SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a party other than the Registrant ¨

Check the appropriate box:

¨ | | Preliminary Proxy Statement |

¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

¨ | | Definitive Additional Materials |

¨ | | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 |

CONCUR TECHNOLOGIES, INC.

(Name of Registrant as Specified in Its Charter)

CONCUR TECHNOLOGIES, INC.

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | | Title of each class of securities to which transaction applies: |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | | Proposed maximum aggregate value of transaction: |

¨ | | Fee paid previously with preliminary materials. |

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | | Amount Previously Paid: |

| | 2) | | Form, Schedule or Registration Statement No.: |

January 24, 2003

To Our Stockholders:

You are cordially invited to attend the 2003 Annual Meeting of Stockholders of Concur Technologies, Inc., which will be held at the Bellevue Club, 11200 Southeast 6th Street, Bellevue, Washington, at 11:00 a.m. local time on Wednesday, March 5, 2003.

Details of the business to be conducted at the meeting are given in the attached Notice of Annual Meeting and Proxy Statement.

It is important that you use this opportunity to take part in the affairs of Concur by voting on the business to come before the meeting. Whether or not you plan to attend the meeting, please complete, sign and date, and return the enclosed proxy in the accompanying reply envelope so that your shares may be represented at the meeting. You may also submit your proxy via the Internet or telephone as specified in the accompanying Internet and telephone voting instructions. If you decide to attend the meeting and wish to change your proxy vote, you may do so automatically by voting in person at the meeting.

We look forward to seeing you at the meeting.

Sincerely,

S. Steven Singh

President, Chief Executive Officer

and Chairman of the Board

CONCUR TECHNOLOGIES, INC.

6222 185th Avenue Northeast

Redmond, WA 98052

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held March 5, 2003

The 2003 Annual Meeting of Stockholders of Concur Technologies, Inc. will be held at the Bellevue Club, 11200 Southeast 6th Street, Bellevue, Washington, at 11:00 a.m. local time on Wednesday, March 5, 2003, for the following purposes:

1. To elect two Class I members of the Board of Directors to serve for a three-year term as more fully described in the accompanying proxy statement.

2. To transact such other business as may properly come before the meeting.

The foregoing items of business are more fully described in the accompanying proxy statement. Only stockholders of record at the close of business on January 24, 2003 are entitled to notice of and to vote at the meeting or any adjournment or postponement thereof. A complete list of stockholders entitled to vote at the meeting will be open to the examination of any stockholder, for any purpose relevant to the meeting, at Concur’s offices at 6222 185th Avenue Northeast, Redmond, Washington, during Concur’s ordinary business hours for ten days before the meeting.

By Order of the Board of Directors of Concur Technologies, Inc.

S. Steven Singh

President, Chief Executive Officer

and Chairman of the Board

Redmond, Washington

January 24, 2003

YOUR VOTE IS IMPORTANT

Whether or not you plan to attend the meeting, please complete, sign and date, and promptly return the accompanying proxy card in the enclosed postage-paid return envelope so that your shares will be represented at the meeting. You may also submit your proxy via the Internet or telephone as specified in the accompanying Internet and telephone voting instructions.This will ensure the presence of a quorum at the meeting and save the expense and extra work of additional solicitation. Sending your proxy card will not prevent you from attending the meeting, revoking your proxy, and voting your stock in person.

CONCUR TECHNOLOGIES, INC.

6222 185th Avenue Northeast

Redmond, WA 98052

PROXY STATEMENT

The accompanying proxy is solicited on behalf of the Board of Directors of Concur Technologies, Inc., a Delaware corporation, for use at Concur’s 2003 Annual Meeting of Stockholders (the “Meeting”), to be held at the Bellevue Club, 11200 Southeast 6th Street, Bellevue, Washington, at 11:00 a.m. local time on Wednesday, March 5, 2003, and at any adjournments or postponements thereof. Concur’s mailing address is 6222 185th Avenue Northeast, Redmond, Washington 98052.

This proxy statement and the accompanying Notice of Annual Meeting and proxy are first being sent to stockholders on or about February 3, 2003. Stockholders are encouraged to review the information provided in this proxy statement in conjunction with Concur’s Annual Report to Stockholders for the fiscal year ended September 30, 2002, a copy of which also accompanies this proxy statement.

VOTING RIGHTS AND SOLICITATION OF PROXIES

Voting

Concur’s common stock is the only type of security entitled to vote at the Meeting. On January 24, 2003, the record date (“Record Date”) for determining stockholders entitled to vote at the Meeting, there were 30,988,583 shares of common stock outstanding. Each stockholder of record on the Record Date is entitled to one vote for each share of common stock held by such stockholder on that date. A majority of the outstanding shares of common stock must be present or represented at the Meeting in order to have a quorum for the conduct of business.

Nominees for election to the Board of Directors of Concur who receive the greatest number of votes at the Meeting will be elected to fill the two open seats. Votes cast by proxy or in person at the Meeting will be tabulated by the inspector of elections appointed for the Meeting.

Abstentions are considered as shares present and entitled to vote and therefore will have the same effect as a vote against a matter presented at the meeting. Brokers who hold shares in street name for customers have the authority to vote on routine matters (including the election of directors); when brokers have not received discretionary voting authority with respect to a non-routine matter, those shares will be considered shares not entitled to vote with respect to such matters, but will be counted toward the establishment of a quorum.

Voting Electronically via the Internet or Telephone

In addition to voting in person or by returning the enclosed proxy card, stockholders whose shares are registered directly with Wells Fargo Shareowner Services may vote either via the Internet or by calling Wells Fargo Shareowner Services. Specific instructions to be followed by any registered stockholder interested in voting via the Internet or telephone are set forth on the enclosed proxy card. The Internet and telephone voting procedures are designed to authenticate the stockholder’s identity and to allow stockholders to vote their shares and confirm that their instructions have been properly recorded.

If your shares are registered in the name of a bank or brokerage you may be eligible nonetheless to vote your shares electronically over the Internet or by telephone. A large number of banks and brokerage firms are participating in the ADP Investor Communication Services online program, which provides eligible stockholders

1

who receive a paper copy of the annual report and proxy statement the opportunity to vote via the Internet or by telephone. If your bank or brokerage firm is participating in ADP’s program, your voting form from the bank or brokerage will provide instructions. If your voting form does not reference Internet or telephone information, please complete and return the paper proxy card in the self-addressed, postage paid envelope provided.

Proxies

Whether or not you are able to attend the Meeting, you are urged to complete, sign and date, and promptly return the accompanying proxy card so that your shares will be represented at the meeting. In the event no directions are specified in the return proxy, it will be voted FOR the director nominees identified in Proposal No. 1 and, in the discretion of the proxy holders, as to other matters that may properly come before the Meeting (including any adjournment to another place and time). You may revoke or change your proxy at any time before the Meeting. To do this, send a written notice of revocation or another signed proxy with a later date to the Corporate Secretary of Concur at Concur’s principal office before the beginning of the Meeting. You may also revoke your proxy by attending the Meeting and voting in person.

Solicitation of Proxies

Concur will bear the entire cost of solicitation, including the preparation, assembly, printing and mailing of this proxy statement, the proxy, and any additional solicitation materials furnished to stockholders. Copies of solicitation materials will be furnished to brokerage houses, fiduciaries, and custodians holding shares in their names that are beneficially owned by others, so that they may forward such solicitation materials to those beneficial owners.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

General

Concur’s Board of Directors is divided into Class I, Class II, and Class III directors with staggered three-year terms. Each director serves for a term ending at the third annual meeting of stockholders following the annual meeting at which he was elected, except that any director appointed by the Board serves for a term ending at the annual meeting of stockholders for the class to which the director was appointed. Each director serves until his successor is elected and qualified or until his earlier death, resignation, or removal.

Information is provided below with respect to the nominees for director and continuing members of the Board of Directors. The proxy holders intend to vote all proxies received by them in the accompanying form for the nominees listed below unless otherwise instructed. In the event any nominee is unable or declines to serve as a director at the time of the Meeting, the proxies will be voted for any nominee who may be designated by the present Board of Directors to fill the vacancy. Each nominee for director has consented to serve as such if elected by the stockholders. The nominees receiving the highest number of affirmative votes of the shares entitled to vote at the Meeting will be elected as Class I members of the Board of Directors, to serve for the terms to which they were elected and until their successors have been elected and qualified. Stockholders may not cumulate votes in the election of directors.

Nominees for Election—Class I Directors (Term to expire in 2006)

S. Steven Singh, age 41, has served as Concur’s President and Chief Executive Officer since 1996, and as a director since 1993, including service as Chairman of the Board of Directors since September 1999. From 1993 to 1996, Mr. Singh was General Manager of the Contact Management Division at Symantec Corporation, a computer software and services company. Mr. Singh holds a B.S. degree in Electrical Engineering from the University of Michigan.

2

Robert Finzi, age 49, has been a director of Concur since September 2002. Since 1991, he has been a General Partner of the Sprout Group, a venture capital firm affiliated with Credit Suisse First Boston. Prior to that, Mr. Finzi was a General Partner of Merrill Lynch Venture Capital, an Associate with Menlo Ventures, and a consultant with Andersen Consulting (now Accenture). Mr. Finzi holds an M.B.A. degree from Harvard Business School and B.S. and M.S. degrees in Industrial Engineering from Lehigh University. Mr. Finzi is a member of the board of directors of InterDent, Inc. and a number of privately held companies.

Continuing Class II Directors (Term to expire in 2004)

Michael J. Levinthal, age 48, has been a director of Concur since April 1998. Since 1984, he has been both a General Partner and a Managing Director of various venture capital funds affiliated with Mayfield Fund, a venture capital firm. Mr. Levinthal holds a B.S. degree in Engineering and an M.S. degree in Industrial Engineering from Stanford University, and an M.B.A. degree from the Graduate School of Business at Stanford University. Mr. Levinthal is a member of the board of directors of Altiris, Inc., an enterprise management software company.

William P. Hannon, age 54, has been a director of Concur since February 2001. Since 2000, he has served as the Managing Director for Citigroup Business Services, the shared services provider for Citigroup Inc. and its affiliates. In addition, he is the Controller and Chief Accounting Officer of Citigroup and is a member of that firm’s Management Committee. From 1996 to 2000, Mr. Hannon served as Chief Financial Officer for Travelers Property Casualty Corp., a subsidiary of Citigroup. Prior to that, Mr. Hannon was a partner at KPMG LLP, where he served in various capacities, including Deputy Managing Partner for the firm’s Financial Services Practice and as a member of the firm’s SEC Reviewing Partners Committee. He was associated with KPMG LLP for 27 years. Mr. Hannon holds a B.B.A. degree in Accounting from Manhattan College. He is a member of the board of advisors of Manhattan College and the board of directors of the National Academy Foundation.

Continuing Class III Directors (Term to expire in 2005)

Michael W. Hilton, age 38, co-founded Concur in 1993, and serves as its Chief Technology Officer. Mr. Hilton has served as Chairman of the Board of Directors from 1996 until September 1999, and has been a director of Concur since 1993. Before co-founding Concur, he served as Senior Development Manager at Symantec Corporation during 1993. Prior to his employment at Symantec, he served as Director of Product Development for Contact Software International, a personal computer software publisher, that was acquired by Symantec. Mr. Hilton holds a B.A. degree in Computer and Information Sciences and a B.S. degree in Mathematics from the University of California, Santa Cruz.

Norman A. Fogelsong, age 51, has been a director of Concur since 1996. He has been a General Partner of Institutional Venture Partners, a venture capital firm, since 1989. Mr. Fogelsong holds a B.S. degree in Industrial Engineering from Stanford University, an M.B.A. degree from Harvard Business School, and a J.D. degree from Harvard Law School. Mr. Fogelsong is a member of the board of directors of Aspect Communications Corporation, a business communications software company.

Board of Directors Meetings and Committees

During fiscal 2002, the Board of Directors held 8 meetings. During this period, each incumbent director attended at least 75% of the aggregate of the number of meetings of the Board of Directors (held during the time period for which each such director served on the Board of Directors) and the number of meetings held by all committees of the Board of Directors on which each such director served.

Concur’s Board of Directors has two standing committees: the Audit Committee and the Compensation Committee.

3

The Audit Committee oversees all aspects of our financial accounting, audit and reporting functions, including disclosure controls and procedures and internal controls and procedures related to such functions, and has direct responsibility for the appointment, compensation and oversight of Concur’s independent auditors. The Audit Committee’s functions include reviewing the general scope of Concur’s annual audit and the fees charged by the independent auditors and meeting with Concur’s independent auditors to review Concur’s critical accounting policies, alternative treatments of Concur’s financial information under GAAP, the adequacy of Concur’s internal control systems and financial reporting procedures, and other significant accounting, financial and internal control matters. The Audit Committee, which met four times in fiscal 2002, currently consists of Messrs. Hannon, Fogelsong, and Levinthal, each of whom meets the independence and other requirements to serve on our Audit Committee under the rules of the Nasdaq Stock Market.

The Compensation Committee makes decisions regarding all forms of salary, bonus, and stock compensation provided to executive officers of Concur, the long-term strategy for employee compensation, the types of stock and other compensation plans to be used by Concur and the shares and amounts reserved thereunder, and such other compensation matters as may from time to time be directed by the Board of Directors. The Compensation Committee, which met one time in fiscal 2002, currently consists of Messrs. Fogelsong, Levinthal, and Finzi.

Compensation | | Committee Interlocks and Insider Participation |

None of the members of the Compensation Committee is, or was at any time, an officer or employee of Concur or any of its subsidiaries. None of Concur’s executive officers serves or has served on the board of directors or compensation committee of any entity that has one or more executive officers serving on Concur’s board of directors or Compensation Committee during the most recently completed fiscal year.

Director Compensation

Members of the Board of Directors receive a cash stipend of approximately $12,000 per year for their services as directors, and are reimbursed for their reasonable travel expenses in attending Board and committee meetings. Directors who are not Company employees are eligible to receive periodic option grants under Concur’s 1998 Directors Stock Option Plan. Each eligible director is automatically granted an option for 50,000 shares on the date he first becomes a member of the Board of Directors and, if he has served as a director continuously since the date of his original option grant, the director is automatically granted an option to purchase 20,000 shares on the date of each annual meeting of stockholders. Each such director is also eligible to receive additional option grants under Concur’s 1998 Directors Stock Option Plan.

All options under the 1998 Directors Stock Option Plan vest as to 25% of the total shares granted on the first anniversary of the grant date, and as to 1/48th of the total shares granted on each subsequent monthly anniversary of the grant date, with exercise prices equal to the fair market value of the common stock on the date of grant. Options cease to vest if the individual ceases to provide services to Concur either as a director or consultant.

Recommendation of the Board of Directors

The Board of Directors recommends a voteFOR the election of each nominated director.

OTHER MATTERS

The Board of Directors knows of no other matters to be presented for stockholder action at the Meeting. However, if other matters do properly come before the Meeting or any adjournments or postponements thereof, the Board of Directors intends that the persons named in the proxies will vote upon such matters in accordance with their best judgment.

4

EXECUTIVE OFFICERS

In addition to the executive officers who are members of the Board of Directors, the following individuals are executive officers of Concur:

Rajeev Singh, age 34, co-founded Concur in 1993 and currently serves as its Chief Operating Officer. Prior to becoming Chief Operating Officer in September 2002, he served in various roles at Concur, including the Executive Vice President of Sales, Marketing & Services. Prior to joining Concur, Mr. Singh served roles in engineering project management at Ford Motor Company and General Motors Corporation.

John F. Adair, age 38, joined Concur in May 2000 and currently serves as its Chief Financial Officer. Prior to becoming Chief Financial Officer in December 2000, he served as Vice President of Finance and Operations. From May 1997 to April 2000, he served as Controller for PACCAR Financial and PACCAR Leasing, affiliates of PACCAR, Inc., the parent company for Kenworth, Peterbilt, and DAF trucks. From April 1993 to April 1997, Mr. Adair served as Senior Vice President of Finance for ValliCorp Holdings and ValliWide Bank.

Kyle R. Sugamele, age 40, joined Concur in August 2000 as its Vice President, General Counsel and Corporate Secretary. From July 1995 to August 2000, Mr. Sugamele served as Vice President, General Counsel, and Corporate Secretary at Cellular Technical Services Company, Inc., a provider of software solutions for the wireless telecommunications industry. From 1991 to 1995, Mr. Sugamele practiced law at the firm of Mundt MacGregor LLP in Seattle. Prior to that time, Mr. Sugamele practiced law at the firm of Graham & Dunn PC in Seattle.

Elena A. Donio, age 32, joined Concur in January 1998 and currently serves as Vice President of Sales and Marketing. Prior to becoming Vice President of Sales and Marketing in September 2002, she served in various roles at Concur, including Vice President of Worldwide Marketing and Vice President of Product Management. From January 1995 to January 1998, she served as a Senior Manager at Deloitte & Touche Consulting Group in its division specializing in SAP implementation services.

Mary A. Gallagher, age 42, joined Concur in March 1999 and currently serves as Vice President of Professional Services. From March 1999 to February 2001, she served as its Vice President of Consulting Services. From January 1993 to March 1999, she served in various consulting management roles at Hyperion Solutions Corporation, a provider of business performance management software. From 1988 to 1993, she served as a Client Services Manager at MAI Systems Corporation, a provider of information system re-engineering and support for hospitality and process manufacturing industries.

Tim Y. FitzGerald, age 36, joined Concur in July 1996 and currently serves as its Vice President of Strategic Alliances. From July 1996 to September 2000, he served as its Vice President of North American Sales. From April 1994 to July 1996, he served as Divisional Vice President of Marketing and Sales for Computer Associates International, Inc., a provider of integrated computer software products.

Simon Nelson, age 43, joined Concur in May 1999 and currently serves as its Vice President and General Manager of EMEA Operations, based in Amersham, Buckinghamshire, United Kingdom. From October 1996 to April 1999, Mr. Nelson was European Professional Services Director for Epicor Software Corporation, an enterprise software company. Mr. Nelson has 25 years experience in working in the European software industry, during which he has held senior management positions for such companies as JBA and Apple Computer.

Susan S. Webber, age 48, joined Concur in May 2002 and currently serves as its Vice President of Human Resources. From February 2000 to May 2002, she served as Vice President of Human Resources and Administration for VoteHere, Inc., a provider of e-voting software. From January 1999 to January 2000, she served as a consultant with the Continuous Learning Group, where she was responsible for executive coaching and leadership initiatives. From April 1994 to January 1999, she served as Executive Officer and Vice President

5

of Human Resources and led the Customer Service, Technical Support and Quality organizations at Data I/O Corporation, a provider of automated device handling, programming, and marking systems for programmable integrated circuits.

OWNERSHIP OF SECURITIES

The following table sets forth, as of January 15, 2003 (except as otherwise indicated in the footnotes below), information with respect to the beneficial ownership of Concur’s common stock by:

| | • | | each person known by Concur to own beneficially more than 5% of the outstanding shares of its common stock; |

| | • | | the “Named Executive Officers,” as such term is defined under “Summary Compensation Table” below; and |

| | • | | all current directors and executive officers as a group. |

Beneficial ownership is determined under the rules of the SEC and generally includes voting or investment power with respect to securities. To our knowledge, the persons and entities named in the table have sole voting and investment power with respect to all shares beneficially owned, subject to community property laws where applicable and except as otherwise indicated below. Shares of common stock subject to options that are exercisable on or before March 16, 2003 (within 60 days of January 15, 2003) are deemed to be outstanding and beneficially owned by the person holding the options for the purpose of computing the percentage ownership of that person. To determine the number of shares beneficially owned by persons other than our directors, executive officers and their affiliates, we have relied on beneficial ownership reports filed by such persons with the SEC.

The percentage of outstanding shares beneficially owned as of January 15, 2003 is based on 30,934,754 shares of common stock outstanding on such date.

Name and Address of Beneficial Owner

| | Amount and Nature of Beneficial Ownership

| | | Percent of Outstanding Shares

| |

| EnTrust Capital, Inc. | | 2,567,759 | | | 8.3 | % |

Norman A. Fogelsong

Institutional Venture Partners VII, L.P. and affiliates | | 2,256,449 | (1) | | 7.3 | % |

Robert Finzi Sprout Group and affiliates | | 1,912,251 | (2) | | 6.2 | % |

| Oak Management Corporation | | 1,803,666 | | | 5.8 | % |

| S. Steven Singh | | 1,570,998 | (3) | | 5.0 | % |

| Michael W. Hilton | | 1,291,531 | (4) | | 4.1 | % |

| Rajeev Singh | | 666,768 | (5) | | 2.1 | % |

| Stephen A. Yount** | | 416,667 | (6) | | 1.3 | % |

| Michael J. Levinthal | | 399,855 | (7) | | 1.3 | % |

| Art Dorfman** | | 232,397 | (8) | | * | |

| Mary Gallagher | | 113,992 | (9) | | * | |

| William P. Hannon | | 51,250 | (10) | | * | |

| All current directors and executive officers as a group (14 persons) | | 8,810,891 | (11) | | 26.6 | % |

| ** | | Person is no longer an executive officer of Concur. |

| (1) | | Represents 10,000 shares owned directly by Mr. Fogelsong, and 44,166 shares subject to options exercisable by Mr. Fogelsong on or before March 16, 2003. Also represents 2,092,961 shares owned by Institutional |

6

| | Venture Partners VII, L.P. (“IVP-VII”), 34,046 shares owned by Institutional Venture Management VII, L.P. (“IVM-VII”), the general partner of IVP VII, and 75,276 shares owned by IVP Founders Fund I, of which Institutional Venture Management VI (“IVM-VI”) is the general partner. Mr. Fogelsong, a director of Concur, is a general partner of IVM-VI and IVM-VII, and disclaims beneficial ownership of these shares except to the extent of his actual pecuniary interest, but exercises shared voting and shared investment power with respect to these shares. The address for Mr. Fogelsong and all of the above Institutional Venture Partners entities is 3000 Sand Hill Road, Building 2, Menlo Park, California 94025. |

| (2) | | Represents 96,142 shares owned by Sprout Venture Capital, L.P., 1,664,033 shares owned by Sprout Capital VIII, L.P., 137,736 shares owned by DLJ ESC II, L.P., and 14,340 shares owned by DLJ Capital Corporation. DLJ Capital Corporation is the Managing General Partner of Sprout Venture Capital, L.P. and Sprout Capital VIII, L.P. DLJ LBO Plans Management Corp. is the General Partner of DLJ ESC II, L.P. Mr. Finzi is a Managing Director of DLJ Capital Corporation. Mr. Finzi disclaims beneficial ownership of these shares except to the extent of his pecuniary interest therein. The address for Mr. Finzi and all of the above Sprout Group entities is 3000 Sand Hill Road, Building 3, Menlo Park, California 94025. |

| (3) | | Includes 865,998 shares owned directly and 705,000 shares subject to options exercisable on or before March 16, 2003. |

| (4) | | Includes 890,468 shares owned directly and 401,063 shares subject to options exercisable on or before March 16, 2003. |

| (5) | | Includes 169,780 shares owned directly and 496,688 shares subject to options exercisable on or before March 16, 2003. |

| (6) | | Includes 20,000 shares owned directly and 396,667 shares subject to options exercisable on or before March 16, 2003. |

| (7) | | Includes 276,390 shares owned directly, 79,299 shares owned indirectly as trustee for certain family trusts, and 44,166 shares subject to options exercisable on or before March 16, 2003. |

| (8) | | Includes 232,397 shares subject to options exercisable on or before March 16, 2003. |

| (9) | | Includes 11,690 shares owned directly and 102,302 shares subject to options exercisable on or before March 16, 2003. |

| (10) | | Includes 10,000 shares owned directly and 41,250 shares subject to options exercisable on or before March 16, 2003. |

| (11) | | Includes 2,264,248 shares subject to options exercisable on or before March 16, 2003, including options described in the above footnotes. |

Section 16(a) Beneficial Ownership Reporting Compliance

Under the securities laws of the United States, Concur’s directors and officers, and any persons who own more than 10% of Concur’s common stock, are required under Section 16(a) of the Securities Exchange Act of 1934 to file initial reports of ownership and reports of changes in ownership with the SEC. Specific due dates have been established by the SEC, and Concur is required to disclose in this proxy statement any failure to file by those dates. Based solely upon its review of the copies of such reports for fiscal 2002 as furnished to Concur and written representations from Concur’s directors and officers, Concur believes that all directors, officers, and greater-than-10% beneficial owners have made all required Section 16(a) filings on a timely basis for such fiscal year.

7

EXECUTIVE COMPENSATION AND RELATED INFORMATION

Summary Compensation Table

The following table sets forth the compensation awarded, earned, or paid for services rendered in all capacities by the Chief Executive Officer and each of the other four most-highly compensated executive officers who served as executive officers as of September 30, 2002 and who received salary and bonus in excess of $100,000 during fiscal 2002 (which includes two persons who are no longer executive officers of Concur) (the “Named Executive Officers”) for each of the last three fiscal years.

| | | Annual Compensation

| | Long-Term Compensation Awards (1)

|

| | | Year

| | Salary

| | Bonus

| | Securities Underlying Options

|

S. Steven Singh President, Chief Executive Officer, and Chairman of the Board | | 2002 2001 2000 | | $ | 226,042 250,008 248,077 | | $ | 0 178,250 36,923 | | 150,000 0 175,000 |

Rajeev Singh Chief Operating Officer | | 2002 2001 2000 | | $ | 212,813 211,578 173,731 | | $ | 0 126,253 32,918 | | 150,000 225,000 165,000 |

Mary A. Gallagher Vice President of Professional Services | | 2002 2001 2000 | | $ | 195,968 202,221 171,821 | | $ | 15,401 70,859 77,287 | | 30,000 5,000 40,500 |

Stephen A. Yount Former Chief Operating Officer | | 2002 2001 2000 | | $ | 234,896 236,579 52,308 | | $ | 0 134,750 0 | | 80,000 225,000 300,000 |

Arthur Dorfman Former Vice President of Worldwide Sales | | 2002 2001 2000 | | $ | 329,148 381,543 139,779 | | $ | 0 0 10,000 | | 50,000 0 365,000 |

| (1) | | None of the Named Executive Officers received any restricted stock awards or long-term incentive plan payouts in fiscal 2002, 2001, or 2000. |

Stock Options

Table of Option Grants in Fiscal 2002

The following table provides information with respect to stock option grants made to the Named Executive Officers during fiscal 2002. No stock appreciation rights were granted to any of the Named Executive Officers during fiscal 2002.

| | | Individual Grants

| | |

Name

| | Number of Securities Underlying Options Granted (1)

| | % of Total Options Granted to Employees in Fiscal 2002 (2)

| | | Exercise Price Per Share (3)

| | Expiration

Date

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term (4)

|

| | | | | | At 5%

| | At 10%

|

| S. Steven Singh | | 150,000 | | 8.18 | % | | $ | 0.8500 | | 11/9/11 | | $ | 80,184 | | $ | 203,202 |

| Rajeev Singh | | 150,000 | | 8.18 | % | | $ | 0.8500 | | 11/9/11 | | $ | 80,184 | | $ | 203,202 |

| Mary A. Gallagher | | 30,000 | | 1.64 | % | | $ | 0.8500 | | 11/9/11 | | $ | 16,037 | | $ | 40,640 |

| Stephen A. Yount | | 80,000 | | 4.36 | % | | $ | 0.8500 | | 11/9/11 | | $ | 42,765 | | $ | 108,374 |

| Arthur Dorfman | | 50,000 | | 2.73 | % | | $ | 0.8500 | | 11/9/11 | | $ | 26,728 | | $ | 67,734 |

8

| (1) | | All options granted in fiscal 2002 were granted pursuant to Concur’s 1998 Equity Incentive Plan and become exercisable with respect to 25% of the shares on the first anniversary of the date of grant and with respect to an additional 2.0833% options each month thereafter and, in certain cases, subject to acceleration upon certain changes in control of Concur. |

| (2) | | Based on 1,832,885 options granted to all employees during fiscal 2002. |

| (3) | | Options were granted at an exercise price equal to the fair market value of Concur’s common stock as of the date of grant. |

| (4) | | The potential realizable value is calculated based upon the term of the option at its time of grant, and by assuming that the aggregate exercise price appreciates at the indicated annual rate compounded annually for the entire term of the option, and that the option is exercised and sold on the last day of its term for the appreciated price. The hypothetical 5% and 10% assumed annual compound rates of stock price appreciation are mandated by the rules of the SEC and do not represent Concur’s estimates or projections of future common stock prices. There can be no assurance that the common stock will appreciate at any particular rate or at all. |

Table of Aggregated Option Exercises and 2002 Fiscal Year-End Option Values

The following table sets forth information with respect to stock option grants to the Named Executive Officers, including the number of shares of common stock purchased upon exercise of options in fiscal 2002, the net value realized upon such exercise, the number of unexercised options outstanding on September 30, 2002 and the value of unexercised “in-the-money” options on September 30, 2002.

Name

| | Shares Acquired on Exercise

| | Value Realized(1)

| | Number of Securities

Underlying Unexercised

Options at

September 30, 2002 Exercisable/Unexercisable

| | Value of Unexercised

In-the-Money Options at

September 30, 2002 Exercisable/Unexercisable(2)

|

| S. Steven Singh | | 0 | | $ | 0 | | 636,056/168,944 | | $ | 553,600/$132,000 |

| Rajeev Singh | | 0 | | $ | 0 | | 404,574/297,426 | | $ | 146,851/$210,544 |

| Mary A. Gallagher | | 0 | | $ | 0 | | 81,343/44,157 | | $ | 219/$26,706 |

| Stephen A. Yount | | 0 | | $ | 0 | | 317,813/287,187 | | $ | 61,091/$148,944 |

| Arthur Dorfman | | 0 | | $ | 0 | | 206,834/208,166 | | $ | 0/$44,000 |

| (1) | | Based on the market price on day of exercise less the option exercise price payable per share. |

| (2) | | These values are based on the positive spread between the respective exercise prices of the outstanding options and $1.73, the closing per share price of Concur’s common stock on the Nasdaq National Market on September 30, 2002; the stated values have not been realized, and may never be realized. |

Employment Contracts and Change in Control Agreements

Certain options granted by Concur to the Named Executive Officers provide that, if Concur is acquired by merger, asset sale, or other change of control of Concur, then all of any unvested shares held by that individual will become vested and exercisable. Certain other options granted by Concur to the Named Executive Officers provide that, if Concur is acquired by merger, asset sale, or other change of control of Concur, and within twelve months thereafter the employee’s employment with the successor entity is terminated without cause, the successor entity effects a material adverse change in the employee’s responsibilities, or the successor entity reduces the employee’s base salary, then all of any unvested shares held by that individual will become vested and exercisable. The numbers of shares subject to all outstanding options held by our Named Executive Officers are set forth above under “Table of Aggregated Option Exercises and 2002 Fiscal Year-End Option Values.”

9

COMMITTEE REPORTS AND STOCK PERFORMANCE GRAPH

Notwithstanding anything to the contrary set forth in any of Concur’s previous filings under the Securities Act of 1933, and the Securities Exchange Act of 1934 that might incorporate future filings, including this proxy statement, in whole or in part, the following Compensation Committee Report, Audit Committee Report, and stock performance graph shall not be incorporated by reference in any such filings.

Compensation Committee Report

The Compensation Committee of the Board administers Concur’s executive compensation program. The current members of the Committee are Messrs. Fogelsong, Levinthal, and Finzi. Each is a non-employee director within the meaning of Section 16 of the Securities Exchange Act of 1934.

General Compensation Philosophy

The Compensation Committee acts on behalf of the Board to establish Concur’s general compensation policies for all employees and to determine the compensation for the Chief Executive Officer and other executive officers. It also administers Concur’s stock option plans. Additionally, the Committee is consulted to approve compensation packages for newly-hired executives. The Committee’s compensation policy for executive officers is designed to promote continued performance, and to attract, motivate, and retain talented executives responsible for the success of Concur.

Executive Compensation

At the conclusion of each fiscal year the Committee meets with the Chief Executive Officer to consider executive compensation for the next fiscal year. The Committee determines the compensation levels for the executive officers by reviewing certain independent information sources as they are available, and from the recommendations of the Chief Executive Officer.

Executive officers of Concur are paid base salaries in line with their responsibilities, as determined in the discretion of the Committee. Executive officers are also eligible to receive incentive bonuses based on achievement of performance targets established at the beginning of the fiscal year. During fiscal year 2002, the objectives used by Concur as the basis for incentive bonuses were the achievement of designated corporate objectives for each executive officer.

Long-term equity incentives for executive officers and other Company employees are effected through stock option grants under Concur’s 1998 Equity Incentive Plan. The Committee believes that equity-based compensation in the form of stock options links the interests of management and employees with those of the stockholders. Substantially all of Concur’s full-time employees participate in the 1998 Equity Incentive Plan. The number of shares subject to each stock option granted to executive officers is within the discretion of the Committee and is based on each executive’s position within Concur, past performance, anticipated future contributions, and prior option grants. Each grant allows the executive to acquire shares of Concur’s common stock at a fixed price per share (the market price on the grant date) in installments generally over a four-year period. The option grants will provide a return only if the executive remains with Concur, and only if the market price appreciates over the option term.

CEO Compensation

The annual base salary for Mr. Singh is reviewed and approved annually by the Committee, and is based upon the criteria set forth under the discussion of Executive Compensation above. Mr. Singh’s target incentive bonus is tied to achieving designated corporate objectives and satisfactorily managing Concur’s overall corporate business plan.

10

Compliance with Section 162(m) of the Internal Revenue Code of 1986

Section 162(m) of the Internal Revenue Code limits the tax deduction to $1.0 million for compensation paid to certain executives of public companies. Having considered the requirements of Section 162(m), the Committee believes that grants made pursuant to the 1998 Equity Incentive Plan meet the requirements that such grants be “performance based” and are, therefore, exempt from the limitations on deductibility. Historically, the combined salary and bonus of each executive officer has been below the $1.0 million limit. The Committee’s present intention is to comply with Section 162(m) unless the Committee believes that required changes would not be in the best interest of Concur or its stockholders.

| | | COMPENSATION COMMITTEE |

| | | Norman A. Fogelsong |

| | | Michael J. Levinthal |

| | | Robert Finzi |

11

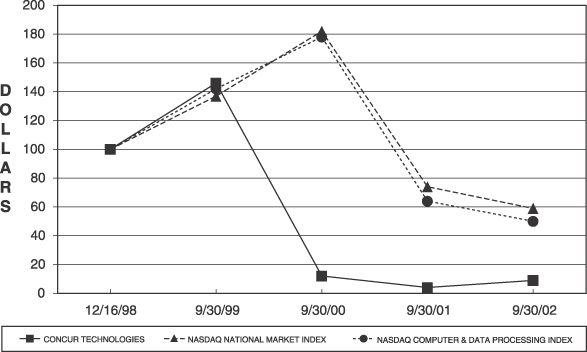

Stock Performance Graph

General

The stock price performance graph below is required by the SEC and should not be deemed to be incorporated by reference in any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, or under the Securities Exchange Act of 1934, except to the extent that Concur specifically incorporates this information by reference, and shall not otherwise be deemed to be soliciting material or filed under such acts.

The graph compares (i) the cumulative total stockholder return on the common stock from Concur’s public offering in December 1998 to September 30, 2002 (measured by the difference between closing prices on each such date) with (ii) the cumulative total return of the Nasdaq National Market Index and the Nasdaq Computer Index over the same period, assuming the investment of $100 in the common stock and in both of the other indices on the date of Concur’s initial public offering, and reinvestment of all dividends.

Comparison of Cumulative Total Return

| | | December 16, 1998

| | September 30, 1999

| | September 30, 2000

| | September 30, 2001

| | September 30, 2002

|

| Concur Technologies | | $ | 100 | | $ | 146 | | $ | 12 | | $ | 4 | | $ | 9 |

| NASDAQ National Market Index | | | 100 | | | 137 | | | 182 | | | 74 | | | 59 |

| NASDAQ Computer & Data Processing Index | | | 100 | | | 142 | | | 178 | | | 64 | | | 50 |

12

Audit Committee Report

The Audit Committee presently is composed of three independent directors and operates under a written charter adopted by the Board of Directors. A copy of the charter was provided as an attachment to Concur’s proxy statement for its 2001 Annual Meeting of Stockholders. The members of the Committee are William P. Hannon, Norman A. Fogelsong, and Michael J. Levinthal. The Committee recommends to the Board of Directors the selection of Concur’s independent auditors.

Management is responsible for Concur’s internal controls and the financial reporting process. The independent auditors are responsible for performing an independent audit of Concur’s consolidated financial statements in accordance with generally accepted auditing standards and to issue a report thereon. The Committee’s responsibility is to monitor and oversee these processes.

In this context, the Committee has met and discussed the fiscal 2002 audited financial statements with management and the independent auditors. Management represented to the Committee that Concur’s consolidated financial statements were prepared in accordance with generally accepted accounting principles, and the Committee has reviewed and discussed the consolidated financial statements with management and the independent auditors. The Committee discussed with the independent auditors matters required to be discussed by Statement on Auditing Standards No.61, entitled Communication with Audit Committees.

Concur’s independent auditors also provided to the Committee the written disclosures required by Independence Standards Board Standard No. 1, entitled Independence Discussions with Audit Committees, and the Committee discussed with the independent auditors that firm’s independence.

Based upon the Committee’s discussion with management and the independent auditors and the Committee’s review of the representation of management and the report of the independent auditors to the Committee, the Committee recommended that the Board include the audited financial statements for fiscal 2002 in Concur’s Annual Report on Form 10-K for the year ended September 30, 2002 filed with the Securities and Exchange Commission.

AUDIT COMMITTEE

William P. Hannon

Norman A. Fogelsong

Michael J. Levinthal

13

INDEPENDENT AUDITOR’S FEES

Concur’s stockholders are not being asked to elect, approve or ratify a principal accountant at this time, as Concur has not formally selected the principal accountant to audit Concur’s financial statements for fiscal 2003 as of the date of this Proxy Statement. We expect that one or more representatives of Ernst & Young LLP, Concur’s independent auditors for fiscal 2002, will be present at the Annual Meeting of Stockholders, will be able to make a statement if they wish to do so, and will be able to respond to appropriate questions.

Audit Fees

In fiscal 2002, the aggregate fees billed by Ernst & Young LLP for its audit of Concur’s financial statements and quarterly reviews were $248,373.

Financial Information Systems Design And Implementation

In fiscal 2002, there were no fees billed by Ernst & Young LLP for financial information systems design and implementation services.

All Other Fees

In fiscal 2002, the aggregate fees billed by Ernst & Young LLP for all other non-audit services were $156,451, consisting of $87,443 for SEC and financial reporting consulting, $14,612 for tax consulting, and $54,396 for consulting in connection with Concur’s acquisition of Captura Software, Inc. The Audit Committee has determined that the provision of these services was compatible with maintaining Ernst & Young LLP’s independence.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Please see “Executive Compensation and Related Information—Employment Contracts and Change in Control Agreements” above for information about certain vesting acceleration provisions of options granted to our Named Executive Officers.

STOCKHOLDER PROPOSALS

Stockholder proposals intended to be presented at Concur’s 2004 Annual Meeting of Stockholders must be received by Concur at its principal executive offices no later than October 6, 2003, in order to be included in Concur’s proxy materials relating to that meeting. Stockholders wishing to bring a proposal before the 2004 Annual Meeting of Stockholders (but not include it in Concur’s proxy materials) must provide written notice of such proposal to the Corporate Secretary of Concur at the principal executive offices of Concur by January 5, 2004. In addition, stockholders must comply with the procedural requirements in Concur’s bylaws, a copy of which may be obtained from Concur. The bylaws are also on file with the SEC.

By Order of the Board of Directors of

Concur Technologies, Inc.

S. Steven Singh

President, Chief Executive Officer

and Chairman of the Board

14

6222 – 185th Avenue N.E. Redmond, WA 98052

| | CONCUR TECHNOLOGIES, INC. ANNUAL MEETING OF STOCKHOLDERS Wednesday, March 5, 2003 Bellevue Club 11200 Southeast 6th Street Bellevue, WA |

| TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: | | |

| | | CONTEN KEEP THIS PORTION FOR YOUR RECORDS |

DETACH AND RETURN THIS PORTION ONLY

THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED.

CONCUR TECHNOLOGIES, INC.

The Board of Directors unanimously recommends a vote “FOR” the Board of Director nominees. | | | | | | | | |

| | | | | For All | | Withhold All | | For All Except | | To withhold authority to vote, mark “For All Except” and write the nominee’s number on the line below. |

| 1. | | Proposal No. 1—Election of Directors; Class I 01) S. Steven Singh 02) Robert Finzi | | ¨ | | ¨ | | ¨

| |

|

THIS PROXY, WHEN PROPERLY EXECUTED, WILL BE VOTED AS DIRECTED OR, IF NO DIRECTION IS GIVEN, WILL BE VOTEDFOR THE PROPOSAL.

Please sign exactly as your name(s) appear on this proxy. If held in joint tenancy, all persons must sign. Trustees, administrators, etc., should include title and authority. Corporations should provide full name of corporation and title of authorized officer signing the proxy.

Address Change? Mark box and indicate changes on the reverse. ¨

|

| | | |

|

| Signature [PLEASE SIGN WITHIN BOX] | | Date | | | | Signature (Joint Owners) | | Date |

There are three ways to vote your Proxy

Your telephone or Internet vote authorizes the Named Proxies to vote your shares in the same manner as if you marked, signed and returned your proxy card.

VOTE BY PHONE – TOLL FREE – 1-800-690-6903 – QUICK *** EASY *** IMMEDIATE

| • | | Use any touch-tone telephone to vote your proxy 24 hours a day, 7 days a week, until 11:59 p.m. Eastern Time on March 4, 2003. |

| • | | You will be prompted to enter your 12-digit Control Number which is located on the reverse. |

| • | | Follow the simple instructions the Vote Voice provides you. |

VOTE BY INTERNET –www.proxyvote.com – QUICK *** EASY *** IMMEDIATE

| • | | Use the Internet to vote your proxy 24 hours a day, 7 days a week, until 11:59 p.m. Eastern Time on March 4, 2003. |

| • | | You will be prompted to enter your 12-digit Control Number which is located on the reverse, to obtain your records and to create an electronic ballot. |

VOTE BY MAIL

Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Concur Technologies, Inc., c/o ADP, 51 Mercedes Way, Edgewood, NY 11717.

If you vote by Phone or Internet, please do not mail your Proxy Card

Ú Please detach here Ú

6222 – 185th Avenue NE Redmond, WA 98052 | | proxy |

This proxy is solicited by the Board of Directors of Concur Technologies, Inc. for use at the Annual Meeting of Stockholders on March 5, 2003.

The shares of stock you hold in your account will be voted as you specify on the reverse.

If no choice is specified, the proxy will be voted “FOR” the Board of Director nominees.

By signing the proxy, you revoke all prior proxies and appoint S. Steven Singh and Kyle R. Sugamele (the “Named Proxies”), and each of them, with full power of substitution, to vote your shares on the matter shown on the reverse side and, in their discretion, on any other matters which may properly come before the Annual Meeting and all adjournments and postponements thereof.

| Address Change: | |

|

| | |

|

| | |

|

| | | If you noted an Address Change on the lines above, please check the corresponding box on the reverse side. (See above for voting instructions) |