UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2008

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 0-30218

tw telecom inc.

(Exact name of Registrant as specified in its charter)

| | |

| Delaware | | 84-1500624 |

| (State or other jurisdiction of | | (I.R.S. Employer |

| incorporation or organization) | | Identification Number) |

| |

| 10475 Park Meadows Drive | | |

| Littleton, Colorado | | 80124 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (303) 566-1000

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer x Accelerated filer ¨

Non-accelerated filer ¨ (Do not check if a smaller reporting company) Smaller reporting company ¨

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The number of shares outstanding oftw telecom inc.’s common stock as of April 30, 2008 was:

tw telecom inc. common stock – 147,100,646 shares

INDEX TO FORM 10-Q

tw telecom inc.

CONDENSED CONSOLIDATED BALANCE SHEETS

| | | | | | | | |

| | | March 31,

2008 | | | December 31,

2007 | |

| | | (unaudited) | | | | |

| | | (amounts in thousands,

except share amounts) | |

| ASSETS | | | | | | | | |

Current assets: | | | | | | | | |

Cash and cash equivalents | | $ | 318,218 | | | | 321,531 | |

Receivables, less allowances of $11,064 and $12,018, respectively | | | 76,415 | | | | 75,976 | |

Prepaid expenses | | | 11,330 | | | | 13,461 | |

Deferred income taxes | | | 8,703 | | | | 8,703 | |

| | | | | | | | |

Total current assets | | | 414,666 | | | | 419,671 | |

| | | | | | | | |

Long-term investments | | | 14,456 | | | | 14,456 | |

Property, plant, and equipment | | | 3,083,907 | | | | 3,022,752 | |

Less accumulated depreciation | | | (1,792,026 | ) | | | (1,727,852 | ) |

| | | | | | | | |

| | | 1,291,881 | | | | 1,294,900 | |

| | | | | | | | |

Deferred income taxes | | | 50,047 | | | | 50,047 | |

Goodwill | | | 412,694 | | | | 412,694 | |

Intangible assets, net of accumulated amortization | | | 48,517 | | | | 51,002 | |

Other assets, net of accumulated amortization | | | 21,363 | | | | 21,948 | |

| | | | | | | | |

Total assets | | $ | 2,253,624 | | | $ | 2,264,718 | |

| | | | | | | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | | |

Current liabilities: | | | | | | | | |

Accounts payable | | $ | 45,448 | | | $ | 46,972 | |

Deferred revenue | | | 27,221 | | | | 26,015 | |

Accrued taxes, franchise and other fees | | | 69,857 | | | | 73,130 | |

Accrued interest | | | 9,624 | | | | 16,707 | |

Accrued payroll and benefits | | | 34,919 | | | | 36,560 | |

Accrued carrier costs | | | 45,551 | | | | 50,898 | |

Current portion of debt and capital lease obligations (note 2) | | | 7,586 | | | | 7,337 | |

Other current liabilities | | | 29,912 | | | | 30,647 | |

| | | | | | | | |

Total current liabilities | | | 270,118 | | | | 288,266 | |

| | | | | | | | |

Long-term debt and capital lease obligations (note 2) | | | 1,368,521 | | | | 1,370,318 | |

Long-term deferred revenue | | | 19,243 | | | | 19,672 | |

Other long-term liabilities | | | 22,899 | | | | 20,237 | |

Stockholders’ equity (note 1): | | | | | | | | |

Preferred stock, $0.01 par value, 20,000,000 shares authorized, no shares issued and outstanding | | | — | | | | — | |

Common stock, $0.01 par value, 439,800,000 shares authorized, 146,977,583 and 146,542,435 shares issued and outstanding, respectively | | | 1,470 | | | | 1,465 | |

Additional paid-in capital | | | 1,625,909 | | | | 1,618,352 | |

Accumulated deficit | | | (1,054,536 | ) | | | (1,053,592 | ) |

| | | | | | | | |

Total stockholders’ equity | | | 572,843 | | | | 566,225 | |

| | | | | | | | |

Total liabilities and stockholders’ equity | | $ | 2,253,624 | | | $ | 2,264,718 | |

| | | | | | | | |

See accompanying notes.

1

tw telecom inc.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | | | | | | | |

| | | Three Months Ended

March 31, | |

| | | 2008 | | | 2007 | |

| | | (amounts in thousands,

except per share amounts) | |

Revenue: | | | | | | | | |

Network services | | $ | 96,806 | | | $ | 99,970 | |

Data and Internet services | | | 92,790 | | | | 69,881 | |

Voice services | | | 83,073 | | | | 79,930 | |

Intercarrier compensation | | | 9,915 | | | | 11,611 | |

| | | | | | | | |

Total revenue | | | 282,584 | | | | 261,392 | |

| | | | | | | | |

Costs and expenses (a): | | | | | | | | |

Operating (exclusive of depreciation, amortization, and accretion shown separately below) | | | 120,821 | | | | 117,380 | |

Selling, general, and administrative | | | 74,480 | | | | 72,473 | |

Depreciation, amortization, and accretion | | | 69,859 | | | | 66,140 | |

| | | | | | | | |

Total costs and expenses | | | 265,160 | | | | 255,993 | |

| | | | | | | | |

Operating income | | | 17,424 | | | | 5,399 | |

Interest expense | | | (20,679 | ) | | | (23,462 | ) |

Interest income | | | 2,686 | | | | 4,539 | |

| | | | | | | | |

Loss before income taxes | | | (569 | ) | | | (13,524 | ) |

Income tax expense | | | 375 | | | | 285 | |

| | | | | | | | |

Net loss | | $ | (944 | ) | | $ | (13,809 | ) |

| | | | | | | | |

Net loss per common share, basic and diluted | | $ | (0.01 | ) | | $ | (0.10 | ) |

| | | | | | | | |

Weighted average shares outstanding, basic and diluted | | | 146,810 | | | | 143,768 | |

| | | | | | | | |

| (a) | Includes non-cash stock-based employee compensation expense (note 1): |

| | | | | | |

Operating | | $ | 925 | | $ | 852 |

| | | | | | |

Selling, general, and administrative | | $ | 5,160 | | $ | 3,943 |

| | | | | | |

See accompanying notes.

2

tw telecom inc.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | | | | | | | |

| | | Three Months Ended

March 31, | |

| | | 2008 | | | 2007 | |

| | | (amounts in thousands) | |

Cash flows from operating activities: | | | | | | | | |

Net loss | | $ | (944 | ) | | $ | (13,809 | ) |

Adjustments to reconcile net loss to net cash provided by operating activities: | | | | | | | | |

Depreciation, amortization, and accretion | | | 69,859 | | | | 66,140 | |

Stock-based compensation | | | 6,085 | | | | 4,795 | |

Amortization of deferred debt issue costs and other | | | 583 | | | | 573 | |

Changes in operating assets and liabilities: | | | | | | | | |

Receivables, prepaid expenses and other assets | | | 1,683 | | | | 1,331 | |

Accounts payable, deferred revenue, and other liabilities | | | (18,392 | ) | | | (19,573 | ) |

| | | | | | | | |

Net cash provided by operating activities | | | 58,874 | | | | 39,457 | |

| | | | | | | | |

Cash flows from investing activities: | | | | | | | | |

Capital expenditures | | | (59,637 | ) | | | (55,104 | ) |

Cash paid for acquisitions, net of cash acquired | | | — | | | | (1,080 | ) |

Purchases of investments | | | — | | | | (5,246 | ) |

Proceeds from maturities of investments | | | — | | | | 88,500 | |

Other investing activities | | | (2,387 | ) | | | (87 | ) |

| | | | | | | | |

Net cash (used in) provided by investing activities | | | (62,024 | ) | | | 26,983 | |

| | | | | | | | |

Cash flows from financing activities: | | | | | | | | |

Net proceeds from issuance of common stock upon exercise of stock options and in connection with the employee stock purchase plan | | | 1,477 | | | | 15,214 | |

Net costs from issuance of debt | | | — | | | | (850 | ) |

Payment of debt and capital lease obligations | | | (1,640 | ) | | | (1,810 | ) |

| | | | | | | | |

Net cash (used in) provided by financing activities | | | (163 | ) | | | 12,554 | |

| | | | | | | | |

Increase (decrease) in cash and cash equivalents | | | (3,313 | ) | | | 78,994 | |

Cash and cash equivalents at beginning of period | | | 321,531 | | | | 221,553 | |

| | | | | | | | |

Cash and cash equivalents at end of period | | $ | 318,218 | | | $ | 300,547 | |

| | | | | | | | |

Supplemental disclosures of cash flow information: | | | | | | | | |

Cash paid for interest | | $ | 27,546 | | | $ | 29,983 | |

| | | | | | | | |

See accompanying notes.

3

tw telecom inc.

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS’ EQUITY

Three Months Ended March 31, 2008

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | |

| | | Common Stock | | Additional

paid-in

capital | | Accumulated

deficit | | | Total

stockholders’

equity | |

| | | Class A | | Class B | | | |

| | | Shares | | Amount | | Shares | | Amount | | | |

| | | (amounts in thousands) | |

Balance at January 1, 2008 | | 146,542 | | $ | 1,465 | | — | | $ | — | | $ | 1,618,352 | | $ | (1,053,592 | ) | | $ | 566,225 | |

Net loss and comprehensive loss | | — | | | — | | — | | | — | | | — | | | (944 | ) | | | (944 | ) |

Shares issued for cash in connection with the exercise of stock options and the employee stock purchase plan | | 177 | | | 2 | | — | | | — | | | 1,475 | | | — | | | | 1,477 | |

Stock based compensation | | 259 | | | 3 | | — | | | — | | | 6,082 | | | — | | | | 6,085 | |

| | | | | | | | | | | | | | | | | | | | | |

Balance at March 31, 2008 | | 146,978 | | $ | 1,470 | | — | | $ | — | | $ | 1,625,909 | | $ | (1,054,536 | ) | | $ | 572,843 | |

| | | | | | | | | | | | | | | | | | | | | |

See accompanying notes.

4

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 1. | Organization and Summary of Significant Accounting Policies |

Description of Business and Capital Structure

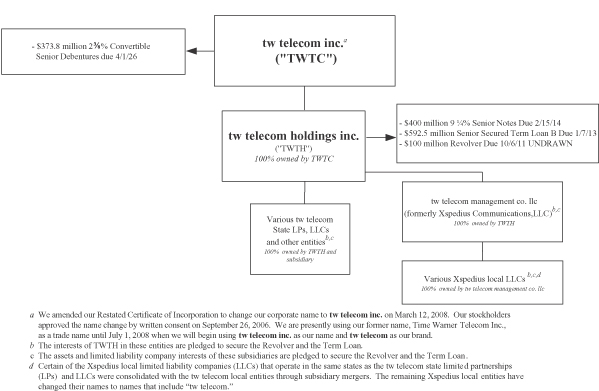

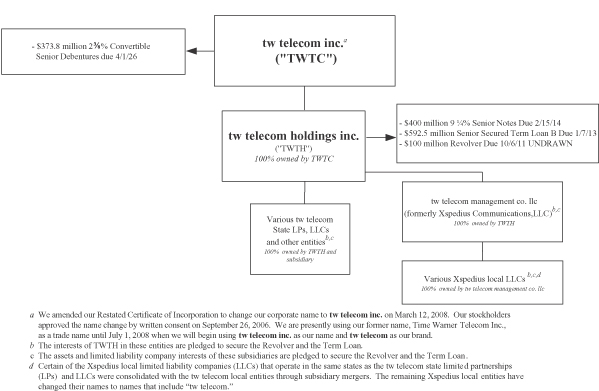

On March 12, 2008, Time Warner Telecom Inc. changed its corporate name totw telecom inc. (the “Company”) through an amendment to the Company’s Restated Certificate of Incorporation. The Company’s stockholders approved the name change by written consent on September 26, 2006. The Company is presently using its former name, Time Warner Telecom Inc., as a trade name until July 1, 2008 when the Company will begin usingtw telecom inc. as its name andtw telecom as its brand.

The Company, a Delaware corporation, is a leading national provider of managed network services, specializing in Ethernet and transport data networking, Internet access, local and long distance voice, voice over Internet protocol (“VoIP”) and network security services to enterprise organizations and communications services companies throughout the U.S.

The Company has one class of common stock outstanding with one vote per share. The Company also is authorized to issue shares of preferred stock. The Company’s Board of Directors has the authority to establish voting powers, preferences, and special rights for the preferred stock. No shares of preferred stock have been issued.

Basis of Presentation

The accompanying interim consolidated financial statements are unaudited, but in the opinion of management, reflect all adjustments necessary for a fair presentation of the results for the periods indicated. The results of operations for any interim period are not necessarily indicative of results for the full year. The accompanying financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto for the year ended December 31, 2007.

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

Basis of Consolidation

The consolidated financial statements include the accounts of the Company and all entities in which the Company has a controlling voting interest (“subsidiaries”). Significant intercompany accounts and transactions have been eliminated.

Recent Accounting Pronouncements

In September 2006, the Financial Accounting Standards Board (“FASB”) issued Statement of Financial Accounting Standards (“SFAS”) No. 157,Fair Value Measurement (“SFAS 157”), which defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles and expands disclosures about fair value measurements. This statement applies to other accounting pronouncements that require or permit fair value measurements. The Company was required to adopt SFAS 157 effective January 1, 2008 on a prospective basis. Subsequent to the issuance of SFAS 157, the FASB deferred the effective date for one year for all nonfinancial assets and nonfinancial liabilities, except for those items that are recognized or disclosed at fair value in the financial statements on a recurring basis. The adoption of SFAS 157 did not have a material impact on the Company’s financial position and results of operations.

5

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – Continued

In February 2007, the FASB issued SFAS No. 159,The Fair Value Option for Financial Assets and Financial Liabilities(“SFAS 159”). The fair value option established by SFAS 159 permits entities to choose to measure eligible financial instruments at fair value. The unrealized gains and losses on items for which the fair value option has been elected should be reported in earnings. The decision to elect the fair value option is determined on an instrument by instrument basis and is irrevocable. Assets and liabilities measured at fair value pursuant to the fair value option should be reported separately in the balance sheet from those instruments measured using other measurement attributes. This statement was effective January 1, 2008. The Company did not elect the fair value option for its existing financial assets and financial liabilities upon adoption of SFAS 159.

In December 2007, the FASB issued SFAS No. 141 (revised 2007), Business Combinations (“SFAS 141R”). SFAS 141R establishes the principles and requirements for how an acquirer: 1) recognizes and measures in its financial statements the identifiable assets acquired, the liabilities assumed, and any non-controlling interest in the acquiree; 2) recognizes and measures the goodwill acquired in the business combination or a gain from a bargain purchase; and 3) discloses the business combination. The statement is effective beginning January 1, 2009. SFAS 141R will only impact the Company if it is party to a business combination after SFAS 141R is effective.

In March 2008, the FASB issued SFAS No. 161 “Disclosures about Derivative Instruments and Hedging Activities – An Amendment to FASB Statement No. 133” which changes the disclosure requirements for derivative instruments and hedging activities. Companies are required to provide enhanced disclosures about (a) how and why an entity uses derivative instruments, (b) how derivative instruments and related hedged items are accounted for under Statement 133 and its related interpretations, and (c) how derivative instruments and related hedged items affect and Company’s financial position, financial performance, and cash flows. The standard is effective for the Company on January 1, 2009 and the Company is currently evaluating the disclosure requirements of this standard.

Cash Equivalents

The Company considers all highly liquid debt instruments with an original maturity of three months or less, when purchased, to be cash equivalents. At March 31, 2008 and December 31, 2007, investments included in cash and cash equivalents of $316.9 million and $320.9 million, respectively, were comprised of money market funds.

Investments

At March 31, 2008 and December 31, 2007, investments of $14.5 million included in long-term investments were comprised of commercial paper with exposure to sub-prime mortgages that is past its maturity date. The Company determined there were no additional impairments required as of March 31, 2008.

Receivables

The Company generally bills in advance for the majority of the services it provides and does not require significant collateral from its customers. The Company evaluates whether receivables are reasonably assured of collection by ongoing credit evaluations of significant customers’ financial condition, and provides an allowance for doubtful accounts based on the expected collectability of all receivables. The allowance for doubtful accounts was $11.1 million, or 13% of gross receivables, at March 31, 2008, and $12.0 million, or 14% of gross receivables, at December 31, 2007.

6

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – Continued

Revenue

The Company’s revenue is derived primarily from business communications services. Network services transmit voice, data and images as well as enable transmission for storage, using state-of-the-art fiber optics. Data and Internet services include services that enable customers to interconnect their internal computer networks and to access external networks, including Internet at high speeds using Ethernet protocol, such as metro and wide area Ethernet, virtual private network solutions and Internet access. Voice services include traditional and next generation voice capabilities, including voice services from stand alone and bundled products, long distance, 800 services, and VoIP. Intercarrier compensation is comprised of switched access services and reciprocal compensation. Switched access represents the compensation from another carrier for the delivery of traffic from a long distance carrier’s point of presence and an end-user’s premises provided through the Company’s switching facilities. The Federal Communications Commission (“FCC”) and state public utility commissions regulate switched access rates in their respective jurisdictions. Reciprocal compensation represents compensation from local exchange carriers (“LECs”) for local exchange traffic originated on another LEC’s facilities and terminated on the Company’s facilities. Reciprocal compensation rates are established by interconnection agreements between the parties based on federal and state regulatory rulings.

The Company’s customers are principally enterprise organizations in the distribution, health care, finance, service and manufacturing industries, state, local and federal government entities as well as long distance carriers, incumbent local exchange carriers (“ILECs”), competitive local exchange carriers (“CLECs”), wireless communications companies, and Internet service providers (“ISPs”).

Revenue for network, data and Internet, and the majority of voice services is generally billed in advance on a fixed rate basis and recognized over the period the services are provided. Revenue for the majority of intercarrier compensation and long distance is generally billed on a transactional basis in arrears determined by customer usage with some fixed rate elements. The transactional elements of voice services are billed in arrears and estimates are used to recognize revenue in the period earned.

The Company evaluates whether receivables are reasonably assured of collection based on certain factors, including the likelihood of billing being disputed by customers. In situations where a billing dispute exists, revenue is not recognized until the dispute is resolved.

Pursuant to Emerging Issues Task Force 99-19,Reporting Revenue Gross as a Principal Versus Net as an Agent,the Company classifies certain taxes and fees billed to customers and remitted to government authorities on a gross versus net basis in revenue and expense. The total amount classified as revenue associated with such taxes and fees was approximately $8.6 million and $6.2 million for the three months ended March 31, 2008 and 2007, respectively.

Significant Customers

The Company has substantial business relationships with a few large customers, including major long distance carriers. The Company’s top 10 customers accounted for an aggregate of 24% and 27% of the Company’s total revenue for the three months ended March 31, 2008 and 2007, respectively. No customer accounted for 10% or more of total revenue for the three months ended March 31, 2008 or 2007.

Operating Expenses

Operating expenses consist of costs directly related to the operation and maintenance of networks and the provisioning of services but exclude depreciation, amortization and accretion, which is reported separately. These

7

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – Continued

costs include the salaries and related benefits and expenses, including stock-based compensation, of customer care, provisioning, network maintenance, technical field, network operations and engineering personnel, costs to repair and maintain the Company’s network, costs paid to other carriers to carry a portion of the Company’s traffic and to interconnect the Company’s networks and for facility leases.

Income Taxes

As of March 31, 2008, the Company had a deferred tax asset of $58.8 million, net of a valuation allowance of $331.8 million. The Company has concluded that it is more likely than not that the net deferred tax asset of $58.8 million will be realized because the Company could utilize tax-planning strategies in the event its net operating losses were to expire. However, the Company believes there may be risks in realizing amounts in excess of the $58.8 million through utilization of available tax planning strategies. Accordingly, the Company has established a valuation allowance for amounts in excess of $58.8 million.

At March 31, 2008, the Company had net operating losses for federal income tax purposes of approximately $1.1 billion. These net operating loss carryforwards, if not utilized to reduce taxable income in future periods, will expire in various amounts beginning in 2019 and ending in 2026.

Asset Retirement Obligations

The Company accounts for asset retirement obligations under FASB Statement No. 143,Accounting for Asset Retirement Obligations (“SFAS 143”) as interpreted by FASB Interpretation No. 47,Accounting for Conditional Asset Retirement Obligations. SFAS 143 requires that the estimated fair value of an asset retirement obligation be recorded when incurred. The associated asset retirement costs are capitalized as part of the carrying amount of the long-lived asset and depreciated over the asset’s estimated useful life. The Company has asset retirement obligations related to decommissioning of electronics in leased facilities and the removal of certain fiber and conduit systems. Considerable management judgment is required in estimating these obligations. Important assumptions include estimates of retirement costs, the timing of the future retirement activities, and the likelihood of retirement provisions being enforced. Changes in these assumptions based on future information could result in adjustments to estimated liabilities.

The Company’s asset retirement obligations were $17.6 million and $17.2 million as of March 31, 2008 and December 31, 2007, respectively, and are included as a component of other long-term liabilities in the accompanying consolidated balance sheets.

Segment Reporting

The Company operates in one segment across the United States.

Loss Per Common Share and Potential Common Share

The Company computes loss per common share in accordance with the provisions of FASB Statement No. 128,Earnings Per Share, which requires companies with complex capital structures to present basic and diluted earnings per share (“EPS”). Basic EPS is measured as the income or loss available to common stockholders divided by the weighted average outstanding common shares for the period. Diluted EPS is similar to basic EPS but presents the dilutive effect on a per share basis of potential common shares (e.g., convertible securities, stock options, etc.) as if they had been converted at the beginning of the periods presented. Potential common shares that have an anti-dilutive effect (e.g., those that increase income per share or decrease loss per share) are excluded from diluted EPS.

8

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – Continued

Basic loss per share for all periods presented herein was computed by dividing the net loss by the weighted average shares outstanding for the period.

The diluted loss per common share for all periods presented was computed by dividing the net loss attributable to common shares by the weighted average common shares outstanding for the period. Options to purchase shares of the Company’s common stock, restricted stock units for common stock to be issued upon vesting and shares of common stock subject to issuance upon conversion of the Company’s convertible debt totaled 34.3 million and 34.0 million shares at March 31, 2008 and 2007, respectively. These shares were excluded from the computation of weighted average shares outstanding because their inclusion would be anti-dilutive.

Stock-Based Compensation

The Company applies the fair value recognition provisions of FASB Statement No. 123R,Share-Based Payment (“SFAS 123R”), which requires the cost of share-based payments to be recognized as expense over the requisite service period. The fair value of options was estimated at the date of grant using a Black-Scholes option pricing model. For purposes of the actual expense recognized in the three months ended March 31, 2008 and 2007, the estimated fair value of the options is amortized to expense on a straight-line basis (net of estimated forfeitures) over the options’ vesting period which is equivalent to the requisite service period. The weighted-average fair value of options granted was $7.25 and $10.90 for the three months ended March 31, 2008 and 2007, respectively, with the following weighted-average assumptions:

| | | | |

| | | Three months ended

March 31, |

| | | 2008 | | 2007 |

Expected volatility | | 50% | | 59% |

Risk-free interest rate | | 2.5% | | 4.5% |

Dividend yield | | 0% | | 0% |

Expected term | | 4 years | | 4 years |

Expected volatilities are based on historical volatility of the Company’s common stock over a period generally commensurate with the expected term of the option. The risk-free rate for stock options granted during the period is determined by using the U.S. Treasury rate for the nearest period that coincides with the expected term. The expected term of stock options represents the weighted-average period the stock options are expected to remain outstanding. The expected term is based on a combination of historical data and a study of the expected term of options in the Company’s peer group.

As of March 31, 2008, there was $40.1 million of total unrecognized compensation expense related to unvested stock options, which is expected to be recognized over a weighted-average period of 2.9 years.

9

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – Continued

| 2. | Long-Term Debt and Capital Lease Obligations |

| | | | | | | | |

| | | March 31,

2008 | | | December 31,

2007 | |

| | | (amounts in thousands) | |

Term Loan B, due 2013 | | $ | 592,500 | | | $ | 594,000 | |

9 1/4% Senior Notes, due 2014 | | | 400,000 | | | | 400,000 | |

2.375% Convertible Senior Debentures, due 2026 | | | 373,750 | | | | 373,750 | |

Capital lease obligations | | | 9,531 | | | | 9,565 | |

| | | | | | | | |

Total obligations | | | 1,375,781 | | | | 1,377,315 | |

Unamortized premium | | | 326 | | | | 340 | |

Current portion | | | (7,586 | ) | | | (7,337 | ) |

| | | | | | | | |

Total long-term obligations | | $ | 1,368,521 | | | $ | 1,370,318 | |

| | | | | | | | |

As of March 31, 2008, the Company’s wholly owned subsidiary, tw telecom holdings inc. (“Holdings”), had outstanding $400 million principal amount of 9 1/4% Senior Notes due February 2014 (the “2014 Notes”). The 2014 Notes are unsecured, unsubordinated obligations of Holdings and are guaranteed by the Company and Holdings’ subsidiaries. The 2014 Notes are callable as of February 15, 2009, 2010, 2011 and 2012 at 104.625%, 103.083%, 101.542% and 100%, respectively. Interest is payable semi-annually on February 15 and August 15. Interest expense, including amortization of deferred debt issuance costs and premium relating to the 2014 Notes, was $9.5 million for both the three months ended March 31, 2008 and 2007. At March 31, 2008, the fair market value of the $400 million of 2014 Notes was approximately $404 million. These notes have not been listed on any securities exchange or inter-dealer automated quotation system, and the estimated market value is based on indicative pricing published by investment banks. While the Company believes these approximations to be reasonably accurate at the time published, indicative pricing can vary widely depending on volume traded by any given investment bank and other factors.

As of March 31, 2008, the Company had outstanding $373.8 million principal amount of 2 3/8% Convertible Senior Debentures due April 1, 2026 (the “Convertible Debentures”). Offering costs of $11.3 million were deferred and are being amortized to interest expense over the term of the Convertible Debentures. The Convertible Debentures are general, unsecured obligations of the Company. Interest is payable semi-annually on April 1 and October 1, commencing October 1, 2006. The Convertible Debentures are redeemable in whole or in part at the Company’s option at any time on or after April 6, 2013 at a redemption price equal to 100% of the principal amount of the debentures to be redeemed, plus accrued and unpaid interest. Holders of the debentures have the option, at any time prior to April 1, 2026, to convert the debentures into shares of the Company’s common stock at a conversion rate of 53.6466 per $1,000 principal amount of debentures representing a conversion price of $18.64 per share. Upon conversion, the Company will have the right to deliver, in lieu of shares of common stock, cash or a combination of cash and shares of common stock. Interest expense, including amortization of deferred debt issuance costs, was $2.4 million for both the three months ended March 31, 2008 and 2007. As of March 31, 2008, none of the holders has converted any Convertible Debentures into common stock. At March 31, 2008, the fair market value of the $373.8 million principal amount of the Convertible Debentures was approximately $385 million. These Convertible Debentures have not been listed on any securities exchange or inter-dealer automated quotation system, and the estimated market value is based on indicative pricing published by investment banks. While the Company believes these approximations to be reasonably accurate at the time published, indicative pricing can vary widely depending on volume traded by any given investment bank and other factors.

10

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – Continued

As of March 31, 2008, Holdings had a $700 million senior secured credit facility (the “Credit Facility”) consisting of a $600 million Term Loan B (“Term Loan”) maturing in January 2013 and an undrawn $100 million revolving credit facility (the “Revolver”) expiring in October 2011. Components of the Credit Facility and related financing are detailed below:

| | • | | The Term Loan is a secured obligation, on a first lien basis, of Holdings. The Term Loan is guaranteed by the Company and Holdings’ subsidiaries. On October 6, 2006, Holdings drew $200 million on the Term Loan to extinguish its then outstanding term loan. On October 31, 2006, Holdings drew the remaining $400 million on the Term Loan. Repayments of the Term Loan are due quarterly in an amount equal to 1/4 of 1% of the aggregate principal amount on the last day of each quarter beginning March 31, 2007, and the balance is payable on January 7, 2013. Interest is computed based on a specified Eurodollar rate plus 1.75% to 2.0%, after giving effect to an amendment on February 15, 2007 which reduced the interest rate by 0.25%. Interest will be reset periodically and is payable at least quarterly. Based on the Eurodollar rate in effect at March 31, 2008, the rate was 4.7%. Interest expense, including amortization of deferred debt issuance costs relating to the Term Loan, was $8.8 million and $11.8 million for the three months ended March 31, 2008 and 2007, respectively. |

| | • | | The Revolver is secured and guaranteed in the same manner as the Term Loan. Interest on outstanding amounts, if any, will be computed based on a specified Eurodollar rate plus 2.0% to 2.75% and will be reset periodically and payable at least quarterly. The Company is required to pay a commitment fee on the undrawn commitment amounts on a quarterly basis of 0.5% per annum. If the Revolver were drawn, certain restrictive financial covenants would apply. Commitment fee expense and amortization of deferred debt issuance costs relating to the Revolver was $159,000 and $157,000 for the three months ended March 31, 2008 and 2007, respectively. |

The 2014 Notes described above are governed by an indenture that contains certain restrictive covenants. These restrictions affect, and in many respects significantly limit or prohibit, among other things, the ability of the Company and its subsidiaries to incur indebtedness, make prepayments of certain indebtedness, pay dividends, make investments, engage in transactions with stockholders and affiliates, issue capital stock of subsidiaries, create liens, sell assets, and engage in mergers and consolidations. The credit agreement for the Term Loan contains similar restrictions. The Revolver covenants contain additional restrictions, as well as certain financial covenants that the Company and its subsidiaries must comply with if it draws on the Revolver.

As of March 31, 2008, the Company and Holdings were in compliance with all of their covenants.

| 3. | Commitments and Contingencies |

Pending legal proceedings are substantially limited to litigation incidental to the business of the Company. In the opinion of management, the ultimate resolution of these matters will not have a material adverse effect on the Company’s financial statements.

Management routinely reviews the Company’s exposure to liabilities incurred in the normal course of its business operations. Where a probable contingency exists and the amount can be reasonably estimated, the Company records the estimated liability. Considerable judgment is required in analyzing and recording such liabilities and actual results could vary significantly from the estimates.

On April 30, 2008, the Company entered into a two year interest rate swap with a 3.23% fixed interest rate that hedges the first $100 million of its $600 million principal amount variable rate Term Loan for a total rate,

11

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – Continued

including the applicable spread, of 5.23% on a notional amount of $100 million. The transaction will be accounted for in accordance with SFAS No. 133, “Accounting for Derivative Instruments and HedgingActivities”, as amended and interpreted, which requires all derivatives to be recorded at fair value on the balance sheet and establishes criteria for designation and effectiveness of derivative transactions for which hedge accounting is applied.

| 5. | Supplemental Guarantor Information |

On February 20, 2004, Holdings (“Issuer”) issued $200 million principal amount of 9 1/4% Senior Notes due 2014 (the “2014 Notes”). On February 9, 2005, Holdings issued an additional $200 million principal amount of the 2014 Notes. The 2014 Notes are guaranteed by the Company (“Parent Guarantor”) and Holdings’ subsidiaries (“Combined Subsidiary Guarantors”). The guarantees are joint and several. A significant amount of the Issuer’s cash flow is generated by the Combined Subsidiary Guarantors. As a result, funds necessary to meet the Issuer’s debt service obligations are provided in large part by distributions or advances from the Combined Subsidiary Guarantors. Under certain circumstances, contractual and legal restrictions, as well as the Company’s financial condition and operating requirements and those of the Company’s subsidiaries, could limit the Issuer’s ability to obtain cash for the purpose of meeting its debt service obligations, including the payment of principal and interest on the 2014 Notes.

The following information sets forth the Company’s Condensed Consolidating Balance Sheets as of March 31, 2008 and December 31, 2007, Condensed Consolidating Statements of Operations for the three months ended March 31, 2008 and 2007, and Condensed Consolidating Statements of Cash Flows for the three months ended March 31, 2008 and 2007.

12

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – Continued

tw telecom inc.

CONDENSED CONSOLIDATING BALANCE SHEET

March 31, 2008

| | | | | | | | | | | | | | | | | | | |

| | | Parent Guarantor | | | Issuer | | | Combined

Subsidiary

Guarantors | | | Eliminations | | | Consolidated |

| | | (amounts in thousands) |

| ASSETS | | | | | | | | | | | | | | | | | | | |

Current assets: | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 20,744 | | | $ | 297,474 | | | $ | — | | | $ | — | | | $ | 318,218 |

Receivables, net | | | — | | | | — | | | | 76,415 | | | | — | | | | 76,415 |

Prepaid expenses and other current assets | | | 945 | | | | 5,831 | | | | 4,554 | | | | — | | | | 11,330 |

Deferred income taxes | | | — | | | | 8,703 | | | | — | | | | — | | | | 8,703 |

| | | | | | | | | | | | | | | | | | | |

Total current assets | | | 21,689 | | | | 312,008 | | | | 80,969 | | | | — | | | | 414,666 |

| | | | | | | | | | | | | | | | | | | |

Long-term investments | | | — | | | | 14,456 | | | | — | | | | — | | | | 14,456 |

Property, plant and equipment, net | | | — | | | | 36,176 | | | | 1,255,705 | | | | — | | | | 1,291,881 |

Deferred income taxes | | | — | | | | 50,047 | | | | — | | | | — | | | | 50,047 |

Goodwill | | | — | | | | — | | | | 412,694 | | | | — | | | | 412,694 |

Intangible and other assets, net | | | 10,208 | | | | 9,755 | | | | 49,917 | | | | — | | | | 69,880 |

| | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 31,897 | | | $ | 422,442 | | | $ | 1,799,285 | | | $ | — | | | $ | 2,253,624 |

| | | | | | | | | | | | | | | | | | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) | | | | | | | | | | | | | | | | | | | |

| | | | | |

Current liabilities: | | | | | | | | | | | | | | | | | | | |

Accounts payable | | $ | — | | | $ | 4,721 | | | $ | 40,727 | | | $ | — | | | $ | 45,448 |

Other current liabilities | | | 4,438 | | | | 48,675 | | | | 171,557 | | | | — | | | | 224,670 |

Intercompany payable (receivable) | | | (1,822,625 | ) | | | (709,516 | ) | | | 2,532,141 | | | | — | | | | — |

| | | | | | | | | | | | | | | | | | | |

Total current liabilities | | | (1,818,187 | ) | | | (656,120 | ) | | | 2,744,425 | | | | — | | | | 270,118 |

| | | | | | | | | | | | | | | | | | | |

Losses in subsidiary in excess of investment | | | 903,491 | | | | 1,127,932 | | | | — | | | | (2,031,423 | ) | | | — |

Long-term debt and capital lease obligations | | | 373,750 | | | | 987,591 | | | | 7,180 | | | | — | | | | 1,368,521 |

Long-term deferred revenue | | | — | | | | — | | | | 19,243 | | | | — | | | | 19,243 |

Other long-term liabilities | | | — | | | | 5,322 | | | | 17,577 | | | | — | | | | 22,899 |

Stockholders’ equity (deficit) | | | 572,843 | | | | (1,042,283 | ) | | | (989,140 | ) | | | 2,031,423 | | | | 572,843 |

| | | | | | | | | | | | | | | | | | | |

Total liabilities and stockholders’ equity (deficit) | | $ | 31,897 | | | $ | 422,442 | | | $ | 1,799,285 | | | $ | — | | | $ | 2,253,624 |

| | | | | | | | | | | | | | | | | | �� | |

13

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – Continued

tw telecom inc.

CONDENSED CONSOLIDATING BALANCE SHEET

December 31, 2007

| | | | | | | | | | | | | | | | | | | |

| | | Parent Guarantor | | | Issuer | | | Combined

Subsidiary

Guarantors | | | Eliminations | | | Consolidated |

| | | (amounts in thousands) |

| ASSETS | | | | | | | | | | | | | | | | | | | |

Current assets: | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 20,563 | | | $ | 300,968 | | | $ | — | | | $ | — | | | $ | 321,531 |

Receivables, net | | | — | | | | — | | | | 75,976 | | | | — | | | | 75,976 |

Prepaid expenses and other current assets | | | 2,720 | | | | 7,148 | | | | 3,593 | | | | — | | | | 13,461 |

Deferred income taxes | | | — | | | | 8,703 | | | | — | | | | — | | | | 8,703 |

| | | | | | | | | | | | | | | | | | | |

Total current assets | | | 23,283 | | | | 316,819 | | | | 79,569 | | | | — | | | | 419,671 |

| | | | | | | | | | | | | | | | | | | |

Long-term investments | | | — | | | | 14,456 | | | | — | | | | — | | | | 14,456 |

Property, plant and equipment, net | | | — | | | | 36,454 | | | | 1,258,446 | | | | — | | | | 1,294,900 |

Deferred income taxes | | | — | | | | 50,047 | | | | — | | | | — | | | | 50,047 |

Goodwill | | | — | | | | — | | | | 412,694 | | | | — | | | | 412,694 |

Intangible and other assets, net | | | 10,349 | | | | 10,728 | | | | 51,873 | | | | — | | | | 72,950 |

| | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 33,632 | | | $ | 428,504 | | | $ | 1,802,582 | | | $ | — | | | $ | 2,264,718 |

| | | | | | | | | | | | | | | | | | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) | | | | | | | | | | | | | | | | | | | |

| | | | | |

Current liabilities: | | | | | | | | | | | | | | | | | | | |

Accounts payable | | $ | — | | | $ | 4,720 | | | $ | 42,252 | | | $ | — | | | $ | 46,972 |

Other current liabilities | | | 2,219 | | | | 62,881 | | | | 176,194 | | | | — | | | | 241,294 |

Intercompany payable (receivable) | | | (1,812,586 | ) | | | (715,560 | ) | | | 2,528,146 | | | | — | | | | — |

| | | | | | | | | | | | | | | | | | | |

Total current liabilities | | | (1,810,367 | ) | | | (647,959 | ) | | | 2,746,592 | | | | — | | | | 288,266 |

| | | | | | | | | | | | | | | | | | | |

Losses in subsidiary in excess of investment | | | 904,024 | | | | 1,125,511 | | | | — | | | | (2,029,535 | ) | | | — |

Long-term debt and capital lease obligations | | | 373,750 | | | | 989,246 | | | | 7,322 | | | | — | | | | 1,370,318 |

Long-term deferred revenue | | | — | | | | — | | | | 19,672 | | | | — | | | | 19,672 |

Other long-term liabilities | | | — | | | | 3,045 | | | | 17,192 | | | | — | | | | 20,237 |

Stockholders’ equity (deficit) | | | 566,225 | | | | (1,041,339 | ) | | | (988,196 | ) | | | 2,029,535 | | | | 566,225 |

| | | | | | | | | | | | | | | | | | | |

Total liabilities and stockholders’ equity (deficit) | | $ | 33,632 | | | $ | 428,504 | | | $ | 1,802,582 | | | $ | — | | | $ | 2,264,718 |

| | | | | | | | | | | | | | | | | | | |

14

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – Continued

tw telecom inc.

CONDENSED CONSOLIDATING STATEMENT OF OPERATIONS

Three Months Ended March 31, 2008

| | | | | | | | | | | | | | | | | | | |

| | | Parent

Guarantor | | | Issuer | | | Combined

Subsidiary

Guarantors | | | Eliminations | | Consolidated | |

| | | (amounts in thousands) | |

Total revenue | | $ | — | | | $ | — | | | $ | 282,584 | | | $ | — | | $ | 282,584 | |

Costs and expenses: | | | | | | | | | | | | | | | | | | | |

Operating, selling, general and administrative | | | — | | | | 39,905 | | | | 155,396 | | | | — | | | 195,301 | |

Depreciation, amortization and accretion | | | — | | | | 3,852 | | | | 66,007 | | | | — | | | 69,859 | |

Corporate expense allocation | | | — | | | | (43,757 | ) | | | 43,757 | | | | — | | | — | |

| | | | | | | | | | | | | | | | | | | |

Total costs and expenses | | | — | | | | — | | | | 265,160 | | | | — | | | 265,160 | |

| | | | | | | | | | | | | | | | | | | |

Operating income | | | — | | | | — | | | | 17,424 | | | | — | | | 17,424 | |

Interest expense, net | | | (2,181 | ) | | | (12,371 | ) | | | (3,441 | ) | | | — | | | (17,993 | ) |

Interest expense allocation | | | 2,181 | | | | 12,371 | | | | (14,552 | ) | | | | | | — | |

| | | | | | | | | | | | | | | | | | | |

Loss before income taxes and equity in undistributed losses of subsidiaries | | | — | | | | — | | | | (569 | ) | | | — | | | (569 | ) |

Income tax expense | | | — | | | | — | | | | 375 | | | | — | | | 375 | |

| | | | | | | | | | | | | | | | | | | |

Net loss before equity in undistributed losses of subsidiaries | | | — | | | | — | | | | (944 | ) | | | — | | | (944 | ) |

Equity in undistributed losses of subsidiaries | | | (944 | ) | | | (944 | ) | | | — | | | | 1,888 | | | — | |

| | | | | | | | | | | | | | | | | | | |

Net loss | | $ | (944 | ) | | $ | (944 | ) | | $ | (944 | ) | | $ | 1,888 | | $ | (944 | ) |

| | | | | | | | | | | | | | | | | | | |

15

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – Continued

tw telecom inc.

CONDENSED CONSOLIDATING STATEMENT OF OPERATIONS

Three Months Ended March 31, 2007

| | | | | | | | | | | | | | | | | | | |

| | | Parent

Guarantor | | | Issuer | | | Combined

Subsidiary

Guarantors | | | Eliminations | | Consolidated | |

| | | (amounts in thousands) | |

Total revenue | | $ | — | | | $ | — | | | $ | 261,392 | | | $ | — | | $ | 261,392 | |

Costs and expenses: | | | | | | | | | | | | | | | | | | | |

Operating, selling, general and administrative | | | — | | | | 37,271 | | | | 152,582 | | | | — | | | 189,853 | |

Depreciation, amortization and accretion | | | — | | | | 3,817 | | | | 62,323 | | | | — | | | 66,140 | |

Corporate expense allocation | | | — | | | | (41,088 | ) | | | 41,088 | | | | — | | | — | |

| | | | | | | | | | | | | | | | | | | |

Total costs and expenses | | | — | | | | — | | | | 255,993 | | | | — | | | 255,993 | |

| | | | | | | | | | | | | | | | | | | |

Operating income | | | — | | | | — | | | | 5,399 | | | | — | | | 5,399 | |

Interest expense, net | | | (2,151 | ) | | | (13,218 | ) | | | (3,554 | ) | | | — | | | (18,923 | ) |

Interest expense allocation | | | 2,151 | | | | 13,218 | | | | (15,369 | ) | | | — | | | — | |

| | | | | | | | | | | | | | | | | | | |

Loss before income taxes and equity in undistributed losses of subsidiaries | | | — | | | | — | | | | (13,524 | ) | | | — | | | (13,524 | ) |

Income tax expense | | | — | | | | — | | | | 285 | | | | — | | | 285 | |

| | | | | | | | | | | | | | | | | | | |

. | | | | | | | | | | | | | | | | | | | |

Net loss before equity in undistributed losses of subsidiaries | | | — | | | | — | | | | (13,809 | ) | | | — | | | (13,809 | ) |

Equity in undistributed losses of subsidiaries | | | (13,809 | ) | | | (13,809 | ) | | | — | | | | 27,618 | | | — | |

| | | | | | | | | | | | | | | | | | | |

Net loss | | $ | (13,809 | ) | | $ | (13,809 | ) | | $ | (13,809 | ) | | $ | 27,618 | | $ | (13,809 | ) |

| | | | | | | | | | | | | | | | | | | |

16

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – Continued

tw telecom inc.

CONDENSED CONSOLIDATING STATEMENT OF CASH FLOWS

Three Months Ended March 31, 2008

| | | | | | | | | | | | | | | | | | | | |

| | | Parent

Guarantor | | | Issuer | | | Combined

Subsidiary

Guarantors | | | Eliminations | | | Consolidated | |

| | | (amounts in thousands) | |

Cash flows from operating activities: | | | | | | | | | | | | | | | | | | | | |

Net loss | | $ | (944 | ) | | $ | (944 | ) | | $ | (944 | ) | | $ | 1,888 | | | $ | (944 | ) |

Adjustments to reconcile net loss to net cash provided by operating activities: | | | | | | | | | | | | | | | | | | | | |

Depreciation, amortization, and accretion | | | — | | | | 3,852 | | | | 66,007 | | | | — | | | | 69,859 | |

Intercompany change | | | (3,954 | ) | | | 6,044 | | | | (202 | ) | | | (1,888 | ) | | | — | |

Deferred debt issue and other | | | 141 | | | | 439 | | | | 3 | | | | — | | | | 583 | |

Stock based compensation | | | — | | | | — | | | | 6,085 | | | | — | | | | 6,085 | |

Changes in operating assets and liabilities | | | 3,461 | | | | (8,273 | ) | | | (11,897 | ) | | | — | | | | (16,709 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net cash provided by (used in) operating activities | | | (1,296 | ) | | | 1,118 | | | | 59,052 | | | | — | | | | 58,874 | |

| | | | | | | | | | | | | | | | | | | | |

Cash flows from investing activities: | | | | | | | | | | | | | | | | | | | | |

Capital expenditures | | | — | | | | (3,036 | ) | | | (56,601 | ) | | | — | | | | (59,637 | ) |

Other investing activities | | | — | | | | (6 | ) | | | (2,381 | ) | | | — | | | | (2,387 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net cash used in investing activities | | | — | | | | (3,042 | ) | | | (58,982 | ) | | | — | | | | (62,024 | ) |

| | | | | | | | | | | | | | | | | | | | |

Cash flows from financing activities: | | | | | | | | | | | | | | | | | | | | |

Net proceeds from issuance of common stock upon exercise of stock options and in connection with the employee stock purchase plan | | | 1,477 | | | | — | | | | — | | | | — | | | | 1,477 | |

Payment of debt and capital lease obligations | | | — | | | | (1,570 | ) | | | (70 | ) | | | — | | | | (1,640 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net cash (used in) provided by financing activities | | | 1,477 | | | | (1,570 | ) | | | (70 | ) | | | — | | | | (163 | ) |

| | | | | | | | | | | | | | | | | | | | |

Increase (decrease) in cash and cash equivalents | | | 181 | | | | (3,494 | ) | | | — | | | | — | | | | (3,313 | ) |

Cash and cash equivalents at beginning of period | | | 20,563 | | | | 300,968 | | | | — | | | | — | | | | 321,531 | |

| | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents at end of period | | $ | 20,744 | | | $ | 297,474 | | | $ | — | | | $ | — | | | $ | 318,218 | |

| | | | | | | | | | | | | | | | | | | | |

17

tw telecom inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – Continued

tw telecom inc.

CONDENSED CONSOLIDATING STATEMENT OF CASH FLOWS

Three Months Ended March 31, 2007

| | | | | | | | | | | | | | | | | | | | |

| | | Parent

Guarantor | | | Issuer | | | Combined

Subsidiary

Guarantors | | | Eliminations | | | Consolidated | |

| | | (amounts in thousands) | |

Cash flows from operating activities: | | | | | | | | | | | | | | | | | | | | |

Net loss | | $ | (13,809 | ) | | $ | (13,809 | ) | | $ | (13,809 | ) | | $ | 27,618 | | | $ | (13,809 | ) |

Adjustments to reconcile net loss to net cash provided by operating activities: | | | | | | | | | | | | | | | | | | | | |

Depreciation, amortization, and accretion | | | — | | | | 3,817 | | | | 62,323 | | | | — | | | | 66,140 | |

Intercompany change | | | (2,303 | ) | | | (3,560 | ) | | | 33,481 | �� | | | (27,618 | ) | | | — | |

Deferred debt issue, extinguishment costs and other | | | 141 | | | | 428 | | | | 4 | | | | — | | | | 573 | |

Stock based compensation | | | — | | | | — | | | | 4,795 | | | | — | | | | 4,795 | |

Changes in operating assets and liabilities | | | 888 | | | | 14,024 | | | | (33,154 | ) | | | — | | | | (18,242 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net cash provided by (used in) operating activities | | | (15,083 | ) | | | 900 | | | | 53,640 | | | | — | | | | 39,457 | |

| | | | | | | | | | | | | | | | | | | | |

Cash flows from investing activities: | | | | | | | | | | | | | | | | | | | | |

Capital expenditures | | | — | | | | (2,521 | ) | | | (52,583 | ) | | | — | | | | (55,104 | ) |

Cash paid for acquisitions, net of cash acquired | | | — | | | | — | | | | (1,080 | ) | | | — | | | | (1,080 | ) |

Purchases of investments | | | — | | | | (5,246 | ) | | | — | | | | — | | | | (5,246 | ) |

Proceeds from maturities of investments | | | 15,000 | | | | 73,500 | | | | — | | | | — | | | | 88,500 | |

Other investing activities | | | — | | | | — | | | | (87 | ) | | | — | | | | (87 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net cash provided by (used in) investing activities | | | 15,000 | | | | 65,733 | | | | (53,750 | ) | | | — | | | | 26,983 | |

| | | | | | | | | | | | | | | | | | | | |

Cash flows from financing activities: | | | | | | | | | | | | | | | | | | | | |

Net costs from issuance of debt | | | — | | | | (850 | ) | | | — | | | | — | | | | (850 | ) |

Net proceeds from issuance of common stock upon exercise of stock options and in connection with the employee stock purchase plan | | | 15,214 | | | | — | | | | — | | | | — | | | | 15,214 | |

Payment of debt and capital lease obligations | | | — | | | | (1,808 | ) | | | (2 | ) | | | — | | | | (1,810 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net cash (used in) provided by financing activities | | | 15,214 | | | | (2,658 | ) | | | (2 | ) | | | — | | | | 12,554 | |

| | | | | | | | | | | | | | | | | | | | |

Increase (decrease) in cash and cash equivalents | | | 15,131 | | | | 63,975 | | | | (112 | ) | | | — | | | | 78,994 | |

Cash and cash equivalents at beginning of period | | | 681 | | | | 223,116 | | | | (2,244 | ) | | | — | | | | 221,553 | |

| | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents at end of period | | $ | 15,812 | | | $ | 287,091 | | | $ | (2,356 | ) | | $ | — | | | $ | 300,547 | |

| | | | | | | | | | | | | | | | | | | | |

18

tw telecom inc.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis provides information concerning the results of operations and financial condition oftw telecom inc. and should be read in conjunction with the accompanying financial statements and notes thereto. Additionally, the following discussion and analysis should be read in conjunction withManagement’s Discussion and Analysis of Financial Condition and Results of Operations and the consolidated financial statements included in Part II of our Annual Report on Form 10-K for the year ended December 31, 2007.

Cautions Concerning Forward Looking Statements

This document contains certain “forward-looking statements,” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding, among other items, our expected financial position, expected capital expenditures, expected revenue mix, expected margins, expected branding expenditures, growth or stability from particular customer segments, the effects of consolidation in the telecommunications industry, anticipated customer disconnections, Modified EBITDA trends, expected network expansion, business, and financing plans. These forward-looking statements are based on management’s current expectations and are naturally subject to risks, uncertainties, and changes in circumstances, certain of which are beyond our control. Actual results may differ materially from those expressed or implied by such forward-looking statements.

The words “believe,” “plan,” “target,” “expect,” “intend,” and “anticipate,” and expressions of similar substance identify forward-looking statements. Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that those expectations will prove to be correct. Important factors that could cause actual results to differ materially from the expectations described in this report are set forth under “Risk Factors” in Item 1A and elsewhere in our Annual Report on Form 10-K for the year ended December 31, 2007, and elsewhere in this report. In addition, actual results may differ from our expectations due to increased customer disconnects, increased competition, inability to obtain rights to build networks into commercial buildings, an economic downturn, delays in launching new products, decreased demand for our existing products, further declines in the prices of and revenue from our services due to competitive pressures, industry consolidation and other industry conditions, increases in the price we pay for use of facilities of Incumbent Local Exchange Carriers, or “ILECs”, due to consolidation in the industry or further deregulation and adverse regulatory rulings or legislative developments, and our failure to achieve all of the expected benefits of our acquisition of Xspedius Communications, LLC (“Xspedius”). Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Overview

We amended our Restated Certificate of Incorporation to change our corporate name totw telecom inc. on March 12, 2008. Our stockholders approved the name change by written consent on September 26, 2006. We are presently using our former name, Time Warner Telecom Inc., as a trade name until July 1, 2008 when we will begin usingtw telecom inc. as our name andtw telecom as our brand.

We are a leading national provider of managed network services, specializing in Ethernet and transport data networking, Internet access, local and long distance voice, VoIP and network security services to enterprise organizations and communications services companies throughout the U.S. Our customers include, among others, enterprise organizations in the distribution, health care, finance, service and manufacturing industries, state, local and federal government entities and long distance carriers, ILECs, competitive local exchange carriers (“CLECs”), wireless communications companies, and Internet service providers (“ISPs”).

19

tw telecom inc.

Through our subsidiaries, we operate in 75 U.S. metropolitan markets. As of March 31, 2008, our fiber networks spanned 25,930 route miles directly connecting 8,587 buildings served entirely by our fiber facilities (on-net). We continue to expand our footprint within our existing markets by connecting our network into additional buildings. We have continued to expand our IP backbone data networking capability between markets supporting end-to-end Ethernet connections and VPN connections for customers, and have also selectively interconnected existing service areas within regional clusters with fiber optic facilities that we own or lease. In addition, we provide on-net inter-city switched services between our markets that offer customers a virtual presence in a remote city.

On October 31, 2006, we acquired Xspedius, which expanded our markets served from 44 to 75, increasing our market density in 12 markets that we already served. This acquisition provided us additional opportunities to serve multi-city and multi-location customers and provide our full product portfolio in additional markets.

Our revenue is derived primarily from business communications services, including network, voice, data, and high-speed Internet access services. Our revenue by customer type by quarter in 2008 and 2007 is as follows:

| | | | | | | | | | | | | | | |

| | | For the Three Months Ended | |

| | | 2007 | | | 2008 | |

| | | March 31, | | | June 30, | | | September 30, | | | December 31, | | | March 31, | |

Enterprise / End Users | | 67 | % | | 68 | % | | 70 | % | | 71 | % | | 71 | % |

Carrier | | 29 | % | | 28 | % | | 26 | % | | 25 | % | | 25 | % |

Intercarrier Compensation | | 4 | % | | 4 | % | | 4 | % | | 4 | % | | 4 | % |

| | | | | | | | | | | | | | | |

Total Revenue | | 100 | % | | 100 | % | | 100 | % | | 100 | % | | 100 | % |

| | | | | | | | | | | | | | | |

The key elements of our business strategy include:

| | • | | Leveraging our extensive local and regional fiber networks and IP backbone networks to increase customer and building penetration in our existing markets; |

| | • | | Increasing revenue growth by focusing on service offerings that meet the sophisticated data needs of our customers, such as our Ethernet and IP business-to-business VPN services, Internet-based services and converged voice and data bundled services, and developing future services to enhance our customers’ voice and data networking ability; |

| | • | | Continuing to diversify our customer base and increasing revenue from enterprise customers, including businesses and local and federal government entities; |

| | • | | Pursuing selected opportunities to expand our network reach to serve new customers and additional locations for existing customers; and |

| | • | | Continuing our disciplined approach to capital and operating expenditures in order to increase operational efficiencies, preserve our liquidity and drive us towards profitability. |

Enterprise Customer Revenue

Revenue from enterprise customers has increased for the past 23 consecutive quarters through March 31, 2008 primarily through sales of our data and Internet products such as Ethernet. Revenue from our enterprise customers represented 71% of our total revenue in the three months ended March 31, 2008 as compared to 67% for the same period in 2007. We expect a growing percentage of our revenue will come from our enterprise customer base as we expand the customer base for our existing products and expand our data and Internet product offerings to existing customers. Our expanded market footprint resulting from the Xspedius acquisition provides for new growth opportunities for us to extend our customer reach and product portfolio into new

20

tw telecom inc.

markets. We expect that the success of initiatives we have implemented to improve customer retention, the success of product offerings targeted at enterprise customers, and our ability to compete for multi-location customers and the success of extending our product portfolio into our acquired markets will influence our future growth rates. Our revenue growth in the three months ended March 31, 2008 was impacted by disconnects from customers that were negatively affected by the subprime mortgage downturn, primarily occurring in 2007.

Carrier Customer Revenue

Revenue from carrier customers declined 6% for the three months ended March 31, 2008 as compared to the same period in 2007. Carrier revenue represented a smaller percentage of our total revenue at 25% in the three months ended March 31, 2008 as compared to 29% for the same period in 2007 due to growth in revenue from enterprise customers, re-pricing of certain services in connection with contract renewals, and disconnections resulting from industry consolidations. We expect continued disconnects from carriers and ISPs related to these and other factors, as discussed below under “Customer Disconnections and Pricing Trends”.

Intercarrier Compensation Revenue

Intercarrier compensation revenue consists of switched access and reciprocal compensation and represented 4% of our total revenue for both the three months ended March 31, 2008 and 2007. Switched access revenue is compensation we receive from other carriers for the delivery of traffic between a long distance carrier’s point of presence and an end user’s premises provided through out switching facilities. Switched access is regulated by the Federal Communications Commission (“FCC”) and state public utility commissions. Reciprocal compensation represents compensation from a local exchange carrier (“LEC”) for local exchange traffic originated on its facilities and terminated on our facilities. Reciprocal compensation rates are established by interconnection agreements between the parties based on federal and state regulatory and judicial rulings.

Intercarrier compensation revenue decreased 15% for the three months ended March 31, 2008 over the same period last year primarily due to discontinuance of certain products previously offered by Xspedius and regulatory and contractual rate reductions. We expect further rate reductions in intercarrier compensation throughout 2008 and may experience fluctuations in revenue due to resolution of customer disputes.

Customer Disconnections and Pricing Trends

Increasing consolidation in the telecommunications industry has occurred in recent years, and in some cases has reduced our revenue from the customers involved. If any of our other customers are acquired or merge, we may lose a portion of their business, which could have a significant impact on our revenue. Consolidation could also result in other companies becoming more formidable competitors, which could result in pressure on our revenue growth. The consolidations involving AT&T over the past several years have and may continue to result in the combined company buying less local transport service from us in SBC’s and BellSouth’s former local service areas. In addition, revenue from what was formerly Cingular Wireless (now AT&T’s wireless unit), which became a wholly owned subsidiary of AT&T, has been declining since Cingular’s acquisition of AT&T Wireless in 2004 and Cingular’s acquisition by AT&T in 2006 and is expected to further decline. Revenue from AT&T’s wireless unit represented approximately 1% of total revenue for the three months ended March 31, 2008 compared with approximately 2% for the three months ended March 31, 2007. Our revenue from AT&T, including AT&T’s wireless unit, represented approximately 6% and 9% of our total revenue for the three months ended March 31, 2008 and 2007, respectively. Excluding intercarrier compensation revenue from AT&T, which results from end user traffic that terminates on our network, our revenue from AT&T, including AT&T’s wireless unit, represented approximately 5% of our total revenue for the three months ended March 31, 2008. The revenue impact of AT&T’s acquisitions of SBC and BellSouth may be mitigated by revenue commitments in our agreement with AT&T. As a result, we do not expect that the impact of these consolidations will materially affect our total revenue over the next several years.

21

tw telecom inc.

Monthly revenue loss from disconnects averaged 1.1% of monthly revenue for the three months ended March 31, 2008, which is consistent with the average monthly revenue loss of 1.1% for 2007 and slightly down from an average of 1.2% for 2006. Customer and service disconnects are primarily associated with industry consolidation, customer network optimization, cost cutting, business contractions, customer financial difficulties, discontinuance of certain acquired products or price competition from other providers. We expect to continue to experience customer and service disconnects for these reasons.

Average monthly customer churn was 1.4% for both the three months ended March 31, 2008 and 2007. We experienced growth in the number of customers offset by churn primarily in our acquired customer base related to a planned program to migrate small acquired customers to our more advanced product suite. Accordingly, we expect ongoing customer churn throughout 2008 from small, lower margin customers that fall below our service profile.

Our revenue and margins may also be reduced as a result of price-cutting by other telecommunications service providers or by pricing pressure on certain more mature products such as point of presence to point of presence dedicated services and inter-city point to point transport services, especially as existing contracts expire and we negotiate renewals.

Pricing of Special Access Services

We provide special access services over our own fiber facilities in competition with ILECs, and we also purchase special access and other services from ILECs to extend the reach of our network. The ILECs have argued before the FCC that the broadband services that they sell, including special access services we buy from them, should no longer be subject to regulation governing price and quality of service. If the special access services we buy from the ILECs were to be further deregulated, ILECs would have a greater ability to increase the price and reduce the service quality of special access services they sell to us.

We have advocated before the FCC that it should modify its special access pricing flexibility rules so that these services return to price-cap regulation to protect against unreasonable price increases. The FCC is reviewing its regulation of special access pricing in a pending proceeding. In addition, the ILECs have filed numerous petitions for forbearance from regulation of their broadband special access services, including Ethernet services offered as special access. The FCC has granted several of these petitions with the result that the Ethernet and OC-n high capacity data services of the petitioning carriers are no longer regulated. We and several of our competitors have appealed these FCC rulings. These FCC actions did not impact the availability of the tariffed TDM special access circuits that we use for access to buildings that are not connected to our network with our fiber. We expect that the ILECs will continue to advocate deregulation of all forms of special access services, and we cannot predict the outcome of the FCC’s proceedings in this regard or the impact of that outcome on our business.

In 2005, we negotiated a five-year wholesale service agreement with AT&T Inc. (formerly SBC Communications Inc.) under which AT&T supplies us with special access and other services for end user access and transport with certain service level commitments through 2010 in SBC’s former 13 state local service territories. We have agreed to maintain certain volume levels in order to receive specified discounts and other terms and conditions, and are subject to certain penalties for early termination of the contract. We have a similar three year agreement with AT&T for the former BellSouth service area that commenced in 2005. When that agreement expires, AT&T’s ability to increase its special access prices will be limited by FCC imposed conditions on its merger with Bell South until 2010. We have agreements or tariffed term and volume plans with the other ILECs which in some cases do not preclude prospective price increases. However, the ability of the ILECs to increase their special access prices is in some cases presently subject to regulatory constraints.

22

tw telecom inc.

Other Financial Trends

We have historically experienced and expect to continue to experience fluctuations in our revenue, margins, and cash flows in the normal course of business from customer and service disconnects, the timing of sales and installations, seasonality, customer disputes and dispute resolutions and repricing of services upon contract renewals. However, we cannot predict the total impact on revenue, margins, and cash flows from these items or their timing.

We have undertaken several initiatives to increase revenue growth, margins and cash flows including revenue assurance initiatives, cost reduction measures such as network grooming and pricing optimization to reduce the overall access costs paid to carriers, enhancing back office support systems to improve operating efficiencies, and network investment initiatives to reduce the cost of equipment to increase overall capital efficiency. If our revenue growth, margins and cash flows decline in the future, we cannot predict whether continued initiatives will be sufficient to maintain current financial performance.

Name and Branding Change

As discussed above, we have changed our corporate name totw telecom inc. and will begin usingtw telecom as our brand name effective July 1, 2008. In connection with our name and branding change, we incurred approximately $0.4 million in branding costs for the three months ended March 31, 2008 and expect to spend $6 million to $7 million for that purpose in 2008, which includes up to $2 million in capital expenditures associated with the name change.

Acquisition Impact

Our acquisition of Xspedius resulted in lower consolidated margins as a result of higher operating costs, especially network costs, in relationship to revenue in the acquired operations. Historically the acquired operations sold a higher proportion of services utilizing the facilities of other carriers than our previously existing operations have done, resulting in lower gross margins and Modified EBITDA margins (Modified EBITDA as a percentage of revenue) than we experienced prior to the acquisition.

We have integrated the acquired operations with our operations and achieved synergies through cost reductions as have been reflected in expanding Modified EBITDA margins over the past few quarters. Our objective is to achieve Modified EBITDA margins in the mid 30% range during the summer of 2008 through continued cost reduction and scaling of our business. However, our long term perspective on our business requires that we continue to balance this objective against revenue growth and cash flow objectives as we make decisions regarding continued investment in our business and expenditures that enable sales opportunities. As in the past, we expect our Modified EBITDA margins to continue to be impacted by integration synergies and branding costs as well as the timing of sales, installations, seasonality and other normal business fluctuations. For these reasons and the possible impact of factors beyond our control, there is no assurance that we will reach our Modified EBITDA margin objective when anticipated, or at all, or if reached will remain at that level.

Critical Accounting Policies and Estimates

We prepare our financial statements in accordance with accounting principles generally accepted in the United States, which require us to make estimates and assumptions that affect reported amounts and related disclosures. We consider an accounting estimate to be critical if:

| | • | | it requires assumptions to be made that were uncertain at the time the estimate was made; and |

| | • | | changes in the estimate or different estimates that could have been selected could have a material impact on our consolidated results of operations or financial condition. |

23

tw telecom inc.

Goodwill

We perform impairment tests at least annually on all goodwill and indefinite-lived intangible assets as required by Financial Accounting Standards Board (“FASB”) Statement No. 142,Goodwill and Other Intangible Assets (“SFAS 142”). Our goodwill and indefinite-lived intangible assets have grown significantly due to our acquisition of Xspedius and the related purchase price allocation. SFAS 142 requires goodwill to be assigned to a reporting unit and tested using a consistent measurement date, which for us is the fourth quarter of each year or more frequently if impairment indicators arise. For purposes of testing goodwill for impairment, our goodwill has been assigned to our one consolidated reporting unit. Potential impairment is indicated when the book value of a reporting unit, including goodwill, exceeds its fair value. If a potential impairment exists, the fair value of the reporting unit is compared to the fair value of its assets and liabilities, excluding goodwill, to estimate the implied value of the reporting unit’s goodwill. If an impairment charge is deemed necessary, a charge is recognized for any excess of the book value over the implied fair value. We determine fair value by performing internal valuation analyses using discounted cash flow, which is a widely accepted valuation technique. Considerable management judgment is necessary to estimate the fair value of assets using inputs such as discount rate and terminal value, among others; accordingly, actual results could vary significantly from estimates.

Impairment of Long-lived Assets

We periodically assess our ability to recover the carrying amount of property, plant and equipment and intangible assets, which requires an assessment of risk associated with our ability to generate sufficient future cash flows from these assets. If we determine that the future cash flows expected to be generated by a particular asset do not exceed the carrying value of that asset, we recognize a charge to write down the value of the asset to its fair value.