MARK R. GREER

312.807.4393

mark.greer@klgates.com

Direct Fax: 312.827.8010

April 27, 2010

VIA EDGAR

Ms. Patsy Mengiste

Securities and Exchange Commission

Division of Investment Management

100 F Street, NE

Washington, DC 20549

Hewitt Series Trust

1933 Act Registration No. 333-059221

1940 Act Registration No. 811-08885

Dear Ms. Mengiste:

This letter responds to the comments you conveyed to me via telephone on April 16, 2010, regarding post-effective amendment no. 15 to the registration statement under the Securities Act of 1933, as amended, which is amendment no. 16 to the registration statement under the Investment Company Act of 1940, as amended, of Hewitt Series Trust (the “Trust”) and its series, the Hewitt Money Market Fund (the “Fund”). For your convenience, each of your comments is repeated below, with responses immediately following. Where revised disclosure from the post-effective amendment is included in a response, we have marked the disclosure in bold to show changes from original post-effective amendment filed on March 1, 2010. Per your request, we have also appended to this correspondence the draft of the Summary Prospectus section of the registration statement.

Although not specifically requested, we represent that all missing data and information in the March 1st filing not otherwise mentioned will be incorporated into the next post-effective amendment.

Registration Statement. Please note – we have included for your convenience, where applicable, the page numbers of the Prospectus located in the post-effective amendment.

Prospectus

| | | | |

1. | | Comment: | | Cover Page: Please delete the sentences describing the Trust and the Fund’s investment objective. |

| | |

| | Response: | | Agreed. The cover page has been revised accordingly. |

| | | | |

2. | | Comment: | | Page 1 of the Summary Section: Please revise the “Investment Objective” section as follows: |

| | |

| | | | • Please delete the first sentence. |

| | |

| | | | • Please delete the phrase “by investing in high quality, short-term securities” at the end of the second sentence because that portion of the sentence describes the Fund’s strategy. |

| | |

| | Response: | | Agreed. The “Investment Objective” section has been revised accordingly and reads as follows: |

| | |

| | | | The Hewitt Money Market Fund (the “Fund”) seeks to provide a high level of income, while preserving capital and liquidity. |

| | |

3. | | Comment: | | Page 1 of the Summary Section: Please combine footnotes 1 and 2 to the Expense Table and condense the resulting single footnote. Please also revise the footnote to clarify who can discontinue the expense waiver agreement and under what circumstances. Please confirm that the percentage listed under the item “Management Fees” in the Expense Table represents the fees gross of the expense waiver disclosed in the footnote. |

| | |

| | Response: | | Agreed. The footnotes to the Expense Table have been combined into one footnote, which has been revised as follows: |

| | |

| | | | “The Management Fee disclosed is the investment advisory fee payable to BlackRock Fund Advisors (“BFA”), the investment adviser to the master portfolio into which the Fund currently invests. BFA has contractually agreed to waive 0.03% of its advisory fees for the Portfolio. This arrangement is in effect through the close of business November 30, 2011 and neither BFA nor the Fund can discontinue the agreement prior to its expiration. Hewitt Associates LLC (“Hewitt”), the Fund’s administrator, has agreed to waive or absorb ordinary operating expenses of the Fund (excluding interest, brokerage commissions and extraordinary expenses of the Fund) in an amount equal to the greater of (a) the amount by which the ordinary operating expenses exceed the aggregate per annum rate of 0.95% of the Fund’s average daily net assets attributable to the Fund or (b) an amount sufficient to ensure that the seven day yield of the Fund does not fall below 0%. This arrangement will remain in effect unless and until the Board of Trustees of the Trust approves its termination.” |

| | |

| | | | We also hereby confirm that the percentage listed under the item “Management Fees” in the Expense Table represents the fees gross of the expense waiver disclosed in the footnote. |

2

| | | | |

4. | | Comment: | | Page 2 of the Summary Section: Please delete the sentence following the Example Expense Chart. |

| | |

| | Response: | | Agreed. The sentence has been deleted. |

| | |

5. | | Comment: | | Please confirm that the expenses for the 1-year period disclosed in the Example Expense Chart will reflect the waiver of expenses in effect for the first year. |

| | |

| | Response: | | We hereby confirm that the expenses for the 1-year period disclosed in the example will reflect the waiver of expenses in effect for the first year. |

| | |

6. | | Comment: | | Page 2 of the Summary Section: Please revise the “Principal Investment Strategies and Policies” section as follows: |

| | |

| | | | • Please disclose as an investment strategy that the Fund concentrates its investments in the banking industry. |

| | |

| | | | • Please disclose, if applicable, that the Fund invests in second-tier securities or, if not, that it invests exclusively in first-tier securities. |

| | |

| | | | • Please disclose the maturity dates of the securities in which the Fund invests. |

| | |

| | Response: | | Agreed. We have revised the section as follows: |

| | |

| | | | “PRINCIPAL INVESTMENT STRATEGIES AND POLICIES |

| | |

| | | | The Fund pursues its investment objective by investing all of its investable assets in the Money Market Master Portfolio (the “Portfolio”), which is a series of the Master Investment Portfolio (“MIP”). The Portfolio has the same investment objective and substantially the same investment policies as the Fund.Under normal market circumstances, the Portfolio maintains a dollar-weighted average maturity of 90 days or less, invests only in securities having remaining maturities of 397 days or less from the date of acquisition, and expects to invest at least 95% of its assets in any combination of high-quality, short-term investments. “High quality” securities are those rated in the top two rating categories by at least two nationally recognized statistical rating organizations (“NRSROs”) (or by one NRSRO if the instrument is rated by only one such organization) or, if unrated, determined by BFA to be of comparable quality to an investment rated as high quality, in accordance with procedures established by the Board of Trustees of MIP. |

| | |

| | | | The Portfolio is a diversified portfolio that invests in a variety of money market instruments, including: Bank Obligations, Commercial Paper and Short-Term Corporate Debt Instruments, Repurchase Agreements, Letters of Credit, Floating- and Variable-Rate Obligations and U.S. Government Obligations (which include debt securities issued or guaranteed as to principal and interest by the U.S. Government or one of its agencies or instrumentalities).The Portfolio may concentrate its investments (i.e., invest 25% or more of its total assets) in obligations of domestic banks.” |

3

| | | | |

7. | | Comment: | | Page 2 of the Summary Section: Please revise the “Main Risks” section as follows: |

| | |

| | | | • List as bullet points each of the risks facing the Fund. |

| | |

| | | | • Add further disclosure regarding each risk facing the Fund. |

| | |

| | | | • Expand on the disclosure regarding “risks generally associated with concentrating investments in the banking industry” by discussing the risk to the Fund of current the market environment. |

| | |

| | Response: | | Agreed. The “Main Risks” section has been revised as follows: |

| | |

| | | | “MAIN RISKS |

| | |

| | | | A variety of factors can affect the performance of the Fund. These include: |

| | |

| | | | • Interest Rate Risk – interest rate risk is the risk that the value of a debt security may fall when interest rates rise. The Portfolio’s investments are subject to the risk of sharply rising or falling interest rates that could cause the Fund’s income to fluctuate as the market value of the Portfolio’s securities fluctuates. |

| | |

| | | | • Credit Risk– credit risk refers to the possibility that the issuer of a security will not be able to make payments of interest and principal when due. If an issuer fails to pay interest or to repay principal, the return on an investment in the Fund would be adversely affected. Changes in an issuer’s credit rating or the market’s perception of an issuer’s creditworthiness may also affect the value of the Portfolio’s investment in that issuer. |

| | |

| | | | • Income Risk – the Fund’s yield will vary as the securities in the Portfolio mature or are sold, and proceeds are reinvested in securities with different interest rates. |

| | |

| | | | • Market Risk – the risk of negative regulatory or market developments affecting the banking and financial services industries, including the risk that one or more markets in which the Portfolio invests will go down in value. Events in the financial sector during the past several years have resulted, and may continue to result, in an unusually high degree of volatility in the financial markets, both domestic and foreign. |

| | |

| | | | An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund.” |

4

| | | | |

8. | | Comment: | | Page 4 of the Summary Section: Please delete the last sentence in the section “Purchase and Sale of Fund Shares” and please delete the second sentence in the section “Tax Information.” |

| | |

| | Response: | | Agreed. Page 4 of the Summary Section has been revised accordingly. |

| | |

9. | | Comment: | | Please confirm that neither the Fund nor any of its related companies pay financial intermediaries for the sale of Fund shares or related services. |

| | |

| | Response: | | We hereby confirm that neither the Fund nor any of its related companies pay financial intermediaries for the sale of Fund shares or related services. |

* * *

We believe that this information responds to all of your comments. Please call me at (312) 807-4393 to confirm the adequacy of our responses.

|

| Very truly yours, |

|

| /s/ Mark R. Greer |

| Mark R. Greer |

5

Summary Prospectus

April 30, 2010

Hewitt Money Market Fund

(Nasdaq Ticker Symbol: HEWXX)

Before you invest, you may want to review the Fund’s Prospectus, which contains more information about the Fund and its risks. You can find the Fund’s Prospectus and other information about the Fund online at http://www.hewittfs.com. You can also get this information at no cost by calling 1-800-890-3200 or by sending an e-mail request to hfscustomerservice@hewitt.com. The Fund’s Prospectus and Statement of Additional Information, dated April 30, 2010, are incorporated by reference into this Summary Prospectus.

INVESTMENT OBJECTIVE

The Hewitt Money Market Fund (the “Fund”) seeks to provide a high level of income, while preserving capital and liquidity.

FEES AND EXPENSES

The table below describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

| | | |

SHAREHOLDER FEES (fees paid directly from your investment): | | | |

Maximum Sales Charge (Load) Imposed on Purchases

(as a percentage of offering price) | | None | |

Maximum Deferred Sales Charge (Load)

(as a percentage of offering price) | | None | |

Maximum Sales Charge (Load) Imposed on Reinvested Dividends

(as a percentage of offering price) | | None | |

Redemption Fee | | None | |

Exchange Fee | | None | |

ANNUAL FUND OPERATING EXPENSES (expenses that you pay

each year as a percentage of the value of your investment) | | | |

Management Fees | | 0.10 | % |

Distribution (12b-1) Fees | | None | |

Other Expenses | | 0.91 | % |

| |

Total Annual Fund Operating Expenses | | 1.01 | % |

Fee Waiver/Expense Reimbursement * | | 0.06 | % |

Total Annual Fund Operating Expenses

(after Fee Waiver/Expense Reimbursement) | | 0.95 | % |

* The Management Fee disclosed is the investment advisory fee payable to BlackRock Fund Advisors (“BFA”), the investment adviser to the master portfolio into which the Fund currently invests. BFA has contractually agreed to waive 0.03% of its advisory fees for the Portfolio. This arrangement is in effect through the close of business November 30, 2011 and neither BFA nor the Fund can discontinue the agreement prior to its expiration. Hewitt Associates LLC (“Hewitt”), the Fund’s administrator, has agreed to waive or absorb ordinary operating expenses of the Fund (excluding interest, brokerage commissions and extraordinary expenses of the Fund) in an amount equal to the greater of (a) the amount by which the ordinary operating expenses exceed the aggregate per annum rate of 0.95% of the Fund’s average daily net assets attributable to the Fund or (b) an amount sufficient to ensure that the seven day yield of the Fund does not fall below 0%. This arrangement will remain in effect unless and until the Board of Trustees of the Trust approves its termination.

6

Example. This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year, that the Fund’s operating expenses remain the same, and that the fee waiver by BFA remains in effect through the close of business on November 30, 2011. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| | | | | | | | |

| Example | | 1

Year | | 3

Years | | 5

Years | | 10

Years |

| | | | |

| | $97 | | $316 | | $552 | | $1,231 |

PRINCIPAL INVESTMENT STRATEGIES AND POLICIES

The Fund pursues its investment objective by investing all of its investable assets in the Money Market Master Portfolio (the “Portfolio”), which is a series of the Master Investment Portfolio (“MIP”). The Portfolio has the same investment objective and substantially the same investment policies as the Fund. Under normal market circumstances, the Portfolio maintains a dollar-weighted average maturity of 90 days or less, invests only in securities having remaining maturities of 397 days or less from the date of acquisition, and expects to invest at least 95% of its assets in any combination of high-quality, short-term investments. “High quality” securities are those rated in the top two rating categories by at least two nationally recognized statistical rating organizations (“NRSROs”) (or by one NRSRO if the instrument is rated by only one such organization) or, if unrated, determined by BFA to be of comparable quality to an investment rated as high quality, in accordance with procedures established by the Board of Trustees of MIP.

The Portfolio is a diversified portfolio that invests in a variety of money market instruments, including: Bank Obligations, Commercial Paper and Short-Term Corporate Debt Instruments, Repurchase Agreements, Letters of Credit, Floating- and Variable-Rate Obligations and U.S. Government Obligations (which include debt securities issued or guaranteed as to principal and interest by the U.S. Government or one of its agencies or instrumentalities). The Portfolio may concentrate its investments (i.e., invest 25% or more of its total assets) in obligations of domestic banks.

MAIN RISKS

A variety of factors can affect the performance of the Fund. These include:

| | • | | Interest Rate Risk – interest rate risk is the risk that the value of a debt security may fall when interest rates rise. The Portfolio’s investments are subject to the risk of sharply rising or falling interest rates that could cause the Fund’s income to fluctuate as the market value of the Portfolio’s securities fluctuates. |

7

| | • | | Credit Risk– credit risk refers to the possibility that the issuer of a security will not be able to make payments of interest and principal when due. If an issuer fails to pay interest or to repay principal, the return on an investment in the Fund would be adversely affected. Changes in an issuer’s credit rating or the market’s perception of an issuer’s creditworthiness may also affect the value of the Portfolio’s investment in that issuer. |

| | • | | Income Risk – the Fund’s yield will vary as the securities in the Portfolio mature or are sold, and proceeds are reinvested in securities with different interest rates. |

| | • | | Market Risk – the risk of negative regulatory or market developments affecting the banking and financial services industries, including the risk that one or more markets in which the Portfolio invests will go down in value. Events in the financial sector during the past several years have resulted, and may continue to result, in an unusually high degree of volatility in the financial markets, both domestic and foreign. |

An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund.

PERFORMANCE

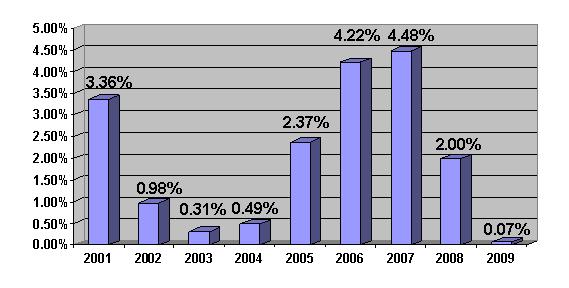

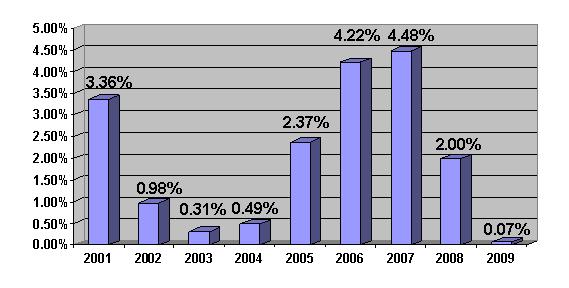

The return information provided below illustrates how the performance of the Fund has varied from year to year, and the Fund’s average annual returns for 1 year, 5 years and since inception, which is one indication of the risks of investing in the Fund. Please remember that the past performance is not necessarily an indication of how the Fund will perform in the future.

8

Year-by-year total return as of 12/31 each year (%)

During the periods shown in the bar chart above:

| | | | | | |

| Best Quarter Return | | Worst Quarter Return |

| 1.26% Q1 2001 | | 0.01% | | Q2 2009 Q3 2009 Q4 2009 |

Average Annual Total Returns as of 12/31/09

| | | | |

| 1 Year | | 5 Year | | Since Inception (12/4/2000) |

| 0.07% | | 2.62% | | 2.06% |

To obtain current 7-day yield information for the shares of the Fund, call 1-800-890-3200.

MANAGEMENT

Investment Adviser.BlackRock Fund Advisors (“BFA”) is the investment adviser of the Portfolio into which the Fund invests. Hewitt Associates LLC (“Hewitt”) is the Fund’s administrator.

PURCHASE AND SALE OF FUND SHARES

Generally, no minimum initial or subsequent investment requirements apply to the purchase of shares of the Fund. However, if shares of the Fund are not held with a financial intermediary that maintains record ownership of shares on an omnibus basis for its customers: (i) the initial purchase of shares must be in an amount of $10,000 or more; (ii) subsequent purchases of shares must be $1,000 or more; and (iii) the Fund will have the right to effect a mandatory

9

redemption of those shares if, as a result of one or more redemptions, a shareholder’s account has an aggregate value of less than $5,000. You should contact your financial intermediary or the Distributor to purchase shares of the Fund or call 1-800-890-3200.

You may redeem all or a portion of your shares of the Fund on any Business Day, without any charge by the Fund, by sending a written redemption request to your financial intermediary or to the Distributor, or by calling the Distributor at 1-800-890-3200. Shares are redeemed at their net asset value per share next computed after the receipt of a redemption request with the required information.

TAX INFORMATION

The Trust intends to declare dividends from its net investment income daily and to pay those dividends monthly. Dividends from net investment income and net realized capital gains, if any, are generally taxable to you as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement such as a 401(k) plan or an individual retirement account.

10

April 27, 2010

VIA EDGAR

Ms. Patsy Mengiste

Securities and Exchange Commission

Division of Investment Management

100 F Street, N.E.

Washington, D.C. 20549

Hewitt Series Trust

1933 Act Registration No. 333-059221

1940 Act Registration No. 811-08885

On behalf of Hewitt Series Trust (the “Trust”), we hereby make the following representations:

| | (i) | the Trust is responsible for the adequacy and accuracy of the disclosure in its filings with the Securities and Exchange Commission (the “Commission”); |

| | (ii) | Staff comments or changes to disclosure in response to Staff comments in the filings reviewed by the Staff do not foreclose the Commission from taking any action with respect to the Trust’s filings; and |

| | (iii) | the Trust acknowledges that it may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

| | |

| HEWITT SERIES TRUST |

| |

| By: | | /s/ Peter E. Ross |

| Name: | | Peter E. Ross |

| Title: | | Secretary |

11