SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

February 14, 2008

Commission File Number 1-12356

DAIMLER AG

(Translation of registrant’s name into English)

MERCEDESSTRASSE 137, 70327 STUTTGART, GERMANY

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

DAIMLER AG

FORM 6-K: TABLE OF CONTENTS

1. Presentation Dr. Dieter Zetsche

2. Presentation Bodo Uebber

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Forward-looking statements in this document:

The figures in this document are preliminary and have neither been approved yet by the Supervisory Board nor audited by the external auditor.

This document contains forward-looking statements that reflect our current views about future events. The words “anticipate,” “assume,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “project,” “should” and similar expressions are used to identify forward-looking statements. These statements are subject to many risks and uncertainties, including an economic downturn or slow economic growth in important economic regions, especially in Europe or North America; changes in currency exchange rates and interest rates; the introduction of competing products and the possible lack of acceptance of our products or services which may limit our ability to raise prices; price increases in fuel, raw materials, and precious metals; disruption of production due to shortages of materials, labor strikes, or supplier insolvencies; a decline in resale prices of used vehicles; the business outlook for Daimler Trucks, which may be affected if the U.S. and Japanese commercial vehicle markets experience a sustained weakness in demand for a longer period than originally expected; the effective implementation of cost reduction and efficiency optimization programs; the business outlook of Chrysler, in which we hold an equity interest, including its ability to successfully implement its restructuring plans; the business outlook of EADS, in which we hold an equity interest, including the financial effects of delays in and potentially lower volumes of future aircraft deliveries; changes in laws, regulations and government policies, particularly those relating to vehicle emissions, fuel economy and safety, the resolution of pending governmental investigations and the outcome of pending or threatened future legal proceedings; and other risks and uncertainties, some of which we describe under the heading “Risk Report” in Daimler’s most recent Annual Report and under the headings “Risk Factors” and “Legal Proceedings” in Daimler’s most recent Annual Report on Form 20-F filed with the Securities and Exchange Commission. If any of these risks and uncertainties materialize, or if the assumptions underlying any of our forward-looking statements prove incorrect, then our actual results may be materially different from those we express or imply by such statements. We do not intend or assume any obligation to update these forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made.

| Annual Press Conference 2007 Results Dr. Dieter Zetsche Chairman of the Board of Management Head of Mercedes-Benz Cars February 14, 2008 |

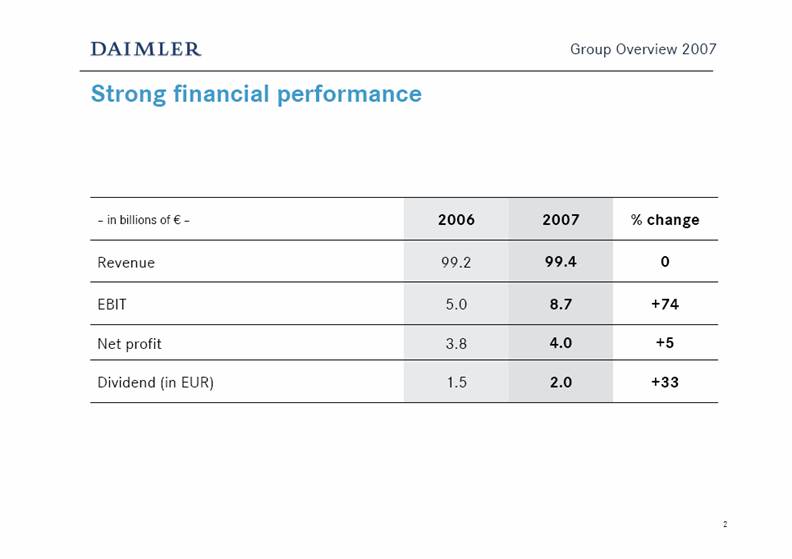

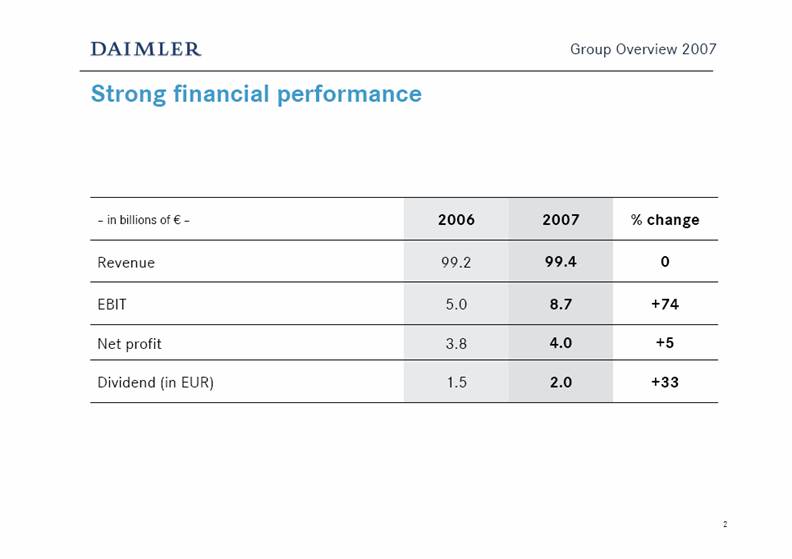

| 2 Strong financial performance +33 +5 +74 0 % change 4.0 3.8 Net profit 8.7 5.0 EBIT 99.4 99.2 Revenue 2.0 1.5 Dividend (in EUR) 2007 2006 – in billions of € – Group Overview 2007 |

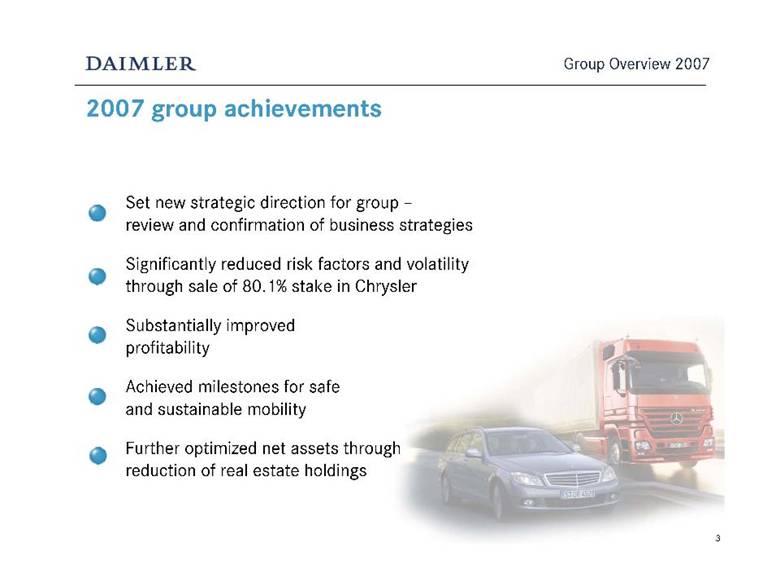

| 3 2007 group achievements Set new strategic direction for group – review and confirmation of business strategies Significantly reduced risk factors and volatility through sale of 80.1% stake in Chrysler Substantially improved profitability Achieved milestones for safe and sustainable mobility Further optimized net assets through reduction of real estate holdings Group Overview 2007 |

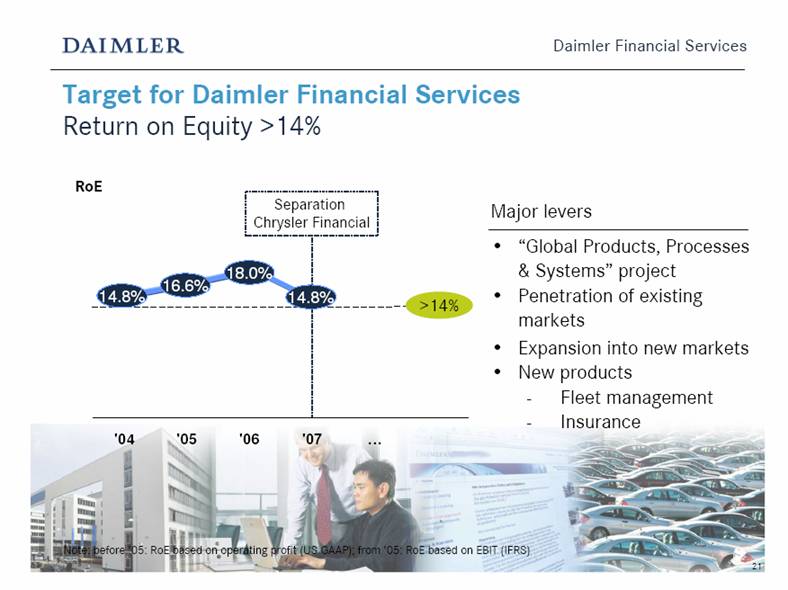

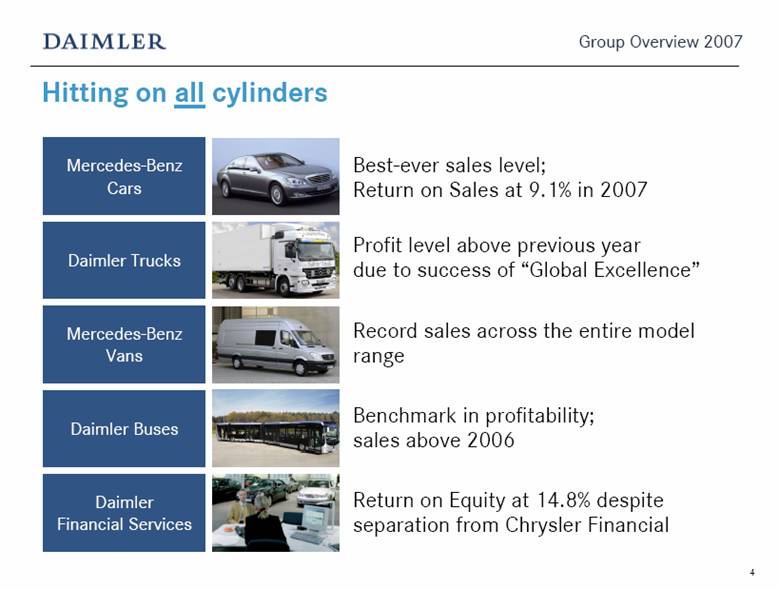

| 4 Hitting on all cylinders Group Overview 2007 Mercedes-Benz Vans Daimler Buses Daimler Financial Services Daimler Trucks Mercedes-Benz Cars Best-ever sales level; Return on Sales at 9.1% in 2007 Profit level above previous year due to success of “Global Excellence” Return on Equity at 14.8% despite separation from Chrysler Financial Benchmark in profitability; sales above 2006 Record sales across the entire model range |

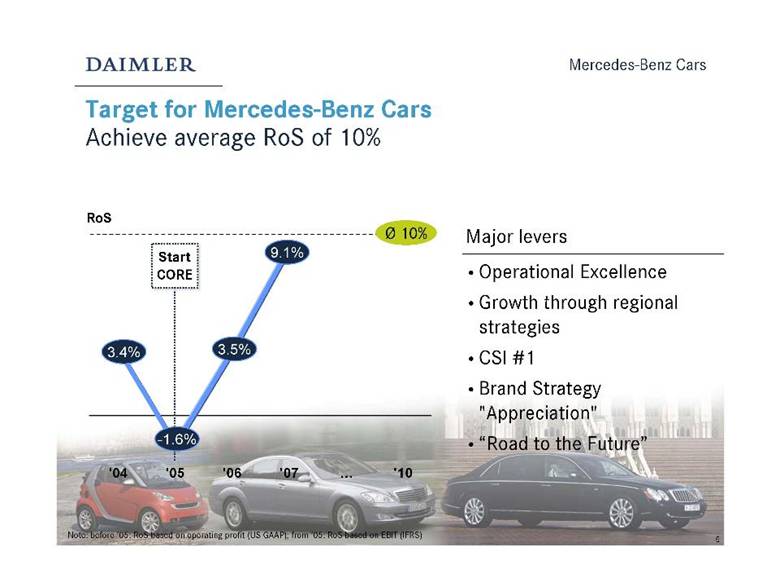

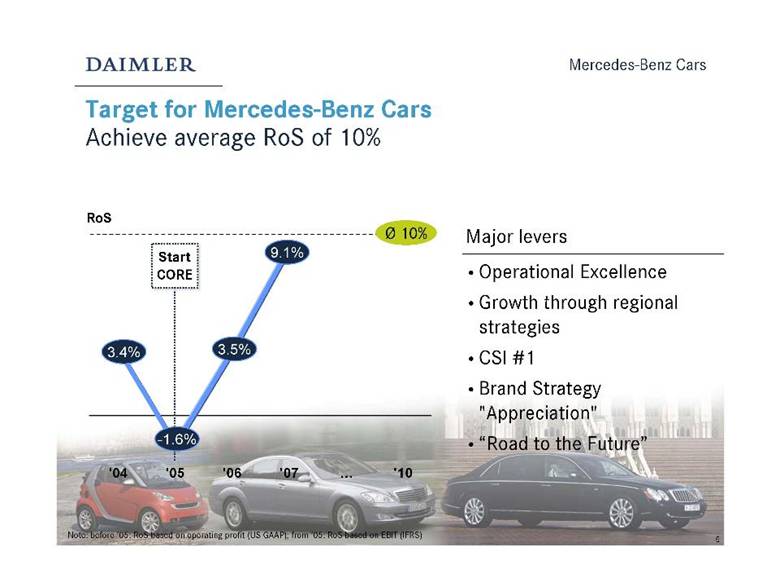

| 5 Target for Mercedes-Benz Cars Achieve average RoS of 10% RoS '04 '05 '06 '07 '10 Note: before ’05: RoS based on operating profit (US GAAP); from ’05: RoS based on EBIT (IFRS) Start CORE Major levers • Operational Excellence • Growth through regional strategies • CSI #1 • Brand Strategy "Appreciation" • “Road to the Future” Mercedes-Benz Cars 3.4% -1.6% 3.5% 9.1% Ø 10% |

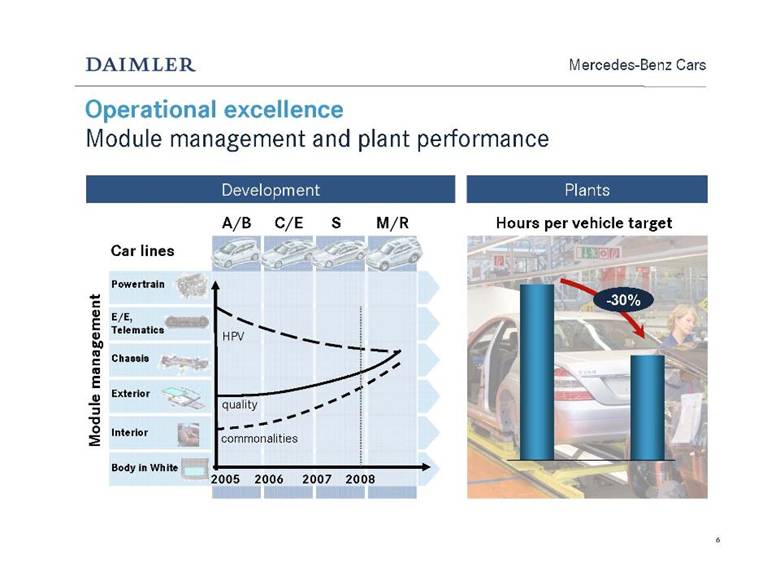

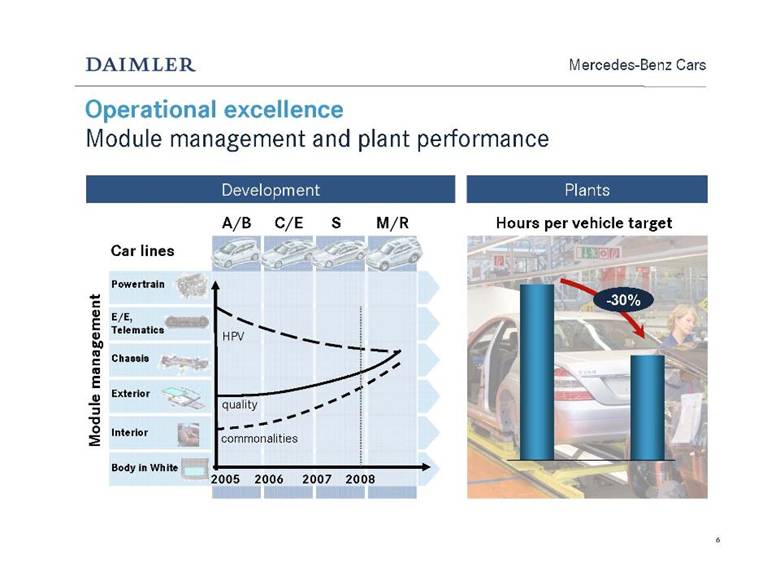

| 6 Development Plants Hours per vehicle target Operational excellence Module management and plant performance Mercedes-Benz Cars -30% 2005 2006 2007 2008 commonalities quality HPV Module management Powertrain E/E, Telematics Chassis Exterior Interior Body in White Car lines A/B M/R C/E S |

| 7 Emerging markets Expanding in high-growth markets Russia, India, and China Mercedes-Benz Cars Local production since ’95 Investment in new plant (SoP ’09) Dealer network in 27 cities +17% Activities New Beijing factory in Sep. ‘06 E-Class CKD since July ’06 C-Class SoP in ’07 Customized EClass >80 dealer outlets +64 % Fastest growing premium brand Dealer network in 38 cities Brand center in Moscow +61% Mercedes- Benz unit sales ’06’07 India China Russia Note: SoP=Start of Production; Unit sales = wholesale |

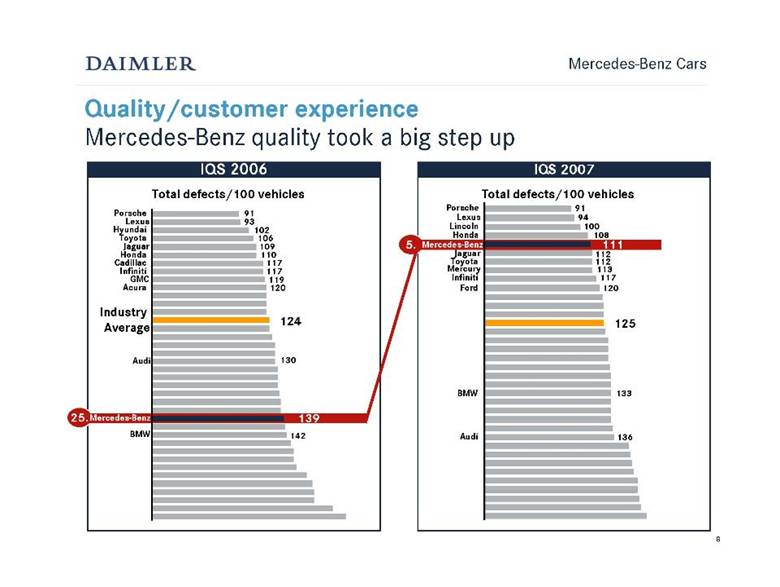

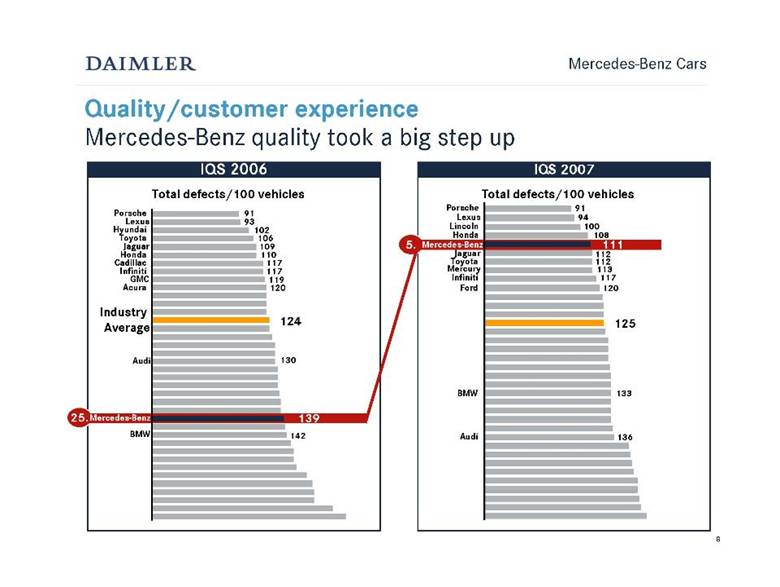

| 8 5. 25. Quality/customer experience Mercedes-Benz quality took a big step up IQS 2006 Total defects/100 vehicles IQS 2007 Mercedes-Benz Cars Total defects/100 vehicles 139 111 124 125 Industry Average Porsche Lexus Hyundai Toyota Jaguar Honda Cadillac Infiniti GMC Acura 120 119 117 117 110 109 106 102 93 91 100 94 91 Porsche 108 Lexus Lincoln Honda Jaguar Toyota Mercury Infiniti Ford 120 117 113 112 112 142 BMW 130 Audi 136 133 BMW Audi Mercedes-Benz Mercedes-Benz |

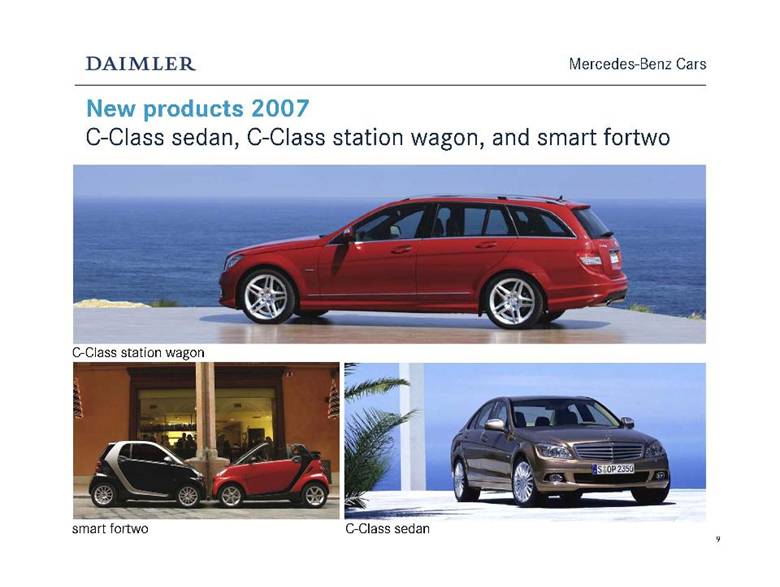

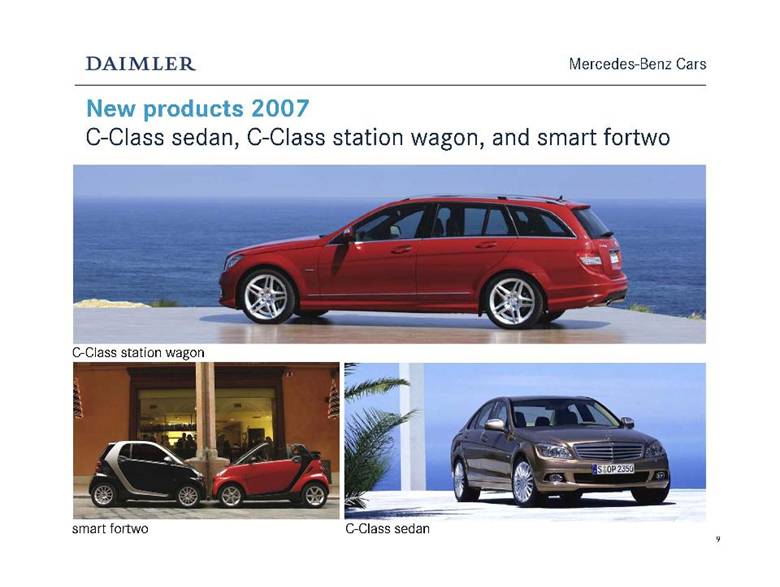

| 9 New products 2007 C-Class sedan, C-Class station wagon, and smart fortwo Mercedes-Benz Cars C-Class station wagon smart fortwo C-Class sedan |

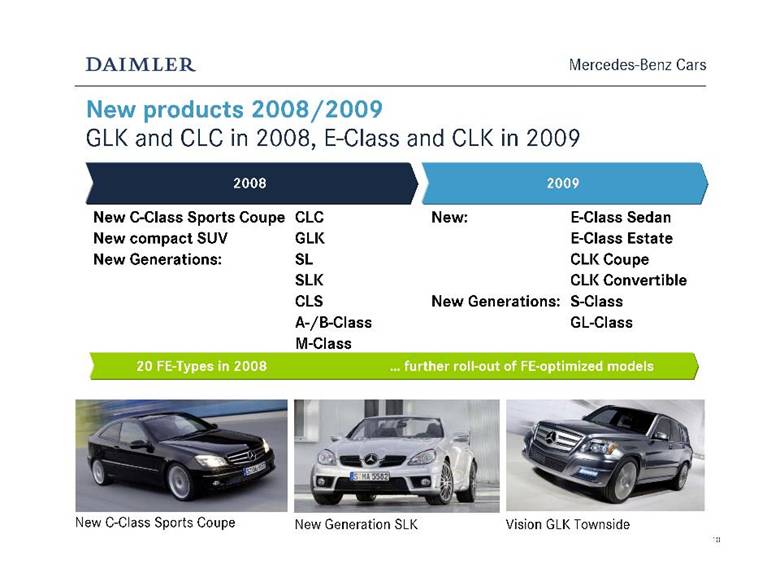

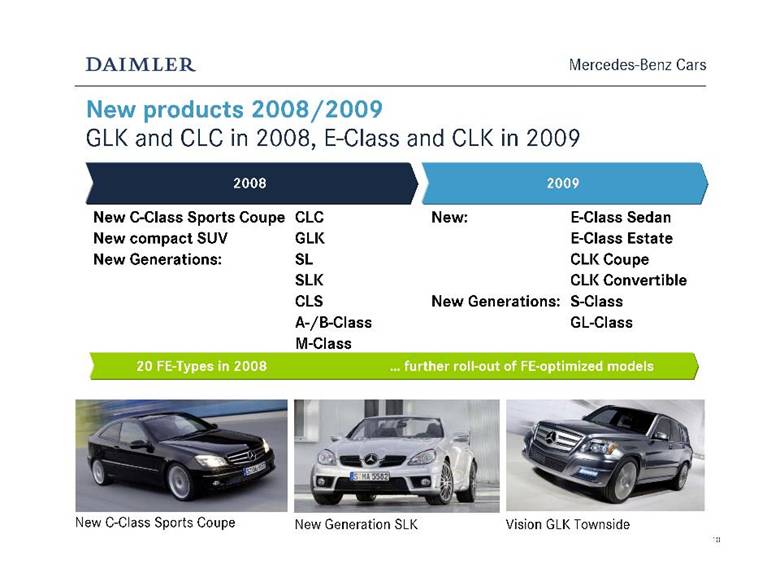

| 10 New products 2008/2009 GLK and CLC in 2008, E-Class and CLK in 2009 Mercedes-Benz Cars New: E-Class Sedan E-Class Estate CLK Coupe CLK Convertible New Generations: S-Class GL-Class 2009 2008 New C-Class Sports Coupe CLC New compact SUV GLK New Generations: SL SLK CLS A-/B-Class M-Class New C-Class Sports Coupe Vision GLK Townside New Generation SLK 20 FE-Types in 2008 further roll-out of FE-optimized models |

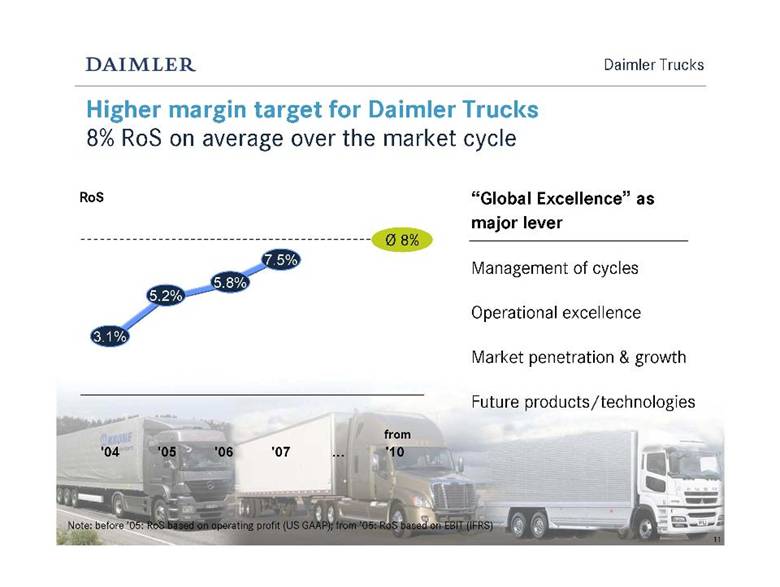

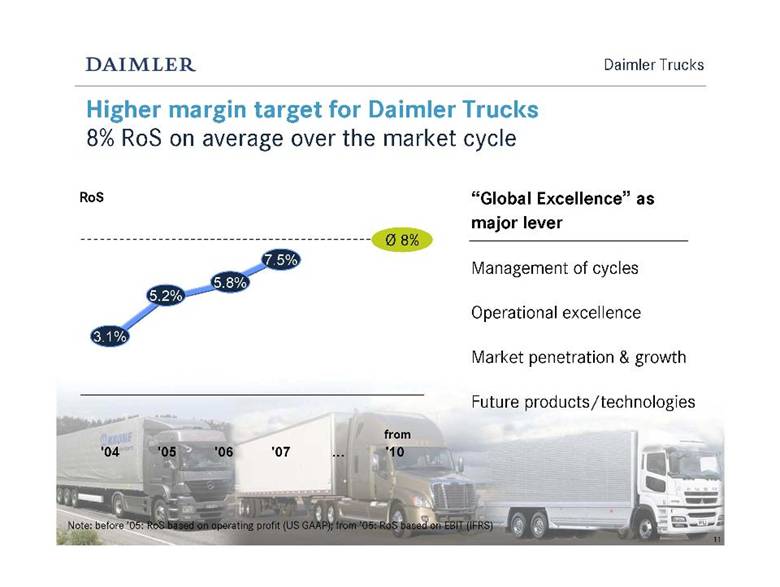

| 11 Higher margin target for Daimler Trucks 8% RoS on average over the market cycle RoS '04 '05 '06 '07 '10 “Global Excellence” as major lever Management of cycles Operational excellence Market penetration & growth Future products/technologies Daimler Trucks Ø 8% 3.1% 5.2% 5.8% 7.5% Note: before ’05: RoS based on operating profit (US GAAP); from ’05: RoS based on EBIT (IFRS) from |

| 12 Management of cycles Higher profitability despite regional market downturns Daimler Trucks 394 586 NAFTA Western Europe Japan S Triad Truck Market ’06’07 -33% 1% -18% -20% Profitability (RoS %) Daimler Trucks 5.8 '06 '07 7.5 Management of cycles (started in 2005) proved successful Thousand units Truck market: HDT, MDT thereof Class 8: -41% 338 334 89 109 1,029 822 +1.7%pts |

| 13 Combined BRIC sales growth Emerging markets Addressing growth markets Brazil, Russia, India, and China Daimler Trucks Brazil MB market leader MB production hub for Latin America, part of global network Modified European and products China Cooperation with Chinese OEM Russia Local plant targeted Sales & service network expansion India JV with Hero contracted Actros production in Pune + 29 % Activities Daimler Truck unit sales ’06’07 |

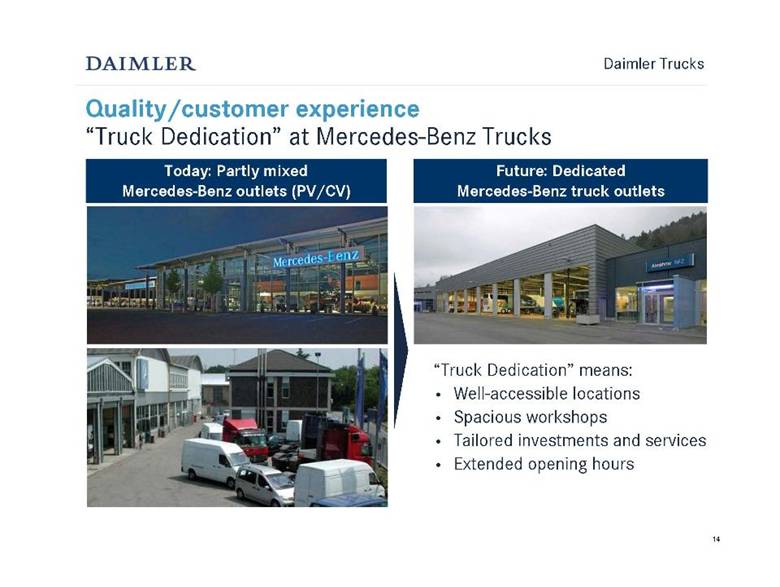

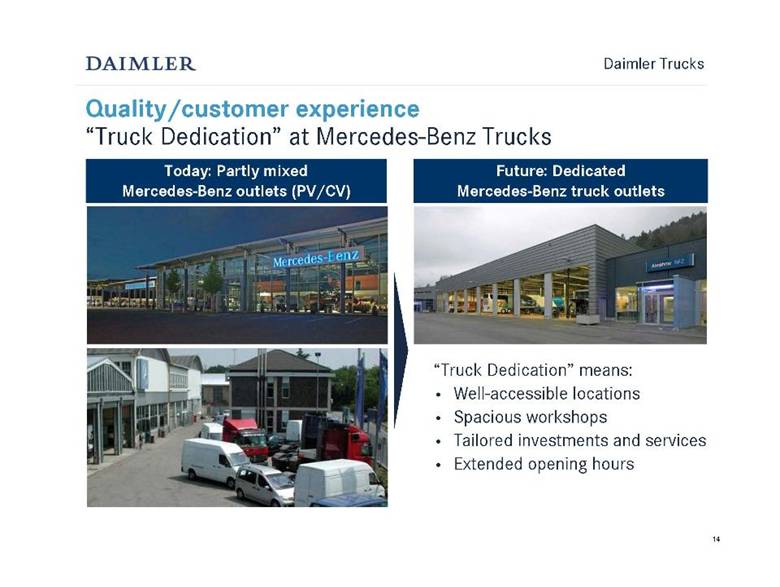

| 14 Daimler Trucks Today: Partly mixed Mercedes-Benz outlets (PV/CV) Future: Dedicated Mercedes-Benz truck outlets “Truck Dedication” means: • Well-accessible locations • Spacious workshops • Tailored investments and services • Extended opening hours Quality/customer experience “Truck Dedication” at Mercedes-Benz Trucks |

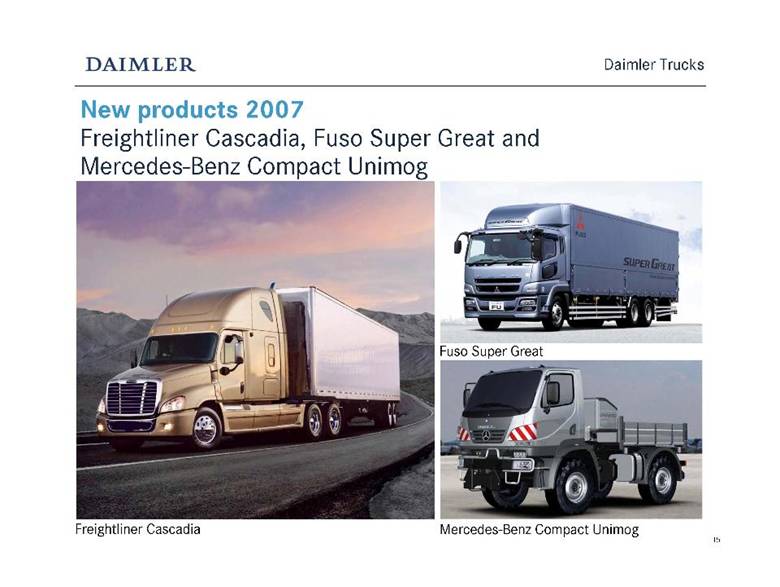

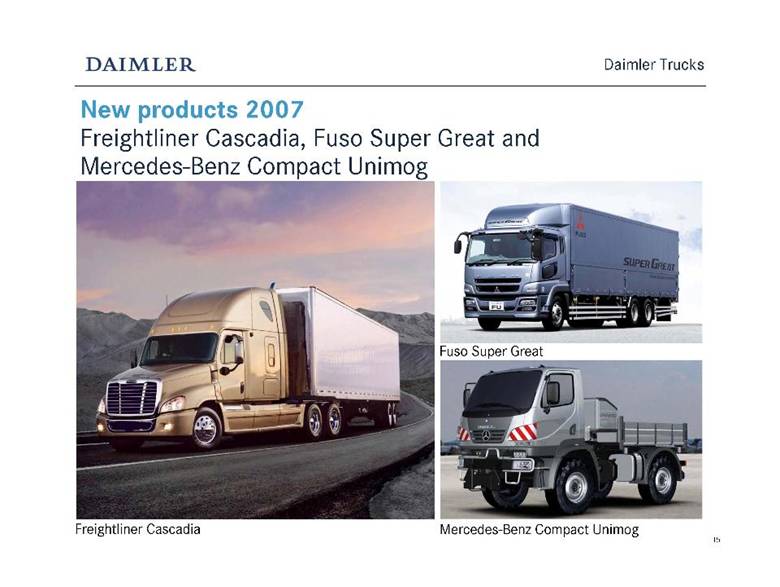

| 15 New products 2007 Freightliner Cascadia, Fuso Super Great and Mercedes-Benz Compact Unimog Daimler Trucks Freightliner Cascadia Fuso Super Great Mercedes-Benz Compact Unimog |

| 16 New products 2008 New Actros and Hybrid LDT and MDT in Europe Daimler Trucks Fuso Canter Eco Hybrid for UK Mercedes-Benz Atego BLUETEC Hybrid New Mercedes-Benz Actros |

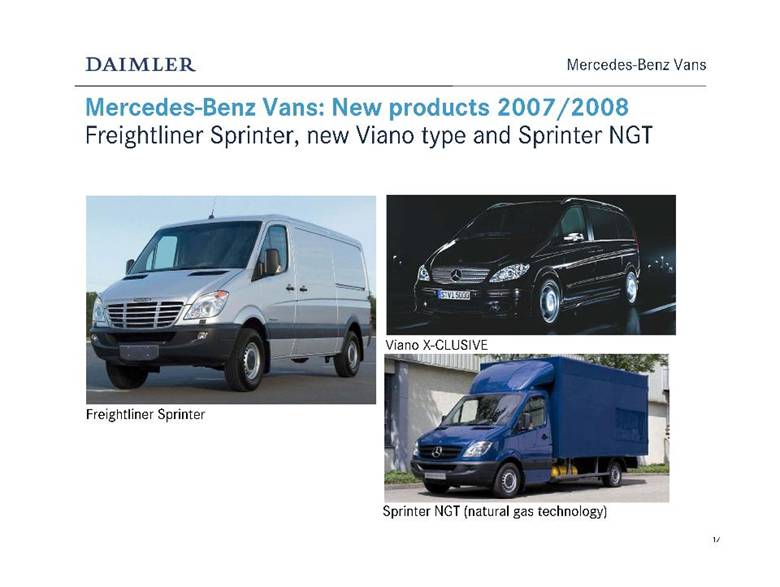

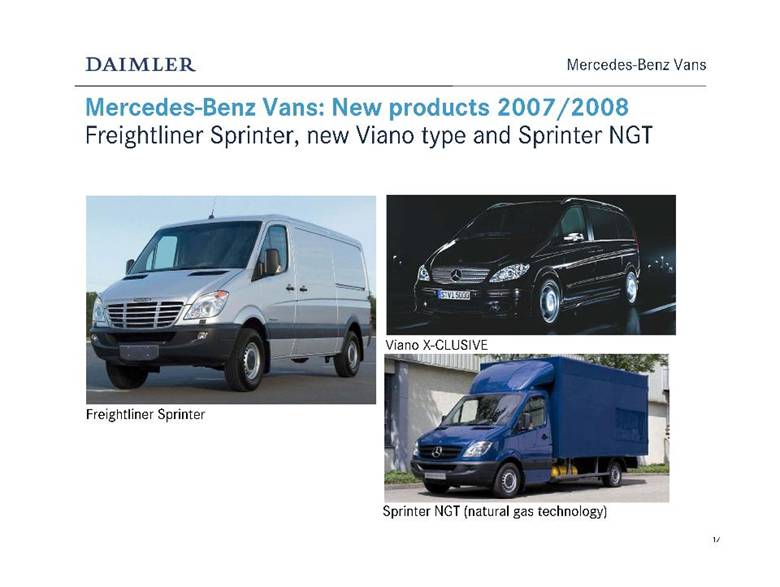

| 17 Mercedes-Benz Vans: New products 2007/2008 Freightliner Sprinter, new Viano type and Sprinter NGT Mercedes-Benz Vans Sprinter NGT (natural gas technology) Viano X-CLUSIVE Freightliner Sprinter |

| 18 Major performance levers • Next product generation (incl. CSI#1) • Efficiency and standardization program • Growth in core and emerging markets • Production capacity enhancement to cover growing market demand Mercedes-Benz Vans Mercedes-Benz Vans |

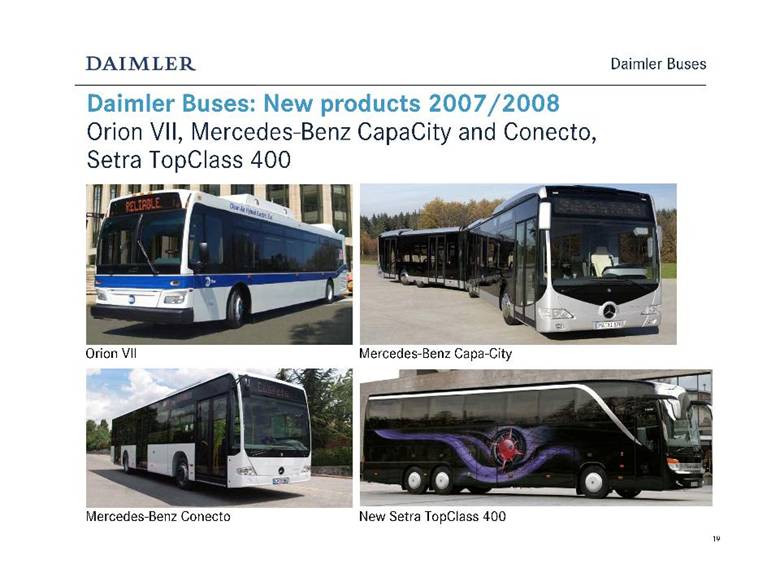

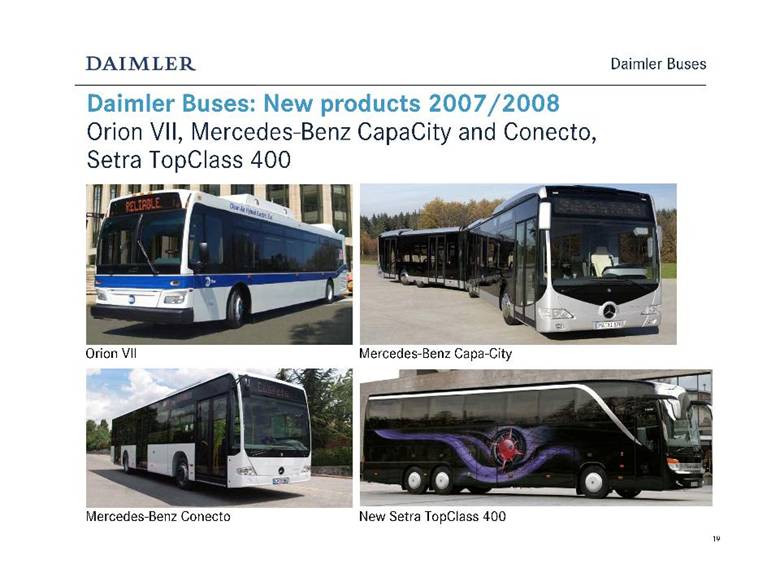

| 19 Daimler Buses: New products 2007/2008 Orion VII, Mercedes-Benz CapaCity and Conecto, Setra TopClass 400 Daimler Buses Mercedes-Benz Conecto Orion VII Mercedes-Benz Capa-City New Setra TopClass 400 |

| 20 Daimler Buses Major performance levers Daimler Buses • Next product generation in Europe • Exploit market opportunities for complete buses • Growth in emerging markets • Leadership in alternative propulsion |

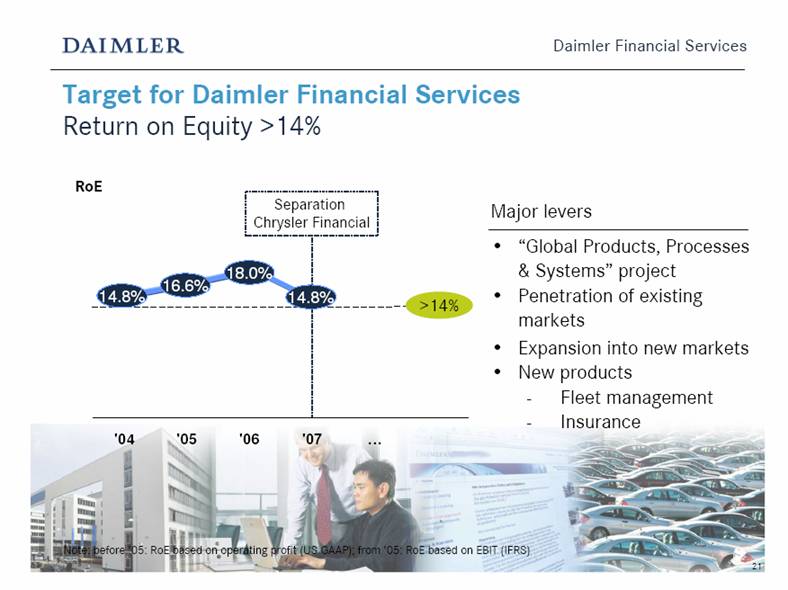

| 21 '04 '05 '06 '07 Target for Daimler Financial Services Return on Equity >14% Major levers • “Global Products, Processes & Systems” project • Penetration of existing markets • Expansion into new markets • New products - Fleet management - Insurance RoE 16.6% 18.0% 14.8% >14% Note: before ’05: RoE based on operating profit (US GAAP); from ’05: RoE based on EBIT (IFRS) Daimler Financial Services Separation Chrysler Financial 14.8% |

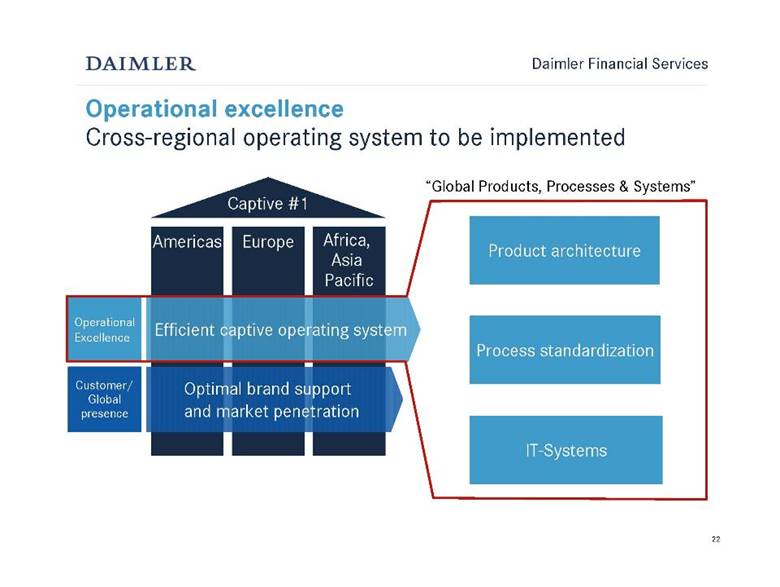

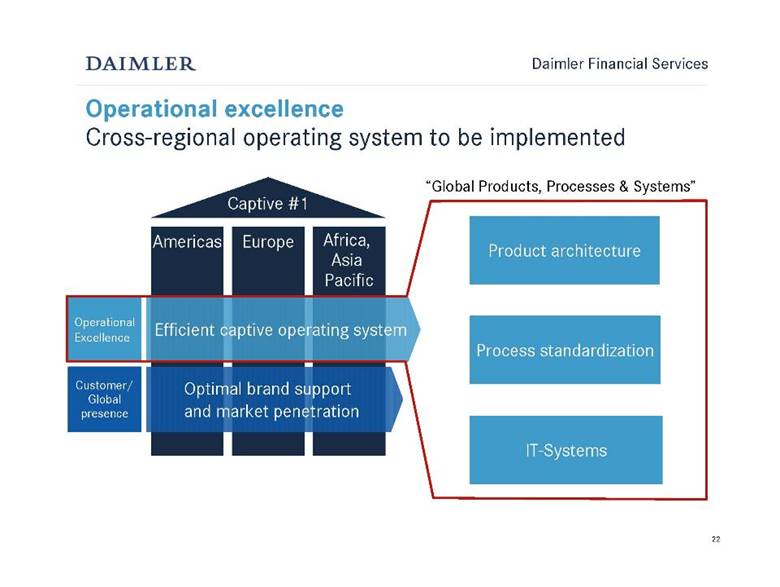

| 22 Operational excellence Cross-regional operating system to be implemented Captive #1 Africa, Asia Pacific Americas Europe Efficient captive operating system Optimal brand support and market penetration Operational Excellence Customer/ Global presence Product architecture Process standardization IT-Systems “Global Products, Processes & Systems” Daimler Financial Services |

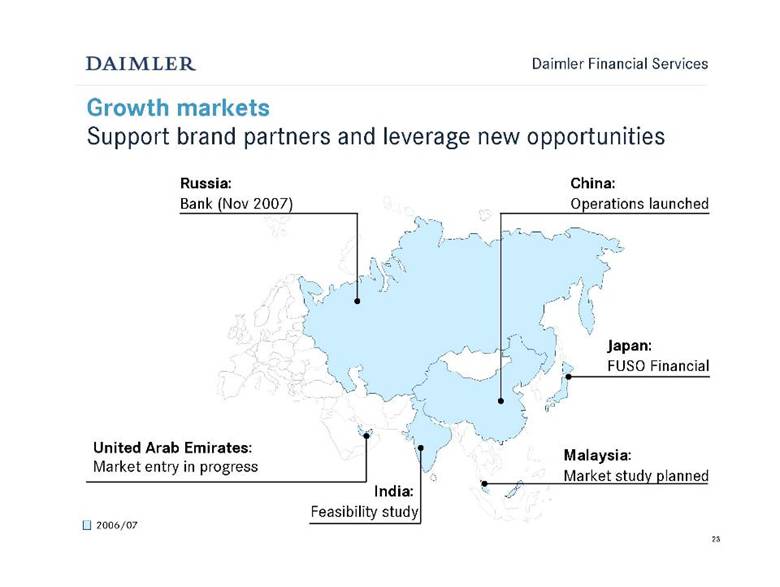

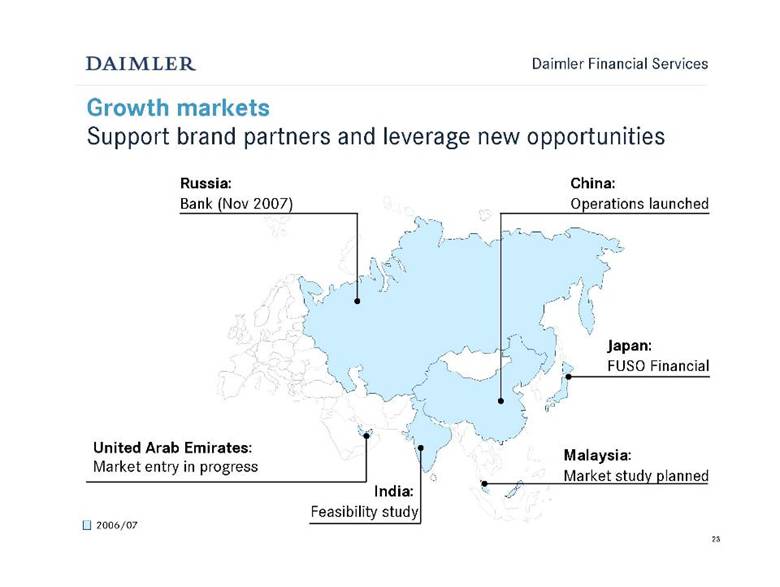

| 23 Growth markets Support brand partners and leverage new opportunities Daimler Financial Services Russia: Bank (Nov 2007) Japan: FUSO Financial Malaysia: Market study planned India: Feasibility study China: Operations launched United Arab Emirates: Market entry in progress 2006/07 |

| [24 |

| 25 Safe and sustainable mobility Emission-free driving with fuel cell/battery-drive Improved & alternative fuels Efficient cars and trucks with efficient powertrains with or without hybrid modules Sustainable Mobility Today Future |

| 26 Gasoline engines Comprehensive approach to efficient driving With and without hybrid modules Sustainable Mobility Hybrid powertrain Mild/full hybrid Diesel engines Transmission Weight/energy management 2nd generation direct injection: V6/V8 CGI Start/Stop Heat management Energy optimization Vehicle optimization Hybrid modules (Gasoline/Diesel) Double clutch New generation transmission Turbocharging w/ direct injection and downsizing BLUETEC Clean diesel DIESOTTO Powertrain Beyond powertrain Fuel economy types New 4-cylinder diesel engine family Efficiency optimized torque converter |

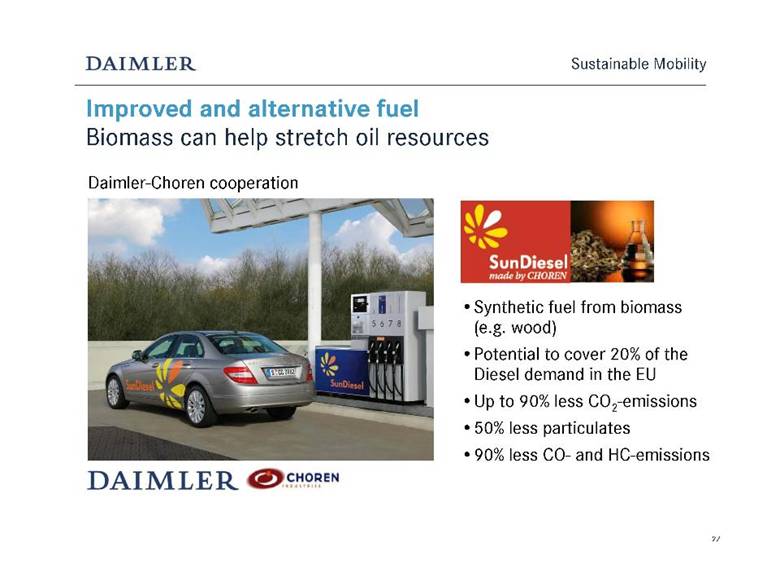

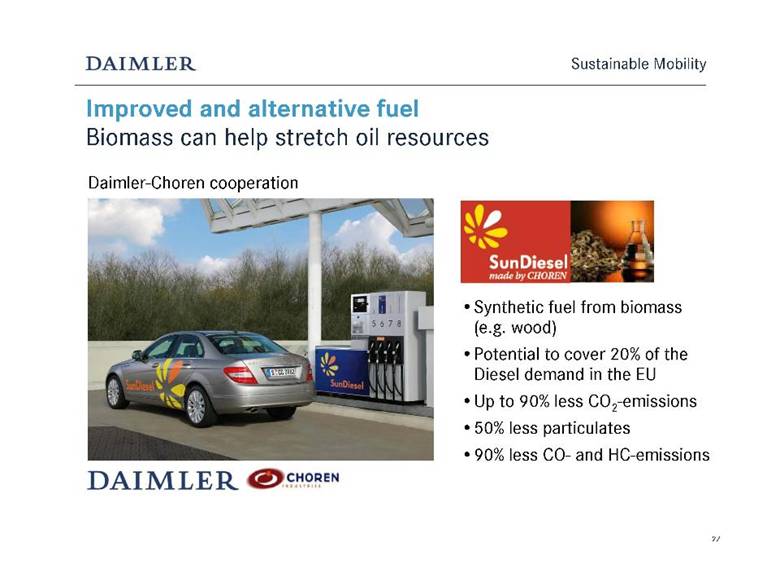

| 27 Improved and alternative fuel Biomass can help stretch oil resources • Synthetic fuel from biomass (e.g. wood) • Potential to cover 20% of the Diesel demand in the EU • Up to 90% less CO2-emissions • 50% less particulates • 90% less CO- and HC-emissions Sustainable Mobility Daimler-Choren cooperation |

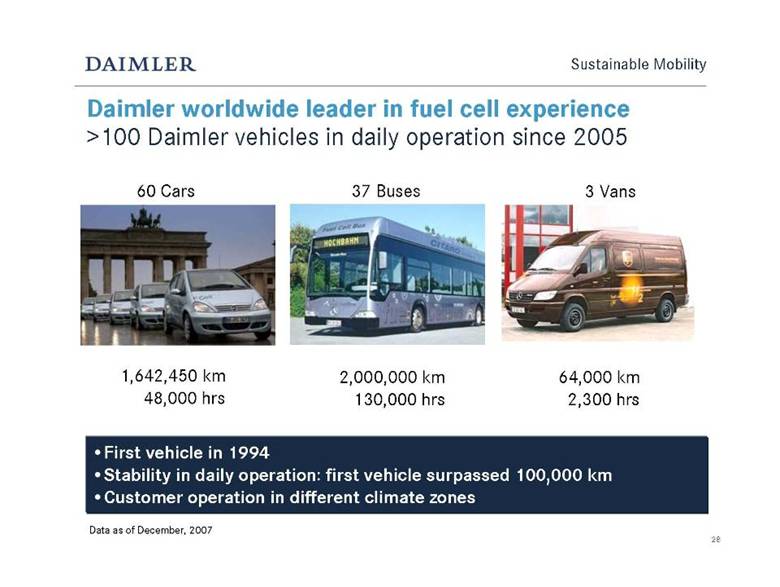

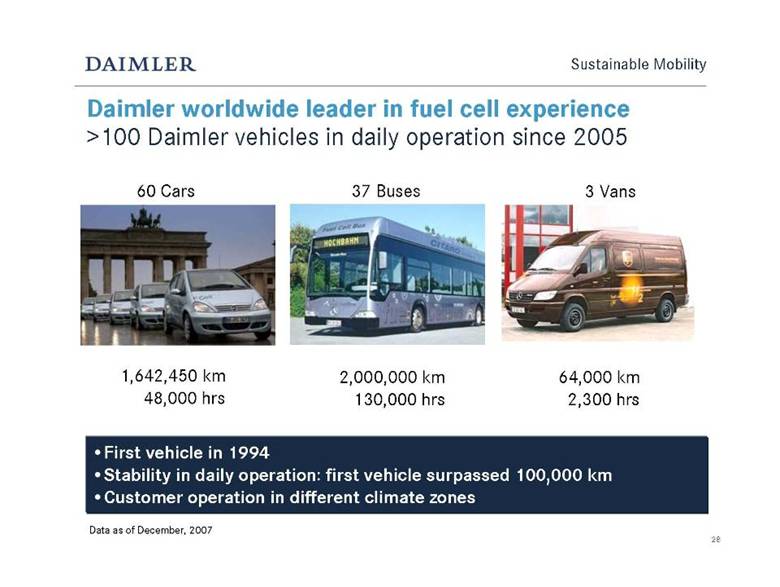

| 28 • First vehicle in 1994 • Stability in daily operation: first vehicle surpassed 100,000 km • Customer operation in different climate zones 60 Cars 37 Buses 3 Vans 1,642,450 km 48,000 hrs 2,000,000 km 130,000 hrs 64,000 km 2,300 hrs Daimler worldwide leader in fuel cell experience >100 Daimler vehicles in daily operation since 2005 Sustainable Mobility Data as of December, 2007 |

| 29 Mercedes-Benz Cars “Road to the Future” Sustainable Mobility – Mercedes-Benz Cars 2007 2008 2009 2010 … •BLUETEC E-Class •BLUETEC ML/R/GL-Class •mhd/ed smart •Hybrid S-Class •Hybrid ML-Class •BLUETEC Hybrid S-/E-Class •New V-Engines •BLUETEC C-Class •Fuel Cell B-Class •DiesOtto •Other BLUETEC Hybrids •NGT B-Class •20 Fuel Economy vehicles •2nd Gen. CGI _ _ _ |

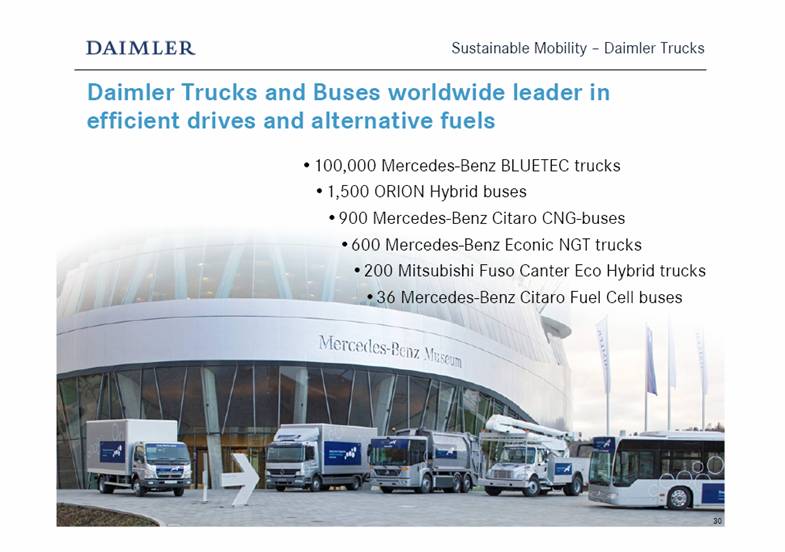

| 30 Daimler Trucks and Buses worldwide leader in efficient drives and alternative fuels Sustainable Mobility – Daimler Trucks • 100,000 Mercedes-Benz BLUETEC trucks • 900 Mercedes-Benz Citaro CNG-buses • 600 Mercedes-Benz Econic NGT trucks • 1,500 ORION Hybrid buses • 200 Mitsubishi Fuso Canter Eco Hybrid trucks • 36 Mercedes-Benz Citaro Fuel Cell buses |

| 31 CSR / Sustainability Manifold initiatives in 2007 40% of all apprenticeships of all German automotive manufacturers Highest health standards for employees (awarded by the EC) Measures to promote diversity among employees Day-care centers for children <3 years at 4 German sites Comprehensive measures to foster compliance |

| 32 We want to achieve the following profitability targets Mercedes-Benz Cars Daimler Trucks Daimler Financial Services Return on Equity Summary >14 % Ø 9% Daimler Automotive Return on Sales Mercedes-Benz Vans Daimler Buses |

| 33 We want to achieve the following profitability targets Mercedes-Benz Cars Daimler Trucks Daimler Financial Services Return on Equity Summary >14 % Ø 9% Daimler Automotive Return on Sales Mercedes-Benz Vans Daimler Buses |

| February 14, 2008 Annual Press Conference FY 2007 and Q4 2007 Results Bodo Uebber Member of the Board of Management Finance & Controlling and Daimler Financial Services |

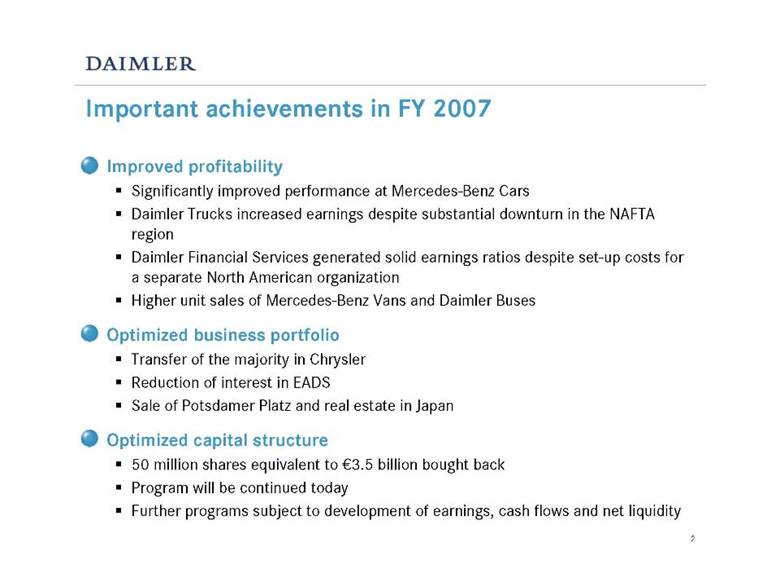

| Important achievements in FY 2007 Improved profitability Significantly improved performance at Mercedes-Benz Cars Daimler Trucks increased earnings despite substantial downturn in the NAFTA region Daimler Financial Services generated solid earnings ratios despite set-up costs for a separate North American organization Higher unit sales of Mercedes-Benz Vans and Daimler Buses Optimized business portfolio Transfer of the majority in Chrysler Reduction of interest in EADS Sale of Potsdamer Platz and real estate in Japan Optimized capital structure 50 million shares equivalent to €3.5 billion bought back Program will be continued today Further programs subject to development of earnings, cash flows and net liquidity 2 |

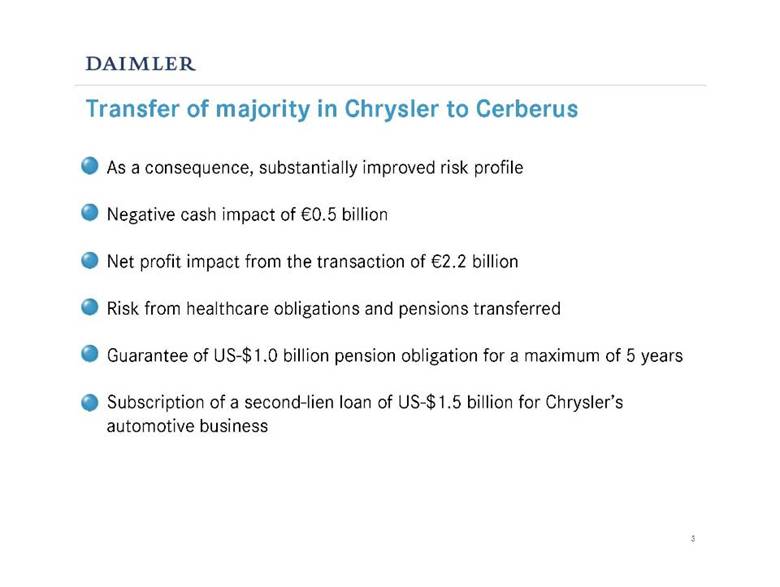

| Transfer of majority in Chrysler to Cerberus As a consequence, substantially improved risk profile Negative cash impact of €0.5 billion Net profit impact from the transaction of €2.2 billion Risk from healthcare obligations and pensions transferred Guarantee of US-$1.0 billion pension obligation for a maximum of 5 years Subscription of a second-lien loan of US-$1.5 billion for Chrysler’s automotive business 3 |

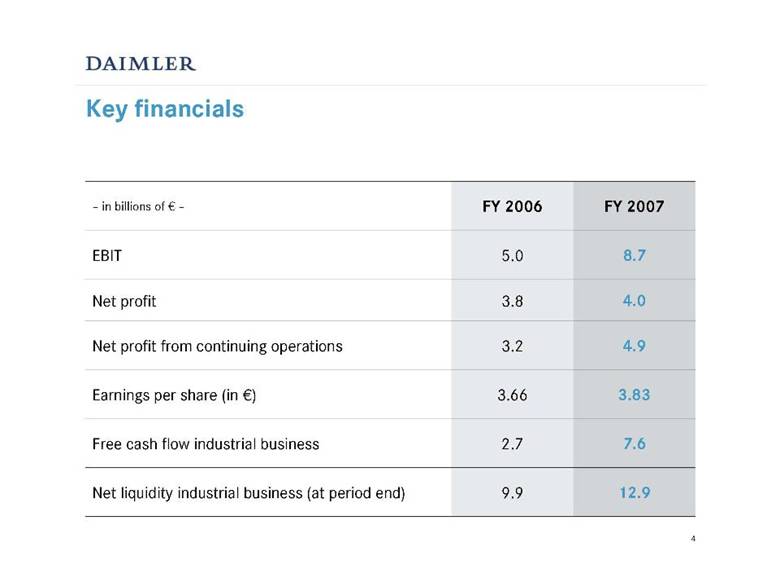

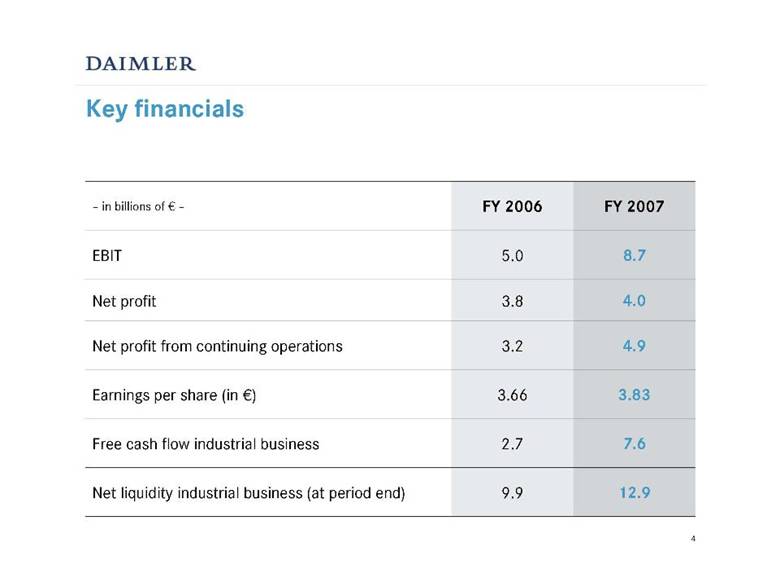

| Key financials 4.9 3.2 Net profit from continuing operations 4.0 3.8 Net profit 8.7 5.0 EBIT 12.9 9.9 Net liquidity industrial business (at period end) 7.6 2.7 Free cash flow industrial business 3.83 3.66 Earnings per share (in €) FY 2007 FY 2006 – in billions of € – 4 |

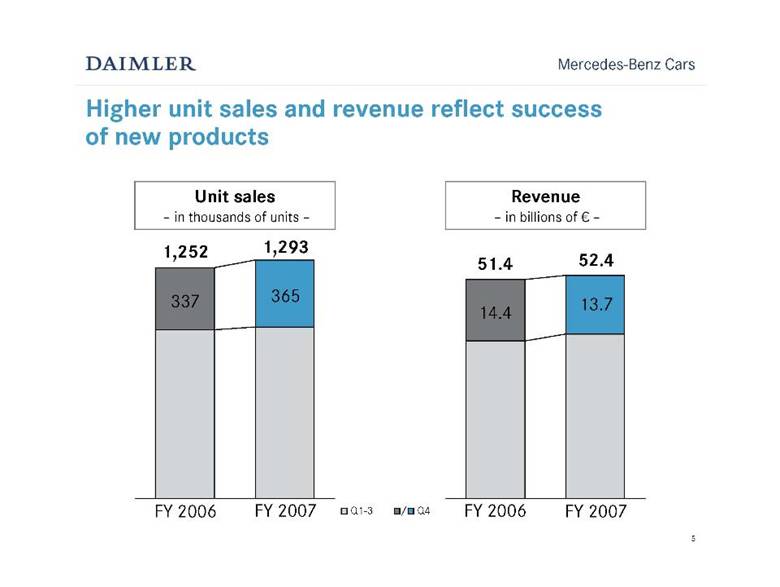

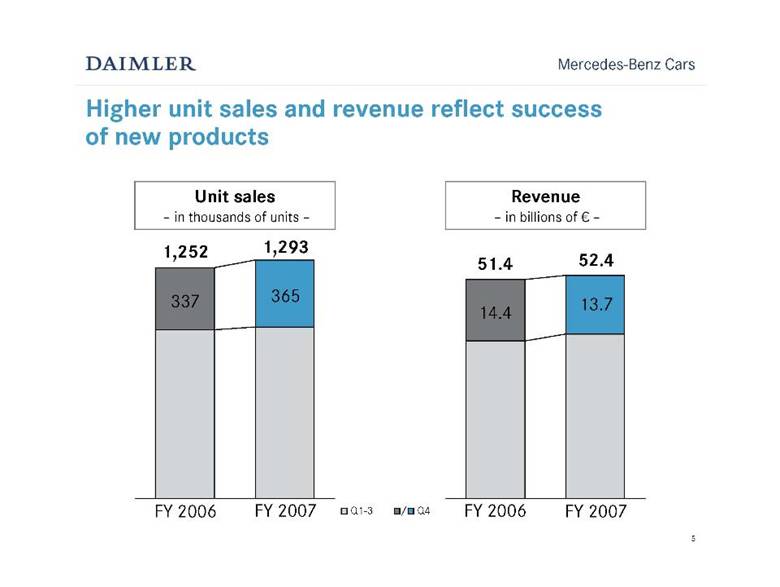

| Mercedes-Benz Cars Higher unit sales and revenue reflect success of new products Unit sales – in thousands of units – Revenue – in billions of € – FY 2006 FY 2007 FY 2006 FY 2007 1,252 1,293 51.4 52.4 337 365 14.4 13.7 Q1-3 / Q4 5 |

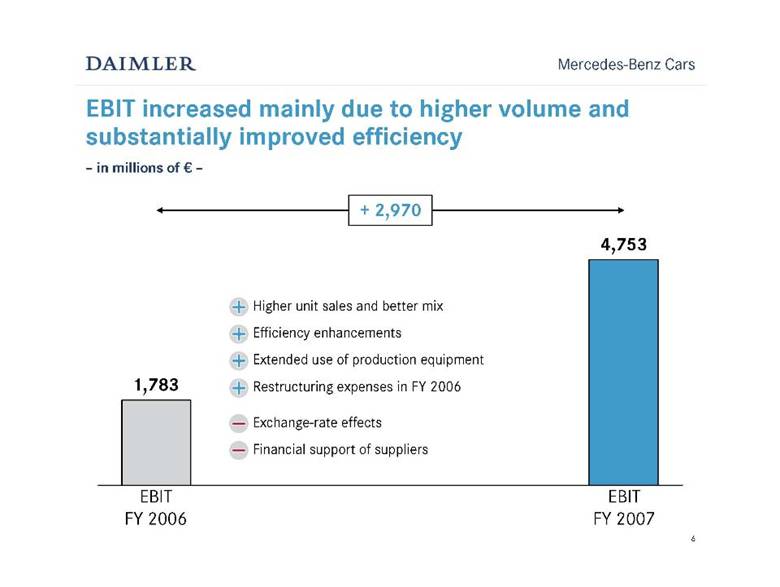

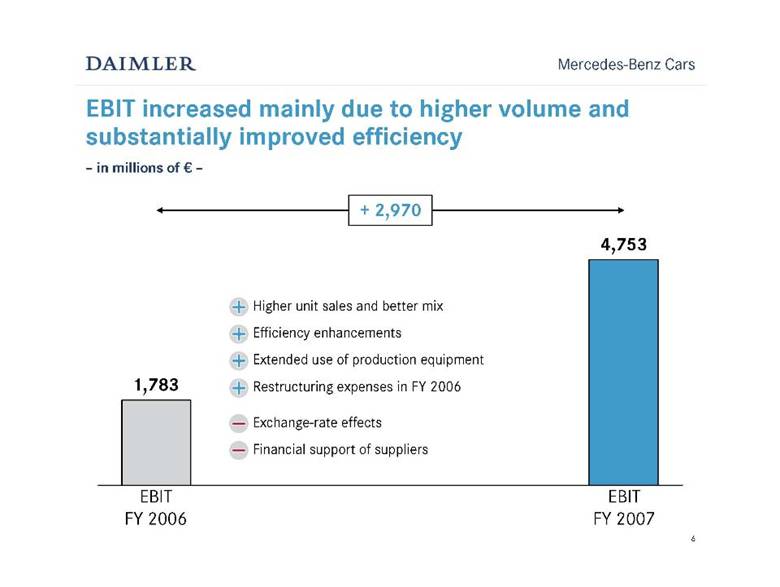

| Mercedes-Benz Cars + Higher unit sales and better mix + Efficiency enhancements + Extended use of production equipment + Restructuring expenses in FY 2006 — Exchange-rate effects — Financial support of suppliers EBIT increased mainly due to higher volume and substantially improved efficiency – in millions of € – EBIT FY 2006 EBIT FY 2007 1,783 4,753 + 2,970 6 |

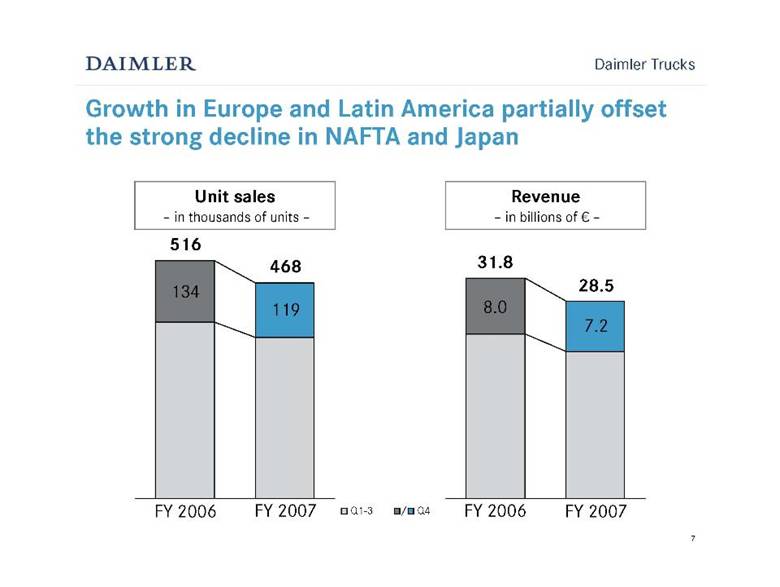

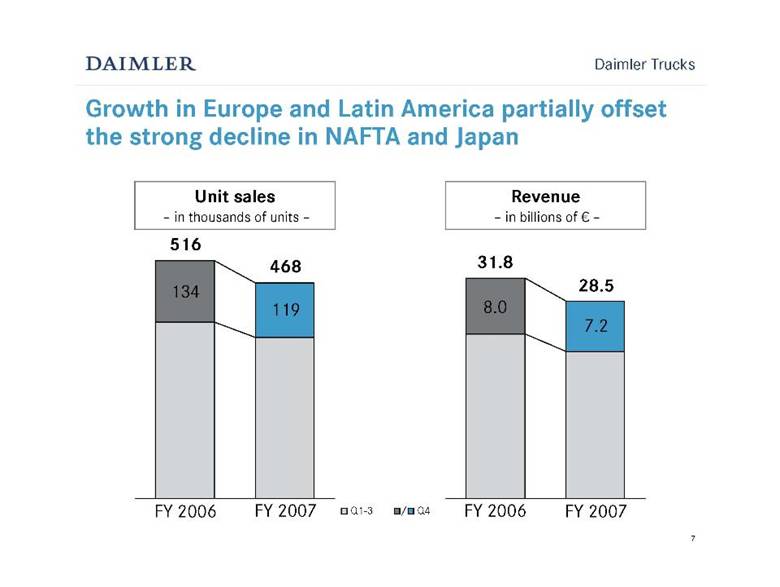

| Daimler Trucks Growth in Europe and Latin America partially offset the strong decline in NAFTA and Japan Unit sales – in thousands of units – Revenue – in billions of € – FY 2006 FY 2007 FY 2006 FY 2007 516 468 31.8 28.5 Q1-3 / Q4 134 119 7.2 8.0 7 |

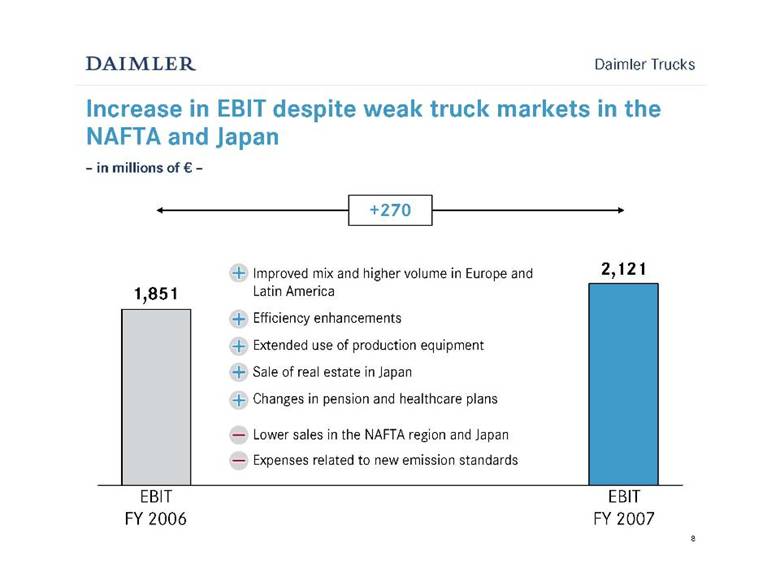

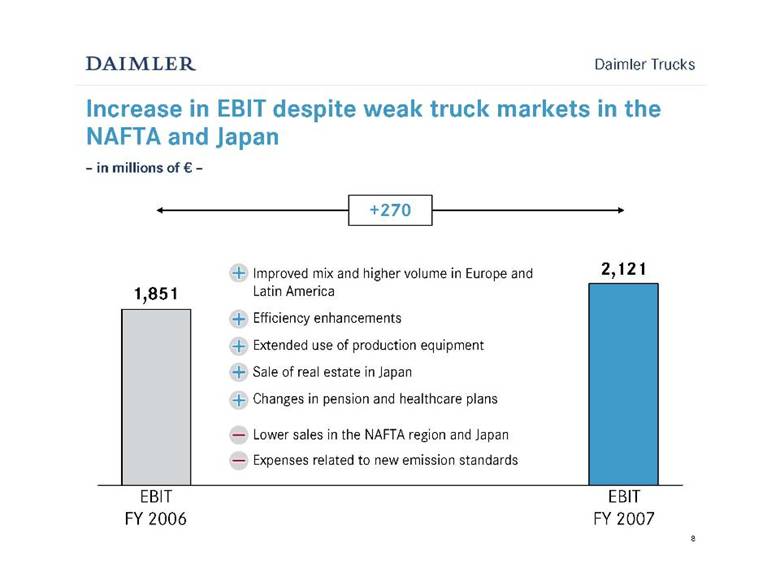

| Daimler Trucks + Improved mix and higher volume in Europe and Latin America + Efficiency enhancements + Extended use of production equipment + Sale of real estate in Japan + Changes in pension and healthcare plans — Lower sales in the NAFTA region and Japan — Expenses related to new emission standards Increase in EBIT despite weak truck markets in the NAFTA and Japan – in millions of € – EBIT FY 2006 EBIT FY 2007 1,851 2,121 +270 8 |

| Daimler Financial Services Contract volume continued to grow in all regions New business – in billions of € – Contract volume – in billions of € – FY 2006 FY 2007 FY 2006 FY 2007 27.8 27.6 59.1 57.0 Q1-3 / Q4 7.0 7.1 9 |

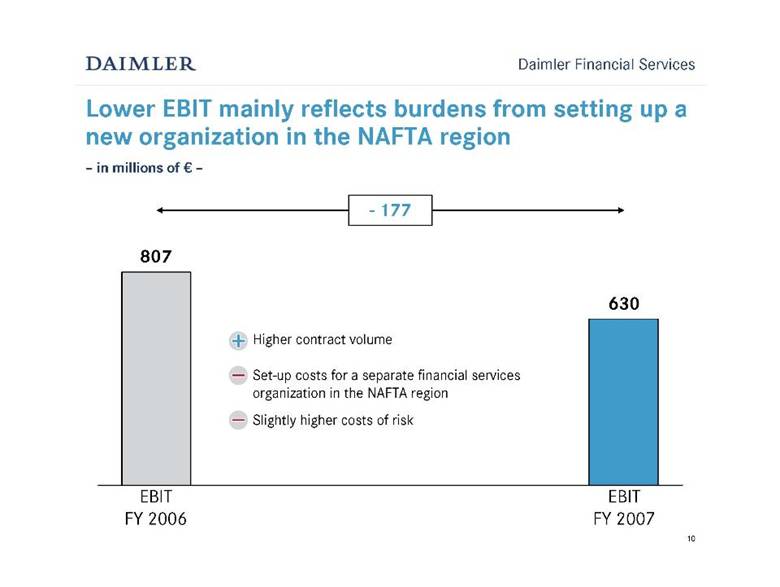

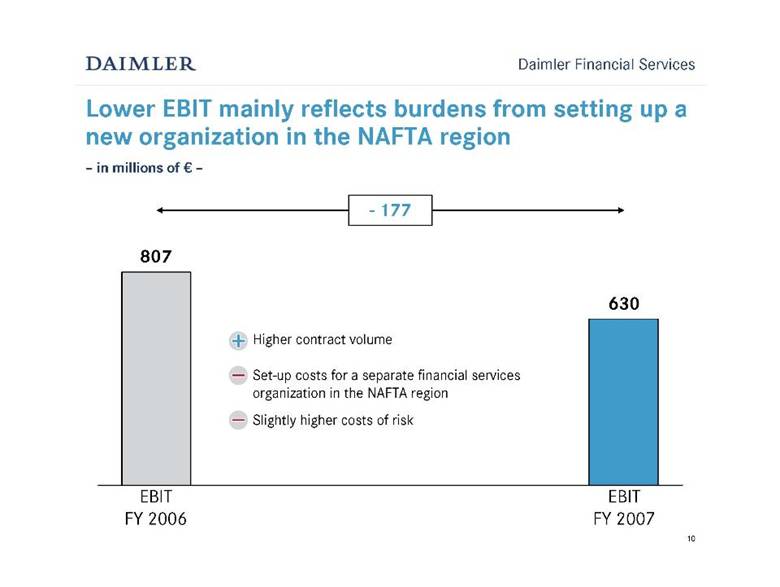

| Daimler Financial Services + Higher contract volume — Set-up costs for a separate financial services organization in the NAFTA region — Slightly higher costs of risk Lower EBIT mainly reflects burdens from setting up a new organization in the NAFTA region – in millions of € – EBIT FY 2006 EBIT FY 2007 807 630 - 177 10 |

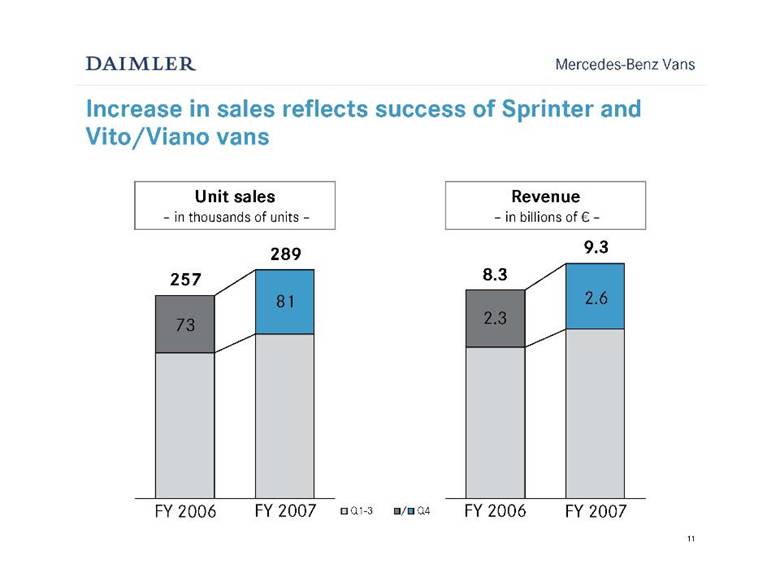

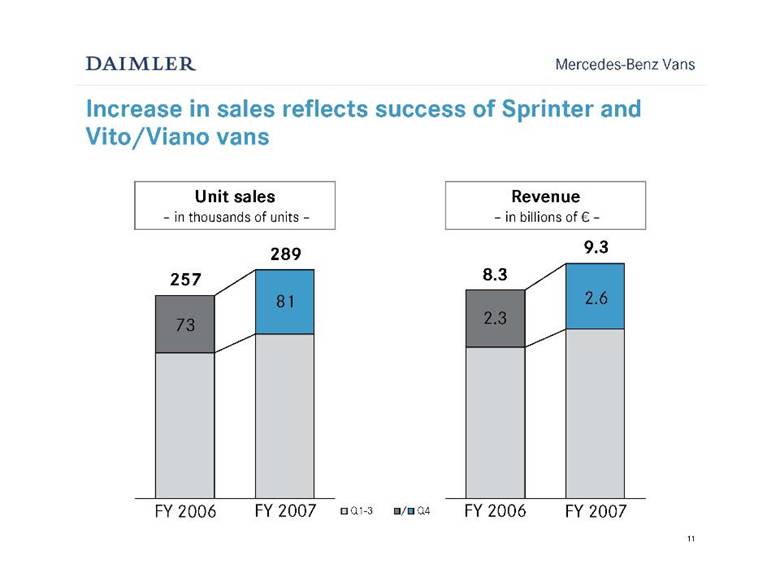

| Increase in sales reflects success of Sprinter and Vito/Viano vans Unit sales – in thousands of units – Revenue – in billions of € – FY 2006 FY 2007 FY 2006 FY 2007 257 289 8.3 9.3 Q1-3 / Q4 73 81 2.6 2.3 Mercedes-Benz Vans 11 |

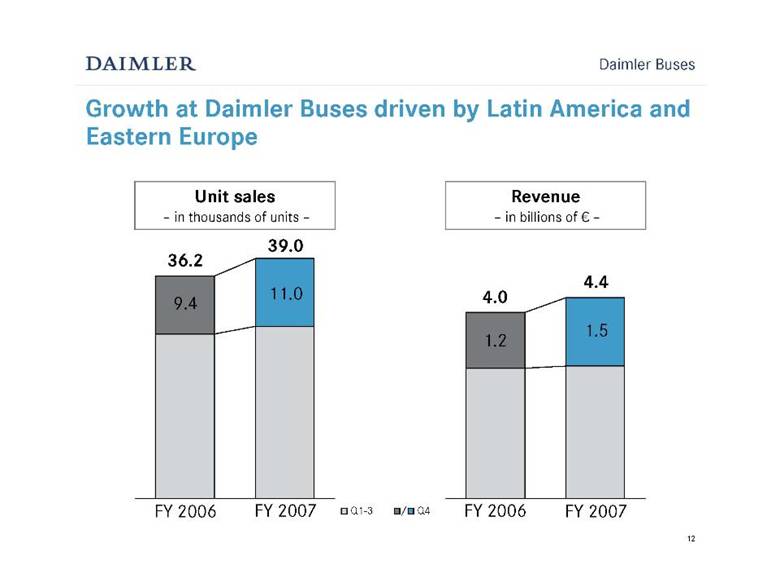

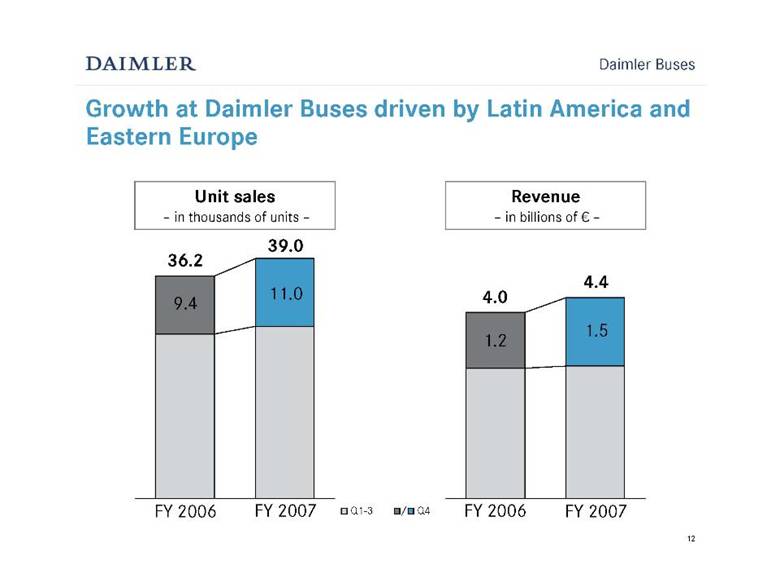

| Growth at Daimler Buses driven by Latin America and Eastern Europe Unit sales – in thousands of units – Revenue – in billions of € – FY 2006 FY 2007 FY 2006 FY 2007 36.2 39.0 4.0 4.4 Q1-3 / Q4 9.4 11.0 1.5 1.2 Daimler Buses 12 |

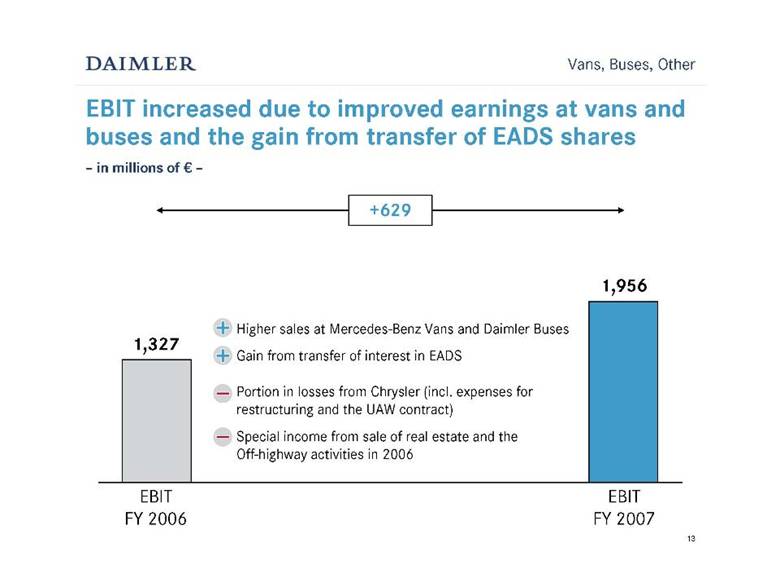

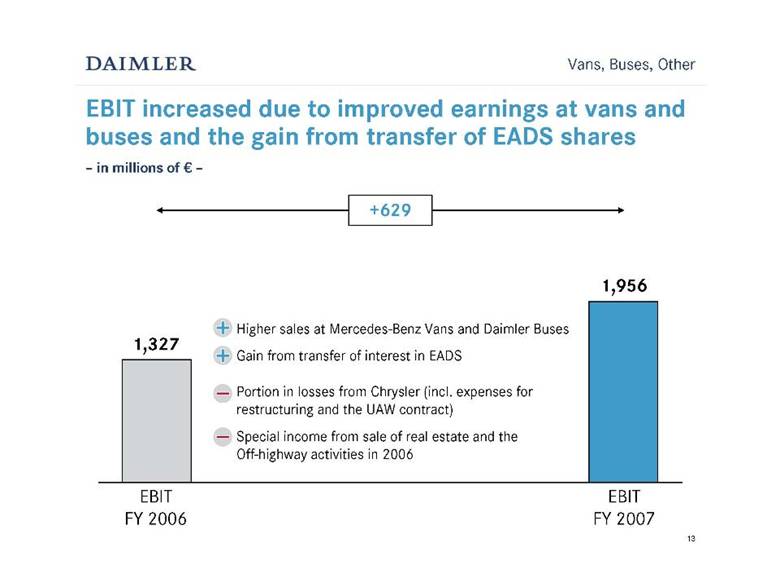

| Vans, Buses, Other + Higher sales at Mercedes-Benz Vans and Daimler Buses + Gain from transfer of interest in EADS — Portion in losses from Chrysler (incl. expenses for restructuring and the UAW contract) — Special income from sale of real estate and the Off-highway activities in 2006 EBIT increased due to improved earnings at vans and buses and the gain from transfer of EADS shares – in millions of € – EBIT FY 2006 EBIT FY 2007 1,327 1,956 +629 13 |

| EBIT improved significantly in Q4 2007 (492) (501) Vans, Buses, Other 109 147 Daimler Financial Services 1,426 978 Mercedes-Benz Cars 512 279 Daimler Trucks 1,393 550 Daimler Group (162) (353) Reconciliation / Elimination Q4 2007 Q4 2006 – in millions of € – 14 |

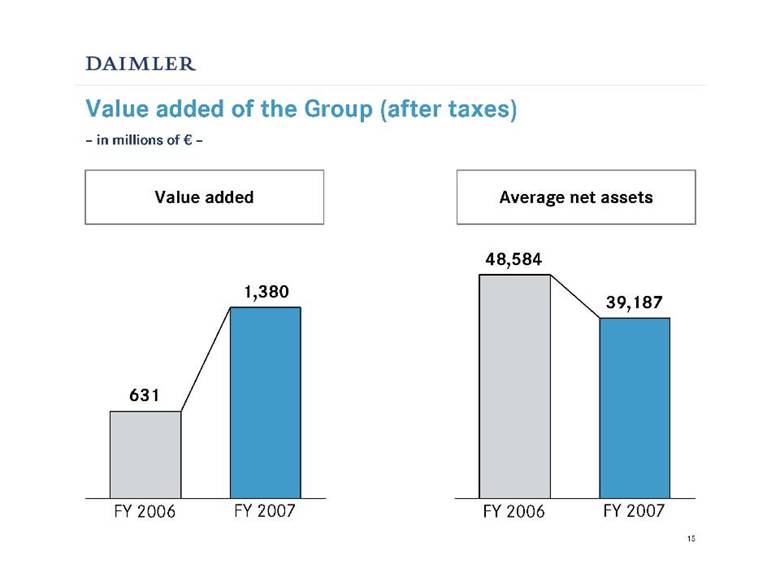

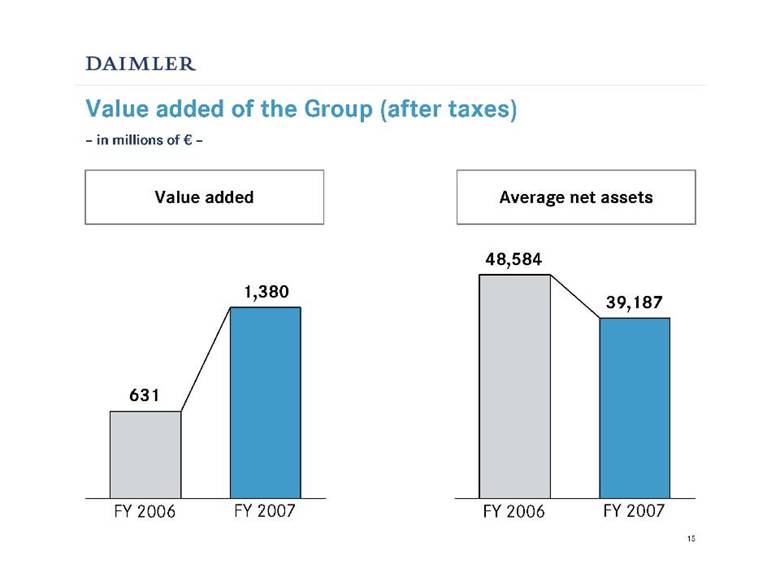

| Value added of the Group (after taxes) – in millions of € – FY 2006 FY 2007 631 1,380 FY 2006 FY 2007 48,584 39,187 Value added Average net assets 15 |

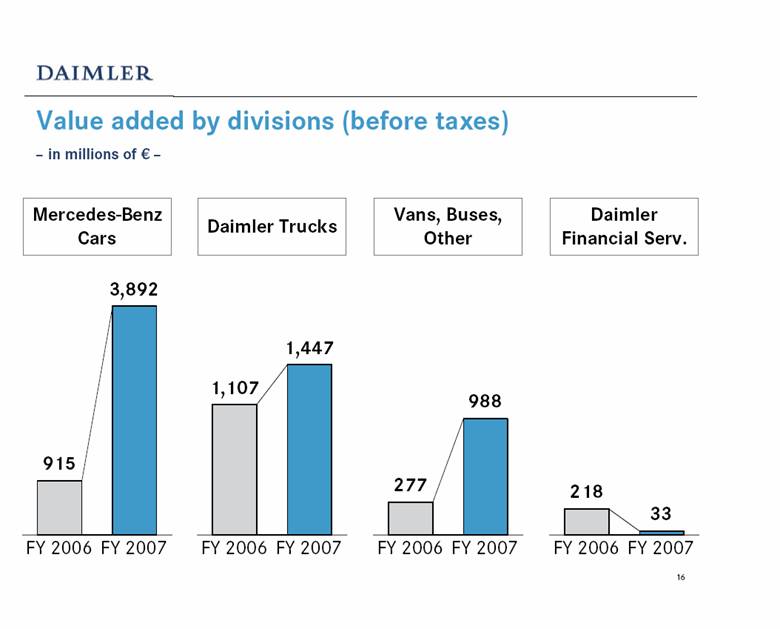

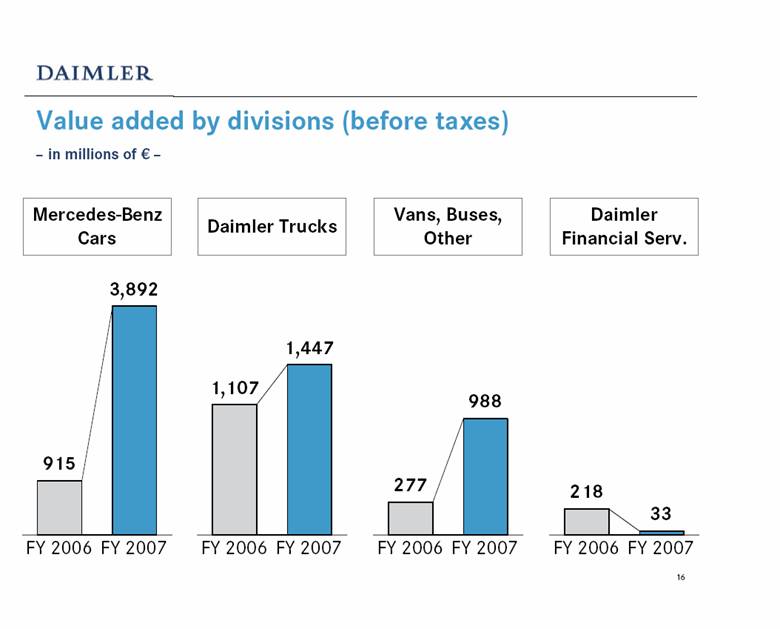

| Value added by divisions (before taxes) – in millions of € – FY 2006 FY 2007 915 3,892 Mercedes-Benz Cars FY 2006 FY 2007 1,107 1,447 Daimler Trucks FY 2006 FY 2007 218 33 Daimler Financial Serv. FY 2006 FY 2007 277 988 Vans, Buses, Other 16 |

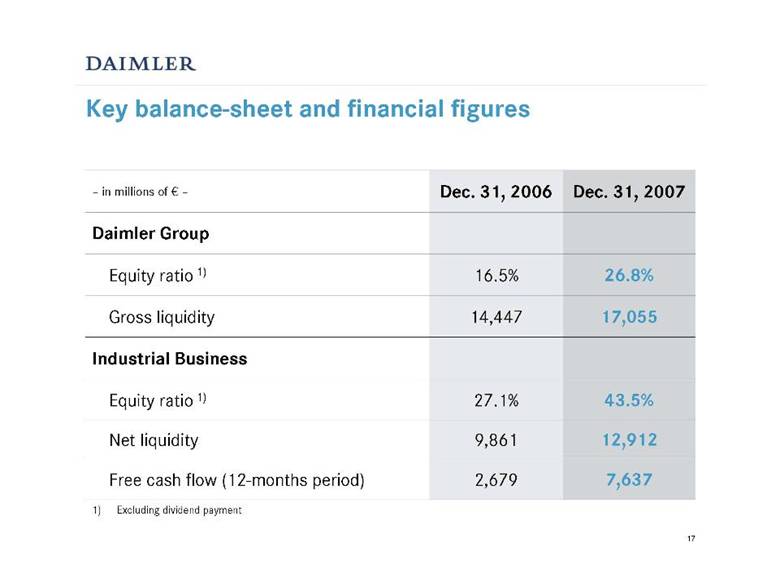

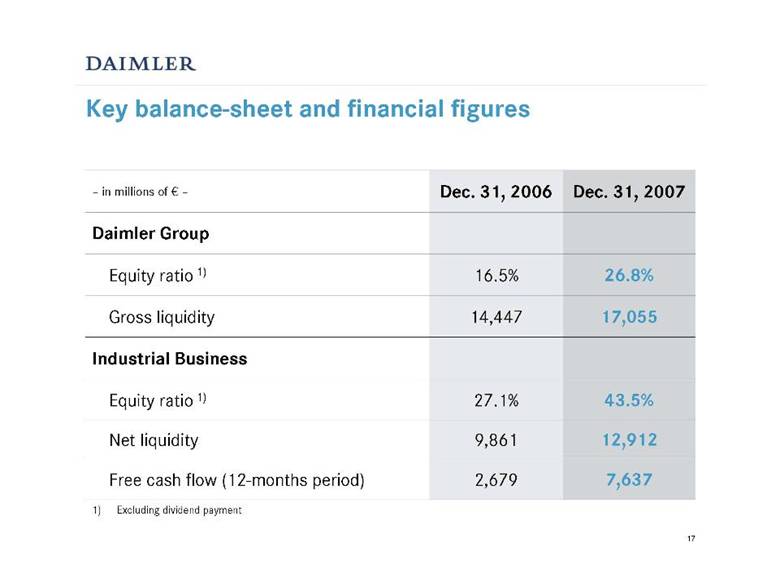

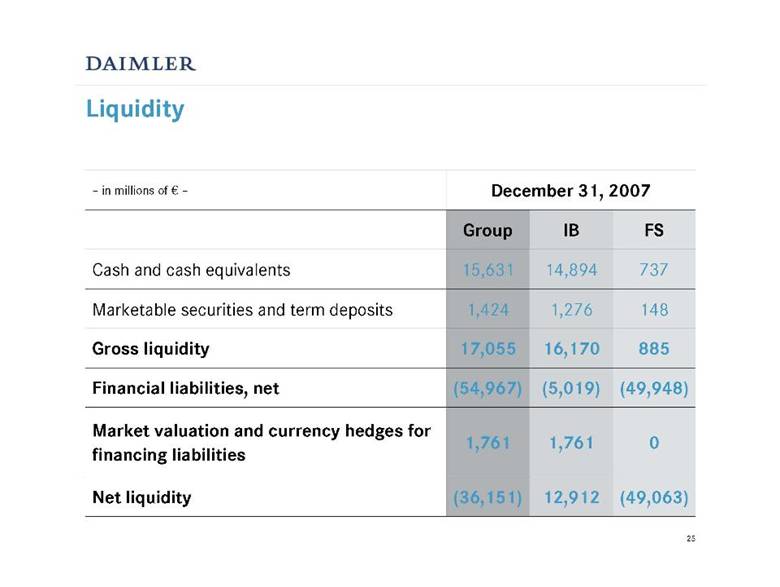

| Key balance-sheet and financial figures 12,912 9,861 Net liquidity 17,055 14,447 Gross liquidity 26.8% 16.5% Equity ratio 1) Daimler Group 7,637 2,679 Free cash flow (12-months period) 43.5% 27.1% Equity ratio 1) Industrial Business Dec. 31, 2007 Dec. 31, 2006 – in millions of € – 1) Excluding dividend payment 17 |

| 50 million shares had been bought back by December 31, 2007, equivalent to an amount of €3.5 billion All these shares were canceled by the end of FY 2007 Share buyback will be continued today Share buyback will be continued ... 18 |

| ... on the basis of increased retained earnings at Daimler AG Net profit of the parent company Daimler AG increased to €12.4 billion, of which: €6.2 billion allocated to retained earnings €4.2 billion additionally allocated to retained earnings subject to the decision of the annual meeting €2.0 billion proposed for dividend payment Boost in net profit resulted from: Strong business performance at Mercedes-Benz Cars and Daimler Trucks Dividend payments from subsidiaries Gain from transfer of interest in EADS Gain from transfer of investments Further programs subject to development of earnings, cash flows and net liquidity 19 |

| Passenger car and light truck markets: Weakening of the North American market is expected to continue Western European markets should perform at prior-year’s levels High growth rates are anticipated for the emerging markets Commercial vehicle markets: Cyclical recovery of the North American market Western European and Japanese truck markets expected at 2007 levels Assumptions for the automotive markets in 2008 20 |

| Sales outlook FY 2008 Mercedes-Benz Cars Unit sales expected above the record levels of 2007 Daimler Trucks Increase in unit sales of Trucks NAFTA anticipated; Trucks Europe/Latin America and Trucks Asia slightly above 2007 levels Mercedes-Benz Vans Extension of the Sprinter model range should result in higher unit sales Daimler Buses Further growth opportunities in Asia and Russia 21 |

| Earnings outlook Mercedes-Benz Cars ... ... expects higher EBIT in 2008 and ROS of 10% on average as of the year 2010 at the latest. Daimler Trucks ... ... expects earnings to increase in 2008, reflecting further efficiency improvements and higher unit sales. Starting in 2010, the division expects a ROS of 8% on average over the business cycle. Daimler Financial Services ... ... assumes a return on equity of at least 14% in 2008. Daimler Group For 2008, the Group expects a substantially higher EBIT from its ongoing business and aims for a ROS of 9% on average for its automotive business over the market and product cycles. 22 |

| February 14, 2008 Annual Press Conference FY 2007 and Q4 2007 Results Questions & Answers |

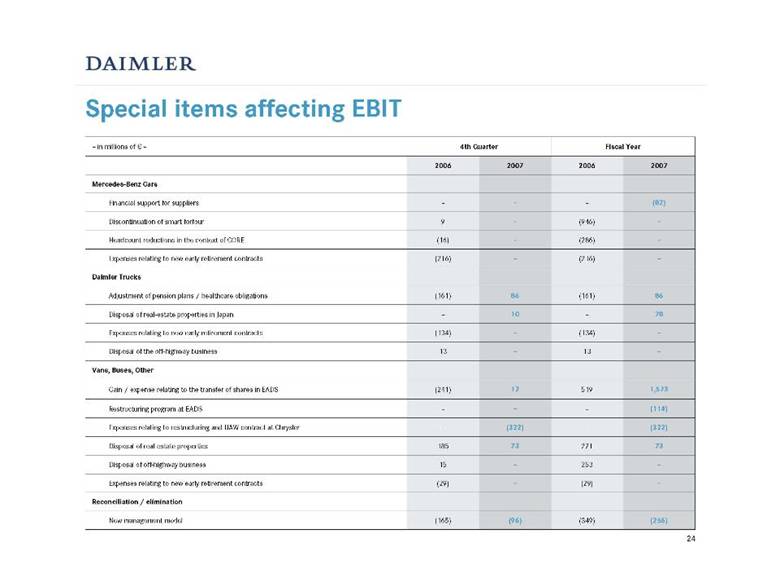

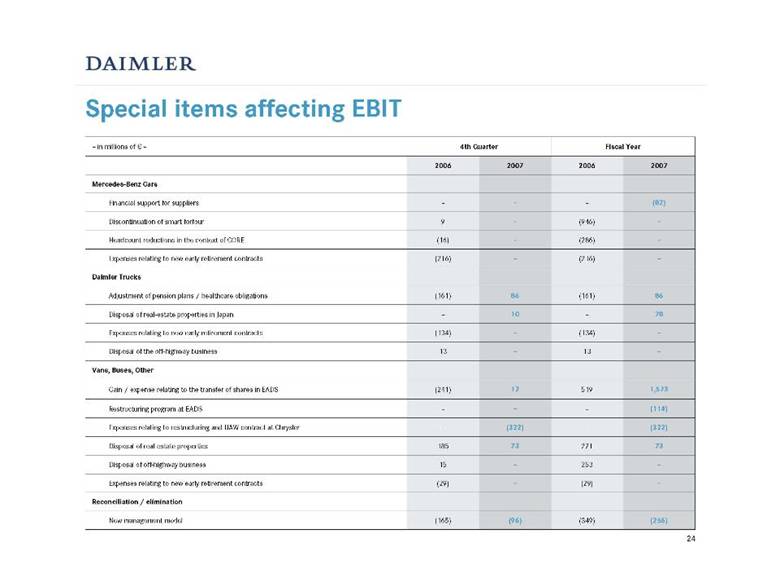

| Special items affecting EBIT 73 271 73 185 Disposal of real-estate properties (114) – – – Restructuring program at EADS 1,573 519 12 (241) Gain / expense relating to the transfer of shares in EADS 86 (161) 86 (161) Adjustment of pension plans / healthcare obligations (82) – – – Financial support for suppliers (322) – (322) – Expenses relating to restructuring and UAW contract at Chrysler – (29) – (29) Expenses relating to new early retirement contracts – 13 – 13 Disposal of the off-highway business – (134) – (134) Expenses relating to new early retirement contracts – (216) – (216) Expenses relating to new early retirement contracts 2007 2006 2007 2006 (165) 15 – (16) 9 4th Quarter (96) – 10 – – Vans, Buses, Other 78 – Disposal of real-estate properties i n Japan Daimler Trucks (256) (349) New management model Reconciliation / elimination – (946) Discontinuation of smart forfour – 253 Disposal of off-highway business Mercedes-Benz Cars – (286) Headcount reductions in the context of CORE Fiscal Year – in millions of € – 24 |

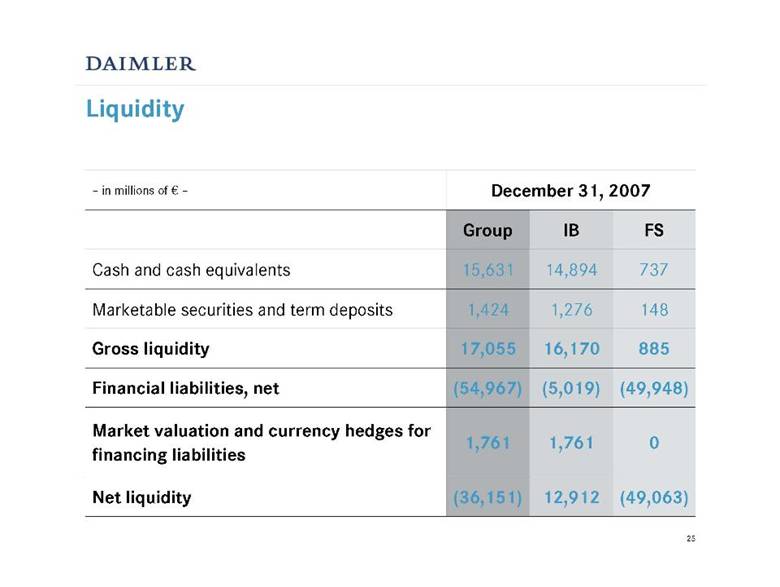

| Liquidity December 31, 2007 – in millions of € – FS IB Group (36,151) 1,761 (54,967) 17,055 1,424 15,631 (49,063) 12,912 Net liquidity 0 1,761 Market valuation and currency hedges for financing liabilities (49,948) (5,019) Financial liabilities, net 148 1,276 Marketable securities and term deposits 737 14,894 Cash and cash equivalents 885 16,170 Gross liquidity 25 |

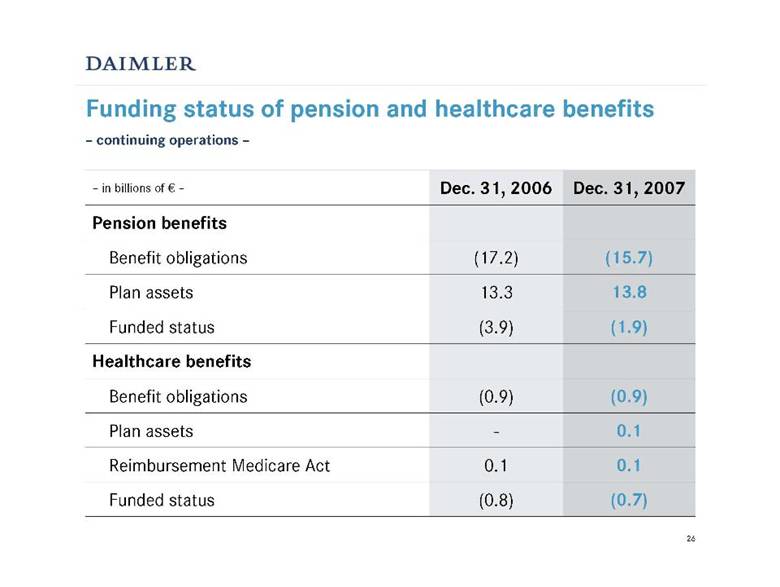

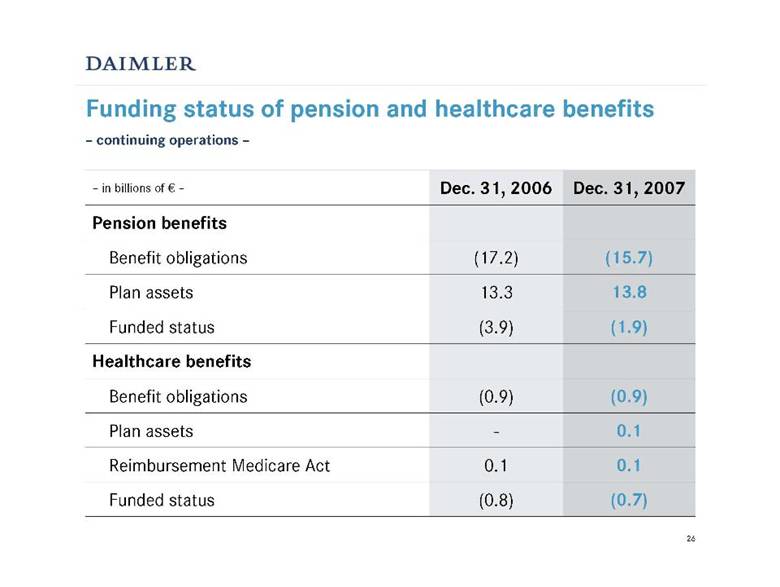

| Funding status of pension and healthcare benefits – continuing operations – 0.1 Plan assets (0.9) (0.9) Benefit obligations (15.7) (17.2) Benefit obligations (1.9) (3.9) Funded status Pension benefits 13.8 13.3 Plan assets (0.7) (0.8) Funded status 0.1 0.1 Reimbursement Medicare Act Healthcare benefits Dec. 31, 2007 Dec. 31, 2006 – in billions of € – 26 |

| Disclaimer This document contains forward-looking statements that reflect our current views about future events. The words “anticipate,” “assume,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “project,” “should” and similar expressions are used to identify forward-looking statements. These statements are subject to many risks and uncertainties, including an economic downturn or slow economic growth in important economic regions, especially in Europe or North America; changes in currency exchange rates and interest rates; the introduction of competing products and the possible lack of acceptance of our products or services which may limit our ability to raise prices; price increases in fuel, raw materials, and precious metals; disruption of production due to shortages of materials, labor strikes, or supplier insolvencies; a decline in resale prices of used vehicles; the business outlook for Daimler Trucks, which may be affected if the U.S. and Japanese commercial vehicle markets experience a sustained weakness in demand for a longer period than originally expected; the effective implementation of cost reduction and efficiency optimization programs; the business outlook of Chrysler, in which we hold an equity interest, including its ability to successfully implement its restructuring plans; the business outlook of EADS, in which we hold an equity interest, including the financial effects of delays in and potentially lower volumes of future aircraft deliveries; changes in laws, regulations and government policies, particularly those relating to vehicle emissions, fuel economy and safety, the resolution of pending governmental investigations and the outcome of pending or threatened future legal proceedings; and other risks and uncertainties, some of which we describe under the heading “Risk Report” in Daimler’s most recent Annual Report and under the headings “Risk Factors” and “Legal Proceedings” in Daimler’s most recent Annual Report on Form 20-F filed with the Securities and Exchange Commission. If any of these risks and uncertainties materialize, or if the assumptions underlying any of our forward-looking statements prove incorrect, then our actual results may be materially different from those we express or imply by such statements. We do not intend or assume any obligation to update these forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Daimler AG |

| | | |

| | | |

| By: | /s/ ppa. | Robert Köthner | |

| | Name: | Robert Köthner |

| | Title: | Vice President |

| | | Chief Accounting Officer |

| | | |

| | | |

| By: | /s/ i.V. | Silvia Nierbauer | |

| | Name: | Silvia Nierbauer |

| | Title: | Director |

| | |

| | |

Date: February 14, 2008 | | |