| Stradley Ronon Stevens & Young, LLP 191 North Wacker Drive Suite 1601 Chicago, IL 60606 312.964.3500 www.stradley.com | |

MARK R. GREER 312.964.3505 mgreer@stradley.com | ||

April 26, 2016

VIA EDGAR

Ms. Deborah O’Neal-Johnson

U.S. Securities and Exchange Commission

100 F Street, N.E.

Washington, DC 20549

Hewitt Series Trust

1933 Act Registration No. 333-59221

1940 Act Registration No. 811-08885

Dear Ms. O’Neal-Johnson:

This letter responds to comments you conveyed on April 15, 2016, regarding post-effective amendment no. 27 to the registration statement under the Securities Act of 1933, as amended (the “1933 Act”), which is amendment no. 28 to the registration statement under the Investment Company Act of 1940, as amended (the “1940 Act”), of Hewitt Series Trust (the “Trust”) (the “Amendment”), on behalf of its sole series, the Hewitt Money Market Fund (the “Fund”). For your convenience, each of your comments on the Amendment, as we understand them, is repeated below, with the Trust’s responses immediately following. Where revised disclosure from the Amendment is included in a response, we have marked the new disclosure in bold below to show those changes. Additionally, we represent that the Trust will include all outstanding information from the Amendment in a subsequent, updated post-effective amendment that will be filed to reflect the changes discussed below.

Prospectus

| 1. | Comment: | In footnote to the fee table in the section titled “Fees and Expenses,” please update the expiration date for the contractual fee waiver so that it expires no sooner than one year from the effective date of the prospectus, pursuant to Instruction 3(e) to Item 3 of Form N-1A. | ||

| Response: | The Fund has revised the disclosure in compliance with Item 3 of Form N-1A. The expiration date of the fee waiver is May 1, 2017, a date more than one year from the anticipated effective date of the Trust’s amended registration statement. | |||

| 2. | Comment: | At the beginning of the section titled “Principal Risks,” please include the disclosure required by Item 4(b)(1)(ii)(C) of Form N-1A. | ||

| Response: | The requested disclosure has been added to the registration statement. | |||

Ms. O’Neal-Johnson

U.S. Securities and Exchange Commission

April 26, 2016

Page 2 of 3

| 3. | Comment: | Please provide via correspondence the completed annual returns table for the Fund. | ||

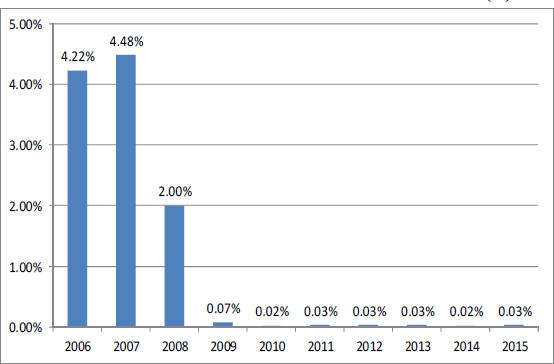

| Response: | The completed annual returns table, as it will appear in the amendment to the Trust’s registration statement, is set forth below: | |||

| YEAR-BY-YEAR TOTAL RETURN AS OF 12/31 EACH YEAR (%) | ||||

| ||||

| During the periods shown in the bar chart above: | ||||

| Best Quarter Return | Worst Quarter Return | |

1.14% (Q3 2007) | 0.00% (Q3 2014) |

AVERAGE ANNUAL TOTAL RETURNS AS OF 12/31/15

| 1 Year | 5 Years | 10 Years | ||||||||||

Fund | 0.03 | % | 0.03 | % | 1.08 | % | ||||||

I-Money Net Money Market Index (reflects no deductions for fees or expenses) | 0.00 | % | 0.00 | % | 1.10 | % | ||||||

| To obtain current 7-day yield information for the shares of the Fund, call 1-800-890-3200. | ||||||||||||

Ms. O’Neal-Johnson

U.S. Securities and Exchange Commission

April 26, 2016

Page 3 of 3

Statement of Additional Information

| 4. | Comment: | In the section titled “Investment Restrictions,” given that the Fund excludes registered investment companies from its concentration policy, consider adding disclosure to clarify that the Fund will consider the consider the concentration of its underlying investments in determining its compliance with its own concentration policy. | ||

| Response: | Pursuant to the Staff’s request, the Fund has amended the disclosure immediately following the list of its fundamental investment restrictions to clarify the consideration of its concentration policy. The revised disclosure now reads as follows: | |||

“With respect to the fundamental policy relating to concentration set forth in paragraph 1 above, the 1940 Act does not define what constitutes “concentration” in an industry, and it is possible that interpretations of concentration could change in the future. Accordingly, the policy in paragraph 1 above will be interpreted to refer to concentration as that term may be interpreted from time to time. In this respect,the Fund will consider the concentration of the Portfolio in determining its compliance with the fundamental policy set forth in paragraph 1. Additionally, and in accordance with SEC staff interpretations, the ability of the Portfolio to concentrate in the obligations of domestic banks means that it is permitted to invest, without limit, in bankers’ acceptances, certificates of deposit and other short-term obligations issued by (a) U.S. banks, (b) U.S. branches of foreign banks (in circumstances in which the U.S. branches of foreign banks are subject to the same regulation as U.S. banks), and (c) foreign branches of U.S. banks (in circumstances in which the Portfolio will have recourse to the U.S. bank for the obligations of the foreign branch).” | ||||

| 5. | Comment: | Pursuant to Item 16(g)(2) of Form N-1A, please confirm whether the Trust has ever received financial support within the last 10 years, as described in that Item of Form N-1A. | ||

| Response: | The Trust hereby confirms that, during the last 10 years, there have been no occasions on which an affiliated person, promoter, or principal underwriter of the Fund, or an affiliated person of such a person, provided any form of financial support to the Fund. | |||

* * *

We believe that this information responds to all of your comments. Please call me at (312) 964-3505 to confirm the adequacy of our responses.

| Very truly yours, |

/s/ Mark Greer |

| Mark Greer, Esq. |

| Copy: | Douglas S. Keith Lian Gregory Alan Goldberg, Esq. |

Hewitt Series Trust

4 Overlook Point

Lincolnshire, IL 60069

April 26, 2016

BY EDGAR

Ms. Deborah O’Neal-Johnson

U.S. Securities and Exchange Commission

100 F Street, N.E.

Washington, DC 20549

Hewitt Series Trust

1933 Act Registration No. 333-59221

1940 Act Registration No. 811-08885

On behalf of Hewitt Series Trust (the “Trust”), we hereby make the following representations:

(i) The Trust is responsible for the adequacy and accuracy of the disclosure in its filings with the Securities and Exchange Commission (the “Commission”);

(ii) Staff comments or changes to disclosure in response to staff comments in the filings reviewed by the staff do not foreclose the Commission from taking any action with respect to the Trust’s filings; and

(iii) The Trust acknowledges that it may not assert staff comments as a defense in any proceeding initiated by the Commission under the federal securities laws of the United States.

| HEWITT SERIES TRUST | ||

| By: | /s/ Douglas S. Keith | |

| Name: | Douglas S. Keith | |

| Title: | Chief Compliance Officer of the Trust | |