UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement | ¨ Confidential, for Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) | |

x Definitive Proxy Statement | ||

¨ Definitive Additional Materials | ||

¨ Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 | ||

Concur Technologies, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a(6)(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

January 25, 2010

To Our Stockholders:

You are cordially invited to attend the 2010 Annual Meeting of Stockholders of Concur Technologies, Inc., which will be held at the Bellevue Club, 11200 Southeast Sixth Street, Bellevue, Washington, at 11:00 a.m. local time on Wednesday, March 10, 2010.

Details of the business to be conducted at the meeting are given in the attached Notice of Annual Meeting and Proxy Statement.

We encourage you to use this opportunity to take part in the affairs of Concur by voting on the business to come before the meeting. Whether or not you plan to attend, please complete, sign and date, and promptly return the enclosed proxy card in the accompanying reply envelope so that your shares will be represented at the meeting. You may also submit your proxy via the Internet or telephone as specified in the accompanying Internet and telephone voting instructions. If you decide to attend the meeting and wish to change your proxy vote, you may do so by voting in person at the meeting.

We look forward to seeing you at the meeting.

| Sincerely, |

|

| S. Steven Singh |

| Chief Executive Officer and Chairman of the Board |

CONCUR TECHNOLOGIES, INC.

18400 N.E. Union Hill Road

Redmond, WA 98052

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held March 10, 2010

The 2010 Annual Meeting of Stockholders of Concur Technologies, Inc. will be held at the Bellevue Club, 11200 Southeast Sixth Street, Bellevue, Washington at 11:00 a.m. local time on Wednesday, March 10, 2010, for the following purposes:

| 1. | To elect two Class II members of the Board of Directors. |

| 2. | To ratify the selection of Grant Thornton LLP as Concur’s independent registered public accounting firm for the fiscal year ending September 30, 2010. |

| 3. | To transact such other business as may properly come before the meeting. |

These items of business are more fully described in the accompanying proxy statement. Only stockholders of record at the close of business on January 20, 2010 are entitled to notice of and to vote at the meeting or any adjournment or postponement of the meeting. A complete list of stockholders entitled to vote at the meeting will be open to the examination of any stockholder, for any purpose relevant to the meeting, at Concur’s offices at 18400 N.E. Union Hill Road, Redmond, Washington 98052, during Concur’s ordinary business hours for ten days before the meeting.

| By Order of the Board of Directors |

|

| S. Steven Singh |

| Chief Executive Officer and Chairman of the Board |

Redmond, Washington

January 25, 2010

YOUR VOTE IS IMPORTANT

Whether or not you plan to attend the meeting, please complete, sign and date, and promptly return the accompanying proxy card in the enclosed postage-paid return envelope so that your shares will be represented at the meeting. You may also submit your proxy via the Internet or telephone as specified in the accompanying Internet and telephone voting instructions. Your participation will help to ensure the presence of a quorum at the meeting and save Concur the extra expense associated with additional solicitation. Sending your proxy card will not prevent you from attending the meeting, revoking your proxy, and voting your stock in person.

CONCUR TECHNOLOGIES, INC.

18400 N.E. Union Hill Road

Redmond, WA 98052

PROXY STATEMENT

The accompanying proxy is solicited on behalf of the Board of Directors of Concur Technologies, Inc., a Delaware corporation, for use at Concur’s 2010 Annual Meeting of Stockholders, to be held at the Bellevue Club, 11200 Southeast Sixth Street, Bellevue, Washington, at 11:00 a.m. local time on Wednesday, March 10, 2010, and at any adjournments or postponements of the meeting. Concur’s mailing address is 18400 N.E. Union Hill Road, Redmond, Washington 98052.

This proxy statement, the accompanying notice of annual meeting, proxy card, and our 2009 Annual Report on Form 10-K are first being sent to stockholders on or about January 29, 2010. Stockholders are encouraged to review this information, which is also posted on the investor relations page of our website atwww.concur.com.

VOTING RIGHTS AND SOLICITATION OF PROXIES

Voting

Shares of Concur’s common stock are the only shares entitled to vote at the meeting. On January 20, 2010, the record date for determining stockholders entitled to vote at the meeting, there were 49,356,234 shares of Concur common stock outstanding. Each stockholder of record on the record date is entitled to one vote for each share of common stock held by such stockholder on that date. A majority of the outstanding shares of common stock must be present or represented at the meeting in order to have a quorum for the conduct of business. Votes cast at the meeting, by proxy or in person, will be tabulated by the inspector of elections appointed for the meeting.

With respect to Proposal 1, nominees for election to the Board of Directors who receive the highest number of affirmative votes at the meeting will be elected to fill the three open seats. The affirmative vote of the holders of a majority of the shares present at the meeting and voted for or against the proposal is necessary for approval of Proposal 2 (ratification of selection of auditor).

If shares are present at the meeting in person or by proxy, but are not voted, those shares will count toward determining whether or not a quorum is present for the conduct of business at the meeting, as will all shares voted “for”, “against”, or “abstain” on a proposal. Shares that are voted “abstain” will have no effect on the outcome of Proposals 1 or 2.

If the beneficial owner of shares that are held of record by a broker does not instruct the broker how to vote the shares, the broker has authority under applicable stock market rules to vote those shares for or against “routine” matters, such as the proposal regarding ratification of auditors (Proposal 2). Where a matter is not considered routine, such as the proposals regarding the election of directors (Proposal 1), the shares held by the broker will not be voted absent specific instruction from the beneficial holder, and will not affect the outcome of the proposal.

1

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting To Be Held on March 10, 2010.

The proxy statement and annual report to security holders are available at www.proxyvote.com.Stockholders may access this proxy statement, the accompanying notice of annual meeting and annual information, a voting proxy, and our 2009 Annual Report on Form 10-K at www.proxyvote.com.

Voting in Person

Stockholders may vote in person at the 2010 Annual Meeting of Stockholders, which will be held at the Bellevue Club, 11200 Southeast Sixth Street, Bellevue, Washington, at 11:00 a.m. local time on Wednesday, March 10, 2010. Directions may be obtained by contacting Corporate Secretary, 18400 N.E. Union Hill Road, Redmond, Washington 98052 or at (425) 702-8808.

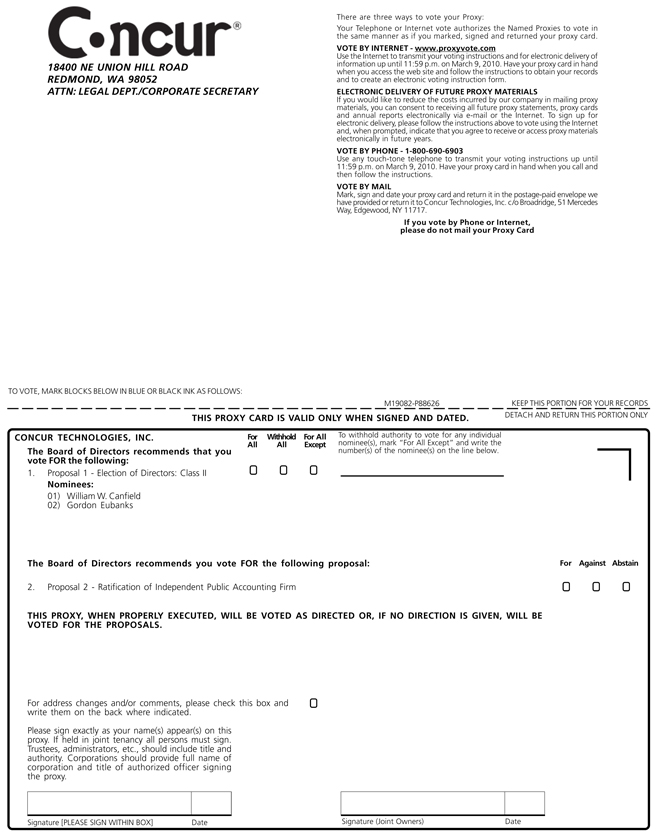

Voting Electronically via the Internet or Telephone

In addition to voting in person or by returning the enclosed proxy card, stockholders whose shares are registered directly with Wells Fargo Shareowner Services may vote their shares either through the Internet or by calling Wells Fargo Shareowner Services. Specific instructions to be followed by any such registered stockholder interested in voting over the Internet or by telephone are set forth on the accompanying proxy card. The Internet and telephone voting procedures are designed to authenticate stockholder identity, allow stockholders to vote their shares, and confirm that their voting instructions have been properly recorded.

If your shares are registered in the name of a bank or brokerage, you may also be eligible to vote your shares electronically over the Internet or by telephone. Many banks and brokerage firms participate in the Broadridge Investor Communication Services online program, which provides eligible stockholders who receive a paper copy of the proxy statement and related proxy materials the opportunity to vote via the Internet or by telephone. If your bank or brokerage firm participates in this Broadridge program, your bank or brokerage firm will provide a voting form with specific instructions for voting your shares. If your voting form does not reference Internet or telephone information, please complete and return the paper proxy card in the self-addressed, postage-paid envelope provided.

Proxies

Whether or not you are able to attend the meeting, we urge you to complete, sign and date, and promptly return the accompanying proxy card so that your shares will be represented at the meeting. If you do not specify otherwise on your signed proxy card, your shares will be voted FOR the director nominees identified in Proposal 1, FOR Proposal 2, and to grant the proxy holders discretion to vote for or against other matters that may properly come before the meeting (including any adjournment to the meeting to another place and time). You may revoke your proxy or change your proxy instructions at any time before the meeting. To do this, send a written notice of revocation, or another signed proxy card with a later date, to Concur, to the attention of Corporate Secretary, 18400 N.E. Union Hill Road, Redmond, Washington 98052. To be effective, your written notice of revocation or newly signed proxy card must be received by Concur prior to the beginning of the meeting. You may also revoke your proxy by attending the meeting and voting in person.

Please note, however, that if you wish to vote at the meeting and your shares are held of record by a broker, bank, or other nominee, you must bring to the meeting a letter from the broker, bank, or other nominee confirming your beneficial ownership of the shares and that such broker, bank, or other nominee is not voting your shares.

2

Solicitation of Proxies

Concur will bear the entire cost of solicitation, including the preparation, assembly, printing, and mailing of this proxy statement, the proxy, Annual Report on Form 10-K, and any additional solicitation materials furnished to stockholders. Copies of solicitation materials will be furnished to brokerage houses, fiduciaries, and custodians holding shares in their names that are beneficially owned by others, so that they may forward those solicitation materials to the beneficial owners. Officers and employees of Concur may, without being additionally compensated, solicit proxies by mail, telephone, facsimile, or personal contact. Concur will pay all proxy-soliciting expenses in connection with the solicitation of votes for the meeting.

PROPOSAL 1

ELECTION OF DIRECTORS

General

Concur’s Board of Directors consists of eight members, two of whom are to be elected at the 2010 annual meeting. Board members are divided into Class I, Class II, and Class III directors, who serve staggered three-year terms. Each director serves for a term ending at the third annual meeting of stockholders following the annual meeting at which he was elected, except that any director appointed by the Board serves for a term ending at the annual meeting of stockholders for the class to which the director was appointed. Each director serves until his successor is elected and qualified or until his earlier death, resignation, or removal. All Concur directors are invited to attend the 2010 annual meeting in person. Seven members of the Board attended our 2009 annual meeting of stockholders.

The identity and background of nominees for director and continuing members of the Board is provided below. The proxy holders intend to vote all proxies they receive in the accompanying form for the nominees listed below unless instructed otherwise. If any nominee is unable or unwilling to serve as a director at the time of the meeting, proxies will be voted for any nominee who may be designated by the present Board of Directors to fill the vacancy. The Board of Directors approved the nomination of the nominees reflected in this Proposal 1. Each nominee for director has consented to serve if elected by the stockholders. The nominees receiving the greatest number of affirmative votes will be elected as Class II members of the Board of Directors. Stockholders may not cumulate votes in the election of directors.

Nominees for Election—Class II Directors (term to expire in 2010)

William W. Canfield, age 71, has been a director of Concur since 2003. Since 1987, he has served as the President and Chief Executive Officer of TALX Corporation, a business process outsourcer of payroll data-centric services. In May 2007, TALX Corporation was acquired by Equifax, Inc. Since May 2007, Mr. Canfield has served as a director of that company. In 2005, Mr. Canfield was found by the SEC to have committed violations of rules under the U.S. securities laws governing the books and records of TALX Corporation, as a result of which he was found to be a cause of certain securities law violations by TALX Corporation. Without admitting or denying any wrongdoing, Mr. Canfield entered into a settlement with the SEC, the terms of which included payment of $859,999 in disgorgement and $100,000 in civil penalties, and consented not to violate specified provisions of U.S. securities laws in the future.

Gordon Eubanks, age 63, has been a director of Concur since June 2005. Mr. Eubanks serves on the boards of directors of Skybox Imaging, Inc. and Perimeter eSecurity, both private enterprise security software companies. From October 2006 to November 2006, Mr. Eubanks served as acting Chief Executive Officer, and, from October 2006 to May 2009 served as a director, of Asempra Technologies, a private software company sold in May 2009. From 2005 to 2006, Mr. Eubanks served as Chairman of the Board of Preventsys, an enterprise security software company, which was sold in June 2006. Since June 2006, Mr. Eubanks has been managing

3

personal investments and working as an advisor to a number of companies. From 1999 to March 2005, Mr. Eubanks served as President and Chief Executive Officer of Oblix, Inc., a provider of enterprise identity management solutions that was acquired by Oracle in 2005. From 1984 to 1999, Mr. Eubanks served as President and Chief Executive Officer of Symantec Corporation, an international technology firm focused on protecting information and computer systems.

Continuing Class III Directors (term to expire in 2011)

Jeffrey T. McCabe, age 53, has been a director of Concur since January 2005. Since May 2007, and from March 2004 to July 2005, Mr. McCabe engaged in a wide range of entrepreneurial activities, including strategic consulting for businesses developing new products and services. From August 2005 to May 2007, he served as Chief Executive Officer and member of Tri-Pen TravelMaster Technologies, LLC, a provider of technology solutions for the travel industry. From January 1994 to March 2004, he served in various executive positions at American Express, including Senior Vice President and General Manager for the United States and Canadian large-market commercial card business of American Express Corporate Services, a global provider of business travel, corporate card, and purchasing card programs for businesses. Prior to that, Mr. McCabe held executive positions at Labinal S.A. and General Motors, where he worked in Europe and Asia with a focus on developing new business relationships.

Edward P. Gilligan, age 50, has been a director of Concur since July 2008. Mr. Gilligan has been Vice Chairman of American Express Company since July 2007 and head of its global consumer, small business and network businesses since October 2009. From July 2007 to October 2009, he was head of the American Express Global Business-to-Business Group. From July 2005 to July 2007, he was Group President, American Express International & Global Corporate Services. Prior to that, he had been Group President, Global Corporate Services since June 2000 and Group President, Global Corporate Services & International Payments, since July 2003. Mr. Gilligan serves on the Concur Board of Directors pursuant to the terms of a Securities Purchase Agreement between Concur and American Express Travel Related Services Company, Inc., a wholly owned subsidiary of American Express Company. Under this agreement, American Express may nominate one person, initially Edward P. Gilligan, to serve on the Concur Board of Directors so long as American Express owns at least 10% of Concur’s outstanding shares of common stock and satisfies other conditions. Pursuant to American Express Company internal policy, Mr. Gilligan has waived any compensation he is entitled to receive from Concur for his service as a member of our Board of Directors.

Rajeev Singh, age 41, has been a director of Concur since April 2008. Mr. Singh co-founded Concur in 1993, became Chief Operating Officer in September 2002, and became President in September 2005. Prior to that, he served in various roles at Concur, including the Executive Vice President of Sales, Marketing & Services. Prior to joining Concur, Mr. Singh served roles in engineering project management at Ford Motor Company and General Motors Corporation. Rajeev Singh and S. Steven Singh are brothers.

Continuing Class I Directors (term to expire in 2012)

S. Steven Singh, age 48, has served as Concur’s Chief Executive Officer since 1996 and as a director since 1993, including service as Chairman of the Board of Directors since September 1999. From 1993 to 1996, Mr. Singh was General Manager of the Contact Management Division at Symantec Corporation, an international technology firm focused on protecting information and computer systems. Mr. Singh serves as Chairman of the NBTA Foundation Board, serves on the board of directors of RightNow Technologies, AdReady, and Washington Roundtable, and is a member of the Voyager Capital Advisory Board. S. Steven Singh and Rajeev Singh are brothers.

Jeffrey T. Seely, age 55, has been a director of Concur since October 2005. Since January 2008, he has served as director and Chief Executive Officer of Recruiting.com Inc. (formerly known as Jobster, Inc.), a provider of on-line corporate recruiting software. From 1998 to November 2007, he served as the President and Chief Executive Officer of ShareBuilder Corporation, an on-line brokerage company and, from 2002 to November 2007, he served as the Chairman of the Board of Directors of that company.

4

Randall H. Talbot, age 56, has been a director of Concur since March 2008. Mr. Talbot has served as director, Chief Executive Officer and President of Symetra Financial Corporation since 2004. He is also director, Chief Executive Officer and President of various subsidiaries of Symetra Financial Corporation. Mr. Talbot joined the former parent of Symetra Financial Corporation, Safeco Corporation, in 1998, and from 1998 to 2004 he served as President of Safeco Life Insurance Company. From 1988 to 1998, he was Chief Executive Officer and President of Talbot Financial Corporation. Mr. Talbot serves on the Directors Council of the American Council of Life Insurers.

Board of Directors Meetings and Committees

The Board of Directors held six meetings during fiscal 2009. Each incumbent director attended at least 75% of the aggregate number of meetings of the Board of Directors (held during the time period for which each such director served on the Board of Directors) and meetings of committees on which each such director served. The Board determined that each of Messrs. Canfield, Eubanks, McCabe, Seely, and Talbot is an independent director as defined in rules of The NASDAQ Stock Market. In making this independence determination with respect to Mr. Canfield, the Board of Directors considered the fact that TALX Corporation uses Concur solutions in the ordinary course of business. In making this independence determination with respect to Mr. Talbot, the Board of Directors considered the fact that Concur purchases financial services solutions from Symetra Financial Corporation and Concur sells solutions to Symetra in the ordinary course of business, and that Mr. Talbot’s son is a non-executive employee of Concur.

The Board of Directors has three standing committees: Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee.

Audit Committee

The Board of Directors has adopted a charter governing the duties and responsibilities of the Audit Committee, which is posted on our Internet website atwww.concur.com. The principal functions of the Audit Committee are:

| • | overseeing the integrity of Concur’s financial statements and its compliance with related legal and regulatory requirements; |

| • | monitoring the adequacy of Concur’s accounting and financial reporting, and its internal controls and processes for financial reporting; |

| • | overseeing Concur’s relationship with its independent auditors, including appointing, evaluating, and setting the compensation of the independent auditors; and |

| • | facilitating communication among the independent auditors, Concur’s management, and the Board of Directors. |

Directors Seely, McCabe, and Eubanks are the members of the Audit Committee. Each member of the committee meets the independence and other requirements to serve on our Audit Committee under applicable securities laws and the rules of the SEC and listing standards of The NASDAQ Stock Market. The Board of Directors has determined that Mr. Seely is an “audit committee financial expert” as defined by the rules of the SEC. The Audit Committee met eight times during fiscal 2009. The report of the Audit Committee is provided below.

Compensation Committee

The Board of Directors has adopted a charter governing the duties and responsibilities of the Compensation Committee, which is posted on our Internet website atwww.concur.com. The principal functions of the Compensation Committee are:

| • | reviewing and making recommendations to the Board of Directors regarding all forms of salary, bonus, and stock compensation provided to executive officers of Concur, the long-term strategy for employee compensation, the types of stock and other compensation plans to be used by Concur and the shares and amounts reserved thereunder; |

5

| • | overseeing the overall administration of Concur’s equity-based compensation and stock option plans; and |

| • | addressing such other compensation matters as may from time to time be directed by the Board of Directors. |

Directors Canfield, Eubanks, and Talbot are the members of the Compensation Committee. Each member of the committee meets the independence and other requirements to serve on our Compensation Committee under applicable securities laws and the rules of the SEC and the listing standards of The NASDAQ Stock Market. Each member of this committee is an “outside director” as defined in Section 162(m) of the Internal Revenue Code and a “non-employee director” as defined in Rule 16b-3 under the Securities Exchange Act of 1934. The Compensation Committee may delegate to one or more subcommittees, or our Chief Executive Officer, the authority to determine compensation to be paid to persons who are not executive officers. The Compensation Committee may delegate to the Chief Executive Officer the authority to grant restricted stock units and stock options to our employees who are not members of the Board of Directors or executive officers, provided that no such restricted stock units or stock options exceed any limit established by the Board or the Compensation Committee. The Compensation Committee met one time during fiscal 2009. The report of the Compensation Committee appears below. For a description of the Compensation Committee’s processes and procedure for consideration and determination of executive officer compensation, see the “Compensation Discussion and Analysis” section of this Proxy Statement.

Nominating and Corporate Governance Committee

The Board of Directors has adopted a charter governing the duties and responsibilities of the Nominating and Corporate Governance Committee, which is posted on our Internet website at www.concur.com. The principal functions of the Nominating and Corporate Governance Committee are:

| • | assisting the Board of Directors in identifying, evaluating, and nominating candidates to serve as members of the Board of Directors; |

| • | recommending to the Board of Directors the director nominees for the next annual meeting of stockholders; |

| • | reviewing and making recommendations to the Board of Directors regarding the composition and operations of the Board; and |

| • | reviewing and making recommendations to the Board of Directors regarding corporate governance policies and ethical conduct. |

Directors McCabe, Canfield, and Eubanks are the members of the Nominating and Corporate Governance Committee. Each member of the committee meets the independence and other requirements to serve on our Nominating and Corporate Governance Committee under applicable securities laws and the rules of the SEC and the listing standards of The NASDAQ Stock Market. The Nominating and Corporate Governance Committee met twice during fiscal 2009.

The Nominating and Corporate Governance Committee generally identifies potential nominees based upon suggestions by our outside directors, members of management, or stockholders, and then evaluates the candidates based upon various factors, including:

| • | integrity; |

| • | high level of education and/or business experience; |

| • | broad-based business acumen; |

| • | understanding of our business and industry; |

6

| • | strategic thinking and willingness to share ideas, network of contacts, and diversity of experience; |

| • | expertise; and |

| • | background. |

The committee uses these and other criteria to evaluate potential nominees. The committee does not evaluate proposed nominees differently depending upon who has made the proposal. To date, we have not paid any third-party fees to assist in this process.

The Nominating and Corporate Governance Committee will consider, and make recommendations to the Board of Directors regarding, any stockholder recommendations for candidates to serve on the Board of Directors. However, it has not adopted a formal process for that consideration because it believes that the informal consideration process has been adequate given the historical absence of those proposals. The committee will review periodically whether a more formal policy should be adopted. If a stockholder wishes to suggest a candidate for committee consideration, the stockholder should send the name of the recommended candidate for director, together with pertinent biographical information, a document indicating the candidate’s willingness to serve if elected, and evidence of the nominating stockholder’s ownership of Concur stock, to the attention of Corporate Secretary, 18400 N.E. Union Hill Road, Redmond, Washington 98052 at least six months prior to the 2011 Annual Meeting of Stockholders to ensure time for meaningful consideration by the committee. For additional nominating requirements, please see “Stockholder Proposals for 2011 Annual Meeting” below. To date, we have not had any candidates submitted by any stockholders for the upcoming annual meeting.

Process for Determining Executive and Director Compensation

Our Compensation Committee oversees our executive officer compensation program, and recommends to the Board for approval the form and amount of executives’ salary, bonus, and equity-based compensation. It also oversees the administration of our equity- and cash-based incentive plans, and addresses other compensation matters as the Board may direct from time to time. The Board makes the final decisions regarding all compensation of our executive officers, based on Compensation Committee recommendations. In determining the form and amount of salary, bonus, and equity-based compensation for executives, the Compensation Committee reviews compensation data for comparable companies and assesses the historical performance and prospects of those companies relative to Concur’s performance and prospects. The Compensation Committee’s charter allows the committee to delegate to one or more committee members, and to our Chief Executive Officer, the authority to determine compensation of employees other than executive officers, but the committee does not currently delegate that authority. In making its determinations about fiscal 2009 executive compensation, neither the committee nor Concur engaged the services of a compensation consultant.

In the first quarter of the fiscal year, our Chief Executive Officer reviews peer group compensation data and makes recommendations to the Compensation Committee on the compensation plans, objectives, and levels for the named executive officers other than himself. He provides the Compensation Committee with his assessment of each named executive officer’s performance during the preceding year generally, and with specific reference to the objectives previously established by the Compensation Committee and the Board. The Compensation Committee considers the compensation of the Chief Executive Officer outside of his presence. The Compensation Committee then prepares its recommendations to the Board for the base salaries, incentive cash amounts (and performance targets), and equity awards for executive officers for that fiscal year. After the end of each fiscal year, the Compensation Committee reviews actual results relative to the performance objectives for that fiscal year and prepares its recommendations to the Board regarding achievement of those objectives and the payout of related incentive cash payments.

In the first quarter of the fiscal year, after receiving the recommendations of the Chief Executive Officer and the Compensation Committee, the independent members of the Board of Directors determine the structure of executive officer compensation for the year. The Board also determines whether incentive compensation awards for the prior fiscal year were earned, based on recommendations of the Chief Executive Officer and a report from the Compensation Committee.

7

Our Compensation Committee also oversees our non-employee director compensation program, and recommends to the Board for approval the form and amount of director compensation. The Board makes the final decisions regarding all compensation of our non-employee directors, based on Compensation Committee recommendations. In determining the form and amount of compensation for directors, the Compensation Committee reviews compensation data for comparable companies and assesses the historical performance and prospects of those companies relative to Concur’s performance and prospects.

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee is, or at any time was, an officer or employee of Concur or any of its subsidiaries, and none had any related person transaction or relationship with Concur. None of Concur’s executive officers serves or has served on the board of directors or compensation committee of any entity that has one or more executive officers serving on Concur’s Board of Directors or Compensation Committee during the most recently completed fiscal year.

Director Compensation

Concur employees who are members of our Board of Directors are not separately compensated for serving as members of the Board. Currently, annual director compensation consists of $100,000 cash and an award of 4,500 restricted stock units. The cash and restricted stock units are awarded on March 15 of each year for service during the preceding 12 months.

All directors are reimbursed for reasonable travel expenses in attending Board and committee meetings. Restricted stock units are awarded to outside directors under our 2007 Equity Incentive Plan, and vest in four equal installments on the first four anniversaries of the grant date. These restricted stock units cease to vest if the outside director ceases to provide services to Concur as a director or consultant.

The following table shows the compensation earned in fiscal 2009 by members of our Board of Directors other than Mr. Steven Singh and Mr. Rajeev Singh, who, as executive officers, are not separately compensated for service on the Board. Mr. Steven Singh’s and Mr. Rajeev Singh’s compensation is detailed under the “Executive Compensation” section of this proxy statement.

Name | Fees Earned or Paid in Cash ($) | Stock Awards (1)(2) ($) | Option Awards (1)(3) ($) | Non-Equity Incentive Plan Compensation ($) | All Other Compensation ($) | Total(4) ($) | ||||||

William W. Canfield | 90,000 | 63,373 | 9,300 | 0 | 0 | 162,673 | ||||||

Gordon Eubanks | 90,000 | 72,430 | 34,627 | 0 | 0 | 197,057 | ||||||

Jeffrey T. McCabe | 90,000 | 72,430 | 21,513 | 0 | 0 | 183,943 | ||||||

Jeffrey T. Seely | 90,000 | 99,268 | 29,009 | 0 | 0 | 218,277 | ||||||

Randall H. Talbot | 90,000 | 54,327 | 0 | 0 | 0 | 144,327 | ||||||

Edward P. Gilligan (5) | 0 | 0 | 0 | 0 | 0 | 0 |

| (1) | The amounts shown in this column represent compensation expense recognized for financial reporting purposes during fiscal 2009 in accordance with Accounting Standards Codification (“ASC”) Topic 718,Stock Compensation, with the exception that estimated forfeitures related to service-based vesting were disregarded in these amounts. Assumptions used in the calculation of this amount for purposes of our financial statements are included in Note 11 of the Notes to Consolidated Financial Statements included in our Annual Report on Form 10-K for the fiscal year ended September 30, 2009. |

| (2) | The following directors were awarded restricted stock units in fiscal 2009, as follows: Mr. Canfield, 3,250 shares; Mr. Eubanks, 3,250 shares; Mr. McCabe, 3,250 shares; Mr. Seely, 3,250 shares; and Mr. Talbot, 3,250 shares. These awards settle in accordance with a four-year vesting schedule under which 25% of the award will vest on March 15, 2010 and 25% of the award will vest on March 15 in each of the next three successive years. |

8

| (3) | Prior to March 2007, each non-employee director received an automatic grant of either: (a) an option to purchase 60,000 shares of our common stock upon first joining the Board of Directors and an automatic grant of an option to purchase 20,000 shares of our common stock on each anniversary of the date of grant of the initial option, each at an exercise price per share equal to the fair market value of our common stock on the date of grant; or (b) an option to purchase 40,000 shares of our common stock upon first joining the Board of Directors and an automatic grant of an option to purchase 10,000 shares of our common stock on each anniversary of the date of grant of the initial option, each at an exercise price per share equal to the fair market value of our common stock on the date of grant, plus an annual cash payment equal to $35,000. As of September 30, 2009, the following directors held options to purchase shares of our common stock as set forth following their respective names: Mr. Canfield, 70,000 shares at prices ranging from $8.69 to $16.00 per share; Mr. Eubanks, 45,000 shares at prices ranging from $10.53 to $16.00 per share; Mr. McCabe, 60,000 shares at prices ranging from $7.86 to $16.00 per share; Mr. Seely, 50,000 shares at prices ranging from $12.46 to $16.00 per share. |

| (4) | Based on the aggregate grant date fair value of awards computed in accordance with the ASC Topic 718, 2009 equity award values for the non-employee directors was as follows: Mr Canfield, $64,870; Mr. Eubanks, $64,870; Mr. McCabe, $64,870; Mr. Seely, $64,870; Mr. Talbot, $64,870 and Mr. Gilligan, $0. Based on aggregate grant date fair value of equity awards, 2009 total compensation for the non-employee directors was as follows: Mr Canfield, $154,870; Mr. Eubanks, $154,870; Mr. McCabe, $154,870; Mr. Seely, $154,870; Mr. Talbot, $154,870 and Mr. Gilligan, $0. |

| (5) | Pursuant to American Express Company internal policy, Mr. Gilligan has waived any compensation he is entitled to receive from Concur for his service as a member of our Board of Directors. |

Recommendation of the Board of Directors

The Board of Directors recommends a voteFOR the election of each nominated director.

9

PROPOSAL 2

RATIFICATION OF SELECTION OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

General

The Audit Committee has selected Grant Thornton LLP (“Grant Thornton”) to serve as our independent registered public accounting firm for the fiscal year ending September 30, 2010. The Audit Committee requests that the stockholders ratify its selection of Grant Thornton to serve as Concur’s independent registered public accounting firm for fiscal 2010. Although stockholder ratification of the appointment of Grant Thornton is not required by our Bylaws or otherwise, we are requesting such ratification because we believe it is good corporate practice to do so. If the stockholders do not ratify the appointment of Grant Thornton, the Audit Committee will investigate the reasons for the stockholders’ rejection and the Audit Committee will reconsider, but might not change, its appointment. However, even if the stockholders ratify the appointment of Grant Thornton, the Audit Committee may appoint a different independent registered public accounting firm at any time if it concludes that doing so would be in the best interests of the Company and the stockholders. We expect that one or more representatives of Grant Thornton will be present at the annual meeting, will be able to make a statement if they wish to do so, and will be able to respond to appropriate questions.

Independent Auditor’s Services and Fees

During Concur’s 2008 and 2009 fiscal years, Grant Thornton served as Concur’s independent auditor. The following table presents fees for services rendered by Grant Thornton during those fiscal years:

Type of Fees | Fee Amounts Fiscal Year 2008 | Fee Amounts Fiscal Year 2009 | ||||

Audit Fees | $ | 500,427 | $ | 562,345 | ||

Audit-Related Fees | 300,293 | 628,291 | ||||

Tax Fees | 56,006 | 24,646 | ||||

All Other Fees | 0 | 0 | ||||

Total | $ | 856,726 | $ | 1,215,282 | ||

Audit Fees for fiscal years 2008 and 2009 consist of fees paid to Grant Thornton for: (i) the audit of Concur’s annual financial statements included in the Annual Report on Form 10-K and review of financial statements included in the Quarterly Reports on Form 10-Q; (ii) the audit of Concur’s internal control over financial reporting with the objective of obtaining reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects; (iii) the attestation of management’s report on the effectiveness of internal control over financial reporting; and (iv) services that are normally provided by the independent registered public accounting firm in connection with statutory and regulatory filings or engagements.

Audit-Related Fees consist of fees for professional services that are reasonably related to the performance of the audit or review of Concur’s financial statements and are not reported underAudit Fees. This category includes fees related to audit and attest services not required by statute or regulations, due diligence related to mergers, acquisitions and investments, and consultations concerning financial accounting and reporting standards.

Tax Fees consist of fees for professional services for tax compliance, tax advice, and tax planning. These services include assistance regarding federal, state and international tax compliance, tax return preparation, and tax audits.

All such services rendered by the independent auditor are permissible under applicable laws and regulations, and were pre-approved by the Audit Committee in accordance with the Audit Committee pre-approval policy described below. The Audit Committee has determined that the provision of these services was compatible with maintaining the auditor’s independence.

10

Audit Committee Pre-Approval Policy

All audit and non-audit services to be performed for Concur by its independent auditor must be pre-approved by the Audit Committee, or a designated member of the Audit Committee, to assure that the provision of such services do not impair the auditor’s independence. The Audit Committee has delegated interim pre-approval authority to the Chairman of the Audit Committee. Any interim pre-approval of service is required to be reported to the Audit Committee at the next scheduled Audit Committee meeting. The Audit Committee does not delegate its responsibility to pre-approve services performed by the independent auditor to management.

The engagement terms and fees for annual audit services are subject to the specific pre-approval of the Audit Committee. The Audit Committee will approve, if necessary, any changes in terms, conditions, and fees resulting from changes in audit scope or other matters. All other audit services not otherwise included in the annual audit services engagement must be specifically pre-approved by the Audit Committee.

Audit-related services are services that are reasonably related to the performance of the audit or review of Concur’s financial statements or traditionally performed by the independent auditor. Examples of audit-related services include employee benefit and compensation plan audits, due diligence related to mergers and acquisitions, attestations by the auditor that are not required by statute or regulation, and consulting on financial accounting/reporting standards. All audit-related services must be specifically pre-approved by the Audit Committee.

The Audit Committee may grant pre-approval of other services that are permissible under applicable laws and regulations and that would not impair the independence of the auditor. All of such permissible services must be specifically pre-approved by the Audit Committee.

Requests or applications for the independent auditor to provide services that require specific approval by the Audit Committee are considered after consultation with management and the auditors. Questions about whether the scope of a proposed service requires specific pre-approval, or is permitted by applicable laws and regulations, are to be referred to the Concur legal department.

Recommendation of the Board

The Board of Directors recommends a voteFOR the ratification of the selection of Grant Thornton LLP as the independent registered public accounting firm of Concur for fiscal 2010.

OTHER MATTERS

The Board of Directors is not aware of any other matters to be presented for stockholder action at the annual meeting. However, if other matters do properly come before the meeting or any adjournment or postponement thereof, the Board of Directors intends that the persons named in the proxies will vote upon such matters in accordance with their best judgment.

OWNERSHIP OF SECURITIES

The following table sets forth information with respect to the beneficial ownership of Concur common stock, as of January 15, 2010, by:

| • | each person known by Concur to own beneficially more than 5% of the outstanding shares; |

| • | each member of the Board of Directors; |

| • | each named executive officer identified in the Summary Compensation Table below; and |

| • | all current directors and executive officers as a group. |

11

Beneficial ownership is determined under the rules of the SEC and generally includes voting or investment power with respect to securities. Unless otherwise indicated, the principal address of each of the stockholders listed below is c/o Concur Technologies, Inc., 18400 N.E. Union Hill Road, Redmond, Washington 98052. To our knowledge, the persons and entities named in the table have sole voting and investment power with respect to all shares beneficially owned by them, subject to community property laws where applicable and except as otherwise indicated below. Shares of common stock subject to options that are exercisable on or before March 16, 2010 (within 60 days after January 15, 2010) are deemed to be outstanding and beneficially owned by the person holding the options for the purpose of computing the percentage ownership of that person. To determine the number of shares beneficially owned by persons other than our directors, executive officers and their affiliates (if any), we have relied on beneficial ownership reports filed by such persons with the SEC.

The percentage of outstanding shares beneficially owned as of January 15, 2010 is based on 49,132,467 shares of common stock outstanding on that date.

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Outstanding Shares | ||||

American Express Travel Related Services Company, Inc. | 7,680,000 | (1) | 15.6 | % | ||

Columbia Wanger Asset Management, L.P. | 2,705,500 | (2) | 5.5 | % | ||

S. Steven Singh | 1,617,881 | (3) | 3.3 | % | ||

Rajeev Singh | 583,707 | (4) | 1.2 | % | ||

John F. Adair | 257,019 | (5) | * | |||

Michael L. Eberhard | 113,400 | (6) | * | |||

William W. Canfield | 93,251 | (7) | * | |||

Jeffrey T. McCabe | 65,688 | (8) | * | |||

Jeffrey T. Seely | 54,063 | (9) | * | |||

Gordon Eubanks | 50,688 | (10) | * | |||

Robert Cavanaugh | 45,352 | (11) | * | |||

Randall H. Talbot | 5,813 | * | ||||

Edward P. Gilligan | 0 | (12) | 0 | % | ||

All current directors and executive officers as a group (14 persons) | 4,060,581 | (13) | 7.9 | % |

| * | Less than 1% |

| (1) | American Express Travel Related Services Company, Inc. (“American Express”) stated in its Schedule 13D filed on August 7, 2008 that such shares include 1,280,000 shares of Concur common stock issuable upon exercise of a warrant acquired by American Express pursuant to Securities Purchase Agreement dated July 29, 2008 with Concur. According to the Schedule 13D filing, American Express has sole voting and dispositive power with respect to all such shares. The address of American Express is 200 Vesey Street, New York, New York 10285. |

| (2) | Columbia Wanger Asset Management, L.P. has sole voting power with respect to 2,665,500 of such shares and sole dispositive power with respect to all such shares. The address of Columbia Wanger Asset Management is. 227 West Monroe Street, Suite 3000, Chicago, IL 60606. |

| (3) | Includes 595,000 shares subject to options. |

| (4) | Includes 87,000 shares owned indirectly, as trustee of a Grantor Retained Annuity Trust, which is the direct owner of these shares, and 459,987 shares subject to options. |

| (5) | Includes 221,372 shares subject to options. |

| (6) | Includes 93,371 shares subject to options. |

| (7) | Includes 20,000 shares owned indirectly, as trustee of the William W. Canfield Revocable Trust, which is the direct owner of these shares, and 70,000 shares subject to options. |

| (8) | Includes 60,000 shares subject to options. |

12

| (9) | Includes 50,000 shares subject to options. |

| (10) | Includes 45,000 shares subject to options. |

| (11) | Includes 28,550 shares subject to options. |

| (12) | Edward P. Gilligan waived compensation, including the receipt of Concur common stock, pursuant to American Express Company internal policy. |

| (13) | Includes 2,207,374 shares subject to options, including options described in the above footnotes. |

13

EXECUTIVE OFFICERS

The following individuals are our executive officers:

S. Steven Singh, Chief Executive Officer and Chairman of the Board of Directors. S. Steven Singh, age 48, has served as Concur’s Chief Executive Officer since 1996 and as a director since 1993, including service as Chairman of the Board of Directors since September 1999. From 1993 to 1996, Mr. Singh was General Manager of the Contact Management Division at Symantec Corporation, an international technology firm focused on protecting information and computer systems. Mr. Singh serves as Chairman of the NBTA Foundation Board, serves on the board of directors of RightNow Technologies, AdReady, and Washington Roundtable, and is a member of the Voyager Capital Advisory Board. S. Steven Singh and Rajeev Singh are brothers.

Rajeev Singh, President and Chief Operating Officer. Rajeev Singh, age 41, has been a director of Concur since April 2008. Mr. Singh co-founded Concur in 1993, became Chief Operating Officer in September 2002, and became President in September 2005. Prior to that, he served in various roles at Concur, including the Executive Vice President of Sales, Marketing & Services. Prior to joining Concur, Mr. Singh served roles in engineering project management at Ford Motor Company and General Motors Corporation. Rajeev Singh and S. Steven Singh are brothers.

John F. Adair, Chief Financial Officer. Mr. Adair, age 45, joined Concur in 2000 as Vice President of Finance and Operations and became Chief Financial Officer in that same year. From 1997 to 2000, Mr. Adair served as Controller for PACCAR Financial and PACCAR Leasing, affiliates of PACCAR, Inc., the parent company for Kenworth, Peterbilt, and DAF trucks. From 1993 to 1997, Mr. Adair served as Senior Vice President of Finance for ValliCorp Holdings and ValliWide Bank.

Kyle R. Sugamele, Chief Legal Officer and Corporate Secretary. Mr. Sugamele, age 47, joined Concur in August 2000 as its Vice President, General Counsel and Corporate Secretary and became Chief Legal Officer and Corporate Secretary in September 2005. From 1995 to 2000, Mr. Sugamele served as Vice President, General Counsel, and Corporate Secretary at Cellular Technical Services Company, Inc., a provider of software solutions for the wireless telecommunications industry. From 1991 to 1995, Mr. Sugamele practiced law at the firm of Mundt MacGregor LLP in Seattle. Prior to that time, Mr. Sugamele practiced law at the firm of Graham & Dunn PC in Seattle.

Michael W. Hilton, Executive Vice President, Worldwide Marketing. Mr. Hilton, age 45, co-founded Concur in 1993 and served as Concur’s Chief Executive Officer until 1996. He became Concur’s Executive Vice President, Worldwide Marketing in October 2007. Mr. Hilton was a director of Concur from 1993 until July 2008 and served as Chairman of the Board of Directors from 1996 until 1999. Before co-founding Concur, he served as Senior Development Manager at Symantec Corporation, an international technology firm focused on protecting information and computer systems, and as Director of Product Development for Contact Software International, a personal computer software publisher that was acquired by Symantec.

Michael L. Eberhard, Executive Vice President, Worldwide Sales and Business Development. Mr. Eberhard, age 44, joined Concur in September 2003 as its Vice President of Large Market Sales, became Executive Vice President, North American Sales in October 2005, and became Executive Vice President, Worldwide Sales and Business Development in September 2007. Prior to joining Concur, Mr. Eberhard held executive and sales leadership positions at Xign Corporation, a provider of electronic invoice presentment and payment services, Ariba Inc., a provider of spend management solutions, PeopleSoft, a provider of enterprise application software, and Dun & Bradstreet Software Services Inc., a distributor of software for financial, human resources, distribution, and manufacturing applications.

Robert Cavanaugh, Executive Vice President, Client Development. Mr. Cavanaugh, age 40, became Executive Vice President, Client Development in October 2007. Prior to that, he served in various roles since joining Concur in 1999, including Executive Vice President, Business Development, Vice President of Business Development, and Senior Director, Consulting Services. Prior to joining Concur, Mr. Cavanaugh held consulting and implementation management positions at Seeker Software and Ceridian Corporation. Mr. Cavanaugh served as an officer in the United States Army Reserve from 1991 to 2000.

14

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis provides information about the material components of our executive compensation program for:

| • | Steve Singh, our Chief Executive Officer; |

| • | John Adair, our Chief Financial Officer; |

| • | Rajeev Singh, our President and Chief Operating Officer; |

| • | Michael Eberhard, our Executive Vice President, Worldwide Sales and Business Development; and |

| • | Robert Cavanaugh, our Executive Vice President, Client Development. |

Throughout this Compensation Discussion and Analysis and the related compensation tables that follow, we refer to these executives collectively as our named executive officers.

Specifically, in this section we provide an overview of our executive compensation philosophy, the overall objectives of our executive compensation program, and each compensation component that we provide. In addition, we explain how the Compensation Committee and Board of Directors arrived at specific compensation policies and decisions involving our named executive officers during 2009. This discussion is intended to provide the context necessary to understand the compensation of these named executive officers, which is detailed in the tables and narratives that follow.

Executive Compensation Objectives and Philosophy

We operate in a competitive business environment that is constantly reshaped by technological advances, evolving market requirements and emerging competitors. To thrive in this environment, we must continue to establish on-demand computing as a long-term service delivery and business model, develop new services and technologies, identify and implement effective business strategies, and demonstrate an ability to capitalize on new business opportunities. To do so, we need to have a highly talented and seasoned leadership team of technical and business professionals. We compete with many other companies in seeking to attract and retain a skilled management team. To meet this challenge, we have employed a compensation philosophy of offering our executives competitive compensation packages that are focused on long-term value creation and rewarding them for achieving our financial and strategic objectives.

Our executive compensation program is designed to attract, retain, and motivate talented individuals with the executive experience and leadership skills necessary for us to increase stockholder value by driving long-term growth in revenue and profitability. We seek to provide executive compensation that is competitive with companies that are similar to Concur. We also seek to provide near-term and long-term financial incentives that reward well-performing executives when strategic corporate objectives designed to increase long-term stockholder value are achieved. We believe that executive compensation should include base salary, cash incentives and equity awards. We also believe that our executive officers’ base salaries should be set at approximately median levels relative to comparable companies, and cash and equity incentives should generally be set at levels that give executives the opportunity to achieve above-average total compensation reflecting above-average company performance. In particular, our executive compensation philosophy is to promote consistent long-term value creation for our shareholders by rewarding long-term growth in selected financial metrics, along with equity incentives.

Our Executive Compensation Peer Group

In determining the components of executive compensation and the amounts of salary, bonus, and equity-based compensation for executives, the Compensation Committee reviews compensation data for selected comparable companies and assesses the historical performance and prospects of those companies relative to Concur’s performance and prospects.

15

For fiscal 2009 the Compensation Committee established a peer group for executive compensation purposes, consisting of publicly traded software companies and selected software-as-a-service companies. Software companies with annual revenues in the range of $200 million to $350 million were included in the group, except for those that had been acquired since the date of their last proxy statement, and software-as-a-service companies with annual revenues over $150 million were included. Our Chief Executive Officer and other members of management provided input on the selection of peer group companies, and the Compensation Committee made the final determination of which companies to include. Executive compensation information for the peer group companies was compiled by management from proxy statements and other public filings.

The fiscal 2009 peer group included the following 35 companies:

| • | Advent Software Inc. |

| • | Alloy Inc. |

| • | Allscripts Healthcare Solution |

| • | Altiris Inc. |

| • | Ariba, Inc. |

| • | Aspen Technology, Inc. |

| • | athenahealth, Inc. |

| • | Blackbaud, Inc. |

| • | Blackboard Inc. |

| • | Blue Coat Systems Inc. |

| • | Commvault Systems Inc. |

| • | DealerTrack Holdings, Inc. |

| • | Deltek, Inc. |

| • | Dynamic Digital Depth, Inc. |

| • | Epiq Systems Inc. |

| • | i2 Technologies, Inc. |

| • | Interwoven, Inc. |

| • | Kenexa Corporation |

| • | Magma Design Automation Inc. |

| • | Manhattan Associates, Inc. |

| • | Midway Games Inc. |

| • | MSC.Software Corporation |

| • | Omniture, Inc. |

| • | Perficient Inc. |

| • | Radiant Systems Inc. |

| • | S1 Corporation |

| • | Skillsoft Public Limited Co. |

| • | Sonicwall Inc. |

| • | SPSS Inc. |

| • | Taleo Corporation |

| • | thinkorswim Group Inc. |

| • | Ultimate Software Group, Inc. |

| • | Vignette Corporation |

| • | WebSense, Inc. |

| • | Wind River Systems, Inc. |

For fiscal 2009, the goal of the Compensation Committee and the Board was to provide executive officer compensation generally in alignment with similar positions at comparable companies. The committee also noted that Concur’s financial performance for the prior fiscal year, and its expected performance for fiscal 2009, were significantly better than the performance of the peer group companies. In order to encourage above-average corporate financial performance, the Compensation Committee and the Board chose to emphasize executive compensation weighted toward incentive compensation.

16

Components of Our Executive Compensation Program

The key elements of our named executive officer compensation program for fiscal 2009 were:

| • | base salary; |

| • | cash incentive; and |

| • | equity incentive. |

The Compensation Committee believes that these elements, which Concur has used for many years and are common in the technology industry, are appropriate components of our executive compensation program.

Generally, the Compensation Committee and the Board believe that the following components of executive compensation should be set at the following approximate percentiles for comparable positions at peer group companies:

Component | Percentile | |

Base Salary | 50th | |

Cash Incentive | 75th | |

Equity Incentive | 75th – 90th |

The Board set the ranges for 2009 incentive compensation significantly higher than the median among the peer group in recognition of the fact that Concur out-performed its peer group companies in fiscal 2008 year and was expected to do so again in fiscal 2009, and performance of this nature should result in above-average total compensation for our executives. However, the Compensation Committee and Board also recognized that individual circumstances requires adjustment of one or more components of compensation for individual executives to reflect individual prior-year performance or to accommodate positions for which peer roles were difficult to establish.

Base Salaries

Base salaries are used to compensate our executive officers for serving as the senior members of our management team, regardless of stockholder returns or our performance relative to our financial objectives. Salaries also serve an important retention function.

In recommending appropriate base salaries for executives in fiscal 2008, the Compensation Committee considered the peer group 50th percentile data and made subjective assessments of each executive officer’s position, experience, responsibilities, performance and work location. As a result of these considerations, the Compensation Committee recommended and the Board set annual base salaries for our named executive officers that were at approximately the 50th percentile of comparable company data for our named executive officers, including our Chief Executive Officer. Mr. Cavanaugh’s base salary was set at $250,000, which is below the 25th percentile of peer group data but was a significant raise from his prior year base salary.

Annual Cash Incentives

Annual cash incentives are intended to motivate our executives to achieve pre-established corporate financial or operational goals that we expect to increase long-term shareholder value. Whether a named executive officer receives a bonus under these arrangements, and the amount of that bonus, depends primarily on our performance relative to company-wide financial objectives. The Board believes that company-wide incentives foster teamwork among senior management and throughout the company, and that consistently achieving better-than-expected financial results increases stockholder value and should be reflected in superior executive compensation. Under the company-wide annual cash incentive plan, if we achieve results that are below the target level, then our executives receive no bonuses, while results above the target level result in larger bonuses (up to double the target bonus amount).

In determining the target annual cash bonus for each named executive officer, the Compensation Committee considered the comparable data for annual cash incentives (target and actual) from the peer group companies. For fiscal 2009, the Board targeted executive incentive cash compensation at approximately the75thpercentile of the

17

peer group data. The Board considered the position, experience, responsibilities, other compensation, and performance of each executive officer, together with the peer group compensation data, based on the recommendations provided by the Chief Executive Officer and the Compensation Committee. As a result, the on-target annual cash incentive compensation of our named executive officers was approximately the 75th percentile for four of our named executives, including Mr. Steven Singh; Mr. Cavanaugh’s target cash incentive was set below the 25th percentile of peer group data but was a significant raise from his prior year target cash incentive.

For fiscal 2009, the targeted annual cash incentives for our named executive officers (at 100% of target) was approximately 122% of base salary for Mr. Steven Singh, 138% of base salary for Mr. Rajeev Singh, and 85% of base salary for Mr. Adair. Mr. Cavanaugh and Mr. Eberhard were compensated under separate cash incentive plans, as described below. The Board established higher incentive compensation levels for Mr. Steven Singh and Mr. Rajeev Singh than for Mr. Adair, because their positions and responsibilities are such that they have a more direct impact on the performance of our business.

Based on recommendations from the Chief Executive Officer and the Compensation Committee, the Board selected fiscal 2009 non-GAAP pre-tax earnings per share as the metric that would determine annual cash bonuses for the named executive officers for fiscal 2009. The Board selected this metric to link bonuses to a broad measure of our overall financial performance for the year. Annual cash bonuses could be earned only if the target non-GAAP pre-tax earnings objective was achieved, and executives were eligible for higher bonuses if the target objective was exceeded, up to a maximum cash bonus for each named executive officer equal to double his target cash bonus. In alignment with Concur’s business outlook for fiscal 2009, the Board set $1.11 non-GAAP pre-tax earnings per share as a level at which the target bonus would be earned, and it set a level (140% of the target objective) at which the maximum bonus could be earned. Ultimately we achieved non-GAAP pre-tax earnings per share of $1.14, which was approximately 105% of target, excluding the impact of Concur’s acquisition of Etap-On-Line during fiscal 2009 as approved by the Board, resulting in our named executive officers earning approximately 113% of their target cash bonus amounts for fiscal 2009.

For fiscal 2009, Mr. Eberhard was compensated under a sales commission plan rather than our company-wide cash incentive program. Because Mr. Eberhard’s position primarily involves responsibility for the revenue-generating efforts by our sales, pre-sales, and business development groups, the Compensation Committee and the Board of Directors believes that it is appropriate to tie his annual cash incentive to revenue-generating efforts, rather than to our overall financial performance for the fiscal year. For this reason, Mr. Eberhard is paid a monthly sales commission based on achievement of sales during the relevant monthly period at a fixed commission rate for all sales up to an annual sales target established by Concur for fiscal 2009. To incentivize achievement in excess of such annual sales target, the fixed commission rate is increased by a factor of one and one-half times for all sales in excess of the annual sales target. In calculating the monthly sales commission, the fixed commission rate generally is applied against the value of signed contracts in terms of annualized recurring revenue and one-time fees. Mr. Eberhard’s target sales commissions for fiscal 2009 was approximately 110% of his base salary if he achieved his annual sales target. There were no minimum or maximum sales commissions that could have been earned by Mr. Eberhard in fiscal 2009.

For fiscal 2009, Mr. Cavanaugh was compensated under a sales commission plan rather than our company-wide cash incentive program. Because Mr. Cavanaugh’s position primarily involves responsibility for the revenue-generating efforts by our client development groups, the Compensation Committee and the Board of Directors believes that it is appropriate to tie his annual cash incentive to revenue-generating efforts, rather than to our overall financial performance for the fiscal year. For this reason, Mr. Cavanaugh is paid a monthly sales commission based on achievement of sales during the relevant monthly period at a fixed commission rate for all sales up to an annual sales target established by Concur for fiscal 2009. To incentivize achievement in excess of such annual sales target, the fixed commission rate is increased by a factor of one and one-half times for all sales in excess of the annual sales target. In calculating the monthly sales commission, the fixed commission rate generally is applied against the value of signed contracts in terms of annualized recurring revenue and one-time fees. Mr. Cavanaugh’s target sales commissions for fiscal 2009 were approximately equal to his base salary if he achieved his annual sales target. There were no minimum or maximum sales commissions that could have been earned by Mr. Cavanaugh in fiscal 2009.

18

Equity Incentives

Equity incentive compensation are intended primarily to motivate our executives to pursue strategies that increase stockholder value over the long term, and secondarily to help retain executives. In fiscal 2009, our equity incentive took the form of grants of restricted stock units under our stockholder-approved 2007 Equity Incentive Plan. Through fiscal 2006, we used stock options as our primary form of equity incentive. Equity awards generally vest over four years, which the Compensation Committee and the Board believe encourages retention of key leadership while aligning their interests with the interest of stockholders with respect to business growth and stock price appreciation.

In determining equity awards for each named executive officer, the Compensation Committee and the Board consider the equity compensation practices of the peer group companies, including stock dilution, and the equity compensation for comparable positions among the peer group companies. For fiscal 2009, the Compensation Committee and the Board determined that the equity compensation component of our executive compensation should generally be in the range of the 75th to 90th percentiles of equity compensation value among our peer group companies.

While the Compensation Committee reviews the realized or unrealized value of prior equity awards, it determines the annual target economic value of equity awards with reference to our peer group benchmark. The Compensation Committee believes that annual equity awards effectively create strong incentives to drive future stockholder return.

Restricted Stock Units.We grant restricted stock units to link executive officer compensation directly to the value of our common stock, to encourage increasing stockholder value over the long term, and to promote executive officer retention. Our restricted stock units generally vest in four equal annual installments on the anniversary of the grant date, when the executive receives shares with value equivalent to the value of our shares on that date, net of tax withholding. Restricted stock units reward the executive to the extent of the full value of the shares, so the executive earns more compensation if our stock price increases, while being assured of some compensation if our stock price stays steady or declines over the period of the award, which helps retain executive officers during times when our stock price declines.

In determining the size of restricted stock unit grants to named executive officers, the Board considered the current value of our common stock, stock dilution, equity compensation practices of the peer group companies, and other forms of equity-based incentive compensation (such as stock options). The Board assessed our executive officers’ ownership of shares of our common stock relative to the peer group data, and considered the dilutive impact of equity awards. After these considerations, in fiscal 2009 the Board granted the named executive officers an aggregate of 177,500 restricted stock units, or approximately 0.24% of our total shares outstanding. The equity incentive compensation grant for our named executive officers in fiscal 2009 was in the range of the approximately the 75th to the 90th percentile of peer group equity incentive compensation for four of our named executive officers, including Mr. Steven Singh; Mr. Adair’s equity grant was set at a level below the 75th percentile to better align with his specific responsibilities and objectives in fiscal 2009.

Stock Options.Prior to fiscal 2007, we awarded stock options to executives in order to link named executive officer compensation to increases in the price of our common stock, which reflects increased stockholder value. All stock options to executive officers were granted with an exercise price equal to or greater than the market price of our stock on the grant date, and typically vest over four years. Stock options therefore compensate our executive officers only if our stock price increases after the date of grant and the executive officer remains employed for the period required for the stock option to become exercisable. The Board considers stock options an effective incentive tool because they motivate named executive officers to increase stockholder value. However, beginning in fiscal 2007, the Board determined that restricted stock unit awards were preferable because they cause less dilution to stockholders as fewer shares would be issued upon settlement of a restricted stock unit award than upon exercise of a stock option of equivalent value. The Board did not grant any stock options to named executive officers in fiscal 2009.

19

Severance and Change-in-Control Agreements

We have no “change-in-control” agreements with our named executive officers that would entitle them to severance benefits in the event of a change in control of Concur, such as a tender offer or merger resulting in Concur being acquired by another company.

Beginning in fiscal 2008, our grants of restricted stock units to named executive officers provide that all covered unvested shares automatically vest in the event of a change in control of Concur (often referred to as “single-trigger” acceleration). Historically, our restricted stock units and stock options held by named executive officers generally provided that vesting under the award would only accelerate if within 12 months after a change in control the employee’s employment with the successor entity is terminated without cause, or the successor entity effects a material adverse change in the employee’s responsibilities, or the successor entity reduces the employee’s base salary (often referred to as “double-trigger” acceleration). Under these agreements, the term “cause” generally means willfully engaging in gross misconduct that is materially and demonstrably injurious to Concur, a willful act of dishonesty intended to result in substantial gain or personal enrichment at the expense of Concur, or a willful and continued failure to substantially perform duties for Concur or its successor after we (or our successor or the surviving entity) deliver a written demand for substantial performance to the officer provided that this demand specifically identifies how we (or our successor or the surviving entity) believe that the officer has not substantially performed his or her duties.

The Compensation Committee and Board made this change because they believe that retention of our executive officers is particularly important if there is a prospect of a change in control. The Compensation Committee and Board therefore determined, beginning in fiscal 2008, to include such single-trigger acceleration of vesting provisions in restricted stock unit awards for named executive officers, to encourage them to remain with Concur with minimal distraction over how a change in control might affect them personally. The same single-trigger acceleration is generally provided for in restricted stock units for other employees as well, beginning in fiscal 2008.

Equity Award Procedures

All restricted stock units and stock options are approved by our Board based on recommendations of the Compensation Committee. The Board approves all individual grants to named executive officers and has delegated to the Chief Executive Officer the authority to make equity awards to non-executive employees, within certain limitations on aggregate grants and specific award terms. All stock options approved by the Board are required to be granted not earlier than the date of approval, and at an exercise price not less than the fair market value of our common stock on the date of grant. Except in the case of a promoted or new executive officer, equity awards to executive officers are typically approved annually when annual grants are made to other key employees.

Tax Considerations

Section 162(m) of the Internal Revenue Code generally limits to $1,000,000 the amount of compensation for certain highly compensated officers that we may deduct for federal income tax purposes in any one year. The Compensation Committee and Board determined not to limit our executive compensation to amounts that are deductible under Section 162(m). However, in fiscal 2009, the Compensation Committee granted annual cash-based incentive awards, performance-based restricted stock units, and options that were intended to qualify as “performance-based compensation” within the meaning of Section 162(m) and therefore exempt from the deduction limit.

In particular, the Compensation Committee and Board has granted restricted stock units that were not granted and will not vest based on pre-determined performance objectives meeting the requirements of Section 162(m). Therefore, for each named executive officer, the value of that restricted stock unit when it vests will count toward the $1,000,000 deductibility limit under Section 162(m). The Compensation Committee and Board determined that restricted stock units are nonetheless a valuable retention tool and important component of the overall compensation program for our named executive officers.

20

EXECUTIVE COMPENSATION