UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ¨

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | |

¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | | Definitive Proxy Statement | | |

¨ | | Definitive Additional Materials | | |

¨ | | Soliciting Material Pursuant to §240.14a-12 | | |

OVERNITE CORPORATION

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

Overnite Corporation

1000 Semmes Avenue

Richmond, Virginia 23224

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that the Annual Meeting of the holders of shares of common stock of Overnite Corporation will be held at the offices of Hunton & Williams LLP, Riverfront Plaza, East Tower, 20th Floor, 951 East Byrd Street, Richmond, Virginia, on Thursday, April 28, 2005, at 10:00 a.m., Eastern Daylight Time, for the following purposes:

| | 1. | to elect a Board of Directors to serve for the ensuing year; |

| | 2. | to ratify the appointment of Deloitte & Touche LLP as independent registered public accounting firm for the fiscal year ending December 31, 2005; and |

| | 3. | to conduct such other business as may properly come before the annual meeting. |

Holders of shares of Overnite common stock of record at the close of business on February 24, 2005, will be entitled to vote at the annual meeting.

You are requested to complete, sign, date, and return the enclosed proxy promptly, regardless of whether you expect to attend the annual meeting. A postage-paid return envelope is enclosed for your convenience.

If you are present at the annual meeting, you may vote in person even if you already have sent in your proxy.

Seating at the annual meeting will be on a first-come, first-served basis. To ensure that you have a seat, please arrive early.

By Order of the Board of Directors

Mark B. Goodwin

Senior Vice President,

General Counsel, and Secretary

OVERNITE CORPORATION

PROXY STATEMENT

FOR

ANNUAL MEETING OF SHAREHOLDERS

To be held April 28, 2005

Approximate date of mailing—March 23, 2005

| Q: | Who is asking for my vote and why are you sending me this document? |

| A: | Our Board of Directors asks that you vote on the matters listed in the Notice of Annual Meeting, which are more fully described in this proxy statement. |

We are providing this proxy statement and related proxy card to shareholders of Overnite in connection with the solicitation by our Board of Directors of proxies to be voted at the annual meeting. A proxy, if duly executed and not revoked, will be voted and, if it contains any specific instructions, will be voted in accordance with those instructions.

| A: | A proxy is your legal designation of another person to vote the stock you own. If you designate someone as your proxy in a written document, that document also is called a proxy or a proxy card. Leo H. Suggs and Mark B. Goodwin have been designated as proxies for the 2005 annual meeting. |

| Q: | Who is eligible to vote? |

| A: | You may vote if you owned shares of Overnite common stock on February 24, 2005, the date established by our Board of Directors under Virginia law for determining shareholders entitled to notice of and to vote at the annual meeting. On the record date, there were 28,259,005 shares of Overnite common stock outstanding. Each share of Overnite common stock is entitled to one vote. |

| Q: | What will I be voting on at the annual meeting? |

| A: | You will be voting on the following matters: |

| | • | | Election of eight directors. |

| | • | | Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2005. |

| | • | | Any other business that properly comes before the annual meeting. |

| Q: | What vote is needed to elect directors? |

| A: | The election of each nominee for director requires the affirmative vote of the holders of a plurality of the shares of Overnite common stock voted in the election of directors. |

| Q: | What vote is needed to ratify the appointment of Deloitte & Touche? |

| A: | The ratification of the appointment of Deloitte & Touche requires that the votes cast in favor of the ratification exceed the number of votes cast opposing the ratification. |

1

| Q: | What are the voting recommendations of the Board of Directors? |

| A: | Our Board of Directors recommends that shareholders vote“FOR” all of the nominees for director and“FOR” the ratification of the appointment of Deloitte & Touche. |

| | • | | attending the annual meeting and voting in person; or |

| | • | | completing, signing, dating, and returning the enclosed proxy card in the self-addressed, postage-prepaid envelope provided. |

Even if you plan to attend the annual meeting, we encourage you to vote your shares by proxy.

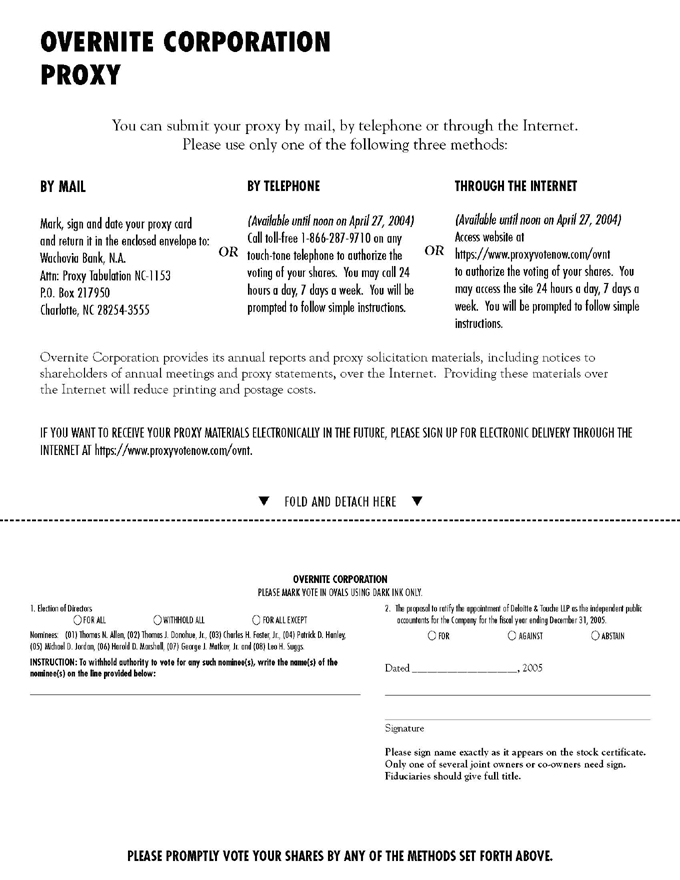

| Q: | Can I vote by telephone or electronically? |

| A. | If you are a registered shareholder (that is, if you hold your stock in certificate form or participate in the Overnite Stock Purchase Program), you may vote by telephone, or electronically through the Internet, by following the instructions included with your proxy card. The deadline for voting by telephone or electronically is noon, Eastern Daylight Time, on April 27, 2005. If your shares are held in “street name,” please check your proxy card or contact your broker or nominee to determine whether you will be able to vote by telephone or electronically. |

| Q: | Can I change or revoke my vote? |

| A: | Any shareholder giving a proxy may change or revoke it at any time before it is voted at the annual meeting. A proxy can be changed or revoked by: |

| | • | | delivering a later dated proxy, or written notice of revocation, to our corporate secretary; or |

| | • | | appearing at the annual meeting and voting in person. |

Attendance at the annual meeting will not itself revoke a proxy.

| Q: | What if I do not specify a choice for a matter when returning a proxy? |

| A: | Shareholders should specify their choice for each matter on the enclosed proxy. If no specific instructions are given, it is intended that all proxies that are signed and returned will be voted“FOR” the election of all nominees for director,“FOR” the ratification of the appointment of Deloitte & Touche and in the discretion of the proxy holders on any other matters that properly come before the annual meeting and any adjournments or postponements of the annual meeting. |

| Q: | Will my shares be voted if I do not provide my proxy? |

| A: | It will depend on how your ownership of shares of Overnite common stock is registered. If you own your shares as a registered holder, which means that your shares of Overnite common stock are registered in your name, your unvoted shares will not be represented at the annual meeting and will not count toward the quorum requirement, which is explained below. If a quorum is obtained, your unvoted shares will not affect whether a proposal is approved or rejected. |

If you own your shares of Overnite common stock in street name, which means that your shares are registered in the name of your broker, your shares may be voted even if you do not provide your broker with voting instructions. Brokers have the authority to vote shares for which their customers do not provide voting instructions on certain “routine” matters.

2

The election of directors and the ratification of the appointment of Deloitte & Touche as our independent registered public accounting firm are considered routine matters for which brokerage firms may vote unvoted shares. When a proposal is not a routine matter and the brokerage firm has not received voting instructions from the beneficial owner of the shares with respect to that proposal, the brokerage firm cannot vote the shares on that proposal. This is called a broker non-vote.

| Q: | Are abstentions and broker non-votes counted? |

| A: | Abstentions, broker non-votes, and, with respect to the election of directors, withheld votes will not be included in the vote totals and will not affect the outcome of the vote. |

| Q: | What constitutes a quorum for the annual meeting? |

| A: | In order for the annual meeting to be conducted, a majority of the outstanding shares of Overnite common stock as of the record date must be present in person or by proxy at the annual meeting. This is referred to as a quorum. Abstentions and shares of record held by a broker or its nominee that are voted on any matter are included in determining whether a quorum is present. Broker shares that are not voted on any matter will not be included in determining whether a quorum is present. |

| Q: | Where can I find the results of the annual meeting? |

| A: | We intend to announce preliminary voting results at the annual meeting and publish final results in our quarterly report on Form 10-Q for the first quarter of 2005. |

| Q: | Where can I find Overnite’s corporate governance materials? |

| A: | Our Corporate Governance Guidelines, Codes of Business Conduct and Ethics, and the charters of the Audit, Executive Compensation, and Nominating and Corporate Governance Committees are available on our Internet website athttp://www.ovnt.com, Corporate Governance, and are available in print to any shareholder upon request by contacting our investor relations department as described in “How can I obtain a copy of Overnite’s annual report on Form 10-K for the fiscal year ended December 31, 2004?” below. |

| Q: | How do I communicate with Overnite’s Board of Directors? |

| A: | Shareholders and other interested persons may communicate with the full Board of Directors, a specified committee of our Board, or a specified individual member of our Board by sending written correspondence to the Chairman of the Nominating and Corporate Governance Committee, in care of Overnite Corporation, 1000 Semmes Avenue, Richmond, Virginia 23224, Attention: Corporate Secretary. The Chairman of the Nominating and Corporate Governance Committee and his duly authorized agents are responsible for collecting and organizing shareholder communications. Absent a conflict of interest, the Chairman of the Nominating and Corporate Governance Committee is responsible for evaluating the materiality of each shareholder communication and determining whether further distribution is appropriate and, if so, whether to (1) the full Board, (2) one or more committee members, (3) one or more Board members, and/or (4) other individuals or entities. |

| Q: | Who pays for the solicitation of proxies? |

| A: | We will pay for the cost of the solicitation of proxies. In addition to the use of the mail, proxies may be solicited personally or by telephone by our officers and regular employees. We have engaged The Altman Group, Inc. to assist in the solicitation of proxies from brokers, nominees, fiduciaries, and other custodians. We will pay that firm $4,500 for its services and reimburse its out-of-pocket expenses for such items as mailing, copying, phone calls, faxes, and other related matters, and will indemnify The Altman Group, Inc. against any losses arising out of that firm’s proxy soliciting services on our behalf. |

3

| Q: | How can I obtain a copy of Overnite’s annual report on Form 10-K for the fiscal year ended December 31, 2004? |

| A: | A copy of our annual report on Form 10-K is enclosed. |

We will provide without charge to each person to whom this proxy statement has been delivered, on the request of any such person, additional copies of our annual report on Form 10-K, including the financial statements and financial statement schedules. Requests should be directed to our investor relations department as described below:

Overnite Corporation

1000 Semmes Avenue

Richmond, Virginia 23224

Attention: Mike Mahan, Investor Relations

Telephone: (804) 231-8852

Upon request, a list of the exhibits to our annual report on Form 10-K, showing the cost of each, will be delivered with the requested copy of our annual report on Form 10-K. Any of the exhibits listed will be provided upon payment of the charge noted on the list.

Copies of our annual report and Form 10-K can also be obtained on our website,www.ovnt.com.

4

PROPOSAL 1:

ELECTION OF DIRECTORS

The Nominating and Corporate Governance Committee has recommended to our Board of Directors, and our Board of Directors has approved, the individuals named below as nominees for election to our Board of Directors. Proxies will be voted for the election as directors for the ensuing year of the individuals named below (or, if for any reason unavailable, of such substitutes as our Board of Directors may designate). Each of the nominees presently serves as a director. Our Board of Directors has no reason to believe that any of the nominees will be unavailable.

Thomas N. Allen; age 66; Director since November 19, 2003; Chairman of The Clovelly Corporation (real estate and restaurant operations) since June, 2001, having previously served as Chairman of East Coast Oil Corporation (retail gasoline and convenience store chain). Other directorship: Noland Company.

Thomas J. Donohue, Jr.; age 40; Director since November 19, 2003; President of Adelphi Capital, LLC (investment banking).

Charles H. Foster, Jr.; age 62; Director since November 19, 2003; Chairman of the Board of Directors of LandAmerica Financial Group, Inc. (provider of real estate transaction services) since January 1, 2005, having previously served as Chairman of the Board of Directors and Chief Executive Officer of LandAmerica through December 31, 2004. Other directorships: LandAmerica Financial Group, Inc. and Universal Corporation.

Patrick D. Hanley; age 60; Director and Senior Vice President and Chief Financial Officer of Overnite Corporation since July 31, 2003; Senior Vice President and Chief Financial Officer of Overnite Transportation Company since June 1996. Other directorship: NewMarket Corporation.

Michael D. Jordan; age 58; Director since November 19, 2003; retired, having previously served as President, Ford Motor Company’s Automotive Consumer Service Group (aftermarket services division of Ford Motor Company) through December 31, 2001. Other directorship: Aftermarket Technology Corp.

Harold D. Marshall; age 68; Director since November 19, 2003; retired, having previously served as President and Chief Operating Officer of Associates First Capital Corporation (provider of diversified financial services). Other directorship: Rush Enterprises, Inc.

George J. Matkov, Jr.; age 62; Director since November 19, 2003; Partner of Matkov, Salzman, Madoff & Gunn (law firm).

Leo H. Suggs; age 65; Director, Chairman, Chief Executive Officer, and President of Overnite Corporation since July 31, 2003; Chairman and Chief Executive Officer of Overnite Transportation Company since April 1996.

Our Board of Directors recommends that shareholders vote “FOR” all of the nominees listed above.

Board of Directors

Our company is managed under the direction of our Board of Directors, which has adopted Corporate Governance Guidelines to set forth certain corporate governance practices. Our Corporate Governance Guidelines are available on our Internet website athttp://www.ovnt.com, Corporate Governance.

Independence of Directors

Upon the recommendation of the Nominating and Corporate Governance Committee, our Board of Directors has determined that each of the following directors is “independent” within the meaning of the general

5

independence standards in the listing standards of The Nasdaq Stock Market, Inc., the market on which shares of Overnite common stock are quoted: Messrs. Allen, Donohue, Foster, Jordan, and Marshall.

Board Meetings

Our Board of Directors meets on a regularly scheduled basis during the year to review significant developments affecting our company and to act on matters requiring Board approval, and may hold special meetings between scheduled meetings when appropriate. During 2004, our Board met five times. During 2004, each of the directors attended 100% of the meetings of our full Board of Directors, and no director attended fewer than 90% of the aggregate of the meetings of the Board of Directors and committees on which the director served.

Meetings of Independent Directors; Presiding Director

Our Corporate Governance Guidelines require that the independent members of our Board of Directors meet in executive session at least three times a year. In 2004, the independent members of our Board of Directors met in executive session as part of each full Board of Directors meeting. Our Board of Directors has determined that a presiding director should chair all meetings of the independent directors, as provided in our Corporate Governance Guidelines. The presiding director position rotates among the chairs of each of the independent Board committees in the following order: Nominating and Corporate Governance Committee; Audit Committee; and Executive Compensation Committee. Shareholders and other interested persons may contact the presiding director, a specified individual independent member of our Board of Directors, or the independent members of our Board of Directors as a group through the method described in “Questions and Answers—How do I communicate with Overnite’s Board of Directors?” on page 3.

Attendance at Annual Meeting

As set forth in our Corporate Governance Guidelines, we expect all of our directors to attend the annual meeting of shareholders each year. All of our directors attended the 2004 annual meeting of shareholders, our first as a public company.

Director Education

The Board has adopted a policy for director continuing education, which provides that Overnite offers, through subject matter experts, continuing education to directors on relevant topics.

Committees of Our Board

Our Board of Directors has established various committees to assist it with the performance of its responsibilities. These committees and their current members are described below.

Audit Committee

Messrs. Jordan (Chairman), Allen, and Marshall currently serve on the Audit Committee. The Audit Committee operates under a written charter adopted by our Board of Directors, which is attached asAnnex A to this proxy statement and is available on our Internet website. See “Questions and Answers—Where can I find Overnite’s corporate governance materials?” on page 3. During 2004, the Audit Committee met on ten occasions. Based on the recommendation of the Nominating and Corporate Governance Committee, our Board of Directors has determined that each of the members of the Audit Committee is “independent” within the meaning of the enhanced independence standards for audit committee members in the Securities Exchange Act of 1934 (the “Exchange Act”) and the rules thereunder, as incorporated into the listing standards of The Nasdaq Stock Market, Inc. Based on the recommendation of the Audit Committee, our Board of Directors has also determined

6

that each of the members of the Audit Committee has the requisite financial knowledge to serve as a member of the Audit Committee and that each of Messrs. Jordan and Marshall is an “audit committee financial expert” within the meaning of the rules promulgated by the Securities and Exchange Commission under the Sarbanes-Oxley Act of 2002. For a description of the Audit Committee’s function, see the Audit Committee Report beginning on page 21.

Executive Compensation Committee

Messrs. Marshall (Chairman), Donohue, and Foster currently serve on the Executive Compensation Committee. The Executive Compensation Committee operates under a written charter adopted by the Board of Directors, which is available on our Internet website. See “Questions and Answers—Where can I find Overnite’s corporate governance materials?” on page 3. Based on the recommendation of the Nominating and Corporate Governance Committee, our Board of Directors has determined that each of the members of the Executive Compensation Committee is “independent” within the meaning of the general independence standards in the listing standards of The Nasdaq Stock Market, Inc. During 2004, the Executive Compensation Committee met on six occasions. This committee determines the compensation of executive-level employees, including our chief executive officer. It also approves bonus awards and initial salaries of new executive-level personnel and may grant stock options, stock appreciation rights (“SARs”), stock awards, and performance shares under the Overnite Corporation Stock Incentive Plan (the “Incentive Plan”). For a description of the objectives of our executive compensation program, see the Report on Executive Compensation beginning on page 17.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee currently consists of Messrs. Foster (Chairman), Allen, and Donohue. The Nominating and Corporate Governance Committee operates under a written charter adopted by our Board of Directors, which is available on our Internet website. See “Questions and Answers—Where can I find Overnite’s corporate governance materials?” on page 3. Our Board of Directors has determined that each of the members of the Nominating and Corporate Governance Committee is “independent” within the meaning of the general independence standards in the listing standards of The Nasdaq Stock Market, Inc. During 2004, this committee met three times. The primary purposes and responsibilities of the Nominating and Corporate Governance Committee are to: (1) identify individuals qualified to become directors, consistent with the criteria approved by our Board of Directors and described in our Corporate Governance Guidelines; (2) recommend to our Board of Directors the selection of nominees for election to our Board of Directors; (3) recommend to our Board of Directors the individual directors to serve on the committees of our Board of Directors; (4) review periodically our Corporate Governance Guidelines and recommend to our Board of Directors governance issues that should be considered by our Board of Directors; (5) review periodically our Codes of Business Conduct and Ethics; and (6) consider other corporate governance and related issues. The Nominating and Corporate Governance Committee also prepares and supervises the Board of Directors’ annual review of director independence, the Board of Directors’ and its committees’ annual self-evaluations and annual director peer review.

Director Candidate Recommendations and Nominations by Shareholders. The Nominating and Corporate Governance Committee’s Charter provides that the Nominating and Corporate Governance Committee will consider director candidate recommendations by shareholders. Any shareholder entitled to vote for the election of directors may (1) recommend candidates for election to our Board of Directors or (2) nominate persons for election to our Board of Directors if such shareholder complies with the procedures set forth in our bylaws and summarized in “Shareholder Proposals” on page 25.

Nominating and Corporate Governance Committee Process for Identifying and Evaluating Director Candidates. The Nominating and Corporate Governance Committee evaluates all director candidates in accordance with the director qualification standards described in the Corporate Governance Guidelines. The Nominating and Corporate Governance Committee evaluates any candidate’s qualifications to serve as a member

7

of our Board of Directors based on the totality of the merits of the candidate and not based on minimum qualifications or attributes. In evaluating a candidate, the Nominating and Corporate Governance Committee takes into account the background and expertise of individual Board members as well as the background and expertise of our Board of Directors as a whole. In addition, the Nominating and Corporate Governance Committee will evaluate a candidate’s independence and his or her background and expertise in the context of our Board’s needs. There are no differences in the manner in which the Committee evaluates director candidates based on whether the candidate is recommended by a shareholder. The Nominating and Corporate Governance Committee did not receive any recommendations from any shareholders in connection with the annual meeting.

Compensation of Directors

Retainer and Stock Compensation

During 2004, all non-employee directors received a retainer of $45,000 per year. In addition, each non-employee director received options to purchase 2,000 shares of Overnite common stock immediately after our initial annual meeting of shareholders. Each non-employee director also received 1,000 shares of restricted stock in a grant made on January 27, 2005 and which will vest on January 27, 2008. Commencing January 1, 2005, all non-employee directors will receive an annual retainer of $55,000. Employee directors do not receive retainers. In 2004, chairpersons of our Board committees, other than the chairperson of the Audit Committee, received an additional annual retainer of $5,000. In 2004, the chairperson of the Audit Committee received an additional annual retainer of $10,000. Commencing January 1, 2005, chairpersons of our Board committees, other than the chairperson of the Audit Committee, will receive an increase in their additional annual retainer to $10,000, and the chairperson of the Audit Committee will receive an increase in the additional annual retainer to $20,000. Half of the retainers are paid in cash and half in shares of Overnite common stock, unless the director elects to receive more than half of the retainer in shares of Overnite common stock.

Commencing January 1, 2005, a deferral plan was implemented that will allow each non-employee director to defer receipt of all or part of the retainer fee into an account that is unfunded and maintained for record-keeping purposes only. The accounts will be credited with earnings and charged with losses based on hypothetical investments. Deferrals of the retainer that is payable in shares of Overnite common stock are credited to the account as if they were invested in Overnite common stock. Deferrals of the retainer that is payable in cash are credited to the account as if they were invested in Overnite common stock or another investment measure available under the plan.

We reimburse each of our non-employee directors for reasonable travel expenses incurred in connection with attending all Board and Board committee meetings.

Stock Ownership Guidelines

Our Board of Directors has established stock ownership guidelines for our non-employee directors. Under these guidelines, all of our non-employee directors are to achieve and maintain ownership of Overnite common stock equal to four times their annual retainer. Until this ownership target is achieved, our non-employee directors are not permitted to sell any of their shares of Overnite common stock without the approval of the Chairman of the Executive Compensation Committee.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

We paid the law firm of Matkov, Salzman, Madoff & Gunn $67,234 for legal services provided to our company during 2004. George J. Matkov, Jr., a member of our Board of Directors, is a partner of Matkov, Salzman, Madoff & Gunn.

8

SECTION 16(a)

BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires that our directors, officers, and persons who own more than 10% of a registered class of our equity securities file reports of ownership and changes in ownership of such securities with the Securities and Exchange Commission and The Nasdaq Stock Market, Inc. Directors, officers, and beneficial owners of more than 10% of Overnite common stock are required by applicable regulations to furnish us with copies of all Section 16(a) forms they file. Based solely upon a review of the copies of the forms and information furnished to us, we believe that during the 2004 fiscal year all filing requirements applicable to our directors, officers, and beneficial owners of more than 10% of Overnite common stock were satisfied, except that the Form 4s for each of our non-employee directors with respect to an option grant made on June 24, 2004 were not filed until July 7, 2004.

STOCK OWNERSHIP

Principal Shareholders

The following table lists any person (including any “group” as that term is used in Section 13(d)(3) of the Exchange Act) who, to our knowledge, was the beneficial owner, as of December 31, 2004, of more than 5% of Overnite’s outstanding voting shares. Under the rules of the Securities and Exchange Commission, a person is the “beneficial owner” of securities if he, she, or it has or shares the power to vote them or to direct their investment or has the right to acquire beneficial ownership of such securities within 60 days through the exercise of an option, warrant or right, the conversion of a security, or otherwise.

| | | | | | |

Name and Address of Beneficial Owners

| | Number of

Shares

| | | Percent

of Class

| |

Federated Investors, Inc. Federated Investors Tower Pittsburgh, Pennsylvania 15222-3779 | | 1,558,100 | (1) | | 5.56% | (1) |

| | |

FMR Corp. 82 Devonshire Street Boston, Massachusetts 02109 | | 1,412,765 | (2) | | 5.044% | (2) |

| (1) | Based solely on the information contained in the Schedule 13G filed by Federated Investors, Inc. on February 14, 2005. |

| (2) | Based solely on the information contained in the Schedule 13G filed by FMR Corp. on February 14, 2005. |

9

Directors and Executive Officers

The following table sets forth, as of January 31, 2005, the beneficial ownership of Overnite common stock by all of our directors, our chief executive officer, and our four other executive officers named in the Summary Compensation Table, and all of our directors and executive officers as a group, as determined based on the rules of the Securities and Exchange Commission discussed above.

| | | | | | | | | | | |

| | | Number of Shares with Sole Voting

and Investment Power

| | Number of

Shares With Shared Voting and

Investment Power

| | Total

Number

of Shares

| | Percent

of

Class

| |

Name of Beneficial Owner or Number of Persons in Group

| | Aggregate Number of Shares

Beneficially Owned(1)

| | Options(2)

| | | |

Thomas N. Allen | | 2,779 | | 2,000 | | — | | 4,779 | | * | |

Thomas J. Donohue, Jr. | | 2,012 | | 2,000 | | — | | 4,012 | | * | |

John W. Fain | | 30,020 | | 20,000 | | — | | 50,020 | | * | |

Charles H. Foster, Jr. | | 2,625 | | 2,000 | | — | | 4,625 | | * | |

Mark B. Goodwin | | 13,020 | | 13,333 | | — | | 26,353 | | * | |

Patrick D. Hanley | | 30,020 | | 20,000 | | — | | 50,020 | | * | |

Michael D. Jordan | | 3,175 | | 2,000 | | — | | 5,175 | | * | |

Gordon S. Mackenzie | | 30,020 | | 20,000 | | — | | 50,020 | | * | |

Harold D. Marshall | | 2,325 | | 2,000 | | — | | 4,325 | | * | |

George J. Matkov, Jr. | | 3,779 | | 2,000 | | — | | 5,779 | | * | |

Leo H. Suggs | | 73,020 | | 40,000 | | — | | 113,020 | | * | |

Directors and executive officers as a group

(13 persons) | | 196,835 | | 125,333 | | — | | 322,168 | | 1.14 | % |

| * | Represents less than 1% of the outstanding common stock of the class. |

| (1) | The number of shares shown in this column represents shares over which the individual has sole investment and voting control. |

| (2) | Reflects the number of shares with respect to which the listed individual has the right to acquire beneficial ownership through the exercise of options at January 31, 2005, or within 60 days thereafter under Overnite’s Incentive Plan. |

10

COMPENSATION OF EXECUTIVE OFFICERS

The following table shows the compensation for the fiscal years ended December 31, 2004, 2003, and 2002 earned or received by or paid to our chief executive officer and each of our four most highly compensated executive officers, other than our chief executive officer, based on salary and bonus information. In this proxy statement, we refer to our chief executive officer and our four other most highly compensated executive officers as our “named executive officers.”

Summary Compensation Table

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Annual Compensation

| | | Long-Term Compensation

| | |

Name and Principal Position

| | Year

| | Salary

| | Bonus

| | | Other Annual

Compensation

| | | Overnite

Restricted

Stock

Awards

| | | Union

Pacific

Restricted

Stock

Awards(6)

| | Overnite

Securities

Underlying

Options/

SARs

| | Union

Pacific

Securities

Underlying

Options/

SARs

| | LTIP

Payouts(7)

| | All Other

Compensation(8)

|

Leo H. Suggs Chairman of the Board of Directors, Chief Executive Officer, and President | | 2004

2003

2002 | | $

| 576,600

457,500

441,667 | | $

| 0

0

0 | (1)

(1)

(2) | | $

| 0

0

0 |

| | $

| 1,191,250

2,400,686

0 | (4)

(5)

| | $

| 0

0

3,109,546 | | 0

120,000

0 | | 0

75,000

50,000 | | 0

1,207,350

0 | | $

| 86,883

56,220

31,113 |

Patrick D. Hanley Senior Vice President and Chief Financial Officer | | 2004

2003

2002 | |

| 294,175

281,000

267,500 | |

| 350,000

0

30,000 |

(1)

(2) | |

| 0

50,000

0 |

(3)

| |

| 160,500

957,962

0 | (4)

(5)

| |

| 0

0

627,405 | | 0

60,000

0 | | 0

16,300

15,000 | | 0

482,940

0 | |

| 19,899

18,766

16,463 |

Gordon S. Mackenzie Senior Vice President and Chief Operating Officer | | 2004

2003

2002 | |

| 276,120

265,500

255,000 | |

| 325,000

0

125,000 |

(1)

(2) | |

| 0

0

0 |

| |

| 160,500

942,315

0 | (4)

(5)

| |

| 0

0

469,933 | | 0

60,000

0 | | 0

16,300

15,000 | | 0

482,940

0 | |

| 19,338

15,482

15,433 |

John W. Fain Senior Vice President— Marketing and Sales | | 2004

2003

2002 | |

| 237,000

227,300

217,300 | |

| 0

0

0 | (1)

(1)

(2) | |

| 0

0

0 |

| |

| 648,000

942,315

0 | (4)

(5)

| |

| 0

0

657,410 | | 0

60,000

0 | | 0

16,300

15,000 | | 0

482,940

0 | |

| 11,837

14,905

10,495 |

Mark B. Goodwin Senior Vice President, General Counsel, Secretary | | 2004

2003

2002 | |

| 217,487

198,424

190,792 | |

| 0

0

0 | (1)

(1)

(2) | |

| 0

50,000

0 |

(3)

| |

| 343,800

416,405

0 | (4)

(5)

| |

| 0

0

328,733 | | 0

40,000

0 | | 0

10,000

9,000 | | 0

289,764

0 | |

| 12,867

10,340

10,440 |

| (1) | Bonus amounts forgone under the Overnite Corporation Equity Swap Program (the “ESP”) for 2003 and 2004 are excluded from the bonus column, and the value of the retention stock units awarded in lieu of these bonuses is included in the Overnite restricted stock awards column. Under the ESP, executive officers can elect to forego all or a portion of their respective annual executive incentive awards in exchange for retention stock units equal to 150% of amount foregone. For 2004, executive officers ages 65 and over were able to elect a two-year ESP option that allows them to elect to forego all or a portion of their respective annual incentive awards in exchange for retention stock units equal to 133% of amount foregone. |

| (2) | Bonus amounts foregone under the Union Pacific Corporation Premium Exchange Program (“Union Pacific PEP”) for 2002 are excluded from the bonus column, and the value of the retention stock units awarded in lieu of these bonuses is included in the Union Pacific restricted stock awards column. Under the Union Pacific PEP, executive officers could elect to forego all or a portion of their respective annual incentive awards in exchange for retention stock units equal to 150% of the incentive amount foregone. |

| (3) | Mr. Hanley and Mr. Goodwin each received a one-time $50,000 Chief Executive Officer discretionary bonus for the successful implementation of our initial public offering in 2003. |

| (4) | Amounts include shares of restricted stock granted as part of the 2004 compensation to Mr. Suggs (5,000 shares, $160,500), Mr. Hanley (5,000 shares, $160,500), Mr. Mackenzie (5,000 shares, $160,500), Mr. Fain (5,000 shares, $160,500), and Mr. Goodwin (3,000 shares, $96,300). These shares of restricted common stock are valued based on $32.10, the closing price for Overnite common stock on January 27, 2005, the date of grant, and are subject to a three-year vesting period; provided, however, Mr. Suggs’ shares of restricted stock shall also fully vest in the event he retires on or after January 31, 2007, provided that he remains in the continuous employ of Overnite until his retirement. We pay dividends on shares of restricted stock at the same rate and times as dividends are paid on all other shares of Overnite common stock. |

Amounts also include retention stock units granted under the ESP in lieu of the bonus amounts foregone in 2004 to Mr. Suggs (32,111 units, $1,030,750), Mr. Fain (15,187 units, $487,500), and Mr. Goodwin (7,710 units, $247,500). Mr. Suggs elected to forego all his 2004 executive incentive award in exchange for grants of retention stock units equal to 133% of the amount foregone and Messrs. Fain and Goodwin elected to forego all their respective executive 2004 incentive awards in exchange for grants of retention stock units equal to 150% of the amount foregone. These retention stock units are valued based on $32.10, the closing price for Overnite common stock on January 27, 2005, the date of the grant, and are subject to a two-year vesting period in the case of Mr. Suggs and a three-year vesting period in the case of Messrs. Fain and Goodwin. For awards of retention stock units, the holder is entitled to receive dividend equivalents during the vesting period that are paid at the same rate and time as dividends would have been paid on an equivalent number of shares of Overnite common stock.

The number and value (based on a closing price for Overnite common stock on December 31, 2004 of $37.24) of shares of restricted stock and retention stock units held by our named executive officers as of December 31, 2004 is as follows: Mr. Suggs: 143,876 shares, $5,357,927; Mr. Hanley: 47,493

11

shares, $1,768,639; Mr. Mackenzie: 46,820 shares, $1,743,577; Mr. Fain: 62,007 shares, $2,309,138; and Mr. Goodwin: 29,136 shares, $1,085,035. The number and value set forth in this paragraph assume the restricted stock granted as part of 2004 compensation and retention stock units granted under the ESP in lieu of bonus amounts foregone in 2004 were made as of December 31, 2004.

| (5) | Amounts include shares of restricted stock granted in 2003 to Mr. Suggs (68,000 shares, $1,499,400), Mr. Hanley (25,000 shares, $551,250), Mr. Mackenzie (25,000 shares, $551,250), Mr. Fain (25,000 shares, $551,250), and Mr. Goodwin (10,000 shares, $220,500). These shares of restricted common stock are valued based on $22.05, the closing price for Overnite common stock on November 5, 2003, the date of grant, and are subject to a three-year vesting period. |

Amounts also include retention stock units granted under the ESP in lieu of the bonus amounts foregone in 2003 to Mr. Suggs (38,765 units, $901,286), Mr. Hanley (17,493 units, $406,712), Mr. Mackenzie (16,820 units, $391,065), Mr. Fain (16,820 units, $391,065), and Mr. Goodwin (8,426 units, $195,905). Messrs. Suggs, Hanley, Mackenzie, Fain, and Goodwin elected to forego all their respective executive 2003 incentive awards in exchange for grants of retention stock units equal to 150% of the amount foregone. These retention stock units are valued based on $23.25, the closing price for Overnite common stock on January 22, 2004, the date of the grant, and are subject to a three-year vesting period. The retention stock units are payable on a one-to-one basis in shares of Overnite common stock on the earlier of the holder’s termination of employment or the date selected by the holder.

| (6) | Amounts set forth in the Union Pacific restricted stock award column represent the value of time-based retention stock units. Amounts include retention stock units granted in 2002 to Mr. Suggs (4,464 units, $207,206). These retention stock units are valued based on $60.53, the closing price for Union Pacific Corporation (“Union Pacific”) common stock on February 23, 2002, the date of the grant, and were subject to a four-year vesting period. Amounts also include retention stock units granted in 2002 to Mr. Suggs (35,000 units, $1,976,800), Mr. Hanley (5,000 units, $282,400), Mr. Mackenzie (5,000 units, $282,400), Mr. Fain (5,000 units, $282,400), and Mr. Goodwin (2,500 units, $141,200). These retention stock units are valued based on $56.48, the closing price for common stock of Union Pacific on July 25, 2002, the date of the grant, and were subject to a four-year vesting period. In addition, amounts include retention stock units granted to Mr. Suggs (15,408 units, $862,540), Mr. Hanley (6,163 units, $345,005), Mr. Mackenzie (3,350 units, $187,533), Mr. Fain (6,699 units, $375,010), and Mr. Goodwin (3,350 units, $187,533) under the Union Pacific PEP. Messrs. Suggs, Hanley, Mackenzie, Fain, and Goodwin elected to forego all or a portion of their respective annual incentive awards in exchange for grants of retention stock units equal to 150% of the amount foregone. These retention stock units are valued based on $55.98, the closing price for Union Pacific common stock on January 30, 2003, the date of the grant, and were subject to a three-year vesting period. For awards of retention stock units, the holder was entitled to receive dividend equivalents during the vesting period that are paid at the same rate and time as dividends would have been paid on an equivalent number of shares of Union Pacific common stock. All of the Union Pacific retention stock units vested upon completion of the initial public offering on November 5, 2003. |

| (7) | Reflects cash and the value of shares of Union Pacific common stock awarded at the end of the three-year performance period under the Union Pacific 2001 Long-Term Plan (the “Union Pacific LTP”). The awards were made 50% in cash and 50% in shares of Union Pacific common stock. The valuation date for the shares of Union Pacific common stock was January 31, 2004, the date of approval by the compensation and benefits committee of the Union Pacific board of directors, based on $69.48 per share, the closing price of Union Pacific common stock at that date. Participants had been awarded retention shares or retention stock units and cash awards under the Union Pacific LTP subject to attainment of performance targets and continued employment through January 31, 2004. Union Pacific agreed, effective upon the completion of the initial public offering, to waive the employment condition under the Union Pacific LTP. |

| (8) | Other Compensation for 2004 includes: (a) executive life insurance premiums (Mr. Suggs, $59,771; Mr. Hanley, $7,671; Mr. Mackenzie, $7,876; Mr. Fain, $3,027; and Mr. Goodwin, $4,481); (b) company-matching contributions to employee contributions to our 401(k) plans (Mr. Suggs, $20,181; Mr. Hanley, $10,296; Mr. Mackenzie, $9,664; Mr. Fain, $8,295; and Mr. Goodwin, $7,612); (c) Group Term Life (Mr. Suggs, $6,841; Mr. Hanley, $1,932; Mr. Mackenzie, $1,798; Mr. Fain, $515; and Mr. Goodwin, $774); and (d) interest earned (Mr. Suggs, $90) under the savings plan for employees of Overnite Transportation Company. |

Potential Awards for the Named Executive Officers under the Overnite Long-Term Incentive Program.Under the Overnite Long-Term Incentive Program, our named executive officers may be able to earn performance shares and cash awards depending upon Overnite’s ability to achieve a three-year cumulative earnings per share target ranging from $5.26 to $5.88 for fiscal years 2004, 2005, and 2006. No performance shares or cash awards are earned if the minimum earnings performance target is not met. Varying levels of awards may be earned based upon the extent to which the performance target is reached, with minimum and maximum awards for our named executive officers as follows:

Mr. Suggs, cash award of $468,750 to $1,406,250 and share award of 15,121 shares to 45,363 shares; Messrs. Hanley, Mackenzie, and Fain, cash awards of $230,000 to $690,000 and share awards of 7,419 shares to 22,258 shares; and Mr. Goodwin, cash award of $125,000 to $375,000 and share award of 4,032 shares to 12,097 shares.

Additionally, if the three-year cumulative earnings per share is between $5.26 and $5.55 and Overnite’s stock price exceeds $35.00 for 20 consecutive days, a premium payment of up to 15% of the cash component will be paid in addition to the award. Any additional payment will be either 15% of the cash target amount payable for achieving the earnings per share target or an amount that, when added to the earnings per share payment, equals 100% of the cash target award, whichever is less.

12

Aggregated Option/SAR Exercises in Last Fiscal Year and FY-End Option/SAR Values

Overnite Options

The following table shows information about the exercise of options to purchase shares of Overnite common stock during the year ended December 31, 2004 by each of our named executive officers and the fiscal year-end value of the unexercised options. Each of the options listed below relates to Overnite common stock.

| | | | | | | | | | | | | | | |

Name

| | Shares

Acquired

on

Exercise

| | Value

Realized

| | Number of Securities

Underlying Unexercised

Options/SARs at FY End

| | Value of Unexercised In-the-Money Options/SARs

at FY End(1)

|

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Leo H. Suggs | | — | | $ | — | | 40,000 | | 80,000 | | $ | 729,600 | | $ | 1,459,200 |

Patrick D. Hanley | | — | | | — | | 20,000 | | 40,000 | | | 364,800 | | | 729,600 |

Gordon S. Mackenzie | | — | | | — | | 20,000 | | 40,000 | | | 364,800 | | | 729,600 |

John W. Fain | | — | | | — | | 20,000 | | 40,000 | | | 364,800 | | | 729,600 |

Mark B. Goodwin | | — | | | — | | 13,333 | | 26,667 | | | 243,194 | | | 486,406 |

| (1) | Value is based on $37.24 per share, the closing price of Overnite common stock on The Nasdaq National Market on December 31, 2004. |

Equity Compensation Plan Information

The following table presents information as of December 31, 2004 with respect to compensation plans under which shares of Overnite common stock are authorized for issuance.

| | | | | | | |

Plan Category

| | Number of Securities to Be

Issued upon Exercise of

Outstanding Options,

Warrants and Rights(1)

| | Weighted Average

Exercise Price of

Outstanding Options,

Warrants and Rights

| | Number of Securities

Remaining Available

for Future Issuance

Under Equity

Compensation Plans(2)

|

Equity Compensation Plans Approved by Shareholders Incentive Stock Plan | | 903,799 | | $ | 22.54 | | 2,596,201 |

Equity Compensation Plans Not Approved by Shareholders(3) | | — | | | — | | — |

Total | | 903,799 | | $ | 22.54 | | 2,596,201 |

| (1) | There are no outstanding warrants or rights. |

| (2) | Amount excludes any securities to be issued upon exercise of outstanding options. |

| (3) | We do not have any equity compensation plans that have not been approved by shareholders. |

Retirement Benefits

We provide pensions under tax-qualified defined benefit plans for substantially all of our employees and the employees of our related entities. Our named executive officers participate in the Retirement Plan for Employees of Overnite Transportation Company (“Retirement Plan”), as well as our Supplemental Executive Retirement Plan (“SERP”).

Retirement Plan. The Retirement Plan is a tax-qualified, noncontributory, defined benefit plan. The amount of annual pension benefit received by an employee covered by the Retirement Plan is based upon the employee’s average annual compensation for his or her most highly compensated five consecutive calendar years and the employee’s years of credited service (up to 30 years). Annual compensation under the Retirement Plan is generally equal to an employee’s W-2 wages, excluding earnings under the Long-Term Incentive Program (as defined below), stock-based income, and taxable life insurance premiums. For the named executive officers, annual compensation under the Retirement Plan for the fiscal year ended December 31, 2004 is approximately the sum of the amounts shown in the salary and bonus columns as well as a portion of All Other Compensation.

13

However, as currently required by the Internal Revenue Code of 1986 (the “Internal Revenue Code”), the Retirement Plan disregards compensation in excess of $205,000.

Supplemental Executive Retirement Plan. The SERP provides a benefit using the same formula as the retirement plan except that the SERP does not apply the Internal Revenue Code limits on compensation that may be recognized under a tax-qualified pension plan or the maximum benefit that may be paid under a tax-qualified pension plan. The SERP also recognizes as compensation amounts of annual bonuses deferred by a participating employee or foregone to participate in the ESP or Union Pacific PEP. In addition, the SERP allows participating employees to be credited with deemed additional service, deemed years of age, or both. The accrued benefit payable under the SERP is reduced by the amount of the accrued benefit payable under the Retirement Plan.

The following table shows the estimated combined annual benefits payable under the Retirement Plan and the SERP at normal retirement age (65).

| | | | | | | | | | | | | | | | | | |

Final Average

Earnings

| | Years of Credited Service

|

| | 5

| | 10

| | 15

| | 20

| | 25

| | 30

|

| $ 200,000 | | $ | 17,250 | | $ | 34,500 | | $ | 51,750 | | $ | 69,000 | | $ | 86,250 | | $ | 103,500 |

| 300,000 | | | 25,875 | | | 51,750 | | | 77,625 | | | 103,500 | | | 129,375 | | | 155,250 |

| 400,000 | | | 34,500 | | | 69,000 | | | 103,500 | | | 138,000 | | | 172,500 | | | 207,000 |

| 500,000 | | | 43,125 | | | 86,250 | | | 129,375 | | | 172,500 | | | 215,625 | | | 258,750 |

| 600,000 | | | 51,750 | | | 103,500 | | | 155,250 | | | 207,000 | | | 258,750 | | | 310,500 |

| 750,000 | | | 64,688 | | | 129,375 | | | 194,063 | | | 258,750 | | | 323,438 | | | 388,125 |

| 800,000 | | | 69,000 | | | 138,000 | | | 207,000 | | | 276,000 | | | 345,000 | | | 414,000 |

| 1,000,000 | | | 86,250 | | | 172,500 | | | 258,750 | | | 345,000 | | | 432,250 | | | 517,500 |

| 1,250,000 | | | 107,813 | | | 215,625 | | | 323,438 | | | 431,250 | | | 539,063 | | | 646,875 |

The benefits shown in the pension plan table are not subject to any reduction for Social Security benefits and are payable in the form of a single life annuity. These amounts will be actuarially adjusted if they are paid in a form other than as a single life annuity. Participants have the option of receiving the portion of their retirement benefits from the SERP under any of the options available under the Retirement Plan, or they may choose a lump sum payment at the time of retirement.

The credited years of service under the pension plans for each of the named executive officers as of December 31, 2004 are as follows: Mr. Suggs, 17 years; Mr. Fain, 23 years; Mr. Hanley, 21 years; Mr. Mackenzie, 9 years; and Mr. Goodwin, 21 years.

Union Pacific has guaranteed payments under the SERP representing benefits accrued through December 31, 2003 to the named executive officers in the event we are unable to meet these obligations.

401(k) Plans

We provide benefits under tax-qualified defined contribution plans for substantially all of our employees and the employees of our related entities. Our named executive officers participate in the Tax Reduction Investment Plan for Employees of Overnite Transportation Company (“TRIP”), as well as our Supplemental Tax Reduction Investment Plan (“Supplemental TRIP”).

Qualified Plan. Under the TRIP, eligible hourly and salaried employees may elect to defer from 1% to 12% of their compensation, up to the IRS maximum ($13,000 for 2004). Employees are eligible to participate at date of hire, and are eligible for a company matching contribution after completion of one year of service. We match 50% of an employee’s deferrals up to 7% of compensation, for a maximum match of 3.5% of compensation. Employees vest completely and immediately with the initial company matching contribution. Based upon achievement of certain financial targets, we may choose each year to make additional matching contributions.

14

The plan also has a catch-up contribution feature for participants over the age of 50 (up to $3000, in 2004). All contributions to the TRIP are currently invested, pursuant to participant elections, in mutual funds and institutional commingled funds managed by the Vanguard Group of Investment Companies.

Supplemental Plan. The Supplemental TRIP is available to certain employees and provides benefits in excess of those permitted under the TRIP. The supplemental 401(k) plan otherwise mirrors the terms of the qualified 401(k) plans. Union Pacific has agreed to guarantee payments to the named executive officers under the Supplemental TRIP with respect to these account balances as of December 31, 2003 in the event that we are unable to meet these obligations.

AGREEMENTS WITH EXECUTIVE OFFICERS

Effective January 22, 2004 (the “Effective Date”), we entered into change of control agreements with each of our named executive officers. The purpose of these agreements is to assure the objective judgment and retain the loyalty of these individuals by giving them assurances of employment security in the event of a change of control of our company. The agreements terminate on December 31, 2006; however, they are extended automatically for an additional 12-month term, as of each anniversary of the Effective Date, unless we give written notice to the named executive officer, no later than the August 1 immediately before the applicable anniversary of the Effective Date, that the term of the agreement will not be extended.

Generally, the named executive officer will be entitled to receive the compensation and benefits described in the immediately following paragraph upon the occurrence of any of the following events:

| | • | | if (1) a change in control of our company (as defined in the agreements) occurs during the term of the agreement and (2) within 24 months after the change in control either (x) we terminate the named executive officer’s employment without cause (as defined in the agreements) or (y) the named executive officer resigns from our company and the named executive officer has good reason (as defined in the agreements) to resign; |

| | • | | if (1) during the term of the agreement we terminate the named executive officer’s employment without cause and (2) a change in control occurs within nine months after the named executive officer’s termination by us; or |

| | • | | if (1) during the term of the agreement we terminate the named executive officer’s employment without cause and (2) on the date of the named executive officer’s termination we are negotiating with, or are in discussions with, a person regarding a transaction that, if completed, would constitute a change in control. |

Upon a termination of the named executive officer’s employment in accordance with any of the immediately preceding events, the named executive officer is entitled to receive the following:

| | • | | payment of any accrued but unpaid salary from our company through the date that the named executive officer’s employment terminates; |

| | • | | payment of any bonus that has been earned from our company but that remains unpaid as of the named executive officer’s termination of employment; |

| | • | | a payment equal to the sum of (x) two times the named executive officer’s (three times in the case of Mr. Suggs) base salary as in effect on the date of the named executive officer’s termination and (y) two times the named executive officer’s (three times in the case of Mr. Suggs) average cash bonus for the three years ending before termination; |

| | • | | credit for an additional two years (three years in the case of Mr. Suggs) of service and attainment of an age that is two years (three years in the case of Mr. Suggs) greater than the named executive officer’s actual age for purposes of computing the named executive officer’s benefit under the SERP; |

15

| | • | | continued participation in our medical and insurance plans, programs, and policies on the same terms and for the same benefits as in effect on the date of the named executive officer’s termination for a period of two years (three years in the case of Mr. Suggs) following termination; and |

| | • | | payment of up to $15,000 for outplacement services. |

In addition, in the event of a change in control of our company, regardless of whether the named executive officer’s employment terminates or is terminated, the named executive officer is entitled to the following:

| | • | | a payment equal to the named executive officer’s award opportunity for the current performance cycle in our long-term incentive plan as if the target performance objectives are met; |

| | • | | accelerated vesting, exercisability, and transferability of all outstanding options, performance shares, restricted stock (including shares issued under the ESP), and other stock-based compensation awards; and |

| | • | | a contribution to a grantor trust owned by the named executive officer with a value equal to the present value of the named executive officer’s accrued benefit under the SERP (such contribution to be paid in the form and at the time prescribed by such plan). |

The agreements provide that none of the benefits described in the immediately preceding bullet points will be provided to the named executive officers with respect to a change in control that occurs while a case is pending against our company under the United States Bankruptcy Code.

In the event that any payment or benefit provided under the agreements constitutes a “parachute payment” (as defined in the Section 280G(b)(2)(A) of the Internal Revenue Code) and the named executive officer incurs a liability under Section 4999 of the Internal Revenue Code as a result of such payment or benefit, the agreements provide that we must pay the named executive officer an amount equal to the amount required to hold the named executive officer harmless from the application of Sections 280G and 4999 of the Internal Revenue Code.

In the event that the named executive officer incurs any attorneys’ fees in connection with the enforcement of the named executive officer’s rights under the agreements, we are obligated to pay such fees.

16

REPORT ON EXECUTIVE COMPENSATION

The following Report on Executive Compensation details the Executive Compensation Committee’s policies applicable to the determination of the compensation of Overnite’s executive officers and other key employees.

Total compensation of executive officers includes:

| | • | | long-term incentives: stock options, restricted stock, and a long-term incentive program. |

The Committee’s objective is to create a total compensation package for each executive position that allows Overnite to attract, retain, and motivate the most highly skilled executives. When assessing total compensation, the Committee reviews a number of factors including: company performance, shareholder value, overall individual responsibilities, individual executive performance, attainment of corporate objectives, competitive market conditions, as well as other subjective factors. The philosophy is to have a base salary that approximates the median of the market for each executive officer and for total compensation for each executive officer to adjust above or below the median based on company performance. The Committee uses executive compensation surveys, internal individual comparison, and competitive proxy information to assist in total compensation determination. In an effort to validate its findings, the Committee uses external consultants to evaluate the compensation of Overnite’s executive officers as it relates to those at comparable companies.

Base Salary

Base salary is annual cash compensation and is determined by the executive’s job responsibilities, experience, individual performance, and competitive market factors. Base salary is reviewed and adjusted annually based on a market-defined salary range, individual and company performance, and overall company budget. In addition, subjective factors such as the achievement of specific company objectives and/or demonstrated capabilities of the individual are considered in determining base salary.

For 2004, Overnite used an independent consultant to validate each executive officer’s base salary. The consultant evaluated data from other less-than-truckload carriers, as well as other transportation and comparably sized revenue companies to Overnite.

Annual Incentive

Following our initial public offering on November 5, 2003, Overnite established the Executive Incentive Compensation and Deferral Plan (“EIP”) under which annual incentive bonuses to executive officers may be awarded. The EIP is intended to reflect the Committee’s belief that a significant portion of the total compensation package of each executive officer should reflect success with respect to overall company performance and increases in shareholder value. Commencing in fiscal year 2004, company performance criteria were established at the beginning of the year and EIP payment is contingent upon the achievement of the stated objectives. These objectives included quantitative performance metrics, including revenue, operating income, net income, operating ratio, and free cash flow, and qualitative measures, including product quality (on-time service and cargo claims), ethics/corporate governance, employee relations/morale, advancement of strategy, and succession planning.

For fiscal year 2004, the Committee made awards under the EIP based on company and individual performance.

Overnite’s executive officers may choose to receive the EIP bonus in cash at the time it is awarded, or they may defer all or a portion of the amount into a fully vested, unfunded liability account that allows deferral of payment until a specified date or the executive’s termination of employment.

17

Alternatively, executive officers may choose to participate in Overnite’s Equity Swap Program (“ESP”). The ESP allows executive officers an option to forego all or a portion of their respective EIP awards in exchange for grants of retention stock units (three-year vesting schedule) equivalent to 150% of the incentive amount foregone. Executive officers age 65 and over have the option to forego all or a portion of their respective EIP award in exchange for grants of retention stock units (two-year vesting schedule) equivalent to 133% of the incentive amount foregone. The ESP is designed to:

| | (1) | serve as an executive retention vehicle (as the units have a two or three-year cliff vesting schedule); |

| | (2) | provide an additional means of increasing equity holdings in Overnite; |

| | (3) | properly align executive interest with overall shareholder return; and |

| | (4) | enable the Overnite’s executive compensation plan to remain competitive. |

Long-Term Incentive Compensation

Stock Options and Restricted Shares

The Committee strongly believes that stock-based compensation in the form of stock options and restricted shares links long-term compensation for executives and key management to long-term increases in shareholder value. In determining the timing and amount of stock awards for any individual, the Committee takes into consideration factors such as: the individual’s position and level of responsibility; the performance with respect to corporate objectives; incentives intended to be provided; the timing of other stock awards; value of the award with respect to other compensation; and the recommendation of senior management. There is no specific formula to assign weighting components to each factor; the Committee bases its decisions on an overall assessment of each individual.

In fiscal year 2004, the Committee approved restricted share awards for the named executive officers based upon the overall success of the company in meeting previously set objectives, which included quantitative performance metrics, including revenue, operating income, net income, operating ratio, and free cash flow, and qualitative measures, including product quality (on-time service and cargo claims), ethics/corporate governance, employee relations/morale, advancement of strategy, and succession planning. These restricted share awards are reflected in the Summary Compensation Table on page 11 of this proxy statement.

Stock Ownership Guidelines

The Board of Directors established share ownership guidelines for executive officers as a way of linking the financial interests of Overnite’s officers with those of its shareholders. Overnite’s equity-based incentive plans reinforce the philosophy that executives should own company stock. Overnite expects executives to achieve and maintain a minimum amount of share ownership acquired primarily through the exercising of options and receipt of stock grants. Until minimum ownership targets, defined as a multiple of an officer’s salary, are achieved, Overnite’s named executive officers are generally not permitted to sell any of their shares of Overnite common stock without the approval of the Committee and certain other officers are not permitted to sell their shares of Overnite common stock without the approval of the Chief Executive Officer. Based on the opportunities provided and reasonable growth in stock price, the Committee believes executives should be able to reach the ownership goals within five years. It is the Committee’s intent to encourage some portion of EIP bonus for executives to be taken as retention stock units.

| | | | | | |

Classification

| | Target

| | Below

Target

| | At or Above Target

|

Chairman/CEO | | 5x | | No sales | | No sales except transfers to be held by spouse, children or parents (including in-laws) without Executive Compensation Committee approval. |

| | | |

Other named executive officers | | 4x | | No sales | | No sales except transfers to be held by spouse, children or parents (including in-laws) without Executive Compensation Committee approval. |

| | | |

Certain other officers | | 1x | | No sales | | No sales except transfers to be held by spouse, children or parents (including in-laws) without CEO approval. |

18

Long-Term Incentive Program

As part of the total compensation package, the Board of Directors established the 2004 Long-Term Incentive Program (the “Long-Term Incentive Program”), which is intended to provide financial incentive to its executive officers and key employees who make significant contributions towards the achievement of the long-term financial goals of the company. The program is a mechanism through which Overnite may share a portion of cumulative income with eligible employees once a threshold level of long-term earnings performance is achieved. The duration of the Long-Term Incentive Program is three years. The award of the performance shares and cash award under this program are subject to all of the terms and conditions of the Executive Incentive Compensation and Deferral Plan and the Stock Incentive Plan.

Participants are able to earn performance shares and cash awards dependent upon Overnite’s ability to achieve a three-year cumulative earnings per share target ranging from $5.26 to $5.88 for fiscal years 2004, 2005, and 2006. Varying levels of awards may be earned based upon achievement of the performance target. If the minimum three-year earnings per share target is achieved, cash awards totaling approximately $2.7 million and performance share awards of approximately 87,000 shares would be made to participants. If the maximum three-year earnings per share target is achieved, cash awards totaling approximately $7.9 million and performance share awards of approximately 256,000 shares would be made to participants. Additionally, if the three-year cumulative earnings per share is between $5.26 and $5.55 and Overnite’s stock price exceeds $35.00 for 20 consecutive days, a premium payment of up to 15% of the cash component will be paid in addition to the award. The additional payment will be either 15% of the cash target amount payable for achieving the earnings per share target or an amount, which, when added to the earnings per share payment, equals 100% of the cash target award, whichever is less. No performance shares or cash awards are earned if minimum earnings performance targets are not met. Any performance shares and cash awards earned will vest and be paid at the end of the performance period. Participants generally must remain employed throughout the performance period to be eligible for any awards earned. The Committee has approved the Long-Term Incentive Program and its 41 participants.

Chief Executive Officer Compensation

As noted above, the Committee used an independent consultant to validate Overnite’s executive officers’ base salaries, including that of the Chief Executive Officer.

Using the compensation philosophy and guidelines for Overnite discussed above, the Committee determined Mr. Suggs’ annual salary and annual incentive for fiscal year 2004 and target awards under the Long-Term Incentive Program. This includes an award of 5,000 restricted shares, which are subject to a three-year vesting period; provided, however, that these shares shall also fully vest in the event Mr. Suggs retires on or after January 31, 2007, provided that he remains in the continuous employ of Overnite until his retirement. In determining Mr. Suggs’ annual salary, annual incentive, and award of restricted shares for fiscal year 2004, the Committee considered quantitative performance metrics, including revenue, operating income, net income, operating ratio, and free cash flow, and qualitative measures, including product quality (on-time service and cargo claims), ethics/corporate governance, employee relations/morale, advancement of strategy, and succession planning. The Committee’s goal was to provide him with total compensation, including salary, annual incentive and stock award for fiscal year 2004 and target awards under the Long-Term Incentive Program commensurate with comparable companies (both transportation and similarly scoped in revenue size).

Tax Legislation—Deductibility

Certain tax legislation of the Internal Revenue Code (“Section 162(m)”) generally precludes a public company from taking a federal income tax deduction for annual compensation in excess of $1,000,000 paid to its executive officers. Certain “performance based compensation” is excluded from the deduction limitation. The Committee has been advised that all of the fiscal year 2004 compensation of Overnite’s executive officers, including compensation resulting from the exercise of stock options, is deductible.

THE EXECUTIVE COMPENSATION COMMITTEE

Harold D. Marshall, Chairman

Charles H. Foster, Jr.

Thomas J. Donohue, Jr.

March 14, 2005

19

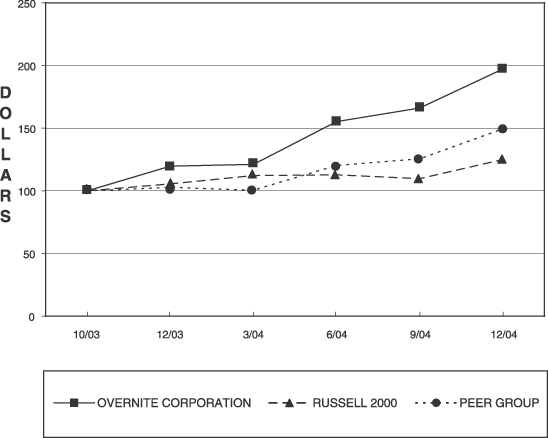

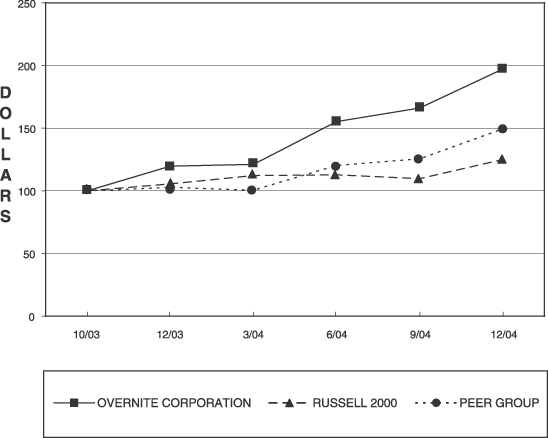

PERFORMANCE GRAPH

The following graph provides an indicator of cumulative total shareholder returns for Overnite from the date Overnite common stock commenced trading following our initial public offering through December 31, 2004, as compared to the Russell 2000 Market Index and a peer group comprised of Arkansas Best Corporation, CNF, Inc., Old Dominion Freight Line, Inc., SCS Transportation, Inc., USF Corporation, and Yellow Roadway Corporation for the same period.

Comparison of Fourteen Month Cumulative Return

Overnite Corporation, Russell 2000 and Peer Group

| | | | | | | | | | | | |

| | | 10/31/03

| | 12/31/03

| | 3/31/04

| | 6/30/04

| | 9/30/04

| | 12/31/04

|

Overnite Corporation | | 100.00 | | 119.74 | | 121.27 | | 155.27 | | 166.21 | | 197.17 |

Russell 2000 | | 100.00 | | 105.65 | | 112.26 | | 112.79 | | 109.57 | | 125.01 |

Peer Group | | 100.00 | | 102.78 | | 100.71 | | 120.25 | | 125.55 | | 149.41 |

The comparison above assumes $100 was invested on October 31, 2003 in Overnite common stock and each of the foregoing indices, and assumes reinvestment of dividends. All calculations have been prepared by Research Data Group, Inc., which is not affiliated with us. The shareholder return shown on the graph above is not necessarily indicative of future performance.

20

THE AUDIT COMMITTEE REPORT

The Audit Committee of the Board of Directors is composed of three independent directors and operates under a written charter adopted by the Board of Directors. Management is responsible for Overnite’s disclosure controls, internal control over financial reporting, preparation of the financial statements, and the financial reporting process. The independent registered public accounting firm is responsible for performing an independent audit of Overnite’s consolidated financial statements and its internal control over financial reporting in accordance with standards of the Public Company Accounting Oversight Board (United States) and for issuing reports thereon. The Audit Committee’s primary responsibility is to monitor and oversee: (1) Overnite’s accounting and financial reporting processes; (2) the reliability of Overnite’s financial statements; (3) the evaluation and management of Overnite’s financial risks; (4) Overnite’s compliance with laws and regulations; and (5) the maintenance of an effective and efficient audit of Overnite’s annual financial statements by a qualified and independent registered public accounting firm and to report thereon to the Board of Directors. The full text of the Committee’s charter is available on Overnite’s website (www.ovnt.com,Corporate Governance).

In carrying out these responsibilities, the Audit Committee, among other things:

| | • | | monitors preparation of quarterly and annual financial reports by Overnite’s management; |

| | • | | supervises the relationship between Overnite and its independent registered public accounting firm, including: having direct responsibility for its appointment (subject to shareholder ratification), fees, and retention; reviewing the scope of its audit services; pre-approving audit and non-audit services; and confirming the independence of the independent registered public accounting firm; and |

| | • | | oversees management’s implementation and maintenance of effective systems of internal control over financial reporting and disclosure controls, including review of Overnite’s policies relating to legal and regulatory compliance, ethics and conflicts of interests, and review of Overnite’s internal auditing program. |

In this context, the Audit Committee met ten times during 2004. During five of such meetings, the Audit Committee also met privately with the internal auditors and Deloitte & Touche LLP, Overnite’s independent registered public accounting firm, all of whom have unrestricted access to the Audit Committee. The Audit Committee has discussed with Deloitte & Touche the matters required to be discussed by Statement on Auditing Standards No. 61 (Codification of Statements on Accounting Standards, AU § 380), including the scope of the auditor’s responsibilities, significant accounting adjustments, and any disagreements with management. The Audit Committee has also discussed any items required to be communicated to it by Deloitte & Touche in accordance with regulations promulgated by the Securities and Exchange Commission and the Public Company Accounting Oversight Board and standards established by the American Institute of Certified Public Accountants and the Independence Standards Board.