Exhibit 99.2

Infosmart Group Limited

(Formerly Sino Excellence Group Limited)

Consolidated financial statements

December 31, 2005 and 2004

(Stated in US dollars)

INFOSMART GROUP LIMITED

(FORMERLY SINO EXCELLENCE GROUP LIMITED)

CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2005 and 2004

Index to Consolidated Financial Statements

| | | Pages |

| | | |

| Report of Independent Registered Public Accounting Firm | | 1 |

| | | |

| Consolidated Statements of Operations | | 2 |

| | | |

| Consolidated Balance Sheets | | 3 - 4 |

| | | |

| Consolidated Statements of Cash Flows | | 5 - 6 |

| | | |

| Consolidated Statements of Stockholders’ Equity | | 7 |

| | | |

| Notes to Consolidated Financial Statements | | 8 - 32 |

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Stockholders of

Infosmart Group Limited

(formerly Sino Excellence Group Limited)

We have audited the accompanying consolidated balance sheets of Infosmart Group Limited (the “Company”) and its subsidiaries as of December 31, 2005 and 2004, and the related consolidated statements of operations, stockholders’ equity and cash flows for each of the two years in the period ended December 31, 2005. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the consolidated financial position of the Company and its subsidiaries as of December 31, 2005 and 2004, and the consolidated results of their operations and their cash flows for each of the two years in the period ended December 31, 2005 in conformity with accounting principles generally accepted in the United States of America.

/s/ PKF

PKF

Certified Public Accountants

Hong Kong

April 27, 2006

Infosmart Group Limited

(formerly Sino Excellence Group Limited)

Consolidated Statements of Operations

(Stated in US Dollars)

| | | Year ended December 31, | |

| | | 2005 | | 2004 | |

| | | | | | |

| Net sales | | $ | 24,577,206 | | $ | 22,421,765 | |

| Cost of sales | | | (18,441,644 | ) | | (17,763,244 | ) |

| | | | | | | | |

| Gross profit | | | 6,135,562 | | | 4,658,521 | |

| Administrative expenses | | | (739,621 | ) | | (673,973 | ) |

| Depreciation - Note 12 | | | (214,534 | ) | | (177,823 | ) |

| Selling and distributing costs | | | (188,058 | ) | | (405,989 | ) |

| | | | | | | | |

| Income from operations before the following | | | | | | | |

items and taxes | | | 4,993,349 | | | 3,400,736 | |

Professional fees for pre-listing exercise | | | (320,892 | ) | | - | |

Reversal of commission payable - Note 6 | | | 718,250 | | | - | |

Other income - Note 7 | | | 302,903 | | | 679,660 | |

Interest expenses | | | (520,827 | ) | | (319,693 | ) |

| | | | | | | | |

| Income before income taxes | | | 5,172,783 | | | 3,760,703 | |

| Income taxes - Note 8 | | | (958,022 | ) | | (736,403 | ) |

| | | | | | | | |

| Net income | | $ | 4,214,761 | | $ | 3,024,300 | |

| | | | | | | | |

| Earning per share - basic and dilutive - Note 9 | | $ | 261 | | $ | 150 | |

| | | | | | | | |

| Weighted average shares outstanding | | | | | | | |

| - basic and dilutive - Note 9 | | | 16,160 | | | 20,183 | |

See notes to consolidated financial statements

Infosmart Group Limited

(formerly Sino Excellence Group Limited)

Consolidated Balance Sheets

(Stated in US Dollars)

| | | As of December 31, | |

| | | 2005 | | 2004 | |

| | | | | | |

ASSETS | | | | | | | |

Current Assets | | | | | | | |

Cash and cash equivalents | | $ | 154,368 | | $ | 95,226 | |

Restricted cash - Note 14(b) | | | 263,085 | | | 133,172 | |

Trade receivables (net of allowance of doubtful debts of $Nil in 2005 and 2004) - Note 14(c) | | | 3,252,678 | | | 1,864,433 | |

Prepaid expenses and other receivables - Note 10 | | | 1,478,343 | | | 280,106 | |

Inventories - Note 11 | | | 1,427,790 | | | 1,712,592 | |

| | | | | | | | |

Total Current Assets | | | 6,576,264 | | | 4,085,529 | |

Deferred taxes - Note 8 | | | 45,724 | | | - | |

Plant and equipment, net - Note 12 | | | 18,298,753 | | | 18,483,179 | |

| | | | | | | | |

TOTAL ASSETS | | | 24,920,741 | | | 22,568,708 | |

| | | | | | | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | |

| | | | | | | | |

LIABILITIES | | | | | | | |

Current Liabilities | | | | | | | |

Trade payables | | | 1,800,984 | | | 3,958,980 | |

Other payables and accrued liabilities - Note 13 | | | 1,102,953 | | | 729,125 | |

Bank borrowings - Note 14 | | | 4,461,840 | | | 3,055,065 | |

Current obligations under capital leases - Note 15 | | | 52,692 | | | 1,694,323 | |

Current portion of other loans - Note 16 | | | 1,996,614 | | | 340,050 | |

| | | | | | | | |

Total Current Liabilities | | | 9,415,083 | | | 9,777,543 | |

Obligations under capital leases - Note 15 | | | - | | | 51,245 | |

Other loans - Note 16 | | | 1,750,131 | | | 2,220,848 | |

Advances from related parties - Note 17 | | | 2,217,054 | | | 3,350,854 | |

Deferred taxes - Note 8 | | | 2,497,054 | | | 1,485,708 | |

| | | | | | | | |

TOTAL LIABILITIES | | $ | 15,879,322 | | $ | 16,886,198 | |

Infosmart Group Limited

(formerly Sino Excellence Group Limited)

Consolidated Balance Sheets (cont’d)

(Stated in US Dollars)

| | | As of December 31, | |

| | | 2005 | | 2004 | |

| | | | | | |

COMMITMENTS AND CONTINGENCIES - Note 18 | | | | | | | |

| | | | | | | | |

STOCKHOLDERS’ EQUITY | | | | | | | |

Common stock - Note 19 | | | | | | | |

2005 - $1 par value; 2004 - $0.12826 par value | | | | | | | |

Authorized: 2005 - 50,000 shares; 2004 - 30,000 shares | | | | | | | |

Issued and outstanding: 2005 - 1 share; 2004 - 20,200 shares | | $ | 1 | | $ | 2,591 | |

Additional paid-in capital | | | 619,877 | | | - | |

Accumulated other comprehensive income | | | 31,658 | | | 3,630 | |

Retained earnings | | | 8,389,883 | | | 5,676,289 | |

| | | | | | | | |

TOTAL STOCKHOLDERS’ EQUITY | | | 9,041,419 | | | 5,682,510 | |

| | | | | | | | |

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | | $ | 24,920,741 | | $ | 22,568,708 | |

See notes to consolidated financial statements

Infosmart Group Limited

(formerly Sino Excellence Group Limited)

Consolidated Statements of Cash Flows

(Stated in US Dollars)

| | | Year ended December 31, | |

| | | 2005 | | 2004 | |

| | | | | | |

Cash flows from operating activities | | | | | |

Net income | | $ | 4,214,761 | | $ | 3,024,300 | |

Adjustments to reconcile net income to net cash flows | | | | | | | |

provided by operating activities : | | | | | | | |

Depreciation | | | 1,695,697 | | | 1,968,242 | |

Deferred income taxes | | | 958,022 | | | 736,403 | |

Gain on disposal of plant and equipment | | | - | | | (9,193 | ) |

| | | | | | | | |

Changes in operating assets and liabilities : | | | | | | | |

Trade receivables | | | (1,378,159 | ) | | (445,176 | ) |

Prepaid expenses and other receivables | | | (1,684,202 | ) | | 490,289 | |

Inventories | | | 289,229 | | | (1,057,541 | ) |

Trade payables | | | (2,163,581 | ) | | 1,686,026 | |

Other payables and accrued liabilities | | | 370,407 | | | 287,327 | |

Advances from related parties | | | (32,846 | ) | | 144,364 | |

| | | | | | | | |

| Net cash flows provided by operating activities | | | 2,269,328 | | | 6,825,041 | |

| | | | | | | | |

Cash flows from investing activities | | | | | | | |

Proceeds from disposal of plant and equipment | | | - | | | 62,274 | |

Acquisition of plant and equipment | | | (1,454,531 | ) | | (3,707,899 | ) |

| | | | | | | | |

| Net cash flows used in investing activities | | $ | (1,454,531 | ) | $ | (3,645,625 | ) |

Infosmart Group Limited

(formerly Sino Excellence Group Limited)

Consolidated Statements of Cash Flows (cont’d)

(Stated in US Dollars)

| | | Year ended December 31, | |

| | | 2005 | | 2004 | |

| | | | | | |

Cash flows from financing activities | | | | | | | |

Dividend paid | | $ | (1,501,167 | ) | $ | (1,284,000 | ) |

Proceeds from new bank loans | | | 3,475,726 | | | 3,505,089 | |

Increase in restricted cash | | | (129,097 | ) | | (132,965 | ) |

Increase (decrease) in bank overdrafts | | | 232,822 | | | (162,539 | ) |

Issue of shares - Note 19 | | | - | | | 25 | |

Advances from related parties | | | - | | | 2,168,828 | |

Proceeds from other loans | | | 1,286,000 | | | - | |

Repayment of other loans | | | (111,770 | ) | | - | |

Repayment of obligations under capital leases | | | (1,693,041 | ) | | (7,057,844 | ) |

Repayment of bank loans | | | (2,315,607 | ) | | (480,134 | ) |

| | | | | | | | |

| Net cash flows used in financing activities | | | (756,134 | ) | | (3,443,540 | ) |

| | | | | | | | |

| Effect of foreign currency translation on cash | | | | | | | |

cash equivalents | | | 479 | | | (971 | ) |

| | | | | | | | |

| Net increase (decrease) in cash and cash equivalents | | | 59,142 | | | (265,095 | ) |

| | | | | | | | |

| Cash and cash equivalents - beginning of year | | | 95,226 | | | 360,321 | |

| | | | | | | | |

| Cash and cash equivalents - end of year | | $ | 154,368 | | $ | 95,226 | |

| | | | | | | | |

| Supplemental disclosures for cash flow information : | | | | | | | |

Non-cash financing activity : | | | | | | | |

Plant and equipment acquired under | | | | | | | |

- capital lease obligations | | | - | | | 5,851,300 | |

- other loan arrangement | | | - | | | 2,560,898 | |

- Capitalisation of advances from spouse of Ms. Sze | | | 617,287 | | | - | |

| | | | | | | | |

Cash paid for : | | | | | | | |

Interest | | | 454,901 | | | 319,693 | |

Income taxes | | | - | | | - | |

See notes to consolidated financial statements

Infosmart Group Limited

(formerly Sino Excellence Group Limited)

Consolidated Statements of Stockholders’ Equity

For the years ended December 31, 2005 and 2004

(Stated in US Dollars)

| | | Common stock | | | | Accumulated other comprehensive | | Retained | | | |

| | | Shares | | Amount | | capital | | income | | earnings | | Total | |

| | | | | | | | | | | | | | |

| Balance, January 1, 2004 | | | 20,002 | | $ | 2,566 | | $ | - | | $ | 7,673 | | $ | 3,935,989 | | $ | 3,946,228 | |

| Issue of shares (ISIEL) - Note 2 & 19 | | | 198 | | | 25 | | | - | | | - | | | - | | | 25 | |

| Comprehensive income | | | | | | | | | | | | | | | | | | | |

Net income | | | - | | | - | | | - | | | - | | | 3,024,300 | | | 3,024,300 | |

Foreign currency translation adjustments | | | - | | | - | | | - | | | (4,043 | ) | | - | | | (4,043 | ) |

| Total comprehensive income | | | | | | | | | | | | | | | | | | 3,020,257 | |

| Dividend | | | - | | | - | | | - | | | - | | | (1,284,000 | ) | | (1,284,000 | ) |

| | | | | | | | | | | | | | | | | | | | |

| Balance, December 31, 2004 | | | 20,200 | | | 2,591 | | | - | | | 3,630 | | | 5,676,289 | | | 5,682,510 | |

| Issue of shares (ISTL) - Note 2 & 19 | | | 4,800,000 | | | 617,287 | | | - | | | - | | | - | | | 617,287 | |

| Reorganization - Note 2 & 19 | | | (4,820,200 | ) | | (619,878 | ) | | 619,878 | | | - | | | - | | | - | |

| Issue of shares - Note 2 & 19 | | | 1 | | | 1 | | | (1 | ) | | - | | | - | | | - | |

| Comprehensive income | | | | | | | | | | | | | | | | | | | |

Net income | | | - | | | - | | | - | | | - | | | 4,214,761 | | | 4,214,761 | |

Foreign currency translation adjustments | | | - | | | - | | | - | | | 28,028 | | | - | | | 28,028 | |

| Total comprehensive income | | | | | | | | | | | | | | | | | | 4,242,789 | |

| Dividend | | | - | | | - | | | - | | | - | | | (1,501,167 | ) | | (1,501,167 | ) |

| | | | | | | | | | | | | | | | | | | | |

| Balance, December 31, 2005 | | | 1 | | $ | 1 | | $ | 619,877 | | $ | 31,658 | | $ | 8,389,883 | | $ | 9,041,419 | |

| | | | | | | | | | | | | | | | | | | | |

See notes to consolidated financial statements

Infosmart Group Limited

(formerly Sino Excellence Group Limited)

Notes to Consolidated Financial Statements

December 31, 2005 and 2004

(Stated in US Dollar)

| 1. | Change of company name |

On December 1, 2005, the Company changed its name from Sino Excellence Group Limited to Infosmart Group Limited.

| 2. | Corporation information and reorganization |

Infosmart Group Limited (the “Company”) was incorporated in the British Virgin Islands on August 23, 2005. The Company was organized principally to manufacture recordable Digital Video Disc (“DVD-R”), an optical digital disc used for storing data and interactive sequences as well as audio and video files, under the two cooperation agreements as detailed in note 3. The Company intends to go public in the US through a reverse acquisition of a US publicly traded company.

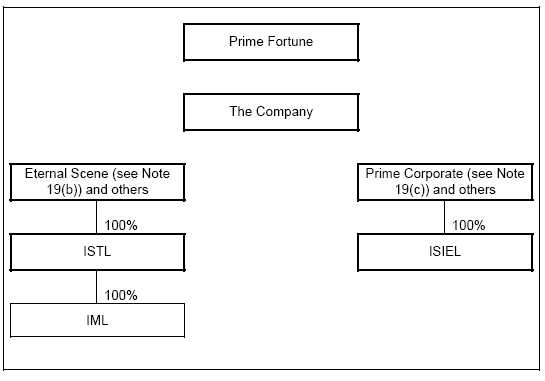

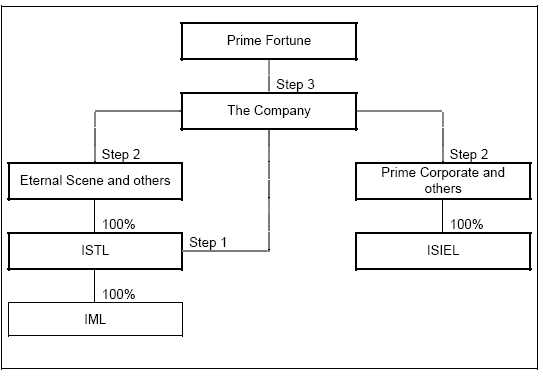

On October 20, 2005, the Company and its subsidiaries (including Info Smart Technology Limited (“ISTL”), Info Smart International Enterprises Limited (“ISIEL”) and Infoscience Media Limited (“IML”)) reorganized its corporate structure (the “Reorganization”) as set forth below:

Company Corporate Structure - Before Reorganization (Figure 1)

Infosmart Group Limited

(formerly Sino Excellence Group Limited)

Notes to Consolidated Financial Statements

December 31, 2005 and 2004

(Stated in US Dollar)

In connection with the Reorganization, on October 20, 2005, Prime Corporate Developments Limited (“Prime Corporate”) whose sole shareholder is Ms. Po-Nei Sze (“Ms. Sze”), converted an advance of $617,287 (equivalent of HK$4,800,000) to ISTL into 4,800,000 shares of ISTL’s voting common stock, par value $0.13 (equivalent of HK$1) per share (“Step 1”). Immediately following such conversion, the Company acquired all of the outstanding and issued shares of common stock of ISTL and ISIEL from their then existing stockholders (the “Stockholders”) (“Step 2”) in consideration for the issuance of 1 share of $1 each of the Company’s voting common stock, representing 100% of the voting power in the Company. Finally, at the direction of the Stockholders, all of the Company’s stock to be issued to the Stockholders were assigned to Prime Fortune Enterprises Limited (“Prime Fortune”) (“Step 3”).

Company Corporate Structure - Reorganization (Figure 2)

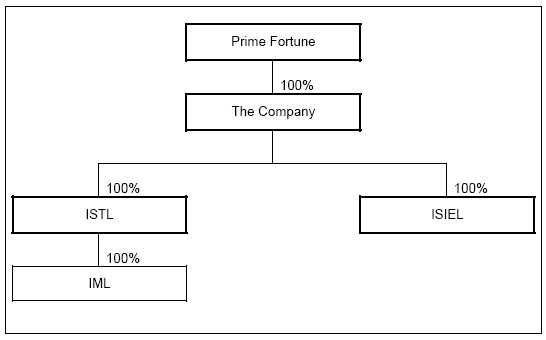

Following the Reorganization, the Company became the holding company of ISTL, IML and ISIEL and is wholly owned by Prime Fortune.

Infosmart Group Limited

(formerly Sino Excellence Group Limited)

Notes to Consolidated Financial Statements

December 31, 2005 and 2004

(Stated in US Dollar)

Company Corporate Structure - After Reorganization (Figure 3)

Prime Fortune was incorporated in the British Virgin Islands on August 23, 2005 and the 1,000 fully-paid issued shares of Prime Fortune were held as follows: 713 shares by Prime Corporate, 212 shares by C. Kwok (“Mr. Kwok”), and 75 shares by an independent third party, Ms. Lui, representing approximately 71.3%, 21.2% and 7.5% of the entire issued common stock of Prime Fortune, respectively.

| 3. | Description of business |

The Company is principally engaged in the manufacturing of DVD recordable discs including 4X, 8X and 16X recording speeds. Usually, the Company commences the production of its products after accepting the customers’ orders and deposits. In case demand of the Company’s products exceed the Company’s production capacity, the shortage on production of DVD discs is outsourced to third parties.

During 2004, the Company primarily produced and sold two products, 4X DVD discs and 8X DVD discs. The main stream of production occurred during the second half of 2004. Because of technology trends and market demand, the Company has also moved towards production of 16X DVD for 2005.

The key raw materials for the production of the Company’s products are PC resin and silver granule. PC resin is mainly used in the molding of DVD discs. Silver granule is mainly used in coating the DVD discs.

The Company’s main suppliers are located in Hong Kong while the Company’s customers are located in both Hong Kong and overseas including Australia and Europe. The Company’s major customers include distributors and retail traders.

Infosmart Group Limited

(formerly Sino Excellence Group Limited)

Notes to Consolidated Financial Statements

December 31, 2005 and 2004

(Stated in US Dollar)

In order to produce DVD Discs ("the Products"), the manufacturers need to obtain two licenses:

| | (1) | license agreement granted from DVD developer (intellectual property owner) to produce the Products (the “License Agreement”); and |

| | (2) | The license for the manufacture of optical discs issued by the Customs and Excise Department of Hong Kong (the "Manufacturing License"). |

The applications for the License Agreement and the Manufacturing License are relatively complex and time-consuming. In order to obtain the Manufacturing License, the Company has to submit an application form with all necessary supporting documents to the Optical Disc License Division of the Customs and Excise Department, the production has to be halted for about a month for the Customs and Excise Department to arrange an appointment for the inspection of manufacturing premises and the Company will be informed of the result within 14 working days. The license is valid on the date of payment for a period of 3 years.

Due to historical association with Mega Century Limited (“Mega Century”), a company formerly controlled by Ms. Sze and her family members up till February 7,2005 when the entire equity interest of Mega Century owned by them was transferred to an independent third party, the Company has entered into cooperation agreements with Mega Century and a third party respectively for the production of the Products instead of halting production for a month during the application period for the licenses. With the relocation of certain production lines from Hong Kong to Brazil and the relocation of Hong Kong production facility from Chai Wan to Tsuen Wan in 2006, there will be a month's period for the Customs and Excise Department to inspect the new production facility in Tsuen Wan. The Company intends to obtain these two licenses before the expiration of the First Cooperation Period and the Second Cooperation Period on December 31, 2006 as detailed below.

Currently the Company operates under two cooperation agreements. The first cooperation agreement (“Agreement 1”) was entered into on December 1, 2002 between ISTL and Mega Century. The second cooperation agreement (“Agreement 2”) was entered into between IML and an independent third party (the “Third Party”) on December 1, 2004.

Agreement 1

Mega Century is engaged in the business of producing the Products. Mega Century has been granted the License Agreement by DVD developer to use certain intellectual properties owned by DVD developer in order to produce the Products. Mega Century is also the holder of the Manufacturing License for the manufacture of optical Disc/Stampers issued by the Customs and Excise Department of Hong Kong. Pursuant to the Agreement 1, during the period from December 1, 2002 to December 31, 2005 (“First Cooperation Period”), Mega Century agrees to share technical know-how with the ISTL and ISTL agrees to provide the production facilities, human and other resources (“Combined Facilities”) to produce the Products.

In accordance with Agreement 1, ISTL is required to purchase from Mega Century at least $1,200,000 worth of Products, cumulatively (the “Minimum Sales”) during the First Cooperation Period. In respect of the Minimum Sales, Mega Century would purchase the necessary raw materials from ISTL at cost (“Production Cost”) incurred by ISTL and Mega Century shall use the Combined Facilities to manufacture the Products and sell to ISTL at the market price for the Products at the time of sale.

Infosmart Group Limited

(formerly Sino Excellence Group Limited)

Notes to Consolidated Financial Statements

December 31, 2005 and 2004

(Stated in US Dollar)

For Products manufactured at the Combined Facilities, Mega Century is responsible for paying all the relevant licensee fees and ISTL is responsible for all the recurrent costs and expenses incurred.

Agreement 1 further provides that the legal title and full beneficial ownership of the first 6,500,000 units of the Products (the “Minimum Quantity”) produced at the Combined Facilities within each whole month during the First Cooperation Period shall belong to ISTL and in this connection ISTL shall have the right to sell the Minimum Quantity to the third party buyers and/or to Mega Century.

For all Products manufactured in excess of the Minimum Quantity, the direct production cost is wholly borne by ISTL and the gross profit is shared between Mega Century and ISTL in the proportion of 30% and 70% respectively.

On January 1, 2004, Mega Century, ISTL and ISIEL entered into an agreement amending Agreement 1 whereby ISIEL agreed to be an additional party to Agreement 1 and to undertake ISTL’s rights and obligations with ISTL jointly and severally.

During 2005 and 2004, the production volume at the Combined Facilities was within the Minimum Quantity under Agreement 1. As a result, the Products wholly belonged to the Company in accordance to Agreement 1. Related party sales and purchases are detailed in note 21.

Up to December 31, 2004, the Company fulfilled the Minimum Sales as required by Agreement 1 and, as a result, there is no purchase commitments regarding such Minimum Sales requirement.

An extension agreement was signed on December 31, 2005 for the extension of the First Cooperation Period to December 31, 2006 with a renewal option.

Agreement 2

With respect to Agreement 2, the Third Party also obtained the relevant License Agreement and Manufacturing License, whereby each of the Third Party and IML agrees that during the period from December 1, 2004 to December 31, 2005 (the “Second Cooperation Period”) to combine operationally their production facilities and resources to produce the Products similar to the arrangement set forth in Agreement 1.

For the Products manufactured at the combined facilities, the Third Party is responsible for paying all the relevant licensee fees and IML is responsible for all the recurrent costs and expenses incurred.

Agreement 2 provides that the legal title and full beneficial ownership of the first 5,000,000 units of the Products (the “Second Minimum Quantity”) produced by the combined production facilities within each whole month during the Second Cooperation Period shall belong to IML and in this connection IML shall have the right to sell the Second Minimum Quantity to third party buyers and/or to the Third Party. For those quantities in excess of the Second Minimum Quantity, they shall belong to the Third Party.

An agreement was signed on December 31, 2005 to extend the Second Cooperation Period to December 31, 2006 with a renewal option.

Infosmart Group Limited

(formerly Sino Excellence Group Limited)

Notes to Consolidated Financial Statements

December 31, 2005 and 2004

(Stated in US Dollar)

| 4. | Continuance of operations |

These financial statements have been prepared on a going concern basis. Due to the fact that the Company is engaged in a capital intensive industry, the Company’s working capital (deficit) as of December 31, 2005 was $(2,838,819). Its ability to continue as a going concern is dependent upon the ability of the Company to meet its obligations and repay its liabilities arising from normal business operations when they come due. The Company plans to satisfy its capital needs through revenue generated from its business and financing transactions through the sale of equity or debt securities.

Management’s plans for the continuation of the Company as a going concern include financing the Company’s operations through debt financing from the banks, trade creditors and investors with extended credit terms. Further, one of the controlling stockholders of Prime Fortune has undertaken to financially support the Company in the course of its operation as necessary. In 2005, the Company started the production of 16X DVD discs to satisfy the market demand and develop new markets in South America. With the launch of new product lines with higher margins than its existing products and the potential of new markets, the management of the Company believes that the new product lines and new markets would bring growth in both revenue and profits and enhance the cash flow position of the Company.

| 5. | Summary of significant accounting policies |

Basis of presentation and consolidation

On October 20, 2005, the Reorganization was completed and accordingly, accounting for recapitalization is adopted for the preparation of consolidated financial statements. Generally, this means that the consolidated financial statements are issued under the name of the legal parent, the Company, but includes the combined financial statements of ISTL and ISIEL. The comparative figures represent their combined financial position, results of operations and cash flows.

The accompanying consolidated financial statements of the Company have been prepared in accordance with generally accepted accounting principles in the United States of America.

The consolidated financial statements include the accounts of the Company and its subsidiaries. All significant inter-company accounts and transactions have been eliminated in consolidation.

Use of estimates

In preparing financial statements in conformity with accounting principles generally accepted in the United States of America, management makes estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the dates of the financial statements, as well as the reported amounts of revenues and expenses during the reporting periods. These accounts and estimates include, but are not limited to, the valuation of accounts receivable, inventories, deferred income taxes and the estimation on useful lives of property, plant and equipment. Actual results could differ from those estimates.

Infosmart Group Limited

(formerly Sino Excellence Group Limited)

Notes to Consolidated Financial Statements

December 31, 2005 and 2004

(Stated in US Dollar)

Concentrations of credit risk

Financial instruments that potentially subject the Company to significant concentrations of credit risk consist principally of trade receivables. The Company extends credit based on an evaluation of the customer’s financial condition, generally without requiring collateral or other security. The Company conducts periodic reviews of the client’s financial conditions and payment practices. Further, the Company will maintain an allowance for doubtful accounts based on the management’s expectations on actual losses possibly incurred. Other than set forth below, no customers represented 10% or more of the Company’s net sales and trade receivables.

At December 31, 2005 and 2004, customers represented 10% or more of the Company’s net sales and their related trade receivables are:

| Net sales | | Year ended December 31, | |

| | | | 2005 | | | 2004 | |

| | | | | | | | |

| DVD Technology | | $ | 1,592,482 | | $ | 3,492,778 | |

| ENet | | | 17,164,213 | | | 16,188,381 | |

| | | | | | | | |

| | | $ | 18,756,695 | | $ | 19,681,159 | |

| Trade receivables | | As of December 31, | |

| | | 2005 | | 2004 | |

| | | | | | |

| DVD Technology | | $ | 376,160 | | $ | 513,912 | |

| Enet | | | 1,610,075 | | | 699,141 | |

| | | | | | | | |

| | | $ | 1,986,235 | | $ | 1,213,053 | |

Cash and cash equivalents

Cash and cash equivalents include all cash, deposits in banks and other highly liquid investments with initial maturities of three months or less.

Restricted cash

Deposits in banks for securities of bank overdrafts facilities that are restricted in use are classified as restricted cash under current assets.

Infosmart Group Limited

(formerly Sino Excellence Group Limited)

Notes to Consolidated Financial Statements

December 31, 2005 and 2004

(Stated in US Dollar)

Trade receivable

Trade receivables are stated at original amount less allowance made for doubtful receivables, if any, based on a review of all outstanding amounts at the year end. Full allowances for doubtful receivables are made when the receivables are overdue for 1 year and an allowance is also made when there is objective evidence that the Company will not be able to collect all amounts due according to original terms of receivables. Bad debts are written off when identified. The Company extends unsecured credit to customers in the normal course of business and believes all trade receivables in excess of the allowances for doubtful receivables to be fully collectible. The Company does not accrue interest on trade accounts receivable. The normal credit terms range from 15 to 60 days. During the reporting years, the Company had no bad debt experience and, accordingly, did not make any allowance for doubtful debts.

Inventories

Inventories are stated at the lower of cost or market. Cost is determined on a first-in, first-out basis and includes all expenditures incurred in bringing the goods to the point of sale and putting them in a saleable condition. In assessing the ultimate realization of inventories, the management makes judgments as to future demand requirements compared to current or committed inventory levels. The Company’s reserve requirements generally increase as the management projected demand requirements; decrease due to market conditions, product life cycle changes. During the reporting years, the Company did not make any allowance for slow-moving or defective inventories.

Plant and equipment

Plant and equipment are stated at cost less accumulated depreciation. Cost represents the purchase price of the asset and other costs incurred to bring the asset into its existing use. Maintenance, repairs and betterments, including replacement of minor items, are charged to expense; major additions to physical properties are capitalized.

Depreciation of plant and equipment is provided using the straight-line method over their estimated useful lives. The principal annual rates are as follows:-

| Production line and equipment | 10% with 30% residual value |

| Leasehold improvements | | | 20 | % |

| Furniture, fixtures and office equipment | | | 20 | % |

| Motor vehicles | | | 20 | % |

With effect from April 1, 2004, the depreciation rate for production line and equipment was changed from 20% to 10% with a residual value of 30% on cost. With reference to a valuation carried out at November 9, 2005 by a major production line and equipment supplier, the management considered that the revised depreciation method reflected more fairly the expected useful lives of the production line and equipment and its resalable value. The effect of a change in an accounting estimate is recognised prospectively by including it in consolidated statements of operations in 2004 and it increased the results of operations for 2004 by $1,650,732.

Infosmart Group Limited

(formerly Sino Excellence Group Limited)

Notes to Consolidated Financial Statements

December 31, 2005 and 2004

(Stated in US Dollar)

Impairment of long-live assets

Long-lived assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of the assets may not be recoverable. The Company recognizes impairment of long-lived assets in the event that the net book values of such assets exceed the future undiscounted cashflows attributable to such assets. No impairment of long-lived assets was recognized for any of the periods presented.

Revenue recognition

Revenue from sales of the Company’s products is recognized when the significant risks and rewards of ownership have been transferred to the buyer at the time of delivery and the sales price is fixed or determinable and collection is reasonably assured.

Advertising and transportation expenses

Advertising, transportation and other product-related costs are charged to expense as incurred.

Advertising expenses amounted to $101,590 and $78,961 during 2005 and 2004 respectively and are included in selling and distributing costs.

Transportation expenses amounted to $447,894 and $746,444 during 2005 and 2004 respectively and are included in cost of sales.

Income taxes

The Company uses the asset and liability method of accounting for income taxes pursuant to SFAS No. 109 “Accounting for Income Taxes”. Under the asset and liability method of SFAS 109, deferred tax assets and liabilities are recognized for the future tax consequences attributable to temporary differences between the financial statements carrying amounts of existing assets and liabilities and loss carryforwards and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled.

Dividends

Dividends are recorded in the Company’s financial statements in the period in which they are declared.

Off-balance sheet arrangements

Other than the bank guarantee given by a bank to a utility company which exempted the Company’s obligation to pay the required utility deposit (note 14), the Company does not have any off-balance sheet arrangements.

Infosmart Group Limited

(formerly Sino Excellence Group Limited)

Notes to Consolidated Financial Statements

December 31, 2005 and 2004

(Stated in US Dollar)

Comprehensive income

The Company has adopted SFAS 130, “Reporting Comprehensive Income”, which establishes standards for reporting and display of comprehensive income, its components and accumulated balances. Accumulated other comprehensive income represents the accumulated balance of foreign currency translation adjustments of the Company.

Foreign currency translation

The functional currency of the Company is Hong Kong dollars (“HK$”). The Company maintains its financial statements in the functional currency. Monetary assets and liabilities denominated in currencies other than the functional currency are translated into the functional currency at rates of exchange prevailing at the balance sheet dates. Transactions denominated in currencies other than the functional currency are translated into the functional currency at the exchanges rates prevailing at the dates of the transaction. Exchange gains or losses arising from foreign currency transactions are included in the determination of net income for the respective periods.

For financial reporting purposes, the financial statements of the Company which are prepared using the functional currency have been translated into United States dollars. Assets and liabilities are translated at the exchange rates at the balance sheet dates and revenue and expenses are translated at the average exchange rates and stockholders’ equity is translated at historical exchange rates. Any translation adjustments resulting are not included in determining net income but are included in foreign exchange adjustment to other comprehensive income, a component of stockholders’ equity.

The exchange rates in effect at December 31, 2005 and 2004 were HK$1 for $0.1290 and $0.1286 respectively. There is no significant fluctuation in exchange rate for the conversion of HK$ to US dollars after the balance sheet date.

Fair value of financial instruments

The carrying values of the Company’s financial instruments, including cash and cash equivalents, restricted cash, trade and other receivables, deposits, dividend payable, trade and other payables approximate their fair values due to the short-term maturity of such instruments. The carrying amounts of borrowings approximate their fair values because the applicable interest rates approximate current market rates.

It is management’s opinion that the Company is not exposed to significant interest, price or credit risks arising from these financial instruments.

The Company is exposed to certain foreign currency risk from export sales transactions and recognized trade receivables as they will affect the future operating results of the Company. The Company did not have any hedging activities during the reporting period. As the functional currency of the Company is HK$, the exchange difference on translation to US dollars for reporting purpose is taken to other comprehensive income.

Infosmart Group Limited

(formerly Sino Excellence Group Limited)

Notes to Consolidated Financial Statements

December 31, 2005 and 2004

(Stated in US Dollar)

Basic and diluted earnings per share

The Company reports basic earnings or loss per share in accordance with SFAS No. 128, “Earnings Per Share”. Basic earnings per share is computed using the weighted average number of shares outstanding during the periods presented. The weighted average number of shares of the Company represents the common stock outstanding during the years.

Recent accounting pronouncements

In November 2004, the FASB issued SFAS No. 151, “Inventory costs - an amendment of ARB No. 43, Chapter 4.” (“SFAS 151”). SFAS 151 amends ARB 43, Chapter 4 to clarify that “abnormal” amount of idle freight, handling costs and spoilage should be recognized as current period charges. SFAS 151 is effective for inventory costs incurred during fiscal years beginning after June 15, 2005.

In December 2004, the FASB issued SFAS No. 123R, “Share-Based Payment” (“SFAS 123R”), which revises SFAS No. 123, “Accounting for Stock Based Compensation”, and supersedes APB 25. Among other items, SFAS 123R eliminates the use of APB 25 and the intrinsic value method of accounting, and requires companies to recognize in the financial statements the cost of employee services received in exchange for awards of equity instruments, based on the grant-date fair value of those awards. This cost is to be recognized over the period during which an employee is required to provide service in exchange for the award (typically the vesting period). SFAS 123R also requires that benefits associated with tax deductions in excess of recognized compensation cost be reported as a financing cash inflow, rather than as an operating cash flow as required under current literature.

SFAS 123R permits companies to adopt its requirements using either a “modified prospective” method, or a “modified retrospective” method.

Under the “modified prospective” method, compensation cost is recognized in the financial statements beginning with the effective date, based on the requirements of SFAS 123R for all share-based awards granted or modified after that date, and based on the requirements of SFAS 123 for all unvested awards granted prior to the effective date of SFAS 123R. Under the “modified retrospective” method, the requirements are the same as under the “modified prospective” method, but this method also permits entities to restate financial statements of previous periods based on proforma disclosures made in accordance with SFAS 123. The Company is adopting SFAS 123R effective January 1, 2006 using the modified prospective method.

In May 2005, the FASB issued SFAS No. 154, “Accounting Changes and Error Corrections” (“SFAS 154”), which changes the requirements for the accounting for and reporting of a change in accounting principle. The statement requires retrospective application to prior period financial statements of changes in accounting principle, unless impracticable to do so. It also requires that a change in the depreciation, amortization, or depletion method for long-lived non-financial assets be accounted as a change in accounting estimate, effected by a change in accounting principle. Accounting for error corrections and accounting estimate changes will continue under the guidance in APB Opinion 20, “Accounting Changes”, as carried forward in this pronouncement. The statement is effective for fiscal years beginning after December 15, 2005.

Infosmart Group Limited

(formerly Sino Excellence Group Limited)

Notes to Consolidated Financial Statements

December 31, 2005 and 2004

(Stated in US Dollar)

In November 2005, the FASB issued FSP Nos. FAS 115-1 and 124-1, “The Meaning of Other-Than-Temporary Impairment and Its Application to Certain Investments.” This FSP addresses the determination as to when an investment is considered impaired, whether the impairment is ‘other-than-temporary’, and the measurement of an impairment loss. The investment is impaired if the fair value is less than cost. The impairment is ‘other-than-temporary’ for equity securities and debt securities that can contractually be prepaid or otherwise settled in such a way that the investor would not recover substantially all of its cost. If ‘other-than-temporary’, an impairment loss shall be recognized in earnings equal to the difference between the investment’s cost and its fair value. The guidance in this FSP is effective in reporting periods beginning after December 15, 2005. The Company is reviewing FSP Nos. FAS 115-1 and 124-1, but does not expect that the adoption of this FSP will have a material effect on its consolidated financial statements.

The Company does not anticipate that the adoption of these standards will have a material impact on these financial statements.

| 6. | Reversal of commission payable |

A major customer of the Company granted full forbearance for commission payable by the Company for previous period.

| | | Year ended December 31, | |

| | | 2005 | | 2004 | |

| | | | | | |

| Machinery rental income | | $ | - | | $ | 481,500 | |

| Factory rental income charged to Mega Century | | | 15,432 | | | 17,873 | |

| Gain on disposal of plant and equipment | | | - | | | 9,193 | |

| Interest income | | | 7,307 | | | 115 | |

| Scrap sales | | | 211,754 | | | 94,731 | |

| Other income | | | 68,410 | | | 76,248 | |

| | | | | | | | |

| | | $ | 302,903 | | $ | 679,660 | |

The components of the provision for income taxes in Hong Kong are:

| | | Year ended December 31, | |

| | | 2005 | | 2004 | |

| | | | | | |

| Current taxes | | $ | - | | $ | - | |

| Deferred taxes | | | 958,022 | | | 736,403 | |

| | | | | | | | |

| | | $ | 958,022 | | $ | 736,403 | |

Infosmart Group Limited

(formerly Sino Excellence Group Limited)

Notes to Consolidated Financial Statements

December 31, 2005 and 2004

(Stated in US Dollar)

The effective income tax expenses differs from the statutory rate of 17.5% in Hong Kong as follows:

| | | Year ended December 31, | |

| | | 2005 | | 2004 | |

| | | | | | |

| Provision for income tax at statutory tax rate | | $ | 905,237 | | $ | 658,123 | |

| Non-deductible items for tax | | | 55,853 | | | 9,859 | |

| Income not subject to tax | | | (3,068 | ) | | (1,610 | ) |

| Effect of increase in statutory tax rate | | | - | | | 70,031 | |

| | | | | | | | |

| Effective income tax expenses | | $ | 958,022 | | $ | 736,403 | |

Deferred tax (assets) liabilities as of December 31, 2005 and 2004 are composed of the following:

| | | As of December 31, | |

| | | 2005 | | 2004 | |

| | | | | | |

| Deferred tax assets | | | | | | | |

Operating losses available for future periods | | $ | (573,653 | ) | $ | (961,632 | ) |

| | | | | | | | |

| Deferred tax liabilities | | | | | | | |

Temporary difference on accelerated tax | | | | | | | |

depreciation on plant and equipment | | | 3,024,983 | | | 2,447,340 | |

| | | | | | | | |

| Deferred tax liabilities, net | | $ | 2,451,330 | | $ | 1,485,708 | |

| | | As of December 31, | |

| | | 2005 | | 2004 | |

| | | | | | |

| Recognised in the balance sheet: | | | | | | | |

Net deferred tax assets | | $ | (45,724 | ) | $ | - | |

Net deferred tax liabilities | | | 2,497,054 | | | 1,485,708 | |

| | | | | | | | |

| | | $ | 2,451,330 | | $ | 1,485,708 | |

As of December 31, 2005 and 2004, the Company has unused tax losses of $3,278,020 and $5,495,044 respectively available for offset against future profits for Hong Kong income tax purposes. The tax losses do not expire under current tax legislation.

Infosmart Group Limited

(formerly Sino Excellence Group Limited)

Notes to Consolidated Financial Statements

December 31, 2005 and 2004

(Stated in US Dollar)

The calculation of the weighted average number of shares outstanding for 2004 is based on the number of outstanding shares of ISTL and ISIEL before the Reorganization. The calculation of the weighted average number of shares outstanding for 2005 is based on the number of outstanding shares of ISTL and ISIEL up to the date of Reorganization and the number of outstanding shares of the Company up to December 31, 2005.

The Company has no dilutive instruments, such as options and warrants. Accordingly, the basic and diluted earnings per share are the same.

| 10. | Prepaid expenses and other receivables |

| | | As of December 31, | |

| | | 2005 | | 2004 | |

| | | | | | |

| Prepaid operating expenses | | $ | - | | $ | 52,394 | |

| Prepaid professional fees for listing | | | 28,896 | | | - | |

| Rental and utility deposits | | | 49,014 | | | 108,923 | |

| Advance to Mega Century | | | 24,882 | | | - | |

| Advance to the Third Party | | | 1,227,738 | | | 1,526 | |

| Other receivables for advancement | | | 147,813 | | | 117,263 | |

| | | | | | | | |

| | | $ | 1,478,343 | | $ | 280,106 | |

The advances to Mega Century and the Third Party are interest-free and unsecured and have no fixed terms of repayment.

| | | As of December 31, | |

| | | 2005 | | 2004 | |

| | | | | | |

| Raw materials | | $ | 272,124 | | $ | 492,116 | |

| Finished goods | | | 1,155,666 | | | 1,220,476 | |

| | | | | | | | |

| | | $ | 1,427,790 | | $ | 1,712,592 | |

Infosmart Group Limited

(formerly Sino Excellence Group Limited)

Notes to Consolidated Financial Statements

December 31, 2005 and 2004

(Stated in US Dollar)

| | | As of December 31, | |

| | | 2005 | | 2004 | |

| | | | | | |

| Costs | | | | | | | |

| Production lines and equipment | | $ | 21,895,934 | | $ | 20,561,147 | |

Leasehold improvements | | | 954,794 | | | 777,788 | |

Furniture, fixtures and office equipment | | | 116,078 | | | 102,125 | |

Motor vehicles | | | 54,924 | | | 54,753 | |

| | | | | | | | |

| | | | 23,021,730 | | | 21,495,813 | |

| | | | | | | | |

| Accumulated depreciation | | | | | | | |

| Production lines and equipment | | | 4,299,143 | | | 2,804,650 | |

Leasehold improvements | | | 363,144 | | | 180,297 | |

Furniture, fixtures and office equipment | | | 42,382 | | | 20,387 | |

Motor vehicles | | | 18,308 | | | 7,300 | |

| | | | | | | | |

| | | | 4,722,977 | | | 3,012,634 | |

| | | | | | | | |

| Net | | | | | | | |

| Production lines and equipment | | | 17,596,791 | | | 17,756,497 | |

Leasehold improvements | | | 591,650 | | | 597,491 | |

Furniture, fixtures and office equipment | | | 73,696 | | | 81,738 | |

Motor vehicles | | | 36,616 | | | 47,453 | |

| | | | | | | | |

| | | $ | 18,298,753 | | $ | 18,483,179 | |

| | | | | | | | |

| | | | | | | | |

| An analysis of production lines and equipment acquired under capital leases (note 15) and pledged to banks for banking facilities (note 14(a)) granted to the Company is as follows: |

| | | Acquired Under capital leases | | Pledged for banking facilities | |

| | | As of December 31, | | As of December 31, | |

| | | 2005 | | 2004 | | 2005 | | 2004 | |

| | | | | | | | | | |

| Costs | | $ | 1,677,000 | | $ | 10,254,575 | | $ | 4,192,500 | | $ | 4,553,489 | |

| Accumulated depreciation | | | (289,283 | ) | | (1,115,782 | ) | | (723,206 | ) | | (867,418 | ) |

| | | | | | | | | | | | | | |

| Net | | $ | 1,387,717 | | $ | 9,138,793 | | $ | 3,469,294 | | $ | 3,686,071 | |

| | | | |

| | | Year ended December 31, | | | Year ended December 31, | |

| | | | 2005 | | | 2004 | | | 2005 | | | 2004 | |

| | | | | | | | | | | | | | |

| Depreciation for the year | | $ | 117,390 | | $ | 1,021,680 | | $ | 292,565 | | $ | 466,007 | |

Infosmart Group Limited

(formerly Sino Excellence Group Limited)

Notes to Consolidated Financial Statements

December 31, 2005 and 2004

(Stated in US Dollar)

The components of depreciation charged are:

| | | Year ended December 31, | |

| | | 2005 | | 2004 | |

| | | | | | |

| Included in factory overheads | | | | | | | |

| Production lines and equipment | | $ | 1,481,163 | | $ | 1,790,419 | |

| | | | | | | | |

| Included in operating expenses | | | | | | | |

Leasehold improvements | | | 181,721 | | | 152,910 | |

Furniture, fixtures and office equipment | | | 21,862 | | | 17,624 | |

Motor vehicles | | | 10,951 | | | 7,289 | |

| | | | | | | | |

| | | | 214,534 | | | 177,823 | |

| | | | | | | | |

| | | $ | 1,695,697 | | $ | 1,968,242 | |

During 2004, equipment included in production lines and equipment with carrying amount of $53,081 (cost of $53,081 less accumulated depreciation of $Nil) was disposed for a consideration of $62,274 resulting in a gain of $9,193.

| 13. | Other payables and accrued liabilities |

| | | As of December 31, | |

| | | 2005 | | 2004 | |

| | | | | | |

| Receipts in advance from new customers | | $ | - | | $ | 7,484 | |

| Customers deposits | | | 201,655 | | | 178,900 | |

| Accrued professional fee | | | 317,340 | | | 167,180 | |

| Staff costs payable | | | 173,047 | | | 39,072 | |

| Other loans interest payable | | | 66,132 | | | - | |

| Other accrued expenses for operations | | | 344,779 | | | 336,489 | |

| | | | | | | | |

| | | $ | 1,102,953 | | $ | 729,125 | |

Infosmart Group Limited

(formerly Sino Excellence Group Limited)

Notes to Consolidated Financial Statements

December 31, 2005 and 2004

(Stated in US Dollar)

| | | As of December 31, | |

| | | 2005 | | 2004 | |

| | | | | | |

| Secured: | | | | | | | |

Bank overdrafts repayable on demand | | $ | 256,140 | | $ | 25,398 | |

Repayable within one year | | | | | | | |

Non-recurring bank loans | | | 794,066 | | | 1,905,776 | |

Other bank borrowings | | | 1,747,847 | | | 1,123,891 | |

| | | | | | | | |

| | | | 2,798,053 | | | 3,055,065 | |

| | | | | | | | |

| Unsecured: | | | | | | | |

Bank overdrafts repayable on demand | | | 2,883 | | | - | |

Repayable within one year | | | | | | | |

Other bank borrowings | | | 1,660,904 | | | - | |

| | | | | | | | |

| | | | 1,663,787 | | | - | |

| | | | | | | | |

| | | $ | 4,461,840 | | $ | 3,055,065 | |

| | As of December 31, 2005, the Company’s banking facilities are composed of the following: |

| | | Amount | |

Facilities granted | | Granted | | Utilized | | Unused | |

| | | | | | | | |

| Bank overdrafts | | $ | 258,000 | | $ | 256,140 | | $ | 1,860 | |

| Non-recurring bank loans | | | 1,290,000 | | | 1,290,000 | | | - | |

| Letter of credit including: | | | | | | | | | | |

| - Outstanding letter of credit | | | 1,548,000 | | | 388,680 | | | 56,473 | |

| - Letter of credit under trust receipt | | | | | | 412,945 | | | | |

| - Invoice advancement | | | | | | 689,902 | | | | |

| Invoice discounting | | | 645,000 | | | 645,000 | | | - | |

| Bank guarantee for utility deposit | | | 143,190 | | | 143,190 | | | - | |

| | | | | | | | | | | |

| | | $ | 3,884,190 | | $ | 3,825,857 | | $ | 58,333 | |

| | As of December 31, 2005, the above banking facilities were secured by the following:- |

| | (a) | first fixed legal charge over 5 DVD-R discs production lines with carrying amounts of $3,469,294 (note 12); |

| | (b) | charge over bank deposit of $263,085; |

| | (c) | charged over trade receivables amounted to $1,668,628; and |

| | (d) | joint and several guarantees executed by Ms. Sze, her spouse and Mr. Kwok. |

Infosmart Group Limited

(formerly Sino Excellence Group Limited)

Notes to Consolidated Financial Statements

December 31, 2005 and 2004

(Stated in US Dollar)

The interest rates of bank loans were at Hong Kong Prime Rate plus 2.5% per annum.

The existing available banking facilities did not have any covenant for the Company to meet. Other unsecured bank borrowings were utilised under the banking facilities granted to the Third Party and all relevant costs were borne by the Company’s directly.

| 15. | Obligations under capital leases |

The Company leases certain production lines and equipment (Note 12) under non-cancelable leases classified as capital leases. The leases are negotiated for terms ranging from 1 to 2 years. Interest rates are fixed at the contract date. All leases are on a fixed repayment basis. None of the leases includes contingent rentals. The following is a schedule of future minimum lease payments for capital leases together with the present value of the net minimum lease payments :-

| | | As of December 31, | |

| | | 2005 | | 2004 | |

| | | | | | |

| Year ending December 31 | | | | | |

2005 | | $ | - | | $ | 1,672,832 | |

2006 | | | 52,919 | | | 102,944 | |

| | | | | | | | |

| Total minimum lease payments | | | 52,919 | | | 1,775,776 | |

| Total capital lease charges | | | (227 | ) | | (30,208 | ) |

| | | | | | | | |

| Present value of lease payments | | | 52,692 | | | 1,745,568 | |

| Current portion | | | (52,692 | ) | | (1,694,323 | ) |

| | | | | | | | |

| Non-current portion | | $ | - | | $ | 51,245 | |

In 2005, a new loan of $1,286,000 was arranged from an independent third party for working capital of the Company. The loan is bearing interest at Hong Kong Prime Rate plus 0.5% per annum, unsecured and repayable in 2006.

In connection with the acquisition of production lines and equipment at cost of $2,560,898 in 2004, a debt financing was arranged with an independent third party and the loan is bearing interest at 5.6% per annum (subject to annual revision), unsecured and repayable by 60 monthly instalments with the first instalment due in April of 2005.

For 2005, the average effective annual interest borrowing rate was approximately of 5.7% (2004 : 5.6%).

Infosmart Group Limited

(formerly Sino Excellence Group Limited)

Notes to Consolidated Financial Statements

December 31, 2005 and 2004

(Stated in US Dollar)

| | The outstanding principal of the other loan is repayable as follows: |

| | | As of December 31, | |

| | | 2005 | | 2004 | |

| Year ending December 31 | | | | | |

2005 | | $ | - | | $ | 340,050 | |

2006 | | | 1,996,614 | | | 476,142 | |

2007 | | | 505,068 | | | 503,504 | |

2008 | | | 534,090 | | | 532,434 | |

2009 | | | 564,778 | | | 563,027 | |

2010 | | | 146,195 | | | 145,741 | |

| | | | | | | | |

| Total | | | 3,746,745 | | | 2,560,898 | |

| Current portion | | | (1,996,614 | ) | | (340,050 | ) |

| | | | | | | | |

| Non-current portion | | $ | 1,750,131 | | $ | 2,220,848 | |

| 17. | Advances from related parties |

Advances from related parties for working capital are as follows:

| | | As of December 31, | |

| | | 2005 | | 2004 | |

| | | | | | |

| External Scene | | $ | - | | $ | 129,000 | |

| Company controlled by minority interest, Ms. Li, (before the Reorganization) of ISTL | | | | | | 96,448 | |

| Mega Century | | | - | | | 490,549 | |

| Prime Corporate | | | 2,217,054 | | | 906,209 | |

| Rise Tech (note 19) | | | - | | | 154,317 | |

| Mr. Kwok | | | - | | | 384,961 | |

| The spouse of Ms. Sze | | | - | | | 1,189,370 | |

| | | | | | | | |

| | | $ | 2,217,054 | | $ | 3,350,854 | |

The above advances are interest-free, unsecured and all of the related parties have undertaken not to demand repayment in the next twelve months.

As of December 31, 2005, the amounts originally due to the spouse of Ms. Sze, Eternal Scene and Ms. Sze amounted to $3,870, $129,000 and $1,707,348 respectively were assigned to Prime Corporate pursuant to consent letters dated December 31, 2005.

Infosmart Group Limited

(formerly Sino Excellence Group Limited)

Notes to Consolidated Financial Statements

December 31, 2005 and 2004

(Stated in US Dollar)

| 18. | Commitments and contingencies |

The Company leases office and factory premises under various non-cancelable operating lease agreements that expire at various dates through years 2004 to 2006, with an option to renew the lease. All leases are on a fixed repayment basis. None of the leases includes contingent rentals. Minimum future commitments under these agreements payable as of December 31, 2005 are as follows :-

| Year ending December 31 | | | |

2006 | | $ | 69,515 | |

Rental expense was $518,967 and $158,051 during 2005 and 2004 respectively.

The authorized, issued and outstanding common stock for the Company and each of its subsidiaries are as follows :

| | | As of December 31, | |

| | | Number of shares | | Amount | |

| | | 2005 | | 2004 | | 2005 | | 2004 | |

| Authorized: | | | | | | | | | | | | | |

The Company of $1 each | | | 50,000 | | | - | | $ | 50,000 | | $ | - | |

ISTL of $0.12826 each | | | - | | | 20,000 | | | - | | | 2,565 | |

ISIEL of $0.12826 each | | | - | | | 10,000 | | | - | | | 1,283 | |

| | | | | | | | | | | | | | |

| | | | 50,000 | | | 30,000 | | $ | 50,000 | | $ | 3,848 | |

| | | | | | | | | | | | | | |

| Issued and outstanding: | | | | | | | | | | | | | |

The Company of $1 each | | | 1 | | | - | | $ | 1 | | $ | - | |

ISTL of $0.12826 each | | | - | | | 20,000 | | | - | | | 2,565 | |

ISIEL of $0.12826 each | | | - | | | 200 | | | - | | | 26 | |

| | | | | | | | | | | | | | |

| | | | 1 | | | 20,200 | | $ | 1 | | $ | 2,591 | |

Authorized

At the date of inception, the Company was authorized to issue 10,000 common shares with par value of US$1.

Infosmart Group Limited

(formerly Sino Excellence Group Limited)

Notes to Consolidated Financial Statements

December 31, 2005 and 2004

(Stated in US Dollar)

Issued and outstanding

On October 20, 2005, the Company acquired the entire issued common stock of ISTL and ISIEL from the Stockholders in consideration of and exchange for allotment and issue of 1 share of $1 each of the Company’s voting common stock, at the direction of the Stockholders, to Prime Fortune.

On October 19, 2005, the authorized shares of ISTL increased from 20,000 shares to 5,000,000 shares. Immediately before the Reorganization, the 20,000 fully-paid issued shares of ISTL were held as to 14,255 shares by Eternal Scene International Limited (“Eternal Scene”)(controlled by Ms. Sze), as to 4,245 shares by Mr. Kwok and as to 1,500 shares by an individual, Ms. Li, representing approximately 71.3%, 21.2% and 7.5% of the entire issued common stock of ISTL, respectively.

In connection with the Reorganization, on October 20, 2005, Ms. Po-Nei Sze, a shareholder of Prime Corporate Developments Limited (“Prime Corporate”), converted an advance of $617,287 (equivalent of HK$4,800,000) to ISTL into 4,800,000 shares of ISTL’s voting common stock, par value $0.13 (equivalent of HK$1) per share.

On January 30, 2004, 198 shares were issued at par in cash to the Stockholders.

Immediately before the Reorganization, the 200 fully-paid issued shares of ISIEL were held as to 161 shares by Prime Corporate Developments Limited (“Prime Corporate”), as to 24 shares by Rise Tech Holdings Limited (“Rise Tech”) and as to 15 shares by Ms. Li representing approximately 80.5%, 12.0% and 7.5% of the entire issued common stock of ISIEL.

On October 20, 2005, 9,997 shares of IML were issued and allotted to ISTL. Immediately after completion of the issue and allotment by IML, ISTL held the entire issued common stock of IML increased from 3 shares to 10,000 shares.

Infosmart Group Limited

(formerly Sino Excellence Group Limited)

Notes to Consolidated Financial Statements

December 31, 2005 and 2004

(Stated in US Dollar)

The Company participates in a defined contribution pension scheme under the Mandatory Provident Fund Schemes Ordinance (“MPF Scheme”) for all its eligible employees in Hong Kong.

The MPF Scheme is available to all employees aged 18 to 64 with at least 60 days of service in employment in Hong Kong. Contributions are made by the Company operating in Hong Kong at 5% of the participants’ relevant income with a ceiling of $2,580 (equivalent of HK$20,000). The participants are entitled to 100% of the Company’s contributions together with accrued returns irrespective of their length of service with the Company, but the benefits are required by law to be preserved until the retirement age of 65. The only obligation of the Company with respect to MPF Scheme is to make the required contributions under the plan.

The assets of the schemes are controlled by trustees and held separately from those of the Company. The Company fully complied the contribution requirement and total pension cost was $66,107 and $43,849 for 2005 and 2004 respectively.

| 21. | Related party transactions |

Apart from the transactions disclosed elsewhere in the financial statements, the Company had the following material transactions with its related parties during the year ended December 31, 2005:

| | | Year ended December 31, | |

| | | 2005 | | 2004 | |

| | | | | | |

| Sales of raw materials to Mega Century at costs actual Incurred | | $ | 29,197 | | $ | 499,217 | |

| Purchases of finished goods from Mega Century at market prices | | | 24,677 | | | 1,292,156 | |

| Sales of finished goods to Mega Century at market prices | | | - | | | 26,040 | |

| Factory rentals received from Mega Century at market rentals | | | 2,572 | | | 17,873 | |

| Machinery rentals received from Mega Century at market rentals | | | - | | | 481,500 | |

| Quarters rentals paid to Eternal Scene at market rentals | | | - | | | 62,274 | |

Note: Only the transactions with Mega Century up to February 7, 2005 are regarded as related party transactions as the management considers that Mega Century was no longer a related party following the transfer of entire interest in Mega Century by Ms. Sze and her family members (Note 3).

Infosmart Group Limited

(formerly Sino Excellence Group Limited)

Notes to Consolidated Financial Statements

December 31, 2005 and 2004

(Stated in US Dollar)

The Company is engaged in the manufacture and distribution of DVD discs. The nature of the products, their production processes, the type of their customers and their distribution methods are substantially similar. In case the demands temporarily exceed the Company’s production capacity, the shortage on production of DVD discs is outsourced. Information for the activities of self-production and outsourcing is disclosed under FAS 131, “Disclosures about Segments of an Enterprise and Related Information” as below :-

| | | Self-production | | Outsourcing | | Total | |

| | | 2005 | | 2004 | | 2005 | | 2004 | | 2005 | | 2004 | |

| | | | | | | | | | | | | | |

| Revenue from external customers | | $ | 21,955,295 | | $ | 14,736,785 | | $ | 2,621,911 | | $ | 7,684,980 | | $ | 24,577,206 | | $ | 22,421,765 | |

| Interest income | | | 7,307 | | | 115 | | | - | | | - | | | 7,307 | | | 115 | |

| Interest expenses | | | 520,827 | | | 319,693 | | | - | | | - | | | 520,827 | | | 319,693 | |

| Depreciation | | | 1,674,059 | | | 1,966,053 | | | 21,638 | | | 2,189 | | | 1,695,697 | | | 1,968,242 | |

| Machinery rental income | | | - | | | 481,500 | | | - | | | - | | | - | | | 481,500 | |

| Segment profit | | | 5,147,974 | | | 3,541,249 | | | 345,701 | | | 219,454 | | | 5,493,675 | | | 3,760,703 | |

| Segment assets | | | 22,498,034 | | | 21,421,067 | | | 1,194,969 | | | 1,147,641 | | | 23,693,003 | | | 22,568,708 | |

| Expenditure for segment assets | | $ | 1,427,097 | | $ | 12,110,617 | | $ | 27,434 | | $ | 9,480 | | $ | 1,454,531 | | $ | 12,120,097 | |

Infosmart Group Limited

(formerly Sino Excellence Group Limited)

Notes to Consolidated Financial Statements

December 31, 2005 and 2004

(Stated in US Dollar)

A reconciliation is provided for unallocated amounts relating to corporate operations which is not included in the segment information.

| | | Year ended December 31, | |

| | | 2005 | | 2004 | |

| | | | | | |

| Total consolidated revenue | | $ | 24,577,206 | | $ | 22,421,765 | |

| | | | | | | | |

| Total profit for reportable segments | | $ | 5,493,675 | | $ | 3,760,703 | |

| Unallocated amounts relating to operations: | | | | | | | |

Professional fees for pre-listing exercise | | | (320,892 | ) | | - | |

| | | | | | | | |

| Income before income taxes | | $ | 5,172,783 | | $ | 3,760,703 | |

| | | | | | | | |

| | | As of December 31, | |

| | | 2005 | | 2004 | |

| Assets | | | | | | | |

| | | | | | | | |

| Total assets for reportable segments | | $ | 23,693,003 | | $ | 22,568,708 | |

| Advance to the Third Party | | | 1,227,738 | | | - | |

| | | | | | | | |

| | | $ | 24,920,741 | | $ | 22,568,708 | |

| | | | | | | | |

The following is a summary of operations by entities located within the indicated geographic areas for 2005 and 2004. All of long-lived assets are located in Hong Kong.

| | | Year ended December 31, | |

| | | 2005 | | 2004 | |

| | | | | | |

| Australia | | $ | 2,130,973 | | $ | 1,225,899 | |

| Brazil | | | 106,344 | | | - | |

| Chile | | | 206,672 | | | - | |

| Germany | | | 52,385 | | | 526,041 | |

| Hong Kong | | | 2,699,221 | | | 829,764 | |

| Korea | | | 207,162 | | | 37,657 | |

| Mainland China | | | 270,995 | | | - | |

| Thailand | | | 120,198 | | | - | |

| United Kingdom | | | 18,553,687 | | | 19,399,919 | |

| USA | | | 17,588 | | | 290,992 | |

| Other countries | | | 211,981 | | | 111,493 | |

| | | | | | | | |

| Total | | $ | 24,577,206 | | $ | 22,421,765 | |

Infosmart Group Limited

(formerly Sino Excellence Group Limited)

Notes to Consolidated Financial Statements

December 31, 2005 and 2004

(Stated in US Dollar)

| 23. | Post balance sheet date event |

For the development of market in Brazil, the Company entered into an agreement on March 20, 2006 with two independent third parties for setting up a subsidiary, Discobrás Indústria E Comércio De Eletro Eletrônica Ltda (“Discobrás”), in Brazil. Discobrás has a social capital of $8,046,281 (equivalent to R$17,385,600) and 99.42% or $8,000,000 (equivalent to R$17,285,600) of which will be subscribed by the Company. The capital contribution to Discobrás is satisfied by certain production lines of $6,000,000 (equivalent to R$12,964,200) and cash consideration of $2,000,000 (equivalent to R$4,321,400). Up to April 27, 2006, $257,800 of cash was contributed by the Company.

Certain amounts included in prior years’ combined balance sheet and the combined statement of operations and cash flows have been reclassified to conform to the current year’s presentation. These reclassifications had no effect on reported total assets, liabilities, shareholders’ equity, or net income.