UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

¨ Preliminary Proxy Statement x Definitive Proxy Statement ¨ Definitive Additional Materials ¨ Soliciting Material Pursuant to §240.14a-12 | | ¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| |

| |

| |

Concur Technologies, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules14a-6(i)(4) and0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

2014 PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

The Annual Meeting of Stockholders of Concur Technologies, Inc. will be held at

HARBOR CLUB

777 108th Avenue NE

Bellevue, Washington 98004

on March 12, 2014, at 11:00 a.m., Pacific Standard Time

January 30, 2014

Dear Stockholder:

You are cordially invited to attend the 2014 Annual Meeting of Stockholders of Concur Technologies, Inc. (“Meeting”), which will be held at the Harbor Club, 777 108th Avenue Northeast, Bellevue, Washington, at 11:00 a.m., Pacific Standard Time on Wednesday, March 12, 2014.

Details of the business to be conducted at the Meeting are given in the attached Notice of Annual Meeting and Proxy Statement.

In 2013, we celebrated our 20th anniversary as a business, and our 15th anniversary as a publicly traded company. Over those 20 years we have taken an idea and turned it into a market defining and market leading company that has created billions of dollars in value for its stockholders, and has the capacity to cross one billion dollars in annual revenues in the upcoming years. Today, we employ nearly 4,000 people and serve more than 20,000 customers worldwide. Reflecting on the accomplishments of the past 20 years can certainly be gratifying, but as you would imagine, our focus is always on the years ahead. We are focused on how we can continue to drive value for corporate customers, business travelers, partners and suppliers. Over the past few years we have been executing against a vision to change the way our industry uses the cloud to deliver products and services in order to improve the end-to-end business travel experience. We call that vision The Perfect Trip™, and in 2013 we generated tremendous momentum around our industry to make that vision a reality.

New customers continued to embrace our services as new customer bookings in fiscal 2013 grew 40% year over year. Revenue in fiscal 2013 grew 24% to $546 million, and we added more than 4,000 new customers. We delivered compelling new services such as TripLink® and ExpenseIt® as well as significant updates to our core Travel and Expense services and our market-leading trip management service, TripIt®. We made significant progress against the ETS-2 government contracting opportunity by signing more than 70% of the addressable opportunity among civilian federal agencies. We began deploying our products across a number of agencies and, beyond our expectations, saw our first agencies go live within the fiscal year in which the business was signed. We also announced and delivered the first version of our Concur T&E Cloud, a platform that allows partners, developers and suppliers to deliver value on top of our product suite for the benefit of our customers. In fiscal 2013, nearly 200 developers have utilized and more than 50 of such developers are already providing products and services via the Concur T&E Cloud.

Business travelers and their employers are embracing the opportunities created by connecting the travel ecosystem through open systems and platforms, and we have an opportunity to deliver even greater value for them. A wide range of partners, from travel management companies to suppliers, are embracing the

opportunity to work through our Concur T&E Cloud to better serve corporate customers and business travelers.

We believe the investments we are making in distribution, service and innovation will continue to drive meaningful benefit for customers, business travelers, partners, suppliers and our company for years to come. We are afforded a position of trust and engagement to meet their needs, change the distribution model in corporate travel, and in so doing, elevate Concur to greater levels of success. We appreciate your continued support as we pursue our goals.

At this year’s Meeting, we will update you on our business and how we continue to drive innovation and offer compelling value to our partners, customers and investors. We will also review our financial performance and answer your questions.

We encourage you to use this opportunity to take part in the affairs of Concur, our collective company, by voting on the business to come before the Meeting. Whether or not you plan to attend, please complete, sign and date, and promptly return the enclosed proxy card in the accompanying reply envelope so that your shares will be represented at the Meeting. You may also submit your proxy via the Internet or telephone as specified in the accompanying Internet and telephone voting instructions. If you decide to attend the Meeting and wish to change your proxy vote, you may do so by voting in person at the Meeting.

We look forward to seeing you at the Meeting.

Sincerely,

| | | | | | |

| |

S. Steven Singh Chief Executive Officer and Chairman of the Board | |  | |

Rajeev Singh President and Chief Operating Officer |

Concur Technologies, Inc.

601 108th Avenue NE, Suite 1000

Bellevue, Washington 98004

Notice of 2014 Annual Meeting of Stockholders

| | | | |

| Time and Date | | Wednesday, March 12, 2014 at 11:00 a.m., Pacific Standard

Time |

| |

Place | | Harbor Club, 777 108th Avenue NE, Bellevue, Washington 98004 |

| | |

Items of Business | | 1. | | To elect the Class III members of the Board of Directors. |

| | |

| | 2. | | To ratify the selection of Grant Thornton LLP as Concur’s independent registered public accounting firm for the fiscal year ending September 30, 2014. |

| | |

| | 3. | | To hold an advisory vote on the compensation of executive officers. |

| | |

| | 4. | | To transact other business that may properly come before the Meeting. |

| |

Record Date | | January 17, 2014. Only stockholders of record at the close of business on the record date are entitled to receive notice of, and to vote at, the 2014 annual meeting of stockholders (“Meeting”). |

| |

Proxy Voting | | IMPORTANT: Please vote your shares at your earliest convenience. This will ensure the presence of a quorum at the Meeting. Promptly voting your shares via the Internet, by telephone, or by signing, dating, and returning the enclosed proxy card will save the expenses and extra work of additional solicitation. If you wish to vote by mail, we have enclosed an addressed envelope, postage prepaid if mailed in the United States. Submitting your proxy now will not prevent you from voting your shares at the Meeting, as your proxy is revocable at your option. |

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on Wednesday, March 12, 2014. Our Proxy Statement and Annual Report on Form 10-K are available atwww.concur.com.

By order of the Board of Directors,

S. Steven Singh

Chief Executive Officer and Chairman of the Board

Bellevue, Washington

January 30, 2014

Proxy Summary

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information you should consider, and you should read the entire Proxy Statement carefully before voting.

2014 Annual Meeting of Stockholders

| | |

Date and Time | | Wednesday, March 12, 2014 at 11:00 a.m., Pacific Standard Time |

| |

Place | | Harbor Club 777 108th Avenue NE Bellevue, Washington 98004 |

| |

Record Date | | January 17, 2014 |

| |

Voting | | Stockholders as of the record date are entitled to vote. Each share of common stock is entitled to one vote for the director nominee and one vote for each of the proposals to be voted on. |

| |

Admission | | No admission card is required to enter the Meeting. |

Meeting Agenda

| | 1. | Elect the Class III members of the Board of Directors. |

| | 2. | Ratify the selection of Grant Thornton LLP as Concur’s independent registered public accounting firm for the fiscal year ending September 30, 2014 (“fiscal 2014”). |

| | 3. | Hold an advisory vote on the compensation of executive officers. |

| | 4. | Transact other business that may properly come before the Meeting. |

Voting Matters and Vote Recommendation

| | |

| Voting Matter | | Board Vote Recommendation |

| |

Election of Class III Directors | | FOR the Director Nominees |

| |

| Ratification of Grant Thornton LLP as our independent registered public accounting firm for fiscal 2014 | | FOR |

| |

| Advisory vote on executive compensation | | FOR |

Nominees for Election—Class III Directors (term to expire in 2017)

Edward P. Gilligan, age 54, has served a director of Concur since 2008.

Jeffrey T. McCabe, age 57, has served a director of Concur since 2005.

Rajeev Singh, age 45, has served as a director of Concur since 2008.

In order to be re-elected as a director, each of Messrs. Gilligan, McCabe and Singh must receive the affirmative vote of the stockholders present at the Meeting. See “Our Board of Directors” for more information.

i

Independent Auditor Ratification

We ask that our stockholders ratify the selection of Grant Thornton LLP as our independent registered public accounting firm for fiscal 2014. See “Audit and Audit-related Matters” for more information.

Executive Compensation Advisory Vote

The Board of Directors recommends that our stockholders vote to approve, on an advisory basis, the compensation paid to our named executive officers, as described in “Executive Compensation.”

Financial and Business Highlights

In fiscal 2013, we delivered strong financial results and continued to make investments to lay the foundation for growth in fiscal 2014 and the years ahead.

Our financial highlights for fiscal 2013 include:

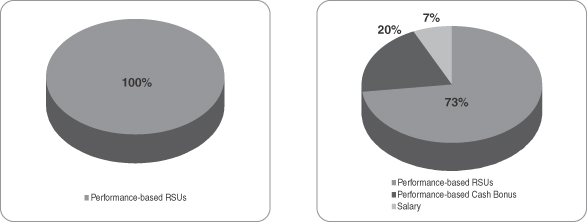

| | • | | Total revenue was $545.8 million, up 24% over fiscal 2012; |

| | • | | Non-GAAP pretax profit was $76.3 million, or $1.33 per share, compared to $78.7 million, or $1.39 per share, for fiscal 2012; |

| | • | | Cash flow from operations was $78.0 million, a decrease of 17% from fiscal 2012; and |

| | • | | The price per share of Concur common stock increased by 49% from $73.73 on the last trading day of fiscal 2012 to $110.50 per share on the last trading day of fiscal 2013. |

Our business highlights from fiscal 2013 include:

| | • | | We revolutionized the corporate travel industry by driving innovation for travelers, businesses and suppliers to fuel The Perfect Trip™. Our mission, to make travel better for the entire travel ecosystem, is supported by our product development efforts, partner and platform initiatives, investments in our Perfect Trip Fund, and strategic acquisitions. |

| | • | | We continued to extend our leadership position in travel and expense management, adding more than 4,000 customers globally in fiscal 2013, as new customer bookings grew 40% as compared to the prior fiscal year. |

| | • | | We launched TripLink to enable transactions booked through travel supplier web sites to simply and automatically appear in Concur, delivering complete visibility, streamlined expense reporting and enhanced duty of care data back to corporate clients. These services, built on the framework of our open platform, complement Concur’s and TripIt’s existing e-mail-based import tools for capturing itinerary data. |

| | • | | We continued to drive innovation and integration with our services through the Concur T&E Cloud. Our APIs enable suppliers, developers, travel management companies (“TMCs”), financial services providers, and others to connect to customers and travelers, delivering an expanded range of services and providing |

ii

| | data insight that gives customers complete clarity into the travel spend. To date, more than 300 companies and customers have built applications using our APIs and connecting to the Concur T&E Cloud. |

| | • | | We launched the Concur App Center this year to help businesses and their travelers discover applications that add value to the enterprise and significantly enhance the travel experience. The Concur App Center represents a rare opportunity for web and mobile software developers to list their apps within a corporate solution to offer both consumer and enterprise apps and then seamlessly link to users’ profiles and configurations. Additionally, we hosted the first annual Concur Developers Conference which attracted hundreds of attendees looking to network with fellow entrepreneurs and learn how to reach corporate travelers through our open platform. Entrepreneurial companies were awarded for their innovative solutions and received funding awards to fuel their businesses. |

| | • | | We celebrated a successful first year working with U.S. government agencies to deploy our travel and expense management services. Implementations are underway for many agencies, more than 10 TMCs are active in our embedded TMC program, and several agencies have already gone live, including the most recent go-live at the Department of Interior. |

| | • | | TripIt and TripIt Pro grew to more than nine million users, highlighting its rich user experience and the growing consumerization of the corporate travel market. TripIt launched many new features this year, including TripIt for Teams, Seat Tracker and a new card-centric design. TripIt has been honored repeatedly as one of the top apps for travelers. |

| | • | | Recognizing the continuous need to simplify the expense report process, we launched ExpenseIt®, representing a time-saving breakthrough by delivering a rich mobile expense app that captures receipts with a phone’s camera, automagically fills out expense line items, and integrates seamlessly with Concur Expense. |

| | • | | We extended and expanded our multi-year agreement with American Express Global Commercial Card business, continuing a long-standing relationship under which American Express promotes our solutions to its clients. We also became the first expense provider to integrate American Express’ new near real-time data capabilities, providing this exciting functionality to American Express® Corporate Card members that use Concur Expense and ExpenseIt |

| | • | | Our workforce grew by 50%, bringing our worldwide headcount to approximately 3,800 employees at the end of fiscal 2013. Employee growth was especially strong internationally, where we focus on building out global teams to serve our customers who now use our products in more than 150 countries. |

| | • | | We completed multiple strategic technology acquisitions in fiscal 2013 which provided new and expanded functionality to our existing technology stack, further extending our leadership position as the preeminent technology partner to the global travel supply chain. The additions of conTgo, TRX and GDSX brought a combination of mobile messaging infrastructure, location-based services, richer data analytics, and TMC mid-office technology to help us deliver against the vision of the Perfect Trip and enable a richer experience and a more robust Concur T&E Cloud platform. |

iii

| | • | | We launched the Concur Perfect Trip Fund to invest in and nurture emerging companies in the Concur T&E Cloud. Through this program, we have made investments in ten emerging companies spanning a range of services, content and systems that have directly enhanced our product suite. |

| | • | | We dramatically expanded the available capital for strategic investments and acquisitions with the completion of a convertible note offering. We closed the year with approximately $800 million in cash, cash equivalents, and short-term investments to execute against our growth objectives. |

2015 Annual Meeting of Stockholders

| | • | | Stockholder proposals submitted for inclusion in our 2015 Proxy Statement pursuant to SEC Rule 14a-8 must be received by us by October 2, 2014; and |

| | • | | Notice of stockholder proposals to be raised from the floor of the 2015 Annual Meeting of Stockholders outside of SEC Rule 14a-8 must be delivered to us no earlier than December 12, 2014 and no later than January 11, 2015. |

iv

Special Note about Forward-Looking Statements

This Proxy Statement contains forward-looking statements regarding our plans, objectives, expectations, intentions, future financial performance, future financial condition, and other statements that are not historical facts. These statements can be identified by our use of the future tense, or by forward-looking words such as “may,” “will,” “expect,” “anticipate,” “believe,” “intend,” “estimate,” “continue” and other similar words and phrases. These forward-looking statements involve many risks and uncertainties, as described in the section titled “Risk Factors,” in our Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”). The occurrence of any of these risks and uncertainties may cause our actual results to differ materially from those anticipated in our forward-looking statements, which could have a material adverse effect on our business, results of operations, and financial condition. All forward-looking statements included in this report are based on information available to us as of the date of this report. We undertake no obligation to revise or update any such forward-looking statements for any reason.

v

Proxy Statement Table of Contents

vi

vii

Information about the Meeting

This Proxy Statement was first mailed to stockholders on or about January 30, 2014. It is furnished in connection with the solicitation of proxies by the Board of Directors of Concur Technologies, Inc. (“Concur,” “Company,” “we” or “our”) to be voted at the 2014 Annual Meeting of Stockholders (“Meeting”) for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders. The Meeting will be held at 11:00 a.m. Pacific Standard Time on March 12, 2014 at the Harbor Club, 777 108th Avenue NE, Bellevue, Washington 98004. Stockholders who execute proxies retain the right to revoke them at any time before the shares are voted by proxy at the Meeting. A stockholder may revoke a proxy by delivering a signed statement to our Corporate Secretary at or prior to the Meeting or by timely executing and delivering, by Internet, telephone, mail, or in person at the Meeting, another proxy dated as of a later date.

Internet Availability of Proxy Materials

Stockholders may access this Proxy Statement, the accompanying Notice of Annual Meeting and annual information, a voting proxy, and our Annual Report on Form 10-K for fiscal year ended September 30, 2013 atwww.proxyvote.com.

Proposals to be Voted on at the Meeting

Proposal 1: Election of Class III Directors

Edward P. Gilligan, Jeffrey T. McCabe and Rajeev Singh, our Class III director nominees, have been nominated for election at the Meeting to hold office until the 2017 Annual Meeting of Stockholders. Messrs. Gilligan, McCabe and Singh were evaluated and recommended by the Nominating and Corporate Governance Committee in accordance with its charter and our Corporate Governance Guidelines, and such nomination was approved by our Board of Directors.

Proposal 2: Ratification of Grant Thornton LLP as Our Independent Registered Public Accounting Firm for Fiscal 2014

The Audit Committee has selected Grant Thornton LLP (“Grant Thornton”) to serve as our independent registered public accounting firm for the fiscal year ending September 30, 2014 (“fiscal 2014”). The Audit Committee requests that the stockholders ratify its selection of Grant Thornton to serve as Concur’s independent registered public accounting firm for fiscal 2014.

Proposal 3: Advisory Vote on Executive Compensation (“Say on Pay”)

Our Board of Directors (“Board”) requests that the stockholders approve, on an advisory basis, the compensation paid to Concur’s named executive officers, as described in the “Executive Compensation” section below, pursuant to the following resolution:

“RESOLVED, that Concur’s stockholders approve, on an advisory basis, the compensation of the named executive officers, as disclosed in Concur’s Proxy Statement for the 2014 Annual Meeting of Stockholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, the 2013 Summary Compensation Table and the other related tables and disclosures.”

1

Other Business

The Board does not intend to bring any other business before the Meeting, and so far as is known to our Board, no matters are to be brought before the Meeting other than as specified in the notice of Meeting. In addition to the scheduled items of business, the Meeting may consider other stockholder proposals and matters relating to the conduct of the Meeting. As to any other business that may properly come before the Meeting, proxies will be voted in accordance with the judgment of the persons voting such proxies.

We expect that representatives of Grant Thornton, independent auditor for Concur, will be present at the Meeting and will be available to respond to appropriate questions.

Voting Procedures

Shares of Concur’s Common Stock Entitled to Vote

Shares of Concur’s common stock are the only shares entitled to vote at the Meeting. On January 17, 2014, the record date for determining stockholders entitled to vote at the Meeting, there were 56,069,187 shares of Concur common stock outstanding. Each stockholder of record on the record date is entitled to one vote for each share of common stock held by such stockholder on that date.

Voting in Person

Stockholders may vote in person at the Meeting, which will be held at the Harbor Club, 777 108th Avenue Northeast, Bellevue, Washington, at 11:00 a.m. Pacific Standard Time on Wednesday, March 12, 2014. Directions may be obtained by contacting the Corporate Secretary, by mail at 601 108th Avenue NE, Suite 1000, Bellevue, Washington 98004 or by phone at (425) 590-5000.

Voting by Mail

Stockholders may vote by mail by signing, dating and returning their proxy card in the self-addressed, postage-paid envelope provided. If you sign and return your proxy card but do not give voting instructions, the shares represented by the proxy will be voted as recommended by the Board.

Voting Electronically via the Internet or Telephone

Stockholders whose shares are registered directly with Wells Fargo Shareowner Services may vote their shares either through the Internet or by calling Wells Fargo Shareowner Services. Specific instructions to be followed by any such registered stockholder interested in voting over the Internet or by telephone are set forth on the accompanying proxy card. The Internet and telephone voting procedures are designed to authenticate stockholder identity, allow stockholders to vote their shares, and confirm that their voting instructions have been properly recorded.

If your shares are registered in the name of a bank or brokerage, you may also be eligible to vote your shares electronically over the Internet or by telephone. Many banks and brokerage firms participate in the Broadridge Investor Communication Services online program, which provides eligible stockholders who receive a paper copy of the Proxy Statement and related proxy materials the opportunity to vote via the Internet or by

2

telephone. If your bank or brokerage firm participates in this program, your bank or brokerage firm will provide a voting form with specific instructions for voting your shares. If your voting form does not reference Internet or telephone information, please complete and return the paper proxy card in the self-addressed, postage-paid envelope provided.

If you vote via the Internet or by telephone, do not return your proxy card.

Revocation of Your Proxy

You may revoke your proxy or change your proxy instructions at any time before the Meeting. To do this, send a written notice of revocation, or another signed proxy card with a later date, to Concur, to the attention of our Corporate Secretary, 601 108th Avenue NE, Suite 1000, Bellevue, Washington 98004. To be effective, Concur must receive your written notice of revocation or newly signed proxy card prior to the beginning of the Meeting. You may also revoke your proxy by attending the Meeting and voting in person.

Please note, however, that if you wish to vote at the Meeting and your shares are held of record by a broker, bank, or other nominee, you must bring to the Meeting a letter from the broker, bank, or other nominee confirming your beneficial ownership of the shares and that such broker, bank, or other nominee is not voting your shares.

Vote Tabulation; Vote Required; Effect of Abstentions and Broker Non-Votes

Vote Tabulation

A majority of the outstanding shares of common stock must be present or represented at the Meeting in order to have a quorum for the conduct of business. Votes cast at the Meeting, by proxy or in person, will be tabulated by the inspector of elections appointed for the Meeting.

Whether or not you are able to attend the Meeting, we urge you to vote by mail or electronically via the Internet or by telephone so that your shares will be represented at the Meeting. If you do not specify otherwise on your properly executed proxy card or over the telephone or via the Internet, your shares will be voted as follows:

| | 1. | FOR the director nominees identified in Proposal 1; |

| | 2. | FOR Proposal 2 (ratification of independent registered public accounting firm); |

| | 3. | FOR Proposal 3 (advisory vote on executive compensation); and |

| | 4. | To grant the proxy holders discretion to vote for or against other matters that may properly come before the Meeting (including any adjournment to the Meeting to another place and time). |

Vote Required

With respect to Proposal 1, the nominees for election to the Board who receive the highest number of affirmative votes at the Meeting will be elected to fill the open seats. The affirmative vote of the holders of a majority of the shares present at the Meeting and voted for or against the proposal is necessary for approval of Proposal 2 (ratification of independent auditor) and Proposal 3 (advisory vote on executive compensation).

3

If shares are present at the Meeting in person or by proxy, but are not voted, those shares will count toward determining whether or not a quorum is present for the conduct of business at the Meeting, as will all shares voted “for”, “against”, or “abstain” on a proposal. Shares not voted, and abstentions, will have no effect on the outcome of any proposal.

If the beneficial owner of shares that are held of record by a broker does not instruct the broker how to vote the shares, the broker has authority under applicable stock market rules to vote those shares for or against “routine” matters, such as the proposal regarding ratification of independent auditor (Proposal 2). Where a matter is not considered routine, in the case of the election of the Class III directors (Proposal 1) and the advisory vote on executive compensation (Proposal 3), the shares held by the broker will not be voted absent specific instruction from the beneficial holder, and will not affect the outcome of the proposal.

Solicitation of Proxies

Concur will bear the entire cost of solicitation, including the preparation, assembly, printing and mailing of this Proxy Statement, the Notice of Annual Meeting, the Annual Report on Form 10-K, and any additional solicitation materials furnished to stockholders. Copies of solicitation materials will be furnished to brokerage houses, fiduciaries and custodians holding shares in their names that are beneficially owned by others, so that they may forward those solicitation materials to the beneficial owners. Officers and employees of Concur may, without being additionally compensated, solicit proxies by mail, telephone, facsimile or personal contact. Concur will pay all proxy-soliciting expenses in connection with the solicitation of votes for the Meeting.

Householding of Proxy Materials

The SEC has adopted rules that permit companies and intermediaries (such as brokers) to satisfy the delivery requirements for proxy statements and annual reports, including notices of internet availability of proxy materials, with respect to two or more stockholders sharing the same address by delivering a single notice of internet availability of proxy materials or other proxy materials addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially means extra convenience for stockholders and cost savings for companies.

A number of brokers with account holders who are Concur stockholders may be “householding” our proxy materials. A single copy of the Notice of Annual Meeting or other proxy materials may be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker that they will be “householding” communications to your address, “householding” will continue until you are notified otherwise or you submit contrary instructions.

If you no longer wish to participate in “householding” and would prefer to receive a separate Notice of Annual Meeting or other proxy materials, you may notify your broker, direct your written request or oral request to our Corporate Secretary by mail at 601 108th Avenue NE, Suite 1000, Bellevue, Washington 98004 or by phone at (425) 590-5000.

4

Stockholders who currently receive multiple copies of the Notice of Annual Meeting or other proxy materials at their addresses and would like to request “householding” of their communications should contact their brokers. In addition, we will promptly deliver, upon written or oral request to the address or telephone number above, a separate copy of the Notice of Annual Meeting or other proxy materials to a stockholder at a shared address to which a single copy of the documents was delivered.

Where to Find More Proxy Voting Information

| | • | | The SEC website has a variety of information about the proxy voting process atwww.sec.gov/spotlight/proxymatters.shtml. |

| | • | | Contact our Corporate Secretary through our website atwww.concur.com/en-us/investors/contact or by phone at (425) 590-5000. |

| | • | | Contact the broker or bank through which you beneficially own your shares. |

5

Corporate Governance at Concur

Corporate Governance Principles and Practice Highlights

Concur is committed to excellence in corporate governance and maintains policies and practices that promote good corporate governance. Many of these policies and practices are designed to ensure compliance with listing requirements of the NASDAQ Stock Market (“NASDAQ”); others are designed to implement corporate governance preferences of the Board.

Corporate Governance Guidelines

Our Corporate Governance Guidelines describe our governance framework. The Corporate Governance Guidelines are intended to ensure our Board has the necessary authority and practices in place to review and evaluate our business operations and to make decisions that are independent of management. Our Corporate Governance Guidelines also are intended to align the interests of directors and management with those of our stockholders, and comply with or exceed the requirements of the NASDAQ listing standards and applicable law. They establish the practices our Board follows with respect to:

| | • | | Board composition and member selection; |

| | • | | Board meetings and involvement of senior management; |

| | • | | chief executive officer performance evaluation; |

| | • | | management succession planning; |

Our Board annually conducts a self-evaluation to assess its adherence to the Corporate Governance Guidelines and committee charters, and identify opportunities to improve Board performance. The Board annually reviews our Corporate Governance Guidelines and committee charters and updates them as necessary to reflect changes in regulatory requirements and evolving oversight practices.

Board Independence

| | • | | A majority of our directors are independent of Concur and management. We are committed to maintaining a majority of independent directors. |

| | • | | The independent directors meet regularly without management present. |

| | • | | Randall H. Talbot serves as the Board’s Lead Independent Director. That role is described below under “Lead Independent Director.” |

Board Committee Independence and Expertise

| | • | | Only independent directors are members of the Audit, Compensation and Nominating and Corporate Governance Committees. |

| | • | | Jeffrey T. Seely, a member of the Audit Committee, is an “audit committee financial expert” as defined under SEC rules. |

6

Hedging and Pledging Policies

| | • | | Our directors and executive officers are prohibited from hedging their ownership of Concur stock, including trading in options, puts, calls, or other derivative instruments related to Concur stock or debt. |

| | • | | Our directors and executive officers are prohibited from pledging their ownership of Concur stock. |

Risk Oversight

| | • | | The Board exercises direct oversight of strategic and major operational risks to Concur. |

| | • | | The Audit Committee periodically reviews and assesses Concur’s major financial risk exposures, its financial reporting and Concur’s system to monitor business risk. |

| | • | | The Compensation Committee considers whether our compensation programs create incentives to take excessive or unreasonable risks that would harm Concur. |

| | • | | The Nominating and Corporate Governance Committee considers governance-related risks in the course of performing its remuneration and policy functions. |

Stock Ownership

| | • | | The Board has adopted stock ownership guidelines for all directors and executive officers. The guidelines were established to promote a long-term perspective in managing the enterprise, and to help align the interests of our stockholders, executives, and directors. A more complete description of the stock ownership requirements appears in “Executive Compensation” below. |

Other Policies and Procedures

| | • | | Concur has an anonymous compliance reporting system available to all employees, and the Audit Committee has procedures in place for the anonymous submission of employee complaints on accounting, internal accounting controls, or auditing matters. |

| | • | | Concur has adopted a code of ethics that applies to all of its directors, officers and employees. |

Key information regarding Concur’s corporate governance initiatives, including Concur’s Corporate Governance Guidelines, Code of Business Conduct and Ethics and the charter for each standing committee of the Board, is posted on our website atwww.concur.com/en-us/about.

Chairman of the Board

S. Steven Singh has served as a member of our Board since 1993, as our Chief Executive Officer since 1996, and as Chairman of the Board since 1999. In light of Mr. Singh’s knowledge of Concur and our industry, and his experience successfully navigating Concur through many successes and challenges, we believe it is appropriate

7

for him to have the principal leadership position on both the executive management team and the Board of Directors. We have no policy mandating whether the positions of Chief Executive Officer and Chairman of the Board should be combined or separated.

Lead Independent Director

In fiscal 2010, we augmented our Board leadership structure by creating the position of Lead Independent Director and appointing Mr. Talbot to that position. Our objective in creating this position was to provide formal support to Mr. Singh in his management of Board affairs, and to acknowledge general investor interest in a greater role of independent directors in the leadership of the Board.

Our Lead Independent Director has the following roles and responsibilities:

| | • | | serving as a liaison between the Chairman of the Board and the Board’s independent directors; |

| | • | | presiding over all Board meetings when the Chairman of the Board is not present; |

| | • | | presiding over all executive sessions of the Board’s independent directors; |

| | • | | convening and presiding over any meetings of the Board’s independent directors that may be necessary from time to time; |

| | • | | coordinating feedback to the Chairman of the Board and Chief Executive Officer on behalf of the Board’s independent directors regarding business issues and management; |

| | • | | consulting with the Chairman of the Board and Chief Executive Officer with respect to agendas for Board meetings and information needs associated with such meetings; |

| | • | | serving as a designated spokesperson for the Board when the Board or the Board’s independent directors determine it would be appropriate for the Lead Independent Director to comment publicly on any matter; |

| | • | | being available for consultation and communication with Concur’s stockholders when the Board or the Board’s independent directors determine it would be appropriate for the Lead Independent Director to do so; and |

| | • | | performing such other duties as may be necessary for the Lead Independent Director to fulfill these responsibilities, or as may be requested by the Board, the Board’s independent directors, or the Chairman of the Board. |

Director Independence

Our Corporate Governance Guidelines provide that a majority of our directors will be independent and that the Board must affirmatively determine that a director has no relationship that would interfere with his exercise of independent judgment in carrying out the responsibilities of a director. Our Board annually reviews director independence with reference to the independence requirements of NASDAQ’s listing rules. To facilitate this review, each director completes annually a questionnaire that provides information about relationships that might affect the determination of independence. Management also provides our Board with relevant facts and circumstances of any relationship bearing on the independence of a director or nominee.

8

The Board has analyzed the independence of each director and determined that a majority of our directors meet the standards of independence under our Corporate Governance Guidelines and applicable NASDAQ listing standards, including that the director is free of any relationship that would interfere with his or her individual exercise of independent judgment.

Board Oversight of Risk Management

Risk is inherent in business, particularly for technology companies pursuing long-term growth opportunities. Our management is responsible for day-to-day risk management activities in the business. The Board, acting directly and through its committees, is responsible for oversight of Concur’s risk management. With the oversight of the Board, Concur has implemented practices and programs designed to help manage the risks to which we are exposed in our business and to align risk-taking appropriately with our efforts to increase stockholder value.

The Board’s risk oversight areas of focus include, but are not limited to:

| | • | | management and Board succession planning; |

| | • | | assessment of strategic risk and major operational risks, including acquisitions and evaluation of our capital structure; and |

| | • | | legal and regulatory compliance. |

The Board conducts its risk oversight both directly and through its committees. The Board’s oversight of risks occurs as an integral and continuous part of its oversight of the business of Concur generally. In addition, the Audit Committee has primary responsibility for overseeing risks associated with our financial statements and financial reporting, credit and liquidity, and legal and regulatory compliance. The Audit Committee receives updates and discusses individual and overall risk areas during its meetings, including financial risk assessments, risk management policies and major financial risk exposures, and the steps management has taken to monitor and control those exposures. The Compensation Committee considers the risks associated with our compensation policies and practices, with respect to both executive compensation and employee compensation generally. The Compensation Committee receives reports and discusses whether our compensation policies and practices create risks that are reasonably likely to have a material adverse effect on Concur. The Nominating and Corporate Governance Committee oversees risks associated with our governance practices, director succession and the leadership structure of the Board.

The Board is kept abreast of its committees’ risk oversight and other activities through reports of the committee chairmen during Board meetings, and through the attendance of committee meetings by Board members who are not necessarily members of the particular committee.

Procedures for Nominating Directors

The Nominating and Corporate Governance Committee generally identifies potential nominees based upon suggestions by our outside directors, members of management, or stockholders, and then evaluates the candidates based upon various factors, including:

| | • | | high level of education and/or business experience; |

9

| | • | | broad-based business acumen; |

| | • | | understanding of our business and industry; |

| | • | | strategic thinking and willingness to share ideas, network of contacts, and diversity of experience; |

The Nominating and Corporate Governance Committee uses these and other criteria to evaluate potential nominees. It does not have a formal policy with regard to the consideration of diversity in identifying and evaluating potential nominees, but the Board and the committee believe that the Board should include a diversity of experience and perspective on business opportunities and challenges. The Nominating and Corporate Governance Committee does not evaluate proposed nominees differently depending upon who has proposed the nominee. To date, we have not paid any third-party fees to assist in this process.

The Nominating and Corporate Governance Committee will consider, and make recommendations to the Board regarding, any stockholder recommendations for candidates to serve on the Board. However, it has not adopted a formal process for that consideration because it believes that the informal consideration process has been adequate given the historical absence of those proposals. The Nominating and Corporate Governance Committee will review periodically whether a more formal policy should be adopted. If a stockholder wishes to suggest a candidate for consideration, the stockholder should send the name of the recommended candidate for director, together with pertinent biographical information, a document indicating the candidate’s willingness to serve if elected, and evidence of the nominating stockholder’s ownership of Concur stock, to the attention of our Corporate Secretary, 601 108th Avenue NE, Suite 1000, Bellevue, Washington 98004 at least six months prior to the 2015 Annual Meeting of Stockholders to ensure time for meaningful consideration by the Nominating and Corporate Governance Committee. For additional nominating requirements, please see “Proposals to be Voted on at the Meeting—Stockholder Proposals for 2015 Annual Meeting” below. To date, we have not had any candidates submitted by any stockholders for the 2015 Annual Meeting.

Certain Relationships and Related Person Transactions

The Audit Committee of the Board of Directors is responsible for review, approval, or ratification of “related-person transactions” between Concur or its subsidiaries and related persons. Under SEC rules, a related person is a director, officer, nominee for director, or 5% stockholder of Concur since the beginning of the last fiscal year, and the immediate family members of these persons. Concur has adopted procedures that apply to any transaction or series of transactions in which Concur or a subsidiary is a participant, the amount involved exceeds $120,000, and a related person has a direct or indirect material interest. Potential transactions involving related persons are reviewed by Concur’s disclosure controls committee. The disclosure controls committee considers whether a transaction may constitute a “related-person transaction” and, if so, any such transaction is forwarded to the Audit Committee for review. The Audit Committee determines whether any such transaction constitutes a “related-person transaction” and may approve, ratify, rescind, or take other action with respect to the transaction in its discretion. There were no “related person transactions” identified in fiscal 2013.

10

Section 16(a) Beneficial Ownership and Reporting Compliance

Concur’s directors and officers, and any persons who own more than 10% of Concur’s common stock, are required under Section 16(a) of the Securities Exchange Act of 1934, as amended to file initial reports of ownership and reports of changes in ownership with the SEC (“Section 16(a) filings”). Specific due dates have been established by the SEC, and Concur is required to disclose in this Proxy Statement any failure to file by those dates. Based solely upon its review of the copies of such reports for fiscal 2013 as furnished to Concur and written representations from Concur’s directors and officers, Concur believes that all directors, officers, and greater-than-10% beneficial owners have made all required Section 16(a) filings on a timely basis for such fiscal year, other than a Form 4 for Robert Cavanaugh, which was filed on September 18, 2013 for a transaction that occurred on August 15, 2013 and a Form 4 for Michael Eberhard, which was filed on December 10, 2012 for a filing that was due December 7, 2012.

Code of Business Conduct and Ethics

The Board has adopted a Code of Business Conduct and Ethics that applies to all directors, officers, and employees of Concur, as required by applicable securities laws and the rules of the SEC and NASDAQ listing standards. A copy of the Code of Business Conduct and Ethics is posted on our website atwww.concur.com/en-us/about/corporate-ethics.

Stockholder Communications

Stockholders may contact an individual director, the Lead Independent Director, our Board of Directors as a group, or a specified Board committee or group, including the non-employee directors as a group, by contacting our Corporate Secretary, through the following means:

| | |

| Website: | | www.concur.com/en-us/investors |

| Phone: | | (425) 590-5000 |

| Mail: | | Office of the Corporate Secretary |

| | Concur Technologies, Inc. |

| | 601 108th Avenue NE, Suite 1000 |

| | Bellevue, Washington 98004 |

Each communication should specify the applicable addressee or addressees to be contacted. Management will initially receive and process communications before forwarding them to the addressee(s). We also may refer communications to other departments in Concur. We generally will not forward to the directors a communication that is primarily commercial in nature, relates to an improper or irrelevant topic, or requests general information about Concur.

11

Our Board of Directors

General

Our Board of Directors consists of seven members. Board members are divided into Class I, Class II, and Class III directors, who serve staggered three-year terms. Each director serves for a term ending at the third Annual Meeting of Stockholders following the Annual Meeting at which he was elected, except that any director appointed by the Board serves for a term ending at the Annual Meeting of Stockholders for the class to which the director was appointed. Each director serves until his successor is elected and qualified or until his earlier death, resignation, or removal.

We ask that our stockholders approve Proposal 1, which nominates Edward P. Gilligan, Jeffrey T. McCabe and Rajeev Singh for election at the Meeting to hold office until the 2017 Annual Meeting of stockholders. Information about the professional background, qualifications, and other board memberships for Messrs. Gilligan, McCabe and Singh and the other members of the Board is provided below.

Meetings and Meeting Attendance

The Board held eight meetings during fiscal 2013. The Board holds regularly scheduled quarterly meetings. Each incumbent director attended at least 75% of the aggregate number of Board meetings and meetings of committees on which such director served. Directors are encouraged to attend the Meeting. Six directors attended the 2013 Annual Meeting of Stockholders. The Board determined that each of Messrs. Eubanks, McCabe, Seely, and Talbot is an independent director as defined in NASDAQ listing standards.

The Board’s three standing committees are the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee. Typically, committee meetings occur the day before the Board meeting. In addition to the quarterly meetings, typically there are special ad hoc meetings each year. At each quarterly Board meeting, time is set aside for the independent directors to meet without management present.

Our Continuing Class I Directors (term to expire in 2015)

Jeffrey T. Seely | Jeffrey T. Seely, age 59, has been a director of Concur since 2005. From 2008 until August 2010, he served as Director and Chief Executive Officer of Recruiting.com Inc. (formerly known as Jobster, Inc.), a provider of on-line corporate recruiting software. From 1998 to 2007, he served as the President and Chief Executive Officer of ShareBuilder Corporation, an on-line brokerage company, and from 2002 to 2007 he served as the Chairman of the Board of Directors of that company. Mr. Seely is a member of our Audit Committee and Nominating and Corporate Governance Committee. The specific attributes that qualify Mr. Seely to serve and that led to the conclusion that Mr. Seely should serve as a member of our Board of Directors include his experience as an entrepreneur and chief executive, and his knowledge of on-line businesses. |

12

S. Steven Singh | S. Steven Singh, age 52, has served as Concur’s Chief Executive Officer since 1996 and as a director since 1993, including service as Chairman of the Board of Directors since 1999. Prior to joining Concur, Mr. Singh was General Manager of the Contact Management Division at Symantec Corporation, an international technology firm focused on protecting information and computer systems. Mr. Singh serves on the boards of directors of CornerStone OnDemand, Buuteeq, Inc., ModuMetal and Cleartrip, Inc, where he serves as Chairman. In addition, Mr. Singh serves as a director at the Washington Roundtable, Chairman of the GBTA Foundation, a director of the W Fund, and a member of the Advisory Board for the Foster School of Business at the University of Washington. S. Steven Singh and Rajeev Singh are brothers. The specific attributes that qualify Mr. Singh to serve and that led to the conclusion that Mr. Singh should serve as a member of our Board of Directors include his perspective as one of our founders and as a large stockholder, his experience as our Chief Executive Officer for many years, his extensive knowledge of the expense management and corporate travel management industries, and his related operational expertise, historic knowledge and familiarity with Concur’s evolution and development. |

Randall H. Talbot | Randall H. Talbot, age 60, has been a director of Concur since 2008. Since January 2011, Mr. Talbot has been Managing Director of Talbot Financial LLC, an investment advisory firm. Mr. Talbot served as director, Chief Executive Officer and President of Symetra Financial Corporation from 2004 to June 2010. Mr. Talbot joined the former parent of Symetra Financial Corporation, Safeco Corporation, in 1998, and from 1998 to 2004 he served as President of Safeco Life Insurance Company. Mr. Talbot serves on the board of directors of Washington Federal, Inc., a bank holding company. Mr. Talbot is our Lead Independent Director and a member of our Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee. The specific attributes that qualify Mr. Talbot to serve and that led to the conclusion that Mr. Talbot should serve as a member of our Board of Directors include his experience as Chief Executive Officer of a large financial institution, and related strategic and operational expertise. |

Our Continuing Class II Directors

Gordon Eubanks | Gordon Eubanks, age 67, has been a director of Concur since 2005. Mr. Eubanks, a private investor, serves on the boards of directors of SilverSky, and PeopleAdmin, Inc., which are all private software companies. From October 2006 to November 2006, Mr. Eubanks served as acting Chief Executive Officer, and, from 2006 to May 2009 served as a director, of Asempra Technologies, a private software company sold in May 2009. From 2005 to 2006, Mr. Eubanks served as Chairman of the Board of Preventsys, an enterprise security software company, which was sold in 2006. Since 2006, Mr. Eubanks has been managing personal investments |

13

| | and working as an advisor to a number of companies. From 1999 to 2005, Mr. Eubanks served as President and Chief Executive Officer of Oblix, Inc., a provider of enterprise identity management solutions that was acquired by Oracle in 2005. From 1984 to 1999, Mr. Eubanks served as President and Chief Executive Officer of Symantec Corporation. Mr. Eubanks is a member of our Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee. The specific attributes that qualify Mr. Eubanks to serve and that led to the conclusion that Mr. Eubanks should serve as a member of our Board of Directors include his extensive experience as an entrepreneur and chief executive officer of a large public company, his knowledge of the technology industry generally, and related strategic and governance expertise. |

Our Class III Director Nominees

Edward P. Gilligan | Edward P. Gilligan, age 54, has been a director of Concur since 2008. Mr. Gilligan has been President of American Express Company since April 2013 and Vice Chairman from 2007. He also serves as head of its global consumer, small business and network businesses since October 2009. From 2007 to 2009, he was head of the American Express Global Business-to-Business Group. From 2005 to 2007, he was Group President, American Express International & Global Corporate Services. Prior to that, he had been Group President, Global Corporate Services since 2000 and Group President, Global Corporate Services & International Payments at American Express International & Global Corporate Services, since 2003. Mr. Gilligan serves on our Board of Directors pursuant to the terms of a Securities Purchase Agreement between Concur and American Express Travel Related Services Company, Inc., a wholly owned subsidiary of American Express Company. Under this agreement, American Express may nominate one person, initially Edward P. Gilligan, to serve on our Board of Directors so long as American Express owns at least 10% of Concur’s outstanding shares of common stock and satisfies other conditions. Pursuant to American Express Company policy, Mr. Gilligan has waived any compensation he would otherwise be entitled to receive from Concur for his service as a member of our Board of Directors. Mr. Gilligan also served on the board of directors of Zipcar, Inc., from May 2012 through March 2013. The specific attributes that qualify Mr. Gilligan to serve and that led to the conclusion that Mr. Gilligan should serve as a member of our Board of Directors include his experience in senior management roles at a large financial services company, his familiarity with the travel and charge card industries, and the perspective he brings as a representative of our largest stockholder. |

14

Jeffrey T. McCabe | Jeffrey T. McCabe, age 57, has been a director of Concur since 2005. Since 2007, and from 2004 to 2005, Mr. McCabe engaged in a wide range of entrepreneurial activities, including strategic consulting for businesses developing new products and services. From 2005 to 2007, he served as Chief Executive Officer of Tri-Pen TravelMaster Technologies, LLC, a provider of technology solutions for the travel industry. From 1994 to 2004, he served in various executive positions at American Express, including Senior Vice President and General Manager for the United States and Canadian large-market commercial card business. Prior to that, Mr. McCabe held executive positions at Labinal S.A. and General Motors, where he worked in Europe and Asia with a focus on developing new business relationships. Mr. McCabe is a member of our Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee. The specific attributes that qualify Mr. McCabe to serve and that led to the conclusion that Mr. McCabe should serve as a member of our Board of Directors include his experience in senior management at travel and charge card companies, his strategic consulting experience, and his knowledge of the travel industry. |

Rajeev Singh | Rajeev Singh, age 45, has been a director of Concur since 2008. Mr. Singh co-founded Concur in 1993, became Chief Operating Officer in 2002, and President in 2005. He earlier served in various roles at Concur, including the Executive Vice President of Sales, Marketing & Services. Prior to joining Concur, Mr. Singh held positions at Ford Motor Company and General Motors Corporation. Rajeev Singh and S. Steven Singh are brothers. The specific attributes that qualify Mr. Singh to serve and that led to the conclusion that Mr. Singh should serve as a member of our Board of Directors include the experience he brings as one of our founders and our Chief Operating Officer for many years, his extensive knowledge of the expense management and corporate travel management industries, and related familiarity with the operations of Concur. |

15

Board Committees

The Board has three standing committees: the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee. The membership and authority of each committee is described below, and the committee charters are available on our website atwww.concur.com/en-us/about/board-committees.

| | | | | | | | |

| Director | | Independent Director | | Audit | | Compensation | | Nominating

and

Corporate

Governance |

Gordon Eubanks | | X | | X | | X | | X |

| | | | |

Edward P. Gilligan | | | | | | | | |

| | | | |

Jeffrey T. McCabe | | X | | X | | X | | X |

| | | | |

Jeffrey T. Seely | | X | | X | | | | X |

| | | | |

Rajeev Singh | | | | | | | | |

| | | | |

S. Steven Singh | | | | | | | | |

| | | | |

Randall H. Talbot | | X | | X | | X | | X |

| | | | |

Total meetings in fiscal 2013 | | N/A | | 12 | | 8 | | 4 |

Below is a description of each standing committee. Each committee has authority to engage legal counsel or other advisors or consultants as it deems appropriate to carry out its responsibilities.

Audit Committee

The principal functions of the Audit Committee are:

| | • | | overseeing the integrity of our financial statements and its compliance with related legal and regulatory requirements; |

| | • | | monitoring the adequacy of our accounting and financial reporting, and its internal controls and processes for financial reporting; |

| | • | | overseeing our relationship with its independent auditors, including appointing, evaluating, and setting the compensation of the independent auditors; and |

| | • | | facilitating communication among the independent auditors, our management, and the Board. |

Messrs. Seely, Eubanks, McCabe, and Talbot are the members of the Audit Committee. Each member of the Audit Committee meets the independence and other requirements to serve on our Audit Committee under applicable SEC rules and NASDAQ listing standards. The Board has determined that Mr. Seely is an “audit committee financial expert” as defined by the rules of the SEC. The report of the Audit Committee is provided below under “Audit and Audit-related Matters.”

Compensation Committee

The principal functions of the Compensation Committee are:

| | • | | Reviewing, approving, and making recommendations to the Board of Directors regarding all forms of salary, bonus, and stock compensation provided to |

16

| | our executive officers, the long-term strategy for employee compensation, the types of stock and other compensation plans to be used by Concur and the shares and amounts reserved thereunder; |

| | • | | overseeing the overall administration of our equity-based compensation and stock option plans; and |

| | • | | addressing such other compensation matters as may from time to time be directed by the Board of Directors. |

Messrs. Eubanks, McCabe, and Talbot are the members of the Compensation Committee. Each member of the Compensation Committee meets the independence and other requirements to serve on our Compensation Committee under applicable SEC rules and NASDAQ listing standards. The report of the Compensation Committee is provided below Under “Executive Compensation.”

Compensation Consultant

The Compensation Committee retains Compensia, Inc. (“Compensia”) to advise the Compensation Committee on marketplace trends in executive compensation, management proposals for compensation programs, and executive officer compensation decisions. Compensia also evaluates equity compensation programs generally. It also consults with the Compensation Committee about its recommendations to the Board on chief executive officer and director compensation.

Consultant Independence

Compensia is directly accountable to the Compensation Committee. To maintain the independence of the firm’s advice, Compensia does not provide any services for Concur other than those described above. In addition, the Compensation Committee conducted a conflict of interest assessment by using the factors applicable to compensation consultants under SEC rules and no conflict of interest was identified.

Nominating and Corporate Governance Committee

The principal functions of the Nominating and Corporate Governance Committee are:

| | • | | assisting the Board in identifying, evaluating, and nominating candidates to serve as members of the Board; |

| | • | | recommending to the Board the director nominees for the next Annual Meeting of Stockholders; |

| | • | | reviewing and making recommendations to the Board regarding the composition and operations of the Board; and |

| | • | | reviewing and making recommendations to the Board regarding corporate governance policies and ethical conduct. |

Messrs. McCabe, Eubanks, Seely, and Talbot are the members of the Nominating and Corporate Governance Committee. Each member of the Nominating and Corporate Governance Committee meets the independence and other requirements to serve on our Nominating and Corporate Governance Committee under applicable SEC rules and NASDAQ listing standards.

17

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee is, or at any time was, an officer or employee of Concur or any of its subsidiaries, and none had any related-person transaction or relationship with Concur. None of our executive officers serves or has served on the board of directors or compensation committee of any entity that has one or more executive officers serving on our Board or Compensation Committee during fiscal 2013.

Director Compensation

Only Board members who are not Concur employees are separately compensated for serving as members of the Board. Accordingly, Messrs. Steve Singh and Rajeev Singh are not separately compensated for serving as members of the Board. In addition, Mr. Gilligan has waived all compensation for serving as a Board member, consistent with the policy of The American Express Company. Currently, annual director compensation for our non-employee directors consists of cash and an award of restricted stock units, as follows:

| | | | | | |

| Position | | Annual Cash

Payment | | | Annual Grant of

Restricted Stock Units |

| All Non-employee Directors (1) | | $ | 60,000 | | | A number of restricted stock units

having a value of $215,000 at

time of grant (2) |

| | |

| Lead Independent Director | | Additional $ | 20,000 | | | — |

| | |

| Chairman of the Audit Committee | | Additional $ | 25,000 | | | — |

| | |

| Member of the Audit Committee | | Additional $ | 12,500 | | | — |

| | |

| Chairman of the Compensation Committee | | Additional $ | 15,000 | | | — |

| | |

| Member of the Compensation Committee | | Additional $ | 7,500 | | | — |

| | |

| Chairman of the Nominating and Corporate Governance Committee | | Additional $ | 10,000 | | | — |

| | |

| Member of the Nominating and Corporate Governance Committee | | Additional $ | 5,000 | | | — |

| (1) | Mr. Gilligan has waived all compensation for serving as a Board member, consistent with The American Express Company internal policy. |

| (2) | Based on the average of the closing sale prices of Concur common stock as quoted on The NASDAQ Global Select Market for the 30 consecutive trading days ending with the trading day that is one trading day prior to the grant date. |

The cash and restricted stock units are awarded on March 15 of each year for service during the preceding 12 months. Restricted stock units are awarded to outside directors under our 2007 Equity Incentive Plan, and fully vest on the first anniversary of the grant date. All directors are reimbursed for reasonable travel expenses incurred to attend Board and committee meetings.

18

The following table shows the compensation earned in fiscal 2013 by the non-employee members of our Board. Messrs. Steve Singh’s and Rajeev Singh’s compensation is detailed below in the “Executive Compensation” section of this Proxy Statement.

| | | | | | | | | | | | |

| Name | | Fees Earned

or Paid in Cash

($) | | | Stock

Awards (1)

($) | | | Total

($) | |

Randall H. Talbot | | | 105,000 | | | | 220,864 | | | | 325,864 | |

| | | |

Jeffrey T. Seely | | | 90,000 | | | | 220,864 | | | | 310,864 | |

| | | |

Gordon Eubanks | | | 92,500 | | | | 220,864 | | | | 313,364 | |

| | | |

Jeffrey T. McCabe | | | 90,000 | | | | 220,864 | | | | 310,864 | |

| | | |

Edward P. Gilligan (2) | | | — | | | | — | | | | — | |

| (1) | Represents the grant date fair value of equity awards calculated in accordance with ASC Topic 718,Stock Compensation. Assumptions used in the calculation of this amount for purposes of our financial statements are included in Note 13 of the Notes to Consolidated Financial Statements included in our Annual Report on Form 10-K for the fiscal year ended September 30, 2013. In fiscal 2013, each non-employee director other than Mr. Gilligan was awarded a restricted stock unit covering 3,089 shares, which will settle in full on March 15, 2014. |

| (2) | Pursuant to The American Express Company internal policy, Mr. Gilligan has waived any compensation he is entitled to receive from Concur for his service as a member of our Board. |

19

Executive Officers

The following individuals are our executive officers:

S. Steven Singh,

Chief Executive Officer and Chairman of the Board | S. Steven Singh, age 52, has served as our Chief Executive Officer since 1996 and as a director since 1993, including service as Chairman of the Board of Directors since 1999. Prior to joining Concur, Mr. Singh was General Manager of the Contact Management Division at Symantec Corporation, an international technology firm focused on protecting information and computer systems. Mr. Singh serves on the boards of directors of CornerStone OnDemand, Buuteeq, Inc., ModuMetal and Cleartrip, Inc, where he serves as Chairman. In addition, Mr. Singh serves as a director at the Washington Roundtable, Chairman of the GBTA Foundation, a director of the W Fund, and a member of the Advisory Board for the Foster School of Business at the University of Washington. S. Steven Singh and Rajeev Singh are brothers. |

Rajeev Singh,

President and Chief Operating Officer | Rajeev Singh, age 45, has been a director of Concur since 2008. Mr. Singh co-founded Concur in 1993, became Chief Operating Officer in 2002, and became President in 2005. He earlier served in various roles at Concur, including the Executive Vice President of Sales, Marketing & Services. Prior to joining Concur, Mr. Singh held positions at Ford Motor Company and General Motors Corporation. Rajeev Singh and S. Steven Singh are brothers. |

Francis J. Pelzer V,

Chief Financial Officer | Mr. Pelzer, age 43, joined Concur in May 2010 as its Chief Financial Officer. From 2004 to May 2010, Mr. Pelzer served as a Director and Vice President in the Software Investment Banking group at Deutsche Bank advising software technology companies on strategic activities such as equity and debt financings, mergers and acquisitions, divestitures and other investor matters. Prior to that, Mr. Pelzer was a Vice President with Credit Suisse First Boston and a management consultant with Kurt Salmon Associates. Mr. Pelzer also serves on the board of Benefitfocus, Inc., a benefits technology provider. |

John Torrey,

Executive Vice President, Corporate Strategy | Mr. Torrey, age 41, joined Concur in October 2007 and serves as Executive Vice President of Corporate Strategy. Prior to joining Concur, he was an equity research analyst at Adams Harkness, Credit Suisse First Boston Technology Group, and Montgomery & Co., where he was also Director of Research. Mr. Torrey began his career at PricewaterhouseCoopers LLP, where he was a senior manager in the firm’s national office and corporate and operations strategy consultant. Mr. Torrey serves on the boards of directors of Cleartrip Inc., RideCharge, Inc., and Visage Mobile, Inc. |

20

Robert Cavanaugh,

Executive Vice President and General Manager, Global Enterprise Business Unit | Mr. Cavanaugh, age 44, joined Concur in 1999 and has served in various roles since that time, including: Executive Vice President and General Manager,Global Enterprise Business Units; Executive Vice President and General Manager, North America; Executive Vice President, Client Development; Executive Vice President, Business Development; Vice President of Business Development; and Senior Director, Consulting Services. Mr. Cavanaugh was appointed Executive Vice President and General Manager, Americas and Global Accounts, in November 2012. Prior to joining Concur, Mr. Cavanaugh held consulting and implementation management positions at Seeker Software and Ceridian Corporation. Mr. Cavanaugh served as an officer in the United States Army Reserve from 1991 to 2000. |

Elena A. Donio,

Executive Vice President and General Manager, Global Small and Mid-Size Business Unit | Ms. Donio, age 44, joined Concur in 1998 and has served in various roles since that time, including: Executive Vice President and General Manager, Global Small & Mid-Size Business Unit; Executive Vice President of Emerging Business; Vice President of Marketing; and Vice President of Product Management. Ms. Donio was appointed Executive Vice President and General Manager, Global Small and Mid-Size Business Unit in November 2012. Prior to joining Concur, Ms. Donio was a Senior Manager in Deloitte Consulting’s SAP practice. |

21

Executive Compensation

Compensation Discussion and Analysis

This Compensation Discussion and Analysis (“CD&A”) provides information about fiscal 2013 compensation for our Chief Executive Officer (“CEO”), our Chief Financial Officer, and our next three most highly-compensated executive officers. These individuals, who we refer to collectively as our “named executive officers” or “NEOs”, are:

| | • | | S. Steven Singh, Chief Executive Officer and Chairman of the Board; |

| | • | | Francis J. Pelzer V, Chief Financial Officer; |

| | • | | Rajeev Singh, President and Chief Operating Officer; |

| | • | | John Torrey, Executive Vice President, Corporate Strategy; and |

| | • | | Robert Cavanaugh, Executive Vice President and General Manager, Americas. |

In this CD&A we describe our executive compensation program, and how our Board of Directors (“Board”) and its Compensation Committee (“Compensation Committee”) arrived at the specific compensation decisions for our NEOs. We refer to certain non-GAAP financial measures, which are reconciled to the most directly comparable financial measures prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) in Appendix A to this proxy statement.

Response to Say-on-Pay Votes

In recent years we have modified our executive compensation programs in significant ways to address concerns expressed by our stockholders and to better align the interests of our NEOs with the interests of our stockholders, including:

| | • | | Adoption of stock ownership guidelines for our CEO, executive officers, and members of the Board; |

| | • | | Adoption of no-hedging and no-pledging policies for our CEO, executive officers, and members of the Board; |

| | • | | Adoption of an executive officer compensation recovery, or “clawback”, policy; and |

| | • | | Engaged an independent national compensation consulting firm to advise us on our executive compensation arrangements. |

The Compensation Committee considered the result of the 2013 stockholder advisory vote on our executive compensation arrangements as part of its general oversight of our executive compensation arrangements. A substantial majority (82%) of stockholders approved the executive compensation arrangements described in our Proxy Statement for the 2013 Annual Meeting; the Compensation Committee considered this to represent general support for its executive compensation philosophy and programs.

Key Elements of Our Executive Compensation Program for Fiscal 2013

We believe the key elements of our fiscal 2013 executive compensation program align the interests of our NEOs with our long-term strategic direction and the interests of stockholders, and help reduce the possibility of our NEOs making business decisions that

22

could promote short-term results or individual compensation at the expense of long-term value.

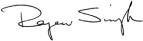

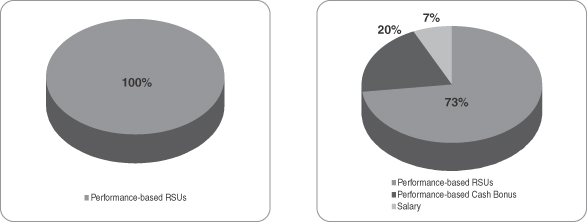

| | • | | Executive Base Salary:Fiscal 2013 base salaries for our NEOs were held unchanged from fiscal 2012 levels, including a nominal salary for our CEO. |

| | • | | Reduced Emphasis on Short-Term Cash Incentives: In fiscal 2013, our CEO and our Chief Operating Officer (“COO”) were both ineligible to receive cash bonuses, and the target bonus opportunities for our other NEOs were reduced, reflecting our greater emphasis on executive compensation, particularly for our most senior executive leadership, that consists primarily of performance-based equity awards that once earned, vest over time. In fiscal 2013, the performance metric for our cash incentive program was non-GAAP pre-tax earnings per share, which the Compensation Committee believed was a broad-based corporate objective that appropriately aligned incentives of executives and objectives of stockholders. |

| | • | | Equity Incentive Awards Linked to Economic Value Added: The performance measure for our restricted stock unit awards for fiscal 2013 was our measure of annualized economic value added, which is a measure based on new and incremental revenue contracted for or recognized in a year. In choosing this performance metric for equity incentive awards, the Compensation Committee believed it was appropriate to utilize a metric for long-term equity incentive awards that was different than the metric used for short-term cash incentive awards, and that the measure utilized should be a leading indicator of our potential future financial performance. In the case of our CEO and our COO, these performance-based equity awards were the only form of incentive compensation granted. |

| | • | | CEO Total Compensation Approximates Median of Peer Group: The target total compensation of our Chief Executive Officer was roughly in line with the median total target compensation level of chief executives in our 2013 peer group, and for our CEO consisted solely of performance-based equity awards. |