Exhibit 10.1

UNIT PURCHASE AGREEMENT

by and among

ALLIANCE LAUNDRY HOLDINGS LLC,

ITS SECURITYHOLDERS,

and

ALH HOLDING INC.

Dated as of December 7, 2004

Table of Contents

| | | | |

| | | | | Page

|

| |

ARTICLE 1 PURCHASE AND SALE TRANSACTIONS | | 1 |

1.01 | | Purchase and Sale Transactions | | 1 |

1.02 | | Calculation of Closing and Final Consideration | | 2 |

1.03 | | Closing Transactions | | 4 |

1.04 | | The Closing | | 5 |

| |

ARTICLE 2 CONDITIONS TO CLOSING | | 6 |

2.01 | | Conditions to Buyer’s Obligations | | 6 |

2.02 | | Conditions to the Sellers’ and the Company’s Obligations | | 8 |

| |

ARTICLE 3 REPRESENTATIONS AND WARRANTIES OF THE SELLERS | | 9 |

3.01 | | Authority | | 9 |

3.02 | | Execution and Delivery; Valid and Binding Agreement | | 9 |

3.03 | | Ownership of Units and PEF Options; Validity of PEF Options | | 9 |

| |

ARTICLE 4 REPRESENTATIONS AND WARRANTIES OF THE COMPANY | | 10 |

4.01 | | Organization and Corporate Power | | 10 |

4.02 | | Subsidiaries | | 10 |

4.03 | | Authorization; No Breach; Valid and Binding Agreement | | 10 |

4.04 | | Company Units | | 11 |

4.05 | | SEC Reports; Financial Statements | | 11 |

4.06 | | Absence of Certain Developments | | 12 |

4.07 | | Title to Properties | | 13 |

4.08 | | Tax Matters | | 14 |

4.09 | | Contracts and Commitments | | 14 |

4.10 | | Intellectual Property | | 15 |

4.11 | | Litigation | | 16 |

4.12 | | Employee Benefit Plans | | 16 |

4.13 | | Insurance | | 17 |

4.14 | | Compliance with Laws | | 17 |

4.15 | | Environmental Compliance and Conditions | | 17 |

4.16 | | Affiliated Transactions | | 18 |

4.17 | | Powers of Attorney; Bank Accounts | | 18 |

4.18 | | Customers and Suppliers | | 19 |

4.19 | | Employment and Labor Matters | | 19 |

4.20 | | Brokerage | | 19 |

| |

ARTICLE 5 REPRESENTATIONS AND WARRANTIES OF BUYER | | 19 |

5.01 | | Organization and Power | | 19 |

5.02 | | Authorization; Valid and Binding Agreement | | 19 |

5.03 | | No Breach | | 20 |

5.04 | | Consents, etc | | 20 |

5.05 | | Litigation | | 20 |

5.06 | | Brokerage | | 20 |

-i-

| | | | |

5.07 | | Investment Representation | | 20 |

5.08 | | Financing | | 20 |

| |

ARTICLE 6 PRE-CLOSING COVENANTS | | 21 |

6.01 | | Conduct of the Business | | 21 |

6.02 | | Access to Books and Records | | 21 |

6.03 | | Regulatory Filings | | 22 |

6.04 | | Conditions | | 22 |

6.05 | | Exclusive Dealing | | 23 |

6.06 | | Notification | | 23 |

6.07 | | Effectiveness of Agreement | | 23 |

6.08 | | Confidentiality; Non-Solicitation | | 24 |

| |

ARTICLE 7 COVENANTS OF BUYER | | 24 |

7.01 | | Access to Books and Records | | 24 |

7.02 | | Notification | | 25 |

7.03 | | Director and Officer Liability and Indemnification | | 25 |

7.04 | | Regulatory Filings | | 25 |

7.05 | | Conditions | | 26 |

7.06 | | Contact with Customers and Suppliers | | 27 |

| |

ARTICLE 8 TERMINATION | | 27 |

8.01 | | Termination | | 27 |

8.02 | | Effect of Termination | | 28 |

| |

ARTICLE 9 SELLER REPRESENTATIVE | | 28 |

9.01 | | Designation | | 28 |

9.02 | | Authority | | 28 |

9.03 | | Exculpation | | 29 |

| |

ARTICLE 10 ADDITIONAL COVENANTS AND AGREEMENTS | | 29 |

10.01 | | Survival | | 29 |

10.02 | | Indemnification by Sellers | | 30 |

10.03 | | Indemnification by Buyer | | 30 |

10.04 | | Escrow Proceeds | | 30 |

10.05 | | Expiration of Claims | | 31 |

10.06 | | Determination of Losses | | 31 |

10.07 | | Procedures Relating to Indemnification | | 33 |

10.08 | | Disclosure Generally | | 34 |

10.09 | | Acknowledgment by Buyer | | 34 |

10.10 | | Cooperation on Tax Matters | | 35 |

10.11 | | Further Assurances | | 36 |

10.12 | | Injunctive Relief | | 36 |

| |

ARTICLE 11 DEFINITIONS | | 37 |

11.01 | | Definitions | | 37 |

11.02 | | Cross-Reference of Other Definitions | | 42 |

11.03 | | Other Definitional Provisions | | 43 |

-ii-

| | | | |

| |

ARTICLE 12 MISCELLANEOUS | | 44 |

12.01 | | Press Releases and Communications | | 44 |

12.02 | | Expenses | | 44 |

12.03 | | Knowledge Defined | | 45 |

12.04 | | Notices | | 45 |

12.05 | | Assignment | | 47 |

12.06 | | Severability | | 47 |

12.07 | | No Strict Construction | | 47 |

12.08 | | Amendment and Waiver | | 47 |

12.09 | | Complete Agreement | | 47 |

12.10 | | Counterparts | | 47 |

12.11 | | Governing Law | | 48 |

12.12 | | Termination of Certain Contracts | | 48 |

12.13 | | No Third Party Beneficiaries | | 48 |

-iii-

| | |

Exhibits and Schedules

| |

|

Exhibit A - Escrow Agreement |

| |

Capitalization Schedule | | |

Consideration Allocation and Mechanics Schedule | | |

Required Consents Schedule | | |

Subsidiary Schedule | | |

Authorization Schedule | | |

Undisclosed Liabilities Schedule | | |

Developments Schedule | | |

Real Property Schedule | | |

Contracts Schedule | | |

Intellectual Property Schedule | | |

Litigation Schedule | | |

Employee Benefits Schedule | | |

Insurance Schedule | | |

Compliance Schedule | | |

Environmental Compliance Schedule | | |

Affiliated Transactions Schedule | | |

Powers of Attorney Schedule | | |

Customers and Suppliers Schedule | | |

Conduct of Business Schedule | | |

Permitted Liens Schedule | | |

-iv-

UNIT PURCHASE AGREEMENT

This UNIT PURCHASE AGREEMENT (this “Agreement”) is made as of December 7, 2004, by and among ALH Holding Inc., a Delaware corporation (“Buyer”), Alliance Laundry Holdings LLC, a Delaware limited liability company (the “Company”), and the Persons listed on the signature pages attached hereto identified as Sellers (the “Sellers”). Capitalized terms used and not otherwise defined herein have the meanings set forth inArticle 11 below.

WHEREAS, pursuant to the terms and conditions of this Agreement, Buyer will purchase from the Sellers, and the Sellers will sell to Buyer, all of the Common Units and PEF Options issued, outstanding, and owned by them on the terms and subject to the conditions set forth herein.

NOW, THEREFORE, in consideration of the premises, representations and warranties and mutual covenants contained herein and of other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

ARTICLE 1

PURCHASE AND SALE TRANSACTIONS

1.01Purchase and Sale Transactions.

At the Closing, on the basis of the representations, warranties, covenants and agreements and subject to the satisfaction or waiver of the terms and conditions set forth herein, each Seller shall sell, assign, transfer and convey to Buyer, and Buyer shall purchase and acquire from such Seller, all of the issued and outstanding Common Units and PEF Options owned by such Seller against payment in cash to such Seller of its portion of the Estimated Aggregate Closing Consideration (as defined below); provided that, with respect to the Rollover Sellers, the cash proceeds to be paid to them shall be reduced by their respective Rollover Amounts and the Rollover Sellers shall instead receive in respect of such reduced amounts their respective Rollover Shares (as set forth on the attachedConsideration Allocation and Mechanics Schedule). Payment for the Common Units and PEF Options shall be made by wire transfer on the Closing Date of immediately available funds to an account specified by the Seller Representative (for further distribution to the Sellers in accordance with the attachedConsideration Allocation and Mechanics Schedule) to Buyer at least two business days prior to the Closing. The allocation of the Estimated Aggregate Closing Consideration (including the Rollover Shares) amongst the Sellers, and the manner in which the Common Units and PEF Options shall be sold to Buyer and the Estimated Aggregate Closing Consideration shall be distributed by the Seller Representative to the Sellers at the Closing, are set forth on the attachedConsideration Allocation and Mechanics Schedule.

1.02Calculation of Closing and Final Consideration.

(a) For purposes of this Agreement, the “Aggregate Closing Consideration” means an amount equal to: (i) $450,000,000,plus (ii) the total amount of Cash on Hand as of the Closing,minus (iii) the outstanding amount of the Indebtedness as of the Closing before taking into account any repayment underSection 1.03(b),plus (iv) the amount, if any, by which the Net Working Capital exceeds the Net Working Capital Target,minus (v) the amount, if any, by which Net Working Capital is less than the Net Working Capital Target,plus (vi) the Management Notes Amount, andminus (vii) the Escrow Amount.

(b) At least three business days prior to the Closing Date, the Seller Representative shall deliver to Buyer its good faith estimate of the Aggregate Closing Consideration (the “Estimated Aggregate Closing Consideration”), which shall include its good faith estimate of Net Working Capital (“Estimated Net Working Capital”). Buyer shall review the Estimated Net Working Capital and shall provide the Seller Representative with objections thereto, if any, at least one business day prior to the Closing Date. If Buyer provides the Seller Representative with any objections to the Estimated Net Working Capital, Buyer and the Seller Representative shall negotiate in good faith to resolve such objections. Any such resolution shall be included in the computation of Estimated Aggregate Closing Consideration. In the event Buyer and the Seller Representative are unable in good faith to resolve such objections prior to the Closing Date, the Estimated Net Working Capital shall be the Net Working Capital as of December 31, 2004 as set forth in the books and records of the Company and its Subsidiaries, and the amount which is determined by such month-end information shall be included in the computation of Estimated Aggregate Closing Consideration.

(c) As promptly as possible, but in any event within 45 days after the Closing Date, Buyer will deliver to the Seller Representative (i) an unaudited, consolidated balance sheet of the Company and its Subsidiaries as of the Closing (which shall have been prepared with the assistance of Buyer’s or the Company’s accountants), and (ii) its calculation of the Aggregate Closing Consideration based on such balance sheet (together, the “Closing Statement”). The Closing Statement shall be prepared consistent with the definitions of the terms Cash on Hand, Indebtedness, Net Working Capital, Management Notes Amounts, and Escrow Amount and the accounting principles and practices referred to therein. The Closing Statement shall entirely disregard (i) any and all affects on the assets or liabilities of the Company and its Subsidiaries of any financing or refinancing arrangements entered into at any time by Buyer or any other transaction entered into by Buyer in connection with the consummation of the transactions contemplated hereby, and (ii) any of the plans, transactions, or changes which Buyer intends to initiate or make or cause to be initiated or made after the Closing with respect to the Company and its Subsidiaries or their business or assets, or any facts or circumstances that are unique or particular to Buyer or any of its assets or liabilities.

(d) Buyer, the Company, and its Subsidiaries shall grant the Seller Representative and its authorized representatives reasonable access to such papers and documents as it or its representatives may reasonably request in connection with their review of the Closing Statement. If the Seller Representative has any objections to the Closing Statement, the Seller Representative shall deliver to Buyer a statement setting forth its objections thereto (an “Objections Statement”), which shall identify in reasonable detail those items and the amount

-2-

thereof on the Closing Statement delivered by Buyer to the Seller Representative which the Seller Representative objects to (the “Disputed Items”). If an Objections Statement is not delivered to Buyer within 30 days after delivery of the Closing Statement, the Closing Statement as prepared by Buyer shall be final, binding and non-appealable by the parties hereto; provided that, in the event Buyer, the Company, or any of its Subsidiaries does not provide any papers or documents reasonably requested by the Seller Representative or any of its authorized representatives within 5 days of request therefor (or such shorter period as may remain in such 30-day period), such 30-day period shall be extended by one day for each additional day required for Buyer, the Company, or one of its Subsidiaries to fully respond to such request. The Seller Representative and Buyer shall negotiate in good faith to resolve the Disputed Items, but if they do not reach a final resolution within 30 days after the delivery of the Objections Statement to Buyer, the Seller Representative and Buyer shall submit any unresolved Disputed Items to the Chicago office of Deloitte & Touche (the “Independent Auditor”). In the event the parties submit any unresolved Disputed Items to the Independent Auditor, each party shall submit a Closing Statement, which in the case of each party may be a Closing Statement which, with respect to the unresolved Disputed Items (but not, for the avoidance of doubt, with respect to any other items), is different than the Closing Statement initially submitted to the Seller Representative, or the Objections Statement, as applicable, together with such supporting documentation as it deems appropriate, to the Independent Auditor within 30 days of the date on which such unresolved Disputed Items were submitted to the Independent Auditor for resolution. The Seller Representative and Buyer shall use their respective commercially reasonable efforts to cause the Independent Auditor to resolve such dispute as soon as practicable, but in any event within 30 days of the date on which the Independent Auditor receives the Closing Statements prepared by the Seller Representative and Buyer. The Independent Auditor shall resolve such dispute by choosing, in its entirety, the Closing Statement proposed by either the Seller Representative or Buyer, and shall make no other resolution of such dispute (including by combining elements of the Closing Statements submitted by both parties, or altering items which are not Disputed Items). The Seller Representative and Buyer shall use their respective commercially reasonable efforts to cause the Independent Auditor to notify them in writing of its resolution of such dispute as soon as practicable. The Closing Statement selected by the Independent Auditor shall be final, binding and non-appealable by the parties hereto. Each party shall bear its own costs and expenses in connection with the resolution of such dispute by the Independent Auditor. The costs and expenses of the Independent Auditor shall be paid by the party whose Closing Statement is not chosen by the Independent Auditor in its resolution of the dispute.

(e)Adjustment Payments.

(i) If the Aggregate Closing Consideration as finally determined pursuant toSection 1.02(d) is greater than the Estimated Aggregate Closing Consideration, then (A) Buyer shall pay to the Seller Representative (for further distribution to the Sellers in accordance with the provisions of theConsideration Allocation and Mechanics Schedule) the aggregate amount of such excess, together with interest thereon compounded annually and computed at a per annum interest rate equal to the Prime Rate from the Closing Date to the date of such payment, and (B) the Escrow

-3-

Agent shall pay to the Seller Representative (for further distribution to the Sellers in accordance with the provisions of theConsideration Allocation and Mechanics Schedule) from the Escrow an aggregate amount of $1,000,000.

(ii) If the Aggregate Closing Consideration as finally determined pursuant toSection 1.02(d) is less than the Estimated Aggregate Closing Consideration, the Escrow Agent shall pay to Buyer from the Escrow the amount of such difference, together with interest thereon compounded annually and computed at a per annum interest rate equal to the Prime Rate from the Closing Date to the date of such payment. If the amount of such shortfall (together with the interest thereon) to be paid to Buyer from the Escrow is less than $1,000,000, then the Escrow Agent shall pay to the Seller Representative (for further distribution to the Sellers in accordance with the provisions of theConsideration Allocation and Mechanics Schedule) from the Escrow an amount equal to (i) $1,000,000,minus (ii) the amount paid to Buyer from the Escrow.

(iii) No Seller shall have any obligation to make any payment in connection with thisSection 1.02.

(f) Any payments required bySection 1.02(e) shall be made by wire transfer of immediately available funds (or by check if to be made by an individual) to an account or accounts specified by the Seller Representative or Buyer, as applicable, within five business days of the date on which the Closing Statement is finalized pursuant toSection 1.02(d). All payments required bySection 1.02(e) shall be deemed to be adjustments for Tax purposes to the aggregate purchase price paid by Buyer for the Common Units and PEF Options purchased by it pursuant to this Agreement (in the manner set forth on theConsideration Allocation and Mechanics Schedule).

(g) Each Seller agrees and acknowledges that he, she, or it will receive the consideration with respect to such Seller’s Common Units and PEF Options set forth in thisArticle 1 (and in the manner set forth on theConsideration Allocation and Mechanics Schedule), and he, she, or it shall not be entitled to any different amount which may be set forth in the LLC Agreement or any agreement, arrangement, or understanding among any of the Sellers or with the Company and/or any of its Subsidiaries. Each Seller agrees and acknowledges that, after giving effect to the transactions contemplated by this Article 1, such Seller is not, from and after the Closing, entitled to receive any distributions from the Company. Furthermore, each Seller agrees and acknowledges that such Seller shall no longer hold any interest in the Company and, without limiting the generality of the foregoing, shall no longer be a member or unitholder thereof effective as of the Closing and thus, subject to the provisions ofSection 7.03, no consent of any Seller shall be required for any amendment, waiver, or modification of the LLC Agreement after the Closing.

1.03Closing Transactions.

(a) Prior to the Closing, the Company shall prepare (with the reasonable assistance of Buyer) all documents necessary for, and the Company and Buyer shall use their respective commercially reasonable efforts to take all actions necessary or appropriate to allow

-4-

the Company and its Subsidiaries to commence, a self tender offer (the “Note Tender Offer”) and consent solicitation (the “Consent Solicitation”) to repurchase any and all of the outstanding Existing Senior Notes. The Note Tender Offer shall be effected in compliance with applicable laws, rules, and regulations. Notwithstanding the foregoing, the Company may, after consultation with the Buyer and the Buyer’s financing sources, elect not to conduct, or to abandon, the Note Tender Offer and Consent Solicitation at any time prior to the Closing. In the event the Company, in its sole discretion, so elects, it shall take commercially reasonable efforts to cause the defeasement (or other similar arrangement) of the Existing Senior Notes at the Closing consistent with the standards set forth inSection 2.01(e)(B).

(b) At the Closing, Buyer shall repay, or cause to be repaid, on behalf of the Company and its Subsidiaries, all amounts necessary to discharge fully the then outstanding balance of the Indebtedness of the Company and its Subsidiaries (including by causing the redemption of all outstanding Preferred Units in accordance with the provisions of the LLC Agreement), other than the Existing Senior Notes and, at Buyer’s election, items (iv) and (v) of clause (a) of the definition of the term Indebtedness, by wire transfer of immediately available funds as directed by the holders of such Indebtedness at or prior to the Closing, and the Company shall deliver to Buyer all appropriate payoff letters and shall make arrangements reasonably satisfactory to Buyer for such holders to deliver Lien releases, canceled notes, and other relevant documentation at the Closing.

(c) At the Closing, Buyer shall exercise each of the PEF Options acquired by it pursuant toSection 1.01 and shall pay the applicable exercise price of such PEF Options to the Sellers party to the PEF Options, pursuant to the attachedConsideration Allocation and Mechanics Schedule. For the avoidance of doubt, such exercise price is included within the Aggregate Closing Consideration and is not additional consideration.

(d) At the Closing, Buyer shall deposit the Escrow Amount with the Escrow Agent, and shall deliver to each of the Rollover Sellers their respective Rollover Shares.

(e) At the Closing, each Seller that is party to any note referred to in the defined term Management Notes Amount shall repay all amounts due and owing to the Company as of the Closing pursuant to such Seller’s note.

1.04The Closing. The closing of the transactions contemplated by this Agreement (the “Closing”) shall take place at the offices of Kirkland & Ellis LLP located at 153 E. 53rd St., New York, New York on January 27, 2005, or if any of the conditions to the Closing set forth inArticle 2 below (other than those to be satisfied at the Closing) have not been satisfied or waived by the party entitled to the benefit thereof prior to such date, then on or prior to the third business day following satisfaction or waiver of all of the closing conditions set forth inArticle 2 hereof (other than those to be satisfied at the Closing), or on such other date as is mutually agreeable to Buyer and the Company. The date of the Closing is herein referred to as the “Closing Date.” The Closing shall be deemed to occur at the close of business on the Closing Date.

-5-

ARTICLE 2

CONDITIONS TO CLOSING

2.01Conditions to Buyer’s Obligations. The obligation of Buyer to consummate the transactions contemplated by this Agreement is subject to the satisfaction of the following conditions as of the Closing Date:

(a) The representations and warranties set forth inArticles 3 and4 hereof shall be true and correct (without regard to any materiality or Material Adverse Effect qualifiers set forth therein) at and as of the Closing Date as though then made and as though the Closing Date was substituted for the date of this Agreement throughout such representations and warranties, except where the failure of such representations and warranties to be true and correct would not in the aggregate have a Material Adverse Effect;

(b) The Company and the Sellers shall have performed in all material respects all of the covenants and agreements required to be performed by them under this Agreement at or prior to the Closing;

(c) No action or proceeding before any court or government body shall be pending wherein an unfavorable judgment, decree or order does or would prevent the performance of this Agreement or the consummation of any of the transactions contemplated hereby, declare unlawful the transactions contemplated by this Agreement or cause such transactions to be rescinded;

(d) The applicable waiting periods, if any, under the HSR Act shall have expired or been terminated;

(e) At the Company’s option, (A) all of the conditions to consummation of the Consent Solicitation shall have been satisfied or waived and the indenture modifications comprising part of the Consent Solicitation shall have been effected, and the Note Tender Offer shall be capable of being consummated upon the availability of the proceeds from the debt financing described in subsection (f) below (subject only to acceptance of and payment for the tendered Existing Senior Notes), or, after prior consultation with the Buyer, (B) defeasement or other arrangements shall have been made with respect to the Existing Senior Notes, the terms and conditions of which are reasonably acceptable to Buyer, the lead agent for Buyer’s proposed senior credit facility and the lead underwriter for Buyer’s proposed high yield financing.

(f) The conditions set forth in the Debt Commitment Letters (as in effect on the date hereof) to the funding of the Credit Facilities and the Interim Loans (as such terms are defined in the Debt Commitment Letters) shall have been satisfied or waived, and the proceeds of such credit facilities shall have been received by, or shall be fully available to, Buyer, other than (i) the failure of a condition or the unavailability of funding solely due to or resulting from a lack of equity financing and/or (ii) the failure solely of the condition, or the unavailability of funding due solely to the failure of the condition, requiring the contemporaneous closing of the transactions contemplated by this Agreement; provided, that, notwithstanding any provision in

-6-

this Agreement to the contrary, Buyer shall not be required to close using the Interim Loans before February 7, 2005.

(g) The Company shall have delivered to Buyer each of the following:

(i) a certificate of the Company, dated the Closing Date, stating that the preconditions specified in subsections (a) and (b) above as they relate to the Company have been satisfied;

(ii) resignation letters from the members of the Board of Managers of the Company and its Subsidiaries who are not employees of the Company and its Subsidiaries (other than the independent managers or trustees of Alliance Laundry Equipment Receivables LLC, Alliance Laundry Equipment Receivables Trust 2000-A, Alliance Laundry Equipment Receivables 2002 LLC, and Alliance Laundry Equipment Receivables Trust 2002-A);

(iii) termination agreements, effective as of the Closing Date, for the agreements indicated on the attachedAffiliated Transactions Schedule as to be terminated on the Closing Date;

(iv) amendments (in form and substance reasonably satisfactory to Buyer) to the material contracts listed on the attachedRequired Consents Schedule, as further described thereon;

(v) an amendment, in form and substance satisfactory to Buyer, of the Company’s mergers and acquisition engagement letter with Lehman Brothers, Inc., providing for acknowledgment that fees and expenses due thereunder are being satisfied at Closing and terminating all of the Company’s obligations thereunder (other than indemnity obligations).

(vi) certified copies of the resolutions duly adopted by the Company’s board of managers authorizing the execution, delivery and performance of this Agreement and the other agreements contemplated hereby, and the consummation of all transactions contemplated hereby and thereby;

(vii) (A) a certified copy of the certificate of incorporation, articles of incorporation or certificate of formation of each of the Company and its Subsidiaries and (B) a certificate of good standing or equivalent certificate from the jurisdiction in which each of the Company and its Subsidiaries is incorporated or formed, in each case, dated within 30 days of the Closing Date; and

(viii) a statement, as contemplated and meeting the requirements of Sections 1.1445-11T(d)(2) of the Treasury Regulations that fifty percent or more of the value of the gross assets of the company does not consist of U.S. real property interests or that ninety percent or more of the value of the gross assets of the Company does not consist of U.S. real property interests plus cash and cash equivalents.

-7-

2.02Conditions to the Sellers’ and the Company’s Obligations. The obligations of the Company and the Sellers to consummate the transactions contemplated by this Agreement are subject to the satisfaction of the following conditions as of the Closing Date:

(a) The representations and warranties set forth inArticle 5 hereof shall be true and correct (without regard to any materiality or Material Adverse Effect qualifiers set forth therein) at and as of the Closing as though then made and as though the Closing Date was substituted for the date of this Agreement throughout such representations and warranties, except where the failure of such representations and warranties to be true and correct would not in the aggregate have a Material Adverse Effect;

(b) Buyer shall have performed in all material respects all the covenants and agreements required to be performed by it under this Agreement at or prior to the Closing;

(c) No action or proceeding before any court or government body shall be pending wherein an unfavorable judgment, decree or order does or would prevent the performance of this Agreement or the consummation of any of the transactions contemplated hereby, declare unlawful the transactions contemplated by this Agreement or cause such transactions to be rescinded;

(d) The applicable waiting periods, if any, under the HSR Act shall have expired or been terminated;

(e) All of the conditions to consummation of the Consent Solicitation shall have been satisfied or waived and the indenture modifications comprising part of the Consent Solicitation shall have been effected, and the Note Tender Offer shall be capable of being consummated upon the availability of the proceeds from the debt financing described inSection 2.01(f) (subject only to acceptance of and payment for the tendered Existing Senior Notes), or defeasement or other arrangements shall have been made with respect to the Existing Senior Notes, the terms and conditions of which are reasonably acceptable to the lead agent for Buyer’s proposed senior credit facility and the lead underwriter for Buyer’s proposed high yield financing.

(f) Buyer shall have delivered to the Company each of the following:

(i) a certificate in the form, dated the Closing Date, stating that the preconditions specified in subsections (a) and (b) hereof have been satisfied;

(ii) certified copies of the resolutions duly adopted by the Buyer’s board of directors (or equivalent governing body) authorizing the execution, delivery and performance of this Agreement and the other agreements contemplated hereby, and the consummation of all transactions contemplated hereby and thereby; and

(iii) (A) a certified copy of the certificate of incorporation or equivalent organizational document of Buyer and (B) a certificate of good standing or equivalent

-8-

certificate from the jurisdiction in which Buyer is incorporated or formed, in each case, dated within 30 days of the Closing Date; and

(g) Buyer shall have made the payments set forth inSections 1.02 and 1.03 to be made by it on the Closing Date.

ARTICLE 3

REPRESENTATIONS AND WARRANTIES OF THE SELLERS

Each Seller, solely for itself, himself, or herself (on a several, and not joint, basis), represents and warrants to Buyer, as of the date hereof and as of the Closing Date, as follows:

3.01Authority. Such Seller has all requisite power and authority and full legal capacity to execute and deliver this Agreement and to perform its, his, or her obligations hereunder.

3.02Execution and Delivery; Valid and Binding Agreement. This Agreement has been duly executed and delivered by such Seller, and assuming that this Agreement is the valid and binding agreement of Buyer and the Company, this Agreement constitutes the valid and binding obligation of such Seller, enforceable in accordance with its terms. The PEF Options are enforceable in accordance with their terms. The execution, delivery and performance of this Agreement by such Seller and the consummation of the transactions contemplated hereby (including those set forth on the Consideration Allocation and Mechanics Schedule) do not, with or without notice, lapse of time, or both, conflict with or result in any material breach of, constitute a material default under, result in a material violation of, result in the creation of any material lien, security interest, charge or encumbrance upon any material assets of such Seller, or require any material authorization, consent, approval, exemption or other material action by or notice to any court, other governmental body or third party, under the provisions of any indenture, mortgage, lease, loan agreement or other material agreement or instrument to which such Seller is bound, or any law, statute, rule or regulation or order, judgment or decree to which such Seller is subject.

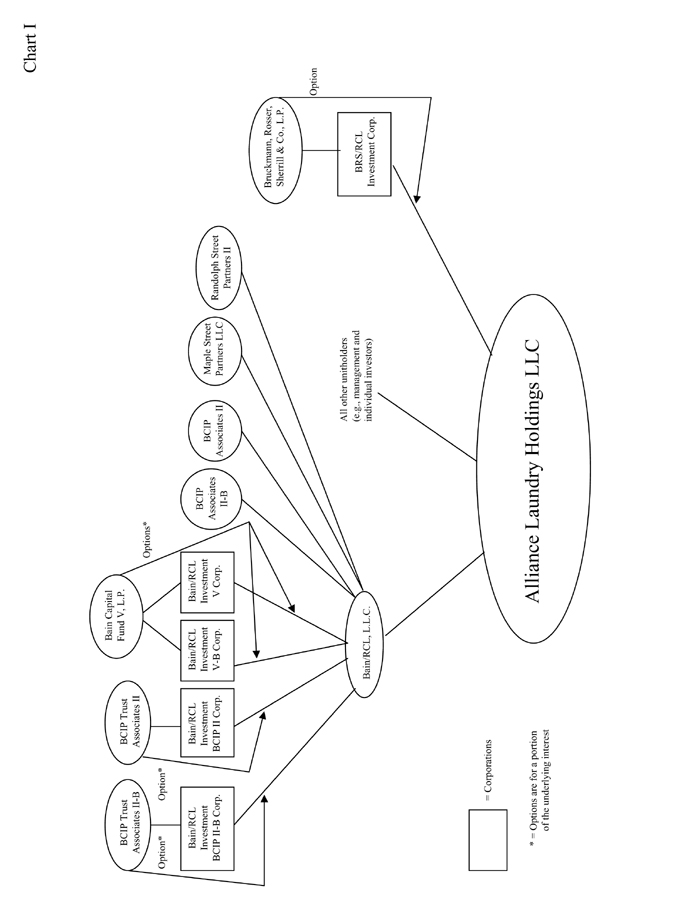

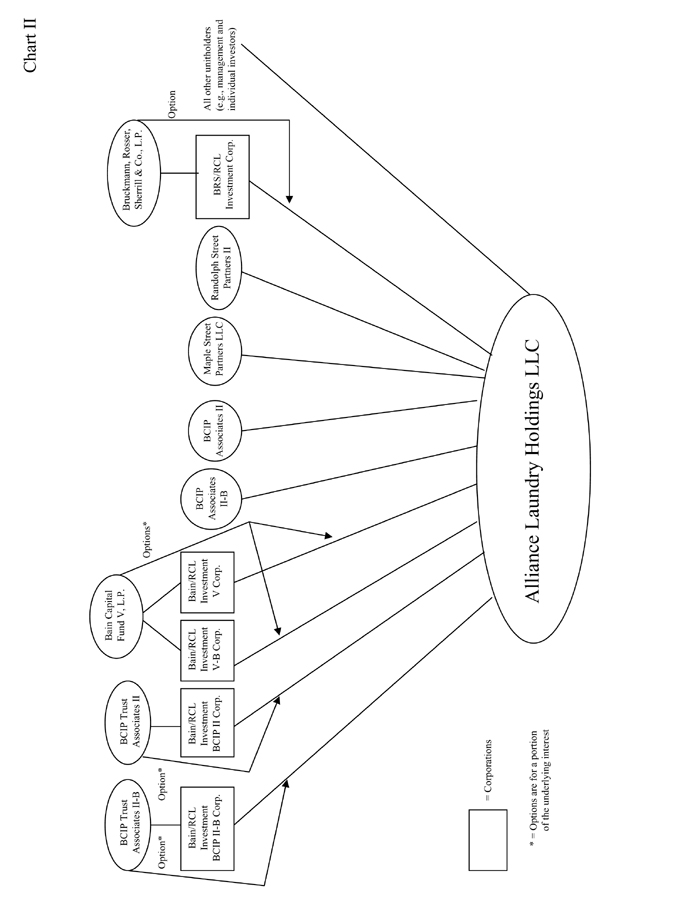

3.03Ownership of Units and PEF Options; Validity of PEF Options. As of the date hereof, and after giving effect to the transaction contemplated by Part I of the Consideration Allocation and Mechanics Schedule, at Closing, such Seller is the record and beneficial owner of the Common Units and PEF Options as set forth opposite its, his, or her name on the attachedCapitalization Schedule. At or prior to Closing, Bain/RCL, L.L.C. and the other Sellers who are its members shall have consummated the transactions contemplated by Part I of the Consideration Allocation and Mechanics Schedule. Sellers include all of the members and other securityholders of Bain/RCL, L.L.C. On the Closing Date, each Seller shall transfer to Buyer good title to the Common Units (including the Common Units delivered pursuant to exercise of the PEF Options) and the PEF Options held by such Seller (in accordance with theConsideration Allocation and Mechanics Schedule), free and clear of all Liens, options, proxies, voting trusts or agreements and other restrictions and limitations of any kind, other than applicable federal and state securities law restrictions. Each PEF Option to which a Seller is a party is a valid and

-9-

binding agreement of such Seller, enforceable against such Seller in accordance with its terms, and permits the transactions contemplated bySection 1.03(c) hereof.

ARTICLE 4

REPRESENTATIONS AND WARRANTIES OF THE COMPANY

The Company represents and warrants to Buyer, as of the date hereof and as of the Closing Date, that:

4.01Organization and Corporate Power. The Company is a limited liability company duly organized, validly existing and in good standing under the laws of the State of Delaware, and the Company has all requisite limited liability company power and authority and all authorizations, licenses and permits necessary to own and operate its properties and to carry on its businesses as now conducted, except where the failure to hold such authorizations, licenses and permits would not have a Material Adverse Effect. The Company is qualified to do business in every jurisdiction in which its ownership of property or the conduct of business as now conducted requires it to qualify, except where the failure to be so qualified would not have a Material Adverse Effect. A true and complete copy of the LLC Agreement shall have been provided to the Buyer.

4.02Subsidiaries. Except as set forth on the attachedSubsidiary Schedule, neither the Company nor any of its Subsidiaries owns or holds the right to acquire any stock, partnership interest, joint venture interest or other equity ownership interest in any other Person. Each of the Company’s Subsidiaries is validly existing and in good standing under the laws of the jurisdiction of its incorporation or formation, has all requisite corporate or limited liability company power and authority and all authorizations, licenses and permits necessary to own its properties and to carry on its businesses as now conducted and is qualified to do business in every jurisdiction in which its ownership of property or the conduct of businesses as now conducted requires it to qualify, except in each such case where the failure to hold such authorizations, licenses and permits or to be so qualified would not have a Material Adverse Effect. Except as set forth on the attachedSubsidiary Schedule, all of the capital stock, units or other equity interests of each of the Subsidiaries is owned by the Company.

4.03Authorization; No Breach; Valid and Binding Agreement. The execution, delivery and performance of this Agreement by the Company and the consummation of the transactions contemplated hereby have been duly and validly authorized by all requisite action (including limited liability company action) on the part of the Company, and no other proceedings (including limited liability company proceedings) on the Company’s or any of its Subsidiaries’ part are necessary to authorize the execution, delivery or performance of this Agreement or the transactions contemplated hereby. Except as set forth on the attachedAuthorization Schedule, the execution, delivery and performance of this Agreement by the Company and the consummation of the transactions contemplated hereby do not, with or without notice, lapse of time, or both, conflict with or result in any material breach of, constitute a material default under, result in a material violation of, result in the creation of any material Lien upon any material assets of the Company or any of its Subsidiaries, or require any material

-10-

authorization, consent, approval, exemption or other material action by or notice to any court or other governmental body, under the provisions of the LLC Agreement or any of its Subsidiaries’ charter or bylaws (or equivalent organizational documents) or any material indenture, mortgage, lease, loan agreement or other material agreement or instrument to which the Company or any of its Subsidiaries is bound, or any law, statute, rule or regulation or order, judgment or decree to which the Company or any of its Subsidiaries is subject. This Agreement has been duly executed and delivered by the Company, and assuming that this Agreement is a valid and binding obligation of Buyer and the Sellers, this Agreement constitutes a valid and binding obligation of the Company, enforceable in accordance with its terms.

4.04Company Units. TheCapitalization Schedule sets forth (i) the issued and outstanding Company Units as of the date hereof and (ii) the issued and outstanding Company Units and PEF Options, after giving effect to the transaction contemplated by Part I of the Consideration Allocation and Mechanics Schedule, as of the Closing Date. Except as set forth on theCapitalization Schedule, the Company does not have any other equity securities or securities containing any equity features authorized, issued or outstanding, and there are no agreements, options, warrants or other rights or arrangements existing or outstanding which provide for the sale or issuance of any of the foregoing by the Company. Except as set forth on the attachedCapitalization Schedule, there are no rights, subscriptions, warrants, options, conversion rights or agreements of any kind outstanding to purchase or otherwise acquire any units or other equity securities of the Company or any of its Subsidiaries of any kind. Except as set forth on theCapitalization Schedule, there are no agreements or other obligations (contingent or otherwise) which require the Company or any of its Subsidiaries to repurchase or otherwise acquire any units of the Company or other equity securities.

4.05SEC Reports; Financial Statements

(a) The Company and its Subsidiaries have filed all documents required to be filed by them pursuant to the terms of the Exchange Act with the Securities and Exchange Commission (the “SEC”) since January 1, 2004 (collectively, the “SEC Reports”). As of their respective dates, the SEC Reports (i) complied in all material respects with the applicable requirements of the Exchange Act, and (ii) did not contain any untrue statement of a material fact or omit to state a material fact required to be stated therein or necessary to make the statements therein, in light of the circumstances under which they were made, not misleading. For purposes of thisSection 4.05(a), the Company and its Subsidiaries will be deemed to be subject to the periodic reporting requirements of the Exchange Act.

(b) The unaudited balance sheet of the Company and its Subsidiaries as of September 30, 2004 and the related unaudited statements of income and cash flows for the nine month period then ended (such balance sheet referred to herein as the “Latest Balance Sheet”), and the audited balance sheet and audited statements of income and cash flows of the Company and its Subsidiaries for the fiscal year ended December 31, 2003 (the “Audited Balance Sheet”), which in each case are included in the SEC Reports, are, together with the notes thereto, referred to herein as the “Financial Statements.” The Financial Statements have been based upon the information concerning the Company and its Subsidiaries contained in the Company’s and its Subsidiaries’ books and records and present fairly in all material respects the financial condition,

-11-

cash flows, and results of operations of the Company and its Subsidiaries as of the times and for the periods referred to therein in accordance with GAAP (subject, in the case of the unaudited financial statements, to absence of footnotes and to normal year-end adjustments).

(c) The Company and its Subsidiaries have no liabilities or obligations, whether known, unknown, accrued, contingent or otherwise, except (i) as set forth in the attachedUndisclosed Liabilities Schedule, (ii) as and to the extent reflected on, disclosed in, or reserved against in the Latest Balance Sheet or the Audited Balance Sheet, or disclosed in the notes thereto, (iii) for liabilities or obligations that were incurred after the date of the Latest Balance Sheet in the ordinary course of business consistent with past practice that have not had and would not have a Material Adverse Effect, and (iv) for liabilities or obligations which are of the general type relating to the subject matter of the representations and warranties of the Company contained inSections 4.08(b),4.09(c),4.10 (b) and4.15(e).

4.06Absence of Certain Developments. Since the date of the Latest Balance Sheet, there has not been any Material Adverse Effect. Except as set forth on the attachedDevelopments Schedule and except as expressly contemplated by this Agreement, since the date of the Latest Balance Sheet, neither the Company nor any of its Subsidiaries has:

(a) borrowed any amount (other than borrowings from banks or similar financial institutions under credit lines in the ordinary course of business);

(b) mortgaged, pledged or subjected to any Lien any of its material assets, except Permitted Liens;

(c) sold, assigned or transferred any of its tangible material assets, except in the ordinary course of business;

(d) sold, assigned, transferred, or exclusively licensed any material patents, trademarks, trade names, copyrights, trade secrets or other intangible assets, except in the ordinary course of business;

(e) suffered any material extraordinary losses or any material damage or waived any rights of material value;

(f) issued, sold or transferred any of its capital stock or other equity securities, securities convertible into its capital stock or other equity securities or warrants, options or other rights to acquire its capital stock or other equity securities, or any bonds or debt securities;

(g) declared any dividend or distribution in respect of Company Units or any redemption, purchase or other acquisition of any Company Units;

(h) made any commitments to make capital expenditures which shall be in effect as of the Closing in excess of $2,000,000 in the aggregate;

-12-

(i) made any material changes in its employee benefit plans or made any material changes in wages, salary, or other compensation with respect to its officers, directors, or employees, in each case other than changes made in the ordinary course of business or pursuant to existing agreements or arrangements;

(j) paid, loaned or advanced (other than the payment of salary and benefits in the ordinary course of business or payment, advance or reimbursement of expenses in the ordinary course of business) any amounts to, or sold, transferred or leased any of its assets to, or entered into any other agreements or transactions with, any of their Affiliates, or made any loan to, or entered into any other agreement or transaction with, any of its directors or officers outside the ordinary course of business;

(k) entered into any other material agreement or transaction, except in the ordinary course of business;

(l) made any material change in any method of accounting or accounting principles or practice, except for changes required by generally accepted accounting principles, or revalued any material assets, or made any material change in its lending practices, in each case relative to general historical practice;

(m) made material payments or paid material discounts to customers (including distributors) or suppliers, other than in the ordinary course of business consistent with past practice;

(n) commenced or settled any litigation involving an amount in excess of $1,000,000 for any one case; or

(o) committed to do any of the foregoing.

4.07Title to Properties.

(a) The Company or one of its Subsidiaries owns good and marketable title to all of the personal property shown on the Latest Balance Sheet, free and clear of all Liens, except for Permitted Liens.

(b) The real property described on the attachedReal Property Schedule constitutes all of the real property owned by the Company and its Subsidiaries (the “Owned Real Property”). The Company or one of its Subsidiaries owns good and marketable title to the Owned Real Property, free and clear of all Liens, except for Permitted Liens. The real property demised by the leases (the “Leased Real Property”) described on the attachedReal Property Schedule constitutes all of the real property leased by the Company and its Subsidiaries. Except to the extent set forth on the attachedReal Property Schedule, the Leased Real Property leases are in full force and effect, and the Company or a Subsidiary holds a valid and existing leasehold interest under each of the leases. The Company has delivered or made available to Buyer complete and accurate copies of each of the leases described on theReal Property Schedule, and none of the leases has been modified in any material respect, except to the extent that such

-13-

modifications are disclosed by the copies delivered or made available to Buyer. Except to the extent set forth on the attachedReal Property Schedule, neither the Company nor any of its Subsidiaries is in default or other breach in any material respect under any of such leases.

4.08Tax Matters

(a) The Company and its Subsidiaries have filed all federal and all material foreign, state, county and local Tax Returns which are required to be filed by them.

(b) To the Company’s knowledge, (i) all such Tax Returns are true and correct in all material respects, (ii) all Taxes required to have been paid by the Company and its Subsidiaries, whether or not shown on a Tax Return, have been paid, (iii) the provision for Taxes on the Audited Balance Sheet is sufficient for all accrued and unpaid Taxes as of the date thereof and (iv) all material Taxes which the Company or any of its Subsidiaries is obligated to withhold from amounts owing to any employee, creditor or third party have been fully paid or properly accrued. There is no dispute or claim concerning any material Tax liability of the Company or any of its Subsidiaries claimed or raised by any taxing authority in writing. To the Company’s knowledge, no dispute or claim concerning any material Tax liability has been threatened against the Company or any of its Subsidiaries.

(c) The Company and its Subsidiaries have not, within the previous 6 years, received any written notice from any jurisdiction where the Company or one of its Subsidiaries was not then paying Taxes regarding a claim for payment of any Tax to that jurisdiction and where the Company or one of its Subsidiaries has not subsequently filed Tax Returns or paid Taxes. There are no Tax Liens (other than Permitted Liens) on any assets of the Company or any of its Subsidiaries. Neither the Company nor any of its Subsidiaries has waived any statute of limitations in respect of Taxes or agreed to any extension of time with respect to a Tax assessment or deficiency. Neither the Company nor any of its Subsidiaries is a party to any Tax allocation, sharing, indemnity, or similar agreement. Except for Alliance Laundry Corporation, for federal and, other than those states that do not permit any limited liability company to be treated for Tax purposes as a partnership or disregarded entity, state Tax purposes, each of the Company and its Subsidiaries is and has been (for every year for which the applicable statute of limitations remains open) classified as a partnership or a disregarded entity and not treated as a corporation.

4.09Contracts and Commitments.

(a) Except as set forth on the attachedContracts Schedule, neither the Company nor any of its Subsidiaries is party to any: (i) agreement relating to any material business acquisition by the Company or such Subsidiary within the last two years, (ii) collective bargaining agreement or contract with any labor union, (iii) written bonus, pension, profit sharing, retirement or other form of deferred compensation plan, other than as described inSection 4.12 hereof or the schedules relating thereto, (iv) stock purchase, stock option or similar plan, (v) material contract for the employment of any officer, individual employee or other individual on a full-time or consulting basis, (vi) agreement or indenture relating to the borrowing of money (including agreements related to off-balance-sheet financings) or to

-14-

mortgaging, pledging or otherwise placing a Lien (other than Permitted Liens) on any of the Company’s or any Subsidiary’s assets, (vii) guaranty of any obligation for borrowed money or other material guaranty, (viii) lease or agreement under which it is lessee of, or holds or operates any personal property owned by any other party, for which the annual rental exceeds $500,000, (ix) lease or agreement under which it is lessor of or permits any third party to hold or operate any property, real or personal, for which the annual rental exceeds $500,000, (x) contract or group of related contracts with the same party for the purchase of products or services, under which the undelivered balance of such products and services has a selling price in excess of $2,000,000 (other than purchase orders entered into in the ordinary course of business), (xi) contract or group of related contracts with the same party for the sale of products or services under which the undelivered balance of such products or services has a sales price in excess of $2,000,000 (other than purchase orders entered into in the ordinary course of business), (xii) contract which prohibits the Company or any of its Subsidiaries from freely engaging in business anywhere in the world (other than confidentiality agreements entered into in the ordinary course of business), or (xiii) any agreement relating to any interest rate, currency, or commodity derivatives or hedging transaction.

(b) Buyer either has been supplied with, or has been given access to, a true and correct copy of all written contracts which are referred to on theContracts Schedule, together with all material amendments, waivers or other changes thereto.

(c) To the Company’s knowledge, (i) neither the Company nor any Subsidiary is in default or other breach in any material respect under any contract listed on theContracts Schedule, and (ii) the other party to each of the contracts listed on theContracts Schedule is not in default or other material breach thereunder, and each such contract is in full force and effect.

4.10Intellectual Property.

(a) The attachedIntellectual Property Schedule sets forth: (i) all of the patents, internet domain names, registered trademarks, registered service marks, registered copyrights, applications for any of the foregoing and material unregistered trademarks, service marks, trade names, and corporate names owned by the Company or any of its Subsidiaries and used in the conduct of the Company’s and its Subsidiaries’ respective businesses, and (ii) all written licenses or other agreements by which the Company or any of its Subsidiaries grants to, permits, or restricts any third party with respect to the use of any material intellectual property rights and all written licenses or other agreements by which any third party grants to, permits, or restricts the Company or any of its Subsidiaries with respect to the use of any material intellectual property rights (collectively “Intellectual Property Licenses”) (other than commercially available off-the-shelf software purchased or licensed for less than a total cost of $250,000 in the aggregate). The Company and its Subsidiaries are the exclusive owners of the Owned Intellectual Property set forth in Section (a)(i) of the Intellectual Property Schedule and the Trade Secrets owned by the Company or any of its Subsidiaries, free and clear of any Liens, other than Permitted Liens, and the Owned Intellectual Property, together with the Intellectual Property used pursuant to the Intellectual Property Licenses, constitutes all of the Intellectual Property used or held for use in and material to the business.

-15-

(b) The Intellectual Property Licenses shall be covered by the representations ofSection 4.09(c) as if set forth on theContracts Schedule. To the Company’s knowledge and except as set forth on the attachedIntellectual Property Schedule, (i) the conduct of the business of the Company and its Subsidiaries has not, within the previous 2 years, infringed or misappropriated in any material respect the rights of any Person in respect of any Intellectual Property and none of the Company or any Subsidiary has, within the previous 2 years, received any written notice of any such material infringement or misappropriation, and (ii) none of the Intellectual Property used in the business is currently being infringed or misappropriated in any material respect and none of the Company or any Subsidiary has, within the previous 2 years, sent any written notice of any such material infringement or misappropriation.

4.11Litigation. Except as set forth on the attachedLitigation Schedule, there are no actions, suits or proceedings pending or, to the Company’s knowledge, threatened against the Company or any of its Subsidiaries, at law or in equity, or before or by any federal, state, municipal or other governmental department, commission, board, bureau, agency or instrumentality, domestic or foreign, and neither the Company nor any of its Subsidiaries is subject to any outstanding judgment, order, settlement or similar agreement or decree of or with any court or governmental body.

4.12Employee Benefit Plans.

(a) Except as listed on the attachedEmployee Benefits Schedule, with respect to employees of the Company or any of its Subsidiaries, neither the Company nor any such Subsidiary maintains or contributes to any “pension plans” (as defined under Section 3(2) of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”)) (the “Pension Plans”) or “welfare plans” (as defined under Section 3(1) of ERISA) (the “Welfare Plans”). The Pension Plans and the Welfare Plans are collectively referred to as the “Plans.” Each of the Pension Plans that is intended to be qualified under Section 401(a) of the Internal Revenue Code of 1986, as amended (the “Code”), has received a favorable determination letter from the Internal Revenue Service. The Plans comply in form and in operation in all material respects with the requirements of the Code and ERISA.

(b) With respect to the Plans, all required contributions of the Company or any of its Subsidiaries that are due have been timely made. No Pension Plan has any “accumulated funding deficiency” (as defined in Section 412 of the Code). Neither the Company nor any of its Subsidiaries or ERISA Affiliates has incurred or could reasonably be expected to incur any liability to the Pension Benefit Guaranty Corporation (the “PBGC”) (other than with respect to PBGC premiums not yet due), and no proceeding by the PBGC to terminate any Pension Plan has been instituted or threatened.

(c) With respect to each Plan, the Company has furnished to Buyer true and complete copies (as applicable) of (i) the most recent determination letter received from the Internal Revenue Service, (ii) the latest financial statements and the latest prepared actuarial reports, and (iii) the latest Form 5500 annual report.

-16-

(d) Except as listed on the attachedEmployee Benefits Schedule, neither the Company nor any of its Subsidiaries or ERISA Affiliates is a participant in or has within the past six years contributed to any multi-employer plan within the meaning of Section 3(37) of ERISA. Each Welfare Plan that is subject to the requirements of Section 4980B of the Code has been maintained in compliance in all material respects with such requirements.

(e) There is no material action, suit, investigation, audit or proceeding pending against or involving or, to the Company’s knowledge, threatened against or involving any Plan before any court or arbitrator or any governmental body.

4.13Insurance. The attachedInsurance Schedule lists each material insurance policy maintained by the Company and its Subsidiaries. All such insurance policies are in full force and effect, all premiums due within the previous two years have been timely paid and to the Company’s knowledge, neither the Company nor any of its Subsidiaries is in default with respect to its obligations under any such insurance policies. Other than the Company’s existing directors and officers liability insurance policy and existing fiduciary liability insurance policy, both of which will terminate upon a change in control of the Company, the Company does not know of any threatened termination or material modification or premium increase with respect to such policies. As of the date hereof, no claims for insurance coverage have been denied (other than customary reservations of rights) with respect to any of the matters set forth on theLitigation Schedule for which the Company or one of its Subsidiaries has made a claim for insurance coverage.

4.14Compliance with Laws. Except as set forth on the attachedCompliance Schedule: (a) the Company and each of its Subsidiaries is in compliance with all applicable laws, regulations, permits and other authorizations of foreign, federal, state and local governments and all agencies thereof, except where the failure to comply would not have a Material Adverse Effect; and (b) no investigation or review by any governmental authority with respect to the Company or any of its Subsidiaries is pending or, to the knowledge of the Company, threatened.

4.15Environmental Compliance and Conditions. Except as set forth on the attachedEnvironmental Compliance Schedule:

(a) The Company and its Subsidiaries have obtained and possess all material permits, licenses and other authorizations required under federal, state and local laws and regulations concerning worker health and safety and pollution or protection of the environment as in effect on or prior to the Closing Date, including all such laws and regulations relating to the emission, discharge, release or threatened release of any chemicals, petroleum, pollutants, contaminants or hazardous or toxic materials, substances or wastes (including asbestos) (“Hazardous Materials”) into ambient air, surface water, groundwater or lands or otherwise relating to the manufacture, processing, distribution, use, treatment, storage, disposal, transport or handling of, or exposure to, any chemicals, petroleum, pollutants, contaminants or hazardous or toxic materials, substances or waste (“Environmental and Safety Requirements”), except where the failure to possess such licenses, permits and authorizations would not reasonably be expected to have a Material Adverse Effect.

-17-

(b) The Company and its Subsidiaries are, and for the previous 3 years have been, in material compliance with all terms and conditions of all permits, licenses and authorizations described inSection 4.15(a) hereof and also are, and for the previous 3 years have been, in material compliance with all other Environmental and Safety Requirements.

(c) Except for liabilities that arise in the ordinary course of business that have not had and would not have a Material Adverse Effect, neither the Company nor any Subsidiary has, within the past 5 years, received any written notice of violations or material liabilities arising under Environmental and Safety Requirements, including any investigatory, remedial or corrective obligation, relating to the Company, its Subsidiaries or their facilities and arising under Environmental and Safety Requirements.

(d) Except for liabilities that arise in the ordinary course of business that have not had and would not have a Material Adverse Effect, the Company and its Subsidiaries have not caused or taken any action (including releases by the Company and its Subsidiaries of Hazardous Substances at any property currently or formerly owned, operated or used by the Company and its Subsidiaries) that has resulted or would reasonably be expected to result in a material liability or material obligation to the Company or any of its Subsidiaries under Environmental and Safety Requirements.

(e) Except for liabilities that arise in the ordinary course of business that have not had and would not have a Material Adverse Effect, to the Company’s knowledge, no Person (other than the Company and its Subsidiaries) has caused or taken any action (including releases of Hazardous Substances at any property currently or formerly owned, operated or used by the Company and its Subsidiaries) that has resulted or would reasonably be expected to result in a material liability or material obligation to the Company or any of its Subsidiaries under Environmental and Safety Requirements.

4.16Affiliated Transactions. Except as set forth on the attachedAffiliated Transactions Schedule, to the Company’s knowledge, no officer, director, member, beneficial owner of such member, or Affiliate of the Company or any individual in such officer’s, director’s, member’s, beneficial owner of any such member’s, or Affiliate’s immediate family is (or owns a 5% or greater ownership interest in or serves as an officer or director of any Person that is) a party to any material agreement, contract, commitment or transaction with the Company or its Subsidiaries or has any material interest in any property used or held for use by the Company or its Subsidiaries, other than transactions with portfolio companies of investment funds managed or advised by Bain Capital Partners, LLC or Bruckmann, Rosser, Sherrill & Co. or their respective Affiliates that are no less favorable to the Company and its Subsidiaries than terms that would be obtained from an unaffiliated third party.

4.17Powers of Attorney; Bank Accounts. The attachedPowers of Attorney Schedule lists (a) the names of all Persons holding powers of attorney on behalf of the Company or any of its Subsidiaries; and (b) the names of all banks and other financial institutions in which the Company or any of its Subsidiaries currently has an account or deposit, along with the account numbers and the names of all Persons authorized to draw on such accounts or deposits.

-18-

4.18Customers and Suppliers. The attachedCustomers and Suppliers Schedule contains a complete and accurate list of (a) the ten largest customers (including distributors) of the Company and its Subsidiaries (based on 2003 sales), together with the volume of the sales made to such customers during 2003, and (b) the ten largest suppliers to the Company and its Subsidiaries (based on 2003 purchases), together with the volume of the purchases made from such suppliers during 2003. To the Company’s knowledge, no customer or supplier listed on the attachedCustomers and Suppliers Schedule has indicated to the Company that the dollar volume of business it intends to conduct with the Company and its Subsidiaries in calendar year 2005 will be substantially less than the dollar volume of business conducted with it in calendar year 2004 (other than, in the case of suppliers, with respect to business relating to carbon or stainless steel).

4.19Employment and Labor Matters. To the Company’s knowledge, (a) there are no material disputes pending or threatened between the Company or any of its Subsidiaries and any of their employees, (b) there are no current union representation questions involving employees of the Company, and (c) no senior executive employee of the Company or any of its Subsidiaries has, within the past six months, indicated to the Company or any of its Subsidiaries in writing any intention to terminate his or her employment with the Company or any such Subsidiary.

4.20Brokerage. Except for the fees and expenses of Lehman Brothers, Inc. (which, except for the fees and expenses to be paid in connection with the Debt Commitment Letters, will be paid by the Sellers or, at or prior to the Closing, by the Company resulting in a reduction of Cash on Hand or an increase in Indebtedness), there are no claims for brokerage commissions, finders’ fees or similar compensation in connection with the transactions contemplated by this Agreement based on any arrangement or agreement made by or on behalf any Seller or of the Company.

ARTICLE 5

REPRESENTATIONS AND WARRANTIES OF BUYER

Buyer represents and warrants to the Sellers and the Company, as of the date hereof and as of the Closing Date, as follows:

5.01Organization and Power. Buyer is a corporation duly organized, validly existing and in good standing under the laws of the state of its organization, with full corporate power and authority to enter into this Agreement and perform its obligations hereunder.

5.02Authorization; Valid and Binding Agreement. The execution, delivery and performance of this Agreement by Buyer and the consummation of the transactions contemplated hereby have been duly and validly authorized by all requisite action (including corporate action), and no other proceedings (including corporate proceedings) on their part are necessary to authorize the execution, delivery or performance of this Agreement. Assuming that this Agreement is a valid and binding obligation of the Sellers and the Company, this Agreement constitutes a valid and binding obligation of Buyer, enforceable in accordance with its terms.

-19-

5.03No Breach. Buyer is not subject to or obligated, to the extent applicable, under its articles of incorporation, its bylaws, any applicable law, or rule or regulation of any governmental authority, or any material agreement or instrument, or any license, franchise or permit, or any order, writ, injunction or decree, which would be breached or violated in any material respect by execution, delivery or performance of this Agreement.

5.04Consents, etc. Except for the applicable requirements of the HSR Act, Buyer is not required to submit any notice, report or other filing with any governmental authority in connection with the execution, delivery or performance by it of this Agreement or the consummation of the transactions contemplated hereby. No consent, approval or authorization of any governmental or regulatory authority or any other party or Person is required to be obtained by Buyer in connection with its execution, delivery and performance of this Agreement or the consummation of the transactions contemplated hereby.

5.05Litigation. There are no actions, suits or proceedings pending or, to Buyer’s knowledge, overtly threatened against or affecting Buyer at law or in equity, or before or by any federal, state, municipal or other governmental department, commission, board, bureau, agency or instrumentality, domestic or foreign, which would adversely affect Buyer’s performance under this Agreement or the consummation of the transactions contemplated hereby.

5.06Brokerage. There are no claims for brokerage commissions, finders’ fees or similar compensation in connection with the transactions contemplated by this Agreement based on any arrangement or agreement made by or on behalf of Buyer.

5.07Investment Representation. Buyer is acquiring the Company Units for its own account with the present intention of holding such securities for investment purposes and not with a view to or for sale in connection with any public distribution of such securities in violation of any federal or state securities laws. Buyer is an “accredited investor” as defined in Regulation D under the Securities Act. Buyer acknowledges that it is informed as to the risks of the transactions contemplated hereby and of ownership of the Company Units.

5.08Financing. Buyer has obtained debt financing commitment letters (the “Debt Commitment Letters”), copies of which have been delivered to the Seller Representative on the date hereof, which copies have been initialed by Buyer and the Seller Representative, and an equity financing commitment letter (the “Equity Commitment Letter”), a copy of which has been delivered to the Seller Representative on the date hereof, which copy has been initialed by Buyer and the Seller Representative, from responsible financial institutions and investors providing for, subject to certain conditions set forth therein, commitments to provide all funds necessary to consummate the transactions contemplated hereby (including any “market flex” terms). As of the date hereof, the Debt Commitment Letters (together with the ancillary documents referenced therein or delivered to Sellers’ counsel) constitute all of the agreements entered into between Lehman Brothers, Inc. and/or its Affiliates and Buyer and its Affiliates with respect to the financing arrangements contemplated thereby. Buyer has no knowledge, as of the date hereof, that such available cash shall not be available or that the debt and equity

-20-

commitments shall not be funded, and Buyer has not made any material misrepresentation with respect to Buyer in connection with obtaining such debt and equity financing commitments.

ARTICLE 6

PRE-CLOSING COVENANTS

6.01Conduct of the Business.

(a) From the date hereof until the Closing Date, except as set forth on the attachedConduct of Business Schedule, the Company shall use its commercially reasonable efforts to carry on its and its Subsidiaries’ business according to its ordinary course of business and substantially in the same manner as heretofore conducted (including with respect to general historical practices relating to off balance sheet financing matters, and which may include using available cash to repay any Indebtedness prior to the Closing).

(b) From the date hereof until the Closing Date, except as otherwise provided for by this Agreement or consented to in writing by Buyer, the Company shall not, and shall not permit any of its Subsidiaries to (i) issue or sell any of its units or any of its Subsidiaries’ capital stock or equity securities, (ii) issue or sell any securities convertible into, or options with respect to, warrants to purchase or rights to subscribe for any of its units or any shares of its Subsidiary’s capital stock or equity securities, (iii) effect any merger, recapitalization, reclassification, stock dividend, stock split or like change in its capitalization, (iv) amend the LLC Agreement or any of its Subsidiaries’ certificate or articles of incorporation or bylaws (or equivalent organizational documents), (v) make any redemption or purchase of any of its units or any shares of its Subsidiary’s capital stock or equity securities, (vi) except for Tax distributions, declare, set aside, or pay any distributions (whether payable in property or securities) with respect to its equity capital, (vii) liquidate, wind up or dissolve (or suffer any liquidation or dissolution), (viii) modify, in any material respect and in comparison to its general historical practice, its lending policies or other material policies relating to the sale and purchase of loans to its off balance-sheet funding entities, or (xi) agree or commit to do any of the foregoing.

(c) From the date hereof until the Closing Date, except as otherwise consented to in writing by Buyer, such consent not to be unreasonably withheld or delayed, the Company shall not, and shall not permit any of its Subsidiaries to, make loans to customers which the Company reasonably believes are not or will not be qualified for sale under the Company’s off balance sheet financing arrangements.

6.02Access to Books and Records. From the date hereof until the Closing Date, the Company shall provide Buyer and its authorized representatives (“Buyer’s Representatives”) with access as deemed reasonable by the Company and the Buyer at all reasonable times and upon reasonable notice to the offices, properties, personnel, books and records of the Company and its Subsidiaries (including subsequent monthly financial statements) in order for Buyer to have the opportunity to make such investigation as it shall reasonably desire to make of the affairs of the Company and its Subsidiaries (except that Buyer shall conduct no environmental sampling or testing of the sort commonly referred to as a Phase II Environmental

-21-

Investigation). The general terms of any such access shall be coordinated through Lehman Brothers, Inc. or Kirkland & Ellis LLP (it being understood that the Buyer will have reasonable access to members of senior management for the purposes of negotiating terms of the financing contemplated by the Debt Commitment Letters without any further coordination from Kirkland & Ellis LLP or Lehman Brothers, Inc.). Buyer acknowledges that it is and remains bound by the Confidentiality Agreement, dated September 22, 2004, between Ontario Teachers’ Pension Plan Board and Lehman Brothers, Inc., as representative of Alliance Laundry Holdings, Inc. (the “Confidentiality Agreement”).

6.03Regulatory Filings.

(a) The Company (and the Sellers, if applicable) shall make or cause to be made all filings and submissions under the HSR Act and any other material laws or regulations applicable to the Company and its Subsidiaries for the consummation of the transactions contemplated herein, such filings and submissions to be made promptly (and in the case of the initial HSR Act filing, as promptly as reasonably practicable, but in any event not later than 10 business days from the date hereof). Subject to applicable laws relating to the exchange of information, Buyer shall have the right to review in advance, and to the extent practicable will consult with the Company on, all the information that appears in any such filings. In exercising the foregoing right, Buyer shall act reasonably and as promptly as practicable.

(b) The Company shall keep Buyer apprised of the status of all filings and submissions referred to inSection 6.03(a), including promptly furnishing Buyer with copies of notices or other communications received by the Company in connection therewith. The Company shall not permit any of its officers, employees or other representatives or agents to participate in any meeting with any governmental authority in respect of such filings and submissions unless it consults with Buyer in advance and, to the extent permitted by such governmental authority, gives Buyer the opportunity to attend and participate thereat.

(c) If any administrative or judicial action or proceeding is instituted (or threatened to be instituted) to prohibit the transactions contemplated by this Agreement, the Company shall use its reasonable efforts to avoid the institution of any such action or proceeding and to contest and resist any such action or proceeding and to have vacated, lifted, reversed or overturned any temporary, preliminary or permanent decree, judgment, injunction or other order that is in effect and that prohibits, prevents, delays or restricts consummation of the transactions contemplated hereby (it being understood that the foregoing obligation of the Company will cease in the event a permanent decree, judgment, injunction or other order is issued or is in effect that is non-appealable and prohibits, prevents, delays or restricts consummation of the transactions contemplated hereby).

6.04Conditions. The Company shall, and shall cause its Subsidiaries to, use commercially reasonable efforts to cause the conditions set forth inSection 2.01 hereof to be satisfied and to consummate the transactions contemplated herein. Without limiting the foregoing, the Company shall, and shall cause its Subsidiaries to, use commercially reasonable efforts to cooperate with Buyer by (i) providing reasonable assistance in the preparation of customary information packages and customary offering materials, and (ii) requiring their senior

-22-