SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the registrant x

Filed by a party other than the registrant ¨

Check the appropriate box:

| | | | | | |

¨ | | Preliminary proxy statement | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14-a6(e)(2)) |

x | | Definitive proxy statement | | |

¨ | | Definitive additional materials | | |

¨ | | Soliciting material under Rule 14a-12 | | |

Global Crossing Limited

(Name of Registrant as specified in its Charter)

Payment of filing fee (Check the appropriate box):

| | | | |

x | | No fee required. |

| |

¨ | | Fee computed on table below per Exchange Act Rule 14a-6(i)(4), and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies: |

| | |

| | | | | |

| | | (2) | | Aggregate number of securities to which transactions applies: |

| | |

| | | | | |

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| | | | | |

| | | (4) | | Proposed maximum aggregate value of transaction: |

| | |

| | | | | |

| | | (5) | | Total fee paid: |

| | |

| | | | | |

| |

¨ | | Fee paid previously with preliminary materials. |

| |

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | | (1) | | Amount previously paid: |

| | |

| | | | | |

| | | (2) | | Form, schedule or registration statement no.: |

| | |

| | | | | |

| | | (3) | | Filing party: |

| | |

| | | | | |

| | | (4) | | Date filed: |

| | |

| | | | | |

April 28, 2006

Dear Shareholder:

The Board of Directors cordially invites you to attend the 2006 Annual General Meeting of Shareholders, which we will hold at 10:00 a.m., Eastern Daylight Time, on June 13, 2006 at the Omni Berkshire Place, 21 East 52nd Street, New York, New York.

The Notice of 2006 Annual General Meeting and Proxy Statement accompanying this letter describe the business to be acted upon at the meeting. The annual report for the year ended December 31, 2005 is also enclosed.

It is important that your shares be represented at the Annual General Meeting, whether or not you plan to attend the meeting in person. Please complete, sign and date the enclosed proxy card and return it in the accompanying prepaid envelope to ensure that your shares will be represented at the meeting.

Thank you for your continued support.

LODEWIJK CHRISTIAAN VAN WACHEM

Chairman of the Board of Directors

Notice of 2006 Annual General Meeting of Shareholders

We will hold the 2006 Annual General Meeting of Shareholders (the “annual meeting”) of Global Crossing Limited (“Global Crossing”) at the Omni Berkshire Place, 21 East 52nd Street, New York, New York, on June 13, 2006, at 10:00 a.m., Eastern Daylight Time, for the following purposes:

To receive the report of the independent registered public accounting firm of Global Crossing and the financial statements for the year ended December 31, 2005 and to take the following actions:

| | 1. | To elect two members of the Board of Directors; |

| | 2. | To increase the authorized share capital of the Company from 55,000,000 common shares to 85,000,000 common shares; |

| | 3. | To appoint Ernst & Young LLP as the independent registered public accounting firm of Global Crossing for the year ending December 31, 2006 and to authorize the Audit Committee to determine their remuneration; and |

| | 4. | To transact any other business that may properly come before the annual meeting and any adjournment or postponement of the meeting. |

Only common and preferred shareholders of record at the close of business on April 18, 2006, which has been fixed as the record date for notice of the annual meeting, are entitled to receive this notice and to vote at the meeting.

It is important that your shares be represented at the annual meeting. Whether or not you expect to attend the meeting, please vote by completing, signing and dating the enclosed proxy card and returning it promptly in the reply envelope provided.

By order of the Board of Directors,

MITCHELL C. SUSSIS

Secretary, Vice President & Deputy General Counsel

April 28, 2006

2006 PROXY STATEMENT

GENERAL INFORMATION

The Board of Directors of Global Crossing Limited (the “Board” or “Board of Directors”) is soliciting your proxy for use at the Annual General Meeting of Shareholders to be held on June 13, 2006 (the “annual meeting”). These proxy materials are being mailed to shareholders beginning on or about April 28, 2006.

Global Crossing Limited, or “GCL,” was formed as an exempt company with limited liability under the laws of Bermuda in 2002. GCL is the successor to Global Crossing Ltd., a company formed under the laws of Bermuda in 1997 (“Old GCL”) which, together with a number of its subsidiaries (collectively, the “GC Debtors”), emerged from reorganization proceedings on December 9, 2003 (the “Effective Date”). Except as otherwise noted herein, references in this proxy statement to “Global Crossing,” “the Company,” “we,” “our” and “us” in respect of time periods on or prior to December 9, 2003 are references to Old GCL and its subsidiaries, while such references in respect of time periods after December 9, 2003 are references to GCL and its subsidiaries.

Our principal executive offices are located at Wessex House, 45 Reid Street, Hamilton HM12, Bermuda. Our telephone number is 441-296-8600. You may visit us at our website located atwww.globalcrossing.com.

Date, Time and Place

We will hold the Annual General Meeting at the Omni Berkshire Place, 21 East 52nd Street, New York, New York, on June 13, 2006 at 10:00 a.m., Eastern Daylight Time, subject to any adjournments or postponements.

Who Can Vote; Votes Per Share

Common and preferred shareholders of record at the close of business on April 18, 2006 are eligible to vote at the annual meeting. As of the close of business on that date, we had outstanding 24,396,387 shares of common stock, par value U.S. $0.01 per share, and 18,000,000 shares of 2.0% Cumulative Senior Convertible Preferred Shares (the “Senior Preferred Shares”), par value U.S. $0.10 per share. As of March 28, 2006, all of the Senior Preferred Shares and 6,567,900 common shares were held by a subsidiary of Singapore Technologies Telemedia Pte Ltd (“ST Telemedia”). The Senior Preferred Shares are convertible into common shares on a one-for-one basis, subject to adjustment in certain circumstances.

Under our bye-laws and the certificate of designations for the Senior Preferred Shares, each common share and each Senior Preferred Share currently entitles the holder to one vote on all matters entitled to be voted on by holders of our common shares, with the Senior Preferred Shares and the common shares voting together as a single class. Each common share and each Senior Preferred Share will therefore be entitled to one vote on each proposal described in this proxy statement. Although the holders of the common shares and Senior Preferred Shares also have certain separate class voting rights under Bermuda law, no separate class vote will take place at the 2006 annual meeting.

Quorum and Voting Requirements

The presence in person or by proxy of at least two shareholders entitled to vote and holding shares representing more than 50 percent of the votes of all outstanding common shares and Senior Preferred Shares

1

will constitute a quorum at the annual meeting. Abstentions and broker “non-votes” are counted for purposes of establishing a quorum. A broker “non-vote” occurs when a nominee (such as a broker) holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power for that particular matter and has not received instructions from the beneficial owner. Under applicable stock exchange rules, we believe that nominees will generally not have discretionary voting power with respect to Proposal 2 set forth below.

Approval of each of the proposals set out below requires the affirmative vote of at least a simple majority of the votes cast. Abstentions and broker “non-votes” will not affect the voting results, although they will have the practical effect of reducing the number of affirmative votes required to achieve a majority by reducing the total number of shares from which the majority is calculated.

How to Vote

If your shares are held in the name of a bank, broker or other holder of record, you will receive instructions from the holder of record that you must follow in order for your shares to be voted. If you are the shareholder of record, you may either vote in person at the meeting or by proxy. All common shares represented by a proxy that is properly executed by the shareholder of record and received by our transfer agent, Computershare Trust Company, N.A. (“Computershare”), by 9:00 a.m., Eastern Daylight Time, on June 13, 2006, will be voted as specified in the proxy, unless validly revoked as described below. To vote by mail, please sign and date your proxy card and mail it in the envelope provided. If you return a proxy by mail and do not specify your vote, your shares will be voted as recommended by the Board of Directors.

As an alternative to appointing a proxy, a shareholder that is a corporation may appoint any person to act as its representative by delivering written evidence of that appointment, which must be received at our principal executive offices not later than one hour before the time fixed for the beginning of the meeting. A representative so appointed may exercise the same powers, including voting rights, as the appointing corporation could exercise if it were an individual shareholder.

The Board of Directors is not currently aware of any business that will be brought before the annual meeting other than the proposals described in this proxy statement. If, however, other matters are properly brought before the annual meeting or any adjournment or postponement of the meeting, the persons appointed as proxies will have, unless the terms of their appointment otherwise provide, discretionary authority to vote the shares represented by duly executed proxies in accordance with their discretion and judgment.

Revocation of Proxies

You may revoke your proxy or, in the case of a corporation, its authorization of a representative, before it is voted (1) by so notifying the Secretary of the Company in writing at the address of our principal executive offices not less than one hour before the time fixed for the beginning of the meeting, (2) by signing and dating a new and different proxy card and mailing it such that it is received by Computershare by 5:00 p.m., Eastern Daylight Time, June 12, 2006 or (3) by voting your shares in person or by an appointed agent or representative at the meeting. You cannot revoke your proxy merely by attending the annual meeting.

Proxy Solicitation

We will bear the costs of soliciting proxies from the holders of our common shares. Proxies will initially be solicited by us by mail, but directors, officers and selected other employees of the Company may also solicit proxies by personal interview, telephone, facsimile or e-mail. Directors, executive officers and any other employees who solicit proxies will not be specially compensated for those services, but may be reimbursed for out-of-pocket expenses incurred in connection with the solicitation. Brokerage houses, nominees, fiduciaries and other custodians will be requested to forward soliciting materials to beneficial owners and will be reimbursed for

2

their reasonable out-of-pocket expenses incurred in sending proxy materials to beneficial owners. We have engaged Georgeson Shareholder Communications, Inc. to assist us in coordinating the mailing of proxy materials at an estimated fee of $1,500 plus disbursements. Computershare has agreed to assist us in connection with the tabulation of proxies.

2005 Audited Financial Statements

Under our bye-laws and Bermuda law, audited financial statements must be presented to shareholders at an annual general meeting of shareholders. To fulfill this requirement, we will present at the annual meeting consolidated financial statements for the fiscal year 2005, which have been audited by Ernst & Young LLP. Copies of those financial statements are included in our 2005 Annual Report to Shareholders (the “Annual Report”), which is attached to this proxy statement. Representatives of Ernst & Young LLP are expected to attend the annual meeting and to respond to appropriate questions and will have the opportunity to make a statement should they so desire.

3

DIRECTORS AND EXECUTIVE OFFICERS

Our bye-laws provide that ST Telemedia and any of its subsidiaries that are shareholders of the Company from time to time (the “STT Shareholder Group”) will be able to appoint up to eight (8) directors to our Board based upon the STT Shareholder Group’s percentage ownership of our shares at any given time. Specifically, for so long as the STT Shareholder Group owns both Global Crossing common shares and Senior Preferred Shares representing in the aggregate not less than the percentages set forth below of our outstanding common shares calculated on a fully diluted basis, the STT Shareholder Group will be entitled to appoint the numbers of Directors indicated below to our Board, holding office at any one time, each for a term of three years (which can be renewed).

| | |

Percentage of Fully Diluted Common Shares

| | Number of Director Designees

|

50% or more | | 8 |

At least 35% | | 6 |

At least 20% | | 4 |

| At least 5% (or, if less, 50% of the aggregate number of common shares (calculated on an as-converted basis) acquired by the STT Shareholder Group on the Effective Date). | | 2 |

If the share ownership percentage of the STT Shareholder Group at any time falls below one of the thresholds specified above, then the term of office of the number of Directors that the STT Shareholder Group is no longer entitled to appoint shall terminate at the following meeting of Shareholders (whether annual or special).

In addition, for so long as the STT Shareholder Group is entitled to appoint at least two Directors, a Director designated by the STT Shareholder Group shall serve as (i) Chairman of the Board, (ii) Chairman of the Audit Committee (to the extent permitted by applicable stock exchange rules), (iii) Chairman of the Compensation Committee, (iv) Chairman of the Executive Committee and (v) Chairman of the Nominating and Corporate Governance Committee.

4

The following table sets forth the names, ages and positions of our Directors, Executive Committee members and executive officers. Additional biographical information concerning these individuals is provided in the text following the table. The Directors’ committee assignments are also set forth below, with the committees further discussed below under “Board Meetings and Committees.”

| | | | |

Name

| | Age

| | Position

|

Lodewijk Christiaan van Wachem | | 74 | | Chairman of the Board of Directors5 |

Peter Seah Lim Huat | | 59 | | Vice Chairman of the Board of Directors4 |

E.C. “Pete” Aldridge, Jr. | | 67 | | Director1, 2, 3 |

Archie Clemins | | 62 | | Director2, 5 |

Donald L. Cromer | | 70 | | Director2, 4 |

Richard R. Erkeneff | | 70 | | Director2, 3 |

Lee Theng Kiat | | 53 | | Director1, 4, 5 |

Charles Macaluso | | 62 | | Director1 |

Michael Rescoe | | 53 | | Director3 |

Robert J. Sachs | | 57 | | Director4, 5 |

Steven T. Clontz | | 55 | | Member of Executive Committee |

Jeremiah D. Lambert | | 71 | | Member of Executive Committee |

John J. Legere | | 47 | | Chief Executive Officer1 |

David R. Carey | | 52 | | Executive Vice President, Strategy and Corporate Development |

Anthony D. Christie | | 45 | | Executive Vice President and Chief Marketing Officer |

Daniel J. Enright | | 46 | | Executive Vice President, Global Operations |

Edward T. Higase | | 39 | | Executive Vice President, Worldwide Carrier Services |

Robert A. Klug. | | 38 | | Chief Accounting Officer |

Jean F.H.P. Mandeville | | 46 | | Executive Vice President and Chief Financial Officer |

John B. McShane | | 44 | | Executive Vice President and General Counsel |

Philip Metcalf | | 47 | | Managing Director, Global Crossing UK |

John R. Mulhearn, Jr. | | 55 | | Senior Vice President, Global Wholesale Voice and Access Management |

José Antonio Ríos | | 60 | | Chief Administrative Officer, President of Global Crossing International and Chairman of the Board of Global Crossing UK |

Gerald B. Santos | | 62 | | Senior Vice President, Corporate Communications |

Michael Toplisek | | 36 | | Senior Vice President, Global Enterprise and Collaboration Services |

Daniel J. Wagner | | 41 | | Chief Information Officer and Executive Vice President, Business Infrastructure |

| 1 | Member, Executive Committee |

| 2 | Member, Government Security Committee |

| 4 | Member, Compensation Committee |

| 5 | Member, Nominating and Corporate Governance Committee |

Director Nominees

Charles Macaluso—Mr. Macaluso has served as a Director of Global Crossing since December 2003. He is a founding principal and the chief executive officer of Dorchester Capital Advisors (formerly East Ridge Consulting, Inc.), a management consulting and corporate advisory firm founded in 1996. From March 1996 to June 1998, Mr. Macaluso was a partner at Miller Associates, Inc., a company principally involved in corporate workouts. From 1989 to 1996, Mr. Macaluso was a partner at The Airlie Group, LLP, a fund specializing in leveraged buyout, mezzanine and equity investments. Mr. Macaluso currently serves as a member of the boards of ICG and Lazy Days, RV, as the lead director of Darling International, and as the chairman of the board of Geo Specialty Chemical.

5

Michael Rescoe—Mr. Rescoe has served as a Director of Global Crossing since December 2003. He is executive vice president and chief financial officer of the Tennessee Valley Authority (the “TVA”), a federal corporation that is the nation’s largest public power provider, a position he has held since July 2003. Mr. Rescoe was a senior officer and the chief financial officer of 3Com Corporation, a global technology manufacturing company specializing in Internet connection technology for both voice and data applications, from April 2000 until November 2002. During 1999 and 2000, Mr. Rescoe was associated with Forstman Little, a leveraged buyout firm. Prior thereto, Mr. Rescoe was chief financial officer of PG&E Corporation, a power and natural gas energy holding company, since 1997. For over a dozen years prior to that Mr. Rescoe was a senior investment banker with Kidder, Peabody and a senior managing director of Bear Stearns specializing in strategy and structured financing.

Directors of the Company with Terms to Expire at the 2007 Annual General Meeting of Shareholders

Lodewijk Christiaan van Wachem—Mr. van Wachem has served as a Director of Global Crossing since December 2003. He is currently a member of the board of directors of ATCO (Canada) Ltd. (energy and logistics). He was chairman of the board of directors of Zurich Financial Services from 1993 through April 2005 and was chairman of the supervisory board of Royal Philips Electronics N.V. from 1993 through March 2005. He became a director of Royal Dutch Shell Group in 1977, president in 1982 and chairman of the committee of managing directors in 1985. He served in that capacity until 1992, when he was appointed chairman of the supervisory board of the Royal Dutch Petroleum Company, a position he held through July 2002. Until 2002 he also served on the supervisory boards of Akzo Nobel, BMW and Bayer, as well as on the board of directors of International Business Machines Corp.

Peter Seah Lim Huat—Mr. Seah has served as a Director of Global Crossing since December 2003. Since January 2005 he has been a member of the Temasek Advisory Panel of Temasek Holdings (Private) Limited (investment company) and since November 2004 he has been a Deputy Chairman on ST Telemedia’s board of directors. From December 2001 until December 2004 he was president and chief executive officer of Singapore Technologies Pte Ltd (“ST”) and also a member of its board of directors. Before joining ST in December 2001, he was a banker for the prior 33 years, retiring as vice chairman & chief executive officer of Overseas Union Bank in September 2001. Mr. Seah is chairman of SembCorp Industries Limited, Singapore Technologies Engineering Ltd and Singapore Computer Systems Limited. Presently, he also sits on the boards of CapitaLand Limited, Chartered Semiconductor Manufacturing Ltd, StarHub Ltd (“Starhub”) and STATS ChipPAC Ltd. Mr. Seah also serves on the boards of the Government of Singapore Investment Corporation, EDB Investments Pte Ltd, PT Indosat Tbk and Siam Commercial Bank Public Company Limited. He is also the vice president of the Singapore Chinese Chamber of Commerce & Industry and the honorary treasurer of Singapore Business Federation Council.

E.C. “Pete” Aldridge, Jr.—Mr. Aldridge has served as a Director of Global Crossing since December 2003. He currently serves on the boards of Lockheed Martin Corporation (systems integrator, information technology) and Alion Science and Technology Corporation (technology). From May 2001 until May 2003, Mr. Aldridge served as Under Secretary of Defense for Acquisition, Technology, and Logistics. In this position, he was responsible for all matters relating to U.S. Department of Defense acquisition, research and development, advanced technology, international programs, and the industrial base. Prior to this appointment, Mr. Aldridge served as chief executive officer of Aerospace Corporation from March 1992 through May 2001; president of McDonnell Douglas Electronic Systems from December 1988 through March 1992; and Secretary of the Air Force from June 1986 through December 1988. Mr. Aldridge has also held numerous other senior positions within the Department of Defense.

Archie Clemins—Mr. Clemins has served as a Director of Global Crossing since December 2003. He has been, since January 2000, the owner and president of Caribou Technologies, Inc., and, since November 2001, co-owner of TableRock International LLC, both international consulting firms, and concentrates on the transition

6

of commercial technology to the government sectors, both in the United States and Asia. In addition to serving on the boards of other technology and venture capital concerns, Mr. Clemins is a Limited Partner with Highway 12 Ventures and is the chairman of Advanced Electron Beams, Inc., which focuses on low energy electron beam technology. As an officer of the United States Navy from 1966 through December 1999, Mr. Clemins’ active duty service included command of the attack submarine USS Pogy. Promoted to Flag (General Officer) rank in 1991, he had five follow-on assignments, including Commander, Pacific Fleet Training Command in San Diego, California and Commander, Seventh Fleet, headquartered in Yokosuka, Japan. Mr. Clemins concluded his military career in Hawaii as an Admiral and the 28th Commander of the U.S. Pacific Fleet.

Donald L. Cromer—Mr. Cromer has served as a Director of Global Crossing since December 2003. He currently acts as a consultant to the U.S. Department of Defense, the United States Air Force, Booz Allen Hamilton Inc. (a strategy and technology consulting firm) and the Institute for Defense Analysis. He currently serves as chairman of the board of trustees for the Aerospace Corporation and is a member of the Corporation of Draper Laboratory, Inc. (a not-for-profit laboratory for applied research, engineering development, education, and technology transfer). He also serves on the boards of the following private companies: Universal Space Network, Vadium, Inc., and Innovative Intelcom Industries. He is also affiliated with the California Space Authority. General Cromer’s military career in the Air Force spanned 32 years. He retired in 1991 as the Commander of Space Division, Los Angeles, California (the satellite, missile and launch vehicle acquisition center for the Air Force). Subsequent to his retirement, he joined Hughes Space and Communications Company and served as president from 1993 to 1998.

Richard R. Erkeneff—Mr. Erkeneff has served as a Director of Global Crossing since December 2003. He was, from October 1995 until August 2003, president and chief executive officer of United Industrial Corporation (“UIC”), a company focused on the design and production of defense, training, transportation and energy systems. Mr. Erkeneff also served as a director of UIC from October 1995 to May 2005. In addition, Mr. Erkeneff was chief executive officer of AAI Corporation (“AAI”), a wholly-owned subsidiary of UIC responsible for the design, manufacture, testing and support of advanced Tactical Unmanned Aerial Vehicles, from November 1993 until August 2003, and president of AAI from November 1993 to January 2003. Prior to joining AAI, Mr. Erkeneff held positions as senior vice president of the Aerospace Group at McDonnell Douglas Corporation, and president and executive vice president of McDonnell Douglas Electronics Systems Company. Mr. Erkeneff continues to serve as a consultant to UIC’s board of directors.

Lee Theng Kiat—Mr. Lee has served as a Director of Global Crossing since December 2003. He has been president and chief executive officer of ST Telemedia since 1994. He joined ST in 1985 and has held various senior ST positions including directorships in Legal and Strategic Business Development. In 1993, following ST’s decision to enter the telecommunications sector, Mr. Lee spearheaded the creation of ST Telemedia as a new business area for ST. Mr. Lee, a lawyer by training, began his career as an officer of the Singapore Legal Service, remaining with that entity for more than eight years. Mr. Lee also serves on the board of directors of several publicly listed companies including StarHub, TeleChoice International Limited and Global Voice Group Limited and on the board of commissioners of PT Indosat Tbk.

Robert J. Sachs—Mr. Sachs has served as a Director of Global Crossing since December 2003. He has been a principal of Continental Consulting Group, LLC, a Boston, Massachusetts based consulting firm serving the cable television industry, since February 2005, having previously held that same position from January 1998 through July 1999. From August 1999 through February 2005, Mr. Sachs was president and chief executive officer of the National Cable & Telecommunications Association (NCTA), the principal trade association of the cable industry in the United States, representing cable television operators, program services, and equipment and service providers. Prior to co-founding Continental Consulting Group in 1998, Mr. Sachs served in various legal and executive capacities for Continental Cablevision, Inc. and its successor, MediaOne, for 18 years. Mr. Sachs serves as a director of Starhub, a Singapore cable television and mobile telephone company in which ST Telemedia holds a control position. Mr. Sachs also serves as a trustee of the Dana-Farber Cancer Institute, the Wang Center for the Performing Arts and WGBH Educational Foundational and is vice-chair of the National Coalition for Cancer Survivorship.

7

Executive Committee Members

Steven T. Clontz—Mr. Clontz has served as a member of the Executive Committee of Global Crossing since December 2003 and is president, chief executive officer of Starhub, having joined Starhub in that capacity in January 1999. Mr. Clontz has also served as a director of Starhub since 1999. From December 1995 through December 1998, Mr. Clontz served as chief executive officer, president and a director of IPC Information Systems, based in New York City. Prior to that, Mr. Clontz worked at BellSouth International, joining in 1987 and holding senior executive positions of increasing responsibility, serving the last three years as president Asia-Pacific. Mr. Clontz currently serves as a director of Interdigital Communications Corporation, Equinix and LiveCargo. Mr. Clontz began his career as an engineer with Southern Bell in 1973.

Jeremiah D. Lambert—Mr. Lambert has served as a member of the Executive Committee of Global Crossing since December 2003 and served Old GCL as co-chairman of the Board, chaired its audit committee and special committee on accounting matters, and also served as a member of Old GCL’s compensation committee until December 2003. A Global Crossing director since April 2002, Mr. Lambert served as chairman of the board of directors of Old GCL’s former subsidiary, Asia Global Crossing, Ltd. (“Asia Global Crossing”), from September 2002 through March 2003. Mr. Lambert is a nationally known lawyer whose practice has focused on corporate clients in regulated industries, including those in the electricity, natural gas and telecom sectors. Mr. Lambert served as a senior partner in Shook, Hardy & Bacon L.L.P. from December 1997 until April 2002, when he withdrew to join Old GCL’s board of directors. Prior to that date, Mr. Lambert was the co-founder and chair of Peabody, Lambert & Meyers, P.C., a law firm in Washington, D.C. Mr. Lambert began his legal practice at Cravath, Swaine & Moore in New York City and is a frequent lecturer and author on legal topics.

John J. Legere—Mr. Legere has been chief executive officer of Global Crossing since October 2001 and has served as a member of the Executive Committee of the Board since December 2003. He also served as a director of Old GCL from October 2001 through December 2003. He served as president and chief executive officer of Asia Global Crossing from February 2000 until January 2002. Mr. Legere has two decades of experience in the telecommunications industry. Prior to joining Asia Global Crossing, he was senior vice president of Dell Computer Corporation and president for Dell’s operations in Europe, the Middle East and Africa from July 1999 until February 2000, and president, Asia-Pacific for Dell from June 1998 until June 1999. From April 1994 to November 1997, Mr. Legere was president and chief executive officer of AT&T Asia/Pacific and spent time also as head of AT&T Global Strategy and Business Development. From 1997 to 1998, he was president of worldwide outsourcing at AT&T Solutions.

Other Executive Officers of the Company

David R. Carey—Mr. Carey was named executive vice president, strategy and corporate development of Global Crossing in November 2003. From March 2002 through November 2003, Mr. Carey served as executive vice president, enterprise sales, where he was responsible for overseeing all sales and marketing activities relating to our enterprise customers. From September 1999 through March 2002, Mr. Carey served in numerous capacities at Global Crossing, including senior vice president-operations planning from January 2002 through March 2002; senior vice president-network planning and development, from December 2000 through January 2002; senior vice president-business and network development from January 2000 through December 2000; and senior vice president-business development from September 1999 through January 2000. Before Global Crossing’s acquisition of Frontier Corporation (“Frontier”) in September 1999 (the “Frontier Acquisition”), Mr. Carey served as senior vice president, marketing and chief marketing officer for Frontier’s business lines from October 1997 through September 1999. Prior to that, Mr. Carey spent seven years in the energy industry, serving as president & chief executive officer of LG&E Natural Inc., and various executive positions at Louisville Gas and Electric Company, both subsidiaries of LG&E Energy Corp. based in Louisville, Kentucky. Mr. Carey began his career with AT&T. During his 15 years there, he held a wide range of executive positions in marketing, sales, operations and personnel.

8

Anthony D. Christie—Mr. Christie was named executive vice president and chief marketing officer of Global Crossing in November 2003. From February 2002 through November 2003, Mr. Christie served as senior vice president, global product management, having previously served as senior vice president, business integration and strategic planning from November 2001. Mr. Christie is accountable for global product strategy development, deployment, marketing, and profit and loss for all wholesale and retail products for the Company. Prior to joining Global Crossing, Mr. Christie was vice president, business development and strategic planning for Asia Global Crossing from March 2000 through October 2001. In this position, Mr. Christie was accountable for all business and corporate development, joint venture and mergers and acquisitions activities, as well as overall strategic planning for the company. Prior to joining Asia Global Crossing, Mr. Christie was general manager and network vice president at AT&T Solutions in New York City from November 1999 through March 2000, having also held the position of Global Sales and Operations vice president in AT&T’s outsourcing division from June 1998 through November 1999. From June 1997 through June 1998, Mr. Christie was a Sloan Fellow at MIT. Prior thereto, Mr. Christie held positions in AT&T’s International Operations Division that included an assignment as the regional managing director for the Consumer Markets Division in Asia.

Daniel J. Enright—Mr. Enright was named executive vice president, operations in June 2003. In this role, Mr. Enright is responsible for our network architecture, planning and engineering, customer operations, network operations and field operations. Mr. Enright is also responsible for managing our network capital, operating expenses and third party maintenance expenses. Mr. Enright has held other positions at Global Crossing, including senior vice president—global network engineering and operations from March 2002 through June 2003; vice president—global service operations from June 2001 through March 2002; vice president North America engineering and field operations from July 2000 through June 2001; and vice president—North America network and field operations from April 1999 through July 2000. Mr. Enright joined Global Crossing following the Frontier Acquisition, where he had served since October 1996 as vice president for network operations and service provisioning. In that role, he led the network operations and service provisioning team during the construction of Frontier’s nationwide fiber-optic network. Prior to Frontier, Mr. Enright held various engineering and operations positions at Highland Telephone and Rochester Telephone.

Edward T. Higase—Mr. Higase has been executive vice president, worldwide carrier services of Global Crossing since September 2004, having previously served as executive vice president, carrier sales and marketing of Global Crossing since January 2002. Since October 2004, Mr. Higase has been responsible for overseeing sales activities for data services related to our carrier, ISP, and ASP customers worldwide. Mr. Higase previously served as president, carrier services for Asia Global Crossing, from August 2000 to December 2001. Prior to Asia Global Crossing, Mr. Higase was corporate director and general manager from November 1999 to August 2000 of the medium-size business Corporate Accounts Division for Dell Computer Corporation in Japan. Prior to this assignment, he served as corporate director, Dell Online for Asia Pacific from August 1998 to November 1999, where he led the growth of Internet-based transactions in the Asia Pacific Region. Mr. Higase began his career with AT&T in Japan. During his nine years with the company, he held a wide range of senior and executive positions in marketing, sales, and business management across AT&T’s business markets division, consumer markets division, outsourcing unit, and the international business unit.

Robert Klug –Mr. Klug was named chief accounting officer of Global Crossing in December 2005. Previously, he held senior roles in the Company’s finance department including vice president, cost of access finance from June 2004 through December 2005, vice president, financial operations from September 2001 through June 2004, chief financial officer Americas from December 2000 through September 2001, chief financial officer, subsea operations from December 1998 through December 2000 and chief accounting officer from 1997 through December 1998. Prior to joining Global Crossing, Mr. Klug spent eight years as an auditor with PricewaterhouseCoopers.

Jean F.H.P. Mandeville—Mr. Mandeville was named executive vice president and chief financial officer of Global Crossing in February 2005. Mr. Mandeville served as a member of our Executive Committee from December 2003 to January 2005. Mr. Mandeville was chief financial officer of ST Telemedia from July 2002

9

through January 2005. From 1992 to June 2002, Mr. Mandeville served in various capacities at British Telecom PLC, including president of Asia Pacific from July 2000 to June 2002, director of international development Asia Pacific from June 1999 to July 2000 and general manager, special projects from January 1998 to July 1999. Mr. Mandeville also previously served on the board of directors of SmarTone HK and LGT Korea, both public companies.

John B. McShane—Mr. McShane was named executive vice president and general counsel of Global Crossing in March 2002. Mr. McShane oversees and manages all of our legal matters. Mr. McShane joined Global Crossing in February 1999 as our European assistant general counsel where he oversaw and managed legal affairs for the European region, including the buildout of our PEC network. As assistant general counsel he also had responsibility for the oversight of worldwide sales and telecommunications network outsourcing transactions for Global Crossing’s Solutions business unit and major vendor supply agreements. Prior to joining Global Crossing, Mr. McShane spent twelve years at several international law firms, including positions as an associate at Simpson Thacher & Bartlett from 1987 through 1996 and as senior counsel at Shearman and Sterling, Cadwalader, Wickersham & Taft, and Brown & Wood, where his main focus was on representing major commercial banks, financial institutions and corporations in connection with a broad range of their corporate, commercial and financing activities.

Philip Metcalf—Mr. Metcalf became Managing Director of GCUK in October 2004. Previously, he held senior posts with Global Crossing affiliates in the UK and the US, including Global Construction from June 2001 to March 2002, Global Service Delivery and Assurance from April 2002 to August 2002, and Managing Director for Europe from April 2002 to August 2004. Additionally, from September 2002 to August 2004, he was CEO of our former Global Marine subsidiary, which he successfully re-structured and sold to new ownership. Prior to joining Global Crossing, Mr. Metcalf was employed by Stone and Webster Engineering (now part of the Shaw Group), where he worked for eight years in various capacities, including Head of Engineering, Head of IT, Project Manager, and ultimately Operations Director. Mr. Metcalf sits on the Boards of substantially all the Global Crossing legal entities in Europe, including the GCUK Board, and is Head of Security in the UK and Head of Safety in the UK (including chairing the Rail Safety Management Group).

John R. Mulhearn, Jr.—Mr. Mulhearn has served as executive vice president, global access management since June 2005, previously serving as senior vice president, global wholesale voice and access management for Global Crossing from October 2004 through June 2005. He has global responsibility for the sale and support of wholesale voice products, and in addition, is accountable for securing agreements and managing the cost structure for all global long haul and local access (switched and special) capabilities in support of Global Crossing’s carrier and enterprise customer segments, as well as for network infrastructure requirements. Previously he served as senior vice president of global access management from May 2002 until September 2004, vice president, global access management from March 2002 until May 2002, vice president North America carrier relations from June 2001 through March 2002 and vice president operations from March 2000 through June 2001. Prior to joining Global Crossing, Mr. Mulhearn previously worked for 28 years at AT&T. During his tenure at AT&T, he held positions in sales, marketing, operations, regulatory, outsourcing and human resources. In 1993, he took an assignment in Canada to work for Unitel Communications Inc. (partially owned by AT&T) as senior vice president of sales and marketing. In that role, Mr. Mulhearn was responsible for government, national and regional commercial accounts.

José Antonio Ríos—Mr. Ríos was named chairman of the board of directors of Global Crossing UK in September 2004 and has been chief administrative officer of Global Crossing since November 2002. Mr. Ríos has also served as president of Global Crossing International since May 2001 and was chairman of the board of Global Crossing’s former Global Marine Systems subsidiary (“Global Marine”) from September 2002 through its divestment in August 2004. Mr. Ríos has more than 20 years of experience managing a wide range of companies in the technology and media sectors. Prior to joining Global Crossing in February 2001 as president Latin America and corporate senior vice president, Mr. Ríos served as president and chief executive officer of Telefónica Media from June 1999 through August 2000 and president of Atento Worldwide from July 2000

10

through June 2002. Earlier in his career, Mr. Ríos was the founding president and chief executive officer of Galaxy Latin America (subsequently named DIRECTV™ Latin America), where he was responsible for the planning, development, and launch of DIRECTV™, a division of Hughes Electronics. During his four-year tenure, he was a vice president of Hughes Electronics and a member of its management committee. Mr. Ríos previously served as the first chief operating officer and corporate vice president of the Cisneros Group of Companies. He was also a founding member of its worldwide executive committee. During his 13-year tenure with the Cisneros Group, Mr. Ríos held a succession of increasingly responsible positions, including tenure as a board member or president in over 60 Cisneros companies worldwide. From 2000 to 2002, Mr. Ríos served as chairman of the supervisory board of Endemol Entertainment, Europe’s premier independent TV production company based in Holland and with operations in 28 countries around the world. He also serves on the board of directors of Claxson Interactive Group Inc. and is an active national board member of Operation Smile, a philanthropic organization that provides global medical assistance to children born with facial deformities. In addition, Mr. Ríos serves as a board member of the Inter-American Dialogue’s Latin America Advisor.

Gerald B. Santos—Mr. Santos was named senior vice president, corporate communications of Global Crossing in October 2001. He manages all aspects of external and internal communications efforts including public relations, marketing communications, employee communications, advertising and branding. Prior to joining Global Crossing, Mr. Santos was vice president of worldwide public relations and communications with Concert Communications from July 1999 through June 2001. Prior to his role at Concert, Mr. Santos held several senior leadership positions in the communications organization within AT&T, most recently as vice president, global communications for AT&T Asia/Pacific from September 1996 through July 1999.

Michael Toplisek—Mr. Toplisek was named senior vice president, global enterprise & collaboration services in March 2006. Mr. Toplisek leads the sales teams in North America, Latin America, the United Kingdom and continental Europe that provide converged IP services to corporations and governments around the world. Mr. Toplisek previously served as a regional vice-president from May 2005 through March 2006 and as an area vice president from September 2000 through May 2005. Mr. Toplisek served Global Crossing as sales director from following the Frontier Acquisition through September 2000, a position he had held since May 1999. Before joining Frontier in July 1997 as a major account representative, Mr. Toplisek held various sales leadership positions at MCI Telecommunications and other corporations in the telecommunications sector.

Daniel J. Wagner—Mr. Wagner was named chief information officer and executive vice president—business infrastructure of Global Crossing in January 2004. Mr. Wagner oversees our global information technology function, including operations, telecommunications, development, security, and technology integration. Mr. Wagner served as chief information officer and senior vice president—business information from August 2002 through December 2003. From March 2002 through August 2002 Mr. Wagner served as senior vice president of information technology, real estate, procurement and vendor management. In addition to his corporate responsibilities, Mr. Wagner served on the board of directors of Global Marine from February 2002 through its divestment in August 2004. Mr. Wagner also served as president of Global Crossing Europe from October 2001 through March 2002 and managing director of Global Crossing UK from January 2001 through October 2001. Mr. Wagner served Global Crossing as vice president of business integration for North America following the Frontier Acquisition. While at Frontier, between June 1999 and July 2000, he held several other key management positions, including senior director of finance and integration, and vice president of service delivery. Before joining Frontier in 1994, Mr. Wagner was a management consultant for Andersen Consulting and his own independent firm for several years.

11

BOARD MEETINGS AND COMMITTEES

The Board and various Committees met numerous times during 2005. The Board held 11 meetings, five of which were telephonic and six of which were “in-person”. The Audit Committee met 14 times, with eight telephonic and six “in-person” meetings. The Compensation Committee met nine times, with three telephonic and six “in-person” meetings. The Government Security Committee met five times, with one telephonic and four “in-person” meetings. The Nominating and Corporate Governance and Executive Committees did not meet in 2005. All of our Directors attended at least 75% of the meetings of the Board and the Committees of which they are members.

We have adopted an ethics policy that applies to all of our Directors, officers (including the chief executive officer and the chief financial officer) and employees. The policy, together with the charters of our Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee, Executive Committee and Government Security Committee, can be found on our website atwww.globalcrossing.com, or can be mailed to shareholders upon written request to our Secretary at Wessex House, 45 Reid Street, Hamilton HM12, Bermuda. If a waiver of our ethics policy is granted to any of our Directors or executive officers, such waiver will be posted on our website within five days of that waiver being granted.

We expect and require all of our Directors to attend our annual meeting of shareholders. All of our Directors attended our previous annual shareholder meeting held on June 14, 2005.

As a “controlled company” (as defined in NASDAQ rules), we are not required to comply with NASDAQ rules that require listed companies to have a majority of independent directors or nominating and compensation committees composed entirely of independent directors or to have written charters for certain committees addressing specified matters. At such time as we are no longer a “controlled company,” if ever, we will amend our committee charters, if necessary, and change the composition of our committees to ensure compliance with these NASDAQ requirements.

The five standing committees of the Board are the Audit Committee, the Compensation Committee, the Nominating and Corporate Governance Committee, the Executive Committee and the Government Security Committee. These committees are described in the following paragraphs.

Audit Committee

The Audit Committee consists of Messrs. Rescoe (chairman), Aldridge and Erkeneff, all of whom satisfy the independence and other qualification requirements of NASDAQ rules. The Board has determined that Mr. Rescoe, the committee’s chairman, is an “audit committee financial expert” as defined in applicable Securities and Exchange Commission (the “Commission”) rules. The primary purpose of the Audit Committee is to assist the Board in fulfilling its responsibility for the integrity of the Company’s financial reports. To carry out this purpose, the Audit Committee oversees: (A) management’s conduct of the Company’s financial reporting process, including the integrity of the financial statements and other financial information provided by the Company to governmental and regulatory bodies, to shareholders and other security holders, or to other users of such information, (B) the Company’s compliance with legal and regulatory requirements that may have a material impact on the Company’s financial statements, (C) the appointment, qualifications (including independence), compensation and performance of the Company’s independent registered public accounting firm and the quality of the annual independent audit of the Company’s financial statements, (D) the performance of the Company’s internal audit function and management’s establishment and application of the Company’s systems of internal accounting and financial controls and disclosure controls, and (E) the adequacy of and adherence to (including any waivers granted to executive officers from adherence to) the Company’s code of business conduct and ethics, and such other matters as are incidental thereto. The Audit Committee also carries out other functions from time to time as assigned to it by the Board.

12

In carrying out its purpose, the goal of the Audit Committee is to serve as an independent and objective monitor of the Company’s financial reporting process and internal control systems, including the activities of the Company’s independent registered public accounting firm and internal audit function, and to provide an open avenue of communication with the Board for, and among, the independent registered public accounting firm, internal audit operations and financial and executive management.

Report of the Audit Committee

Management is responsible for the preparation of the Company’s financial statements and the independent registered public accounting firm is responsible for examining those statements. In connection with the preparation of the December 31, 2005 financial statements, the Audit Committee (1) reviewed and discussed the audited financial statements with management; (2) discussed with the independent registered public accounting firm the matters required to be discussed under generally accepted auditing standards, including Statement on Auditing Standards No. 61 (as the same may be amended or supplemented); and (3) received the written disclosures and the letter from the independent registered public accounting firm required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), as the same may be modified or supplemented, and has discussed with the independent registered public accounting firm the firm’s independence.

Based upon these reviews and discussions, the Audit Committee recommended, and the Board of Directors approved, that the Company’s audited financial statements be included in the annual report on Form 10-K for the fiscal year ended December 31, 2005, for filing with the Securities and Exchange Commission. The Audit Committee also selected Ernst & Young LLP as the independent registered public accounting firm for the fiscal year ending December 31, 2006, subject to the rights of the shareholders under Bermuda law to appoint the auditors at the annual meeting.

THE AUDIT COMMITTEE

Michael Rescoe, Chairman

E.C. “Pete” Aldridge, Jr.

Richard R. Erkeneff

Principal Accounting Firm Fees

The following table sets forth the fees billed to the Company for the fiscal years ended December 31, 2005 and 2004 by our present principal independent registered public accounting firm, Ernst & Young LLP:

| | | | | | | | |

| | | 2005

| | | 2004

| |

Audit Fees | | $ | 8,409,000 | (1) | | $ | 10,186,000 | (2) |

Audit Related Fees | | | | | | | — | |

Tax Fees | | | 226,000 | | | | 278,000 | (3) |

All Other Fees | | | | | | | — | |

| | |

|

|

| |

|

|

|

Total | | $ | 8,635,000 | | | $ | 10,464,000 | |

| (1) | Includes (a) $1,209,000 of fees and expenses related to the preparation of financial statements for our United Kingdom subsidiary in connection with its 2005 annual report on Form 20-F and its private placement of approximately $404 million principal amount of senior notes in December 2004; and (b) $2,300,000 of fees and expenses related to the audit of our internal control over financial reporting pursuant to Section 404 of the Sarbanes-Oxley Act of 2002. |

| (2) | Includes (a) $1,359,000 of fees and expenses related to the preparation of financial statements for our United Kingdom subsidiary in connection with its private placement of approximately $404 million principal amount of senior notes in December 2004; and (b) $3,200,000 of fees and expenses related to the |

13

| | audit of our internal control over financial reporting pursuant to Section 404 of the Sarbanes-Oxley Act of 2002. |

| (3) | Includes fees and expenses relating to tax return preparation and consulting services in Europe and Latin America. |

Pursuant to paragraph (c)(7)(i)(B) of Rule 2-01 of Commission Regulation S-X, the Audit Committee has adopted a pre-approval policy pursuant to which the committee delegated to its chairman the authority to approve in advance audit or non-audit services to be performed by the Company’s independent accountants, provided that the chairman and management are required to report any such pre-approval decision to the Audit Committee at its next scheduled meeting. This pre-approval policy is intended to be utilized only when it would be impracticable to call a meeting of the full committee.

Compensation Committee

The Compensation Committee consists of Messrs. Seah (chairman), Cromer, Lee and Sachs. The primary purpose of the Compensation Committee is to discharge certain responsibilities of the Board related to the compensation of the Company’s “key employees” (as defined by the committee) and related matters. In fulfilling this purpose, the Compensation Committee performs the following functions:

| | • | | Establishes the overall compensation philosophy and policies of the Company, subject to concurrence by the Board. |

| | • | | Annually reviews peer company market data to assess the Company’s competitive position for each significant component of key employee compensation. |

| | • | | Approves corporate goals and objectives relevant to compensation for all key employees other than the CEO and the executive vice presidents (“EVPs”), and recommends those goals and objectives for approval by the Board with respect to the CEO and the EVPs; provided that the Compensation Committee itself approves goals and objectives for awards intended to qualify for an exemption under Section 162(m) of the Internal Revenue Code of 1986, as amended (“Performance-Based Executive Compensation”). |

| | • | | Based on an evaluation of the key employees’ performance against those corporate goals and objectives, (i) approves the compensation level for each key employee other than the CEO and the EVPs and (ii) recommends to the Board the compensation level for the CEO and the EVPs; provided that the Compensation Committee itself determines all Performance-Based Executive Compensation. |

| | • | | Administers awards and compensation programs and plans intended to qualify as Performance-Based Executive Compensation, including determining performance measures and goals; setting thresholds, targets, and maximum awards; reviewing performance compared to goals; and certifying goal attainment and approving incentive payments. |

| | • | | Reviews the key employee compensation programs and equity-based compensation plans to determine whether they are properly coordinated and achieving their intended purposes and makes or recommends any appropriate modifications, including the establishment of new such programs. |

| | • | | Grants awards of shares or share options pursuant to the Company’s equity-based plans. |

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee consists of Messrs. van Wachem (chairman), Clemins, Lee and Sachs. The Nominating and Corporate Governance Committee assists the Board in fulfilling its responsibility to the shareholders by (i) identifying individuals qualified to serve as directors and recommending that the Board support the selection of the nominees for all directorships, whether such directorships are filled by the Board or the shareholders, (ii) developing and recommending to the Board a set of corporate governance

14

guidelines and principles and (iii) reviewing, on a periodic basis, the overall corporate governance of the Company and recommending improvements when necessary. The Company’s corporate governance guidelines, as recommended by the Nominating and Corporate Governance Committee and approved by the Board of Directors, can be found on our website atwww.globalcrossing.com, or can be mailed to shareholders upon written request to our Secretary at Wessex House, 45 Reid Street, Hamilton HM12, Bermuda.

Executive Committee

The Executive Committee consists of Messrs. Lee (chairman), Aldridge (with Mr. Erkeneff serving as Mr. Aldridge’s alternate member of the Committee consistent with the Alternate Director provisions of the Company’s bye-laws), Clontz, Lambert, Legere, and Macaluso. The Executive Committee has the power to exercise all the powers of the Board when exigencies or practical considerations prevent the convening of the full Board in a timely manner, subject to such limitations as the Board and/or applicable law may from time to time impose. In addition, the Committee may meet to review and discuss the strategic direction of and major developments at the Company, and may advise and make recommendations to management and the Board relating to such matters.

Government Security Committee

The Government Security Committee (the “Security Committee”) consists of Messrs. Aldridge (chairman), Cromer, Clemins and Erkeneff. The Security Committee discharges those responsibilities related to the security of the Company’s domestic United States operations as are required of the Security Committee or its individual members pursuant to the terms of the Network Security Agreement (“NSA”) dated as of September 24, 2003 among the Company, Old GCL, ST Telemedia, the Federal Bureau of Investigation, the United States Department of Justice, the Department of Defense, and the Department of Homeland Security. The NSA, a copy of which is included as an exhibit to our 2002 annual report on Form 10-K, establishes processes and procedures to ensure the security of our U.S. network assets, which include transmission and routing equipment, switches and associated operational support systems and personnel (referred to in the NSA as the “Domestic Communications Infrastructure”). The Committee is comprised solely of Directors who are U.S. citizens who, if not already in possession of U.S. security clearances, must apply for U.S. security clearances pursuant to Executive Order 12968 immediately upon their appointment to the Security Committee.

15

SECURITY OWNERSHIP OF MANAGEMENT AND OTHERS

The following table sets forth, as of April 18, 2006, certain information regarding the beneficial ownership of the Company’s common shares by (1) each person or entity who is known by us to beneficially own 5% or more of our common shares, (2) each of our Directors and Executive Committee members, (3) each of our executive officers named in the Summary Compensation Table under the heading “Compensation of Executive Officers and Directors” below and (4) all of our Directors, Executive Committee members and executive officers as a group. To our knowledge, each such shareholder has sole voting and investment power with respect to the shares shown, unless otherwise noted. For purposes of this table, an individual is deemed to have sole beneficial ownership of securities owned jointly with such individual’s spouse. Amounts appearing in the table below include (1) all common shares outstanding as of April 18, 2006 and (2) all common shares issuable upon the exercise of options, warrants or other rights within 60 days of April 18, 2006.

Beneficial Ownership of Common Shares

| | | | | |

| | | Number of

Shares(1)

| | Percentage

of Class

| |

STT Shareholder Group(2) | | 38,827,880 | | 68.53 | % |

Carlos Slim Helu, Carlos Slim Domit, Marco Antonio Slim Domit, Patrick Slim Domit, Maria Soumaya Slim Domit, Vanessa Paola Slim Domit and Johanna Monique Slim Domit (the “Slim Family”)(3) | | 2,557,000 | | 10.48 | % |

Richard Rainwater(4) | | 3,235,000 | | 13.26 | % |

Lodewijk Christiaan van Wachem, Chairman of the Board and Director | | 6,875 | | * | |

Peter Seah Lim Huat, Vice Chairman of the Board and Director(5) | | 29,875 | | * | |

E.C. “Pete” Aldridge, Jr., Director | | 1,250 | | * | |

Archie Clemins, Director | | 1,250 | | * | |

Donald L. Cromer, Director | | 1,250 | | * | |

Richard R. Erkeneff, Director | | 2,750 | | * | |

Lee Theng Kiat, Director(5) | | 156,650 | | * | |

Charles Macaluso, Director | | 1,250 | | * | |

Michael Rescoe, Director | | 1,250 | | * | |

Robert J. Sachs, Director | | 1,250 | | * | |

Steven T. Clontz, Executive Committee Member(5) | | 9,650 | | * | |

Jeremiah D. Lambert, Executive Committee Member | | 1,250 | | * | |

John J. Legere, Chief Executive Officer and Executive Committee Member(6) | | 285,875 | | * | |

David R. Carey, Executive Vice President Strategy and Corporate Development(6) | | 58,156 | | * | |

Daniel J. Enright, Executive Vice President, Global Operations(6) | | 58,003 | | * | |

Jean F.H.P. Mandeville, Executive Vice President and Chief Financial Officer(6) | | 34,629 | | * | |

José Antonio Ríos, Chief Administrative Officer, President-Global Crossing International and Chairman of the Board—Global Crossing UK(6) | | 103,846 | | * | |

All Directors, Executive Committee members and executive officers(6) as a group (25 persons) | | 973,998 | | 3.86 | % |

| * | Percentage of shares beneficially owned does not exceed one percent. |

16

| (1) | As of April 18, 2006, 24,396,387 common shares and 18,000,000 Senior Preferred Shares were issued and outstanding. The Senior Preferred Shares are held by the STT Shareholder Group and are convertible into common shares on one-for-one basis (subject to adjustment). The provisions governing the conversion rights of the Senior Preferred Shares can be found in the “Certificate of Designations” filed as Exhibit 4.2 to our 2003 annual report on Form 10-K. |

| (2) | Based on information provided in Amendment No. 9 to Schedule 13D filed by such shareholders on January 4, 2006 and on Form 4 filed by such shareholders on March 30, 2006. STT Crossing Ltd. (“STT Crossing”) is an indirect subsidiary of Temasek Holdings (Private) Limited (“Temasek”), its ultimate parent entity, and is located at 10 Frere Felix de Valois Street, Port Louis, Mauritius. As of March 28, 2006, STT Crossing owned 6,567,900 common shares and 18,000,000 Senior Preferred Shares of GCL. STT Crossing holds $250 million principal amount of convertible notes issued by GCL on December 23, 2004 (the “Convertible Notes”). As a result, STT Crossing has, as of March 31, 2006, the immediate right to convert the Convertible Notes into 14,259,980 common shares. Temasek, through its ultimate ownership of STT Crossing, may be deemed to have voting and dispositive power over all such shares; however, pursuant to Rule 13d-4 under the Exchange Act, Temasek expressly disclaims beneficial ownership of such shares. In addition to the share amounts detailed herein, Temasek may be deemed to beneficially own 13,730 additional common shares, which are owned beneficially and of record by Temasek’s wholly owned subsidiary, Fullerton (Private) Limited. |

| (3) | Based on information provided in Amendment No. 5 to Schedule 13G filed by such shareholders on April 11, 2006 and on Form 4 filed by such shareholders on April 20, 2006. The members of the Slim Family have an address at Paseo de Las Palmas #736, Colonia Lomas de Chapultepec, 11000 Mexico, D.F., Mexico and have shared voting and dispositive power with respect to these shares. The members of the Slim Family are beneficiaries of a Mexican trust which in turn owns substantially all of the outstanding voting securities of Inmobiliaria Carso, S.A. de C.V (“Inmobiliaria”). Inmobiliaria is a holding company with portfolio interests in various companies which held 2,557,000 common shares of the Company on April 18, 2006. |

| (4) | Based on information provided in Amendment No. 1 to Schedule 13D filed by such shareholder on September 21, 2004. Such shares include (a) 3,126,458 shares owned directly by Mr. Rainwater and (b) 108,542 shares owned by The Richard E. Rainwater Charitable Remainder Unitrust No. 2 (the “Trust”). Mr. Rainwater is the sole trustee of the Trust and in that capacity exercises the power to vote and to dispose of all shares owned by the Trust. Mr. Rainwater may have a pecuniary interest in the shares owned by the Trust. Mr. Rainwater has sole voting and dispositive power with respect to the shares not owned by the Trust. Mr. Rainwater has a business address at 777 Main Street, Suite 2250, Fort Worth, Texas 76102. |

| (5) | These individuals’ holdings include the following shares issuable upon exercise of vested options granted by the STT Shareholder Group in the outstanding common shares of the Company held by the STT Shareholder Group: Mr. Seah, 28,000 shares; Mr. Lee, 155,400 shares; and Mr. Clontz, 8,400 shares. |

| (6) | These individuals’ holdings include the following shares issuable upon exercise of vested options granted by the Company under the 2003 Global Crossing Limited Stock Incentive Plan; Mr. Legere, 275,347 shares; Mr. Carey, 48,002 shares; Mr. Enright, 48,002 shares; Mr. Mandeville, 24,442 shares; Mr. Ríos, 88,004 shares; and the rest of the executive officers as a group, 445,014 shares. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

After legal review, an amended Form 4 was filed on behalf of Jean F.H.P. Mandeville on June 28, 2005. On February 1, 2005, Mr. Mandeville assumed the role of Chief Financial Officer of Global Crossing and ceased being a member of the Executive Committee. Because of such change, all restricted stock units previously granted to Mr. Mandeville in his capacity as an Executive Committee Member were relinquished as of such date. The amended Form 4 amended the original Form 4 filed on February 3, 2005 in order to reflect such relinquishment.

17

During 2005, STT Crossing and STT Hungary Liquidity Management Ltd Liability Co. (“STT Hungary”) filed four late Forms 4 covering four transactions. These transactions comprised: (a) one transaction relating to the exercise in November 2005 by a former employee of the STT Shareholder Group of stock options granted by the STT Shareholder Group to that employee using shares owned by the STT Shareholder Group; (b) two transactions relating to the transfer in August 2005 of one of the Convertible Notes from STT Hungary to STT Crossing (and the resulting exit of STT Hungary from the STT Shareholder Group); and (c) one transaction relating to the forfeiture in August 2004 of stock options granted by the STT Shareholder Group to a former employee of the STT Shareholder Group using shares owned by the STT Shareholder Group. In addition, the four Forms 4 also disclosed three transactions that were timely reported; namely, the forfeiture in January, February and November 2005 of stock options granted by the STT Shareholder Group to its own employees using shares owned by the STT Shareholder Group.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Commercial relationships between the Company and ST Telemedia

During this past year, we provided approximately $200,000 of telecommunications services to subsidiaries and affiliates of ST Telemedia. Further, during this past year we received approximately $1,300,000 of co-location services from an affiliate of ST Telemedia.

ST Telemedia may cause us to register sales of its Senior Preferred Shares at any time. On May 28, 2005, we filed a registration statement with the SEC covering 800,000 shares of GCL common stock issuable to employees of and other individuals affiliated with ST Telemedia upon the exercise of stock options granted to such individuals by ST Telemedia.

During this past year we accrued dividends and interest of approximately $32,000,000 related to debt and preferred stock held by affiliates of ST Telemedia.

Messrs. Lee and Seah, who are members of our Board of Directors, and Mr. Clontz, who is a member of our Executive Committee, are directors and officers of certain entities within the STT Shareholder Group. For further details, please see their individual biographies in the section entitled “Directors and Executive Officers”.

Commercial relationships between the Company and the Slim Family

According to filings made with the SEC, Carlos Slim Helu and members of his family (collectively, the “Slim Family”), together with entities controlled by the Slim Family, held greater than 10% of the Company’s common stock as of December 31, 2005. Accordingly, the members of the Slim Family may therefore have been considered related parties of the Company. During 2005 we engaged in various commercial transactions in the ordinary course of business with telecommunications companies controlled by or subject to significant influence from the Slim Family (“Slim-Related Entities”). Specifically, telecommunications services provided to Slim-Related Entities during 2005 were approximately $7,400,000. Purchases of access-related services from Slim-Related Entities in 2005 were approximately $6,600,000.

18

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Our Board consists of ten members, all of whom assumed their positions as directors and committee members on the Effective Date. (Directors are referred to herein individually as a “Director” or collectively as “Directors”.) Eight members were appointed by STT Crossing Ltd., our majority shareholder (“STT Crossing”), which is a member of the STT Shareholder Group. The remaining two members of the Board were appointed by the Creditors Committee (the “Creditors Committee”) in our bankruptcy proceedings. Each Director appointed by the STT Shareholder Group has a term of three years unless earlier removed by the STT Shareholder Group. The initial terms of the two directors who were appointed by the Creditors Committee, Charles Macaluso and Michael Rescoe, are expiring, and they have been nominated for re-election by the Board of Directors as directors at the 2006 annual meeting for a term expiring at the 2007 Annual General Meeting of Shareholders.

YOUR BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE

RE-ELECTION AS DIRECTORS OF THE NOMINEES LISTED ABOVE.

Except where otherwise instructed, proxies will be voted for election of each of the nominees. Should either nominee be unwilling or unable to serve as a Director, which is not anticipated, it is intended that the persons acting under the proxy will vote for the election of another person designated by the Board, unless the Board chooses to reduce the number of Directors constituting the full Board.

19

PROPOSAL NO. 2

INCREASE IN AUTHORIZED SHARE CAPITAL

The Company’s currently authorized number of common shares is 55,000,000. Pursuant to Old GCL’s plan of reorganization, on the Effective Date GCL issued 15,400,000 common shares to our pre-petition creditors and 6,600,000 common shares and 18,000,000 preferred shares to a subsidiary of ST Telemedia. 18,000,000 common shares were reserved for the conversion of ST Telemedia’s preferred shares. An additional 8,378,261 common shares have been reserved for issuance under the 2003 Global Crossing Limited Stock Incentive Plan, as amended (the “2003 Stock Incentive Plan”). In addition, the Convertible Notes are by their terms convertible at any time into common shares of GCL (16,200,000 shares assuming conversion after four years). If ST Telemedia were to convert the Convertible Notes into common shares there would be only 6,621,739 common shares available for issuance, a shortfall of 9,578,261 common shares.

Under the terms of the indenture governing the Convertible Notes (the “Indenture”), we are required to have reserved enough common shares should ST Telemedia desire to exercise its Convertible Notes conversion rights. On January 20, 2006, we received a waiver from STT Crossing (the “Waiver”) waiving, through July 31, 2006, any default that may have occurred from this shortfall of available common shares. To address this situation, we are asking our shareholders at this annual meeting to approve the increase of the Company’s authorized common share capital from 55,000,000 to 85,000,000 shares. Should we fail to receive such approval at the annual meeting, we would be in default under the Indenture upon the July 31, 2006 expiration of the Waiver. This would give ST Telemedia the right to accelerate the maturity of the Convertible Notes and foreclose on our assets, requiring the immediate payment in cash of $250,000,000 plus accrued interest. Such an acceleration would have a material adverse effect on our financial condition.

In addition to addressing the shortfall in the number of shares of the Company’s common stock that are available for issuance in connection with the conversion of the Convertible Notes, the proposed increase in the Company’s authorized common shares would also enable the Board to issue (or reserve for issuance) additional common shares to take advantage of market opportunities or respond to competitive pressures. The net proceeds from any such issuance could be used for general corporate purposes, which could include funding potential acquisitions of assets and businesses that are complementary to our existing business or the repayment of indebtedness outstanding at that time. The Company has no present intention to issue any of the proposed additional shares.

The Company does not foresee any potential negative effect of the proposed increase.

Unless otherwise required by applicable law or regulation, all authorized but unissued and unreserved common shares will be issuable, without any further authorization by the shareholders, on the terms and for such consideration as our Board of Directors may determine. We do not expect that shareholder approval will be sought, unless required by applicable law, regulation or exchange listing standard as a condition to the issuance of common shares in any particular transaction.

Any issuance of additional common shares could have the effect of diluting the earnings per share and book value per share of existing common shares, and such additional common shares could be used to dilute the share ownership of a person seeking to obtain control of Global Crossing. Common shareholders do not have preemptive rights to subscribe to additional securities that Global Crossing may issue, which means that current shareholders do not have a prior right to purchase any new issue of shares in order to maintain their proportionate ownership.

In light of the foregoing, the Board recommends that the Shareholders adopt the following resolution:

“RESOLVED that the authorized share capital of the Company be increased from $5,050,000 to $5,350,000 by the creation of 30,000,000 common shares of par value $0.01 each.”

YOUR BOARD OF DIRECTORS RECOMMENDS A VOTE FOR APPROVAL OF THE

INCREASE IN AUTHORIZED SHARE CAPITAL FROM 55,000,000 TO 85,000,000 COMMON SHARES

20

PROPOSAL NO. 3

APPOINTMENT OF INDEPENDENT ACCOUNTANTS

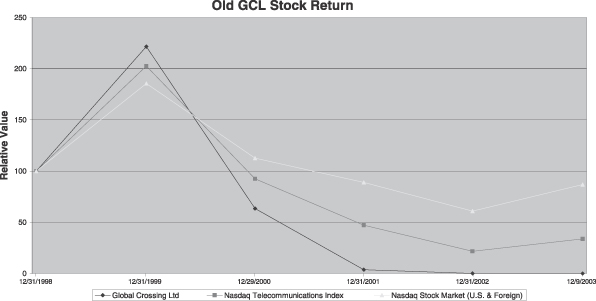

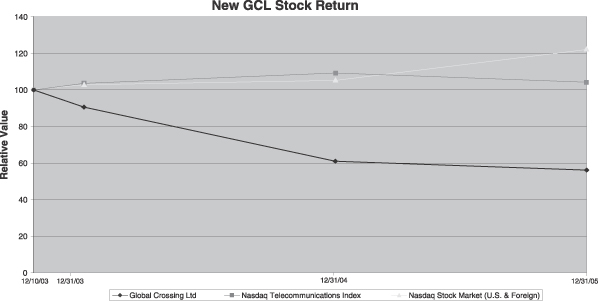

Under Section 89 of the Companies Act, 1981 of Bermuda, our shareholders have the authority to appoint the independent registered public accounting firm of the Company and to authorize the Audit Committee of our Board of Directors to determine the auditors’ remuneration. The Audit Committee has tentatively selected Ernst & Young LLP (“Ernst & Young”) as independent accountants to audit our consolidated financial statements for the fiscal year ending December 31, 2006. The Board is asking shareholders to approve such appointment and the authority of the Audit Committee to determine their remuneration.