The accompanying proxy is solicited on behalf of the Board of Directors of Concur Technologies, Inc., a Delaware corporation, for use at Concur’s 2006 Annual Meeting of Stockholders, to be held at the Bellevue Club, 11200 Southeast 6th Street, Bellevue, Washington, at 11:00 a.m. local time on Wednesday, March 8, 2006, and at any adjournments or postponements of the meeting. Concur’s mailing address is 18400 N.E. Union Hill Road, Redmond, Washington 98052.

This proxy statement, the accompanying Notice of Annual Meeting, and the form of proxy card are first being sent to stockholders on or about January 31, 2006. Stockholders are encouraged to review the information provided in this proxy statement in conjunction with Concur’s Annual Report to Stockholders for the fiscal year ended September 30, 2005, a copy of which also accompanies this proxy statement.

Shares of Concur’s common stock are the only shares entitled to vote at the meeting. On January 24, 2006, the record date for determining stockholders entitled to vote at the meeting, there were 33,409,768 shares of common stock outstanding. Each stockholder of record on the record date is entitled to one vote for each share of common stock held by such stockholder on that date. A majority of the outstanding shares of common stock must be present or represented at the meeting in order to have a quorum for the conduct of business. Votes cast by proxy or in person at the meeting will be tabulated by the inspector of elections appointed for the meeting.

Nominees for election to the Board of Directors who receive the highest number of affirmative votes at the meeting will be elected to fill the two open seats. If shares are present at the meeting in person or by proxy, but are not voted, those shares will count toward determining whether or not a quorum is present for the conduct of business at the meeting, as will all shares voted “for”, “against”, or “abstain” on a proposal. Shares that are voted “abstain” will have no effect on the outcome of Proposal 1.

If the beneficial owner of shares that are held of record by a broker does not give instructions to the broker as to how to vote the shares, the broker has authority under applicable stock market rules to vote those shares for or against “routine” matters, such as the proposal regarding election of directors. Where a matter is not considered routine, the shares held by the broker will not be voted without specific instruction from the beneficial holder, and they will not affect the outcome of the proposal.

In addition to voting in person or by returning the enclosed proxy card, stockholders whose shares are registered directly with Wells Fargo Shareowner Services may vote their shares either via the Internet or by calling Wells Fargo Shareowner Services. Specific instructions to be followed by any registered stockholder interested in voting via the Internet or by telephone are set forth on the accompanying proxy card. The Internet and telephone voting procedures are designed to authenticate the stockholder’s identity and to allow stockholders to vote their shares and confirm that their voting instructions have been properly recorded by Concur.

If your shares are registered in the name of a bank or brokerage, you may also be eligible to vote your shares electronically over the Internet or by telephone. A large number of banks and brokerage firms are participating in the ADP Investor Communication Services online program, which provides eligible stockholders who receive a paper copy of the annual report and proxy statement the opportunity to vote via the Internet or by telephone. If your bank or brokerage firm participates in ADP’s program, your voting form from the bank

or brokerage firm will provide you with specific instructions for voting your shares. If your voting form does not reference Internet or telephone information, please complete and return the paper proxy card in the self-addressed, postage paid envelope provided.

Proxies

Whether or not you are able to attend the meeting, Concur urges you to complete, sign and date, and promptly return the accompanying proxy card so that your shares will be represented at the meeting. In the event that you do no specify otherwise on your proxy card, it will be voted FOR the director nominees identified in Proposal No. 1 and, in the discretion of the proxy holders, for or against other matters that may properly come before the meeting (including any adjournment to the meeting to another place and time). You may revoke or change your proxy at any time before the meeting. To do this, send a written notice of revocation, or another signed proxy card with a later date to Concur, to the attention of Corporate Secretary, 18400 N.E. Union Hill Road, Redmond, Washington 98052. To be effective, your written notice of revocation or newly signed proxy card must be received by Concur prior to the beginning of the meeting. You may also revoke your proxy by attending the meeting and voting in person.

Please note, however, that if your shares are held of record by a broker, bank, or other nominee, and you wish to vote at the meeting, you must bring to the meeting a letter from the broker, bank, or other nominee confirming your beneficial ownership of the shares and that such broker, bank, or other nominee is not voting your shares.

Solicitation of Proxies

Concur will bear the entire cost of solicitation, including the preparation, assembly, printing, and mailing of this proxy statement, the proxy, and any additional solicitation materials furnished to stockholders. Copies of solicitation materials will be furnished to brokerage houses, fiduciaries, and custodians holding shares in their names that are beneficially owned by others, so that they may forward such solicitation materials to those beneficial owners. Officers and employees of Concur may, without being additionally compensated, solicit proxies by mail, telephone, facsimile, or personal contact. All proxy-soliciting expenses will be paid by Concur in connection with the solicitation of votes for the meeting.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

General

Concur’s Board of Directors consists of six members, two of whom are to be elected at our annual meeting. Members of the Board of Directors are divided into Class I, Class II, and Class III directors, with staggered three-year terms. Each director serves for a term ending at the third annual meeting of stockholders following the annual meeting at which he was elected, except that any director appointed by the Board serves for a term ending at the annual meeting of stockholders for the class to which the director was appointed. Each director serves until his successor is elected and qualified or until his earlier death, resignation, or removal. All Concur directors are invited to attend the meeting in person. Six members of the Board attended our 2005 Annual Meeting of Stockholders.

Information is provided below with respect to the nominees for director and continuing members of the Board of Directors. The proxy holders intend to vote all proxies received by them in the accompanying form for the nominees listed below unless otherwise instructed. In the event any nominee is unable or declines to serve as a director at the time of the meeting, the proxies will be voted for any nominee who may be designated by the present Board of Directors to fill the vacancy. The Board of Directors approved the nomination of the nominees reflected in this Proposal No. 1. Each nominee for director has consented to serve as such if elected by the stockholders. The nominees receiving the highest number of affirmative votes of the shares entitled to vote at the meeting will be elected as Class I members of the Board of Directors, to serve for the terms to which they were elected and until their successors have been elected and qualified. Stockholders may not cumulate votes in the election of directors.

2

Nominees for Election — Class I Directors (Term to expire in 2009)

S. Steven Singh, age 44, has served as Concur’s Chief Executive Officer since 1996, and as a director since 1993, including service as Chairman of the Board of Directors since September 1999. From 1993 to 1996, Mr. Singh was General Manager of the Contact Management Division at Symantec Corporation, a computer software and services company. Mr. Singh holds a B.S. degree in Electrical Engineering from the University of Michigan. Mr. Singh is a member of the board of directors of Workstream Inc., an enterprise workforce management solutions and services company.

Jeffrey T. Seely, age 51, has been a director of Concur since October 2005. Since 1998, he has served as the President and Chief Executive Officer of ShareBuilder Corporation, an on-line brokerage company and, since 2002, he has served as the Chairman of the Board of Directors of that company. Mr. Seely holds a B.A. degree in Economics from St. Lawrence University and an M.B.A. degree from Columbia University.

Continuing Class II Directors (Term to expire in 2007)

William W. Canfield, age 67, has been a director of Concur since July 2003. Since 1987, he has served as the President and Chief Executive Officer of TALX Corporation, a business process outsourcer of payroll data-centric services and, since 1988, he has served as the Chairman of the Board of Directors of that company. Mr. Canfield holds a B.S. degree in Electrical Engineering from Purdue University and an M.B.A. degree from Washington University.

Gordon Eubanks, age 59, has been a director of Concur since June 2005. From 1999 to March 2005, he served as the President and Chief Executive Officer of Oblix, Inc., a provider of enterprise identity management solutions. From 1984 to 1999, Mr. Eubanks served as the President and Chief Executive Officer of Symantec Corporation, a provider of information security and availability software and services solutions. Mr. Eubanks holds a Bachelor of Science degree in Electrical Engineering from Oklahoma State University and a M.S. degree in Computer Science from the Naval Postgraduate School. Mr. Eubanks serves on the boards of directors of Applied Minds, Genuity Estate, and M7.

Continuing Class III Directors (Term to expire in 2008)

Michael W. Hilton, age 41, co-founded Concur in 1993, and serves as its Chief Technology Officer. Mr. Hilton has served as Chairman of the Board of Directors from 1996 until 1999, and has been a director of Concur since 1993. Before co-founding Concur, he served as Senior Development Manager at Symantec Corporation during 1993. Prior to his employment at Symantec, he served as Director of Product Development for Contact Software International, a personal computer software publisher, that was acquired by Symantec. Mr. Hilton holds a B.A. degree in Computer and Information Sciences and a B.S. degree in Mathematics from the University of California, Santa Cruz.

Jeffrey T. McCabe, age 49, has been a director of Concur since January 2005. Since August 2005, he has served as Chief Executive Officer and member of Tri-Pen TravelMaster Technologies, LLC, a provider of technology solutions for the travel industry. From March 2004 to July 2005, Mr. McCabe was involved in a wide range of entrepreneurial activities, including strategic consulting for businesses developing new products and services. From 1994 to March 2004, he served in various executive positions at American Express, including Senior Vice President and General Manager for the United States and Canadian large-market commercial card business of American Express Corporate Services, a global provider of business travel, corporate card, and purchasing card programs for businesses. Prior to that, Mr. McCabe held executive positions at Labinal S.A. and General Motors, where he worked in Europe and Asia with a focus on developing new business relationships. Mr. McCabe holds a B.S. degree in English and General Engineering from the United States Naval Academy.

Board of Directors Meetings and Committees

The Board of Directors held seven meetings during fiscal 2005. Each incumbent director attended at least 75% of the aggregate total number of meetings of the Board of Directors (held during the time period for which each such director served on the Board of Directors) and meetings of committees on which each such director served. The Board of Directors has determined that each of Messrs. Seely, Canfield, Eubanks, and McCabe are independent directors as defined in the listing standards of The NASDAQ Stock Market.

3

The Board of Directors has three standing committees: the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee.

Audit Committee

The Board of Directors has adopted a charter governing the duties and responsibilities of the Audit Committee, which is posted on our Internet website atwww.concur.com. The principal functions of the Audit Committee include:

| • | | overseeing the integrity of Concur’s financial statements and its compliance with related legal and regulatory requirements; |

| • | | monitoring the adequacy of Concur’s accounting and financial reporting, and its internal controls and processes for financial reporting; |

| • | | overseeing Concur’s relationship with its independent auditors, including appointing, evaluating, and setting the compensation of the independent auditors; and |

| • | | facilitating communication among the independent auditors, Concur’s management, and the Board of Directors. |

The members of the Audit Committee are Messrs. Seely, Canfield, and McCabe, each of whom meets the independence and other requirements to serve on our Audit Committee under applicable securities laws and the rules of the SEC and listing standards of The NASDAQ Stock Market. The Board of Directors has determined that Messrs. Seely and Canfield are “audit committee financial experts” as defined by the rules of the SEC. The Audit Committee met 14 times during fiscal 2005. The report of the Audit Committee is provided below.

Compensation Committee

The Board of Directors has adopted a charter governing the duties and responsibilities of the Compensation Committee, which is posted on our Internet website atwww.concur.com. The principal functions of the Compensation Committee include:

| • | | reviewing and making recommendations to the Board of Directors regarding all forms of salary, bonus, and stock compensation provided to executive officers of Concur, the long-term strategy for employee compensation, the types of stock and other compensation plans to be used by Concur and the shares and amounts reserved thereunder; |

| • | | overseeing the overall administration of Concur’s equity-based compensation and stock option plans; and |

| • | | addressing such other compensation matters as may from time to time be directed by the Board of Directors. |

The members of the Compensation Committee are Messrs. Canfield and Eubanks, each of whom meets the independence and other requirements to serve on our Compensation Committee under applicable securities laws and the rules of the SEC and the listing standards of The NASDAQ Stock Market. The Compensation Committee met four times during fiscal 2005. The report of the Compensation Committee is provided below.

Nominating and Corporate Governance Committee

The Board of Directors has adopted a charter governing the duties and responsibilities of the Nominating and Corporate Governance Committee, which is posted on our Internet website atwww.concur.com. The principal functions of the Nominating and Corporate Governance Committee are:

| • | | assisting the Board of Directors in identifying, evaluating, and nominating candidates to serve as members of the Board of Directors; |

| • | | recommending director nominees for the next annual meeting of stockholders to the Board of Directors; |

| • | | reviewing and making recommendations to the Board of Directors regarding the composition and operations of the Board; and |

4

| • | | reviewing and making recommendations to the Board of Directors regarding corporate governance policies and ethical conduct. |

The members of the Nominating and Corporate Governance Committee are Messrs. McCabe and Eubanks, each of whom meets the independence and other requirements to serve on our Nominating and Corporate Governance Committee under applicable securities laws and the rules of the SEC and the listing standards of The NASDAQ Stock Market. The Nominating and Corporate Governance Committee met one time during fiscal 2005.

The Nominating and Corporate Governance Committee generally identifies nominees based upon suggestions by our outside directors, members of management, or stockholders, and then evaluates the candidates based upon a number of factors, including:

| • | | high level of education and/or business experience; |

| • | | broad-based business acumen; |

| • | | understanding of our business and industry; |

| • | | strategic thinking and willingness to share ideas, network of contacts, and diversity of experience; |

The committee uses these and other criteria to evaluate potential nominees. The committee does not evaluate proposed nominees differently depending upon who has made the proposal. To date, we have not paid any third-party fees to assist in this process.

The Nominating and Corporate Governance Committee will consider, and make recommendations to the Board of Directors, regarding any stockholder recommendations for candidates to serve on the Board of Directors. However, it has not adopted a formal process for that consideration because it believes that the informal consideration process has been adequate given the historical absence of those proposals. The committee will review periodically whether a more formal policy should be adopted. If a stockholder wishes to suggest a candidate for committee consideration, the stockholder should send the name of the recommended candidate for director, together with pertinent biographical information, a document indicating the candidate’s willingness to serve if elected, and evidence of the nominating stockholder’s ownership of Concur stock, to the attention of Corporate Secretary, 18400 N.E. Union Hill Road, Redmond, Washington 98052 at least six months prior to the 2007 Annual Meeting of Stockholders to ensure time for meaningful consideration by the committee. For additional nominating requirements, please see “Stockholder Proposals For 2007 Annual Meeting” below. To date, we have not had any candidates submitted by any stockholders for the upcoming annual meeting.

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee is, or was at any time, an officer or employee of Concur or any of its subsidiaries. None of Concur’s executive officers serves or has served on the board of directors or compensation committee of any entity that has one or more executive officers serving on Concur’s board of directors or Compensation Committee during the most recently completed fiscal year.

Director Compensation

Members of the Board of Directors who are not employees of Concur receive compensation for their services as directors as provided below. These “outside directors” do not receive additional compensation for their services as directors.

Each outside director who joined the Board prior to June 2003 was granted an option for 50,000 shares under the 1998 Directors Stock Option Plan on the date he first became a member of the Board of Directors and, if he has served as a director continuously since the date of his original option grant, he is granted an additional option for 20,000 shares under the 1998 Directors Stock Option Plan on the date of each annual meeting of stockholders.

5

Each outside director who joins the Board after June 2003 may select one of the following two compensation arrangements. Under the first arrangement, the outside director receives a cash stipend of approximately $35,000 per year, is granted an option for 40,000 shares under the 1998 Directors Stock Option Plan on the date he first becomes a member of the Board of Directors, and, if he has served as a director continuously since the date of his original option grant, he is granted an additional option for 10,000 shares under the 1998 Directors Stock Option Plan on the date of each annual meeting of stockholders. Under the second arrangement, the outside director is granted an option for 60,000 shares under the 1998 Directors Stock Option Plan on the date he first becomes a member of the Board of Directors and, if he has served as a director continuously since the date of his original option grant, he is granted an additional for 20,000 shares under the 1998 Directors Stock Option Plan on the date of each annual meeting of stockholders.

All directors are reimbursed for their reasonable travel expenses in attending Board and committee meetings. Each outside director is eligible to receive additional option grants under the terms of the Concur’s 1998 Directors Stock Option Plan. All options issued to outside directors under the 1998 Directors Stock Option Plan vest as to 25% of the total shares granted on the first anniversary of the grant date, and as to 1/48th of the total shares granted on each subsequent monthly anniversary of the grant date, with exercise prices equal to the fair market value of the common stock on the date of grant. These options cease to vest if the outside director ceases to provide services to Concur either as a director or consultant.

Recommendation of the Board of Directors

The Board of Directors recommends a voteFOR the election of each nominated director.

OTHER MATTERS

The Board of Directors is not aware of any other matters to be presented for stockholder action at the meeting. However, if other matters do properly come before the meeting or any adjournments or postponements thereof, the Board of Directors intends that the persons named in the proxies will vote upon such matters in accordance with their best judgment.

OWNERSHIP OF SECURITIES

The following table sets forth information with respect to the beneficial ownership of common stock, as of January 10, 2006, by:

| • | | each person known by Concur to own beneficially more than 5% of the outstanding shares; |

| • | | each of the Named Executive Officers identified in the Summary Compensation Table below; and |

| • | | all current directors and executive officers as a group. |

Beneficial ownership is determined under the rules of the SEC and generally includes voting or investment power with respect to securities. Unless otherwise indicated, the principal address of each of the stockholders listed below is c/o Concur Technologies, Inc., 18400 N.E. Union Hill Road, Redmond, Washington 98052. To our knowledge, the persons and entities named in the table have sole voting and investment power with respect to all shares beneficially owned by them, subject to community property laws where applicable and except as otherwise indicated below. Shares of common stock subject to options that are exercisable on or before March 10, 2006 (within 60 days of January 10, 2006) are deemed to be outstanding and beneficially owned by the person holding the options for the purpose of computing the percentage ownership of that person. To determine the number of shares beneficially owned by persons other than our directors, executive officers and their affiliates, we have relied on beneficial ownership reports filed by such persons with the SEC.

The percentage of outstanding shares beneficially owned as of January 10, 2006 is based on 33,378,717 shares of common stock outstanding on such date.

6

Name and Address of Beneficial Owner

| | | | Amount and Nature

of Beneficial

Ownership

| | Percent of

Outstanding

Shares

|

|---|

| Brown Capital Management, Inc. | | | | | 4,449,170 | (1) | | | 13.3 | % |

| Westfield Capital Management, Co. LLC | | | | | 3,500,097 | (2) | | | 10.5 | % |

| EnTrust Capital Inc. and affiliates | | | | | 2,457,709 | (3) | | | 7.4 | % |

Robert Finzi

Sprout Group and affiliates | | | | | 1,985,171 | (4) | | | 5.9 | % |

| Michael W. Hilton | | | | | 1,396,549 | (5) | | | 4.2 | % |

| S. Steven Singh | | | | | 1,382,561 | (6) | | | 4.1 | % |

| Rajeev Singh | | | | | 859,775 | (7) | | | 2.6 | % |

| Simon Nelson | | | | | 58,263 | (8) | | | * | |

| William W. Canfield | | | | | 41,792 | (9) | | | * | |

| Michael L. Eberhard | | | | | 49,611 | (10) | | | * | |

| Dennis J. O’Donnell | | | | | 37,197 | (11) | | | * | |

| Jeffrey T. McCabe | | | | | 16,250 | (12) | | | * | |

| Jeffrey T. Seely | | | | | 0 | | | | * | |

| Gordon Eubanks | | | | | 0 | | | | * | |

| All current directors and executive officers as a group (10 persons) | | | | | 6,284,394 | (13) | | | 18.8 | % |

| (1) | | We obtained information about shares owned by Brown Capital Management, Inc. (“Brown”) and its reporting affiliates from a Form 13G filed by Brown with the SEC reporting share ownership as of February 9, 2005. The address for Brown and its reporting affiliates is 1201 N. Calvert Street, Baltimore, MD 21202. |

| (2) | | We obtained information about shares owned by Westfield Capital Management, Co. LLC (“Westfield”) and its reporting affiliates from a Form 13G filed by Westfield with the SEC reporting share ownership as of February 14, 2005. The address for Westfield and its reporting affiliates is Residence One Financial Center, Boston, MA 02111. |

| (3) | | We obtained information about shares owned by EnTrust Capital Inc. and its reporting affiliates from a Form 13G filed by EnTrust Capital Inc. with the SEC reporting share ownership as of February 13, 2003. The address for EnTrust Capital Inc. and its reporting affiliates is 717 Fifth Avenue, New York, New York 10022. |

| (4) | | Represents 96,143 shares owned by Sprout Venture Capital, L.P. (“Sprout VC”), 1,664,034 shares owned by Sprout Capital VIII, L.P. (“Sprout Cap VIII”), 137,737 shares owned by DLJ ESC II, L.P. (“ESC II”), 14,341 shares owned by DLJ Capital Corporation (“DLJ CC”), and 72,916 shares subject to options exercisable by Robert Finzi on or before March 10, 2006. DLJ CC is the General Partner of Sprout VC and Managing General Partner of Sprout Cap VIII. DLJ LBO Plans Management Corp. (“DLJ LBO”) is the General Partner of ESC II and is a wholly-owned subsidiary of Credit Suisse First Boston Private Equity, Inc. (“CSFB-PE”). CSFB-PE and DLJ CC are wholly-owned subsidiaries of Credit Suisse (USA), Inc. (“CS-USA”). Mr. Finzi is a Managing Director of DLJ CC. Mr. Finzi disclaims beneficial ownership of these shares except to the extent of his pecuniary interest therein. The address for Mr. Finzi, Sprout VC, Sprout Cap III, ESC II, DLJ CC, CS-USA and CSFB-PE is Eleven Madison Avenue, New York, New York 10010. |

| (5) | | Includes 800,486 shares owned directly and 596,063 shares subject to options exercisable on or before March 10, 2006. |

| (6) | | Includes 609,957 shares owned directly and 772,604 shares subject to options exercisable on or before March 10, 2006. |

| (7) | | Includes 83,504 shares owned directly and 776,271 shares subject to options exercisable on or before March 10, 2006. |

7

| (8) | | Includes 3,127 shares owned directly and 55,136 shares subject to options exercisable on or before March 10, 2006. |

| (9) | | Includes 12,000 shares owned indirectly as trustee of the William W. Canfield Revocable Trust, which is the direct beneficial owner of these shares, and 29,792 shares subject to options exercisable on or before March 10, 2006. |

| (10) | | Includes 861 shares owned directly and 48,750 shares subject to options exercisable on or before March 10, 2006. |

| (11) | | Includes 12,613 shares owned directly and 24,584 shares subject to options exercisable on or before March 10, 2006. |

| (12) | | Includes 16,250 shares subject to options exercisable on or before March 10, 2006. |

| (13) | | Includes 2,838,521 shares subject to options exercisable on or before March 10, 2006, including options described in the above footnotes. |

8

EQUITY COMPENSATION PLANS

Securities Authorized for Issuance under Equity Compensation Plans

The following table summarizes Concur’s equity compensation plans as of September 30, 2005:

| | | | (a)

| | (b)

| | (c)

|

|---|

Plan Category

| | | | Number of securities

to be issued upon

exercise of outstanding

options, warrants

and rights

| | Weighted-average

exercise price

of outstanding

options, warrants

and rights

| | Number of securities

remaining available for

future issuance under

equity compensation

plans (excluding

securities reflected in

column (a))

|

|---|

| Equity compensation plans approved by security holders (1) | | | | | 5,959,404 | | | $ | 5.79 | | | | 1,825,837 | |

| Equity compensation plans not approved by security holders | | | | | 518,213 | | | | 10.09 | | | | 616,255 | |

Total | | | | | 6,477,617 | | | $ | 6.13 | | | | 2,442,092 | |

| (1) | | Under the terms of Concur’s 1998 Employee Stock Purchase Plan, on each January 1, the aggregate number of shares of common stock reserved for issuance under such plan is increased automatically by a number of shares equal to 1% of our total outstanding shares as of the immediately preceding December 31, up to a maximum of 320,000 shares per year. As of January 1, 2006, the aggregate number of shares of common stock reserved for issuance under such plan was 540,073. |

Equity Compensation Plans Not Approved By Stockholders

1999 Stock Incentive Plan

In December 1998, the Board of Directors adopted the 1999 Stock Incentive Plan (the “1999 Plan”) to grant non-qualified stock options to employees, officers, consultants, independent contractors and advisors of Concur, or any parent or subsidiary of Concur. The 1999 Plan was designed to meet the “broadly based plans” exemption from the stockholder approval requirement for stock option plans under The NASDAQ Stock Market listing requirements that were then in place. Accordingly, we did not seek stockholder approval of the 1999 Plan.

To date, we have reserved 1,500,000 shares for issuance under the 1999 Plan. Upon the expiration, cancellation, or termination of unexercised options, the shares of Concur’s common stock subject to such options will again be available for the grant of options under the 1999 Plan. Options granted under the 1999 Plan have an exercise price not less than the fair market value of the Common Stock on the date of grant. They generally become exercisable over a four-year period based on continued service and expire ten years after the grant date, subject to earlier termination in the event of a participant’s termination of service with Concur. Options granted to officers cannot exceed 45% of all shares reserved for grants under the 1999 Plan. Other terms and conditions of the 1999 Plan are substantially the same as in the 1998 Equity Incentive Plan (“1998 Plan”) except that the 1999 Plan does not comply with the requirements for tax deductibility under Section 162(m) of the Internal Revenue Code, and adoption of, and amendments to, the 1999 Plan do not require approval of Company stockholders. As of January 10, 2006, options to purchase an aggregate of 883,745 shares of common stock had been granted under the 1999 Plan (of which, options to purchase 367,722 shares had been exercised) and 616,255 shares remained available for grant.

9

EXECUTIVE OFFICERS

The following individuals are the executive officers of Concur under Section 16(a) of the Securities Exchange Act of 1934:

S. Steven Singh, Chief Executive Officer and Chairman of the Board of Directors. For biographical information about Mr. Singh, please see “Proposal 1: Election of Directors.” S. Steven Singh and Rajeev Singh are brothers.

Michael W. Hilton, Chief Technology Officer and member of the Board of Directors. For biographical information about Mr. Hilton, please see “Proposal 1: Election of Directors.”

Rajeev Singh, President and Chief Operating Officer. Mr. Singh, age 37, co-founded Concur in 1993, became Chief Operating Officer in September 2002, and became President in September 2005. Prior to that, he served in various roles at Concur, including the Executive Vice President of Sales, Marketing & Services. Prior to joining Concur, Mr. Singh served roles in engineering project management at Ford Motor Company and General Motors Corporation. Rajeev Singh and S. Steven Singh are brothers.

John F. Adair, Chief Financial Officer. Mr. Adair, age 41, joined Concur in May 2000 as Vice President of Finance and Operations and became Chief Financial Officer in December 2000. From 1997 to April 2000, Mr. Adair served as Controller for PACCAR Financial and PACCAR Leasing, affiliates of PACCAR, Inc., the parent company for Kenworth, Peterbilt, and DAF trucks. From 1993 to 1997, Mr. Adair served as Senior Vice President of Finance for ValliCorp Holdings and ValliWide Bank.

Kyle R. Sugamele, Chief Legal Officer and Corporate Secretary. Mr. Sugamele, age 43, joined Concur in August 2000 as its Vice President, General Counsel and Corporate Secretary and became Chief Legal Officer and Corporate Secretary in September 2005. From 1995 to August 2000, Mr. Sugamele served as Vice President, General Counsel, and Corporate Secretary at Cellular Technical Services Company, Inc., a provider of software solutions for the wireless telecommunications industry. From 1991 to 1995, Mr. Sugamele practiced law at the firm of Mundt MacGregor LLP in Seattle. Prior to that time, Mr. Sugamele practiced law at the firm of Graham & Dunn PC in Seattle.

10

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth, for each of the last three fiscal years, the compensation awarded, earned, or paid for services rendered in all capacities by the Chief Executive Officer and each of the other four most-highly compensated executive officers who served as executive officers as of September 30, 2005 and who received a salary and bonus in excess of $100,000 during fiscal 2005 (collectively, the “Named Executive Officers”).

| | | |

| | Annual Compensation

| | Long-Term

Compensation

Awards (1)

| |

|---|

| | | | Year

| | Salary

| | Bonus

| | Securities

Underlying

Options

|

|---|

| S. Steven Singh | | | | | 2005 | | | $ | 270,624 | | | $ | 0 | | | | 90,000 | |

Chief Executive Officer and Chairman of the Board

| | | | | 2004 | | | | 244,855 | | | | 0 | | | | 14,000 | |

| | | | | | 2003 | | | | 212,500 | | | | 0 | | | | 91,000 | |

| |

| Rajeev Singh | | | | | 2005 | | | $ | 243,541 | | | $ | 0 | | | | 80,000 | |

President and Chief Operating Officer

| | | | | 2004 | | | | 236,308 | | | | 0 | | | | 14,000 | |

| | | | | | 2003 | | | | 240,000 | | | | 0 | | | | 91,000 | |

| |

| Michael L. Eberhard | | | | | 2005 | | | $ | 175,000 | | | $ | 126,997 | | | | 95,000 | |

Vice President of Large Market Sales

| | | | | 2004 | | | | 175,000 | | | | 93,554 | | | | 0 | |

| | | | | | 2003 | | | | 13,349 | | | | 0 | | | | 40,000 | |

| |

| Simon Nelson | | | | | 2005 | | | $ | 188,550 | | | $ | 85,532 | | | | 0 | |

Vice President

| | | | | 2004 | | | | 205,919 | | | | 79,625 | | | | 7,500 | |

| and General Manager of EMEA Operations | | | | | 2003 | | | | 184,617 | | | | 67,786 | | | | 12,000 | |

| |

| Dennis J. O’Donnell | | | | | 2005 | | | $ | 130,000 | | | $ | 111,243 | | | | 40,000 | |

Vice President of Middle Market Sales

| | | | | 2004 | | | | 130,000 | | | | 115,854 | | | | 0 | |

and Market Development

| | | | | 2003 | | | | 45,333 | | | | 42,204 | | | | 20,000 | |

| (1) | | None of the Named Executive Officers received any restricted stock awards or long-term incentive plan payouts in fiscal 2005, 2004, or 2003. |

Stock Options

Table of Option Grants in Fiscal 2005

The following table provides information with respect to stock option grants made to the Named Executive Officers during fiscal 2005. No stock appreciation rights were granted to any of the Named Executive Officers during fiscal 2005.

All options granted in fiscal 2005 were granted pursuant to the 1998 Plan. Generally, stock options under this plan become exercisable with respect to 25% of the shares on the first anniversary of the date of grant and with respect to an additional 1/48th of the shares for each of the next 36 months thereafter and, in certain cases, subject to acceleration upon a change of control.

The potential realizable value of the options in the table below is calculated based upon the term of the option at its time of grant, and by assuming that the aggregate exercise price appreciates at the indicated annual rate compounded annually for the entire term of the option, and that the option is exercised and sold on the last day of its term for the hypothetical appreciated price. The hypothetical 5% and 10% assumed annual compound rates of stock price appreciation are mandated by the rules of the SEC and do not represent Concur’s estimates or projections of future common stock prices. There can be no assurance that the common stock will appreciate at any particular rate or at all.

11

| | | | Individual Grants

| |

|---|

| | | |

| |

| |

| |

| | Potential Realizable Value

at Assumed Annual Rates

of Stock Price Appreciation

for Option Term

| |

|---|

Name

| | | | Number of

Securities

Underlying

Options

Granted

| | % of Total

Options Granted

to Employees in

Fiscal 2005 (1)

| | Exercise

Price Per

Share (2)

| | Expiration

Date

| | At 5%

| | At 10%

|

|---|

| S. Steven Singh | | | | | 50,000 | | | | 4.32 | % | | $ | 7.86 | | | | 01/21/2015 | | | $ | 247,156 | | | $ | 626,341 | |

| | | | | | 40,000 | | | | 3.46 | % | | $ | 11.20 | | | | 01/21/2015 | | | $ | 64,125 | | | $ | 367,473 | |

| Rajeev Singh | | | | | 40,000 | | | | 3.46 | % | | $ | 7.86 | | | | 01/21/2015 | | | $ | 197,724 | | | $ | 501,072 | |

| | | | | | 40,000 | | | | 3.46 | % | | $ | 11.20 | | | | 01/21/2015 | | | $ | 64,125 | | | $ | 367,473 | |

| Michael L. Eberhard | | | | | 95,000 | | | | 8.22 | % | | $ | 7.86 | | | | 01/21/2015 | | | $ | 469,596 | | | $ | 1,190,047 | |

| Simon Nelson | | | | | 0 | | | | 0.00 | % | | $ | 0.00 | | | | n/a | | | $ | 0.00 | | | $ | 0.00 | |

| Dennis J. O’Donnell | | | | | 40,000 | | | | 3.46 | % | | $ | 7.86 | | | | 01/21/2015 | | | $ | 197,724 | | | $ | 501,073 | |

| (1) | | Based on 1,155,200 options granted to all employees during fiscal 2005. |

| (2) | | Options were granted at an exercise price equal to the fair market value of Concur’s common stock as of the date of grant. |

Table of Aggregated Option Exercises and 2005 Fiscal Year-End Option Values

The following table sets forth information with respect to stock option grants to the Named Executive Officers, including the number of shares of common stock purchased upon exercise of such options in fiscal 2005, the net value realized upon such exercise, the number of unexercised options outstanding on September 30, 2005 and the value of unexercised “in-the-money” options on September 30, 2005.

| | | |

| |

| | Number of Securities

Underlying Unexercised

Options at

September 30, 2005

| | Value of Unexercised

In-the-Money Options at

September 30, 2005 (2)

| |

|---|

Name

| | | | Shares

Acquired

on Exercise

| | Value

Realized (1)

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| S. Steven Singh | | | | | 180,000 | | | $ | 1,987,200 | | | | 742,994 | | | | 77,006 | | | $ | 6,151,814 | | | $ | 517,306 | |

| Rajeev Singh | | | | | 70,625 | | | $ | 595,392 | | | | 749,369 | | | | 67,006 | | | $ | 6,027,539 | | | $ | 472,206 | |

| Michael L. Eberhard | | | | | 0 | | | $ | 0 | | | | 20,000 | | | | 115,000 | | | $ | 6,600 | | | $ | 435,050 | |

| Simon Nelson | | | | | 43,083 | | | $ | 345,453 | | | | 55,139 | | | | 5,478 | | | $ | 279,284 | | | $ | 26,848 | |

| Dennis J. O’Donnell | | | | | 0 | | | $ | 0 | | | | 11,667 | | | | 48,333 | | | $ | 64,040 | | | $ | 226,140 | |

| (1) | | Based on the market price on day of exercise less the option exercise price payable per share. |

| (2) | | These values are based on the positive spread between the respective exercise prices of the outstanding options and $12.37, the closing per share price of Concur’s common stock on The NASDAQ National Market on September 30, 2005; the stated values have not been realized, and may never be realized. |

Employment Contracts, Termination of Employment, and Change-in-Control Agreements

Some options granted to the Named Executive Officers provide that, if Concur is acquired by merger, asset sale, or other change of control of Concur, then all of any unvested shares held by that individual will become vested and exercisable. Other options granted to the Named Executive Officers provide that, if Concur is acquired by merger, asset sale, or other change of control of Concur, and within twelve months thereafter the employee’s employment with the successor entity is terminated without cause, the successor entity effects a material adverse change in the employee’s responsibilities, or the successor entity reduces the employee’s base salary, then all of any unvested shares held by that individual will become vested and exercisable. The numbers of shares subject to all outstanding options held by our Named Executive Officers are set forth above under “Table of Aggregated Option Exercises and 2005 Fiscal Year-End Option Values.”

12

COMMITTEE REPORTS AND STOCK PERFORMANCE GRAPH

Notwithstanding anything to the contrary set forth in any of Concur’s previous filings under the Securities Act of 1933, and the Securities Exchange Act of 1934 that might incorporate future filings, including this proxy statement, in whole or in part, the following Compensation Committee Report, Audit Committee Report, and stock performance graph shall not be incorporated by reference in any such filings.

Compensation Committee Report

The Compensation Committee of the Board of Directors administers, among other things, the compensation of the executive officers of Concur.

Compensation Philosophy

The Compensation Committee reviews and makes recommendations to the Board of Directors regarding all forms of salary, bonus, and equity-based compensation provided to the Chief Executive Officer and other executive officers. It also oversees the overall administration of Concur’s equity-based compensation and stock option plans and addresses such other compensation matters as may from time to time be directed by the Board of Directors. The Compensation Committee’s compensation policy for executive officers is designed to attract, motivate, and retain talented executives responsible for the success of Concur and to promote the long-term interests of Concur and its stockholders. The Compensation Committee places emphasis on performance-based components, such as stock options and bonuses, the value of which could increase or decrease to reflect changes in corporate and individual performance. These short-term and long-term incentive compensation policies are intended to reinforce management’s objectives to enhance profitability and stockholder value.

Executive Compensation

At the beginning of each fiscal year, the Compensation Committee meets with the Chief Executive Officer to review the objectives of Concur and its executive officers for such year and establish parameters for performance-based year-end bonuses and/or stock option awards. These parameters are intended to reflect both Concur’s objectives for such year as well as the foundation for meeting Concur’s longer-term objectives.

At the conclusion of each fiscal year, the Compensation Committee meets with the Chief Executive Officer to review the performance of Concur and its executive officers against the objectives and parameters that were established at the beginning of the year and to establish the basis for making recommendations to the Board of Directors for executive compensation, including year-end bonuses and/or stock option awards. In making recommendations to the Board of Directors, the Compensation Committee takes into account various qualitative and quantitative indicators of corporate and individual performance and various compensation benchmarks in determining the level and composition of compensation for the executive officers of Concur. The Compensation Committee also considers the recommendations of the Chief Executive Officer for the compensation of the other executive officers, and considers the compensation of the Chief Executive Officer outside of his presence.

Executive officers are paid base salaries in line with their responsibilities, as determined in the discretion of the Board of Directors based on recommendations provided by the Compensation Committee. Executive officers are also eligible to receive incentive bonuses based on achievement of performance targets established at the beginning of the fiscal year. During fiscal 2005, the objectives used by Concur as the basis for incentive bonuses were the achievement of designated corporate objectives for the executive officers, including earnings per share and customer retention targets.

Long-term equity incentives for executive officers and other Concur employees are effected through stock option grants under Concur’s 1998 Equity Incentive Plan. The Compensation Committee believes that equity-based compensation in the form of stock options links the interests of management and employees with those of the stockholders. A substantial number of Concur’s full-time employees participate in the 1998 Equity Incentive Plan. The number of shares subject to each stock option granted to executive officers is within the discretion of the Board of Directors based on recommendations provided by the Compensation Committee and is based on each executive’s position, past performance, anticipated future contributions, and prior option grants. Each option grant allows the executive to acquire shares of Concur’s common stock at a fixed price

13

per share (the market price on the grant date) in installments generally over a four-year period. The option grants will provide a return only if the executive remains with Concur, and only if the market price appreciates over the option term.

Chief Executive Officer Compensation

The annual base salary for S. Steven Singh, Chief Executive Officer and Chairman of the Board of Directors, is reviewed and approved annually by the Board of Directors based on recommendations provided by the Compensation Committee and upon the criteria set forth under the discussion of Executive Compensation above. During fiscal 2005, the objectives used by Concur as the basis for Mr. Singh’s incentive bonus were the achievement of designated corporate objectives, including earnings per share and customer retention targets, and the satisfactory management of Concur’s overall corporate business plan.

Compliance with Section 162(m) of the Internal Revenue Code of 1986

Section 162(m) of the Internal Revenue Code limits the tax deduction to $1.0 million for compensation paid to certain executives of public companies. Having considered the requirements of Section 162(m), the Compensation Committee believes that grants made pursuant to the 1998 Equity Incentive Plan meet the requirements that such grants be “performance based” and are, therefore, exempt from the limitations on deductibility. Historically, the combined salary and bonus of each executive officer has been below the $1.0 million limit. The Compensation Committee’s present intention is to comply with Section 162(m) unless it believes that required changes would not be in the best interest of Concur or its stockholders.

COMPENSATION COMMITTEE

William W. Canfield

Gordon Eubanks

Robert Finzi

14

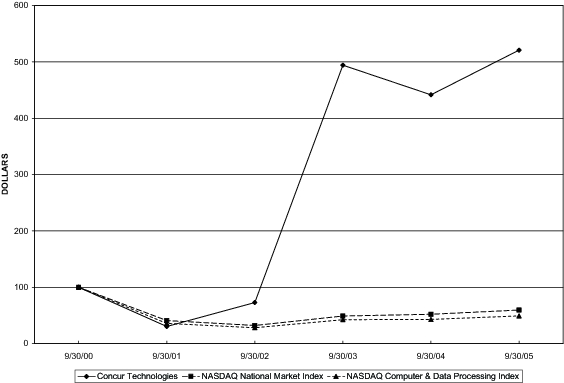

Stock Performance Graph

General

The following graph compares (i) the cumulative total stockholder return on the common stock from September 30, 2000 to September 30, 2005 (measured by the difference between closing prices on each such date) with (ii) the cumulative total return of the Nasdaq National Market Index and the Nasdaq Computer Index over the same period, assuming the investment of $100 in the common stock and in both of the other indices on September 30, 2000, and reinvestment of all dividends.

Comparison of Cumulative Total Return

| | | | September 30,

2000

| | September 30,

2001

| | September 30,

2002

| | September 30,

2003

| | September 30,

2004

| | September 30,

2005

|

|---|

| Concur Technologies | | | | $ | 100 | | | $ | 30.32 | | | $ | 72.84 | | | $ | 494.32 | | | $ | 441.68 | | | $ | 520.84 | |

| NASDAQ National Market Index | | | | | 100 | | | | 40.86 | | | | 32.19 | | | | 49.04 | | | | 52.09 | | | | 59.46 | |

| NASDAQ Computer & Data Processing Index | | | | | 100 | | | | 35.87 | | | | 28.20 | | | | 42.30 | | | | 42.91 | | | | 49.19 | |

15

Audit Committee Report

The Audit Committee of the Board of Directors has reviewed and discussed with management and the independent auditors the audited consolidated financial statements of Concur as of and for the fiscal year ended September 30, 2005.

The Audit Committee discussed with the independent auditors matters required to be discussed by Statement on Auditing Standards No. 61, entitled “Communication with Audit Committees,” as amended, by the Auditing Standards Board of the American Institute of Certified Public Accountants.

The Audit Committee has received and reviewed the written disclosures from the independent auditors required by Independence Standard No. 1, entitled “Independence Discussions with Audit Committees,” as amended, by the Independence Standards Board, and has discussed with the independent auditors that firm’s independence.

Based upon the Audit Committee’s discussion with management and the independent auditors and the Audit Committee’s review of the representations of management and the report of the independent auditors to the Audit Committee, the Audit Committee approved the inclusion of the audited consolidated financial statements referred to above in Concur’s Annual Report on Form 10-K for the fiscal year ended September 30, 2005 filed with the United States Securities and Exchange Commission.

AUDIT COMMITTEE

Jeffrey T. Seely

William W. Canfield

Jeffrey T. McCabe

16

INDEPENDENT AUDITORS

Concur’s stockholders are not being asked to elect, approve, or ratify a principal accountant at this time, as Concur has not formally selected the principal accountant to audit Concur’s financial statements for fiscal 2006 as of the date of this Proxy Statement in accordance with Concur’s standard practices. We expect that one or more representatives of Deloitte & Touche LLP, Concur’s independent auditors for fiscal 2005, will be present at the meeting, will be able to make a statement if they wish to do so, and will be able to respond to appropriate questions.

Independent Auditors’ Services and Fees

The following table presents the aggregate fees for services rendered by Deloitte & Touche LLP and its affiliates (“Deloitte”) billed to Concur during fiscal 2004 and fiscal 2005:

Type of Fees

| | | | Fee Amounts

| |

|---|

| | | | Fiscal 2004

| | Fiscal 2005

|

|---|

| Audit Fees | | | | $ | 337,738 | | | $ | 851,231 | |

| Audit-Related Fees | | | | | 31,825 | | | | 23,369 | |

| Tax Fees | | | | | 10,171 | | | | 3,375 | |

| All Other Fees | | | | | 16,401 | | | | 1,320 | |

Total | | | | $ | 396,134 | | | $ | 879,295 | |

Audit Fees for fiscal 2005 consist of fees paid to Deloitte for (i) the audit of Concur’s annual financial statements included in the Annual Report on Form 10-K and review of financial statements included in the Quarterly Reports on Form 10-Q; (ii) the audit of Concur’s internal control over financial reporting with the objective of obtaining reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects; (iii) the attestation of management’s report on the effectiveness of internal control over financial reporting; and (iv) services that are normally provided by the independent registered public accounting firm in connection with statutory and regulatory filings or engagements.Audit Fees for fiscal 2004 consisted of items (i) and (iv) only.

Audit-Related Fees consist of fees for professional services that are reasonably related to the performance of the audit or review of Concur’s financial statements and are not reported underAudit Fees. This category includes fees related to audit and attest services not required by statute or regulations, due diligence related to mergers, acquisitions and investments, and consultations concerning financial accounting and reporting standards.

Tax Fees consist of fees for professional services for tax compliance, tax advice, and tax planning. These services include assistance regarding federal, state and international tax compliance, return preparation, and tax audits.

All such services rendered by the independent auditors are permissible under applicable laws and regulations, and were pre-approved by the Audit Committee in accordance with the Audit Committee pre-approval policy described below. The Audit Committee has determined that the provision of these services was compatible with maintaining the auditors’ independence.

Financial Information Systems Design And Implementation Fees

In fiscal 2005, there were no fees billed by the independent auditors for financial information systems design and implementation services.

Audit Committee Pre-Approval Policy

All audit and non-audit services to be performed for Concur by its independent auditors must be pre-approved by the Audit Committee, or a designated member of the Audit Committee, to assure that the provision of such services do not impair the auditor’s independence. The Audit Committee has delegated interim pre-approval authority to the Chairman of the Audit Committee. Any interim pre-approval of service is required to be reported to the Audit Committee at the next scheduled Audit Committee meeting. The Audit Committee does not delegate its responsibility to pre-approve services performed by the independent auditors to management.

17

The annual audit services engagement terms and fees are subject to the specific pre-approval of the Audit Committee. The Audit Committee will approve, if necessary, any changes in terms, conditions, and fees resulting from changes in audit scope or other matters. All other audit services not otherwise included in the annual audit services engagement must be specifically pre-approved by the Audit Committee.

Audit-related services are services that are reasonably related to the performance of the audit or review of Concur’s financial statements or traditionally performed by the independent auditors. Examples of audit-related services include employee benefit and compensation plan audits, due diligence related to mergers and acquisitions, attestations by the auditors that are not required by statute or regulation, and consulting on financial accounting/reporting standards. All audit-related services must be specifically pre-approved by the Audit Committee.

The Audit Committee may grant pre-approval of other services that are permissible under applicable laws and regulations and that would not impair the independence of the auditors. All of such permissible services must be specifically pre-approved by the Audit Committee.

Requests or applications for the independent auditors to provide services that require specific approval by the Audit Committee are considered after consultation with management and the auditors. Questions about whether the scope of a proposed service requires specific pre-approval, or is permitted by applicable laws and regulations, are to be referred to the Concur legal department.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Please see “Executive Compensation and Related Information — Employment Contracts and Change in Control Agreements” above for information about certain vesting acceleration provisions of options granted to our Named Executive Officers.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Under the securities laws of the United States, Concur’s directors and officers, and any persons who own more than 10% of Concur’s common stock, are required under Section 16(a) of the Securities Exchange Act of 1934 to file initial reports of ownership and reports of changes in ownership with the SEC. Specific due dates have been established by the SEC, and Concur is required to disclose in this proxy statement any failure to file by those dates. Based solely upon its review of the copies of such reports for fiscal 2005 as furnished to Concur and written representations from Concur’s directors and officers, Concur believes that all directors, officers, and greater-than-10% beneficial owners have made all required Section 16(a) filings on a timely basis for such fiscal year.

CODE OF BUSINESS CONDUCT AND ETHICS

The Board of Directors has adopted a Code of Business Conduct and Ethics applicable to all directors, officers, and employees of Concur, as required by applicable securities laws and the rules of the SEC and listing standards of The NASDAQ Stock Market. A copy of the Code of Business Conduct and Ethics is posted on our Internet website atwww.concur.com.

STOCKHOLDER PROPOSALS FOR 2007 ANNUAL MEETING

Stockholder proposals intended to be presented at Concur’s 2007 Annual Meeting of Stockholders must be received by Concur at its principal executive offices no later than October 3, 2006, in order to be included in Concur’s proxy materials relating to that meeting. Stockholders wishing to bring a proposal before the 2007 Annual Meeting of Stockholders (but not include it in Concur’s proxy materials) must provide such proposal in writing to Concur no later than January 7, 2007, nor earlier than December 8, 2006, to the attention of Corporate Secretary, 18400 N.E. Union Hill Road, Redmond, Washington 98052. In addition, stockholders must comply with the procedural requirements in Concur’s bylaws, a copy of which may be obtained from Concur. Concur’s bylaws are also on file with the SEC.

18

STOCKHOLDER COMMUNICATIONS

We do not have a formal process by which stockholders may communicate directly with members of our Board of Directors. We believe that an informal process, in which any communication sent to the Board of Directors in care of the Chief Executive Officer, Corporate Secretary, or other executive officer of Concur is generally to be forwarded to the Board of Directors, serves the needs of the Board and our stockholders. All stockholder communications that are received by executive officers for the Board’s attention are forwarded to the Board. In view of SEC disclosure requirements relating to this issue, the Nominating and Corporate Governance Committee may in the future consider adoption of more specific procedures. Until such other procedures are adopted and posted on our Internet website atwww.concur.com, any communications to the Board of Directors should be sent to it in care of Corporate Secretary, 18400 N.E. Union Hill Road, Redmond, Washington 98052.

By Order of the Board of Directors of

Concur Technologies, Inc.

S. Steven Singh

Chief Executive Officer and Chairman of the Board

19

18400 NE Union Hill Road

Redmond, WA 98052

Attn: Corporate Secretary | There are three ways to vote your Proxy Your telephone or Internet vote authorizes the Named Proxies to vote in the same manner as if you marked, signed and returned your proxy card. VOTE BY PHONE - TOLL FREE - 1-800-690-6903 -

QUICK ««« EASY ««« IMMEDIATE |

| Use any touch-tone telephone to vote your proxy 24 hours a day, 7 days a week, until 11:59 p.m. Eastern Time on March 7, 2006. |

| Have your proxy card in hand when you call and follow the simple instructions the Vote Voice provides you. |

VOTE BY INTERNET - www.proxyvote.com -

QUICK ««« EASY ««« IMMEDIATE |

| Use the Internet to vote your proxy 24 hours a day, 7 days a week, until 11:59 p.m. Eastern Time on March 7, 2006. |

| Have your proxy card in hand when you access the website and follow the instructions to obtain your records and to create an electronic ballot. |

VOTE BY MAIL Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Concur Technologies, Inc., c/o ADP, 51 Mercedes Way, Edgewood, NY 11717. |

If you vote by Phone or Internet,

please do not mail your Proxy Card |

| TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: | CONCUR | KEEP THIS PORTION FOR YOUR RECORDS |

| | | DETACH AND RETURN THIS PORTION ONLY |

| THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. |

| | CONCUR TECHNOLOGIES, INC. | | | | | | | | | |

| | | | | | | | | | | | | |

| | The Board of Directors unanimously recommends

a vote "FOR" the Board of Director nominees. | | | | | | | | | |

| | | | | | For

All | | Withhold

All | | For All

Except | | To withhold authority to vote, mark "For All Except"

and write the nominee's number on the line below. | |

| | | 1. | Proposal No. 1 - Election of Directors;

Class I

01) S. Steven Singh

02) Jeffrey T. Seely | | o | | o | | o | |

|

|

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | THIS PROXY, WHEN PROPERLY EXECUTED, WILL BE VOTED AS DIRECTED OR, IF NO DIRECTION IS GIVEN, WILL BE VOTED FOR THE PROPOSAL. | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | Please sign exactly as your name(s) appear on this proxy. If held in joint tenancy, all persons must sign. Trustees, administrators, etc., should include title and authority. Corporations should provide full name of corporation and title of authorized officer signing the proxy. | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | For address changes and/or comments, please check this box o

and write them on the back where indicated. | |

| | | | | | |

| | | | Yes | | No |

| | HOUSEHOLDING ELECTION - Please indicate if you

consent to receive certain future investor

communications in a single package per household. | | o | | o |

| | | | | | |

| |

| | | | |

| | Signature [PLEASE SIGN WITHIN BOX] | Date | | Signature (Joint Owners) | Date |

CONCUR TECHNOLOGIES, INC.

ANNUAL MEETING OF STOCKHOLDERS

Wednesday, March 8, 2006, 11:00 a.m.

Bellevue Club, 11200 Southeast 6th Street, Bellevue, WA

IMPORTANT NOTICE REGARDING

DELIVERY OF SHAREHOLDER DOCUMENTS |

The Securities and Exchange Commission has adopted rules that permit companies to send a single copy of annual reports, proxy statements, prospectuses and other disclosure documents to two or more investors sharing the same address, subject to certain conditions. The “householding” rules will provide greater convenience for investors and cost savings for companies by reducing the number of duplicate documents that investors

receive.

Implementation and Consent

Unless we receive contrary instructions, if you have the same last name or are a member of the same family as any other investor who shares the same address, your household will receive only one copy of Concur Technologies' annual report, proxy statement and other disclosure documents, although you will receive a separate proxy card for each investor in the household. This program began January 1, 2004.

Withholding Consent

If you wish to continue receiving separate annual reports and proxy statements for each household account, you must check the appropriate box on the reverse side of this proxy card.

Revoking and Duration of Consent

If you choose to revoke your consent to the householding program at a future date, you may do so by writing to Corporate Secretary, 18400 NE Union Hill Road, Redmond, WA 98052. We will remove you from the householding program within 30 days of receipt of your revocation of your consent. If we do not receive instructions from you to discontinue householding, your proxy materials will continue to be “househeld” until we notify you otherwise. However, if at any time you would like a separate copy of the annual report or proxy statement, please write us at the address shown above, and we will deliver it promptly.

Concur Technologies encourages your participation in this program. It not only allows us to reduce costs, but is more environmentally friendly by reducing the unnecessary use of materials.

January, 2006

| |

| | |

18400 NE Union Hill Road

Redmond, WA 98052 | proxy |

|

|

This proxy is solicited by the Board of Directors of Concur Technologies, Inc. for use at the Annual Meeting of Stockholders on March 8, 2006. This proxy will be voted as you specify on the reverse side. If no choice is specified, the proxy will be voted "FOR" the Board of Director nominees. By signing the proxy, you revoke all prior proxies and appoint S. Steven Singh and Kyle R. Sugamele (the "Named Proxies"), and each of them, with full power of substitution, to vote on the matter shown on the reverse side and, in their discretion, on any other matters which may properly come before the Annual Meeting and all adjournments and postponements thereof. |

| |

| | Address Changes/Comments: | | |

| | | |

| | | |

(If you noted any Address Changes/Comments above, please mark corresponding box on the reverse side.)

(See above for voting instructions)