UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ý ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2011

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 001-15253

Janus Capital Group Inc.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) | 43-1804048 (I.R.S. Employer Identification No.) | |

151 Detroit Street, Denver, Colorado (Address of principal executive offices) | 80206 (Zip Code) |

(303) 333-3863

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

|---|---|---|

| Common Stock, $ 0.01 Per Share Par Value | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None | ||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Company was required to file such reports), and (2) has been subject to the filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy of information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

As of June 30, 2011, the aggregate market value of common equity held by non-affiliates was $1,760,915,086. As of February 22, 2012, there were 188,397,957 shares of the Company's common stock, $0.01 par value per share, issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the following documents are incorporated herein by reference into Part of the Form 10-K as indicated:

Document | Part of Form 10-K into Which Incorporated | |

| Company's Definitive Proxy Statement for the 2012 Annual Meeting of Stockholders | Part III |

JANUS CAPITAL GROUP INC.

2011 FORM 10-K ANNUAL REPORT

TABLE OF CONTENTS

| | | Page | ||

|---|---|---|---|---|

PART I | ||||

Item 1. | Business | 2 | ||

Item 1A. | Risk Factors | 7 | ||

Item 1B. | Unresolved Staff Comments | 10 | ||

Item 2. | Properties | 10 | ||

Item 3. | Legal Proceedings | 10 | ||

Item 4. | Mine Safety Disclosures | 10 | ||

PART II | ||||

Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 11 | ||

Item 6. | Selected Financial Data | 13 | ||

Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 15 | ||

Item 7A. | Quantitative and Qualitative Disclosures about Market Risk | 30 | ||

Item 8. | Financial Statements and Supplementary Data | 34 | ||

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 71 | ||

Item 9A. | Controls and Procedures | 71 | ||

Item 9B. | Other Information | 72 | ||

PART III | ||||

Item 10. | Directors, Executive Officers and Corporate Governance | 72 | ||

Item 11. | Executive Compensation | 72 | ||

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 72 | ||

Item 13. | Certain Relationships and Related Transactions, and Director Independence | 72 | ||

Item 14. | Principal Accountant Fees and Services | 72 | ||

PART IV | ||||

Item 15. | Exhibits and Financial Statement Schedules | 72 | ||

Signatures | 81 | |||

1

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. In addition, Janus Capital Group Inc. and its subsidiaries (collectively, "JCG" or the "Company") may make other written and oral communications from time to time (including, without limitation, in the Company's 2011 Annual Report to Stockholders) that contain such statements. Forward-looking statements include statements as to industry trends, future expectations of the Company and other matters that do not relate strictly to historical facts and are based on certain assumptions by management. These statements are often identified by the use of words such as "may," "will," "expect," "believe," "anticipate," "intend," "could," "should," "estimate" or "continue," and similar expressions or variations. These statements are based on the beliefs and assumptions of Company management based on information currently available to management. Such forward-looking statements are subject to risks, uncertainties and other factors that could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. Important factors that could cause actual results to differ materially from the forward-looking statements include, among others, the risks described in Part I, Item 1A, Risk Factors, and elsewhere in this report and other documents filed or furnished by JCG from time to time with the Securities and Exchange Commission. JCG cautions readers to carefully consider such factors. Furthermore, such forward-looking statements speak only as of the date on which such statements are made. Except to the extent of the Company's ongoing obligations under applicable securities law and stock exchange rules, the Company undertakes no obligation to release publicly any revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated events.

Janus Capital Group Inc. and its subsidiaries (collectively, "JCG" or the "Company") provide investment management, administration, distribution and related services to individual and institutional investors through mutual funds, other pooled investment vehicles, separate accounts and subadvised relationships (collectively referred to as "investment products") in both domestic and international markets. Over the last several years, JCG has expanded its business to become a more diversified manager with increased investment product offerings and distribution capabilities. JCG offers three distinct types of investment advisory services, including fundamental equity (includes growth and core equity, global and international equity, and value investment disciplines), fixed income and mathematical equity, through its three primary subsidiaries, Janus Capital Management LLC ("Janus"), INTECH Investment Management LLC ("INTECH") and Perkins Investment Management LLC ("Perkins"). Each of JCG's primary subsidiaries specializes in specific investment styles and disciplines. JCG's investment products are distributed through three channels: retail intermediary, institutional and international. Each distribution channel focuses on specific investor groups and the unique requirements of each group. As of December 31, 2011, JCG managed $148.2 billion of assets for shareholders, clients and institutions around the globe.

Revenues are generally based upon a percentage of the market value of assets under management and are calculated as a percentage of the daily average asset balance in accordance with contractual agreements. Certain investment products are also subject to performance fees, which vary based on a product's relative performance as compared to a benchmark index and the level of assets subject to such fees. Assets under management primarily consist of domestic and international equity and debt securities. Accordingly, fluctuations in domestic and international financial markets, relative investment performance, sales and redemptions of investment products, and changes in the composition of assets under management are all factors that have a direct effect on JCG's operating results.

2

Subsidiaries

Janus

Janus considers itself a leader in U.S. and global equity investing, beginning with the launch of the Janus Fund over 40 years ago. Janus offers growth and core equity, global and international equity, as well as balanced, fixed income and retail money market investment products. Janus' investment teams take a long-term view and use a bottom-up, company-by-company investment approach to gain a differentiated view in the marketplace. Janus believes its depth of research, experienced portfolio managers and analysts, willingness to make concentrated investments when Janus believes it has a research edge and commitment to delivering strong long-term results for its investors differentiate Janus from its competitors.

During 2011, Janus continued to further diversify its business through the build-out of the fixed income franchise, ending 2011 with more than $20 billion of fixed income assets under management for the first time in the Company's history. At December 31, 2011, Janus managed $88.7 billion of long-term assets and $1.5 billion of money market assets, or 61% of total Company assets under management.

INTECH

INTECH has managed institutional portfolios since 1987, establishing one of the industry's longest continuous performance records of mathematical equity investment strategies. INTECH's unique investment process is based on a mathematical theorem that seeks to add value for clients by capitalizing on the volatility in stock price movements. INTECH's goal is to achieve long-term returns that outperform a specified benchmark index while controlling risks and trading costs. At December 31, 2011, INTECH managed $39.9 billion, or 27% of total Company assets under management.

Perkins

Perkins has managed value-disciplined investment products since 1980, focusing on building diversified portfolios of what it believes to be high-quality, undervalued stocks with favorable reward characteristics. With its fundamental research and careful consideration for risk, Perkins has established a reputation as a leading value manager. Perkins offers value-disciplined investment products, including small, mid and large cap and global value investment products. At December 31, 2011, Perkins managed $18.1 billion, or 12% of total Company assets under management.

Distribution Channels

Retail Intermediary Channel

The retail intermediary channel serves financial intermediaries and retirement platforms in the U.S., which include asset managers, banks and trusts, broker-dealers, independent planners, third-party 401(k) administrators and insurance companies. In addition, this channel serves existing individual investors who access JCG's investment products through mutual fund supermarkets.

Assets in the advisory subchannel, a component of the retail intermediary channel, have more than tripled since 2004 and totaled $23.8 billion at December 31, 2011. Significant investments have been made in strengthening the Company's presence in the advisory subchannel over the last several years, doubling the number of external and internal wholesalers, focusing on technology and building out robust home office coverage, including a dedicated analyst relations team. Overall assets in the retail intermediary channel totaled $96.5 billion, or 65% of total Company assets under management, at December 31, 2011.

Institutional Channel

The institutional channel serves corporations, endowments, foundations, Taft-Hartley funds and public fund clients and focuses on distribution direct to the plan sponsor and through consulting relationships. Investors in the institutional channel often rely on advice from third-party consultants. The institutional

3

channel operates in the U.S. market. Accordingly, JCG has assembled a consultant relations team dedicated to providing information and services to institutional consultants. Although the current asset base in this channel is weighted heavily toward INTECH's mathematical products, the Company is striving for increased penetration of Janus equity and fixed income strategies as well as Perkins products. Assets in the institutional channel totaled $36.4 billion, or 25% of total Company assets under management, at December 31, 2011.

International Channel

The international channel primarily serves professional retail investors outside of the U.S., including central and local government pension plans, corporate pension plans, multi-managers, insurance companies and private banks. International products are offered through separate accounts, subadvisory relationships and Janus Capital Funds Plc, a Dublin-domiciled trust. During 2011, JCG continued to strategically expand global distribution and product capabilities in the international channel. Assets in the international channel totaled $15.3 billion, or 10% of total Company assets under management, at December 31, 2011.

COMPETITION

The investment management industry is relatively mature and saturated with competitors that provide services similar to JCG. As such, JCG encounters significant competition in all areas of its business. JCG competes with other investment managers, mutual fund advisers, brokerage and investment banking firms, insurance companies, hedge funds, venture capitalists, banks and other financial institutions, many of which are larger, have proprietary access to certain distribution channels, have a broader range of product choices and investment capabilities, and have greater capital resources. Additionally, the marketplace for investment products is rapidly changing; investors are becoming more sophisticated; the demand for and access to investment advice and information are becoming more widespread; and more investors are demanding investment vehicles that are customized to their personal requirements.

JCG believes its ability to successfully compete in the investment management industry will be based on its ability to achieve consistently strong investment performance, provide exceptional client service, build upon its distribution relationships and continue to create new ones, develop new investment products well-suited for its distribution channels and attractive to underlying clients and investors, offer a diverse platform of investment choices and vehicles, provide effective shareowner servicing, retain and strengthen the confidence of its clients, and attract and retain talented investment and sales personnel.

REGULATION

The U.S. Securities and Exchange Commission (the "SEC") is the federal agency generally responsible for administering the U.S. federal securities laws. The investment management industry is subject to extensive federal, state and international laws and regulations intended to benefit or protect the shareholders of investment products such as those managed by JCG's subsidiaries and advisory clients of JCG subsidiaries. The costs of complying with such laws and regulations have significantly increased and may continue to contribute significantly to the costs of doing business as an investment adviser. These laws and regulations generally grant supervisory agencies broad administrative powers, including the power to limit or restrict the conduct of businesses such as JCG's, and to impose sanctions for failure to comply with the laws and regulations. Possible consequences or sanctions for such failure to comply include, but are not limited to, voiding of investment advisory and subadvisory agreements, the suspension of individual employees (particularly investment management and sales personnel), limitations on engaging in certain lines of business for specified periods of time, revocation of registrations, disgorgement of profits, and censures and fines. Further, such laws and regulations may provide the basis for civil litigation that may also result in significant costs and reputational harm to covered entities such as JCG.

4

The Investment Advisers Act of 1940

Certain subsidiaries of JCG are registered investment advisers under the Investment Advisers Act of 1940, as amended (the "Investment Advisers Act") and, as such, are regulated by the SEC. The Investment Advisers Act requires registered investment advisers to comply with numerous and pervasive obligations, including, among others, recordkeeping requirements, operational procedures, registration and reporting requirements, and disclosure obligations. Certain subsidiaries of JCG are also registered with regulatory authorities in various states and foreign countries, and thus are subject to the oversight and regulation by such states' and countries' regulatory agencies.

The Investment Company Act of 1940

Certain of JCG's subsidiaries act as adviser or subadviser to both proprietary and nonproprietary mutual funds, which are registered with the SEC pursuant to the Investment Company Act of 1940, as amended (the "1940 Act"). Certain of JCG's subsidiaries also serve as adviser or subadviser to investment products that are not required to be registered under the 1940 Act. As an adviser or subadviser to a registered investment company, these subsidiaries must comply with the requirements of the 1940 Act and related regulations including, among others, requirements relating to operations, fees charged, sales, accounting, recordkeeping, disclosure and governance. In addition, the adviser or subadviser to a registered investment company generally has obligations with respect to the qualification of the registered investment company under the Internal Revenue Code of 1986, as amended (the "Code").

Broker-Dealer Regulations

JCG's limited purpose broker-dealer subsidiary, Janus Distributors LLC ("JD"), is registered with the SEC under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and is a member of the Financial Industry Regulatory Authority ("FINRA"), the securities industry's domestic self-regulatory organization. JD is the general distributor and agent of the sale and distribution of shares of certain mutual funds that are directly advised or serviced by certain of JCG's subsidiaries. The SEC imposes various requirements on JD's operations including disclosure, recordkeeping and accounting. FINRA has established conduct rules for all securities transactions among broker-dealers and private investors, trading rules for the over-the-counter markets and operational rules for its member firms. The SEC and FINRA also impose net capital requirements on registered broker-dealers.

JD is also subject to regulation under state law. The federal securities laws prohibit states from imposing substantive requirements on broker-dealers that exceed those under federal law. This does not preclude the states from imposing registration requirements on broker-dealers that operate within their jurisdiction or from sanctioning these broker-dealers and their employees for engaging in misconduct.

ERISA

Certain JCG subsidiaries are also subject to the Employee Retirement Income Security Act of 1974, as amended ("ERISA"), and related regulations to the extent they are considered "fiduciaries" under ERISA with respect to some of their clients. ERISA, related provisions of the Code, and regulations issued by the U.S. Department of Labor impose duties on persons who are fiduciaries under ERISA and prohibit some transactions involving the assets of each ERISA plan that is a client of a JCG subsidiary as well as some transactions by the fiduciaries (and several other related parties) to such plans.

Dodd-Frank Act

On July 21, 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act (the "Dodd-Frank Act") was signed into law. The Dodd-Frank Act enacted numerous legal and regulatory changes for the financial services industry. Many provisions of the Dodd-Frank Act are subject to rulemaking by the SEC and other agencies and will take effect over several years. The regulations affect, among other things, corporate governance, including proxy access by shareholders and "say-on-pay" with respect to

5

executive compensation. The Company will continue to review and evaluate the Dodd-Frank Act and the extent of its impact on its business as the various rules and regulations required for implementation continue to be adopted.

International Regulations

Certain JCG subsidiaries are authorized to conduct investment business in international markets and are subject to foreign regulation. JCG's international subsidiaries are subject to the regulatory supervision and requirements of various agencies, including the Financial Services Authority in the United Kingdom, the Central Bank of Ireland, the Securities and Futures Commission of Hong Kong, the Monetary Authority of Singapore, the Financial Services Agency of Japan, the Commissione Nazionale per le Societa e la Borsa in Italy, the Federal Financial Supervisory Authority of Germany, the Australian Securities and Investments Commission, and the Canadian Provincial Securities Commissions. These regulatory agencies have broad supervisory and disciplinary powers, including, among others, the power to temporarily or permanently revoke the authorization to conduct regulated business, the suspension of registered employees, and censures and fines for both regulated businesses and their registered employees.

Many of the non-U.S. securities exchanges and regulatory authorities have imposed rules (and others may impose rules) relating to capital requirements applicable to JCG's foreign subsidiaries. These rules, which specify minimum capital requirements, are designed to measure general financial integrity and liquidity and require that a minimum amount of assets be kept in relatively liquid form.

EMPLOYEES

As of December 31, 2011, JCG had 1,125 full-time employees. None of these employees are represented by a labor union.

AVAILABLE INFORMATION

Copies of JCG's filings with the SEC can be obtained from the SEC's Public Reference Room at 100 F Street, N.E., Washington, DC 20549. Information can be obtained about the operation of the Public Reference Room by calling the SEC at (800) SEC-0330. The SEC also maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov.

JCG makes available free of charge its annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K and amendments thereto as soon as reasonably practical after such filing has been made with the SEC. Reports may be obtained through the Investor Relations section of JCG's website (http://ir.janus.com) or by contacting JCG at (888) 834-2536. The contents of JCG's website are not incorporated herein for any purpose.

JCG's Officer Code of Ethics for Principal Executive Officer and Senior Financial Officers (including its chief executive officer, chief financial officer and controller) (the "Officer Code"); Corporate Code of Business Conduct and Ethics for all employees; corporate governance guidelines; and the charters of key committees of the board of directors (including the Audit, Compensation, Nominating and Corporate Governance, and Planning and Strategy committees) are available on its website (http://ir.janus.com/documents.cfm), and printed copies are available to any shareholder upon request by calling JCG at (888) 834-2536. Any future amendments to or waivers of the Officer Code will be posted to the Investor Relations section of JCG's website.

ADDITIONAL FINANCIAL INFORMATION

See additional financial information about segments and geographical areas in Part II, Item 8, Financial Statements and Supplementary Data, Note 19 — Segment and Geographic Information, of this Annual Report on Form 10-K.

6

JCG's revenues and profits are primarily dependent on the value, composition and relative investment performance of its investment products.

Any decrease in the value or amount of assets under management will cause a decline in revenues and operating results. Assets under management may decline for various reasons, many of which are not under JCG's control.

Factors that could cause assets under management and revenues to decline include the following:

- •

- Declines in equity markets. JCG's assets under management are concentrated in the U.S. equity markets and, to a lesser extent, in the international equity markets. As such, declines in the financial markets or the market segments in which JCG's investment products are concentrated will cause assets under management to decrease.

- •

- Declines in fixed income markets. In the case of fixed income investment products, which invest in high-quality short-term instruments as well as other fixed income securities, the value of the assets may decline as a result of changes in interest rates, available liquidity in the markets in which a security trades, an issuer's actual or perceived creditworthiness, or an issuer's ability to meet its obligations.

- •

- Redemptions and other withdrawals. Investors, in response to adverse market conditions, inconsistent investment performance, the pursuit of other investment opportunities or other factors, may reduce their investments in specific JCG investment products or in the market segments in which JCG's investment products are concentrated.

- •

- Operations in international markets. The investment products managed by JCG may have significant investments in international markets that are subject to risk of loss from political or diplomatic developments, government policies, civil unrest, currency fluctuations and changes in legislation related to foreign ownership. International markets, particularly emerging markets, which are often smaller and may not have the liquidity of established markets, may lack established regulations and may experience significantly more volatility than established markets.

- •

- Relative investment performance. JCG's investment products are often judged on their performance as compared to benchmark indices, peer groups or on an absolute return basis. Any period of underperformance of investment products may result in the loss of existing assets and impact JCG's ability to attract new assets. In addition, approximately 42% of the Company's assets under management at December 31, 2011, are subject to performance fees. Performance fees are based on each product's investment performance as compared to an established benchmark index over a specified period of time. If investment products subject to performance fees underperform their respective benchmark index for a defined period, JCG's revenues and thus results of operations may be adversely impacted. In addition, performance fees subject JCG's revenues to increased volatility.

JCG's results are dependent on its ability to attract and retain key personnel.

The investment management business is highly dependent on the ability to attract, retain and motivate highly skilled and often highly specialized technical, executive, sales and investment management personnel. The market for investment and sales professionals is extremely competitive and is increasingly characterized by the frequent movement of portfolio managers, analysts and salespersons among different firms. Any changes to management structure, shifts in corporate culture, changes to corporate governance authority, or adjustments or reductions to compensation could impact JCG's ability to retain key personnel and could result in legal claims. If JCG is unable to retain key personnel, it could adversely affect JCG's ability to attract and retain assets under management, results of operations and financial condition.

7

JCG is dependent upon third-party distribution channels to access clients and potential clients.

JCG's ability to market and distribute its investment products is significantly dependent on access to the client base of insurance companies, defined contribution plan administrators, securities firms, broker-dealers, banks and other distribution channels. These companies generally offer their clients various investment products in addition to, and in competition with, JCG. Further, the private account business uses referrals from financial planners, investment advisers and other professionals. JCG cannot be certain that it will continue to have access to these third-party distribution channels or have an opportunity to offer some or all of its investment products through these channels. In addition, JCG's existing relationships with third-party distributors and access to new distributors could be adversely impacted by recent consolidation within the financial services industry. Consolidation may result in increased distribution costs, a reduction in the number of third parties distributing JCG's investment products or increased competition to access third-party distribution channels. The inability to access clients through third-party distribution channels could adversely affect JCG's business prospects, ability to attract and retain assets under management, results of operations and financial condition.

INTECH's investment process is highly dependent on key employees and proprietary software.

INTECH's investment process is based on complex and proprietary mathematical models that seek to outperform various indices by capitalizing on the volatility in stock price movements while controlling trading costs and overall risk relative to the index. The maintenance of such models for current products and the development of new products are highly dependent on certain key INTECH employees. If INTECH is unable to retain key personnel or properly transition key personnel responsibilities to others, or if the mathematical investment strategies fail to produce the intended results, INTECH may not be able to maintain its historical level of investment performance, which could adversely affect JCG's ability to attract and retain assets under management, results of operations and financial condition.

The regulatory environment in which JCG operates has changed and may continue to change.

JCG may be adversely affected as a result of new or revised legislation or regulations, or by changes in the interpretation or enforcement of existing laws and regulations. The costs and burdens of compliance with these and other new reporting and operational requirements and regulations have increased significantly and may continue to increase the cost of operating mutual funds and other investment products, which could adversely affect JCG's ability to attract and retain assets under management, results of operations and financial condition. (See Part I, Item 1, Business — Regulation, of this Annual Report on Form 10-K.)

Any damage to JCG's reputation could harm its business and lead to a loss of assets under management, revenues and net income.

JCG's reputation is critical to the success of its business. If the Company's reputation is harmed, it could impede its ability to attract and retain customers and key personnel, and could adversely affect JCG's ability to attract and retain assets under management, results of operations and financial condition.

JCG's business may be vulnerable to failures or breaches in support systems and customer service functions.

The ability to consistently and reliably obtain securities pricing information, process shareowner transactions and provide reports and other customer service to the shareowners of funds and other investment products managed by JCG, as well as the protection of confidential information maintained by the Company, is essential to JCG's operations. Any delays, errors or inaccuracies in obtaining pricing information, JCG's ability to price illiquid or thinly traded securities without readily obtainable market quotes, processing shareowner transactions or providing reports, and any other inadequacies in other customer service functions could alienate customers, result in financial loss and potentially give rise to

8

claims against JCG. If this were to occur, it could adversely affect JCG's ability to attract and retain assets under management, results of operations and financial condition.

JCG's customer service capabilities as well as JCG's ability to obtain prompt and accurate securities pricing information and to process shareowner transactions and reports are dependent on communication and information systems and services provided by third-party vendors. JCG's established disaster recovery plans could suffer failures or interruptions due to various natural or man-made causes, and the backup procedures and capabilities may not be adequate to avoid extended interruptions. Additionally, JCG places significant reliance on its automated systems, thereby increasing the related risks if such systems were to fail. A failure of these systems could adversely affect JCG's ability to attract and retain assets under management, results of operations and financial condition.

In addition, JCG maintains confidential information relating to its clients and business operations. JCG's systems could be infiltrated by unauthorized users or damaged by computer viruses or other malicious software code, or authorized persons could inadvertently or intentionally release confidential or proprietary information. Such disclosure could be detrimental to JCG's reputation and lead to legal claims, regulatory action, increased costs or loss of revenue, among other things.

JCG's business is dependent on investment advisory agreements that are subject to termination, non-renewal or reductions in fees.

JCG derives revenue from investment advisory agreements with mutual funds and other investment products. The termination of or failure to renew one or more of these agreements or the reduction of the fee rates applicable to such agreements could have a material adverse effect on JCG's revenues and profits, and ability to attract and maintain assets under management. With respect to investment advisory agreements with mutual funds, these agreements may be terminated by either party with notice, or terminated in the event of an "assignment" (as defined in the 1940 Act), and must be approved and renewed annually by the independent members of each fund's board of directors or trustees, or its shareowners, as required by law. In addition, the board of directors or trustees of certain funds and separate accounts generally may terminate these investment advisory agreements upon written notice for any reason and without penalty.

JCG's indebtedness could adversely affect its financial condition and results of operations.

JCG's indebtedness could limit its ability to obtain additional financing for working capital, capital expenditures, acquisitions, debt servicing requirements or other purposes. Debt servicing requirements will increase JCG's vulnerability to adverse economic, market and industry conditions; limit JCG's flexibility in planning for or reacting to changes in business operations or to the asset management industry overall; and place JCG at a disadvantage in relation to competitors that have lower debt levels. In addition, all of JCG's outstanding debt, excluding its convertible debt, is subject to an increase in interest rates in the event of a credit rating downgrade by either Standard & Poor's ("S&P") Rating Service or Moody's Investors Service, Inc. ("Moody's"). Certain of JCG's indebtedness is also subject to repurchase at 101% of the principal balance if the Company experiences a change of control, and in connection therewith, the applicable notes become rated below investment grade. (See Part II, Item 8, Financial Statements and Supplementary Data, Note 7 — Debt, of this Annual Report on Form 10-K.) Any or all of the above events and factors could adversely affect JCG's ability to attract and retain assets under management, results of operations and financial condition.

JCG is involved in various legal proceedings and regulatory matters and may be involved in such proceedings in the future.

JCG is involved in various matters, including litigation and other regulatory matters, some of which seek specified or unspecified compensatory and punitive damages, and JCG may be involved in additional matters in the future. Any settlement or judgment on the merits of such matters could

9

adversely affect JCG's ability to attract and retain assets under management, results of operations and financial condition.

Additionally, JCG has and may in the future receive requests for information in connection with certain investigations or proceedings from various governmental and regulatory authorities. These requests may result in increased costs or reputational harm to the Company, which may cause lower sales and increased redemptions.

JCG operates in a highly competitive environment and its current fee structure may be reduced.

The investment management business is highly competitive and has relatively low barriers to entry. JCG's current fee structure may be subject to downward pressure due to these factors. Moreover, in recent years there has been a trend toward lower fees in the investment management industry. Fee reductions on existing or future new business as well as changes in regulations pertaining to its fee structure could adversely affect JCG's results of operations and financial condition.

JCG has a significant level of goodwill and intangible assets that are subject to annual impairment review.

Goodwill and intangible assets totaled $1.8 billion at December 31, 2011. The value of these assets may not be realized for a variety of reasons, including, but not limited to, significant redemptions, loss of clients and unfavorable economic conditions. JCG has recorded goodwill and intangible asset impairments in the past and could incur similar charges in the future. JCG reviews the carrying value of intangible assets not subject to amortization on an annual basis, or more frequently if indications exist suggesting that the fair value of its intangible assets may be below their carrying value. JCG evaluates the value of intangible assets subject to amortization whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Should a review indicate impairment, a write-down of the carrying value of the intangible asset could occur, resulting in a non-cash charge that may, in turn, adversely affect JCG's ability to attract and retain assets under management, results of operations and financial condition.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

JCG's headquarters are located in Denver, Colorado. JCG leases office space from non-affiliated companies for administrative, investment and shareowner servicing operations in Denver, Glendale and Aurora, Colorado; Chicago, Illinois; Princeton, New Jersey; West Palm Beach, Florida; London; Paris; Milan; Munich; Singapore; Hong Kong; Tokyo; and Melbourne.

In the opinion of management, the space and equipment owned or leased by the Company are adequate for existing operating needs.

The information set forth in response to Item 103 of Regulation S-K under "Legal Proceedings" is incorporated by reference from Part II, Item 8, Financial Statements and Supplementary Data, Note 16 — Litigation and Other Regulatory Matters, of this Annual Report on Form 10-K.

ITEM 4. MINE SAFETY DISCLOSURES

None.

10

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

JCG Common Stock

JCG's common stock is traded on the New York Stock Exchange ("NYSE") (symbol: JNS). The following table sets forth the high and low sale prices as reported on the NYSE composite tape for each completed quarter since January 1, 2010.

| | 2011 | 2010 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Quarter | High | Low | High | Low | |||||||||

First | $ | 14.54 | $ | 11.56 | $ | 15.00 | $ | 11.66 | |||||

Second | $ | 12.68 | $ | 8.79 | $ | 15.72 | $ | 8.88 | |||||

Third | $ | 10.12 | $ | 5.92 | $ | 11.08 | $ | 8.81 | |||||

Fourth | $ | 7.32 | $ | 5.63 | $ | 13.11 | $ | 10.44 | |||||

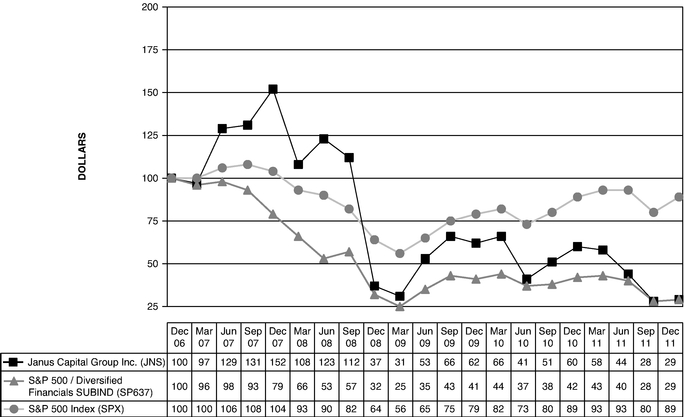

The following graph illustrates the cumulative total shareholder return (rounded to the nearest whole dollar) of JCG's common stock over the five-year period ending December 30, 2011, the last trading day of 2011, and compares it to the cumulative total return on the S&P 500 Index and the S&P Diversified Financials Index. The comparison assumes a $100 investment on December 31, 2006, in JCG's common stock and in each of the foregoing indices and assumes reinvestment of dividends, if any. This table is not intended to forecast future performance of JCG's common stock.

On December 31, 2011, there were 3,017 holders of record of JCG's common stock.

11

The payment of cash dividends is within the discretion of JCG's Board of Directors and will depend on many factors, including, but not limited to, JCG's results of operations, financial condition, capital requirements, restrictions imposed by financing arrangements, general business conditions and legal requirements. On January 24, 2012, JCG's Board of Directors declared a regular quarterly cash dividend of $0.05 per share, which was paid on February 21, 2012, to stockholders of record at the close of business on February 6, 2012. This quarterly rate represents an annualized dividend payout of $0.20 per share of common stock. The following $0.05 per share quarterly cash dividends were paid during 2011:

Record Date | Payment Date | |

|---|---|---|

| May 2, 2011 | May 13, 2011 | |

| July 29, 2011 | August 12, 2011 | |

| October 31, 2011 | November 14, 2011 |

JCG declared an annual $0.04 per share dividend in the second quarter 2010 and 2009.

Common Stock Repurchases

JCG's Board of Directors authorized five separate $500 million share repurchase programs beginning in July 2004 with the most recent authorization in July 2008. As of December 31, 2011, $521.2 million is available under the current authorizations. JCG has not repurchased any of its common stock since 2008. Any repurchases of debt securities or common stock will depend on prevailing market conditions, the Company's liquidity requirements, contractual and legal restrictions, and other factors.

12

ITEM 6. SELECTED FINANCIAL DATA

The selected financial data below should be read in conjunction with Part II, Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations, of this Annual Report on Form 10-K and Part II, Item 8, Financial Statements and Supplementary Data, of this Annual Report on Form 10-K.

| | Year Ended December 31, | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||

| | (dollars in millions, except operating data and per share data) | |||||||||||||||

Income Statement: | ||||||||||||||||

Revenues (1) | $ | 981.9 | $ | 1,015.7 | $ | 848.7 | $ | 1,037.9 | $ | 1,117.0 | ||||||

Operating expenses (2) | 670.1 | 734.1 | 1,526.2 | 704.8 | 767.7 | |||||||||||

Operating income (loss) | 311.8 | 281.6 | (677.5 | ) | 333.1 | 349.3 | ||||||||||

Interest expense (3) | (51.0 | ) | (63.2 | ) | (74.0 | ) | (75.5 | ) | (58.8 | ) | ||||||

Other, net (4) | (18.1 | ) | 26.6 | (4.7 | ) | (50.8 | ) | 32.4 | ||||||||

(Loss) gain on early extinguishment of debt (5) | (9.9 | ) | — | 5.8 | — | — | ||||||||||

Income tax provision | (79.4 | ) | (76.4 | ) | 6.3 | (68.8 | ) | (116.4 | ) | |||||||

Equity in earnings of unconsolidated affiliates | — | — | — | 9.0 | 7.2 | |||||||||||

Income (loss) from continuing operations | 153.4 | 168.6 | (744.1 | ) | 147.0 | 213.7 | ||||||||||

Discontinued operations (6) | — | — | — | (1.5 | ) | (75.7 | ) | |||||||||

Net income (loss) | 153.4 | 168.6 | (744.1 | ) | 145.5 | 138.0 | ||||||||||

Noncontrolling interests | (10.5 | ) | (8.7 | ) | (13.0 | ) | (8.6 | ) | (21.7 | ) | ||||||

Net income (loss) attributable to JCG | $ | 142.9 | $ | 159.9 | $ | (757.1 | ) | $ | 136.9 | $ | 116.3 | |||||

Basic earnings (loss) per share attributable to JCG common shareholders (7) | ||||||||||||||||

Income (loss) from continuing operations | $ | 0.78 | $ | 0.89 | $ | (4.55 | ) | $ | 0.87 | $ | 1.09 | |||||

Discontinued operations | — | — | — | (0.01 | ) | (0.43 | ) | |||||||||

Net income (loss) | $ | 0.78 | $ | 0.89 | $ | (4.55 | ) | $ | 0.86 | $ | 0.66 | |||||

Diluted earnings (loss) per share attributable to JCG common shareholders (7) | ||||||||||||||||

Income (loss) from continuing operations | $ | 0.78 | $ | 0.88 | $ | (4.55 | ) | $ | 0.86 | $ | 1.07 | |||||

Discontinued operations | — | — | — | (0.01 | ) | (0.42 | ) | |||||||||

Net income (loss) | $ | 0.78 | $ | 0.88 | $ | (4.55 | ) | $ | 0.85 | $ | 0.65 | |||||

Dividends declared per share | $ | 0.15 | $ | 0.04 | $ | 0.04 | $ | 0.04 | $ | 0.04 | ||||||

Balance Sheet (as of December 31): | ||||||||||||||||

Total assets | $ | 2,644.0 | $ | 2,726.8 | $ | 2,530.3 | $ | 3,336.7 | $ | 3,564.1 | ||||||

Long-term debt | $ | 595.2 | $ | 586.7 | $ | 792.0 | $ | 1,106.0 | $ | 1,127.7 | ||||||

Other long-term liabilities | $ | 465.5 | $ | 453.3 | $ | 438.5 | $ | 450.5 | $ | 470.0 | ||||||

Redeemable noncontrolling interests | $ | 85.4 | $ | 82.8 | $ | 101.1 | $ | 106.8 | $ | 245.8 | ||||||

Operating data (in billions): | ||||||||||||||||

Year-end assets under management | $ | 148.2 | $ | 169.5 | $ | 159.7 | $ | 123.5 | $ | 206.7 | ||||||

Average assets under management | $ | 162.3 | $ | 160.7 | $ | 134.5 | $ | 174.2 | $ | 190.4 | ||||||

Long-term net flows (8) | $ | (12.2 | ) | $ | (10.8 | ) | $ | 0.9 | $ | (0.6 | ) | $ | 9.8 | |||

13

- (1)

- Revenues generally vary with average assets under management. However, revenues also include performance fees, which vary with relative investment performance and the amount of assets subject to such fees. Beginning in 2007, certain mutual funds became subject to performance fees. Mutual fund performance fees represent up to a positive or negative 15 basis point adjustment to the base management fee. JCG incurred negative $20.9 million of performance fees from mutual funds during the year ended December 31, 2011, as a result of underperformance compared to the mutual funds' respective benchmarks. JCG earned positive $11.0 million and $16.5 million of performance fees from mutual funds during the years ended December 31, 2010 and 2009, respectively, and positive $11.2 million of performance fees from mutual funds during each of the years ended December 31, 2008 and 2007.

- (2)

- Operating expenses include impairments, restructuring, legal fees and settlement costs (net of insurance recoveries). Impairment charges are related to goodwill, mutual fund advisory contracts, terminated investment management relationships with assigned intangible values and facility closures. Impairment charges and legal costs (net of insurance recoveries) totaled $856.7 million and $31.4 million, respectively, in 2009.

- (3)

- In July 2009, JCG completed concurrent common stock and convertible senior notes offerings ("July 2009 issuance of convertible senior notes"). In August 2009, the combined proceeds of the common stock and convertible senior notes offerings, together with available cash, were used to repurchase a $443.3 million aggregate principal amount of the Company's outstanding 2011, 2012 and 2017 senior notes in a tender offer ("August 2009 tender offer"). Interest expense for 2010 declined primarily as a result of the August 2009 tender offer, partially offset by interest expense associated with the July 2009 issuance of convertible senior notes. During the fourth quarter 2010, JCG exercised its call right on the $120.9 million carrying value of the 6.250% Senior Notes and retired the notes in January 2011. Interest expense for 2008 increased from 2007 as a result of issuing $748.4 million of additional debt in 2007.

- (4)

- Net gains (losses) on trading securities of $(7.9) million, $7.1 million, $10.6 million, $(41.1) million and $17.6 million were recognized in earnings for 2011, 2010, 2009, 2008 and 2007, respectively. Net investment gains in 2010 include the $14.3 million cumulative effect of correcting the accounting for JCG's hedge on mutual fund share awards. In addition, JCG recognized impairment charges of $5.2 million on available-for-sale securities in 2009 and $21.0 million and $18.2 million in 2008 and 2007, respectively, associated with structured investment vehicle ("SIV") securities acquired from money market funds advised by Janus in 2007. In the fourth quarter 2010, JCG sold the SIV securities and recognized a $5.8 million net gain. During 2007, JCG classified certain investment securities as trading.

- (5)

- During 2009, JCG recognized a $5.8 million net gain on early extinguishment of debt related to the repurchase of a portion of the Company's outstanding 2011, 2012 and 2017 senior notes in a tender offer. During the first quarter 2011, JCG recognized a $9.9 million net loss on early extinguishment of debt as a result of JCG exercising its call right on the $120.9 million carrying value of the 6.250% Senior Notes which were retired on January 14, 2011. Under the terms of the call, JCG was required to pay the present value of interest that would have been paid if the debt had remained outstanding through scheduled maturity.

- (6)

- During the third quarter 2007, JCG initiated a plan to dispose of Rapid Solutions Group ("RSG"), previously reported as the Printing and Fulfillment segment. The results of discontinued operations for 2007 include impairment charges totaling $67.1 million (net of a $6.2 million tax benefit) to write down the carrying value of RSG to estimated fair value less costs to sell.

- (7)

- Each component of earnings per share presented has been individually rounded.

- (8)

- Long-term net flows represent total Company net sales and redemptions, excluding money market assets. Money market flows have been excluded due to the short-term nature of such investments.

14

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

2011 SUMMARY

JCG finished 2011 with assets under management of $148.2 billion, a decrease of 12.6% from 2010, as a result of long-term net outflows combined with market volatility. Long-term net outflows of $12.2 billion in 2011 were primarily driven by performance challenges in certain fundamental equity investment products.

Five-year investment performance remained strong across all strategies. Short-term investment performance for fundamental equity and fixed income strategies has improved while three-year performance metrics across all strategies have declined.

Net income attributable to JCG for 2011 totaled $142.9 million, or $0.78 per diluted share, compared with net income of $159.9 million, or $0.88 per diluted share, for 2010.

During 2011, JCG made significant progress on a number of strategic priorities, including:

- •

- Further diversification of the business through continued build-out of the fixed income franchise, with more than $20 billion of fixed income assets under management at the end of 2011, an increase of 35% from 2010.

- •

- Strategic expansion of distribution capabilities through the build-out of JCG's institutional and international channels.

- •

- Expansion of product offerings with the launch of approximately $120 million of U.S. and non-U.S. products across the equity, fixed income and alternative disciplines.

- •

- Achievement of JCG's long-term goal of operating margins in excess of 30%, with full-year operating margin of 31.8%.

Looking forward to 2012, JCG is focused on controlling expenses while continuing to invest in the business for long-term growth as the Company seeks to become more diversified and to continue to increase its global presence. JCG anticipates downward pressure on operating margins in 2012 as a result of expected negative mutual fund performance fees.

INVESTMENT PERFORMANCE

Investment products are generally evaluated based on their investment performance relative to other investment products with similar disciplines and strategies or benchmark indices. JCG's relative investment performance is as follows:

- •

- 56% of the Company's complex-wide mutual funds have a 4- or 5-star Overall Morningstar RatingTM at December 31, 2011.

- •

- 43%, 34% and 81% of complex-wide mutual fund assets ranked in the top half of their Lipper categories on a one-, three- and five-year total return basis, respectively, as of December 31, 2011.

- •

- 38%, 38% and 79% of the Company's fundamental equity mutual fund assets ranked in the top half of their Lipper categories on a one-, three- and five-year total return basis, respectively, as of December 31, 2011.

- •

- 80%, 5% and 100% of the Company's fixed income mutual fund assets ranked in the top half of their Lipper categories on a one-, three- and five-year total return basis, respectively, as of December 31, 2011.

15

- •

- 75%, 43% and 69% of the Company's mathematical equity strategies surpassed their respective benchmarks, net of fees, over the one-, three- and five-year periods, respectively, as of December 31, 2011.

Assets Under Management

Valuation

The value of assets under management is derived from the cash and investment securities underlying JCG's investment products. Investment security values are determined using unadjusted or adjusted quoted market prices and independent third-party price quotes in active markets. For debt securities with maturities of 60 days or less, the amortized cost method is used to determine the value. Securities for which market prices are not readily available or are considered unreliable are internally valued using appropriate methodologies for each security type or by engaging third-party specialists. The value of the vast majority of the securities underlying JCG's investment products is derived from readily available and reliable market price quotations.

The pricing policies for mutual funds advised by JCG's subsidiaries (the "Funds") are established by the Funds' Independent Board of Trustees and are designed to test and validate fair value measurements. Responsibility for pricing securities held within separate and subadvised accounts may be delegated by the separate or subadvised client to JCG or another party.

Assets Under Management and Flows

Total Company assets under management decreased $21.3 billion, or 12.6%, from 2010, as a result of long-term net outflows of $12.2 billion and net market depreciation of $9.1 billion. Long-term net flows represent total Company net sales and redemptions, excluding money market assets.

Fundamental equity long-term net outflows were $12.1 billion in 2011 compared with long-term net outflows of $4.3 billion in 2010. The increase in net outflows was primarily driven by underperformance in fundamental equity and lower demand for active equity strategies.

JCG continued to make progress toward building out its fixed income franchise, with positive long-term net inflows of $4.9 billion in 2011 compared to $4.0 billion in 2010.

Mathematical equity strategies continue to deliver positive relative investment performance, which led to a decline in redemptions in 2011. Mathematical equity long-term net outflows were $5.0 billion in 2011 compared with $10.5 billion in 2010.

16

The following table presents the components of JCG's assets under management (in billions):

| | Year Ended December 31, | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | 2011 | 2010 | 2009 | |||||||

Beginning of period assets | $ | 169.5 | $ | 159.7 | $ | 123.5 | ||||

Long-term sales | ||||||||||

Fundamental equity | 20.8 | 26.1 | 21.9 | |||||||

Fixed income | 10.7 | 8.5 | 5.7 | |||||||

Mathematical equity (1) | 4.5 | 4.4 | 5.8 | |||||||

Long-term redemptions | �� | |||||||||

Fundamental equity | (32.9 | ) | (30.4 | ) | (18.8 | ) | ||||

Fixed income | (5.8 | ) | (4.5 | ) | (2.3 | ) | ||||

Mathematical equity (1) | (9.5 | ) | (14.9 | ) | (11.4 | ) | ||||

Long-term net flows (2) | ||||||||||

Fundamental equity | (12.1 | ) | (4.3 | ) | 3.1 | |||||

Fixed income | 4.9 | 4.0 | 3.4 | |||||||

Mathematical equity | (5.0 | ) | (10.5 | ) | (5.6 | ) | ||||

Total long-term net flows | (12.2 | ) | (10.8 | ) | 0.9 | |||||

Net money market flows | — | (0.2 | ) | (6.2 | ) | |||||

Market/fund performance | (9.1 | ) | 20.8 | 41.5 | ||||||

End of period assets | $ | 148.2 | $ | 169.5 | $ | 159.7 | ||||

Average assets under management | ||||||||||

Fundamental equity | $ | 100.6 | $ | 102.1 | $ | 80.5 | ||||

Fixed income | 17.6 | 12.9 | 7.5 | |||||||

Mathematical equity | 42.6 | 44.1 | 43.9 | |||||||

Money market | 1.5 | 1.6 | 2.6 | |||||||

Total | $ | 162.3 | $ | 160.7 | $ | 134.5 | ||||

- (1)

- 2011 gross sales and redemptions exclude the transfer of $1.1 billion within mathematical equity strategies in the first quarter 2011.

- (2)

- Excludes money market flows. Money market sales and redemptions are presented net on a separate line due to the short-term nature of the investments.

17

Assets and Flows by Investment Discipline

JCG, through its primary subsidiaries, offers investment products based on a diversified set of investment disciplines. Janus offers growth and core equity, global and international equity, as well as balanced, fixed income and retail money market investment products. INTECH offers mathematical-based investment products and Perkins offers value-disciplined investments. Assets and flows by investment discipline are as follows (in billions):

| | Years ended December 31, | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | 2011 | 2010 | 2009 | |||||||

Growth/Core (1) | ||||||||||

Beginning of period assets | $ | 60.9 | $ | 60.9 | $ | 44.5 | ||||

Sales | 10.7 | 12.4 | 10.6 | |||||||

Redemptions | (18.7 | ) | (18.6 | ) | (11.5 | ) | ||||

Net redemptions | (8.0 | ) | (6.2 | ) | (0.9 | ) | ||||

Market/fund performance | (3.2 | ) | 6.2 | 17.3 | ||||||

End of period assets | $ | 49.7 | $ | 60.9 | $ | 60.9 | ||||

Global/International | ||||||||||

Beginning of period assets | $ | 27.9 | $ | 23.8 | $ | 14.1 | ||||

Sales | 4.8 | 6.0 | 4.7 | |||||||

Redemptions | (7.7 | ) | (6.3 | ) | (3.3 | ) | ||||

Net sales (redemptions) | (2.9 | ) | (0.3 | ) | 1.4 | |||||

Market/fund performance | (6.6 | ) | 4.4 | 8.3 | ||||||

End of period assets | $ | 18.4 | $ | 27.9 | $ | 23.8 | ||||

Mathematical Equity (2) | ||||||||||

Beginning of period assets | $ | 44.1 | $ | 48.0 | $ | 42.4 | ||||

Sales | 4.5 | 4.4 | 5.8 | |||||||

Redemptions | (9.5 | ) | (14.9 | ) | (11.4 | ) | ||||

Net redemptions | (5.0 | ) | (10.5 | ) | (5.6 | ) | ||||

Market/fund performance | 0.8 | 6.6 | 11.2 | |||||||

End of period assets | $ | 39.9 | $ | 44.1 | $ | 48.0 | ||||

Fixed Income (1) | ||||||||||

Beginning of period assets | $ | 15.3 | $ | 10.3 | $ | 5.5 | ||||

Sales | 10.7 | 8.5 | 5.7 | |||||||

Redemptions | (5.8 | ) | (4.5 | ) | (2.3 | ) | ||||

Net sales | 4.9 | 4.0 | 3.4 | |||||||

Market/fund performance | 0.4 | 1.0 | 1.4 | |||||||

End of period assets | $ | 20.6 | $ | 15.3 | $ | 10.3 | ||||

Value | ||||||||||

Beginning of period assets | $ | 19.8 | $ | 15.0 | $ | 9.1 | ||||

Sales | 5.3 | 7.7 | 6.6 | |||||||

Redemptions | (6.5 | ) | (5.5 | ) | (4.0 | ) | ||||

Net sales (redemptions) | (1.2 | ) | 2.2 | 2.6 | ||||||

Market/fund performance | (0.5 | ) | 2.6 | 3.3 | ||||||

End of period assets | $ | 18.1 | $ | 19.8 | $ | 15.0 | ||||

18

| | Years ended December 31, | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | 2011 | 2010 | 2009 | |||||||

Money Market | ||||||||||

Beginning of period assets | $ | 1.5 | $ | 1.7 | $ | 7.9 | ||||

Sales | 1.0 | 0.8 | 3.6 | |||||||

Redemptions | (1.0 | ) | (1.0 | ) | (9.8 | ) | ||||

Net redemptions | — | (0.2 | ) | (6.2 | ) | |||||

Market/fund performance | — | — | — | |||||||

End of period assets | $ | 1.5 | $ | 1.5 | $ | 1.7 | ||||

- (1)

- Growth/core and fixed income assets have been reclassified to reflect a 50%/50% split of the Janus Balanced Fund between the two categories.

- (2)

- 2011 gross sales and redemptions exclude the transfer of $1.1 billion within mathematical equity strategies in the first quarter 2011.

Revenues

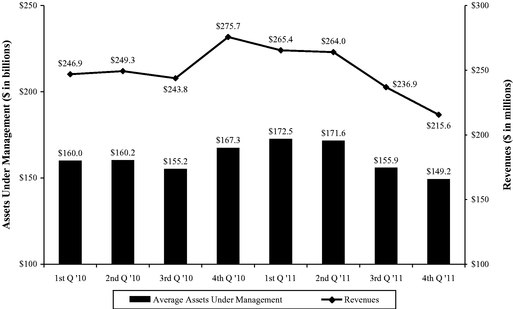

Revenues are generally based upon a percentage of the market value of assets under management and are calculated as a percentage of the daily average asset balance in accordance with contractual agreements. Certain investment products are also subject to performance fees, which vary based on a product's relative performance as compared to an established benchmark index over a specified period of time and the level of assets subject to such fees. Assets under management primarily consist of domestic and international equity and debt securities. Accordingly, fluctuations in domestic and international financial markets, relative investment performance, sales and redemptions of investment products, and changes in the composition of assets under management are all factors that have a direct effect on JCG's operating results. The following graph depicts the direct relationship between average assets under management and investment management revenues:

19

Results of Operations

2011 Compared to 2010

Investment management fees increased $9.7 million, or 1.2%, primarily as a result of the 1.0% increase in average assets under management.

Performance fee revenue is derived from certain mutual funds and separate accounts. The decrease in total performance fee revenue of $44.3 million was primarily due to negative performance fees incurred on certain mutual funds in 2011. These negative mutual fund performance fees totaled $20.9 million and were driven by underperformance compared to the mutual funds' respective benchmarks. Mutual fund performance fees represent up to a positive or negative 15 basis point adjustment to the base management fee.

At December 31, 2011, $54.7 billion and $7.6 billion of mutual fund and private account assets, respectively, were subject to performance fees. As approved by mutual fund shareholders in 2010, six additional mutual funds representing $29.7 billion of assets under management at December 31, 2011, became subject to performance fees in 2011, with the first fee adjustment for the impacted funds calculated in the second quarter 2011. Had these additional mutual fund assets been subject to performance fees for the full 12 months ended December 31, 2011, an incremental $57.7 million in negative performance fees would have been recognized in 2011.

Employee compensation and benefits decreased $19.6 million, or 6.2%, principally due to lower investment team incentive compensation as a result of lower profits and a change in the compensation plan. Effective July 1, 2011, JCG adopted a new investment team incentive compensation plan designed to link variable compensation to operating income. The previous investment team incentive compensation plan was linked to individual long-term investment performance and also tied the aggregate level of compensation to revenue.

Long-term incentive compensation decreased $20.1 million, or 24.2%, primarily due to a decline of $19.0 million from the vesting of awards granted in previous years and a decrease of $12.6 million in Perkins senior profits interest awards expense, which was driven by a decline in investment performance in 2011. The Perkins senior profits interest awards have a formula-driven terminal value based on revenue and relative investment performance of investment products managed by Perkins. (See discussion of Perkins senior profits interest awards on page 24.) The decrease in long-term incentive compensation was partially offset by $13.0 million of expense from new awards granted in 2011.

Long-term incentive awards granted during 2011 totaled $66.8 million and will generally be recognized ratably over a four-year period. Future long-term incentive amortization will also be impacted by the 2012 annual grant totaling $55.0 million, which will generally be recognized ratably over a four-year period. In addition to these awards, JCG granted $1.2 million in price-vesting units to its Chief Executive Officer on December 30, 2011. These price-vesting units comprise two tranches of $0.6 million each. The first tranche is subject to a stock price hurdle representing a 27% premium over the $6.31 closing price of the Company's common stock on the date of grant and the second tranche is subject to a stock price hurdle representing a 58% premium over the same closing price. Both tranches vest ratably over a four-year service period. To achieve each price hurdle, the Company's common stock must close at or above the prescribed price for 20 consecutive trading days at any time during the service period of the award. The units only vest if both the price hurdle and the service conditions are met. The price-vesting units award is required to be amortized using the graded-vesting method due to the underlying market conditions as represented by the stock price hurdles. In addition, the expense will be recognized irrespective of achieving the price hurdles provided service conditions are satisfied.

Marketing and advertising decreased $7.8 million, or 21.8%, primarily due to $9.1 million of fund proxy costs included in the prior year for the election of the mutual fund trustees for JCG's domestic mutual funds.

20

Depreciation and amortization expense decreased $5.8 million, or 14.8%, primarily as a result of lower amortization of deferred commissions from a decline in sales of certain mutual fund shares.

General, administrative and occupancy expense decreased $12.3 million, or 10.1%, primarily as a result of $13.6 million of client reimbursements related to two significant fund administrative errors during the third quarter 2010. The errors were unrelated and involved delayed security trades in client portfolios. The securities underlying both trades appreciated in value between the time that the trades should have occurred and the time the trades were executed. The $13.6 million incurred in the third quarter 2010 represented the amount necessary to make clients whole by paying the increased costs of trades due to appreciation in value of the applicable securities. During the fourth quarter 2010, JCG received insurance recoveries relating to the fund administrative errors totaling $6.5 million, resulting in a full year net impact of $7.1 million.

Interest expense declined $12.2 million, or 19.3%, primarily as a result of the retirement of $120.9 million of outstanding debt in the first quarter 2011 and a 25 basis point decrease in the interest rates payable on all of JCG's senior notes, excluding the convertible senior notes, as a result of S&P increasing JCG's credit rating to BBB- on January 10, 2011. During the fourth quarter 2010, JCG exercised its call right on the $120.9 million carrying value of the 6.250% Senior Notes and retired the notes in January 2011. Under the terms of the call, JCG was required to pay the present value of the interest that would have been paid if the debt remained outstanding through maturity. As a result, JCG recognized a $9.9 million net loss on early extinguishment of debt in the first quarter 2011.

Net investment losses totaling $21.9 million for the year ended December 31, 2011, primarily include $13.0 million of mark-to-market losses on seed capital classified as trading securities, a $7.2 million loss from mark-to-market adjustments on the mutual fund share award economic hedge and $1.9 million of losses generated by put spread option contracts. The put spread option contracts were purchased by the Company in the fourth quarter 2011 to mitigate potential negative impacts on 2012 profitability in the case of a market downturn.

The mark-to-market losses on trading securities were partially offset by $1.2 million of gains generated by an economic hedging strategy implemented in late 2008, covering the majority of seed capital. The hedging strategy utilizes futures contracts to mitigate a portion of the earnings volatility created by the mark-to-market accounting of seed capital investments. JCG may modify or discontinue this hedging strategy at any time.

JCG's income tax provision includes the reversal of $5.2 million of income tax contingency reserves in 2011 as a result of the expiration of statutes of limitations, creating a net tax benefit of $3.3 million.

Noncontrolling interests in net income increased from $8.7 million in 2010 to $10.5 million in 2011 primarily due to an increase of $4.2 million in the noncontrolling interest portion of Perkins earnings, partially offset by $1.8 million of losses associated with the noncontrolling interest in consolidated investment products.

2010 Compared to 2009

Investment management fees increased $150.6 million, or 22.0%, primarily as a result of the 19.5% increase in average assets under management driven by improved market conditions.

Performance fee revenue increased $3.7 million, or 12.8%, primarily due to an increase of $9.2 million in separate account performance fees, partially offset by a $5.5 million decline in fees earned on mutual funds. JCG recognized performance fees of $17.1 million in 2010 from a separate account client, which terminated in late 2010.

Shareowner servicing fees and other revenue increased $12.7 million, or 9.4%, over the prior year primarily from higher transfer agent fees. Transfer agent fees are based on average assets under

21

management distributed directly to investors by Janus, excluding money market assets, which increased 21.4% over the prior year.

Employee compensation and benefits increased $17.9 million, or 6.0%, principally due to higher investment team incentive compensation. The investment team compensation plan in 2010 was linked to individual long-term investment performance, but also tied the aggregated level of compensation to revenue, which increased from 2009.

Long-term incentive compensation increased $22.1 million, or 36.2%, primarily as a result of awards granted in 2010 and from a higher valuation of the Perkins senior profits interest awards based on 2010 relative investment performance.

Also included in long-term incentive compensation in 2010 is a $2.7 million mark-to-market adjustment for changes in fair value of mutual fund share awards. During the fourth quarter 2010, JCG concluded that the accounting for the mutual fund share awards and the associated hedge was incorrect. Accordingly, for financial accounting purposes, the hedging relationship was terminated and mark-to-market adjustments on the awards and associated hedge, previously recognized as increases or decreases in the mutual fund share award liability, were recorded in earnings in the fourth quarter 2010. See discussion of net investment gains below for the impact of recording investment gains in earnings. JCG assessed the significance of the incorrect accounting and concluded that recognizing a cumulative adjustment in the fourth quarter 2010 was not material either to JCG's financial statements for any reported individual prior period or on a cumulative basis to 2010.

Marketing and advertising increased $8.0 million, or 28.8%, primarily due to $9.1 million of fund proxy costs for the election of the mutual fund trustees for JCG's domestic mutual funds in 2010.

Distribution expenses increased $32.5 million, or 30.2%, as a result of a similar increase in assets under management subject to third-party concessions. Distribution fees are calculated based on a contractual percentage of the market value of assets under management distributed through third-party intermediaries.

Depreciation and amortization expense increased $3.2 million, or 8.9%, primarily as a result of higher amortization of deferred commissions from an increase in sales of certain mutual fund shares.

General, administrative and occupancy expense decreased $19.1 million, or 13.6%, primarily as a result of lower legal expenses due to litigation settlements and an unfavorable judgment totaling $31.4 million in 2009. The decrease was partially offset by $13.6 million of client reimbursements related to two significant fund administrative errors during the third quarter 2010, net of insurance recoveries of $6.5 million received during the fourth quarter 2010, resulting in a full year net impact of $7.1 million.

Interest expense declined $10.8 million, or 14.6%, primarily as a result of the August 2009 tender offer, partially offset by $7.7 million of interest expense associated with the July 2009 issuance of convertible senior notes.

Net investment gains totaling $24.7 million include a $14.3 million gain from mark-to-market adjustments on the mutual fund share award hedge which were recorded in earnings in the fourth quarter 2010. Also included in net investment gains for 2010 is a $5.8 million gain from the sale of SIV securities originally acquired in 2007 from money market funds advised by Janus (the "Money Funds"). In December 2007, JCG purchased securities originally owned by Stanfield Victoria Funding LLC from certain Money Funds in response to Moody's downgrading these securities to a rating below what is generally permitted to be held in the Money Funds.

Mark-to-market gains on trading securities for the year ended December 31, 2010, were partially offset by losses generated by the economic hedging strategy implemented in late 2008. Net investment losses of $5.6 million for the year ended December 31, 2009, include impairment charges totaling $6.6 million, which were primarily related to seed capital classified as available-for-sale.

22

JCG's income tax provision includes the reversal of $24.4 million of income tax contingency reserves in 2010 as a result of the expiration of statutes of limitations, creating a net tax benefit of $15.7 million.

Noncontrolling interests in net income decreased $4.3 million, or 33.1%, primarily due to JCG's acquisition of an additional 3% interest in INTECH in 2010 combined with lower INTECH earnings and assets under management.

LIQUIDITY AND CAPITAL RESOURCES

Cash Flows

A summary of cash flow data from continuing operations for the years ended December 31 is as follows (in millions):

| | 2011 | 2010 | 2009 | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

Cash flows provided by (used for): | ||||||||||

Operating activities | $ | 224.6 | $ | 246.6 | $ | 176.5 | ||||

Investing activities | 21.7 | (148.0 | ) | (9.6 | ) | |||||

Financing activities | (259.5 | ) | (50.1 | ) | (124.8 | ) | ||||

Net (decrease) increase in cash and cash equivalents | (13.2 | ) | 48.5 | 42.1 | ||||||

Balance at beginning of year | 373.2 | 324.7 | 282.6 | |||||||

Cash balance at end of year | $ | 360.0 | $ | 373.2 | $ | 324.7 | ||||

2011 Cash Flows

On an annual basis, JCG's cash flow from operations historically has been positive and sufficient to fund ordinary operations and capital requirements. Fluctuations in operating cash flows are attributable to changes in net income and working capital items, which can vary from period to period based on the amount and timing of cash receipts and payments. The decrease in cash flow from operations from the prior year was primarily driven by lower revenues as a result of a decline in performance fee revenue.

Cash provided by investing activities in 2011 includes purchases, sales and maturities of investments as well as economic hedging and vesting of mutual fund share awards. Purchases of investments in 2011 totaling $199.0 million include $120.7 million from the seeding of new investment products and $36.4 million from the economic hedging of mutual fund share awards. Sales and maturities of investments totaling $228.0 million include the maturity of $93.1 million of U.S. Treasury notes, which were purchased in the second quarter 2010 and matured in August 2011, $46.9 million from the vesting of mutual fund share awards and proceeds of $32.6 million from the disposal of SIV securities in the first quarter 2011. The SIV securities were traded on December 1, 2010, and settled on February 23, 2011. Accordingly, the sale was recognized on the trade date and the majority of the cash flow associated with the trade was recognized at settlement.