UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | ¨ | | Preliminary Proxy Statement. |

| | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)). |

| | x | | Definitive Proxy Statement. |

| | ¨ | | Definitive Additional Materials. |

| | ¨ | | Soliciting Material Pursuant to Rule 14a-12. |

MAGMA DESIGN AUTOMATION, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | | |

| | |

| | | x | | No fee required. |

| | |

| | | ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(l) and 0-11. |

| | | |

| | | | | (1) | | Title of each class of securities to which transaction applies: |

| | | |

| | | | | (2) | | Aggregate number of securities to which transaction applies: |

| | | |

| | | | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | | | | (4) | | Proposed maximum aggregate value of transaction: |

| | | |

| | | | | (5) | | Total fee paid: |

| | |

| | | ¨ | | Fee paid previously with preliminary materials. |

| | |

| | | ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | | |

| | | | | (1) | | Amount Previously Paid: |

| | | |

| | | | | (2) | | Form, Schedule or Registration Statement No.: |

| | | |

| | | | | (3) | | Filing Party: |

| | | |

| | | | | (4) | | Date Filed: |

MAGMA DESIGN AUTOMATION, INC.

5460 BAYFRONT PLAZA

SANTA CLARA, CALIFORNIA 95054

(408) 565-7500

August 3, 2005

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of Magma Design Automation, Inc. that will be held on Tuesday, August 30, at 10:00 a.m. at the offices of Fenwick & West LLP, 801 California Street, Mountain View, California.

The formal notice of the Annual Meeting of Stockholders and the proxy statement are included with this invitation.

After reading this proxy statement, please mark, date, sign and return the enclosed proxy in the enclosed prepaid envelope, to ensure that your shares will be represented. YOUR SHARES CANNOT BE VOTED UNLESS YOU SIGN, DATE AND RETURN THE ENCLOSED PROXY OR ATTEND THE ANNUAL MEETING OF STOCKHOLDERS IN PERSON. Your vote is important, so please return your proxy promptly. A copy of our 2005 Annual Report to Stockholders is also enclosed.

The Board of Directors and management look forward to seeing you at the meeting.

Sincerely yours,

Rajeev Madhavan

Chairman of the Board and

Chief Executive Officer

MAGMA DESIGN AUTOMATION, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held August 30, 2005

To the Stockholders of Magma Design Automation, Inc.:

The Annual Meeting of Stockholders (the “Annual Meeting”) of Magma Design Automation, Inc., a Delaware corporation, will be held on Tuesday, August 30, 2005 at the offices of Fenwick & West LLP, 801 California Street, Mountain View, California, at 10:00 a.m. Pacific Time, for the following purposes:

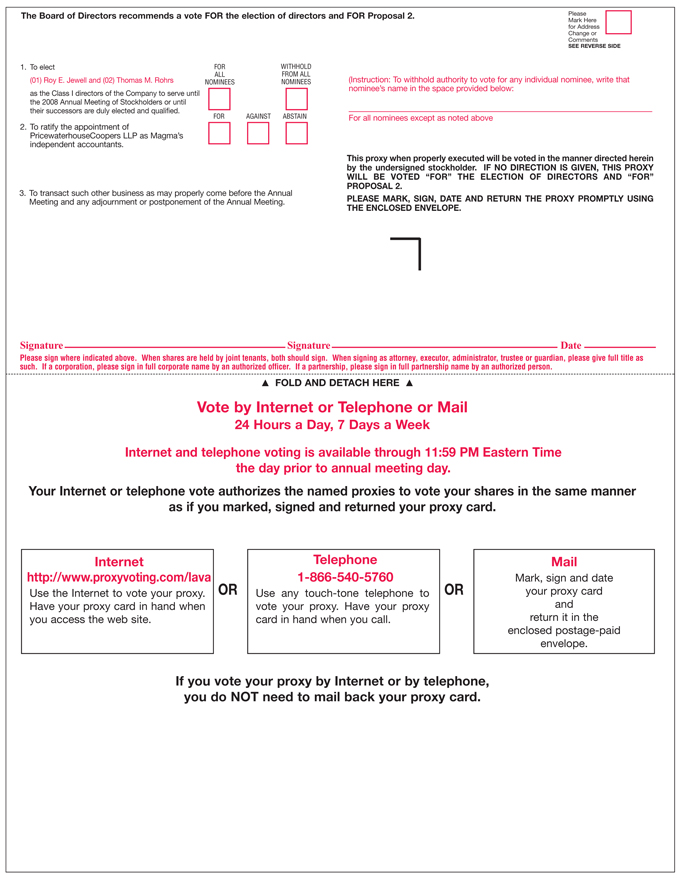

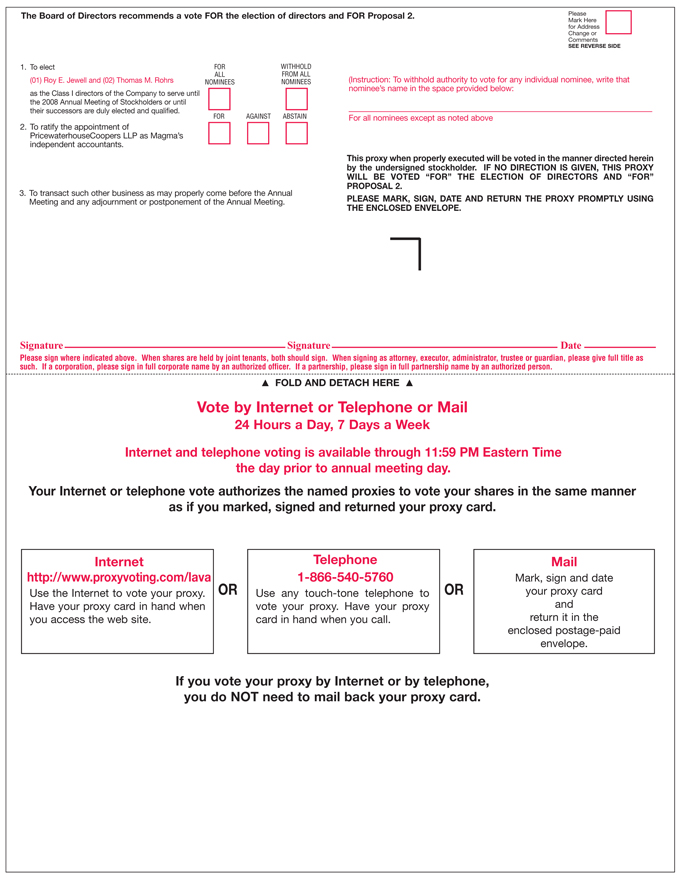

| | 1. | | To elect two Class I directors to serve until the 2008 Annual Meeting of Stockholders or until their successors are duly elected and qualified; |

| | 2. | | To ratify the appointment of PricewaterhouseCoopers LLP as Magma’s independent accountants; and |

| | 3. | | To transact such other business as may properly come before the Annual Meeting and any adjournment or postponement of the Annual Meeting. |

Stockholders of record as of the close of business on July 28, 2005 are entitled to notice of and to vote at the Annual Meeting and any adjournment or postponement thereof. A complete list of stockholders entitled to vote at the Annual Meeting will be available at the office of Magma’s Secretary, 5460 Bayfront Plaza, Santa Clara, California, for ten days prior to the meeting.

It is important that your shares are represented at the meeting. Even if you plan to attend the meeting, we hope that you will promptly mark, sign, date and return the enclosed proxy. This will not limit your right to attend or vote at the meeting.

By Order of the Board of Directors

Beth Roemer

Vice President, General Counsel and Secretary

August 3, 2005

MAGMA DESIGN AUTOMATION, INC.

5460 BAYFRONT PLAZA

SANTA CLARA, CALIFORNIA 95054

PROXY STATEMENT

This proxy statement is furnished in connection with the solicitation by the Board of Directors of Magma Design Automation, Inc., a Delaware corporation, of proxies in the accompanying form to be used at the Annual Meeting of Stockholders of Magma to be held at the offices of Fenwick & West LLP, 801 California Street, Mountain View, California, on Tuesday, August 30, 2005, at 10:00 a.m. Pacific Time, and any adjournment or postponement thereof (the “Annual Meeting”). Magma’s principal executive offices are located at 5460 Bayfront Plaza, Santa Clara, California 95054 and its telephone number is (408) 565-7500.

Magma’s 2005 Annual Report to Stockholders, including the Annual Report on Form 10-K (together, the “Annual Report”) containing financial statements and financial statement schedules required to be filed for the year ended March 31, 2005, is being mailed together with these proxy solicitation materials to all stockholders entitled to vote at the Annual Meeting. This proxy statement, the accompanying form of proxy and Magma’s Annual Report will first be mailed to stockholders entitled to vote at the Annual Meeting on or about August 3, 2005.

Who Can Vote

Stockholders of record at the close of business on July 28, 2005 (the “Record Date”), are entitled to notice of and to vote at the Annual Meeting. As of the close of business on the Record Date, Magma had 34,795,856 shares of common stock, $.0001 par value, outstanding.

How You Can Vote

You may vote your shares at the Annual Meeting either in person or by proxy. To vote by proxy, you should mark, date, sign and mail the proxy card in the enclosed prepaid envelope. Giving a proxy will not affect your right to vote your shares if you attend the Annual Meeting and want to vote in person. The shares represented by the proxies received in response to this solicitation and not properly revoked prior to the Annual Meeting will be voted at the Annual Meeting in accordance with the instructions therein. On the matters coming before the Annual Meeting for which a choice has been specified by a stockholder on the proxy card, the shares will be voted accordingly. If you return your proxy, but do not mark your voting preference, the individuals named as proxies will vote your sharesFOR the election of the two nominees for director listed in this proxy statement andFOR the ratification of the appointment of Magma’s independent accountants.

Registered stockholders can simplify their voting and save Magma additional expense by calling (866) 540-5760 or voting via the Internet athttp://www.proxyvoting.com/lava. Beneficial holders can vote via the Internet athttp://www.proxyvote.com. Telephone and Internet voting information is provided on the proxy card if these options are available to you. Votes submitted via the Internet or by telephone must be received by 11:59 p.m., Eastern Time, on August 29, 2005. Submitting your proxy via the Internet or by telephone will not affect your right to vote in person should you decide to attend the Annual Meeting.

Revocation of Proxies

Stockholders can revoke their proxies at any time before they are exercised in any of three ways:

| | • | | by voting in person at the Annual Meeting; |

| | • | | by submitting written notice of revocation to the Secretary of Magma prior to or at the Annual Meeting; or |

| | • | | by submitting another proxy of a later date that is properly executed prior to or at the Annual Meeting. |

1

Required Vote and Voting of Proxies

On all matters, each holder of common stock is entitled to one vote for each share held as of the Record Date. Directors are elected by a plurality vote; the two nominees who receive the most votes cast in their favor will be elected to serve as directors. Proposal No. 2 will be decided by the affirmative vote of the majority of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on that proposal.

Quorum; Abstentions; Broker Non-Votes

Votes cast by proxy or in person at the Annual Meeting will be tabulated by the Inspector of Elections. The Inspector will also determine whether or not a quorum is present. In general, under Delaware law and Magma’s bylaws a quorum for the transaction of business at the Annual Meeting is established if a majority of shares entitled to vote are present or represented by proxy at the meeting.

Abstentions with respect to any proposal, with the exception of proposals on the election of directors, are treated as shares present or represented and entitled to vote on that proposal and thus have the same effect as negative votes. If a broker that is the record holder of shares indicates on a proxy that it does not have discretionary authority to vote on a particular proposal as to such shares, or if shares are not voted in other circumstances in which proxy authority is defective or has been withheld with respect to a particular proposal, these non-voted shares will be counted for quorum purposes but are not deemed to be present or represented for purposes of determining whether stockholder approval of that proposal has been obtained.

IMPORTANT

Please mark, sign and date the enclosed proxy and return it in the enclosed postage-prepaid return envelope so that, whether you intend to be present at the Annual Meeting or not, your shares can be voted. This will not limit your rights to attend or vote at the Annual Meeting.

2

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Board of Directors, as now authorized, consists of seven members divided into three classes of approximately equal size. The Class I members of the Board of Directors are scheduled for election at the Annual Meeting, to serve until the 2008 annual meeting of stockholders, or until their successors have been elected by the stockholders or appointed by the Board of Directors pursuant to the Company’s bylaws. The current Class I directors are Roy E. Jewell and Thomas M. Rohrs. Mr. Jewell was appointed as a Class I director in July 2001. Mr. Rohrs was appointed as a Class I director in July 2003. The nominees nominated by the Compensation and Nominating Committee of the Board to serve as the two Class I members are Roy E. Jewell and Thomas M. Rohrs, each of whom has consented to serve if elected. If either nominee is unable to serve as a director at the time of the Annual Meeting, proxies may be voted for any nominee designated by the Board of Directors to fill the vacancy.

The Class II directors are Timothy J. Ng, Chester J. Silvestri and Susumu Kohyama. The Class III directors are Rajeev Madhavan and Kevin C. Eichler.

Biographical information concerning each of the director nominees is set forth below:

| | | | | | |

Name

| | Served as Director Since

| | Age

| | Principal Business Experience

|

Roy E. Jewell | | 2001 | | 50 | | Roy E. Jewell has served as Magma’s President since May 2001 and as one of its directors since July 2001. Mr. Jewell has served as the Company’s Chief Operating Officer since March 2001. From 1999 to March 2001, Mr. Jewell served as the Chief Executive Officer of a company he co-founded, Clarisay, Inc., a supplier of surface acoustic wave filters. From 1998 to 1999, Mr. Jewell was a member of the CEO Staff at Avant! Corporation, a provider of software products for integrated circuit designs. From 1992 to 1998, Mr. Jewell was the President and Chief Executive Officer of Technology Modeling Associates, Inc. or TMA, subsequently acquired by Avant! Corporation. Prior to that time, Mr. Jewell served in various marketing positions at TMA. |

| | | |

Thomas M. Rohrs | | 2003 | | 54 | | Thomas M. Rohrs was appointed to the Company’s board of directors in July 2003. Mr. Rohrs currently serves as an independent advisor or consultant to a number of companies. In addition, Mr. Rohrs currently serves on the board of directors of Ultraclean Technology Inc., Electroglas Inc. and several private companies. From 1997 until July 2003, Mr. Rohrs was an executive at Applied Materials, Inc., a manufacturer of products and services to the semiconductor industry, in a number of positions including Senior Vice President, Global Operations and Member of the Executive Committee. From 1992 to 1997, Mr. Rohrs held various positions at Silicon Graphics, Inc., a computer hardware company, most recently as Vice President, Worldwide Operations. From 1989 to 1992, Mr. Rohrs was Senior Vice President, Manufacturing and Customer Service, of MIPS Computer Systems. From 1977 to 1989, Mr. Rohrs held various management positions at Hewlett Packard Company, most recently as Group Operations Manager, Personal Computer Group. |

3

Required Vote

The nominees for the two Class I director seats who receive the most affirmative votes of shares present in person or represented by proxy and entitled to vote on this proposal at the Annual Meeting will be elected to serve as directors. Unless marked to the contrary, proxies received will be voted“FOR” the nominees.

The Board of Directors recommends a vote “FOR” election as director of the nominees set forth above.

Biographical information concerning the Class II directors as of the Annual Meeting, who will serve until the 2006 Annual Meeting, is set forth below.

| | | | | | |

Name

| | Served as

Director

Since

| | Age

| | Principal Business Experience

|

Timothy J. Ng | | 2003 | | 40 | | Timothy J. Ng was appointed to Magma’s Board in March 2003. Mr. Ng has been Managing Director of Technology Mergers & Acquisitions at Deutsche Bank Securities, Inc., a global investment banking firm, since February 2005. From February 2004 to February 2005, Mr. Ng served as an independent consultant providing investment banking advice, with emphasis on mergers and acquisitions and valuation. From April 2003 to January 2004, Mr. Ng was Managing Director at SoundView Technology Group, Inc., a technology-focused investment bank, where he also served as the head of SoundView’s mergers and acquisitions group. Previously, Mr. Ng served as a Managing Director in the mergers and acquisitions department at Credit Suisse First Boston, and as a member of its Global Technology Group from 1999 to December 2002. From 1995 to 1999, Mr. Ng was a Director at Cowen & Company, a technology and health care industry-focused investment bank, where he co-founded the mergers and acquisitions group. From 1986 to 1995, Mr. Ng served in various investment banking positions at Morgan Stanley Dean Witter and The First Boston Corporation in New York, both global investment banking institutions. |

| | | |

Chester J. Silvestri | | 2003 | | 56 | | Chester J. Silvestri was appointed to Magma’s Board in July 2003. At present, Mr. Silvestri is an independent investor and consultant to the high-tech industry. From June 2003 to May 2005, Mr. Silvestri was Chief Executive Officer of CEVA, Inc., a licensor of digital signal processing cores and platform-level intellectual property to semiconductor and electronic industries. Mr. Silvestri has over 25 years’ experience in the semiconductor industry. From January 2003 until his appointment at CEVA, Mr. Silvestri served as a consultant to the high tech industry. From June 2002 to January 2003, Mr. Silvestri held the position of Chairman of Arcot Systems, having been President and CEO from 1999 to 2002. Arcot Systems is the developer of the “Verified by Visa” credit card authentication software product. From 1998 to 1999, Mr. Silvestri was COO of Tripath Technology, Inc. From 1992 to 1998, Mr. Silvestri held various positions at Sun Microsystems, Inc., most recently as President of the Microelectronic Division. Prior to Sun, Mr. Silvestri was Vice President and General Manager of the Technology Licensing division of MIPS Computer Systems, Inc. from 1986 to 1992. Before joining MIPS, Mr. Silvestri held various marketing management positions at Intel, both in the U.S. and in Europe. |

4

| | | | | | |

Name

| | Served as

Director

Since

| | Age

| | Principal Business Experience

|

Susumu Kohyama | | 2005 | | 61 | | Susumu Kohyama was appointed to Magma’s Board in June 2005. Dr. Kohyama has been President and CEO of Toshiba Ceramics Co., Ltd., a leading materials company serving the semiconductor and LCD industries, since June 2004. Dr. Kohyama has over 25 years’ experience in the semiconductor industry. From 1998 through April 2001, Dr. Kohyama served in various senior management capacities at Toshiba Corporation. After April 2001 he served in various senior management positions at Toshiba Semiconductor Company and in 2003 became Chief Technology Officer of Toshiba’s Electronic Devices Group. Dr. Kohyama has been a member of the Board of Directors of Toshiba Corporation since 1997. |

Biographical information concerning the Class III directors as of the Annual Meeting, who will serve until the 2007 Annual Meeting, is set forth below.

| | | | | | |

Name

| | Served as Director Since

| | Age

| | Principal Business Experience

|

Rajeev Madhavan | | 1997 | | 39 | | Rajeev Madhavan, one of Magma’s founders, has served as Chief Executive Officer and Chairman of the Board of Directors since Magma’s inception in 1997. Prior to co-founding Magma, from 1994 until 1997, Mr. Madhavan founded and served as the President and Chief Executive Officer of Ambit Design Systems, Inc., an electronic design automation software company, later acquired by Cadence Design Systems, Inc., an electronic design automation software company. |

| | | |

Kevin C. Eichler | | 2003 | | 45 | | Kevin C. Eichler is currently Vice President and Chief Financial Officer of MIPS Technologies (MIPS), a leading provider of industry-standard processor architectures and cores for digital consumer and business applications. He previously served as Chief Financial Officer and Vice President of Operations for Visigenic Software, a provider of software tools for distributed object technologies for the Internet, Intranet and enterprise computing environments. Mr. Eichler’s previous roles include financial management positions with Microsoft Corp. and NeXT, Inc. Mr. Eichler presently serves on the board of directors for SupportSoft (SPRT), a leading provider of Real-Time Service Management (RTSM™) software; and for Ultra Clean Holdings (UCTT), a developer and supplier of critical subsystems for the semiconductor capital equipment industry. |

Board Meetings and Committees

The Board of Directors held six Board meetings during the year ended March 31, 2005. All directors attended at least 75% of the aggregate number of meetings of the Board of Directors and of the committees on which such directors served.

Independent Directors

The Board believes that a substantial majority of the Board members should be independent directors. The Board also believes that it is useful and appropriate to have members of management, including the Chief

5

Executive Officer, as directors. The Board has determined that each of our directors other than Messrs. Madhavan and Jewell qualifies as an “independent director” in accordance with Nasdaq listing requirements. The Nasdaq independence definition includes a series of objective tests, such as that the director is not an employee of the Company and has not engaged in various types of business dealings with the Company. As required by Nasdaq rules, the Board has made the additional determination, as to each independent director, that no relationship exists which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In making these determinations, the directors reviewed and discussed information provided by the directors and the Company with regard to each director’s business and personal activities as they may relate to Magma and Magma’s management.

The members of the Audit Committee each meet special independence standards established by the Securities and Exchange Commission (the “SEC”) for audit committees. In addition, the Board has determined that Mr. Eichler satisfies the definition of an “audit committee financial expert” under SEC rules. This designation does not impose any duties, obligations or liabilities on Mr. Eichler that are greater than those generally imposed on him as a member of the Audit Committee and the Board, and his designation as an audit committee financial expert pursuant to this SEC requirement does not affect the duties, obligations or liability of any other member of the Audit Committee or the Board.

Board Responsibilities

The primary responsibilities of the Board are the oversight, counseling and direction of Magma’s management in the long-term interests of Magma and its stockholders. These responsibilities include: selecting and regularly evaluating the performance of the Chief Executive Officer and other senior executives; planning for succession with respect to the position of Chief Executive Officer and monitoring management’s succession planning for other senior executives; reviewing and, where appropriate, approving Magma’s major financial objectives and strategic and operating plans and actions; and overseeing the conduct of Magma’s business and the processes for maintaining Magma’s integrity with regard to its financial statements and other public disclosures and compliance with law and ethics.

The Board and its committees hold scheduled meetings throughout the year and also hold special meetings and act by written consent from time to time as appropriate. During the fiscal year ended March 31, 2005, the Board of Directors held six meetings. Committees of the Board held an additional sixteen meetings during the fiscal year. The Board has a policy of encouraging but not requiring members to attend the annual meetings of stockholders. Four Board members attended the 2004 Annual Meeting of Stockholders.

6

Board Committees and Charters

The Board has two standing Committees: the Audit Committee and the Compensation and Nominating Committee. The Board appoints the members and chairpersons of these committees. Each member of these committees is an independent director in accordance with Nasdaq standards. Each committee has a written charter approved by the Board, which is available on Magma’s website at http://investor.magma-da.com/governance/home.cfm.

| | |

| Audit Committee |

| |

| Members: | | Messrs. Eichler (Chairman), Rohrs and Silvestri. |

| |

| Number of Meetings in Fiscal 2005: | | Eight |

| |

| Functions: | | Assists the Board in its general oversight of Magma’s financial reporting, internal controls and audit functions and is directly responsible for the appointment, oversight and compensation of the independent accountants. Pre-approves all audit services and permitted non-audit services. The responsibilities and activities of the Audit Committee are described in greater detail in “Report of the Audit Committee.” |

| |

| Compensation and Nominating Committee | | |

| |

| Members: | | Messrs. Meyercord (Chairman)*, Eichler, Ng, Rohrs and Silvestri. |

| |

| Number of Meetings in Fiscal 2005: | | Eight |

| |

| Functions: | | Reviews and approves salaries, performance-based incentives and other matters relating to executive compensation, and administers Magma’s stock option plans, including reviewing and granting stock options to executive officers. The Committee also reviews and approves Magma’s compensation plans, benefit programs and arrangements for other officers, employees and consultants of Magma, and establishes compensation for members of Magma’s Board of Directors. In addition, the Committee recommends guidelines for performance reviews and conducts the surveys and inquiries that the Committee considers to be appropriate and necessary to carry out its duties. In its role as Magma’s nominating committee, the Committee identifies, evaluates and recommends director candidates to the Board. For more information, see “Nominations to the Board” and “Report of the Compensation and Nominating Committee.” |

*Mr. Meyercord resigned from Magma’s Board of Directors on June 10, 2005. A new Compensation Committee chairman has not yet been appointed.

Nominations to the Board

The Compensation and Nominating Committee identifies, evaluates and nominates new directors for consideration by the full Board, and establishes criteria for Board and Committee membership. The

7

Compensation and Nominating Committee charter includes a written policy with regard to the nomination process. The Committee evaluates potential new director candidates based on a variety of criteria, including the candidate’s relevant experience, other board memberships held, diversity and collective experience of the Board and its committees, as well as independence and possible conflicts of interest. There are no specific minimum qualifications that an individual must meet in order to be nominated; each is considered on a case-by-case basis. Candidates may come to the attention of the Committee from current Board members, stockholders, professional search firms, officers or other persons. The Committee will review all candidates in the same manner regardless of the source of the recommendation.

The Compensation and Nominating Committee will consider properly submitted stockholder recommendations of candidates. Any stockholder recommendation must include the candidate’s name and qualifications for Board membership, the candidate���s age, business address, residence address, principal occupation or employment, the number of shares beneficially owned by the candidate and information that would be required to solicit a proxy under federal securities law. In addition, the recommendation must include the stockholder’s name, address and the number of shares beneficially owned and the period they have been held. The recommendation should be sent to Beth Roemer, Corporate Secretary, Magma Design Automation, Inc., 5460 Bayfront Plaza, California 95054. To be timely for next year’s annual meeting, the recommendation must be delivered to the Corporate Secretary no sooner than 120 days and no later than 90 days prior to the first anniversary of this Annual Meeting.

Stockholder Communications

Stockholders wishing to send communications to the Board should provide the comments by mail to Beth Roemer, Corporate Secretary, Magma Design Automation, Inc., 5460 Bayfront Plaza, California 95054. The Secretary will review all stockholder communications and has the authority to disregard any communications that are inappropriate or irrelevant to the Company and its operations, or to take other appropriate actions with respect to such communications. If a stockholder communication is deemed appropriate, the Secretary will submit it to the Chairman of the Board.

Code of Ethics

Magma’s written Code of Ethics applies to all of its directors and employees, including its executive officers. The Code of Ethics is available on Magma’s website at http://investor.magma-da.com/governance/home.cfm. Changes to or waivers of the Code of Ethics will be disclosed on the same website.

Director Compensation

Directors who are employees of Magma do not receive compensation for service on the Board of Directors. During fiscal 2005, Messrs. Madhavan and Jewell were Magma’s only employee directors. For a description of compensation agreements with Messrs. Madhavan and Jewell, see “Executive Compensation—Employment Agreements and Change of Control Agreements.”

Directors who are not employees of Magma receive a cash retainer of $20,000 per year for services as a member of the Board of the Directors. In addition, the Chairman of each of the two Board Committees receives a cash retainer of $10,000 per year for service as Chairman of the Committee. Non-employee directors also receive a fee of $1,000 for each Board or Committee meeting attended, and a fee of $500 for each Board or Committee meeting held by teleconference. Pursuant to the 2001 Stock Incentive Plan, which was approved by Magma’s stockholders, each non-employee director also receives an annual stock option grant as well as an initial stock option grant upon appointment or election to the Board of Directors. Each new non-employee director receives an initial stock option grant to purchase 50,000 shares of Magma common stock upon appointment or election. The initial option vests as to 25% of the shares on the first anniversary of the date of grant with the remaining shares vesting monthly over the following three years. Following the conclusion of each regular annual meeting

8

of stockholders, each continuing non-employee director receives an additional option to purchase 20,000 shares at an exercise price equal to the fair market value of the common stock on the date of grant. When a non-employee director is appointed to the Board of Directors at a time other than at an annual meeting, such director receives a pro rata portion of the 20,000 share grant. The annual grants and the interim grants vest in full on the day immediately prior to the annual meeting of stockholders in the year immediately following the year of the grant if the director continues as a member of the Board on that date. All options will vest fully upon a change in control of Magma, as set forth under the 2001 Stock Incentive Plan. It is Magma’s policy to reimburse each non-employee member of the Board of Directors for out-of-pocket expenses incurred in attending meetings of the Board or its Committees.

Compensation Committee Interlocks and Insider Participation

Messrs. Eichler, Meyercord, Ng, Rohrs and Silvestri, all non-employee directors, served as members of the Compensation Committee during fiscal 2005. None of Magma’s executive officers serves as a member of the board of directors or compensation committee of any entity that has one or more of its executive officers serving as a member of Magma’s Board of Directors or Compensation Committee.

9

PROPOSAL NO. 2

RATIFICATION OF INDEPENDENT ACCOUNTANTS

Upon the recommendation of the Audit Committee, the Board of Directors has appointed the firm of PricewaterhouseCoopers LLP (“PwC”) as Magma’s independent accountants for the fiscal year ending April 2, 2006, subject to ratification by the stockholders and approval of PwC’s fee proposal by the Audit Committee. Representatives of PwC are expected to be present at the Annual Meeting. They will have an opportunity to make a statement, if they desire to do so, and will be available to respond to appropriate questions.

PwC prepared a report on the financial statements of Magma for the fiscal year ended March 31, 2005. PwC did not include, in its report on Magma’s financial statements, an adverse opinion or a disclaimer of opinion, or a qualification or modification as to uncertainty, audit scope, or accounting principles. During Magma’s fiscal year ended March 31, 2005, there were no disagreements between Magma and PwC on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to PwC’s satisfaction, would have caused PwC to make reference to the subject matter of the disagreement in connection with its report on Magma’s financial statements. Further, there were no “reportable events” (as that term is defined in Item 304(a)(1)(v) of Regulation S-K of the Securities Act of 1933) during Magma’s fiscal year ended March 31, 2005.

The firm of KPMG LLP (“KPMG”) served as Magma’s independent accountants until it was replaced by PwC on June 24, 2003. Magma’s Audit Committee made the decision to change accountants based on a review of proposals made to the Committee by different accounting firms. On June 27, 2003, Magma filed a Current Report on Form 8-K with the Securities and Exchange Commission to announce this change.

KPMG prepared a report on the financial statements of Magma for each of the fiscal years ended March 31, 2003 and 2002. KPMG did not include, in any report on Magma’s financial statements, an adverse opinion or a disclaimer of opinion, or a qualification or modification as to uncertainty, audit scope, or accounting principles.

During Magma’s two fiscal years ended March 31, 2003, and the subsequent interim period through June 24, 2003, there were no disagreements between Magma and KPMG on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to KPMG’s satisfaction, would have caused KPMG to make reference to the subject matter of the disagreement in connection with its reports on Magma’s financial statements.

Audit And Non-Audit Fees

The following table provides fees paid by the Company for professional services rendered by PwC for the fiscal years ended March 31, 2005 and March 31, 2004.

| | | | | | |

| | | Fiscal 2005 PwC

| | Fiscal 2004 PwC

|

Audit Fees | | $ | 1,832,459 | | $ | 407,000 |

Audit-Related Fees | | $ | 0 | | $ | 0 |

Tax Fees | | $ | 320,705 | | $ | 219,000 |

All Other Fees | | $ | 2,774 | | $ | 139,000 |

| | |

|

| |

|

|

Total Fees | | $ | 2,155,938 | | $ | 765,000 |

| | |

|

| |

|

|

Audit Feeswere for professional services rendered for the audit of the Company’s consolidated financial statements included in the Company’s Annual Report on Form 10-K, and review of the interim consolidated financial statements included in quarterly reports on Form 10-Q and services that are normally provided by independent accountants in connection with statutory and regulatory filings or engagements.

10

Audit-Related Feeswere for assurance and related services that are reasonably related to the performance of the audit or review of the Company’s consolidated financial statements and are not reported under “Audit Fees.” These services include employee benefit plan audits, accounting consultations in connection with attest services that are not required by statute or regulation, and consultations concerning financial accounting and reporting standards.

Tax Feeswere for professional services for federal, state and international tax compliance, tax advice and tax planning.

All Other Feeswere for services other than the services reported above, including seminars and software licensing.

The Audit Committee has concluded that the provision of the non-audit services listed above is compatible with maintaining the independence of PwC. All audit services, audit related services, tax services and other services provided by PwC were pre-approved by the Audit Committee, or were pre-approved by the Audit Committee Chairman and later ratified by the Committee, in accordance with the rules and regulations of the SEC.

Pre-Approval Policies and Procedures

The Audit Committee has delegated the authority to the Committee Chairman, Mr. Kevin C. Eichler, to approve up to $50,000 in PwC services in the interim between Committee meetings. The Committee has also delegated the authority to management to approve up to $15,000 per individual project for PwC tax projects related to international tax consulting and up to $15,000 per individual project related to general tax consulting in the interim between Committee meetings, subject to the condition that all PwC services be reviewed and any interim approval of fees be ratified at the next succeeding Committee meeting.

Required Vote

Ratification will require the affirmative vote of a majority of the shares present at the Annual Meeting in person or represented by proxy. In the event ratification is not obtained, the Board of Directors will review its future selection of Magma’s independent accountants.

The Board of Directors recommends a vote “FOR” ratification of PricewaterhouseCoopers LLP as Magma’s independent accountants.

11

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information as of June 30, 2005 as to shares of common stock beneficially owned by: (i) each person who is known by Magma to own beneficially more than 5% of its common stock; (ii) each of Magma’s executive officers named under “Executive Compensation—Summary Compensation Table;” (iii) each of Magma’s current directors; (iv) each of Magma’s nominees for director; and (v) all directors and executive officers of Magma as a group. Unless otherwise stated below, beneficial ownership information is based solely upon information furnished by the respective stockholders in their filings with the Securities and Exchange Commission. Unless otherwise noted below, the address of each beneficial owner is c/o Magma Design Automation, Inc., 5460 Bayfront Plaza, Santa Clara, California 95054. The percentage of common stock beneficially owned is based on 33,595,563 shares outstanding as of June 30, 2005. Shares of common stock that may be issued pursuant to the exercise or conversion of options, warrants or convertible securities within 60 days of June 30, 2005 are deemed to be issued and outstanding in calculating the percentage ownership of those individuals possessing such interest, but not for any other individuals.

| | | | | |

Name and Address of Beneficial Owner

| | Number of Shares of

Common Stock

Beneficially Owned(1)

| | Percentage of

Common Stock

Beneficially Owned

| |

5% Stockholders: | | | | | |

Federated Investors, Inc. (2) | | 3,533,042 | | 10.5 | % |

Andreas Bechtolsheim (3) | | 3,121,414 | | 9.3 | % |

T. Rowe Price Associates, Inc. (4) | | 2,858,100 | | 8.5 | % |

Ahmet H. Okumus (5) | | 1,778,970 | | 5.3 | % |

| | |

Named Executive Officers and Directors: | | | | | |

Rajeev Madhavan (6) | | 1,811,901 | | 5.3 | % |

Roy E. Jewell (7) | | 468,483 | | 1.4 | % |

Saeid Ghafouri (8) | | 137,207 | | * | |

Hamid Savoj (9) | | 341,377 | | * | |

Gregory C. Walker (10) | | 82,498 | | * | |

Kevin C. Eichler (11) | | 34,166 | | * | |

Susumu Kohyama | | — | | * | |

Timothy J. Ng (12) | | 54,026 | | * | |

Thomas M. Rohrs (13) | | 46,908 | | * | |

Chester J. Silvestri (14) | | 46,908 | | * | |

All directors and executive officers as a group (10 persons) (15) | | 3,023,474 | | 8.6 | % |

| * | | Amount represents less than 1% of the outstanding shares of Magma’s common stock. |

| (1) | | To Magma’s knowledge, the persons named in the table have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them, subject to community property laws where applicable and the information contained in the notes to this table. |

| (2) | | Federated Investors, Inc. (“Parent”) is the parent holding company of Federated Investment Management Company, Federated Investment Counseling and Federated Global Management Investment Corp., which act as investment advisors to registered investment companies and separate accounts that own these shares of Magma’s common stock. All of Parent’s outstanding stock is held in the Voting Shares Irrevocable Trust (“Trust”) for which John J. Donahue, Rhodora J. Donahue and J. Christopher Donahue act as trustees (collectively, “Trustees”). The Trustees have collective voting control over the Trust. The Parent, Trust and each of the Trustees disclaim beneficial ownership of these shares. The address of these entities and persons is Federated Investors Tower, Pittsburgh, Pennsylvania 15222-3779. |

| (3) | | Per stockholder effective 5/20/05. Stockholder’s address is Incline Village, NV 89451. |

| (4) | | These shares are owned by various individual and institutional investors to which T. Rowe Price Associates, Inc. (“Price Associates”) serves as investment advisor. Price Associates has sole voting power over 522,200 shares and sole investment power over 2,858,100 shares and disclaims beneficial ownership of these shares. The address of Price Associates is 100 E. Pratt Street, Baltimore, Maryland 21202. |

12

| (5) | | Ahmet H. Okumus (“Okumus”) shares voting and/or dispositive power over these shares with: (a) Okumus Opportunity Fund, Ltd., (b) Okumus Technology Value Fund, Ltd., (c) Okumus Market Neutral Fund, Ltd., and (d) Okumus Diversified Value Fund, Ltd., all of which are entities incorporated in the British Virgin Islands, for which Okumus Capital, LLC, a Delaware limited liability company of which Okumus is the managing member, serves as the investment manager; (b) Okumus Opportunity Partners, LP, a Delaware limited partnership, for which Okumus Advisors, LLC, a Delaware limited liability company of which Okumus is the managing member, serves as general partner and investment advisor; (c) Okumus Technology Value Partners, LP, a Delaware limited partnership, for which Okumus Technology Advisors, LLC, a Delaware limited liability company for which Okumus Technology Advisors, LLC, a Delaware limited liability company of which Okumus is the managing member, serves as general partner and investment advisor; (d) Okumus Market Neutral Partners, LP, a Delaware limited liability company of which Okumus is the managing member, serves as general partner and investment advisor; and (e) Okumus Diversified Value Partners, L.P., a Delaware limited partnership, for which Okumus Diversified Advisors, LLC, a Delaware limited liability company of which Okumus is the managing member, serves as general partner and investment advisor. The address of Okumus is 850 Third Avenue, 10th Floor, New York, New York 10022. |

| (6) | | Includes 608,689 shares issuable upon exercise of stock options. Also, includes 308,156 shares held by the Madhavan Living Trust UAD 10/29/1998. Mr. Madhavan and his spouse, Geetha Madhavan, are trustees of the Madhavan Living Trust UAD 10/29/1998. Also includes 5,001 shares which, if exercised, would be subject to Magma’s lapsing right of repurchase. |

| (7) | | Includes 403,523 shares issuable upon exercise of stock options. |

| (8) | | Includes 137,207 shares issuable upon exercise of stock options. |

| (9) | | Includes 156,547 shares issuable upon exercise of stock options. Also includes 182,927 shares of restricted stock subject to Magma’s lapsing right of repurchase. |

| (10) | | Includes 82,498 shares issuable upon exercise of stock options. |

| (11) | | Includes 34,166 shares issuable upon exercise of stock options. |

| (12) | | Includes 54,026 shares issuable upon exercise of stock options. |

| (13) | | Includes 46,908 shares issuable upon exercise of stock options. |

| (14) | | Includes 46,908 shares issuable upon exercise of stock options. |

| (15) | | Includes 187,928 shares that are subject to Magma’s lapsing right of repurchase and 1,570,472 shares issuable upon exercise of stock options. |

13

EXECUTIVE COMPENSATION

The following table summarizes compensation paid to Magma’s Chief Executive Officer and Magma’s four other most highly paid executive officers (the “Named Executive Officers”) for services rendered in all capacities to Magma for the fiscal years ended March 31, 2005, 2004 and 2003.

Summary Compensation Table

| | | | | | | | | | | | | | | | | | | |

Name and Principal Position

| | Year

| | Annual Compensation

| | | Long-Term

Compensation Awards

| | | All Other

Compensation

| |

| | | Salary

| | Bonus(1)

| | Other Annual Compensation

| | | Restricted

Stock

Awards

(#)

| | | Securities

underlying

Options

(#)

| | | | |

Rajeev Madhavan Chief Executive Officer | | 2005

2004

2003 | | 400,000

325,000

225,000 | | —

163,800

90,000 | | —

—

— |

| | | | | | 120,000

250,000

60,000 |

| | 746

378

189 | (2)

(2)

(2) |

| | | | | | | |

Roy E. Jewell President and Chief Operating Officer | | 2005

2004

2003 | | 400,000

325,000

240,000 | | —

163,800

90,000 | | —

—

583,911 |

(4) | | | | | | 120,000

422,393

60,000 |

(3)

| | 851

632

342 | (2)

(2)

(2) |

| | | | | | | |

Saeid Ghafouri (5) Sr. Vice President, Worldwide Field Operations | | 2005

2004

2003 | | 275,000

250,000

374,608 | | —

22,300

70,000 | | 173,764

383,628

— | (6)

(7)

| | | | | | 60,000

50,000

290,000 |

| | 810

468

166 | (2)

(2)

(2) |

| | | | | | | |

Hamid Savoj (8) Senior Vice President, Product Development | | 2005

2004

2003 | | 315,000

300,000

194,717 | | 196,875

79,380

160,700 | | —

—

— |

| | $ | 2,249,984 | (9) | | 35,000

210,000

50,000 |

| | 593

368

204 | (2)

(2)

(2) |

| | | | | | | |

Gregory C. Walker (10) Sr. Vice President, Finance and Chief Financial Officer | | 2005

2004

2003 | | 315,000

300,000

146,122 | | —

71,820

98,500 | | —

—

— |

| | | | | | 70,000

60,000

300,000 |

| | 1,173

709

220 | (2)

(2)

(2) |

| (1) | | Amounts paid as bonuses for services rendered are reported for the year in which they were earned even if they were paid in the following fiscal year. |

| (2) | | Represents group term life insurance payments. |

| (3) | | Includes 297,393 shares granted to Mr. Jewell in May 2003 in connection with the repurchase of certain of Mr. Jewell’s shares in connection with his repayment of a promissory note to Magma. In October 2001, Mr. Jewell exercised an option to purchase 428,570 shares of common stock at the exercise price of $10.50 per share by executing a full recourse promissory note bearing interest of 5.5% per annum and due in March 2006. On May 14, 2003, the Company repurchased 209,753 shares of common stock from Mr. Jewell for an aggregate purchase price of $3.6 million, or $17.00 per share, which was the closing sale price of the common stock on that date, and he repaid the principal and related accrued interest outstanding under the promissory note in full (excluding certain indebtedness forgiven pursuant to the terms of the note). On the same date, Magma granted Mr. Jewell an option to purchase 297,393 shares of its common stock at an exercise price of $7.00 per share. Of the 297,393 shares, 209,753 shares were immediately vested and the remaining 87,640 shares vested monthly over a 22-month period. |

| (4) | | Represents forgiveness of outstanding indebtedness pursuant to the terms of Mr. Jewell’s promissory note discussed in footnote 3 above. |

| (5) | | Mr. Ghafouri was appointed an executive officer in January 2003. |

| (6) | | Represents commissions earned in fiscal year 2005. |

| (7) | | Represents commissions earned in fiscal year 2004. |

| (8) | | Mr. Savoj was appointed an executive officer in January 2003. |

| (9) | | Consists of an award of 182,927 shares, all of which were unvested as of 3/31/05. The shares had a value of $2,171,343 as of 3/31/05, based on the closing trading price of Magma common stock on that date. 35% of the total number of shares granted under the award vests on 11/15/05; 20% of the total number of shares granted will vest on each of 11/15/06 and 11/15/07, and the remaining 25% will vest on 11/15/08, provided that Mr. Savoj is continuously employed by Magma during that time. The award is subject to accelerated vesting in the event of a change of control (see Employment Agreements and Change of Control Agreements). Magma has no current plans to pay dividends on these shares or any other shares of its common stock. |

| (10) | | Mr. Walker joined Magma as an executive officer in August 2002. |

14

Stock Options

The following tables set forth certain information with respect to stock options granted to and exercised by the named executive officers during fiscal 2005, and the number and value of the options held by each individual as of March 31, 2005. Unless otherwise noted, options vest ratably over 24 months beginning on the first month following the date of grant. The exercise price is equal to 100% of the fair market value of Magma’s common stock on the date of grant, except as noted. The options have a maximum term of 10 years, but may terminate earlier in connection with certain events related to termination of employment.

Option Grants in Fiscal Year 2005

| | | | | | | | | | | | | | | |

Name

| | Individual Grants

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term ($)(2)

|

| | Number of

Securities

Underlying

Options

Granted

| | Percent of Total

Options Granted

to Employees in

Fiscal Year

(%)(1)

| | Exercise

Price Per

Share ($)

| | | |

| | | | | Expiration

Date

| | 5%

| | 10%

|

Rajeev Madhavan | | 60,000 | | 1.7736 | | $ | 20.08 | | 4/28/14 | | $ | 757,692.25 | | $ | 1,920,140.91 |

| | | 60,000 | | 1.7736 | | | 13.47 | | 2/07/15 | | | 508,272.64 | | | 1,288,062.66 |

| | | | | | |

Roy E. Jewell | | 60,000 | | 1.7736 | | | 20.08 | | 4/28/14 | | | 757,692.25 | | | 1,920,140.92 |

| | | 60,000 | | 1.7736 | | | 13.47 | | 2/07/15 | | | 508,272.64 | | | 1,288,062.66 |

| | | | | | |

Saeid Ghafouri | | 30,000 | | .8868 | | | 20.08 | | 4/28/14 | | | 378,846.12 | | | 960,070.46 |

| | | 30,000 | | .8868 | | | 13.47 | | 2/07/15 | | | 254,136.32 | | | 644,031.33 |

| | | | | | |

Hamid Savoj | | 35,000 | | 1.0346 | | | 20.08 | | 4/28/14 | | | 441,987.15 | | | 1,120,082.20 |

| | | | | | |

Gregory C. Walker | | 35,000 | | 1.0346 | | | 20.08 | | 4/28/14 | | | 441,987.14 | | | 1,120,082.20 |

| | | 35,000 | | 1.0346 | | | 13.47 | | 2/07/15 | | | 296,492.37 | | | 751,369.88 |

| (1) | | The percentage of total options granted is based on a total of 3,382,991 options granted to employees in fiscal year 2005. |

| (2) | | The 5% and 10% assumed rates of appreciation are suggested by the rules of the Securities and Exchange Commission and do not represent Magma’s estimates or projections of its future common stock price. There can be no assurance that any of the values reflected in the table will be achieved. |

Aggregated Option Exercises in Last Fiscal Year

and Fiscal Year-End Option Values

| | | | | | | | | | | | |

Name

| | Shares Acquired on

Exercise (#)

| | Value

Realized ($)(1)

| | Number of Securities

Underlying Unexercised

Options at March 31, 2005 (#)

| | Value of Unexercised In-the-Money Options at March 31, 2005 ($)(2)

|

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Rajeev Madhavan | | — | | — | | 522,647 | | 250,210 | | 570,316.04 | | 9,600.32 |

Roy E. Jewell | | 70,000 | | 567,220.52 | | 360,501 | | 155,106 | | 1,288,106.09 | | 0.00 |

Saeid Ghafouri | | 5,000 | | 55,163.00 | | 97,207 | | 142,293 | | 57,404.11 | | 63,413.39 |

Hamid Savoj | | 10,714 | | 71,910.68 | | 127,380 | | 128,335 | | 14,679.55 | | 0.00 |

Gregory C. Walker | | 50,000 | | 261,334.55 | | 37,915 | | 154,585 | | 5,290.82 | | 89,959.18 |

| (1) | | Calculated on the basis of the fair market value of the underlying securities at the exercise date minus the exercise price. |

| (2) | | Calculated on the basis of the fair market value of the underlying securities at March 31, 2005 ($11.87 per share) minus the exercise price. |

15

Employment Agreements and Change of Control Agreements

Magma does not have formal employment agreements with any of its executive officers.

Magma’s named executive officers are parties to stock option and restricted stock agreements that provide for acceleration of vesting upon specified events:

Rajeev Madhavan is party to an option agreement that provides for:

| | • | | 50% vesting upon a change in control of Magma which is followed by either termination without cause or constructive termination within 12 months of such change in control of Magma. Change in control means the acquisition of Magma by another entity in which Magma’s stockholders do not own more than 50% of the voting power of the surviving entity or the sale of all or substantially all of its assets. |

Roy E. Jewell and Saeid Ghafouri each are party to option agreements that provide for:

| | • | | 25% vesting upon a change in control of Magma; and |

| | • | | 50% vesting upon a change in control of Magma which is followed by either termination without cause or constructive termination within 12 months of the change in control of Magma. |

Gregory C. Walker is party to an option agreement that provides for:

| | • | | 25% vesting upon a change in control of Magma; and |

| | • | | 25% vesting upon a change in control of Magma which is followed by either termination without cause or constructive termination within 12 months of the change in control of Magma. |

For options granted to the named executive officers effective October 22, 2003 and subsequent to that date, all agreements will provide for acceleration of vesting upon the following specified events:

| | • | | 25% vesting upon a change in control of Magma; and |

| | • | | 50% vesting upon a change in control of Magma which is followed by either termination without cause or constructive termination as defined by the Board. |

16

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

As of March 31, 2005, Magma maintained its 2001 Stock Incentive Plan and 2001 Employee Stock Purchase Plan, both of which were approved by stockholders. Magma’s 1997 Stock Incentive Plan and 1998 Stock Incentive Plan, both of which were terminated in connection with Magma’s initial public offering in November 2001, were also approved by stockholders. In addition, Magma maintains the 2004 Employment Inducement Award Plan, which was not approved by stockholders. The Inducement Plan provides for awards to recently hired employees who are not executive officers or directors in compliance with Rule 4350(k)(1)(A) of the National Association of Securities Dealers, Inc. (“NASD”). The following table gives information about equity awards under these plans as of March 31, 2005:

| | | | | | | | |

| | | (a) | | (b) | | (c) | |

Plan Category

| | Number of Shares to

be Issued Upon

Exercise of

Outstanding Options

| | Weighted-Average

Exercise Price of

Outstanding Options

| | Number of Shares

Remaining Available

for Equity Compensation

Plans (Excluding Shares

Reflected in Column (a))

| |

Equity compensation plans approved by stockholders: | | | | | | | | |

1997, 1998, 2001 Stock Incentive Plans | | 9,579,297 | | $ | 15.3559 | | 680,410 | (1) |

2001 Employee Stock Purchase Plan | | — | | | — | | 3,337,419 | (2) |

Equity compensation plans not approved by stockholders (3) | | — | | | — | | — | |

2004 Employment Inducement Award Plan | | 387,625 | | | 14.2953 | | 612,375 | |

| | |

| |

|

| |

|

|

Total | | 9,966,922 | | $ | 15.3147 | | 4,630,204 | |

| | |

| |

|

| |

|

|

| (1) | | The 2001 Stock Incentive Plan contains an “evergreen” provision whereby the number of shares reserved for issuance increases automatically on January 1 of each year by an amount equal to the lesser of 6 million shares or 6% of Magma’s total outstanding shares of common stock as of the immediately preceding December 31, or a lesser amount as determined by the Board of Directors. |

| (2) | | The 2001 Employee Stock Purchase Plan contains an “evergreen” provision whereby the number of shares reserved for issuance increases automatically on January 1 of each year by an amount equal to the lesser of 3 million shares or 3% of Magma’s total outstanding shares of common stock on that date, or a lesser amount determined by the Board of Directors. |

| (3) | | In connection with Magma’s acquisition of Moscape, Inc. in August 2000, Magma assumed options to purchase stock initially granted under Moscape’s 1997 Incentive Stock Plan. The options have been converted into options to purchase Magma common stock on the terms specified in the agreement and plan of reorganization with Moscape but are otherwise administered in accordance with the terms of Moscape’s plan. No additional awards have been or will be made under Moscape’s plan. The options generally vest over four years and expire ten years after the date of grant. As of March 31, 2005 there were outstanding options to purchase a total of 23,658 shares of Magma common stock under this plan, with a weighted average exercise price of $10.31 per share. Information regarding these assumed options is not included in the table above. |

The Compensation Committee Report, Stock Price Performance Graph, and Audit Committee Report that follow are required by the Securities and Exchange Commission. The information in these sections shall not be deemed to be incorporated by reference by any general statement incorporating this proxy statement by reference into any filing under the Securities Act of 1933 or under the Securities Exchange Act of 1934, except to the extent that we specifically incorporate this information by reference. In addition, this information shall not otherwise be deemed “soliciting material” or filed under these Acts.

17

REPORT OF THE COMPENSATION AND NOMINATING COMMITTEE

OF THE BOARD OF DIRECTORS ON EXECUTIVE COMPENSATION

The Compensation Committee was established in August 2000 and was reorganized as the Compensation and Nominating Committee in June 2004. This report deals solely with the Committee’s compensation functions and responsibilities. The Committee is responsible for developing and monitoring compensation arrangements for the executive officers of Magma; recommending guidelines for the review of performance and the establishment of compensation and benefit policies for all other employees; conducting those reviews, investigations and surveys it considers appropriate and necessary in the exercise of its duties; administering Magma’s stock option plans, Magma’s 2001 Employee Stock Purchase Plan, the 2004 Employment Inducement Award Plan and other compensation plans; and performing other activities and functions related to executive officer compensation as may be assigned from time to time by the Board of Directors. The Committee held eight meetings during the fiscal year and has also met informally at various times during the year and made decisions by unanimous written consent. The Committee reviews and approves stock option grants for executive officers. In 2002, the Committee approved the designation of the Chief Executive Officer and the President as the “Stock Option Committee” for purposes of approving regular monthly grants to newly hired employees and consultants and selective retention or meritorious grants as proposed by management. The Stock Option Committee is authorized to approve grants to non-executives only, subject to certain guidelines set forth by the Committee.

Compensation Policy

At or near the beginning of each fiscal year, the Committee establishes base salary levels and target bonuses for Magma’s Chief Executive Officer and Magma’s President and Chief Operating Officer. The Committee also acts on behalf of the Board of Directors to establish the general compensation policy for Magma’s executive officers. The President has the authority to establish the level of base salary payable to all other employees of Magma, including officers reporting to him, subject to the approval of the Committee. In addition, the President has the responsibility for approving the bonus programs to be in effect for all other officers and key employees each fiscal year, subject to the approval of the Committee. For fiscal year 2005, the process utilized by the President in determining officer compensation levels took into account both qualitative and quantitative factors.

The Committee believes that the compensation of the executive officers should be greatly influenced by Magma’s performance. Consistent with this philosophy, a designated portion of the annual compensation of the Chief Executive Officer, the President and other executive officers is contingent solely upon corporate performance objectives. Bonus awards are currently based on a percentage of base salary, and are subject to the achievement of some minimum level of measurable performance, below which no bonus will be awarded. Bonus awards are also subject to a maximum award amount. The performance objectives, limited in number in order to achieve maximum focus, are recommended to the full Board for approval.

Fiscal Year 2005 Executive Officer Compensation

Each executive officer’s compensation package consists of three elements:

| | • | | base compensation, which reflects individual performance and is designed primarily to be competitive with salary levels in a comparative group; |

| | • | | variable or bonus compensation payable based on the achievement of financial performance goals and individual performance; and |

| | • | | long-term stock-based incentive compensation, which rewards Magma’s growth and increased stockholder value. |

The base salaries and incentive compensation of, and stock option grants to, the executive officers are determined in part by the Committee in reliance on surveys of prevailing competitive salaries and equity

18

practices in the technology sector for similar positions and by evaluating those salary standards against the achievement by Magma of its corporate goals. The cash and equity compensation of Magma’s executive officers was compared to equivalent data in the Radford Survey and competitive market compensation levels to determine base salary, target bonuses and target total cash compensation. The Radford Survey was selected because it provided reliable data from a large number of participating companies and focused primarily on the high technology sector. The Committee believes that the total value of the compensation package over the total years served by the executive should be assessed relative to the return to shareholders over that period, and that the most important and the largest component of executive compensation should be the stock component. Magma’s cash and equity compensation levels were benchmarked against companies similar to Magma in terms of product or industry, geography, company stage and revenue levels. While the Radford Survey is a useful tool that Magma employs in evaluating executive compensation, Magma principally relies on competitive industry data. The Compensation Committee believes that the total cash compensation for Magma’s executive officers for fiscal year 2005 was competitive with the total cash compensation for executive officers at companies with which Magma competes for executives.

Incentive Compensation. For fiscal year 2005, the Committee reviewed the Executive Bonus Plan and Magma’s performance objectives to be used for purposes of bonus determination. The Committee assigned a target bonus to each executive officer, which target bonus was either a precise dollar figure or a percentage of the executive officer’s base salary. The Committee also approved the performance objectives to be used for bonus determination, and the overall structure and mechanics of the Executive Bonus Plan. Bonuses are determined with reference to the percentage relationship of actual to targeted realization of Magma’s performance objectives, and are adjusted for individual performance. There were no bonuses awarded for FY 2005.

Stock Options. The Committee believes that stock options should be awarded both as a reward for long term performance and to encourage long term retention. Stock options are granted under Magma’s stock option plans according to guidelines that take into account the executive officer’s responsibility level, comparison with comparable awards to individuals in similar positions in the industry, Magma’s long-term objectives for maintaining and expanding technological leadership through product development and growth, Magma’s expected performance, the executive officer’s performance and contribution during the last fiscal year, and the executive officer’s existing holdings of unvested stock options, particularly where retention may be a consideration. However, the Committee does not strictly adhere to these factors in all cases and will vary the size of the grant made to each executive officer as the particular circumstances warrant. Stock options typically have been granted to executive officers when the executive officer joins Magma, or in connection with a significant change in responsibilities and, occasionally, to achieve equity within a peer group. The Committee believes that equity-based compensation closely aligns the interests of executive officers with those of stockholders by providing an incentive to manage Magma with a focus on long-term strategic objectives set by Magma’s Board of Directors relating to growth and stockholder value. The Committee considers the following metrics when making an option grant: the projected value of the option grant if projected shareholder returns are attained over the option period; the value of the grant as determined by the Black-Scholes model or the binomial model (or other models as recommended by the Financial Accounting Standards Board or the Securities and Exchange Commission); the value of shares currently held by the executive, as well as the number and value of shares previously sold (including the amount realized to date from stock options previously exercised). The Committee evaluated the performance of the executive officers against the strategic objectives for fiscal year 2005 set by the Board of Directors and concluded that such performance warrants the level of long-term compensation awarded them as set forth in “Executive Compensation—Option Grants in Fiscal Year 2005.” The Committee reexamines long-term compensation levels each year.

Stock option grants generally allow the executive officer to acquire shares of common stock at the fair market value in effect on the date of grant. The options generally vest in a series of installments over a four-year period, or such other period as determined by the Committee, contingent upon the executive officer’s continued employment with Magma. Accordingly, the option will provide a return to the executive officer only if he or she remains in Magma’s employ, and then only if the market price of the common stock appreciates over the option term. Subsequent grants may be made to executive officers when the Committee believes that the executive

19

officer has demonstrated greater potential, achieved more than originally expected, or assumed expanded responsibilities. Additionally, subsequent grants may be made to remain competitive with similar companies. See “Executive Compensation—Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values.”

Equity data from the Radford Survey is also used for general comparison purposes in determining stock option grants to executive officers; however, Magma relies principally upon competitive industry data. Initial stock options grants generally become exercisable over a four-year period and are typically granted at a price that is equal to the fair market value of the common stock on the date of grant. Option grants that become exercisable over shorter periods of 12, 24 or 36 months may be granted for retention purposes. In fiscal year 2005, the Committee, in its discretion, granted stock options to the five named executive officers. These grants become exercisable over a 24-month period and have a ten-year term.

2001 Employee Stock Purchase Plan. Magma’s 2001 Employee Stock Purchase Plan (“2001 Purchase Plan”), which Magma’s stockholders approved in August 2001, became effective in connection with Magma’s initial public offering. Employees, including executive officers, but excluding 5% or greater stockholders, are eligible to participate through payroll deductions of up to 15% of their compensation, subject to a purchase limitation of $25,000 of fair market value per calendar year, as set forth under the 2001 Purchase Plan. Such payroll deductions accumulate over a three-month accumulation period without interest. Shares of common stock are purchased at the end of the accumulation period at a price equal to 85% of the fair market value per share of common stock on either the first day preceding the offering period or the last date of the accumulation period, whichever is less.

Fiscal Year 2005 Compensation for the Chief Executive Officer

Compensation for the Chief Executive Officer is determined by the process discussed above. Base salary, target bonus, stock option grants, performance objectives and schedule of adjustment to the target bonus for Mr. Madhavan was established by the Committee. Mr. Madhavan’s base salary level and target bonus were based upon the Compensation Committee’s discretionary evaluation of a number of factors, including the Radford Survey. For fiscal 2005, the Compensation Committee established Mr. Madhavan’s base salary at $400,000.No bonus was awarded for fiscal year 2005.Mr. Madhavan was awarded a stock option grant of 120,000 shares during fiscal year 2005, which vests ratably over a 24-month period. Mr. Madhavan was not eligible to participate in the 2001 Employee Stock Purchase Plan. Mr. Madhavan’s base salary level and target bonus were based upon the Compensation Committee’s discretionary evaluation of a number of factors, including the Radford Survey. In the judgment of the Compensation Committee, Mr. Madhavan’s total compensation package is fair and reasonable.

Tax Deductibility of Executive Compensation

Section 162(m) of the Internal Revenue Code places a $1.0 million limit on the tax deductibility of compensation paid or accrued with respect to a covered employee of a publicly-held corporation. The Committee believes that all compensation realized in fiscal year 2005 by the executive officers is deductible under Section 162(m). It is the general intention of the Committee to comply with 162(m), and Magma’s option plan complies with the requirements of that section to permit deductibility; however, Magma reserves the right to pay compensation that is not deductible if the Committee determines that it is appropriate to do so.

Compensation and Nominating Committee

Wade Meyercord, Chairman

Kevin C. Eichler

Timothy J. Ng

Thomas M. Rohrs

Chester J. Silvestri

20

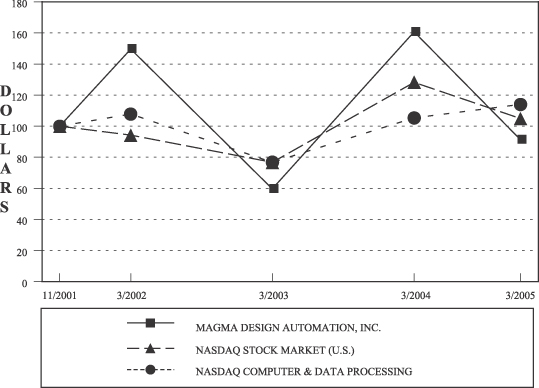

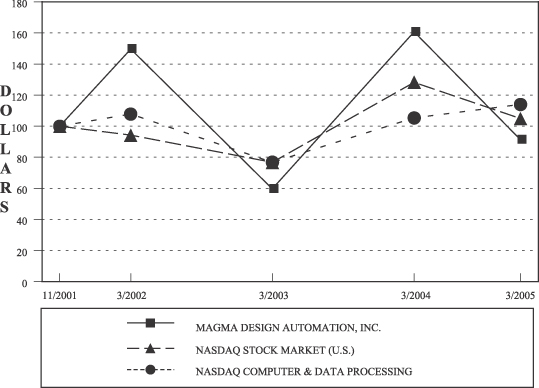

COMPARISON OF 40 MONTH CUMULATIVE TOTAL RETURN*

AMONG MAGMA DESIGN AUTOMATION, INC., THE NASDAQ STOCK MARKET (U.S.) INDEX AND THE NASDAQ COMPUTER & DATA PROCESSING INDEX

| | | | | | | | | | |

| | | Cumulative Total Return

|

| | | 11/20/01 | | 3/02 | | 3/03 | | 3/04 | | 3/05 |

MAGMA DESIGN AUTOMATION, INC. | | 100.00 | | 149.69 | | 59.62 | | 160.62 | | 91.31 |

NASDAQ STOCK MARKET (U.S.) | | 100.00 | | 116.19 | | 61.70 | | 108.08 | | 104.92 |

NASDAQ COMPUTER & DATA PROCESSING | | 100.00 | | 104.93 | | 80.66 | | 113.85 | | 113.99 |

| * | | $100 invested on 11/20/01 in stock or on 10/31/01 in index—including reinvestment of dividends. Fiscal year ending March 31. |

21

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The ultimate responsibility for good corporate governance rests with the Board, whose primary roles are oversight, counseling and direction to Magma’s management in the best long-term interests of Magma and its stockholders. The Audit Committee of the Board of Directors has been established for the purpose of overseeing the accounting and financial reporting processes of the Company and audits of Magma’s annual financial statements. The Audit Committee is made up solely of independent directors, as defined in the applicable Nasdaq and SEC rules. The Committee operates under a written charter adopted and regularly reviewed by the Board, a copy of which is available athttp://investor.magma-da.com/governance/home.cfm#auditcharter. The responsibilities of the Committee, as reflected in the charter most recently revised by the Board in April of 2004, are intended to be in accordance with applicable requirements for corporate audit committees. The Audit Committee is currently composed of three directors appointed by the Board, including at least one independent member determined by the Board to meet the qualifications of an “audit committee financial expert” in accordance with SEC rules. Kevin C. Eichler is the independent director who has been determined to be an audit committee financial expert.

As more fully described in its charter, the Audit Committee acts in an oversight capacity and necessarily relies on the work and assurances of Magma’s management, which has the primary responsibility for internal controls and financial statements and reports. The Committee also relies on the work and assurances of Magma’s independent accountants, who are responsible for performing an independent audit of Magma’s consolidated financial statements in accordance with generally accepted auditing standards and for issuing a report thereon. It is not the duty of the Audit Committee to plan or conduct audits or to determine that Magma’s financial statements are complete and accurate and are in accordance with generally accepted accounting principles. The Audit Committee has the ultimate authority and responsibility to select, compensate, evaluate, and when appropriate, replace Magma’s independent auditors. The Audit Committee also has the authority to engage its own outside advisers, as it determines appropriate, apart from counsel or advisers hired by Magma’s management.

In performing its functions and responsibilities, the Audit Committee reviewed and discussed with management Magma’s audited financial statements as of and for the year ended March 31, 2005. The Audit Committee also discussed with PwC the matters required to be discussed by Statement on Auditing Standards No. 61, as amended (“Communication with Audit Committees”), and received the written disclosures and a letter from the independent accountants required by Independence Standards Board Standard No. 1 (“Independence Discussions with Audit Committees”). The Committee’s review with management and the auditors included a discussion of the quality, not merely the acceptability, of Magma’s accounting principles, the reasonableness of significant estimates and judgments, and the clarity of disclosure in Magma’s financial statements and public reports, including the disclosure related to critical accounting estimates. Based upon these reviews and discussions, and the report of the independent auditors, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in Magma’s Annual Report on Form 10-K for the year ended March 31, 2005.

The Committee also discussed with PwC the independence of the firm and the potential for conflicts of interest. In accordance with Audit Committee policy and the requirements of law, all services to be provided by PwC are pre-approved by the Audit Committee, or are pre-approved by the Audit Committee Chairman and later ratified by the Committee. Pre-approval includes audit services, audit-related services, tax services and other services. The law prohibits a publicly traded company from obtaining certain non-audit services from its auditing firm. Magma obtains these services from service providers other than PwC as needed.

Audit Committee

Kevin C. Eichler (Chairman)

Chet Silvestri

Thomas Rohrs

22

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Magma’s Policies

It is our policy that all employees must avoid any activity that is or has the appearance of being adverse or competitive with Magma, or that interferes with the proper performance of their duties, responsibilities or loyalty to Magma. These policies are included in our Code of Ethics, which covers Magma’s directors, executive officers and other employees. Any waivers to these conflict rules with regard to a director or executive officer require the prior approval of the Board or the Audit Committee.

Relationships and Related Party Transactions

Mr Ng is a managing director with Deutsche Bank. In connection with Magma’s repurchase of common stock and its repurchase of convertible notes in May 2005, Deutsche Bank was paid approximately $65,000. During fiscal 2005, Masoud Ghafouri, a brother of Saeid Ghafouri, Magma’s Senior Vice President of Worldwide Sales, was employed by Magma as Director of Purchasing and Facilities, in which capacity he earned aggregate compensation of $150,300.

Indebtedness of Management

None of our directors, executive officers, nominees for such positions, or their family members, have been indebted to Magma or its subsidiaries at any time in the past fiscal year.

STOCKHOLDER PROPOSALS FOR THE 2006 ANNUAL MEETING