UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12 |

Westmoreland Coal Company

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | | | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | (5) | | Total fee paid: |

| | | | |

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | | | |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | | | |

| | (3) | | Filing Party: |

| | | | |

| | (4) | | Date Filed: |

| | | | |

WESTMORELAND COAL COMPANY

9540 S. Maroon Circle, Suite 200

Englewood, Colorado 80112

March 28, 2012

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Westmoreland Stockholders:

The Annual Meeting of Stockholders of Westmoreland Coal Company will be held at The Crowne Plaza Hotel located at 27 North 27th Street, Billings, Montana 59101 on Tuesday, May 22, 2012 at 8:30 a.m. Mountain Daylight Time, for the following purposes:

| | 1. | The election of six directors to the Board of Directors to serve for a one-year term; |

| | 2. | Advisory approval of Westmoreland Coal Company’s executive compensation; |

| | 3. | To approve the amendments to the Amended and Restated 2007 Equity Incentive Plan for Employees and Non-Employee Directors; |

| | 4. | The ratification of the appointment of Ernst & Young LLP as principal independent auditor for fiscal year 2012; and |

| | 5. | To transact such other business as may properly come before the meeting or any postponement or adjournment thereof. |

Only stockholders of record at the close of business on March 26, 2012 will be entitled to notice of and to vote at the meeting and any postponement or adjournment thereof.

YOUR VOTE IS IMPORTANT. Whether or not you plan to attend the annual meeting, we hope you will vote as soon as possible. You may vote by proxy over the Internet or by telephone, or, if you received paper copies of the proxy materials, you can also vote by mail by following the instructions on the proxy card or voting instruction card. Voting over the Internet, by telephone or by written proxy or voting instruction card will ensure your representation at the annual meeting regardless of whether you attend in person.

This proxy statement, the annual report to stockholders and the proxy voter card are being mailed on or about April 9, 2012.

By Order of the Board of Directors,

/s/ Jennifer S. Grafton

Jennifer S. Grafton

General Counsel and Secretary

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON MAY 22, 2012. This notice, the accompanying proxy statement and Westmoreland Coal Company’s annual report to stockholders for the fiscal year ended December 31, 2011 are available at www.proxyvote.com. |

Table of Contents

| | Page |

| 1 |

| | |

| 1 |

| | |

| 4 |

| | |

| 6 |

| | |

| 11 |

| | |

| 12 |

| | |

| 14 |

| | |

| 14 |

| | |

| 15 |

| | |

| 26 |

| | |

| 32 |

| | |

| 32 |

| | |

| 40 |

WESTMORELAND COAL COMPANY

9540 S. Maroon Circle, Suite 200

Englewood, Colorado 80112

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

To be held May 22, 2012

GENERAL INFORMATION ABOUT THE 2012 ANNUAL MEETING OF STOCKHOLDERS This proxy statement is being furnished by the Board of Directors (the “Board”) of Westmoreland Coal Company (the “Company”) to holders of our common stock and depositary shares in connection with the solicitation by the Board of Directors of proxies to be voted at the Annual Meeting of Stockholders of Westmoreland Coal Company to be held at The Crowne Plaza Hotel located at 27 North 27th Street, Billings, Montana 59101 on Tuesday, May 22, 2012 at 8:30 a.m. Mountain Daylight Time, for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders (the “Annual Meeting”) and this proxy statement.

This proxy statement and the enclosed proxy voter card relating to the Annual Meeting of Stockholders are first being mailed to stockholders on or about April 9, 2012. As of March 26, 2012, the record date, members of the Company’s senior management and directors are the record and beneficial owners of a total of 316,444 shares (approximately 2.3%) of the Company’s outstanding common stock and have no ownership in the Company’s outstanding depositary shares. It is management’s intention to vote all of its shares in the manner recommended by the Board for each matter to be considered by the stockholders.

QUESTIONS AND ANSWERS ABOUT THE 2012 ANNUAL MEETING OF STOCKHOLDERS

Who can vote at the meeting?

Only stockholders who owned our common stock or depositary shares, each of which represents one quarter of a share of Series A Convertible Exchangeable Preferred Stock, $1.00 par value (“depositary shares”), of record at the close of business on March 26, 2012 are entitled to vote. Each holder of common stock is entitled to one vote per share. Each holder of depositary shares is entitled to one vote per share. There were 13,899,965 shares of common stock and 639,840 depositary shares outstanding on March 26, 2012.

What constitutes a quorum for the meeting?

The holders of a majority of the aggregate voting power of the common stock and depositary shares outstanding on the record date, present in person or by proxy at the Annual Meeting, shall constitute a quorum to conduct business at the Annual Meeting. Abstentions and “broker non-votes” (shares held by a broker or nominee that does not have discretionary authority to vote on a particular matter and has not received voting instructions from its client) are counted for purposes of determining the presence or absence of a quorum for the transaction of business at the Annual Meeting.

| | ● | Via the Internet at www.proxyvote.com; |

| | ● | By phone at 1-800-690-6903; or |

| | ● | By completing and mailing in a paper proxy card. |

If your shares are registered directly in your name with Computershare Trust Company, our transfer agent, you are considered a stockholder of record with respect to those shares and the proxy card and voting instructions have been sent directly to you by Broadridge Financial Solutions, Inc. If, like most stockholders, you hold your shares in “street name” through a stockbroker, bank or other nominee rather than directly in your own name, you may not vote your shares in person at the Annual Meeting without obtaining authorization from your stockbroker, bank or other nominee, and you need to submit voting instructions to your stockbroker, bank or other nominee in order to cast your vote. Generally, you will receive instructions from your stockbroker, bank or other nominee that you must follow in order to have your shares voted.

We encourage you to register your vote via the Internet. If you attend the Annual Meeting, you may also submit your vote in person and any votes that you previously submitted – whether via the Internet, by phone or by mail – will be superseded by the vote that you cast at the Annual Meeting. Whether your proxy is submitted by the Internet, by phone or by mail, if it is properly completed and submitted and if you do not revoke it prior to the Annual Meeting, your shares will be voted at the Annual Meeting as specified by you or, if you do not specify a choice as to a particular matter, in the manner set forth in this proxy statement.

Can I change my vote after I return my proxy card?

Yes. Even after you have submitted your proxy card, you may change your vote at any time before the proxy is exercised by either filing with our Secretary a written notice of revocation or a duly executed proxy card bearing a later date or by voting in person at the Annual Meeting. The powers of the proxy holders will be suspended if you attend the Annual Meeting in person and so request. However, attendance at the Annual Meeting will not, by itself, revoke a previously granted proxy. If you want to change or revoke your proxy and you hold your shares in “street name,” contact your broker or the nominee that holds your shares. Any written notice of revocation sent to us must include the stockholder’s name and must be received prior to the Annual Meeting to be effective.

What vote is required to approve each item?

Our directors are elected by plurality vote, which means that, with respect to Proposal 1, the nominees who receive the largest number of “FOR” votes cast will be elected. Neither broker non-votes nor abstentions will have any effect on the election of directors. Approval of Proposals 2, 3 and 4 requires the affirmative vote of a majority of the shares present or represented by proxy and entitled to vote at the Annual Meeting. Broker non-votes will have no effect with respect to any non-routine matter for which a broker does not have authority to vote. Abstentions will have the same effect as a vote against the proposals, other than Proposal 1.

Which ballot measures are considered “routine” or “non-routine”?

The ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for 2012 (Proposal 4) is a matter considered routine under applicable rules. A broker or other nominee may generally vote on routine matters, and therefore broker non-votes are not expected in connection with Proposal 4.

The election of directors (Proposal 1), advisory approval of the Company’s executive compensation (Proposal 2), and the approval of the amendments to the Company’s Amended and Restated 2007 Equity Incentive Plan for Employees and Non-Employee Directors (Proposal 3) are matters considered non-routine under applicable rules. A broker or other nominee cannot vote without instructions on non-routine matters, and therefore there may be broker non-votes on Proposals 1, 2 and 3.

How are you handling solicitation of votes?

The accompanying proxy is solicited on behalf of our Board and the cost of solicitation borne by us. In addition to solicitations by mail, our directors, officers, and employees may solicit proxies by telephone, e-mail and personal interview, but will receive no additional compensation for doing so. We will also request brokerage houses, custodians, nominees, and fiduciaries to forward copies of the proxy material to those persons for whom they hold shares and request instructions for voting the proxies. We will reimburse those brokerage houses and other persons for their reasonable expenses for such services.

Do I have any rights of appraisal?

Under Delaware law, stockholders are not entitled to dissenters’ rights on any proposal referred to herein.

Where can I find the voting results of the Annual Meeting?

We will announce preliminary general voting results at the Annual Meeting and publish final detailed voting results on a Form 8-K that we will file within four business days after the Annual Meeting.

How do I submit a stockholder proposal for the 2013 Annual Meeting?

Any proposal that a stockholder wishes to be considered for inclusion in our proxy statement and proxy card for the 2013 Annual Meeting of Stockholders (the “2013 Annual Meeting”) must be submitted to the Secretary at our offices, 9540 S. Maroon Circle, Suite 200, Englewood, Colorado 80112, no later than November 28, 2012. In addition, such proposals must comply with the requirements of Rule 14a-8 under the Securities Exchange Act of 1934.

If a stockholder wishes to present a proposal before the 2013 Annual Meeting, without having the proposal included in our proxy statement and proxy card, such stockholder must give written notice to the Secretary at the address noted above. The Secretary must receive such notice no earlier than January 22, 2013 and no later than February 21, 2013, and the stockholder must comply with the provisions of Sections 2.5 or 2.6, as applicable, of our bylaws. Only proposals included in the proxy statement or that comply with our advance notice bylaw requirements will be considered properly brought before the Annual Meeting.

Does the Company offer an opportunity to receive future proxy materials electronically?

Yes. If you are a stockholder of record or a member of the 401(k) plan, you may, if you wish, receive future proxy statements and annual reports online rather than receiving proxy materials in paper form. If you elect this feature, you will receive an e-mail message notifying you when the materials are available, along with a web address for viewing the materials and instructions for voting by telephone or on the Internet. If you have more than one account, you may receive separate e-mail notifications for each account. You may sign up for electronic delivery in two ways:

| | ● | If you vote online, you may sign up for electronic delivery at that time; or |

| | ● | You may sign up at any time by visiting http://enroll.icsdelivery.com/wlb. |

If you received this proxy statement electronically, you do not need to do anything to continue receiving proxy materials electronically in the future. If you hold your shares in a brokerage account, you may also have the opportunity to receive proxy materials electronically. Please follow the instructions of your broker.

How can I get electronic access to the proxy materials and the annual report?

This proxy statement and our 2011 Annual Report are available at www.proxyvote.com; reference your ballot materials for access information.

Will I receive a separate proxy statement if I share the same address and last name as another stockholder?

No. If you are the beneficial owner, but not the record holder, of shares of our stock, your broker, bank or other nominee may only deliver one copy of this proxy statement and our Annual Report to multiple stockholders who share an address, unless that nominee has received contrary instructions from one or more of the stockholders. We will deliver promptly, upon written or oral request, a separate copy of this proxy statement and our Annual Report to a stockholder at a shared address to which a single copy of the documents was delivered. Beneficial owners sharing an address who are receiving multiple copies of proxy materials and annual reports and who wish to receive a single copy of such materials in the future will need to contact their broker, bank or other nominee to request that only a single copy of each document be mailed to all stockholders at the shared address in the future.

| Name | Age | Director/ Executive Officer Since | Position |

| Keith E. Alessi | 57 | 2007 | Director; Chief Executive Officer |

| Michael R. D’Appolonia | 63 | 2008 | Director – Independent |

| Gail E. Hamilton | 62 | 2011 | Director – Independent |

| Richard M. Klingaman | 76 | 2006 | Director – Independent; Chairman of the Board |

| Jan B. Packwood | 68 | 2011 | Director – Independent |

| Robert C. Scharp | 65 | 2011 | Director – Independent |

| Jennifer S. Grafton | 36 | 2011 | General Counsel and Secretary |

| Douglas P. Kathol | 59 | 2010 | Executive Vice President |

| Robert P. King | 59 | 2012 | President and Chief Operating Officer |

| Joseph E. Micheletti | 46 | 2011 | Senior Vice President – Coal Operations |

| Kevin A. Paprzycki | 41 | 2008 | Chief Financial Officer and Treasurer |

Director Information

The Board has fixed the number of directors following the Annual Meeting at six. All our directors bring to our Board a wealth of leadership experience derived from their service as executives of corporations. Certain individual qualifications and skills of our directors that contribute to the Board’s effectiveness as a whole are described in the following paragraphs.

Keith E. Alessi serves as a Director and our Chief Executive Officer. Since he began working for us in 2007, he has assumed various roles including Executive Chairman, President and other various interim roles. Prior to Westmoreland, Mr. Alessi was an adjunct lecturer at the Ross School of Business at the University of Michigan from 2001 to 2010 and was an Adjunct Professor at The Washington and Lee University Law School from 1999 to 2007. He previously served as Chief Executive Officer, Chief Operating Officer or Chief Financial Officer of a number of public and private companies from 1982 to 2000. Mr. Alessi currently serves as a member of the board of directors of Town Sports International Holdings, Inc. and MWI Veterinary Supply, Inc.

Mr. Alessi has over 30 years of turnaround management experience gained in senior executive capacity. This has given him unique insights into the hurdles, challenges and opportunities facing Westmoreland and provides him the necessary leadership experience to lead the Company.

Michael R. D’Appolonia most recently served as President and Chief Executive Officer of Kinetic Systems, Inc., a global provider of process and mechanical solutions to the electronics, solar and biopharmaceutical industries. From 1986 to 2006, Mr. D’Appolonia was an executive and Principal of Nightingale & Associates, LLC, and its predecessor company Nightingale & Associates, Inc., a global management consulting firm providing financial and operational restructuring services to mid-market companies in the US and overseas. From January 2002 through June 2006, Mr. D’Appolonia served as Nightingale’s President. Mr. D’Appolonia is a member of the board of directors of Exide Technologies, Inc. In addition, he was a member of the board of directors of The Washington Group International, Inc. from 2001 to 2007.

Mr. D’Appolonia’s experience as a Chief Executive Officer of a large global organization, along with his public company board experience, brings to our Board the perspective of a leader facing a similar set of current external economic, social and governance issues.

Gail E. Hamilton most recently served as Executive Vice President of Symantec Corporation, an infrastructure software and services provider, retiring in 2005. Previously, she served as the General Manager of the Communications Division of Compaq Computer Corporation and as the General Manager of the Telecom Platform Division for Hewlett-Packard Company. She is currently a director of Arrow Electronics Inc., OpenText Corp., and Ixia. In the last five years, Ms. Hamilton has also served as a director of Washington Group International and Surgient, Inc.

Ms. Hamilton is a former senior executive with business and operational experience at a public technology company, whose strategic planning and business development experience are invaluable in guiding the development and progression of our information technology infrastructure and programs. In addition, Ms. Hamilton’s extensive public and private board experience will bring further professionalism and insight to the board room.

Richard M. Klingaman has been a consultant to the natural resources and energy industries since May 1992. Prior to consulting, Mr. Klingaman was a senior executive with Penn Virginia Corporation, a natural resources company specializing in coal, oil, natural gas, timber, lime and limestone.

Mr. Klingaman’s extensive experience in the mining and energy industries, including as Senior Vice President of a large natural resources company, provides him with an intimate knowledge of our operations and our industry.

Jan B. Packwood was the President and Chief Executive Officer of IDACORP, Inc. (NYSE: IDA), a holding company whose main subsidiary, Idaho Power Company, is an electric utility engaged in the generation, transmission, distribution, sale and purchase of electric energy, from 1999 to 2006. Prior to such time, Mr. Packwood served in various executive-level capacities of Idaho Power Company beginning in the 1980s. He currently serves as a director of IDACORP, Inc. and of various IDACORP, Inc. subsidiaries, including Idaho Power Company, IDACORP Financial Services, Inc. and Ida-West Energy Company.

As the former President and Chief Executive Officer of an electric utility involved in the mining and use of coal in the Pacific Northwest, Mr. Packwood brings to the Board a vast knowledge of our and our main customers’ business, including an understanding of the risks faced by our own power plant and the power plants we supply. This expertise will be invaluable in directing the future of our power plant operations, as well as providing insight into potential growth and expansion activities in our mining segment.

Robert C. Scharp was previously the Chief Executive Officer of Shell Coal Pty Ltd from 1997 to 2000 and then Chief Executive Officer of Anglo Coal Australia from 2000 to 2001. He served as the Chairman of the Shell Canada Energy Mining Advisory Council from 2005 to 2010. He had a 22 year career with Kerr McGee Corporation including serving as President - Kerr McGee Coal Corporation and Senior Vice President - Oil and Gas Production. Mr. Scharp was a director of Bucyrus International from 2005 to 2011 and was a director of Foundation Coal Holdings from 2005 to 2009. Mr. Scharp is also a retired Army National Guard colonel.

Mr. Scharp brings a wealth of coal mining industry experience to the Board, including invaluable chief executive operational oversight of coal mine operations. Mr. Scharp’s vast industry experience will assist the Board in driving future operational mining excellence and evaluating potential growth and expansion opportunities.

Executive Officer Information

Keith E. Alessi, our Chief Executive Officer, is discussed above under “Director Information.”

Jennifer S. Grafton joined Westmoreland as Associate General Counsel in December 2008 and was named General Counsel and Secretary in February 2011. Prior to Westmoreland, Ms. Grafton worked in the corporate group of various Denver-based and national law firms focusing her practice on securities and corporate governance. She is a member of the Colorado bar.

Douglas P. Kathol joined Westmoreland in 2003 as Vice President – Development, adding additional responsibility as Treasurer in 2008. In 2010, Mr. Kathol was named Executive Vice President. Prior to Westmoreland, Mr. Kathol spent almost twenty years in various positions, including Senior Vice President of Norwest Corporation, a consulting firm providing expertise to the energy, mining, and natural resources industries.

Robert P. King joined Westmoreland in March 2012 as President and Chief Operating Officer. From 2006 through 2012, Mr. King held various executive leadership roles at Consol Energy, Inc., including Executive Vice President – Business Advancement and Support Services from 2009 through March 2012. Mr. King has over 30 years experience in the coal industry, both underground and surface mines.

Joseph E. Micheletti joined Westmoreland in 2001 and has held a series of positions with Westmoreland since such time, including President and General Manager of our Jewett Mine. In June 2011, Mr. Micheletti was named Senior Vice President – Coal Operations. Mr. Micheletti has worked in the production, maintenance, processing, and engineering disciplines of the mining industry for 24 years and sits as a Director of the Rocky Mountain Coal Mining Institute.

Kevin A. Paprzycki joined Westmoreland as Controller and Principal Accounting Officer in June 2006 and was named Chief Financial Officer in April 2008. In June 2010, he was also named Treasurer. Prior to Westmoreland, Mr. Paprzycki was Corporate Controller at Applied Films Corporation from 2005 to 2006. Mr. Paprzycki became a certified public accountant in 1994 and a certified financial manager and certified management accountant in 2004.

We are committed to maintaining the highest standards of business conduct and corporate governance, which we believe are essential to running our business efficiently, serving our stockholders and maintaining our integrity in the marketplace. The Code of Conduct Handbook for directors, officers and employees, in conjunction with the Certificate of Incorporation, Bylaws, Board committee charters and Corporate Governance Guidelines, form the framework for the governance of Westmoreland. All of these documents are available on our website at www.westmoreland.com. On an annual basis, all directors, officers and employees sign an acknowledgement that they have received and reviewed the guidelines provided in the Code of Conduct Handbook. We will post on this website any amendments to the Code of Conduct Handbook or waivers of the Code of Conduct Handbook for directors and executive officers. You can request a copy of any of these documents by writing to the Corporate Secretary, Westmoreland Coal Company, 9540 S. Maroon Circle, Suite 200, Englewood, Colorado 80112.

Board Structure and Risk Oversight

The Board separated the positions of Chairman of the Board and Chief Executive Officer in May 2009 and elected Richard M. Klingaman, an independent director, as our Chairman, and Keith E. Alessi as our Chief Executive Officer. Separating these positions allows our CEO to focus on our day-to-day business, while allowing the Chairman of the Board to lead the Board in its fundamental role of providing advice to and independent oversight of management. The Board recognizes the time, effort, and energy that the CEO is required to devote to his position in the current business environment, as well as the commitment required to serve as our Chairman, particularly as the Board’s oversight responsibilities continue to grow. The Board believes this leadership structure has enhanced the Board’s oversight of risk and independence from our management, the ability of the Board to carry out its roles and responsibilities on behalf of our stockholders, and our overall corporate governance.

Risk is inherent with every business, and how well a business manages risk can ultimately influence its success. We face a number of risks, including economic risks, operational risks, environmental and regulatory risks, and others, such as the impact of competition, weather conditions and pressures from competing fuel sources. Management is responsible for the day-to-day management of risks that we face, while the Board, as a whole and through its committees, has responsibility for the oversight of risk management. In its risk oversight role, the Board has the responsibility to satisfy itself that the risk management processes designed and implemented by management are adequate and functioning as designed.

The Board believes that establishing the right “tone at the top” and full and open communication between management and the Board are essential for effective risk management and oversight. Our Chairman talks regularly with our CEO to discuss strategy and the risks we face. The executive management team attends the quarterly board meetings and is available to address any questions or concerns raised by the Board on risk management-related matters. Each quarter, the Board receives presentations from senior management on strategic matters involving our operations and is provided extensive materials that highlight the various factors that could lead to risk in our organization. The Board holds a strategic planning session with the management team on an annual basis to discuss strategies, key challenges, and risks and opportunities for us. Further, the Board is empowered to hire its own advisors without management approval to assist it in fulfilling its duties.

While the Board is ultimately responsible for our risk oversight, our committees assist the Board in fulfilling its oversight responsibilities in certain areas of risk. The Audit Committee assists the Board in fulfilling its oversight responsibilities with respect to risk management in the areas of financial reporting, internal controls and compliance with legal and regulatory requirements. The Compensation and Benefits Committee assists the Board in fulfilling its oversight responsibilities with respect to the management of risks arising from our compensation policies and programs. The Nominating and Corporate Governance Committee is tasked with overseeing succession planning for our directors and executive officers. On an annual basis, pursuant to such committee’s charters, the committees assess risk and have specific conversations with senior management regarding the risks faced.

Committees of the Board of Directors

As of the date of this proxy statement, our Board has seven directors and the following four committees: (1) Audit; (2) Compensation and Benefits; (3) Nominating and Corporate Governance; and (4) Executive. From time-to-time, the Board will form a Pricing Committee to address specific transactions such as debt or equity issuances. The Board has set the number of directors following the Annual Meeting at six. The current committee membership, the number of meetings during 2011 and the function of each of the committees are described below. Each of the committees operates under a written charter adopted by the Board. All of the committee charters are available on our website at www.westmoreland.com. During 2011, the Board held nine meetings plus a two-day strategic planning session. Each director serving during 2011 attended 100% of the aggregate of all Board and applicable

committee meetings held during the period that he or she served as a director. Directors are expected to attend the Annual Meeting of Stockholders. All directors attended the last Annual Meeting of Stockholders.

| Name of Director | | Audit | | Compensation and Benefits | | Nominating and Corporate Governance | | Executive | |

| Non-Employee Directors: | | | | | | | | | |

| Thomas J. Coffey | | Chair | | Member | | | | | |

| Michael R. D’Appolonia | | | | Chair | | Member | | Member | |

| Gail E. Hamilton | | Member | | Member | | | | | |

| Richard M. Klingaman | | | | | | | | Member | |

| Jan B. Packwood | | Member | | | | Chair | | | |

| Robert C. Scharp | | Member | | | | Member | | | |

| Employee Director: | | | | | | | | | |

| Keith E. Alessi | | | | | | | | Chair | |

| Number of Meetings in 2011 | | 5 | | 4 | | 3 | | 2 | |

Audit Committee

The Audit Committee provides oversight of the quality and integrity of our accounting, auditing and financial reporting practices and is responsible for retaining and terminating our independent accounts. The committee exercises its oversight obligations through regular meetings with management, the Director of Internal Audit and our independent registered public accounting firm, Ernst & Young LLP. The Audit Committee is also responsible for oversight of risks relating to accounting matters, financial reporting and regulatory compliance. To satisfy these oversight responsibilities, the committee separately meets with our Chief Financial Officer, the Director of Internal Audit, Ernst & Young LLP and management. The committee also receives periodic reports regarding issues such as the status and findings of audits being conducted by the internal and independent auditors, the status of material litigation, accounting changes that could affect our financial statements and proposed audit adjustments. The Board has determined that Michael D’Appolonia, Jan Packwood and Bob Scharp qualify as an “audit committee financial expert” as defined in Item 407(d)(5) of Regulation S-K.

Audit Committee Report

Under its charter, the Audit Committee assists the Board of Directors in fulfilling the Board’s responsibility for oversight of Westmoreland’s financial reporting process and practices, and its internal control over financial reporting. Management is primarily responsible for our financial statements, the reporting process and assurance for the adequacy of the internal control over financial reporting. Our independent registered public accounting firm, Ernst & Young LLP, is responsible for performing an independent audit of Westmoreland’s financial statements and internal control over financial reporting, and for expressing an opinion on the conformity of our audited financial statements to generally accepted accounting principles used in the United States and the adequacy of our internal control over financial reporting.

The Audit Committee has reviewed and discussed with Ernst & Young LLP Westmoreland’s audited consolidated financial statements and internal control over financial reporting. The Audit Committee has discussed with Ernst & Young LLP, during the 2011 fiscal year, the matters required to be discussed by Statement on Auditing Standards No. 61, as amended (Communication with Audit Committees) as adopted by the Public Company Accounting Oversight Board. The Audit Committee has received and reviewed the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the Public Company Accounting Oversight Board regarding such firm’s communications with the Audit Committee concerning independence, and has discussed with the independent accountants their independence.

The Audit Committee discussed with our internal and independent auditors the overall scope and plans for their respective audits. The Audit Committee meets with the independent auditors, with and without management present, to discuss the results of its examinations, the evaluations of our internal controls and the overall quality of our financial reporting. The Audit Committee also has reviewed and discussed the audited financial statements with management.

Based on the reviews and discussions described above, the Audit Committee recommended to the Board that the audited financial statements and assessment of internal controls over financial reporting be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2011. The Audit Committee has selected Ernst & Young LLP as our independent registered public accounting firm for fiscal year 2012.

Thomas J. Coffey, Chairman

Gail E. Hamilton

Jan B. Packwood

Robert C. Scharp

Compensation and Benefits Committee

The Compensation and Benefits Committee is responsible for assuring that the Board, our Chief Executive Officer, other executive officers, and our key management are compensated appropriately and in a manner consistent with our approved compensation strategy, internal equity considerations, competitive practice, and any relevant laws or regulations. In addition, the committee reviews our compensation programs to ensure that our programs are not promoting imprudent risk-taking. In accordance with its charter, the committee may retain and terminate outside counsel, compensation consultants, or other experts or consultants, as it deems appropriate, form and delegate authority to subcommittees and delegate authority to one or more designated members of the committee. To assist it in satisfying its oversight responsibilities, the committee chose in February 2011 to continue its relationship with Buck Consulting, which began in February 2010, and meets regularly with management to understand the financial, human resources and stockholder implications of compensation decisions being made.

Compensation and Benefits Committee Risk Assessment

On an annual basis, the committee reviews and discusses the structure of our compensation program to assess whether any aspect of the program could potentially be expected to provide an incentive to our executive officers or other employees to take any unnecessary or inappropriate risks that could threaten our operating results, financial condition or impact long-term stockholder value. To assist the committee in their review in February 2012, the committee engaged Buck Consulting to conduct a risk assessment of our incentive-based compensation plans (including the annual and long-term incentive programs) and our compensation practices.

Based on the findings of Buck Consulting, our internal controls, policies and risk-mitigating components in our incentive arrangements as well as the committee’s formal review and discussion, the committee believes our compensation programs represent an appropriate balance of short-term and long-term compensation and do not encourage executive officers or other employees to take on unnecessary or excessive risks that are reasonably likely to have a material adverse effect on us.

Our incentive compensation is designed to reward bonus-eligible employees for committing to and achieving goals that are intended to be challenging yet provide them a reasonable opportunity to reach the threshold amount, while requiring meaningful growth to reach the target level and substantial growth to reach the maximum level. The amount of growth required to reach the maximum level of compensation is developed within the context of the normal business planning cycle and, while difficult to achieve, is not viewed to be at such an aggressive level that it would induce bonus-eligible employees to take inappropriate risks that could threaten our financial or operating stability. In addition, the annual bonus program contains a cap on the maximum financial payout to employees as a whole.

Our executive compensation program includes the following features to help minimize risk.

Compensation Mix. We allocate compensation between fixed and contingent components, between annual cash incentives and long-term time-based equity incentives, based in part on an employee’s position and level of responsibility within the organization. We believe our mix of compensation elements helps to ensure that executives and other employees who are eligible for incentive compensation do not focus on achieving short-term results at the expense of the long-term growth and sustainability of the Company. None of our employees receives compensation that is primarily derived from commissions.

Base salary is the only assured portion of compensation that we provide to our executives and other employees. Consequently, our incentive compensation arrangements are intended to reward performance.

The annual incentive plan establishes cash-based award opportunities that are payable if, and only to the extent that, pre-established corporate financial and individual performance objectives are achieved, subject to the discretion of the committee to exclude certain events outside our direct control and to reward exemplary performance.

The equity-based component of the executive compensation program consists of grants of time-vested and performance-based restricted stock units. The use of both time-based and performance-based restricted stock units for fiscal 2012 balances our desire to drive long-term stock price growth with the retention pressures we face from our direct peers, as well as from emerging and evolving competitors.

Stock Ownership Guidelines. We have established stock ownership guidelines to ensure that our executives’ interests are aligned with those of stockholders. These guidelines also help ensure that the decisions our executives implement to achieve our financial and strategic objectives are focused on our long-term growth and health. We believe that this policy effectively mitigates the possibility that our executives would make business decisions to influence stock price increases in the short-term that cannot be sustained over the long-term or would liquidate their equity holdings to capture short-term fluctuations in our stock price.

Board Approval of Transactions. Management must obtain approval from the Board for significant transactions (i.e., mergers, acquisitions, dividends, etc.) that could impact the achievement of previously approved financial performance targets used in the executive compensation program, and the Compensation and Benefit Committee retains the discretion to ignore the impact of certain factors over which management has no control (such as accounting changes or force majeure events) for purposes of determining whether pre-established performance targets have been met.

Compensation and Benefits Committee Interlocks and Insider Participation

During 2011, each of Messrs. Coffey and D’Appolonia and Ms. Hamilton served on our Compensation and Benefits Committee. None of these directors was a current or former officer or employee of the Company, and none had any related party transaction involving the Company that is disclosable under Item 404 of Regulation S-K. During 2011, none of our executive officers served on the board of directors of any entity that had one or more executive officers serving on our Board.

Compensation and Benefits Committee Report

The Compensation and Benefits Committee has reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K with management. Based on this review and discussion, the Compensation and Benefits Committee recommended to the Board that the Compensation Discussion and Analysis, provided below, be included in this proxy statement.

Michael R. D’Appolonia, Chairman

Thomas J. Coffey

Gail E. Hamilton

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee identifies and recommends individuals qualified to be nominated as members of the Board and considers director candidates brought to the Board by stockholders. The committee also provides oversight on corporate governance matters and provides for the evaluation of Board, committee, and individual director performance, as well as provides oversight on succession planning.

The committee regularly assesses the mix of skills and industry experience currently represented on the Board, whether any vacancies on the Board are expected due to retirement or otherwise, the skills represented by retiring directors, and additional skills highlighted during the Board self-assessment process that could improve the overall quality and ability of the Board to carry out its functions. In the event vacancies are anticipated, or arise, the Nominating and Corporate Governance Committee considers various potential candidates for director and employs the same process for evaluating all candidates, including those submitted by stockholders. The committee is responsible for ensuring all director nominees undergo a thorough background check prior to nomination or appointment as a director and to review any adverse findings prior to such nomination or appointment. Candidates may come to the attention of the committee through current Board members, professional search firms, stockholders or other persons. In late 2010, we utilized the services of the National Association of Corporate Directors to help identify potential director candidates for election to the Board.

The committee initially evaluates a candidate based on publicly available information and any additional information supplied by the party recommending the candidate. If the candidate appears to satisfy the selection criteria and the committee’s initial evaluation is favorable, the candidate is contacted by the chairman of the committee for an interview to determine the mutual levels of interest in pursuing the candidacy. The committee is tasked with considering whether the candidate is (i) independent pursuant to the

requirements of The NASDAQ Stock Market, (ii) accomplished in his or her field and has a reputation, both personal and professional, that is consistent with our ideals and integrity, (iii) able to read and understand basic financial statements, (iv) knowledgeable as to us and the issues affecting our business, (v) committed to enhancing stockholder value, (vi) able to understand fully the legal responsibilities of a director and the governance processes of a public company, (vii) able to develop a good working relationship with other Board members and senior management and (viii) able to suggest business opportunities to us. If these discussions and considerations are favorable, the committee makes a final recommendation to the Board to nominate the candidate for election.

In considering whether to recommend any particular candidate, including incumbent directors, for inclusion in the Board’s slate of recommended director nominees, the Nominating and Corporate Governance Committee takes into consideration a number of criteria which include: professional work experience; skills; expertise; diversity; personal and professional integrity; character; temperament; business judgment; time availability in light of other commitments; dedication; conflicts of interest; and public company experience. The committee does not assign specific weights to particular criteria and no particular criterion is a prerequisite for each prospective nominee. The committee focuses on issues of diversity, such as diversity of education, professional experience and differences in viewpoints and skills. The committee does not have a formal policy with respect to diversity; however, the Board and the committee believe that it is essential that the Board members represent diverse viewpoints and strives to ensure that the slate of nominees represents a wide breadth of diverse backgrounds and skill sets to adequately represent the needs of the stockholders. With respect to the nomination of continuing directors for re-election, the individual’s contributions to the Board are also considered. We believe that the backgrounds and qualifications of our directors, considered as a group, provide a composite mix of skills, experience, and knowledge that will assure that the Board can continue to fulfill its responsibilities.

The Board’s retirement policy mandates that directors elected to the Board at our annual meeting retire from the Board at the first annual meeting of stockholders following the director’s 75th birthday. The Board grandfathered all directors then serving as a director at the time the policy was adopted in November 2010, making the new retirement policy only applicable to current and future directors who will turn 75 after May 2010.

Stockholders may recommend individuals to the Nominating and Corporate Governance Committee for consideration as potential director candidates by submitting their names, together with appropriate biographical information and background materials and a statement as to whether the stockholder or group of stockholders making the recommendation has beneficially owned more than 5% of our common stock for at least a year as of the date such recommendation is made, to the Nominating and Corporate Governance Committee, c/o Secretary, Westmoreland Coal Company, 9540 South Maroon Circle, Suite 200, Englewood, Colorado 80112. Assuming that appropriate biographical and background material has been provided on a timely basis, the committee will evaluate stockholder-recommended candidates by following the same process, and applying the same criteria, as it follows for candidates submitted by others. If the Board determines to nominate a stockholder-recommended candidate and recommends his or her election, then his or her name will be included in our proxy statement for the next annual meeting.

Stockholders also have the right to nominate director candidates directly, without any action or recommendation on the part of the committee or the Board, by following the procedures set forth in Section 2.6, “Advance Notice of Nominees,” in our bylaws. Among other things, a stockholder wishing to nominate a director candidate must give notice to us within the specified time period that includes the information about the stockholder and the proposed nominee required by the bylaws. Any stockholder wishing to nominate a candidate for election to the Board pursuant to the bylaw provision must strictly comply with the procedures specified in Section 2.6 of the bylaws. Candidates nominated by stockholders in accordance with these procedures could be presented by the nominating stockholder from the floor of the annual meeting, but would not be included in our proxy statement for the next annual meeting, unless the Board made its own determination to include such candidate.

Other Committees

During 2011, the Board had two other committees in addition to the committees set forth above: the Executive Committee and the Pricing Committee. Pursuant to its charter adopted by the Board in February 2012, the Executive Committee is authorized to act on behalf of the Board during periods between Board meetings. During 2011, the Executive Committee held two meetings. The Pricing Committee acts in the event of offerings of the Company’s securities with respect to matters such as determining the price and terms at which such securities shall be sold to underwriters and the public. During 2011, the Pricing Committee held no meetings, but acted by unanimous written consent on several occasions with respect to the contribution of shares to our pension plans and with respect to the issuance of debt in February 2011.

Director Independence

NASDAQ Marketplace Rules require that a majority of the Board be independent. No director qualifies as independent unless the Board determines that the director has no direct or indirect relationship with the Company that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In assessing the independence of its members, the Board examined the commercial, industrial, banking, consulting, legal, accounting, charitable and familial relationships of each member. The Board's inquiry extended to both direct and indirect relationships with the Company. Based upon both detailed written submissions by its members and discussions regarding the facts and circumstances pertaining to each member, considered in the context of applicable NASDAQ Marketplace Rules, the Board has determined that all of the directors nominated for election, other than Mr. Alessi, are independent. The independent directors meet during most Board meetings in separate executive session without management present. The Chairman of the Board, who is an independent director, presides over these meetings. Each member of the Audit Committee must, in addition to the independence requirements of the NASDAQ Marketplace Rules, meet the heightened independence standards required for audit committee members under the NASDAQ Marketplace Rules listing standards, Section 10A of the Securities Exchange Act of 1934, and Rule 10A-3 thereunder. The Board determined that Messrs. Coffey, Packwood and Scharp and Ms. Hamilton, the 2011 Audit Committee members, each met such heightened independence standards.

Communicating with the Board

Stockholders who wish to write directly to the Board on any topic should address communications to the Board of Directors in care of the Chairman, Westmoreland Coal Company Board of Directors, 9540 S. Maroon Circle, Suite 200 Englewood, Colorado 80112. Our Chairman will report on stockholder communications to the Board and provide copies or specific summaries to directors on matters deemed to be of appropriate importance. In general, communications from stockholders relating to corporate governance will be forwarded to the Board unless they are frivolous, obscene, repeat the same information contained in earlier communications, or fails to identify the author.

The elements of our 2012 director compensation are reflected in the table below. We believe that it is important to attract and retain outstanding non-employee directors and target compensation at the median of our peer group. In February 2012, the Compensation and Benefits Committee recommended and the Board approved the below compensation structure for fiscal year 2012. All non-employee directors receive the “Annual Cash Retainer” in addition to any other retainers they may be entitled for service as the Chairman or as the Chair of a committee.

| Type of Compensation | | Amount |

| Annual Cash Retainer | | $35,000 |

Annual Stock Award Retainer (restricted stock units with one-year vest) | | $70,000 valued at fair market value on date of grant |

| Annual Retainer for Chairman | | $35,000 |

| Annual Retainer for Committee Chair: | | |

| Audit Committee | | $7,000 |

| Compensation and Benefits Committee | | $5,000 |

| Nominating and Corporate Governance Committee | | $3,000 |

| Annual Retainer for Serving on the Audit, C&B or N&CG Committees | | $5,000 per committee |

Attendance at Board or Committee Meeting (in-person) | | $1,500 per meeting |

Attendance at Board or Committee Meeting (telephonic) | | $1,000 per meeting |

2011 Non-Employee Director Compensation

| | | | | | | | | | |

Name(1) | | Fees Earned Or Paid In Cash($) | | | Grant Date Fair Value of Stock Awards($)(2) | | | Total Compensation ($) | |

| Thomas J. Coffey | | | 75,500 | | | | 50,009 | | | | 125,509 | |

| Michael R. D’Appolonia | | | 73,500 | | | | 50,009 | | | | 123,509 | |

| Gail E. Hamilton | | | 61,375 | | | | 50,009 | | | | 111,384 | |

| Richard M. Klingaman | | | 85,000 | | | | 50,009 | | | | 135,009 | |

| Jan B. Packwood | | | 65,067 | | | | 50,009 | | | | 115,076 | |

| Robert C. Scharp | | | 63,375 | | | | 50,009 | | | | 113,384 | |

| Former Directors(3) | | | | | | | | | | | | |

| William M. Stern | | | 5,667 | | | | — | | | | 5,667 | |

| Frank T. Vicino, Jr. | | | 4,889 | | | | — | | | | 4,889 | |

__________

| (1) | Mr. Alessi, who is our Chief Executive Officer, does not receive any additional compensation for his services as a director. |

| (2) | 2,940 restricted stock units were awarded to each non-employee director elected to the Board in May 2011. The restricted stock units vest on May 24, 2012. The grant date fair value of these awards was $17.01 per share. |

| (3) | Messrs. Stern and Vicino were serving as our preferred directors in early 2011. Upon the repayment of the outstanding preferred dividends in early February 2011, the preferred director positions were eliminated. |

Non-Employee Director Stock Ownership Guidelines

In March 2011, the Board adopted stock ownership guidelines for non-employee directors under which the directors are expected to own Westmoreland equity equal in value to three times the annual cash retainer, with a five-year timetable to comply.

2011 Outstanding Equity Awards at Fiscal Year-End for Directors

| Option Awards | |

| Name | | Securities Underlying Unexercised Options (#) Exercisable | | | Securities Underlying Unexercised Options (#) Unexercisable | | | Option Exercise Price ($) | | | Option Expiration Date | |

| Thomas J. Coffey | | | 5,000 | | | | 0 | | | | 15.31 | | | | 5/24/12 | |

| | | 1,762 | | | | 0 | | | | 25.14 | | | | 6/23/16 | |

| Richard M. Klingaman | | | 3,733 | | | | 0 | | | | 23.99 | | | | 2/2716 | |

The following table sets forth information, as of March 1, 2012, concerning beneficial ownership by: holders of more than 5% of any class of our voting securities; directors; each of the named executive officers listed in the Summary Compensation Table; and all directors and executive officers as a group. The information provided in the table is based on our records, information filed with the SEC and information provided to us, except where otherwise noted. The number of shares beneficially owned by each entity or individual is determined under SEC rules, and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares as to which the entity or individual has sole or shared voting power or investment power and also any shares that the entity or individual has the right to acquire within 60 days of March 1, 2012 through the exercise of any stock options, the conversion of depositary shares at a conversion ratio of 1.708 shares of common stock for each depositary share, the vesting of restricted stock or upon the exercise or conversion of other rights. Unless otherwise indicated, each person has sole voting and investment power with respect to the shares set forth in the table. The percentage calculations set forth in the table are based on 13,879,458 shares of common stock outstanding and 639,840 depositary shares outstanding on March 1, 2012.

Name of Beneficial Owner | | Common Stock | | | % of Common | | | Depositary Shares | | | % of Depositary Shares | |

| |

| 5% or Greater Equity Holders | | | | | | | | | | | | |

| Jeffrey L. Gendell (1) | | | 3,071,144 | | | | 22.12 | % | | | 3,700 | | | | * | |

| Frank Vicino, Jr. (2) | | | 188,574 | | | | 1.34 | % | | | 108,730 | | | | 16.99 | % |

| Stephen D. Rosenbaum (3) | | | 131,404 | | | | * | | | | 60,000 | | | | 9.38 | % |

| T. Rowe Price (4) | | | 774,320 | | | | 5.58 | % | | | — | | | | — | |

| Officers and Directors | |

| Thomas J. Coffey (5) | | | 41,696 | | | | * | | | | — | | | | — | |

| Michael R. D’Appolonia | | | 9,448 | | | | * | | | | — | | | | — | |

| Gail E. Hamilton | | | 0 | | | | * | | | | — | | | | — | |

| Richard M. Klingaman | | | 10,343 | | | | * | | | | — | | | | — | |

| Jan B. Packwood | | | 0 | | | | * | | | | — | | | | — | |

| Robert C. Scharp | | | 0 | | | | * | | | | — | | | | — | |

| Keith E. Alessi (6) | | | 153,895 | | | | 1.10 | % | | | — | | | | — | |

| Kevin A. Paprzycki (7) | | | 17,953 | | | | * | | | | — | | | | — | |

| Douglas P. Kathol (8) | | | 42,067 | | | | * | | | | | | | | | |

| Joseph E. Micheletti (9) | | | 8,232 | | | | * | | | | — | | | | — | |

| Morris W. Kegley (10) | | | 17,255 | | | | * | | | | — | | | | — | |

| John V. O’Laughlin (11) | | | 42,884 | | | | * | | | | — | | | | — | |

| Directors and Executive Officers as a Group (11 persons) | | | 287,984 | | | | 2.05 | % | | | — | | | | — | |

_________

* Percentages of less than 1% are indicated by an asterisk |

| (1) | The total for Mr. Gendell includes shares of common stock, as well as shares of common stock issuable upon conversion of depositary shares. According to a Schedule 13D/A filed January 6, 2012, Mr. Gendell owns 549,000 shares of common stock of which he has sole voting and dispositive power. In addition, Tontine Capital Partners, L.P. and other limited partnerships and limited liability companies that are affiliates of Tontine Capital Partners, L.P. own 2,515,826 shares of common stock and 3,700 depositary shares that are convertible into 6,318 shares of common stock. Mr. Gendell is either a managing member of, or a managing member of the general partner of, these limited partnerships and limited liability companies and has shared voting and dispositive power over these shares. All of the foregoing shares may be deemed to be beneficially owned by Mr. Gendell. Mr. Gendell disclaims beneficial ownership of these shares for purposes of Section 16(a) under the Exchange Act, or otherwise, except as to shares directly owned by Mr. Gendell or representing Mr. Gendell’s pro rata interest in, and interest in the profits of, these limited partnerships and limited liability companies. The address for Mr. Gendell is 55 Railroad Avenue, Greenwich, CT 06830. |

| (2) | According to a Schedule 13D/A filed on February 19, 2010, Mr. Frank Vicino Jr. beneficially owns 108,730 depositary shares of which he has sole voting and sole dispositive power for 86,750 shares, and shared voting and dispositive power over 21,980 shares. The common stock total for Mr. Vicino includes 185,673 common shares issuable upon conversion of depositary shares. The address for Mr. Vicino is 3312 NE 40th Street, Fort Lauderdale, Fl 33308. |

| 3) | The total for Mr. Rosenbaum includes shares of common stock, as well as shares of common stock issuable upon conversion of depositary shares. The depositary shares are convertible into 102,459 shares of common stock. The address for Mr. Rosenbaum is 817 N. Calvert Street, Baltimore, MD 21202. |

| (4) | According to a Schedule 13G/A filed on February 13, 2012, these securities are owned by various individual and institutional investors, which T. Rowe Price Associates, Inc. (Price Associates) serves as an investment adviser with power to direct investments and/or sole power to vote the securities. For purposes of the reporting requirements of the Securities Exchange Act of 1934, Price Associates is deemed to be a beneficial owner of such securities; however, Price Associates expressly disclaims that it is, in fact, the beneficial owner of such securities. The principal business address of T. Rowe Price is 100 East Pratt St., Baltimore, Maryland 21202. |

| (5) | Includes 5,000 common shares that may be purchased upon exercise of options under the 2000 Non Employee Director Stock Incentive Plan. |

| (6) | Includes 5,959 shares of common stock held by Prudential Retirement, as trustee of the Westmoreland’s 401(k) plan, 30,556 shares of common stock that may be purchased upon the exercise of options under our 2002 Plan, 60,000 shares of common stock that may be purchase upon the exercise of options under our 2007 Plan and 10,027 shares of restricted stock issued under our 2007 Plan that will vest on April 1, 2012. |

| (7) | Includes 4,419 shares of common stock held by Prudential Retirement, as trustee of the Westmoreland’s 401(k) plan, 7,000 shares of common stock that may be purchased upon exercise of options under our 2007 Plan and 1,911 shares of restricted stock issued under our 2007 Plan that will vest on April 1, 2012. |

| (8) | Includes 5,215 shares of common stock held by Prudential Retirement, as trustee of the Westmoreland’s 401(k) plan, 7,500 shares of common stock that may be purchased upon exercise of options under our 2002 Plan, 7,000 shares of common stock which may be purchased upon exercise of options under our 2007 Plan and 2,500 shares of restricted stock issued under our 2007 Plan that will vest on April 1, 2012. In addition, beneficial ownership includes 13,878 shares of common stock owned by Mr. Kathol's wife. Mr. Kathol expressly disclaims beneficial ownership of these securities, and this disclosure shall not be an admission that the reporting person is the beneficial owner of such securities for purposes of Section 16 or for any other purpose. |

| (9) | Includes 953 shares of common stock held by Prudential Retirement, as trustee of the Westmoreland’s 401(k) plan, 5,000 shares of common stock that may be purchased upon exercise of options under our 2007 Plan and 670 shares of restricted stock issued under our 2007 Plan that will vest on April 1, 2012. |

| (10) | Includes 4,671 shares of common stock held by Prudential Retirement, as trustee of the Westmoreland’s 401(k) plan, 7,000 shares of common stock that may be purchased upon exercise of options under our 2007 Plan and 1,500 shares of restricted stock issued under our 2007 Plan that will vest on April 1, 2012. |

| (11) | Includes 6,828 shares of common stock held by Prudential Retirement, as trustee of the Westmoreland’s 401(k) plan, 12,000 shares of common stock that may be purchased upon exercise of options under our 2002 Plan, 15,000 shares of common stock which may be purchased upon exercise of options under our 2007 Plan and 1,508 shares of restricted stock issued under our 2007 Plan that will vest on April 1, 2012. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires our executive officers and directors and persons who own more than ten percent of a registered class of our equity securities to file reports of ownership and changes in ownership on Forms 3, 4 and 5 with the SEC and The NASDAQ Stock Market. To the knowledge of management, based solely on its review of such reports, no person who at any time during the fiscal year ended December 31, 2011, was a director, executive officer, or beneficial owner of more than ten percent of any class of equity securities of the Company failed to file on a timely basis reports required by Section 16(a) of the Securities Exchange Act of 1934 during the most recent fiscal year.

EQUITY COMPENSATION PLAN INFORMATION

At December 31, 2011, we had stock options and stock appreciation rights (“SARs”) outstanding from two stockholder-approved stock plans and one plan for non-employee directors that was not approved by stockholders. The 2000 Nonemployee Directors’ Stock Incentive Plan is the only plan not approved by stockholders and provided for the grant of stock options to non-employee directors at the time they were first elected to the Board and at the time of each subsequent re-election to the Board. In October 2009, the Board terminated the 2000 Nonemployee Directors’ Stock Incentive Plan and several other stock-holder approved plans. The termination of these plans does not impair the rights of any participant under any award granted pursuant to the plans. All new equity issuances, whether to directors or officers, are made out of our stockholder-approved 2007 plan.

| Plan Category | | Number of Securities to be Issued Upon Exercise of Outstanding Options (a) | | | Weighted Average Exercise Price of Outstanding Options (b) | | | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column (a)) (c) | |

| Equity plans approved by security holders | | | 199,606 | (1) | | $ | 20.98 | | | | 80,566 | (3) |

| Equity plans not approved by security holders | | | 30,000 | (2) | | $ | 15.31 | | | | 0 | |

| Total | | | 229,606 | | | $ | 20.24 | | | | 80,566 | |

__________

| (1) | Excludes SARs to acquire 100,100 shares of common stock with exercise prices above $12.75, the closing price of a share of our common stock as reported on The NASDAQ Stock Market on December 30, 2011. At December 31, 2011, 100,100 SARs were outstanding with base prices between $19.37 and $29.48. |

| (2) | Excludes SARs to acquire 16,067 shares of common stock with exercise prices above $12.75, the closing price of a share of our common stock as reported on The NASDAQ Stock market on December 30, 2011. At December 31, 2011, 16,067 SARs were outstanding with base prices between $23.985 and $25.14. |

| (3) | Number of securities remaining available for future issuance reflects the reservation of 302,033 shares for issuance to certain employees upon the completion of certain time-based vesting restrictions related to restricted stock units issued on July 1, 2009, July 1, 2010, and April 1, 2011. |

Throughout its history, including over recent years, Westmoreland Coal Company has experienced major changes, requiring redefinition of our business model. Originally focused on underground mining in the Appalachian Basin, we have since divested ourselves of all eastern mining properties and assets, moved our headquarters to Colorado and purchased six surface coal mining operations. Since 2001, we have focused on niche coal markets where we can take advantage of long-term coal contracts and rail transportation advantages. To understand our company and the way in which we compensate our executives, it is important to understand the business environment we have operated in over the past several years, the challenges that we have faced, and the progress we have made towards returning the company to profitability. This understanding will provide insight into our past compensation practices and the steps we are taking to align the pay of our executives with creating long-term stockholder value.

Historical Business Environment

Our business has a high proportion of revenues, and therefore cash flows, set or limited by long-term supply contracts with a small number of customers. While these contracts provide certain long term visibility and stability, their exclusivity and terms significantly restrict our ability to react financially if there is an event which negatively impacts our customers’ ability to buy coal. We also have ongoing responsibility for substantial post-retirement health care liabilities associated with our discontinued Appalachian Basin underground mining operations. We had been challenged during recent history with generating sufficient cash at our operating subsidiaries to fund both the increasing costs of corporate overhead and these post-retirement liabilities. In 2007, we hired Mr. Keith E. Alessi as Chief Executive Officer (“CEO”) at a difficult time in our history. Since 2007, Mr. Alessi has led efforts which have successfully standardized our operations, reduced corporate overhead and post retirement costs, stabilized cash flow, provided meaningful liquidity to our balance sheet and set a new, focused strategic vision. This new vision led to the acquisition of the Kemmerer mine in January of 2012.

Fiscal 2011 – The Year in Review

Fiscal year 2011 was a year in which we improved liquidity, successfully weathered several external challenges that impacted our customers, relocated our corporate offices and ultimately announced a major acquisition. Our business model relies primarily upon long term, cost plus contracts, with a small number of large customers. During 2011, the Pacific Northwest experienced unprecedented amounts of snow that led to a prolonged hydroelectric power season. This negatively impacted our largest customer well into the summer period. In addition, flooding associated with the high snow pack disrupted rail transportation and mining production, which resulted in a further reduction in coal sales across our northern tier mining operations. Lastly, an explosion and fire at one of our major customers in November resulted in further loss of revenue. Despite these large interruptions in our operations in 2011, we ended the year within 10% of our record adjusted EBITDA from fiscal year 2010 due to timely reaction and stringent cost management.

In February, we issued $150 million in senior secured bonds in order to refinance existing debt and to provide ourselves additional liquidity. This, combined with favorable financial results from 2010, led to the elimination of a going-concern audit opinion in our financial statements. In December, we bolstered our reserves through the acquisition of 158 million tons of coal at our Absaloka mine. This acquisition was in line with our strategic objective of increasing coal reserves and extending mine lives at all of our operations.

In November 2011, the management team successfully relocated the corporate offices from Colorado Springs to south Denver. This move not only cut overhead costs through a reduction in office rent, lowered travel expenses and decreased consulting costs, but broadened the available pool of talent from which to draw new employees and executives and brought us geographically closer to our key business partners. By designing an office from scratch, we were able to build a new environment that reflects the core values of the company, with all offices identical in size, including the executive officers’ offices, and no executive has a corner office. The new office atmosphere supports our overall compensation philosophy of limited perquisites and encourages a team environment.

Finally, we moved to diversify and grow the business through the execution of a Purchase and Sale Agreement with Chevron Mining Inc. for the purchase of the Kemmerer mine in Kemmerer, Wyoming. Both of these activities demonstrated the management team’s keen attention to fulfilling the strategic plan and growth model set out by the Board of Directors in early 2011. We announced this transaction in December 2011 and was successfully closed in January 2012.

General Compensation Practices and Philosophy

Based on a holistic review and overhaul of the compensation program in 2010, our philosophy for total compensation packages for fiscal year 2012 is consistent with fiscal year 2011, but significantly different than in prior periods. Our prior approach was reflective of the state of the company and the need to incent management to bring the company through the difficult period of turning around its financial performance. The new compensation philosophy is forward-looking in nature and is intended to more closely align the performance of the company to that of enhancing stockholder value.

Westmoreland now bases its total compensation strategy on a moderate growth model. As a moderate growth company, Westmoreland seeks to maintain salaries at or near peer group medians, shifts a portion of short-term incentive to long-term incentive and increases the percentage of long-term incentives as a percentage of total compensation. Our named executive officers remain at-will employees and do not have employment agreements, including the CEO.

The Westmoreland benefits philosophy is to provide executive officers with protection and security through health and welfare, retirement, disability insurance and life insurance programs. During fiscal year 2011, the CEO and other executive officers were eligible to receive the same benefits that are generally available to other Westmoreland employees. In addition to the company-wide benefits, the Board elected to provide executive physical examinations to executive officers starting in fiscal year 2012, for which we cover the costs that are not otherwise covered under each executive officer’s chosen health plan. We believe that the executive physical is a prudent measure to help ensure the health of our executives. The executive physical benefit is a benefit generally provided by our peer companies and is available at a reasonable cost to Westmoreland.

Our compensation program is intended to retain and reward our executives and is guided by several key principles:

| | ● | Design a program that aligns with long-term stockholder interests through the use of equity awards; |

| | ● | Target compensation is at median of peer group, with the long-term goal of bringing lower compensated executives to target levels as they continue to gain experience; |

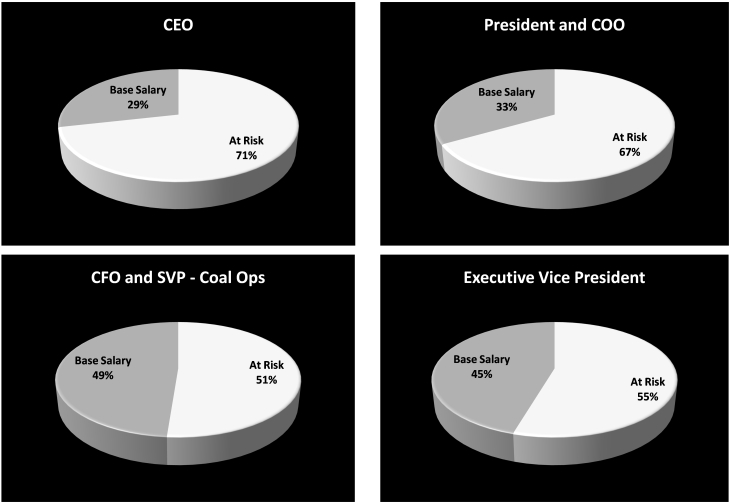

| | ● | Link pay to performance by making a substantial portion of total executive compensation variable or “at risk” over the long-term; and |

| | ● | Provide a compensation program that emphasizes direct compensation as opposed to perquisites and other benefits. |

Stock Ownership Guidelines and Clawback Policies

In order to better align the interests of our executive management team with the interests of our stockholders and to promote our commitment to sound corporate governance, the Compensation and Benefits Committee approved stock ownership guidelines in 2011. The executive management team is expected to be in compliance with these guidelines within five years of becoming subject to the policy. The ownership requirement for our executive officers is calculated as a multiple of base salary as follows:

| Executive Level | | Multiple of Base Salary | |

| CEO | | | 3.0 | x |

| COO | | | 2.0 | x |

| CFO, EVP and SVP | | | 1.5 | x |

| Other executive officers | | | 1.0 | x |

At this time, the Committee has not adopted a clawback policy for the executive management team. While in full support of such a policy, the Compensation and Benefits Committee is waiting for more formal guidance from the Securities and Exchange Commission in response to the recent Dodd Frank legislation before adoption and implementation of a formal policy.

Compensation Methodology

Peer Comparisons and Survey Data

Our peer group is based on criteria that represent the characteristics that define the markets in which we compete for talent, rather than simply the markets in which we compete for business. In creating our peer group, we noted that there are very few comparably-sized publicly-traded coal companies to align ourselves with for comparative purposes. In addition, a third of our executive team comes from segments other than mining. With these and other factors in mind, we identified two characteristics that we believe would have the greatest influence on how we perform, as well as on the leadership talent that we need to drive outstanding

performance. First, we are capital-intensive and second, we maintain long-term contracts as part of the business relationship that is established with customers. Based on such characteristics, we identified the below peer group for 2011 with the assistance of the compensation consultant engaged by the Compensation and Benefits Committee. The companies included in the peer group differ from those listed in the indices used to prepare our stock price performance graph, which can be found in our 2011 Annual Report to Stockholders. We believe that the peer group listed below, when used in conjunction with third-party compensation survey information, enables us to provide an accurate assessment of market practices for the compensation of our executive management team.

| Name | | FY 2010 Net Income in Millions ($) | | | FY 2010 Revenues in Millions ($) | |

| Atwood Oceanics | | | 272 | | | | 645 | |

| Calgon Carbon Corp. | | | 35 | | | | 482 | |

| Drew Industries Inc. | | | 28 | | | | 573 | |

| Dril-Quip Inc. | | | 102 | | | | 566 | |

| Forward Air Corp. | | | 32 | | | | 484 | |

| Genessee & Wyoming Inc. | | | 79 | | | | 630 | |

| Gulf Island Fabrication Inc. | | | 13 | | | | 248 | |

| Hecla Mining Co. | | | 49 | | | | 419 | |

| Heico Corp. | | | 55 | | | | 617 | |