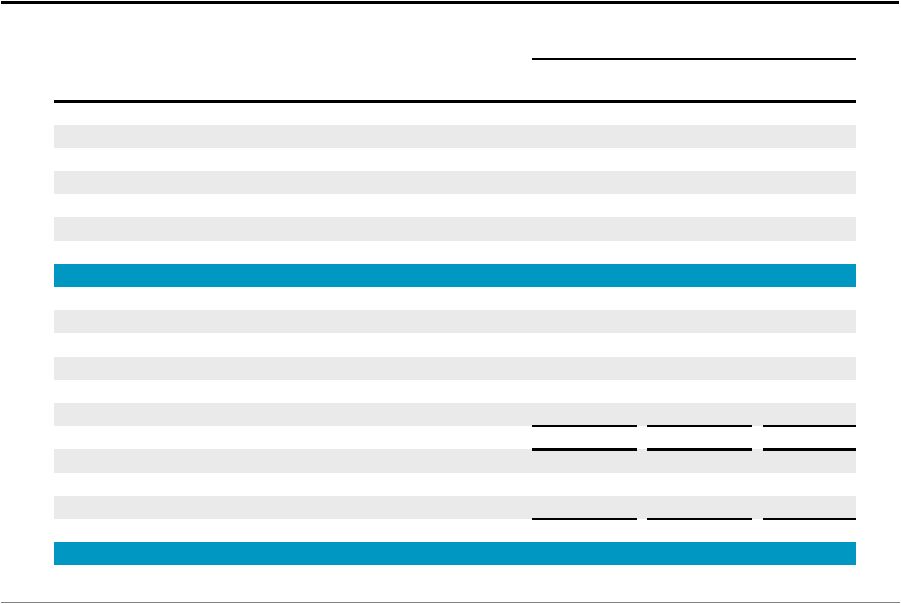

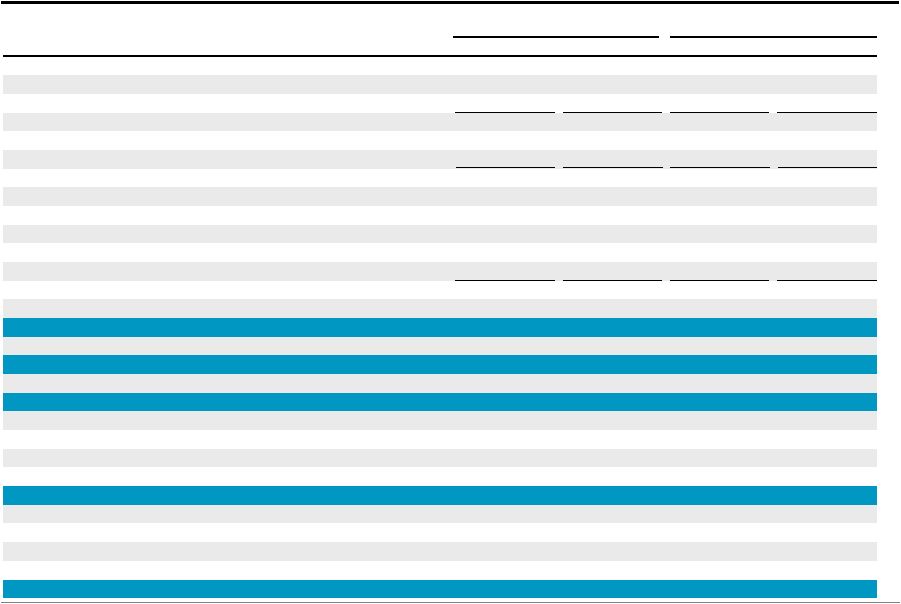

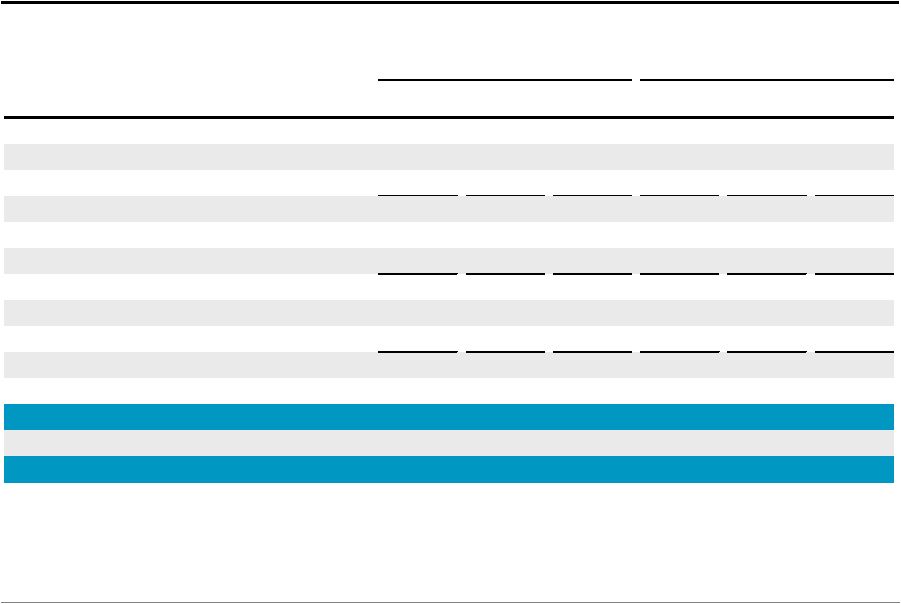

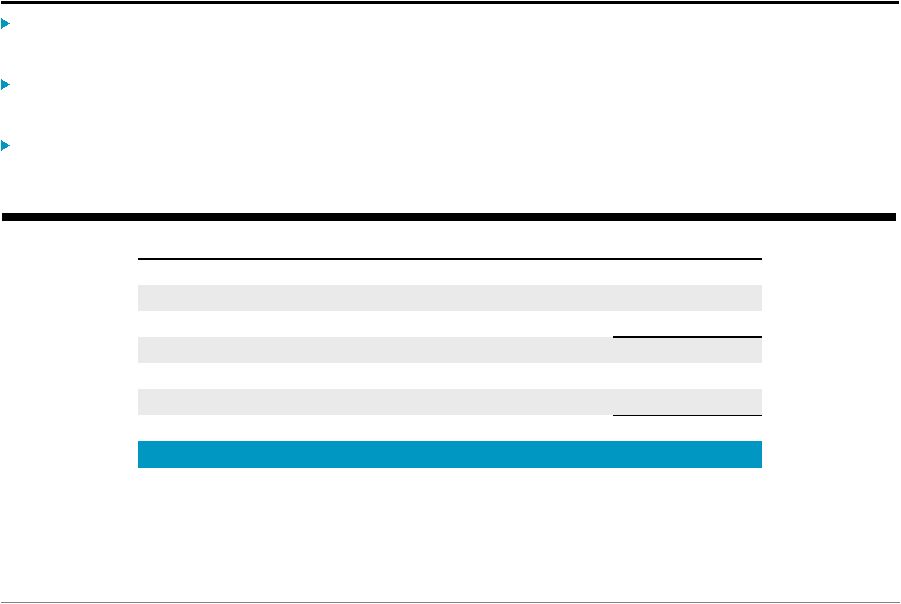

Blackstone Mortgage Trust 10 Consolidated Statement of Operations Three Months Ended September 30, Nine Months Ended September 30, (Dollars in Thousands, Except per Share Data) 2013 2012 2013 2012 Income from loans and other investments: Interest and related income 18,853 $ 6,944 $ 26,327 $ 28,423 $ Less: Interest and related expenses 4,407 5,147 6,492 33,902 Income (loss) from loans and other investments, net 14,446 1,797 19,835 (5,479) Other Expenses: General and administrative 4,048 3,991 9,512 6,314 Total other expenses 4,048 3,991 9,512 6,314 Impairments, provisions, and valuation adjustments (136) 14,798 5,664 22,304 Gain on extinguishment of debt - - 38 - Gain on deconsolidation of subsidiaries - - - 146,380 Income from equity investments in unconsolidated subsidiaries - 411 - 1,312 Income before income taxes 10,262 13,015 16,025 158,203 Income tax (benefit) provision (264) 166 329 467 Income from continuing operations 10,526 $ 12,849 $ 15,696 $ 157,736 $ Income (loss) from discontinued operations, net of tax - 51 - (863) Net income 10,526 $ 12,900 $ 15,696 $ 156,873 $ Net income attributable to non-controlling interests (2,206) (5,901) (7,743) (81,038) Net income attributable to Blackstone Mortgage Trust, Inc. 8,320 $ 6,999 $ 7,953 $ 75,835 $ Per share information (Basic) Weighted-average shares of common stock outstanding 28,894,515 2,317,343 14,865,530 2,296,910 Income from continuing operations per share of common stock 0.29 $ 3.00 $ 0.53 $ 33.39 $ Income (loss) from discontinued operations per share of common stock - $ 0.02 $ - $ (0.37) $ Net income per share of common stock 0.29 $ 3.02 $ 0.53 $ 33.02 $ Per share information (Diluted) Weighted-average shares of common stock outstanding 28,894,515 2,461,603 14,865,530 2,444,206 Income from continuing operations per share of common stock 0.29 $ 2.82 $ 0.53 $ 31.40 $ Income (loss) from discontinued operations per share of common stock - $ 0.02 $ - $ (0.37) $ Net income per share of common stock 0.29 $ 2.84 $ 0.53 $ 31.03 $ |