Filed by WellPoint Health Networks Inc.

pursuant to Rule 425 of the Securities

Act of 1933 and deemed filed pursuant

to Rule 14a-12 of the Securities

Exchange Act of 1934

Subject Company: Cobalt Corporation

Commission File No.: 1-14177

Certain statements contained in this filing contain forward-looking statements. Actual results could differ materially due to, among other things, operational and other difficulties associated with integrating acquired businesses, nonacceptance of managed care coverage, business conditions and competition among managed care companies, rising health care costs, trends in medical loss ratios, health care reform, delays in receipt of regulatory approvals for pending transactions and other regulatory issues. Additional risk factors are listed from time to time in WellPoint’s various SEC reports, including, but not limited to, WellPoint’s Annual Report on Form 10-K for the year ended December 31, 2002.

This filing may be deemed to be solicitation material with respect to the proposed transaction between Cobalt Corporation and WellPoint. In connection with the proposed transaction, WellPoint has filed with the SEC a registration statement on Form S-4 that contains a preliminary proxy statement-prospectus regarding the proposed transaction. The information contained in the preliminary proxy statement-prospectus is not complete and may be changed. When it becomes available, the final proxy statement-prospectus will be sent to the stockholders of Cobalt seeking their approval of the proposed transaction. Stockholders of Cobalt are encouraged to read the final proxy statement-prospectus because it will contain important information about the proposed transaction. The final proxy statement-prospectus and all other documents filed or to be filed by Cobalt or WellPoint with the SEC are or will be available for free both on the SEC’s web site (www.sec.gov) and from Cobalt’s and WellPoint’s respective corporate secretaries. Cobalt and its directors and executive officers may be deemed to be participants in the solicitation of proxies with respect to the proposed transaction. Information regarding the interests of Cobalt’s directors and executive officers will be included in the final proxy statement-prospectus.

Beginning July 29, 2003 and continuing from time to time thereafter, certain of the following slides will be used by senior management of WellPoint Health Networks Inc. in making presentations to analysts and investors or potential investors in various meetings and conferences.

1

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

CIBC World Markets

Boston Investor Meetings

Leonard D. Schaeffer

Chairman and CEO

WellPoint Health Networks Inc.

July 29, 2003

This presentation contains non-GAAP financial measures as defined in the rules of the Securities and Exchange Commission. As required by the rules, a reconciliation of those measures to the most directly comparable GAAP measures is available at our website, which can be found at www.wellpoint.com.

[LOGO]

1

The following presentation may be deemed to be solicitation material with respect to the proposed transaction between Cobalt Corporation and WellPoint. In connection with the proposed transaction, WellPoint has filed with the SEC a registration statement on Form S-4 that contains a preliminary proxy statement-prospectus regarding the proposed transaction. The information contained in the preliminary proxy statement-prospectus is not complete and may be changed. When it becomes available, the final proxy statement-prospectus will be sent to the stockholders of Cobalt seeking their approval of the proposed transaction. Stockholders of Cobalt are encouraged to read the final proxy statement-prospectus because it will contain important information about the proposed transaction.�� The final proxy statement-prospectus and all other documents filed or to be filed by Cobalt or WellPoint with the SEC are or will be available for free both on the SEC’s web site (www.sec.gov) and from Cobalt’s and WellPoint’s respective corporate secretaries. Cobalt and its directors and executive officers may be deemed to be participants in the solicitation of proxies with respect to the proposed transaction. Information regarding the interests of Cobalt’s directors and executive officers will be included in the final proxy statement-prospectus.

2

[LOGO]

Business Process

| | Financial & Operational Integrity | | |

|

| | 1 Develop & Manage Networks & Quality | | Increased Satisfaction |

| | 2 Design Plans & Products to Meet Customer Needs | | • Members |

| | 3 Price Right | | • Associates |

Business Plan | | 4 Sell/Renew Profitable Business | | • Health Care Professionals |

| | 5 Bill Timely & Correctly | | • Distribution Channels |

| | 6 Collect Timely & Completely | | • Payors |

| | 7 Pay Claims Timely & Accurately | | • Shareholders |

|

Common Technology Infrastructure |

3

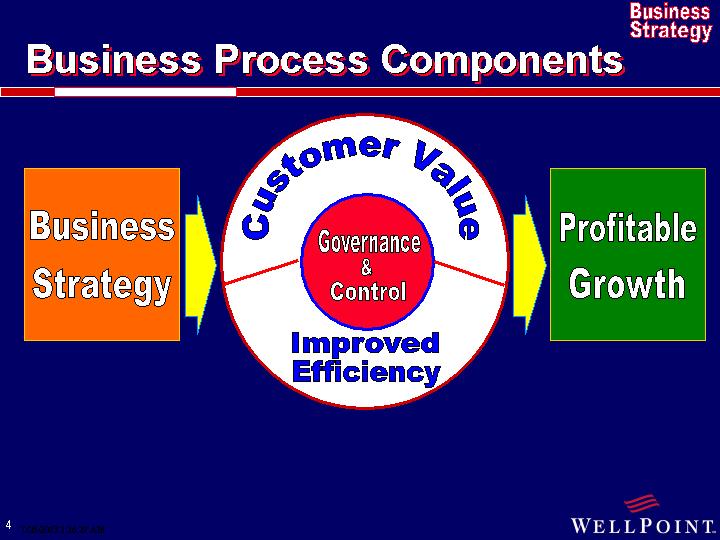

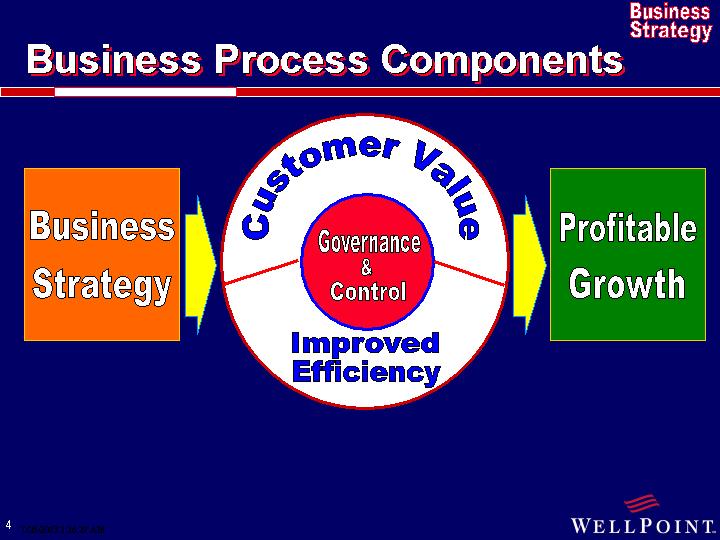

Business Process Components

| | Governance & Control | | |

| | | | |

Business Strategy | | Customer Value | | Profitable Growth |

| | | | |

| | Improved Efficiency | | |

4

Business Strategy | | Governance & Control | | |

| | | | |

Leverage Competitive Advantages | | Customer Value | | Profitable Growth |

| | | | |

| | Improved Efficiency | | |

| | | | |

| | • Broad product offerings | | |

| | • Diverse customer base | | |

| | • Pricing flexibility | | |

| | • Regional geographic focus | | |

5

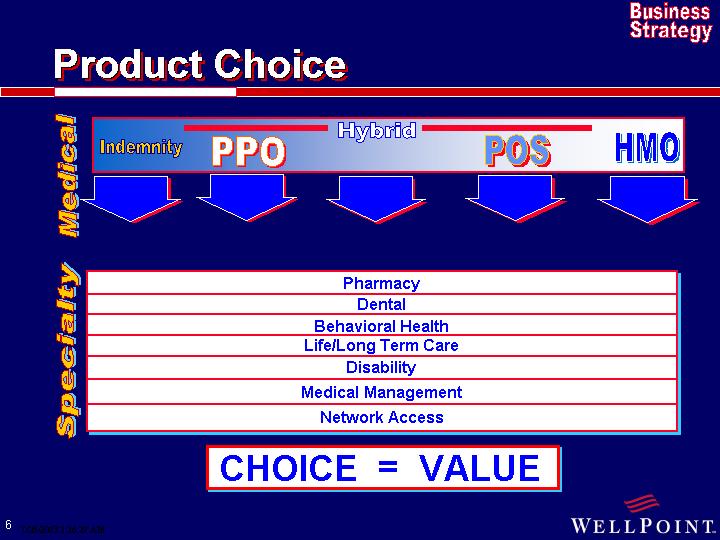

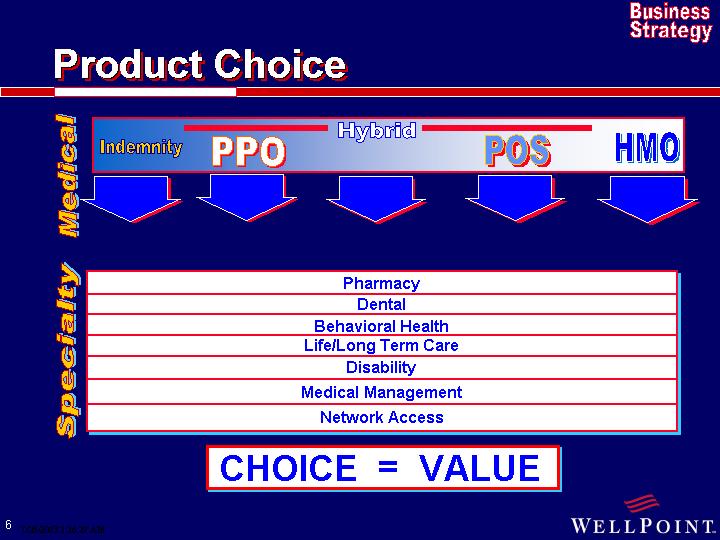

Product Choice

Medical |

|

Hybrid |

Indemnity | | PPO | | | | POS | | HMO |

|

Specialty |

|

Pharmacy |

Dental |

Behavioral Health |

Life/Long Term Care |

Disability |

Medical Management |

Network Access |

|

CHOICE = VALUE |

6

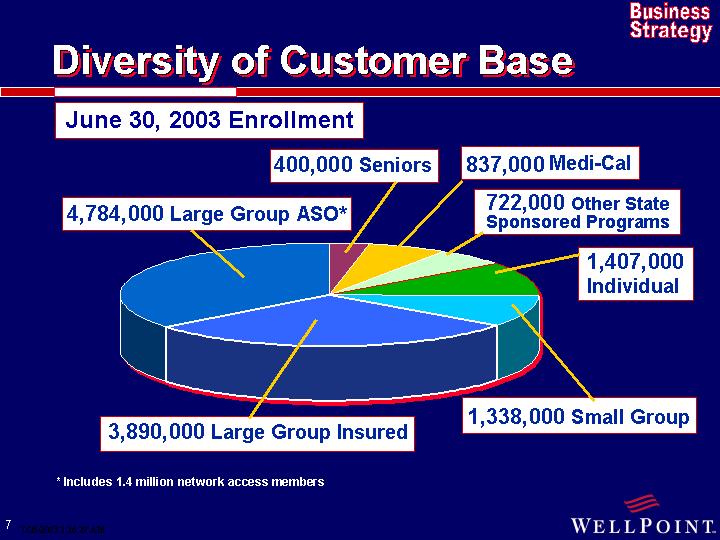

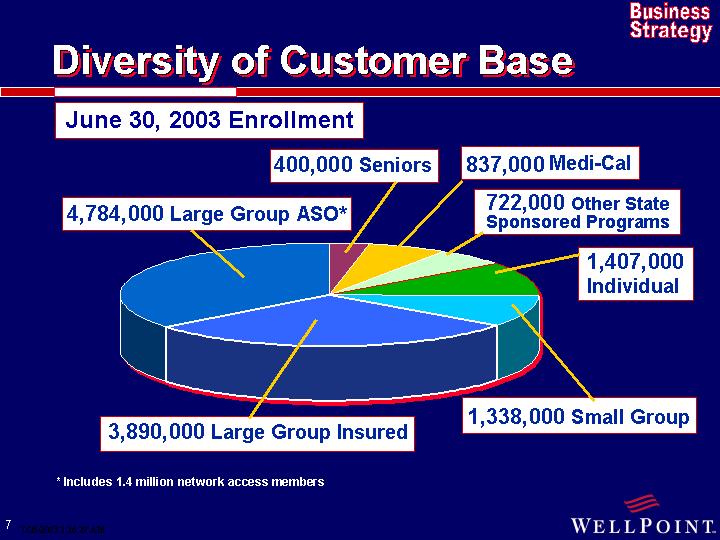

Diversity of Customer Base

June 30, 2003 Enrollment

[CHART]

4,784,000 Large Group ASO*

400,000 Seniors

837,000 Medi-Cal

722,000 Other State Sponsored Programs

1,407,000 Individual

1,338,000 Small Group

3,890,000 Large Group Insured

* Includes 1.4 million network access members

7

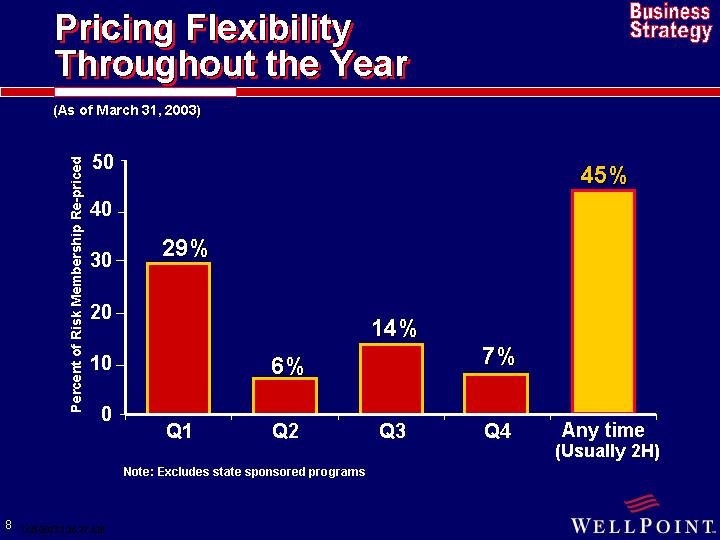

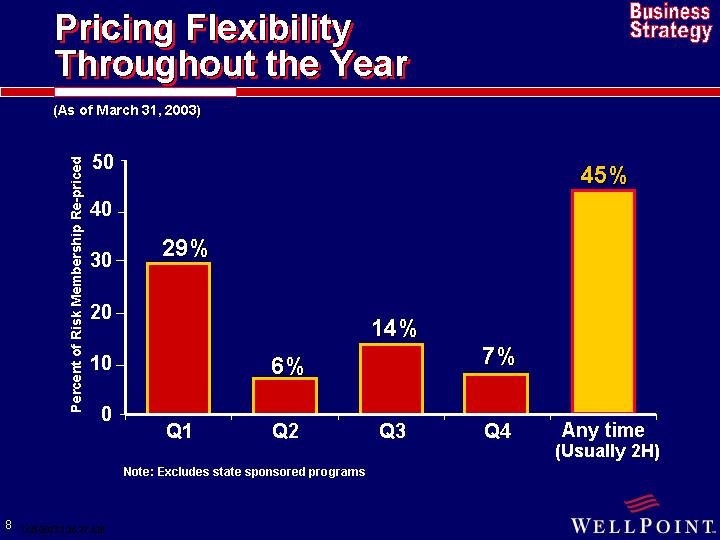

Pricing Flexibility

Throughout the Year

(As of March 31, 2003)

[CHART]

Percent of Risk Membership Re-Priced:

Q1 - 29%

Q2 - 6%

Q3 - 14%

Q4 - 7%

Any time (usually 2H) - 45%

Note: Excludes state sponsored programs

8

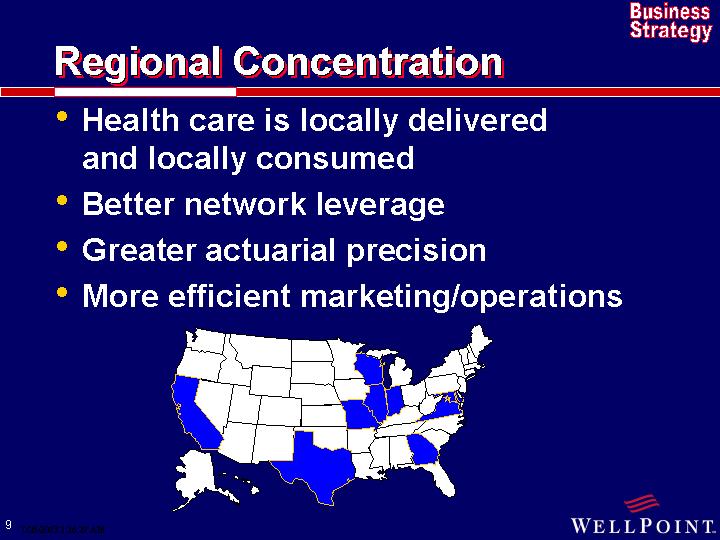

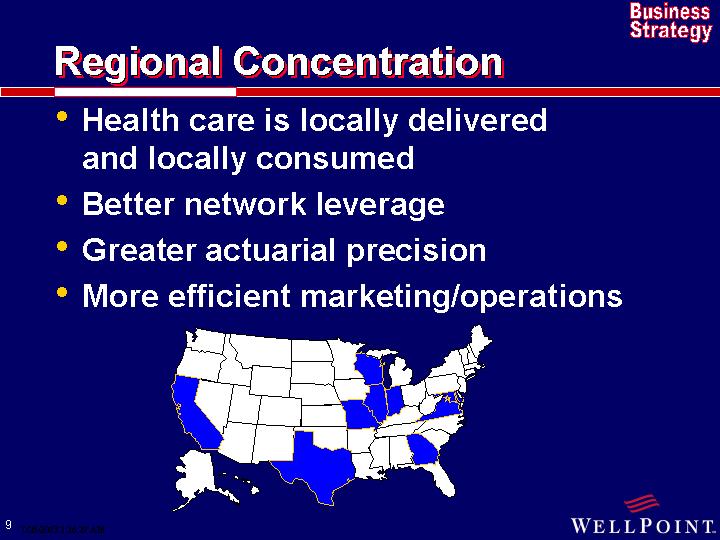

Regional Concentration

• Health care is locally delivered and locally consumed

• Better network leverage

• Greater actuarial precision

• More efficient marketing/operations

[GRAPHIC]

9

Internal Growth Strategy

Increase Market Share |

|

Enrollment Growth

5% |

|

Price Right |

|

L.T. Medical Trend at 5% |

Revenues Increase 10% |

MCR Remains Constant |

|

Increase Gross U/M

10% |

|

Flat SG&A PMPM |

|

Increase Net U/M

14% |

|

Cash Flow > Net Income |

|

15% Net Income Growth |

Enhanced Shareholder Value |

|

[CHART] |

|

Stock Price |

10

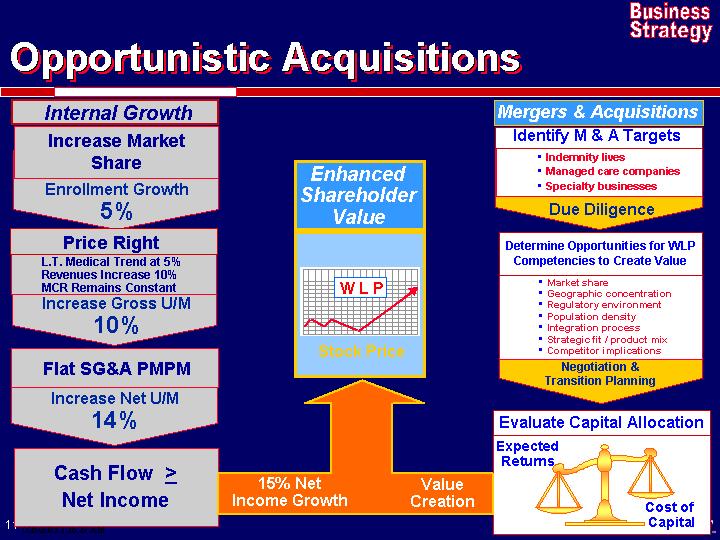

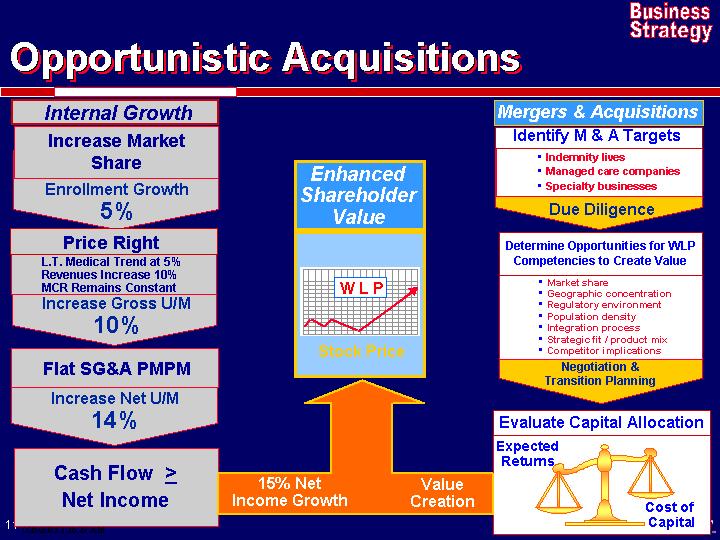

Opportunistic Acquisitions

Internal Growth |

|

Increase Market Share |

|

Enrollment Growth

5% |

|

Price Right |

|

L.T. Medical Trend at 5% |

Revenues Increase 10% |

MCR Remains Constant |

|

Increase Gross U/M

10% |

|

Flat SG&A PMPM |

|

Increase Net U/M

14% |

|

Cash Flow > Net Income |

|

15% Net Income Growth |

Enhanced Shareholder Value

[CHART]

Stock Price

Value Creation |

|

Mergers & Acquisitions |

|

Identify M & A Targets |

|

• Indemnity lives |

• Managed care companies |

• Specialty businesses |

|

Due Diligence |

|

Determine Opportunities for WLP

Competencies to Create Value |

|

• Market share |

• Geographic concentration |

• Regulatory environment |

• Population density |

• Integration process |

• Strategic fit / product mix |

• Competitor implications |

|

Negotiation &

Transition Planning |

|

Evaluate Capital Allocation |

|

[GRAPHIC] |

11

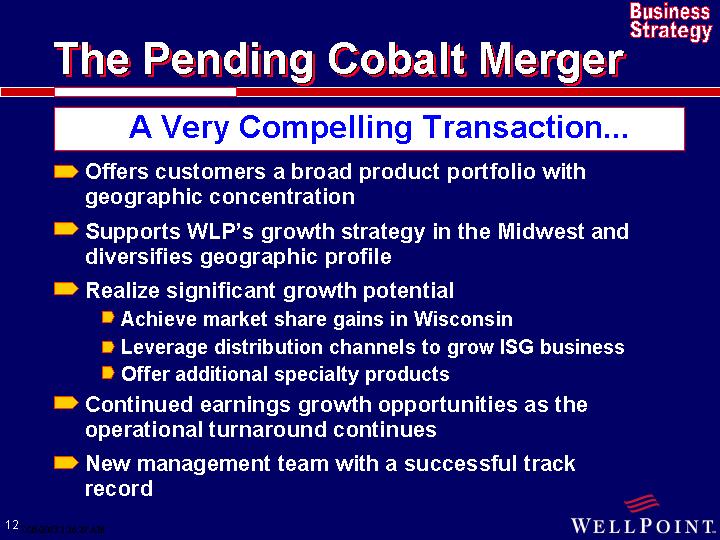

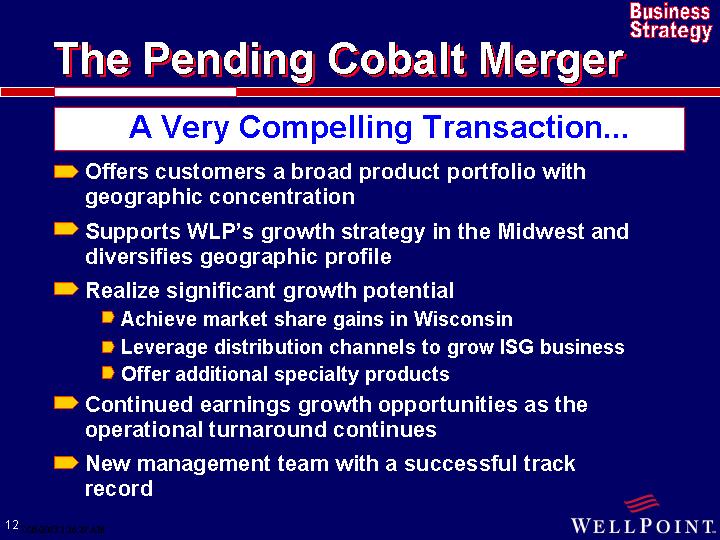

The Pending Cobalt Merger

A Very Compelling Transaction...

• Offers customers a broad product portfolio with geographic concentration

• Supports WLP’s growth strategy in the Midwest and diversifies geographic profile

• Realize significant growth potential

• Achieve market share gains in Wisconsin

• Leverage distribution channels to grow ISG business

• Offer additional specialty products

• Continued earnings growth opportunities as the operational turnaround continues

• New management team with a successful track record

12

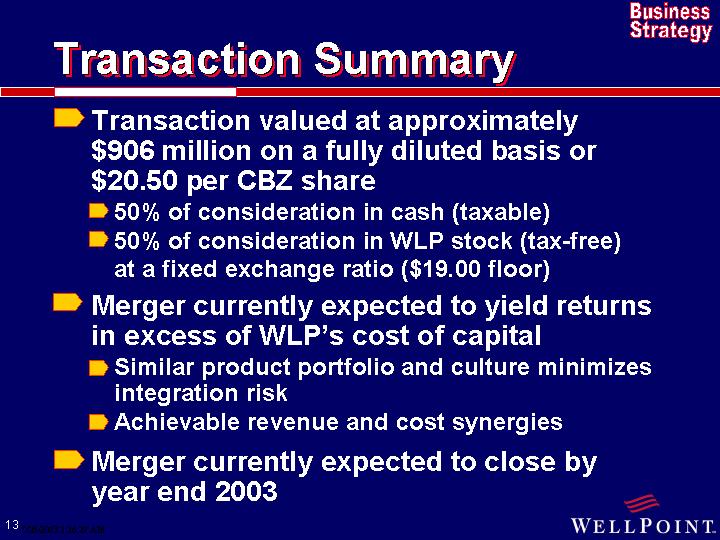

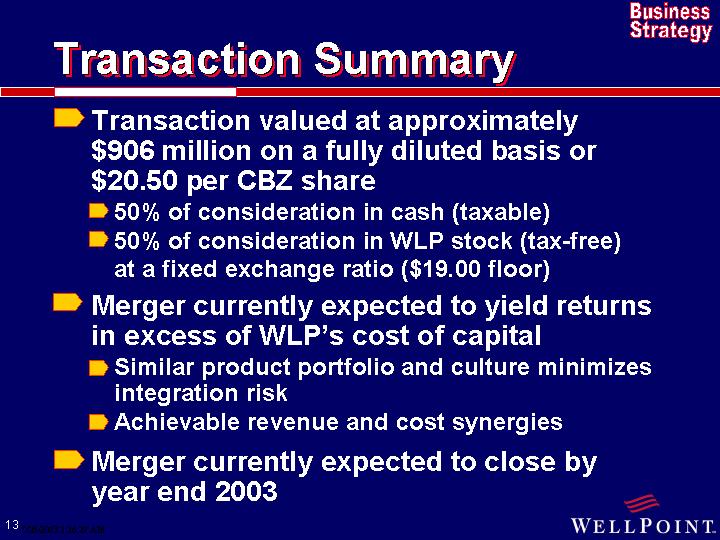

Transaction Summary

• Transaction valued at approximately $906 million on a fully diluted basis or $20.50 per CBZ share

• 50% of consideration in cash (taxable)

• 50% of consideration in WLP stock (tax-free) at a fixed exchange ratio ($19.00 floor)

• Merger currently expected to yield returns in excess of WLP’s cost of capital

• Similar product portfolio and culture minimizes integration risk

• Achievable revenue and cost synergies

• Merger currently expected to close by year end 2003

13

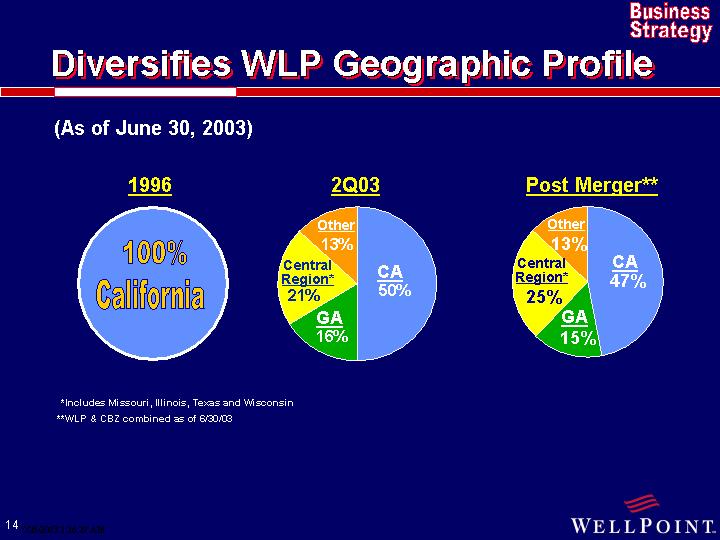

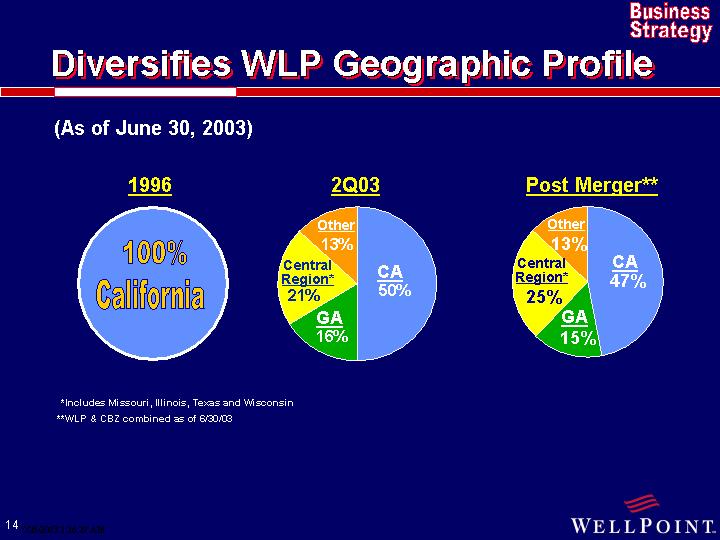

Diversifies WLP Geographic Profile

(As of June 30, 2003)

1996 | | 2Q03 | | Post Merger** |

| | | | |

[CHART] | | [CHART] | | [CHART] |

100% California | | CA 50% | | CA 47% |

| | GA 16% | | GA 15% |

| | Central Region 21% | | Central Region 25% |

| | Other 13% | | Other 13% |

* | Includes Missouri, Illinois, Texas and Wisconsin |

| |

** | WLP & CBZ combined as of 6/30/03 |

14

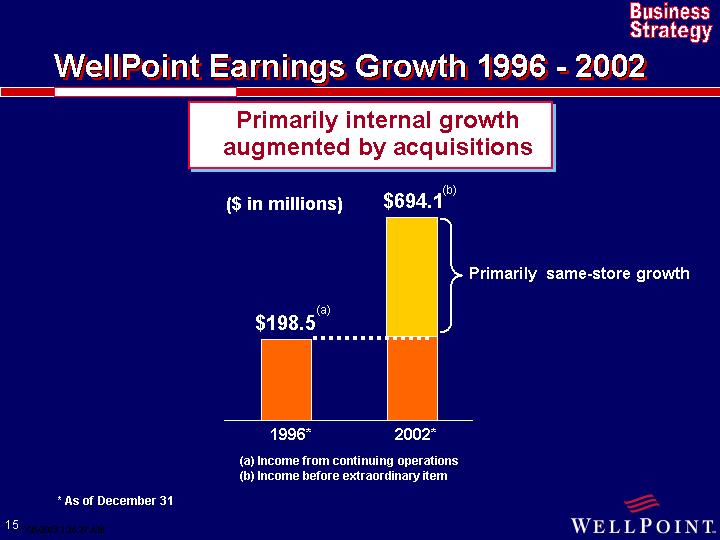

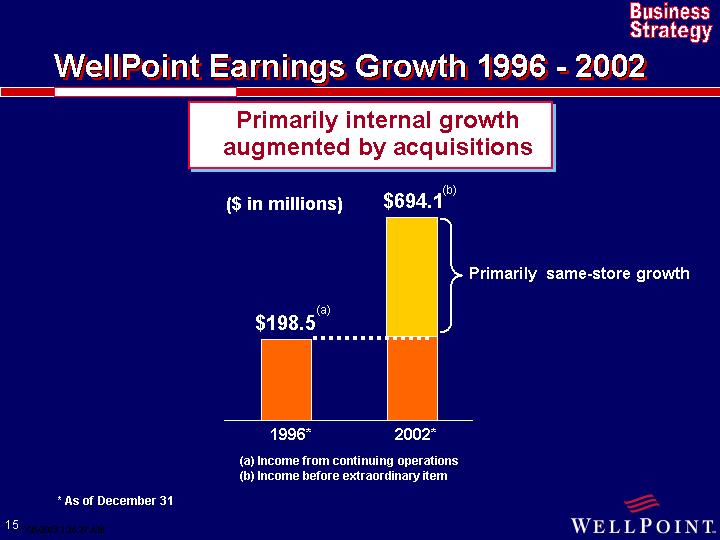

WellPoint Earnings Growth 1996 - 2002

Primarily internal growth

augmented by acquisitions

($ in millions)

1996* - $198.5 (a)

2002* - $694.1 (b)

[CHART]

(a) Income from continuing operations

(b) Income before extraordinary item

* As of December 31

15

[GRAPHIC]

| | Governance & Control | | |

| | | | |

Business Strategy | | Customer Value | | Profitable Growth |

| | | | |

| | Improved Efficiency | | |

What Members Want...

• Choice

• Access

• Information

16

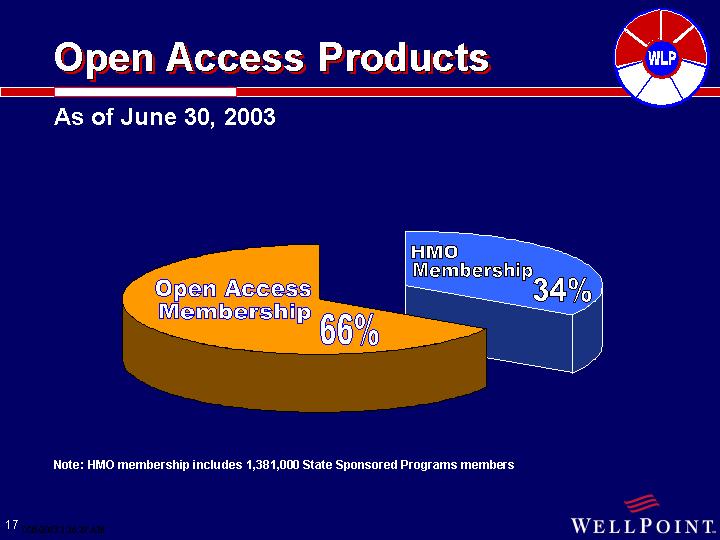

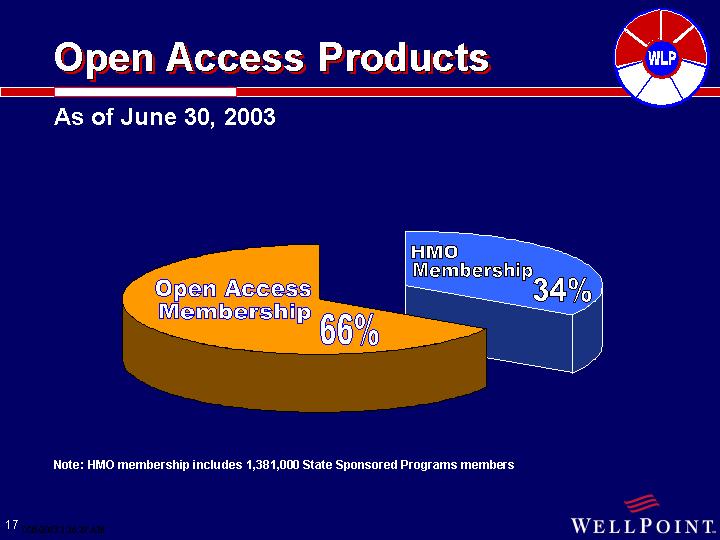

Open Access Products

As of June 30, 2003

[CHART]

Open Access Membership 66%

HMO Membership 34%

Note: HMO membership includes 1,381,000 State Sponsored Programs members

17

Products That Meet Customer Needs

PlanScape | | Low price point products for individuals |

| | |

FlexScape | | Defined contribution plan for small employers |

| | |

Power CareAdvocate | | Health improvement program for large group members |

| | |

Power HealthFund | | Provides resources that assist members with health care decisions |

| | |

Ethnic Marketing | | Outreach to Hispanic, Asian & African American communities |

18

Current CA Networks

Midwife Network | | 17 |

Audiologist Network | | 309 |

Physical Therapy Network | | 2,145 |

Acupuncture Network | | 932 |

Chiropractic Network | | 2,494 |

Behavioral Health Services | | 4,632 Physicians |

| | 122 Facilities |

Prudent Buyer (PPO) | | 46K Physicians |

| | 416 Hospitals |

BCC HMO | | 29K Physicians |

| | 408 Hospitals |

Medicare Risk | | 13K Physicians |

| | 139 Hospitals |

Medi-Cal Managed Care | | 14K Physicians |

| | 210 Hospitals |

Clinical Lab Network | | 236 Sites |

Imaging Centers Network | | 291 Sites |

Workers Comp | | 10K PPO Physicians |

| | 284 Frontline Physicians |

Ambulance Network | | 37 companies |

Med. Products & Services | | 1,181 Locations |

| | |

Vision Network | | 3,525 Optometrists |

| | 1,023 MD’s |

Hospice Network | | 97 Sites |

| | (81 Agencies) |

Home Health Network | | 266 Sites |

| | (178 Agencies) |

Standard Hospital Network | | 439 |

Medicare Select | | 56 Hospitals |

Ambulatory Surgery Network | | 317 Facilities |

Dialysis Centers | | 266 Sites |

Alternative Birth Centers | | 8 Sites |

Employee Assistance Prog. | | 663 Counselors |

Pharmacy Net. | | 4,321 Chain |

| | 633 Independent |

Dental Network | | 2,685 Dent Net Dent. |

| | 10K PPO Dentists |

| | |

Preventive Care Network | | 116 Sites |

Home Infusion Network | | 116 Sites |

| | (68 Agencies) |

Skilled Nursing Facility | | 477 Facilities |

Centers for Expertise Net. | | 20 Facilities |

Key: Professional Network, Institutional Network, Specialty Product Network

19

Cost Indicators

[GRAPHIC]

Name | | Address | | City | | Phone | | Zip | | Inpatient | | Outpatient | | Links |

| | | | | | | | | | | | | | |

Barlow Hospital * | | 2000 Stadium Way | | Los Angeles | | (213) 250-4200 | | 93026 | | ### | | N/A | | MPQ |

| | | | | | | | | | | | | | |

Brotman Medical Center * | | 3828 Delmas Ter | | Culver City | | (310) 836-7000 | | 90232 | | ### | | ## | | MPQ |

| | | | | | | | | | | | | | |

California Hospital Medical Center * | | 1401 S Grand Ave | | Los Angles | | (213) 748-2411 | | 90015 | | ## | | ## | | MPQ |

| | | | | | | | | | | | | | |

Cedars Sinai Medical Center * | | 8700 Beverly Blvd | | West Hollywood | | (310) 855-5000 | | 90048 | | #### | | #### | | MPQ |

| | | | | | | | | | | | | | |

Centinela Hospital Medical Center * | | 555 E Hardy St | | Inglewood | | (310) 673-4669 | | 93301 | | ### | | ## | | MPQ |

| | | | | | | | | | | | | | |

Century City Hospital * | | 2070 Century Park E | | Los Angles | | (310) 553-6211 | | 90067 | | ## | | ## | | MPQ |

| | | | | | | | | | | | | | |

Childrens Hospital Los Angeles * | | 4650 W Sunset Blvd | | Los Angles | | (323) 660-2450 | | 90027 | | ### | | ## | | MPQ |

| | | | | | | | | | | | | | |

Daniel Freeman Marina Hosp * | | 4650 Lincoln Blvd | | Marina Del Ray | | (310) 823-8911 | | 90292 | | ## | | # | | MPQ |

| | | | | | | | | | | | | | |

Daniel Freeman Mem Hosp * | | 333 N Prairie Ave | | Inglewood | | (310) 674-7050 | | 90301 | | # | | # | | MPQ |

| | | | | | | | | | | | | | |

Encino Tarzana Reg Med Ctr-Encino Campus * | | 16237 Ventura Blvd | | Encino | | (818) 995-5000 | | 91436 | | # | | ## | | MPQ |

| | | | | | | | | | | | | | |

Glendale Memorial Hosp & Hlth Cntr. * | | 1420 S Central Ave | | Glendale | | (818) 502-1900 | | 91204 | | # | | ## | | MPQ |

| | | | | | | | | | | | | | |

Good Samaritan Hospital * | | 616 Witmer St | | Los Angles | | (213) 977-2121 | | 90017 | | # | | ## | | MPQ |

| | | | | | | | | | | | | | |

Kennath Norris Jr Cancer Hospital* | | 1441 Eastlake Ave | | Los Angles | | (323) 865-3000 | | 90033 | | ### | | ### | | MPQ |

| | | | | | | | | | | | | | |

Midway Hospital Medical Center ** | | 5925 San Vicente Blvd | | Los Angles | | (323) 938-3161 | | 90019 | | ### | | ## | | MPQ |

| | Each hospital is placed into one of four cost categories |

| | |

|

# | | In general, least expensive |

| | |

## | | In general, less expensive |

| | |

### | | In general, more expensive |

| | |

#### | | In general, most expensive |

20

Quality Indicators

[LOGO] Brought to you by Blue Cross of California

Blue Cross of California (BCC) is an independent Licensee of the Blue Cross Association (BCA) ©2001 BCC

Hospital Clinical Experience and Outcomes for Selected Procedure

| | CEDARS-SINAI

MEDICAL CENTER | | UCLA MEDICAL CENTER | | PROVIDENCE ST JOSEPH MEDICAL

CENTER |

| | | | | | |

Valve Replacement and Repair: Inpatient | | | | |

| | | | | | |

Patients Having Procedure in One Year | | 208 | | 221 | | 68 |

| | | | | | |

Severely III Patients Having Procedure in One Year | | 170 | | 192 | | n/a |

| | | | | | |

Complication Rate | | As Expected | | [See Discussion] | | As Expected |

| | | | | | |

Post-Operative Infection Rate | | As Expected | | As Expected [ See Discussion] | | As Excepted |

Hospital Over all Patient Safety Standards

| | CEDARS-SINAI

MEDICAL CENTER | | UCLA MEDICAL CENTER | | PROVIDENCE ST JOSEPH MEDICAL

CENTER |

| | | | | | |

Computerized Physician Order Empty | | Good Progress Toward Standard | | Good Progress Toward Standard | | Date Not Available |

| | | | | | |

Intensive Care Unit Physician Staffing | | Meets Standard | | Meets Standard | | Date Not Available |

Hospital Raputation

| | CEDARS-SINAI

MEDICAL CENTER | | UCLA MEDICAL CENTER | | PROVIDENCE ST JOSEPH MEDICAL

CENTER |

| | | | | | |

Public Perception for Heart Care | | Best in Los Angeles-Long Beach | | Good in Los Angeles-Long Beach | | Good in Los Angeles-Long Beach |

| | | | | | |

JCAHO Accreditation | | Yes | | Yes | | Yes |

| | | | | | |

Hospital’s Comment | | | | Comment | | Comment |

21

What Employers Want...

• Tools to manage medical inflation

• Service Innovation

22

Tools to Manage Medical Inflation

[GRAPHIC]

Medical Inflation

[GRAPHIC] | | [GRAPHIC] |

| | |

Plan Design | | Health Management |

[GRAPHIC]

Network Configuration

23

Plan Design

[GRAPHIC]

Medical Inflation

[GRAPHIC] | | [GRAPHIC] |

| | |

Plan Design | | Health Management |

[GRAPHIC]

Network Configuration

24

Employer Flexibility

• Plan designs today are rich

• 85% of WLP’s CA PPO members have $250 or less deductible

• 65% have an office visit co-pay of $10 or less

• 89% of WLP’s CA HMO members have 100% coinsurance for inpatient care

• Changes can significantly impact trends

• Branded drug deductible ($250) reduces pharmacy trend from 17% to negative 12% in PlanScape plans

25

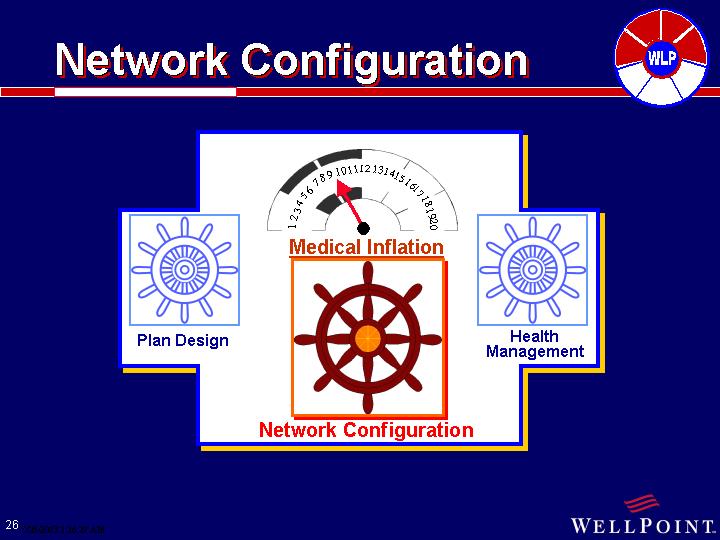

Network Configuration

[GRAPHIC]

Medical Inflation

[GRAPHIC] | | [GRAPHIC] |

| | |

Plan Design | | Health Management |

[GRAPHIC]

Network Configuration

26

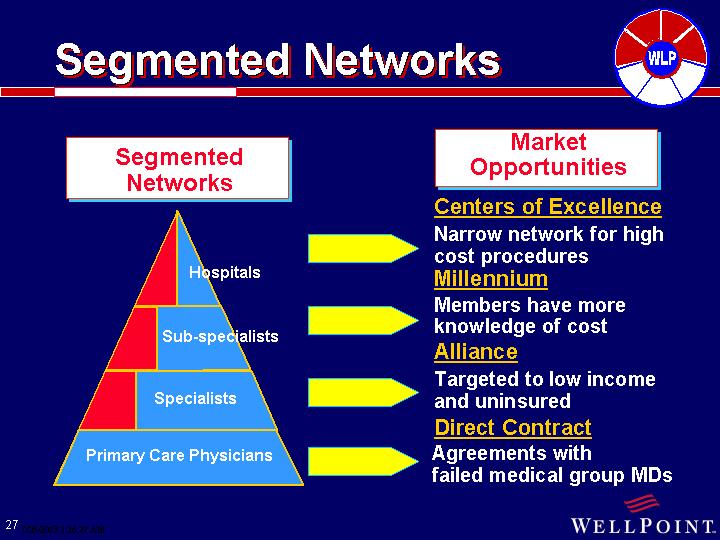

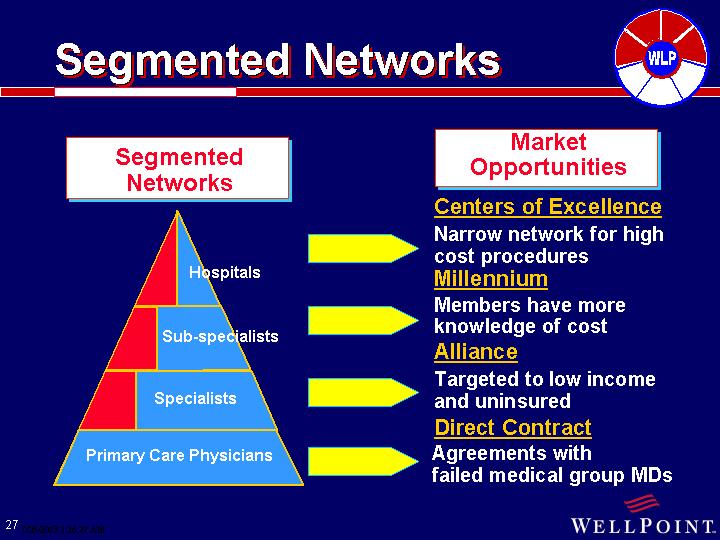

Segmented Networks

Segmented

Networks | | Market

Opportunities |

| | |

| | Centers of Excellence |

Hospitals | | Narrow network for high cost procedures |

| | |

| | Millennium |

Sub-specialists | | Members have more knowledge of cost |

| | |

| | Alliance |

Specialists | | Targeted to low income and uninsured |

| | |

| | Direct Contract |

Primary Care Physicians | | Agreements with failed medical group MDs |

27

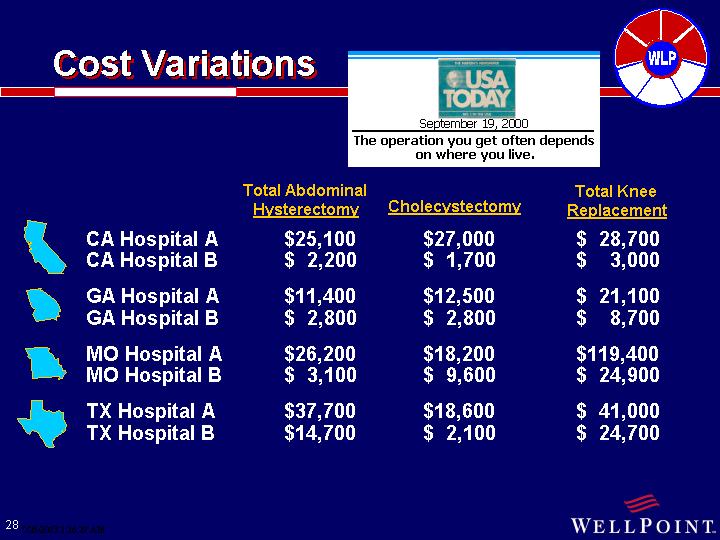

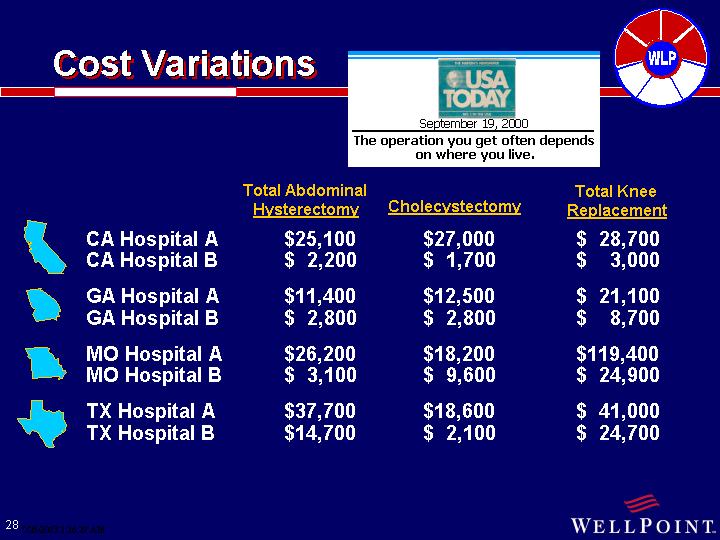

Cost Variations

[LOGO]

September 19, 2000

The operation you get often depends on where you live.

| | | Total Abdominal

Hysterectomy | | Cholecystectomy | | Total Knee

Replacement | |

| | | | | | | | |

[GRAPHIC] | CA Hospital A | | $ | 25,100 | | $ | 27,000 | | $ | 28,700 | |

| CA Hospital B | | $ | 2,200 | | $ | 1,700 | | $ | 3,000 | |

| | | | | | | | | | | |

[GRAPHIC] | GA Hospital A | | $ | 11,400 | | $ | 12,500 | | $ | 21,100 | |

| GA Hospital B | | $ | 2,800 | | $ | 2,800 | | $ | 8,700 | |

| | | | | | | | | | | |

[GRAPHIC] | MO Hospital A | | $ | 26,200 | | $ | 18,200 | | $ | 119,400 | |

| MO Hospital B | | $ | 3,100 | | $ | 9,600 | | $ | 24,900 | |

| | | | | | | | | | | |

[GRAPHIC] | TX Hospital A | | $ | 37,700 | | $ | 18,600 | | $ | 41,000 | |

| TX Hospital B | | $ | 14,700 | | $ | 2,100 | | $ | 24,700 | |

28

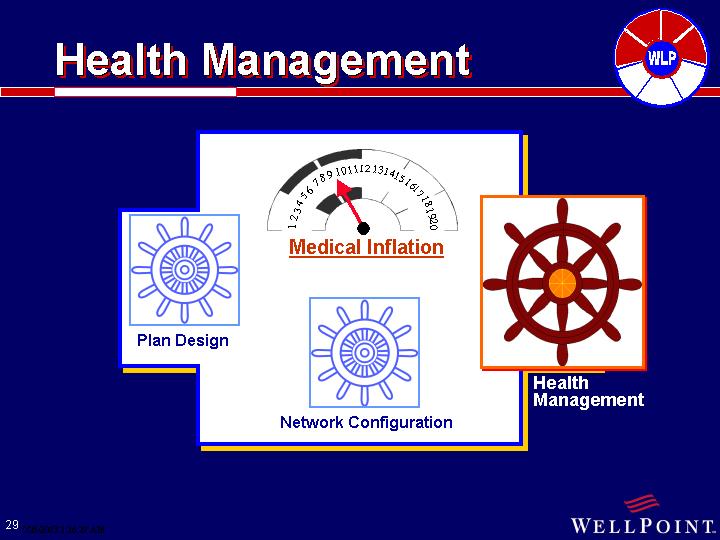

Health Management

[GRAPHIC]

Medical Inflation

[GRAPHIC] | | [GRAPHIC] |

| | |

Plan Design | | Health Management |

[GRAPHIC]

Network Configuration

29

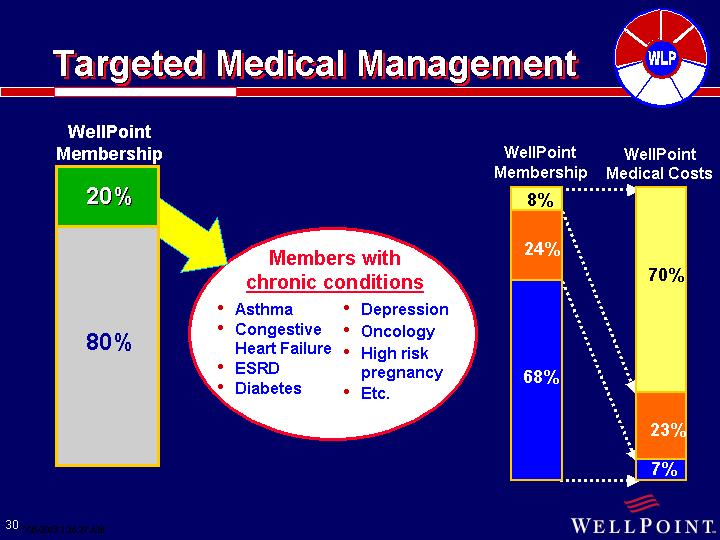

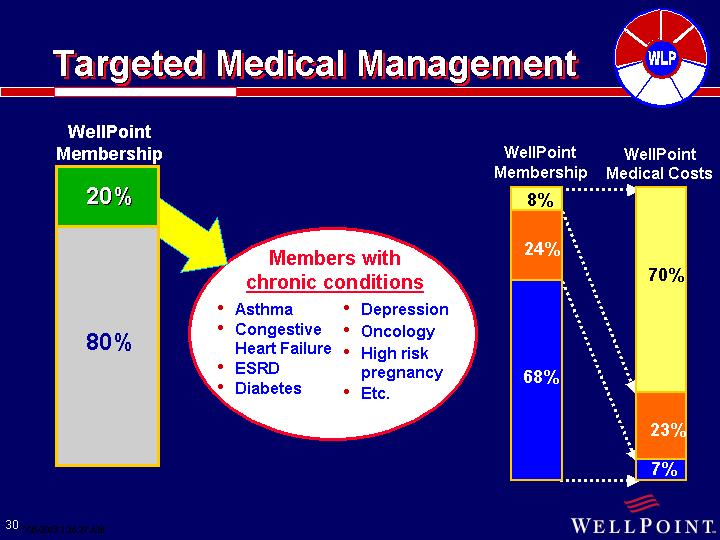

Targeted Medical Management

WellPoint Membership

[CHART]

Members with chronic conditions |

|

• Asthma |

• Congestive Heart Failure |

• ESRD |

• Diabetes |

• Depression |

• Oncology |

• High risk pregnancy |

• Etc. |

WellPoint Membership

[CHART]

WellPoint Medical Costs

[CHART]

30

Outcomes:

Diabetes Program

Outcomes

Inpatient Utilization for DCM Participants vs. Non-Participants

[CHART]

Average Number of ER Admissions per Patient

[CHART]

31

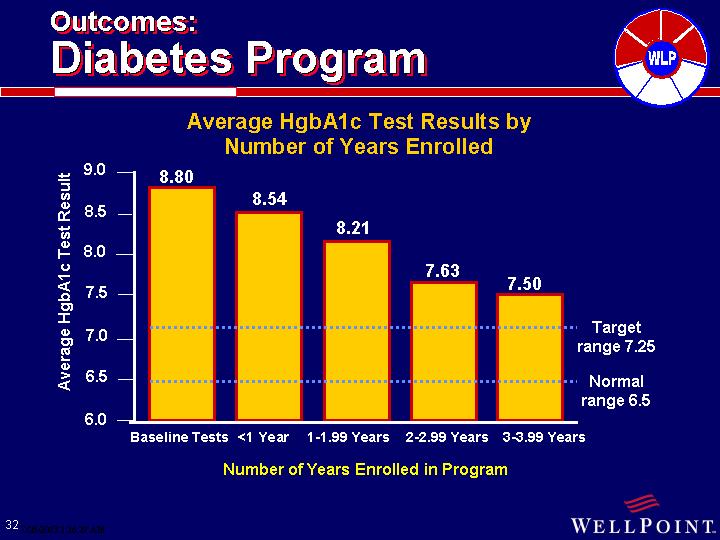

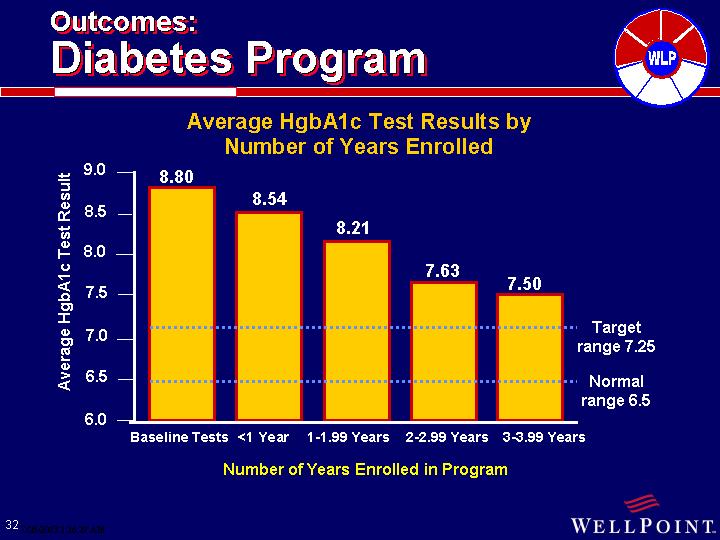

Average HgbA1c Test Results by Number of Years Enrolled

[CHART]

32

Outcomes:

Asthma Program

Asthma Program Decreased Emergency Room Visits

Baseline: 1998 Re-Measure: 2000*

[CHART]

Results are statistically significant.

* Baseline period is 12 months prior to identification and varies by member.

Re-measurement period is 24 months post baseline.

33

Service Innovations

Sophisticated Research Tools

Meet Customer Needs & Expectations [GRAPHIC]

• E-Business

• Member Self-service

• Employer Access

• Provider Access

• AgentFinder & AgentConnect

• Virtual call centers

• One-call resolution

• Enhanced work flow management

• Advanced imaging technology

• Bar coding applications

• Telemedicine

34

| | Governance & Control | | |

| | | | |

Business Strategy | | Customer Value | | Profitable Growth |

| | | | |

| | Improved Efficiency | | |

• Claims submission and processing

35

[LOGO]

Why Pay a Claim Faster?

• Improve doctor and hospital relationships

• More timely data for actuarial analysis

• Lower administrative costs

36

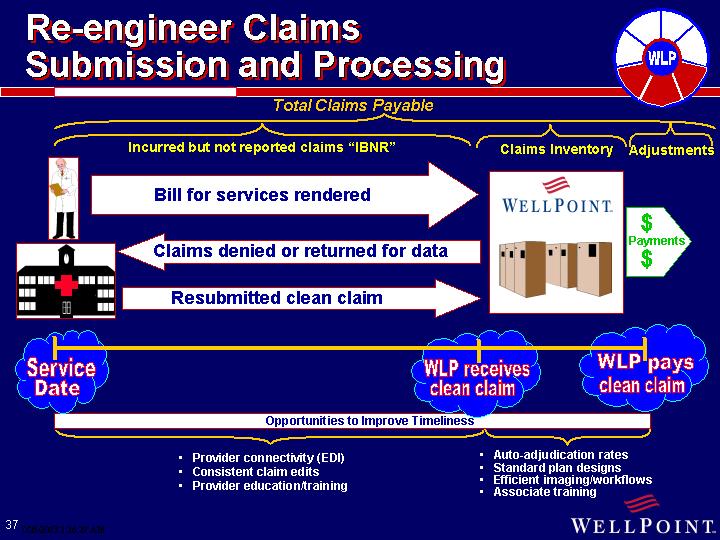

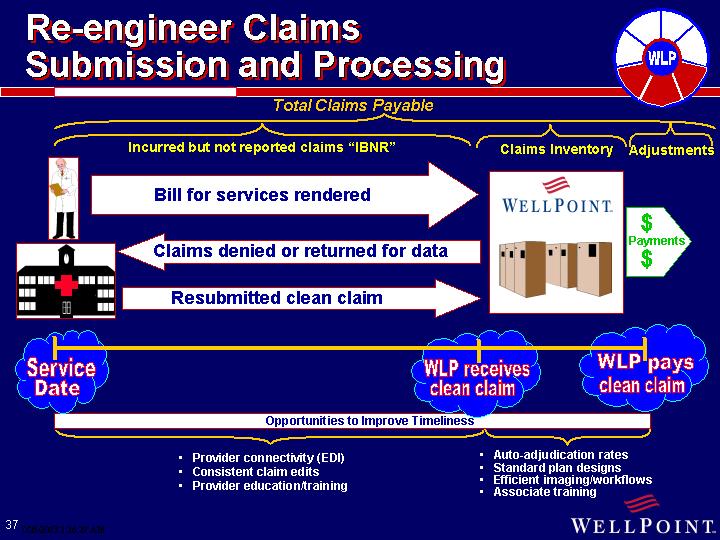

Re-engineer Claims Submission and Processing

Total Claims Payable

| | Incurred but not reported claims “IBNR” | | Claims Inventory | | Adjustments |

| | | | | | |

[GRAPHIC] | | Bill for services rendered | | [LOGO]

[GRAPHIC] | | |

| | | | $ |

[GRAPHIC] | | Claims denied or returned for data | | Payments |

| | | $ |

| Resubmitted clean claim | | |

Service Date | | WLP receives clean claim | | WLP pays clean claim |

| | | | |

Opportunities to Improve Timeliness |

|

| | • Provider connectivity (EDI) | | • Auto-adjudication rates |

| | • Consistent claim edits | | • Standard plan designs |

| | • Provider education/training | | • Efficient imaging/workflows |

| | | | • Associate training |

| | | | | | | | |

37

| | Governance & Control | | |

| | | | |

Business Strategy | | Customer Value | | Profitable Growth |

| | | | |

| | Improved Efficiency | | |

• Corporate governance

• Management process

38

[LOGO]

Corporate Governance

• Meet virtually all recommended best practices | | |

| | |

• Nine-member Board of Directors, eight independent directors | | [GRAPHIC] |

| | |

• Audit, Compensation, Nominating & Governance committees comprised entirely of independent directors | | |

• Each committee has a detailed charter | | [GRAPHIC] |

• Committees have appropriate skill mix | |

39

Comprehensive Management Process

Extensive

Monitoring | | | | Reasonability

Checks |

| | | | |

| | Detailed Three-Year and Annual Plan | | |

• Daily | | • Comprised of detailed assumptions of the business units | | • Rolling reforecast |

• Weekly | | • Reviewed by CEO, CFO and Chief Actuary | | • Legal Entity reviews |

•Monthly | | • Approved by Board of Directors | | |

•Quarterly | | | | |

| | | | |

| | Corrective Action as Appropriate | | |

40

| | Governance & Control | | |

| | | | |

Business Strategy | | Customer Value | | Profitable Growth |

| | | | |

| | Improved Efficiency | | |

• Increased membership

• Earnings growth

• Excellent cash flow

• Enhanced shareholder value

41

[LOGO]

Member Growth

Total Medical Membership*

(in thousands)

[CHART]

| | 2,797 | | 4,485 | | 6,638 | | 6,892 | | 7,515 | | 8,201 | | 10,528 | | 13,223 | | 13,378 | |

| | 1995 | | 1996 | | 1997 | | 1998 | | 1999 | | 2000 | | 2001 | | 2002 | | 2Q03 | |

California Membership Growth: | | 7 | % | 27 | % | 17 | % | 7 | % | 15 | % | 8 | % | 6 | % | 11 | % | 5 | %** |

* Readjusted to reflect the inclusion of network access & Puerto Rico joint venture membership

** Reflects growth from June 30, 2002

42

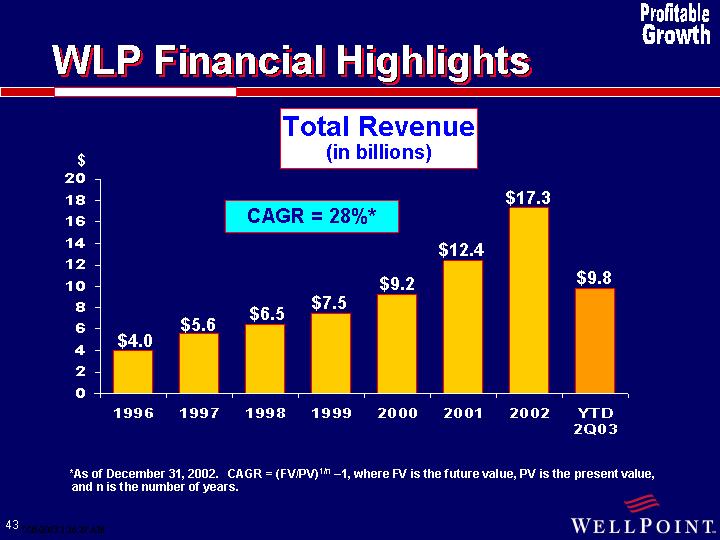

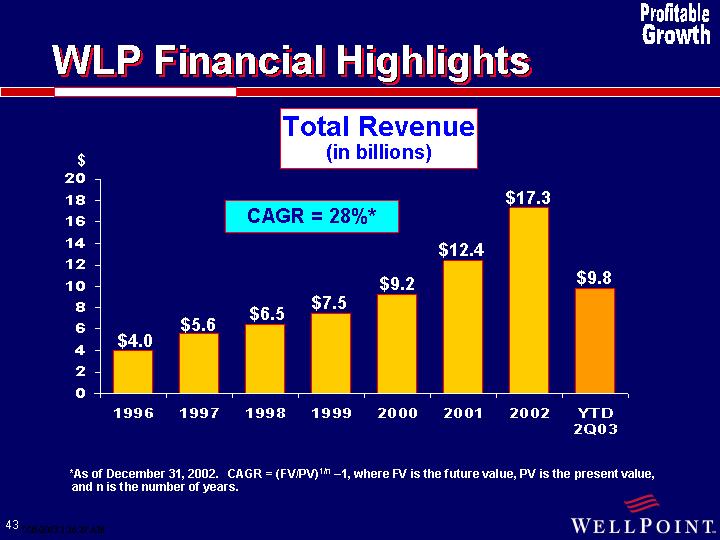

WLP Financial Highlights

Total Revenue

(in billions)

CAGR=28%

[CHART]

$4.0 | | $5.6 | | $6.5 | | $7.5 | | $9.2 | | $12.4 | | $17.3 | | $9.8 |

1996 | | 1997 | | 1998 | | 1999 | | 2000 | | 2001 | | 2002 | | YTD 2Q03 |

* As of December 31, 2002. CAGR = (FV/PV)1/n –1, where FV is the future value, PV is the present value, and n is the number of years.

43

Income from

Continuing Operations(a)

(in millions)

CAGR=22%(e)

[CHART]

$198.5 | | $224.9 | | $263.0 | | $297.2 | | $342.3 | | $414.7 | | $660.9 | | $417.5 |

1996 | | 1997 | | 1998 | | 1999 | | 2000 | | 2001 | | 2002 | | YTD 2Q03 |

(a) Before extraordinary items and cumulative effect of accounting change, if applicable

(b) 1997 income from continuing operations of $229.4 million excludes: i) $9.0 million of nonrecurring costs, net of tax, related to write-down of the Company’s dental practice management operations, discontinuance of certain medical practice management operations, and severance and retention payments associated with the GBO acquisition, ii) $4.5 million charge, net of tax, associated with prior investments in certain distribution channels outside of California, and iii) $18 million of investment gains in HPI, net of tax

(c) 1998 income from continuing operations of $319.5 million excludes a charge of $29.0 million, net of tax, related to WellPoint’s previous holdings in FPA Medical Management, Inc. and the impact of favorable IRS tax ruling of $85.5 million

(d) 2002 income from continuing operations before extraordinary item of $694.1 million excludes $33.2 million of net realized investment gains, net of tax

(e) As of December 31, 2002. CAGR = (FV/PV)1/n –1, where FV is the future value, PV is the present value, and n is the number of years.

44

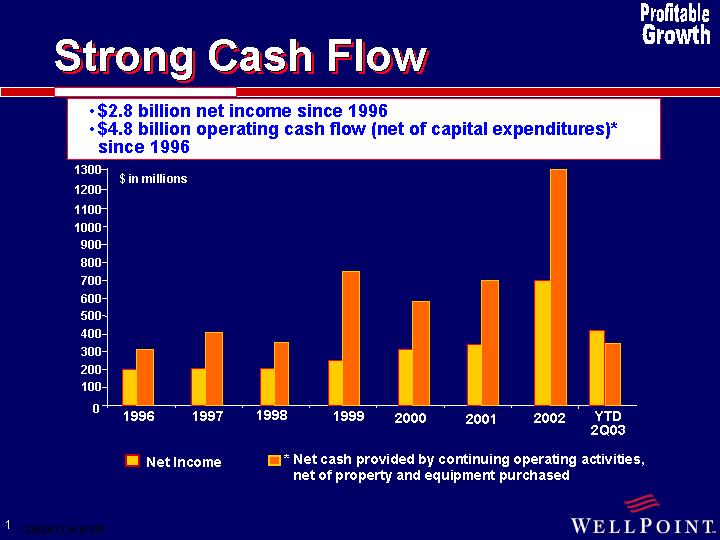

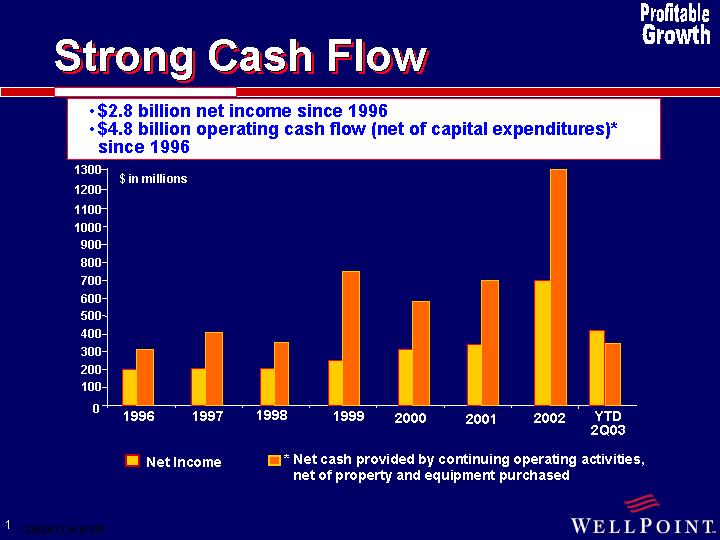

Strong Cash Flow

• $2.8 billion net income since 1996

• $4.8 billion operating cash flow (net of capital expenditures)* since 1996

[CHART]

* Net cash provided by continuing operating activities, net of property and equipment purchased

45

• Since December 1996 WLP has:

• Bought back $1.2 billion of its common stock

• Completed eight acquisitions for $1.5 billion

• Increased cash & investments by $5.8 billion

• Reinvested $520 million in PP&E

46

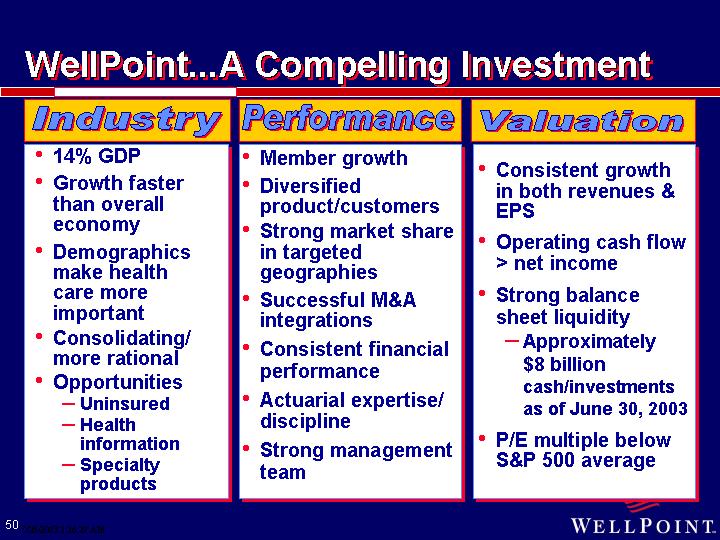

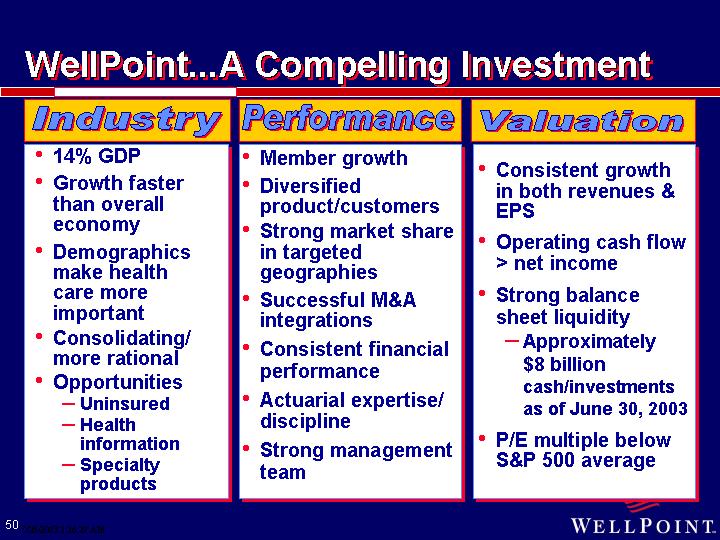

WellPoint...A Compelling Investment

Health Care Industry

• 14% GDP

• Growth faster than overall economy

• Demographics make health care more important

• Consolidating / more rational

• Opportunities

• Uninsured

• Health information

• Specialty products

47

WLP Performance

• Member growth

• Diversified product/customers

• Strong market share in targeted geographies

• Successful M&A integrations

• Consistent financial performance

• Actuarial expertise/discipline

• Strong management team

48

WLP Valuation

• Consistent growth in both revenues & EPS

• Operating cash flow > net income

• Strong balance sheet liquidity

• Approximately $8 billion in cash/investments as of June 30, 2003

• P/E multiple below S&P 500 average

49

Industry

• 14% GDP

• Growth faster than overall economy

• Demographics make health care more important

• Consolidating/ more rational

• Opportunities

• Uninsured

• Health information

• Specialty products

Performance

• Member growth

• Diversified product/customers

• Strong market share in targeted geographies

• Successful M&A integrations

• Consistent financial performance

• Actuarial expertise/ discipline

• Strong management team

Valuation

• Consistent growth in both revenues & EPS

• Operating cash flow > net income

• Strong balance sheet liquidity

• Approximately $8 billion cash/investments as of June 30, 2003

• P/E multiple below S&P 500 average

50

[LOGO]

51