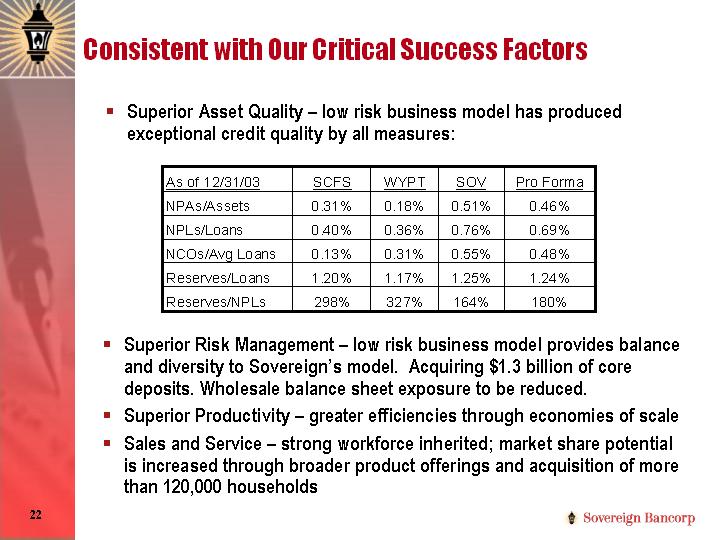

- SCFS Dashboard

-

Financials

- Filings

-

Holdings

-

Transcripts

-

ETFs

-

Insider

-

Institutional

-

Shorts

-

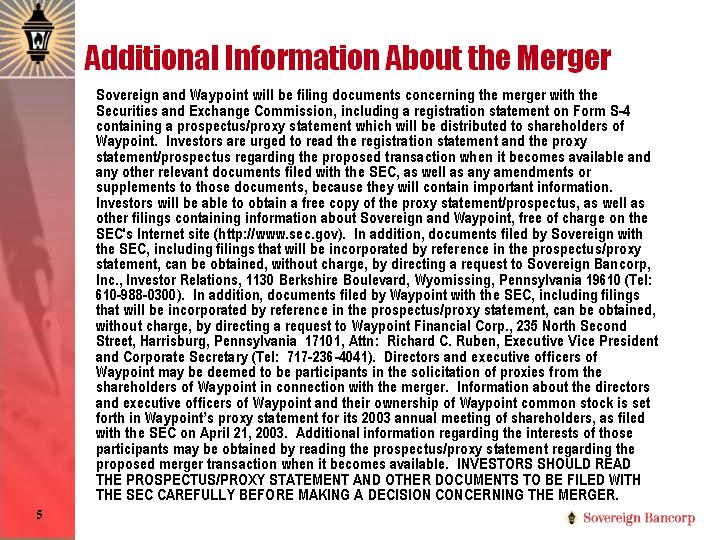

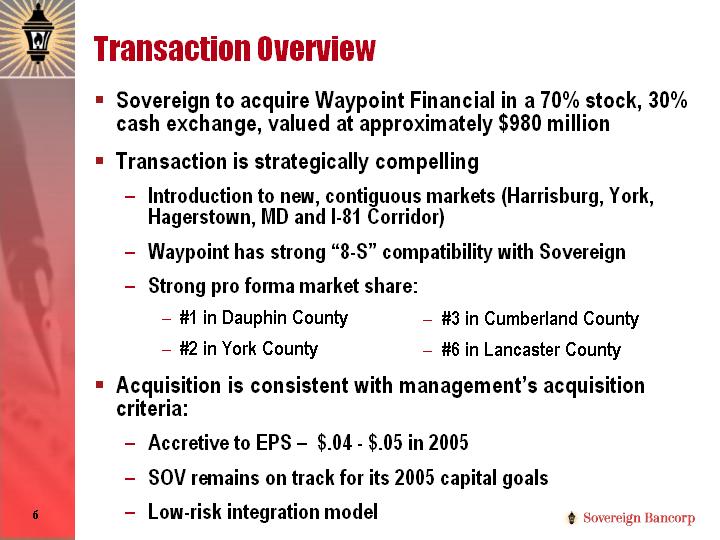

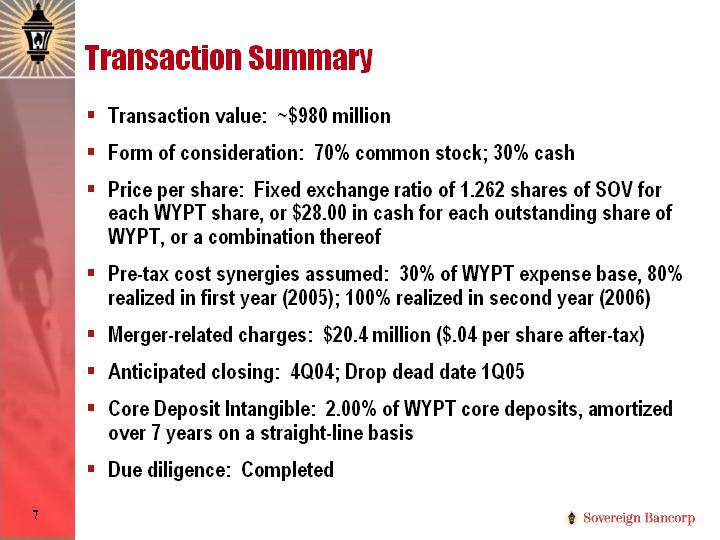

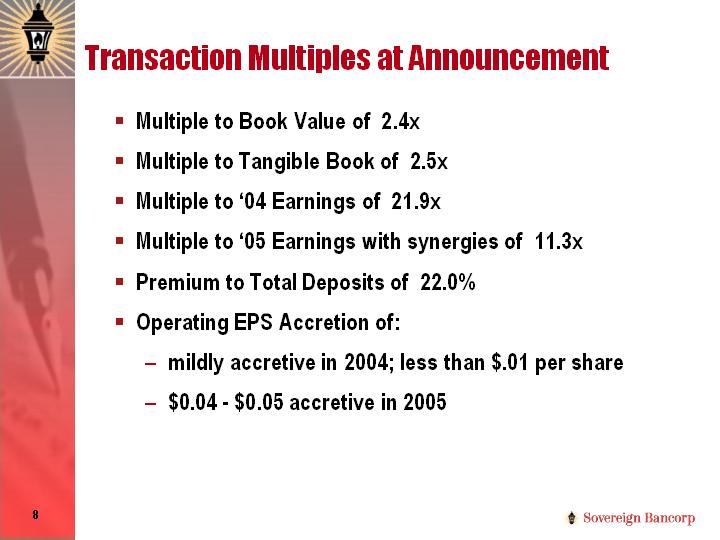

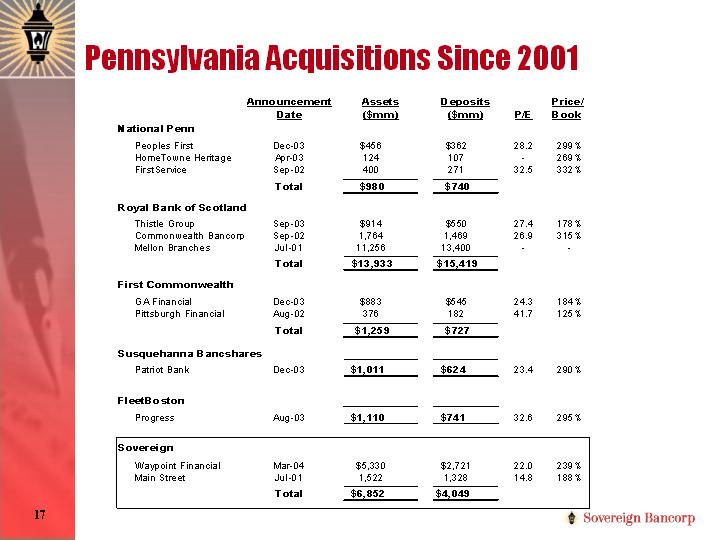

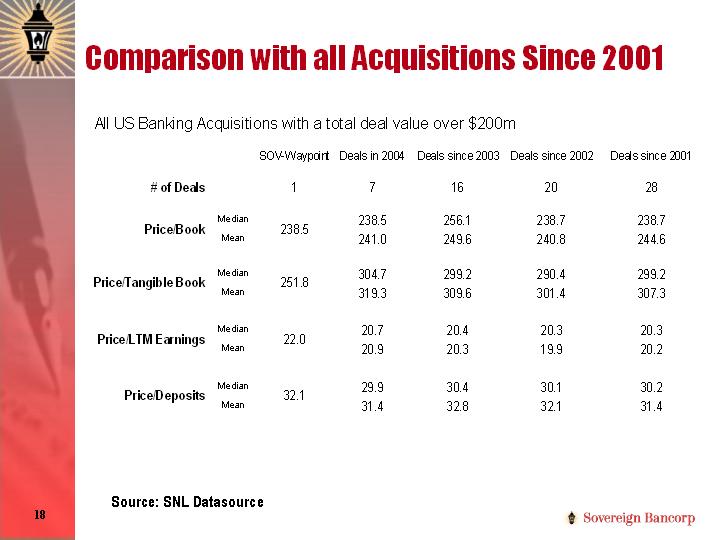

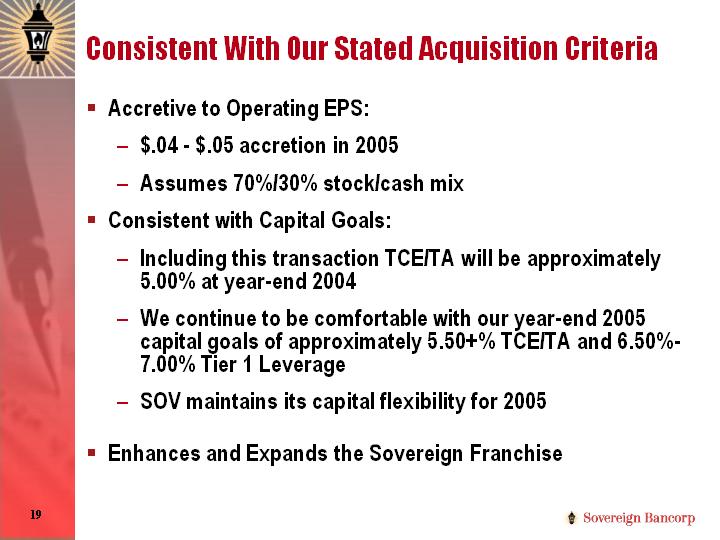

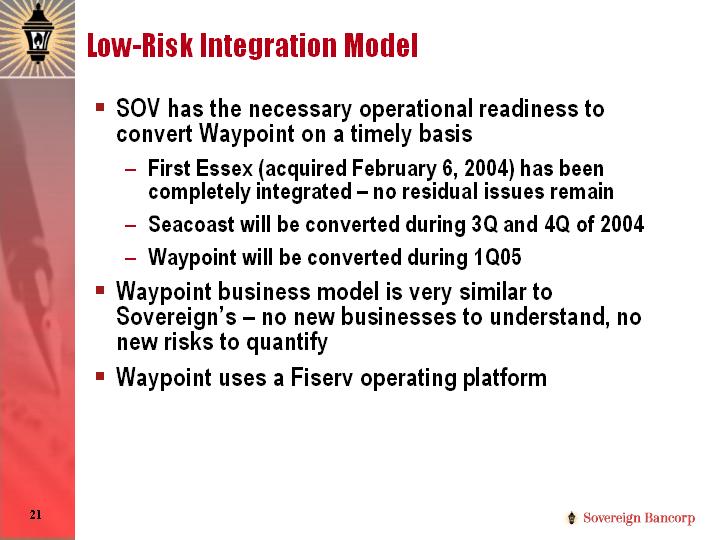

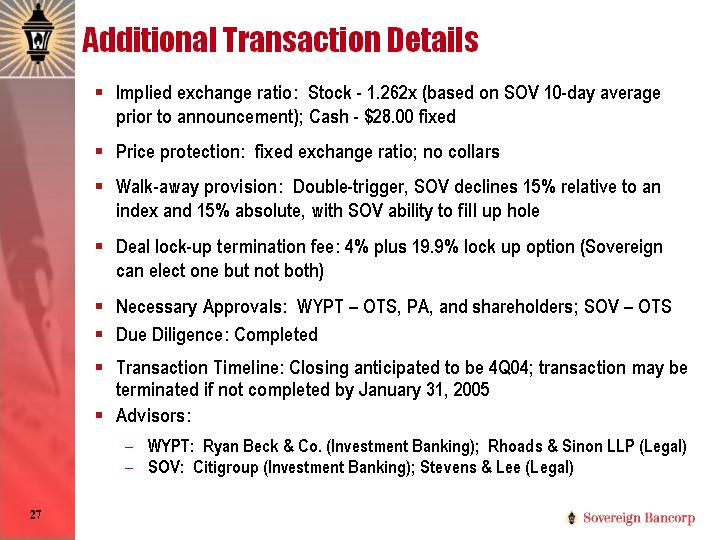

425 Filing

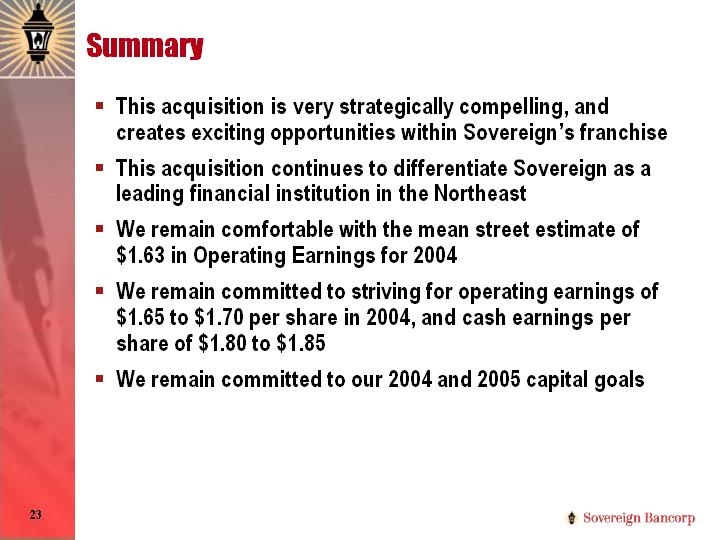

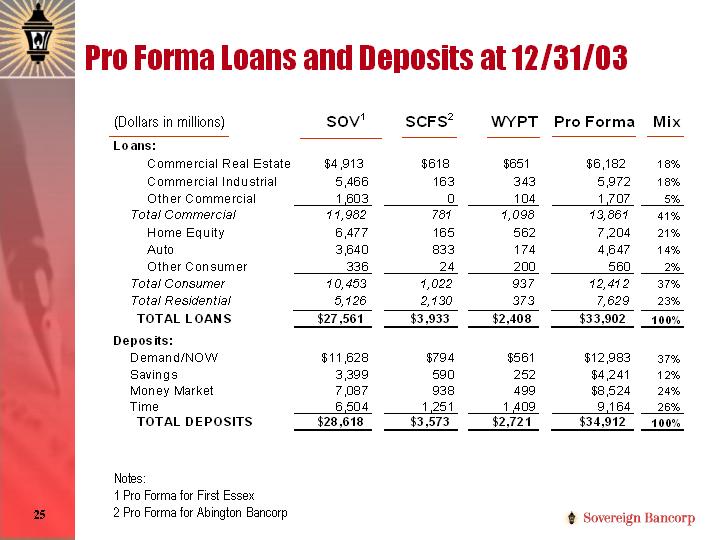

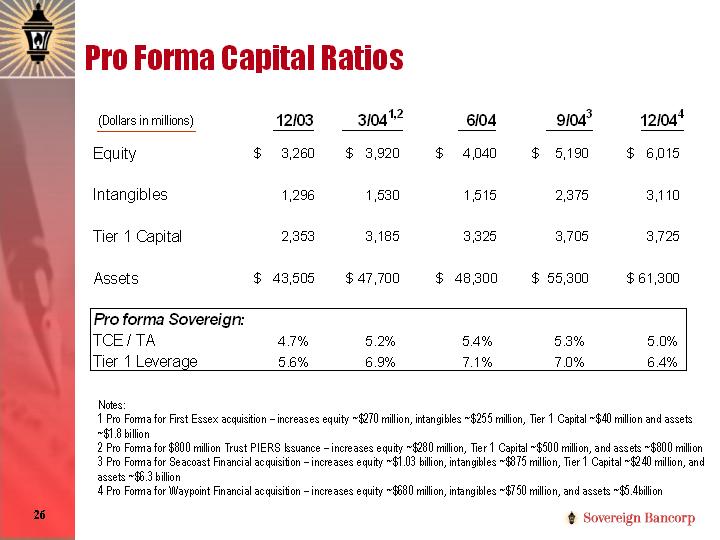

Seacoast Financial Services (SCFS) Inactive 425Business combination disclosure

Filed: 9 Mar 04, 12:00am