | ) | | — |

| | — |

| | (17,181 | ) |

| Cash and cash equivalents at beginning of period | | 24,542 |

| | 332,380 |

| | — |

| | — |

| | 356,922 |

|

| Cash and cash equivalents at end of period | | $ | 24,542 |

| | $ | 315,199 |

| | $ | — |

| | $ | — |

| | $ | 339,741 |

|

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis provides information regarding the results of operations and financial condition of the Company and should be read in conjunction with the accompanying condensed consolidated financial statements and notes thereto. This discussion and analysis also should be read in conjunction with Management’s Discussion and Analysis of Financial Condition and Results of Operations and the consolidated financial statements included in Part II of our Annual Report on Form 10-K for the year ended December 31, 2011. References in this item to “we,” “our,” or “us” are to the Company and its subsidiaries on a consolidated basis unless the context otherwise requires.

In order to assist the reader in understanding certain terms relating to the telecommunications business that are used in this quarterly report on Form 10-Q, we refer you to the glossary included following Part III of our Annual Report on Form 10-K for the year ended December 31, 2011.

Cautions Concerning Forward-Looking Statements

This document contains certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995, including statements regarding, among other items, our expected financial position, expected capital expenditures, the impact of the economic downturn, activities and results, expected revenue mix, expected revenue changes, the impact of accounting changes, future tax benefits and expense, expense trends, future liquidity and capital resources, product plans, growth or stability from particular customer segments, building penetration plans, anticipated customer disconnections and customer and revenue churn, Modified EBITDA trends, expected network expansion and grooming, potential changes in certain accounting reserves and allowances and business and financing plans. These forward-looking statements are based on management’s current expectations and are naturally subject to risks, uncertainties, and changes in circumstances, certain of which are beyond our control. Actual results may differ materially from those expressed or implied by such forward-looking statements.