InSinkErator A Business Unit of Emerson Electric Co. Unaudited Condensed, Consolidated and Combined Financial Statements as of September 30, 2021 and June 30, 2022, and for the Nine Months Ended June 30, 2021 and 2022

INDEX TO UNAUDITED CONDENSED, CONSOLIDATED AND COMBINED FINANCIAL STATEMENTS Unaudited Condensed, Consolidated and Combined Financial Statements of InSinkErator Unaudited Condensed, Consolidated and Combined Statements of Earnings for the nine months ended June 30, 2021 and 2022 3 Unaudited Condensed, Consolidated and Combined Statements of Comprehensive Income for the nine months ended June 30, 2021 and 2022 4 Condensed, Consolidated and Combined Balance Sheets as of September 30, 2021 and June 30, 2022 (Unaudited) 5 Unaudited Condensed, Consolidated and Combined Statements of Equity for the nine months ended June 30, 2021 and 2022 6 Unaudited Condensed, Consolidated and Combined Statements of Cash Flows for the nine months ended June 30, 2021 and 2022 7 Notes to Unaudited Condensed, Consolidated and Combined Financial Statements 8 2

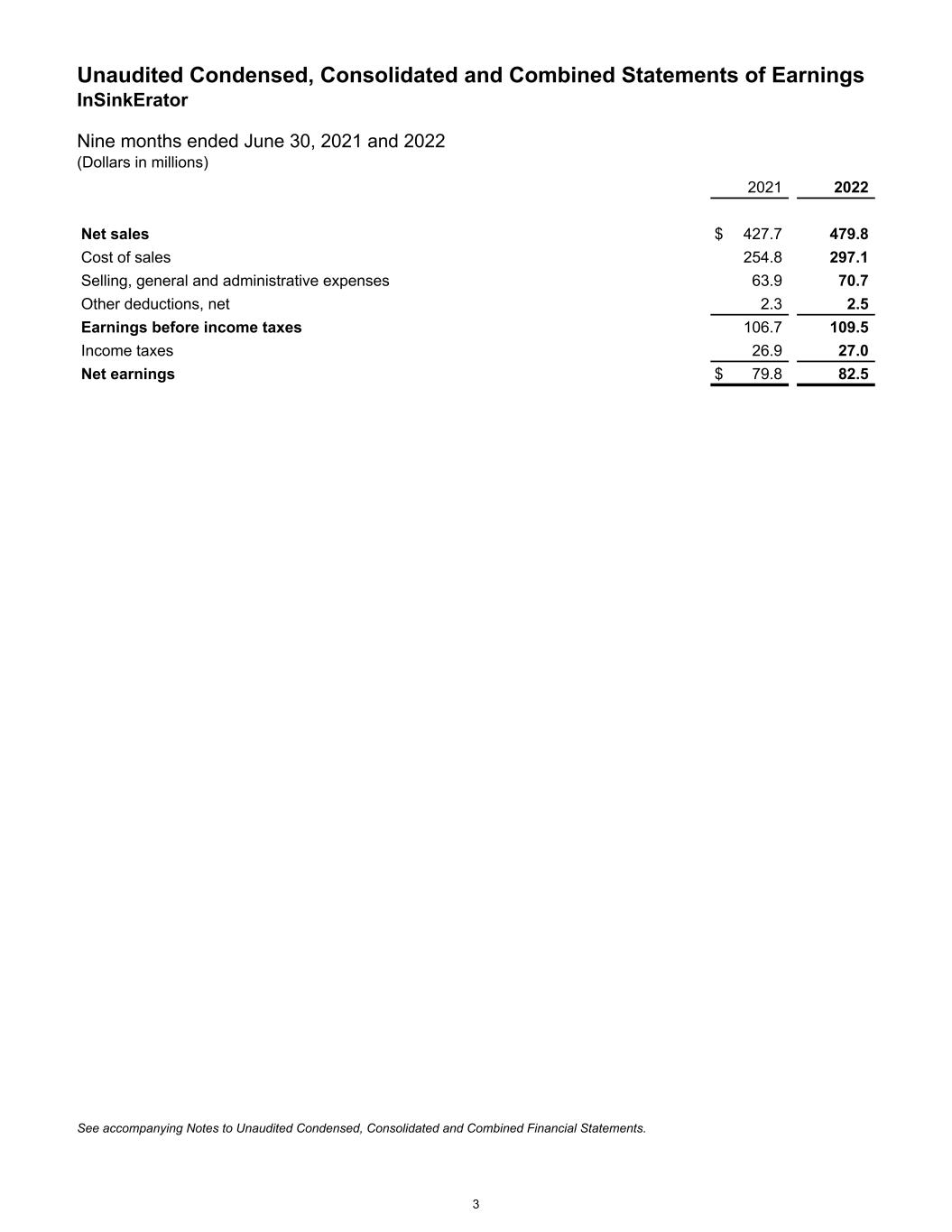

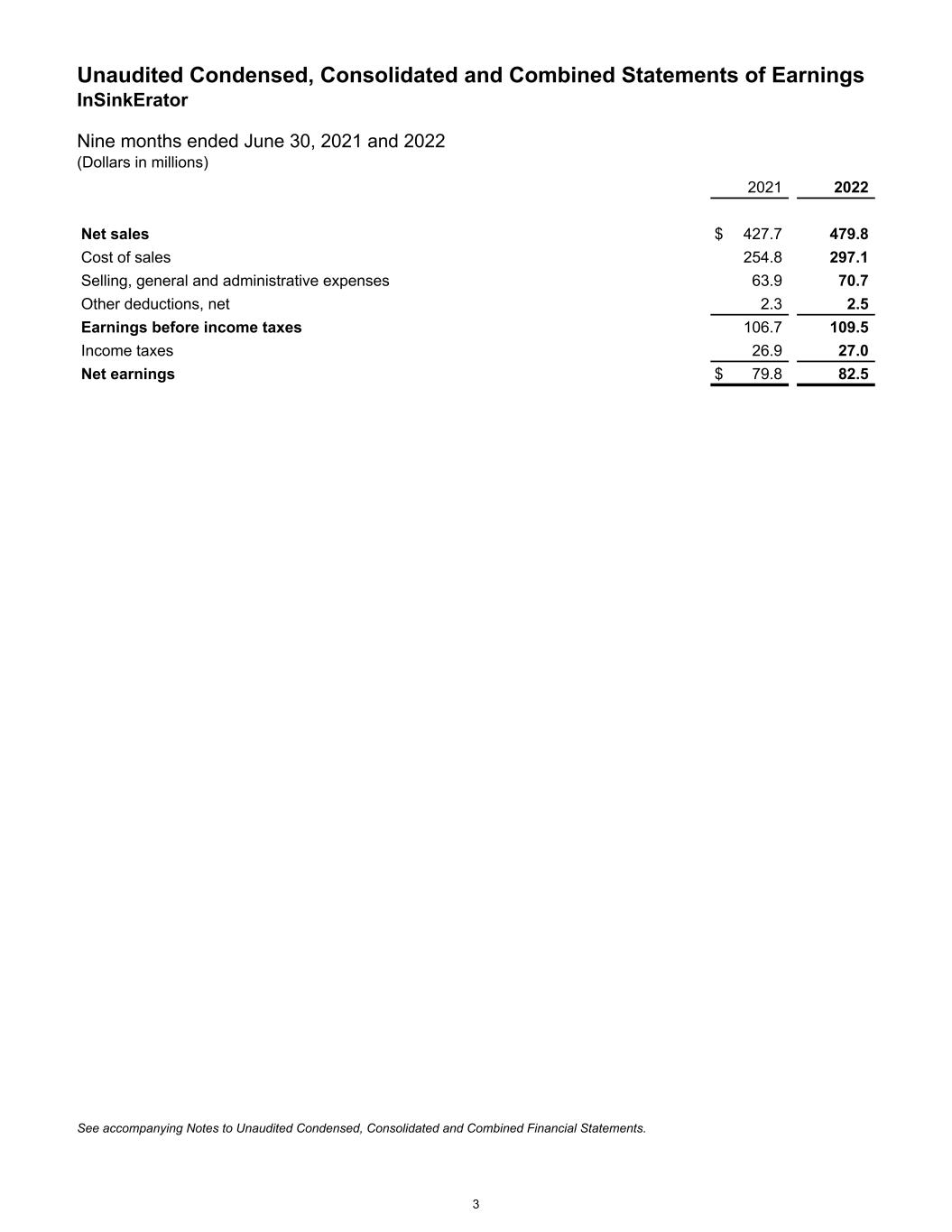

Unaudited Condensed, Consolidated and Combined Statements of Earnings InSinkErator Nine months ended June 30, 2021 and 2022 (Dollars in millions) 2021 2022 Net sales $ 427.7 479.8 Cost of sales 254.8 297.1 Selling, general and administrative expenses 63.9 70.7 Other deductions, net 2.3 2.5 Earnings before income taxes 106.7 109.5 Income taxes 26.9 27.0 Net earnings $ 79.8 82.5 See accompanying Notes to Unaudited Condensed, Consolidated and Combined Financial Statements. 3

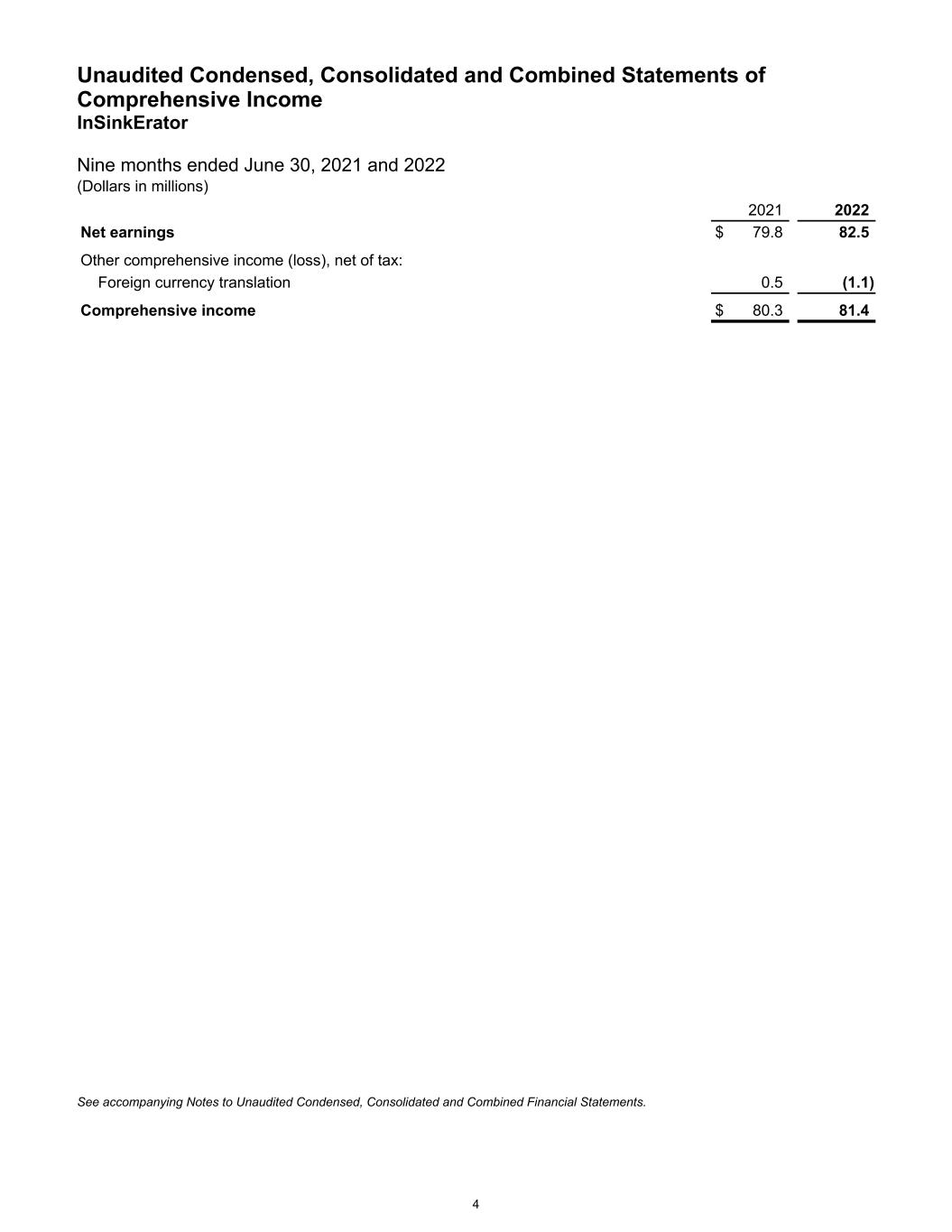

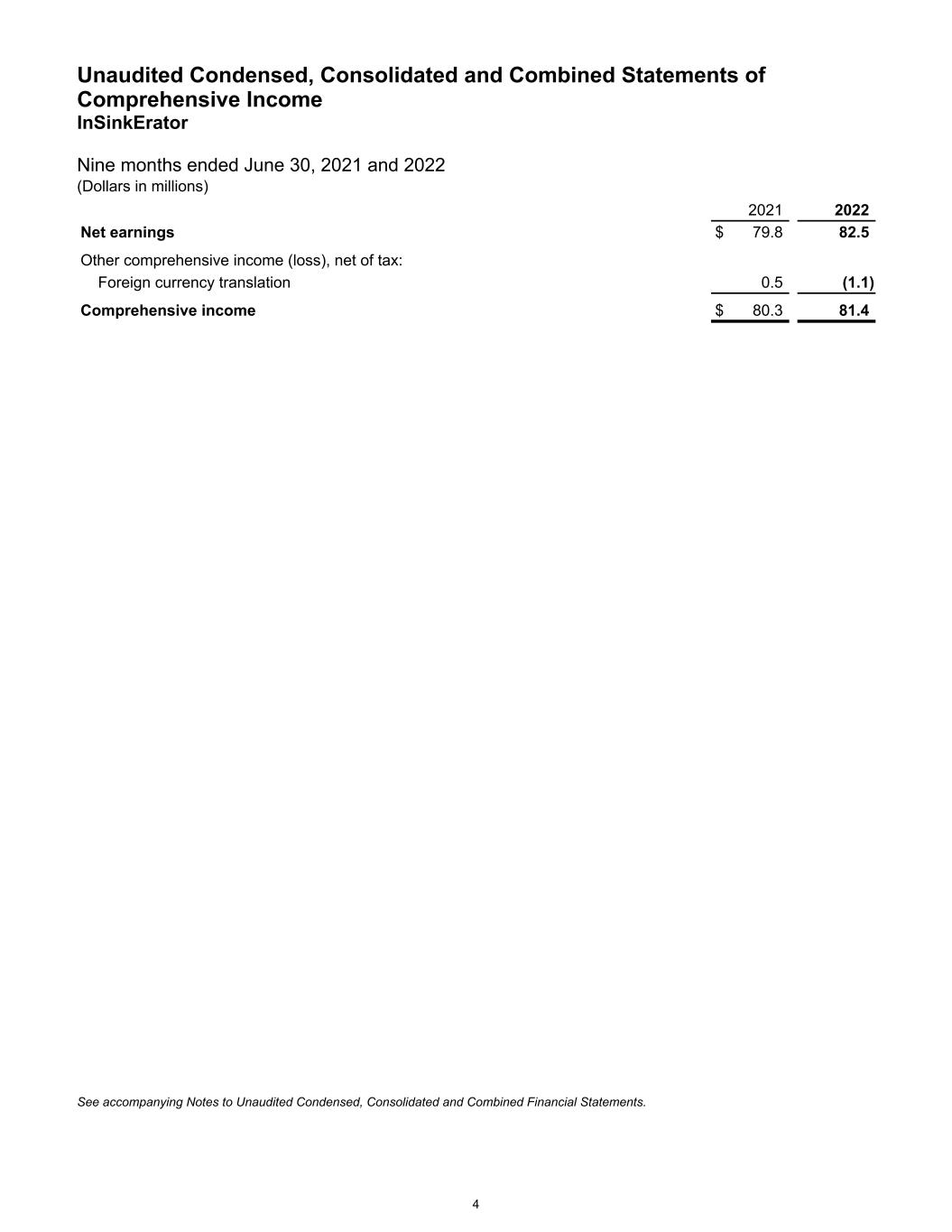

Unaudited Condensed, Consolidated and Combined Statements of Comprehensive Income InSinkErator Nine months ended June 30, 2021 and 2022 (Dollars in millions) 2021 2022 Net earnings $ 79.8 82.5 Other comprehensive income (loss), net of tax: Foreign currency translation 0.5 (1.1) Comprehensive income $ 80.3 81.4 See accompanying Notes to Unaudited Condensed, Consolidated and Combined Financial Statements. 4

Condensed, Consolidated and Combined Balance Sheets InSinkErator (Dollars in millions) Sept 30, 2021 June 30, 2022 ASSETS (Unaudited) Current assets Cash and cash equivalents $ 2.8 4.1 Receivables, net of allowances for credit losses of $0.1 and $0.1, respectively 84.0 90.2 Inventories 51.9 75.2 Income tax receivable 1.4 2.9 Other current assets 4.8 5.0 Total current assets 144.9 177.4 Property, plant and equipment, net 127.6 134.9 Other assets Goodwill 2.4 2.2 Other intangible assets 3.4 2.2 Deferred income taxes 1.0 1.2 Other 11.7 10.0 Total other assets 18.5 15.6 Total assets $ 291.0 327.9 LIABILITIES AND EQUITY Current liabilities Accounts payable $ 97.8 75.1 Accrued expenses 65.1 74.3 Income taxes payable 0.9 — Total current liabilities 163.8 149.4 Deferred income taxes 9.0 6.9 Other long-term liabilities 10.0 9.6 Equity Net parent investment 108.6 163.5 Accumulated other comprehensive income (0.4) (1.5) Total equity 108.2 162.0 Total liabilities and equity $ 291.0 327.9 See accompanying Notes to Unaudited Condensed, Consolidated and Combined Financial Statements. 5

Unaudited Condensed, Consolidated and Combined Statements of Equity InSinkErator Nine months ended June 30, 2021 and 2022 (Dollars in millions) 2021 2022 Net parent investment Beginning balance $ 119.4 108.6 Net earnings 79.8 82.5 Net transfer to Emerson (100.0) (27.6) Ending balance 99.2 163.5 Accumulated other comprehensive income (loss) Beginning balance (0.9) (0.4) Foreign currency translation 0.5 (1.1) Ending balance (0.4) (1.5) Total equity $ 98.8 162.0 See accompanying Notes to Unaudited Condensed, Consolidated and Combined Financial Statements. 6

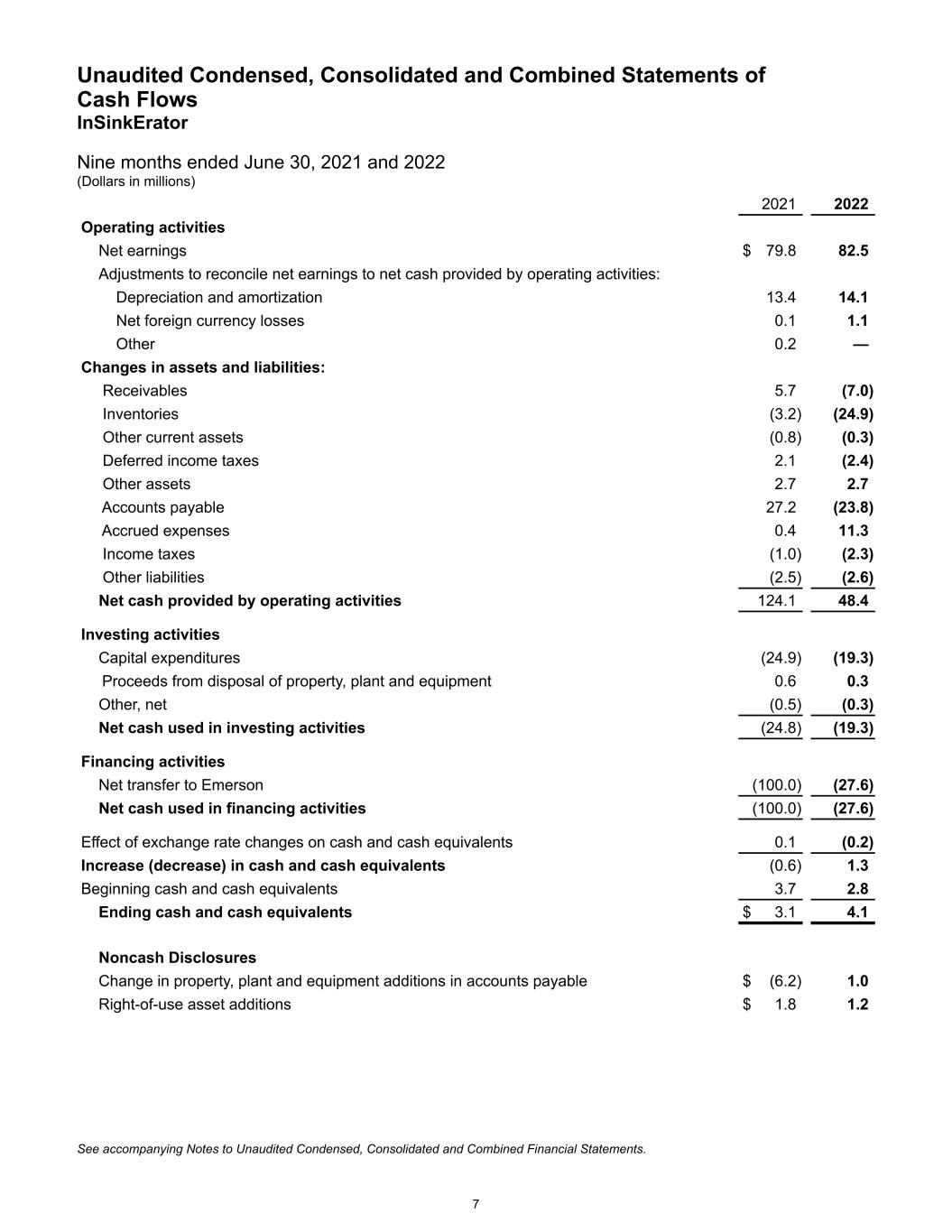

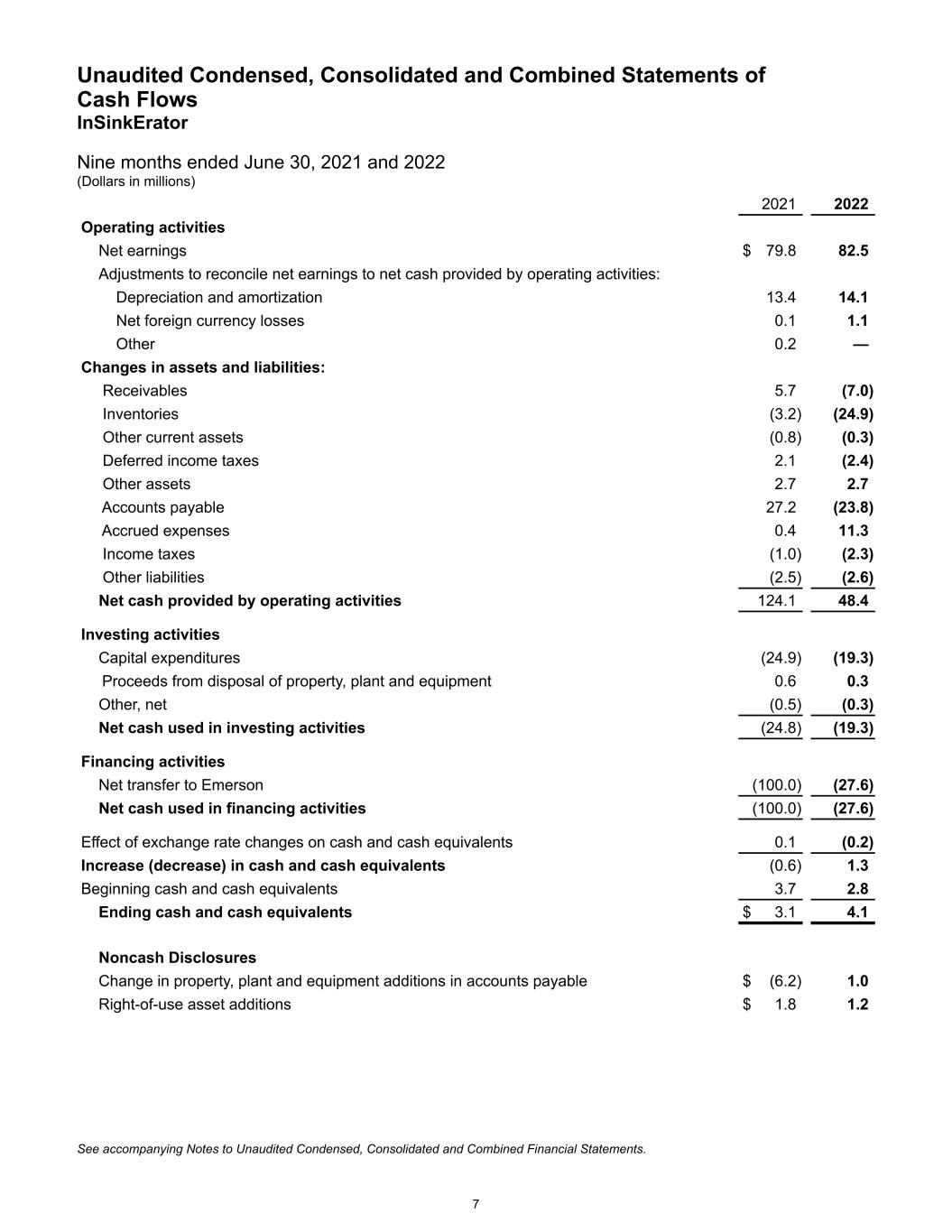

Unaudited Condensed, Consolidated and Combined Statements of Cash Flows InSinkErator Nine months ended June 30, 2021 and 2022 (Dollars in millions) 2021 2022 Operating activities Net earnings $ 79.8 82.5 Adjustments to reconcile net earnings to net cash provided by operating activities: Depreciation and amortization 13.4 14.1 Net foreign currency losses 0.1 1.1 Other 0.2 — Changes in assets and liabilities: Receivables 5.7 (7.0) Inventories (3.2) (24.9) Other current assets (0.8) (0.3) Deferred income taxes 2.1 (2.4) Other assets 2.7 2.7 Accounts payable 27.2 (23.8) Accrued expenses 0.4 11.3 Income taxes (1.0) (2.3) Other liabilities (2.5) (2.6) Net cash provided by operating activities 124.1 48.4 Investing activities Capital expenditures (24.9) (19.3) Proceeds from disposal of property, plant and equipment 0.6 0.3 Other, net (0.5) (0.3) Net cash used in investing activities (24.8) (19.3) Financing activities Net transfer to Emerson (100.0) (27.6) Net cash used in financing activities (100.0) (27.6) Effect of exchange rate changes on cash and cash equivalents 0.1 (0.2) Increase (decrease) in cash and cash equivalents (0.6) 1.3 Beginning cash and cash equivalents 3.7 2.8 Ending cash and cash equivalents $ 3.1 4.1 Noncash Disclosures Change in property, plant and equipment additions in accounts payable $ (6.2) 1.0 Right-of-use asset additions $ 1.8 1.2 See accompanying Notes to Unaudited Condensed, Consolidated and Combined Financial Statements. 7

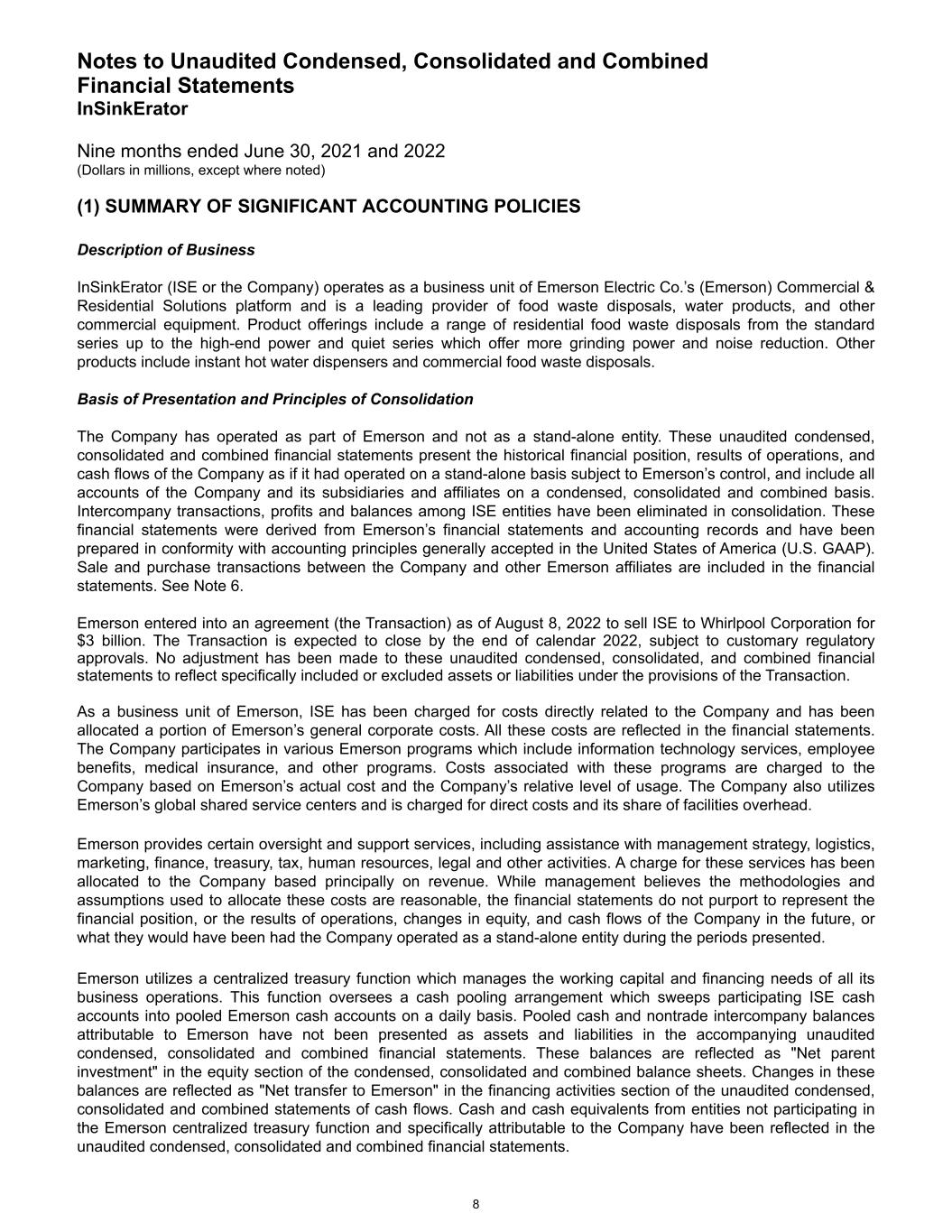

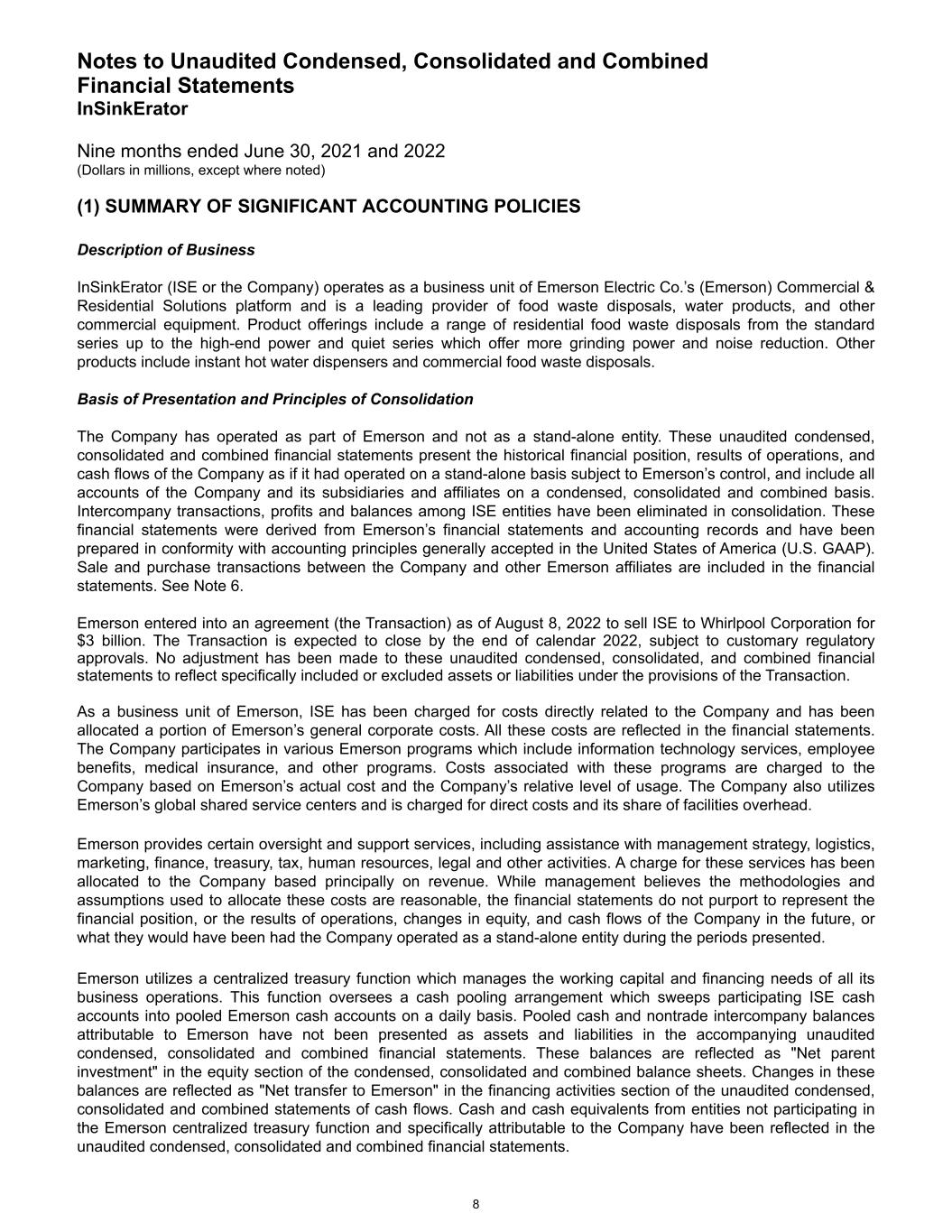

Notes to Unaudited Condensed, Consolidated and Combined Financial Statements InSinkErator Nine months ended June 30, 2021 and 2022 (Dollars in millions, except where noted) (1) SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Description of Business InSinkErator (ISE or the Company) operates as a business unit of Emerson Electric Co.’s (Emerson) Commercial & Residential Solutions platform and is a leading provider of food waste disposals, water products, and other commercial equipment. Product offerings include a range of residential food waste disposals from the standard series up to the high-end power and quiet series which offer more grinding power and noise reduction. Other products include instant hot water dispensers and commercial food waste disposals. Basis of Presentation and Principles of Consolidation The Company has operated as part of Emerson and not as a stand-alone entity. These unaudited condensed, consolidated and combined financial statements present the historical financial position, results of operations, and cash flows of the Company as if it had operated on a stand-alone basis subject to Emerson’s control, and include all accounts of the Company and its subsidiaries and affiliates on a condensed, consolidated and combined basis. Intercompany transactions, profits and balances among ISE entities have been eliminated in consolidation. These financial statements were derived from Emerson’s financial statements and accounting records and have been prepared in conformity with accounting principles generally accepted in the United States of America (U.S. GAAP). Sale and purchase transactions between the Company and other Emerson affiliates are included in the financial statements. See Note 6. Emerson entered into an agreement (the Transaction) as of August 8, 2022 to sell ISE to Whirlpool Corporation for $3 billion. The Transaction is expected to close by the end of calendar 2022, subject to customary regulatory approvals. No adjustment has been made to these unaudited condensed, consolidated, and combined financial statements to reflect specifically included or excluded assets or liabilities under the provisions of the Transaction. As a business unit of Emerson, ISE has been charged for costs directly related to the Company and has been allocated a portion of Emerson’s general corporate costs. All these costs are reflected in the financial statements. The Company participates in various Emerson programs which include information technology services, employee benefits, medical insurance, and other programs. Costs associated with these programs are charged to the Company based on Emerson’s actual cost and the Company’s relative level of usage. The Company also utilizes Emerson’s global shared service centers and is charged for direct costs and its share of facilities overhead. Emerson provides certain oversight and support services, including assistance with management strategy, logistics, marketing, finance, treasury, tax, human resources, legal and other activities. A charge for these services has been allocated to the Company based principally on revenue. While management believes the methodologies and assumptions used to allocate these costs are reasonable, the financial statements do not purport to represent the financial position, or the results of operations, changes in equity, and cash flows of the Company in the future, or what they would have been had the Company operated as a stand-alone entity during the periods presented. Emerson utilizes a centralized treasury function which manages the working capital and financing needs of all its business operations. This function oversees a cash pooling arrangement which sweeps participating ISE cash accounts into pooled Emerson cash accounts on a daily basis. Pooled cash and nontrade intercompany balances attributable to Emerson have not been presented as assets and liabilities in the accompanying unaudited condensed, consolidated and combined financial statements. These balances are reflected as "Net parent investment" in the equity section of the condensed, consolidated and combined balance sheets. Changes in these balances are reflected as "Net transfer to Emerson" in the financing activities section of the unaudited condensed, consolidated and combined statements of cash flows. Cash and cash equivalents from entities not participating in the Emerson centralized treasury function and specifically attributable to the Company have been reflected in the unaudited condensed, consolidated and combined financial statements. 8

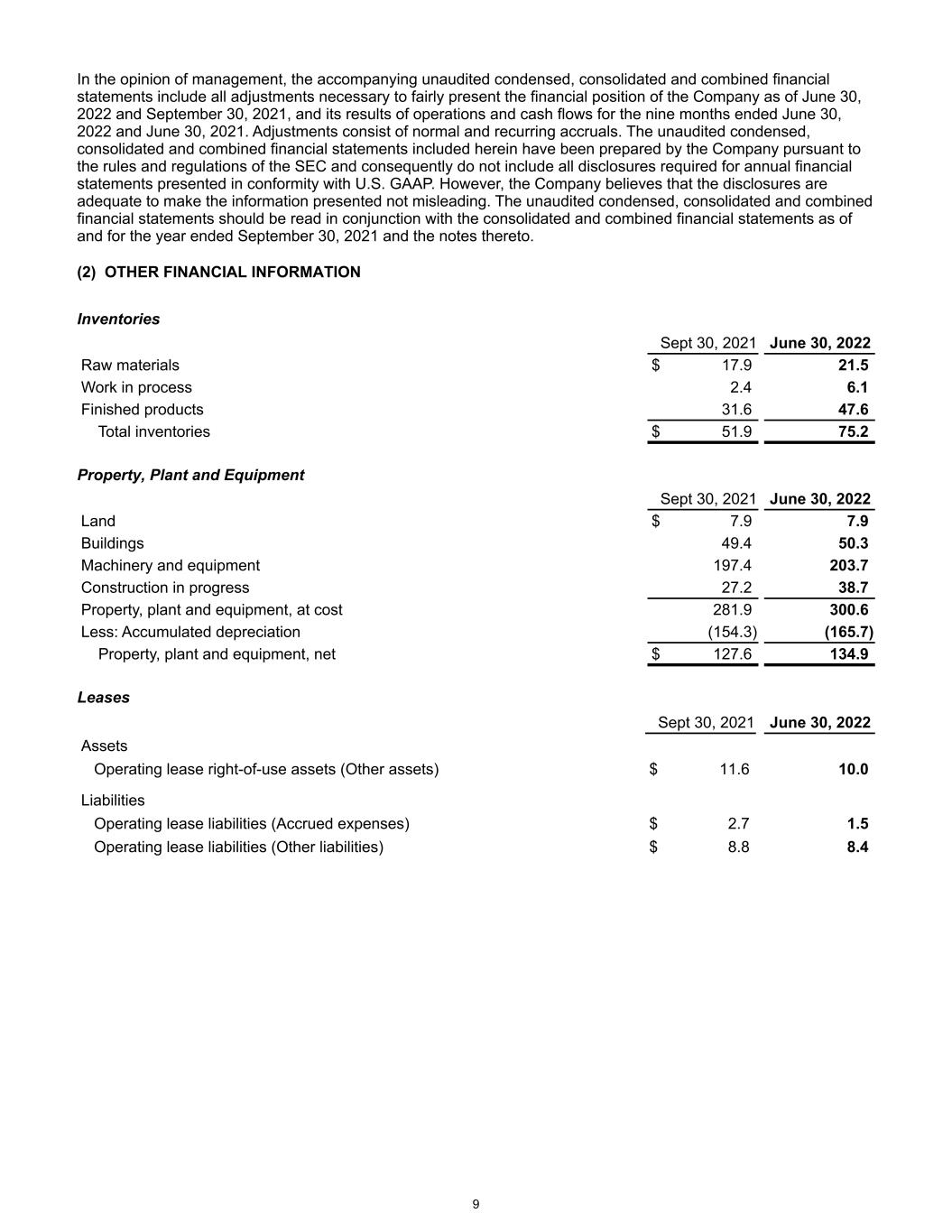

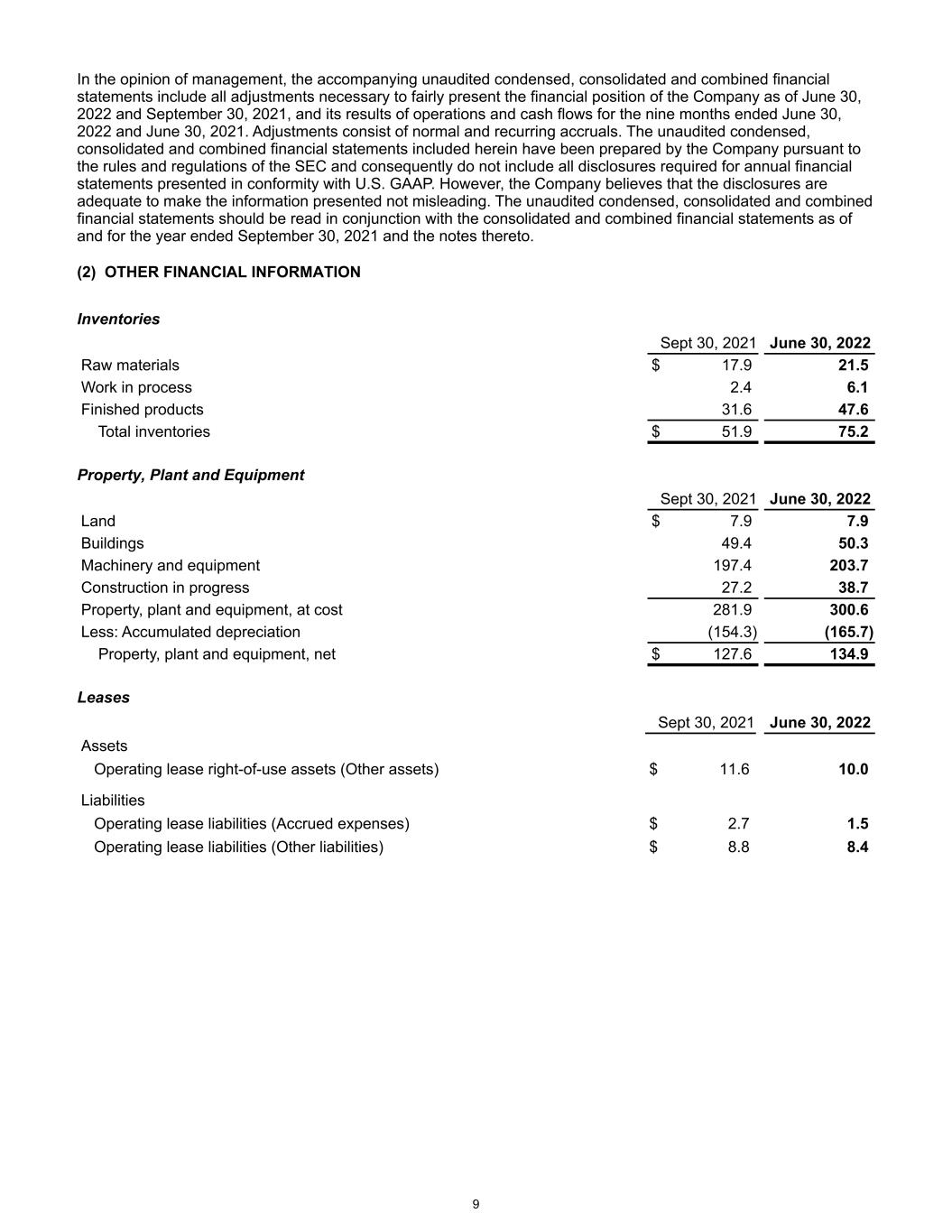

In the opinion of management, the accompanying unaudited condensed, consolidated and combined financial statements include all adjustments necessary to fairly present the financial position of the Company as of June 30, 2022 and September 30, 2021, and its results of operations and cash flows for the nine months ended June 30, 2022 and June 30, 2021. Adjustments consist of normal and recurring accruals. The unaudited condensed, consolidated and combined financial statements included herein have been prepared by the Company pursuant to the rules and regulations of the SEC and consequently do not include all disclosures required for annual financial statements presented in conformity with U.S. GAAP. However, the Company believes that the disclosures are adequate to make the information presented not misleading. The unaudited condensed, consolidated and combined financial statements should be read in conjunction with the consolidated and combined financial statements as of and for the year ended September 30, 2021 and the notes thereto. (2) OTHER FINANCIAL INFORMATION Inventories Sept 30, 2021 June 30, 2022 Raw materials $ 17.9 21.5 Work in process 2.4 6.1 Finished products 31.6 47.6 Total inventories $ 51.9 75.2 Property, Plant and Equipment Sept 30, 2021 June 30, 2022 Land $ 7.9 7.9 Buildings 49.4 50.3 Machinery and equipment 197.4 203.7 Construction in progress 27.2 38.7 Property, plant and equipment, at cost 281.9 300.6 Less: Accumulated depreciation (154.3) (165.7) Property, plant and equipment, net $ 127.6 134.9 Leases Sept 30, 2021 June 30, 2022 Assets Operating lease right-of-use assets (Other assets) $ 11.6 10.0 Liabilities Operating lease liabilities (Accrued expenses) $ 2.7 1.5 Operating lease liabilities (Other liabilities) $ 8.8 8.4 9

Items Reported in Accrued Expenses Items reported in accrued expenses include the following: Sept 30, 2021 June 30, 2022 Customer rebates and quantity discounts $ 14.3 20.8 Warranty $ 12.6 14.0 Salaries and other employee compensation $ 11.0 9.8 Product liability $ 4.1 8.4 Profit sharing $ 9.7 7.0 Items Reported in Earnings Items reported in earnings during the nine months ended June 30, 2021 and 2022 include the following: 2021 2022 Selling expense $ 23.7 25.3 Depreciation expense $ 11.7 12.6 (3) OTHER DEDUCTIONS, NET Other deductions, net are summarized as follows for the nine months ended June 30: 2021 2022 Restructuring expense (see Note 4) $ 2.0 1.6 Foreign currency loss, net 0.1 1.1 Other, net 0.2 (0.2) Total $ 2.3 2.5 Other, net is composed of several items that are individually immaterial, including losses on disposals of property, plant and equipment and other items. (4) RESTRUCTURING Restructuring activity reflects costs associated with the Company's efforts to continually improve operational efficiency and deploy assets to remain competitive. Restructuring expenses were $1.6 and $2.0, for the nine months ended June 30, 2022 and 2021, respectively. The change in the liability for the restructuring costs during the nine months ended June 30, 2022 is as follows: 2021 Expense Utilized/Paid 2022 Severance and benefits $ 0.5 0.1 (0.3) 0.3 Facilities — 1.5 (1.5) — Total $ 0.5 1.6 (1.8) 0.3 Costs incurred in 2021 and 2022 primarily related to costs from a facility move including contract termination, outside storage, moving fixed assets, and information technology. (5) GOODWILL AND OTHER INTANGIBLES The change in the carrying value of goodwill during the nine months ended June 30, 2022 is attributable to foreign currency translation. The Company has recognized no impairments of goodwill. Other intangibles consisted of capitalized software for internal use and customer relationships. 10

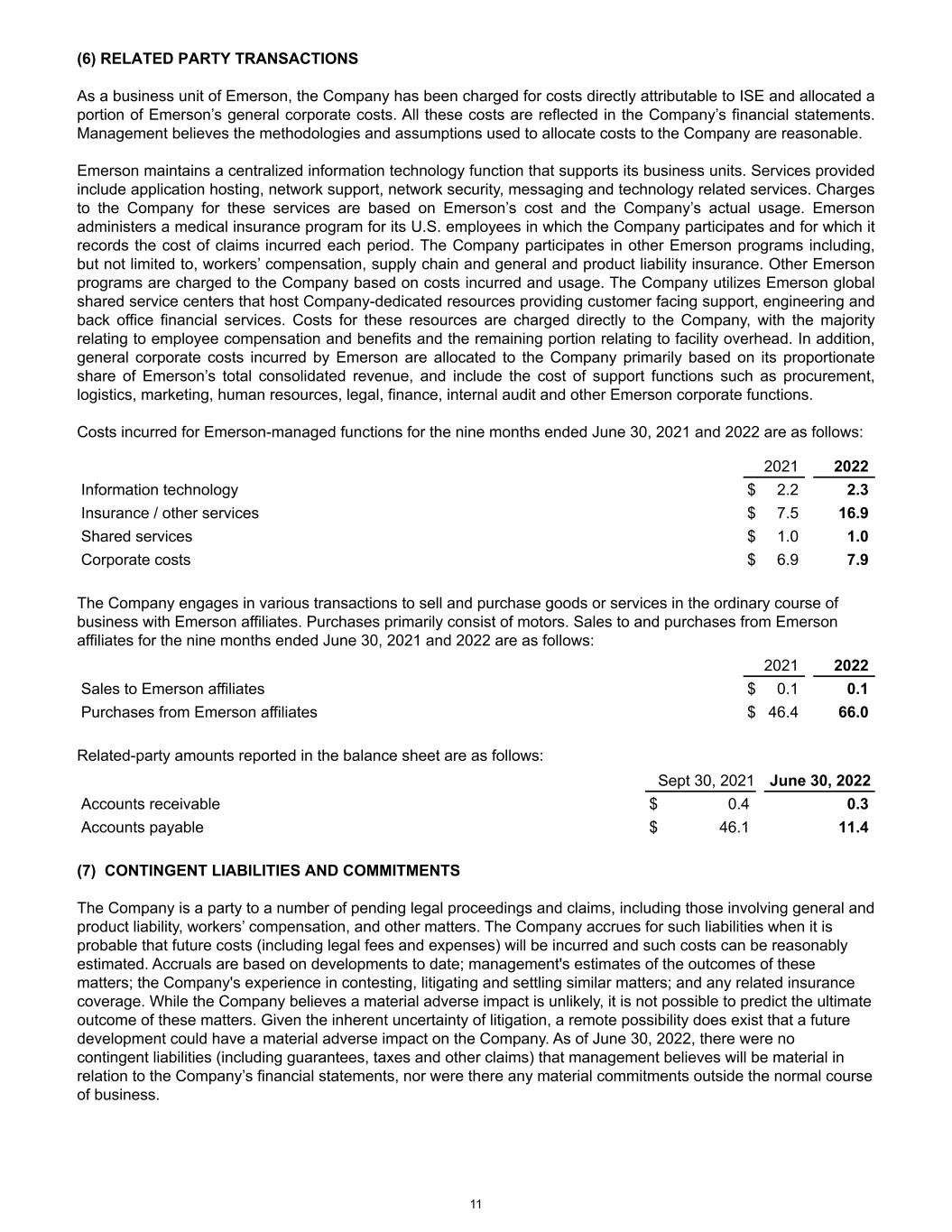

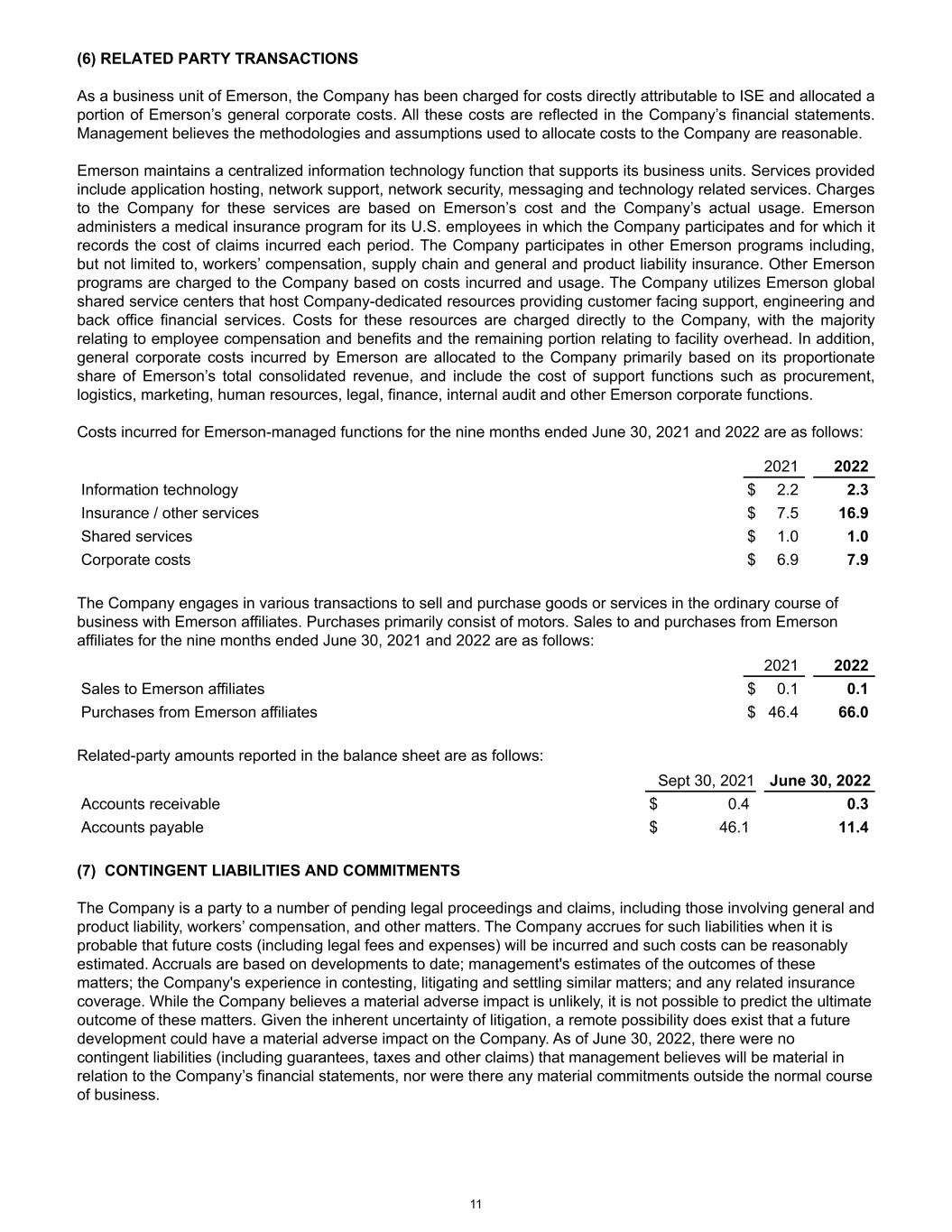

(6) RELATED PARTY TRANSACTIONS As a business unit of Emerson, the Company has been charged for costs directly attributable to ISE and allocated a portion of Emerson’s general corporate costs. All these costs are reflected in the Company’s financial statements. Management believes the methodologies and assumptions used to allocate costs to the Company are reasonable. Emerson maintains a centralized information technology function that supports its business units. Services provided include application hosting, network support, network security, messaging and technology related services. Charges to the Company for these services are based on Emerson’s cost and the Company’s actual usage. Emerson administers a medical insurance program for its U.S. employees in which the Company participates and for which it records the cost of claims incurred each period. The Company participates in other Emerson programs including, but not limited to, workers’ compensation, supply chain and general and product liability insurance. Other Emerson programs are charged to the Company based on costs incurred and usage. The Company utilizes Emerson global shared service centers that host Company-dedicated resources providing customer facing support, engineering and back office financial services. Costs for these resources are charged directly to the Company, with the majority relating to employee compensation and benefits and the remaining portion relating to facility overhead. In addition, general corporate costs incurred by Emerson are allocated to the Company primarily based on its proportionate share of Emerson’s total consolidated revenue, and include the cost of support functions such as procurement, logistics, marketing, human resources, legal, finance, internal audit and other Emerson corporate functions. Costs incurred for Emerson-managed functions for the nine months ended June 30, 2021 and 2022 are as follows: 2021 2022 Information technology $ 2.2 2.3 Insurance / other services $ 7.5 16.9 Shared services $ 1.0 1.0 Corporate costs $ 6.9 7.9 The Company engages in various transactions to sell and purchase goods or services in the ordinary course of business with Emerson affiliates. Purchases primarily consist of motors. Sales to and purchases from Emerson affiliates for the nine months ended June 30, 2021 and 2022 are as follows: 2021 2022 Sales to Emerson affiliates $ 0.1 0.1 Purchases from Emerson affiliates $ 46.4 66.0 Related-party amounts reported in the balance sheet are as follows: Sept 30, 2021 June 30, 2022 Accounts receivable $ 0.4 0.3 Accounts payable $ 46.1 11.4 (7) CONTINGENT LIABILITIES AND COMMITMENTS The Company is a party to a number of pending legal proceedings and claims, including those involving general and product liability, workers’ compensation, and other matters. The Company accrues for such liabilities when it is probable that future costs (including legal fees and expenses) will be incurred and such costs can be reasonably estimated. Accruals are based on developments to date; management's estimates of the outcomes of these matters; the Company's experience in contesting, litigating and settling similar matters; and any related insurance coverage. While the Company believes a material adverse impact is unlikely, it is not possible to predict the ultimate outcome of these matters. Given the inherent uncertainty of litigation, a remote possibility does exist that a future development could have a material adverse impact on the Company. As of June 30, 2022, there were no contingent liabilities (including guarantees, taxes and other claims) that management believes will be material in relation to the Company’s financial statements, nor were there any material commitments outside the normal course of business. 11

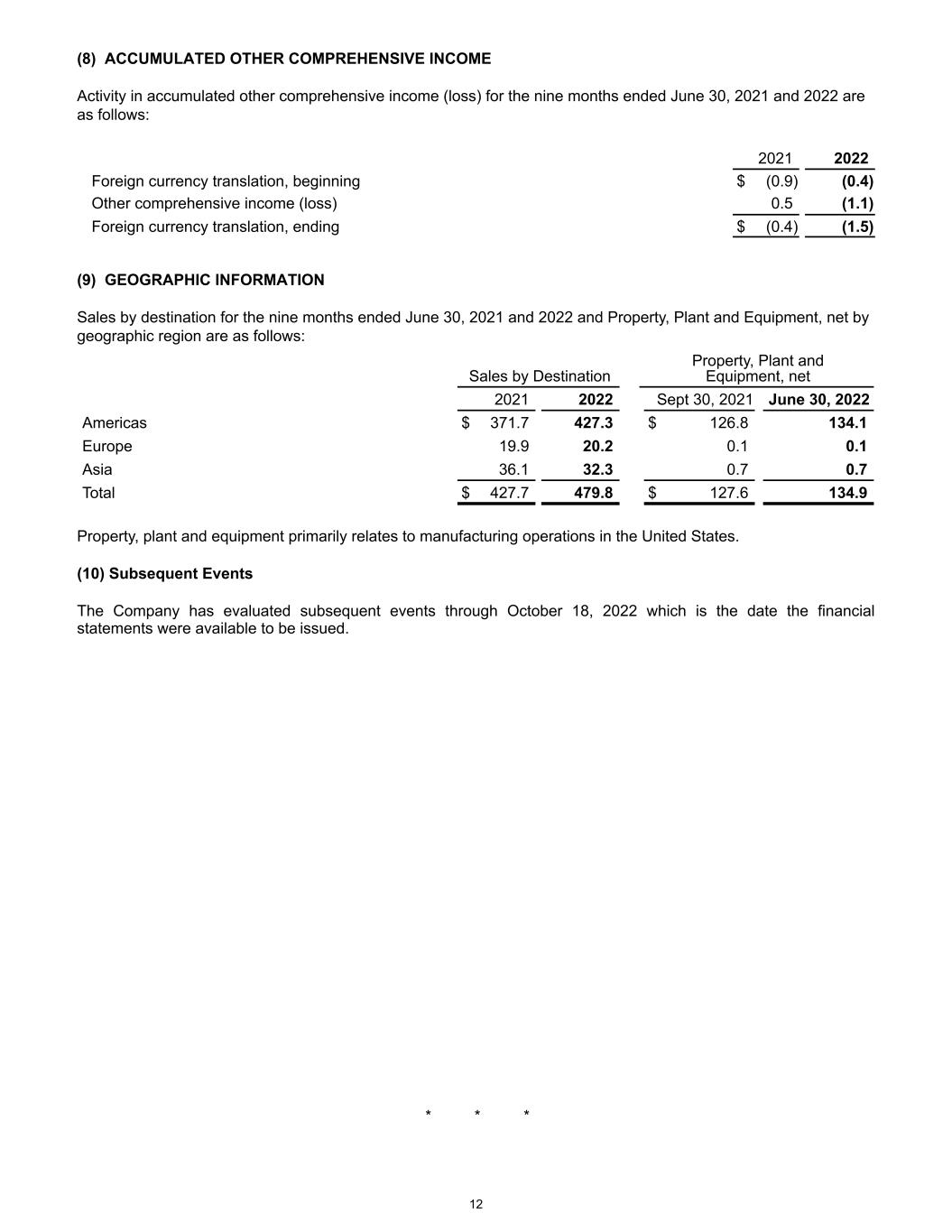

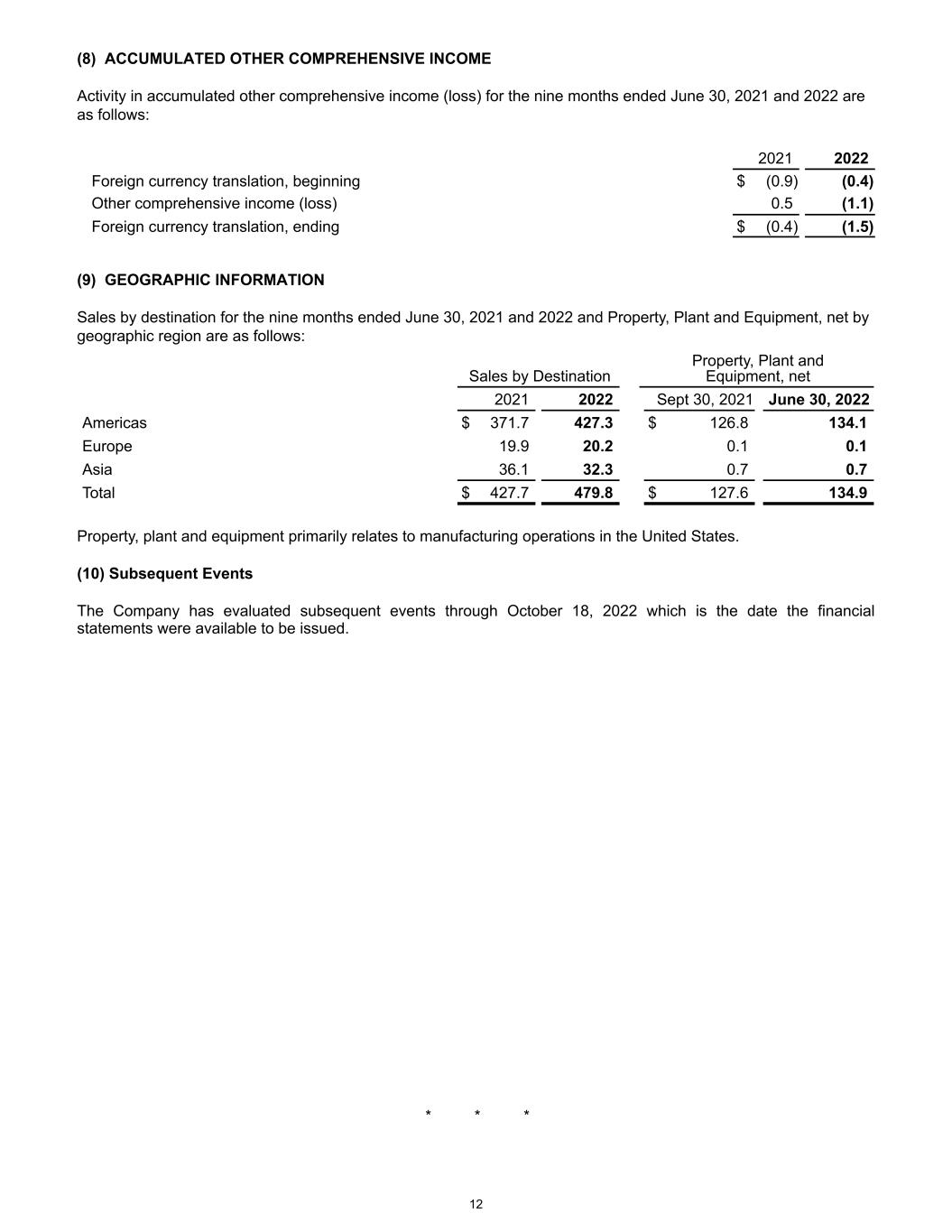

(8) ACCUMULATED OTHER COMPREHENSIVE INCOME Activity in accumulated other comprehensive income (loss) for the nine months ended June 30, 2021 and 2022 are as follows: 2021 2022 Foreign currency translation, beginning $ (0.9) (0.4) Other comprehensive income (loss) 0.5 (1.1) Foreign currency translation, ending $ (0.4) (1.5) (9) GEOGRAPHIC INFORMATION Sales by destination for the nine months ended June 30, 2021 and 2022 and Property, Plant and Equipment, net by geographic region are as follows: Sales by Destination Property, Plant and Equipment, net 2021 2022 Sept 30, 2021 June 30, 2022 Americas $ 371.7 427.3 $ 126.8 134.1 Europe 19.9 20.2 0.1 0.1 Asia 36.1 32.3 0.7 0.7 Total $ 427.7 479.8 $ 127.6 134.9 Property, plant and equipment primarily relates to manufacturing operations in the United States. (10) Subsequent Events The Company has evaluated subsequent events through October 18, 2022 which is the date the financial statements were available to be issued. '* * * 12