Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

Bear Stearns

16th Annual

Health Care Conference

David C. Colby

Executive Vice President &

Chief Financial Officer

WellPoint Health Networks Inc.

September 8, 2003

This presentation contains non-GAAP financial measures as defined in the rules of the Securities and Exchange Commission. As required by the rules, a reconciliation of those measures to the most directly comparable GAAP measures is available at our website, which can be found at www.wellpoint.com.

[WELLPOINT LOGO]

1

The following presentation may be deemed to be solicitation material with respect to the proposed transaction between Cobalt Corporation and WellPoint. In connection with the proposed transaction, WellPoint has filed with the SEC a final proxy statement-prospectus, dated August 22, 2003, regarding the proposed transaction. The final proxy statement-prospectus has been sent to the stockholders of Cobalt seeking their approval of the proposed transaction. Stockholders of Cobalt are encouraged to read the final proxy statement-prospectus because it contains important information about the proposed transaction. The final proxy statement-prospectus and all other documents filed by Cobalt or WellPoint with the SEC are available for free both on the SEC's web site (www.sec.gov) and from Cobalt’s and WellPoint's respective corporate secretaries. Cobalt and its directors and executive officers may be deemed to be participants in the solicitation of proxies with respect to the proposed transaction. Information regarding the interests of Cobalt’s directors and executive officers is included in the final proxy statement-prospectus.

2

Agenda

• WellPoint Profile

• An Effective Business Process

• Continued Growth Opportunities

3

WellPoint Profile

• Second largest health plan in U.S. with over 13.3 million medical members and more than 49 million specialty members

• Broad range of medical and specialty products

• Organized by customer segment / diverse customer base

• Regional geographic focus

• One Company, multiple brands

[GRAPHIC]

4

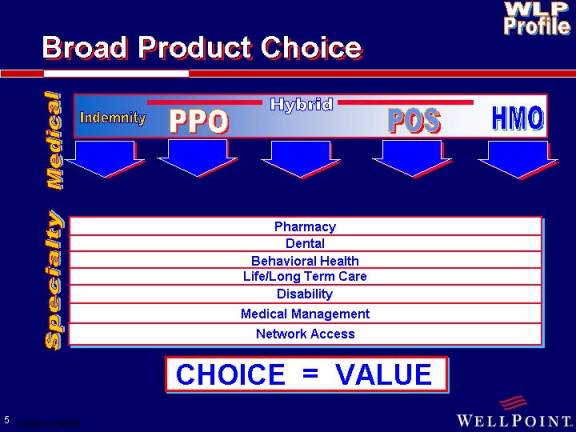

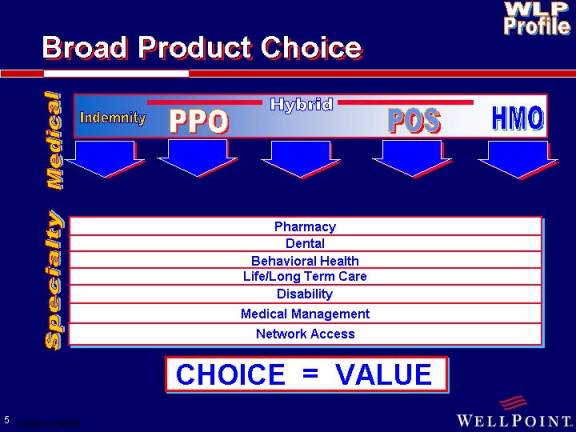

Broad Product Choice

[GRAPHIC]

CHOICE = VALUE

5

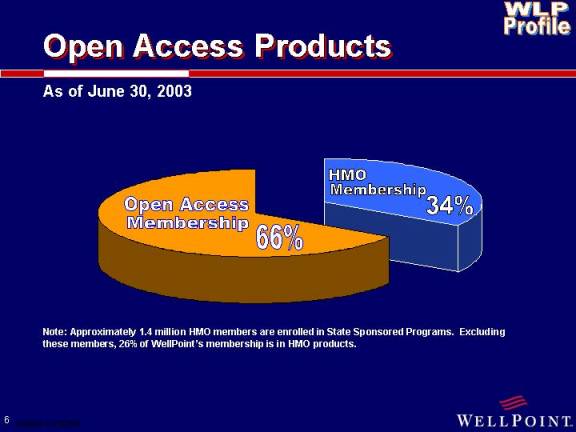

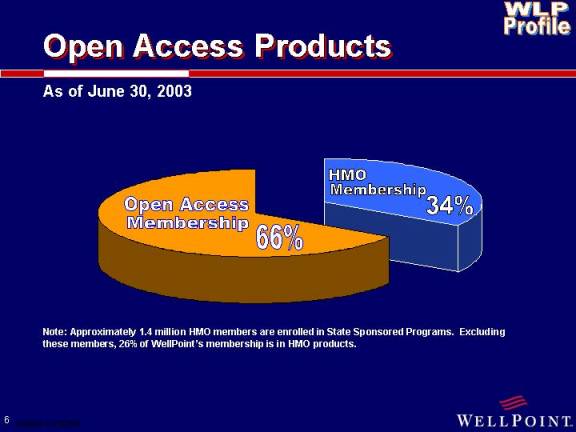

Open Access Products

As of June 30, 2003

[CHART]

Note: Approximately 1.4 million HMO members are enrolled in State Sponsored Programs. Excluding these members, 26% of WellPoint’s membership is in HMO products.

6

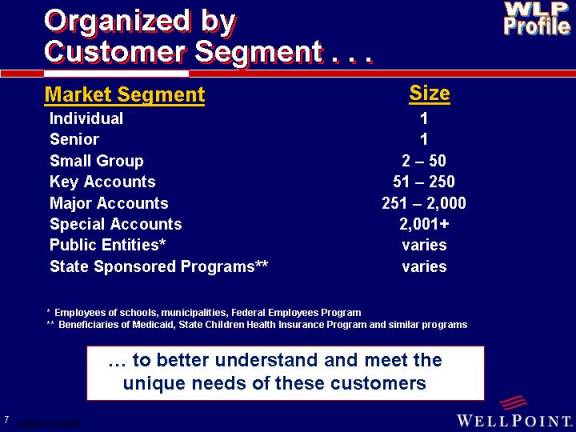

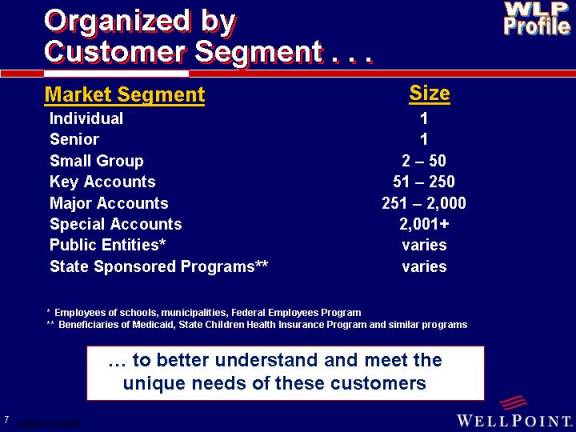

Organized by

Customer Segment . . .

Market Segment | | | Size | |

Individual | | 1 | |

Senior | | 1 | |

Small Group | | 2 - 50 | |

Key Accounts | | 51 - 250 | |

Major Accounts | | 251 - 2,000 | |

Special Accounts | | 2,001+ | |

Public Entities* | | varies | |

State Sponsored Programs** | | varies | |

* Employees of schools, municipalities, Federal Employees Program

** Beneficiaries of Medicaid, State Children Health Insurance Program and similar programs

. .. . to better understand and meet the unique needs of these customers

7

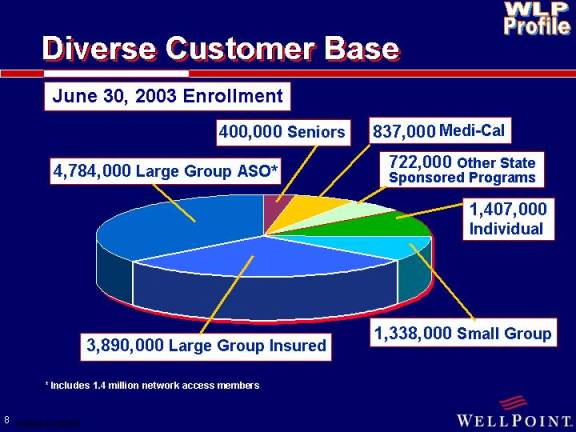

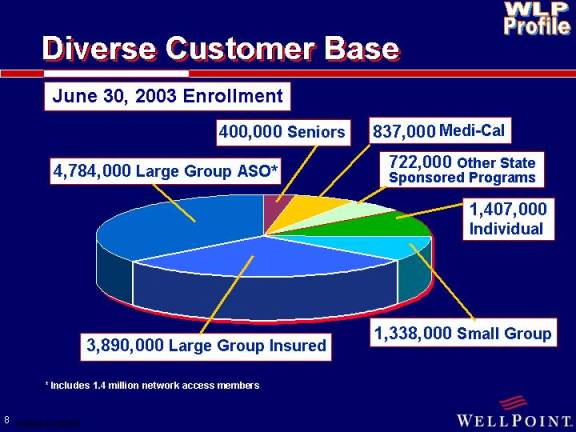

Diverse Customer Base

[CHART]

* Includes 1.4 million network access members

8

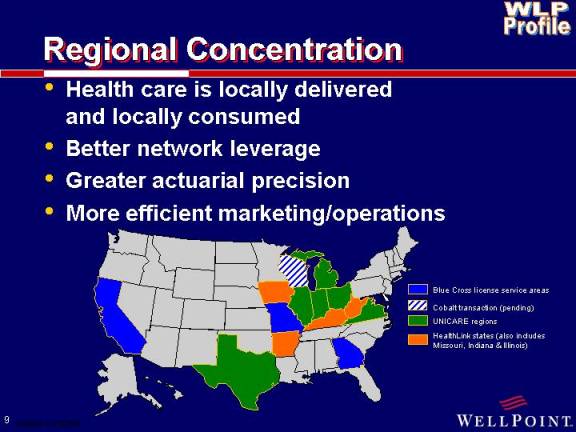

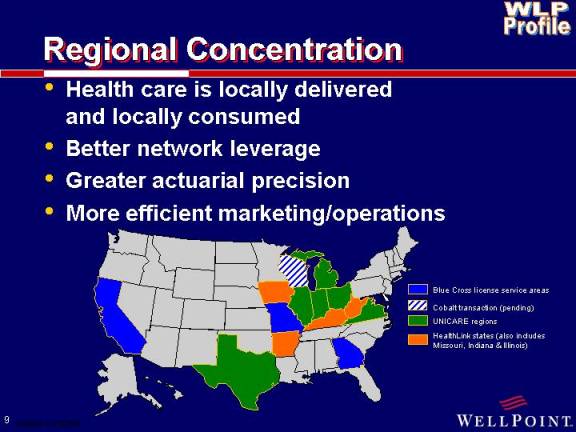

Regional Concentration

• Health care is locally delivered and locally consumed

• Better network leverage

• Greater actuarial precision

• More efficient marketing/operations

[MAP]

9

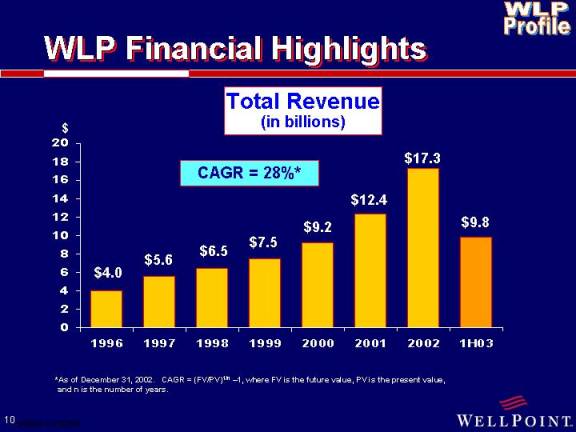

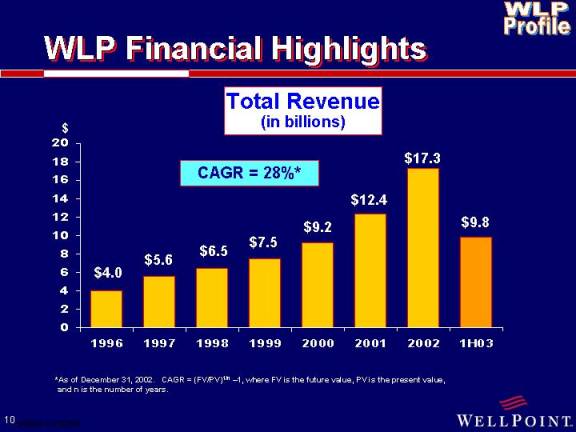

WLP Financial Highlights

Total Revenue

(in billions)

[CHART]

* As of December 31, 2002. CAGR = (FV/PV)1/n –1, where FV is the future value, PV is the present value, and n is the number of years.

10

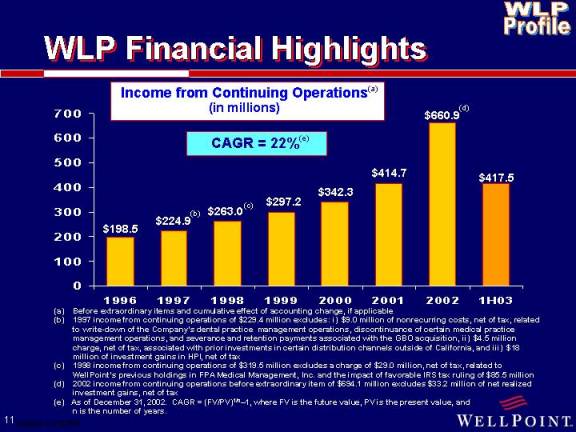

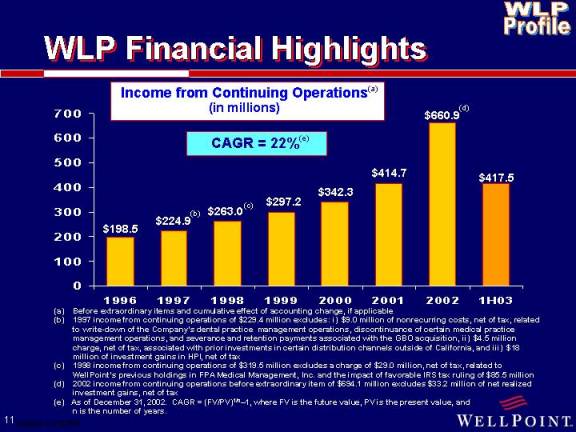

WLP Financial Highlights

Income from Continuing Operations(a)

(in millions)

[CHART]

(a) Before extraordinary items and cumulative effect of accounting change, if applicable

(b) 1997 income from continuing operations of $229.4 million excludes: i) $9.0 million of nonrecurring costs, net of tax, related to write-down of the Company’s dental practice management operations, discontinuance of certain medical practice management operations, and severance and retention payments associated with the GBO acquisition, ii) $4.5 million charge, net of tax, associated with prior investments in certain distribution channels outside of California, and iii) $18 million of investment gains in HPI, net of tax

(c) 1998 income from continuing operations of $319.5 million excludes a charge of $29.0 million, net of tax, related to WellPoint’s previous holdings in FPA Medical Management, Inc. and the impact of favorable IRS tax ruling of $85.5 million

(d) 2002 income from continuing operations before extraordinary item of $694.1 million excludes $33.2 million of net realized investment gains, net of tax

(e) As of December 31, 2002. CAGR = (FV/PV)1/n–1, where FV is the future value, PV is the present value, and n is the number of years.

11

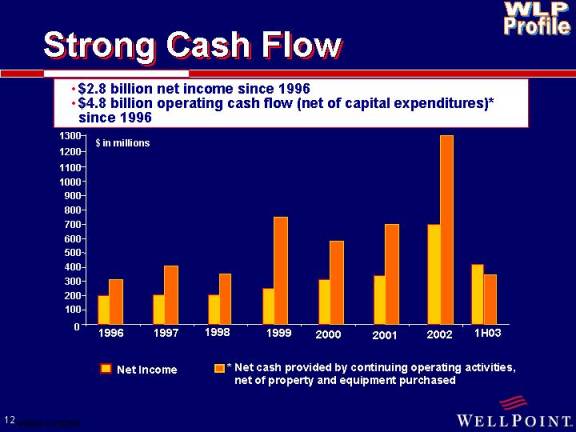

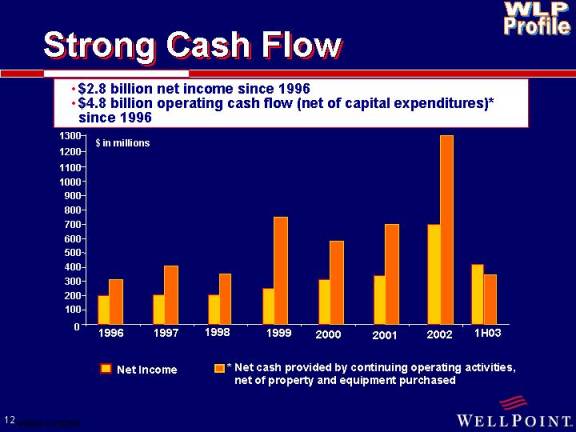

Strong Cash Flow

• $2.8 billion net income since 1996

• $4.8 billion operating cash flow (net of capital expenditures)* since 1996

[CHART]

* Net cash provided by continuing operating activities, net of property and equipment purchased

12

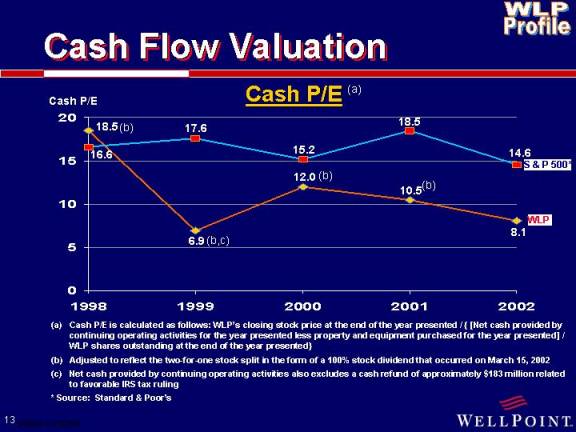

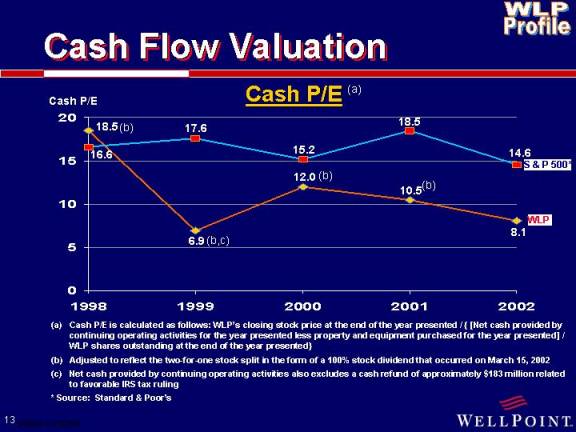

Cash Flow Valuation

Cash P/E(a)

[CHART]

(a) Cash P/E is calculated as follows: WLP’s closing stock price at the end of the year presented / { [Net cash provided by continuing operating activities for the year presented less property and equipment purchased for the year presented] / WLP shares outstanding at the end of the year presented}

(b) Adjusted to reflect the two-for-one stock split in the form of a 100% stock dividend that occurred on March 15, 2002

(c) Net cash provided by continuing operating activities also excludes a cash refund of approximately $183 million related to favorable IRS tax ruling

* Source: Standard & Poor’s

13

Agenda

• WellPoint Profile

• An Effective Business Process

• Continued Growth Opportunities

14

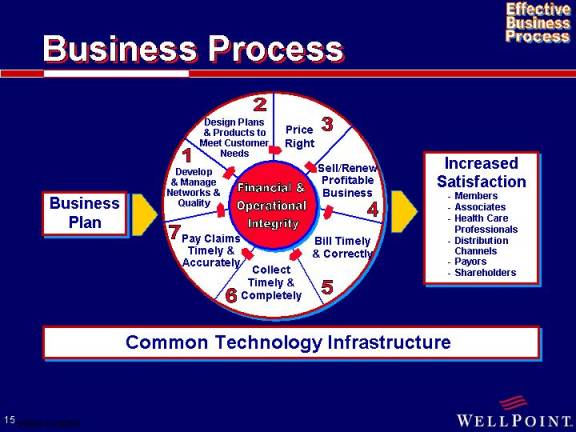

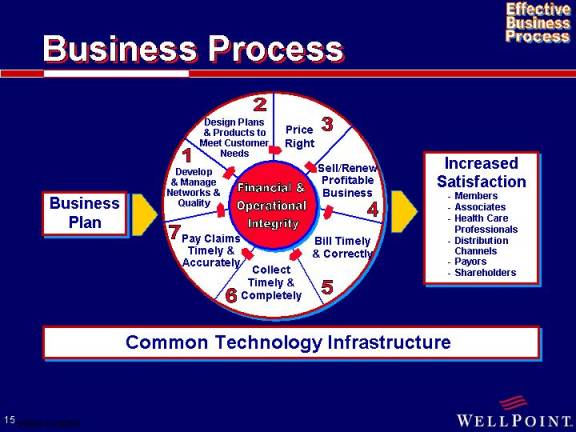

Business Process

[GRAPHIC]

Common Technology Infrastructure

15

Develop and Manage Quality Networks

• Optimize the quality of medical care in collaboration with physician and hospital partners

– Improves member health and quality of life

– Reduces costs > more affordable health care

[GRAPHIC] [GRAPHIC]

16

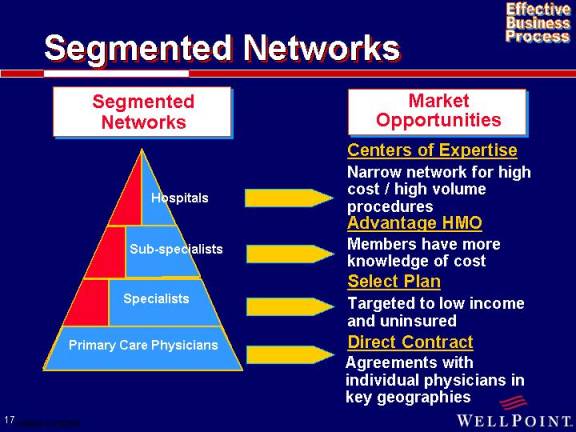

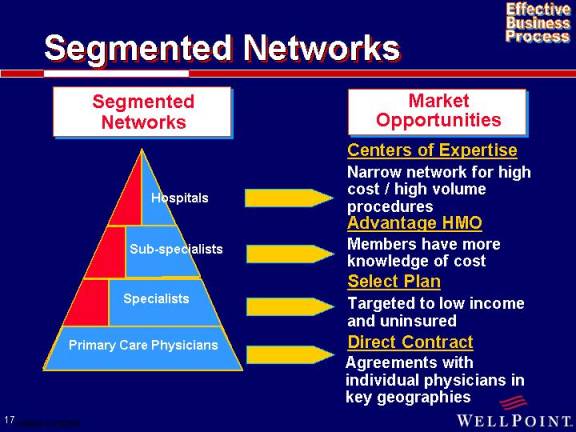

Segmented Networks

Segmented Networks | | Market Opportunities |

[GRAPHIC]

17

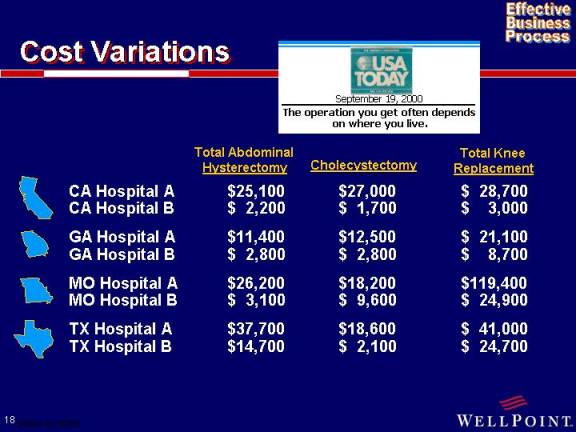

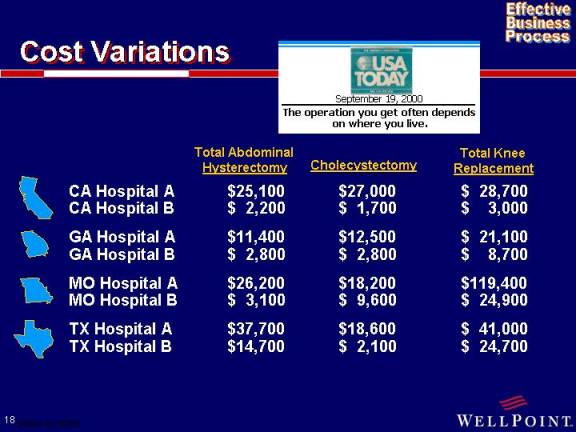

Cost Variations

[GRAPHIC]

| | Total Abdominal Hysterectomy | | Cholecystectomy | | Total Knee Replacement | |

CA Hospital A | | $ | 25,100 | | $ | 27,000 | | $ | 28,700 | |

CA Hospital B | | $ | 2,200 | | $ | 1,700 | | $ | 3,000 | |

| | | | | | | |

GA Hospital A | | $ | 11,400 | | $ | 12,500 | | $ | 21,100 | |

GA Hospital B | | $ | 2,800 | | $ | 2,800 | | $ | 8,700 | |

| | | | | | | |

MO Hospital A | | $ | 26,200 | | $ | 18,200 | | $ | 119,400 | |

MO Hospital B | | $ | 3,100 | | $ | 9,600 | | $ | 24,900 | |

| | | | | | | |

TX Hospital A | | $ | 37,700 | | $ | 18,600 | | $ | 41,000 | |

TX Hospital B | | $ | 14,700 | | $ | 2,100 | | $ | 24,700 | |

18

Targeted Medical Management

[GRAPHIC]

19

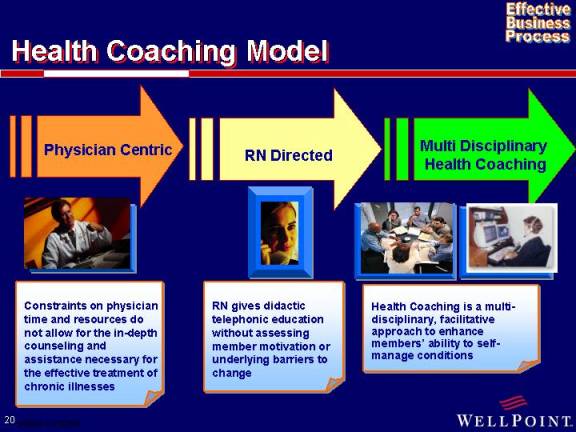

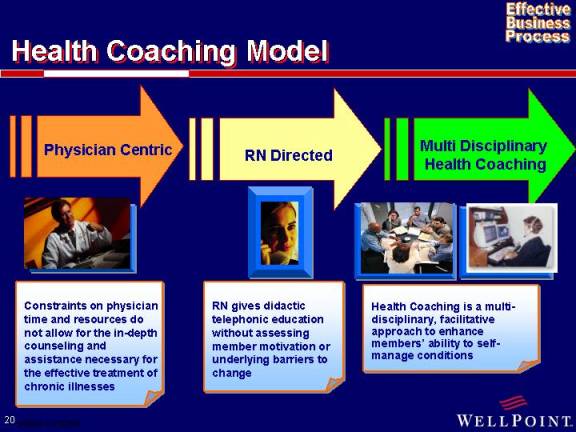

Health Coaching Model

Physician Centric | | RN Directed | | Multi-Disciplinary

Health Coaching |

Constraints on physician time and resources do not allow for the in-depth counseling and assistance necessary for the effective treatment of chronic illnesses | | RN gives didactic telephonic education without assessing member motivation or underlying barriers to change | | Health Coaching is a multi-disciplinary, facilitative approach to enhance members’ ability to self-manage conditions |

20

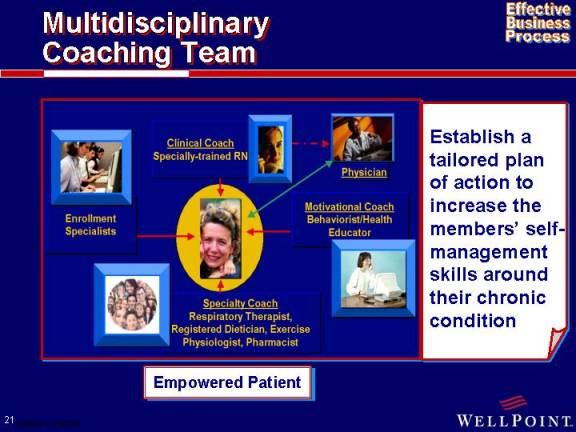

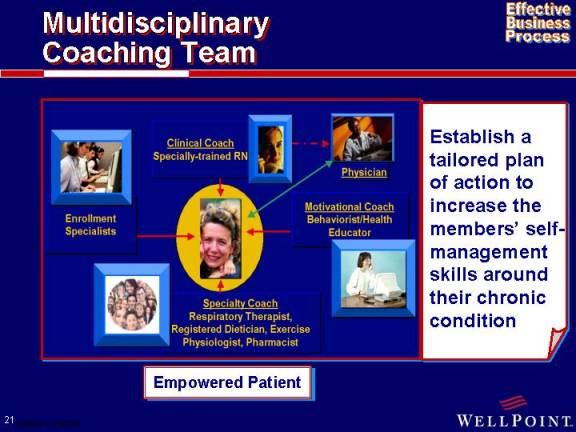

Multidisciplinary Coaching Team

[GRAPHIC]

Establish a tailored plan of action to increase the members’ self-management skills around their chronic condition

21

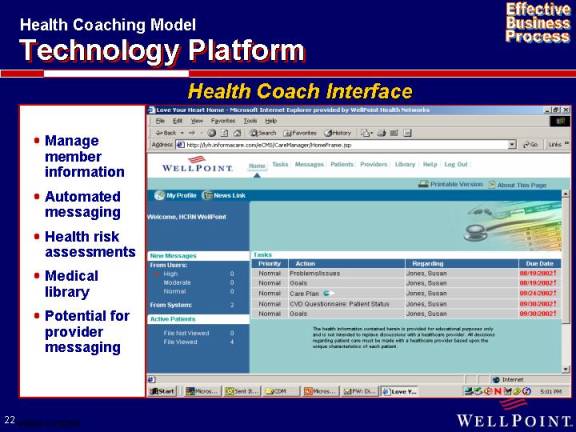

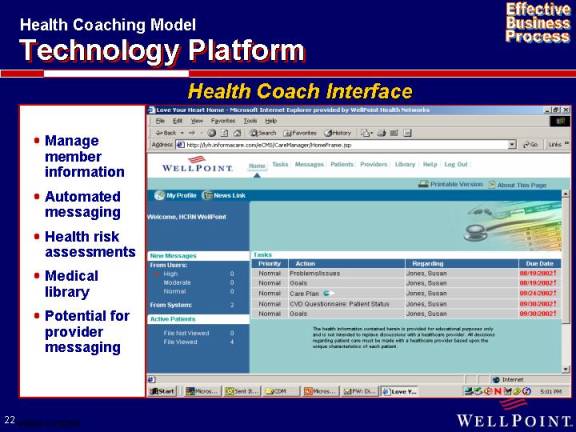

Health Coaching Model

Technology Platform

Health Coach Interface

• Manage member information

• Automated messaging

• Health risk assessments

• Medical library

• Potential for provider messaging

[GRAPHIC]

22

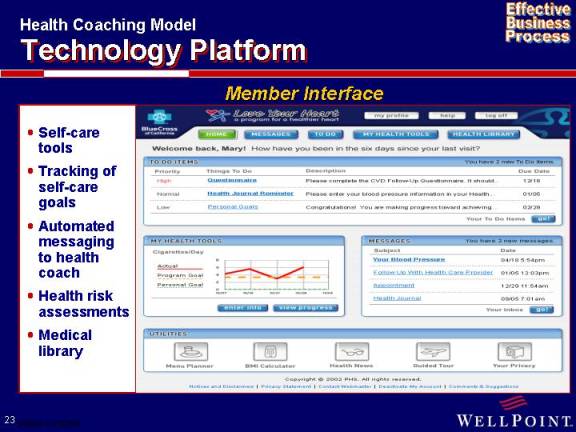

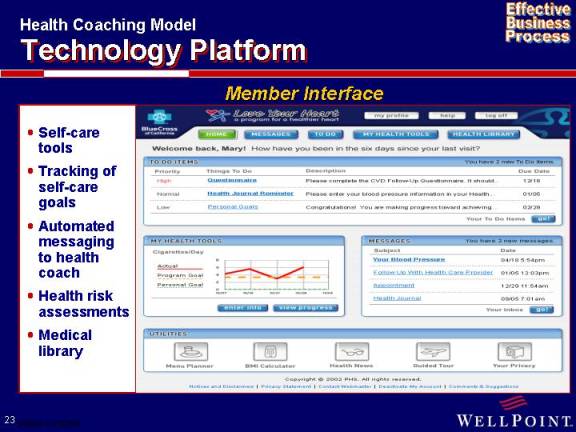

Health Coaching Model

Technology Platform

Member Interface

• Self-care tools

• Tracking of self-care goals

• Automated messaging to health coach

• Health risk assessments

• Medical library

[GRAPHIC]

23

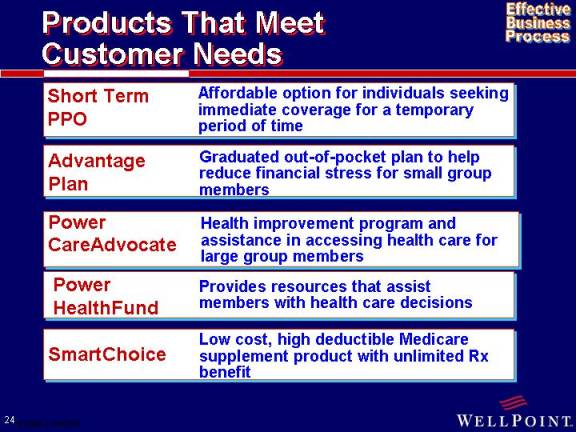

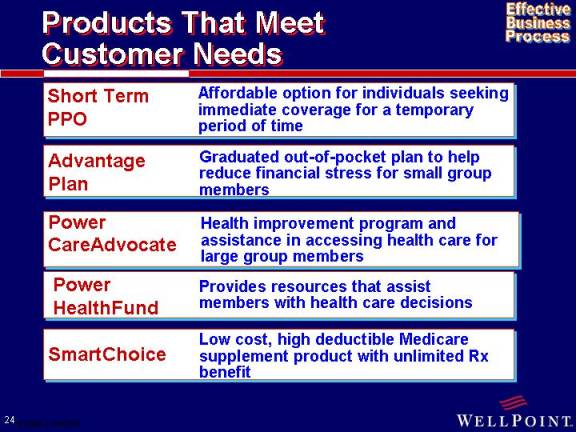

Products That Meet Customer Needs

Short Term PPO | | Affordable option for individuals seeking immediate coverage for a temporary period of time |

| | |

Advantage Plan | | Graduated out-of-pocket plan to help reduce financial stress for small group members |

| | |

Power CareAdvocate | | Health improvement program and assistance in accessing health care for large group members |

| | |

Power HealthFund | | Provides resources that assist members with health care decisions |

| | |

SmartChoice | | Low cost, high deductible Medicare supplement product with unlimited Rx benefit |

24

WellPoint Pharmacy Management

• Fourth largest PBM with approximately 36 million members

• Offers full spectrum of PBM services

[GRAPHIC]

• Provide innovative programs to manage drug trend

• Clinical programs are outcomes-focused and patient-centric

25

Other Specialty Products

Dental | | PPO, DHMO & FFS |

| | |

Life | | Basic & supplemental group term, dependent coverage, AD&D |

| | |

Disability | | Group STD & LTD |

| | |

Behavioral Health | | Full range of Behavioral Health services, including EAP plans |

| | |

WC MCS | | Network management, bill review, medical management and case management, all on non-risk basis |

26

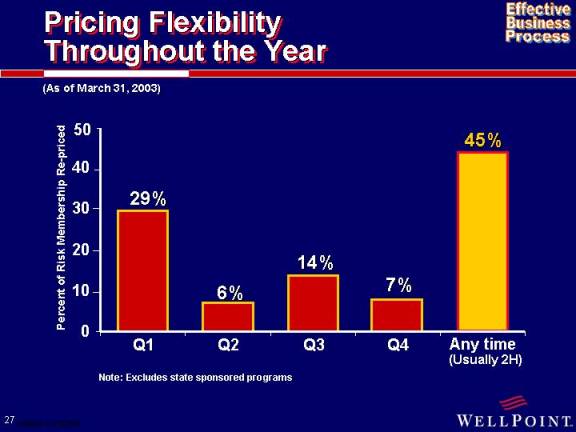

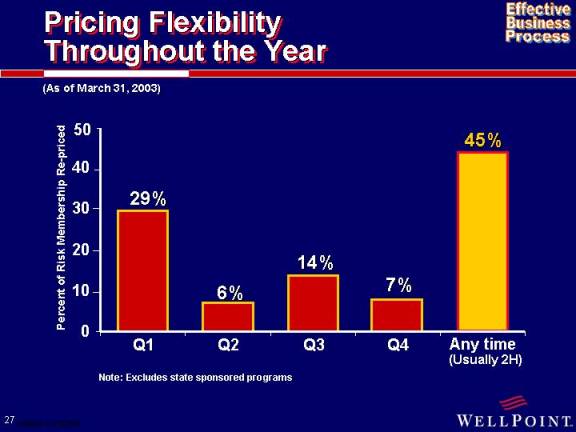

Pricing Flexibility Throughout the Year

(As of March 31, 2003)

[CHART]

Note: Excludes state sponsored programs

27

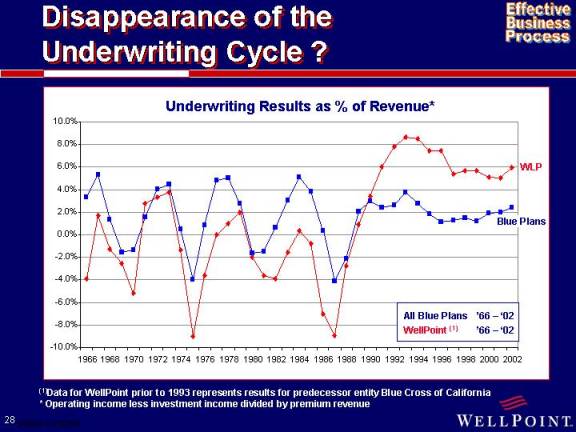

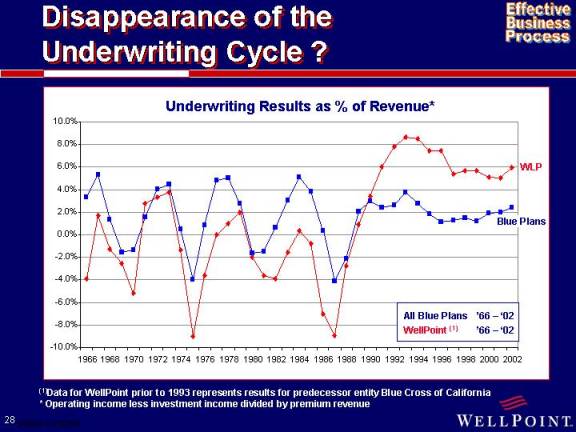

Disappearance of the Underwriting Cycle ?

Underwriting Results as % of Revenue*

[CHART]

(1) Data for WellPoint prior to 1993 represents results for predecessor entity Blue Cross of California

* Operating income less investment income divided by premium revenue

28

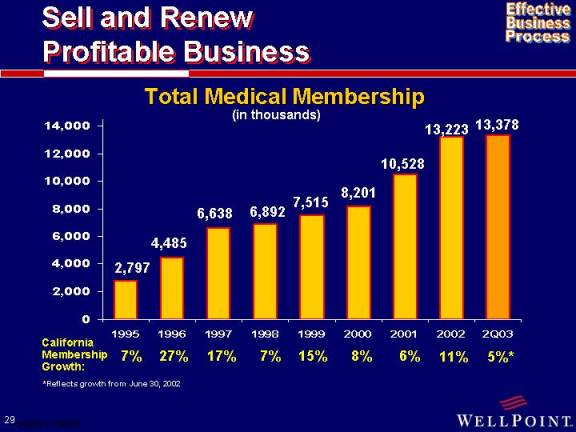

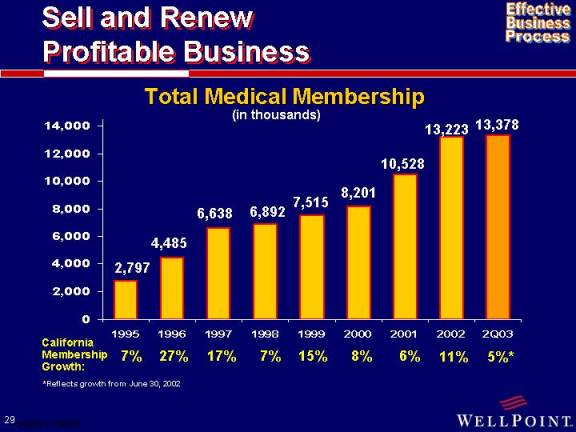

Sell and Renew Profitable Business

Total Medical Membership

(in thousands)

[GRAPHIC]

*Reflects growth from June 30, 2002

29

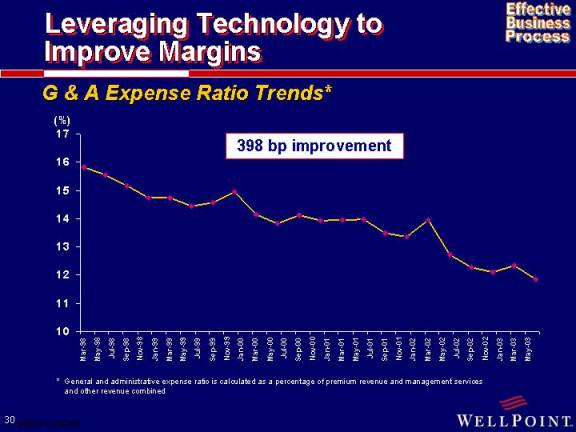

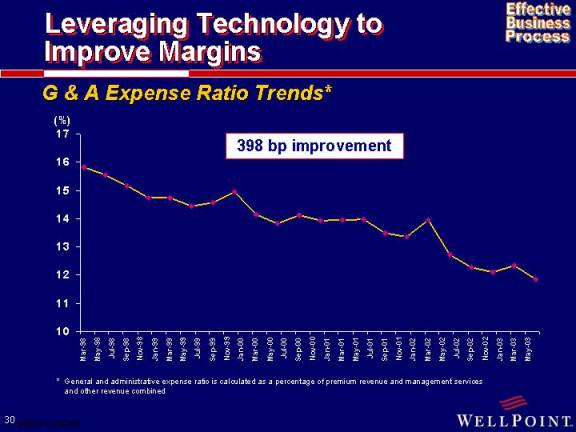

Leveraging Technology to Improve Margins

G & A Expense Ratio Trends*

[CHART]

* General and administrative expense ratio is calculated as a percentage of premium revenue and management services and other revenue combined

30

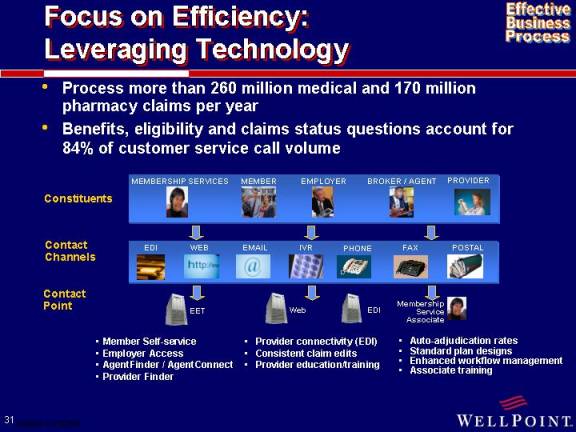

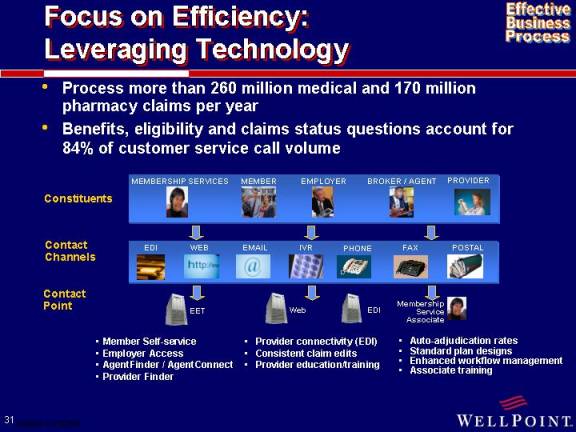

Focus on Efficiency:

Leveraging Technology

• Process more than 260 million medical and 170 million pharmacy claims per year

• Benefits, eligibility and claims status questions account for 84% of customer service call volume

[GRAPHIC]

• | | Member Self-service | | • | | Provider connectivity (EDI) | | • | | Auto-adjudication rates |

• | | Employer Access | | • | | Consistent claim edits | | • | | Standard plan designs |

• | | AgentFinder / AgentConnect | | • | | Provider education/training | | • | | Enhanced workflow management |

• | | Provider Finder | | | | | | • | | Associate training |

| | | | | | | | | | |

31

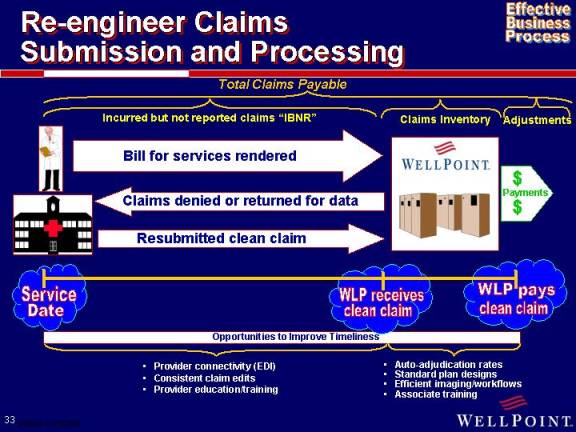

Why Pay a Claim Faster?

• Improve doctor and hospital relationships

• More timely data for actuarial analysis

• Lower administrative costs

32

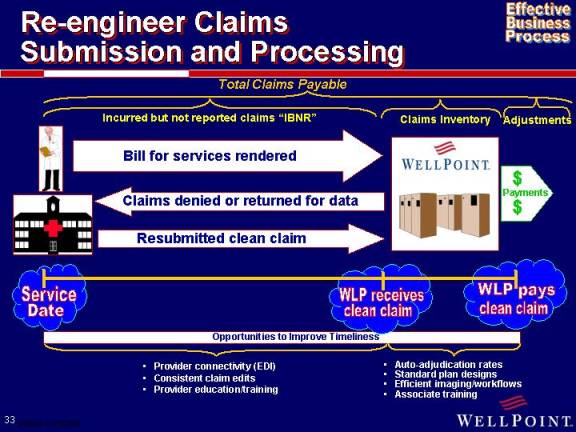

Re-engineer Claims Submission and Processing

[GRAPHIC]

• | | Provider connectivity (EDI) | | • | | Auto-adjudication rates |

• | | Consistent claim edits | | • | | Standard plan designs |

• | | Provider education/training | | • | | Efficient imaging/workflows |

| | | | • | | Associate training |

33

Agenda

• WellPoint Profile

• An Effective Business Process

• Continued Growth Opportunities

34

| Continued

Growth

Opportunities |

Internal Growth Strategy

[GRAPHIC]

35

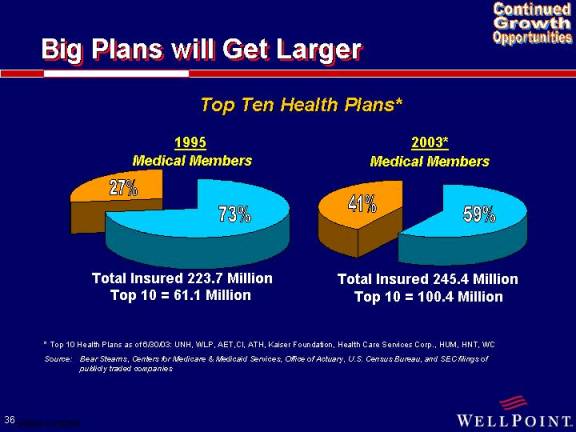

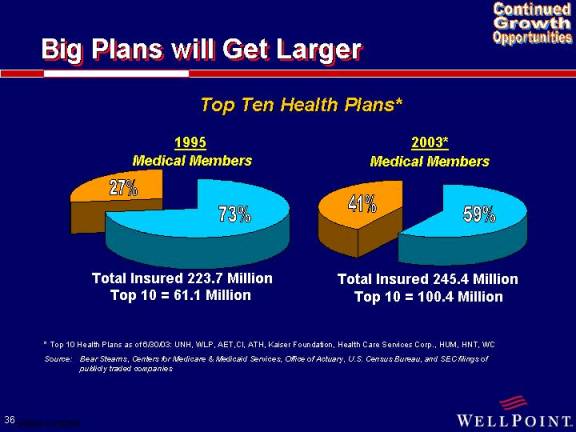

Big Plans will Get Larger

Top Ten Health Plans*

[CHART]

* Top 10 Health Plans as of 6/30/03: UNH, WLP, AET,CI, ATH, Kaiser Foundation, Health Care Services Corp., HUM, HNT, WC

Source: Bear Stearns, Centers for Medicare & Medicaid Services, Office of Actuary, U.S. Census Bureau, and SEC filings of publicly traded companies

36

Fragmented Industry

Many smaller, regional players in key geographies

[GRAPHIC]

Represents more than 18 million lives in these states

Sources: InterStudy PPO Directory and Performance Report 3.0; The InterStudy Competitive Edge, Part I: HMO Directory, July 1, 2002

37

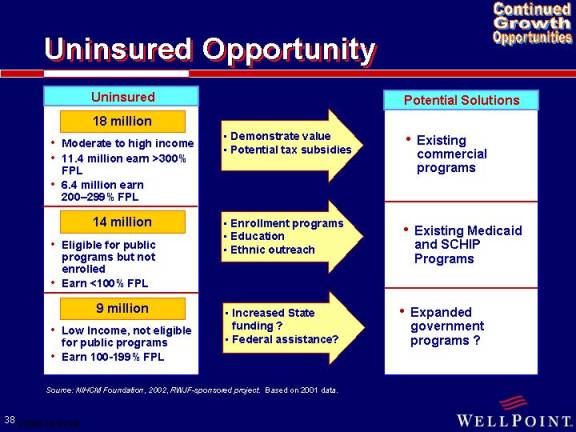

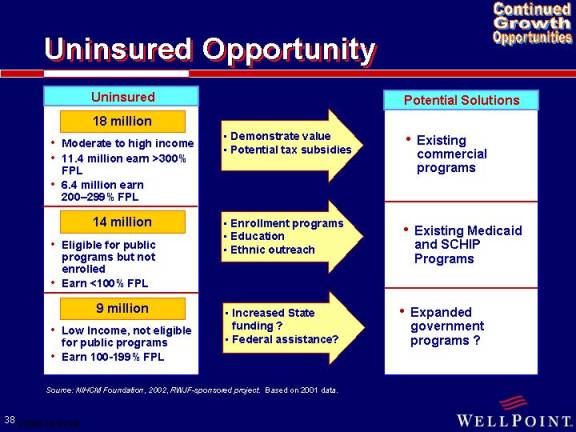

Uninsured Opportunity

Uninsured | | | | Potential Solutions |

18 million | | | | |

• Moderate to high income | | • Demonstrate value | | • Existing commercial programs |

• 11.4 million earn >300% FPL | | • Potential tax subsidies | | |

• 6.4 million earn 200–299% FPL | | | | |

14 million | | | | |

• Eligible for public programs but not enrolled | | • Enrollment programs | | • Existing Medicaid and SCHIP Programs |

• Earn <100% FPL | | • Education | | |

| | • Ethnic outreach | | |

9 million | | | | |

• Low Income, not eligible for public programs | | • Increased State funding ? | | • Expanded government programs ? |

•Earn 100-199% FPL | | • Federal assistance? | | |

Source: NIHCM Foundation, 2002, RWJF-sponsored project. Based on 2001 data.

38

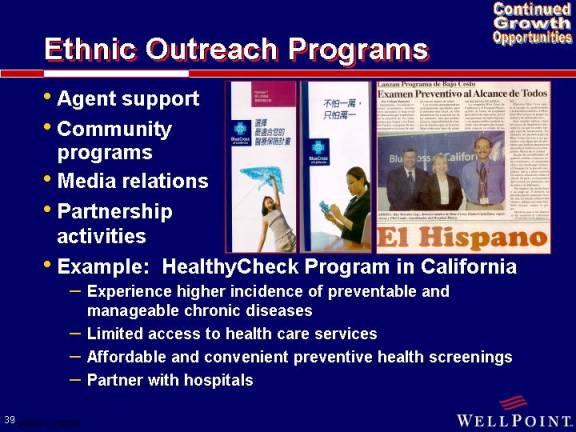

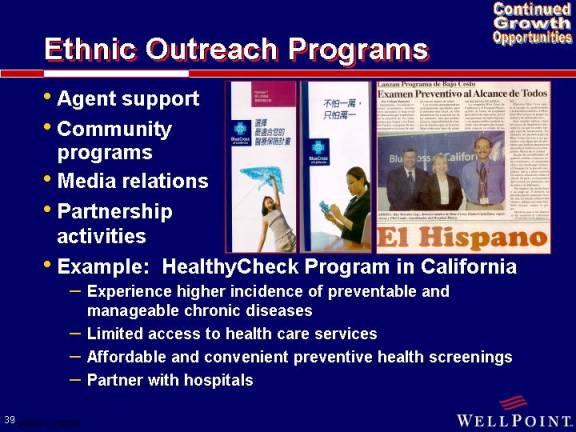

Ethnic Outreach Programs

• Agent support

• Community programs

• Media relations

• Partnership activities

• Example: HealthyCheckProgram in California

– Experience higher incidence of preventable and manageable chronic diseases

– Limited access to health care services

– Affordable and convenient preventive health screenings

– Partner with hospitals

39

Blue Card Program

• Opportunity to grow national accounts business

[GRAPHIC]

[GRAPHIC]

Source: WLP internal reports

40

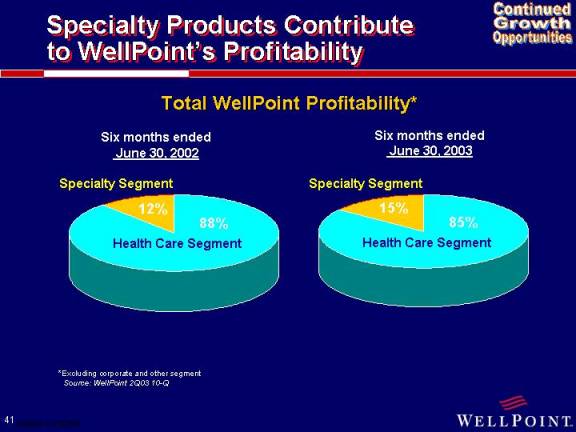

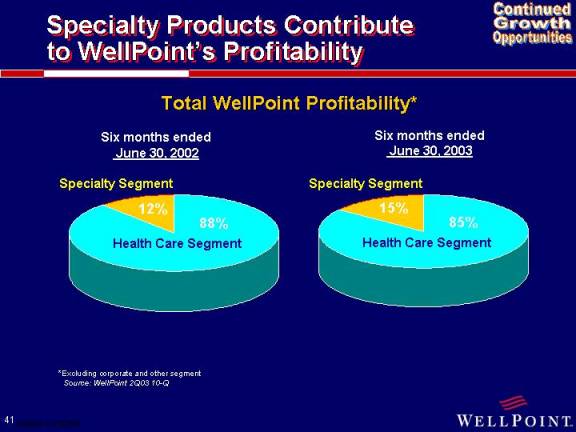

Specialty Products Contribute to WellPoint’s Profitability

Total WellPoint Profitability*

*Excluding corporate and other segment

Source: WellPoint 2Q03 10-Q

41

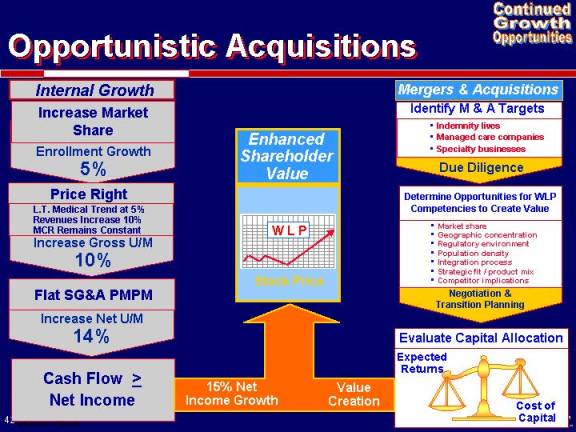

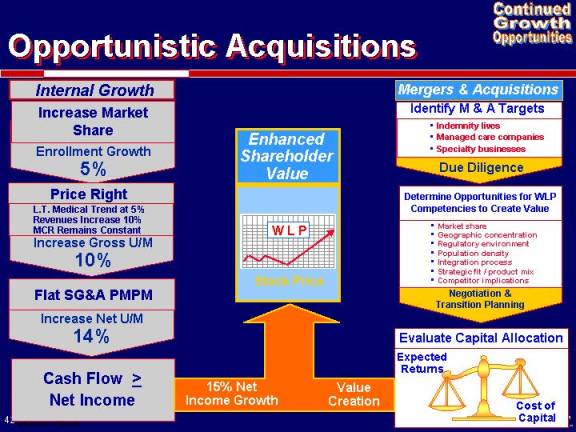

Opportunistic Acquisitions

[GRAPHIC]

42

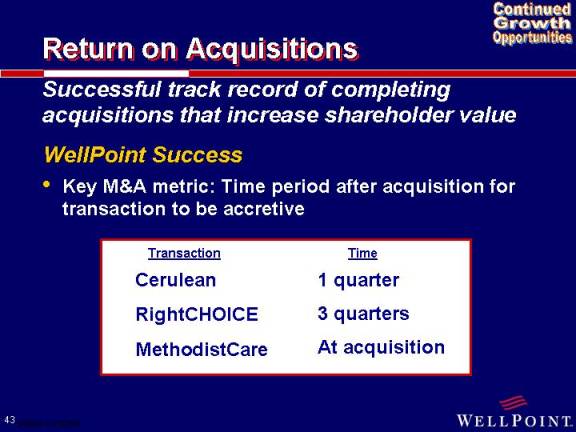

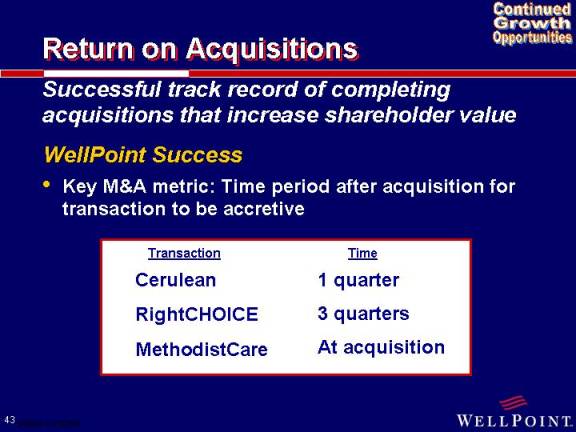

Return on Acquisitions

Successful track record of completing acquisitions that increase shareholder value

WellPoint Success

• Key M&A metric: Time period after acquisition for transaction to be accretive

Transaction | | Time |

Cerulean | | 1 quarter |

RightCHOICE | | 3 quarters |

MethodistCare | | At acquisition |

43

The Pending Cobalt Merger

[Cobalt Logo]

A Very Compelling Transaction...

• Offers customers a broad product portfolio with geographic concentration

• Supports WLP’s growth strategy in the Midwest and diversifies geographic profile

• Realize significant growth potential

– Achieve market share gains in Wisconsin

– Leverage distribution channels to grow ISG business

– Offer additional specialty products

• Continued earnings growth opportunities as the operational turnaround continues

• New management team with a successful track record

44

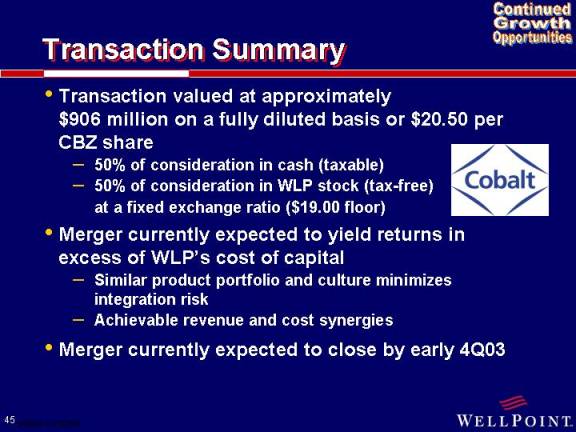

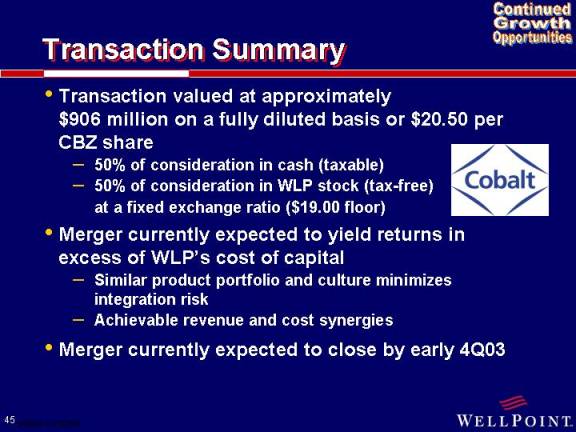

Transaction Summary

• Transaction valued at approximately $906 million on a fully diluted basis or $20.50 per CBZ share

– 50% of consideration in cash (taxable)

– 50% of consideration in WLP stock (tax-free) at a fixed exchange ratio ($19.00 floor)

• Merger currently expected to yield returns in excess of WLP’s cost of capital

– Similar product portfolio and culture minimizes integration risk

– Achievable revenue and cost synergies

• Merger currently expected to close by early 4Q03

45

Diversifies WLP Geographic Profile

(As of June 30, 2003)

1996 | | 2Q03 | | Post Merger ** |

| | | | |

[GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] |

* Includes Missouri, Illinois, Texas and Wisconsin

** WLP & CBZ combined as of 6/30/03

46

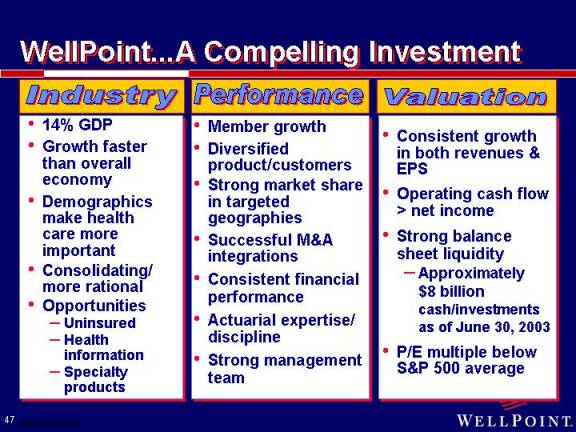

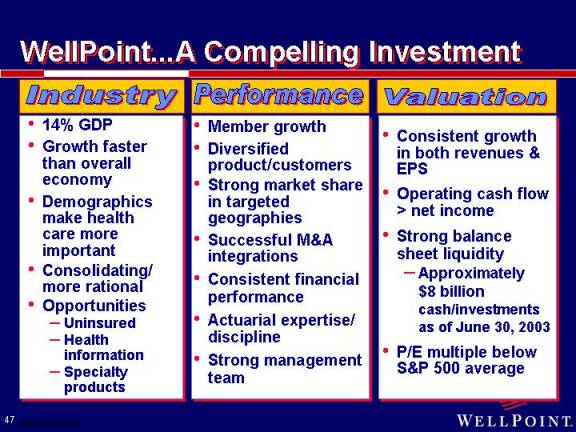

WellPoint...A Compelling Investment

Industry | | Performance | | Valuation |

• 14% GDP | | • Member growth | | • Consistent growth in both revenues & EPS |

• Growth faster than overall economy | | • Diversified product/customers | | • Operating cash flow > net income |

• Demographics make health care more important | | • Strong market share in targeted geographies | | • Strong balance sheet liquidity |

• Consolidating/more rational | | • Successful M&A integrations | | - Approximately $8 billion cash/investments as of June 30, 2003 |

• Opportunities | | • Consistent financial performance | | • P/E multiple below S&P 500 average |

– Uninsured | | • Actuarial expertise/discipline | | |

– Health information | | • Strong management team | | |

– Specialty products | | | | |

47

[WELLPOINT LOGO]