QuickLinks -- Click here to rapidly navigate through this document

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2004

DAIMLERCHRYSLER AG

(Translation of registrant's name into English)

EPPLESTRASSE 225, 70567 STUTTGART, GERMANY

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.]

[Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.]

[If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- ]

This report on Form 6-K is hereby incorporated by reference in the registration statement on Form F-3 of DaimlerChrysler North America Holding Corporation (Registration Statement No. 333-13160) and the registration statements on Form S-8 (Nos. 333-5074, 333-7082, 333-8998, 333-86934 and 333-86936) of DaimlerChrysler AG

DAIMLERCHRYSLER AG

FORM 6-K: TABLE OF CONTENTS

- 1.

- Interim Report to Stockholders for the three- and nine-month periods ended September 30, 2004

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This document contains forward-looking statements that reflect management's current views with respect to future events. The words "anticipate," "assume," "believe," "estimate," "expect," "intend," "may," "plan," "project" and "should" and similar expressions identify forward-looking statements. Such statements are subject to risks and uncertainties, including, but not limited to: an economic downturn in Europe or North America; changes in currency exchange rates and interest rates; introduction of competing products; increased sales incentives; and decline in resale prices of used vehicles. If any of these or other risks and uncertainties occur (some of which are described under the heading "Risk Report" in DaimlerChrysler's most recent Annual Report and under the heading "Risk Factors" in DaimlerChrysler's most recent Annual Report on Form 20-F filed with the Securities and Exchange Commission), or if the assumptions underlying any of these statements prove incorrect, then actual results may be materially different from those expressed or implied by such statements. We do not intend or assume any obligation to update any forward-looking statement, which speaks only as of the date on which it is made.

1

DaimlerChrysler

Q3 2004

Interim Report

Contents

| 4 | | Business Review | | 7

9

11 | | Mercedes Car Group

Chrysler Group

Commercial Vehicles | | 13

15 | | Services

Other Activities |

16 |

|

Analysis of the

Financial Situation |

|

22

27 |

|

Consolidated Financial

Statements

Notes to Consolidated

Financial Statements |

|

47 |

|

Financial Calendar |

| | DaimlerChrysler Group

| |

|---|

| | Q3 04

| | Q3 04

| | Q3 03

| | Change

| |

|---|

Amounts in millions

| | US $1

| | €

| | €

| | in %

| |

|---|

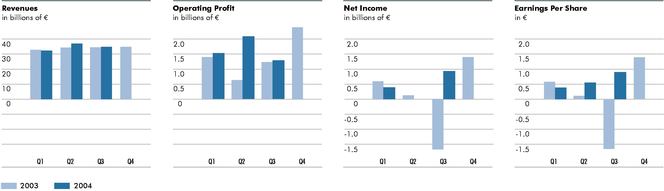

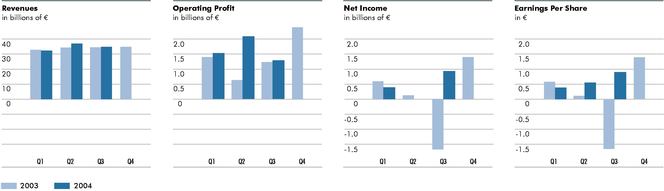

| Revenues | | 43,324 | | 34,891 | | 34,114 | | +2 | 2 |

| European Union | | 13,980 | | 11,259 | | 11,796 | | -5 | |

| | Germany | | 6,485 | | 5,224 | | 5,932 | | -12 | |

| United States | | 19,351 | | 15,584 | | 16,185 | | -4 | |

| Other markets | | 9,993 | | 8,048 | | 6,133 | | +31 | |

| Employees (September 30) | | | | 386,195 | | 375,213 | | +3 | |

| Research and development costs | | 1,783 | | 1,436 | | 1,284 | | +12 | |

| Investment in property, plant and equipment | | 2,198 | | 1,770 | | 1,593 | | +11 | |

| Cash provided by operating activities | | 1,803 | | 1,452 | | 4,225 | | -66 | |

| Operating profit | | 1,654 | | 1,332 | | 1,246 | | +7 | |

| Net income (loss) | | 1,181 | | 951 | | (1,653 | ) | — | |

| | per share (in US $/€) | | 1.17 | | 0.94 | | (1.63 | ) | — | |

- 1

- Rate of exchange: € 1 = US $1.2417 (based on the noon buying rate on September 30, 2004).

- 2

- A 4% increase after adjusting for the effects of currency translation and changes in the consolidated Group.

2

Q1-3

| | DaimlerChrysler Group

| |

|---|

| | Q1-3 04

| | Q1-3 04

| | Q1-3 03

| | Change

| |

|---|

Amounts in millions

| | US $1

| | €

| | €

| | in %

| |

|---|

| Revenues | | 129,527 | | 104,314 | | 101,226 | | +3 | 2 |

| European Union | | 42,880 | | 34,533 | | 35,343 | | -2 | |

| | Germany | | 20,183 | | 16,254 | | 17,436 | | -7 | |

| United States | | 59,851 | | 48,201 | | 47,967 | | +0 | |

| Other markets | | 26,796 | | 21,580 | | 17,916 | | +20 | |

| Employees (September 30) | | | | 386,195 | | 375,213 | | +3 | |

| Research and development costs | | 5,059 | | 4,074 | | 4,147 | | -2 | |

| Investment in property, plant and equipment | | 5,918 | | 4,766 | | 4,707 | | +1 | |

| Cash provided by operating activities | | 12,730 | | 10,252 | | 13,694 | | -24 | |

| Operating profit | | 6,170 | | 4,969 | | 3,290 | | +51 | |

| Net income (loss) | | 2,409 | | 1,940 | | (956 | ) | — | |

| | per share (in US $/€) | | 2.37 | | 1.91 | | (0.94 | ) | — | |

- 1

- Rate of exchange: € 1 = US $1.2417 (based on the noon buying rate on September 30, 2004).

- 2

- A 7% increase after adjusting for the effects of currency translation and changes in the consolidated Group.

3

Business Review

- •

- Group operating profit increases from €1.2 billion to €1.3 billion despite high exceptional changes

- •

- Revenues rise from €34.1 billion to €34.9 billion

- •

- Lower operating profit for Mercedes Car Group

- •

- Chrysler Group continues its positive business development

- •

- Solid earnings by Commercial Vehicles division

- •

- Services' operating profit at a high level

- •

- Net income of €1.0 billion (Q3 2003: net loss of €1.7 billion, including €2.0 billion impairment on investment in EADS); earnings per share of €0.94 (Q3 2003: loss per share of €1.63)

- •

- DaimlerChrysler continues to expect a significant improvement in operating profit for the full year

Slightly weaker growth in global automotive sales

- •

- The global economy developed well in the first nine months of this year. Compared with the very strong growth of the first half of the year, however, the third quarter was slightly less dynamic. While primarily the economies of the United States and China still showed significant expansion, developments were disappointing in some major European countries, particularly Germany.

- •

- The development of global demand for automobiles was generally positive in the third quarter. The market for commercial vehicles benefited in particular from the dynamic world economy. For passenger cars, the high oil price and the resulting consumer uncertainty contributed to diminishing demand in some markets. In the first nine months, unit sales in the US market, which remained intensely competitive, amounted to 12.8 million vehicles–slightly more than in Q3 2003. Total market volume in Western Europe also increased slightly to 12.1 million vehicles despite the lack of an economic turnaround in the major markets of Germany and France. Demand remained sluggish in Japan, while the momentum of Chinese passenger car demand weakened during the third quarter.

Group operating profit increases to €1.3 billion

- •

- DaimlerChrysler achieved a third-quarter operating profit of €1.3 billion, surpassing the prior-year result of €1.2 billion by 7%, despite higher net exceptional charges.

- •

- The Mercedes Car Group's operating profit of €304 million was lower than in the prior year due to the predominantly lifecycle-related change in the model mix at Mercedes-Benz Passenger Cars, high start-up and launch costs for new products and the continuation of the comprehensive quality offensive. Earnings were also impacted by the appreciation of the euro against the US dollar. At smart, there were substantial negative effects from higher marketing costs and lower unit sales of some models.

- •

- With an operating profit of €217 million in the third quarter the Chrysler Group exceeded its prior-year earnings (€147 million) yet again. This was primarily the result of an improved model mix and lower average sales incentives reflecting the market success of the new vehicles, partially offset by lower shipments to dealers and restructuring charges of €104 million.

4

- •

- Due to expenses of €405 million arising from the quality measures and recall campaigns at Mitsubishi Fuso Truck and Bus Corporation (MFTBC), the Commercial Vehicles division's operating profit of €159 million did not reach the level of the prior-year quarter (€198 million). Without the charge relating to MFTBC, earnings would have been significantly higher than in Q3 2003, due to the higher unit sales, the efficiency-enhancement programs, and the attractive product range. Ending the truck-engine joint venture with Hyundai Motor resulted in a positive earnings effect of €60 million.

- •

- The Services division increased its operating profit from €284 million to €412 million. The result for this quarter includes a charge of €119 million in respect of Toll Collect. The increase in earnings is primarily a result of the improved portfolio quality and reduced need for risk provisioning.

- •

- The Other Activities segment improved its result to an operating profit of €258 million (Q3 2003: operating loss of €104 million), due to the higher contribution to earnings from our shareholding in EADS and the ending of the negative contribution from our shareholding in Mitsubishi Motors Corporation (MMC). The operating profit by DaimlerChrysler Off-Highway was similar to the level of the prior-year quarter. The settlement reached with Bombardier to end the arbitration proceedings resulted in a positive contribution to operating profit of €120 million.

- •

- Net income for the third quarter amounted to €951 million. The prior-year quarter's net loss of €1.7 billion was influenced by the impairment of our shareholding in EADS amounting to €2.0 billion. Earnings per share improved to €0.94 (Q3 2003: a loss per share of €1.63).

Growth also in unit sales and revenues

- •

- DaimlerChrysler sold a total of 1.1 million vehicles in the third quarter, surpassing the figure for the prior-year quarter by 2%.

- •

- Unit sales of 293,200 vehicles by the Mercedes Car Group were 4% lower than in Q3 2003. The Chrysler Group sold 594,900 (Q3 2003: 629,000) passenger cars and light trucks. And the Commercial Vehicles division sold 192,800 trucks, vans and buses, an increase of 56%.

- •

- Despite the appreciation of the euro against the US dollar, DaimlerChrysler's total revenues increased by 2% to €34.9 billion, mainly due to the higher unit sales. Adjusted for changes in the consolidated Group and currency-translation effects, there was a growth of 4%.

Workforce

- •

- At the end of the third quarter of 2004, DaimlerChrysler employed a total workforce of 386,200 people worldwide (+3%).

- •

- The increase was particularly strong in the Commercial Vehicles division. Contributory factors were new recruitment in Europe and North America, but most significantly the consolidation of MFTBC with its 18,300 employees. Employment levels also increased at the Mercedes Car Group, the Services division and the joint sales organization for Mercedes-Benz passenger cars and commercial vehicles. Staffing levels at the Chrysler Group decreased, mainly due to the sale of component plants. An additional factor is that the 8,400 employees of the MTU Aero Engines business unit, which was sold at the end of 2003, are no longer included. Adjusted for changes in the consolidated Group, the workforce expanded by 2%.

- •

- On July 23, 2004, management and employee representatives reached an agreement in Germany entitled "Securing the Future 2012", which will allow annual cost savings of €500 million starting in 2006.

5

Outlook

- •

- We assume that the global economy will continue to grow in the fourth quarter of this year, although the high growth rates of the first half of the year are unlikely to be repeated. For 2004 as a whole, the world economy should expand by around 4%. However, economic expansion is threatened by the high price of oil and other raw materials.

- •

- For the automobile business, demand in the fourth quarter seems likely to weaken. We expect only moderate aggregate growth for the passenger car markets of the triad. While the global market for passenger cars is likely to grow by some 4% in 2004, we expect only about 1.5% growth for the Western European market. Sales volumes in the market for commercial vehicles should continue at similar levels in the coming months. For North America, South America, and especially for the Middle East, we expect strong demand for commercial vehicles during the rest of the year.

- •

- For full-year 2004, the Mercedes Car Group anticipates a slight increase in unit sales over the prior year's volume of 1.2 million passenger vehicles. Operating profit will be substantially lower than last year as a result of a changed model mix, higher marketing expenditure at smart, exchange-rate effects, increased advance expenditure for new products, and the comprehensive quality offensive.

- •

- The Chrysler Group is convinced that the positive developments of the first three quarters will continue, due in particular to the success of its new products. Despite the difficult market environment with a continuation of high sales incentives, the Chrysler Group expects to achieve considerable positive earnings in full-year 2004.

- •

- Despite the charges relating to MFTBC's recall campaigns and quality measures, the Commercial Vehicles division expects a significant improvement in operating profit for the year 2004. The main reasons for this positive development are the increased unit sales, together with the division's attractive product range and its cost-cutting programs.

- •

- The positive business trend in the field of automotive financial services should continue for the Services division, although the latest interest-rate rises could have a negative impact on refinancing costs. Toll Collect's preparations to introduce its toll system for trucks in Germany on January 1, 2005 are running according to plan. Operating profit for full-year 2004 might be lower than the very high level of 2003, however, due to charges related to the division's shareholding in Toll Collect.

- •

- EADS assumes that the recovery of the civil-aircraft sector will continue. Revenues are expected to increase and its operating result should also improve. We therefore assume that the contribution to Group operating profit from EADS will be higher than in 2003.

- •

- For full-year 2004, DaimlerChrysler anticipates an increase in unit sales from 4.3 million to 4.8 million passenger cars, trucks, vans and buses. At the same time, we expect a significant increase in revenues from €136.4 billion to around €145 billion. The key factors behind this are the positive business developments at the Chrysler Group and Commercial Vehicles.

- •

- The size of the workforce should increase from 362,100 at the end of 2003 to around 386,000 at the end of this year, primarily due to the initial consolidation of MFTBC. Investment in property, plant and equipment should rise from last year's €6.6 billion to around €7 billion. Research and development expenditure is expected to be around the same level as last year (€5.6 billion).

- •

- Based on the above assessments, DaimlerChrysler continues to expect a significant improvement in operating profit for the full year compared to 2003 (€5.1 billion excluding restructuring expenditures at the Chrysler Group and excluding the capital gain realized on the sale of MTU Aero Engines).

6

Mercedes Car Group

- •

- Unit sales of 293,200 vehicles, lower than in Q3 2003

- •

- Operating profit lower than in prior year, mainly due to changed model mix, comprehensive quality offensive and higher charges from smart

- •

- First deliveries of new A-Class

- •

- Presentation in Paris of Mercedes-Benz sports tourers: "Vision R" and "Vision B"

| | Q3 04

| | Q3 04

| | Q3 03

| | Change

|

|---|

Amounts in millions

| | US $

| | €

| | €

| | in %

|

|---|

| Operating profit | | 377 | | 304 | | 793 | | -62 |

| Revenues | | 15,051 | | 12,121 | | 12,742 | | -5 |

| Unit sales | | | | 293,172 | | 305,443 | | -4 |

| Production | | | | 310,578 | | 298,324 | | +4 |

| Employees (September 30) | | | | 107,812 | | 105,380 | | +2 |

Unit sales

| | Q3 04

| | Q3 03

| | Change

|

|---|

| |

| |

| | in %

|

|---|

| Total | | 293,172 | | 305,443 | | -4 |

| Western Europe | | 190,415 | | 208,231 | | -9 |

| | Germany | | 87,670 | | 103,574 | | -15 |

| United States | | 56,377 | | 50,142 | | +12 |

| Japan | | 10,263 | | 11,249 | | -9 |

| Other markets | | 36,117 | | 35,821 | | +1 |

Third quarter substantially affected by model changeovers

- •

- Unit sales by the Mercedes Car Group of 293,200 vehicles in the third quarter were below the prior-year level (-4%). As a result of the lower unit sales, revenues also decreased to €12.1 billion.

- •

- Operating profit of €304 million did not reach prior year's level. This was due to the predominantly lifecycle-related change in the model mix at Mercedes-Benz Passenger Cars, high launch and start-up costs for the second product offensive, and the costs of the ongoing comprehensive quality offensive. There was also a negative impact on earnings from the strength of the euro against the US dollar. At smart, operating profit was significantly impacted by higher marketing costs and lower unit sales of some models.

256,600 Mercedes-Benz passenger cars sold worldwide

- •

- The Mercedes-Benz brand sold 256,600 vehicles worldwide (Q3 2003: 273,900). The decrease was mainly a result of lower unit sales for lifecycle reasons of the S-Class and the M-Class, which will be replaced by new models next year. Sales of the A-Class were also lower due to the model changeover, with the first new models being delivered to customers in September.

- •

- The new generation of the C-Class (93,400 vehicles, +8%) and the new roadster SLK (14,500 vehicles, +197%) were very well received by the market. And with sales of 19,200 units, the S-Class was well ahead of its competitors, despite a decrease for lifecycle reasons. And despite lower unit sales, the E-Class maintained its leading position with 68,000 vehicles sold worldwide.

7

- •

- Whereas weak demand in Western Europe, especially Germany, caused unit sales to decrease by 13% to 155,800 vehicles, in the United States they increased significantly by 12% to 56,400 vehicles.

Presentation of the new Mercedes-Benz sports tourers: the "Vision R" and the "Vision B"

- •

- At the Paris International Motor Show, Mercedes-Benz presented two studies for a new vehicle category: the "Vision B", a compact sports tourer, and the "Vision R", the European version of a grand sports tourer. Both of these cars combine the comfort of a sporty sedan with the versatility of a station wagon, the spaciousness of a van and the multi-functionality of an SUV. The sports tourers, which will be launched next year, were extremely well received by customers and the press.

Increased unit sales at smart due to smart forfour

- •

- The smart brand sold 36,500 cars in the third quarter of this year. The 16% increase in overall sales reflects sales of the newly launched smart forfour which amounted to 16,700 units. There will be additional sales potential now that a diesel model and right-hand-drive versions of this car are also available.

- •

- With the market launch of the smart fortwo cdi in Canada, the cars of the smart brand are now on sale in North America for the first time. The first vehicles were delivered to customers at the beginning of October.

| | Q1-3 04

| | Q1-3 04

| | Q1-3 03

| | Change

|

|---|

Amounts in millions

| | US $

| | €

| | €

| | in %

|

|---|

| Operating profit | | 2,044 | | 1,646 | | 2,342 | | -30 |

| Revenues | | 45,660 | | 36,772 | | 38,387 | | -4 |

| Unit sales | | | | 878,513 | | 914,573 | | -4 |

| Production | | | | 942,764 | | 931,509 | | +1 |

| Employees (September 30) | | | | 107,812 | | 105,380 | | +2 |

Unit sales

| | Q1-3 04

| | Q1-3 03

| | Change

|

|---|

| |

| |

| | in %

|

|---|

| Total | | 878,513 | | 914,573 | | -4 |

| Western Europe | | 587,445 | | 619,637 | | -5 |

| | Germany | | 272,896 | | 294,667 | | -7 |

| United States | | 160,851 | | 158,775 | | +1 |

| Japan | | 29,635 | | 32,355 | | -8 |

| Other markets | | 100,582 | | 103,806 | | -3 |

8

Chrysler Group

- •

- Chrysler Group continues its positive business development

- •

- Increase in operating profit

- •

- Jeep® Grand Cherokee and Dodge Dakota complete this year's launch of nine new models

| | Q3 04

| | Q3 04

| | Q3 03

| | Change

|

|---|

Amounts in millions

| | US $

| | €

| | €

| | in %

|

|---|

| Operating profit | | 269 | | 217 | | 147 | | +48 |

| Revenues | | 14,304 | | 11,520 | | 12,496 | | -8 |

| Unit sales | | | | 594,929 | | 628,965 | | -5 |

| Production | | | | 586,645 | | 597,578 | | -2 |

| Employees (September 30) | | | | 84,701 | | 94,571 | | -10 |

Unit sales

| | Q3 04

| | Q3 03

| | Change

|

|---|

| |

| |

| | in %

|

|---|

| Total | | 594,929 | | 628,965 | | -5 |

| NAFTA | | 558,084 | | 586,043 | | -5 |

| | United States | | 483,986 | | 517,435 | | -6 |

| Other markets | | 36,845 | | 42,922 | | -14 |

Continuation of positive business developments

- •

- The Chrysler Group increased worldwide retail sales by 3% to 651,900 units. The increase was primarily due to the great success of the new products, such as the Chrysler 300 and 300C, the Dodge Magnum, and the new minivans Dodge Grand Caravan and Chrysler Town & Country. Third-quarter retail sales in the United States rose by 4% to 536,400 vehicles, and the Chrysler Group achieved a market share in the quarter of 11.9% (Q3 2003: 11.4%).

- •

- Factory shipments in the third quarter decreased to 594,900 vehicles (Q3 2003: 629,000), primarily due to the Jeep® Grand Cherokee changeover; the new model has been shipped to dealers since September.

- •

- At the end of the third quarter, dealers' inventories in the United States were reported at 563,100 vehicles (end of Q3 2003: 528,300 vehicles). However, in terms of days' supply, inventories decreased from 86 to 83 days.

Operating profit up by 48%

- •

- Third-quarter revenues decreased by 8% to €11.5 billion; measured in US dollars, they were at the same level as in Q3 2003.

- •

- Operating profit increased from €147 million to €217 million. The increase was primarily the result of an improved model mix and lower sales incentives reflecting the market success of the new vehicles, partially offset by lower shipments. Operating profit for Q3 2004 includes restructuring charges of €104 million for the planned closure and disposal of manufacturing facilities.

9

More product launches

- •

- In the third quarter, the Chrysler Group commenced shipments of the Jeep® Grand Cherokee and the Dogde Dakota to dealers. Both of these new models have received a very positive response from customers and the press. This completes the launch of the nine new products scheduled for the year 2004.

Substantial manufacturing investment

- •

- The Chrysler Group has significantly improved manufacturing flexibility at its Jefferson North plant in Detroit, where the Jeep® Grand Cherokee is produced. It is now possible to assemble various vehicle models on one assembly line, while an additional model is being prepared for production.

| | Q1-3 04

| | Q1-3 04

| | Q1-3 03

| | Change

|

|---|

Amounts in millions

| | US $

| | €

| | €

| | in %

|

|---|

| Operating profit | | 1,293 | | 1,041 | | (649 | ) | — |

| Revenues | | 45,677 | | 36,786 | | 37,009 | | -1 |

| Unit sales | | | | 2,061,123 | | 1,998,246 | | +3 |

| Production | | | | 2,007,821 | | 1,970,807 | | +2 |

| Employees (September 30) | | | | 84,701 | | 94,571 | | -10 |

Unit sales

| | Q1-3 04

| | Q1-3 03

| | Change

|

|---|

| |

| |

| | in %

|

|---|

| Total | | 2,061,123 | | 1,998,246 | | +3 |

| NAFTA | | 1,933,259 | | 1,872,828 | | +3 |

| | United States | | 1,704,601 | | 1,630,568 | | +5 |

| Other markets | | 127,864 | | 125,418 | | +2 |

10

Commercial Vehicles

- •

- Significant increases in unit sales and revenues

- •

- Substantial charges resulting from recall campaigns and quality measures at MFTBC

- •

- Considerable improvement in earnings from ongoing business

- •

- Numerous new products unveiled at the International Commercial Vehicle Show in Hanover

| | Q3 04

| | Q3 04

| | Q3 03

| | Change

|

|---|

Amounts in millions

| | US $

| | €

| | €

| | in %

|

|---|

| Operating profit | | 197 | | 159 | | 198 | | -20 |

| Revenues | | 11,420 | | 9,197 | | 6,756 | | +36 |

| Unit sales | | | | 192,767 | | 123,241 | | +56 |

| Production | | | | 189,062 | | 120,727 | | +57 |

| Employees (September 30) | | | | 114,810 | | 90,568 | | +27 |

Unit sales

| | Q3 04

| | Q3 03

| | Change

|

|---|

| |

| |

| | in %

|

|---|

| Total | | 192,767 | | 123,241 | | +56 |

| Western Europe | | 63,371 | | 58,561 | | +8 |

| | Germany | | 25,780 | | 26,246 | | -2 |

| United States | | 38,310 | | 29,090 | | +32 |

| South America | | 17,006 | | 10,660 | | +60 |

| Other markets | | 74,080 | | 24,930 | | +197 |

Strong growth continues in third quarter

- •

- In the third quarter of this year, the Commercial Vehicles division increased its unit sales by 56% to 192,800 vehicles. Revenues rose accordingly by 36% to €9.2 billion. Even without Mitsubishi Fuso Truck and Bus Corporation (MFTBC), which has been consolidated with a one-month time lag of since March 31, 2004, unit sales and revenues would have increased significantly by 20% and 16% respectively.

- •

- Despite expenses of €405 million due to recall campaigns and quality measures at MFTBC, Commercial Vehicles achieved positive earnings, although its operating profit of €159 million did not reach the level of the prior-year quarter. A charge of €70 million had already been recognized in the second quarter. Without the charge from MFTBC, earnings would have been significantly higher than in Q3 2003 due to the higher unit sales, the efficiency-enhancement programs and the attractive product range. Ending the truck-engine joint venture with Hyundai Motor resulted in a positive earnings effect of €60 million.

Positive developments in nearly all business units

- •

- The positive sales trend in the truck business continued in the third quarter.

Unit sales by the business unit Trucks NAFTA (Freightliner, Sterling, Thomas Built Buses) rose by 29% to 43,100 vehicles. In Class 8, we increased our unit sales in an expanding market for heavy-duty trucks by 23%. Sales of medium-duty trucks also increased by 13%.

11

The business unit Trucks Europe/Latin America (Mercedes-Benz) achieved growth of 25% with sales of 36,000 units. This was primarily due to market recovery in South America and Turkey, positive market developments in Western Europe, and strong demand from the Middle East.

MFTBC's unit sales increased from 43,900 to 45,900 vehicles. Outside Japan, unit sales increased by 29% to 29,700 vehicles. In Japan, the decrease from the high level of 20,800 vehicles in Q3 2003 (due to purchases brought forward in connection with stricter emission regulations) to 16,200 trucks and buses was influenced by the discussion about the quality of the vehicles.

- •

- The Mercedes-Benz Vans business unit increased its unit sales by 16% to 60,000 vehicles. The main factors were the positive sales trends in North America, Eastern Europe and South America. The Viano and Vito models contributed decisively this growth.

- •

- The DaimlerChrysler Buses business unit achieved an 8% increase in unit sales to 8,400 buses. We sold more buses than in the prior-year quarter, particularly in South America and NAFTA but also in Europe.

Innovative products and technologies displayed at the International Commercial Vehicle Show

- •

- In September, the division unveiled the completely revised Mercedes-Benz truck series, Atego and Axor, as well as the new diesel technology, BlueTec, which enables heavy-duty trucks to fulfill the Euro-4 and Euro-5 emission standards. The Setra brand was shown for the first time with the twin-axle S415 GT, the fourth model of its ComfortClass 400, which was launched in spring.

| | Q1-3 04

| | Q1-3 04

| | Q1-3 03

| | Change

|

|---|

Amounts in millions

| | US $

| | €

| | €

| | in %

|

|---|

| Operating profit | | 1,111 | | 895 | | 467 | | +92 |

| Revenues | | 30,759 | | 24,772 | | 19,110 | | +30 |

| Unit sales | | | | 503,494 | | 355,974 | | +41 |

| Production | | | | 525,365 | | 360,455 | | +46 |

| Employees (September 30) | | | | 114,810 | | 90,568 | | +27 |

Unit sales

| | Q1-3 04

| | Q1-3 03

| | Change

|

|---|

| |

| |

| | in %

|

|---|

| Total | | 503,494 | | 355,974 | | +41 |

| Western Europe | | 194,410 | | 175,722 | | +11 |

| | Germany | | 74,605 | | 70,402 | | +6 |

| United States | | 109,642 | | 82,417 | | +33 |

| South America | | 42,943 | | 28,750 | | +49 |

| Other markets | | 156,499 | | 69,085 | | +127 |

12

Services

- •

- Ongoing strong performance from Financial Services

- •

- Operating profit at a high level

- •

- Preparations for toll-collection system on schedule

| | Q3 04

| | Q3 04

| | Q3 03

| | Change

|

|---|

Amounts in millions

| | US $

| | €

| | €

| | in %

|

|---|

| Operating profit | | 512 | | 412 | | 284 | | +45 |

| Revenues | | 4,276 | | 3,444 | | 3,470 | | -1 |

| Contract volume | | 130,100 | | 104,776 | | 102,200 | | +3 |

| New business | | 18,224 | | 14,677 | | 13,132 | | +12 |

| Employees (September 30) | | | | 10,988 | | 10,857 | | +1 |

Further increase in operating profit

- •

- The Services division increased its third-quarter operating profit to €412 million (Q3 2003: €284 million). The results for this period include a charge of €119 million from Toll Collect for additional operating expenditure to secure the start-up of the system. The increased operating profit in the financial services business is due primarily to the improved portfolio quality and reduced need for risk provisioning.

- •

- New business increased to €14.7 billion due to the application of sales-promotion programs and even more intensive cooperation with the Group's sales organization, and was 12% higher than a year earlier despite the appreciation of the euro against the US dollar.

- •

- Contract volume of €104.8 billion surpassed the prior-year level by 3%. Adjusted for the effects of currency translation, there was an increase of 7%. At the end of the third quarter, the division had 6,393,900 vehicles on its books worldwide.

Very positive business trend in North America

- •

- DaimlerChrysler Services continued its profitable business development in North America. Contract volume amounted to €75.5 billion (end of Q3 2003: €75.3 billion), with a rise of 6% after adjusting for currency-translation effects. The effectiveness of business routines was further improved by optimizing systems and processes. Credit-risk costs were once again reduced. Bonus programs were introduced to increase new business and profitability, and activities designed to enhance customer retention were further expanded.

Growth in additional important markets

- •

- We achieved new business of €3.2 billion in our European markets in the third quarter, while contract volume increased by 8% to €24.2 billion. In Latin America and Africa, DaimlerChrysler Services expanded its contract volume to €1.8 billion (+28%). Our portfolio also increased in Asia, by 6% to €3.2 billion.

DaimlerChrysler Bank extends its product range

- •

- DaimlerChrysler Bank has further strengthened its position with new business of €1.9 billion. Contract volume rose to €13.9 billion (+10%). DaimlerChrysler Bank has extended its product

13

Toll Collect prepares system startup for January 1, 2005

- •

- After the successful execution of important tests, Toll Collect GmbH, in which DaimlerChrysler Services holds a 45% stake, started a trial run of its toll-collection system in September. The last phase serves to check and optimize the system's functionality and the interplay between all system components. Toll Collect is thus on schedule to begin collecting truck tolls in Germany on January 1, 2005.

| | Q1-3 04

| | Q1-3 04

| | Q1-3 03

| | Change

|

|---|

Amounts in millions

| | US $

| | €

| | €

| | in %

|

|---|

| Operating profit | | 1,372 | | 1,105 | | 1,037 | | +7 |

| Revenues | | 12,763 | | 10,279 | | 10,586 | | -3 |

| Contract volume | | 130,100 | | 104,776 | | 102,200 | | +3 |

| New business | | 48,175 | | 38,798 | | 36,380 | | +7 |

| Employees (September 30) | | | | 10,988 | | 10,857 | | +1 |

14

Other Activities

- •

- Continued positive development at EADS

Other Activites

| | Q3 04

| | Q3 04

| | Q3 03

| | Change

|

|---|

| | US $

| | €

| | €

| | in %

|

|---|

| Operating profit (loss) | | 320 | | 258 | | (104 | ) | — |

| Revenues | | 652 | | 525 | | 523 | | +0 |

The Other Activities segment includes our shareholding in the European Aeronautic Defence and Space Company (EADS) and, since January 1, 2004, the DaimlerChrysler Off-Highway business unit. The prior-year figures have been adjusted for comparability. Other Activities also includes Corporate Research, the Group's real-estate activities, and our holding and finance companies. The operating profit for the prior-year period also included the contribution to earnings from our shareholding in Mitsubishi Motors Corporation (MMC), which since June 30, 2004 has been included in the Group's consolidated financial statements as an investment measured at fair value.

The operating profit contributions generated by our shareholding in EADS are included in DaimlerChrysler's operating profit with a time-lag of one quarter.

The increase in the Other Activities segment's operating profit is primarily due to the increased contribution from our investment in EADS and the fact that there is no longer any contribution from MMC, which recorded a significant negative contribution in the prior year, as well as the income arising from the end of the arbitration procedure with Bombardier.

DaimlerChrysler Off-Highway

- •

- The third-quarter revenues of €440 million generated by the business unit DaimlerChrysler Off-Highway were 6% higher than in the prior year. In addition to growth in the field of Electric Power Generation, revenues from sales of ship and train engines also increased.

- •

- Incoming orders of €434 million did not equal the high level of Q3 2003 (-5%). After the strong order intake in the first half of this year, particularly in Electric Power Generation, demand subsided in the third quarter, especially in Asia.

EADS

- •

- The European Aeronautic Defence and Space Company (EADS), the world's second-largest aerospace and defense company, will publish its figures for the third quarter on November 4, 2004. The business trend of EADS remained positive during the third quarter. EADS is confident of achieving its goals for the 2004 financial year.

- •

- Airbus gained several major orders in the third quarter and maintained its leading position in the market for civil aircraft. In August, Airbus received an order for the five-thousandth aircraft in the company's 30-year history. Deliveries of 63 aircraft in the third quarter were higher than in Q3 2003.

Other Activities

| | Q1-3 04

| | Q1-3 04

| | Q1-3 03

| | Change

|

|---|

| | US $

| | €

| | €

| | in %

|

|---|

| Operating profit | | 592 | | 477 | | 185 | | +158 |

| Revenues | | 1,717 | | 1,383 | | 1,424 | | -3 |

15

Analysis of the Financial Situation

| | Operating Profit (Loss) by Segment

| |

|---|

| | Q3 04

| | Q3 04

| | Q3 03

| | Q1-3 04

| | Q1-3 04

| | Q1-3 03

| |

|---|

In millions

| | US $

| | €

| | €

| | US $

| | €

| | €

| |

|---|

| Mercedes Car Group | | 377 | | 304 | | 793 | | 2,044 | | 1,646 | | 2,342 | |

| Chrysler Group | | 269 | | 217 | | 147 | | 1,293 | | 1,041 | | (649 | ) |

| Commercial Vehicles | | 197 | | 159 | | 198 | | 1,111 | | 895 | | 467 | |

| Services | | 512 | | 412 | | 284 | | 1,372 | | 1,105 | | 1,037 | |

| Other Activities | | 320 | | 258 | | (104 | ) | 592 | | 477 | | 185 | |

| Eliminations | | (21 | ) | (18 | ) | (72 | ) | (242 | ) | (195 | ) | (92 | ) |

| DaimlerChrysler Group | | 1,654 | | 1,332 | | 1,246 | | 6,170 | | 4,969 | | 3,290 | |

Group third-quarter operating profit surpasses prior-year result despite high charges

- •

- In the third quarter of 2004, the DaimlerChrysler Group recorded an operating profit of €1,332 million, thus surpassing the prior-year result by €86 million, or 7%.

- •

- This improvement came from the Financial Services business which increased its operating profit by €218 million to €549 million, due primarily to the improved portfolio quality and reduced need for risk provisioning.

- •

- The operating profit attained by the Industrial Business was €783 million, but did not equal the high level of the prior-year quarter (€915 million). The reduction in earnings was caused by charges from the Mercedes Car Group and expenditures of €405 million in the Commercial Vehicles division for quality-improving actions and recall campaigns at Mitsubishi Fuso Truck and Bus Corporation (MFTBC). Furthermore, the operating profit of the Services division was reduced by additional expenses from Toll Collect (€119 million) relating to the planned start of operations on January 1, 2005. Positive effects arose from an increase in operating profit of €70 million by the Chrysler Group. The operating result of the prior-year quarter was adversely affected by an operating loss of €240 million related to the Group's investment in Mitsubishi Motors.

- •

- Effective January 1, 2004, the DaimlerChrysler Off-Highway business unit, which was previously a part of the Commercial Vehicles division, was allocated to Other Activities. Those two divisions' prior-year figures for operating profit have been adjusted for comparability.

- •

- Effective June 29, 2004, DaimlerChrysler ceased accounting for its investment in Mitsubishi Motors using the equity method of accounting as the Group can no longer exercise significant influence over Mitsubishi Motors Corporation's business and financial policies due to the significant dilution of the Group's equity interest.

Decrease in operating profit by the Mercedes Car Group

- •

- In the third quarter, the Mercedes Car Group division achieved an operating profit of €304 million, which was significantly lower than in the third quarter of 2003 (€793 million).

- •

- In the Mercedes-Benz Passenger Cars business unit, operating profit was adversely affected by life-cycle-related decreases in unit sales of the S-, M- and A-Class, which were only partially offset by the new generation of the C-Class and the new SLK, as well as higher expenses and advance expenditures associated with the products of the second model offensive. Two additional negative factors were the continued strength of the euro against the US dollar and expenses related to the comprehensive quality offensive.

- •

- The smart business unit posted a significant operating loss in the current period, which was impacted by high marketing costs in connection with the launch of the smart forfour and lower unit sales of the smart fortwo and the smart roadster compared to the prior-year period.

16

Improvement in earnings at Chrysler Group

- •

- Chrysler Group posted an operating profit of €217 million in the third quarter of 2004 compared with an operating profit of €147 million in the third quarter of 2003.

- •

- The increase in operating profit from the prior-year period was primarily the result of a lower average sales incentive expense per vehicle and shifts in product mix to higher margin vehicles, partially offset by lower vehicle shipments. The lower sales incentive expense and shifts in product mix to higher margin vehicles included the impact of the successful launch of the new products in 2004. Vehicle shipments of 594,900 in the third quarter of 2004 were 34,000 lower than the prior period, primarily due to the model change over to the new Jeep® Grand Cherokee.

- •

- Additionally, restructuring charges totaling €104 million were included in the operating profit of the third quarter of 2004 compared to €37 million in the third quarter of 2003. These charges in 2004 primarily related to workforce reductions due to the planned closing or disposition of manufacturing facilities in 2004 and 2005.

| | Operating Profit

|

|---|

| | Q3 04

| | Q3 04

| | Q3 03

| | Q1-3 04

| | Q1-3 04

| | Q1-3 03

|

|---|

In millions

| | US $

| | €

| | €

| | US $

| | €

| | €

|

|---|

| Industrial Business | | 972 | | 783 | | 915 | | 4,239 | | 3,414 | | 2,213 |

| Financial Services | | 682 | | 549 | | 331 | | 1,931 | | 1,555 | | 1,077 |

| DaimlerChrysler Group | | 1,654 | | 1,332 | | 1,246 | | 6,170 | | 4,969 | | 3,290 |

Operating profit reduced at Commercial Vehicles by charges for quality-enhancement actions and recall campaigns

- •

- The Commercial Vehicles division achieved an operating profit of €159 million in the third quarter (Q3 2003: €198 million). This result was substantially affected by charges of €405 million relating to the quality-enhancement actions and recall campaigns at MFTBC.

- •

- The division achieved a considerable positive operating result despite the effects of quality measures and recall campaigns at MFTBC due to significant profitability advances in all other business units. In addition to the further implementation and sustained effects of the efficiency-improving measures in the business units, there were also positive effects on earnings from higher unit sales of trucks, vans and buses. The discontinuation of the engine joint venture with Hyundai Motor also contributed an additional €60 million to the division's operating profit.

Services' operating profit remains high due to strong performance by Financial Services

- •

- In the third quarter of 2004, the Services division's operating profit increased to €412 million (Q3 2003: €284 million).

- •

- The increase in operating profit of €218 million to €549 million in the Financial Services business was the result of the improved portfolio quality and improvements within the risk management of the contract portfolios in North America and Europe. In addition, valuation adjustments were made in the third quarter to reflect the improved risk management situation which resulted in an overall reduction in risk costs.

- •

- Charges totaling €119 million from our investment in Toll Collect resulted from additional operating expenses to secure the start of the system.

Positive earnings for Other Activities

- •

- Other Activities reported an operating profit of €258 million for the third quarter, compared with an operating loss of €104 million in the same period of 2003.

- •

- The negative result for the prior-year quarter was almost solely due to the Group's proportionate share of the negative contribution to earnings from Mitsubishi Motors (€240 million). As a result of

17

non-participation in a capital increase at Mitsubishi Motors, DaimlerChrysler lost its significant influence on Mitsubishi Motors' business and financial policies, and therefore ceased accounting for its investment using the equity method of accounting as of June 29, 2004. The Group's operating profit for the current quarter therefore did not include a proportionate share of Mitsubishi Motors' results.

- •

- In September 2004, DaimlerChrysler and Bombardier concluded a settlement agreement with respect to all claims asserted by Bombardier in connection with the sale of DaimlerChrysler Rail Systems GmbH (Adtranz). As a result of the settlement, a gain from the sale of Adtranz which had been deferred with no effect on the income statement was realized as income in the current quarter. After the deduction of the sale price adjustment and other anticipated settlement costs in the third quarter of 2004, the net gain amounted to €120 million.

- •

- In addition, Other Activities' operating profit also included a positive contribution from EADS, which was higher than in the prior-year quarter due in particular to the strong performance by Airbus.

Reconciliation from operating profit to income before financial income

- •

- "Pension and postretirement benefit income (expenses), other than current and prior service costs and settlement/curtailment losses" is the sum of the interest costs of pension and health-care obligations, the expected return on plan assets and the amortization of unrecognized net actuarial gains or losses. Operating profit excludes these components of the net periodic pension costs since they are driven by financial factors and do not reflect the operating performance of the divisions.

| | Reconciliation of Group Operating Profit to Income before Financial Income

| |

|---|

| | Q3 04

| | Q3 04

| | Q3 03

| | Q1-3 04

| | Q1-3 04

| | Q1-3 03

| |

|---|

In millions

| | US $

| | €

| | €

| | US $

| | €

| | €

| |

|---|

| Operating profit | | 1,654 | | 1,332 | | 1,246 | | 6,170 | | 4,969 | | 3,290 | |

| | Pension and postretirement benefit income (expenses), other than current and prior service costs and settlement/curtailment losses | | (256 | ) | (206 | ) | (221 | ) | (769 | ) | (619 | ) | (661 | ) |

| | Operating (profit) loss from affiliated and associated companies and financial (income) loss from related operating companies | | (125 | ) | (101 | ) | 152 | | (133 | ) | (107 | ) | (71 | ) |

| | Operating profit from discontinued operations | | — | | — | | 22 | | — | | — | | (31 | ) |

| | Miscellaneous items | | (413 | ) | (332 | ) | (298 | ) | (461 | ) | (372 | ) | (330 | ) |

| Income before financial income | | 860 | | 693 | | 901 | | 4,807 | | 3,871 | | 2,197 | |

- •

- "Operating (profit) loss from affiliated and associated companies and financial (income) loss from related operating companies" includes the contributions to earnings from the operating investments which are reported as a component of financial income in the consolidated statements of income (loss). These contributions are allocated to the operating profits of the respective divisions. In the third quarter of 2004, this resulted in a positive overall contribution to operating profit of €101 million (Q3 2003: negative contribution of €152 million). The improvement was almost entirely due to the discontinued negative result of Mitsubishi Motors. In addition, the profit contribution from EADS increased compared with the prior-year period. The discontinuation of the engine joint venture with Hyundai Motor resulted in an additional positive effect on "operating profit (loss) from affiliated and associated companies and financial income (loss) from related operating companies" in the current quarter.

- •

- "Operating profit from discontinued operations" represents the operating profit of the former business unit MTU Aero Engines which is presented in the consolidated statements of income (loss) for the third quarter of 2003 as "Loss from discontinued operations, net of taxes".

- •

- "Miscellaneous items" in the period under review were almost entirely comprised of the MFTBC minority stockholders' proportionate interest in the expenses for quality-enhancement actions and recall campaigns of MFTBC. These expenses are not allocated to operating profit since the quality problems at MFTBC relate to vehicles sold prior to DaimlerChrysler's initial investment. In the prior year, this reconciling item reflected almost solely the settlement of a consolidated class action suit in connection with the merger of Daimler-Benz and Chrysler to form DaimlerChrysler AG. A charge of €

18

Significant improvement in financial income and net income

- •

- Financial income for the third quarter amounted to €167 million (Q3 2003: financial loss of €2,233 million). Income from investments improved by €2,419 million to €238 million; the increase largely reflects the impairment of €1,960 million recognized in the prior-year period on the Group's shareholding in EADS. Furthermore, income from investments in the prior-year quarter was affected by the negative contribution from the Group's equity-method investment in Mitsubishi Motors. In the third quarter of 2004, a gain of €253 million was realized from the sale of the Group's 10.5% interest in Hyundai Motor Company (HMC). Net interest expense of €93 million was similar to the level of Q3 2003 (€99 million). The current quarter also included net other financial income of €22 million (Q3 2003: €47 million).

- •

- Net income for the third quarter of 2004 amounted to €951 million (Q3 2003: net loss of €1,653 million). This considerable improvement was due partially to the increase in operating profit, but primarily due to the development of financial income.

- •

- Earnings per share amounted to €0.94, compared with a loss per share of €1.63 in Q3 2003. The impairment of the Group's investment in EADS reduced the result for the prior-year period by €1.94.

Increase in total assets due to first-time consolidation of MFTBC and expansion of sales-financing business

- •

- Compared with December 31, 2003, total assets increased by €8.8 billion to €187.1 billion. This development was mainly caused by the expansion of the Financial Services business and the full consolidation of MFTBC, effective March 31, 2004. Currency translation effects were responsible for €1.3 billion of the increase in total assets.

- •

- The increase in property, plant and equipment as of September 30, 2004, was primarily a result of consolidating MFTBC. Financial assets declined during the period due primarily to the elimination of the carrying value of the Group's initial investment in MFTBC which occurred in connection with the full consolidation of that company, the sale of the Group's investment in Hyundai Motor Company, and the decreasing carrying value of the investment in Mitsubishi Motors Corporation. Moreover, the inclusion of MFTBC in the consolidated group and fluctuations in production volumes during the year caused increases in inventories, trade liabilities and other liabilities. Other receivables were reduced by the valuation and termination of derivative financial instruments. The increases in equipment on operating leases and receivables from financial services were mainly caused by the expansion of the sales financing business and by exchange rate effects. Accrued liabilities increased primarily due to the full consolidation of MFTBC. The change in minority interests was almost solely due to the first-time consolidation of MFTBC, since 35% of its stock is held by shareholders outside the DaimlerChrysler Group.

- •

- Stockholders' equity at September 30, 2004, of €34.5 billion was slightly higher than at the end of 2003 due primarily to the current year net income and currency translation effects. These factors were partially offset by the dividend distribution for the 2003 financial year and the decreased valuation of the Group's derivative financial instruments and available-for-sale securities.

- •

- The equity ratio at September 30, 2004, was 18.4% compared with 18.5% at the end of 2003. The equity ratio for the Industrial Business was 25.7% (December 31, 2003: 26.1%). The decrease in these ratios was partly attributed to the first-time consolidation of MFTBC.

Statement of cash flows affected by changes in working capital

- •

- Cash provided by operating activities of €10.3 billion was lower than in the first nine months of last year (€13.7 billion). This development was primarily due to a lower level of cash released from the working capital of the Industrial Business. The lower increase in accrued liabilities was partly related to higher contributions to pension funds than in the prior-year period (€0.9 billion; Q1-Q3 2003: €0.5 billion). On the other hand, cash inflows were higher as a result of improved business results.

19

Events after the end of the third quarter of 2004

- •

- Since the end of the third quarter of 2004, apart from the aforementioned developments, there have been no further occurrences which are of major significance to DaimlerChrysler and which could lead to a modified assessment of the Group's position. The course of business in October 2004 confirms the statements made in the Outlook.

Additional Information

- •

- In August 2004, the Securities and Exchange Commission (SEC) notified DaimlerChrysler AG that it has opened an investigation relating to the company's compliance with the U.S. Foreign Corrupt Practices Act. The investigation follows the filing of a "whistleblower" complaint with the U.S. Department of Labor (DOL) under the Sarbanes-Oxley Act by a former DaimlerChrysler Corporation employee whose employment was terminated earlier this year. The terminated employee filed a lawsuit against DaimlerChrysler Corporation in the U.S. District Court for the Eastern District of Michigan in September 2004 which contains substantially the same allegations as in the DOL complaint and additional allegations relating to other federal and state law claims arising from the termination. DaimlerChrysler is cooperating with the SEC investigation. In response to a separate informal request, the company is also voluntarily providing information to the SEC regarding its implementation of various provisions of the Sarbanes-Oxley Act, including those relating to the process for reporting information to the Audit Committee. This request follows the filing of another whistleblower complaint with the DOL by a former employee of DaimlerChrysler Corporation.

This document contains forward-looking statements that reflect management's current views with respect to future events. The words "anticipate," "assume," "believe," "estimate," "expect," "intend," "may," "plan," "project" and "should" and similar expressions identify forward-looking statements. Such statements are subject to risks and uncertainties, including, but not limited to: an economic downturn in Europe or North America; changes in currency exchange rates and interest rates; introduction of competing products; increased sales incentives; and decline in resale prices of used vehicles. If any of these or other risks and uncertainties occur (some of which are described under the heading "Risk Report" in DaimlerChrysler's most recent Annual Report and under the heading "Risk Factors" in DaimlerChrysler's most recent Annual Report on Form 20-F filed with the Securities and Exchange Commission), or if the assumptions underlying any of these statements prove incorrect, then actual results may be materially different from those expressed or implied by such statements. We

20

do not intend or assume any obligation to update any forward-looking statement, which speaks only as of the date on which it is made.

21

DaimlerChrysler AG and Subsidiaries

Unaudited Condensed Consolidated Statements of Income (Loss) Q3

| | Consolidated

| | Industrial Business

| | Financial Services

| |

|---|

| | Q3 2004

| | Q3 2004

| | Q3 2003

| | Q3 2004

| | Q3 2003

| | Q3 2004

| | Q3 2003

| |

|---|

(in millions, except per share amounts)

| | (Note 1) $

| | €

| | €

| | €

| | €

| | €

| | €

| |

|---|

| Revenues | | 43,324 | | 34,891 | | 34,114 | | 31,449 | | 30,643 | | 3,442 | | 3,471 | |

| Cost of sales | | (35,491 | ) | (28,583 | ) | (27,408 | ) | (25,976 | ) | (24,691 | ) | (2,607 | ) | (2,717 | ) |

| Gross margin | | 7,833 | | 6,308 | | 6,706 | | 5,473 | | 5,952 | | 835 | | 754 | |

| Selling, administrative and other expenses | | (5,482 | ) | (4,415 | ) | (4,600 | ) | (4,122 | ) | (4,261 | ) | (293 | ) | (339 | ) |

| Research and development | | (1,783 | ) | (1,436 | ) | (1,284 | ) | (1,436 | ) | (1,284 | ) | — | | — | |

| Other income (therein gain on issuance of related company stock of €24 in 2003) | | 421 | | 340 | | 116 | | 328 | | 103 | | 12 | | 13 | |

| Turnaround plan expenses—Chrysler Group | | (129 | ) | (104 | ) | (37 | ) | (104 | ) | (37 | ) | — | | — | |

| Income before financial income | | 860 | | 693 | | 901 | | 139 | | 473 | | 554 | | 428 | |

| | Impairment of investment in EADS | | — | | — | | (1,960 | ) | — | | (1,960 | ) | — | | — | |

| | Other financial income (expense), net | | 207 | | 167 | | (273 | ) | 161 | | (229 | ) | 6 | | (44 | ) |

| Financial income (expense), net | | 207 | | 167 | | (2,233 | ) | 161 | | (2,189 | ) | 6 | | (44 | ) |

| Income (loss) before income taxes | | 1,067 | | 860 | | (1,332 | ) | 300 | | (1,716 | ) | 560 | | 384 | |

| Income tax benefit (expense) | | (100 | ) | (81 | ) | (296 | ) | 120 | | (142 | ) | (201 | ) | (154 | ) |

| Minority interests | | 214 | | 172 | | (5 | ) | 173 | | (3 | ) | (1 | ) | (2 | ) |

| Income (loss) from continuing operations | | 1,181 | | 951 | | (1,633 | ) | 593 | | (1,861 | ) | 358 | | 228 | |

| Loss from discontinued operations, net of taxes | | — | | — | | (20 | ) | — | | (20 | ) | — | | — | |

| Net income (loss) | | 1,181 | | 951 | | (1,653 | ) | 593 | | (1,881 | ) | 358 | | 228 | |

Earnings (loss) per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings (loss) per share | | | | | | | | | | | | | | | |

| | | Income (loss) from continuing operations | | 1.17 | | 0.94 | | (1.61 | ) | | | | | | | | |

| | | Loss from discontinued operations | | — | | — | | (0,02 | ) | | | | | | | | |

| | Net income (loss) | | 1.17 | | 0.94 | | (1.63 | ) | | | | | | | | |

| Diluted earnings (loss) per share | | | | | | | | | | | | | | | |

| | | Income (loss) from continuing operations | | 1.17 | | 0.94 | | (1.61 | ) | | | | | | | | |

| | | Loss from discontinued operations | | — | | — | | (0,02 | ) | | | | | | | | |

| | Net income (loss) | | 1.17 | | 0.94 | | (1.63 | ) | | | | | | | | |

The accompanying notes are an integral part of these Unaudited Interim Condensed Consolidated Financial Statements.

22

DaimlerChrysler AG and Subsidiaries

Unaudited Condensed Consolidated Statements of Income (Loss) Q1-3

| | Consolidated

| | Industrial Business

| | Financial Services

| |

|---|

| | Q1-3 2004

| | Q1-3 2004

| | Q1-3 2003

| | Q1-3 2004

| | Q1-3 2003

| | Q1-3 2004

| | Q1-3 2003

| |

|---|

(in millions, except per share amounts)

| | (Note 1) $

| | €

| | €

| | €

| | €

| | €

| | €

| |

|---|

| Revenues | | 129,527 | | 104,314 | | 101,226 | | 94,041 | | 90,638 | | 10,273 | | 10,588 | |

| Cost of sales | | (104,297 | ) | (83,995 | ) | (81,972 | ) | (76,168 | ) | (73,648 | ) | (7,827 | ) | (8,324 | ) |

| Gross margin | | 25,230 | | 20,319 | | 19,254 | | 17,873 | | 16,990 | | 2,446 | | 2,264 | |

| Selling, administrative and other expenses | | (16,001 | ) | (12,886 | ) | (13,308 | ) | (11,991 | ) | (12,279 | ) | (895 | ) | (1,029 | ) |

| Research and development | | (5,059 | ) | (4,074 | ) | (4,147 | ) | (4,074 | ) | (4,147 | ) | — | | — | |

| Other income (therein gain on issuance of related company stock of €24 in 2003) | | 831 | | 668 | | 440 | | 629 | | 406 | | 39 | | 34 | |

| Turnaround plan expenses—Chrysler Group | | (194 | ) | (156 | ) | (42 | ) | (156 | ) | (42 | ) | — | | — | |

| Income before financial income | | 4,807 | | 3,871 | | 2,197 | | 2,281 | | 928 | | 1,590 | | 1,269 | |

| | Impairment of investment in EADS | | — | | — | | (1,960 | ) | — | | (1,960 | ) | — | | — | |

| | Other financial income (expense), net (therein loss on issuance of associated company stock of €135 in 2004) | | (869 | ) | (700 | ) | (403 | ) | (710 | ) | (361 | ) | 10 | | (42 | ) |

| Financial income (expense), net | | (869 | ) | (700 | ) | (2,363 | ) | (710 | ) | (2,321 | ) | 10 | | (42 | ) |

| Income (loss) before income taxes | | 3,938 | | 3,171 | | (166 | ) | 1,571 | | (1,393 | ) | 1,600 | | 1,227 | |

| Income tax expense | | (1,695 | ) | (1,365 | ) | (764 | ) | (778 | ) | (246 | ) | (587 | ) | (518 | ) |

| Minority interests | | 166 | | 134 | | (20 | ) | 139 | | (15 | ) | (5 | ) | (5 | ) |

| Income (loss) from continuing operations | | 2,409 | | 1,940 | | (950 | ) | 932 | | (1,654 | ) | 1,008 | | 704 | |

| Loss from discontinued operations, net of taxes | | — | | — | | (6 | ) | — | | (6 | ) | — | | — | |

| Net income (loss) | | 2,409 | | 1,940 | | (956 | ) | 932 | | (1,660 | ) | 1,008 | | 704 | |

Earnings (loss) per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings (loss) per share | | | | | | | | | | | | | | | |

| | | Income (loss) from continuing operations | | 2.38 | | 1.92 | | (0.93 | ) | | | | | | | | |

| | | Loss from discontinued operations | | — | | — | | (0.01 | ) | | | | | | | | |

| | Net income (loss) | | 2.38 | | 1.92 | | (0.94 | ) | | | | | | | | |

| Diluted earnings (loss) per share | | | | | | | | | | | | | | | |

| | | Income (loss) from continuing operations | | 2.37 | | 1.91 | | (0.93 | ) | | | | | | | | |

| | | Loss from discontinued operations | | — | | — | | (0.01 | ) | | | | | | | | |

| | Net income (loss) | | 2.37 | | 1.91 | | (0.94 | ) | | | | | | | | |

The accompanying notes are an integral part of these Unaudited Interim Condensed Consolidated Financial Statements.

23

DaimlerChrysler AG and Subsidiaries

Condensed Consolidated Balance Sheets

| | Consolidated

| | Industrial Business

| | Financial Services

|

|---|

| | Sept. 30,

2004

| | Sept. 30,

2004

| | Dec. 31,

2003

| | Sept. 30,

2004

| | Dec. 31,

2003

| | Sept. 30,

2004

| | Dec. 31,

2003

|

|---|

(in millions)

| | (unaudited)

(Note 1) $

| | (unaudited)

€

| |

€

| | (unaudited)

€

| | (unaudited)

€

| | (unaudited)

€

| | (unaudited)

€

|

|---|

| Assets | | | | | | | | | | | | | | |

| Goodwill | | 2,622 | | 2,112 | | 1,816 | | 2,053 | | 1,757 | | 59 | | 59 |

| Other intangible assets | | 3,765 | | 3,032 | | 2,819 | | 2,958 | | 2,731 | | 74 | | 88 |

| Property, plant and equipment, net | | 43,894 | | 35,350 | | 32,917 | | 35,204 | | 32,761 | | 146 | | 156 |

| Investments and long-term financial assets | | 9,061 | | 7,297 | | 8,748 | | 6,946 | | 8,416 | | 351 | | 332 |

| Equipment on operating leases, net | | 34,159 | | 27,510 | | 24,385 | | 3,723 | | 2,890 | | 23,787 | | 21,495 |

| Fixed assets | | 93,501 | | 75,301 | | 70,685 | | 50,884 | | 48,555 | | 24,417 | | 22,130 |

| Inventories | | 23,345 | | 18,801 | | 14,948 | | 17,301 | | 13,560 | | 1,500 | | 1,388 |

| Trade receivables | | 8,668 | | 6,981 | | 6,081 | | 6,833 | | 5,851 | | 148 | | 230 |

| Receivables from financial services | | 71,564 | | 57,634 | | 52,638 | | — | | — | | 57,634 | | 52,638 |

| Other receivables | | 15,738 | | 12,674 | | 15,848 | | 8,411 | | 11,129 | | 4,263 | | 4,719 |

| Securities | | 5,097 | | 4,105 | | 3,268 | | 3,667 | | 2,801 | | 438 | | 467 |

| Cash and cash equivalents | | 9,243 | | 7,444 | | 11,017 | | 6,506 | | 9,719 | | 938 | | 1,298 |

| Non-fixed assets | | 133,655 | | 107,639 | | 103,800 | | 42,718 | | 43,060 | | 64,921 | | 60,740 |

| Deferred taxes | | 3,796 | | 3,057 | | 2,688 | | 2,901 | | 2,527 | | 156 | | 161 |

| Prepaid expenses | | 1,335 | | 1,075 | | 1,095 | | 993 | | 1,002 | | 82 | | 93 |

| Total assets | | 232,287 | | 187,072 | | 178,268 | | 97,496 | | 95,144 | | 89,576 | | 83,124 |

Liabilities and stockholders' equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Capital stock | | 3,269 | | 2,633 | | 2,633 | | | | | | | | |

| Additional paid-in capital | | 9,935 | | 8,001 | | 7,915 | | | | | | | | |

| Retained earnings | | 36,638 | | 29,506 | | 29,085 | | | | | | | | |

| Accumulated other comprehensive loss | | (6,991 | ) | (5,630 | ) | (5,152 | ) | | | | | | | |

| Treasury stock | | — | | — | | — | | | | | | | | |

| Stockholders' equity | | 42,851 | | 34,510 | | 34,481 | | 25,025 | | 26,361 | | 9,485 | | 8,120 |

| Minority interests | | 1,110 | | 894 | | 470 | | 872 | | 454 | | 22 | | 16 |

| Accrued liabilities | | 52,457 | | 42,246 | | 39,172 | | 41,228 | | 38,439 | | 1,018 | | 733 |

| Financial liabilities | | 94,364 | | 75,996 | | 75,690 | | 8,291 | | 11,779 | | 67,705 | | 63,911 |

| Trade liabilities | | 17,815 | | 14,347 | | 11,583 | | 14,183 | | 11,359 | | 164 | | 224 |

| Other liabilities | | 12,183 | | 9,812 | | 8,805 | | 7,325 | | 6,030 | | 2,487 | | 2,775 |

| Liabilities | | 124,362 | | 100,155 | | 96,078 | | 29,799 | | 29,168 | | 70,356 | | 66,910 |

| Deferred taxes | | 2,973 | | 2,394 | | 2,736 | | (4,425 | ) | (3,377 | ) | 6,819 | | 6,113 |

| Deferred income | | 8,534 | | 6,873 | | 5,331 | | 4,997 | | 4,099 | | 1,876 | | 1,232 |

| Total liabilities | | 189,436 | | 152,562 | | 143,787 | | 72,471 | | 68,783 | | 80,091 | | 75,004 |

Total liabilities and stockholders' equity |

|

232,287 |

|

187,072 |

|

178,268 |

|

97,496 |

|

95,144 |

|

89,576 |

|

83,124 |

The accompanying notes are an integral part of these Unaudited Interim Condensed Consolidated Financial Statements.

24

DaimlerChrysler AG and Subsidiaries

Unaudited Condensed Consolidated Statements of Changes in Stockholders' Equity

| |

| |

| |

| | Accumulated other comprehensive loss

| |

| |

| |

|---|

(in millions of €)

| | Capital stock

| | Additional paid-in capital

| | Retained earnings

| | Cumulative translation adjustment

| | Available-

for-sale securities

| | Derivative financial instruments

| | Minimum pension liability

| | Treasury stock

| | Total

| |

|---|

| Balance at January 1, 2003 | | 2,633 | | 7,819 | | 30,156 | | 612 | | (74 | ) | 1,065 | | (7,207 | ) | — | | 35,004 | |

| | Net income | | — | | — | | (956 | ) | — | | — | | — | | — | | — | | (956 | ) |

| | Other comprehensive income (loss) | | — | | — | | — | | (665 | ) | 208 | | 1,041 | | (11 | ) | — | | 573 | |

| Total comprehensive loss | | | | | | | | | | | | | | | | | | (383 | ) |

| Stock based compensation | | — | | 68 | | — | | — | | — | | — | | — | | — | | 68 | |

| Issuance of shares upon exercise of options | | — | | 1 | | — | | — | | — | | — | | — | | — | | 1 | |

| Purchase of capital stock | | — | | — | | — | | — | | — | | — | | — | | (28 | ) | (28 | ) |

| Re-issuance of treasury stock | | — | | — | | — | | — | | — | | — | | — | | 28 | | 28 | |

| Dividends | | — | | — | | (1,519 | ) | — | | — | | — | | — | | — | | (1,519 | ) |

| Balance at September 30, 2003 | | 2,633 | | 7,888 | | 27,681 | | (53 | ) | 134 | | 2,106 | | (7,218 | ) | — | | 33,171 | |

Balance at January 1, 2004 |

|

2,633 |

|

7,915 |

|

29,085 |

|

(949 |

) |

333 |

|

2,227 |

|

(6,763 |

) |

— |

|

34,481 |

|

| | Net income | | — | | — | | 1,940 | | — | | — | | — | | — | | — | | 1,940 | |

| | Other comprehensive income (loss) | | — | | — | | — | | 228 | | (138 | ) | (568 | ) | — | | — | | (478 | ) |

| Total comprehensive income | | | | | | | | | | | | | | | | | | 1,462 | |

| Stock based compensation | | — | | 86 | | — | | — | | — | | — | | — | | — | | 86 | |

| Purchase of capital stock | | — | | — | | — | | — | | — | | — | | — | | (23 | ) | (23 | ) |

| Re-issuance of treasury stock | | — | | — | | — | | — | | — | | — | | — | | 23 | | 23 | |

| Dividends | | — | | — | | (1,519 | ) | — | | — | | — | | — | | — | | (1,519 | ) |

| Balance at September 30, 2004 | | 2,633 | | 8,001 | | 29,506 | | (721 | ) | 195 | | 1,659 | | (6,763 | ) | — | | 34,510 | |

The accompanying notes are an integral part of these Unaudited Interim Condensed Consolidated Financial Statements.

25

DaimlerChrysler AG and Subsidiaries

Unaudited Condensed Consolidated Statements of Cash Flows

| | Consolidated

| | Industrial Business

| | Financial Services

| |

|---|

| | Q1-3

2004

| | Q1-3

2004

| | Q1-3

2003

| | Q1-3

2004

| | Q1-3

2003

| | Q1-3

2004

| | Q1-3

2003

| |

|---|

(in millions)

| | (Note 1) $

| |

€

| |

€

| |

€

| |

€

| |

€

| |

€

| |

|---|

| Net income (loss) | | 2,409 | | 1,940 | | (956 | ) | 932 | | (1,660 | ) | 1,008 | | 704 | |

| Income (loss) applicable to minority interests | | (166 | ) | (134 | ) | 20 | | (139 | ) | 15 | | 5 | | 5 | |

| Gains on disposals of businesses | | (337 | ) | (271 | ) | (81 | ) | (271 | ) | (81 | ) | — | | — | |

| Impairment of investment in EADS | | — | | — | | 1,960 | | — | | 1,960 | | — | | — | |

| Depreciation and amortization of equipment on operating leases | | 4,927 | | 3,968 | | 4,218 | | 388 | | 438 | | 3,580 | | 3,780 | |

| Depreciation and amortization of fixed assets | | 5,344 | | 4,304 | | 4,364 | | 4,258 | | 4,288 | | 46 | | 76 | |

| Change in deferred taxes | | 227 | | 183 | | (197 | ) | (372 | ) | (678 | ) | 555 | | 481 | |

| Equity (income) loss from associated companies | | 996 | | 802 | | 212 | | 815 | | 222 | | (13 | ) | (10 | ) |

| Change in financial instruments | | (272 | ) | (219 | ) | 292 | | (229 | ) | 249 | | 10 | | 43 | |

| (Gains) losses on disposals of fixed assets/securities | | (512 | ) | (412 | ) | (343 | ) | (422 | ) | (343 | ) | 10 | | — | |

| Change in trading securities | | (38 | ) | (31 | ) | 39 | | (32 | ) | 44 | | 1 | | (5 | ) |

| Change in accrued liabilities | | 1,059 | | 853 | | 2,111 | | 777 | | 2,104 | | 76 | | 7 | |

| Turnaround plan expenses—Chrysler Group | | 194 | | 156 | | 42 | | 156 | | 42 | | — | | — | |

| Turnaround plan payments—Chrysler Group | | (200 | ) | (161 | ) | (218 | ) | (161 | ) | (218 | ) | — | | — | |

| Changes in other operating assets and liabilities: | | | | | | | | | | | | | | | |

| | —Inventories, net | | (3,823 | ) | (3,079 | ) | (1,355 | ) | (3,078 | ) | (1,643 | ) | (1 | ) | 288 | |

| | —Trade receivables | | 422 | | 340 | | (478 | ) | 268 | | (490 | ) | 72 | | 12 | |

| | —Trade liabilities | | 2,501 | | 2,014 | | 2,450 | | 2,026 | | 2,489 | | (12 | ) | (39 | ) |

| | —Other assets and liabilities | | (1 | ) | (1 | ) | 1,614 | | (170 | ) | 1,320 | | 169 | | 294 | |

| Cash provided by operating activities | | 12,730 | | 10,252 | | 13,694 | | 4,746 | | 8,058 | | 5,506 | | 5,636 | |

| Purchases of fixed assets: | | | | | | | | | | | | | | | |

| | —Increase in equipment on operating leases | | (16,261 | ) | (13,096 | ) | (11,851 | ) | (3,096 | ) | (3,143 | ) | (10,000 | ) | (8,708 | ) |

| | —Purchase of property, plant and equipment | | (5,918 | ) | (4,766 | ) | (4,707 | ) | (4,728 | ) | (4,649 | ) | (38 | ) | (58 | ) |

| | —Purchase of other fixed assets | | (375 | ) | (302 | ) | (213 | ) | (291 | ) | (166 | ) | (11 | ) | (47 | ) |

| Proceeds from disposals of equipment on operating leases | | 10,189 | | 8,206 | | 9,586 | | 3,546 | | 3,576 | | 4,660 | | 6,010 | |

| Proceeds from disposals of fixed assets | | 936 | | 754 | | 277 | | 728 | | 253 | | 26 | | 24 | |

| Payments for investments in businesses | | (252 | ) | (203 | ) | (813 | ) | (201 | ) | (764 | ) | (2 | ) | (49 | ) |

| Proceeds from disposals of businesses | | 1,481 | | 1,193 | | 232 | | 1,173 | | 185 | | 20 | | 47 | |

| (Increase) decrease in receivables from financial services, net | | (4,649 | ) | (3,744 | ) | (4,180 | ) | — | | 33 | | (3,744 | ) | (4,213 | ) |

| (Acquisition) disposition of securities (other than trading), net | | (940 | ) | (757 | ) | (216 | ) | (782 | ) | (152 | ) | 25 | | (64 | ) |

| Change in other cash | | (144 | ) | (117 | ) | 33 | | (102 | ) | (38 | ) | (15 | ) | 71 | |

| Cash used for investing activities | | (15,933 | ) | (12,832 | ) | (11,852 | ) | (3,753 | ) | (4,865 | ) | (9,079 | ) | (6,987 | ) |

| Change in financial liabilities (including amounts for commercial paper borrowings, net of €(346) ($(430)) and €(731) in 2004 and 2003, respectively) | | 472 | | 380 | | 2,421 | | (2,552 | ) | 261 | | 2,932 | | 2,160 | |

| Dividends paid (incl. profit transferred from subsidiaries) | | (1,911 | ) | (1,539 | ) | (1,535 | ) | (1,532 | ) | (1,522 | ) | (7 | ) | (13 | ) |

| Proceeds from issuance of capital stock (incl. minority interests) | | 29 | | 23 | | 28 | | (137 | ) | (11 | ) | 160 | | 39 | |

| Purchase of treasury stock | | (29 | ) | (23 | ) | (28 | ) | (23 | ) | (28 | ) | — | | — | |

| Cash provided by (used for) financing activities | | (1,439 | ) | (1,159 | ) | 886 | | (4,244 | ) | (1,300 | ) | 3,085 | | 2,186 | |

| Effect of foreign exchange rate changes on cash and cash equivalents (originally maturing within 3 months) | | 99 | | 80 | | (580 | ) | 73 | | (530 | ) | 7 | | (50 | ) |

| Net increase (decrease) in cash and cash equivalents (originally maturing within 3 months) | | (4,543 | ) | (3,659 | ) | 2,148 | | (3,178 | ) | 1,363 | | (481 | ) | 785 | |

| Cash and cash equivalents (originally maturing within 3 months) | | | | | | | | | | | | | | | |

| | At beginning of period | | 13,369 | | 10,767 | | 9,100 | | 9,469 | | 8,161 | | 1,298 | | 939 | |

| | At end of period | | 8,826 | | 7,108 | | 11,248 | | 6,291 | | 9,524 | | 817 | | 1,724 | |

The accompanying notes are an integral part of these Unaudited Interim Condensed Consolidated Financial Statements.

26

DaimlerChrysler AG and Subsidiaries

Notes to Unaudited Interim Condensed Consolidated Financial Statements

1. Presentation of Condensed Consolidated Financial Statements