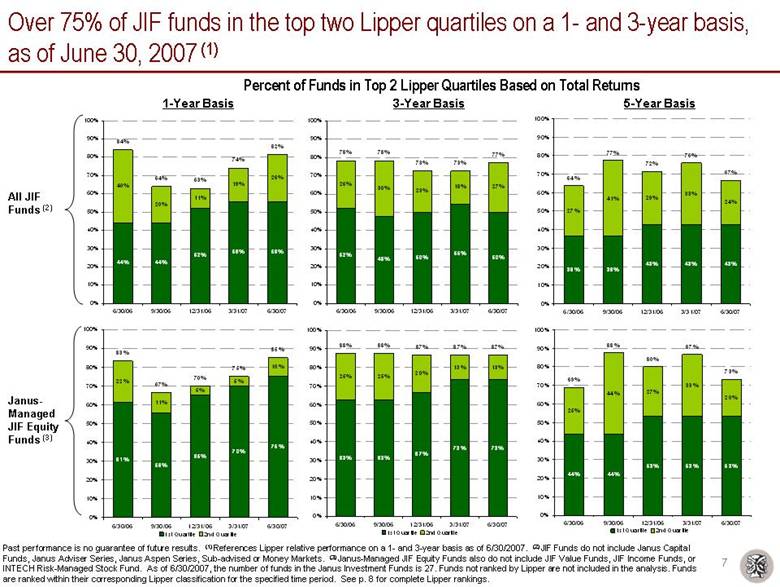

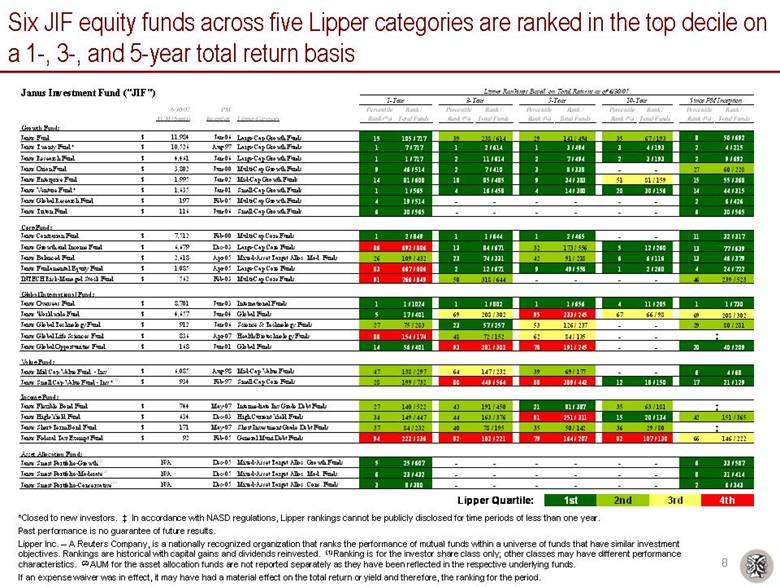

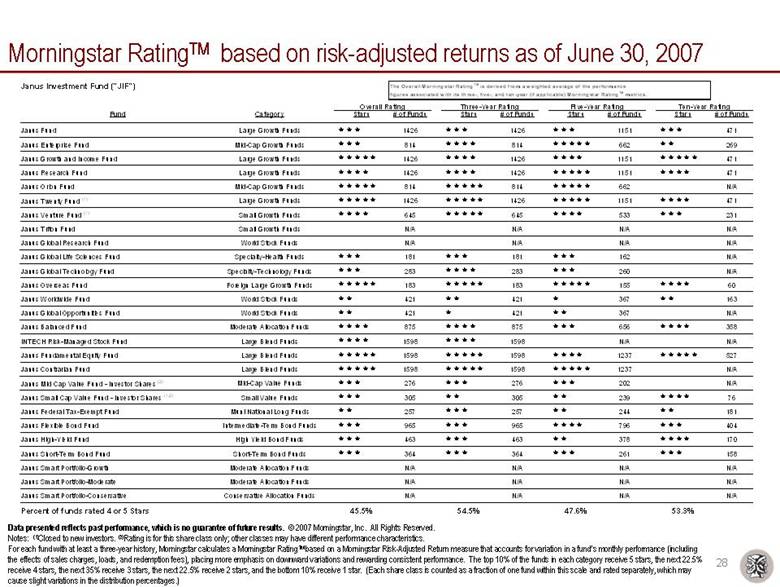

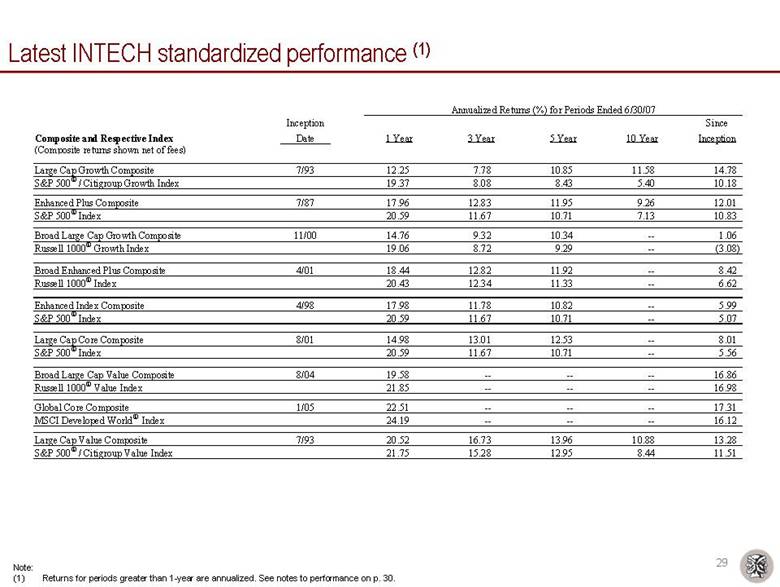

| Continuing to deliver strong long-term investment performance Janus products continue to outperform peers across multiple time periods (1) 85%, 87% and 73% of Janus-managed JIF equity funds in the top 2 Lipper quartiles on a 1-, 3-, and 5-year total return basis, respectively, as of June 30, 2007 46% of JIF funds have a 4 or 5 star Morningstar overall rating at June 30, 2007, based on risk-adjusted returns All eight JIF equity growth funds are in the top 2 Lipper quartiles on a since PM inception, 1-, 3-, and 5-year total return basis, as of June 30, 2007 As INTECH celebrates its 20th anniversary, long-term performance remains strong, despite recent relative underperformance All seven product strategies with at least a 3-year performance track record are outperforming their respective benchmarks since inception (2) Since inception, the same seven product strategies have “batting averages” greater than 75% and 85% for the rolling 3- and 5-year periods, respectively, as of June 30, 2007 (3) Notes:(1) Performance reported as of 6/30/2007. Data presented reflects past performance, which is no guarantee of future results. See p. 8 and 28 for complete Lipper rankings and Morningstar ratings. Percentile ranking calculations exclude Janus Money Market Funds.(2) Performance reported as of 6/30/2007, on an annualized basis and net of fees. See p. 29 and 30 for standardized INTECH performance.(3) Batting average is defined as the percentage of periods a strategy has outperformed its relative benchmark, gross of fees. Periods are calculated on a monthly basis, since inception through 6/30/2007. |