UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08789

VALIC Company II

(Exact name of registrant as specified in charter)

2929 Allen Parkway, Houston, TX 77019

(Address of principal executive offices) (Zip code)

Kurt W. Bernlohr

Senior Vice President

The Variable Annuity Life Insurance Company

2929 Allen Parkway

Houston, TX 77019

(Name and address of agent for service)

Registrant’s telephone number, including area code: (713) 831-6133

Date of fiscal year end: August 31

Date of reporting period: August 31, 2009

Item 1. Reports to Stockholders

VALIC Company II, Annual Report at August 31, 2009.

VALIC Company II

Annual Report, August 31, 2009

SAVING :INVESTING :PLANNING

VALIC Company II

ANNUAL REPORT AUGUST 31, 2009

TABLE OF CONTENTS

VALIC Company II

PRESIDENT’S LETTER

Dear Valued Investor:

We are pleased to provide you with the Annual Report for VALIC Company II. The report contains the investment portfolio information and the financial statements of VALIC Company II for the twelve-month period ending August 31, 2009.

The reporting period was one of extreme volatility divided roughly into two equal periods that experienced radically different market results. The total return for the Standard & Poor’s (S&P) 500® Index* was -18.25% for the entire twelve-month period, -41.82 for the first six-months of the period (September 1, 2008 through February 28, 2009) and +40.52% for the second six-months (March 1, 2009 through August 31, 2009). These results mirrored the mood of many investors during the period, with fear and pessimism gradually giving way to hope and optimism that perhaps the market had bottomed and was on its way to a sustainable recovery.

Beginning with the “Great September Crash of 2008” and continuing into the early months of 2009, the U.S. and global economy continued to deteriorate. Unemployment rose, housing prices plunged, credit markets deteriorated and consumer confidence eroded. Despite massive government bailouts, stimulus programs, interest rate reductions and other interventions — both in the U.S. and abroad — lower investment values were generally experienced across virtually all assets classes.

March saw markets abruptly reverse course and experience strong gains throughout most asset classes. Constant talk of “green shoots” — which, while not demonstrating economic growth, suggested that the economy was stabilizing. During this time, the Federal government also continued to actively participate in the economy. Among other things, the government initiated bankruptcy filings by Chrysler and General Motors, introduced a wide ranging proposal to reform regulations for the financial markets and created an “executive pay czar” for firms receiving TARP funds.

But as the reporting period came to a close, lingering concerns remained whether the economy would continue to stabilize or return to declining growth, as much of the recent improvements occurred in the face of continuing weak economic data. Job losses increased more than expected with the unemployment rate rising to 9.5%. Consumer confidence and spending remained sluggish. Housing markets generally continued to disappoint. And even many touted improvements in certain economic indicators often took the form of slower rates of decline rather than demonstrations of fundamental, sustainable growth.

The continued market uncertainty has understandably shaken the confidence of many investors who may question their ability to make the right investment decisions. But now, more than ever, it is important to stick to investment fundamentals and have a long-term investment strategy. Meet with your financial advisor. Review your goals and time horizons. Now is as good of time as any to take greater control of your financial future.

Thank you for your continued confidence in our ability to help you meet your investment goals.

Sincerely,

Kurt W. Bernlohr, President

VALIC Company II

| * | The Standard & Poor’s (S&P) 500 includes a representative sample of leading companies in leading industries that reflect the U.S. stock market. It is not a managed fund, has no identifiable objective and cannot be purchased. It does not provide an indication of how individual investments performed in the past or how they will perform in the future. Past performance of an index does not guarantee the future performance of any investment. |

1

VALIC Company II

EXPENSE EXAMPLE — August 31, 2009 (Unaudited)

Disclosure of Fund Expenses in Shareholder Reports

As a shareholder of a Fund in VALIC Company II (“VC II”), you incur ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at March 1, 2009 and held until August 31, 2009. Shares of VC II are currently issued and redeemed only in connection with investments in and payments under variable annuity contracts and variable life insurance policies (“Variable Contracts”) and qualified retirement plans (the “Plans”) offered by The Variable Annuity Life Insurance Company (“VALIC”), the investment adviser to VC II and other life insurance companies affiliated with VALIC. The fees and expenses associated with the Variable Contracts and Plans are not included in these Examples, and had such fees and expenses been included your costs would have been higher. Please see your Variable Contract prospectus or Plan document for more details on the fees associated with the Variable Contract or Plans.

Actual Expenses

The “Actual” section of the table provides information about your actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the column under the heading entitled “Expenses Paid During the Six Months Ended August 31, 2009” to estimate the expenses you paid on your account during this period. The “Expenses Paid During the Six Months Ended August 31, 2009” column and the “Expense Ratio as of August 31, 2009” column do not include fees and expenses that may be charged by the Variable Contracts or Plans, in which the Funds are offered. Had these fees and expenses been included, the “Expenses Paid During the Six Months Ended August 31, 2009” column would have been higher and the “Ending Account Value” would have been lower.

Hypothetical Example for Comparison Purposes

The “Hypothetical” section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. The “Expenses Paid During the Six Months Ended August 31, 2009” column and the “Expense Ratio as of August 31, 2009” column do not include fees and expenses that may be charged by the Variable Contracts or Plans, in which the Funds are offered. Had these fees and expenses been included, the “Expenses Paid During the Six Months Ended August 31, 2009” column would have been higher and the “Ending Account Value” would have been lower.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any fees and expenses that may be charged by the Variable Contracts or Plans. Please refer to your Variable Contract prospectus or Plan document for more information. Therefore, the “hypothetical” example is useful in comparing ongoing costs and will not help you determine the relative total costs of owning different funds. In addition, if these fees and expenses were included, your costs would have been higher.

2

VALIC Company II

EXPENSE EXAMPLE — August 31, 2009 (Unaudited) — (continued)

| | | | | | | | | | | | | | | |

| | | Actual

| | Hypothetical

| | | |

Fund

| | Beginning

Account Value

at March 1,

2009

| | Ending

Account Value

Using Actual

Return at

August 31,

2009

| | Expenses Paid

During the Six

Months Ended

August 31,

2009*

| | Beginning

Account Value

at March 1,

2009

| | Ending

Account Value

Using a

Hypothetical

5% Assumed

Return at

August 31,

2009

| | Expenses Paid

During the

Six Months Ended

August 31,

2009*

| | Expense

Ratio

as of

August 31,

2009*

| |

Aggressive Growth Lifestyle# | | $1,000.00 | | $1,356.73 | | $0.59 | | $1,000.00 | | $1,024.70 | | $0.51 | | 0.10 | % |

Capital Appreciation# | | $1,000.00 | | $1,301.56 | | $4.93 | | $1,000.00 | | $1,020.92 | | $4.33 | | 0.85 | % |

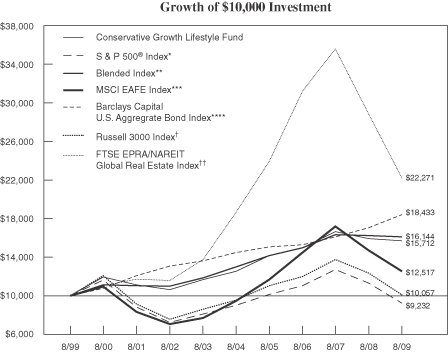

Conservative Growth Lifestyle# | | $1,000.00 | | $1,227.62 | | $0.56 | | $1,000.00 | | $1,024.70 | | $0.51 | | 0.10 | % |

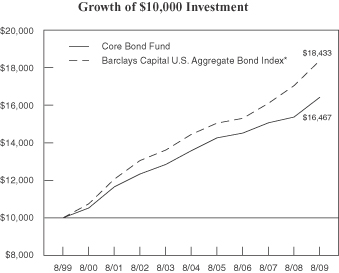

Core Bond# | | $1,000.00 | | $1,127.97 | | $4.13 | | $1,000.00 | | $1,021.32 | | $3.92 | | 0.77 | % |

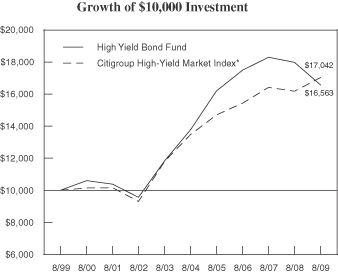

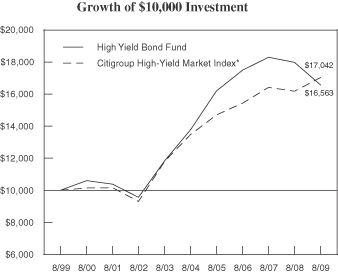

High Yield Bond# | | $1,000.00 | | $1,276.84 | | $5.68 | | $1,000.00 | | $1,020.21 | | $5.04 | | 0.99 | % |

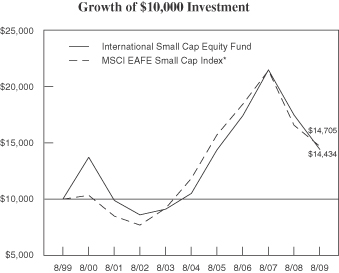

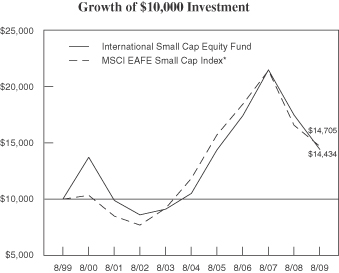

International Small Cap Equity# | | $1,000.00 | | $1,412.90 | | $6.08 | | $1,000.00 | | $1,020.16 | | $5.09 | | 1.00 | % |

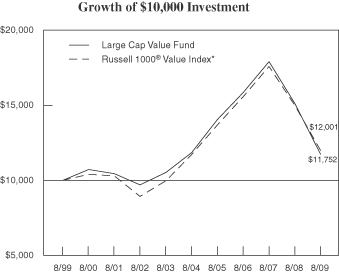

Large Cap Value#@ | | $1,000.00 | | $1,310.49 | | $4.72 | | $1,000.00 | | $1,021.12 | | $4.13 | | 0.81 | % |

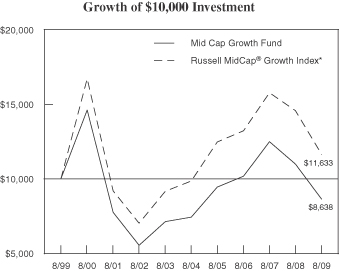

Mid Cap Growth#@ | | $1,000.00 | | $1,415.65 | | $5.18 | | $1,000.00 | | $1,020.92 | | $4.33 | | 0.85 | % |

Mid Cap Value#@ | | $1,000.00 | | $1,511.30 | | $6.65 | | $1,000.00 | | $1,019.91 | | $5.35 | | 1.05 | % |

Moderate Growth Lifestyle# | | $1,000.00 | | $1,302.45 | | $0.58 | | $1,000.00 | | $1,024.70 | | $0.51 | | 0.10 | % |

Money Market II# | | $1,000.00 | | $1,001.87 | | $2.78 | | $1,000.00 | | $1,022.43 | | $2.80 | | 0.55 | % |

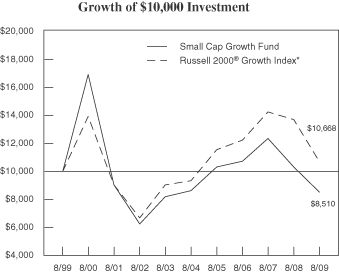

Small Cap Growth #@ | | $1,000.00 | | $1,489.60 | | $7.28 | | $1,000.00 | | $1,019.36 | | $5.90 | | 1.16 | % |

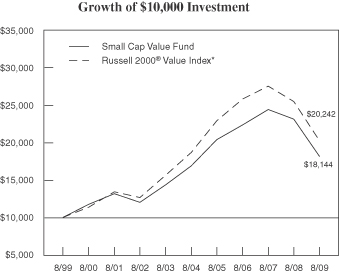

Small Cap Value#@ | | $1,000.00 | | $1,490.20 | | $5.96 | | $1,000.00 | | $1,020.42 | | $4.84 | | 0.95 | % |

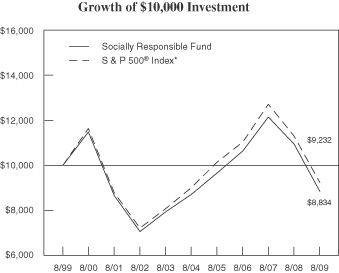

Socially Responsible#@ | | $1,000.00 | | $1,428.80 | | $3.43 | | $1,000.00 | | $1,022.38 | | $2.85 | | 0.56 | % |

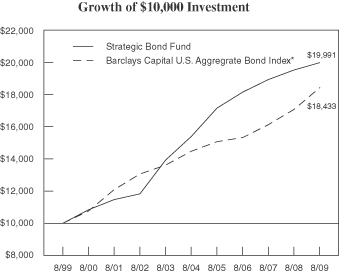

Strategic Bond# | | $1,000.00 | | $1,197.90 | | $4.93 | | $1,000.00 | | $1,020.72 | | $4.53 | | 0.89 | % |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 184 days then divided by 365 days. These ratios do not reflect fees and expenses associated with the Variable Contracts or Plans. If such fees and expenses had been included, the expenses would have been higher. Please refer to your Variable Contract prospectus for details on the expenses that apply to the Variable Contracts or your Plan document for details on the administration fees charged by your Plan sponsor. |

| # | During the stated period, the investment adviser waived a portion of or all fees and assumed a portion of or all expenses for the Fund. As a result, if these fees and expenses had not been waived or assumed, the “Actual/Hypothetical Ending Account Value” would have been lower and the “Actual/Hypothetical Expenses Paid During the Six Months Ended August 31, 2009” and the “Expense Ratios” would have been higher. |

| @ | Through expense offset arrangements resulting from broker commission recapture, a portion of the Fund's expenses has been reduced. Had the expense reductions been taken into account, the Expense Example would have been as follows: |

| | | | | | | | | | | | | | |

| | | Actual

| | Hypothetical

| | |

Fund

| | Beginning

Account Value

at March 1,

2009

| | Ending

Account Value

Using Actual

Return at

August 31,

2009

| | Expenses Paid

During the Six

Months Ended

August 31,

2009*

| | Beginning

Account Value

at March 1,

2009

| | Ending

Account Value

Using a

Hypothetical

5% Assumed

Return at

August 31,

2009

| | Expenses Paid

During the

Six Months Ended

August 31,

2009*

| | Expense

Ratio

as of

August 31,

2009*

|

Large Cap Value# | | $1,000.00 | | $1,310.49 | | $4.66 | | $1,000.00 | | $1,021.17 | | $4.08 | | 0.80% |

Mid Cap Growth# | | $1,000.00 | | $1,415.65 | | $4.75 | | $1,000.00 | | $1,021.27 | | $3.97 | | 0.78% |

Mid Cap Value# | | $1,000.00 | | $1,511.30 | | $6.46 | | $1,000.00 | | $1,020.06 | | $5.19 | | 1.02% |

Small Cap Growth# | | $1,000.00 | | $1,489.60 | | $7.15 | | $1,000.00 | | $1,019.46 | | $5.80 | | 1.14% |

Small Cap Value# | | $1,000.00 | | $1,490.20 | | $5.96 | | $1,000.00 | | $1,020.42 | | $4.84 | | 0.95% |

Socially Responsible# | | $1,000.00 | | $1,428.80 | | $3.31 | | $1,000.00 | | $1,022.48 | | $2.75 | | 0.54% |

3

VALIC Company II Aggressive Growth Lifestyle Fund

PORTFOLIO PROFILE — August 31, 2009 (Unaudited)

Industry Allocation*

| | | |

Domestic Equity Investment Companies | | 57.1 | % |

Fixed Income Investment Companies | | 17.3 | |

International Equity Investment Companies | | 25.7 | |

| | |

|

|

| | | 100.1 | % |

| | |

|

|

| * | Calculated as a percentage of net assets |

4

VALIC Company II Aggressive Growth Lifestyle Fund

PORTFOLIO OF INVESTMENTS — August 31, 2009

| | | | | | | |

| | |

| Security Description | | Shares | | | Market Value

(Note 2) | |

| |

AFFILIATED REGISTERED INVESTMENT COMPANIES#(1) — 100.1% | |

Domestic Equity Investment Companies — 57.1% | |

VALIC Co. I Blue Chip Growth Fund | | 775,682 | | | $ | 6,174,429 | |

VALIC Co. I Small Cap Special Values Fund | | 997,070 | | | | 7,009,402 | |

VALIC Co. I Stock Index Fund | | 369,082 | | | | 7,872,522 | |

VALIC Co. I Value Fund | | 736,674 | | | | 5,974,425 | |

VALIC Co. II Capital Appreciation Fund | | 1,286,086 | | | | 9,658,506 | |

VALIC Co. II Large Cap Value Fund | | 343,370 | | | | 3,217,378 | |

VALIC Co. II Mid Cap Value Fund | | 517,611 | | | | 6,578,832 | |

VALIC Co. II Small Cap Growth Fund† | | 122,866 | | | | 1,143,881 | |

VALIC Co. II Small Cap Value Fund | | 595,865 | | | | 5,887,149 | |

| | | | | |

|

|

|

Total Domestic Equity Investment Companies | |

(cost $46,311,287) | | | | | | 53,516,524 | |

| | | | | |

|

|

|

Fixed Income Investment Companies — 17.3% | |

VALIC Co. II Core Bond Fund | | 335,230 | | | | 3,338,893 | |

VALIC Co. II High Yield Bond Fund | | 636,094 | | | | 4,319,081 | |

VALIC Co. II Strategic Bond Fund | | 832,779 | | | | 8,577,627 | |

| | | | | |

|

|

|

Total Fixed Income Investment Companies | |

(cost $14,411,902) | | | | | | 16,235,601 | |

| | | | | |

|

|

|

International Equity Investment Companies — 25.7% | |

VALIC Co. I Foreign Value Fund | | 630,123 | | | | 5,255,229 | |

VALIC Co. I Global Real Estate Fund | | 1,184,169 | | | | 8,928,629 | |

VALIC Co. I International Equities Fund | | 1,212,640 | | | | 7,106,070 | |

VALIC Co. I International Growth I Fund | | 297,516 | | | | 2,737,143 | |

| | | | | |

|

|

|

Total International Equity Investment Companies | |

(cost $19,643,655) | | | | | | 24,027,071 | |

| | | | | |

|

|

|

TOTAL INVESTMENTS | | | | | | | |

(cost $80,366,844)(2) | | 100.1 | % | | | 93,779,196 | |

Liabilities in excess of other assets | | (0.1 | ) | | | (83,387 | ) |

| | |

|

| |

|

|

|

NET ASSETS — | | 100.0 | % | | $ | 93,695,809 | |

| | |

|

| |

|

|

|

| † | Non-income producing security |

| # | The Aggressive Growth Lifestyle Fund invests in various VALIC Company I or VALIC Company II Funds, some of which are not presented in this report. Additional information on the underlying funds including such fund’s prospectuses and shareholder reports, is available at our website, www.valic.com. |

| (2) | See Note 5 for cost of investments on a tax basis. |

The following is a summary of the inputs used to value the Fund’s net assets as of August 31, 2009 (see Note 2):

| | | | | | | | | | | | |

| | | Level 1 -

Unadjusted

Quoted

Prices

| | Level 2 -

Other

Observable

Inputs

| | Level 3 -

Significant

Unobservable

Inputs

| | Total

|

Affiliated Registered Investment Companies: | | | | | | | | | | | | |

Domestic Equity Investment Companies | | $ | 53,516,524 | | $ | – | | $ | – | | $ | 53,516,524 |

Fixed Income Investment Companies | | | 16,235,601 | | | – | | | – | | | 16,235,601 |

International Equity Investment Companies | | | 24,027,071 | | | – | | | – | | | 24,027,071 |

| | |

|

| |

|

| |

|

| |

|

|

Total | | $ | 93,779,196 | | $ | – | | $ | – | | $ | 93,779,196 |

| | |

|

| |

|

| |

|

| |

|

|

See Notes to Financial Statements

5

VALIC Company II Capital Appreciation Fund

PORTFOLIO PROFILE — August 31, 2009 (Unaudited)

Industry Allocation*

| | | |

Computers | | 8.4 | % |

Medical — Biomedical/Gene | | 7.6 | |

Applications Software | | 6.2 | |

Medical Products | | 5.9 | |

Medical — Drugs | | 5.7 | |

Retail — Discount | | 4.5 | |

Enterprise Software/Service | | 4.5 | |

E-Commerce/Services | | 3.7 | |

Oil Field Machinery & Equipment | | 3.1 | |

Computers — Memory Devices | | 3.0 | |

Savings & Loans/Thrifts | | 3.0 | |

Pharmacy Services | | 2.8 | |

Web Portals/ISP | | 2.8 | |

Transport — Rail | | 2.6 | |

Retail — Auto Parts | | 2.5 | |

Oil & Gas Drilling | | 2.4 | |

Aerospace/Defense | | 2.2 | |

Schools | | 2.2 | |

E-Commerce/Products | | 2.1 | |

Retail — Restaurants | | 2.0 | |

Banks — Fiduciary | | 1.9 | |

Athletic Footwear | | 1.9 | |

Electronic Components — Semiconductors | | 1.8 | |

Energy — Alternate Sources | | 1.7 | |

Retail — Major Department Stores | | 1.5 | |

Commercial Services — Finance | | 1.5 | |

Distribution/Wholesale | | 1.4 | |

Transport — Services | | 1.4 | |

Oil Companies — Exploration & Production | | 1.4 | |

Cable/Satellite TV | | 1.3 | |

Beverages — Non-alcoholic | | 1.3 | |

Chemicals — Specialty | | 1.3 | |

Medical — Generic Drugs | | 1.3 | |

Retail — Apparel/Shoe | | 1.1 | |

Telecommunication Equipment | | 1.1 | |

Banks — Super Regional | | 1.0 | |

| | |

|

|

| | | 100.1 | % |

| | |

|

|

| * | Calculated as a percentage of net assets |

6

VALIC Company II Capital Appreciation Fund

PORTFOLIO OF INVESTMENTS — August 31, 2009

| | | | | |

| | |

| Security Description | | Shares | | Market Value

(Note 2) |

|

COMMON STOCK — 100.1% | | | |

Aerospace/Defense — 2.2% | | | | | |

Lockheed Martin Corp. | | 14,400 | | $ | 1,079,712 |

| | | | |

|

|

Applications Software — 6.2% | | | | | |

Intuit, Inc.† | | 28,100 | | | 780,337 |

Microsoft Corp. | | 52,100 | | | 1,284,265 |

Salesforce.com, Inc.† | | 18,200 | | | 944,034 |

| | | | |

|

|

| | | | | | 3,008,636 |

| | | | |

|

|

Athletic Footwear — 1.9% | | | | | |

NIKE, Inc., Class B | | 16,200 | | | 897,318 |

| | | | |

|

|

Banks - Fiduciary — 1.9% | | | | | |

State Street Corp. | | 17,500 | | | 918,400 |

| | | | |

|

|

Banks - Super Regional — 1.0% | | | | | |

Wells Fargo & Co. | | 17,800 | | | 489,856 |

| | | | |

|

|

Beverages - Non - alcoholic — 1.3% | | | | | |

The Coca - Cola Co. | | 13,100 | | | 638,887 |

| | | | |

|

|

Cable/Satellite TV — 1.3% | | | | | |

Comcast Corp., Class A | | 42,000 | | | 643,440 |

| | | | |

|

|

Chemicals - Specialty — 1.3% | | | | | |

Ecolab, Inc. | | 14,900 | | | 630,121 |

| | | | |

|

|

Commercial Services - Finance — 1.5% | | | | | |

Mastercard, Inc., Class A | | 3,500 | | | 709,205 |

| | | | |

|

|

Computers — 8.4% | | | | | |

Apple, Inc.† | | 8,500 | | | 1,429,785 |

Hewlett - Packard Co. | | 32,600 | | | 1,463,414 |

International Business Machines Corp. | | 10,200 | | | 1,204,110 |

| | | | |

|

|

| | | | | | 4,097,309 |

| | | | |

|

|

Computers - Memory Devices — 3.0% | | | | | |

EMC Corp.† | | 93,000 | | | 1,478,700 |

| | | | |

|

|

Distribution/Wholesale — 1.4% | | | | | |

WW Grainger, Inc. | | 7,900 | | | 691,013 |

| | | | |

|

|

E - Commerce/Products — 2.1% | | | | | |

Amazon.com, Inc.† | | 12,600 | | | 1,022,994 |

| | | | |

|

|

E - Commerce/Services — 3.7% | | | | | |

eBay, Inc.† | | 54,100 | | | 1,197,774 |

Priceline.com, Inc.† | | 4,000 | | | 615,920 |

| | | | |

|

|

| | | | | | 1,813,694 |

| | | | |

|

|

Electronic Components - Semiconductors — 1.8% | | | |

Intel Corp. | | 42,200 | | | 857,504 |

| | | | |

|

|

Energy - Alternate Sources — 1.7% | | | | | |

First Solar, Inc.† | | 6,700 | | | 814,586 |

| | | | |

|

|

Enterprise Software/Service — 4.5% | | | | | |

CA, Inc. | | 40,000 | | | 891,600 |

Oracle Corp. | | 58,400 | | | 1,277,208 |

| | | | |

|

|

| | | | | | 2,168,808 |

| | | | |

|

|

Medical Products — 5.9% | | | | | |

Johnson & Johnson | | 21,200 | | | 1,281,328 |

Stryker Corp. | | 22,100 | | | 916,266 |

Varian Medical Systems, Inc.† | | 15,200 | | | 654,664 |

| | | | |

|

|

| | | | | | 2,852,258 |

| | | | |

|

|

Medical - Biomedical/Gene — 7.6% | | | | | |

Amgen, Inc.† | | 21,100 | | | 1,260,514 |

Biogen Idec, Inc.† | | 16,900 | | | 848,549 |

Gilead Sciences, Inc.† | | 26,700 | | | 1,203,102 |

Life Technologies Corp.† | | 7,900 | | | 351,787 |

| | | | |

|

|

| | | | | | 3,663,952 |

| | | | |

|

|

| | | | | |

| | |

| Security Description | | Shares | | Market Value

(Note 2) |

|

| | | | | | |

Medical - Drugs — 5.7% | | | | | |

Abbott Laboratories | | 10,900 | | $ | 493,007 |

Bristol - Myers Squibb Co. | | 39,000 | | | 863,070 |

Forest Laboratories, Inc.† | | 23,700 | | | 693,699 |

Merck & Co., Inc. | | 21,800 | | | 706,974 |

Myriad Pharmaceuticals, Inc.† | | 4,500 | | | 20,250 |

| | | | |

|

|

| | | | | | 2,777,000 |

| | | | |

|

|

Medical - Generic Drugs — 1.3% | | | | | |

Mylan, Inc.† | | 42,600 | | | 624,942 |

| | | | |

|

|

Oil & Gas Drilling — 2.4% | | | | | |

Diamond Offshore Drilling, Inc. | | 6,300 | | | 563,346 |

Noble Corp. | | 16,800 | | | 588,504 |

| | | | |

|

|

| | | | | | 1,151,850 |

| | | | |

|

|

Oil Companies - Exploration & Production — 1.4% | | | |

Southwestern Energy Co.† | | 18,000 | | | 663,480 |

| | | | |

|

|

Oil Field Machinery & Equipment — 3.1% | | | | | |

Cameron International Corp.† | | 22,000 | | | 785,620 |

National - Oilwell Varco, Inc.† | | 19,400 | | | 705,190 |

| | | | |

|

|

| | | | | | 1,490,810 |

| | | | |

|

|

Pharmacy Services — 2.8% | | | | | |

Express Scripts, Inc.† | | 18,700 | | | 1,350,514 |

| | | | |

|

|

Retail - Apparel/Shoe — 1.1% | | | | | |

Ross Stores, Inc. | | 11,900 | | | 555,016 |

| | | | |

|

|

Retail - Auto Parts — 2.5% | | | | | |

AutoZone, Inc.† | | 4,400 | | | 647,900 |

O’Reilly Automotive, Inc.† | | 14,800 | | | 566,544 |

| | | | |

|

|

| | | | | | 1,214,444 |

| | | | |

|

|

Retail - Discount — 4.5% | | | | | |

Dollar Tree, Inc.† | | 3,700 | | | 184,778 |

Family Dollar Stores, Inc. | | 23,200 | | | 702,496 |

Wal - Mart Stores, Inc. | | 25,300 | | | 1,287,011 |

| | | | |

|

|

| | | | | | 2,174,285 |

| | | | |

|

|

Retail - Major Department Stores — 1.5% | | | | | |

TJX Cos., Inc. | | 20,500 | | | 736,975 |

| | | | |

|

|

Retail - Restaurants — 2.0% | | | | | |

McDonald’s Corp. | | 17,200 | | | 967,328 |

| | | | |

|

|

Savings & Loans/Thrifts — 3.0% | | | | | |

Hudson City Bancorp, Inc. | | 68,500 | | | 898,720 |

New York Community Bancorp, Inc. | | 51,800 | | | 551,152 |

| | | | |

|

|

| | | | | | 1,449,872 |

| | | | |

|

|

Schools — 2.2% | | | | | |

Apollo Group, Inc., Class A† | | 7,600 | | | 492,632 |

ITT Educational Services, Inc.† | | 5,400 | | | 566,946 |

| | | | |

|

|

| | | | | | 1,059,578 |

| | | | |

|

|

Telecom Services — 0.0% | | | | | |

Harris Stratex Networks, Inc.† | | 3,875 | | | 23,483 |

| | | | |

|

|

Telecommunication Equipment — 1.1% | | | | | |

Harris Corp. | | 15,600 | | | 541,788 |

| | | | |

|

|

Transport - Rail — 2.6% | | | | | |

Burlington Northern Santa Fe Corp. | | 7,600 | | | 630,952 |

Union Pacific Corp. | | 10,600 | | | 633,986 |

| | | | |

|

|

| | | | | | 1,264,938 |

| | | | |

|

|

Transport - Services — 1.4% | | | | | |

C.H. Robinson Worldwide, Inc. | | 12,200 | | | 686,372 |

| | | | |

|

|

7

VALIC Company II Capital Appreciation Fund

PORTFOLIO OF INVESTMENTS — August 31, 2009 — (continued)

| | | | | | | |

| | |

| Security Description | | Shares | | | Market Value

(Note 2) | |

| |

COMMON STOCK (continued) | | | | | | | |

Web Portals/ISP — 2.8% | | | | | | | |

Google, Inc., Class A† | | 2,900 | | | $ | 1,338,843 | |

| | | | | |

|

|

|

TOTAL LONG-TERM INVESTMENT SECURITIES | | | | | | | |

(cost $49,591,308)(1) | | 100.1 | % | | | 48,547,911 | |

Liabilities in excess of other assets | | (0.1 | ) | | | (38,008 | ) |

| | |

|

| |

|

|

|

NET ASSETS — | | 100.0 | % | | $ | 48,509,903 | |

| | |

|

| |

|

|

|

| † | Non-income producing security |

| (1) | See Note 5 for cost of investments on a tax basis. |

The following is a summary of the inputs used to value the Fund’s net assets as of August 31, 2009 (see Note 2):

| | | | | | | | | | | | |

| | | Level 1 -

Unadjusted

Quoted

Prices

| | Level 2 -

Other

Observable

Inputs

| | Level 3 -

Significant

Unobservable

Inputs

| | Total

|

Long-Term Investment Securities: | | | | | | | | | | | | |

Common Stock: | | | | | | | | | | | | |

Applications Software | | $ | 3,008,636 | | $ | – | | $ | – | | $ | 3,008,636 |

Computers | | | 4,097,309 | | | – | | | – | | | 4,097,309 |

Medical Products | | | 2,852,258 | | | – | | | – | | | 2,852,258 |

Medical — Biomedical/Gene | |

| 3,663,952

| | | – | | | – | | | 3,663,952 |

Medical — Drugs | | | 2,777,000 | | | – | | | – | | | 2,777,000 |

Other Industries* | | | 32,148,756 | | | – | | | – | | | 32,148,756 |

| | |

|

| |

|

| |

|

| |

|

|

Total | | $ | 48,547,911 | | $ | – | | $ | – | | $ | 48,547,911 |

| | |

|

| |

|

| |

|

| |

|

|

| * | Sum of all other industries each of which individually has an aggregate market value of less than 5% of net assets. |

See Notes to Financial Statements

8

VALIC Company II Conservative Growth Lifestyle Fund

PORTFOLIO PROFILE — August 31, 2009 (Unaudited)

Industry Allocation*

| | | |

Fixed Income Investment Companies | | 56.2 | % |

Domestic Equity Investment Companies | | 30.8 | |

International Equity Investment Companies | | 13.1 | |

| | |

|

|

| | | 100.1 | % |

| | |

|

|

| * | Calculated as a percentage of net assets |

9

VALIC Company II Conservative Growth Lifestyle Fund

PORTFOLIO OF INVESTMENTS — August 31, 2009

| | | | | | | |

| | |

| Security Description | | Shares | | | Market

Value

(Note 2) | |

| |

AFFILIATED REGISTERED INVESTMENT COMPANIES#(1) — 100.1% | |

Domestic Equity Investment Companies — 30.8% | |

VALIC Co. I Blue Chip Growth Fund | | 107,853 | | | $ | 858,510 | |

VALIC Co. I Small Cap Special Values Fund | | 452,644 | | | | 3,182,086 | |

VALIC Co. I Stock Index Fund | | 151,871 | | | | 3,239,418 | |

VALIC Co. I Value Fund | | 220,235 | | | | 1,786,108 | |

VALIC Co. II Capital Appreciation Fund | | 304,117 | | | | 2,283,918 | |

VALIC Co. II Large Cap Value Fund | | 79,344 | | | | 743,450 | |

VALIC Co. II Mid Cap Value Fund | | 249,031 | | | | 3,165,180 | |

VALIC Co. II Small Cap Growth Fund† | | 25,360 | | | | 236,098 | |

VALIC Co. II Small Cap Value Fund | | 231,620 | | | | 2,288,401 | |

| | | | | |

|

|

|

Total Domestic Equity Investment Companies | |

(cost $14,398,891) | | | | | | 17,783,169 | |

| | | | | |

|

|

|

Fixed Income Investment Companies — 56.2% | |

VALIC Co. I Government Securities Fund | | 270,849 | | | | 2,914,332 | |

VALIC Co. II Core Bond Fund | | 1,401,290 | | | | 13,956,853 | |

VALIC Co. II High Yield Bond Fund | | 943,696 | | | | 6,407,693 | |

VALIC Co. II Strategic Bond Fund | | 884,083 | | | | 9,106,057 | |

| | | | | |

|

|

|

Total Fixed Income Investment Companies | |

(cost $29,691,054) | | | | | | 32,384,935 | |

| | | | | |

|

|

|

International Equity Investment Companies — 13.1% | |

VALIC Co. I Foreign Value Fund | | 259,883 | | | | 2,167,428 | |

VALIC Co. I Global Real Estate Fund | | 256,327 | | | | 1,932,708 | |

VALIC Co. I International Equities Fund | | 591,900 | | | | 3,468,535 | |

| | | | | |

|

|

|

Total International Equity Investment Companies | |

(cost $6,100,112) | | | | | | 7,568,671 | |

| | | | | |

|

|

|

TOTAL INVESTMENTS | |

(cost $50,190,057)(2) | | 100.1 | % | | | 57,736,775 | |

Liabilities in excess of other assets | | (0.1 | ) | | | (78,195 | ) |

| | |

|

| |

|

|

|

NET ASSETS — | | 100.0 | % | | $ | 57,658,580 | |

| | |

|

| |

|

|

|

| † | Non-income producing security |

| # | The Conservative Growth Lifestyle Fund invests in various VALIC Company I or VALIC Company II Funds, some of which are not presented in this report. Additional information on the underlying funds including such fund’s prospectuses and shareholder reports, is available at our website, www.valic.com. |

| (2) | See Note 5 for cost of investments on a tax basis. |

The following is a summary of the inputs used to value the Fund’s net assets as of August 31, 2009 (see Note 2):

| | | | | | | | | | | | |

| | | Level 1 -

Unadjusted

Quoted

Prices

| | Level 2 -

Other

Observable

Inputs

| | Level 3 -

Significant

Unobservable

Inputs

| | Total

|

Affiliated Registered Investment Companies: | | | | | | | | | | | | |

Domestic Equity Investment Companies | | $ | 17,783,169 | | $ | – | | $ | – | | $ | 17,783,169 |

Fixed Income Investment Companies | | | 32,384,935 | | | – | | | – | | | 32,384,935 |

International Equity Investment Companies | | | 7,568,671 | | | – | | | – | | | 7,568,671 |

| | |

|

| |

|

| |

|

| |

|

|

Total | | $ | 57,736,775 | | $ | – | | $ | – | | $ | 57,736,775 |

| | |

|

| |

|

| |

|

| |

|

|

See Notes to Financial Statements

10

VALIC Company II Core Bond Fund

PORTFOLIO PROFILE — August 31, 2009 (Unaudited)

Industry Allocation*

| | | |

Federal Home Loan Mtg. Corp. | | 24.1 | % |

Repurchase Agreements | | 7.6 | |

Federal National Mtg. Assoc. | | 6.8 | |

Diversified Financial Services | | 6.7 | |

United States Treasury Notes | | 6.4 | |

Electric — Integrated | | 4.3 | |

Diversified Banking Institutions | | 3.9 | |

Banks — Commercial | | 3.2 | |

United States Treasury Bonds | | 3.1 | |

Government National Mtg. Assoc. | | 2.3 | |

Telephone — Integrated | | 2.0 | |

Oil Companies — Exploration & Production | | 2.0 | |

Special Purpose Entities | | 1.8 | |

Cable/Satellite TV | | 1.5 | |

Pipelines | | 1.4 | |

Finance — Investment Banker/Broker | | 1.4 | |

Banks — Super Regional | | 1.3 | |

Insurance — Multi-line | | 1.0 | |

Transport — Rail | | 0.7 | |

Medical — Drugs | | 0.7 | |

Cellular Telecom | | 0.7 | |

Oil Companies — Integrated | | 0.7 | |

Medical — Hospitals | | 0.6 | |

Telecom Services | | 0.6 | |

Medical Products | | 0.5 | |

Banks — Money Center | | 0.4 | |

Steel — Producers | | 0.5 | |

Non — Hazardous Waste Disposal | | 0.5 | |

Electric — Generation | | 0.4 | |

Multimedia | | 0.4 | |

Beverages — Non-alcoholic | | 0.4 | |

Office Automation & Equipment | | 0.4 | |

Insurance — Mutual | | 0.4 | |

Cable TV | | 0.4 | |

Chemicals — Diversified | | 0.4 | |

Diversified Minerals | | 0.3 | |

Insurance — Life/Health | | 0.3 | |

Airlines | | 0.3 | |

Finance — Auto Loans | | 0.3 | |

Finance — Other Services | | 0.3 | |

Food — Misc. | | 0.3 | |

Transport — Air Freight | | 0.3 | |

Containers — Metal/Glass | | 0.3 | |

Satellite Telecom | | 0.3 | |

Electronic Components — Semiconductors | | 0.3 | |

Brewery | | 0.2 | |

Medical — Biomedical/Gene | | 0.2 | |

Finance — Commercial | | 0.2 | |

Gas — Distribution | | 0.2 | |

Insurance — Property/Casualty | | 0.2 | |

Property Trust | | 0.2 | |

Finance — Mortgage Loan/Banker | | 0.2 | |

Medical — Generic Drugs | | 0.2 | |

Medical — HMO | | 0.2 | |

Metal — Copper | | 0.2 | |

Pharmacy Services | | 0.2 | |

Metal — Aluminum | | 0.2 | |

Paper & Related Products | | 0.2 | |

Independent Power Producers | | 0.2 | |

Cruise Lines | | 0.2 | |

Banks — Fiduciary | | 0.2 | |

Transport — Services | | 0.2 | |

Schools | | 0.2 | |

Finance — Credit Card | | 0.2 | |

Diversified Manufacturing Operations | | 0.2 | |

Investment Companies | | 0.1 | |

Metal — Diversified | | 0.1 | |

Casino Hotels | | 0.1 | |

Chemicals — Specialty | | 0.1 | |

| | | |

Consumer Products — Misc. | | 0.1 | |

Food — Meat Products | | 0.1 | |

Insurance Brokers | | 0.1 | |

Retail — Discount | | 0.1 | |

Oil & Gas Drilling | | 0.1 | |

Aerospace/Defense | | 0.1 | |

Oil Refining & Marketing | | 0.1 | |

Enterprise Software/Service | | 0.1 | |

Medical Labs & Testing Services | | 0.1 | |

Agricultural Chemicals | | 0.1 | |

Finance — Consumer Loans | | 0.1 | |

Distribution/Wholesale | | 0.1 | |

Casino Services | | 0.1 | |

Decision Support Software | | 0.1 | |

Funeral Services & Related Items | | 0.1 | |

Research & Development | | 0.1 | |

Broadcast Services/Program | | 0.1 | |

Electronics — Military | | 0.1 | |

Gambling (Non-Hotel) | | 0.1 | |

Transactional Software | | 0.1 | |

| | |

|

|

| | | 98.9 | % |

| | |

|

|

| * | Calculated as a percentage of net assets |

Credit Quality†#

| | | |

Government — Agency | | 36.5 | % |

Government — Treasury | | 10.4 | |

AAA | | 3.6 | |

AA | | 3.9 | |

A | | 15.8 | |

BBB | | 16.4 | |

BB | | 4.5 | |

B | | 3.2 | |

CCC | | 1.7 | |

CC | | 0.2 | |

C | | 0.1 | |

Below C | | 0.5 | |

Not Rated@ | | 3.2 | |

| | |

|

|

| | | 100.0 | % |

| | |

|

|

| * | Calculated as a percentage of net assets. |

| @ | Represents debt issues that either have no rating, or the rating is unavailable from the data source. |

| † | Source: Standard and Poors |

| # | Calculated as percentage of total debt issues, excluding short-term securities. |

11

VALIC Company II Core Bond Fund

PORTFOLIO OF INVESTMENTS — August 31, 2009

| | | | | | |

| | |

| Security Description | | Principal

Amount | | Market Value

(Note 2) |

|

ASSET BACKED SECURITIES — 6.0% |

Diversified Financial Services — 6.0% |

Banc of America Commercial Mtg., Inc.

Series 2006-6, Class AM

5.39% due 10/10/45(1) | | $ | 660,000 | | $ | 422,452 |

Bear Stearns Commercial Mtg. Securities, Inc.

Series 2007-PW15, Class A2

5.21% due 02/11/44 | | | 390,000 | | | 383,836 |

Chase Funding Mtg. Loan Asset-Backed Certs.

Series 2003-6, Class 1A6

4.59% due 05/25/15(1) | | | 162,129 | | | 149,476 |

Chase Mtg. Finance Corp.

Series 2007-A2, Class 1A1

4.05% due 07/25/37(2)(3) | | | 931,809 | | | 790,535 |

Citigroup Commercial Mtg. Trust

Series 2008-C7, Class AM

6.30% due 12/01/49(1)(3) | | | 870,000 | | | 590,951 |

Commercial Mtg. Asset Trust

Series 1999-C1, Class D

7.35% due 01/17/32(1) | | | 1,377,000 | | | 1,464,072 |

Commercial Mtg. Pass Through Certs.

Series 2006-CN2A, Class A2FL

0.50% due 02/05/19*(1)(4) | | | 1,035,000 | | | 767,332 |

GE Capital Commercial Mtg. Corp.

Series 2004-C2, Class A4

4.89% due 03/10/40(1) | | | 340,000 | | | 326,817 |

GMAC Commercial Mtg. Securities, Inc.

Series 2003-C2, Class A2

5.67% due 05/10/40(1)(3) | | | 100,000 | | | 102,687 |

JP Morgan Chase Commercial Mtg. Securities Corp.

Series 2006-LDP9, Class AM

5.37% due 05/15/47(1) | | | 1,330,000 | | | 870,465 |

JP Morgan Chase Commercial Mtg. Securities Corp.

Series 2008-C2, Class AM

6.80% due 02/12/51(1)(3) | | | 1,698,000 | | | 846,786 |

LB Commercial Conduit Mtg. Trust

Series 1998-C1, Class E

7.00% due 02/18/30(1) | | | 285,000 | | | 309,378 |

Residential Asset Securities Corp.

Series 2003-KS10, Class AI6

4.54% due 12/25/33 | | | 166,896 | | | 142,444 |

Swift Master Auto Receivables Trust

Series 2007-2, Class A

0.92% due 10/15/12(4) | | | 2,260,734 | | | 2,145,075 |

Wells Fargo Mtg. Backed Securities Trust

Series 2006-AR12, Class 2A1

6.10% due 09/25/36(2) | | | 380,867 | | | 289,225 |

| | | | | |

|

|

Total Asset Backed Securities | | | | | | |

(cost $11,855,302) | | | | | | 9,601,531 |

| | | | | |

|

|

CONVERTIBLE BONDS & NOTES — 0.0% |

Telecom Services — 0.0% |

ICO North America, Inc.

7.50% due 08/15/09†(6)(10)(11)(12)(13)(14)

(cost $28,000) | | | 28,000 | | | 9,800 |

| | | | | |

|

|

U.S.CORPORATE BONDS & NOTES — 34.1% |

Advertising Services — 0.0% |

Visant Holding Corp.

Company Guar. Notes

7.63% due 10/01/12 | | | 25,000 | | | 25,125 |

| | | | | |

|

|

Aerospace/Defense — 0.1% |

Meccanica Holdings USA

Company Guar. Notes

7.38% due 07/15/39* | | | 148,000 | | | 168,530 |

| | | | | |

|

|

| | | | | | |

| | |

| Security Description | | Principal

Amount | | Market Value

(Note 2) |

|

| | | | | | | |

Agricultural Chemicals — 0.1% |

Terra Capital, Inc.

Company Guar. Notes

7.00% due 02/01/17 | | $ | 160,000 | | $ | 150,800 |

| | | | | |

|

|

Airlines — 0.3% |

American Airlines, Inc.

Pass Through Certs.

Series 2001-1, Class A-2

6.82% due 05/23/11 | | | 145,000 | | | 124,700 |

American Airlines, Inc.

Pass Through Certs.

Series 2001-2, Class A-2

7.86% due 04/01/13 | | | 18,000 | | | 17,190 |

Continental Airlines, Inc.

Pass Through Certs.

Series 2001-1, Class A-2

6.50% due 06/15/11 | | | 80,000 | | | 76,000 |

Delta Air Lines, Inc.

Pass Through Certs.

Series 2001-1, Class A2

7.11% due 03/18/13 | | | 75,000 | | | 72,375 |

Northwest Airlines, Inc.

Pass Through Certs.

Series 2002-1, Class G2

6.26% due 11/20/21 | | | 158,539 | | | 112,167 |

United AirLines, Inc.

Pass Through Certs.

Series 2001-1 Class B

6.93% due 09/01/11 | | | 82,000 | | | 108,650 |

| | | | | |

|

|

| | | | | | | 511,082 |

| | | | | |

|

|

Banks - Commercial — 1.3% |

BB&T Corp.

Senior Notes

3.10% due 07/28/11 | | | 310,000 | | | 313,059 |

CoBank ACB

Sub. Notes

7.88% due 04/16/18* | | | 80,000 | | | 77,372 |

Credit Suisse/New York

Sub. Notes

6.00% due 02/15/18 | | | 460,000 | | | 473,103 |

KeyBank NA

Sub. Notes

5.45% due 03/03/16 | | | 258,000 | | | 226,186 |

KeyBank NA

Sub. Notes

7.41% due 10/15/27 | | | 82,000 | | | 81,891 |

PNC Bank NA

Sub. Notes

6.88% due 04/01/18 | | | 170,000 | | | 180,434 |

Sovereign Bank

Sub. Notes

8.75% due 05/30/18 | | | 106,000 | | | 115,420 |

Union Bank of California NA

Sub. Notes

5.95% due 05/11/16 | | | 170,000 | | | 165,815 |

Wachovia Bank NA

Sub. Notes

5.00% due 08/15/15 | | | 446,000 | | | 429,702 |

Wachovia Bank NA

Sub. Notes

5.60% due 03/15/16 | | | 90,000 | | | 91,097 |

| | | | | |

|

|

| | | | | | | 2,154,079 |

| | | | | |

|

|

12

VALIC Company II Core Bond Fund

PORTFOLIO OF INVESTMENTS — August 31, 2009 — (continued)

| | | | | | |

| | |

| Security Description | | Principal

Amount | | Market Value

(Note 2) |

|

U.S. CORPORATE BONDS & NOTES (continued) |

Banks - Fiduciary — 0.2% |

State Street Capital Trust IV

Company Guar. Notes

1.63% due 06/15/37(4) | | $ | 420,000 | | $ | 262,279 |

| | | | | |

|

|

Banks - Money Center — 0.0% |

Chase Capital III

Company Guar. Notes

0.91% due 03/01/27(4) | | | 92,000 | | | 57,920 |

| | | | | |

|

|

Banks - Super Regional — 1.2% |

BAC Capital Trust XIII

Bank Guar. Notes

0.70% due 03/15/12(4)(5) | | | 822,000 | | | 397,716 |

Bank of America Corp.

Senior Notes

4.90% due 05/01/13 | | | 439,000 | | | 443,181 |

National City Corp.

Senior Notes

4.90% due 01/15/15 | | | 99,000 | | | 99,117 |

PNC Preferred Funding Trust I

Jr. Sub. Notes

6.11% due 03/15/12*(4)(5) | | | 250,000 | | | 145,173 |

USB Capital IX

Company Guar. Notes

6.19% due 04/15/11(4)(5) | | | 523,000 | | | 376,560 |

Wachovia Corp.

Sub. Notes

5.63% due 10/15/16 | | | 155,000 | | | 154,587 |

Wells Fargo Bank NA

Sub. Notes

5.75% due 05/16/16 | | | 311,000 | | | 318,654 |

| | | | �� | |

|

|

| | | | | | | 1,934,988 |

| | | | | |

|

|

Beverages - Non-alcoholic — 0.4% |

Bottling Group LLC

Company Guar. Notes

6.95% due 03/15/14 | | | 304,000 | | | 356,086 |

The Coca-Cola Co.

Senior Notes

4.88% due 03/15/19 | | | 320,000 | | | 335,537 |

| | | | | |

|

|

| | | | | | | 691,623 |

| | | | | |

|

|

Brewery — 0.2% |

Anheuser-Busch InBev Worldwide, Inc.

Company Guar. Notes

7.75% due 01/15/19* | | | 336,000 | | | 393,420 |

| | | | | |

|

|

Broadcast Services/Program — 0.1% |

Nexstar Broadcasting, Inc.

Company Guar. Notes

0.50% due 01/15/14*(16) | | | 179,648 | | | 70,063 |

Nexstar Broadcasting, Inc.

Company Guar. Notes

7.00% due 01/15/14 | | | 60,000 | | | 23,700 |

| | | | | |

|

|

| | | | | | | 93,763 |

| | | | | |

|

|

Building Products-Cement — 0.0% |

Texas Industries, Inc.

Company Guar. Notes

7.25% due 07/15/13 | | | 50,000 | | | 46,750 |

| | | | | |

|

|

Cable TV — 0.4% |

Comcast Corp.

Company Guar. Notes

5.90% due 03/15/16 | | | 550,000 | | | 586,717 |

| | | | | |

|

|

| | | | | | |

| | |

| Security Description | | Principal

Amount | | Market Value

(Note 2) |

|

| | | | | | | |

Cable/Satellite TV — 1.5% |

CCH II LLC/CCH II Capital Corp.

Senior Notes

10.25% due 09/15/10†(6)(7) | | $ | 34,000 | | $ | 37,782 |

CCH II LLC/CCH II Capital Corp.

Company Guar. Notes

10.25% due 10/01/13†*(6)(7) | | | 309,000 | | | 323,291 |

CCO Holdings LLC/CCO Holdings Capital Corp.

Senior Notes

8.75% due 11/15/13†(6)(7) | | | 30,000 | | | 30,300 |

Charter Communications Operating LLC/Charter Communications Operating Capital

Senior Notes

10.38% due 04/30/14†*(6)(7) | | | 338,000 | | | 342,225 |

Comcast Corp.

Company Guar. Notes

5.85% due 11/15/15 | | | 236,000 | | | 255,840 |

COX Communications, Inc.

Senior Notes

6.95% due 06/01/38* | | | 125,000 | | | 136,596 |

COX Communications, Inc.

Notes

7.13% due 10/01/12 | | | 156,000 | | | 172,947 |

COX Communications, Inc.

Senior Notes

9.38% due 01/15/19* | | | 348,000 | | | 443,583 |

CSC Holdings, Inc.

Senior Notes

8.50% due 06/15/15* | | | 125,000 | | | 126,250 |

DirecTV Holdings LLC/DirecTV Financing Co.

Company Guar. Notes

7.63% due 05/15/16 | | | 340,000 | | | 357,850 |

Time Warner Cable, Inc.

Company Guar. Notes

6.75% due 06/15/39 | | | 190,000 | | | 203,176 |

| | | | | |

|

|

| | | | | | | 2,429,840 |

| | | | | |

|

|

Casino Hotels — 0.1% |

MGM Mirage, Inc.

Senior Sec. Notes

11.13% due 11/15/17* | | | 75,000 | | | 80,719 |

Turning Stone Resort Casino Enterprise

Senior Notes

9.13% due 09/15/14* | | | 118,000 | | | 108,265 |

| | | | | |

|

|

| | | | | | | 188,984 |

| | | | | |

|

|

Casino Services — 0.1% |

Indianapolis Downs LLC & Capital Corp.

Senior Sec. Notes

11.00% due 11/01/12* | | | 75,000 | | | 53,250 |

Snoqualmie Entertainment Authority

Senior Sec. Notes

9.13% due 02/01/15* | | | 120,000 | | | 66,000 |

| | | | | |

|

|

| | | | | | | 119,250 |

| | | | | |

|

|

Cellular Telecom — 0.6% |

Cingular Wireless Services, Inc.

Senior Notes

7.88% due 03/01/11 | | | 594,000 | | | 644,392 |

Cricket Communications, Inc.

Company Guar. Notes

9.38% due 11/01/14 | | | 28,000 | | | 26,390 |

Cricket Communications, Inc.

Company Guar. Notes

10.00% due 07/15/15 | | | 115,000 | | | 111,262 |

13

VALIC Company II Core Bond Fund

PORTFOLIO OF INVESTMENTS — August 31, 2009 — (continued)

| | | | | | |

| | |

| Security Description | | Principal

Amount | | Market Value

(Note 2) |

|

U.S. CORPORATE BONDS & NOTES (continued) |

Cellular Telecom (continued) |

Nextel Communications, Inc.

Company Guar. Notes

5.95% due 03/15/14 | | $ | 200,000 | | $ | 168,000 |

| | | | | |

|

|

| | | | | | | 950,044 |

| | | | | |

|

|

Chemicals - Diversified — 0.4% |

E.I. du Pont de Nemours & Co.

Senior Notes

4.75% due 03/15/15 | | | 160,000 | | | 170,714 |

Olin Corp.

Senior Notes

8.88% due 08/15/19 | | | 45,000 | | | 45,450 |

The Dow Chemical Co.

Senior Notes

5.90% due 02/15/15 | | | 155,000 | | | 154,725 |

The Dow Chemical Co.

Senior Notes

8.55% due 05/15/19 | | | 193,000 | | | 210,226 |

| | | | | |

|

|

| | | | | | | 581,115 |

| | | | | |

|

|

Chemicals - Specialty — 0.1% |

Huntsman International LLC

Company Guar. Notes

7.88% due 11/15/14 | | | 85,000 | | | 75,650 |

Momentive Performance Materials, Inc.

Company Guar. Notes

9.75% due 12/01/14 | | | 75,000 | | | 48,750 |

Momentive Performance Materials, Inc.

Company Guar. Notes

12.50% due 06/15/14* | | | 66,000 | | | 62,370 |

| | | | | |

|

|

| | | | | | | 186,770 |

| | | | | |

|

|

Computer Services — 0.0% |

Compucom Systems, Inc.

Senior Sub. Notes

12.50% due 10/01/15* | | | 65,000 | | | 58,500 |

| | | | | |

|

|

Consumer Products - Misc. — 0.1% |

American Achievement Corp.

Company Guar. Notes

8.25% due 04/01/12* | | | 185,000 | | | 181,300 |

| | | | | |

|

|

Containers - Metal/Glass — 0.1% |

Ball Corp.

Company Guar. Notes

7.13% due 09/01/16 | | | 176,000 | | | 176,000 |

| | | | | |

|

|

Decision Support Software — 0.1% |

Vangent, Inc.

Company Guar. Notes

9.63% due 02/15/15 | | | 125,000 | | | 116,250 |

| | | | | |

|

|

Direct Marketing — 0.0% |

Affinity Group, Inc.

Company Guar. Notes

9.00% due 02/15/12 | | | 95,000 | | | 60,800 |

| | | | | |

|

|

Distribution/Wholesale — 0.1% |

KAR Holdings, Inc.

Company Guar. Notes

4.48% due 05/01/14(4) | | | 108,000 | | | 89,100 |

KAR Holdings, Inc.

Company Guar. Notes

8.75% due 05/01/14 | | | 42,000 | | | 39,585 |

| | | | | |

|

|

| | | | | | | 128,685 |

| | | | | |

|

|

| | | | | | |

| | |

| Security Description | | Principal

Amount | | Market Value

(Note 2) |

|

| | | | | | | |

Diversified Banking Institutions — 3.8% |

Bank of America Corp.

Sub. Notes

5.75% due 08/15/16 | | $ | 391,000 | | $ | 373,821 |

Bank of America Corp.

Senior Notes

5.75% due 12/01/17 | | | 318,000 | | | 309,331 |

Bank of America Corp.

Notes

6.50% due 08/01/16 | | | 318,000 | | | 327,696 |

Bank of America Corp.

Sub. Notes

7.25% due 10/15/25 | | | 75,000 | | | 72,643 |

Citigroup, Inc.

Sub. Notes

5.00% due 09/15/14 | | | 669,000 | | | 612,945 |

Citigroup, Inc.

Senior Notes

5.50% due 04/11/13 | | | 211,000 | | | 210,019 |

Citigroup, Inc.

Senior Notes

5.85% due 07/02/13 | | | 385,000 | | | 387,319 |

Citigroup, Inc.

Senior Notes

6.13% due 05/15/18 | | | 336,000 | | | 315,923 |

Citigroup, Inc.

Sub. Notes

6.13% due 08/25/36 | | | 168,000 | | | 131,541 |

Citigroup, Inc.

Senior Notes

6.88% due 03/05/38 | | | 202,000 | | | 182,440 |

GMAC LLC

Senior Notes

6.00% due 12/15/11 | | | 250,000 | | | 228,750 |

GMAC LLC

Company Guar. Notes

6.88% due 09/15/11* | | | 278,000 | | | 256,455 |

GMAC LLC

Sub. Notes

8.00% due 12/31/18* | | | 295,000 | | | 214,613 |

JP Morgan Chase & Co.

Sub. Notes

4.89% due 09/01/15(4) | | | 317,000 | | | 286,175 |

Morgan Stanley

Sub. Notes

4.75% due 04/01/14 | | | 158,000 | | | 156,857 |

Morgan Stanley

Senior Notes

6.00% due 04/28/15 | | | 888,000 | | | 938,017 |

The Goldman Sachs Group, Inc.

Senior Notes

5.13% due 01/15/15 | | | 363,000 | | | 376,191 |

The Goldman Sachs Group, Inc.

Senior Notes

5.95% due 01/18/18 | | | 260,000 | | | 270,662 |

The Goldman Sachs Group, Inc.

Sub. Notes

6.75% due 10/01/37 | | | 401,000 | | | 401,473 |

| | | | | |

|

|

| | | | | | | 6,052,871 |

| | | | | |

|

|

Diversified Financial Services — 0.6% |

General Electric Capital Corp.

Senior Notes

5.88% due 01/14/38 | | | 344,000 | | | 305,371 |

14

VALIC Company II Core Bond Fund

PORTFOLIO OF INVESTMENTS — August 31, 2009 — (continued)

| | | | | | |

| | |

| Security Description | | Principal

Amount | | Market Value

(Note 2) |

|

U.S. CORPORATE BONDS & NOTES (continued) |

Diversified Financial Services (continued) |

General Electric Capital Corp.

Senior Notes

6.88% due 01/10/39 | | $ | 568,000 | | $ | 563,329 |

USAA Capital Corp.

Notes

3.50% due 07/17/14* | | | 126,000 | | | 125,430 |

| | | | | |

|

|

| | | | | | | 994,130 |

| | | | | |

|

|

Diversified Manufacturing Operations — 0.1% |

General Electric Co.

Senior Notes

5.25% due 12/06/17 | | | 119,000 | | | 121,497 |

| | | | | |

|

|

Electric - Generation — 0.4% |

Edison Mission Energy

Senior Notes

7.20% due 05/15/19 | | | 280,000 | | | 203,000 |

The AES Corp.

Senior Notes

8.00% due 10/15/17 | | | 320,000 | | | 306,400 |

The AES Corp.

Senior Notes

8.88% due 02/15/11 | | | 190,000 | | | 195,700 |

| | | | | |

|

|

| | | | | | | 705,100 |

| | | | | |

|

|

Electric - Integrated — 3.5% |

Ameren Corp.

Senior Notes

8.88% due 05/15/14 | | | 259,000 | | | 282,001 |

CenterPoint Energy Houston Electric LLC

General and Refunding Mtg. Notes

7.00% due 03/01/14 | | | 266,000 | | | 295,757 |

Commonwealth Edison Co.

1st Mtg. Notes

6.15% due 09/15/17 | | | 181,000 | | | 199,011 |

Dominion Resources, Inc.

Jr. Sub Notes

6.30% due 09/30/66(4) | | | 506,000 | | | 369,380 |

Energy East Corp.

Notes

6.75% due 07/15/36 | | | 365,000 | | | 402,103 |

Entergy Gulf States Louisiana LLC

1st Mtg. Bonds

6.00% due 05/01/18 | | | 479,000 | | | 496,853 |

Entergy Texas, Inc.

1st Mtg. Notes

7.13% due 02/01/19 | | | 30,000 | | | 33,085 |

FirstEnergy Corp.

Senior Notes

7.38% due 11/15/31 | | | 248,000 | | | 273,779 |

FirstEnergy Solutions Corp.

Company Guar. Notes

6.05% due 08/15/21* | | | 201,000 | | | 203,191 |

FirstEnergy Solutions Corp.

Company Guar. Notes

6.80% due 08/15/39* | | | 371,000 | | | 378,950 |

Mirant Americas Generation LLC

Senior Notes

8.30% due 05/01/11 | | | 395,000 | | | 396,975 |

Mirant Mid - Atlantic LLC

Pass Through Certs., Series B

9.13% due 06/30/17 | | | 89,453 | | | 89,117 |

Nevada Power Co.

General and Refunding Mtg. Notes

7.13% due 03/15/19 | | | 442,000 | | | 503,491 |

| | | | | | |

| | |

| Security Description | | Principal

Amount | | Market Value

(Note 2) |

|

| | | | | | | |

Electric - Integrated (continued) |

Pepco Holdings, Inc.

Senior Notes

6.13% due 06/01/17 | | $ | 90,000 | | $ | 91,789 |

Pepco Holdings, Inc.

Senior Notes

6.45% due 08/15/12 | | | 490,000 | | | 521,312 |

PPL Electric Utilities Corp.

1st Mtg. Bonds

6.25% due 05/15/39 | | | 195,000 | | | 219,872 |

PSEG Power LLC

Company Guar. Notes

7.75% due 04/15/11 | | | 115,000 | | | 123,969 |

Sierra Pacific Power Co.

General and Refunding Mtg. Notes

6.75% due 07/01/37 | | | 359,000 | | | 390,844 |

Texas Competitive Electric Holdings Co., LLC

Company Guar. Notes, Series A

10.25% due 11/01/15 | | | 165,000 | | | 109,312 |

Texas Competitive Electric Holdings Co., LLC

Company Guar. Notes, Series B

10.25% due 11/01/15 | | | 25,000 | | | 16,562 |

Toledo Edison Co.

1st Mtg. Notes

7.25% due 05/01/20 | | | 153,000 | | | 178,394 |

| | | | | |

|

|

| | | | | | | 5,575,747 |

| | | | | |

|

|

Electronic Components - Semiconductors — 0.3% |

Amkor Technology, Inc.

Senior Notes

7.75% due 05/15/13 | | | 90,000 | | | 89,100 |

National Semiconductor Corp.

Senior Notes

6.60% due 06/15/17 | | | 215,000 | | | 198,186 |

Spansion LLC

Senior Sec. Notes

5.33% due 06/01/13†*(4)(6)(7) | | | 145,000 | | | 128,688 |

| | | | | |

|

|

| | | | | | | 415,974 |

| | | | | |

|

|

Electronics - Military — 0.1% |

L - 3 Communications Corp.

Company Guar. Notes

6.38% due 10/15/15 | | | 95,000 | | | 89,538 |

| | | | | |

|

|

Enterprise Software/Service — 0.1% |

Oracle Corp.

Senior Notes

3.75% due 07/08/14 | | | 160,000 | | | 165,298 |

| | | | | |

|

|

Finance - Auto Loans — 0.3% |

Ford Motor Credit Co. LLC

Senior Notes

7.38% due 02/01/11 | | | 275,000 | | | 265,845 |

Ford Motor Credit Co. LLC

Notes

7.88% due 06/15/10 | | | 222,000 | | | 221,537 |

| | | | | |

|

|

| | | | | | | 487,382 |

| | | | | |

|

|

Finance - Commercial — 0.2% |

CIT Group, Inc.

Senior Notes

5.80% due 07/28/11 | | | 38,000 | | | 22,633 |

15

VALIC Company II Core Bond Fund

PORTFOLIO OF INVESTMENTS — August 31, 2009 — (continued)

| | | | | | |

| | |

| Security Description | | Principal

Amount | | Market Value

(Note2) |

|

U.S. CORPORATE BONDS & NOTES (continued) |

Finance - Commercial (continued) |

Textron Financial Corp.

Senior Notes

5.40% due 04/28/13 | | $ | 410,000 | | $ | 361,482 |

| | | | | |

|

|

| | | | | | | 384,115 |

| | | | | |

|

|

Finance - Consumer Loans — 0.1% |

SLM Corp.

Senior Notes

5.13% due 08/27/12 | | | 174,000 | | | 136,590 |

| | | | | |

|

|

Finance - Credit Card — 0.2% |

FIA Card Services NA

Sub. Notes

7.13% due 11/15/12 | | | 230,000 | | | 238,597 |

| | | | | |

|

|

Finance - Investment Banker/Broker — 1.2% |

Lehman Brothers Holdings Capital Trust VII

Company Guar. Notes

5.86% due 05/31/12†(4)(5)(6)(7) | | | 148,000 | | | 15 |

Lehman Brothers Holdings, Inc.

Sub. Notes

6.75% due 12/28/17†(6)(7) | | | 179,000 | | | 18 |

Lehman Brothers Holdings, Inc.

Sub. Notes

7.50% due 05/11/38†(6)(7) | | | 230,000 | | | 23 |

Merrill Lynch & Co., Inc.

Sub. Notes

5.70% due 05/02/17 | | | 187,000 | | | 175,018 |

Merrill Lynch & Co., Inc.

Sub. Notes

6.22% due 09/15/26 | | | 215,000 | | | 193,916 |

Merrill Lynch & Co., Inc.

Senior Notes

6.40% due 08/28/17 | | | 176,000 | | | 173,447 |

The Bear Stearns Cos., Inc.

Senior Notes

5.30% due 10/30/15 | | | 355,000 | | | 359,809 |

The Bear Stearns Cos., Inc.

Senior Notes

5.70% due 11/15/14 | | | 283,000 | | | 303,717 |

The Bear Stearns Cos., Inc.

Senior Notes

6.40% due 10/02/17 | | | 595,000 | | | 645,672 |

| | | | | |

|

|

| | | | | | | 1,851,635 |

| | | | | |

|

|

Finance - Mortgage Loan/Banker — 0.2% |

Countrywide Financial Corp.

Sub. Notes

6.25% due 05/15/16 | | | 150,000 | | | 145,511 |

Countrywide Home Loans, Inc.

Company Guar. Notes

4.00% due 03/22/11 | | | 190,000 | | | 191,842 |

| | | | | |

|

|

| | | | | | | 337,353 |

| | | | | |

|

|

Food - Meat Products — 0.0% |

Smithfield Foods, Inc.

Senior Sec. Notes

10.00% due 07/15/14* | | | 75,000 | | | 76,500 |

| | | | | |

|

|

Food - Misc. — 0.3% |

HJ Heinz Finance Co.

Company Guar. Notes

7.13% due 08/01/39* | | | 148,000 | | | 173,788 |

| | | | | | |

| | |

| Security Description | | Principal

Amount | | Market Value

(Note 2) |

|

| | | | | | | |

Food - Misc. (continued) | | | | | | |

Kraft Foods, Inc.

Senior Notes

6.75% due 02/19/14 | | $ | 256,000 | | $ | 290,536 |

| | | | | |

|

|

| | | | | | | 464,324 |

| | | | | |

|

|

Funeral Services & Related Items — 0.1% | | | | | | |

Carriage Services, Inc.

Senior Notes

7.88% due 01/15/15 | | | 125,000 | | | 112,500 |

| | | | | |

|

|

Gambling (Non-Hotel) — 0.1% | | | | | | |

Downstream Development Authority

Senior Sec. Notes

12.00% due 10/15/15* | | | 140,000 | | | 88,550 |

| | | | | |

|

|

Gas - Distribution — 0.2% | | | | | | |

Sempra Energy

Senior Notes

6.50% due 06/01/16 | | | 340,000 | | | 373,942 |

| | | | | |

|

|

Home Furnishings — 0.0% | | | | | | |

Simmons Co.

Senior Disc. Notes

10.00% due 12/15/14(8) | | | 7,000 | | | 2,170 |

| | | | | |

|

|

Independent Power Producers — 0.2% | | | | | | |

NRG Energy, Inc.

Company Guar. Notes

7.38% due 02/01/16 | | | 280,000 | | | 267,750 |

| | | | | |

|

|

Insurance Brokers — 0.1% | | | | | | |

Marsh & McLennan Cos., Inc.

Senior Notes

5.15% due 09/15/10 | | | 145,000 | | | 145,222 |

USI Holdings Corp.

Senior Sub. Notes

9.75% due 05/15/15* | | | 40,000 | | | 32,650 |

| | | | | |

|

|

| | | | | | | 177,872 |

| | | | | |

|

|

Insurance - Life/Health — 0.3% | | | | | | |

Americo Life, Inc.

Notes

7.88% due 05/01/13* | | | 109,000 | | | 77,390 |

Monumental Global Funding II

Senior Sec. Notes

5.65% due 07/14/11* | | | 120,000 | | | 122,645 |

Prudential Financial, Inc.

Senior Notes

6.20% due 01/15/15 | | | 302,000 | | | 316,362 |

| | | | | |

|

|

| | | | | | | 516,397 |

| | | | | |

|

|

Insurance - Multi - line — 0.7% | | | | | | |

Hartford Financial Services Group, Inc.

Senior Notes

5.95% due 10/15/36 | | | 349,000 | | | 255,789 |

Metlife, Inc.

Senior Notes

6.13% due 12/01/11 | | | 200,000 | | | 213,749 |

MetLife, Inc.

Senior Notes

6.75% due 06/01/16 | | | 175,000 | | | 191,431 |

Metropolitan Life Global Funding I

Notes

5.13% due 06/10/14* | | | 380,000 | | | 395,992 |

| | | | | |

|

|

| | | | | | | 1,056,961 |

| | | | | |

|

|

16

VALIC Company II Core Bond Fund

PORTFOLIO OF INVESTMENTS — August 31, 2009 — (continued)

| | | | | | |

| | |

| Security Description | | Principal

Amount | | Market Value

(Note 2) |

|

U.S. CORPORATE BONDS & NOTES (continued) |

Insurance - Mutual — 0.4% | | | | | | |

Liberty Mutual Group, Inc.

Company Guar. Bonds

10.75% due 06/15/58*(4) | | $ | 384,000 | | $ | 337,920 |

Massachusetts Mutual Life Insurance Co.

Notes

8.88% due 06/01/39* | | | 228,000 | | | 255,859 |

| | | | | |

|

|

| | | | | | | 593,779 |

| | | | | |

|

|

Insurance - Property/Casualty — 0.2% | | | | | | |

ACE INA Holdings, Inc.

Company Guar. Notes

5.60% due 05/15/15 | | | 269,000 | | | 288,077 |

W.R. Berkley Corp.

Senior Notes

6.25% due 02/15/37 | | | 95,000 | | | 74,820 |

| | | | | |

|

|

| | | | | | | 362,897 |

| | | | | |

|

|

Investment Management/Advisor Services — 0.0% | | | | | | |

Ameriprise Financial, Inc.

Senior Notes

5.35% due 11/15/10 | | | 8,000 | | | 8,015 |

| | | | | |

|

|

Medical Labs & Testing Services — 0.1% | | | | | | |

Howard Hughes Medical Institute

Senior Notes

3.45% due 09/01/14 | | | 155,000 | | | 157,197 |

| | | | | |

|

|

Medical Products — 0.5% | | | | | | |

Baxter International, Inc.

Senior Notes

5.90% due 09/01/16 | | | 500,000 | | | 558,392 |

CareFusion Corp.

Senior Notes

4.13% due 08/01/12* | | | 180,000 | | | 183,426 |

LVB Acquisition Holding LLC

Company Guar. Notes

10.38% due 10/15/17(10) | | | 54,000 | | | 56,295 |

| | | | | |

|

|

| | | | | | | 798,113 |

| | | | | |

|

|

Medical - Biomedical/Gene — 0.2% | | | | | | |

Amgen, Inc.

Senior Notes

5.85% due 06/01/17 | | | 350,000 | | | 386,533 |

| | | | | |

|

|

Medical - Drugs — 0.6% | | | | | | |

Axcan Intermediate Holdings, Inc.

Senior Notes

9.25% due 03/01/15 | | | 75,000 | | | 77,063 |

Merck & Co., Inc.

Senior Notes

4.00% due 06/30/15 | | | 128,000 | | | 133,408 |

Wyeth Bonds

5.50% due 02/01/14 | | | 693,000 | | | 757,768 |

| | | | | |

|

|

| | | | | | | 968,239 |

| | | | | |

|

|

Medical - Generic Drugs — 0.2% | | | | | | |

Watson Pharmaceuticals, Inc.

Senior Notes

6.13% due 08/15/19 | | | 336,000 | | | 345,447 |

| | | | | |

|

|

Medical - HMO — 0.2% | | | | | | |

UnitedHealth Group, Inc.

Senior Notes

5.25% due 03/15/11 | | | 195,000 | | | 201,779 |

| | | | | | |

| | |

| Security Description | | Principal

Amount | | Market Value

(Note 2) |

|

| |

Medical - HMO (continued) | | | | | | |

WellPoint, Inc.

Senior Notes

5.00% due 01/15/11 | | $ | 117,000 | | $ | 120,929 |

| | | | | |

|

|

| | | | | | | 322,708 |

| | | | | |

|

|

Medical - Hospitals — 0.6% | | | | | | |

Community Health Systems, Inc.

Company Guar. Notes

8.88% due 07/15/15 | | | 120,000 | | | 120,450 |

HCA, Inc.

Senior Notes

7.50% due 11/15/95 | | | 250,000 | | | 163,928 |

HCA, Inc.

Senior Notes

8.50% due 04/15/19* | | | 375,000 | | | 379,687 |

HCA, Inc.

Senior Sec. Notes

9.25% due 11/15/16 | | | 175,000 | | | 177,187 |

IASIS Healthcare LLC/IASIS Capital Corp.

Company Guar. Notes

8.75% due 06/15/14 | | | 125,000 | | | 122,188 |

| | | | | |

|

|

| | | | | | | 963,440 |

| | | | | |

|

|

Metal - Aluminum — 0.2% | | | | | | |

Alcoa, Inc.

Senior Notes

6.50% due 06/15/18 | | | 224,000 | | | 213,193 |

Noranda Aluminum Acquisition Corp.

Company Guar. Notes

5.41% due 11/15/14(10) | | | 108,856 | | | 66,402 |

| | | | | |

|

|

| | | | | | | 279,595 |

| | | | | |

|

|

Metal - Copper — 0.2% | | | | | | |

Freeport-McMoRan Corp.

Company Guar. Notes

8.75% due 06/01/11 | | | 301,000 | | | 321,517 |

| | | | | |

|

|

Multimedia — 0.4% | | | | | | |

News America, Inc.

Company Guar. Notes

6.15% due 03/01/37 | | | 205,000 | | | 198,022 |

News America, Inc. Company

Guar. Notes

6.90% due 08/15/39* | | | 185,000 | | | 194,698 |

Time Warner Entertainment Co. LP

Senior Notes

8.38% due 07/15/33 | | | 256,000 | | | 308,296 |

| | | | | |

|

|

| | | | | | | 701,016 |

| | | | | |

|

|

Non - Hazardous Waste Disposal — 0.5% | | | | | | |

Allied Waste North America, Inc.

Company Guar. Notes

7.38% due 04/15/14 | | | 125,000 | | | 130,298 |

Republic Services, Inc.

Senior Notes

5.50% due 09/15/19* | | | 120,000 | | | 119,807 |

Republic Services, Inc.

Notes

6.09% due 03/15/35* | | | 75,000 | | | 68,298 |

Waste Management, Inc.

Company Guar. Notes

6.38% due 11/15/12 | | | 162,000 | | | 177,301 |

17

VALIC Company II Core Bond Fund

PORTFOLIO OF INVESTMENTS — August 31, 2009 — (continued)

| | | | | | |

| | |

| Security Description | | Principal

Amount | | Market Value

(Note 2) |

|

U.S. CORPORATE BONDS & NOTES (continued) | | | | | | |

Non - Hazardous Waste Disposal (continued) | | | | | | |

Waste Management, Inc.

Company Guar. Notes

7.75% due 05/15/32 | | $ | 205,000 | | $ | 237,049 |

| | | | | |

|

|

| | | | | | | 732,753 |

| | | | | |

|

|

Office Automation & Equipment — 0.4% | | | | | | |

Pitney Bowes, Inc.

Senior Notes

5.25% due 01/15/37 | | | 510,000 | | | 507,324 |

Xerox Corp.

Senior Notes

6.35% due 05/15/18 | | | 165,000 | | | 168,840 |

| | | | | |

|

|

| | | | | | | 676,164 |

| | | | | |

|

|

Oil & Gas Drilling — 0.1% | | | | | | |

Rowan Cos., Inc.

Senior Notes

7.88% due 08/01/19 | | | 160,000 | | | 168,656 |

| | | | | |

|

|

Oil Companies - Exploration & Production — 1.3% | | | | | | |

Chesapeake Energy Corp.

Senior Notes

7.25% due 12/15/18 | | | 100,000 | | | 91,500 |

Chesapeake Energy Corp.

Company Guar. Notes

7.50% due 09/15/13 | | | 665,000 | | | 651,700 |

Devon Financing Corp. ULC

Company Guar. Notes

6.88% due 09/30/11 | | | 550,000 | | | 600,173 |

Hilcorp Energy I LP

Senior Notes

7.75% due 11/01/15* | | | 145,000 | | | 133,763 |

Kerr-McGee Corp.

Company Guar. Notes

6.95% due 07/01/24 | | | 168,000 | | | 173,486 |

Sabine Pass LNG LP

Senior Sec. Notes

7.50% due 11/30/16 | | | 515,000 | | | 417,150 |

| | | | | |

|

|

| | | | | | | 2,067,772 |

| | | | | |

|

|

Oil Companies - Integrated — 0.7% | | | | | | |

ConocoPhillips Holding Co.

Senior Notes

6.95% due 04/15/29 | | | 196,000 | | | 225,963 |

Hess Corp.

Senior Notes

7.13% due 03/15/33 | | | 195,000 | | | 216,395 |

Hess Corp.

Senior Notes

7.88% due 10/01/29 | | | 265,000 | | | 314,535 |

Phillips Petroleum Co.

Debentures

7.00% due 03/30/29 | | | 293,000 | | | 328,277 |

| | | | | |

|

|

| | | | | | | 1,085,170 |

| | | | | |

|

|

Oil Refining & Marketing — 0.1% | | | | | | |

Valero Energy Corp.

Senior Notes

6.63% due 06/15/37 | | | 191,000 | | | 166,017 |

| | | | | |

|

|

Paper & Related Products — 0.2% | | | | | | |

Georgia - Pacific LLC

Company Guar. Notes

7.00% due 01/15/15* | | | 90,000 | | | 86,625 |

| | | | | | |

| | |

| Security Description | | Principal

Amount | | Market Value

(Note 2) |

|

| | | | | | | |

Paper & Related Products (continued) | | | | | | |

Georgia - Pacific LLC

Company Guar. Notes

7.13% due 01/15/17* | | $ | 20,000 | | $ | 19,200 |

MeadWestvaco Corp.

Senior Notes

7.38% due 09/01/19 | | | 170,000 | | | 172,810 |

| | | | | |

|

|

| | | | | | | 278,635 |

| | | | | |

|

|

Pharmacy Services — 0.2% | | | | | | |

Express Scripts, Inc.

Senior Notes

6.25% due 06/15/14 | | | 175,000 | | | 191,256 |

Express Scripts, Inc.

Senior Notes

7.25% due 06/15/19 | | | 112,000 | | | 129,885 |

| | | | | |

|

|

| | | | | | | 321,141 |

| | | | | |

|

|

Physicians Practice Management — 0.0% | | | | | | |

US Oncology, Inc.

Senior Sec. Notes

9.13% due 08/15/17* | | | 75,000 | | | 78,000 |

| | | | | |

|

|

Pipelines — 1.4% | | | | | | |

Boardwalk Pipelines LLC

Company Guar. Notes

5.75% due 09/15/19 | | | 297,000 | | | 294,300 |

Copano Energy LLC

Company Guar. Notes

8.13% due 03/01/16 | | | 545,000 | | | 521,838 |

Copano Energy LLC / Copano Energy Finance Corp.

Company Guar. Notes

7.75% due 06/01/18 | | | 50,000 | | | 46,250 |

Dynegy - Roseton Danskammer

Pass Through Certs., Series B

7.67% due 11/08/16 | | | 215,000 | | | 192,425 |

Enterprise Products Operating LLC

Company Guar. Notes

4.60% due 08/01/12 | | | 175,000 | | | 181,587 |

ONEOK, Inc.

Senior Notes

6.00% due 06/15/35 | | | 159,000 | | | 152,277 |

Plains All American Pipeline, LP

Senior Notes

4.25% due 09/01/12 | | | 249,000 | | | 254,235 |

Williams Cos., Inc.

Senior Notes

7.88% due 09/01/21 | | | 540,000 | | | 584,730 |

| | | | | |

|

|

| | | | | | | 2,227,642 |

| | | | | |

|

|

Property Trust — 0.2% | | | | | | |

WEA Finance LLC / WT Finance Australia Property, Ltd.

Company Guar. Notes

6.75% due 09/02/19* | | | 360,000 | | | 354,592 |

| | | | | |

|

|

Publishing - Periodicals — 0.0% | | | | | | |

The Reader’s Digest Association, Inc.

Company Guar. Notes

9.00% due 02/15/17†(6)(7) | | | 120,000 | | | 2,850 |

| | | | | |

|

|

Recycling — 0.0% | | | | | | |

Aleris International, Inc.

Company Guar. Notes

9.00% due 12/15/14†(6)(7)(10) | | | 100,000 | | | 510 |

| | | | | |

|

|

18

VALIC Company II Core Bond Fund

PORTFOLIO OF INVESTMENTS — August 31, 2009 — (continued)

| | | | | | |

| | |

| Security Description | | Principal

Amount | | Market Value

(Note 2) |

|

U.S. CORPORATE BONDS & NOTES (continued) |

Research & Development — 0.1% | | | | | | |

Alion Science and Technology Corp.

Company Guar. Notes

10.25% due 02/01/15 | | $ | 155,000 | | $ | 102,300 |

| | | | | |

|

|

Retail - Discount — 0.1% | | | | | | |

Wal - Mart Stores, Inc.

Senior Notes

3.20% due 05/15/14 | | | 170,000 | | | 173,450 |

| | | | | |

|

|

Retail - Regional Department Stores — 0.0% | | | | | | |

Macy’s Retail Holdings, Inc.

Company Guar. Notes

6.65% due 07/15/24 | | | 22,000 | | | 17,013 |

| | | | | |

|

|

Schools — 0.2% | | | | | | |

Princeton University

Senior Notes

5.70% due 03/01/39 | | | 226,000 | | | 241,896 |

| | | | | |

|

|

Special Purpose Entities — 1.0% | | | | | | |

CCM Merger, Inc.

Notes

8.00% due 08/01/13* | | | 150,000 | | | 121,500 |

CDX North America High

Yield Credit Linked Certificates,

Series 10-T

8.88% due 06/29/13*(15) | | | 496,770 | | | 458,891 |

Chukchansi Economic Development Authority

Senior Notes

8.00% due 11/15/13* | | | 120,000 | | | 96,000 |

Citicorp Lease Pass - Through Trust 1999-1

Pass Thru Certs.

8.04% due 12/15/19* | | | 239,000 | | | 214,184 |

Principal Life Global Funding I

Senior Sec. Notes

5.25% due 01/15/13* | | | 739,000 | | | 751,126 |

| | | | | |

|

|

| | | | | | | 1,641,701 |

| | | | | |

|

|

Steel - Producers — 0.4% |

Reliance Steel & Aluminum Co.

Company Guar. Notes

6.85% due 11/15/36 | | | 690,000 | | | 538,373 |

Ryerson, Inc.

Company Guar. Notes

7.86% due 11/01/14(4) | | | 125,000 | | | 106,250 |

| | | | | |

|

|

| | | | | | | 644,623 |

| | | | | |