UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-08915 |

| |

| Exact name of registrant as specified in charter: | | Strategic Partners Asset Allocation Funds |

| |

| Address of principal executive offices: | | Gateway Center 3, 100 Mulberry Street, Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Deborah A. Docs Gateway Center 3, 100 Mulberry Street, Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 973-367-7521 |

| |

| Date of fiscal year end: | | 7/31/2005 |

| |

| Date of reporting period: | | 1/31/2005 |

Item 1 – Reports to Stockholders – [ INSERT REPORT ]

SEMIANNUAL REPORT

JANUARY 31, 2005

STRATEGIC PARTNERS

ASSET ALLOCATION FUNDS

STRATEGIC PARTNERS

Conservative Growth Fund

OBJECTIVE

Seeks current income and a reasonable level of capital appreciation

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

Dear Shareholder,

March 15, 2005

We hope that you find the semiannual report for the Strategic Partners Conservative Growth Fund informative and useful. As a Strategic Partners Mutual Fund shareholder, you may be thinking where you can find additional growth opportunities. You could invest in last year’s top-performing asset class and hope that history repeats itself or you could stay in cash while waiting for the “right moment” to invest.

We believe it is wise to take advantage of developing domestic and global investment opportunities through a diversified portfolio of stock and bond mutual funds. A diversified asset allocation offers two advantages. It helps you manage downside risk by not being overly exposed to any particular asset class, plus it gives you a better opportunity to have at least some of your assets in the right place at the right time. Your financial professional can help you create a diversified investment plan that may include mutual funds that cover all the basic asset classes and reflects your personal investment profile and tolerance for risk.

Strategic Partners Mutual Funds gives you a wide range of choices that can help you make progress toward your financial goals. Our funds feature leading asset managers not just from a single company but from the entire investment industry.

Thank you for choosing Strategic Partners Mutual Funds.

Sincerely,

Judy A. Rice, President

Strategic Partners Conservative Growth Fund

| | |

| Strategic Partners Asset Allocation Funds/Strategic Partners Conservative Growth Fund | | 1 |

Your Fund’s Performance

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data current to the most recent month-end by visiting our website at www.strategicpartners.com or by calling (800) 225-1852. The maximum initial sales charge is 5.50% (Class A Shares).

| | | | | | | | |

| Cumulative Total Returns1 as of 1/31/05 | | | | | | | | |

| | | Six Months | | One Year | | Five Years | | Since Inception2 |

Class A | | 6.87% | | 5.87% | | 29.50% | | 43.88% |

Class B | | 6.48 | | 5.10 | | 24.91 | | 37.51 |

Class C | | 6.48 | | 5.10 | | 24.91 | | 37.51 |

Class M | | N/A | | N/A | | N/A | | 3.20 |

Class R | | N/A | | N/A | | N/A | | 3.29 |

Class X | | N/A | | N/A | | N/A | | 3.11 |

Class Z | | 7.00 | | 6.13 | | 31.03 | | 46.12 |

S&P 500 Index3 | | 8.15 | | 6.22 | | –8.55 | | *** |

Customized Blend4 | | 6.99 | | 6.30 | | 28.18 | | **** |

Lipper Balanced Funds Avg.5 | | 6.88 | | 5.12 | | 13.39 | | ***** |

| | | | | | | | | |

| Average Annual Total Returns1 as of 12/31/04 | | | | |

| | | | | One Year | | Five Years | | Since Inception2 |

Class A | | | | 2.77% | | 3.90% | | 5.35% |

Class B | | | | 2.86 | | 4.14 | | 5.54 |

Class C | | | | 6.86 | | 4.31 | | 5.54 |

Class M | | | | N/A | | N/A | | N/A |

Class R | | | | N/A | | N/A | | N/A |

Class X | | | | N/A | | N/A | | N/A |

Class Z | | | | 9.02 | | 5.33 | | 6.60 |

S&P 500 Index3 | | | | 10.87 | | –2.30 | | 2.17 |

Customized Blend4 | | | | 9.10 | | 4.89 | | 5.75 |

Lipper Balanced Funds Avg.5 | | | | 7.93 | | 2.01 | | 3.82 |

The cumulative total returns do not reflect the deduction of applicable sales charges. If reflected, the applicable sales charges would reduce the cumulative total returns performance quoted. Class A shares are subject to a maximum front-end sales charge of 5.50%. Under certain circumstances, Class A shares may be subject to a contingent deferred sales charge (CDSC) of 1%. Class B and Class C shares are subject to a maximum CDSC of 5% and 1% respectively. Class M and Class X shares are subject to a maximum CDSC of 6%. Class R and Class Z shares are not subject to a sales charge.

| | |

| 2 | | Visit our website at www.strategicpartners.com |

1Source: Prudential Investments LLC and Lipper Inc. The average annual total returns take into account applicable sales charges. During certain periods shown, fee waivers and/or expense reimbursements were in effect. Without such fee waivers and expense reimbursements, the returns for the classes would have been lower. Class A, Class B, Class C, Class M, Class R, and Class X shares are subject to an annual distribution and service (12b-1) fee of up to 0.30%, 1.00%, 1.00%, 1.00%, 0.75%, and 1.00% respectively. Approximately seven years after purchase, Class B shares will automatically convert to Class A shares on a quarterly basis. Approximately eight years after purchase, Class M shares will automatically convert to Class A shares on a quarterly basis. Approximately ten years after purchase (eight years in the case of shares purchased prior to August 19, 1998), Class X shares will automatically convert to Class A shares on a quarterly basis. Class Z shares are not subject to a 12b-1 fee. The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares.

2Inception dates: Class A, Class B, Class C, and Class Z, 11/18/98; Class M, Class R, and Class X, 10/04/04.

3The Standard & Poor’s 500 Composite Stock Price Index (S&P 500 Index) is an unmanaged index of 500 stocks of large U.S. public companies. It gives a broad look at how U.S. stock prices have performed.

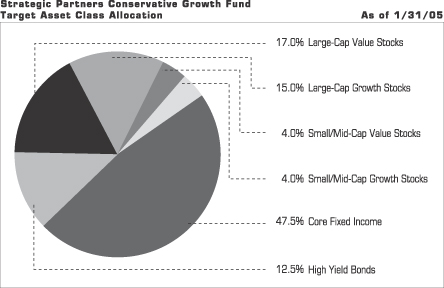

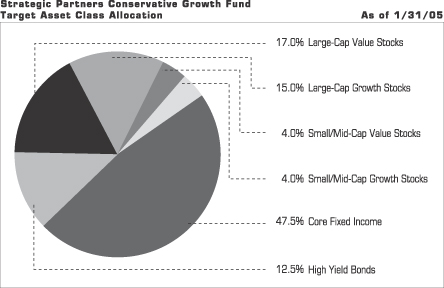

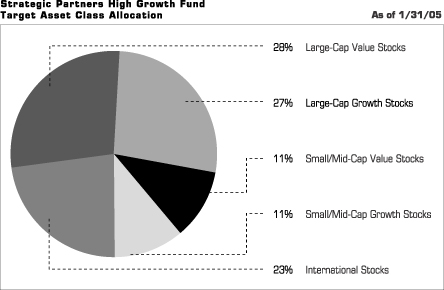

4The Customized Benchmark for Strategic Partners Conservative Growth Fund (Customized Blend) is a model portfolio consisting of the S&P Barra Value Index (15%), the S&P Barra Growth Index (15%), the Russell 2000 Value Index (5%), the Russell 2000 Growth Index (5%), the Lehman Brothers U.S. Aggregate Bond Index (40%), and the Lehman Brothers U.S. Corporate High Yield Index (20%). Each component of the Customized Blend is an unmanaged index generally considered as representing the performance of its asset class. The Customized Blend is intended to provide a theoretical comparison to the Fund’s performance, based on the amounts allocated to each asset class. The Customized Blend does not reflect deductions for any sales charges or operating expenses of a mutual fund.

5The Lipper Balanced Funds Average (Lipper Average) represents returns based on the average return of all funds in the Lipper Balanced Funds category for the periods noted. Funds in the Lipper Average have a primary investment objective of conserving principal by maintaining at all times a balanced portfolio of both stocks and bonds. Typically, the stock:bond ratio ranges around 60%:40%.

Investors cannot invest directly in an index. The returns for the S&P 500 Index and the Customized Blend would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes. Returns for the Lipper Average reflect the deduction of operating expenses, but not sales charges or taxes. The Since Inception returns for the S&P 500 Index, Customized Blend, and the Lipper Average are measured from the closest month-end to inception date, and not from the Fund’s actual inception date.

***S&P 500 Index Closest Month-End to inception cumulative total returns as of 1/31/05 are 11.18% for Classes A, B, C, and Z. S&P 500 Index Closest Month-End to inception cumulative total returns as of 1/31/05 are 6.57% for Classes M, R, and X.

****Customized Blend Closest Month-End to inception cumulative total returns as of 1/31/05 are 39.22% for Classes A, B, C, and Z. Customized Blend Closest Month-End to inception cumulative total returns as of 1/31/05 are 4.46% for Classes M, R, and X.

*****Lipper Average Closest Month-End to inception cumulative total returns as of 1/31/05 are 25.31% for Classes A, B, C, and Z. Lipper Average Closest Month-End to inception cumulative total returns as of 1/31/05 are 5.02% for Classes M, R, and X.

| | |

| Strategic Partners Asset Allocation Funds/Strategic Partners Conservative Growth Fund | | 3 |

Your Fund’s Performance

Fund objective

The investment objective of the Strategic Partners Conservative Growth Fund (the Fund) is current income and a reasonable level of capital appreciation. There can be no assurance that the Fund will achieve its investment objective.

Please note that on or about March 31, 2005, the Fund intends to change its name to Strategic Partners Conservative Allocation Fund and to change certain subadvisers for certain portions of the Fund’s portfolio.

Asset classes are classifications of investments

Stocks are shares of ownership in a firm. Owners share in the profits after debts are paid and in the firm’s appreciation in value. Generally, the prices of stocks vary with investors’ estimates of a firm’s earnings prospects, including the impact of broader economic conditions.

Bonds are loans to a company, government, or government agency. They carry a fixed interest rate or one that varies according to the terms specified in the bond. They have a maturity date at which they must be repaid. Generally, bond prices fluctuate with current interest rates and with events that affect the debtor’s prospects of repaying the loan. High yield bonds are also known as “junk” bonds. They are subject to greater risk of loss of principal and interest, including default risk, than higher-rated bonds.

| | |

| 4 | | Visit our website at www.strategicpartners.com |

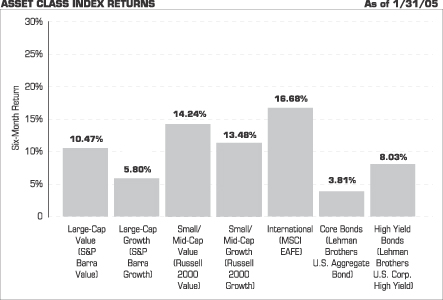

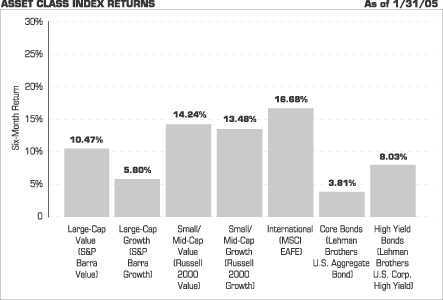

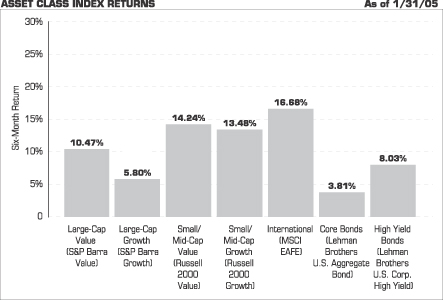

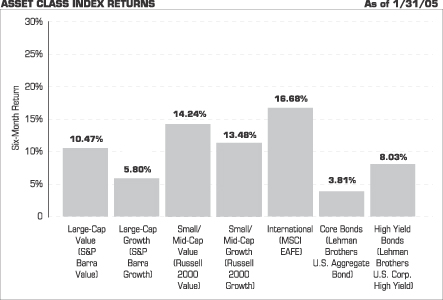

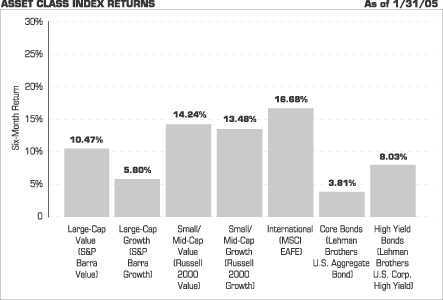

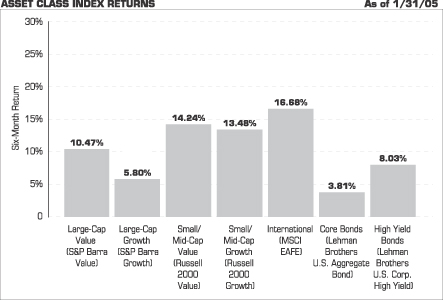

Source: Lipper Inc.

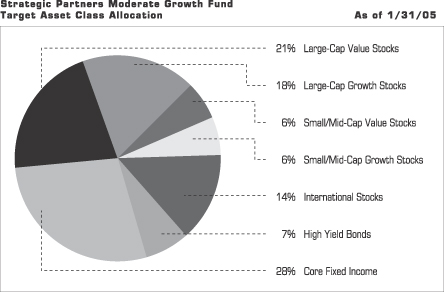

The chart above shows the total returns for six months ended January 31, 2005, of various securities indexes that are generally considered representative of broad market sectors and does not reflect a mutual fund’s expenses. The performance cited does not represent the performance of the Strategic Partners Conservative Growth Fund. Past performance is not indicative of future results. Investors cannot invest directly in an index.

The S&P Barra Value Index contains those securities in the S&P 500 Index with higher book-to-price ratios.

The S&P Barra Growth Index contains those securities in the S&P 500 Index with lower book-to-price ratios.

The Russell 2000 Value Index contains those securities in the Russell 2000 Index with a below-average growth orientation. Companies in this index generally have low price-to-book and price-to-earnings ratios, higher dividend yields, and lower forecasted growth values.

The Russell 2000 Growth Index contains those securities in the Russell 2000 Index with an above-average growth orientation. Companies in this index tend to exhibit higher price-to-book and price-to-earnings ratios, lower dividend yields, and higher forecasted growth values.

The Morgan Stanley Capital International Europe, Australasia, and Far East Index (MSCI EAFE Index) is an unmanaged, weighted index that reflects stock price movements in Europe, Australasia, and the Far East. It gives a broad look at how foreign stock prices have performed.

The Lehman Brothers U.S. Aggregate Bond Index is an unmanaged index of investment-grade securities issued by the U.S. government and its agencies, and by corporations with between 1 and 10 years remaining to maturity. It gives a broad look at how short- and intermediate-term bonds have performed.

The Lehman Brothers U.S. Corporate High Yield Index is an unmanaged index of fixed-rate, noninvestment-grade debt securities with at least one year remaining to maturity. The Lehman Brothers U.S. Corporate High Yield Index gives a broad look at how high yield (junk) bonds have performed.

| | |

| Strategic Partners Asset Allocation Funds/Strategic Partners Conservative Growth Fund | | 5 |

Fees and Expenses (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested on August 1, 2004, at the beginning of the period, and held through the six-month period ended January 31, 2005.

The Fund may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table. These fees apply to Individual Retirement Accounts (IRAs), Section 403(b) accounts, and Section 529 plan accounts. As of the close of the six months covered by the table, IRA fees included a setup fee of $5, a maintenance fee of up to $36 annually ($18 for the six-month period), and a termination fee of $10. Section 403(b) accounts and Section 529 plan accounts are each charged an annual $25 fiduciary maintenance fee ($12.50 for the six-month period). Some of the fees vary in amount, or are waived, based on your total account balance or the number of JennisonDryden or Strategic Partners funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information provided in the expense table. Additional fees have the effect of reducing investment returns.

Actual Expenses

The first line for each share class in the following table provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not

| | |

| 6 | | Visit our website at www.strategicpartners.com |

be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only, and do not reflect any transactional costs such as sales charges (loads). Therefore the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Classes M, R and X have been in existence for less than six months, therefore no expenses are presented for these classes. Classes M, R and X commenced October 4, 2004.

| | | | | | | | | | | | | | |

Strategic Partners

Conservative Growth

Fund | | Beginning Account

Value

August 1, 2004 | | Ending Account

Value January 31, 2005 | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the Six-

Month Period* |

| | | | | | | | | | | | | | | |

| Class A | | Actual | | $ | 1,000 | | $ | 1,069 | | 1.37 | % | | $ | 7.14 |

| | | Hypothetical | | $ | 1,000 | | $ | 1,018 | | 1.37 | % | | $ | 6.97 |

| | | | | | | | | | | | | | | |

| Class B | | Actual | | $ | 1,000 | | $ | 1,065 | | 2.12 | % | | $ | 11.03 |

| | | Hypothetical | | $ | 1,000 | | $ | 1,015 | | 2.12 | % | | $ | 10.77 |

| | | | | | | | | | | | | | | |

| Class C | | Actual | | $ | 1,000 | | $ | 1,065 | | 2.12 | % | | $ | 11.03 |

| | | Hypothetical | | $ | 1,000 | | $ | 1,015 | | 2.12 | % | | $ | 10.77 |

| | | | | | | | | | | | | | | |

| Class Z | | Actual | | $ | 1,000 | | $ | 1,070 | | 1.12 | % | | $ | 5.84 |

| | | Hypothetical | | $ | 1,000 | | $ | 1,020 | | 1.12 | % | | $ | 5.70 |

| | | | | | | | | | | | | | | |

* Fund expenses for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended January 31, 2005, and divided by the 365 days in the Fund’s fiscal year ending July 31, 2005 (to reflect the six-month period).

| | |

| Strategic Partners Asset Allocation Funds/Strategic Partners Conservative Growth Fund | | 7 |

This Page Intentionally Left Blank

Portfolio of Investments

as of January 31, 2005 (Unaudited)

| | | | | |

| Shares | | Description | | Value (Note1) |

| | | | | | |

LONG-TERM INVESTMENTS 79.6% | | | |

COMMON STOCK 38.5% | | | |

| |

Aerospace & Defense 0.6% | | | |

| 2,240 | | Applied Signal Technology, Inc. | | $ | 66,013 |

| 2,580 | | DRS Technologies, Inc.(a) | | | 104,748 |

| 200 | | Empresa Brasileira de Aeronautica SA | | | 6,370 |

| 1,500 | | Engineered Support Systems, Inc. | | | 87,015 |

| 6,400 | | Lockheed Martin Corp. | | | 369,984 |

| 2,990 | | Mercury Computer Systems, Inc.(a) | | | 92,600 |

| 2,750 | | Moog, Inc. (Class A shares)(a) | | | 119,598 |

| 6,500 | | Northrop Grumman Corp. | | | 337,220 |

| | | | |

|

|

| | | | | | 1,183,548 |

| |

Air Freight & Logistics 0.2% | | | |

| 6,900 | | United Parcel Service, Inc., (Class B shares) | | | 515,292 |

| |

Apparel 0.2% | | | |

| 9,160 | | Ashworth, Inc.(a) | | | 103,233 |

| 2,580 | | Oxford Industries, Inc. | | | 95,925 |

| 5,400 | | Phillips-Van Heusen Corp. | | | 146,934 |

| | | | |

|

|

| | | | | | 346,092 |

| |

Auto Components | | | |

| 5,420 | | IMPCO Technologies, Inc.(a) | | | 31,599 |

| | |

Automobiles | | | | | |

| 2,200 | | Winnebago Industries, Inc. | | | 75,878 |

| |

Banks 0.1% | | | |

| 3,300 | | BankUnited Financial Corp. (Class A shares)(a) | | | 96,294 |

| 1,100 | | Hibernia Corp. (Class A shares) | | | 28,952 |

| 2,700 | | PrivateBancorp, Inc. | | | 88,290 |

| | | | |

|

|

| | | | | | 213,536 |

| |

Biotechnology 0.9% | | | |

| 10,400 | | Amgen, Inc.(a) | | | 647,296 |

| 14,900 | | Genentech, Inc.(a) | | | 710,879 |

| 10,500 | | Gilead Sciences, Inc.(a) | | | 347,550 |

| 10,300 | | Medimmune, Inc.(a) | | | 243,647 |

| | | | |

|

|

| | | | | | 1,949,372 |

See Notes to Financial Statements.

| | |

| Strategic Partners Asset Allocation Funds/Strategic Partners Conservative Growth Fund | | 9 |

Portfolio of Investments

as of January 31, 2005 (Unaudited) Cont’d.

| | | | | |

| Shares | | Description | | Value (Note1) |

| | | | | | |

Building Products 0.1% | | | |

| 3,400 | | Watsco, Inc. | | $ | 117,674 |

| |

Capital Markets 1.6% | | | |

| 4,800 | | Goldman Sachs Group, Inc. | | | 517,680 |

| 7,800 | | Lehman Brothers Holdings, Inc. | | | 711,282 |

| 9,500 | | Mellon Financial Corp. | | | 278,825 |

| 19,400 | | Merrill Lynch & Co., Inc. | | | 1,165,358 |

| 16,000 | | The Bank of New York Co., Inc. | | | 475,360 |

| 25,100 | | The Charles Schwab Corp. | | | 282,124 |

| | | | |

|

|

| | | | | | 3,430,629 |

| |

Chemicals 0.5% | | | |

| 8,600 | | E. I. Du Pont de Nemours & Co. | | | 409,016 |

| 27,100 | | Mosaic Company(a) | | | 447,150 |

| 1,600 | | Scotts Co. (Class A shares)(a) | | | 108,736 |

| 1,500 | | Valspar Corp. | | | 73,500 |

| | | | |

|

|

| | | | | | 1,038,402 |

| |

Commercial Banks 0.5% | | | |

| 15,706 | | Bank of America Corp. | | | 728,287 |

| 4,330 | | Nara Bancorp, Inc. | | | 86,384 |

| 2,900 | | Oriental Financial Group | | | 81,780 |

| 1,780 | | Signature Bank(a) | | | 54,165 |

| 2,950 | | Southwest Bancorp of Texas, Inc. | | | 58,322 |

| | | | |

|

|

| | | | | | 1,008,938 |

| |

Commercial Services & Supplies 1.1% | | | |

| 5,300 | | Administaff, Inc.(a) | | | 77,327 |

| 8,100 | | Allied Waste Industries, Inc.(a) | | | 67,311 |

| 20,100 | | Cendant Corp. | | | 473,356 |

| 1,750 | | Chemed Corp. | | | 125,335 |

| 2,300 | | Kelly Services, Inc. (Class A shares) | | | 66,930 |

| 9,660 | | Kforce, Inc.(a) | | | 106,936 |

| 2,090 | | Laureate Education, Inc.(a) | | | 92,712 |

| 1,590 | | Mcgrath Rentcorp | | | 68,306 |

| 3,220 | | Navigant Consulting, Inc.(a) | | | 77,055 |

| 18,900 | | PHH Corp.(a) | | | 415,800 |

| 3,890 | | Providence Service, Corp.(a) | | | 78,967 |

| 3,200 | | Republic Services, Inc. | | | 105,504 |

| 2,500 | | School Specialty, Inc.(a) | | | 97,225 |

| 15,700 | | Waste Management, Inc. | | | 455,300 |

| | | | |

|

|

| | | | | | 2,308,064 |

See Notes to Financial Statements.

| | |

| 10 | | Visit our website at www.strategicpartners.com |

| | | | | |

| Shares | | Description | | Value (Note1) |

| | | | | | |

Communication Equipment 1.1% | | | |

| 19,400 | | Avaya, Inc.(a) | | $ | 278,390 |

| 34,400 | | Cisco Systems, Inc.(a) | | | 620,576 |

| 6,700 | | Harmonic, Inc.(a) | | | 76,380 |

| 97,200 | | Nortel Networks Corp. (Canada)(a) | | | 315,900 |

| 18,500 | | Qualcomm, Inc. | | | 688,940 |

| 3,700 | | Research In Motion Ltd.(a) | | | 263,773 |

| 6,960 | | Symmetricom, Inc.(a) | | | 67,721 |

| | | | |

|

|

| | | | | | 2,311,680 |

| |

Computers & Peripherals 1.2% | | | |

| 11,600 | | Apple Computer, Inc.(a) | | | 892,040 |

| 17,300 | | Dell, Inc.(a) | | | 722,448 |

| 4,000 | | IBM Corp. | | | 373,680 |

| 1,900 | | Lexmark International, Inc.(a) | | | 158,365 |

| 3,100 | | M-Systems Flash Disk Pioneers (Israel)(a) | | | 62,341 |

| 3,880 | | Optimal Group, Inc.(a) | | | 51,876 |

| 15,900 | | Seagate Technology (Cayman Islands)(a) | | | 269,028 |

| | | | |

|

|

| | | | | | 2,529,778 |

| |

Consumer Finance 0.6% | | | |

| 17,900 | | American Express Co. | | | 954,965 |

| 12,500 | | MBNA Corp. | | | 332,250 |

| | | | |

|

|

| | | | | | 1,287,215 |

| | |

Distributors | | | | | |

| 4,030 | | Beacon Roofing Supply, Inc.(a) | | | 80,600 |

| |

Diversified Financial Services 1.9% | | | |

| 2,900 | | Accredited Home Lenders Holding Co.(a) | | | 140,882 |

| 7,900 | | AmeriCredit Corp.(a) | | | 193,945 |

| 2,300 | | Astoria Financial Corp. | | | 86,572 |

| 22,500 | | Citigroup, Inc. | | | 1,103,625 |

| 6,600 | | Eaton Vance Corp. | | | 165,198 |

| 33,100 | | J.P. Morgan Chase & Co. | | | 1,235,622 |

| 4,500 | | Jefferies Group, Inc. | | | 175,500 |

| 13,700 | | Principal Financial Group | | | 555,946 |

| 4,750 | | Raymond James Financial, Inc. | | | 148,058 |

| 500 | | Student Loan Corp. | | | 90,330 |

| | | | |

|

|

| | | | | | 3,895,678 |

| |

Diversified Manufacturing | | | |

| 142 | | GenTek, Inc.(a) | | | 6,355 |

See Notes to Financial Statements.

| | |

| Strategic Partners Asset Allocation Funds/Strategic Partners Conservative Growth Fund | | 11 |

Portfolio of Investments

as of January 31, 2005 (Unaudited) Cont’d.

| | | | | |

| Shares | | Description | | Value (Note1) |

| | | | | | |

Diversified Telecommunication Services 0.6% | | | |

| 6,400 | | Alltel Corp. | | $ | 352,256 |

| 3,340 | | SafeNet, Inc.(a) | | | 113,360 |

| 22,300 | | SBC Communications, Inc. | | | 529,848 |

| 8,200 | | Verizon Communications, Inc. | | | 291,838 |

| | | | |

|

|

| | | | | | 1,287,302 |

| |

Electric Utilities 0.8% | | | |

| 3,000 | | E.ON AG ADR (Germany) | | | 268,170 |

| 9,400 | | Exelon Corp. | | | 415,950 |

| 4,200 | | PNM Resources, Inc. | | | 105,966 |

| 12,600 | | TXU Corp. | | | 871,920 |

| | | | |

|

|

| | | | | | 1,662,006 |

| |

Electrical Equipment | | | |

| 8,050 | | Artesyn Technologies, Inc.(a) | | | 81,949 |

| |

Electronic Equipment & Instruments 0.7% | | | |

| 31,200 | | Agilent Technologies, Inc.(a) | | | 689,832 |

| 3,190 | | BEI Technologies, Inc. | | | 89,926 |

| 1,200 | | Ceradyne, Inc.(a) | | | 40,476 |

| 7,400 | | Checkpoint Systems, Inc.(a) | | | 115,144 |

| 2,360 | | Faro Technologies, Inc.(a) | �� | | 68,062 |

| 3,600 | | FLIR Systems, Inc.(a) | | | 219,420 |

| 3,260 | | Radisys Corp.(a) | | | 56,887 |

| 10,100 | | Sanmina-SCI Corp.(a) | | | 62,418 |

| 12,850 | | SRS Labs., Inc.(a) | | | 66,692 |

| | | | |

|

|

| | | | | | 1,408,857 |

| |

Energy Equipment & Services 1.4% | | | |

| 1,730 | | Cal Dive International, Inc.(a) | | | 75,601 |

| 5,000 | | ENSCO International, Inc. | | | 171,150 |

| 18,100 | | GlobalSantaFe Corp. | | | 640,016 |

| 11,100 | | Halliburton Co. | | | 456,543 |

| 2,160 | | Maverick Tube Corp.(a) | | | 73,570 |

| 5,500 | | Patterson-UTI Energy, Inc. | | | 106,975 |

| 17,300 | | Schlumberger Ltd. (Netherlands) | | | 1,177,092 |

| 5,620 | | Superior Energy Services, Inc.(a) | | | 89,470 |

| 1,900 | | Unit Corp.(a) | | | 69,426 |

| | | | |

|

|

| | | | | | 2,859,843 |

See Notes to Financial Statements.

| | |

| 12 | | Visit our website at www.strategicpartners.com |

| | | | | |

| Shares | | Description | | Value (Note1) |

| | | | | | |

Food & Staples Retailing 0.9% | | | |

| 6,400 | | Costco Wholesale Corp. | | $ | 302,528 |

| 52,900 | | Kroger Co.(a) | | | 904,590 |

| 7,600 | | Whole Foods Market, Inc. | | | 679,592 |

| | | | |

|

|

| | | | | | 1,886,710 |

| |

Food Products 0.3% | | | |

| 19,700 | | Cadbury Schweppes PLC, ADR | | | 715,110 |

| |

Health Care Equipment & Supplies 0.6% | | | |

| 5,200 | | Abaxis, Inc.(a) | | | 70,512 |

| 1,490 | | Advanced Neuromodulation Systems, Inc.(a) | | | 58,870 |

| 4,200 | | Alcon, Inc. (Switzerland) | | | 332,639 |

| 3,700 | | Closure Medical Corp.(a) | | | 73,408 |

| 3,700 | | Cooper Companies, Inc. | | | 283,789 |

| 12,650 | | Encore Medical Corp.(a) | | | 71,346 |

| 900 | | Intuitive Surgical, Inc.(a) | | | 35,910 |

| 1,630 | | Laserscope(a) | | | 48,167 |

| 3,650 | | Lifeline Systems, Inc.(a) | | | 99,609 |

| 15,950 | | Orthovita, Inc.(a) | | | 61,089 |

| 2,590 | | PolyMedica Corp. | | | 96,944 |

| 15,450 | | Spectranetics Corp.(a) | | | 95,790 |

| 900 | | St. Jude Medical, Inc. | | | 35,352 |

| | | | |

|

|

| | | | | | 1,363,425 |

| |

Health Care Providers & Services 1.9% | | | |

| 4,200 | | Accredo Health, Inc.(a) | | | 125,076 |

| 3,690 | | America Service Group, Inc.(a) | | | 101,217 |

| 5,000 | | American Healthways, Inc.(a) | | | 155,900 |

| 2,100 | | Amerigroup Corp.(a) | | | 86,331 |

| 9,400 | | Caremark Rx, Inc.(a) | | | 367,540 |

| 6,300 | | Cigna Corp. | | | 505,575 |

| 3,700 | | Covance, Inc.(a) | | | 157,250 |

| 8,600 | | Express Scripts, Inc. (Class A shares)(a) | | | 638,033 |

| 2,640 | | Kindred Healthcare, Inc.(a) | | | 72,310 |

| 3,570 | | LabOne, Inc.(a) | | | 119,774 |

| 6,804 | | Medco Health Solutions, Inc.(a) | | | 289,646 |

| 4,800 | | Pharmaceutical Product Development, Inc.(a) | | | 198,960 |

| 5,100 | | Serologicals Corp. International(a) | | | 120,564 |

| 6,400 | | UnitedHealth Group, Inc. | | | 568,959 |

| 4,400 | | WellPoint, Inc.(a) | | | 534,600 |

| | | | |

|

|

| | | | | | 4,041,735 |

See Notes to Financial Statements.

| | |

| Strategic Partners Asset Allocation Funds/Strategic Partners Conservative Growth Fund | | 13 |

Portfolio of Investments

as of January 31, 2005 (Unaudited) Cont’d.

| | | | | |

| Shares | | Description | | Value (Note1) |

| | | | | | |

Homebuilding 0.2% | | | |

| 6,200 | | Hovnanian Enterprises, Inc. (Class A shares)(a) | | $ | 323,888 |

| |

Hotels, Restaurants & Leisure 0.8% | | | |

| 3,200 | | Brinker International, Inc.(a) | | | 120,352 |

| 2,200 | | CEC Entertainment, Inc.(a) | | | 86,108 |

| 10,020 | | Cosi, Inc.(a) | | | 60,120 |

| 11,000 | | McDonald’s Corp. | | | 356,290 |

| 2,300 | | Mikohn Gaming Corp.(a) | | | 23,000 |

| 3,025 | | Rare Hospitality International, Inc.(a) | | | 95,288 |

| 6,950 | | Scientific Games Corp. (Class A shares)(a) | | | 178,754 |

| 3,300 | | Sonic Corp.(a) | | | 105,072 |

| 10,600 | | Starbucks Corp.(a) | | | 572,400 |

| | | | |

|

|

| | | | | | 1,597,384 |

| |

Household Durables 0.6% | | | |

| 6,200 | | Harman International Industries, Inc. | | | 754,230 |

| 3,200 | | Meritage Corp.(a) | | | 206,880 |

| 4,200 | | Snap-On, Inc. | | | 139,062 |

| 2,800 | | Standard-Pacific Corp. | | | 186,284 |

| | | | |

|

|

| | | | | | 1,286,456 |

| |

Household Products 0.5% | | | |

| 2,270 | | Cost Plus, Inc.(a) | | | 59,542 |

| 6,900 | | Kimberly-Clark Corp. | | | 452,019 |

| 8,300 | | Procter & Gamble Co. | | | 441,809 |

| | | | |

|

|

| | | | | | 953,370 |

| |

Industrial Conglomerates 1.5% | | | |

| 53,300 | | General Electric Co. | | | 1,925,729 |

| 4,800 | | Phelps Dodge Corp. | | | 462,240 |

| 18,800 | | Tyco International Ltd. (Bermuda) | | | 679,432 |

| | | | |

|

|

| | | | | | 3,067,401 |

| |

Insurance 1.8% | | | |

| 4,800 | | Affirmative Insurance Holdings, Inc.(a) | | | 77,184 |

| 7,062 | | American International Group, Inc. | | | 468,140 |

| 2,500 | | Commerce Group, Inc. | | | 163,275 |

| 2,650 | | Delphi Financial Group (Class A shares) | | | 119,091 |

| 13,400 | | Genworth Financial, Inc. | | | 355,502 |

| 3,110 | | Infinity Property & Casualty Corp. | | | 101,853 |

| 8,200 | | Loews Corp. | | | 557,600 |

| 5,600 | | MBIA, Inc. | | | 334,544 |

See Notes to Financial Statements.

| | |

| 14 | | Visit our website at www.strategicpartners.com |

| | | | | |

| Shares | | Description | | Value (Note1) |

| | | | | | |

| 3,100 | | Philadelphia Consolidated Holding Corp.(a) | | $ | 207,917 |

| 1,500 | | Protective Life Corp. | | | 61,740 |

| 14,341 | | St. Paul Travelers Cos., Inc. (The) | | | 538,361 |

| 9,050 | | Tower Group, Inc. | | | 106,247 |

| 9,100 | | XL Capital, Ltd. (Cayman Islands) (Class A shares) | | | 680,498 |

| | | | |

|

|

| | | | | | 3,771,952 |

| |

Internet & Catalog Retail 0.5% | | | |

| 12,500 | | eBay, Inc.(a) | | | 1,018,750 |

| |

Internet Software & Services 1.3% | | | |

| 3,590 | | Ask Jeeves, Inc.(a) | | | 101,812 |

| 12,010 | | Digitas, Inc.(a) | | | 125,384 |

| 1,700 | | Equinix, Inc.(a) | | | 71,298 |

| 5,000 | | Google, Inc. (Class A shares)(a) | | | 978,150 |

| 2,020 | | InfoSpace, Inc.(a) | | | 95,364 |

| 3,710 | | j2 Global Communications, Inc.(a) | | | 120,501 |

| 8,650 | | Keynote Systems, Inc.(a) | | | 107,866 |

| 4,890 | | RADVision Ltd. (Israel)(a) | | | 71,883 |

| 2,370 | | RADWARE Ltd. (Israel)(a) | | | 57,804 |

| 28,800 | | Yahoo!, Inc.(a) | | | 1,014,049 |

| | | | |

|

|

| | | | | | 2,744,111 |

| |

IT Services 0.2% | | | |

| 15,900 | | Accenture Ltd.(a) | | | 414,195 |

| |

Leisure Equipment & Products | | | |

| 6,770 | | K2, Inc.(a) | | | 95,186 |

| |

Machinery 0.2% | | | |

| 5,100 | | Deere & Co. | | | 354,093 |

| |

Media 0.8% | | | |

| 5,900 | | CNET Networks, Inc.(a) | | | 64,900 |

| 2,900 | | DirectTV Group, Inc.(a) | | | 43,645 |

| 5,840 | | Image Entertainment, Inc.(a) | | | 33,288 |

| 20,182 | | News Corp. Inc. (Class A shares) | | | 343,094 |

| 2,600 | | Scholastic Corp.(a) | | | 89,050 |

| 6,800 | | Sinclair Broadcast Group, Inc. (Class A shares) | | | 55,964 |

| 24,000 | | Sirius Satellite Radio, Inc.(a) | | | 158,880 |

| 8,000 | | Univision Communications, Inc. (Class A shares)(a) | | | 218,480 |

| 5,810 | | Valueclick, Inc.(a) | | | 76,866 |

See Notes to Financial Statements.

| | |

| Strategic Partners Asset Allocation Funds/Strategic Partners Conservative Growth Fund | | 15 |

Portfolio of Investments

as of January 31, 2005 (Unaudited) Cont’d.

| | | | | |

| Shares | | Description | | Value (Note1) |

| | | | | | |

| 10,214 | | Viacom, Inc. (Class B shares) | | $ | 381,391 |

| 5,600 | | XM Satellite Radio Holdings, Inc. (Class A shares)(a) | | | 178,696 |

| | | | |

|

|

| | | | | | 1,644,254 |

| |

Metals & Mining 0.2% | | | |

| 12,100 | | Inco Ltd. (Canada)(a) | | | 398,211 |

| |

Multi-Utilities & Unregulated Power 0.6% | | | |

| 6,800 | | Dominion Resources, Inc. | | | 471,784 |

| 3,900 | | Oneok, Inc. | | | 108,030 |

| 15,300 | | Sempra Energy | | | 569,466 |

| | | | |

|

|

| | | | | | 1,149,280 |

| |

Multiline Retail 0.4% | | | |

| 15,400 | | Target Corp. | | | 781,858 |

| |

Office Electronics 0.4% | | | |

| 2,800 | | Marlin Business Services, Inc.(a) | | | 50,960 |

| 43,400 | | Xerox Corp.(a) | | | 689,192 |

| | | | |

|

|

| | | | | | 740,152 |

| |

Oil & Gas 2.5% | | | |

| 6,100 | | Cabot Oil and Gas Corp. | | | 287,188 |

| 8,800 | | Chesapeake Energy Corp. | | | 154,616 |

| 4,900 | | Eni SpA—ADR (Italy) | | | 598,780 |

| 5,400 | | Exxon Mobil Corp. | | | 278,640 |

| 15,540 | | Grey Wolf, Inc.(a) | | | 82,362 |

| 6,600 | | Kerr-McGee Corp. | | | 407,550 |

| 13,200 | | Nexen, Inc. (Canada) | | | 548,328 |

| 11,300 | | Occidental Petroleum Corp. | | | 659,693 |

| 3,930 | | Oil States International, Inc.(a) | | | 74,867 |

| 28,300 | | Suncor Energy, Inc. (Canada) | | | 905,599 |

| 6,400 | | Swift Energy Co.(a) | | | 193,728 |

| 2,080 | | Total SA, (France) (Class B Shares) | | | 446,023 |

| 5,044 | | Total SA, ADR (France) | | | 542,482 |

| | | | |

|

|

| | | | | | 5,179,856 |

| |

Paper & Forest Products 0.3% | | | |

| 12,000 | | Georgia-Pacific Corp. | | | 385,200 |

| 8,200 | | International Paper Co. | | | 321,030 |

| | | | |

|

|

| | | | | | 706,230 |

See Notes to Financial Statements.

| | |

| 16 | | Visit our website at www.strategicpartners.com |

| | | | | |

| Shares | | Description | | Value (Note1) |

| | | | | | |

Personal Products 0.3% | | | |

| 8,400 | | Estee Lauder Cos., Inc. (The) | | $ | 379,176 |

| 6,000 | | Gillette Co. | | | 304,320 |

| | | | |

|

|

| | | | | | 683,496 |

| |

Pharmaceuticals 2.1% | | | |

| 3,390 | | Alexion Pharmaceuticals, Inc.(a) | | | 83,869 |

| 5,300 | | Allergan, Inc. | | | 402,535 |

| 3,460 | | Atherogenics, Inc.(a) | | | 64,183 |

| 1,975 | | Barr Pharmaceuticals, Inc.(a) | | | 93,911 |

| 3,500 | | Chattem, Inc.(a) | | | 126,245 |

| 3,420 | | Connetics Corp.(a) | | | 83,516 |

| 4,900 | | Cypress Bioscience, Inc.(a) | | | 66,910 |

| 17,600 | | Eli Lilly & Co. | | | 954,623 |

| 6,750 | | KV Pharmaceutical Co. (Class A Shares)(a) | | | 138,713 |

| 9,202 | | Nabi Biopharmaceuticals(a) | | | 118,798 |

| 24,700 | | Novartis AG ADR (Switzerland) | | | 1,182,635 |

| 5,680 | | QLT, Inc. (Canada)(a) | | | 91,846 |

| 2,720 | | Rigel Pharmaceuticals, Inc.(a) | | | 52,197 |

| 10,500 | | Roche Holding AG ADR (Switzerland) | | | 559,233 |

| 4,890 | | Salix Pharmaceuticals Ltd.(a) | | | 73,595 |

| 2,500 | | Vaxgen, Inc.(a) | | | 37,200 |

| 6,500 | | Wyeth | | | 257,595 |

| | | | |

|

|

| | | | | | 4,387,604 |

| |

Real Estate Investment Trust 0.1% | | | |

| 2,500 | | Entertainment Properties Trust | | | 105,275 |

| 3,230 | | Saxon Capital, Inc. | | | 69,930 |

| 1,800 | | SL Green Realty Corp. | | | 95,814 |

| | | | |

|

|

| | | | | | 271,019 |

| |

Retail 0.2% | | | |

| 2,400 | | Aaron Rents, Inc. (Class B shares) | | | 50,976 |

| 5,300 | | CSK Auto Corp.(a) | | | 83,581 |

| 3,390 | | Ezcorp, Inc.(a) | | | 64,681 |

| 2,100 | | Guitar Center, Inc.(a) | | | 120,225 |

| 3,890 | | Jos. A. Bank Clothiers, Inc.(a) | | | 111,643 |

| | | | |

|

|

| | | | | | 431,106 |

| |

Semiconductors & Semiconductor Equipment 0.6% | | | |

| 16,200 | | Marvell Technology Group Ltd. (Bermuda)(a) | | | 541,890 |

| 9,600 | | Maxim Integrated Products | | | 374,496 |

See Notes to Financial Statements.

| | |

| Strategic Partners Asset Allocation Funds/Strategic Partners Conservative Growth Fund | | 17 |

Portfolio of Investments

as of January 31, 2005 (Unaudited) Cont’d.

| | | | | |

| Shares | | Description | | Value (Note1) |

| | | | | | |

| 4,080 | | Microsemi Corporation(a) | | $ | 62,954 |

| 9,380 | | O2Micro International Ltd.(a) | | | 83,201 |

| 6,080 | | Sirf Technology Holdings, Inc.(a) | | | 64,144 |

| 3,810 | | Ultratech Stepper, Inc.(a) | | | 56,426 |

| | | | |

|

|

| | | | | | 1,183,111 |

| |

Software 2.0% | | | |

| 5,500 | | Adobe Systems, Inc. | | | 312,950 |

| 13,500 | | Electronic Arts, Inc.(a) | | | 868,590 |

| 7,950 | | Embarcadero Technologies, Inc.(a) | | | 62,328 |

| 6,120 | | Epicor Software Corp.(a) | | | 82,559 |

| 2,700 | | Global Payments, Inc. | | | 154,683 |

| 5,500 | | Infocrossing, Inc.(a) | | | 98,945 |

| 8,200 | | Mercury Interactive Corp.(a) | | | 358,914 |

| 4,670 | | Merge Technologies, Inc.(a) | | | 86,629 |

| 41,300 | | Microsoft Corp. | | | 1,085,363 |

| 4,700 | | Navteq Corp.(a) | | | 179,963 |

| 4,560 | | Smith Micro Software, Inc.(a) | | | 34,063 |

| 3,900 | | Sonic Solutions(a) | | | 69,459 |

| 12,070 | | Synplicity, Inc.(a) | | | 82,076 |

| 13,900 | | Systeme, Anwedungen, Produkte AG, ADR (Germany) | | | 538,208 |

| 3,280 | | THQ, Inc.(a) | | | 72,980 |

| | | | |

|

|

| | | | | | 4,087,710 |

| |

Specialty Retail 1.2% | | | |

| 14,200 | | Bed Bath & Beyond, Inc.(a) | | | 572,118 |

| 7,230 | | Charlotte Russe Holdings, Inc.(a) | | | 77,506 |

| 12,600 | | Chico’s FAS, Inc.(a) | | | 663,768 |

| 6,900 | | Lowe’s Cos., Inc. | | | 393,231 |

| 2,400 | | Stein Mart, Inc.(a) | | | 47,352 |

| 24,800 | | Toys R’ Us, Inc.(a) | | | 531,960 |

| 6,600 | | Williams-Sonoma, Inc.(a) | | | 228,360 |

| | | | |

|

|

| | | | | | 2,514,295 |

| |

Telecommunications | | | |

| 19,021 | | Netia SA (Poland)(a) | | | 26,275 |

| 226 | | NTL, Inc.(a) | | | 15,375 |

| | | | |

|

|

| | | | | | 41,650 |

| |

Textiles, Apparel & Luxury Goods 0.2% | | | |

| 5,900 | | Coach, Inc.(a) | | | 330,990 |

See Notes to Financial Statements.

| | |

| 18 | | Visit our website at www.strategicpartners.com |

| | | | | |

| Shares | | Description | | Value (Note1) |

| | | | | | |

Thrifts & Mortgage Finance 0.2% | | | |

| 6,400 | | Freddie Mac | | $ | 417,856 |

| |

Tobacco 0.4% | | | |

| 13,900 | | Altria Group, Inc. | | | 887,237 |

| |

Transportation 0.1% | | | |

| 1,520 | | Forward Air Corp.(a) | | | 64,775 |

| 1,965 | | Old Dominion Freight Line, Inc.(a) | | | 69,463 |

| 6,030 | | Vitran Corp., Inc. (Canada) (Class A shares)(a) | | | 89,605 |

| | | | |

|

|

| | | | | | 223,843 |

| |

Wireless Telecommunication Services 0.6% | | | |

| 17,500 | | American Tower Corp. (Class A shares)(a) | | | 317,100 |

| 35,200 | | Nextel Communications, Inc.(a) | | | 1,009,888 |

| | | | |

|

|

| | | | | | 1,326,988 |

| | | | |

|

|

| | | Total common stocks | | | 80,650,799 |

| | | | |

|

|

PREFERRED STOCK | | | |

| |

Telecommunications | | | |

| 350 | | McLeodUSA, Inc., 2.50% | | | 945 |

| | | | |

|

|

See Notes to Financial Statements.

| | |

| Strategic Partners Asset Allocation Funds/Strategic Partners Conservative Growth Fund | | 19 |

Portfolio of Investments

as of January 31, 2005 (Unaudited) Cont’d.

| | | | | | | | |

Moody’s

Rating | | Principal

Amount (000) | | Description | | Value (Note 1) |

| | | | | | | | | |

| CORPORATE BONDS 15.4% |

|

| Aerospace/Defense 0.3% |

| B2 | | $ | 75 | | Alliant Techsystems, Inc., Sr. Sub. Notes,

8.50%, 5/15/11 | | $ | 80,813 |

| Caa3 | | | 105 | | BE Aerospace, Inc., Sr. Sub. Notes,

8.875%, 5/1/11 | | | 107,100 |

| B1 | | | 125 | | Esterline Technologies, Sr. Sub. Notes,

7.75%, 6/15/13 | | | 135,000 |

| Caa1 | | | 50 | | K & F Acquisition Inc., Sr. Sub. Notes,

7.75%, 11/15/14 | | | 49,750 |

| Ba3 | | | 100 | | L-3 Communications Corp., Sr. Sub. Notes,

7.625%, 6/15/12 | | | 109,000 |

| B1 | | | 100 | | Sequa Corp., Sr. Notes,

8.875%, 4/1/08 | | | 107,500 |

| Caa1 | | | 25 | | Standard Aero, Inc. Sr. Sub. Notes,

8.25%, 9/1/14 | | | 26,875 |

| B3 | | | 50 | | TD Funding Corp., Gtd. Notes,

8.375%, 7/15/11 | | | 53,000 |

| | | | | | | |

|

|

| | | | | | | | | 669,038 |

|

| Airlines 0.1% |

| Caa2 | | | 150 | | AMR Corp., Notes, MTN

10.55%, 3/12/21 | | | 88,500 |

| Ba2 | | | 45 | | Continental Airlines, Inc., Notes,

7.57%, 3/15/20 | | | 36,209 |

| Ba2 | | | 39 | | Continental Airlines, Inc., Ser. 981B,

6.75%, 3/15/17 | | | 31,147 |

| Ba2 | | | 70 | | Continental Airlines, Inc., Ser. 991B,

6.80%, 8/2/18 | | | 57,429 |

| | | | | | Delta Air Lines, Inc., Notes, | | | |

| Caa2 | | | 40 | | 10.00%, 8/15/08 | | | 23,000 |

| Ca | | | 50 | | 8.30%, 12/15/29 | | | 19,750 |

| | | | | | | |

|

|

| | | | | | | | | 256,035 |

|

| Automobiles 0.1% |

| A3 | | | 200 | | DaimlerChrysler NA Holding Corp., Notes, FRN, MTN

2.96%, 5/24/06(e) | | | 200,861 |

See Notes to Financial Statements.

| | |

| 20 | | Visit our website at www.strategicpartners.com |

| | | | | | | | |

Moody’s

Rating | | Principal

Amount (000) | | Description | | Value (Note 1) |

| | | | | | | | | |

| Automotive 0.2% |

| Baa3 | | $ | 125 | | ArvinMeritor, Inc., Notes,

8.75%, 3/1/12 | | $ | 139,844 |

| B3 | | | 10 | | Collins & Aikman Products Co.,

Sr. Sub. Notes,

12.875%, 8/15/12 | | | 8,275 |

| B3 | | | 10 | | Cooper-Standard Automotive, Inc., Notes,

8.375%, 12/15/14 | | | 9,500 |

| B3 | | | 50 | | Tenneco Automotive, Inc., Sr. Sub Notes,

8.625%, 11/15/14 | | | 52,000 |

| B1 | | | 59 | | TRW Automotive, Inc., Sr. Notes,

9.375%, 2/15/13 | | | 66,375 |

| | | | | | Visteon Corp., Notes, | | | |

| Ba1 | | | 20 | | 8.25%, 8/1/10 | | | 20,100 |

| Ba1 | | | 50 | | 7.00%, 3/10/14 | | | 45,750 |

| | | | | | | |

|

|

| | | | | | | | | 341,844 |

|

| Banking 0.2% |

| AA2 | | | 400 | | HSBC Bank, Sr. Notes, FRN

2.59%, 9/21/07(e) | | | 400,138 |

| Baa2 | | | 110 | | Kazkommerts International BV (Netherlands), Gtd. Notes,

7.875%, 4/7/14 | | | 109,175 |

| | | | | | | |

|

|

| | | | | | | | | 509,313 |

|

| Building Materials & Construction 0.2% |

| Ba2 | | | 100 | | American Standard, Inc., Gtd. Notes,

7.375%, 4/15/05 | | | 100,857 |

| Ba1 | | | 100 | | D.R. Horton, Inc., Sr. Notes,

7.875%, 8/15/11 | | | 114,929 |

| B3 | | | 25 | | Goodman Global Holding Co., Inc.

Sr. Notes, FRN

5.76%, 6/15/12(e) | | | 25,625 |

| Ba2 | | | 25 | | K Hovnanian Enterprises, Inc., Gtd. Notes,

6.25%, 1/15/15 | | | 25,344 |

| Ba2 | | | 65 | | KB Home, Sr. Sub. Notes,

8.625%, 12/15/08 | | | 73,409 |

| B3 | | | 50 | | THL Buildco, Inc., Sr. Sub Notes,

8.50%, 9/1/14 | | | 51,375 |

| | | | | | | |

|

|

| | | | | | | | | 391,539 |

See Notes to Financial Statements.

| | |

| Strategic Partners Asset Allocation Funds/Strategic Partners Conservative Growth Fund | | 21 |

Portfolio of Investments

as of January 31, 2005 (Unaudited) Cont’d.

| | | | | | | | |

Moody's

Rating | | Principal

Amount (000) | | Description | | Value (Note 1) |

| | | | | | | | | |

| Cable 0.4% |

| Ca | | $ | 50 | | Callahan Nordrhein Westfalen (Germany), Sr. Disc. Notes, Zero Coupon (until 7/15/05),

16.00%, 7/15/10(b)(f) | | $ | 2,000 |

| B2 | | | 175 | | Charter Communications Holdings LLC,

Sr. Notes,

10.25%, 1/15/10 - 9/15/10 | | | 166,625 |

| Ca | | | 420 | | Charter Communications Holdings,

Sr. Disc. Notes,

Zero Coupon (until 5/15/06),

11.75%, 5/15/11(f) | | | 291,900 |

| Ca | | | 100 | | Charter Communications Holdings,

Sr. Notes,

10.00%, 5/15/11 | | | 79,750 |

| B1 | | | 25 | | CSC Holdings, Inc., Sr. Notes, Series B,

7.625%, 4/1/11 | | | 27,250 |

| | | | | | Sr. Notes, | | | |

| B1 | | | 50 | | 6.75%, 4/15/12 | | | 52,500 |

| B1 | | | 50 | | 7.25%, 7/15/08 | | | 52,875 |

| B1 | | | 50 | | 7.875%, 12/15/07 | | | 53,875 |

| B2 | | | 60 | | Kabel Deutschland GmbH, (Germany),

Sr. Notes,

10.625%, 7/1/14 | | | 67,800 |

| Ba3 | | | 145 | | Rogers Cablesystems Ltd. (Canada),

Sr. Notes,

10.00%, 3/15/05 | | | 146,022 |

| | | | | | | |

|

|

| | | | | | | | | 940,597 |

|

| Capital Goods 0.8% |

| B3 | | | 75 | | ALH Finance LLC, Sr. Sub. Notes,

8.50%, 1/15/13 | | | 76,500 |

| | | | | | Allied Waste of North America, Inc.,

Sr. Notes, | | | |

| B2 | | | 220 | | 8.50%, 12/1/08 | | | 229,349 |

| B2 | | | 25 | | 7.875%, 4/15/13 | | | 24,813 |

| B3 | | | 75 | | Amsted Industries, Inc., Sr. Notes,

10.25%, 10/15/11 | | | 84,375 |

| Caa1 | | | 75 | | Blount, Inc., Sr. Sub. Notes,

8.875%, 8/1/12 | | | 81,563 |

| Ba3 | | | 95 | | Case New Holland, Inc., Sr. Notes,

9.25%, 8/1/11 | | | 103,788 |

See Notes to Financial Statements.

| | |

| 22 | | Visit our website at www.strategicpartners.com |

| | | | | | | | |

Moody’s

Rating | | Principal

Amount (000) | | Description | | Value (Note 1) |

| | | | | | | | | |

| Caa2 | | $ | 35 | | Great Lakes Dredge & Dock Corp.,

Sr. Sub. Notes,

7.75%, 12/15/13 | | $ | 30,450 |

| B3 | | | 60 | | Invensys PLC (United Kingdom), Sr. Notes,

9.875%, 3/15/11 | | | 64,350 |

| B3 | | | 75 | | Johnson Diversified Holdings, Inc.,

Zero Coupon (until 5/15/07),

10.67%, 5/15/13(f) | | | 65,063 |

| B2 | | | 75 | | Johnson Diversified, Inc., Gtd. Notes,

9.625%, 5/15/12 | | | 83,625 |

| B1 | | | 125 | | Joy Global, Inc., Sr. Sub. Notes,

8.75%, 3/15/12 | | | 139,999 |

| B3 | | | 100 | | Rexnord Corp., Gtd. Notes,

10.125%, 12/15/12 | | | 112,000 |

| Caa1 | | | 75 | | Sensus Metering Systems, Inc.,

Sr. Sub. Notes,

8.625%, 12/15/13 | | | 77,250 |

| Ba3 | | | 20 | | SPX Corp., Sr. Notes,

7.50%, 1/1/13 | | | 21,950 |

| Ba3 | | | 75 | | Stena AB, (Sweeden),

7.50%, 11/1/13 | | | 76,313 |

| B3 | | | 90 | | Terex Corp.,

Gtd. Notes,

10.375%, 4/1/11 | | | 99,900 |

| B3 | | | 20 | | Sr. Sub. Notes,

9.25%, 7/15/11 | | | 22,150 |

| B2 | | | 100 | | The Manitowoc Co., Inc., Sr. Sub. Notes,

10.50%, 8/1/12 | | | 114,999 |

| Caa1 | | | 75 | | Thermadyne Holdings Corp., Gtd. Notes,

9.25%, 2/1/14 | | | 72,750 |

| B1 | | | 25 | | United Rentals of North America, Inc.,

Gtd. Notes,

6.50%, 2/15/12 | | | 24,563 |

| B2 | | | 50 | | Sr. Sub. Notes,

7.75%, 11/15/13 | | | 48,625 |

| | | | | | | |

|

|

| | | | | | | | | 1,654,375 |

|

| Chemicals 0.6% |

| B3 | | | 50 | | Borden US Finance Corp./Nova Scotia Finance, Sec’d Notes,

9.00%, 7/15/14 | | | 55,000 |

See Notes to Financial Statements.

| | |

| Strategic Partners Asset Allocation Funds/Strategic Partners Conservative Growth Fund | | 23 |

Portfolio of Investments

as of January 31, 2005 (Unaudited) Cont’d.

| | | | | | | | |

Moody’s

Rating | | Principal

Amount (000) | | Description | | Value (Note 1) |

| | | | | | | | | |

| B2 | | $ | 80 | | Equistar Chemicals L.P., Gtd. Notes,

10.125%, 9/1/08 | | $ | 91,200 |

| | | | | | Huntsman International LLC, Gtd. Notes, | | | |

| Baa3 | | | 150 | | Hercules, Inc., Debs. Notes,

6.60%, 8/1/27 | | | 152,999 |

| B2 | | | 10 | | Huntsman Advanced Materials,

Sec’d. Notes,

11.00%, 7/15/10 | | | 11,750 |

| | | | | | Huntsman International LLC, Gtd. Notes, | | | |

| B3 | | | 75 | | 9.875%, 3/1/09 | | | 81,750 |

| Caa1 | | | 14 | | 10.125%, 7/1/09 | | | 14,700 |

| B2 | | | 125 | | IMC Global, Inc.,

Debs.,

6.875%, 7/15/07 | | | 127,500 |

| B1 | | | 90 | | Gtd. Notes,

11.25%, 6/1/11 | | | 101,700 |

| B2 | | | 75 | | ISP Chemco, Inc., Gtd. Notes,

10.25%, 7/1/11 | | | 83,625 |

| B2 | | | 50 | | Koppers, Inc., Gtd Notes,

9.875%, 10/15/13 | | | 56,750 |

| B1 | | | 25 | | Lyondell Chemical Co., Sec’d Notes,

11.125%, 7/15/12 | | | 29,375 |

| B2 | | | 125 | | Nalco Co., Sr. Notes,

7.75%, 11/15/11 | | | 134,063 |

| Caa1 | | | 45 | | OM Group, Inc., Gtd. Notes,

9.25%, 12/15/11 | | | 47,925 |

| B3 | | | 75 | | Rhodia SA, (France)

Sr. Notes,

10.25%, 6/1/10 | | | 85,313 |

| Caa1 | | | 75 | | Sr. Sub. Notes,

8.875%, 6/1/11 | | | 76,875 |

| B3 | | | 50 | | Rockwood Specialties Corp.,

Sr. Sub. Notes,

10.625%, 5/15/11 | | | 57,000 |

| | | | | | | |

|

|

| | | | | | | | | 1,207,525 |

|

| Consumer 0.4% |

| B2 | | | 50 | | Alderwoods Group, Inc., Sr. Notes,

7.75%, 9/15/12 | | | 53,625 |

| A3 | | | 500 | | Clorox Co., Notes, FRN

2.54%, 12/14/07(e) | | | 499,809 |

See Notes to Financial Statements.

| | |

| 24 | | Visit our website at www.strategicpartners.com |

| | | | | | | | |

Moody’s

Rating | | Principal

Amount (000) | | Description | | Value (Note 1) |

| | | | | | | | | |

| NR | | $ | 50 | | K2, Inc., Sr. Notes,

7.375%, 7/1/14 | | $ | 53,688 |

| B3 | | | 59 | | KinderCare Learning Centers, Inc.,

Sr. Sub. Notes,

9.50%, 2/15/09 | | | 59,148 |

| B3 | | | 50 | | Knowledge Learning Corp Inc.,

Sr. Sub Notes,

7.75%, 2/1/15 | | | 50,250 |

| Ca | | | 80 | | Levi Strauss & Co., Sr. Notes,

12.25%, 12/15/12 | | | 86,400 |

| Caa1 | | | 75 | | Propex Fabrics, Inc., Sr. Notes,

10.00%, 12/1/12 | | | 75,938 |

| | | | | | | |

|

|

| | | | | | | | | 878,858 |

|

| Electric 1.8% |

| B1 | | | 40 | | AES Corp.,

Sec’d. Notes,

8.75%, 5/15/13 | | | 44,800 |

| B2 | | | 195 | | Sr. Notes,

9.375%, 9/15/10 | | | 220,593 |

| Ba1 | | | 132 | | AES Eastern Energy LP,

9.00%, 1/2/17 | | | 150,827 |

| B3 | | | 30 | | Allegheny Energy Supply, Notes,

8.25%, 4/15/12 | | | 33,375 |

| B2 | | | 130 | | Aquila, Inc., Sr. Notes,

9.95%, 2/1/11 | | | 146,413 |

| B | | | 205 | | Calpine Corp., Sec’d. Notes,

8.75%, 7/15/13 | | | 155,800 |

| | | | | | CMS Energy Corp., Sr. Notes, | | | |

| B3 | | | 115 | | 7.50%, 1/15/09 | | | 121,756 |

| B3 | | | 50 | | 8.50%, 4/15/11 | | | 55,813 |

| | | | | | Dynegy Holdings, Inc., Sec’d. Notes, | | | |

| B3 | | | 60 | | 9.875%, 7/15/10 | | | 65,700 |

| B3 | | | 145 | | 10.125%, 7/15/13 | | | 160,950 |

| B1 | | | 75 | | Edison Mission Energy, Sr. Notes,

7.73%, 6/15/09 | | | 79,500 |

| | | | | | Endesa (Chile), Ser. W.I., | | | |

| Ba2 | | | 75 | | 8.35%, 8/1/13 | | | 87,938 |

| Ba2 | | | 150 | | 8.625%, 8/1/15 | | | 180,414 |

| Ba2 | | | 74 | | Homer City Funding LLC, Gtd. Notes,

8.14%, 10/1/19 | | | 83,055 |

See Notes to Financial Statements.

| | |

| Strategic Partners Asset Allocation Funds/Strategic Partners Conservative Growth Fund | | 25 |

Portfolio of Investments

as of January 31, 2005 (Unaudited) Cont’d.

| | | | | | | |

Moody’s

Rating | | Principal

Amount (000) | | Description | | Value (Note 1) |

| | | | | | | | |

| Ba3 | | $ 4 | | Midland Funding Corp,

Sr. Sec’d. Notes, Ser. A,

11.75%, 7/23/05 | | $ | 4,619 |

| | | | | Midwest Generation LLC, | | | |

| B1 | | 30 | | 8.30%, 7/2/09 | | | 32,400 |

| B1 | | 60 | | 8.56%, 1/2/16 | | | 67,200 |

| B1 | | 50 | | 8.75%, 5/1/34 | | | 55,875 |

| B3 | | 35 | | Mission Energy Holdings, Sec’d. Notes,

13.50%, 7/15/08 | | | 43,663 |

| Ba2 | | 60 | | Nevada Power Co.,

6.50%, 4/15/12 | | | 63,150 |

| Ba2 | | 5 | | Notes,

10.875%, 10/15/09 | | | 5,731 |

| NR | | GBP 7 | | NoteCo Ltd., (United Kingdom), FRN,

6.92%, 6/30/25(e) | | | 13,995 |

| B2 | | $170 | | NRG Energy, Inc., Sec’d. Notes

8.00%, 12/15/13 | | | 183,175 |

| B2 | | 50 | | Orion Power Holdings, Inc., Sr. Notes,

12.00%, 5/1/10 | | | 62,500 |

| Baa2 | | 150 | | Pacific Gas & Electric Co.,

1st Mortgage, FRN

3.26%, 4/3/06(e) | | | 150,148 |

| Baa3 | | 200 | | PP&L Capital Funding, Inc., Sr. Notes,

7.75%, 4/15/05 | | | 201,692 |

| Ba1 | | 300 | | PPL Capital Funding Trust, Gtd. Notes,

7.29%, 5/18/06 | | | 312,356 |

| B1 | | 66 | | Reliant Energy-Mid Atlantic, Ser. B,

9.24%, 7/2/17 | | | 75,564 |

| B1 | | 125 | | Reliant Resources, Inc., Sec’d. Notes,

9.50%, 7/15/13 | | | 140,000 |

| B2 | | 40 | | Sierra Pacific Resources, Sr. Notes,

8.625%, 3/15/14 | | | 44,450 |

| Ba2 | | 175 | | TECO Energy, Inc., Sr. Notes,

7.50%, 6/15/10 | | | 192,500 |

| B1 | | 150 | | Texas Genco LLC, Sr. Notes,

6.875%, 12/15/14 | | | 155,250 |

| B2 | | 75 | | TNP Enterprises, Inc., Sr. Sub. Notes,

10.25%, 4/1/10 | | | 79,125 |

| Baa2 | | 95 | | TXU Energy Co. LLC, Notes, FRN

3.42%, 1/17/06(e) | | | 95,248 |

See Notes to Financial Statements.

| | |

| 26 | | Visit our website at www.strategicpartners.com |

| | | | | | | | |

Moody’s

Rating | | Principal

Amount (000) | | Description | | Value (Note 1) |

| | | | | | | | | |

| B2 | | $ | 15 | | Utilicorp Canada Finance Corp.,

Gtd. Notes,

7.75%, 6/15/11 | | $ | 15,525 |

| | | | | | | |

|

|

| | | | | | | | | 3,581,100 |

|

| Energy-Other 0.6% |

| BA2 | | | 150 | | Chesapeake Energy Corp., Sr. Notes,

6.375%, 6/15/15 | | | 152,999 |

| B2 | | | 25 | | Encore Acquisition Co., Sr. Sub. Notes,

6.25%, 4/15/14 | | | 24,938 |

| Ba3 | | | 30 | | Forest Oil Corp., Sr. Notes

8.00%, 12/15/11 | | | 34,013 |

| B3 | | | 75 | | Hanover Compressor Co., Sr. Notes,

8.625%, 12/15/10 | | | 81,000 |

| B2 | | | 50 | | Hanover Equipment Trust, Sec’d Notes,

8.75%, 9/1/11 | | | 54,000 |

| B2 | | | 25 | | Houston Exploration Co., Sr. Sub. Notes,

7.00%, 6/15/13 | | | 26,250 |

| B2 | | | 8 | | Magnum Hunter Resources, Inc.,

Gtd. Notes,

9.60%, 3/15/12 | | | 9,140 |

| Ba3 | | | 50 | | Newfield Exploration Co., Sr. Sub. Notes,

8.375%, 8/15/12 | | | 55,500 |

| B2 | | | 100 | | Parker Drilling Co., Sr. Notes,

9.625%, 10/1/13 | | | 111,125 |

| NR | | | 250 | | Pemex Project Funding Master Trust,

9.25%, 3/30/18 | | | 312,499 |

| Ba3 | | | 75 | | Premcor Refining Group,

Gtd. Notes,

6.75%, 5/1/14 | | | 78,563 |

| Ba3 | | | 25 | | Sr. Notes,

6.75%, 2/1/11 | | | 26,688 |

| B2 | | | 50 | | Sr. Sub. Notes,

7.75%, 2/1/12 | | | 54,375 |

| | | | | | Pride International Inc., Sr. Notes, | | | |

| NR | | | 25 | | 7.375%, 7/15/14 | | | 27,500 |

| B2 | | | 105 | | Stone Energy Corp., Sr. Sub. Notes,

8.25%, 12/15/11 | | | 112,875 |

| Ba3 | | | 50 | | Vintage Petrolium, Inc.,

Sr. Notes,

8.25%, 5/1/12 | | | 55,000 |

See Notes to Financial Statements.

| | |

| Strategic Partners Asset Allocation Funds/Strategic Partners Conservative Growth Fund | | 27 |

Portfolio of Investments

as of January 31, 2005 (Unaudited) Cont’d.

| | | | | | | | |

Moody’s

Rating | | Principal

Amount (000) | | Description | | Value (Note 1) |

| | | | | | | | | |

| B1 | | $ | 25 | | Sr. Sub. Notes,

7.875%, 5/15/11 | | $ | 26,688 |

| | | | | | | |

|

|

| | | | | | | | | 1,243,153 |

|

| Food 0.3% |

| B3 | | | 8 | | Agrilink Foods, Inc., Sr. Sub. Notes,

11.875%, 11/1/08 | | | 8,320 |

| Ba3 | | | 25 | | Ahold Finance USA, Inc., Notes,

8.25%, 7/15/10 | | | 28,250 |

| B3 | | | 50 | | Carrols Corp., Sr. Sub. Notes,

9.00%, 1/15/13 | | | 52,125 |

| | | | | | Del Monte Corp., Sr. Sub. Notes, | | | |

| B2 | | | 125 | | 8.625%, 12/15/12 | | | 138,906 |

| B2 | | | 125 | | 6.75%, 2/15/15 | | | 126,250 |

| Ba1 | | | 140 | | Delhaize America, Inc., Gtd. Notes,

8.125%, 4/15/11 | | | 162,753 |

| | | | | | Dole Foods Co., Sr. Notes, | | | |

| B2 | | | 50 | | 8.625%, 5/1/09 | | | 54,813 |

| B2 | | | 50 | | 8.875%, 3/15/11 | | | 53,688 |

| B3 | | | 40 | | Pathmark Stores, Inc., Gtd. Notes,

8.75%, 2/1/12 | | | 38,250 |

| Ba2 | | | 80 | | Smithfield Foods, Inc., Sr. Notes,

8.00%, 10/15/09 | | | 88,300 |

| | | | | | | |

|

|

| | | | | | | | | 751,655 |

|

| Gaming 0.7% |

| B1 | | | 75 | | Argosy Gaming Co., Sr. Sub. Notes,

7.00%, 1/15/14 | | | 82,500 |

| Ba3 | | | 100 | | Aztar Corp., Sr. Sub. Notes,

9.00%, 8/15/11 | | | 109,750 |

| Ba3 | | | 15 | | 7.875%, 6/15/14 | | | 16,500 |

| B1 | | | 50 | | Boyd Gaming Corp., Sr. Sub. Notes,

8.75%, 4/15/12 | | | 55,125 |

| B2 | | | 50 | | Isle of Capri Casinos, Inc., Sr. Sub. Notes,

7.00%, 3/1/14 | | | 50,625 |

| B2 | | | 55 | | Kerzner International Ltd., Gtd. Notes,

8.875%, 8/15/11 | | | 59,950 |

| Ba1 | | | 250 | | MGM Mirage, Inc.,

Notes,

6.00%, 10/1/09 | | | 255,000 |

| Ba2 | | | 130 | | Gtd. Notes,

9.75%, 6/1/07 | | | 144,300 |

See Notes to Financial Statements.

| | |

| 28 | | Visit our website at www.strategicpartners.com |

| | | | | | | | |

Moody’s

Rating | | Principal

Amount (000) | | Description | | Value (Note 1) |

| | | | | | | | | |

| Ba3 | | $ | 100 | | Mohegan Tribal Gaming Authority,

Sr. Sub. Notes,

8.00%, 4/1/12 | | $ | 107,625 |

| | | | | | Park Place Entertainment Corp., Sr. Notes, | | | |

| Ba2 | | | 20 | | 9.375%, 2/15/07 | | | 21,875 |

| Ba2 | | | 20 | | 8.875%, 9/15/08 | | | 22,525 |

| Ba1 | | | 130 | | 7.50%, 9/1/09 | | | 144,300 |

| Ba2 | | | 35 | | 8.125%, 5/15/11 | | | 40,075 |

| Ba3 | | | 90 | | Station Casinos, Inc., Sr. Notes,

6.00%, 4/1/12 | | | 92,250 |

| B2 | | | 105 | | Venetian Casino Resort LLC, Gtd. Notes,

11.00%, 6/15/10 | | | 118,650 |

| NR | | | 75 | | Wynn Las Vegas LLC,

6.625%, 12/1/14 | | | 73,688 |

| | | | | | | |

|

|

| | | | | | | | | 1,394,738 |

|

| Health Care & Pharmaceuticals 1.0% |

| B3 | | | 25 | | Alliance Imaging, Inc., Sr. Sub. Notes,

7.25%, 12/15/12 | | | 25,250 |

| B3 | | | 75 | | Concentra Operating Corp.,

9.50%, 8/15/10 | | | 83,250 |

| B3 | | | 125 | | 9.125%, 6/1/12 | | | 138,750 |

| Ba1 | | | 25 | | Coventry Health Care, Inc., Sr. Notes,

5.875%, 1/15/12 | | | 25,375 |

| Ba1 | | | 45 | | Sr. Notes,

8.125%, 2/15/12 | | | 49,163 |

| B3 | | | 75 | | Elan Finance PLC, Sr. Notes,

7.75%, 11/15/11 | | | 78,375 |

| Ba2 | | | 180 | | HCA, Inc., Debs.,

7.50%, 12/15/23 | | | 185,520 |

| Ba2 | | | 60 | | Notes, MTN

9.00%, 12/15/14 | | | 71,159 |

| Caa2 | | | 75 | | Healthsouth Corp., Notes,

7.625%, 6/1/12 | | | 75,188 |

| Caa2 | | | 150 | | Sr. Notes,

8.50%, 2/1/08 | | | 155,062 |

| B3 | | | 40 | | IASIS Healthcare LLC, Sr. Sub. Notes,

8.75%, 6/15/14 | | | 43,100 |

| Caa1 | | | 45 | | Inverness Medical Innovations, Inc., Sr. Sub Notes,

8.75%, 2/15/12 | | | 46,125 |

See Notes to Financial Statements.

| | |

| Strategic Partners Asset Allocation Funds/Strategic Partners Conservative Growth Fund | | 29 |

Portfolio of Investments

as of January 31, 2005 (Unaudited) Cont’d.

| | | | | | | | |

Moody’s

Rating | | Principal

Amount (000) | | Description | | Value (Note 1) |

| | | | | | | | | |

| B3 | | $ | 131 | | Magellan Health Services, Inc., Sr, Notes,

9.375%, 11/15/08 | | $ | 141,579 |

| Ba1 | | | 50 | | Medco Health Solutions, Inc., Sr. Notes,

7.25%, 8/15/13 | | | 56,512 |

| Caa1 | | | 65 | | Medical Device Manufacturing, Gtd. Notes,

10.00%, 7/15/12 | | | 70,200 |

| B3 | | | 100 | | Medquest, Inc., Sr. Sub. Notes,

11.875%, 8/15/12 | | | 117,000 |

| Ba3 | | | 40 | | NeighborCare, Inc., Sr. Sub. Notes,

6.875%, 11/15/13 | | | 42,150 |

| B1 | | | 50 | | Omega Healthcare Investors, Inc., Notes,

6.95%, 8/1/07 | | | 51,875 |

| B1 | | | 25 | | 7.00%, 4/1/14 | | | 25,250 |

| B2 | | | 100 | | Resources-Care, Inc., Sr. Notes,

10.625%, 11/15/08 | | | 109,250 |

| B2 | | | 55 | | Select Medical Corp., Sr. Sub. Notes,

9.50%, 6/15/09 | | | 58,644 |

| Ba2 | | | 60 | | Senior Housing Properties Trust, Sr. Notes,

8.625%, 1/15/12 | | | 68,250 |

| B3 | | | 50 | | Tenet Healthcare Corp., Sr. Notes,

6.375%, 12/1/11 | | | 44,875 |

| B3 | | | 35 | | 6.50%, 6/1/12 | | | 31,150 |

| B3 | | | 50 | | 9.25%, 2/1/15 | | | 50,000 |

| NR | | | 75 | | Vanguard Health Holding Co.,

Sr. Sub. Notes,

9.00%, 10/1/14 | | | 80,250 |

| Ba3 | | | 40 | | Ventas Realty LP, Gtd. Notes,

8.75%, 5/1/09 | | | 44,250 |

| Ba3 | | | 110 | | Sr. Notes,

9.00%, 5/1/12 | | | 127,600 |

| Caa1 | | | 100 | | Warner Chilcott Corp., Sr. Sub. Notes,

8.75%, 2/1/15 | | | 102,750 |

| | | | | | | |

|

|

| | | | | | | | | 2,197,902 |

| | |

| Lodging 0.5% | | | | | |

| B1 | | | 75 | | FelCor Lodging LP, Gtd. Notes,

9.00%, 6/1/11 | | | 84,375 |

| B1 | | | 50 | | FelCor Suites LP, Gtd. Notes,

7.625%, 10/1/07 | | | 52,375 |

| Ba3 | | | 40 | | HMH Properties, Inc., Sr. Notes, Ser. B,

7.875%, 8/1/08 | | | 41,050 |

See Notes to Financial Statements.

| | |

| 30 | | Visit our website at www.strategicpartners.com |

| | | | | | | | |

Moody’s

Rating | | Principal

Amount (000) | | Description | | Value (Note 1) |

| | | | | | | | | |

| Ba3 | | $ | 125 | | Host Marriott LP, Sr. Notes,

9.50%, 1/15/07 | | $ | 135,313 |

| Ba3 | | | 75 | | 7.00%, 8/15/12 | | | 78,375 |

| Ba3 | | | 40 | | 7.125%, 11/1/13 | | | 42,100 |

| B2 | | | 25 | | John Q Hammons Hotels LP,

8.875%, 5/15/12 | | | 28,125 |

| Ba3 | | | 100 | | La Quinta Properties, Inc., Sr. Notes,

8.875%, 3/15/11 | | | 110,375 |

| Ba2 | | | 125 | | Royal Caribbean Cruises Ltd. (Liberia), Sr. Notes,

8.00%, 5/15/10 | | | 141,250 |

| | | | | | Starwood Hotels & Resorts Worldwide, Inc., Notes, | | | |

| Ba1 | | | 125 | | 7.875%, 5/1/12 | | | 142,500 |

| Ba1 | | | 175 | | 7.375%, 11/15/15 | | | 196,000 |

| | | | | | | |

|

|

| | | | | | | | | 1,051,838 |

| |

| Media & Entertainment 1.1% | | | |

| Caa1 | | | 75 | | Advertising Direct Solutions, Sr. Notes,

9.25%, 11/15/12 | | | 79,125 |

| B3 | | | 40 | | AMC Entertainment, Inc., Sr. Sub. Notes,

8.00%, 3/1/14 | | | 39,650 |

| Caa1 | | | 65 | | American Color Graphics, Notes,

10.00%, 6/15/10 | | | 55,413 |

| B2 | | | 5 | | American Media Operation, Inc.,

Gtd. Notes, Ser. B,

10.25%, 5/1/09 | | | 5,231 |

| B2 | | | 100 | | Canwest Media, Inc. (Canada),

Sr. Sub. Notes,

10.625%, 5/15/11 | | | 111,375 |

| B2 | | | 82 | | Dex Media East LLC, Gtd. Notes,

12.125%, 11/15/12 | | | 98,195 |

| B2 | | | 167 | | Dex Media West LLC, Sr. Sub. Notes,

9.875%, 8/15/13 | | | 189,335 |

| B1 | | | 80 | | DirecTV Holdings LLC, Sr. Notes,

8.375%, 3/15/13 | | | 90,100 |

| Ba3 | | | 80 | | Echostar DBS Corp., Gtd. Notes,

6.625%, 10/1/14 | | | 80,800 |

| Ba2 | | | 30 | | Entercom Radio LLC, Gtd. Notes,

7.625%, 3/1/14 | | | 32,250 |

See Notes to Financial Statements.

| | |

| Strategic Partners Asset Allocation Funds/Strategic Partners ConservativeGrowth Fund | | 31 |

Portfolio of Investments

as of January 31, 2005 (Unaudited) Cont’d.

| | | | | | | | |

Moody’s

Rating | | Principal

Amount (000) | | Description | | Value (Note 1) |

| | | | | | | | | |

| B2 | | $ | 150 | | Gray Communications Systems, Inc.,

Sr. Sub Notes,

9.25%, 12/15/11 | | $ | 166,875 |

| B1 | | | 125 | | Intelsat Bermuda, Sr. Notes,

8.25%, 1/15/13 | | | 129,375 |

| B1 | | | 75 | | Intrawest Corp., Sr. Notes,

7.50%, 10/15/13 | | | 78,750 |

| | | | | | Leslies Poolmart, Sr. Notes, | | | |

| B2 | | | 100 | | 7.75%, 2/1/13 | | | 101,750 |

| B3 | | | 35 | | Lowes Cineplex Entertainment Corp., Sr. Sub. Notes,

9.00%, 8/1/14 | | | 36,663 |

| B2 | | | 100 | | Marquee, Inc., Sr. Notes,

8.625%, 8/15/12 | | | 108,500 |

| B2 | | | 75 | | Medianews Group, Inc., Sr. Sub. Notes,

6.875%, 10/1/13 | | | 74,625 |

| Ba3 | | | 30 | | Morris Publishing, Sr. Sub. Notes,

7.00%, 8/1/13 | | | 30,525 |

| B3 | | | 25 | | New Skies Satellites NV (Netherlands)

Sr. Notes, FRN

7.44%, 11/1/11(e) | | | 26,063 |

| Caa1 | | | 25 | | Sr. Sub. Notes,

9.125%, 11/1/12 | | | 25,750 |

| B3 | | | 25 | | Primedia, Inc.,

Sr. Notes, FRN

7.67%, 5/15/10(e) | | | 26,375 |

| B3 | | | 50 | | Gtd. Notes,

8.875%, 5/15/11 | | | 52,750 |

| B2 | | | 50 | | Quebecor Media, Inc. (Canada), Sr. Notes,

11.125%, 7/15/11 | | | 56,250 |

| B2 | | | 175 | | R.R. Donnelley Financial Corp.,

Sr. Sub. Notes,

10.875%, 12/15/12 | | | 204,749 |

| Caa1 | | | 45 | | Six Flags, Inc., Sr. Notes,

9.625%, 6/1/14 | | | 42,413 |

| Ba3 | | | 150 | | Sun Media Corp. (Canada), Gtd. Notes,

7.625%, 2/15/13 | | | 159,750 |

| B3 | | | 50 | | Universal City Florida Holding Co.,

Sr. Notes,

8.375%, 5/1/10 | | | 52,000 |

| B2 | | | 45 | | Vail Resorts, Inc., Sr. Sub. Notes.,

6.75%, 2/15/14 | | | 45,394 |

See Notes to Financial Statements.

| | |

| 32 | | Visit our website at www.strategicpartners.com |

| | | | | | | | |

Moody’s

Rating | | Principal

Amount (000) | | Description | | Value (Note 1) |

| | | | | | | | | |

| | | | | | Vertis, Inc., Sec’d. Notes, | | | |

| B2 | | $ | 66 | | 9.75%, 4/1/09 | | $ | 71,775 |

| B3 | | | 55 | | 10.875%, 6/15/09 | | | 59,263 |

| Caa1 | | | 10 | | WDAC Subsidiary Corp.,

8.375%, 12/1/14 | | | 9,750 |

| | | | | | | |

|

|

| | | | | | | | | 2,340,819 |

|

| Metals 0.5% |

| B3 | | | 125 | | AK Steel Corp., Gtd.,

7.875%, 2/15/09 | | | 128,125 |

| B3 | | | 50 | | Sr. Notes,

7.75%, 6/15/12 | | | 51,375 |

| Ba3 | | | 50 | | Arch Western Finance LLC, Sr. Notes,

6.75%, 7/1/13 | | | 51,000 |

| B1 | | | 75 | | Century Aluminum Co., Gtd. Notes,

7.50%, 8/15/14 | | | 80,063 |

| B1 | | | 80 | | CSN Islands VII Corp. (Cayman Islands), Gtd. Notes,

10.75%, 9/12/08 | | | 90,700 |

| B1 | | | 50 | | Foundation PA Coal Co. Notes,

7.25%, 8/1/14 | | | 52,375 |

| B3 | | | 118 | | Ispat Inland ULC, Sec’d. Notes,

9.75%, 4/1/14 | | | 145,434 |

| B1 | | | 75 | | Novelis, Inc., (Canada) Sr. Notes,

7.25%, 2/15/15 | | | 76,875 |

| B1 | | | 25 | | Oregon Steel Mills, Inc., Gtd. Notes,

10.00%, 7/15/09 | | | 27,750 |

| Ba3 | | | 100 | | Russel Metals, Inc., (Canada), Sr. Notes,

6.375%, 3/1/14 | | | 100,000 |

| B2 | | | 50 | | Ryerson Tull, Inc., Sr. Notes,

8.25%, 12/15/11 | | | 49,000 |

| Ba2 | | | 89 | | United States Steel LLC, Sr. Notes,

10.75%, 8/1/08 | | | 105,243 |

| | | | | | | |

|

|

| | | | | | | | | 957,940 |

|

| Non Captive Finance 1.5% |

| A3 | | | 400 | | Ford Motor Credit Co., Notes,

7.50%, 3/15/05 | | | 401,899 |

| A3 | | | 600 | | Ford Motor Credit Co., Notes, FRN, MTN

3.10%, 7/18/05 | | | 598,686 |

| Aaa | | JPY | 67,000 | | General Electric Capital Corp., (Japan)

Sr. Notes,

1.40%, 11/2/06 | | | 661,102 |

See Notes to Financial Statements.

| | |

| Strategic Partners Asset Allocation Funds/Strategic Partners Conservative Growth Fund | | 33 |

Portfolio of Investments

as of January 31, 2005 (Unaudited) Cont’d.

| | | | | | | |

Moody’s

Rating | | Principal

Amount (000) | | Description | | Value (Note 1) |

| | | | | | | | |

| Aaa | | JPY 8,000 | | General Electric Capital Corp., (Japan) Sr. Unsub. Notes,

0.10%, 12/20/05 | | $ | 77,315 |

| Baa1 | | $ 100 | | General Motors Acceptance Corp. MTN, FRN,

4.23%, 5/19/05 | | | 100,420 |

| Baa1 | | 300 | | General Motors Acceptance Corp.,

7.50%, 7/15/05 | | | 304,988 |

| Baa1 | | 1,000 | | General Motors Acceptance Corp., Notes,

6.875%, 9/15/11 | | | 1,004,167 |

| | | | | | |

|

|

| | | | | | | | 3,148,577 |

|

| Packaging 0.4% |

| B2 | | 75 | | Anchor Glass Container Corp., Sec’d. Notes,

11.00%, 2/15/13 | | | 80,625 |

| B3 | | 100 | | Berry Plastics, Sr. Sub. Notes,

10.75%, 7/15/12 | | | 114,000 |

| B1 | | 100 | | Crown Euro Holdings SA (France),

Sec’d. Notes,

9.50%, 3/1/11 | | | 111,500 |

| Caa1 | | 25 | | Graham Packaging Co., Inc., Sr. Notes,

8.50%, 10/15/12 | | | 25,938 |

| Caa2 | | 75 | | 9.875%, 10/15/14 | | | 78,563 |

| B2 | | 175 | | Greif Brothers Corp., Sr. Sub. Notes,

8.875%, 8/1/12 | | | 193,375 |

| B1 | | 180 | | Owens-Brockway Glass Containers,

Sec’d. Notes,

8.75%, 11/15/12 | | | 200,249 |

| | | | | | |

|

|

| | | | | | | | 804,250 |

| |

| Paper 0.4% | | | |

| Ba3 | | 125 | | Abitibi-Consolidated Co. CDA,

5.25%, 6/20/08 | | | 121,874 |

| B2 | | 85 | | Ainsworth Lumber Co. Ltd.,

Sr. Notes, (Canada)

6.75%, 3/15/14 | | | 82,344 |

| Ba3 | | 75 | | Bowater Canada Finance, Gtd. Notes,

7.95%, 11/15/11 | | | 80,352 |

| Caa1 | | 25 | | Caraustar Industries, Inc., Gtd. Notes,

9.875%, 4/1/11 | | | 27,438 |

| Ba3 | | 60 | | Cascades, Inc. (Canada),

7.25%, 2/15/13 | | | 62,700 |

See Notes to Financial Statements.

| | |

| 34 | | Visit our website at www.strategicpartners.com |

| | | | | | | | |

Moody’s

Rating | | Principal

Amount (000) | | Description | | Value (Note 1) |

| | | | | | | | | |

| B2 | | $ | 100 | | Cellu Tissue Holdings, Inc., Sec’d. Notes,

9.75%, 3/15/10 | | $ | 105,250 |

| Ba3 | | | 75 | | Georgia-Pacific Corp., Notes,

7.50%, 5/15/06 | | | 78,094 |

| Ba3 | | | 20 | | 8.125%, 5/15/11 | | | 23,000 |

| Ba3 | | | 75 | | 8.875%, 5/15/31 | �� | | 95,625 |

| B2 | | | 75 | | Millar Western Forest Products Ltd. (Canada),

7.75%, 11/15/13 | | | 78,375 |

| Ba3 | | | 25 | | Tembec Industries, Inc. (Canada), Gtd. Notes,

8.625%, 6/30/09 | | | 24,844 |

| Ba3 | | | 55 | | 7.75%, 3/15/12 | | | 52,250 |

| | | | | | | |

|

|

| | | | | | | | | 832,146 |

| |

| Pipelines & Other 0.6% | | | |

| B2 | | | 75 | | AmeriGas Partners, LP, Sr. Notes,

8.875%, 5/20/11 | | | 81,000 |

| B3 | | | 210 | | EL Paso Corp.,

Gtd. Notes,

7.75%, 6/1/13

| | | 218,400 |

| Caa1 | | | 25 | | Sr. Notes,

7.00%, 5/15/11 | | | 25,125 |

| Caa1 | | | 150 | | 7.75%, 1/15/32 | | | 145,875 |

| Baa3 | | | 50 | | Enterprise Products Operation LP, Sr. Notes,

5.60%, 10/15/14 | | | 51,235 |

| B2 | | | 40 | | Ferrellgas Partners LP, Notes,

8.75%, 6/15/12 | | | 42,800 |

| B1 | | | 50 | | Inergy LP, Sr. Notes,

6.875%, 12/15/14 | | | 49,750 |

| B1 | | | 25 | | MarkWest Energy Partners LP, Sr. Notes,

6.875%, 11/1/14 | | | 25,125 |

| Ba2 | | | 50 | | Pacific Energy Partners LP, Sr. Notes,

7.125%, 6/15/14 | | | 52,750 |

| B1 | | | 50 | | Southern Natural Gas, Notes,

8.875%, 3/15/10 | | | 55,625 |

| | | | | | Tennessee Gas Pipeline, Debs., | | | |

| B1 | | | 160 | | 7.00%, 3/15/27 - 10/15/28 | | | 165,353 |

| B1 | | | 125 | | 7.625%, 4/1/37 | | | 132,500 |

See Notes to Financial Statements.

| | |

| Strategic Partners Asset Allocation Funds/Strategic Partners Conservative Growth Fund | | 35 |

Portfolio of Investments

as of January 31, 2005 (Unaudited) Cont’d.

| | | | | | | | |

Moody’s

Rating | | Principal

Amount (000) | | Description | | Value (Note 1) |

| | | | | | | | | |

| B3 | | $ | 40 | | TranMontaigne, Inc., Sr. Sub. Notes,

9.125%, 6/1/10 | | $ | 43,000 |

| | | | | | Williams Companies., Inc., Notes, | | | |

| B1 | | | 150 | | 7.125%, 9/1/11 | | | 163,125 |

| B1 | | | 45 | | 8.125%, 3/15/12 | | | 51,750 |

| | | | | | | |

|

|

| | | | | | | | | 1,303,413 |

|

| Retailers 0.4% |

| B3 | | | 25 | | Asbury Automotive Group, Inc.,

Sr. Sub. Notes,

8.00%, 3/15/14 | | | 25,063 |

| Ba2 | | | 15 | | AutoNation, Inc., Sr. Notes,

9.00%, 8/1/08 | | | 16,875 |

| B1 | | | 75 | | Group 1 Automotive, Inc., Sr. Sub. Notes,