11815 NORTH PENNSYLVANIA STREET

CARMEL, INDIANA 46032

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD DECEMBER 21, 2006

To our Shareholders:

NOTICE IS HEREBY GIVEN THAT the Annual Meeting of Shareholders (“Meeting”) of 40|86 Strategic Income Fund (the "Fund"), will be held at the office of 40|86 Advisors, Inc., 535 College Drive, Building K, Carmel, Indiana, at 11:00 a.m., local time on December 21, 2006. The following proposals will be voted on at the Meeting:

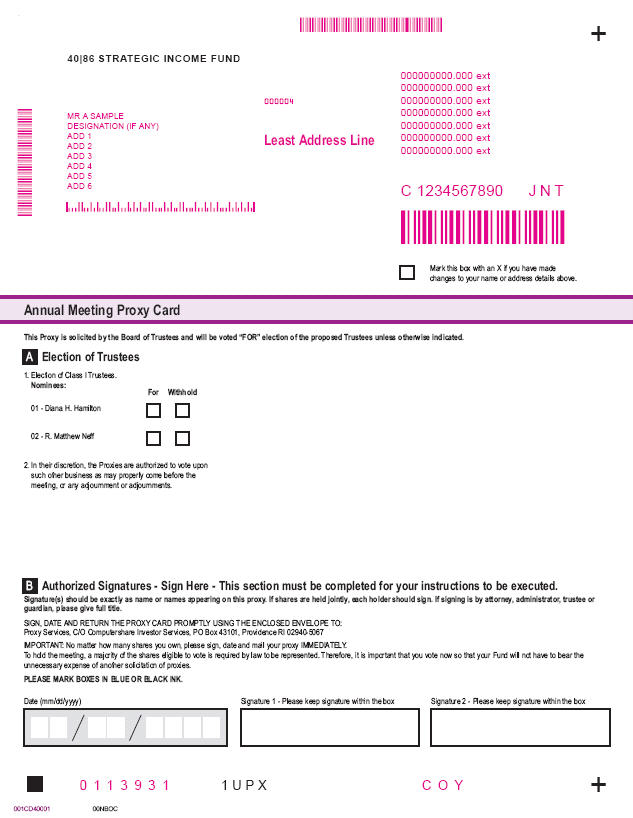

1. To elect two (2) Trustees to serve for a Class I term ending in 2009; and

2. To transact such other business as may properly come before the Meeting, or any adjournment or postponement thereof.

These items are discussed in greater detail in the attached Proxy Statement.

Only shareholders of record at the close of business on November 24, 2006 are entitled to notice of, and to vote at, this Meeting or any adjournment thereof.

By Order of the Trustees

Jeffrey M. Stautz, Secretary

November 28, 2006

Carmel, Indiana

WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE SIGN AND PROMPTLY RETURN THE ENCLOSED PROXY IN THE ENCLOSED SELF-ADDRESSED ENVELOPE. IN ORDER TO AVOID THE ADDITIONAL EXPENSE TO THE FUND OF FURTHER SOLICITATION, WE ASK YOUR COOPERATION IN MAILING IN YOUR PROXY PROMPTLY. INSTRUCTIONS FOR THE PROPER EXECUTION OF PROXIES ARE SET FORTH ON THE INSIDE COVER.

11815 North Pennsylvania Street

Carmel, Indiana 46032

PROXY STATEMENT

This Proxy Statement is furnished to shareholders in connection with the solicitation of proxies by the Board of Trustees of the 40|86 Strategic Income Fund (the "Fund") for the Annual Meeting of Shareholders (the "Meeting") to be held at the office of 40|86 Advisors, Inc. (“40|86” or the “Adviser”), 535 College Drive, Building K, Carmel, Indiana on December 21, 2006, at 11:00 a.m., local time, (and at any adjournments thereof), for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders.

Shareholders of record at the close of business on November 24, 2006 (“Record Date”) are entitled to be present and to vote at the Meeting. Each share of beneficial interest of the Fund (“Share”) is entitled to one vote and each fractional Share shall be entitled to a proportionate fractional vote, except that shares held in the treasury of the Fund as of the Record Date shall not be voted. Shares represented by executed and unrevoked proxy cards will be voted in accordance with the specifications made thereon. Returned proxy cards that are unmarked will be voted in favor of the nominees for Trustee (“Nominees”), in accordance with the recommendation of the Board of Trustees as to all other proposals described in the Proxy Statement, and at the discretion of the proxyholders on any other matter that may properly have come before the Annual Meeting or any adjournments thereof.

If the enclosed proxy card is executed and returned, it nevertheless may be revoked by another proxy card or by letter directed to the Fund. To be effective, such revocation must be received prior to the Meeting and indicate the shareholder's name. In addition, any shareholder who attends the Meeting in person may vote by ballot at the Meeting, thereby canceling any proxy previously given. The solicitation of proxies will be made primarily by mail. Authorization to execute proxies may be obtained by telephonic or electronically transmitted instructions.

The holders of a majority of the Shares issued and outstanding and entitled to vote at the Meeting, present in person or represented by proxy, shall be requisite and shall constitute a quorum for the transaction of business. In the absence of a quorum, the shareholders present or represented by proxy and entitled to vote at the Meeting shall have the power to adjourn the Meeting from time to time. Action on any matter is approved if a majority of shares present in person or by proxy and entitled to vote at a meeting of shareholders at which a quorum is present. Any adjourned meeting may be held as adjourned without further notice. At any adjourned meeting at which a quorum shall be present, any business may be transacted as if the meeting had been held as originally called.

As of the Record Date, November 24, 2006, there were 6,839,660.777 Shares of the Fund Outstanding. To the Fund's knowledge, no shareholder beneficially owned five percent or more of the Fund’s outstanding Shares on that date.

The Fund mailed to shareholders a copy of its annual report for the last fiscal year on August 29, 2006. Should you require an additional annual report, the Fund will furnish the annual report to you without charge upon your request. Such requests should be directed to the Fund at 11815 North Pennsylvania Street, Carmel, Indiana 46032, Attention: Jeffrey M. Stautz, Fund Secretary.

The principal executive offices of the Fund are located at 11815 North Pennsylvania, Carmel, Indiana 46032. The Fund’s Adviser is located at 535 College Drive, Carmel, Indiana 46032.

ANNUAL ELECTION OF TRUSTEES BY SHAREHOLDERS

In accordance with the Fund’s Amended Declaration of Trust (“Declaration of Trust”), the Fund’s Board of Trustees (the “Board”) is divided into three classes: Class I, Class II and Class III, as nearly equal in number as possible. Each Class serves for three years, with one Class being elected each year upon expiration of its term. The Board is currently comprised of five Trustees apportioned among the Classes as indicated below:

| Class I: | Ms. Hamilton and Mr. Neff (whose terms expire in 2006) |

| | |

| Class II: | Ms. Kurzawa and Mr. Plump (whose terms expire in 2007) |

| | |

| Class III: | Mr. Otto (whose term expires in 2008) |

At the Meeting, shareholders will be asked to elect two Class I Trustees to hold office until the year 2009 Annual Meeting of Shareholders or thereafter when their respective successors are elected and duly qualified. Ms. Hamilton and Mr. Neff are not considered “interested persons” as that term is defined under the Investment Company Act of 1940, as amended (“1940 Act”) (“Independent Trustees”).

At the August 31, 2006 board meeting, the Board, including a majority of the Independent Trustees, nominated Ms. Hamilton and Mr. Neff to be re-elected by the Fund’s shareholders at the Annual Meeting. Ms. Hamilton and Mr. Neff will both serve until her or his successor is duly elected and qualified.

NOTICE OF ELECTION OF TRUSTEE BY BOARD

Additionally, the Nominating Committee met to discuss potential Board members and after due consideration, on June 7, 2006, the Nominating Committee nominated Mr. Steven R. Plump to serve as an Independent Trustee. The Nominating Committee took into consideration the knowledge, background and experience of the nominee. Also, on June 7, 2006, pursuant to Section 2.3 of the Declaration of Trust, the Board of Trustees, including all the Independent Trustees, elected Mr. Plump to serve as a Class II trustee for a term ending at the 2007 Annual Meeting of Shareholders. Mr. Plump will serve until his successor is duly elected and qualified.

Mr. Jeffrey Stautz, Ms. Sarah Bertrand and Mr. Karl Kindig, the persons named on the accompanying proxy card, intend to vote each received proxy for the election of the Nominees, unless shareholders specifically indicate on their proxy card the desire to withhold authority to vote for election to office. It is not contemplated that any Nominee will be unable to serve as a Board member for any reason, but if that should occur prior to the meeting, the proxyholders reserve the right to substitute another person of their choice as nominee.

The following information regarding the Nominees, and each Trustee whose term will continue after the Meeting, includes such person’s age, positions with the Adviser (if any), principal occupation and business experience for the last five years, and the number of years each has served as a Trustee. No Trustee or Nominee is related to any other.

NAME OF TRUSTEE OR NOMINEE | AGE | | TERM OF OFFICE AND LENGTH OF TIME SERVED | | PRINCIPAL OCCUPATION AND BUSINESS EXPERIENCE | NUMBER OF 40|86 FAMILY OF FUNDS AND PORTFOLIOS OVERSEEN** | | PUBLIC DIRECTORSHIPS |

NOMINEES | | | | | | | | |

Class I: Term Expires 2006 | | | | | | | | |

Independent Trustee Nominees | | | | | | | | |

| DIANA H. HAMILTON | 50 | | Trustee Since December 2004 | | President, Sycamore Advisors, LLC, a municipal finance advisory firm; Formerly, State of Indiana Director of Public Finance. Trustee of one other investment company managed by the Adviser. | 2 registered investment companies consisting of 6 portfolios | | None |

| R. MATTHEW NEFF | 51 | | Trustee Since December 2004 | | Chairman and Chief Executive Officer of Senex Financial Corp., a financial services company engaged in the healthcare finance field. Trustee of one other investment company managed by the Adviser. | 2 registered investment companies consisting of 6 portfolios | | None |

NAME OF TRUSTEE OR NOMINEE | AGE | | TERM OF OFFICE AND LENGTH OF TIME SERVED | | PRINCIPAL OCCUPATION AND BUSINESS EXPERIENCE | NUMBER OF 40|86 FAMILY OF FUNDS AND PORTFOLIOS OVERSEEN** | | PUBLIC DIRECTORSHIPS |

OTHER TRUSTEES | | | | | | | | |

Class II: Term Expires 2007 | | | | | | | | |

Independent Trustee | | | | | | | | |

| STEVEN R. PLUMP | 53 | | Trustee Since June 2006 | | Group Vice President, Global Marketing and Sales and Chief Marketing Officer of Eli Lilly Company. Trustee of one other investment company managed by the Adviser. | 2 registered investment companies consisting of 6 portfolios | | None |

Interested Trustee | | | | | | | | |

| AUDREY L. KURZAWA* | 39 | | Since June 2005 Formerly, Treasurer since October 2002 | | President and Trustee of the Trust; Certified Public Accountant; Controller and Senior Vice President, Adviser. President and Trustee of one other investment company managed by the Adviser. | 2 registered investment companies consisting of 6 portfolios | | None |

Class III: Term Expires 2008 | | | | | | | | |

Independent Trustee | | | | | | | | |

| VINCENT J. OTTO | 47 | | None | | Chief Executive Officer, Commerce Street Venture Fund, a financial company engaged in assisting with raising capital. Formerly, Executive Vice President and Chief Financial Officer, Waterfield Mortgage Company and Union Federal Bank. Formerly, Director, Federal Home Loan Bank of Indianapolis. Trustee of one other investment company managed by the Adviser. | 2 registered investment companies consisting of 6 portfolios | | None |

____________

* | The Trustee so indicated is considered an “interested person,” of the Fund as defined in the 1940, due to her employment with the Adviser and its affiliates. |

** | The 40|86 Family of Funds consists of 40|86 Strategic Income Fund and 40|86 Series Trust. |

All Trustees and officers have a mailing address c/o 40|86 Advisors, Inc., 535 College Drive, Carmel, IN 46032.

Compensation of Trustees

Each Independent Trustee receives an annual retainer fee of $7,500 and a meeting fee of $1,500 for each Board meeting. For each separate committee meeting (that is, a committee meeting not conducted in conjunction with a Board meeting), each Independent Trustee receives $750. Additionally, each Independent Trustee receives a fee of $500 for attending each telephonic Board of Trustees meeting. The Chairman of the Board receives an additional per-meeting fee of $375 for in-person Board meetings. The Fund also reimburses each Independent Trustee for travel and out-of-pocket expenses. The Adviser pays all compensation of officers and Trustees of the Fund who are affiliated with the Adviser.

The Fund does not pay any other remuneration to its officers and Trustees, and the Fund does not have a bonus, pension, profit-sharing or retirement plan.

During the Fund’s fiscal year ended June 30, 2006, the Board held seven meetings. Each of the Trustees then in office attended at least 75% of the aggregate of the total number of meetings of the Board and committee meetings held during the fiscal year.

The aggregate amount of compensation paid to each Independent Trustee by the Fund for the fiscal year ended June 30, 2006, and by all funds in the 40|86 Family of Funds for which such Trustee was a Board member (the number of which is set forth in parenthesis next to each Trustee's total compensation) was as follows:

NAME OF TRUSTEE/NOMINEE | | AGGREGATE COMPENSATION FROM FUND* | | TOTAL COMPENSATION FROM FUND AND FUND COMPLEX PAID TO TRUSTEE** | |

Independent Trustees/Nominee | | | | | |

| Diana H. Hamilton . . . . . . . . . . . . . . . . . . . . . . | | $ | 15,750 | | $ | 34,375 (6) | |

| R. Matthew Neff. . . . . . . . . . . . . . . . . . . . . . . . | | $ | 13,375 | | $ | 28,250 (6) | |

| Vincent J. Otto . . . . . . . . . . . . . . . . . . . . . . . . . | | $ | 7,375 | | $ | 16,250 (6) | |

| Steven R. Plump. . . . . . . . . . . . . . . . . . . . . . . . | | $ | 0 | | $ | 0 | |

Interested Trustee/Nominee and Officers | | | | | | | |

| Audrey L. Kurzawa . . . . . . . . . . . . . . . . . . . . . . | | $ | 0 | | $ | 0 | |

| Daniel J. Murphy. . . . . . . . . . . . . . . . . . . . . . . | | $ | 0 | | $ | 0 | |

| William T. Devanney, Jr. . . . . . . . . . . . . . . . . . . | | $ | 0 | | $ | 0 | |

| Jeffrey M. Stautz. . . . . . . . . . . . . . . . . . . . . . . . | | $ | 0 | | $ | 0 | |

| Sarah L. Bertrand. . . . . . . . . . . . . . . . . . . . . . . | | $ | 0 | | $ | 0 | |

____________

* | There were no reimbursed expenses paid to the Trustees for attending Board meetings. |

** | Represents total compensation from all investment companies in the fund complex, including the Fund and 40|86 Series Trust, for which the Trustee or Officer serves as a Board Member. |

Beneficial Ownership of Shares Held in the Fund by Each Trustee and Nominees for Election as Trustee

TRUSTEES | AGGREGATE DOLLAR RANGE OF EQUITY IN THE FUND | | AGGREGATE DOLLAR RANGE OF SECURITIES IN ALL 40|86 FUND COMPLEX | |

Independent Trustees/Nominees | | | | |

| Diana H. Hamilton. . . . . . . . . . . . . . . . . . . . . . | None | | None | |

| R. Matthew Neff. . . . . . . . . . . . . . . . . . . . . . . . | None | | None | |

| Vincent J. Otto. . . . . . . . . . . . . . . . . . . . . . . . . | None | | None | |

| Steven R. Plump. . . . . . . . . . . . . . . . . . . . . . . . | None | | None | |

Interested Trustee* | | | | |

| Audrey L. Kurzawa. . . . . . . . . . . . . . . . . . . . . . | None | | None | |

____________

* | The Trustee so indicated is considered an “interested person,” of the Fund as defined in the Investment Company Act of 1940, as amended (the "1940 Act"), due to her employment with the Adviser and its affiliates. |

For the preceding five years, to the knowledge of the Fund, none of the Independent Trustees, nor his or her immediate family members, beneficially owned any class of securities in, or had any direct or indirect business relationships with, the Adviser, the Fund’s independent registered public accountants, nor any person (other than a registered investment company) directly or indirectly controlling, controlled by, or under common control with the Adviser of the Fund.

To the knowledge of the Fund's management, as of the Record Date, the Trustees and officers of the Fund owned an aggregate of less than one percent of the outstanding shares of the Fund.

Audit Committee

The Fund has an Audit Committee comprised of all of the Independent Trustees who are independent and financially literate as defined in Section 303A of the listing standards of the New York Stock Exchange (NYSE). The Board has determined in accordance with Section 303A that Mr. Otto possesses accounting or related financial management expertise and qualifies as an “audit committee financial expert.” The principal responsibilities of the Audit Committee are to (1) review and recommend to the Board for its consideration the Fund’s independent registered public accountants; (2) review with the independent registered public accountants the scope and performance of the audit; (3) discuss with the independent registered public accountants certain matters relating to the Fund’s financial statements, including any adjustment to such financial statements recommended by such independent registered public accountants; (4) review on a periodic basis a formal written statement from the independent registered public accountants with respect to their independence, and discuss with the independent registered public accountants any relationships or services disclosed in the statement that may impact their objectivity and independence; and (5) consider the comments of the independent registered public accountants and management’s responses thereto with respect to the quality and adequacy of the Fund’s accounting and financial reporting policies, practices and internal controls. During the fiscal year ended June 30, 2006, the Audit Committee held five meetings.

The Fund adopted an amended Audit Committee Charter (the “Charter”) on August 19, 2004. In accordance with proxy rules promulgated by the Securities and Exchange Commission (“SEC”), a fund audit committee charter is required to be filed at least once every three years as an exhibit to a fund’s proxy statement. The Audit Committee Charter for the Fund was filed as Exhibit A to the Fund’s proxy statement filed with the Securities and Exchange Commission on December 8, 2004. The Fund’s Audit Committee has received written disclosures and the letter required by the Independence Standards Board Standard No. 1 from PricewaterhouseCoopers LLC (“PwC”), Independent Registered Public Accounting Firm to the Fund.

Representatives of PwC are not expected to be present at the Annual Meeting but have been given the opportunity to make a statement if they so desire and are expected to be available by telephone to respond to appropriate questions.

The Report of the Audit Committee, dated November 9, 2006 is attached as Exhibit A to this proxy statement.

Set forth in the tables below are fees billed by PwC to the Fund for the Fund’s last two fiscal years ended June 30:

| | | 2005 | | |

Audit Fee | Audit Related Fees | | Tax Fees | Other Fees |

| $23,815 | $0 | | $2,600 | $0 |

| | | 2006 | | �� |

Audit Fee | Audit Related Fees | | Tax Fees | Other Fees |

| $23,700 | $0 | | $3,000 | $0 |

The Audit Committee approved the tax related services listed above and determined that the provision of such services is compatible with PwC maintaining its independence. PwC’s tax services include reviewing both federal and state income tax returns and capital gains distributions.

The Audit Committee is required to pre-approve permitted non-audit services provided by PwC to the Adviser and certain of its affiliates to the extent that the services related directly to the operations and financial reporting of the Fund. No such non-audit services were provided by PwC during the Fund’s 2005 or 2006 fiscal years.

The aggregate fees paid by the Fund, its Adviser and certain of its affiliates to PwC for non-audit services that did not require Audit Committee pre-approval totaled approximately $62,067 for 2005 and $58,000 for 2006. These services and fees were disclosed to the Audit Committee subsequent to the engagement of PwC to audit the Fund’s financial statements. The Audit Committee has determined that the provision of these services is compatible with maintaining PwC’s independence.

Nominating Committee

The Trust has a Nominating Committee comprised of all of the Independent Trustees. The Nominating Committee is responsible for nominating individuals to serve as Trustees, including as Independent Trustees. Each member of the Nominating Committee must be an Independent Trustee. During the fiscal year ended June 30, 2006, the Nominating Committee held six meetings.

During the fiscal year ended June 30, 2006, the Committee members met periodically to discuss matters relating to the nomination of an additional Class II Trustee. In the interim, the Committee Members reviewed resumes and questionnaires for prospective nominees. The Nominating Committee met to interview prospective nominees and on June 7, 2006, nominated one individual to be elected by the Trustees.

Information Regarding the Fund’s Process for Nominating Trustee Candidates

Nominating Committee Charter. The Nominating Committee has a written charter. A copy of the Fund’s Nominating Committee Charter is attached as Appendix B to this proxy statement.

Nominee Qualifications. The Committee requires that Trustee candidates have a college degree or equivalent business experience. While there is no formal list of qualifications, the Nominating Committee considers, among other things, whether prospective nominees have distinguished records in their primary careers, integrity, and substantive knowledge in areas important to the Board of Trustees’ operations, such as background or education in finance, auditing, marketing, the workings of the securities markets, or investment advice. For candidates to serve as Independent Trustees, they must be independent from the Adviser, its affiliates and other principal service providers. The Nominating Committee also considers whether the prospective candidates’ workloads would allow them to attend meetings of the Board of Trustees, be available for service on Board committees, and devote the time and effort necessary to attend to Board matters and the rapidly changing regulatory environment in which the Trust operates.

Different substantive areas may assume greater or lesser significance at particular times, in light of the Board’s present composition and the Nominating Committee’s (or the Board’s) perceptions about future issues and needs.

Identifying Nominees. In identifying potential nominees for the Board, the Nominating Committee may consider candidates recommended by one or more of the following sources: (i) the Fund’s current Trustees, (ii) the Fund’s officers, (iii) the Adviser, and (iv) any other source the Committee deems to be appropriate, including shareholders. Resumes of candidates may be sent to the Secretary of the Trust at 11825 N. Pennsylvania Street, Carmel, Indiana 46032. The Committee may, but is not required to, retain a third party search firm at the Fund’s expense to identify potential candidates. The Nominating Committee initially evaluates prospective candidates on the basis of their resumes, considered in light of the criteria discussed above. Those prospective candidates that appear likely to be able to fill a significant need of the Board would be contacted by a Nominating Committee member by telephone to discuss the position; if there appeared to be sufficient interest, an in-person meeting with one or more Nominating Committee members would be arranged. If the Nominating Committee, based on the results of these contacts, believed it had identified a viable candidate, it would air the matter with all Trustees for input. The Trust has not paid a fee to third parties to assist in finding the current nominees. The Nominating Committee may consider candidates proposed by personnel of the Adviser or its affiliates.

Other Committees

Compensation Committee

The Trust has a Compensation Committee comprised of all of the Independent Trustees. The Compensation Committee periodically reviews and evaluates the compensation of the Independent Trustees and recommends any appropriate changes, as necessary. During the fiscal year ended June 30, 2006, the Compensation Committee held one meeting.

Other Committees

At a Board meeting on May 18, 2006, the Board completed a comprehensive discussion and review of the functions of the then existing Insurance and Retirement Committees. The Board, including all the Independent Trustees, agreed that the Insurance and Retirement Committees were no longer necessary and that the functions of these committees could be performed efficiently by the full Board. At that meeting, the Board approved the dissolution of both of these committees.

Trustee Attendance at the Shareholder Meeting

The Fund has no formal policy regarding Trustee attendance at shareholder meetings. None of the Fund’s Independent Trustees attended the Annual Meeting held in December 2005. The President of the Fund, who is also a Trustee, attended the Annual Meeting held in December 2005.

The Fund’s Board of Trustees, Including the “Independent” Trustees,

Recommends that Shareholders Vote “For” Election of Each of the

Nominees to Serve as Trustees of the Fund.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 (the “Exchange Act”) requires the officers and Trustees of the Fund and persons who own more than ten percent of a registered class of the Fund’s equity securities to file reports of ownership and changes in ownership on Forms 3, 4 and 5 with the SEC and NYSE. Officers, Trustees and greater than ten percent stockholders of the Fund are required by SEC regulations to furnish the Fund with copies of all filed Forms 3, 4 and 5.

Based solely on the Fund’s review of the copies of such forms, and amendments thereto, furnished to it during or with respect to its most recent fiscal year, and written representations from certain reporting persons that they were not required to file Form 5 with respect to the most recent fiscal year, the Fund believes that all of its officers, Trustees, greater than ten percent beneficial owners and other persons subject to Section 16 of the Exchange Act due to the requirements of Section 30 of the 1940 Act (i.e. any advisory board member, investment adviser or affiliated person of the Adviser) have complied with all filing requirements applicable to them with respect to transactions during the Fund’s most recent fiscal year.

OTHER MATTERS

If a proxy card is properly executed and returned accompanied by instructions to withhold authority to vote, represents a broker "non-vote" (that is, a proxy card from a broker or nominee indicating that such person has not received instructions from the beneficial owner or other person entitled to vote shares of the Fund on a particular matter with respect to which the broker or nominee does not have discretionary power) or marked with an abstention (collectively, "Abstentions"), the Fund's shares represented thereby will be considered to be present at the meeting for purposes of determining the existence of a quorum for the transaction of business. Under Massachusetts law, Abstentions do not constitute a vote "for" or "against" a matter and will be disregarded in determining "votes cast" on an issue.

The Fund's Board is not aware of any other matter, which may come before the meeting. However, should any such matter with respect to the Fund properly come before the meeting, it is the intention of the proxy holders to vote the proxy in accordance with their judgment on any such matter.

The Fund will request broker/dealer firms, custodians, nominees and fiduciaries to forward proxy materials to the beneficial owners of the shares held of record. The Fund will reimburse such broker/dealer firms, custodians, nominees and fiduciaries for their reasonable expenses incurred in connection with such proxy solicitation. In addition to the solicitation of proxies by mail, officers of the Fund and employees of the Adviser and its affiliates, without additional compensation, may solicit proxies in person, by telephone or otherwise.

The Fund will bear the cost of soliciting proxies. In addition to the use of the mail, proxies may be solicited personally, by telephone, by telegraph, or by electronic transmission (e-mail).

SHAREHOLDERS COMMUNICATION AND PROPOSALS

Shareholder Communications

Shareholders may send written communications to the Fund’s Board of Trustees or to an individual Trustee by mailing such correspondence to the Secretary of the Fund (addressed to 11815 North Pennsylvania Street, Carmel,

Indiana 46032). Such communications must be signed by the shareholder and identify the number of shares held by the shareholder. Properly submitted shareholder communications will, as appropriate, be forwarded to the entire Board of Trustees or to the individual Trustee. Any shareholder proposal submitted pursuant to Rule 14a-8 under the Exchange Act, as amended, must continue to meet all the requirements of Rule 14a-8.

Shareholder Proposals

Proposals that shareholders wish to include in the Fund’s proxy statement for the Fund’s next Annual Meeting of Shareholders must be received by the Fund at the principal executive offices of the Fund at 11815 North Pennsylvania Street, Carmel, Indiana 46032 no later than June 30, 2007, and must satisfy the other requirements of the federal securities laws.

EXECUTIVE OFFICERS OF THE FUND

NAME AND POSITION WITH THE FUND | AGE | PRINCIPAL OCCUPATION AND BUSINESS EXPERIENCE FOR THE LAST FIVE YEARS |

Audrey L. Kurzawa, President since June 2005 and formerly, Treasurer since October 2002 | 39 | President and Trustee of the Trust; Certified Public Accountant; Controller and Senior Vice President, Adviser. President and Trustee of one other investment company managed by the Adviser. |

| | | |

Jeffrey M. Stautz, Secretary and Chief Legal Officer Since May 2005 | 48 | Vice President, General Counsel, Chief Compliance Officer and Secretary, 40|86 Advisors, Inc. Secretary and Chief Legal Officer of one other mutual fund managed by the Adviser. Previously, Partner, Baker & Daniels, LLP. |

| | | |

Daniel J. Murphy, Treasurer Since June 2005 | 50 | Certified Public Accountant; President of Conseco Services, LLC and Senior Vice President and Treasurer of various Conseco affiliates. Treasurer of one other mutual fund managed by the Adviser. |

| | | |

William T. Devanney, Vice President Since June 1993 | 49 | Senior Vice President, Corporate Taxes of Conseco Services, LLC and various Conseco affiliates. Vice President of one other mutual fund managed by the Adviser. |

| | | |

Sarah L. Bertrand, Assistant Secretary and Chief Compliance Officer Since December 2004 | 37 | Second Vice President, Legal & Compliance, and Assistant Secretary, 40|86 Advisors, Inc. Chief Compliance Officer and Assistant Secretary of one other mutual fund managed by the Adviser. |

ADDITIONAL INFORMATION

40|86 Advisors, Inc., located at 535 College Drive, Carmel, Indiana 46032, serves as the Fund’s investment adviser.

Computershare Trust, N.A., located at 250 Royall Street, Canton, Massachusetts 02021, serves as the Fund’s transfer agent. U.S. Bancorp Fund Services, LLC serves as the Fund’s accounting servicing agent.

NOTICE TO BANKS, BROKER/DEALERS VOTING TRUSTEES AND THEIR NOMINEES

Please advise the Fund, in care of Computershare Trust, N.A., whether other persons are the beneficial owners of the shares for which proxies are being solicited and, if so, the number of copies of the proxy statement and other soliciting material you wish to receive in order to supply copies to the beneficial owners of shares.

IT IS IMPORTANT THAT PROXY CARDS BE RETURNED PROMPTLY. THEREFORE, SHAREHOLDERS WHO DO NOT EXPECT TO ATTEND THE MEETING IN PERSON ARE URGED TO COMPLETE, SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD IN THE ENCLOSED STAMPED ENVELOPE

Dated: November 28, 2006

EXHIBIT A

40|86 STRATEGIC INCOME FUND

REPORT OF THE AUDIT COMMITTEE

The role of the Audit Committee is to assist the Board of Trustees in its oversight of the 40|86 Strategic Income Fund (the ÅgFundÅh) financial reporting process. The Audit Committee operates pursuant to a Charter that was most recently amended and approved by the Board on August 19, 2004. Additionally, the Audit Committee reviewed the Charter at its August 31, 2006 meeting and concluded that no amendments or changes were necessary. A copy of the Audit Committee Charter was filed as Exhibit A to the FundÅfs proxy statement filed with the Securities and Exchange Commission on December 8, 2004. As set forth in the Charter, management of the Fund is responsible for maintaining appropriate systems for accounting and internal controls. The Fund's independent registered accounting firm is responsible for planning and conducting an audit to determine whether the financial statements present fairly in all material respects the financial position and results of the operations of the Fund.

PricewaterhouseCoopers, LLP ("PwC") was the Independent Registered Public Accountants for the Fund for the fiscal year ended June 30, 2006. In performing its oversight function, the Audit Committee reviewed and discussed the audited financial statements for the Fund's fiscal year ended June 30, 2006 with Fund management and PwC. The Audit Committee discussed with PwC the matters required to be discussed by Statement on Auditing Standards No. 61, COMMUNICATIONS WITH AUDIT COMMITTEES, as modified or supplemented. The Audit Committee also received the written disclosures from PwC required by Independence Standards Board Standard No. 1, INDEPENDENT DISCUSSIONS WITH AUDIT COMMITTEES, as currently in effect. Finally, the Committee considered whether the provision by PwC relating to non-audit services to the Fund, or of professional services to the Adviser and those affiliates thereof that provide services to the Fund, is compatible with maintaining PwC's independence and has discussed with PwC its independence. PwC has not provided to the Fund, the Adviser or those affiliates thereof that provide services to the Fund, any information technology services relating to financial information design and implementation or internal audit services.

Members of the Fund's Audit Committee are not professionally engaged in the practice of auditing or accounting and are not employed by the Fund for accounting, financial management or internal control. Moreover, the Audit Committee relies on, and makes no independent verification of, the facts presented and the representations made to it by Fund management and PwC. Accordingly, the Audit Committee's oversight does not provide an independent basis to determine that management has maintained appropriate accounting and/or financial reporting principles and policies, or internal controls and procedures, designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit Committee's considerations and discussions referred to above do not provide assurance that the audit of the Fund's financial statements has been carried out in accordance with generally accepted auditing standards or that the financial statements are presented in accordance with generally accepted accounting principles.

Based on its consideration of the Fund's audited financial statements and the discussions referred to above with Fund management and PwC, and subject to the limitations on the responsibilities and role of the Audit Committee as set forth in the Charter and discussed above, the Audit Committee recommended the inclusion of the Fund's audited financial statements for the year ended June 30, 2006 in the Fund's Annual Report dated June 30, 2006.

At a meeting held on August 31, 2006, upon the recommendation of the Audit Committee, a majority of the Trustees who are not "interested persons" of the Fund (as defined in the Investment Company Act of 1940 (the “1940 Act”)) selected PwC as Independent Registered Public Accountants for the Fund for the fiscal year ending June 30, 2007. It is expected that representatives of PwC will not be present at the Meeting, but will be available by telephone to answer any questions that may arise. In reliance on Rule 32a-4 under the 1940 Act, the Fund is not seeking shareholder ratification of the selection of PwC as independent auditors.

SUBMITTED BY THE AUDIT COMMITTEE OF THE FUND:

Vince J. Otto, Chairman of Audit Committee

Diana H. Hamilton, Chairman of the Board

R. Matthew Neff

Steven R. Plump

EXHIBIT B

40|86 STRATEGIC INCOME FUND (“FUND”)

NOMINATING COMMITTEE CHARTER

Adopted as of December 2, 2004

The Board of Trustees (the “Board”) of 40|86 Strategic Income Fund (the “Fund”) has adopted this Charter to govern the activities of the Nominating Committee (the “Committee”) of the Board.

Statement of Purpose and Responsibility

The selection and nomination of the independent Trustees of the Fund is committed to the discretion of the then independent Trustees of the Fund. The primary purpose and responsibility of the Committee is the screening and nomination of candidates for election to the Board as independent trustee.

Organization and Governance

The Committee shall be comprised of as many Trustees as the Board shall determine, but in any event not fewer than two (2) Trustees. The Committee must consist entirely of Board members who are not “interested persons” of the Fund, as defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended. The Board may remove or replace any member of the Committee at any time in its sole discretion.

One or more members of the Committee may be designated by the Board as the Committee’s chairman or co-chairman, as the case may be.

The Committee will not have regularly scheduled meetings. Committee meetings shall be held as and when the Committee of the Board determines necessary or appropriate in accordance with the Fund’s Bylaws.

Qualifications for Trustee Nominees

The Committee requires that Trustee candidates have a college degree or equivalent business experience. The Committee may take into account a wide variety of factors in considering Trustee candidates, including (but not limited to): (i) availability and commitment of a candidate to attend meetings and perform his or her responsibilities on the Board, (ii) relevant industry and related experience, (iii) educational background, and (iv) ability, judgment and experience.

Identification of Nominees

In identifying potential nominees for the Board, the Committee may consider candidates recommended by on or more of the following sources: (i) the Fund’s current Trustees, (ii) the Fund’s officers, (iii) the Fund’s investment adviser, and (iv) any other source the Committee deems to be appropriate. The Committee may, but is not required to, retain a third party search firm at the Fund’s expense to identify potential candidates.