UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08895

Voya Funds Trust

(Exact name of registrant as specified in charter)

| 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, AZ | 85258 |

| (Address of principal executive offices) | (Zip code) |

The Corporation Trust Company, 1209 Orange Street, Wilmington, DE 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-992-0180

Date of fiscal year end: March 31

Date of reporting period: March 31, 2023

Item 1. Reports to Stockholders.

(a) The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1):

Annual Report

March 31, 2023

Classes A, C, I, R, R6 and W

Fixed-Income Funds

■

Voya GNMA Income Fund

■

Voya High Yield Bond Fund

■

Voya Intermediate Bond Fund

■

Voya Short Duration High Income Fund

■

Voya Short Term Bond Fund

■

Voya Strategic Income Opportunities Fund

| | | As permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of each fund’s annual and semi-annual shareholder reports, like this annual report, are not sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Voya funds’ website (https://individuals.voya.com/literature), and you will be notified by mail each time a report is posted and provided with a website link to access the report. | | |

| | | If you already elected to receive shareholder reports electronically, you need not take any action. You may elect to receive shareholder reports and other communications from each fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 1-800-992-0180 or by sending an e-mail request to Voyaim_literature@voya.com. | | |

| | | You may elect to receive all future reports in paper free of charge. If you received this document in the mail, please follow the instructions to elect to continue receiving paper copies of your shareholder reports. If you received this document through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with us, you can call 1-800-992-0180 or send an email request to Voyaim_literature@voya.com to let each fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with the Voya funds complex if you invest directly with the funds. | | |

| | | This report is submitted for general information to shareholders of the Voya mutual funds. It is not authorized for distribution to prospective shareholders unless accompanied or preceded by a prospectus which includes details regarding the funds’ investment objectives, risks, charges, expenses and other information. This information should be read carefully. | | |

| | | | | E-Delivery Sign-up – details inside | |

| | | | | | Go Paperless with E-Delivery! | | | | | |

| | | Sign up now for on-line prospectuses, fund reports, and proxy statements. | | |

| | | Just go to individuals.voya.com/page/e-delivery, follow the directions and complete the quick 5 Steps to Enroll. | | |

| | | You will be notified by e-mail when these communications become available on the internet. | | |

PROXY VOTING INFORMATION

A description of the policies and procedures that the Funds use to determine how to vote proxies related to portfolio securities is available: (1) without charge, upon request, by calling Shareholder Services toll-free at (800) 992-0180; (2) on the Funds’ website at www.voyainvestments.com; and (3) on the U.S. Securities and Exchange Commission’s (“SEC’s”) website at www.sec.gov. Information regarding how the Funds voted proxies related to portfolio securities during the most recent 12-month period ended June 30 is available without charge on the Funds’ website at www.voyainvestments.com and on the SEC’s website at www.sec.gov.

QUARTERLY PORTFOLIO HOLDINGS

The Funds file their complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form NPORT-P. The Funds’ Forms NPORT-P are available on the SEC’s website at www.sec.gov. Each Fund’s complete schedule of portfolio holdings is available at: www.voyainvestments.com and without charge upon request from the Fund by calling Shareholder Services toll-free at (800) 992-0180.

[This Page Intentionally Left Blank]

| | | Index | | | | Description | | |

| | | ICE BofAML U.S. Dollar 3-Month Deposit Offered Rate Constant Maturity Index | | | | The index is designed to track the performance of a synthetic asset paying London Interbank Offered Rate (“LIBOR”) to a stated maturity. The index is based on the assumed purchase at par of a synthetic instrument having exactly its stated maturity and with a coupon equal to that day’s fixing rate. That issue is assumed to be sold the following business day (priced at a yield equal to the current day rate) and rolled into a new instrument. | | |

| | | ICE BofA 1-3 Year U..S. Treasury Index | | | | The index is an unmanaged index that tracks the performance of the direct sovereign debt of the U.S. Government having a maturity of at least one year and less than three years. | | |

| | | ICE BofA 1-3 Year BB U.S. Cash Pay High Yield Index | | | | The index is a subset of ICE BofA U.S. Cash Pay High Yield Index including all securities with a remaining term to final maturity of less than 3 years and rated BB1 through BB3, inclusive. The index tracks the performance of US dollar denominated below investment grade corporate debt, currently in a coupon paying period, that is publicly issued in US domestic market. | | |

| | | Bloomberg GNMA Index | | | | An index comprised of all fixed security mortgage pools sponsored by GNMA, including GNMA Graduated Payment Mortgages. | | |

| | | Bloomberg High Yield Bond — 2% Issuer

Constrained Composite Index | | | | An index that includes all fixed income securities having a maximum quality rating of Ba1, a minimum amount outstanding of $150 million, and at least one year to maturity. | | |

| | | Bloomberg U.S. 1-3 Year Government/Credit Bond Index | | | | A widely recognized index of publicly issued fixed rate, investment grade debt securities, including Treasuries, Agencies and credit securities with a maturity of one to three years. | | |

| | | Bloomberg U.S. Aggregate Bond Index | | | | An index of publicly issued investment grade U.S. government, mortgage-backed, asset-backed and corporate debt securities. | | |

| | | Bloomberg U.S. Universal Bond Index | | | | The index represents the union of the U.S. Aggregate Index, U.S. Corporate High Yield Index, Investment Grade 144A Index, Eurodollar Index, U.S. Emerging Markets Index, and the non-ERISA eligible portion of the CMBS Index. The index covers USD-denominated, taxable bonds that are rated either investment grade or high-yield. | | |

| Portfolio Managers’ Report | Voya GNMA Income Fund |

| | Investment Type Allocation

as of March 31, 2023

(as a percentage of net assets) | |

| | | | | | |

| | U.S. Government Agency Obligations | | | 67.6% | |

| | Collateralized Mortgage Obligations | | | 50.3% | |

| | Commercial Mortgage-Backed Securities | | | 3.1% | |

| | Asset-Backed Securities | | | 0.1% | |

| | Liabilities in Excess of Other Assets* | | | (21.1)% | |

| | Net Assets | | | 100.0% | |

| | *

Includes short-term investments. | |

| | Portfolio holdings are subject to change daily. | |

Securities issued by the U.S. Treasury are backed by the full faith and credit of the federal government. Securities issued by individual agencies and organizations may be backed by the full faith and credit of the federal government as to principal or interest but are not direct obligations of the U.S. Treasury. Securities of some agencies and organizations are backed solely by the entity’s own resources or by the ability of the entity to borrow from the U.S. Treasury. Government securities also include certain mortgage-related securities that are sponsored by a U.S. government agency or organization and are not direct obligations of the U.S. government.

Performance: For the year ended March 31, 2023, the Fund’s Class A shares, excluding sales charges, provided a total return of -4.53%, compared to the Bloomberg GNMA Index (the “Index” or “Bloomberg GNMA”), which returned -4.48%, for the same period.

Portfolio Specifics: Monetary policy backdrop has changed drastically from the previous year as the US Federal Reserve has embarked on a policy tightening campaign aimed at reducing inflation, most likely, at the expense of the labor market. Since March of last year, the Fed has increased the Fed Funds rate by 4.75% resulting in an inverted 2-10s yield curve for the majority of the period. As of March 31, 2023, the difference between 2-year and 10-year rate stands at 56 basis points (“bp”), inverted. Additionally, although the bulk of Fed tightening is behind us, the market currently expects another 25 bp rate hike in May. Afterwards, there will be a divergence between market expectation and Fed guidance when it comes to the rate path going into next year.

Excess performance of the Fund was largely driven by off-benchmark collateralized mortgage obligation (“CMO”) holdings. Additional contribution came in the form of duration and curve exposure.

The Fund’s net asset value decreased greater than 7%, primarily driven by price depreciation into the massive rate sell-off.

The Fund uses Treasury futures to hedge exposure to interest rate risk. A mild short position in duration and a flattening bias across key rate durations detracted for the fiscal year.

Current Strategy & Outlook: The landscape for agency mortgage-backed securities (“MBS”) and the US housing market has materially evolved since early 2022. Due to Fed’s aggressive rate hike schedule, currently around 99% of the mortgage universe does not have an economic rate incentive to refinance according to Morgan Stanley’s Total Refinance-able Index. On a national level, home price appreciated by 3% from March 2022 to June 2022 and have been steadily declining since then resulting in home prices remaining flat year-over-year. As a result of stable, if not falling, home prices keeping home-owner equity elevated, cash-out refinancings for newly originated mortgages will remain muted, in our opinion. Additionally, the combination of worsening housing affordability and declining housing inventory has led to lower turnover speeds. These factors combined have caused historically low prepayment speeds and very low organic net supply.

Going forward, as the Fed approaches the end of their rate hiking cycle and pauses to learn the efficacy of the rate increases thus far, treasury and mortgage rates in our view, should stabilize, and rate volatility should decline. As a result of the banking crisis in Spring 2023, banks could start tightening their credit box in the near term. In the long run, bank demand will remain an interesting debate, with the market balancing the odds of increased bank demand stemming from an expansion of BASEL guidelines to regional banks, versus the odds of lower bank demand resulting from additional restrictions imposed on duration and convexity exposures. Given the influences mentioned above, among others, we will continue to monitor changing trends in purchases and refinancings and analyze how borrowers react in the current environment.

The views expressed in this commentary are informed opinions. They should not be considered promises or advice. The views expressed reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Fund holdings are subject to change daily. The outlook for this Fund may differ from that presented for other Voya mutual funds. The Fund’s performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statement. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class.

| Voya GNMA Income Fund | Portfolio Managers’ Report |

| | | Average Annual Total Returns for the Periods Ended March 31, 2023 | | |

| | | | | | 1 Year | | | 5 Year | | | 10 Year | | |

| | | Including Sales Charge: | | |

| | | Class A(1) | | | | | -6.97% | | | | | | -0.29% | | | | | | 0.52% | | | |

| | | Class C(2) | | | | | -6.21% | | | | | | -0.55% | | | | | | 0.02% | | | |

| | | Class I | | | | | -4.11% | | | | | | 0.54% | | | | | | 1.08% | | | |

| | | Class R6(3) | | | | | -4.21% | | | | | | 0.54% | | | | | | 1.08% | | | |

| | | Class W | | | | | -4.15% | | | | | | 0.49% | | | | | | 1.05% | | | |

| | | Excluding Sales Charge: | | |

| | | Class A | | | | | -4.53% | | | | | | 0.21% | | | | | | 0.77% | | | |

| | | Class C | | | | | -5.28% | | | | | | -0.55% | | | | | | 0.02% | | | |

| | | Class I | | | | | -4.11% | | | | | | 0.54% | | | | | | 1.08% | | | |

| | | Class R6(3) | | | | | -4.21% | | | | | | 0.54% | | | | | | 1.08% | | | |

| | | Class W | | | | | -4.15% | | | | | | 0.49% | | | | | | 1.05% | | | |

| | | Bloomberg GNMA | | | | | -4.48% | | | | | | 0.26% | | | | | | 0.87% | | | |

| | | | | |

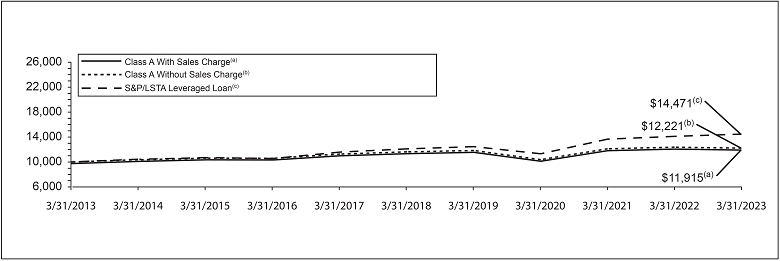

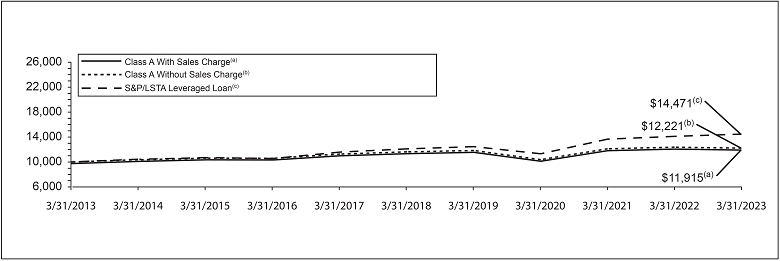

Based on a $10,000 initial investment, the graph and table above illustrate the total return of Voya GNMA Income Fund against the index indicated. The index is unmanaged, has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

The Fund’s performance is shown both with and without the imposition of sales charges.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Fund distributions or the redemption of Fund shares.

The performance shown includes, if applicable, the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total net return. Had all fees and expenses been considered, the total net returns would have been lower.

Performance data represents past performance and is no assurance of future results. Investment return and principal

value of an investment in the Fund will fluctuate. Shares, when sold, may be worth more or less than their original cost. The Fund’s current performance may be lower or higher than the performance data shown. Please log on to www.voyainvestments.com or call (800) 992-0180 to get performance through the most recent month end.

Fund holdings are subject to change daily.

(1)

Reflects deduction of the maximum Class A sales charge of 2.50%.

(2)

Reflects deduction of the Class C deferred sales charge of 1% for the 1 year return.

(3)

R6 incepted on July 31, 2020. Class R6 shares performance shown for the period prior to their inception date is the performance of Class I shares without adjustment for any differences in the expenses between the two classes. If adjusted for such differences, returns would be different.

| Portfolio Managers’ Report | Voya High Yield Bond Fund |

| | Investment Type Allocation

as of March 31, 2023

(as a percentage of net assets) | |

| | | | | | |

| | Corporate Bonds/Notes | | | 92.9% | |

| | Bank Loans | | | 0.8% | |

| | Common Stock | | | 0.3% | |

| | Convertible Bonds/Notes | | | 0.0% | |

| | Assets in Excess of Other Liabilities* | | | 6.0% | |

| | Net Assets | | | 100.0% | |

| | *

Includes short-term investments. | |

| | Portfolio holdings are subject to change daily. | |

Performance: For the year ended March 31, 2023, the Fund’s Class A shares, excluding sales charges, provided a total return of -5.07%, compared to the Bloomberg High Yield Bond — 2% Issuer Constrained Composite Index (the “Index” or “Bloomberg High Yield Bond — 2% Issuer Constrained Composite”), which returned -3.35%, for the same period.

Portfolio Specifics: Inflationary pressures remained top of mind, forcing the U.S. Federal Reserve to aggressively raise interest rates further into restrictive territory. This led to periodic rate volatility and higher overall yields, dampening bond market returns during the trailing 12-month period. Spreads for the high yield (“HY”) bond market ended the period 130 basis points (“bp”) wider on an option-adjusted basis (“OAS”) at 455 bp, as the prospects for a recession quickly grew, and the fundamental health of HY issuers came into focus.

Within the Fund, security selection in media and entertainment, cable and satellite and technology detracted from performance. In contrast, relative benefits included security selection in retailers, an underweight allocation to healthcare and pharma, and the portfolio’s cash position, which provided a positive effect due to the negative total returns experienced in the overall HY bond market.

Current Strategy & Outlook: In our opinion, strains in parts of the financial system are likely to cause the Fed to trim its tightening plans. We believe quick action by regulators has largely addressed concerns of systemic risk in the banking system. In our view, bank balance sheets are generally healthy, and the lack of fundamental consumer and corporate imbalances should limit the severity of any sort of| | Top Ten Holdings

as of March 31, 2023*

(as a percentage of net assets) | |

| | | | | | |

| | Royal Caribbean Cruises Ltd., 5.375%,

07/15/27 | | | 0.7% | |

| | Sirius XM Radio, Inc., 5.000%, 08/01/27 | | | 0.6% | |

| | Sprint Corp., 7.125%, 06/15/24 | | | 0.6% | |

| | Ford Motor Credit Co. LLC, 4.125%, 08/17/27 | | | 0.6% | |

| | American Airlines, Inc./AAdvantage Loyalty IP Ltd., 5.750%, 04/20/29 | | | 0.6% | |

| | Carnival Corp., 6.000%, 05/01/29 | | | 0.5% | |

| | Univision Communications, Inc., 6.625%,

06/01/27 | | | 0.5% | |

| | EnLink Midstream LLC, 5.375%, 06/01/29 | | | 0.5% | |

| | PetSmart, Inc. / PetSmart Finance Corp., 7.750%, 02/15/29 | | | 0.5% | |

| | International Game Technology PLC, 5.250%, 01/15/29 | | | 0.5% | |

| | *

Excludes short-term investments. | |

| | Portfolio holdings are subject to change daily. | |

The long game still needs to play out: a higher cost of capital for banks will tighten lending conditions and raise borrowing costs for companies and consumers, increasing the potential for at least a mild recession, in our view. Since the challenges to the banking system are likely to be disinflationary, further Fed rate hikes may be limited. In our opinion, the focus may soon shift to when the Fed might begin lowering rates. For that to happen, we believe labor markets and economic growth would need to weaken substantially from current levels. Employment data remain solid despite an uptick in the unemployment rate, and the economy has remained remarkably resilient, supported by strong consumer spending.

We believe the HY market would be able to reasonably navigate a mild recessionary outcome with no broad contagion risk from the banking fallout. In terms of sector positioning, we remain positive on the energy sector and are looking to add some exposure after trimming exposure early in the year on tight valuations. Our view is shaped by a positive surprise from Organization of the Petroleum Exporting Countries to support prices in the near term and ongoing structural tailwinds given capital discipline of energy companies and underinvestment in the sector. Additionally, we also remain overweight building materials due to favorable supply and demand dynamics in the housing sector, despite the increase in mortgage rates. With the widening in spreads in March, valuations appear more attractive, and the fundamental health of HY issuers remains generally adequate. Nonetheless, we expect dispersion in performance among borrowers to continue and pockets of stress to emerge as the cycle matures. As such, our focus will be on security selection and finding pockets of value in an increasingly dispersed market.

*

Effective May 1, 2023, Mohamed Basma, CFA was added as a portfolio manager for the Fund and Richard Cumberledge, CFA was removed as a portfolio manager for the Fund.

The views expressed in this commentary are informed opinions. They should not be considered promises or advice. The views expressed reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Fund holdings are subject to change daily. The outlook for this Fund may differ from that presented for other Voya mutual funds. The Fund’s performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statement. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class.

| Voya High Yield Bond Fund | Portfolio Managers’ Report |

| | | Average Annual Total Returns for the Periods Ended March 31, 2023 | | |

| | | | | | 1 Year | | | 5 Year | | | 10 Year | | | Since Inception

of Class R

January 30, 2014 | | |

| | | Including Sales Charge: | | |

| | | Class A(1) | | | | | -7.40% | | | | | | 1.75% | | | | | | 2.99% | | | | | | — | | | |

| | | Class C(2) | | | | | -6.75% | | | | | | 1.48% | | | | | | 2.46% | | | | | | — | | | |

| | | Class I | | | | | -4.83% | | | | | | 2.59% | | | | | | 3.60% | | | | | | — | | | |

| | | Class R | | | | | -5.38% | | | | | | 1.99% | | | | | | — | | | | | | 2.74% | | | |

| | | Class R6(3) | | | | | -4.74% | | | | | | 2.68% | | | | | | 3.52% | | | | | | — | | | |

| | | Class W | | | | | -4.88% | | | | | | 2.53% | | | | | | 3.52% | | | | | | — | | | |

| | | Excluding Sales Charge: | | |

| | | Class A | | | | | -5.07% | | | | | | 2.26% | | | | | | 3.24% | | | | | | — | | | |

| | | Class C | | | | | -5.87% | | | | | | 1.48% | | | | | | 2.46% | | | | | | — | | | |

| | | Class I | | | | | -4.83% | | | | | | 2.59% | | | | | | 3.60% | | | | | | — | | | |

| | | Class R | | | | | -5.38% | | | | | | 1.99% | | | | | | — | | | | | | 2.74% | | | |

| | | Class R6(3) | | | | | -4.74% | | | | | | 2.68% | | | | | | 3.52% | | | | | | — | | | |

| | | Class W | | | | | -4.88% | | | | | | 2.53% | | | | | | 3.52% | | | | | | — | | | |

| | | Bloomberg High Yield Bond – 2% Issuer Constrained Composite | | | | | -3.35% | | | | | | 3.19% | | | | | | 4.09% | | | | | | 3.90% | | | |

| | | | | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of Voya High Yield Bond Fund against the index indicated. The index is unmanaged, has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

The Fund’s performance is shown both with and without the imposition of sales charges.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Fund distributions or the redemption of Fund shares.

The performance shown includes, if applicable, the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total net return. Had all fees and expenses been considered, the total net returns would have been lower.

Performance data represents past performance and is no assurance of future results. Investment return and principal value of an

investment in the Fund will fluctuate. Shares, when sold, may be worth more or less than their original cost. The Fund’s current performance may be lower or higher than the performance data shown. Please log on to www.voyainvestments.com or call (800) 992-0180 to get performance through the most recent month end.

Fund holdings are subject to change daily.

(1)

Reflects deduction of the maximum Class A sales charge of 2.50%.

(2)

Reflects deduction of the Class C deferred sales charge of 1% for the 1 year return.

(3)

Class R6 incepted on August 3, 2016. The Class R6 shares performance shown for the period prior to their inception date is the performance of Class A shares without adjustment for any differences in the expenses between the two classes. If adjusted for such differences, returns would be different.

| Portfolio Managers’ Report | Voya Intermediate Bond Fund |

| | Investment Type Allocation

as of March 31, 2023

(as a percentage of net assets) | |

| | | | | | |

| | Corporate Bonds/Notes | | | 30.2% | |

| | U.S. Government Agency Obligations | | | 20.1% | |

| | Collateralized Mortgage Obligations | | | 16.1% | |

| | U.S. Treasury Obligations | | | 14.7% | |

| | Asset-Backed Securities | | | 11.5% | |

| | Commercial Mortgage-Backed Securities | | | 6.0% | |

| | Sovereign Bonds | | | 0.4% | |

| | Purchased Options | | | 0.0% | |

| | Assets in Excess of Other Liabilities* | | | 1.0% | |

| | Net Assets | | | 100.0% | |

| | *

Includes short-term investments. | |

| | Portfolio holdings are subject to change daily. | |

Performance: For the year ended March 31, 2023, the Fund’s Class A shares, excluding sales charges, provided a total return of -5.82% compared to the Bloomberg U.S. Aggregate Bond Index (the “Index” or “Bloomberg U.S. Aggregate Bond”), which returned -4.78% for the same period.

Portfolio Specifics: Bond markets continued to struggle against the backdrop of interest rate hikes from the U.S. Federal Reserve. Trailing 12-month performance for bonds, as measured by the Bloomberg Aggregate remained negative. On the heels of one of the most difficult calendar years for bonds, returns recovered in the second half of the reporting period. The first six months of negative performance reflected persistent inflation pressures and a determined hawkish Fed, with the 10-year Treasury yield reaching nearly 4.25% during the fall. As inflation peaked, yields eased and bond markets staged a recovery rally to erase some of the earlier losses. The rally was tempered after a gangbuster employment report for the month of January 2023 and continued comments from Fed officials to raise interest rates further. The rally was then reignited with challenges in some US regional banks as well as the takeover of Credit Suisse by Swiss rival UBS. Higher interest rates and higher bond volatility remained a challenge and non-government sectors struggled and broadly trailed the US Treasury market for the trailing 12 months.

Sector allocations for the entire period detracted from performance, with overweights detracting from performance the most in the first 3-months. Early in the period, credit markets struggled as investors grew weary of the economic risks — including a recession — as a result of the Fed’s aggressive tightening program. Overweights across corporate and securitized sectors weighed performance during this time. Markets then proved more resilient as the economy continued to show signs of growth and inflation showed signs of peaking in the fall of 2022. This combination fueled a rally across| | Top Ten Holdings

as of March 31, 2023

(as a percentage of net assets) | |

| | | | | | |

| | United States Treasury Note, 3.625%,

03/31/28 | | | 2.7% | |

| | United States Treasury Bond, 3.875%,

02/15/43 | | | 2.6% | |

| | United States Treasury Note, 4.625%,

03/15/26 | | | 2.4% | |

| | United States Treasury Note, 3.875%,

03/31/25 | | | 1.6% | |

| | United States Treasury Bond, 4.000%,

11/15/52 | | | 1.3% | |

| | United States Treasury Note, 2.750%,

05/15/25 | | | 0.6% | |

| | United States Treasury Note, 3.500%,

02/15/33 | | | 0.6% | |

| | Uniform Mortgage-Backed Securities, 3.000%, 05/01/52 | | | 0.6% | |

| | United States Treasury Note, 4.000%,

02/29/28 | | | 0.6% | |

| | Uniform Mortgage-Backed Securities, 3.000%, 01/01/52 | | | 0.6% | |

| | Portfolio holdings are subject to change daily. | |

Security selection, in aggregate, added to performance over the period. The most notable contributions came from agency residential mortgage-backed (“RMBS”) securities that included collateralized mortgage obligations and other non-standard pools. As well as, investment grade (“IG”) where our preference for BBB rated bonds and limited exposure to regional banks supported performance. Detractions arose within asset-backed security which captures our investments in higher yielding collateralized loan obligations, as well as commercial mortgage-backed securities (“CMBS”) were our more credit sensitive investment trailed the broader market.

Duration and yield curve positioning detracted from performance. The Fund’s yield curve positioning and the convexity profile weighed on performance as rate volatility remained elevated throughout the reporting period.

The Fund primarily used futures and swaps for cash management purposes. As a result, derivatives had a negative impact on performance during the reporting period.

Current Strategy & Outlook: High levels of rate volatility illustrate the lack of certainty regarding the direction of the Fed, the economy and markets. On the one hand, we believe the left tail risk of reaccelerating inflation has diminished, on the other, a new scenario of a more widespread banking crisis has taken its place. While the likelihood of either of these scenarios materializing, in our opinion, remains slim, so does the likelihood of a soft landing. All of this adds to the challenges of navigating this environment.

We remain relatively defensive, with a preference for higher quality spread sectors such as IG corporates and agency mortgages. We are comfortable with our mortgage credit exposure, non-agency RMBS and credit risk transfer securities. We believe commerical real estate will likely face difficult refinancing conditions going forward, testing the CMBS market. However, in a departure from the previous, long-standing paradigm of “location, location, location”, it is our opinion that property type has emerged as the key dimension that will likely drive future credit performance. In CMBS, our preference is tilted toward multi-family properties, and away from office. With a bias towards liquidity, tactical trades will most likely take place in the corporate arena.

The views expressed in this commentary are informed opinions. They should not be considered promises or advice. The views expressed reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Fund holdings are subject to change daily. The outlook for this Fund may differ from that presented for other Voya mutual funds. The Fund’s performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statement. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class.

| Voya Intermediate Bond Fund | Portfolio Managers’ Report |

| | | Average Annual Total Returns for the Periods Ended March 31, 2023 | | |

| | | | | | 1 Year | | | 5 Year | | | 10 Year | | |

| | | Including Sales Charge: | | |

| | | Class A(1) | | | | | -8.13% | | | | | | 0.21% | | | | | | 1.31% | | | |

| | | Class C(2) | | | | | -7.46% | | | | | | -0.07% | | | | | | 0.81% | | | |

| | | Class I | | | | | -5.51% | | | | | | 1.04% | | | | | | 1.92% | | | |

| | | Class R | | | | | -6.04% | | | | | | 0.44% | | | | | | 1.32% | | | |

| | | Class R6(3) | | | | | -5.46% | | | | | | 1.10% | | | | | | 1.95% | | | |

| | | Class W | | | | | -5.59% | | | | | | 0.96% | | | | | | 1.83% | | | |

| | | Excluding Sales Charge: | | |

| | | Class A | | | | | -5.82% | | | | | | 0.71% | | | | | | 1.57% | | | |

| | | Class C | | | | | -6.54% | | | | | | -0.07% | | | | | | 0.81% | | | |

| | | Class I | | | | | -5.51% | | | | | | 1.04% | | | | | | 1.92% | | | |

| | | Class R | | | | | -6.04% | | | | | | 0.44% | | | | | | 1.32% | | | |

| | | Class R6(3) | | | | | -5.46% | | | | | | 1.10% | | | | | | 1.95% | | | |

| | | Class W | | | | | -5.59% | | | | | | 0.96% | | | | | | 1.83% | | | |

| | | Bloomberg U.S. Aggregate Bond | | | | | -4.78% | | | | | | 0.91% | | | | | | 1.36% | | | |

| | | | | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of Voya Intermediate Bond Fund against the index indicated. The index is unmanaged, has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

The Fund’s performance is shown both with and without the imposition of sales charges.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Fund distributions or the redemption of Fund shares.

The performance shown includes, if applicable, the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total net return. Had all fees and expenses been considered, the total net returns would have been lower.

Performance data represents past performance and is no assurance of future results. Investment return and principal value of an

investment in the Fund will fluctuate. Shares, when sold, may be worth more or less than their original cost. The Fund’s current performance may be lower or higher than the performance data shown. Please log on to www.voyainvestments.com or call (800) 992-0180 to get performance through the most recent month end.

Fund holdings are subject to change daily.

(1)

Reflects deduction of the maximum Class A sales charge of 2.50%.

(2)

Reflects deduction of the Class C deferred sales charge of 1% for the 1 year return.

(3)

Class R6 incepted on May 31, 2013. The Class R6 shares performance shown for the period prior to their inception date is the performance of Class I shares without adjustment for any differences in the expenses between the two classes. If adjusted for such differences, returns would be different.

| Portfolio Managers’ Report | Voya Short Duration High Income Fund |

| | Investment Type Allocation

as of March 31, 2023

(as a percentage of net assets) | |

| | | | | | |

| | Corporate Bonds/Notes | | | 97.5% | |

| | Assets in Excess of Other Liabilities* | | | 2.5% | |

| | Net Assets | | | 100.0% | |

| | *

Includes short-term investments. | |

| | Portfolio holdings are subject to change daily. | |

Performance: For the period since inception on February 9, 2023, through March 31, 2023, the Fund’s Class A shares, excluding sales charges, provided a total return of -0.21% compared to the ICE BofA 1 – 3 year U.S. Treasury Index and ICE BofA 1 – 3 year BB U.S. Cash Pay High Index, which returned 1.27% and 0.36%, respectively, for the same period.

Portfolio Specifics: The broad high-yield bond market was volatile, with March ushering in the two largest U.S. bank failures since 2008 and the collapse of Credit Suisse in Europe. Headlines rattled markets initially. But U.S. investor confidence was quickly restored as the Federal Reserve and U.S. government responded decisively and with unprecedented speed to tackle the issues facing regional banks; and UBS stepped in to purchase Credit Suisse.

For the reporting period, the Fund’s exposures to financial services, healthcare and media detracted from performance. By contrast, Fund performance benefited from industry weightings and a consistent credit selection framework. Industries contributing the most to performance were technology, support-services, and air transportation.

Current Strategy & Outlook: In our view, the Fund’s short duration high income strategy remains an attractive fixed income solution in an environment of tighter monetary conditions and slowing economic growth. As investors seek to adjust to higher interest rates without taking excess credit risk, the Fund’s shorter maturity profile emphasizes securities that are likely to be repaid the soonest. In our opinion, this potentially lessens the price volatility that may be highly amplified in passively managed, indexed strategies.

While the current period has been compared to the financial crisis of 2008, there are key differences. Most important, the financial crisis of 2008 was a credit crisis. Today, banks are better capitalized — leverage is lower and liquidity is higher. Rather than being a challenge to the entire industry, problems| | Top Ten Holdings

as of March 31, 2023

(as a percentage of net assets) | |

| | | | | | |

| | Connect Finco SARL / Connect US Finco LLC, 6.750%, 10/01/26 | | | 3.7% | |

| | Mileage Plus Holdings LLC / Mileage Plus Intellectual Property Assets Ltd., 6.500%, 06/20/27 | | | 3.3% | |

| | DISH DBS Corp., 5.250%, 12/01/26 | | | 3.1% | |

| | SeaWorld Parks & Entertainment, Inc., 8.750%, 05/01/25 | | | 2.8% | |

| | Martin Midstream Partners L.P. / Martin Midstream Finance Corp., 11.500%,

02/15/28 | | | 2.4% | |

| | Millennium Escrow Corp., 6.625%, 08/01/26 | | | 2.3% | |

| | RP Escrow Issuer LLC, 5.250%, 12/15/25 | | | 2.2% | |

| | LD Holdings Group LLC, 6.500%, 11/01/25 | | | 2.2% | |

| | Goodyear Tire & Rubber Co/The, 9.500%, 05/31/25 | | | 2.0% | |

| | Delta Air Lines, Inc., 7.000%, 05/01/25 | | | 2.0% | |

| | Portfolio holdings are subject to change daily. | |

Until the extent of bank stress spillover is well understood, it is difficult to estimate the impact on the overall economy. Credit accessibility — a potential downstream effect — could impact spending and hiring, potentially curbing growth. Lagged effects of policy tightening and the durability of household balance sheets are additional risks.

Tightening credit conditions have the same effect as rate increases and therefore can serve as a substitute, allowing the Fed to be less hawkish. The most recent Federal Open Market Committee (“FOMC”) policy statement reinforces this view, with the Fed softening its rate guidance language. In light of this, it’s notable that the two-year U.S. Treasury yield — historically, a directional indicator of the Fed funds rate — has dropped sharply from its peak. Finally, inflation continues to recede, in our view also aligning with a less aggressive Fed in the future.

In our view, U.S. high yield’s risk/reward opportunity is compelling. We believe the asset class enjoys a favorable technical backdrop, due to robust “rising star” volume and a less active primary market in 2022, following record new issuance in 2020 and 2021. Credit statistics and fundamentals are healthy, near-term refinancing obligations remain low and managements continue to prioritize debt reduction. As a result, defaults are expected to normalize but not significantly exceed historical averages. A supportive commodity price backdrop also substantiates this view. With the market trading at a deep discount to face value, we believe high-yield bonds offer attractive total return potential and higher spreads that compensate for the risks.

Longer duration issues are the most likely to be impacted by rising interest rates, but in our view, the overall high-yield market should have a dampened response due to its larger coupon relative to other fixed income alternatives. As a result, we believe U.S. high yield bonds offer investors compelling opportunities for diversification and performance potential, through attractive yields with lower rate sensitivity.

The views expressed in this commentary are informed opinions. They should not be considered promises or advice. The views expressed reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Fund holdings are subject to change daily. The outlook for this Fund may differ from that presented for other Voya mutual funds. This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements. The Fund’s performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class. An index has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

| Voya Short Duration High Income Fund | Portfolio Managers’ Report |

| | | Cumulative Total Returns for the Period Ended March 31, 2023 | | |

| | | | | | Since Inception

of Class A, I and R6

Febraury 9, 2023 | | |

| | | Including Sales Charge: | | |

| | | Class A(1) | | | | | -2.73% | | | |

| | | Class I | | | | | -0.17% | | | |

| | | Class R6 | | | | | -0.17% | | | |

| | | Excluding Sales Charge: | | |

| | | Class A | | | | | -0.21% | | | |

| | | Class I | | | | | -0.17% | | | |

| | | Class R6 | | | | | -0.17% | | | |

| | | ICE BofA 1-3 year U.S. Treasury Index(2) | | | | | 1.27% | | | |

| | | ICE BofA 1-3 year BB U.S. Cash Pay High Yield Index(2) | | | | | 0.36% | | | |

| | | | | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of Voya Short Duration High Income Fund against the indices indicated. An index is unmanaged, has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

The Fund’s performance is shown both with and without the imposition of sales charges.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Fund distributions or the redemption of Fund shares.

The performance shown includes, if applicable, the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total net return. Had all fees and expenses been considered, the total net returns would have been lower.

It is important to note that the Fund has a limited operating history. Performance over a longer period of time may be more meaningful than short-term performance.

Performance data represents past performance and is no assurance of future results. Investment return and principal value of an investment in the Fund will fluctuate. Shares, when sold, may be worth more or less than their original cost. The Fund’s current performance may be lower or higher than the performance data shown. Please log on to www.voyainvestments.com or call (800) 992-0180 to get performance through the most recent month end.

Fund holdings are subject to change daily.

(1)

Reflects deduction of the maximum Class A sales charge of 2.50%.

(2)

Since inception performance for the index is shown as of February 9, 2023.

| Portfolio Managers’ Report | Voya Short Term Bond Fund |

| | Investment Type Allocation

as of March 31, 2023

(as a percentage of net assets) | |

| | | | | | |

| | Corporate Bonds/Notes | | | 38.0% | |

| | U.S. Treasury Obligations | | | 25.4% | |

| | Asset-Backed Securities | | | 18.6% | |

| | Commercial Mortgage-Backed Securities | | | 7.6% | |

| | Collateralized Mortgage Obligations | | | 6.1% | |

| | U.S. Government Agency Obligations | | | 0.1% | |

| | Assets in Excess of Other Liabilities* | | | 4.2% | |

| | Net Assets | | | 100.0% | |

| | *

Includes short-term investments. | |

| | Portfolio holdings are subject to change daily. | |

Performance: For the year ended March 31, 2023, the Fund’s Class A shares, excluding sales charges, provided a total return of -0.83% compared to the Bloomberg U.S. 1-3 Year Government/Credit Bond Index (the “Index” or “Bloomberg U.S. 1-3 Year Government/Credit Bond”), which returned 0.26%, for the same period.

Portfolio Specifics: On the heels of one of the most difficult calendar years for bonds, returns recovered in the second half of the reporting period. The first six months of negative performance reflected persistent inflation pressures and a determined hawkish Fed, with the 10-year Treasury yield reaching nearly 4.25% during the fall. As inflation peaked, yields eased and bond markets staged a recovery rally to erase some of the earlier losses. The rally was tempered after a gangbuster employment report for the month of January 2023 and continued comments from U.S. Federal Reserve officials to raise interest rates further. The rally was then reignited with challenges in some U.S. regional banks as well as the takeover of Credit Suisse by Swiss rival UBS. Higher interest rates and higher bond volatility remained a challenge and non-government sectors struggled and broadly trailed the U.S. Treasury market for the trailing 12 months.

Duration positioning detracted most for the period, followed by sector allocation. Security selection contributed. Rate volatility driven by Fed hawkishness and mixed data prints contributed to the negative print from duration. Sector allocation detraction was led by commercial mortgage-backed securities (“CMBS”), as the sector struggled to locate financing, particularly within office properties, and commercial real estate (“CRE”) investments by regional banks had knock on effects on the sector amid the regional banking crisis in March. Positive security selection was driven by selection within investment grade corporates where we focus on financials and industrials, and we are| | Top Ten Holdings

as of March 31, 2023*

(as a percentage of net assets) | |

| | | | | | |

| | United States Treasury Note, 4.625%,

03/15/26 | | | 16.4% | |

| | United States Treasury Note, 0.125%,

01/15/24 | | | 6.9% | |

| | United States Treasury Note, 3.875%,

03/31/25 | | | 1.2% | |

| | UBS-Barclays Commercial Mortgage Trust 2013-C6 C, 4.102%, 04/10/46 | | | 1.2% | |

| | Ginnie Mae 2015-H32 FH, 5.226%,

12/20/65 | | | 1.0% | |

| | BRSP 2021-FL1 B Ltd., 6.661%, 08/19/38 | | | 1.0% | |

| | Ginnie Mae Series 2016-H16 FE, 3.155%, 06/20/66 | | | 1.0% | |

| | OHA Credit Partners XIII Ltd. 2016-13A AR, 5.985%, 10/25/34 | | | 0.9% | |

| | BBCMS Trust 2021-AGW E, 7.834%,

06/15/36 | | | 0.9% | |

| | OHA Credit Partners XVI 2021-16A A, 5.945%, 10/18/34 | | | 0.7% | |

| | *

Excludes short-term investments. | |

| | Portfolio holdings are subject to change daily. | |

During the reporting period, the Fund used futures primarily for cash management purposes, as well as some Credit Default Swap Index (“CDX”) as hedges. As a result, derivatives had a negative impact on performance, as we used the CDX to hedge overall fund risk as opposed to using them for natural duration hedging.

Current Strategy & Outlook: Looking forward, we believe the left tail risk of reaccelerating inflation has diminished, however a new scenario of a more widespread banking crisis has taken its place. While, in our opinion, the likelihood of either of these scenarios materializing remains slim, so does the likelihood of a soft landing. Services inflation remains too hot for comfort and will limit the Fed’s ability to ease in response to further signs of stress. As a result, we remain relatively defensive, with a preference for higher quality spread sectors. Sticking with our preference of consumer related risk over corporate risk, we are comfortable with our asset-backed security exposure, however, in an effort to remain liquid, tactical trades will most likely take place in the corporate arena. And finally, as alluded to above, we believe CRE will likely face difficult refinancing conditions going forward. However, in a departure from the previous, long-standing paradigm of “location, location, location”, in our opinion, property type has emerged as the key dimension that will likely drive future credit performance. In CMBS, our bias is tilted toward multi-family properties, and away from office.

The views expressed in this commentary are informed opinions. They should not be considered promises or advice. The views expressed reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Fund holdings are subject to change daily. The outlook for this Fund may differ from that presented for other Voya mutual funds. The Fund’s performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statement. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class.

| Voya Short Term Bond Fund | Portfolio Managers’ Report |

| | | Average Annual Total Returns for the Periods Ended March 31, 2023 | | |

| | | | | | 1 Year | | | 5 Year | | | 10 year | | | Since Inception

of Class R

July 31, 2014 | | |

| | | Including Sales Charge: | | |

| | | Class A(1) | | | | | -3.35% | | | | | | 0.55% | | | | | | 0.75% | | | | | | — | | | |

| | | Class C(2) | | | | | -2.44% | | | | | | 0.33% | | | | | | 0.26% | | | | | | — | | | |

| | | Class I | | | | | -0.54% | | | | | | 1.36% | | | | | | 1.29% | | | | | | — | | | |

| | | Class R | | | | | -0.96% | | | | | | 0.89% | | | | | | — | | | | | | 0.76% | | | |

| | | Class R6(3) | | | | | -0.50% | | | | | | 1.39% | | | | | | 1.33% | | | | | | — | | | |

| | | Class W | | | | | -0.47% | | | | | | 1.38% | | | | | | 1.28% | | | | | | — | | | |

| | | Excluding Sales Charge: | | |

| | | Class A | | | | | -0.83% | | | | | | 1.06% | | | | | | 1.01% | | | | | | — | | | |

| | | Class C | | | | | -1.47% | | | | | | 0.33% | | | | | | 0.26% | | | | | | — | | | |

| | | Class I | | | | | -0.54% | | | | | | 1.36% | | | | | | 1.29% | | | | | | — | | | |

| | | Class R | | | | | -0.96% | | | | | | 0.89% | | | | | | — | | | | | | 0.76% | | | |

| | | Class R6(3) | | | | | -0.50% | | | | | | 1.39% | | | | | | 1.33% | | | | | | — | | | |

| | | Class W | | | | | -0.47% | | | | | | 1.38% | | | | | | 1.28% | | | | | | — | | | |

| | | Bloomberg U.S. 1-3 Year Government/Credit Bond | | | | | 0.26% | | | | | | 1.26% | | | | | | 1.01% | | | | | | 1.06% | | | |

| | | | | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of Voya Short Term Bond Fund against the index indicated. The index is unmanaged, has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

The Fund’s performance is shown both with and without the imposition of sales charges.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Fund distributions or the redemption of Fund shares.

The performance shown includes, if applicable, the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total net return. Had all fees and expenses been considered, the total net returns would have been lower.

Performance data represents past performance and is no assurance of future results. Investment return and principal value of an

investment in the Fund will fluctuate. Shares, when sold, may be worth more or less than their original cost. The Fund’s current performance may be lower or higher than the performance data shown. Please log on to www.voyainvestments.com or call (800) 992-0180 to get performance through the most recent month end.

Fund holdings are subject to change daily.

(1)

Reflects deduction of the maximum Class A sales charge of 2.50%.

(2)

Reflects deduction of the Class C deferred sales charge of 1% for the 1 year return.

(3)

Class R6 incepted on July 31, 2013. The Class R6 shares performance shown for the period prior to their inception date is the performance of Class I shares without adjustment for any differences in the expenses between the two classes. If adjusted for such differences, returns would be different.

| Portfolio Managers’ Report | Voya Strategic Income Opportunities Fund |

| | Investment Type Allocation

as of March 31, 2023

(as a percentage of net assets) | |

| | | | | | |

| | Collateralized Mortgage Obligations | | | 26.1% | |

| | Corporate Bonds/Notes | | | 21.9% | |

| | Commercial Mortgage-Backed Securities | | | 18.7% | |

| | Asset-Backed Securities | | | 14.8% | |

| | Bank Loans | | | 8.2% | |

| | Sovereign Bonds | | | 3.6% | |

| | U.S. Treasury Obligations | | | 1.7% | |

| | Purchased Options | | | 0.0% | |

| | Convertible Bonds/Notes | | | 0.0% | |

| | U.S. Government Agency Obligations | | | 0.0% | |

| | Common Stock | | | 0.0% | |

| | Preferred Stock | | | 0.0% | |

| | Assets in Excess of Other Liabilities* | | | 5.0% | |

| | Net Assets | | | 100.0% | |

| | *

Includes short-term investments. | |

| | Portfolio holdings are subject to change daily. | |

Performance: For the year ended March 31, 2023, the Fund’s Class A shares, excluding sales charges, provided a total return of -2.94% compared to the ICE BofA U.S. Dollar 3-Month Deposit Offered Rate Constant Maturity Index and the Bloomberg U.S. Universal Bond Index, which returned 2.39% and -4.61% respectively, for the same period.

Portfolio Specifics: The Fund underperformed the ICE BofA U.S. Dollar 3-Month Deposit Offered Rate Constant Maturity Index. Duration and yield curve decisions detracted the most, as interest rates continued to rise, and bond prices fell over the period. Sector allocation also detracted, reflecting concerns on the impact of the economy from continued US Federal Reserve rate hikes, while security selection was a modest contributor over the period.

Bond markets continued to struggle against the backdrop of interest rate hikes from the Fed. On the heels of one of the most difficult calendar years for bonds, returns recovered in the second half of the reporting period. The first six months of negative performance reflected persistent inflation pressures and a determined hawkish Fed, with the 10-year Treasury yield reaching nearly 4.25% during the fall. As inflation peaked, yields eased, and bond markets staged a recovery rally to erase some of the| | Top Ten Holdings

as of March 31, 2023*

(as a percentage of net assets) | |

| | | | | | |

| | Mexican Bonos, 7.750%, 05/29/31 | | | 1.1% | |

| | Republic of South Africa Government Bond, 8.875%, 02/28/35 | | | 0.8% | |

| | Prima Capital CRE Securitization 2019-7A D Ltd., 4.250%, 12/25/50 | | | 0.6% | |

| | GS Mortgage Securities Corp. II 2021-ARDN B, 6.334%, 11/15/36 | | | 0.5% | |

| | Bank of America Corp., 3.384%, 04/02/26 | | | 0.5% | |

| | Med Trust 2021-MDLN D, 6.685%, 11/15/38 | | | 0.5% | |

| | Morgan Stanley, 2.188%, 04/28/26 | | | 0.5% | |

| | JPMorgan Chase & Co., 2.083%, 04/22/26 | | | 0.5% | |

| | Morgan Stanley, 0.985%, 12/10/26 | | | 0.5% | |

| | Morgan Stanley, 4.679%, 07/17/26 | | | 0.5% | |

| | *

Excludes short-term investments. | |

| | Portfolio holdings are subject to change daily. | |

Duration and yield curve positioning detracted from performance. Even with a low duration profile, the significantly greater than expected rate hiking from the Fed weighed on performance. Sector allocation also weighed on performance, as rate volatility and concerns on the economic impact the Fed’s aggressive actions were challenges to performance. Allocations to commercial mortgage-backed securities (“CMBS”) and high yield (“HY”) had the greatest impact on performance, with CMBS reflecting concerns on the commercial real estate market and HY performance tied to the cyclicality of the United State economy. Offsetting some of this was positive contributions from asset-backed securities allocations, underscoring the lower risk profile of the sector and emerging market allocations which rebounded in response to decision by the Chinese officials to step away from their zero Covid policies. Security selection was mixed and in aggregate modestly added to results over the period. Contributions from CMBS were supported by more credit-sensitive investments as well as the selection of our US Treasuries.

The Fund primarily used futures, swaps and forward contracts for efficient portfolio and cash management purposes. As a result, derivatives had a negative impact on performance during the reporting period.

Current Strategy & Outlook: High levels of rate volatility illustrate the lack of certainty regarding the direction of the Fed, the economy and markets. On the one hand, we believe the left tail risk of reaccelerating inflation has diminished, on the other a new scenario of a more widespread banking crisis has taken its place. While, in our opinion, the likelihood of either of these scenarios materializing remains slim, so does the likelihood of a soft landing. All of this adds to the challenges of navigating this environment.

| Voya Strategic Income Opportunities Fund | Portfolio Managers’ Report |

We remain relatively defensive, with a preference for higher quality spread sectors such as investment grade corporates and agency mortgages. We are comfortable with our mortgage credit exposure, non-agency residential mortgage-backed securities and credit risk transfer securities. We believe commercial real estate will likely face difficult refinancing conditions going forward, testing the CMBS market. However, in a departure from the previous, long-standing paradigm of “location, location, location”, in our opinion property type has emerged as the key dimension that will likely drive future credit performance. In CMBS, our preference is tilted toward multi-family properties, and away from office. With a bias towards liquidity, tactical trades will most likely take place in the corporate arena.

The views expressed in this commentary are informed opinions. They should not be considered promises or advice. The views expressed reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Fund holdings are subject to change daily. The outlook for this Fund may differ from that presented for other Voya mutual funds. The Fund’s performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statement. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class.

| Portfolio Managers’ Report | Voya Strategic Income Opportunities Fund |

| | | Average Annual Total Returns for the Periods Ended March 31, 2023 | | |

| | | | | | 1 Year | | | 5 Years | | | 10 year | | |

| | | Including Sales Charge: | | |

| | | Class A(1) | | | | | -5.41% | | | | | | 0.63% | | | | | | 2.02% | | | |

| | | Class C(2) | | | | | -4.71% | | | | | | 0.39% | | | | | | 1.49% | | | |

| | | Class I | | | | | -2.84% | | | | | | 1.40% | | | | | | 2.61% | | | |

| | | Class R | | | | | -3.25% | | | | | | 0.87% | | | | | | 1.99% | | | |

| | | Class R6(3) | | | | | -2.69% | | | | | | 1.46% | | | | | | 2.62% | | | |

| | | Class W | | | | | -2.83% | | | | | | 1.39% | | | | | | 3.16% | | | |

| | | Excluding Sales Charge: | | |

| | | Class A | | | | | -2.94% | | | | | | 1.14% | | | | | | 2.28% | | | |

| | | Class C | | | | | -3.78% | | | | | | 0.39% | | | | | | 1.49% | | | |

| | | Class I | | | | | -2.84% | | | | | | 1.40% | | | | | | 2.61% | | | |

| | | Class R | | | | | -3.25% | | | | | | 0.87% | | | | | | 1.99% | | | |

| | | Class R6(3) | | | | | -2.69% | | | | | | 1.46% | | | | | | 2.62% | | | |

| | | Class W | | | | | -2.83% | | | | | | 1.39% | | | | | | 2.43% | | | |

| | | ICE BofA U.S. Dollar 3-Month Deposit Offered Rate Constant Maturity Index | | | | | 2.39% | | | | | | 1.58% | | | | | | 1.07% | | | |

| | | Bloomberg U.S. Universal Bond Index | | | | | -4.61% | | | | | | 1.05% | | | | | | 1.62% | | | |

| | | | | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of Voya Strategic Income Opportunities Fund against the indices indicated. An index is unmanaged, has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

The Fund’s performance is shown both with and without the imposition of sales charges.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Fund distributions or the redemption of Fund shares.

The performance shown includes, if applicable, the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total net return. Had all fees and expenses been considered, the total net returns would have been lower.

Performance data represents past performance and is no assurance of future results. Investment return and principal value of an

investment in the Fund will fluctuate. Shares, when sold, may be worth more or less than their original cost. The Fund’s current performance may be lower or higher than the performance data shown. Please log on to www.voyainvestments.com or call (800) 992-0180 to get performance through the most recent month end.

Fund holdings are subject to change daily.

(1)

Reflects deduction of the maximum Class A sales charge of 2.50%.

(2)

Reflects deduction of the Class C deferred sales charge of 1% for the 1 year return.

(3)

Class R6 incepted on October 23, 2015. The Class R6 shares performance shown for the period prior to their inception date is the performance of Class I shares without adjustment for any differences in the expenses between the two classes. If adjusted for such differences, returns would be different.

shareholder expense examples (Unaudited)

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, redemption fees, and exchange fees, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses. These Examples are intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period from October 1, 2022 to March 31, 2023. The Funds’ expenses are shown without the imposition of any sales charges or fees. Expenses would have been higher if such charges were included.

Actual Expenses

The left section of the table shown below, “Actual Fund Return,” provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The right section of the table shown below, “Hypothetical (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in each Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the hypothetical section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different mutual funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | Actual Fund Return | | | Hypothetical (5% return before expenses) | |

| | | | Beginning

Account

Value

October 1,

2022 | | | Ending

Account

Value

March 31,

2023 | | | Annualized

Expense

Ratio | | | Expenses Paid

During the

Period Ended

March 31,

2023* | | | Beginning

Account

Value

October 1,

2022 | | | Ending

Account

Value

March 31,

2023 | | | Annualized

Expense

Ratio | | | Expenses Paid

During the

Period Ended

March 31,

2023* | |

| Voya GNMA Income Fund | |

| Class A | | | | $ | 1,000.00 | | | | | $ | 1,038.50 | | | | | | 0.84% | | | | | $ | 4.27 | | | | | $ | 1,000.00 | | | | | $ | 1,020.74 | | | | | | 0.84% | | | | | $ | 4.23 | | |

| Class C | | | | | 1,000.00 | | | | | | 1,033.40 | | | | | | 1.59 | | | | | | 8.06 | | | | | | 1,000.00 | | | | | | 1,017.00 | | | | | | 1.59 | | | | | | 8.00 | | |

| Class I | | | | | 1,000.00 | | | | | | 1,040.00 | | | | | | 0.54 | | | | | | 2.75 | | | | | | 1,000.00 | | | | | | 1,022.24 | | | | | | 0.54 | | | | | | 2.72 | | |

| Class R6 | | | | | 1,000.00 | | | | | | 1,040.10 | | | | | | 0.49 | | | | | | 2.49 | | | | | | 1,000.00 | | | | | | 1,022.49 | | | | | | 0.49 | | | | | | 2.47 | | |

| Class W | | | | | 1,000.00 | | | | | | 1,039.70 | | | | | | 0.59 | | | | | | 3.00 | | | | | | 1,000.00 | | | | | | 1,021.99 | | | | | | 0.59 | | | | | | 2.97 | | |

| Voya High Yield Bond Fund | |

| Class A | | | | $ | 1,000.00 | | | | | $ | 1,078.80 | | | | | | 1.07% | | | | | $ | 5.55 | | | | | $ | 1,000.00 | | | | | $ | 1,019.60 | | | | | | 1.07% | | | | | $ | 5.39 | | |

| Class C | | | | | 1,000.00 | | | | | | 1,073.50 | | | | | | 1.82 | | | | | | 9.41 | | | | | | 1,000.00 | | | | | | 1,015.86 | | | | | | 1.82 | | | | | | 9.15 | | |

| Class I | | | | | 1,000.00 | | | | | | 1,079.40 | | | | | | 0.72 | | | | | | 3.73 | | | | | | 1,000.00 | | | | | | 1,021.34 | | | | | | 0.72 | | | | | | 3.63 | | |

| Class R | | | | | 1,000.00 | | | | | | 1,076.10 | | | | | | 1.32 | | | | | | 6.83 | | | | | | 1,000.00 | | | | | | 1,018.35 | | | | | | 1.32 | | | | | | 6.64 | | |

| Class R6 | | | | | 1,000.00 | | | | | | 1,079.60 | | | | | | 0.66 | | | | | | 3.42 | | | | | | 1,000.00 | | | | | | 1,021.64 | | | | | | 0.66 | | | | | | 3.33 | | |

| Class W | | | | | 1,000.00 | | | | | | 1,080.30 | | | | | | 0.82 | | | | | | 4.25 | | | | | | 1,000.00 | | | | | | 1,020.84 | | | | | | 0.82 | | | | | | 4.13 | | |

shareholder expense examples (Unaudited) (continued)

| | | | Actual Fund Return | | | Hypothetical (5% return before expenses) | |

| | | | Beginning

Account

Value

October 1,

2022 | | | Ending

Account

Value

March 31,

2023 | | | Annualized

Expense

Ratio | | | Expenses Paid

During the

Period Ended

March 31,

2023* | | | Beginning

Account

Value

October 1,

2022 | | | Ending

Account

Value

March 31,

2023 | | | Annualized

Expense

Ratio | | | Expenses Paid

During the

Period Ended

March 31,

2023* | |

| Voya Intermediate Bond Fund | |

| Class A | | | | $ | 1,000.00 | | | | | $ | 1,047.40 | | | | | | 0.72% | | | | | $ | 3.68 | | | | | $ | 1,000.00 | | | | | $ | 1,021.34 | | | | | | 0.72% | | | | | $ | 3.63 | | |

| Class C | | | | | 1,000.00 | | | | | | 1,042.40 | | | | | | 1.47 | | | | | | 7.49 | | | | | | 1,000.00 | | | | | | 1,017.60 | | | | | | 1.47 | �� | | | | | 7.39 | | |

| Class I | | | | | 1,000.00 | | | | | | 1,049.10 | | | | | | 0.36 | | | | | | 1.84 | | | | | | 1,000.00 | | | | | | 1,023.14 | | | | | | 0.36 | | | | | | 1.82 | | |

| Class R | | | | | 1,000.00 | | | | | | 1,046.10 | | | | | | 0.97 | | | | | | 4.95 | | | | | | 1,000.00 | | | | | | 1,020.09 | | | | | | 0.97 | | | | | | 4.89 | | |

| Class R6 | | | | | 1,000.00 | | | | | | 1,049.30 | | | | | | 0.30 | | | | | | 1.53 | | | | | | 1,000.00 | | | | | | 1,023.44 | | | | | | 0.30 | | | | | | 1.51 | | |

| Class W | | | | | 1,000.00 | | | | | | 1,048.70 | | | | | | 0.47 | | | | | | 2.40 | | | | | | 1,000.00 | | | | | | 1,022.59 | | | | | | 0.47 | | | | | | 2.37 | | |

| Voya Short Duration High Income Fund | |

| Class A** | | | | $ | 1,000.00 | | | | | $ | 997.90 | | | | | | 0.85% | | | | | $ | 1.19 | | | | | $ | 1,000.00 | | | | | $ | 1,020.69 | | | | | | 0.85% | | | | | $ | 4.28 | | |

| Class I** | | | | | 1,000.00 | | | | | | 998.30 | | | | | | 0.60 | | | | | | 0.84 | | | | | | 1,000.00 | | | | | | 1,021.94 | | | | | | 0.60 | | | | | | 3.02 | | |

| Class R6** | | | | | 1,000.00 | | | | | | 998.30 | | | | | | 0.60 | | | | | | 0.84 | | | | | | 1,000.00 | | | | | | 1,021.94 | | | | | | 0.60 | | | | | | 3.02 | | |

| Voya Short Term Bond Fund | |

| Class A | | | | $ | 1,000.00 | | | | | $ | 1,024.20 | | | | | | 0.62% | | | | | $ | 3.13 | | | | | $ | 1,000.00 | | | | | $ | 1,021.84 | | | | | | 0.62% | | | | | $ | 3.13 | | |

| Class C | | | | | 1,000.00 | | | | | | 1,020.40 | | | | | | 1.37 | | | | | | 6.90 | | | | | | 1,000.00 | | | | | | 1,018.10 | | | | | | 1.37 | | | | | | 6.89 | | |

| Class I | | | | | 1,000.00 | | | | | | 1,025.70 | | | | | | 0.35 | | | | | | 1.77 | | | | | | 1,000.00 | | | | | | 1,023.19 | | | | | | 0.35 | | | | | | 1.77 | | |

| Class R | | | | | 1,000.00 | | | | | | 1,022.90 | | | | | | 0.87 | | | | | | 4.39 | | | | | | 1,000.00 | | | | | | 1,020.59 | | | | | | 0.87 | | | | | | 4.38 | | |

| Class R6 | | | | | 1,000.00 | | | | | | 1,025.90 | | | | | | 0.30 | | | | | | 1.52 | | | | | | 1,000.00 | | | | | | 1,023.44 | | | | | | 0.30 | | | | | | 1.51 | | |

| Class W | | | | | 1,000.00 | | | | | | 1,025.50 | | | | | | 0.37 | | | | | | 1.87 | | | | | | 1,000.00 | | | | | | 1,023.09 | | | | | | 0.37 | | | | | | 1.87 | | |

| Voya Strategic Income Opportunities Fund | |

| Class A | | | | $ | 1,000.00 | | | | | $ | 1,021.80 | | | | | | 0.85% | | | | | $ | 4.28 | | | | | $ | 1,000.00 | | | | | $ | 1,020.69 | | | | | | 0.85% | | | | | $ | 4.28 | | |

| Class C | | | | | 1,000.00 | | | | | | 1,016.80 | | | | | | 1.60 | | | | | | 8.05 | | | | | | 1,000.00 | | | | | | 1,016.95 | | | | | | 1.60 | | | | | | 8.05 | | |

| Class I | | | | | 1,000.00 | | | | | | 1,022.00 | | | | | | 0.61 | | | | | | 3.08 | | | | | | 1,000.00 | | | | | | 1,021.89 | | | | | | 0.61 | | | | | | 3.07 | | |

| Class R | | | | | 1,000.00 | | | | | | 1,019.30 | | | | | | 1.10 | | | | | | 5.54 | | | | | | 1,000.00 | | | | | | 1,019.45 | | | | | | 1.10 | | | | | | 5.54 | | |

| Class R6 | | | | | 1,000.00 | | | | | | 1,023.50 | | | | | | 0.54 | | | | | | 2.72 | | | | | | 1,000.00 | | | | | | 1,022.24 | | | | | | 0.54 | | | | | | 2.72 | | |

| Class W | | | | | 1,000.00 | | | | | | 1,021.80 | | | | | | 0.60 | | | | | | 3.02 | | | | | | 1,000.00 | | | | | | 1,021.94 | | | | | | 0.60 | | | | | | 3.02 | | |

*

Expenses are equal to each Fund's respective annualized expense ratios multiplied by the average account value over the period, multiplied by 182/365 to reflect the most recent fiscal half-year.

**

Commencement of operations was February 9, 2023. Expenses paid for the actual Fund's return reflect the 51-day period ended March 31, 2023

report of independent registered public accounting firm

To the Shareholders of Voya GNMA Income Fund, Voya High Yield Bond Fund, Voya Intermediate Bond Fund, Voya Short Duration High Income Fund, Voya Short Term Bond Fund and Voya Strategic Income Opportunities Fund and the Board of Trustees of Voya Funds Trust

Opinion on the Financial Statements

We have audited the accompanying statements of assets and liabilities of Voya GNMA Income Fund, Voya High Yield Bond Fund, Voya Intermediate Bond Fund, Voya Short Duration High Income Fund, Voya Short Term Bond Fund and Voya Strategic Income Opportunities Fund (collectively referred to as the “Funds”) (six of the funds constituting Voya Funds Trust (the “Trust”)), including the portfolios of investments, as of March 31, 2023, and the related statements of operations and changes in net assets and the financial highlights for each of the periods indicated in the table below and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of each of the Funds (six of the funds constituting Voya Funds Trust) at March 31, 2023, and the results of their operations, changes in net assets and financial highlights for each of the periods indicated in the table below, in conformity with U.S. generally accepted accounting principles.

Individual fund constituting

Voya Funds Trust | | | Statement of Operations | | | Statements of changes in

net assets | | | Financial highlights | | | |

| Voya GNMA Income Fund | | | For the year ended March 31, 2023 | | | For each of the two years in the period ended March 31, 2023 | | | For each of the four years in the period ended March 31, 2023 | | | |

| Voya High Yield Bond Fund | | | For the year ended March 31, 2023 | | | For each of the two years in the period ended March 31, 2023 | | | For each of the four years in the period ended March 31, 2023 | | | |

| Voya Intermediate Bond Fund | | | For the year ended March 31, 2023 | | | For each of the two years in the period ended March 31, 2023 | | | For each of the four years in the period ended March 31, 2023 | | | |

| Voya Short Duration High Income Fund | | | For the period from February 9, 2023 (commencement of operations) through March 31, 2023 | | | | | | | |

| Voya Short Term Bond Fund | | | For the year ended March 31, 2023 | | | For each of the two years in the period ended March 31, 2023 | | | For each of the four years in the period ended March 31, 2023 | | | |

| Voya Strategic Income Opportunities Fund | | | For the year ended March 31, 2023 | | | For each of the two years in the period ended March 31, 2023 | | | For each of the four years in the period ended March 31, 2023 | | | |

The financial highlights for the year ended March 31, 2019 were audited by another independent registered public accounting firm whose report, dated May 23, 2019, expressed an unqualified opinion on those financial highlights.

Basis for Opinion