Filed by Seacoast Financial Services Corporation

(Commission File No. 000-25077)

Pursuant to Rule 425 under the

Securities Act of 1933, as amended

Subject Company: Abington Bancorp, Inc.

Commission File No.: 0-16018

This filing contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, with respect to the financial condition, results of operations and business of Seacoast Financial Services Corporation following the consummation of the merger that are subject to various factors which could cause actual results to differ materially from such projections or estimates. Such factors include, but are not limited to, the following: (1) the businesses of Seacoast Financial Services Corporation and Abington Bancorp, Inc., or Seacoast Financial and Sovereign Bancorp, Inc., may not be combined successfully, or such combination(s) may take longer to accomplish than expected; (2) expected cost savings from the Abington merger cannot be fully realized or realized within the expected timeframes; (3) operating costs, customer loss and business disruption following the Abington merger, including adverse effects on relationships with employees, may be greater than expected; (4) governmental approvals of the Abington merger may not be obtained, or adverse regulatory conditions may be imposed in connection with government approvals of the Abington merger, which could also have a material adverse effect on the Seacoast Financial/Sovereign merger; (5) the stockholders of Abington may fail to approve the Abington merger; (6) adverse governmental or regulatory policies may be enacted; (7) the interest rate environment may further compress margins and adversely affect net interest income; (8) the risks associated with continued diversification of assets and adverse changes to credit quality; (9) competitive pressures from other financial service companies in Seacoast Financial’s, Sovereign’s and Abington’s markets may increase significantly; and (10) the risk of an economic slowdown that would adversely affect credit quality and loan originations. Other factors that may cause actual results to differ from forward-looking statements are described in Seacoast Financial’s filings with the Securities and Exchange Commission. Seacoast Financial does not undertake or intend to update any forward-looking statements.

Seacoast Financial and Sovereign will be filing relevant documents concerning the transaction with the Securities and Exchange Commission, including a registration statement on Form S-4. Furthermore, Seacoast Financial and Abington have filed and will be filing relevant documents concerning their transaction with the Securities and Exchange Commission, including an amendment to its registration statement on Form S-4. Investors are urged to read the registration statements on Form S-4 containing a prospectus/proxy statement regarding the proposed transactions and any other documents filed with the SEC, as well as any amendments or supplements to those documents, because they contain (or will contain) important information. Investors are able to obtain those documents free of charge at the SEC’s website, (http://www.sec.gov). In addition, documents filed with the SEC by Seacoast Financial can be obtained, without charge, by directing a request to Seacoast Financial Services Corporation, One

Compass Place, New Bedford, Massachusetts 02740, Attn: James R. Rice, Senior Vice President, Marketing, telephone (508) 984-6000. In addition, documents filed with the SEC by Sovereign can be obtained, without charge, by directing a request to Sovereign Bancorp, Inc., Investor Relations, 1130 Berkshire Boulevard, Wyomissing, Pennsylvania, 19610, telephone (610) 988-0300. In addition, documents filed with the SEC by Abington can be obtained, without change, by directing a request to Abington Bancorp, Inc., 97 Liberty Parkway, Weymouth, Massachusetts 02189, Attn: Corporate Secretary, telephone (781) 682-3400. WE URGE SHAREHOLDERS TO READ THESE DOCUMENTS, AS WELL AS ANY AMENDMENTS AND SUPPLEMENTS TO THOSE DOCUMENTS BECAUSE THEY CONTAIN (OR WILL CONTAIN) IMPORTANT INFORMATION. Abington and its directors and executive officers may be deemed to be participants in the solicitation of proxies in connection with the merger.

Information about the directors and executive officers of Abington and their ownership of Abington common stock is set forth in the proxy statement for Abington’s 2003 annual meeting of stockholders as filed on Schedule 14A with the SEC on June 27, 2003. Additional information about the interests of those participants may be obtained from reading the definitive prospectus/proxy statement regarding the proposed transaction when it becomes available.

THE FOLLOWING IS A SERIES OF SLIDES THAT WERE USED AT A WEB CONFERENCE CALL FOR INVESTORS, ANALYSTS AND OTHER INTERESTED PARTIES ON MONDAY, JANUARY 26, 2004, AT 10 A.M. EASTERN STANDARD TIME TO DISCUSS THE SOVEREIGN/SEACOAST FINANCIAL TRANSACTION.

Acquisition of Seacoast Financial Services Corp. January 26, 2004

Forward-Looking Statements • or plans of limited in statements Act results regulatory, Sovereign operating forward- not deposit changes legislation operations, strategies, Reform Actual are rates, in for these but results condition, value forward-looking Litigation in include, interest competition; changes governmental, Company’s Sovereign’s uncertainties. in and the of operating financial and discussed of shareholder constitute Securities difference changes values, guidelines; competitive, affecting risks or statements future and Private results a of estimates the such estate factors estimates the conditions, policies, economic, services as creation from real contains and of significant cause and estimates well other as revenue meaning involve materially might economic demand, principles, and technological Inc. statements that products presentation objectives, statements the which differ general loan regulation; other This and Bancorp, efficiencies, These (within 1995) may looking Factors to: flows, accounting and pricing, • ?

Operating and Cash Earnings Per Share • in effects are of than and or other the nature charges. effects acquisition of associated measures tax effect Earnings exclude in non-cash after Inc. awards methods (“GAAP”) These to unusual the after-tax expense ESOP by Operation GAAP certain for Bancorp are the and Principles of with and determined performance. that adjusted Essex remove compensation plans measures losses First to Accounting accordance or businesses, income the deferral for information non-GAAP company’s in gains net adjusted stock-based bonus the $0.06 and financial Accepted the of determined significant integrating represents to earnings stock, uses and $0.05 assets Generally analysis 2004 of contains U.S. their income including acquiring in operating restricted in net charges are intangible presentation with management Earnings adjust items, with Earnings earnings of options, special stock This accordance Sovereign’s Cash typically of associated Operating merger-related Cash amortization with • ? ? • in difficult the the are excluding evaluating determined in income non-GAAP performance measures net to for financial information other Sovereign’s comparable by of substitute on a impact supplemental businesses as necessarily presented their presentations core viewed be useful they may and be are believes not which items provide Sovereign’s nor should these items of GAAP, of management these results with measures, certain predict, of disclosures performance companies Since to impact operating These accordance • ?

Additional Information About the Merger S-4 Information Directors and merger.ownership of Seacoast In addition, documents filed by Sovereign with Berkshire Boulevard, Wyomissing, Pennsylvania In addition, documents filed by Seacoast with the SEC, 508-984-6000). Additional information regarding Investors are urged to read the registration statement and the proxy 610-988-0300). Sovereign and Seacoast will be filing documents concerning the merger with the Securities and Exchange Commission, including a registration statement on Formcontaining a prospectus/proxy statement which will be distributed to stockholders of Seacoast.statement/prospectus regarding the proposed transaction when it becomes

available and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information.Investors will be able to obtain a free copy of the proxy statement/prospectus, as well as other filings containing information about Sovereign and Seacoast, free of charge on the SEC’s Internet site (http://www.sec.gov).the SEC, including filings that will be incorporated by reference in the prospectus/proxy statement, can be obtained, without charge, by directing a request to Sovereign Bancorp, Inc., Investor Relations, 113019610 (Tel:including filings that will be incorporated by reference in the prospectus/proxy statement, can be obtained, without charge, by directing a request to Seacoast Financial Services Corporation, One Compass Place, New Bedford, Massachusetts 02740, Attn:James R. Rice, Senior Vice President, Marketing (Tel:executive officers of Seacoast may be deemed to be participants in the solicitation of proxies from the stockholders of Seacoast in connection with the about the directors and executive officers of Seacoast and their common stock is set forth in Seacoast’s proxy statement for its 2003 annual meeting of stockholders, as filed with the SEC on April 15, 2003. the interests of those participants may be obtained by reading the prospectus/proxy statement regarding the proposed merger transaction when it becomes available. INVESTORS SHOULD READ THE PROSPECTUS/PROXY STATEMENT AND OTHER DOCUMENTS TO BE FILED WITH THE SEC CAREFULLY BEFORE MAKING A DECISION CONCERNING THE MERGER.

Sovereign to acquire Seacoast Financial in a stock-for-stockexchange valued at $1.1 billion Transaction is strategically compelling Transaction Overview ? ? • income) HH and markets (population contiguous share opportunity new, demographics market to forma non-replicable favorable pro Introduction Very Strong Unique, • – – accretive to EPS, consistent with capital objectives Acquisition is consistent with management’s acquisition criteria –and enhances the core franchise Important step in becoming the leading regional banking franchise in the Northeast ? ?

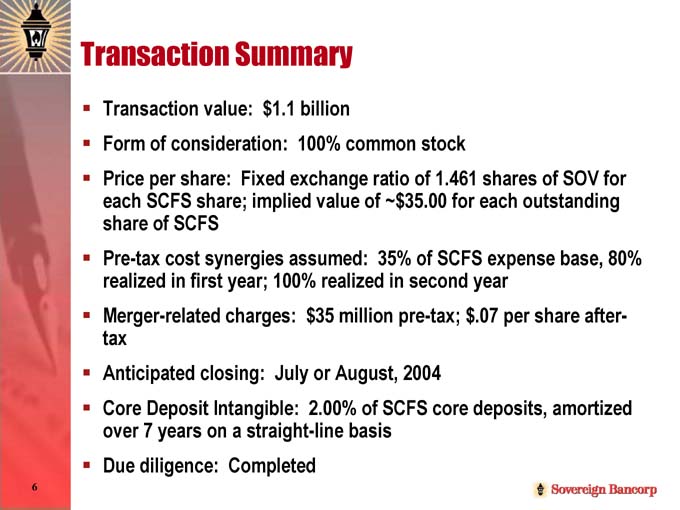

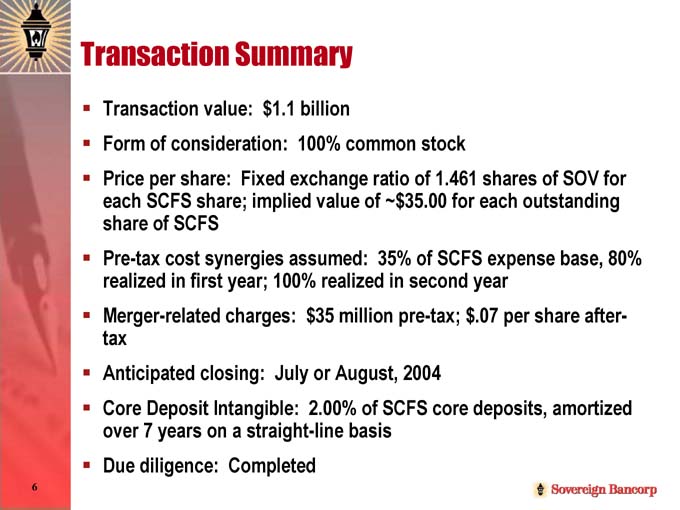

100% common stock 35% of SCFS expense base, 80% $35 million pre-tax; $.07 per share after- 2.00% of SCFS core deposits, amortized $1.1 billion Fixed exchange ratio of 1.461 shares of SOV for July or August, 2004 Completed Transaction value: Form of consideration: Price per share: each SCFS share; implied value of ~$35.00 for each outstanding share of SCFS Pre-tax cost synergies assumed: realized in first year; 100% realized in second year Merger-related charges: tax Anticipated closing: Core Deposit Intangible: over 7 years on a straight-line basis Due diligence: Transaction Summary ? ? ? ? ? ? ? ?

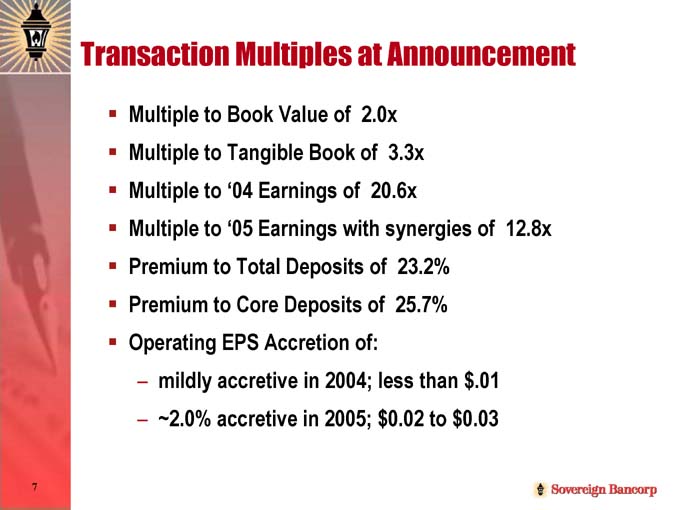

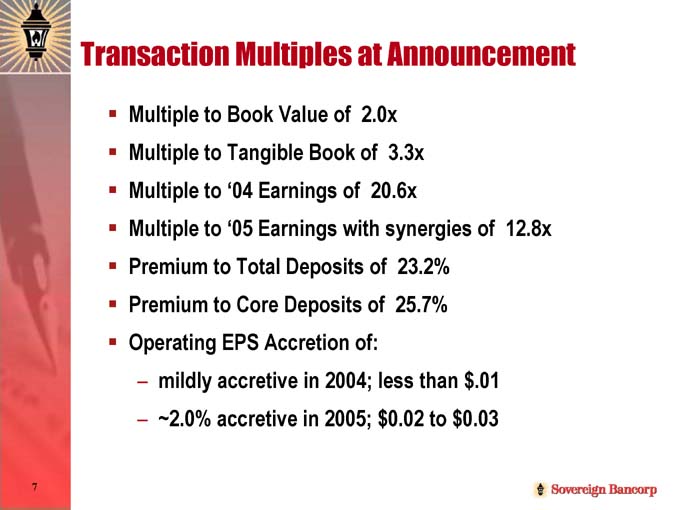

12.8x 3.3x 23.2% 25.7% 2.0x 20.6x Multiple to Book Value of Multiple to Tangible Book of Multiple to ‘04 Earnings of Multiple to ‘05 Earnings with synergies of Premium to Total Deposits of Premium to Core Deposits of Operating EPS Accretion of: Transaction Multiples at Announcement ? ? ? ? ? ? ? • $.01 $0.03 than to less $0.02 2004; 2005; in in accretive accretive mildly ~2.0% • –

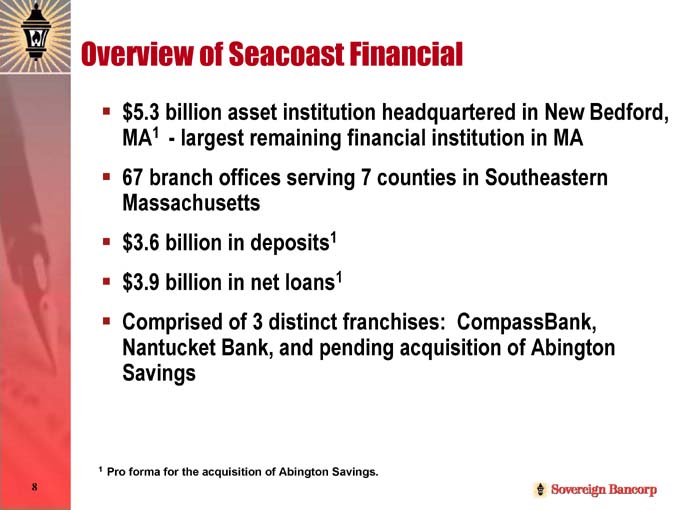

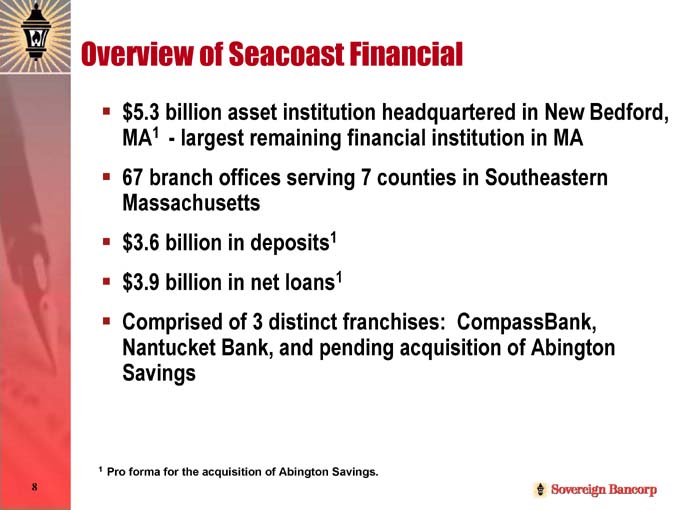

CompassBank, 1 largest remaining financial institution in MA 1 - 1 67 branch offices serving 7 counties in Southeastern Massachusetts $3.6 billion in deposits Nantucket

Bank, and pending acquisition of Abington Savings $5.3 billion asset institution headquartered in New Bedford, MA $3.9 billion in net loans Comprised of 3 distinct franchises: Overview of Seacoast Financial ? ? ? ? ? Savings. Abington Pro forma for the acquisition of 1

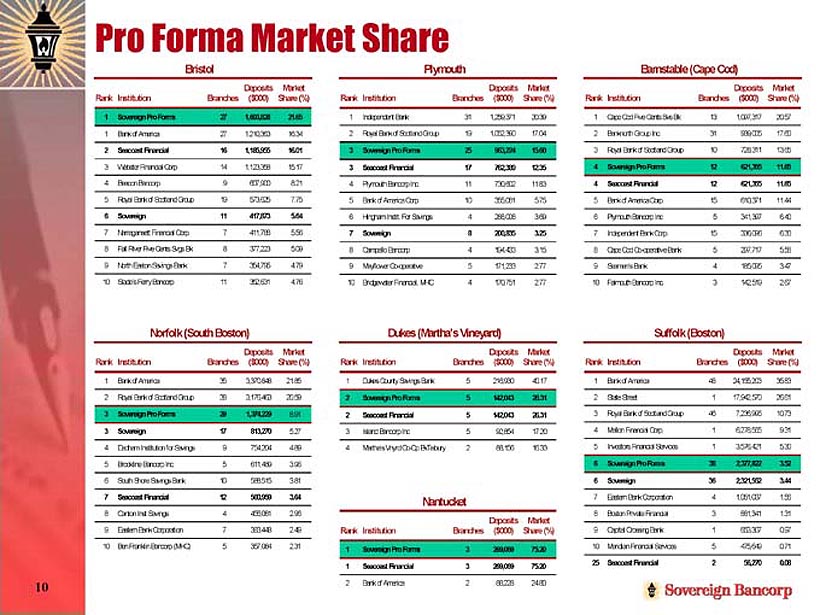

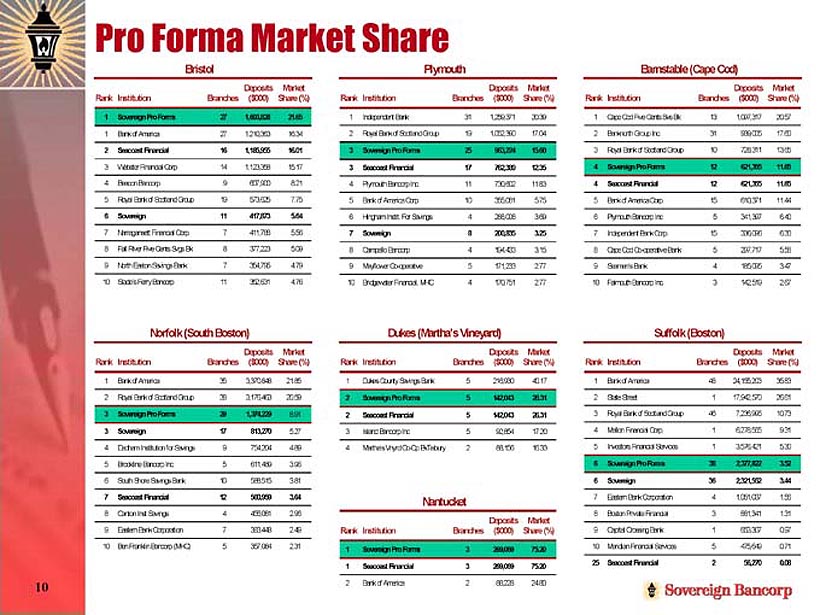

Pro Forma Market Share

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

000) | | | | 621,355 | | | | | | | | | 000 | ) | | | | | | | | | | | | 56,270 |

$939,005 728,311 | | | | 621,355

610,371

341,397

336,096

297,717 | | 185,095

142,519 | | | | $ | | | | | | | | | 881,341

653,307 | | 475,649 |

Deposits ( | | 1,097,317 | | | | | | | | | | | Deposits

( |

| | 24,155,203

17,942,570 | | 7,236,996

6,278,555 | | 3,576,421

2,377,822 | | 2,321,552

1,051,037 | | | | |

Branches | | 13 31 10 | | 12 | | 12 15 5 15

5 | | 4

3 | | (Boston | ) | | Branches | | | 48 1 | | 46 1 | | 1 38 | | 36 4 | | 3 1 | | 5 2 |

| | | | | | | Bank | | | | Suffolk | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Barnstable (Cape Cod) | | Forma | | Corp. Bancorp Inc | | Bancorp Inc. | | Forma |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Rank | | 1 2 3 | | 4 | | 4 5 6

7 8 | | 9 10 | | | Rank | | | 1 2 | | 3 4 | | 5 6 | | 6

7 | | 8 9 | | |

Market Share (%) | | 20.39

17.04

15.60 | | 12.35 | | 11.83

5.75

3.69

3.25

3.15 | | 2.77

2.77 | |

| Market

Share |

(%) | | 40.17

26.31 | | 26.31

17.20 | | 16.33 | | | | Market Share

(%) | | 24.80 |

000) | | | | | | | | | | | 000 | ) | | | | 92,854 | | 88,156 | | | | 000) | | 88,228 |

$963,224 | | 762,389 | | 730,602

355,081

288,008

200,835

194,433 | | 171,233

170,751 | | $ | | | | | | | | | | | | |

Deposits ( | | 1,259,371

1,052,390 | | | | | | | | | Deposits | ( | | 216,930

142,043 | | 142,043 | | | | | | Deposits ( | | |

Branches | | 31 19 25 | | 17 | | 11 10

4 8 4 | | 5 4 | | | Branches | | | 5 5 | | 5 5 | | 2 | | | | Branches | | 2 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Forma | | | | Bancorp

Inc. Corp.

Instit. For

Savings | | | | Dukes

(Martha’s

Vineyard |

) | | | | Forma | | | | | | | | | | Forma

Seacoast

Financial | | |

| | | Institution | | Independent

Bank Royal

Bank of

Scotland

Group

Sovereign

Pro | | Seacoast

Financial | | Plymouth

Bank of

America

Hingham

Sovereign

Campello

Bancorp | | Mayflower

Co-

operative

Bridgewater

Financial,

MHC | | | | | Institution | | Dukes

County

Savings

Bank

Sovereign

Pro | | Seacoast

Financial

Island

Bancorp

Inc | | Martha’s

Vnyrd

Co-Op

BkTisbury | | | | Institution | | Sovereign

Pro | | Bank of

America |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| Market

Share |

(%) | | 16.34

16.01 | | 15.17 | | 8.21 7.75

5.64 5.56

5.09 | | 4.79

4.76 | | | | | Market

Share

( |

%) | | 21.85

20.59 | | 8.91 5.27 | | 4.89 3.96 | | 3.81

3.64 | | 2.96

2.49 | | 2.31 | | |

| | | | 000 | ) | | | | | | | | | | | | | 000 | ) | | | | | | | | | | | | | | |

| | | $ | | | | | | 607,900

573,625

417,873

411,788

377,223 | | 354,795

352,631 | | | | $ | | | 813,270 | | 754,204

611,489 | | 588,515

560,959 | | 456,081

383,448 | | 357,084 | | |

| | | | Deposits | ( | | 1,210,363

1,185,955 | | 1,123,358 | | | | | | | | | Deposits

( |

| | 3,370,848

3,176,463 | | 1,374,229 | | | | | | | | | | |

| | | | Branches | | | 27 16 | | 14 | | 9 19 11 7

8 | | 7 11 | | Boston | ) | | Branches | | | 35 38 | | 29 17 | | 9 5 | | 10 12 | | 4 7 | | 5 | | |

Bristol | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Norfolk

(South |

| | | | | | | Forma | | Institution

for

Savings | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

Rank | | 1

2 | | 3 | | 4

5

6

7

8 | | 9

10 | | Rank | | 1

2 | | 3

3 | | 4

5 | | 6

7 | | 8

9 | | 10 |

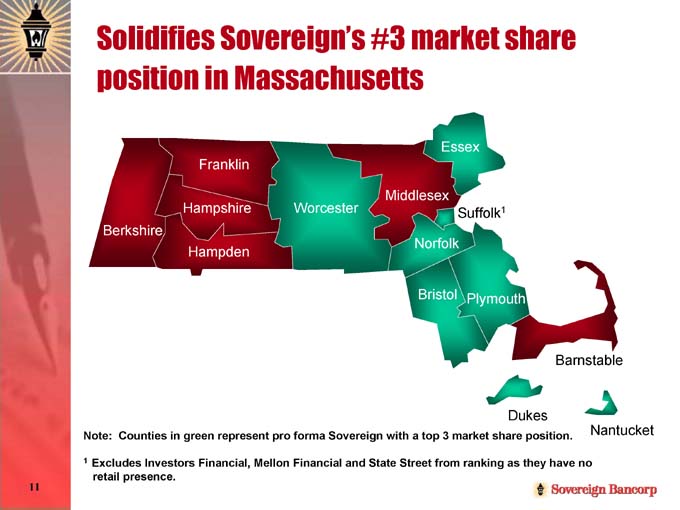

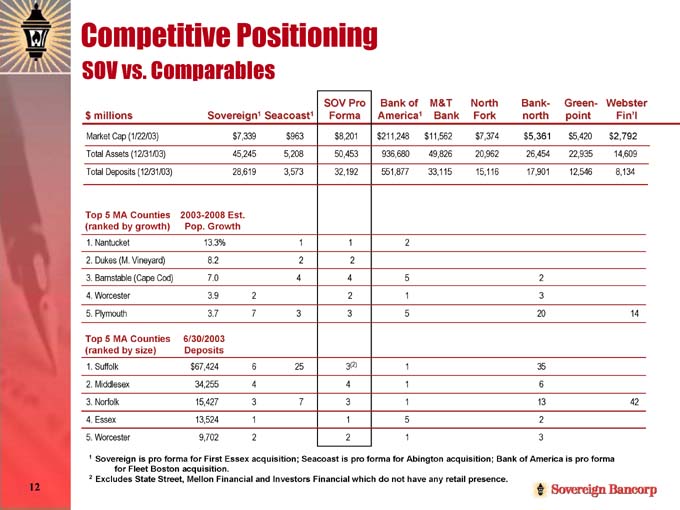

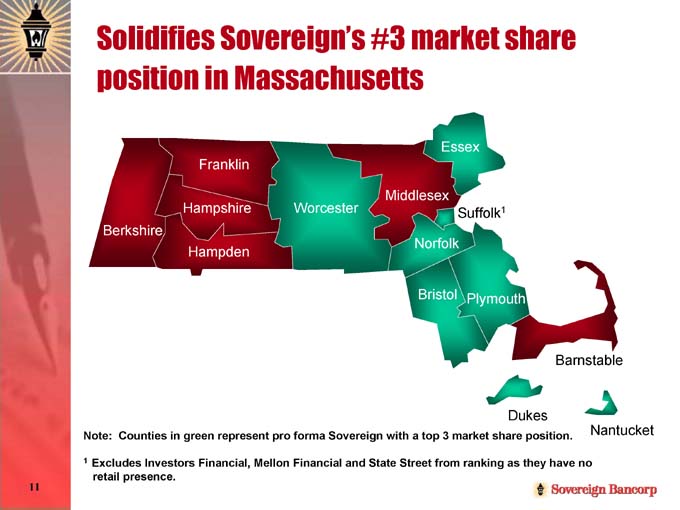

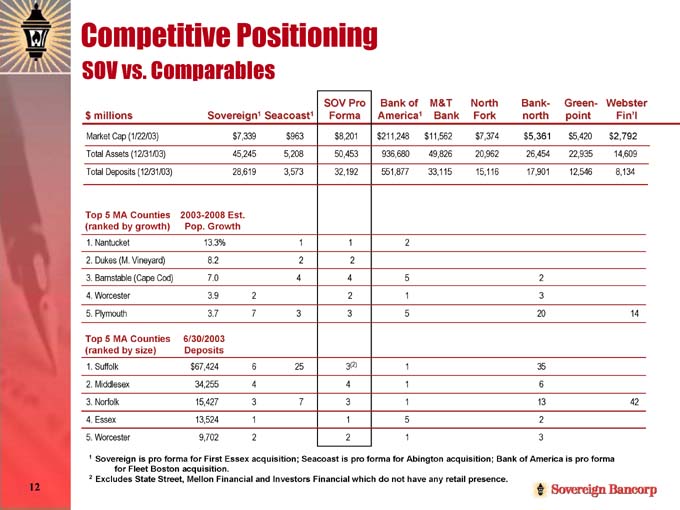

Solidifies Sovereign’s #3 market share position in Massachusetts Financial and State Street from ranking as they have no Mellon Excludes Investors Financial, retail presence. 1

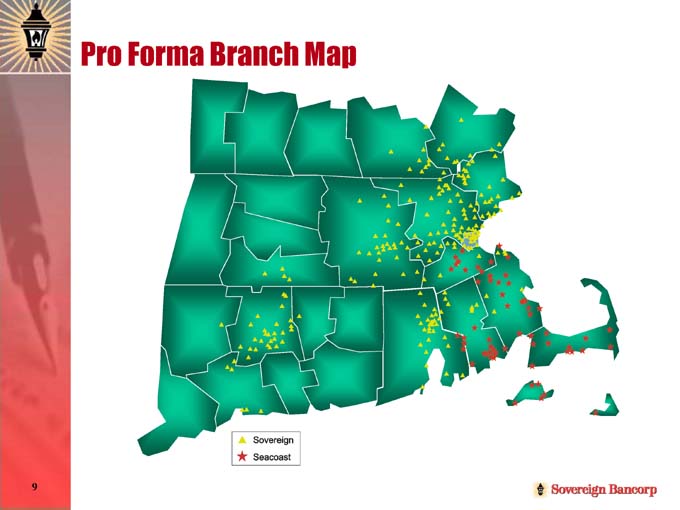

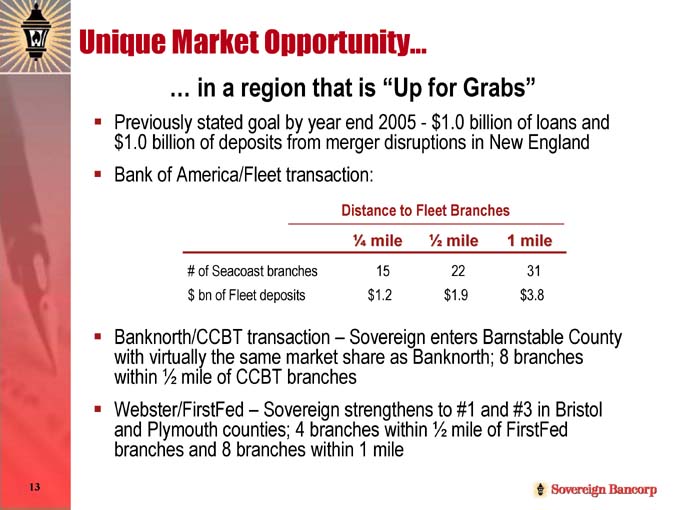

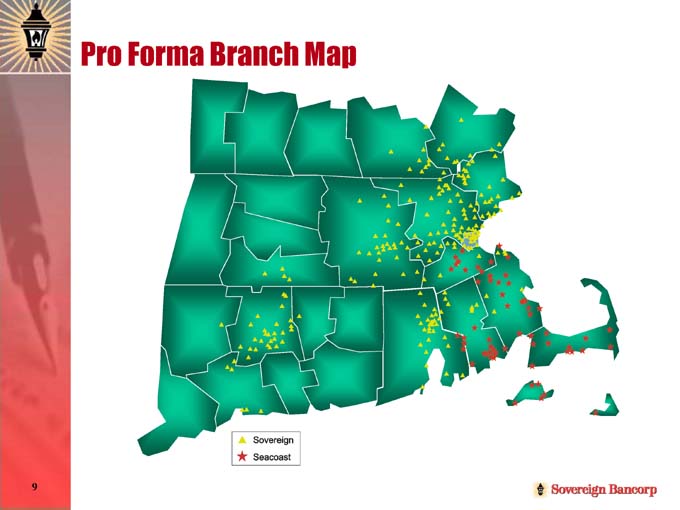

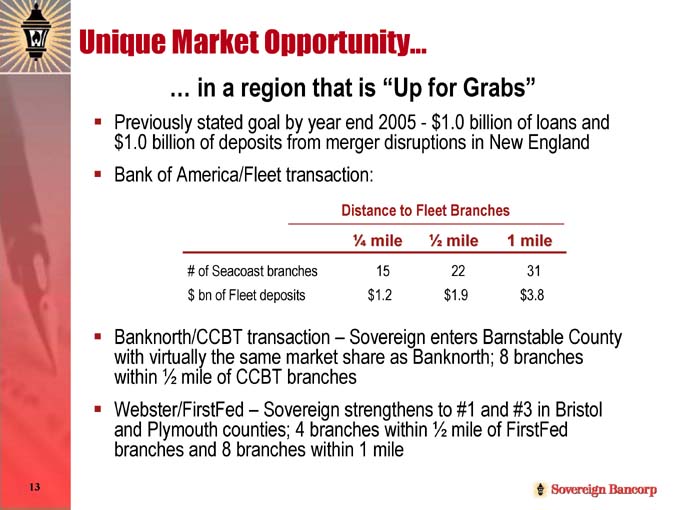

$1.0 billion of loans and in a region that is “Up for Grabs” Distance to Fleet Branches … Previously stated goal by year end 2005 -$1.0 billion of deposits from merger disruptions in New England Bank of America/Fleet transaction: Unique Market Opportunity… ? ? mile ½ mile ¼ 1 mile # of Seacoast branches $ bn of Fleet deposits 15 $1.2 22 $1.9 31 $3.8 Sovereign enters Barnstable County Sovereign strengthens to #1 and #3 in Bristol mile of FirstFed with virtually the same market share as Banknorth; 8 branches mile of CCBT branches Webster/FirstFed –and Plymouth counties; 4 branches within ½branches and 8 branches within 1 mile Banknorth/CCBT transaction – within ½ ? ?

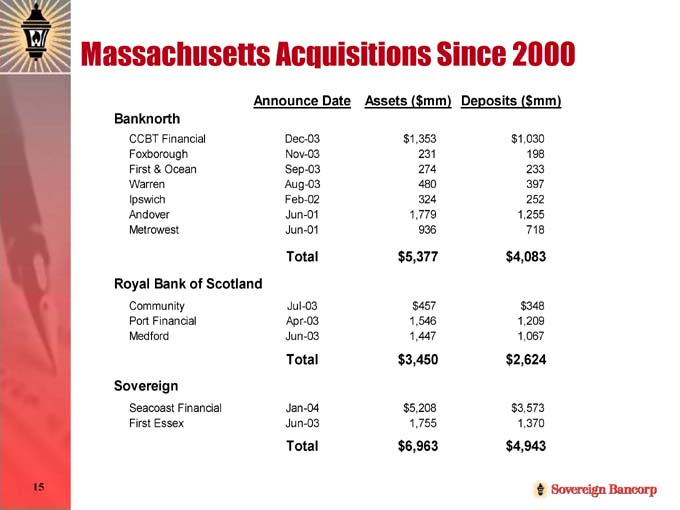

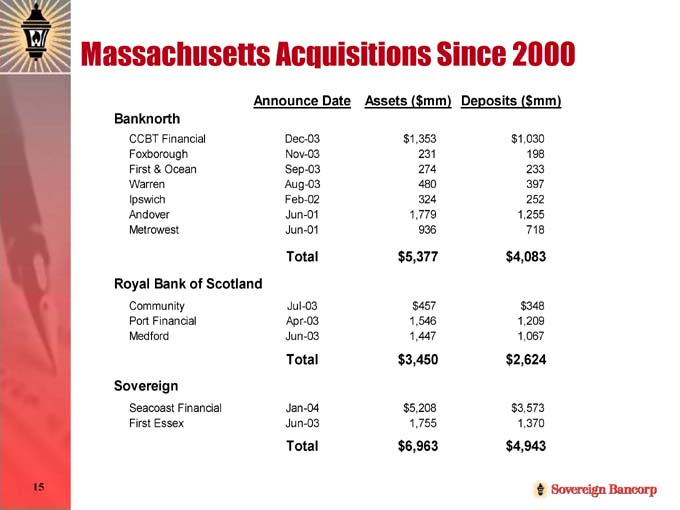

Massachusetts Acquisitions Since 2000

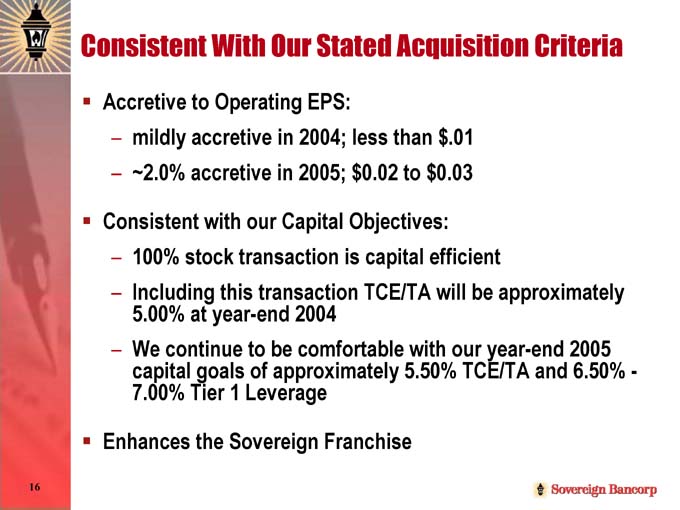

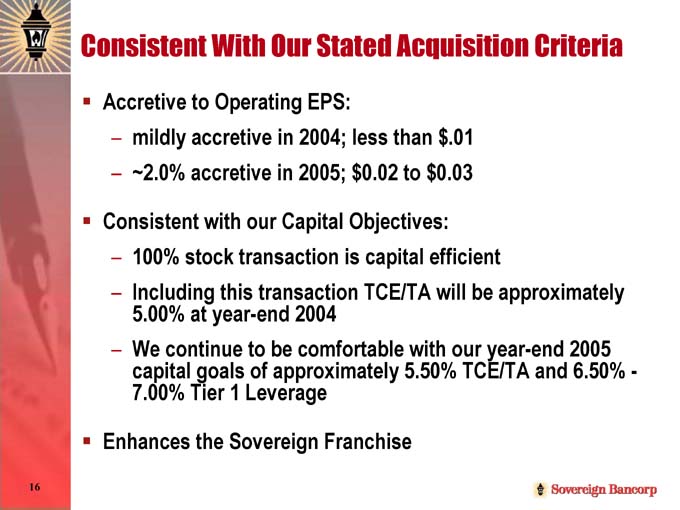

Accretive to Operating EPS: Consistent With Our Stated Acquisition Criteria ? • $.01 $0.03 than to less $0.02 2004; 2005; in in accretive accretive mildly ~2.0% • – Consistent with our Capital Objectives: ? • -20056.50% approximately year-endand be TCE/TA our efficient will with5.50% capital TCE/TA is comfortable 2004 approximately transaction be transaction toofLeverage thisyear-end goals1 stock Includingat continue Tier 100% 5.00% Wecapital7.00% • – Enhances the Sovereign Franchise ?

Seacoast has a low-risk business model emphasizing retail and no existing mortgage banking operation capital markets, commercial lending and government banking) Consistent With Our Vision and Mission commercial banking; Transaction opens up new markets to deliver Sovereign’s broader array of products and services (e.g. cash management, Fill-in acquisition of a manageable size to integrate quickly and seamlessly Creates leading market share positions in many of our micro-markets Sovereign is a proven, skilled expert at integrating acquisitions: ? ? ? ? ? • 2004) 6, February close acquisition (to Bancorp Bancorp Branch Street Essex Fleet Main First • –

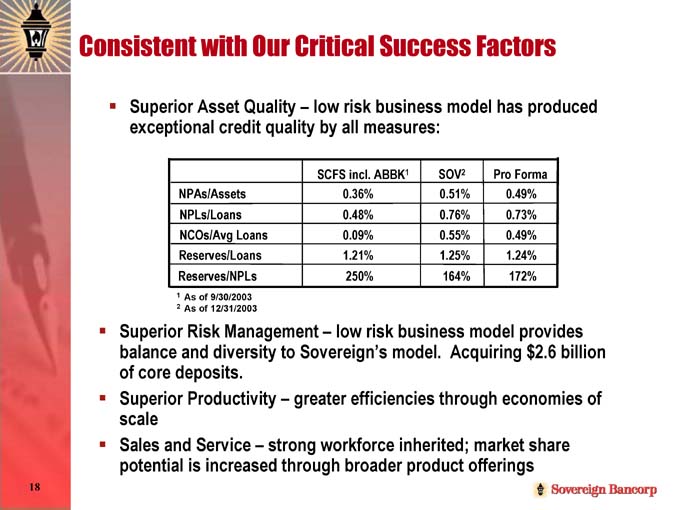

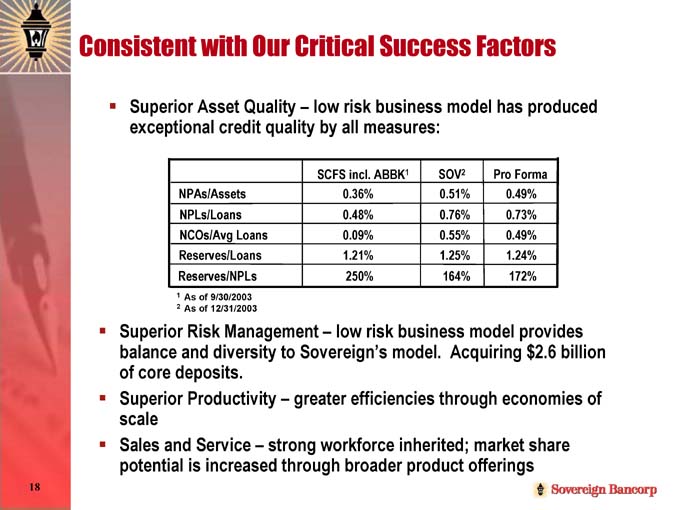

Consistent with Our Critical Success Factors • produced has model business measures: risk all low by – quality Quality credit Asset Superior exceptional • billion of provides $2.6 economies share model Acquiring market offerings through business model. inherited; product risk efficiencies broader low • Sovereign’s greater workforce through to – strong Management diversity – increased Service Risk and deposits. Productivity is and Superior balance core Superior scale Sales potential of • ?

This acquisition is very strategically compelling, andcreates exciting opportunities within Sovereign’s franchise This acquisition continues to differentiate Sovereignas a leading financial institution in the Northeast We remain comfortable with the mean street estimate of $1.63 in Operating Earnings for 2004 We remain committed to striving for operating earnings of $1.65 to $1.70 per share in 2004, and cash earnings per share of $1.80 to $1.85 We remain committed to our 2004 and 2005 capital goals Summary ? ? ? ? ?

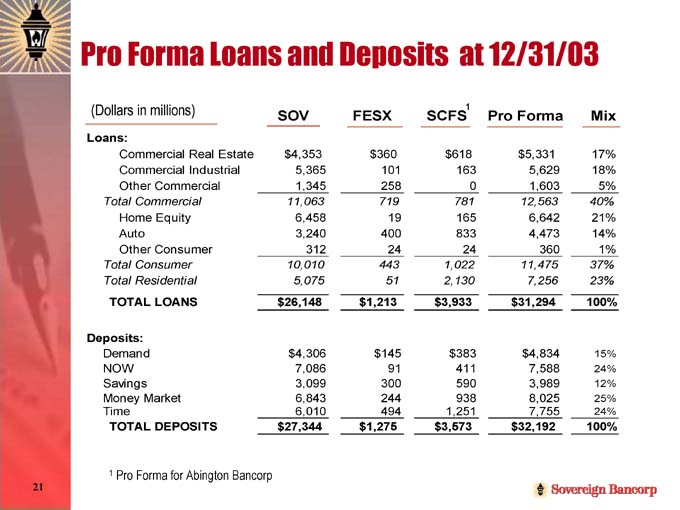

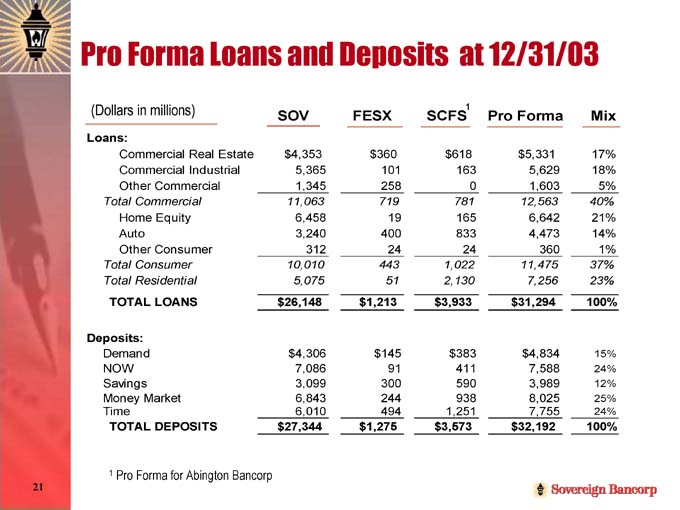

at 12/31/03 Pro Forma Loans and Deposits

| | | | | | | | | | |

| | | 5,331

5,629

1,603 | | 6,642

4,473

360 | | 7,256 | | 4,834

7,588

3,989

8,025

7,755 |

| | | 12,563 | | 11,475 | | | | $ |

| | | $ | | 31,294 | | | | 32,192 |

| | | | | | | | | | | | |

1 | | 618 163

781 | | 165 833

24 | | | | 383 411 590 938 | | |

| | | | | | | | | $1,251 | | |

| | | $1,022 | | 2,130

3,933 | | | | 3,573 | | |

SCFS | | | | | | $ | | $ |

| | | 360 101

258 719 | | 19 400 24

443 | | 51 | | 145 91 300 244 494 | | |

| | | | | | | | | $ | | |

| | | $ | | 1,213 | | | | 1,275 | | |

FESX | | | | | | $ | | $ |

| | | 4,353 5,365

1,345 | | 6,458

3,240 312 | | 5,075 | | 4,306 7,086 3,099

6,843 6,010 | | |

| | | 11,063 | | 10,010 | | | | $ | | |

SOV | | $ | | 26,148 | | | | 27,344 | | |

| | | | | | | $ | | $ |

| | | Commercial

Real Estate

Commercial

Industrial

Other

Commercial | | Home

Equity

Auto

Other

Consumer | | TOTAL

LOANS | | | | | | Pro

Forma

for

Abington

Bancorp |

(Dollars in millions) Loans: | | Total

Commercial | | Total

Consumer | | Total

Residential | | Deposits:

Demand

NOW | | Savings

Money

Market

Time

TOTAL

DEPOSITS | | 1 |

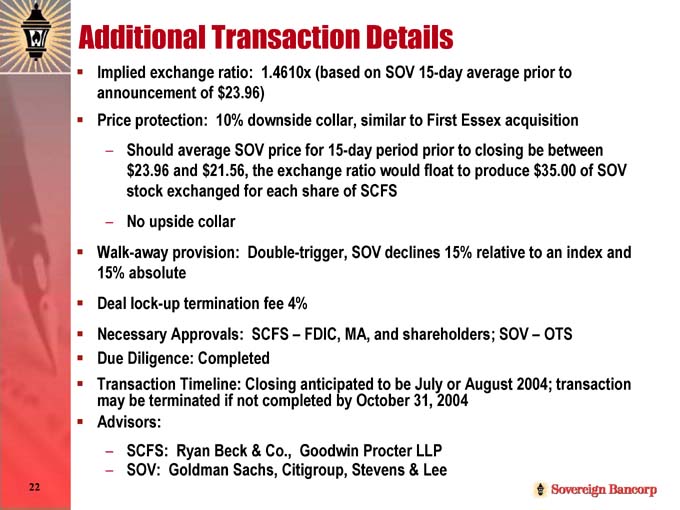

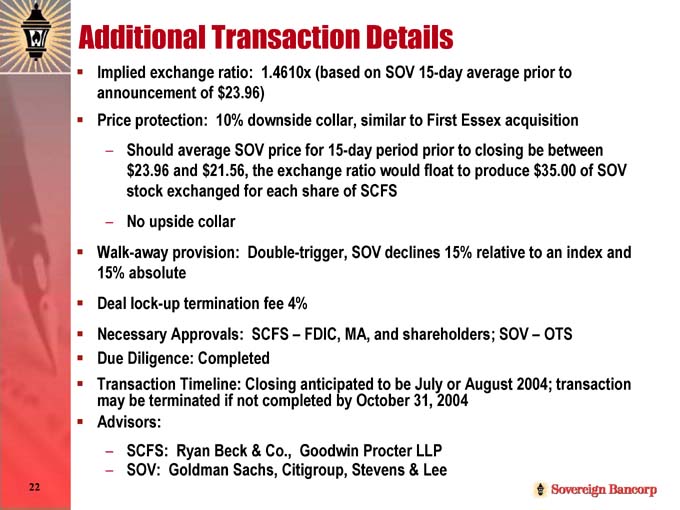

Additional Transaction Details OTS 1.4610x (based on SOV 15-day average prior to FDIC, MA, and shareholders; SOV – Goodwin Procter LLP 10% downside collar, similar to First Essex acquisition stock exchanged for each share of SCFS Double-trigger, SOV declines 15% relative to an index and SCFS – Ryan Beck & Co., Goldman Sachs, Citigroup, Stevens & Lee Should average SOV price for 15-day period prior to closing be between $23.96 and $21.56, the exchange ratio would float to produce $35.00 of SOV No upside collar SCFS: SOV: Implied exchange ratio: announcement of $23.96) Price protection: – – Walk-away provision: 15% absolute Deal lock-up termination fee 4% Necessary Approvals: Due Diligence: Completed Transaction Timeline: Closing anticipated to be July or August 2004; transactionmay be terminated if not completed by October 31, 2004 Advisors: – – ? ? ? ? ? ? ? ?

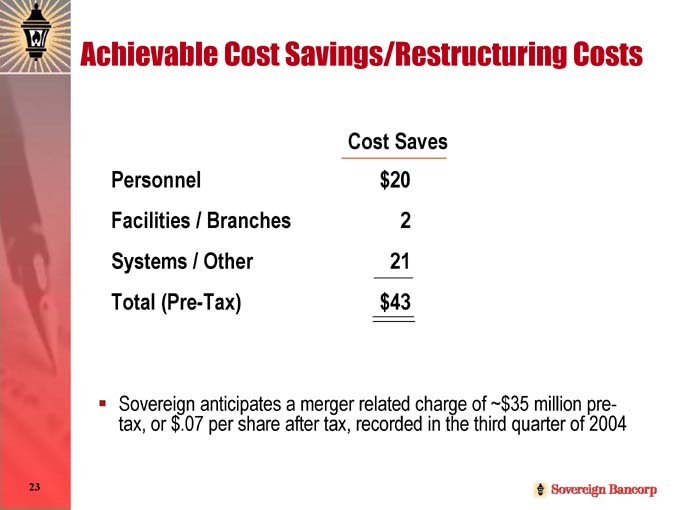

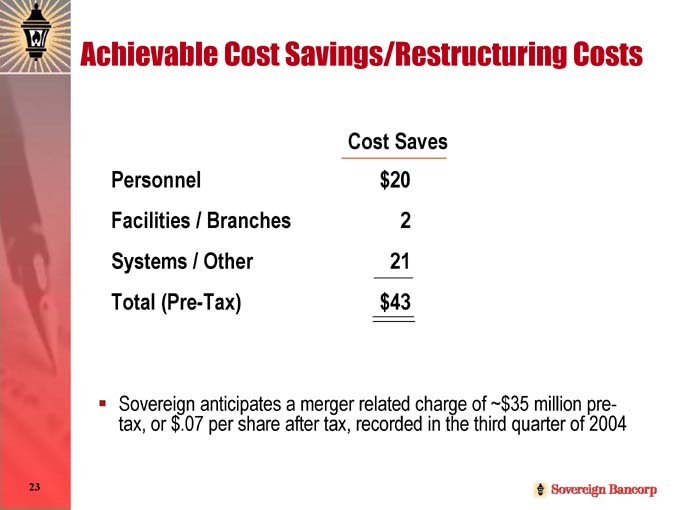

Achievable Cost Savings/Restructuring Costs Cost Saves Personnel Facilities / Branches Systems / Other Total (Pre-Tax) $20 2 21 $43 Sovereign anticipates a merger related charge of ~$35 million pre-tax, or $.07 per share after tax, recorded in the third quarter of 2004 ?