UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

|

| | |

| þ | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12 |

Westmoreland Coal Company

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box): |

| | | | |

| þ | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | | | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | (5) | | Total fee paid: |

| | | | |

|

| | | | |

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | | | |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | | | |

| | (3) | | Filing Party: |

| | | | |

| | (4) | | Date Filed: |

Westmoreland Values

Our Vision, Mission, and Values reflect who we are

and what we stand for as a company.

|

|

Our Vision

To deliver the premium value in the coal industry. |

|

| | |

Our Mission

Westmoreland Coal Company is dedicated to diligently applying our mining expertise to attain economic advantages.

• Leverage unique operations• Maximize transportation advantages• Identify and develop niche reserves• Cultivate unique partnerships• Sustain efficiency and standardization

| | |

| | Our Values

Our decisions and practices are guided by the values below. They are the core to who we are and how we behave as a company.

To excel at the pillars of coal mining by: • Environmental stewardship• State-of-the-art mining techniques

To exceed partner expectations by: • Fair and collaborative approach• Community and tribal partnerships• Delivery of shareholder value• Agile and responsive interactions• Commitment focused - we do what we say

To maintain a foundation of integrity by: • Honest, transparent, and respectful communication• Highest legal and ethical standards• Pride in our work and our company• Dedication to diversity - respect and honor all |

| |

| |

| | |

| |

| �� | |

2014: A Year of Growth for Westmoreland Coal Company

Westmoreland Coal Company had a whole new look by the end of 2014. We closed the acquisition of six surface mines in Canada, along with interests in activated carbon facilities and a char plant. We moved quickly to integrate the new mines into the Westmoreland family by combining our procurement, human resource and legal teams. We successfully aligned the accounting and financial reporting of our U.S. and Canadian mines to streamline cross-border information exchange. After a successful public offering of Westmoreland common stock, we continued to grow with our acquisition of the general partner of Oxford Resource Partners, LP, which marked our entry into the master limited partnership space. To finish off the year, we also acquired Buckingham Coal Company to increase our presence in northern Appalachia and, on a small scale, return to our historic roots of underground mining. By the end of 2014, we had increased our workforce from 1,370 employees to 3,440. We increased our total proven or probable coal reserves by approximately 750 million tons and approximately doubled annual production on a proforma basis.

WESTMORELAND COAL COMPANY

9540 S. Maroon Circle, Suite 200

Englewood, Colorado 80112

April [ ], 2016

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Westmoreland Stockholders:

We invite you to join us for the 2015 Annual Meeting of Stockholders of Westmoreland Coal Company, which will once again be held as a virtual meeting. You will be able to attend the 2015 Annual Meeting, vote, and submit your questions during the meeting via live webcast by visiting www.virtualshareholdermeeting.com/WLB2015. Be sure to have your 12-Digit Control Number to enter the meeting. The Annual Meeting of Stockholders of Westmoreland Coal Company will be held via the Internet on Tuesday, May 19, 2015 at 8:30 a.m. Mountain Daylight Time, for the following purposes:

| |

| 1. | The election of eight directors to the Board of Directors to serve for a one-year term; |

| |

| 2. | Advisory approval of Westmoreland Coal Company's executive compensation; |

| |

| 3. | The ratification of the appointment of Ernst & Young LLP as principal independent auditor for fiscal year 2015; |

| |

| 4. | Vote on the ratification of certain amendments to Westmoreland Coal Company's Certificate of Incorporation; |

| |

| 5. | Vote on a shareholder proposal, if properly presented at the Annual Meeting of Stockholders; and |

| |

| 6. | To transact such other business as may properly come before the meeting or any postponement or adjournment thereof. |

Only stockholders of record at the close of business on April 14, 2015 will be entitled to notice of and to vote at the meeting and any postponement or adjournment thereof.

YOUR VOTE IS IMPORTANT. Whether or not you plan to attend the annual meeting, we hope you will vote as soon as possible. You may vote by proxy over the Internet or by telephone, or, if you received paper copies of the proxy materials, you can also vote by mail by following the instructions on the proxy card or voting instruction card. Voting over the Internet, by telephone or by written proxy or voting instruction card will ensure your representation at the annual meeting regardless of whether you attend.

This proxy statement, the annual report to stockholders and the proxy voter card are being mailed on or about April 24, 2015.

|

| | |

| | By Order of the Board of Directors, | |

| | | |

| | By Order of the Board of Directors, Jennifer S. Grafton SVP, Chief Administrative Officer and Secretary | |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE STOCKHOLDER MEETING TO BE HELD ON MAY 19, 2015.

This notice, the accompanying proxy statement and Westmoreland Coal Company's annual report to stockholders for the fiscal year ended December 31, 2014 are available at www.proxyvote.com.

PROXY SUMMARY

We provide below highlights of certain information in this proxy statement. As it is only a summary, please review the complete proxy statement and 2014 annual report before you vote.

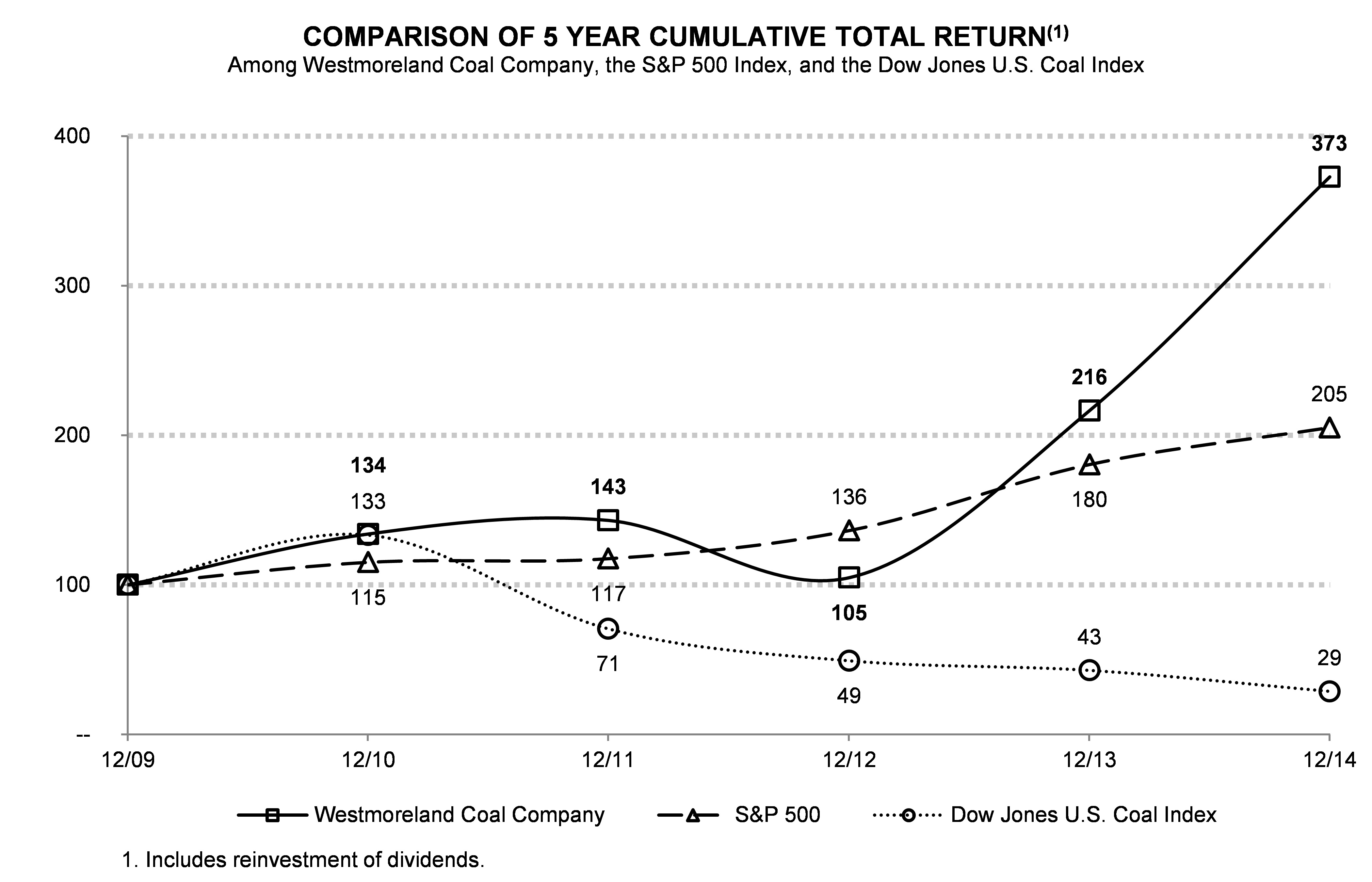

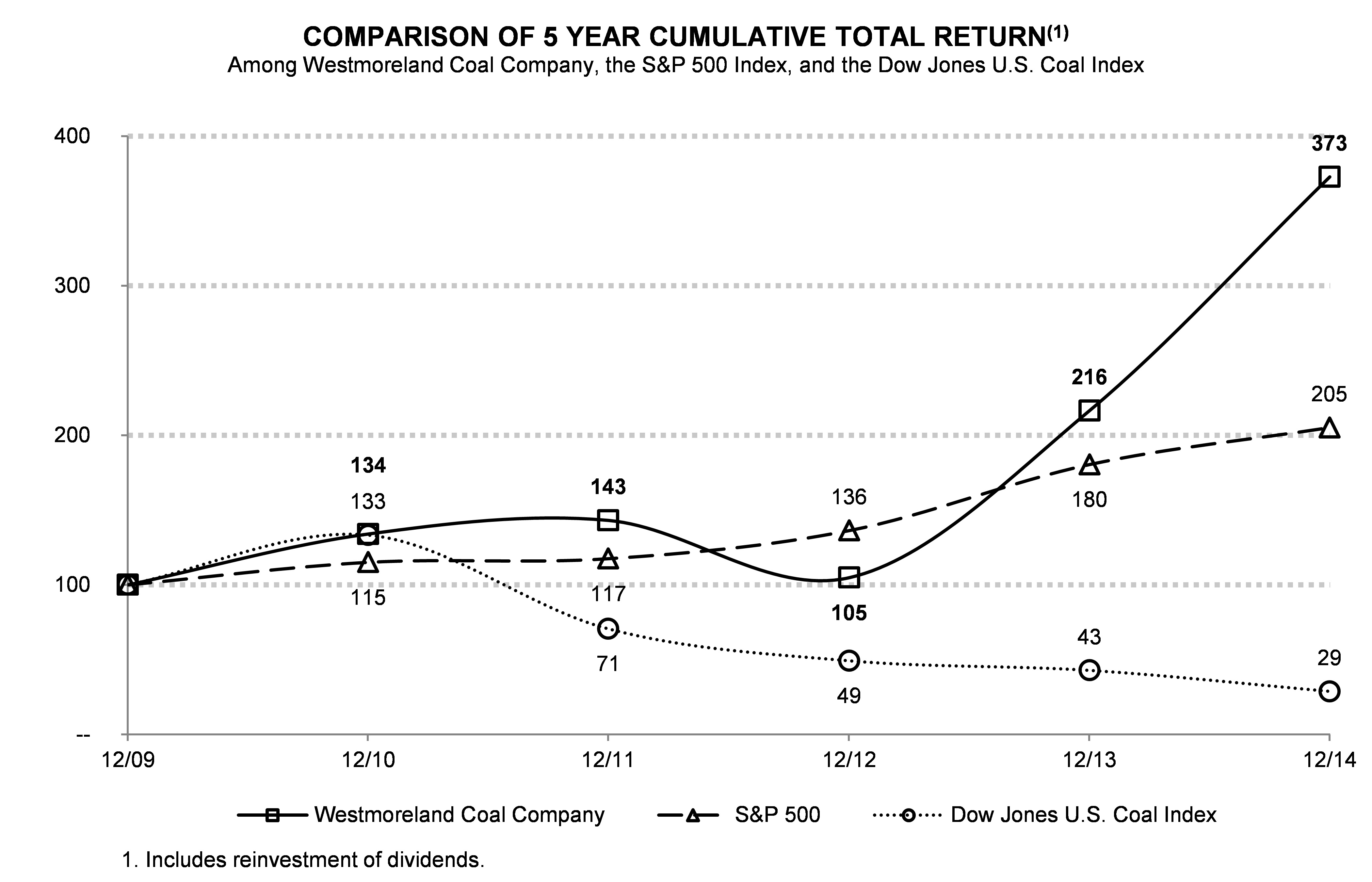

2014 Westmoreland Performance Highlights

After years of hard work, Westmoreland was in a position to take advantage of unique market opportunities resulting in 2014 being a year of growth. The following are key highlights from fiscal year 2014:

| |

| • | After signing the purchase agreement in late 2013, we completed the acquisition of six active surface coal mines in Canada that diversified us into a favorable mining jurisdiction and additional business lines, such as activated carbon and char, as well as the creation of our first true export market capacity. To accomplish all this, we successfully set up a bridge loan to facilitate the raise of $425 million in senior add-on bonds, which also allowed for the prepayment of debt previously held by our subsidiary Westmoreland Mining LLC; |

| |

| • | We amended our existing revolving credit facility with The PrivateBank and Trust Company to add Bank of the West as a lender and to increase the maximum available borrowing capacity to $50 million, which may be increased to $100 million and can be used for borrowings and letters of credit, which was further amended in connection with our December refinancing; |

| |

| • | Our new Canadian corporate office took to the Westmoreland way and, in the midst of a relocation of our entire office in Edmonton, we accomplished a consolidation of all Canadian accounting and finance, and a cross border integration of our procurement, human resources and legal teams; |

| |

| • | Our labor specialists and local mine teams successfully negotiated union contract extensions at our Coal Valley and Poplar River mines in Canada and our Beulah mine in the United States; |

| |

| • | We completed a public offering of Westmoreland common stock that raised approximately $60 million for general corporate purposes and increased our overall financial flexibility in order to pursue organic and acquisition growth strategies; |

| |

| • | We monetized our port capacity agreement with Westshore Terminals in British Columbia in favor of a new supply chain collaboration with Ridley Terminals in British Columbia and CN Railroad that supports our export coal mine; |

| |

| • | We entered into long term extensions on coal supply agreements with Saskatchewan Power Corporation at our Estevan Mine in Saskatchewan, Canada, and with FMC Corporation and Tata Chemicals North America Inc. at our Kemmerer Mine in Wyoming; |

| |

| • | We agreed to invest with our partner Cabot Corporation in our activated carbon plant in Estevan, Saskatchewan, to approximately double the operation's capacity by 2017; |

| |

| • | At the end of the year, we entered the MLP space through an acquisition of Oxford Resources GP, LLC, the general partner of Oxford Resource Partners, LP, and as a result of several related transactions we now own approximately 79% of Oxford Resource Partners, LP, which has been renamed Westmoreland Resource Partners, LP ("WMLP" and such series of transactions the "WMLP Transactions"); |

| |

| • | At the same time as our entry into the MLP space, we refinanced and restructured our debt, previously consisting of 10.75% senior secured notes, and now split between a term loan and 8.75% senior secured notes. At the same time, we restructured $175 million in existing debt at the WMLP level. Our revolving credit agreement was also renegotiated to fit our new structure, as described above; |

| |

| • | In December, we announced the redemption of our Series A preferred stock that closed early in 2015 ending our dividend obligation with respect to that equity; and |

| |

| • | At the very end of the year, we completed the acquisition of Buckingham Coal Company, LLC, an underground mine, which ultimately closed on January 1, 2015. |

See page 42 for information about reconciliation of non-GAAP financial measures.

Corporate Governance Highlights

At Westmoreland Coal Company, good governance remains a critical component of our corporate culture. Several of our key governance strengths and actions are noted in the table below.

|

| |

| BOARD AND OTHER GOVERNANCE INFORMATION | 2014* |

| Size of Board | 8 |

| Number of Independent Directors | 7 |

| Diverse Board (as to Gender, Experience and Skills) | Yes |

| Annual Election of All Directors | Yes |

| Majority Voting for Directors | Yes |

| Separate Chairman & CEO | Yes |

| Independent Directors Meet Without Management Present | Yes |

| Annual Board Self-Evaluation Conducted by Independent Third-Party | Yes |

| Annual Equity Grant to Non-Employee Directors | Yes |

| Board Orientation Program | Yes |

| Code of Business Conduct and Ethics for Directors | Yes |

| Corporate Governance Guidelines for Directors | Yes |

| Annual Advisory Approval of Executive Compensation | Yes |

| Policy Prohibiting Use of Corporate Funds for Political Expenditures | Yes |

_____________________

* As of April 16, 2015

Meeting Agenda Items

Item 1-Election of Directors - Our board recommends a vote FOR the election of the director candidates nominated by the board.

You are being asked to elect eight directors. Each of our current directors is standing for reelection to hold office until the next annual meeting of stockholders and until his or her successor is duly elected and qualified. All directors attended greater than 86% of the meetings of the board and board committees on which they served in 2014, with six directors attending 100%.

SUMMARY INFORMATION ABOUT OUR DIRECTOR NOMINEES

|

| | | | | | | | |

| | | AGE | | DIRECTOR SINCE | | OCCUPATION AS OF 3/24/14 | | INDEPENDENT |

| Keith E. Alessi | | 60 | | 2007 | | Chief Executive Officer, Westmoreland Coal Company | | |

| Terry J. Bachynski | | 57 | | 2014 | | Natural Resource Consultant in Canada | | X |

| Gail E. Hamilton | | 65 | | 2011 | | Retired IT Executive | | X |

| Michael G. Hutchinson | | 59 | | 2012 | | Retired Audit Partner, Deloitte & Touche | | X |

| Richard M. Klingaman | | 79 | | 2006 | | Retired Energy Industry Consultant | | X |

| Craig R. Mackus | | 63 | | 2013 | | Retired Equipment Manufacturer CFO | | X |

| Jan B. Packwood | | 71 | | 2011 | | Retired Public Utility CEO | | X |

| Robert C. Scharp | | 68 | | 2011 | | Retired Coal Industry Executive | | X |

Item 2-Advisory Approval of Our Executive Compensation - Our board recommends a vote FOR this proposal.

We are asking stockholders to approve on an advisory basis the compensation of our named executive officers, who are discussed in more detail in the Compensation Discussion and Analysis, which starts on page 16. We hold this advisory vote on an annual basis.

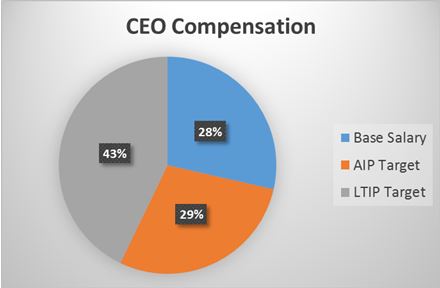

SUMMARY INFORMATION ON OUR EXECUTIVE COMPENSATION PROGRAM

Our executive compensation program is designed to reward our leadership team for delivering results and building long-term value. We believe our program's performance measures align the interests of our stockholders and senior executives by tying pay outcomes to our short- and long-term performance. Several important features of our executive compensation program are:

| |

| ü | No employment agreements for executive officers; all executive officers are at-will employees, subject to certain rights to which they are entitled in the event that they are terminated in connection with a change of control of our business; |

| |

| ü | No company aircraft or company-provided vehicles, other than vehicles used at mine operation sites; |

| |

| ü | No SERPS, defined benefit plans or other executive-only retirement plans; |

| |

| ü | Our long-term incentive awards included performance-vested restricted stock units whose value is based on achievement of three-year targets; and |

| |

| ü | We require our executive officers to have significant ownership of company stock. |

Westmoreland also has a strong history of setting executive compensation at levels that shareholders approve of:

|

| |

| Say on Pay Vote |

| Annual Stock Holder Meeting | Approval Percentage |

| 2014 | 98.73% |

| 2013 | 98.49% |

| 2012 | 97.02% |

| 2011 | 99.20% |

For more information on our compensation programs, total compensation in 2014 and our compensation philosophy, see our Compensation Discussion and Analysis that starts on page 16.

Item 3-Ratification of Appointment of Ernst & Young LLP for 2015 - Our board recommends a vote FOR this proposal.

Ernst & Young LLP has been our independent registered public accounting firm since 2009. The fees paid to Ernst & Young LLP are detailed on page 37. One or more representatives of Ernst & Young LLP will be present at the meeting, will be given the opportunity to make a statement if they desire to do so, and will be available to respond to appropriate questions.

Item 4-Approval of certain amendments to Westmoreland Coal Company's Certificate of Incorporation - Our board recommends a vote FOR this proposal.

We are asking stockholders to approve certain amendments to our Certificate of Incorporation, which are discussed in more detail in our changes to Certificate of Incorporation section on page 38.

Item 5-Vote on a shareholder proposal, if properly presented at the Annual Meeting of Stockholders - Our board recommends a vote AGAINST this proposal.

We are asking stockholders to vote against the proxy access shareholder proposal submitted by the Comptroller of the City of New York, Scott M. Stringer, on behalf of the New York City Employees’ Retirement System, the New York City Fire Department Pension Fund, the New York City Teachers’ Retirement System, the New York City Police Pension Fund and the New York City Board of Education Retirement System, which is discussed in more detail in the shareholder proposal and our corresponding statement of opposition section beginning on page 39.

PROXY STATEMENT

Table of Contents

WESTMORELAND COAL COMPANY

9540 S. Maroon Circle, Suite 200

Englewood, Colorado 80112

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

To be held May 19, 2015

GENERAL INFORMATION ABOUT THE 2015 ANNUAL MEETING OF STOCKHOLDERS

This proxy statement is being furnished by the Board of Directors (the “Board”) of Westmoreland Coal Company (the “Company”) to holders of our common stock and depositary shares in connection with the solicitation by the Board of proxies to be voted at the Annual Meeting of Stockholders of Westmoreland Coal Company (the “Annual Meeting”). The Annual Meeting will be held via the Internet on Tuesday, May 19, 2015 at 8:30 a.m. Mountain Daylight Time, for the purposes set forth in the accompanying Notice of Annual Meeting and this proxy statement.

This proxy statement and the enclosed proxy voter card relating to the Annual Meeting are first being mailed to stockholders on or about April 24, 2015. As of April 2, 2015, the Company's officers and directors are the record and beneficial owners of a total of 612,104 shares (approximately 3.41%) of the Company's outstanding common stock. It is management's intention to vote all of its shares in the manner recommended by the Board for each matter to be considered by the stockholders.

QUESTIONS AND ANSWERS ABOUT THE 2015 ANNUAL MEETING OF STOCKHOLDERS

What is a Virtual Annual Meeting?

A virtual annual meeting of stockholders is an official annual meeting held over the Internet that offers the ability to verify attendance and provides an interactive element that allows for real-time voting in a secure environment. The virtual meeting also enables two-way engagement, allowing stockholders to ask questions of corporate officers and directors. The virtual meeting provides Westmoreland a low-cost way for stockholders to attend and interact with management, and has the potential to increase participation and reduce costs associated with meeting facilities and travel.

Westmoreland will be hosting the 2015 Annual Meeting live via the Internet. A summary of the information you need to attend the meeting online is provided below:

| |

| • | Any stockholder can attend the 2015 Annual Meeting live via the Internet at www.virtualshareholdermeeting.com/WLB2015; |

| |

| • | Webcast starts at 8:30 a.m. Mountain Time; |

| |

| • | Stockholders may vote and submit questions while attending the Annual Meeting on the Internet; |

| |

| • | Please have your 12-Digit Control Number to enter the Annual Meeting; |

| |

| • | Instructions on how to attend and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at www.virtualshareholdermeeting.com/WLB2015; and |

| |

| • | Webcast replay of the Annual Meeting will be available until May 19, 2016. |

Who can vote at the meeting?

Only common stockholders who were owners of record at the close of business on April 14, 2015 are entitled to vote. Each holder of common stock is entitled to one vote per share. There were [l] shares of common stock outstanding on April 14, 2015.

What constitutes a quorum for the meeting?

The holders of a majority of the aggregate voting power of the common stock and depositary shares outstanding on the record date, present in person or by proxy at the Annual Meeting, shall constitute a quorum to conduct business at the Annual Meeting. Abstentions and “broker non-votes” (shares held by a broker or nominee that does not have discretionary authority to vote on a particular matter and has not received voting instructions from its client) are counted for purposes of determining the presence or absence of a quorum for the transaction of business at the Annual Meeting.

How do I vote?

| |

| • | Via the Internet at www.proxyvote.com; |

| |

| • | By phone for registered and beneficial owners at 1-800-690-6903; or |

| |

| • | By completing and mailing in a paper proxy card. |

If your shares are registered directly in your name with our transfer agent, you are considered a stockholder of record with respect to those shares and the proxy card and voting instructions have been sent directly to you. If, like most stockholders, you hold your shares in “street name” through a stockbroker, bank or other nominee rather than directly in your own name, you may not vote your shares in person at the Annual Meeting without obtaining authorization from your stockbroker, bank or other nominee. You need to submit voting instructions to your stockbroker, bank or other nominee in order to cast your vote.

We encourage you to register your vote via the Internet. If you attend the virtual Annual Meeting, you may also submit your vote in person over the Internet and any votes that you previously submitted - whether via the Internet, by phone or by mail - will be superseded by the vote that you cast at the Annual Meeting. Whether your proxy is submitted by the Internet, by phone or by mail, if it is properly completed and submitted and if you do not revoke it prior to the Annual Meeting, your shares will be voted at the Annual Meeting as specified by you or, if you do not specify a choice as to a particular matter, in the manner set forth in this proxy statement.

If you have additional questions, need assistance in submitting your proxy or voting your shares of our Common Stock, or need additional copies of the Proxy Statement or the enclosed proxy card, please contact Alliance Advisors LLC.

Alliance Advisors LLC

200 Broadacres Drive, 3rd Floor, Bloomfield, NJ 07003

855-325-6676

Banks and Brokers Call: (973) 873-7700

Can I change my vote after I return my proxy card?

Yes. Even after you have submitted your proxy card, you may change your vote at any time before the proxy is exercised by either filing with our Secretary a written notice of revocation or a duly executed proxy card bearing a later date or by voting in person at the Annual Meeting. The powers of the proxy holders will be suspended if you attend the Annual Meeting in person and so request. However, attendance at the virtual Annual Meeting will not, by itself, revoke a previously granted proxy. If you want to change or revoke your proxy and you hold your shares in “street name,” contact your broker or the nominee that holds your shares. Any written notice of revocation sent to us must include the stockholder's name and must be received prior to the Annual Meeting to be effective.

What vote is required to approve each item?

Under our bylaws, which were amended and restated in February 2015, we have a majority vote standard for election of directors. In an uncontested election, each director will be elected by a vote of the majority of the votes cast, meaning the number of shares cast “for” a director exceeds the number of votes cast “against” that director. In a contested election, the directors will be elected by a plurality of the votes cast, meaning the directors receiving the largest number of “for” votes will be elected to the open positions. With respect to Proposal 1, regardless of whether the majority of votes cast or plurality standard applies, broker non-votes, abstentions and withheld votes will have no effect because such votes are not treated as being cast.

In an uncontested election, a nominee who does not receive a majority vote will not be elected. An incumbent director who is not elected because he or she does not receive a majority vote will continue to serve as a holdover director until the earliest of: (a) 90 days after the date on which the election inspector determines the voting results as to that director, (b) the date on which the Board appoints an individual to fill the office held by that director, or (c) the date of that director's resignation.

Approval of Proposals 2, 4 and 5, requires the affirmative vote of a majority of the shares present or represented by proxy and entitled to vote at the Annual Meeting. With respect to Proposals 2, 4 and 5, broker non-votes will have no effect, but abstentions from other shares entitled to vote will have the same effect as a vote against such proposals.

Which ballot measures are considered “routine” or “non-routine”?

The ratification of the appointment of Ernst & Young LLP as the Company's independent registered public accounting firm for 2015 (Proposal 3) is a matter considered routine under applicable rules. A broker or other nominee may generally vote on routine matters, and therefore broker non-votes are not expected in connection with Proposal 3.

The election of directors (Proposal 1), the advisory approval of the Company's executive compensation (Proposal 2), the approval of certain amendments to Westmoreland Coal Company's Certificate of Incorporation (Proposal 4) and the shareholder proposal (Proposal 5) are matters considered non-routine under applicable rules. A broker or other nominee cannot vote without instructions on non-routine matters, and therefore there may be broker non-votes on Proposals 1, 2, 4 and 5.

How are you handling solicitation of votes?

The accompanying proxy is solicited on behalf of our Board and the cost of solicitation is borne by us. In addition to solicitations by mail, our directors, officers, and employees may solicit proxies by telephone, e-mail and personal interview, but will receive no additional compensation for doing so. We have also retained Alliance Advisors LLC for proxy solicitation and related services in connection with our 2015 Annual Meeting of Stockholders. Under our agreement with Alliance, Alliance will receive a fee of $11,000 and we will reimburse them for reasonable and customary out-of-pocket expenses incurred in performing such services. We will also request brokerage houses, custodians, nominees, and fiduciaries to forward copies of the proxy material to those persons for whom they hold shares and request instructions for voting the proxies. We will reimburse those brokerage houses and other persons for their reasonable expenses for such services.

Do I have any rights of appraisal?

Under Delaware law, stockholders are not entitled to dissenters' rights on any proposal referred to herein.

Where can I find the voting results of the Annual Meeting?

We will announce preliminary general voting results at the Annual Meeting and publish final detailed voting results on a Form 8-K that we will file with the SEC within four business days after the Annual Meeting.

How do I submit a stockholder proposal for the 2016 Annual Meeting?

Any proposal that a stockholder wishes to be considered for inclusion in our proxy statement and proxy card for the 2016 Annual Meeting of Stockholders (the “2016 Annual Meeting”) must be submitted to the Company's Secretary at our offices, 9540 S. Maroon Circle, Suite 200, Englewood, Colorado 80112, no later than December 19, 2015. In addition, such proposals must comply with the requirements of Rule 14a-8 under the Securities Exchange Act of 1934.

If a stockholder wishes to present a proposal before the 2016 Annual Meeting, without having the proposal included in our proxy statement and proxy card, such stockholder must give written notice to the Secretary at the address noted above. The Secretary must receive such notice no earlier than January 20, 2016 and no later than February 19, 2016, and the stockholder must comply with the provisions of Sections 2.5 or 2.6, as applicable, of our bylaws. Only proposals included in the proxy statement or that comply with our advance notice bylaw requirements will be considered properly brought before the Annual Meeting.

Does the Company offer an opportunity to receive future proxy materials electronically?

Yes. If you are a stockholder of record or a member of the 401(k) plan, you may, if you wish, receive future proxy statements and annual reports online rather than receiving proxy materials in paper form. If you elect this feature, you will receive an e-mail message notifying you when the materials are available, along with a web address for viewing the materials and instructions for voting by telephone or on the Internet. You may sign up for electronic delivery at any time by visiting http://enroll.icsdelivery.com/wlb. If you received this proxy statement electronically, you do not need to do anything to continue receiving proxy materials electronically in the future. If you hold your shares in a brokerage account, you may also have the opportunity to receive proxy materials electronically. Please follow the instructions of your broker.

How can I get electronic access to the proxy materials and the annual report?

This proxy statement and our 2014 annual report are available at www.proxyvote.com; see your ballot for information.

Will I receive a separate proxy statement if I share the same address and last name as another stockholder?

No. If you are the beneficial owner, but not the record holder, of shares of our stock, your broker, bank or other nominee may only deliver one copy of this proxy statement and our annual report to multiple stockholders who share an address, unless that nominee has received contrary instructions from one or more of the stockholders. We will deliver promptly, upon written or oral request, a separate copy of this proxy statement and our annual report to a stockholder at a shared address to which a single copy of the documents was delivered. Beneficial owners sharing an address who are receiving multiple copies of proxy materials and annual reports and who wish to receive a single copy of such materials in the future will need to contact their broker, bank or other nominee to request that only a single copy of each document be mailed to all stockholders at the shared address in the future.

DIRECTORS AND EXECUTIVE OFFICERS

|

| | | |

| Name | Age | Director/ Executive Officer Since | Position |

| Keith E. Alessi | 60 | 2007 | Director; Chief Executive Officer |

| Terry J. Bachynski | 57 | 2014 | Director - Independent |

| Gail E. Hamilton | 65 | 2011 | Director - Independent |

| Michael G. Hutchinson | 59 | 2012 | Director - Independent |

| Richard M. Klingaman | 79 | 2006 | Director - Independent; Chairman of the Board |

| Craig R. Mackus | 63 | 2013 | Director - Independent |

| Jan B. Packwood | 71 | 2011 | Director - Independent; Vice Chairman of the Board |

| Robert C. Scharp | 68 | 2011 | Director - Independent |

| Kevin A. Paprzycki | 44 | 2008 | Chief Financial Officer |

| Jennifer S. Grafton | 39 | 2011 | Senior Vice President, Chief Administrative Officer and Corporate Secretary |

| John A. Schadan | 49 | 2014 | President Canada Operations |

| Joseph E. Micheletti | 49 | 2011 | Executive Vice President |

______________________________________ |

| |

| (1) | Mr. Paprzycki also acted as Treasurer throughout 2014 before relinquishing the role on February 20, 2015. |

| (2) | Ms. Grafton acted as General Counsel and Secretary during 2014, before being promoted to Senior Vice President, Chief Administrative Officer and Secretary on November 20, 2014. |

| (3) | Mr. Schadan was Senior Vice President, Canada Operations, before being promoted to Executive Vice President on August 1, 2014, and then President - Canada Operations on March 13, 2015. |

| (4) | Mr. Micheletti was Senior Vice President, Coal Operations, before being promoted to Executive Vice President on August 1, 2014. |

Director Information

The Board has fixed the number of directors at eight. All our directors bring to our Board a wealth of leadership experience derived from their service as executives and respected professionals. Certain individual qualifications and skills of our directors that contribute to the Board's effectiveness as a whole are described in the following paragraphs.

Keith E. Alessi has served in various capacities at Westmoreland since 2007 and currently serves as our Chief Executive Officer. Prior to Westmoreland, Mr. Alessi was an adjunct lecturer at the University of Michigan Ross School of Business from 2001 to 2010 and was an Adjunct Professor at The Washington and Lee University Law School from 1999 to 2007. He previously served as Chief Executive Officer, Chief Operating Officer or Chief Financial Officer of a number of public and private companies from 1982 to 2000. Mr. Alessi currently serves as a member of the board of directors of MWI Veterinary Supply, Inc.

Mr. Alessi has over 30 years of turnaround management experience gained in a senior executive capacity. This has given him unique insights into the hurdles, challenges and opportunities facing Westmoreland and provides him the necessary leadership experience to lead the integration of the globally-diversified mining assets as its Chief Executive Officer.

Terry J. Bachynski has over 30 years’ experience in the energy business, having served in several executive management and board positions with various private and public companies, including Suncor Energy Inc., Gulf Canada Resources Limited, CS Resources Limited, EPCOR Utilities Inc. and Syncrude Canada. Since 2001, Mr. Bachynski has been President and CEO of JDEL Associates Ltd. which provides regulatory, environmental, stakeholder, aboriginal and government affairs consulting services to industry for the development and operation of major resource development projects, primarily in Western Canada. Mr. Bachynski sits on the boards of several private companies including Universe Machines Corporation, Unified Alloys Ltd. and Millennium EMS Solutions Ltd. Mr. Bachynski has an LL.B. from the University of Western Ontario and resides in Edmonton, Alberta, Canada.

Mr. Bachynski has performed a wide range of roles in his extensive career in the energy sector. Mr. Bachynski provides the Board with a unique insight into challenges and opportunities specific to natural resource development in Canada. His experience will bring an active voice for our recently acquired Canadian Operations to the Board.

Gail E. Hamilton most recently served as Executive Vice President of Symantec Corporation, an infrastructure software and services provider, retiring in 2005. Previously, she served as the General Manager of the Communications Division of Compaq

Computer Corporation and as the General Manager of the Telecom Platform Division for Hewlett-Packard Company. She is currently a director of Arrow Electronics Inc., OpenText Corp., and Ixia.

Ms. Hamilton is a former senior executive with business and operational experience at a public technology company, whose strategic planning and business development experience are invaluable in guiding the development and progression of our information technology infrastructure and programs. In addition, Ms. Hamilton's extensive public and private board experience will bring further professionalism and insight to the board room.

Michael G. Hutchinson recently retired from Deloitte & Touche. His Deloitte career spanned nearly 35 years, leading their Denver Energy and Natural Resources Practice for the last fifteen years while at the same time managing the Audit and Enterprise Risk Management practice of the Denver office. Mr. Hutchinson currently serves as a member of the board of directors of One Gas, Inc. and as its audit committee chairman.

As the former lead audit partner at a top four auditing firm, Mr. Hutchinson brings to the Board his substantial expertise in accounting and finance matters, which he gained during his 35 years of experience in public accounting. Mr. Hutchinson is well qualified to serve as a director based on his experience with accounting principles, financial controls and evaluating financial statements of public companies in the energy sector, particularly from an auditor's perspective.

Richard M. Klingaman has been a consultant to the natural resources and energy industries since May 1992. Prior to consulting, Mr. Klingaman was a senior executive with Penn Virginia Corporation, a natural resources company specializing in coal, oil, natural gas, timber, lime and limestone.

Mr. Klingaman's extensive experience in the mining and energy industries, including as Senior Vice President of a large natural resources company, provides him with an intimate knowledge of our operations and our industry.

Craig R. Mackus became Chief Financial Officer of Bucyrus International, Inc. in June 2004 after serving as Vice President-Finance from October 2002 through June 2004 and as Controller from February 1988 through May 2006. Mr. Mackus retired from Bucyrus International, Inc. in 2011 upon its merger with Caterpillar. He also served as Bucyrus's secretary from May 1996 through his retirement in 2011.

As a senior manager of an international manufacturing company provided equipment to the mining industry, Mr. Mackus brings significant financial, governance and operational mining experience to the Board. As the CFO during a major merger transaction between Bucyrus International Inc. and Caterpillar, Mr. Mackus provides the Board with his first-hand experience in significant M&A activity.

Jan B. Packwood was the President and Chief Executive Officer of IDACORP, Inc. (NYSE: IDA), a holding company whose main subsidiary, Idaho Power Company, is an electric utility engaged in the generation, transmission, distribution, sale and purchase of electric energy, from 1999 to 2006. Prior to such time, Mr. Packwood served in various executive-level capacities of Idaho Power Company beginning in the 1980s. He currently serves as a director of IDACORP, Inc. and of various IDACORP, Inc. subsidiaries, including Idaho Power Company, IDACORP Financial Services, Inc. and Ida-West Energy Company.

As the former President and Chief Executive Officer of an electric utility involved in the mining and use of coal in the Pacific Northwest, Mr. Packwood brings to the Board a vast knowledge of our and our main customers' business, including an understanding of the risks faced by our own power plant and the power plants we supply. This expertise will be invaluable in directing the future of our power plant operations, as well as providing insight into potential growth and expansion activities in our mining segment.

Robert C. Scharp was previously the Chief Executive Officer of Shell Coal Pty Ltd from 1997 to 2000 and then Chief Executive Officer of Anglo Coal Australia from 2000 to 2001. He served as the Chairman of the Shell Canada Energy Mining Advisory Council from 2005 to 2010. He had a 22 year career with Kerr McGee Corporation including serving as President - Kerr McGee Coal Corporation and Senior Vice President - Oil and Gas Production. Mr. Scharp was a director of Bucyrus International from 2005 to 2011 and was a director of Foundation Coal Holdings from 2005 to 2009. Mr. Scharp is also a retired Army National Guard colonel.

Mr. Scharp brings a wealth of coal mining industry experience to the Board, including invaluable chief executive operational oversight of coal mine operations. Mr. Scharp's vast industry experience will assist the Board in driving future operational mining excellence and evaluating potential growth and expansion opportunities.

Executive Officer Information

Keith E. Alessi, who joined Westmoreland in 2007 and serves as Chief Executive Officer, is discussed above under “Director Information.”

Kevin A. Paprzycki joined Westmoreland as Controller and Principal Accounting Officer in June 2006 and was named Chief Financial Officer in April 2008. In June 2010, he was also named Treasurer, a role that he relinquished in 2015. Prior to Westmoreland, Mr. Paprzycki was Corporate Controller at Applied Films Corporation from 2005 to 2006. Mr. Paprzycki became a certified public accountant in 1994 and a certified financial manager and certified management accountant in 2004.

Jennifer S. Grafton joined Westmoreland as Associate General Counsel in December 2008 and was named General Counsel and Secretary in February 2011. She was recently promoted to Senior Vice President, Chief Administrative Officer and Secretary in which she oversees a variety of functions including legal, human resources and risk management. Prior to Westmoreland, Ms. Grafton worked in the corporate group of various Denver-based and national law firms focusing her practice on securities and corporate governance. She is a member of the Colorado bar.

Joseph E. Micheletti joined Westmoreland in 1998 and has held key leadership positions at several Westmoreland mining projects, including President and General Manager of our Jewett Mine, and was promoted to Executive Vice President on August 1, 2014. Mr. Micheletti is responsible for Westmoreland Coal Company’s U.S. mining projects, overseeing the safe, cost effective, and environmentally responsible operation of the company’s mining activities. He holds a Bachelor of Science degree in Mineral Processing Engineering from Montana College of Mineral Science and Technology. Mr. Micheletti has worked in the production, maintenance, processing, and engineering disciplines of the mining industry for 24 years and sits as a Director of the Rocky Mountain Coal Mining Institute.

John A. Schadan joined Westmoreland in April 2014 as Senior Vice President before being promoted to Executive Vice President, and was recently promoted again to President - Canada Operations on March 13, 2015. Mr. Schadan’s career has encompassed both the western Canadian coal business as well as engineering and construction for a major international firm, and spans a variety of disciplines including mine engineering, environmental and regulatory approvals, business development, marketing, commercial contract negotiations, establishing joint venture partnerships, operations and general management. Prior to joining Westmoreland, Mr. Schadan worked for Sherritt’s coal division as VP Operations from March 2013, and prior to that was employed at SNC Lavalin beginning in 1999. Mr. Schadan is a registered Professional Engineer in the Province of Alberta and holds a mining engineering degree from Queen’s University. He currently sits as a Director for both the Alberta Chamber of Resources and Safe Saskatchewan.

CORPORATE GOVERNANCE

We are committed to maintaining the highest standards of business conduct and corporate governance, which we believe are essential to running our business efficiently, serving our stockholders and maintaining our integrity in the marketplace. The Code of Conduct Handbook for directors, officers and employees, in conjunction with the Certificate of Incorporation, Bylaws, Board committee charters and Corporate Governance Guidelines, form the framework for the governance of Westmoreland. All of these documents are available on our website at www.westmoreland.com. On an annual basis, all directors, officers and employees sign an acknowledgment that they have received and reviewed the guidelines provided in the Code of Conduct Handbook. We will post on our website any amendments to the Code of Conduct Handbook or waivers of the Code of Conduct Handbook for directors and executive officers. You can request a copy of any of these documents by writing to the Corporate Secretary, Westmoreland Coal Company, 9540 S. Maroon Circle, Suite 200, Englewood, Colorado 80112.

Board Structure

The Board of Directors does not have a policy regarding the separation of the roles of Chief Executive Officer ("CEO") and Chairman of the Board as the Board believes it is in the best interests of Westmoreland to make that determination based on the position and direction of Westmoreland, and the membership of the Board. Currently, the roles of Chairman of the Board and CEO are split so that our CEO can focus on our day-to-day business, allowing the Chairman of the Board to lead the Board in its fundamental role of providing advice to and independent oversight of management. On March 21, 2014, Mr. Alessi was asked to resume his service as CEO to facilitate an efficient transition of the Sherritt business into Westmoreland. Accordingly, Mr. Klingaman was elevated to the Chairman of the Board position where he chaired all regular and independent executive sessions of the Board and, with input from the CEO, set the agenda for Board meetings. We believe this structure promotes a unified approach to corporate strategy development and allows for a bridge between management and the Board, helping each to pursue its common purpose more efficiently.

Risk Oversight by the Board of Directors

Risk is inherent with every business, and how well a business manages risk can ultimately influence its success. We face a number of risks, including economic risks, operational risks, environmental and regulatory risks, and others, such as the impact of competition, weather conditions and pressures from competing fuel sources. Management is responsible for the day-to-day supervision of risks that we face, while the Board, as a whole and through its committees, has responsibility for the oversight of risk management. In its risk oversight role, the Board has the responsibility to satisfy itself that the risk management processes designed and implemented by management are adequate and functioning as designed.

The Board believes that establishing the right “tone at the top” and full and open communication between management and the Board are essential for effective risk management and oversight. Our Chairman has regular communications with our CEO to discuss strategy and the risks we face. The executive management team attends the quarterly board meetings and is available to address any questions or concerns raised by the Board on risk management related matters. Each quarter, the Board receives presentations from senior management on strategic matters involving our operations and is provided extensive materials that highlight the various factors that could lead to risk in our organization. The Board holds a strategic planning session with the management team on an annual basis to discuss strategies, key challenges, and risks and opportunities for us. Further, the Board is empowered to hire its own advisors without management approval to assist it in fulfilling its duties.

While the Board is ultimately responsible for our risk oversight, our committees assist the Board in fulfilling its oversight responsibilities in certain areas of risk. The Audit Committee assists the Board in fulfilling its oversight responsibilities with respect to risk management in the areas of financial reporting, internal controls and compliance with legal and regulatory requirements. The Compensation and Benefits Committee assists the Board in fulfilling its oversight responsibilities with respect to the management of risks arising from our compensation policies and programs. The Nominating and Corporate Governance Committee is tasked with the oversight of succession planning for our directors and executive officers. On an annual basis, pursuant to such committee's charters, the committees assess risk and have specific conversations with senior management regarding the risks faced.

Director Independence

NASDAQ Marketplace Rules require that a majority of the Board be independent. No director qualifies as independent unless the Board determines that the director has no direct or indirect relationship with the Company that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In assessing the independence of its members, the Board examined the commercial, industrial, banking, consulting, legal, accounting, charitable and familial relationships of each member. The Board's inquiry extended to both direct and indirect relationships with the Company. Based upon both detailed written submissions by nominees and discussions regarding the facts and circumstances pertaining to each nominee, considered in the context of applicable NASDAQ Marketplace Rules, the Board has determined that all of the nominees for election, other than Mr. Alessi, are independent. The independent directors meet during most Board meetings in separate executive session led by our Chairman and without management present.

Each member of the Audit Committee must, in addition to the independence requirements of the NASDAQ Marketplace Rules, meet the heightened independence standards required for audit committee members under the NASDAQ Marketplace Rules listing standards, Section 10A of the Securities Exchange Act of 1934, and Rule 10A-3 thereunder. The Board determined that Messrs. Hutchinson, Bachynski, Mackus and Packwood, the 2014 Audit Committee members, each met such heightened independence standards. Beginning in July 2013, each member of the Compensation and Benefits Committee was required to also meet heightened independence standards under the NASDAQ Marketplace Rules listing standards. The Board determined that Ms. Hamilton and Messrs. Hutchinson, Scharp and Mackus, the 2014 Compensation and Benefits Committee members, met such heightened independence standards.

Communicating with the Board

Stockholders who wish to write directly to the Board on any topic should address communications to the Board of Directors in care of the Chairman of the Board, Westmoreland Coal Company Board of Directors, 9540 S. Maroon Circle, Suite 200 Englewood, Colorado 80112. Our Chairman of the Board will report on stockholder communications to the Board and provide copies or specific summaries to directors on matters deemed to be of appropriate importance. In general, communications from stockholders relating to corporate governance will be forwarded to the Board unless they are frivolous, obscene, repeat the same information contained in earlier communications, or fail to identify the author.

COMMITTEES OF THE BOARD OF DIRECTORS

Throughout 2014, our Board consisted of eight directors and the following four committees: (1) Audit; (2) Compensation and Benefits; (3) Nominating and Corporate Governance; and (4) Executive. Each of the committees operates under a written charter adopted by the Board. All of the committee charters are available on our website at www.westmoreland.com. On February 20, 2015, the Board created a Health, Safety and Environment committee, which has begun drafting a charter and setting goals for the year. During 2014, the Board held eleven meetings. Each of our current directors attended at least 86% of the aggregate of all Board and applicable committee meetings held during the period that he or she served as a director, with six directors attending 100%. All directors attended the last Annual Meeting of Stockholders and all are expected to attend this year's Annual Meeting of Stockholders. The 2014 committee membership, number of meetings held during 2014 and function of each of the committees are described in the table below.

|

| | | | | | | | |

| Name of Director | | Audit | | Compensation and Benefits | | Nominating and Corporate Governance | | Executive |

| Non-Employee Directors: | | | | | | | | |

| Terry J. Bachynski | | Member | | | | Member | | |

| Gail E. Hamilton | | | | Member | | Member | | |

| Michael G. Hutchinson | | Chair | | Member | | | | |

| Richard M. Klingaman | | | | | | | | Chair |

| Craig R. Mackus | | Member | | Member | | | | |

| Jan B. Packwood | | Member | | | | Chair | | Member |

| Robert C. Scharp | | | | Chair | | Member | | Member |

| Employee Director: | | | | | | | | |

| Keith E. Alessi | | | | | | | | Member |

| Number of Meetings in 2014 | | 4 | | 5 | | 4 | | 3 |

Audit Committee

The Audit Committee provides oversight of the quality and integrity of our accounting, auditing and financial reporting practices and is responsible for retaining and terminating our independent accounts. The committee exercises its oversight obligations through regular meetings with management, the Director of Internal Audit and our independent registered public accounting firm, Ernst & Young LLP. The Audit Committee is also responsible for oversight of risks relating to accounting matters, financial reporting and regulatory compliance. To satisfy these oversight responsibilities, the committee separately meets with our Chief Financial Officer, the Director of Internal Audit, Ernst & Young LLP and management. The committee also receives periodic reports regarding issues such as the status and findings of audits being conducted by the internal and independent auditors, the status of material litigation, accounting changes that could affect our financial statements and proposed audit adjustments. The Board has determined that Michael G. Hutchinson qualifies as an “audit committee financial expert” as defined in Item 407(d)(5) of Regulation S-K.

Audit Committee Report

Under its charter, the Audit Committee assists the Board of Directors in fulfilling the Board's responsibility for oversight of Westmoreland's financial reporting process and practices, and its internal control over financial reporting. Management is primarily responsible for our financial statements, the reporting process and assurance for the adequacy of the internal control over financial reporting. Our independent registered public accounting firm, Ernst & Young LLP, is responsible for performing an independent audit of Westmoreland's financial statements and internal control over financial reporting, and for expressing an opinion on the conformity of our audited financial statements to generally accepted accounting principles used in the United States and the adequacy of our internal control over financial reporting.

The Audit Committee has reviewed and discussed with Ernst & Young LLP Westmoreland's audited consolidated financial statements and internal control over financial reporting. The Audit Committee has discussed with Ernst & Young LLP, during the 2014 fiscal year, the matters required to be discussed by Statement on Auditing Standards No. 16, as amended (Communication with Audit Committees) as adopted by the Public Company Accounting Oversight Board. The Audit Committee has received and reviewed the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the Public Company Accounting Oversight Board regarding such firm's communications with the Audit Committee concerning independence, and has discussed with the independent accountants their independence.

The Audit Committee discussed with our internal and independent auditors the overall scope and plans for their respective audits. The Audit Committee meets with the independent auditors, with and without management present, to discuss the results of its examinations, the evaluations of our internal controls and the overall quality of our financial reporting. The Audit Committee also has reviewed and discussed the audited financial statements with management.

Based on the reviews and discussions described above, the Audit Committee recommended to the Board that the audited financial statements and assessment of internal controls over financial reporting be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2014. The Audit Committee has selected Ernst & Young LLP as our independent registered public accounting firm for fiscal year 2015.

Michael G. Hutchinson, Chairman

Terry J. Bachynski

Jan B. Packwood

Craig R. Mackus

Compensation and Benefits Committee

The Compensation and Benefits Committee is responsible for assuring that the Board, our Chief Executive Officer, other executive officers, and our key management are compensated appropriately and in a manner consistent with our approved compensation strategy, internal equity considerations, competitive practice, and any relevant laws or regulations. In addition, the committee reviews our compensation programs to ensure that our programs are not promoting imprudent risk-taking. In accordance with its charter, the committee may retain and terminate outside counsel, compensation consultants, or other experts or consultants, as it deems appropriate, form and delegate authority to subcommittees and delegate authority to one or more designated members of the committee. To assist it in satisfying its oversight responsibilities, the committee approved the continued engagement of Pay Governance to serve as its compensation consultant for fiscal year 2015.

Compensation and Benefits Committee Risk Assessment

On an annual basis, the committee reviews the structure of our compensation program to assess whether any aspect of the program could provide an incentive to our executive officers or other employees to take any unnecessary or inappropriate risks that could threaten our operating results, financial condition or impact long-term stockholder value. To assist the committee in its annual review it engaged Pay Governance in January 2014 to conduct a risk assessment of our incentive-based compensation plans (including the annual and long-term incentive programs) and our compensation practices.

Based on the findings of Pay Governance, our internal controls, policies and risk-mitigating components in our incentive arrangements, as well as the committee's formal review and discussion, the committee believes our compensation programs represent an appropriate balance of short-term and long-term compensation and do not encourage executive officers or other employees to take on unnecessary or excessive risks that are reasonably likely to have a material adverse effect on us.

Our incentive compensation is designed to reward bonus-eligible employees for committing to and achieving goals that are intended to be challenging yet provide them a reasonable opportunity to reach the threshold amount, while requiring meaningful growth to reach the target level and substantial growth to reach the maximum level. The amount of growth required to reach the maximum level of compensation is developed within the context of the normal business planning cycle and, while difficult to achieve, is not viewed to be at such an aggressive level that it would induce bonus-eligible employees to take inappropriate risks that could threaten our financial or operating stability. The annual bonus program contains a cap on the maximum financial payout to employees as a whole.

Our executive compensation program includes the following features to help minimize risk.

Compensation Mix. We allocate compensation between fixed and contingent components, and between annual cash incentives and long-term time-based incentives, based in part on an employee's position and level of responsibility within the organization. We believe our mix of compensation elements helps to ensure that executives and other employees who are eligible for incentive compensation do not focus on achieving short-term results at the expense of the long-term growth and sustainability of the Company. None of our employees receive commissions.

Base salary is the only assured portion of compensation that we provide to our executives and other employees. Consequently, our incentive compensation arrangements are intended to reward performance.

The annual incentive plan establishes cash-based award opportunities that are payable if, and only to the extent that, pre-established corporate financial, operational safety and individual performance objectives are achieved. The committee has discretion to exclude certain events outside our direct control and to reward exemplary performance.

The long-term component of the executive compensation program consists of grants of time-vested and performance-based restricted stock units or cash awards. The use of both time-based and performance-based awards for fiscal 2015 balances our desire to drive long-term growth with the retention pressures we face from our direct peers, as well as from emerging and evolving competitors.

Stock Ownership Guidelines. We have established stock ownership guidelines to ensure that our executives' interests are aligned with those of stockholders. These guidelines also help ensure that the decisions our executives implement to achieve our financial and strategic objectives are focused on our long-term growth and health. We believe that this policy effectively mitigates the possibility that our executives would make business decisions to influence stock price increases in the short-term that cannot be sustained over the long-term or would liquidate their equity holdings to capture short-term fluctuations in our stock price.

Board Approval of Transactions. Management must obtain approval from the Board for significant transactions (i.e., mergers, acquisitions, dividends, etc.) that could impact the achievement of previously approved financial performance targets used in the executive compensation program, and the Compensation and Benefit Committee retains the discretion to ignore the impact of certain factors over which management has no control (such as accounting changes or force majeure events) for purposes of determining whether pre-established performance targets have been met.

Compensation and Benefits Committee Interlocks and Insider Participation

During 2014, each of Messrs. Hutchinson, Mackus and Scharp, and Ms. Hamilton served on our Compensation and Benefits Committee. None of these directors was a current or former officer or employee of the Company, and none had any related party transaction involving the Company that is disclosable under Item 404 of Regulation S-K. During 2014, none of our executive officers served on the board of directors of any entity that had one or more executive officers serving on our Board.

Compensation and Benefits Committee Report

The Compensation and Benefits Committee has reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K with management. Based on this review and discussion, the Compensation and Benefits Committee recommended to the Board that the Compensation Discussion and Analysis, provided herein, be included in this proxy statement and incorporated by reference into Westmoreland's Annual Report on Form 10-K for the fiscal year ended December 31, 2014.

Robert C. Scharp, Chairman

Gail E. Hamilton

Michael G. Hutchinson

Craig R. Mackus

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee identifies and recommends individuals qualified to be nominated as members of the Board and considers director candidates brought to the Board by stockholders. The committee oversees succession planning. It also provides oversight on corporate governance matters and conducts the evaluation of the Board, committees, and individual director performance.

The committee regularly assesses the mix of skills and industry experience currently represented on the Board, whether any vacancies on the Board are expected due to retirement or otherwise, the skills represented by retiring directors, and additional skills highlighted during the Board self-assessment process that could improve the overall quality and ability of the Board to carry out its functions. In the event vacancies are anticipated or arise, the Nominating and Corporate Governance Committee considers various potential candidates for director and employs the same process for evaluating all candidates, including those submitted by stockholders. The committee is responsible for ensuring all director nominees undergo a thorough background check prior to nomination or appointment as a director and to review any adverse findings prior to such nomination or appointment. Candidates may come to the attention of the committee through current Board members, professional search firms, stockholders or other persons.

The committee initially evaluates a candidate based on publicly available information and any additional information supplied by the party recommending the candidate. If the candidate appears to satisfy the selection criteria and the committee's initial evaluation is favorable, the candidate is contacted by the chairman of the committee for an interview to determine the mutual levels of interest in pursuing the candidacy. The committee is tasked with considering whether the candidate is (i) independent pursuant to the requirements of The NASDAQ Stock Market, (ii) accomplished in his or her field and has a reputation, both personal and professional, that is consistent with our ideals and integrity, (iii) able to read and understand basic financial statements, (iv) knowledgeable as to us and the issues affecting our business, (v) committed to enhancing stockholder value, (vi) able to understand fully the legal responsibilities of a director and the governance processes of a public company, (vii) able to develop a good working relationship with other Board members and senior management and (viii) able to suggest business opportunities to us. If these discussions and considerations are favorable, the committee makes a final recommendation to the Board to nominate the candidate for election.

In considering whether to recommend any particular candidate, including incumbent directors, for inclusion in the Board's slate of recommended director nominees, the Nominating and Corporate Governance Committee takes into consideration a number of criteria, including: professional work experience; skills; expertise; diversity; personal and professional integrity; character; temperament; business judgment; time availability in light of other commitments; dedication; conflicts of interest; and public company experience. The committee does not assign specific weights to particular criteria and no particular criterion is a prerequisite for each prospective nominee. The committee focuses on issues of diversity, such as diversity of education, professional experience and differences in viewpoints and skills. The committee does not have a formal policy with respect to diversity; however, the Board and the committee believe that it is essential that the Board members represent diverse viewpoints and strive to ensure that the slate of nominees represents a wide breadth of diverse backgrounds and skill sets to adequately represent the needs of the stockholders. With respect to the nomination of continuing directors for re-election, the individual's contributions to the Board are also considered. We believe that the backgrounds and qualifications of our directors, considered as a group, provide a composite mix of skills, experience, and knowledge that will assure that the Board can continue to fulfill its responsibilities.

The Board's retirement policy mandates that directors elected to the Board at our annual meeting retire from the Board at the first annual meeting of stockholders following the director's 75th birthday. The Board grandfathered all directors then serving as a director at the time the policy was adopted in November 2010, making the new retirement policy only applicable to current and future directors who will turn 75 after May 2010.

Stockholders may recommend individuals to the Nominating and Corporate Governance Committee for consideration as potential director candidates by submitting their names, together with appropriate biographical information and background materials and a statement as to whether the stockholder or group of stockholders making the recommendation has beneficially owned more than 5% of our common stock for at least a year as of the date such recommendation is made, to the Nominating and Corporate Governance Committee, c/o Corporate Secretary, Westmoreland Coal Company, 9540 South Maroon Circle, Suite 200, Englewood, Colorado 80112. Assuming that appropriate biographical and background material has been provided on a timely basis, the committee will evaluate stockholder-recommended candidates by following the same process, and applying the same criteria, as it follows for candidates submitted by others. If the Board determines to nominate a stockholder-recommended candidate and recommends his or her election, then his or her name will be included in our proxy statement for the next annual meeting.

Stockholders also have the right to nominate director candidates directly, without any action or recommendation on the part of the committee or the Board, by following the procedures set forth in Section 2.6, “Advance Notice of Nominees,” in our bylaws. Among other things, a stockholder wishing to nominate a director candidate must give notice to us within the specified time period that includes the information about the stockholder and the proposed nominee required by the bylaws. Any stockholder wishing to nominate a candidate for election to the Board pursuant to the bylaw provision must strictly comply with the procedures specified in Section 2.6 of the bylaws.

Jan B. Packwood, Chairman

Gail E. Hamilton

Robert C. Scharp

Terry J. Bachynski

Executive Committee

During 2014, the Board had an Executive Committee. Pursuant to its charter reviewed and adopted on an annual basis, the Executive Committee is authorized to act on behalf of the Board during periods between Board meetings. During 2014, the Executive Committee held three meetings.

DIRECTOR COMPENSATION

The Board's goal in designing director compensation is to provide a competitive package that will enable it to attract and retain highly skilled individuals with relevant experience and that reflects the time and talent required to serve on the Board. Compensation for our non-employee directors is reviewed by the Compensation and Benefits Committee with the assistance of Pay Governance. The table below reflects the total director compensation for 2014.

2014 Non-Employee Director Compensation

|

| | | |

Name(1) | Fees Earned Or Paid In Cash($) | Grant Date Fair Value of Stock Awards($)(2) | Total Compensation ($) |

| Keith E. Alessi | — | — | — |

| Terry J. Bachynski | 33,925 | 69,558 | 103,483 |

| Gail E. Hamilton | 84,624 | 90,021 | 174,645 |

| Michael G. Hutchinson | 100,206 | 90,021 | 190,227 |

| Richard M. Klingaman | 124,733 | 90,021 | 214,754 |

| Craig R. Mackus | 88,221 | 90,021 | 178,242 |

| Jan B. Packwood | 103,303 | 90,021 | 193,324 |

| Robert C. Scharp | 104,144 | 90,021 | 194,165 |

____________________ |

| |

| (1) | Mr. Alessi did not receive any additional compensation for his services as a director. |

| (2) | An equivalent of $90,000 of restricted stock units were awarded to each non-employee director elected to the Board in May 2014. The restricted stock units vest on May 20, 2015. Mr. Bachynski was elected to the Board on August 8, 2014, and received both a prorated equity award at that time and a prorated cash retainer at the end of the third quarter. |

Approved 2015 Non-Employee Director Compensation Structure

In February 2015, the Compensation and Benefits Committee recommended, and the Board approved, the below compensation structure for fiscal year 2015. All non-employee directors receive the “Annual Cash Retainer” in addition to any other retainers they may be entitled for service as the Chair of a committee or for serving as a member of a committee.

|

| | |

| Type of Compensation | | Amount |

| Annual Cash Retainer | | $55,000 |

Annual Stock Award Retainer (restricted stock units with one-year vest) | | $90,000 stock equivalent |

| Annual Chairman of the Board Premium | | $55,000 |

| Annual Retainer for Committee Chair: | | |

| Audit Committee | | $15,000 |

| Compensation and Benefits Committee | | $15,000 |

| Nominating and Corporate Governance Committee | | $8,000 |

| Annual Retainer for Serving on a Committee: | | |

| Audit Committee | | $10,000 |

| Compensation and Benefits Committee | | $7,500 |

| Nominating and Corporate Governance Committee | | $5,000 |

Attendance at Board or Committee Meeting (in-person) | | $1,500 per meeting |

Attendance at Board or Committee Meeting (telephonic) | | $1,000 per meeting |

Non-Employee Director Stock Ownership Guidelines

In February 2014, the Board adopted stock ownership guidelines for non-employee directors under which the directors are expected to own a threshold amount of Westmoreland equity. Each non-employee director is now required to hold Westmoreland common stock with an aggregate value of at least three times his or her annual cash retainer. The directors have a five-year window to comply with these new guidelines.

BENEFICIAL OWNERSHIP OF SECURITIES

The following table sets forth information, as of April 2, 2015 (the "Table Date"), concerning beneficial ownership by: holders of more than 5% of any class of our voting securities; directors; each of the named executive officers listed in the Summary Compensation Table; and all directors and executive officers as a group. The information provided in the table is based on our records, information filed with the SEC and information provided to us, except where otherwise noted. The number of shares beneficially owned by each entity or individual is determined under SEC rules, and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares as to which the entity or individual has sole or shared voting power or investment power and also any shares that the entity or individual has the right to acquire within 60 days of the Table Date through the exercise of any stock options, the vesting of restricted stock or upon the exercise or conversion of other rights. Unless otherwise indicated, each person has sole voting and investment power with respect to the shares set forth in the table. The percentage calculations set forth in the table are based on 17,769,746 shares of common stock outstanding on the Table Date.

|

| | |

| Name of Beneficial Owner | Common Stock | % of Common |

| 5% or Greater Equity Holders | | |

Jeffrey L. Gendell(1) | 1,087,377 | 6.12% |

Charles L. Frischer(2) | 997,521 | 5.61% |

BlackRock Inc.(3) | 965,412 | 5.43% |

| Officers and Directors |

Terry J. Bachynski(4) | 1,573 | * |

Gail E. Hamilton(5) | 22,136 | * |

Michael G. Hutchinson(5) | 14,269 | * |

Richard M. Klingaman(5) | 32,479 | * |

Craig R. Mackus(5) | 10,244 | * |

Jan B. Packwood(5) | 22,136 | * |

Robert C. Scharp(5) | 22,136 | * |

Keith E. Alessi(6) | 361,404 | 2.02% |

Robert P. King(7) | 46,066 | * |

Kevin A. Paprzycki(8) | 33,507 | * |

Jennifer S. Grafton(9) | 17,759 | * |

Joseph E. Micheletti(10) | 27,641 | * |

| John A. Schadan | 754 | * |

| Directors and Executive Officers as a Group (13 persons) | 612,104 | 3.41% |

____________________

|

| |

| * Percentages of less than 1% are indicated by an asterisk |

| (1) | According to a Schedule 13D/A filed December 10, 2014, Mr. Gendell owns 549,000 shares of common stock of which he has sole voting and dispositive power. In addition, Tontine Capital Partners, L.P. and other limited partnerships and limited liability companies that are affiliates of Tontine Capital Partners, L.P. own 538,377 shares of common stock. Mr. Gendell is either a managing member of, or a managing member of the general partner of, these limited partnerships and limited liability companies and has shared voting and dispositive power over these shares. All of the foregoing shares may be deemed to be beneficially owned by Mr. Gendell. Mr. Gendell disclaims beneficial ownership of these shares for purposes of Section 16(a) under the Exchange Act, or otherwise, except as to shares directly owned by Mr. Gendell or representing Mr. Gendell’s pro rata interest in, and interest in the profits of, these limited partnerships and limited liability companies. The address for Mr. Gendell is 1 Sound Shore Drive, Greenwich, CT 06830. |

| (2) | According to a Schedule 13D filed March 4, 2015, Mr. Frischer directly, or through his IRA, owns 985,211 shares of commons stock of which he has sole voting and dispositive power. Mr. Frischer is also the sole general partner of the Libby Frischer Family Partnership, a New York partnership (the "Partnership"), which owns 12,130 shares of common stock with sole voting and dispositive power. Mr. Frischer does not disclaim beneficial ownership of the shares owned by the Partnership. Mr. Frischer's address is 4404 52nd Avenue NE, Seattle, Washington 98105. |

|

| |

| (3) | According to a Schedule 13G/A filed on February 2, 2015, BlackRock Inc., a parent holding company of certain institutional investment managers registered under the Exchange Act and certain other entities, beneficially owns 965,412 shares with sole dispositive power, and has sole voting power to 934,763 of those shares. The principal business address of BlackRock Inc. is 40 East 52nd street, New York, New York 10022. |