UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

¨ Preliminary Proxy Statement x Definitive Proxy Statement ¨ Definitive Additional Materials ¨ Soliciting Material Pursuant to §240.14a-12 | | ¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| |

| |

| |

Concur Technologies, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

January 24, 2013

Dear Stockholder:

You are cordially invited to attend the 2013 Annual Meeting of Stockholders of Concur Technologies, Inc., which will be held at the Harbor Club, 777 108th Avenue Northeast, Bellevue, Washington, at 11:00 a.m. Pacific Time on Wednesday, March 13, 2013.

Details of the business to be conducted at the Meeting are given in the attached Notice of Annual Meeting and Proxy Statement.

When we look back at fiscal 2012 years from now, I believe that we’ll see it as a key inflection point for Concur, for our customers and their business travelers, and for our industry as a whole. The extraordinary growth in mobile use is spurring a new wave of technology innovation focused around the consumer experience. For Concur, these trends have created enormous opportunity for us to expand our addressable market, and to begin defining a new set of solutions that can deliver value to our customers and the industry for decades to come. We are committed to fundamentally improving the experience and value delivered across the entire corporate travel supply chain.

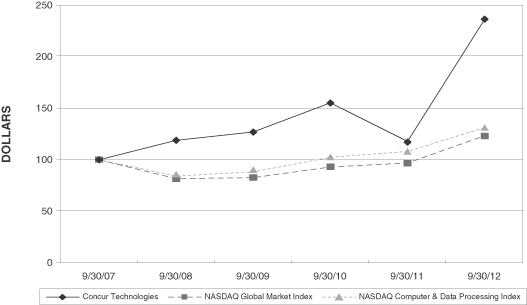

Fiscal 2012 was a tremendous success, with momentum across our financial, operational and strategic objectives. Revenue grew 26%, operating margin was 20%, non-GAAP pre-tax earnings per share was $1.39, we generated $93.6 million in cash flow from operations, and new customer bookings were the highest in our history. Behind the financial numbers, we executed against the goal we set last year to begin aggressively ramping our sales and distribution capacity, and these investments are laying the foundation for growth in 2013 and the years ahead.

We had notable success in the Federal Government market with our significant award of the ETS-2 U.S. Federal Government contract. We are excited about working with the General Services Administration and the civilian federal agencies to meet their travel and expense management needs while driving meaningful cost savings for the American taxpayer.

Over the past twenty years, we’ve built Concur into one of the world’s largest enterprise Cloud Application companies. Looking ahead to the next decade, we plan to build upon that success and scale by leveraging our investments in content, big data, and mobile to evolve Concur from being a provider of leading cloud solutions into a platform for content and commerce that plays a significant central role in the $1 trillion travel market. In doing so, we plan to deliver incredible value to business travelers, corporate customers, third-party developers, and suppliers by linking them together in an efficient real-time supply chain that starts with an incredible user experience.

At this year’s Meeting, we will update you on Concur’s business and how Concur continues to drive innovation and offer compelling value to our partners,

customers and investors. We will also review our financial performance and answer your questions.

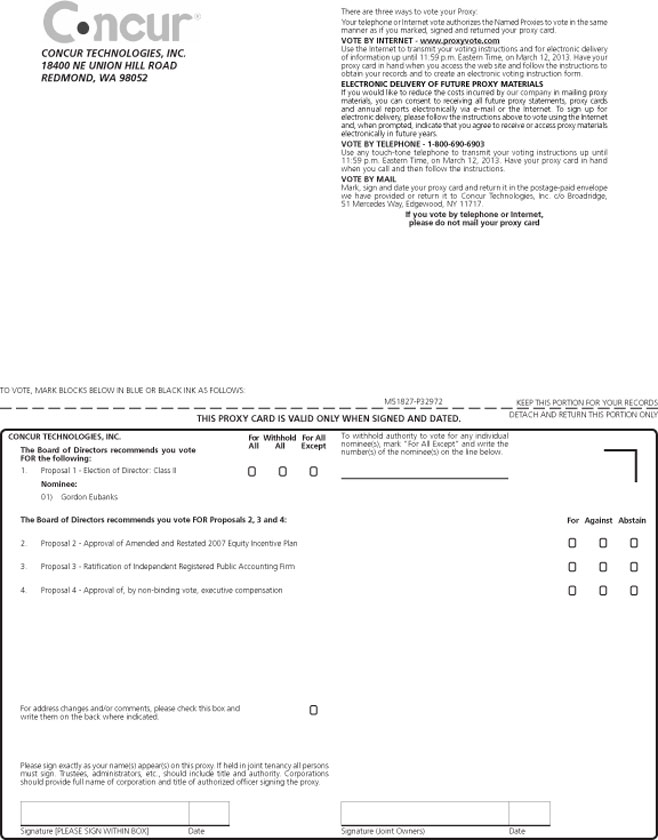

We encourage you to use this opportunity to take part in the affairs of Concur by voting on the business to come before the Meeting. Whether or not you plan to attend, please complete, sign and date, and promptly return the enclosed proxy card in the accompanying reply envelope so that your shares will be represented at the Meeting. You may also submit your proxy via the Internet or telephone as specified in the accompanying Internet and telephone voting instructions. If you decide to attend the Meeting and wish to change your proxy vote, you may do so by voting in person at the Meeting.

We look forward to seeing you at the Meeting.

Sincerely,

| | | | | | |

| |

S. Steven Singh Chief Executive Officer and Chairman of the Board | |  | |

Rajeev Singh President and Chief Operating Officer |

Concur Technologies, Inc.

18400 N.E. Union Hill Road

Redmond, Washington 98052

Notice of 2013 Annual Meeting of Stockholders

| | | | |

Time and Date | | March 13, 2013 at 11:00 a.m. Pacific Time |

| |

Place | | Harbor Club, 777 108th Avenue Northeast, Bellevue, Washington 98004 |

| | |

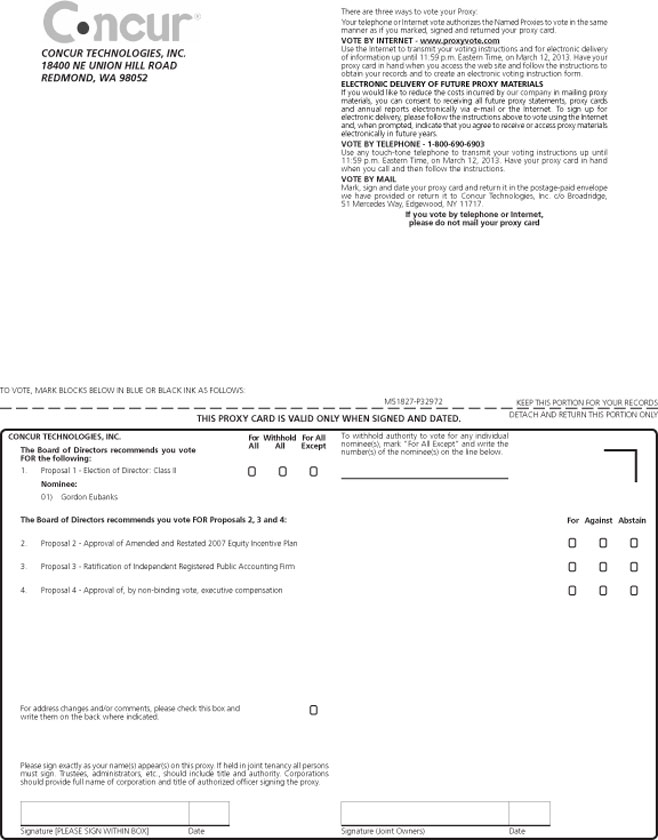

Items of Business | | 1. | | To elect the Class II member of the Board of Directors. |

| | |

| | 2. | | To approve Concur’s Amended and Restated 2007 Equity Incentive Plan, including amendments to increase the authorized number of shares available for issuance thereunder Section 162(m) approval, and make certain technical modifications. |

| | |

| | 3. | | To ratify the selection of Grant Thornton LLP as Concur’s independent registered public accounting firm for the fiscal year ending September 30, 2013. |

| | |

| | 4. | | To hold an advisory vote on the compensation of executive officers. |

| | |

| | 5. | | To transact other business that may properly come before the Meeting. |

| |

Record Date | | January 18, 2013. Only stockholders of record at the close of business on the record date are entitled to receive notice of, and to vote at, the Meeting. |

| |

Proxy Voting | | IMPORTANT: Please vote your shares at your earliest convenience. This will ensure the presence of a quorum at the Meeting. Promptly voting your shares via the Internet, by telephone, or by signing, dating, and returning the enclosed proxy card will save the expenses and extra work of additional solicitation. If you wish to vote by mail, we have enclosed an addressed envelope, postage prepaid if mailed in the United States. Submitting your proxy now will not prevent you from voting your shares at the Meeting, as your proxy is revocable at your option. |

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on March 13, 2013. Our Proxy Statement and Annual Report on Form 10-K are available atwww.concur.com.

By order of the Board of Directors,

S. Steven Singh

Chief Executive Officer and Chairman of the Board

Redmond, Washington

January 24, 2013

Proxy Summary

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information you should consider, and you should read the entire Proxy Statement carefully before voting.

Annual Meeting of Stockholders

| | |

Date and Time | | March 13, 2013 at 11:00 a.m. Pacific Time |

| |

Place | | Harbor Club 777 108th Avenue Northeast Bellevue, Washington 98004 |

| |

Record Date | | January 18, 2013 |

| |

Voting | | Stockholders as of the record date are entitled to vote. Each share of common stock is entitled to one vote for the director nominee and one vote for each of the proposals to be voted on. |

| |

Admission | | No admission card is required to enter the Meeting. |

Meeting Agenda

| | 1. | Elect the Class II member of the Board of Directors. |

| | 2. | Approve Concur’s Amended and Restated 2007 Equity Incentive Plan, including amendments to increase the authorized number of shares available for issuance thereunder, Section 162(m) approval, and make certain technical modifications. |

| | 3. | Ratify the selection of Grant Thornton LLP as Concur’s independent registered public accounting firm for the fiscal year ending September 30, 2013. |

| | 4. | Hold an advisory vote on the compensation of executive officers. |

| | 5. | Transact other business that may properly come before the Meeting. |

Voting Matters and Vote Recommendation

| | |

| Voting Matter | | Board Vote Recommendation |

| |

Election of Class II Director | | FORthe Director Nominee |

| |

| Approval of Concur’s Amended and Restated 2007 Equity Incentive Plan | | FOR |

| |

| Ratification of Grant Thornton LLP as our independent registered public accounting firm for fiscal 2013 | | FOR |

| |

Advisory vote on executive compensation | | FOR |

Election of Class II Director

Gordon Eubanks, age 66, is the Class II director nominee and has served as a director of Concur since 2005. In order to be re-elected as a director, Mr. Eubanks must receive the affirmative vote of the stockholders present at the Meeting. See “Our Board of Directors” for more information.

i

Approval of Concur’s Amended and Restated 2007 Equity Incentive Plan

We ask that our stockholders approve Concur’s Amended and Restated 2007 Equity Incentive Plan (“2007 Plan”), including amendments to increase the authorized number of shares of common stock available for issuance thereunder by 4,600,000, to make certain technical modifications to the 2007 Plan and to approve the 2007 Plan for purposes of Section 162(m). See “Amended and Restated 2007 Equity Incentive Plan” for more information. A complete copy of the 2007 Plan is attached as Appendix A to this Proxy Statement.

Independent Auditor Ratification

We ask that our stockholders ratify the selection of Grant Thornton LLP as our independent registered public accounting firm for fiscal 2013. See “Audit and Audit-related Matters” for more information.

Executive Compensation Advisory Vote

Our Board of Directors recommends that our stockholders vote to approve, on an advisory basis, the compensation paid to Concur’s named executive officers, as described in “Executive Compensation.”

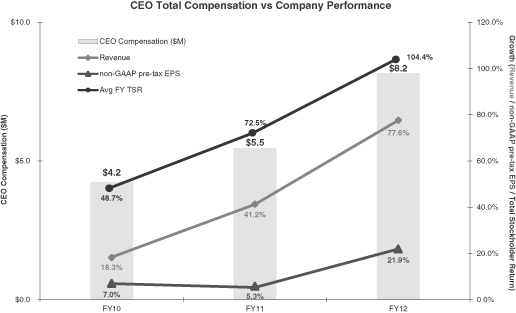

Executive Compensation Matters

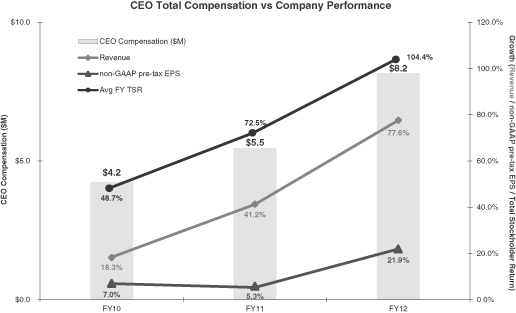

Business Highlights

In fiscal 2012, we delivered strong financial results and continued to make investments to lay the foundation for growth in fiscal 2013 and the years ahead.

Our financial highlights for fiscal 2012 include:

| | • | | We added a record number of customers in fiscal 2012, growing to more than 15,000 companies using our services across our global customer base as of the end of fiscal 2012; |

| | • | | Total revenue in fiscal 2012 was $439.8 million, up 26% over fiscal 2011; |

| | • | | Fiscal 2012 non-GAAP pretax income was $78.7 million, or $1.39 per share, compared to $66.3 million, or $1.20 per share, for fiscal 2011; and |

| | • | | Cash flow from operations was $93.6 million, an increase of 22% over fiscal 2011. |

Our business highlights since the beginning of fiscal 2012 include:

| | • | | We continued to drive innovation for travelers, businesses and suppliers through our vision of the Perfect Trip™ by delivering new services and solutions under the Concur T&E Cloud, Concur Open Booking, and Concur Big Data. |

| | • | | We continued our global expansion with a major launch in Japan, a new service facility in Manila, Philippines, a new office in Frankfurt, Germany, and expansion of our other offices around the world. |

| | • | | We extended our leadership into new vertical markets such as healthcare/pharmaceuticals and higher education, and particularly in the public sector |

ii

| | market where Concur’s integrated travel and expense management solution was selected to power the U.S. General Services Administration (GSA) program for managing online bookings, travel authorizations and voucher processing. |

| | • | | We unveiled new partnerships and integrations, such as Trip Maximizer for Concurforce, the Concur offering designed especially for Salesforce.com customers, and cloud-to-cloud integration with Netsuite. |

| | • | | We continued to help fuel the growth of the travel industry through strategic investments in creative emerging companies, including Buuteeq, Inc., Room 77, Inc., Nor1, Inc., Yapta, Inc., and Evature Technologies. |

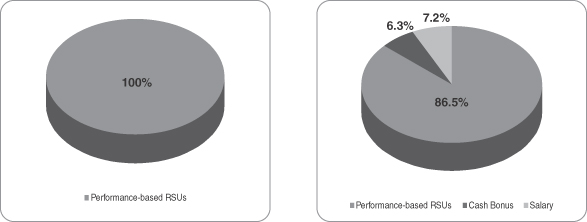

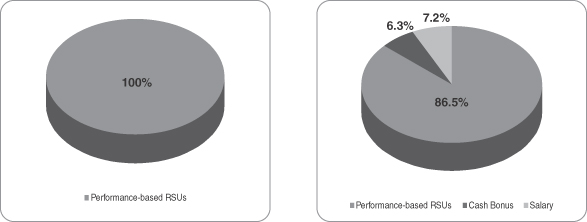

Best Practices in Executive Compensation

Our executive compensation program incentivizes superior individual and business performance. Some of our leading practices include:

| | • | | CEO pay is aligned with performance; |

| | • | | Executive base salaries were not increased in fiscal 2012; |

| | • | | Cash incentive awards are linked to Company performance; |

| | • | | Most pay is in the form of long-term equity incentive awards, which are linked to Company performance; |

| | • | | No cash incentive awards are paid, and no equity incentive awards will vest, if Company performance is below target; |

| | • | | Executive compensation recovery policy applies to incentive-based cash compensation; |

| | • | | No executives are contractually entitled to cash severance or change-in-control payments; and |

| | • | | Stock ownership guidelines apply to our executive officers and directors. |

2014 Annual Meeting

| | • | | Stockholder proposals submitted for inclusion in our 2014 Proxy Statement pursuant to SEC Rule 14a-8 must be delivered to us by October 2, 2013; and |

| | • | | Notice of stockholder proposals to be raised from the floor of the 2014 Annual Meeting of Stockholders outside of SEC Rule 14a-8 must be delivered to us no earlier than December 13, 2013 and no later than January 12, 2014. |

iii

Special Note about Forward-Looking Statements

This Proxy Statement contains forward-looking statements regarding our plans, objectives, expectations, intentions, future financial performance, future financial condition, and other statements that are not historical facts. These statements can be identified by our use of the future tense, or by forward-looking words such as “may,” “will,” “expect,” “anticipate,” “believe,” “intend,” “estimate,” “continue” and other similar words and phrases. These forward-looking statements involve many risks and uncertainties, as described in the section titled “Risk Factors,” in our Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”). The occurrence of any of these risks and uncertainties may cause our actual results to differ materially from those anticipated in our forward-looking statements, which could have a material adverse effect on our business, results of operations, and financial condition. All forward-looking statements included in this report are based on information available to us as of the date of this report. We undertake no obligation to revise or update any such forward-looking statements for any reason.

iv

Table of Contents

v

vi

Information about the Meeting

This Proxy Statement was first mailed to stockholders on or about January 30, 2013. It is furnished in connection with the solicitation of proxies by the Board of Directors of Concur Technologies, Inc. (“Concur”) to be voted at the 2013 Annual Meeting of Stockholders for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders. The Annual Meeting of Stockholders will be held at 11:00 a.m. Pacific Time on March 13, 2013 at the Harbor Club, 777 108th Avenue Northeast, Bellevue, Washington 98004. Stockholders who execute proxies retain the right to revoke them at any time before the shares are voted by proxy at the Meeting. A stockholder may revoke a proxy by delivering a signed statement to our Corporate Secretary at or prior to the Meeting or by timely executing and delivering, by Internet, telephone, mail, or in person at the Meeting, another proxy dated as of a later date.

Internet Availability of Proxy Materials

Stockholders may access this Proxy Statement, the accompanying Notice of Annual Meeting and annual information, a voting proxy, and our Annual Report on Form 10-K for fiscal year ended September 30, 2012 atwww.proxyvote.com.

Proposals to be Voted on at the Meeting

Proposal 1: Election of Class II Director

Gordon Eubanks, our Class II director nominee, has been nominated for election at the Meeting to hold office until the 2016 Annual Meeting of Stockholders. Mr. Eubanks was evaluated and recommended by the Nominating and Corporate Governance Committee in accordance with its charter and our Corporate Governance Guidelines, and such nomination was approved by our Board of Directors.

Proposal 2: Approval of Amended and Restated 2007 Equity Incentive Plan

Our Board of Directors requests that the stockholders approve the Amended and Restated 2007 Equity Incentive Plan (“2007 Plan”), pursuant to the following resolution:

“RESOLVED, that Concur’s stockholders approve Concur’s Amended and Restated 2007 Equity Incentive Plan (“2007 Plan”) as disclosed in Concur’s Proxy Statement for the 2013 Annual Meeting of Stockholders, including amendments to increase the authorized number of shares of common stock available for issuance thereunder by 4,600,000 and to make certain technical amendments to enable shares withheld or remitted to Concur to satisfy a participant’s tax withholding obligations related to awards issued thereunder the 2007 Plan to become available for issuance under the Amended and Restated 2007 Equity Incentive Plan, and to approve the 2007 Plan for purposes of Section 162(m) of the Internal Revenue Code of 1986, as amended.”

Proposal 3: Ratification of Grant Thornton LLP as Our Independent Auditor for Fiscal 2013

The Audit Committee has selected Grant Thornton LLP (“Grant Thornton”) to serve as our independent registered public accounting firm for the fiscal year ending September 30, 2013. The Audit Committee requests that the stockholders ratify its selection of Grant Thornton to serve as Concur’s independent registered public accounting firm for fiscal 2013.

1

Proposal 4: Advisory Vote on Executive Compensation

Our Board of Directors requests that the stockholders approve, on an advisory basis, the compensation paid to Concur’s Named Executive Officers, as described in “Executive Compensation”, pursuant to the following resolution:

“RESOLVED, that Concur’s stockholders approve, on an advisory basis, the compensation of the executive officers, as disclosed in Concur’s Proxy Statement for the 2013 Annual Meeting of Stockholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, the 2012 Summary Compensation Table and the other related tables and disclosure.”

Other Business

The Board of Directors does not intend to bring any other business before the Meeting, and so far as is known to our Board, no matters are to be brought before the Meeting other than as specified in the notice of Meeting. In addition to the scheduled items of business, the Meeting may consider other stockholder proposals and matters relating to the conduct of the Meeting. As to any other business that may properly come before the Meeting, proxies will be voted in accordance with the judgment of the persons voting such proxies.

We expect that representatives of Grant Thornton, independent auditor for Concur for fiscal 2012 and the current fiscal year, will be present at the Meeting and will be available to respond to appropriate questions.

Voting Procedures

Shares of Concur’s Common Stock Entitled to Vote

Shares of Concur’s common stock are the only shares entitled to vote at the Meeting. On January 18, 2013, the record date for determining stockholders entitled to vote at the Meeting, there were 55,116,051 shares of Concur common stock outstanding. Each stockholder of record on the record date is entitled to one vote for each share of common stock held by such stockholder on that date.

Voting in Person

Stockholders may vote in person at the Meeting, which will be held at the Harbor Club, 777 108th Avenue Northeast, Bellevue, Washington, at 11:00 a.m. Pacific Time on Wednesday, March 13, 2013. Directions may be obtained by contacting Concur’s Corporate Secretary, Kyle Sugamele, 18400 N.E. Union Hill Road, Redmond, Washington 98052 or at (425) 702-8808.

Voting by Mail

Stockholders may vote by mail by signing, dating and returning their proxy card in the self-addressed, postage-paid envelope provided. If you sign and return your proxy card but do not give voting instructions, the shares represented by the proxy will be voted as recommended by the Board of Directors.

2

Voting Electronically via the Internet or Telephone

Stockholders whose shares are registered directly with Wells Fargo Shareowner Services may vote their shares either through the Internet or by calling Wells Fargo Shareowner Services. Specific instructions to be followed by any such registered stockholder interested in voting over the Internet or by telephone are set forth on the accompanying proxy card. The Internet and telephone voting procedures are designed to authenticate stockholder identity, allow stockholders to vote their shares, and confirm that their voting instructions have been properly recorded.

If your shares are registered in the name of a bank or brokerage, you may also be eligible to vote your shares electronically over the Internet or by telephone. Many banks and brokerage firms participate in the Broadridge Investor Communication Services online program, which provides eligible stockholders who receive a paper copy of the Proxy Statement and related proxy materials the opportunity to vote via the Internet or by telephone. If your bank or brokerage firm participates in this Broadridge program, your bank or brokerage firm will provide a voting form with specific instructions for voting your shares. If your voting form does not reference Internet or telephone information, please complete and return the paper proxy card in the self-addressed, postage-paid envelope provided.

If you vote via the Internet or by telephone, do not return your proxy card.

Revocation of Your Proxy

You may revoke your proxy or change your proxy instructions at any time before the Meeting. To do this, send a written notice of revocation, or another signed proxy card with a later date, to Concur, to the attention of Concur’s Corporate Secretary, Kyle Sugamele, 18400 N.E. Union Hill Road, Redmond, Washington 98052. To be effective, Concur must receive your written notice of revocation or newly signed proxy card prior to the beginning of the Meeting. You may also revoke your proxy by attending the Meeting and voting in person.

Please note, however, that if you wish to vote at the Meeting and your shares are held of record by a broker, bank, or other nominee, you must bring to the Meeting a letter from the broker, bank, or other nominee confirming your beneficial ownership of the shares and that such broker, bank, or other nominee is not voting your shares.

Vote Tabulation; Vote Required; Effect of Abstentions and Broker Non-Votes

Vote Tabulation

A majority of the outstanding shares of common stock must be present or represented at the Meeting in order to have a quorum for the conduct of business. Votes cast at the Meeting, by proxy or in person, will be tabulated by the inspector of elections appointed for the Meeting.

Whether or not you are able to attend the Meeting, we urge you to vote by mail or electronically via the Internet or by telephone so that your shares will be represented at the Meeting. If you do not specify otherwise on your properly executed proxy card or over the telephone or via the Internet, your shares will be voted as follows:

| | 1. | FOR the director nominee identified in Proposal 1 |

3

| | 5. | To grant the proxy holders discretion to vote for or against other matters that may properly come before the Meeting (including any adjournment to the Meeting to another place and time). |

Vote Required

With respect to Proposal 1, the nominee for election to the Board of Directors who receives the highest number of affirmative votes at the Meeting will be elected to fill the open seat. The affirmative vote of the holders of a majority of the shares present at the Meeting and voted for or against the proposal is necessary for approval of Proposal 2 (approval of the 2007 Plan), Proposal 3 (ratification of independent auditor), and Proposal 4 (advisory vote on executive compensation).

If shares are present at the Meeting in person or by proxy, but are not voted, those shares will count toward determining whether or not a quorum is present for the conduct of business at the Meeting, as will all shares voted “for”, “against”, or “abstain” on a proposal. Shares not voted, and abstentions, will have no effect on the outcome of any proposal.

If the beneficial owner of shares that are held of record by a broker does not instruct the broker how to vote the shares, the broker has authority under applicable stock market rules to vote those shares for or against “routine” matters, such as the proposal regarding ratification of independent auditor (Proposal 3). Where a matter is not considered routine, in this case the election of the Class II director (Proposal 1), the approval of the 2007 Plan (Proposal 2), and the advisory vote on executive compensation (Proposal 4), the shares held by the broker will not be voted absent specific instructions from the beneficial holder, and will not affect the outcome of the proposal.

Solicitation of Proxies

Concur will bear the entire cost of solicitation, including the preparation, assembly, printing and mailing of this Proxy Statement, the Notice of Annual Meeting, the Annual Report on Form 10-K, and any additional solicitation materials furnished to stockholders. Copies of solicitation materials will be furnished to brokerage houses, fiduciaries and custodians holding shares in their names that are beneficially owned by others, so that they may forward those solicitation materials to the beneficial owners. Officers and employees of Concur may, without being additionally compensated, solicit proxies by mail, telephone, facsimile or personal contact. Concur will pay all proxy-soliciting expenses in connection with the solicitation of votes for the Meeting.

Householding of Proxy Materials

The SEC has adopted rules that permit companies and intermediaries (such as brokers) to satisfy the delivery requirements for proxy statements and annual reports, including notices of Internet availability of proxy materials, with respect to two or more stockholders sharing the same address by delivering a single notice of Internet availability of proxy materials or other proxy materials addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially means extra convenience for stockholders and cost savings for companies.

4

A number of brokers with account holders who are Concur stockholders may be “householding” our proxy materials. A single copy of the Notice of Annual Meeting or other proxy materials may be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker that they will be “householding” communications to your address, “householding” will continue until you are notified otherwise or you submit contrary instructions.

If you no longer wish to participate in “householding” and would prefer to receive a separate Notice of Annual Meeting or other proxy materials, you may notify your broker, direct your written request to Concur’s Corporate Secretary, Kyle Sugamele, at 18400 N.E. Union Hill Road, Redmond, Washington 98052 or at (425) 702-8808.

Stockholders who currently receive multiple copies of the Notice of Annual Meeting or other proxy materials at their addresses and would like to request “householding” of their communications should contact their brokers. In addition, we will promptly deliver, upon written or oral request to the address or telephone number above, a separate copy of the Notice of Annual Meeting to a stockholder at a shared address to which a single copy of the documents was delivered.

Where to Find More Proxy Voting Information

| | • | | The Securities and Exchange Commission website has a variety of information about the proxy voting process atwww.sec.gov/spotlight/proxymatters.shtml. |

| | • | | Contact Concur’s Corporate Secretary, Kyle Sugamele, through our website atwww.concur.com or by phone at (425) 702-8808. |

| | • | | Contact the broker or bank through which you beneficially own your shares. |

5

Corporate Governance at Concur

Corporate Governance Principles and Practice Highlights

Concur is committed to excellence in corporate governance and maintains policies and practices that promote good corporate governance. Many of these policies and practices are designed to ensure compliance with listing requirements of the NASDAQ Stock Market (“NASDAQ”); others are designed to implement corporate governance preferences of the Board.

Corporate Governance Guidelines

Our Corporate Governance Guidelines describe our governance framework. The Corporate Governance Guidelines are intended to ensure our Board has the necessary authority and practices in place to review and evaluate our business operations and to make decisions that are independent of management. Our Corporate Governance Guidelines also are intended to align the interests of directors and management with those of our stockholders, and comply with or exceed the requirements of the NASDAQ listing standards and applicable law. They establish the practices our Board follows with respect to:

| | • | | Board composition and member selection; |

| | • | | Board meetings and involvement of senior management; |

| | • | | chief executive officer performance evaluation; |

| | • | | management succession planning; |

Our Board annually conducts a self-evaluation to assess its adherence to the Corporate Governance Guidelines and committee charters and to identify opportunities to improve Board performance. The Board annually reviews our Corporate Governance Guidelines and committee charters and updates them as necessary to reflect changes in regulatory requirements and evolving oversight practices.

Board Independence

| | • | | A majority of our directors are independent of Concur and management. We are committed to maintaining a majority of independent directors. |

| | • | | The independent directors meet regularly without management present. |

| | • | | Randall H. Talbot serves as the Board’s Lead Independent Director. That role is described below under “—Lead Independent Director.” |

Board Committee Independence and Expertise

| | • | | Only independent directors are members of the Audit, Compensation, and Nominating and Corporate Governance Committees. |

| | • | | Jeffrey T. Seely, a member of the Audit Committee, is an “audit committee financial expert” as defined under SEC rules. |

6

Hedging and Pledging Policies

| | • | | Our directors and executive officers are prohibited from hedging their ownership of Concur stock, including trading in options, puts, calls, or other derivative instruments related to Concur stock or debt, in accordance with our anti-hedging policy. |

| | • | | Our directors and executive officers are prohibited from pledging their ownership of Concur stock in accordance with our anti-pledging policy. |

Risk Oversight

| | • | | The Board of Directors exercise oversight of strategic and major operational risks to Concur. |

| | • | | The Audit Committee periodically reviews and assesses Concur’s major financial risk exposures, its financial reporting and Concur’s system to monitor business risk. |

The Compensation Committee considers whether our compensation programs create incentives to take excessive or unreasonable risks that would harm Concur.

The Nominating and Corporate Governance Committee considers governance-related risks in the course of performing its remuneration and policy functions.

Stock Ownership

| | • | | Our Board of Directors has adopted stock ownership guidelines for all directors and executive officers. The guidelines were established to promote a long-term perspective in managing the enterprise, and to help align the interests of our stockholders, executives, and directors. A more complete description of the stock ownership requirements appears in “Executive Compensation.” |

Other Policies and Procedures

| | • | | Concur has an anonymous compliance reporting system available to all employees, and the Audit Committee has procedures in place for the anonymous submission of employee complaints on accounting, internal accounting controls, or auditing matters. |

| | • | | Concur has adopted a code of ethics that applies to all of its directors, officers and employees. |

Key information regarding Concur’s corporate governance initiatives, including Concur’s Corporate Governance Principles, Code of Business Conduct and Ethics and the charter for each standing committee of the Board, is posted on our website atwww.concur.com.

Chairman of the Board

S. Steven Singh has served as a member of our Board of Directors since 1993, as our Chief Executive Officer since 1996, and as Chairman of the Board since 1999. In light of Mr. Singh’s knowledge of Concur and our industry, and his experience successfully navigating Concur through many successes and challenges, we believe it is appropriate for him to have the principal leadership position on both the executive management team

7

and the Board of Directors. We have no policy mandating whether the positions of Chief Executive Officer and Chairman of the Board should be combined or separated.

Lead Independent Director

In fiscal 2010, we augmented our Board leadership structure by creating the position of Lead Independent Director and appointing Mr. Talbot to that position. Our objective in creating this position was to provide formal support to Mr. Singh in his management of Board affairs, and to acknowledge general investor interest in a greater role of independent directors in the leadership of the Board of Directors.

Our Lead Independent Director has the following roles and responsibilities:

| | • | | serving as a liaison between the Chairman of the Board and the Board’s independent directors; |

| | • | | presiding over all Board meetings when the Chairman of the Board is not present; |

| | • | | presiding over all executive sessions of the Board’s independent directors; |

| | • | | convening and presiding over any meetings of the Board’s independent directors that may be necessary from time to time; |

| | • | | coordinating feedback to the Chairman of the Board and Chief Executive Officer on behalf of the Board’s independent directors regarding business issues and management; |

| | • | | consulting with the Chairman of the Board and Chief Executive Officer with respect to agendas for Board meetings and information needs associated with such meetings; |

| | • | | serving as a designated spokesperson for the Board when the Board or the Board’s independent directors determine it would be appropriate for the Lead Independent Director to comment publicly on any matter; |

| | • | | being available for consultation and communication with Concur’s stockholders when the Board or the Board’s independent directors determine it would be appropriate for the Lead Independent Director to do so; and |

| | • | | performing such other duties as may be necessary for the Lead Independent Director to fulfill these responsibilities, or as may be requested by the Board, the Board’s independent directors, or the Chairman of the Board. |

Director Independence

Our Corporate Governance Guidelines provide that a majority of our directors will be independent and that the Board of Directors must affirmatively determine that a director has no relationship that would interfere with his or her exercise of independent judgment in carrying out the responsibilities of a director. Our Board of Directors annually reviews director independence with reference to the independence requirements of NASDAQ. To facilitate this review, annually each director completes a questionnaire that provides information about relationships that might affect the determination of independence. Management also provides our Board with relevant facts and circumstances of any relationship bearing on the independence of a director or nominee.

8

The Board of Directors has analyzed the independence of each director and determined that a majority of our directors meet the standards of independence under our Corporate Governance Guidelines and applicable NASDAQ listing standards, including that the director is free of any relationship that would interfere with his or her individual exercise of independent judgment.

Board Oversight of Risk Management

Risk is inherent in business, particularly for technology companies pursuing long-term growth opportunities. Our management is responsible for day-to-day risk management activities in the business. The Board of Directors, acting directly and through its committees, is responsible for oversight of Concur’s risk management. With the oversight of the Board of Directors, Concur has implemented practices and programs designed to help manage the risks to which we are exposed in our business and to align risk-taking appropriately with our efforts to increase stockholder value.

The Board’s risk oversight areas of focus include, but are not limited to:

| | • | | management and Board succession planning; |

| | • | | assessment of strategic risk and major operational risks, including acquisitions and evaluation of our capital structure; and |

| | • | | legal and regulatory compliance. |

The Board conducts its risk oversight both directly and through its committees. The Board’s oversight of risks occurs as an integral and continuous part of its general oversight of the business of Concur. In addition, the Audit Committee has primary responsibility for overseeing risks associated with our financial statements and financial reporting, credit and liquidity, and legal and regulatory compliance. The Audit Committee receives updates and discusses individual and overall risk areas during its meetings, including financial risk assessments, risk management policies and major financial risk exposures, and the steps management has taken to monitor and control those exposures. The Compensation Committee considers the risks associated with our compensation policies and practices, with respect to both executive compensation and employee compensation generally. The Compensation Committee receives reports and discusses whether our compensation policies and practices create risks that are reasonably likely to have a material adverse effect on Concur. The Nominating and Corporate Governance Committee oversees risks associated with our governance practices, director succession and the leadership structure of the Board.

The Board is kept abreast of its committees’ risk oversight and other activities through reports of the committee chairmen during Board meetings, and through the attendance of committee meetings by Board members who are not necessarily members of the particular committee.

Procedures for Nominating Directors

The Nominating and Corporate Governance Committee generally identifies potential nominees based upon suggestions by our outside directors, members of management, or stockholders, and then evaluates the candidates based upon various factors, including:

| | • | | high level of education and/or business experience; |

9

| | • | | broad-based business acumen; |

| | • | | understanding of our business and industry; |

| | • | | strategic thinking and willingness to share ideas, network of contacts, and diversity of experience; |

The committee uses these and other criteria to evaluate potential nominees. The committee does not have a formal policy with regard to the consideration of diversity in identifying and evaluating potential nominees, but the Board of Directors and the committee believe that the Board of Directors should include a diversity of experience and perspective on business opportunities and challenges. The committee does not evaluate proposed nominees differently depending upon who has proposed the nominee. To date, we have not paid any third-party fees to assist in this process.

The Nominating and Corporate Governance Committee will consider, and make recommendations to the Board of Directors regarding, any stockholder recommendations for candidates to serve on the Board of Directors. However, it has not adopted a formal process for that consideration because it believes that the informal consideration process has been adequate given the historical absence of those proposals. The committee will review periodically whether a more formal policy should be adopted. If a stockholder wishes to suggest a candidate for committee consideration, the stockholder should send the name of the recommended candidate for director, together with pertinent biographical information, a document indicating the candidate’s willingness to serve if elected, and evidence of the nominating stockholder’s ownership of Concur stock, to the attention of Concur’s Corporate Secretary, Kyle Sugamele, 18400 N.E. Union Hill Road, Redmond, Washington 98052 at least six months prior to the 2014 Annual Meeting of Stockholders to ensure time for meaningful consideration by the committee. For additional nominating requirements, please see “Proposals to be Voted on at the Meeting—Stockholder Proposals for 2014 Annual Meeting” below. To date, we have not had any candidates submitted by any stockholders for the 2014 Annual Meeting.

Certain Relationships and Related-Person Transactions

The Audit Committee of the Board of Directors is responsible for review, approval, or ratification of “related-person transactions” between Concur or its subsidiaries and related persons. Under SEC rules, a related person is a director, officer, nominee for director, or 5% stockholder of the company since the beginning of the last fiscal year, and the immediate family members of these persons. Concur has adopted procedures that apply to any transaction or series of transactions in which Concur or a subsidiary is a participant, the amount involved exceeds $120,000, and a related person has a direct or indirect material interest. Potential transactions involving related persons are reviewed by Concur’s disclosure controls committee. The disclosure controls committee considers whether a transaction may constitute a “related-person transaction” and, if so, any such transaction is forwarded to the Audit Committee for review. The Audit Committee determines whether any such transaction constitutes a “related-person transaction” and may approve, ratify, rescind, or take other action with respect to the transaction in its discretion. There were no “related-person transactions” identified in fiscal 2012.

10

Section 16(a) Beneficial Ownership and Reporting Compliance

Concur’s directors and officers, and any persons who own more than 10% of Concur’s common stock, are required under Section 16(a) of the Securities Exchange Act of 1934 to file initial reports of ownership and reports of changes in ownership with the SEC. Specific due dates have been established by the SEC, and Concur is required to disclose in this Proxy Statement any failure to file by those dates. Based solely upon its review of the copies of such reports for fiscal 2012 as furnished to Concur and written representations from Concur’s directors and officers, Concur believes that all directors, officers, and greater-than-10% beneficial owners have made all required Section 16(a) filings on a timely basis for such fiscal year, other than a Form 4 for Elena A. Donio, which was filed on August 15, 2012 for a transaction that occurred on August 10, 2012.

Code of Business Conduct and Ethics

The Board of Directors has adopted a Code of Business Conduct and Ethics that applies to all directors, officers, and employees of Concur, as required by applicable securities laws and the rules of the SEC and NASDAQ listing standards. A copy of the Code of Business Conduct and Ethics is posted on our website atwww.concur.com.

Stockholder Communications

Stockholders may contact an individual director, the Lead Independent Director, our Board of Directors as a group, or a specified Board committee or group, including the non-employee directors as a group, by contacting Concur’s Corporate Secretary, Kyle Sugamele, through the following means.

| | |

| Website: | | www.concur.com |

| Phone: | | (425) 702-8808 |

| Mail: | | Corporate Secretary |

| | Concur Technologies, Inc. |

| | 18400 N.E. Union Hill Road |

| | Redmond, Washington 98052 |

Each communication should specify the applicable addressee or addressees to be contacted. Management will initially receive and process communications before forwarding them to the addressee(s). We also may refer communications to other departments in Concur. We generally will not forward to the directors a communication that is primarily commercial in nature, relates to an improper or irrelevant topic, or requests general information about Concur.

11

Our Board of Directors

General

Concur’s Board of Directors consists of seven members. Board members are divided into Class I, Class II, and Class III directors, who serve staggered three-year terms. Each director serves for a term ending at the third Annual Meeting of Stockholders following the Annual Meeting at which he was elected, except that any director appointed by the Board serves for a term ending at the Annual Meeting of Stockholders for the class to which the director was appointed. Each director serves until his successor is elected and qualified or until his earlier death, resignation, or removal.

We ask that our stockholders approve Proposal 1, which nominates Gordon Eubanks, our Class II director nominee, for election at the Meeting to hold office until the 2016 Annual Meeting of Stockholders. Information about the professional background, qualifications, and other board memberships for Mr. Eubanks and the other members of the Board of Directors is provided below.

Meetings and Meeting Attendance

The Board of Directors held nine meetings during fiscal 2012. Each incumbent director attended at least 75% of the aggregate number of Board meetings and meetings of committees on which such director served. Directors are encouraged to attend the Meeting. Six directors attended the 2012 Annual Meeting. The Board determined that each of directors Eubanks, McCabe, Seely and Talbot is an independent director as defined in the NASDAQ listing standards.

The Board’s three standing committees are the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee.

Our Board of Directors holds regularly scheduled quarterly meetings. Typically, committee meetings occur the day before a Board meeting. In addition to the quarterly meetings, typically there are special ad hoc meetings each year. At each quarterly Board meeting, time is set aside for the independent directors to meet without management present.

Our Continuing Class I Directors (term to expire in 2015)

S. Steven Singh | S. Steven Singh, age 51, has served as Concur’s Chief Executive Officer since 1996 and as a director since 1993, including service as Chairman of the Board of Directors since 1999. Prior to joining Concur, Mr. Singh was General Manager of the Contact Management Division at Symantec Corporation, an international technology firm focused on protecting information and computer systems. Mr. Singh serves on the boards of directors of CornerStone OnDemand, ClearTrip Inc., Buuteeq, Inc., and ModuMetal. In addition, Mr. Singh serves as a director at the Washington Roundtable, Chairman of the GBTA Foundation, a director of the W Fund, and a member of the Advisory Board for the Foster School of Business at the University of Washington. S. Steven Singh and Rajeev Singh are brothers. We believe Mr. Singh’s specific attributes that qualify him to serve as a member of |

12

| | our Board of Directors include his perspective as one of our founders and as a large stockholder, his experience as our Chief Executive Officer for many years, his extensive knowledge of the expense management and corporate travel management industries, and his related operational expertise, historic knowledge and familiarity with Concur’s evolution and development. |

Jeffrey T. Seely | Jeffrey T. Seely, age 58, has been a director of Concur since 2005. From 2008 to August 2010, he served as director and Chief Executive Officer of Recruiting.com Inc. (formerly known as Jobster, Inc.), a provider of on-line corporate recruiting software. From 1998 to 2007, he served as the President and Chief Executive Officer of ShareBuilder Corporation, an on-line brokerage company, and from 2002 to 2007 he served as the Chairman of the Board of Directors of that company. Mr. Seely serves as a trustee of the Washington State Investment Board, which manages the pension fund assets for Washington state employees and retirees. Mr. Seely is a member of our Audit Committee and Nominating and Corporate Governance Committee. We believe Mr. Seely’s specific attributes that qualify him to serve as a member of our Board of Directors include his experience as an entrepreneur and chief executive, and his knowledge of on-line businesses. |

Randall H. Talbot | Randall H. Talbot, age 59, has been a director of Concur since 2008. Since January 2011, Mr. Talbot has been Managing Director of Talbot Financial LLC, an investment advisory firm. Mr. Talbot served as director, Chief Executive Officer and President of Symetra Financial Corporation from 2004 to June 2010. Mr. Talbot joined the former parent of Symetra Financial Corporation, Safeco Corporation, in 1998, and from 1998 to 2004 he served as President of Safeco Life Insurance Company. Mr. Talbot serves on the board of directors of Washington Federal, Inc., a savings and loan holding company. Mr. Talbot is our Lead Independent Director and a member of our Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee. We believe Mr. Talbot’s specific attributes that qualify him to serve as a member of our Board of Directors include his experience as chief executive officer of a large financial institution, and related strategic and operational expertise. |

Our Class II Director Nominee

Gordon Eubanks | Gordon Eubanks, age 66, has been a director of Concur since 2005. Mr. Eubanks, a private investor, serves on the boards of directors of Perimeter eSecurity, PeopleAdmin, Inc., and Solera Networks, all private software companies. From October 2006 to November 2006, Mr. Eubanks served as acting Chief Executive Officer and, from 2006 to May 2009, served as a director of Asempra Technologies, a private software company sold in May 2009. From 2005 to 2006, Mr. Eubanks served as Chairman of the Board of Preventsys, an enterprise security software company, which was sold in 2006. Since 2006, Mr. Eubanks has been managing |

13

| | personal investments and working as an advisor to a number of companies. From 1999 to 2005, Mr. Eubanks served as President and Chief Executive Officer of Oblix, Inc., a provider of enterprise identity management solutions that was acquired by Oracle in 2005. From 1984 to 1999, Mr. Eubanks served as President and Chief Executive Officer of Symantec Corporation, an international technology firm focused on protecting information and computer systems. Mr. Eubanks is a member of our Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee. We believe Mr. Eubanks’ specific attributes that qualify him to serve as a member of our Board of Directors include his extensive experience as an entrepreneur and chief executive officer of a large public company, his knowledge of the technology industry generally, and related strategic and governance expertise. |

Our Continuing Class III Directors (term to expire in 2014)

Jeffrey T. McCabe | Jeffrey T. McCabe, age 56, has been a director of Concur since 2005. Since 2007, and from 2004 to 2005, Mr. McCabe engaged in a wide range of entrepreneurial activities, including strategic consulting for businesses developing new products and services. From 2005 to 2007, he served as Chief Executive Officer of Tri-Pen TravelMaster Technologies, LLC, a provider of technology solutions for the travel industry. From 1994 to 2004, he served in various executive positions at American Express, including Senior Vice President and General Manager for the United States and Canadian large-market commercial card business. Prior to that, Mr. McCabe held executive positions at Labinal S.A. and General Motors, where he worked in Europe and Asia with a focus on developing new business relationships. Mr. McCabe is a member of our Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee. We believe that Mr. McCabe’s specific attributes that qualify him to serve as a member of our Board of Directors include his experience in senior management at travel and charge-card companies, his strategic consulting experience, and his knowledge of the travel industry. |

Edward P. Gilligan | Edward P. Gilligan, age 53, has been a director of Concur since 2008. Mr. Gilligan has been Vice Chairman of American Express Company since 2007 and head of its global consumer, small business and network businesses since October 2009. From 2007 to 2009, he was head of the American Express Global Business-to-Business Group. From 2005 to 2007, he was Group President, American Express International & Global Corporate Services. Prior to that, he had been Group President, Global Corporate Services since 2000 and Group President, Global Corporate Services & International Payments, since 2003. Mr. Gilligan serves on the Concur Board of Directors pursuant to the terms of a Securities Purchase Agreement between Concur and American Express Travel Related Services Company, Inc., a wholly owned subsidiary of American Express Company. Under this |

14

| | agreement, American Express may nominate one person, initially Edward P. Gilligan, to serve on the Concur Board of Directors so long as American Express owns at least 10% of Concur’s outstanding shares of common stock and satisfies other conditions. Pursuant to American Express Company’s internal policy, Mr. Gilligan has waived any compensation he would otherwise be entitled to receive from Concur for his service as a member of our Board of Directors. Mr. Gilligan serves on the board of directors of Zipcar, Inc., a car-sharing network company. We believe Mr. Gilligan’s specific attributes that qualify him to serve as a member of our Board of Directors include his experience in senior management roles at a large financial services company, his familiarity with the travel and charge-card industries, and the perspective he brings as a representative of our largest stockholder. |

Rajeev Singh | Rajeev Singh, age 44, has been a director of Concur since 2008. Mr. Singh co-founded Concur in 1993, became Chief Operating Officer in 2002, and President in 2005. He earlier served in various roles at Concur, including Executive Vice President of Sales, Marketing & Services. Prior to joining Concur, Mr. Singh held positions at Ford Motor Company and General Motors Corporation. Mr. Singh serves on the boards of directors of PaySimple and Apptio, and holds board positions at Partnership for Learning and SeeYourImpact. Rajeev Singh and S. Steven Singh are brothers. We believe Rajeev Singh’s specific attributes that qualify him to serve as a member of our Board of Directors include the experience he brings as one of our founders and our Chief Operating Officer for many years, his extensive knowledge of the expense management and corporate travel management industries, and related familiarity with the operations of Concur. |

Board Committees

The Board of Directors has three standing committees: Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee. The membership and authority of each committee is described below, and the committee charters are available on our website atwww.concur.com.

| | | | | | | | |

| Director | | Independent Director | | Audit | | Compensation | | Nominating and

Corporate

Governance |

| | | | |

Gordon Eubanks | | X | | X | | X | | X |

| | | | |

Edward P. Gilligan | | | | | | | | |

| | | | |

Jeffrey T. McCabe | | X | | X | | X | | X |

| | | | |

Jeffrey T. Seely | | X | | X | | | | X |

| | | | |

Rajeev Singh | | | | | | | | |

| | | | |

S. Steven Singh | | | | | | | | |

| | | | |

Randall H. Talbot | | X | | X | | X | | X |

| | | | |

Total meetings held in fiscal 2012 | | N/A | | 8 | | 7 | | 2 |

15

Below is a description of each standing committee. Each committee has authority to engage legal counsel or other advisors or consultants as it deems appropriate to carry out its responsibilities.

Audit Committee

The principal functions of the Audit Committee are:

| | • | | overseeing the integrity of Concur’s financial statements and its compliance with related legal and regulatory requirements; |

| | • | | monitoring the adequacy of Concur’s accounting and financial reporting, and its internal controls and processes for financial reporting; |

| | • | | overseeing Concur’s relationship with its independent auditors, including appointing, evaluating, and setting the compensation of the independent auditors; and |

| | • | | facilitating communication among the independent auditors, Concur’s management, and the Board of Directors. |

Directors Seely, Eubanks, McCabe, and Talbot are the members of the Audit Committee. Each member of the committee meets the independence and other requirements to serve on our Audit Committee under applicable SEC rules and NASDAQ listing standards. The Board of Directors has determined that Mr. Seely is an “audit committee financial expert” as defined by the rules of the SEC. The report of the Audit Committee is provided below.

Compensation Committee

The principal functions of the Compensation Committee are:

| | • | | Reviewing, approving, and making recommendations to the Board of Directors regarding all forms of salary, bonus, and stock compensation provided to executive officers of Concur, the long-term strategy for employee compensation, the types of stock and other compensation plans to be used by Concur and the shares and amounts reserved thereunder; |

| | • | | overseeing the overall administration of Concur’s equity-based compensation and stock option plans; and |

| | • | | addressing such other compensation matters as may from time to time be directed by the Board of Directors. |

Directors Eubanks, McCabe, and Talbot are the members of the Compensation Committee. Each member of the committee meets the independence and other requirements to serve on our Compensation Committee under applicable SEC rules and NASDAQ listing standards. The report of the Compensation Committee is provided below.

Compensation Consultant

The Compensation Committee retains Compensia, Inc. (“Compensia”) to advise the Compensation Committee on marketplace trends in executive compensation, management proposals for compensation programs, and executive officer compensation decisions. Compensia also evaluates equity compensation programs generally. It also consults with the Compensation Committee about its recommendations to the Board of Directors on chief executive officer and director compensation.

16

Consultant Independence

Compensia is directly accountable to the Compensation Committee. To maintain the independence of the firm’s advice, Compensia does not provide any services for Concur other than those described above. In addition, the Compensation Committee conducted a conflict of interest assessment by using the factors applicable to compensation consultants under SEC rules, and no conflict of interest was identified.

Nominating and Corporate Governance Committee

The principal functions of the Nominating and Corporate Governance Committee are:

| | • | | assisting the Board of Directors in identifying, evaluating, and nominating candidates to serve as members of the Board of Directors; |

| | • | | recommending to the Board of Directors the director nominees for the next Annual Meeting of Stockholders; |

| | • | | reviewing and making recommendations to the Board of Directors regarding the composition and operations of the Board; and |

| | • | | reviewing and making recommendations to the Board of Directors regarding corporate governance policies and ethical conduct. |

Directors McCabe, Eubanks, Seely, and Talbot are the members of the Nominating and Corporate Governance Committee. Each member of the committee meets the independence and other requirements to serve on our Nominating and Corporate Governance Committee under applicable SEC rules and NASDAQ listing standards.

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee is, or at any time was, an officer or employee of Concur or any of its subsidiaries, and none had any related-person transaction or relationship with Concur. None of Concur’s executive officers serves or has served on the board of directors or compensation committee of any entity that has one or more executive officers serving on Concur’s Board of Directors or Compensation Committee during the most recently completed fiscal year.

17

Director Compensation

Only Board members who are not Concur employees are separately compensated for serving as members of the Board. Accordingly, Mr. Steven Singh and Mr. Rajeev Singh are not separately compensated for serving as members of the Board. In addition, Mr. Gilligan has waived all compensation for serving as a Board member, consistent with the internal policy of American Express Company. Currently, annual director compensation for our non-employee directors consists of cash and an award of restricted stock units, as follows:

| | | | |

| Position | | Annual Cash

Payment | | Annual Grant of

Restricted Stock Units |

All Non-employee Directors (1) | | $60,000 | | A number of restricted stock units

having a value of $215,000 at

time of grant (2) |

| | |

Lead Independent Director | | Additional $20,000 | | — |

| | |

Chairman of the Audit Committee | | Additional $25,000 | | — |

| | |

Member of the Audit Committee | | Additional $12,500 | | — |

| | |

Chairman of the Compensation Committee | | Additional $15,000 | | — |

| | |

Member of the Compensation Committee | | Additional $7,500 | | — |

| | |

Chairman of the Nominating and Corporate Governance Committee | | Additional $10,000 | | — |

| | |

Member of the Nominating and Corporate Governance Committee | | Additional $5,000 | | — |

| (1) | Mr. Gilligan has waived all compensation for serving as a Board member, consistent with American Express Company’s internal policy. |

| (2) | Based on the average of the closing sale prices of Concur common stock as quoted on The NASDAQ Stock Market for the thirty consecutive trading days ending with the trading day that is one trading day prior to the grant date. |

The cash and restricted stock units are awarded on March 15 of each year for service during the preceding 12 months. Restricted stock units are awarded to outside directors under our 2007 Equity Incentive Plan, and fully vest on the first anniversary of the grant date. All directors are reimbursed for reasonable travel expenses incurred to attend Board and committee meetings.

The following table shows the compensation earned in fiscal 2012 by the non-employee members of our Board of Directors. Mr. Steven Singh’s and Mr. Rajeev Singh’s compensation is detailed in “Executive Compensation” of this Proxy Statement.

| | | | | | | | | | | | |

| Name | | Fees Earned

or Paid in Cash

($) | | | Stock

Awards (1)

($) | | | Total

($) | |

Randall H. Talbot | | | 105,000 | | | | 221,469 | | | | 326,469 | |

| | | |

Jeffrey T. Seely | | | 90,000 | | | | 221,469 | | | | 311,469 | |

| | | |

Gordon Eubanks | | | 92,500 | | | | 221,469 | | | | 314,169 | |

| | | |

Jeffrey T. McCabe | | | 90,000 | | | | 221,469 | | | | 311,469 | |

| | | |

Edward P. Gilligan (2) | | | — | | | | — | | | | — | |

| (1) | Represents the grant date fair value of equity awards calculated in accordance with ASC Topic 718, Stock Compensation. Assumptions used in the calculation of this amount for purposes of our financial statements are included in Note 13 of the Notes to Consolidated Financial Statements included in our Annual Report on Form 10-K for the fiscal year ended September 30, 2012. In fiscal 2012, each non-employee director other than Mr. Gilligan was awarded a restricted stock unit covering 3,693 shares, settling in full on March 15, 2013. |

| (2) | Pursuant to American Express Company’s internal policy, Mr. Gilligan has waived any compensation he is entitled to receive from Concur for his service as a member of our Board of Directors. |

18

Amended and Restated 2007 Equity Incentive Plan

We ask that our stockholders approve Proposal 2, which amends and restates the 2007 Plan in its entirety, including amendments to increase the authorized number of shares of common stock available for issuance thereunder by 4,600,000 shares and to make certain technical amendments to enable shares withheld or remitted to Concur to satisfy a participant’s tax withholding obligations related to awards issued under the 2007 Plan to become available for issuance under the 2007 Plan.

We are also asking our stockholders to approve the material terms of the 2007 Plan to preserve corporate income tax deductions that may become available to us pursuant to Section 162(m) of the Internal Revenue Code of 1986 (“Section 162(m)”). Pursuant to Section 162(m), we generally may not deduct for federal income tax purposes compensation paid to our Chief Executive Officer and our three most highly compensated employees (referred to in the Internal Revenue Code of 1986, as amended (“the Code”), as “covered persons”) to the extent that any of these persons receive more than $1.0 million in compensation in any single year. However, if compensation qualifies as “performance-based” for Section 162(m) purposes, we may deduct it for federal income tax purposes, even if it exceeds $1.0 million in a single year. In order for future awards under the 2007 Plan to qualify as performance-based compensation, our stockholders must approve the material provisions of the 2007 Plan, as well as the types of performance criteria that may be used as performance factors under the 2005 Plan and the limits on the number of securities that may be granted to any individual in any single year.

This section of this Proxy Statement provides you with more information about the 2007 Plan.

Purpose of the 2007 Plan

The 2007 Plan allows Concur, under the direction of the Compensation Committee of the Board of Directors or those persons to whom administration of the 2007 Plan, or part of the 2007 Plan, has been delegated or permitted by law, to make grants of stock options, restricted stock, restricted stock units, stock appreciation rights and stock bonus awards to employees, directors, consultants, independent contractors and advisors. The purpose of these stock awards is to attract and retain talented employees, directors, consultants, independent contractors and advisors and further align their interests and those of our stockholders by continuing to link a portion of their compensation with Concur’s performance.

The Board of Directors believes that the increase in the number of shares reserved for issuance under the 2007 Plan is in the best interests of Concur and its stockholders because of the continuing need to provide equity-based awards to attract and retain quality employees. Competition for skilled software engineers and other key employees in the software and high technology industries is intense and the use of significant equity-based awards for retention and motivation of such personnel is pervasive in the software and high technology industries. The Board believes that the proposed authorization of additional shares for issuance under the 2007 Plan will provide Concur with additional flexibility to facilitate the expansion and retention of its workforce. The Board of Directors has not made any determinations as to the grant of any equity-based awards that would be covered by the proposed authorization of additional shares for issuance under the 2007 Plan.

19

Key Terms

The following is a summary of the key provisions of the 2007 Plan.

Term: | January 22, 2007 to January 21, 2017 |

Eligible Participants: | All employees, directors, consultants, and independent contractors of Concur or any subsidiary of Concur are eligible to receive awards under the 2007 Plan, provided they render bona fide services to Concur. The Compensation Committee will determine which individuals will participate in the 2007 Plan. As of January 18, 2013, there were approximately 2,650 employees and five non-employee directors who were eligible to participate in the 2007 Plan. |

Shares Authorized and Available for Grant: | A total of 7,000,000 shares are authorized and reserved for issuance under the 2007 Plan. As of January 18, 2013, only restricted stock units had been granted under the 2007 Plan, 2,389,591 restricted stock units are outstanding and 589,485 restricted stock units are available for grant. The proposed amendments to the 2007 Plan would increase the number of shares of common stock reserved for issuance thereunder by 4,600,000. |

Award Types: | Non-qualified stock options |

Incentive stock options

Restricted stock

Restricted stock units

Stock appreciation rights

Stock bonuses

Determining the Number of Shares Available for Grant: | For purposes of determining the number of shares available for grant under the 2007 Plan against the maximum number of shares authorized, any full-value award (i.e., issuance of shares pursuant to any award other than a stock option or a stock appreciation right) will reduce the number of shares available for issuance under the 2007 Plan by 1.5 shares for each share of such full-value award (subject to recapture in the event the award is not settled). The proposed amendments to the 2007 Plan would enable shares withheld or remitted to Concur to satisfy a participant’s tax withholding obligations related to awards issued under the 2007 Plan to become available for issuance under the 2007 Plan. |

Share Limits on Awards: | No more than 1,200,000 shares may be granted to any individual under the 2007 Plan during any calendar year, other than new employees, who are eligible to receive up to 1,500,000 shares in the |

20

| | calendar year during which they begin employment. These limits are intended to ensure that awards will qualify under Section 162(m) of the Code, if applicable. Failure to qualify under this section might result in Concur’s inability to take a tax deduction for part of its performance-based compensation to senior executives. Further, the aggregate number of shares that may be issued pursuant to the exercise of tax-favored “incentive stock options” (as defined in the Code) cannot exceed 25,000,000. The foregoing number takes into account only issuances, and is not adjusted if shares are returned to the 2007 Plan due to having been forfeited or repurchased at their original issue price. |

Vesting: | Vesting schedules will be determined by the Compensation Committee when each award is granted. Options will generally vest over four years. |

Terms during which Awards may be Outstanding: | Stock options will have a term no longer than ten years, except in the case of incentive stock options granted to holders of more than 10% of Concur’s voting power, which shall have a term no longer than five years. Stock appreciation rights will have a term no longer than ten years. Restricted stock unit awards generally will not be outstanding longer than four years from grant. Restricted stock awards and stock bonus awards result in the immediate issuance of shares. |

Repricing Prohibited: | Repricing of stock options or stock appreciation rights issued under the 2007 Plan or reducing the exercise price of those options or rights without stockholder approval is prohibited. |

Terms applicable to Stock Options and Stock Appreciation Rights

The exercise price of stock options and stock appreciation rights granted under the 2007 Plan may not be less than fair market value (generally, the last reported sale price of Concur common stock on the date of grant, and if that is not a trading day, the last reported sale price of Concur common stock on the trading day immediately prior to the date of grant). On the record date, the closing price of our common stock was $71.18 per share. The term of these awards may not be longer than ten years. The Compensation Committee will determine the other terms and conditions applicable to such award, including vesting and exercisability, at the time of grant.

Terms applicable to Restricted Stock Awards, Restricted Stock Unit Awards and Stock Bonus Awards

The Compensation Committee will determine the terms and conditions applicable to restricted stock awards, restricted stock unit awards and stock bonus awards under the 2007 Plan. The Compensation Committee may make the grant, issuance, retention and/or

21

vesting of restricted stock awards, restricted stock unit awards and stock bonus awards contingent upon continued employment with Concur, the passage of time, or such performance criteria and the level of achievement relative to such criteria, as it deems appropriate.

Eligibility Under Section 162(m)

Awards may, but need not, include performance criteria that satisfy Section 162(m). To the extent that awards are intended to qualify as “performance-based compensation” under Section 162(m), the performance criteria may include the following criteria, among others, either individually, alternatively or in any combination, applied to either Concur as a whole or to a business unit, affiliate or business segment, either individually, alternatively, or in any combination, and measured either annually or cumulatively over a period of years (or a period shorter than a year, if required in the context of the award), on an absolute basis or relative to a pre-established target, to previous years’ results or to a designated comparison group, in each case as specified by the Compensation Committee in the award:

| | • | | Net revenue or net revenue growth |

| | • | | Earnings before interest, taxes, depreciation and amortization, including earnings before interest, taxes, depreciation and amortization as adjusted by Concur in publicly reported statements |

| | • | | Operating income, including operating income as adjusted by Concur in publicly reported statements |

| | • | | Net income, including net income as adjusted by Concur in publicly reported statements |

| | • | | Earnings per share, including earnings per share as adjusted by Concur in publicly reported statements |

| | • | | Total stockholder return |

| | • | | Cash flow, including cash flow from operations |

| | • | | Employee productivity and satisfaction metrics |

| | • | | Strategic plan development and implementation (including individual performance objectives that relate to achievement of Concur’s or any business unit’s strategic plan) |

| | • | | Individual confidential business objectives |

To the extent that an award under the 2007 Plan is designated as a “performance award,” but is not intended to qualify as performance-based compensation under Section 162(m), the performance criteria can include the achievement of other strategic objectives, in addition to those listed above, as determined by the Board of Directors.

Notwithstanding satisfaction of any completion of any performance criteria described above, to the extent specified at the time of grant of an award, the number of shares of common stock, stock options or other benefits granted, issued, retainable or vested under an award on account of satisfaction of performance criteria may be reduced by the Compensation Committee on the basis of such further considerations as the Compensation Committee in its sole discretion determines.

22

Transferability