UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-08915 |

| |

| Exact name of registrant as specified in charter: | | Target Asset Allocation Funds |

| |

| Address of principal executive offices: | | Gateway Center 3, 100 Mulberry Street, Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Deborah A. Docs Gateway Center 3, 100 Mulberry Street, Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

| Date of fiscal year end: | | 7/31/2008 |

| |

| Date of reporting period: | | 1/31/2008 |

Item 1 – Reports to Stockholders

| | |

| JANUARY 31, 2008 | | SEMIANNUAL REPORT |

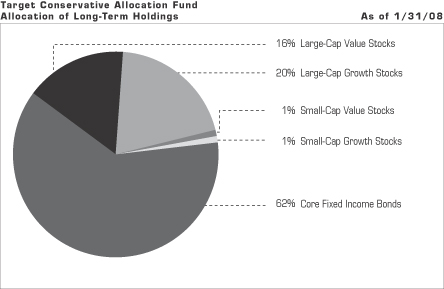

Target Conservative Allocation Fund

OBJECTIVE

Seeks current income and a reasonable level of capital appreciation

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

The accompanying financial statements as of January 31, 2008, were not audited and, accordingly, no auditor’s opinion is expressed on them.

Target Funds, Prudential, Prudential Financial and the Rock Prudential logo are registered service marks of The Prudential Insurance Company of America, Newark, NJ, and its affiliates.

March 14, 2008

Dear Shareholder:

On the following pages, you’ll find your semiannual report for the Target Conservative Allocation Fund.

Target Asset Allocation Funds are managed by institutional-quality asset managers selected, matched, and monitored by a research team from Prudential Investments LLC. Portions of the Funds’ assets are assigned to carefully chosen asset managers, with the allocations actively managed on the basis of our projections for the financial markets and the managers’ individual strengths.

We believe our Target Conservative Allocation Fund will help you to achieve broad, actively managed diversification at a targeted risk/return balance with a single investment purchase. We appreciate your continued confidence in us.

Sincerely,

Judy A. Rice, President

Target Asset Allocation Funds

| | |

| Target Asset Allocation Funds/Target Conservative Allocation Fund | | 1 |

Your Fund’s Performance

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at www.prudential.com or by calling (800) 225-1852. The maximum initial sales charge is 5.50% (Class A shares). Gross operating expenses: Class A, 1.50%; Class B, 2.20%; Class C, 2.20%; Class M, 2.20%; Class R, 1.95%; Class X, 2.20%; Class Z, 1.20%. Net operating expenses apply to: Class A, 1.45%; Class B, 2.20%; Class C, 2.20%; Class M, 2.20%; Class R, 1.70%; Class X, 2.20%; Class Z, 1.20%, after contractual reduction through 11/30/2008.

| | | | | | | | | | | | |

| Cumulative Total Returns as of 1/31/08 | | | | | | | | | | |

| | | Six Months | | | One Year | | | Five Years | | | Since Inception1 | |

Class A | | 4.07 | % | | 5.32 | % | | 55.05 | % | | 72.85 | % |

Class B | | 3.70 | | | 4.54 | | | 49.44 | | | 61.50 | |

Class C | | 3.70 | | | 4.54 | | | 49.44 | | | 61.50 | |

Class M | | 3.70 | | | 4.54 | | | N/A | | | 21.44 | |

Class R | | 3.94 | | | 4.95 | | | N/A | | | 23.46 | |

Class X | | 3.80 | | | 4.54 | | | N/A | | | 21.45 | |

Class Z | | 4.20 | | | 5.58 | | | 57.07 | | | 76.84 | |

Customized Blend2 | | 2.26 | | | 4.11 | | | 47.21 | | | ** | |

S&P 500 Index3 | | –4.32 | | | –2.31 | | | 76.44 | | | *** | |

Lipper Mixed-Asset Target Allocation Conservative Funds Avg.4 | | 1.19 | | | 2.44 | | | 36.64 | | | **** | |

| | | | | | | | | | | | |

| Average Annual Total Returns5 as of 12/31/07 | | | | | | | | | | |

| | | | | | One Year | | | Five Years | | | Since Inception1 | |

Class A | | | | | 1.05 | % | | 8.10 | % | | 5.62 | % |

Class B | | | | | 1.05 | | | 8.36 | | | 5.48 | |

Class C | | | | | 5.04 | | | 8.51 | | | 5.48 | |

Class M | | | | | 0.05 | | | N/A | | | 5.64 | |

Class R | | | | | 6.55 | | | N/A | | | 6.97 | |

Class X | | | | | 0.14 | | | N/A | | | 5.37 | |

Class Z | | | | | 7.09 | | | 9.60 | | | 6.53 | |

Customized Blend2 | | | | | 6.38 | | | 8.15 | | | ** | |

S&P 500 Index3 | | | | | 5.49 | | | 12.82 | | | *** | |

Lipper Mixed-Asset Target Allocation Conservative Funds Avg.4 | | | | | 4.49 | | | 6.66 | | | **** | |

The cumulative total returns do not reflect the deduction of applicable sales charges. If reflected, the applicable sales charges would reduce the cumulative total returns

| | |

| 2 | | Visit our website at www.prudential.com |

performance quoted. Class A shares are subject to a maximum front-end sales charge of 5.50%. Under certain circumstances, Class A shares may be subject to a contingent deferred sales charge (CDSC) of 1%. Class B and Class C shares are subject to a maximum CDSC of 5% and 1%, respectively. Class M and Class X shares are subject to a maximum CDSC of 6%. Class R and Class Z shares are not subject to a sales charge.

Source: Prudential Investments LLC and Lipper Inc. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

1Inception dates: Class A, B, C, and Z, 11/18/98; Class M, R, and X, 10/04/04.

2The Customized Benchmark for Target Conservative Allocation Fund (Customized Blend) is a model portfolio consisting of the Russell 3000 Index (40%) and the Lehman Brothers U.S. Aggregate Bond Index (60%). The Customized Blend is an unmanaged index generally considered as representing the performance of the Fund’s asset classes. The Customized Blend is intended to provide a theoretical comparison of the Fund’s performance, based on the amounts allocated to each asset class rather than on amounts allocated to various Fund segments. The Customized Blend does not reflect deductions for any sales charges or operating expenses of a mutual fund.

3The Standard & Poor’s 500 Composite Stock Price Index (S&P 500 Index) is an unmanaged index of 500 stocks of large U.S. public companies. It gives an indication of how U.S. stock prices have performed.

4The Lipper Mix-Asset Target Allocation Conservative Funds Average (Lipper Average) represents returns based on the average return of all funds in the Lipper Mixed-Equity Funds category for the periods noted. Funds in the Lipper Average have a primary investment objective of conserving principal by maintaining at all times a balanced portfolio of both stocks and bonds. Mixed-Asset Funds are funds that, by portfolio practice, maintain a mix of between 20% and 40% equity securities, with the remainder invested in bonds, cash, and cash equivalents.

5The average annual total returns take into account applicable sales charges. Class A, Class B, Class C, Class M, Class R, and Class X shares are subject to an annual distribution and service (12b-1) fee of up to 0.30%, 1.00%, 1.00%, 1.00%, 0.75%, and 1.00%, respectively. Approximately seven years after purchase, Class B shares will automatically convert to Class A shares on a quarterly basis. Approximately eight years after purchase, Class M shares will automatically convert to Class A shares on a quarterly basis. Approximately 10 years after purchase, Class X shares will automatically convert to Class A shares on a quarterly basis. Class Z shares are not subject to a 12b-1 fee. The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares.

**Customized Blend Closest Month-End to Inception cumulative total returns as of 1/31/08 are 63.22% for Classes A, B, C, and Z; and 24.11% for Classes M, R, and X. Customized Blend Closest Month-End to Inception average annual total returns as of 12/31/07 are 5.71% for Classes A, B, C, and Z; and 7.34% for Classes M, R, and X.

***S&P 500 Index Closest Month-End to Inception cumulative total returns as of 1/31/08 are 37.26% for Classes A, B, C, and Z; and 31.56% for Classes M, R, and X. S&P 500 Index Closest Month-End to Inception average annual total returns as of 12/31/07 are 4.26% for Classes A, B, C, and Z; and 10.90% for Classes M, R, and X.

****Lipper Average Closest Month-End to Inception cumulative total returns as of 1/31/08 are 55.09% for Classes A, B, C, and Z; and 18.17% for Classes M, R, and X. Lipper Average Closest Month-End to Inception average annual total returns as of 12/31/07 are 5.04% for Classes A, B, C, and Z; and 5.69% for Classes M, R, and X.

Investors cannot invest directly in an index. The returns for the S&P 500 Index and the Customized Blend would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes. Returns for the Lipper Average reflect the deduction of operating expenses, but not sales charges or taxes. The Since Inception returns for the S&P 500 Index, the Customized Blend, and the Lipper Average are measured from the closest month-end to inception date, and not from the Fund’s actual inception date.

| | |

| Target Asset Allocation Funds/Target Conservative Allocation Fund | | 3 |

Your Fund’s Performance (continued)

Fund objective

The investment objective of the Target Conservative Allocation Fund is current income and a reasonable level of capital appreciation. There can be no assurance that the Fund will achieve its investment objective.

| | |

| 4 | | Visit our website at www.prudential.com |

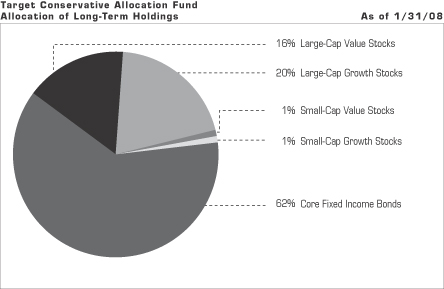

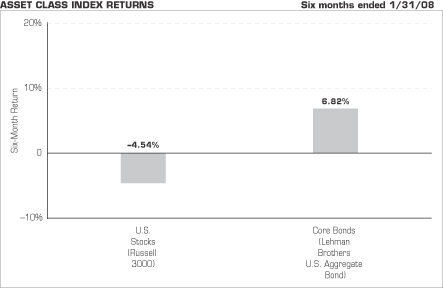

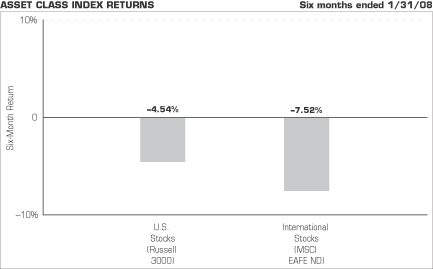

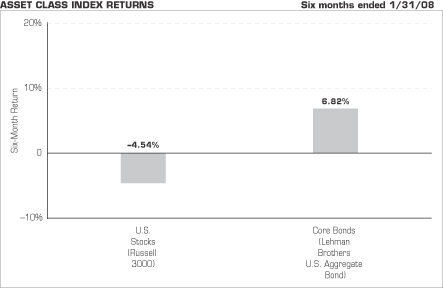

Source: Lipper Inc.

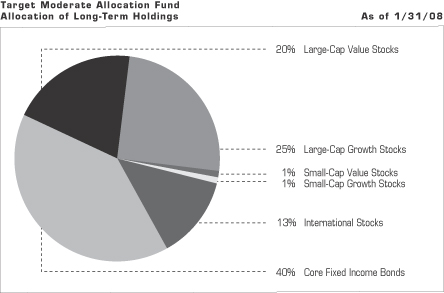

The chart above shows the total returns for six months ended January 31, 2008, of various securities indexes that are generally considered representative of broad market sectors. It does not reflect a mutual fund’s expenses. The performance cited does not represent the performance of the Target Conservative Allocation Fund. Past performance is not indicative of future results. Investors cannot invest directly in an index.

The Russell 3000 Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market.

The Lehman Brothers U.S. Aggregate Bond Index is an unmanaged index of investment-grade securities issued by the U.S. government and its agencies, and by corporations with between one and 10 years remaining to maturity. It gives a broad look at how short- and intermediate-term bonds have performed.

| | |

| Target Asset Allocation Funds/Target Conservative Allocation Fund | | 5 |

Fees and Expenses (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested on August 1, 2007, at the beginning of the period, and held through the six-month period ended January 31, 2008. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to individual retirement accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of JennisonDryden Funds, including the Target Asset Allocation Funds, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information provided in the expense table. Additional fees have the effect of reducing investment returns.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before

| | |

| 6 | | Visit our website at www.prudential.com |

expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only, and do not reflect any transactional costs such as sales charges (loads). Therefore the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | |

Target

Conservative

Allocation Fund | | Beginning Account

Value

August 1, 2007 | | Ending Account

Value January 31, 2008 | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the Six-

Month Period* |

| | | | | | | | | | | | | | |

| Class A | | Actual | | $ | 1,000.00 | | $ | 1,040.70 | | 1.45 | % | | $ | 7.44 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,017.85 | | 1.45 | % | | $ | 7.35 |

| | | | | | | | | | | | | | |

| Class B | | Actual | | $ | 1,000.00 | | $ | 1,037.00 | | 2.20 | % | | $ | 11.26 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,014.08 | | 2.20 | % | | $ | 11.14 |

| | | | | | | | | | | | | | |

| Class C | | Actual | | $ | 1,000.00 | | $ | 1,037.00 | | 2.20 | % | | $ | 11.26 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,014.08 | | 2.20 | % | | $ | 11.14 |

| | | | | | | | | | | | | | |

| Class M | | Actual | | $ | 1,000.00 | | $ | 1,037.00 | | 2.20 | % | | $ | 11.26 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,014.08 | | 2.20 | % | | $ | 11.14 |

| | | | | | | | | | | | | | |

| Class R | | Actual | | $ | 1,000.00 | | $ | 1,039.40 | | 1.70 | % | | $ | 8.71 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,016.59 | | 1.70 | % | | $ | 8.62 |

| | | | | | | | | | | | | | |

| Class X | | Actual | | $ | 1,000.00 | | $ | 1,038.00 | | 2.20 | % | | $ | 11.27 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,014.08 | | 2.20 | % | | $ | 11.14 |

| | | | | | | | | | | | | | |

| Class Z | | Actual | | $ | 1,000.00 | | $ | 1,042.00 | | 1.20 | % | | $ | 6.16 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,019.10 | | 1.20 | % | | $ | 6.09 |

* Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended January 31, 2008, and divided by the 366 days in the Fund’s fiscal year ending July 31, 2008 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

| | |

| Target Asset Allocation Funds/Target Conservative Allocation Fund | | 7 |

Portfolio of Investments

as of January 31, 2008 (Unaudited)

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

LONG-TERM INVESTMENTS 102.9% | | | |

COMMON STOCKS 39.8% | | | |

| |

Aerospace 0.7% | | | |

| 1,070 | | Aerovironment, Inc.(a) | | $ | 24,621 |

| 315 | | Alliant Techsystems, Inc.(a) | | | 33,343 |

| 630 | | BE Aerospace, Inc.(a) | | | 24,324 |

| 1,750 | | Boeing Co. (The) | | | 145,565 |

| 420 | | DRS Technologies, Inc. | | | 22,541 |

| 7,137 | | Lockheed Martin Corp. | | | 770,225 |

| 1,075 | | Moog, Inc. (Class A Stock)(a) | | | 49,493 |

| 1,520 | | Orbital Sciences Corp.(a) | | | 35,416 |

| 2,000 | | United Technologies Corp. | | | 146,820 |

| | | | | |

| | | | | 1,252,348 |

| |

Aerospace & Defense 0.9% | | | |

| 700 | | AAR Corp.(a) | | | 20,622 |

| 7,281 | | General Dynamics Corp. | | | 614,953 |

| 200 | | Goodrich Corp. | | | 12,510 |

| 1,000 | | HEICO Corp. | | | 44,510 |

| 4,600 | | Honeywell International, Inc. | | | 271,722 |

| 7,750 | | Northrop Grumman Corp. | | | 615,040 |

| 100 | | Teledyne Technologies, Inc.(a) | | | 5,163 |

| | | | | |

| | | | | 1,584,520 |

| |

Air Freight & Couriers 0.1% | | | |

| 1,100 | | FedEx Corp. | | | 102,828 |

| |

Airlines | | | |

| 2,200 | | Southwest Airlines Co. | | | 25,806 |

| |

Auto Components 0.1% | | | |

| 6,750 | | Johnson Controls, Inc. | | | 238,747 |

| |

Auto Parts & Related 0.1% | | | |

| 5,900 | | AutoNation, Inc.(a) | | | 96,052 |

| |

Automobile Manufacturers | | | |

| 4,000 | | Ford Motor Co.(a) | | | 26,560 |

| 200 | | Winnebago Industries, Inc. | | | 4,212 |

| | | | | |

| | | | | 30,772 |

See Notes to Financial Statements.

| | |

| Target Asset Allocation Funds/Target Conservative Allocation Fund | | 9 |

Portfolio of Investments

as of January 31, 2008 (Unaudited) continued

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Automobiles | | | |

| 3,000 | | General Motors Corp. | | $ | 84,930 |

| |

Automotive Parts 0.1% | | | |

| 250 | | Advance Auto Parts, Inc. | | | 8,920 |

| 1,630 | | Amerigon, Inc.(a) | | | 27,906 |

| 1,950 | | Paccar, Inc. | | | 91,494 |

| | | | | |

| | | | | 128,320 |

| |

Beverages 0.5% | | | |

| 2,400 | | Anheuser-Busch Cos., Inc. | | | 111,648 |

| 10,579 | | Coca-Cola Co. (The) | | | 625,959 |

| 2,400 | | Coca-Cola Enterprises, Inc. | | | 55,368 |

| 400 | | Molson Coors Brewing Co. (Class B Stock) | | | 17,868 |

| 2,600 | | PepsiCo, Inc. | | | 177,294 |

| | | | | |

| | | | | 988,137 |

| |

Biotechnology 0.6% | | | |

| 5,300 | | Amgen, Inc.(a) | | | 246,927 |

| 9,044 | | Genentech, Inc.(a) | | | 634,798 |

| 890 | | Genomic Health, Inc.(a) | | | 18,681 |

| 500 | | LifeCell Corp.(a) | | | 19,755 |

| 7,900 | | Millennium Pharmaceuticals, Inc.(a) | | | 119,843 |

| | | | | |

| | | | | 1,040,004 |

| |

Building Products 0.1% | | | |

| 785 | | Lennox International, Inc. | | | 29,171 |

| 3,600 | | Masco Corp. | | | 82,548 |

| | | | | |

| | | | | 111,719 |

| |

Business Services 0.1% | | | |

| 200 | | Administaff, Inc. | | | 6,002 |

| 2,300 | | Manpower, Inc. | | | 129,398 |

| | | | | |

| | | | | 135,400 |

| |

Capital Markets 0.1% | | | |

| 675 | | KBW, Inc.(a) | | | 20,054 |

| 2,297 | | Raymond James Financial, Inc. | | | 64,523 |

| 675 | | Waddell & Reed Financial, Inc. (Class A Stock) | | | 22,396 |

| | | | | |

| | | | | 106,973 |

See Notes to Financial Statements.

| | |

| 10 | | Visit our website at www.prudential.com |

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Chemicals 1.1% | | | |

| 2,561 | | Air Products & Chemicals, Inc. | | $ | 230,541 |

| 575 | | Airgas, Inc. | | | 26,686 |

| 1,700 | | Celanese Corp. (Class A Stock) | | | 63,206 |

| 12,200 | | Dow Chemical Co. (The) | | | 471,652 |

| 450 | | DuPont (E.I.) de Nemours & Co. | | | 20,331 |

| 3,500 | | Eastman Chemical Co. | | | 231,245 |

| 325 | | FMC Corp. | | | 17,277 |

| 400 | | Lubrizol Corp. (The) | | | 21,044 |

| 200 | | Mosaic Co. (The)(a) | | | 18,202 |

| 2,500 | | PPG Industries, Inc. | | | 165,225 |

| 4,718 | | Praxair, Inc. | | | 381,733 |

| 3,050 | | Rohm & Haas Co. | | | 162,718 |

| 1,050 | | Scotts Miracle-Gro Co. (The) (Class A Stock) | | | 40,992 |

| 900 | | Terra Industries, Inc.(a) | | | 40,563 |

| 1,425 | | Valspar Corp. | | | 28,543 |

| 620 | | Zoltek Cos., Inc.(a) | | | 22,630 |

| | | | | |

| | | | | 1,942,588 |

| |

Clothing & Apparel 0.2% | | | |

| 2,720 | | FGX International Holdings Ltd. (Virgin Islands)(a) | | | 27,472 |

| 5,900 | | Gap, Inc. (The) | | | 112,808 |

| 1,480 | | Iconix Brand Group, Inc.(a) | | | 30,769 |

| 950 | | NIKE, Inc. (Class B Stock) | | | 58,672 |

| 1,050 | | Phillips-Van Heusen Corp. | | | 44,247 |

| 300 | | VF Corp. | | | 23,211 |

| | | | | |

| | | | | 297,179 |

| |

Commercial Banks 0.5% | | | |

| 25 | | City National Corp. | | | 1,422 |

| 1,800 | | Colonial BancGroup, Inc. (The) | | | 28,260 |

| 2,750 | | Comerica, Inc. | | | 119,955 |

| 550 | | Cullen/Frost Bankers, Inc. | | | 29,942 |

| 5,100 | | Huntington Bancshares, Inc. | | | 68,595 |

| 1,900 | | National City Corp. | | | 33,801 |

| 800 | | Provident Bankshares Corp. | | | 16,584 |

| 500 | | Sterling Financial Corp. | | | 8,895 |

| 575 | | United Bankshares, Inc. | | | 18,492 |

| 15,600 | | Wachovia Corp. | | | 607,308 |

| | | | | |

| | | | | 933,254 |

See Notes to Financial Statements.

| | |

| Target Asset Allocation Funds/Target Conservative Allocation Fund | | 11 |

Portfolio of Investments

as of January 31, 2008 (Unaudited) continued

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Commercial Services 0.6% | | | |

| 5,700 | | Accenture Ltd. (Class A Stock) (Bermuda) | | $ | 197,334 |

| 3,500 | | Apollo Group, Inc. (Class A Stock)(a) | | | 279,090 |

| 2,791 | | Cardtronics, Inc.(a) | | | 21,853 |

| 560 | | FirstService Corp. (Canada)(a) | | | 12,628 |

| 1,038 | | Healthcare Services Group, Inc. | | | 25,170 |

| 1,225 | | Healthspring, Inc.(a) | | | 25,345 |

| 630 | | HMS Holdings Corp.(a) | | | 19,908 |

| 800 | | HNI Corp. | | | 26,928 |

| 1,500 | | ITT Educational Services, Inc.(a) | | | 137,025 |

| 600 | | McKesson Corp. | | | 37,674 |

| 1,500 | | Moody’s Corp. | | | 52,485 |

| 400 | | Paychex, Inc. | | | 13,088 |

| 800 | | Pharmaceutical Product Development, Inc. | | | 34,688 |

| 2,040 | | Rollins, Inc. | | | 36,292 |

| 940 | | Team, Inc.(a) | | | 28,247 |

| 3,000 | | Waste Management, Inc. | | | 97,320 |

| 525 | | Watson Wyatt Worldwide, Inc. (Class A Stock) | | | 25,804 |

| 700 | | Weight Watchers International, Inc. | | | 29,820 |

| | | | | |

| | | | | 1,100,699 |

| |

Communication Equipment 0.1% | | | |

| 9,200 | | Alcatel-Lucent (France) | | | 58,236 |

| 1,300 | | Arris Group, Inc.(a) | | | 11,427 |

| 525 | | CommScope, Inc.(a) | | | 23,284 |

| | | | | |

| | | | | 92,947 |

| |

Computer Hardware 0.8% | | | |

| 150 | | Affiliated Computer Services, Inc. (Class A Stock)(a) | | | 7,312 |

| 6,480 | | Apple, Inc.(a) | | | 877,133 |

| 100 | | Computer Sciences Corp.(a) | | | 4,232 |

| 5,700 | | Dell, Inc.(a) | | | 114,228 |

| 9,900 | | EMC Corp.(a) | | | 157,113 |

| 1,450 | | International Business Machines Corp. | | | 155,643 |

| 1,780 | | Magma Design Automation, Inc.(a) | | | 20,292 |

| 300 | | Oracle Corp.(a) | | | 6,165 |

| 5,200 | | Synopsys, Inc.(a) | | | 114,504 |

| | | | | |

| | | | | 1,456,622 |

| |

Computer Networking | | | |

| 610 | | Atheros Communications, Inc.(a) | | | 16,659 |

See Notes to Financial Statements.

| | |

| 12 | | Visit our website at www.prudential.com |

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Computer Services & Software 0.1% | | | |

| 1,290 | | Advent Software, Inc.(a) | | $ | 58,256 |

| 600 | | Autodesk, Inc.(a) | | | 24,690 |

| 370 | | Concur Technologies, Inc.(a) | | | 12,972 |

| 200 | | Diebold, Inc. | | | 5,176 |

| 1,610 | | Innerworkings, Inc.(a) | | | 22,298 |

| 265 | | Micros Systems, Inc.(a) | | | 16,319 |

| 1,940 | | Nuance Communications, Inc.(a) | | | 30,827 |

| 350 | | SanDisk Corp.(a) | | | 8,908 |

| 550 | | Sun Microsystems, Inc.(a) | | | 9,625 |

| | | | | |

| | | | | 189,071 |

| |

Computers & Peripherals | | | |

| 800 | | Lexmark International, Inc. (Class A Stock)(a) | | | 28,968 |

| |

Construction 0.1% | | | |

| 900 | | Granite Construction, Inc. | | | 34,263 |

| 200 | | Herman Miller, Inc. | | | 6,356 |

| 600 | | Hovnanian Enterprises, Inc. (Class A Stock)(a) | | | 5,934 |

| 900 | | KBR, Inc.(a) | | | 28,431 |

| 300 | | Meritage Homes Corp.(a) | | | 4,815 |

| 2,625 | | Toll Brothers, Inc.(a) | | | 61,110 |

| | | | | |

| | | | | 140,909 |

| |

Consumer Finance | | | |

| 370 | | Cash America International, Inc. | | | 12,029 |

| 1,775 | | First Cash Financial Services, Inc.(a) | | | 17,768 |

| 740 | | McGrath RentCorp | | | 17,234 |

| | | | | |

| | | | | 47,031 |

| |

Consumer Products & Services 0.7% | | | |

| 13,000 | | Altria Group, Inc. | | | 985,660 |

| 1,000 | | American Greetings Corp. (Class A Stock) | | | 20,520 |

| 400 | | Avon Products, Inc. | | | 14,008 |

| 1,370 | | Bare Escentuals, Inc.(a) | | | 32,661 |

| 3,850 | | Procter & Gamble Co. | | | 253,907 |

| 300 | | Snap-On, Inc. | | | 14,736 |

| | | | | |

| | | | | 1,321,492 |

| |

Containers & Packaging | | | |

| 450 | | Silgan Holdings, Inc. | | | 21,312 |

See Notes to Financial Statements.

| | |

| Target Asset Allocation Funds/Target Conservative Allocation Fund | | 13 |

Portfolio of Investments

as of January 31, 2008 (Unaudited) continued

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Distribution/Wholesale | | | |

| 450 | | Owens & Minor, Inc. | | $ | 18,594 |

| 550 | | WESCO International, Inc.(a) | | | 23,232 |

| | | | | |

| | | | | 41,826 |

| |

Distributors | | | |

| 200 | | W.W. Grainger, Inc. | | | 15,914 |

| |

Diversified 0.1% | | | |

| 6,300 | | Ingersoll-Rand Co. Ltd. (Class A Stock) (Bermuda) | | | 248,976 |

| |

Diversified Financial Services 0.4% | | | |

| 100 | | GFI Group, Inc.(a) | | | 8,821 |

| 1,500 | | Janus Capital Group, Inc. | | | 40,515 |

| 13,417 | | JPMorgan Chase & Co. | | | 637,978 |

| 1,482 | | KKR Financial Holdings LLC | | | 24,068 |

| | | | | |

| | | | | 711,382 |

| |

Diversified Manufacturing Operations 0.3% | | | |

| 13,664 | | Hewlett-Packard Co. | | | 597,800 |

| |

Education | | | |

| 543 | | American Public Education, Inc.(a) | | | 21,399 |

| 720 | | DeVry, Inc. | | | 39,737 |

| | | | | |

| | | | | 61,136 |

| |

Electric Utilities 0.3% | | | |

| 500 | | Entergy Corp. | | | 54,090 |

| 2,000 | | Exelon Corp. | | | 152,380 |

| 1,900 | | FirstEnergy Corp. | | | 135,318 |

| 2,400 | | FPL Group, Inc. | | | 154,752 |

| 4,100 | | Sierra Pacific Resources | | | 61,377 |

| | | | | |

| | | | | 557,917 |

| |

Electrical Equipment 0.1% | | | |

| 425 | | General Cable Corp.(a) | | | 24,654 |

| 575 | | Regal-Beloit Corp. | | | 21,804 |

| 1,300 | | Thomas & Betts Corp.(a) | | | 58,825 |

| | | | | |

| | | | | 105,283 |

| |

Electronic Components 0.6% | | | |

| 1,800 | | Agilent Technologies, Inc.(a) | | | 61,038 |

| 600 | | Checkpoint Systems, Inc.(a) | | | 14,256 |

See Notes to Financial Statements.

| | |

| 14 | | Visit our website at www.prudential.com |

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Electronic Components (continued) | | | |

| 300 | | Emerson Electric Co. | | $ | 15,252 |

| 2,100 | | Energizer Holdings, Inc.(a) | | | 196,602 |

| 1,400 | | FLIR Systems, Inc.(a) | | | 42,392 |

| 1,000 | | Garmin Ltd. | | | 72,150 |

| 200 | | Hubbell, Inc. (Class B Stock) | | | 9,536 |

| 300 | | Itron, Inc.(a) | | | 24,720 |

| 200 | | PerkinElmer, Inc. | | | 4,978 |

| 175 | | Rofin-Sinar Technologies, Inc.(a) | | | 7,439 |

| 13,475 | | Tyco Electronics Ltd. (Bermuda) | | | 455,590 |

| 2,700 | | Waters Corp.(a) | | | 155,115 |

| | | | | |

| | | | | 1,059,068 |

| |

Electronic Equipment & Instruments 0.2% | | | |

| 3,500 | | Avnet, Inc.(a) | | | 124,635 |

| 1,400 | | Diamond Offshore Drilling, Inc. | | | 158,102 |

| | | | | |

| | | | | 282,737 |

| |

Energy - Alternate Sources | | | |

| 100 | | First Solar, Inc.(a) | | | 18,177 |

| |

Energy Equipment | | | |

| 1,280 | | Oil States International, Inc.(a) | | | 44,877 |

| |

Energy Equipment & Services 0.3% | | | |

| 400 | | Cameron International Corp.(a) | | | 16,104 |

| 575 | | Complete Production Services, Inc.(a) | | | 9,143 |

| 730 | | Dril-Quip, Inc.(a) | | | 35,434 |

| 11,500 | | Halliburton Co. | | | 381,455 |

| 2,500 | | National-Oilwell Varco, Inc.(a) | | | 150,575 |

| 1,355 | | Superior Energy Services, Inc.(a) | | | 54,322 |

| | | | | |

| | | | | 647,033 |

| |

Engineering/Construction 0.1% | | | |

| 100 | | Fluor Corp. | | | 12,167 |

| 800 | | Foster Wheeler Ltd.(a) | | | 54,776 |

| 925 | | URS Corp.(a) | | | 40,607 |

| | | | | |

| | | | | 107,550 |

| |

Entertainment & Leisure 0.4% | | | |

| 1,440 | | Allegiant Travel Co.(a) | | | 45,043 |

| 1,600 | | Harley-Davidson, Inc. | | | 64,928 |

| 5,483 | | Las Vegas Sands, Inc.(a) | | | 480,695 |

See Notes to Financial Statements.

| | |

| Target Asset Allocation Funds/Target Conservative Allocation Fund | | 15 |

Portfolio of Investments

as of January 31, 2008 (Unaudited) continued

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Entertainment & Leisure (continued) | | | |

| 630 | | Life Time Fitness, Inc.(a) | | $ | 27,934 |

| 950 | | Royal Caribbean Cruises Ltd. | | | 38,266 |

| 1,570 | | Scientific Games Corp. (Class A Stock)(a) | | | 37,366 |

| | | | | |

| | | | | 694,232 |

| |

Environmental Services | | | |

| 1,300 | | Allied Waste Industries, Inc.(a) | | | 12,805 |

| 2,890 | | Darling International, Inc.(a) | | | 33,524 |

| 655 | | Waste Connections, Inc.(a) | | | 19,100 |

| | | | | |

| | | | | 65,429 |

| |

Exchange Traded Funds | | | |

| 500 | | iShares Nasdaq Biotechnology Index Fund | | | 38,975 |

| 10 | | iShares Russell 1000 Value Index Fund | | | 769 |

| 650 | | iShares Russell 2000 Value Index Fund | | | 44,018 |

| | | | | |

| | | | | 83,762 |

| |

Farming & Agriculture 0.6% | | | |

| 9,121 | | Monsanto Co. | | | 1,025,565 |

| |

Financial - Bank & Trust 1.5% | | | |

| 750 | | Astoria Financial Corp. | | | 20,385 |

| 27,249 | | Bank of America Corp. | | | 1,207,614 |

| 1,850 | | Bank of New York Mellon Corp. (The) | | | 86,265 |

| 1,600 | | BB&T Corp. | | | 58,048 |

| 500 | | Pacific Capital Bancorp | | | 10,750 |

| 700 | | Prosperity Bancshares, Inc. | | | 20,125 |

| 10,275 | | Regions Financial Corp. | | | 259,341 |

| 300 | | Sovereign Bancorp, Inc. | | | 3,741 |

| 700 | | State Street Corp. | | | 57,484 |

| 1,325 | | SunTrust Banks, Inc. | | | 91,359 |

| 2,650 | | TCF Financial Corp. | | | 56,313 |

| 5,725 | | U.S. Bancorp | | | 194,364 |

| 21,218 | | Wells Fargo & Co. | | | 721,624 |

| 600 | | Whitney Holding Corp. | | | 16,104 |

| 750 | | Zions Bancorp | | | 41,055 |

| | | | | |

| | | | | 2,844,572 |

| |

Financial - Brokerage | | | |

| 3,725 | | TD Ameritrade Holding Corp.(a) | | | 69,881 |

See Notes to Financial Statements.

| | |

| 16 | | Visit our website at www.prudential.com |

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Financial Services 2.0% | | | |

| 575 | | Affiliated Managers Group, Inc.(a) | | $ | 56,528 |

| 2,150 | | AMBAC Financial Group, Inc. | | | 25,198 |

| 1,560 | | Ameriprise Financial, Inc. | | | 86,284 |

| 300 | | Bear Stearns Cos., Inc. (The) | | | 27,090 |

| 246 | | Calamos Asset Management, Inc. (Class A Stock) | | | 5,368 |

| 2,850 | | Capital One Financial Corp. | | | 156,209 |

| 2,850 | | CIT Group, Inc. | | | 79,686 |

| 18,025 | | Citigroup, Inc. | | | 508,665 |

| 100 | | CME Group, Inc. | | | 61,890 |

| 1,800 | | Eaton Vance Corp. | | | 67,086 |

| 1,100 | | Federated Investors, Inc. (Class B Stock) | | | 46,827 |

| 4,646 | | Goldman Sachs Group, Inc. (The) | | | 932,777 |

| 819,000 | | Industrial And Commercial Bank of China (Class H Stock) (China) | | | 493,020 |

| 590 | | Investment Technology Group, Inc.(a) | | | 27,712 |

| 800 | | Jefferies Group, Inc. | | | 16,176 |

| 8,863 | | Lehman Brothers Holdings, Inc. | | | 568,739 |

| 1,350 | | Merrill Lynch & Co., Inc. | | | 76,140 |

| 6,150 | | Morgan Stanley | | | 303,994 |

| 100 | | Student Loan Corp. (The) | | | 11,842 |

| 2,840 | | TheStreet.com, Inc. | | | 31,524 |

| 1,790 | | ValueClick, Inc.(a) | | | 39,076 |

| 2,900 | | Western Union Co. (The) | | | 64,960 |

| | | | | |

| | | | | 3,686,791 |

| |

Food Products 0.2% | | | |

| 5,000 | | Archer-Daniels-Midland Co. | | | 220,250 |

| 2,050 | | General Mills, Inc. | | | 111,950 |

| | | | | |

| | | | | 332,200 |

| |

Foods 0.3% | | | |

| 200 | | Campbell Soup Co. | | | 6,322 |

| 600 | | Corn Products International, Inc. | | | 20,280 |

| 100 | | Kellogg Co. | | | 4,790 |

| 6,800 | | Kraft Foods, Inc. (Class A Stock) | | | 198,968 |

| 6,900 | | Kroger Co. (The) | | | 175,605 |

| 575 | | Ralcorp Holdings, Inc.(a) | | | 31,286 |

| 850 | | SYSCO Corp. | | | 24,692 |

| 5,700 | | Tyson Foods, Inc. (Class A Stock) | | | 81,225 |

| | | | | |

| | | | | 543,168 |

| |

Gas Utilities | | | |

| 800 | | Atmos Energy Corp. | | | 22,976 |

See Notes to Financial Statements.

| | |

| Target Asset Allocation Funds/Target Conservative Allocation Fund | | 17 |

Portfolio of Investments

as of January 31, 2008 (Unaudited) continued

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Healthcare Equipment & Supplies 0.2% | | | |

| 3,925 | | Covidien Ltd. | | $ | 175,173 |

| 1,900 | | Kinetic Concepts, Inc.(a) | | | 94,582 |

| 875 | | Medical Action Industries, Inc.(a) | | | 14,630 |

| 500 | | Somanetics Corp.(a) | | | 13,400 |

| | | | | |

| | | | | 297,785 |

| |

Healthcare Providers & Services 0.2% | | | |

| 7,950 | | CIGNA Corp. | | | 390,822 |

| 450 | | Inventiv Health, Inc.(a) | | | 14,800 |

| 1,050 | | LHC Group, Inc.(a) | | | 24,213 |

| | | | | |

| | | | | 429,835 |

| |

Healthcare Services 0.9% | | | |

| 225 | | Aetna, Inc. | | | 11,984 |

| 860 | | Amedisys, Inc.(a) | | | 36,662 |

| 500 | | AMERIGROUP Corp.(a) | | | 18,760 |

| 3,500 | | Biogen Idec, Inc.(a) | | | 213,325 |

| 300 | | Covance, Inc.(a) | | | 24,948 |

| 1,230 | | Healthways, Inc.(a) | | | 69,249 |

| 1,800 | | Humana, Inc.(a) | | | 144,540 |

| 200 | | Intuitive Surgical, Inc.(a) | | | 50,800 |

| 693 | | IPC The Hospitalist Co., Inc.(a) | | | 14,567 |

| 1,075 | | Pediatrix Medical Group, Inc.(a) | | | 73,197 |

| 1,220 | | Psychiatric Solutions, Inc.(a) | | | 36,807 |

| 3,140 | | Radnet, Inc.(a) | | | 28,291 |

| 700 | | Sunrise Senior Living, Inc.(a) | | | 20,097 |

| 17,393 | | UnitedHealth Group, Inc. | | | 884,260 |

| 1,150 | | WellPoint, Inc.(a) | | | 89,930 |

| | | | | |

| | | | | 1,717,417 |

| |

Hotels & Motels 0.5% | | | |

| 5,733 | | MGM Mirage(a) | | | 419,770 |

| 1,225 | | Starwood Hotels & Resorts Worldwide, Inc. | | | 55,431 |

| 4,635 | | Wynn Resorts Ltd. | | | 532,933 |

| | | | | |

| | | | | 1,008,134 |

| |

Hotels & Restaurants | | | |

| 1,475 | | AFC Enterprises, Inc.(a) | | | 13,673 |

| 2,475 | | Triarc Cos., Inc. (Class B Stock) | | | 23,018 |

| | | | | |

| | | | | 36,691 |

See Notes to Financial Statements.

| | |

| 18 | | Visit our website at www.prudential.com |

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Hotels, Restaurants & Leisure 0.8% | | | |

| 6,100 | | Carnival Corp. | | $ | 271,389 |

| 200 | | Chipotle Mexican Grill, Inc. (Class A Stock)(a) | | | 24,348 |

| 980 | | Home Inns & Hotels Management, Inc., ADR (China)(a) | | | 27,430 |

| 20,664 | | McDonald’s Corp. | | | 1,106,557 |

| 1,700 | | Wyndham Worldwide Corp. | | | 40,052 |

| | | | | |

| | | | | 1,469,776 |

| |

Household Durables 0.2% | | | |

| 300 | | Black & Decker Corp. | | | 21,762 |

| 3,600 | | Centex Corp. | | | 100,008 |

| 1,300 | | Fortune Brands, Inc. | | | 90,896 |

| 3,400 | | Lennar Corp. (Class A Stock) | | | 70,040 |

| 800 | | Lennar Corp. (Class B Stock) | | | 15,376 |

| 1,150 | | Tempur-Pedic International, Inc. | | | 22,793 |

| | | | | |

| | | | | 320,875 |

| |

Household Products 0.1% | | | |

| 3,000 | | Kimberly-Clark Corp. | | | 196,950 |

| |

Independent Power Producers & Energy Traders 0.1% | | | |

| 1,900 | | NRG Energy, Inc.(a) | | | 73,321 |

| 8,925 | | Reliant Energy, Inc.(a) | | | 189,835 |

| | | | | |

| | | | | 263,156 |

| |

Industrial Conglomerates 0.7% | | | |

| 4,675 | | 3M Co. | | | 372,364 |

| 19,250 | | General Electric Co. | | | 681,642 |

| 350 | | Teleflex, Inc. | | | 20,692 |

| 5,875 | | Tyco International Ltd. (Bermuda) | | | 231,240 |

| | | | | |

| | | | | 1,305,938 |

| |

Insurance 1.7% | | | |

| 550 | | AFLAC, Inc. | | | 33,732 |

| 9,400 | | Allstate Corp. (The) | | | 463,138 |

| 2,300 | | American International Group, Inc. | | | 126,868 |

| 3,740 | | Amtrust Financial Services, Inc. | | | 58,718 |

| 750 | | Assurant, Inc. | | | 48,668 |

| 2,000 | | Axis Capital Holdings Ltd. | | | 80,080 |

| 1,050 | | Chubb Corp. | | | 54,380 |

| 425 | | Delphi Financial Group, Inc. (Class A Stock) | | | 13,337 |

| 640 | | eHealth, Inc.(a) | | | 16,762 |

| 800 | | Endurance Specialty Holdings Ltd. (Bermuda) | | | 32,416 |

See Notes to Financial Statements.

| | |

| Target Asset Allocation Funds/Target Conservative Allocation Fund | | 19 |

Portfolio of Investments

as of January 31, 2008 (Unaudited) continued

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Insurance (continued) | | | |

| 10,725 | | Genworth Financial, Inc. (Class A Stock) | | $ | 261,046 |

| 1,800 | | Hanover Insurance Group, Inc. (The) | | | 81,990 |

| 1,400 | | Hartford Financial Services Group, Inc. | | | 113,078 |

| 1,462 | | HCC Insurance Holdings, Inc. | | | 40,731 |

| 655 | | Hilb Rogal & Hobbs Co. | | | 23,698 |

| 1,000 | | IPC Holdings Ltd. (Bermuda) | | | 25,730 |

| 1,175 | | Lincoln National Corp. | | | 63,873 |

| 2,650 | | MBIA, Inc. | | | 41,075 |

| 9,750 | | MetLife, Inc. | | | 574,957 |

| 600 | | Philadelphia Consolidated Holding Corp.(a) | | | 21,480 |

| 1,150 | | Protective Life Corp. | | | 45,701 |

| 1,100 | | Prudential Financial, Inc. | | | 92,807 |

| 1,350 | | RenaissanceRe Holdings Ltd. (Bermuda) | | | 76,936 |

| 500 | | State Auto Financial Corp. | | | 13,965 |

| 7,600 | | Travelers Cos., Inc. (The) | | | 365,560 |

| 1,140 | | United Fire & Casualty Co. | | | 38,053 |

| 7,850 | | Unum Group | | | 177,567 |

| 350 | | W.R. Berkley Corp. | | | 10,591 |

| 2,200 | | XL Capital Ltd. (Class A Stock) (Cayman Islands) | | | 99,000 |

| | | | | |

| | | | | 3,095,937 |

| |

Internet Services 1.0% | | | |

| 1,110 | | Aladdin Knowledge Systems Ltd. (Israel)(a) | | | 23,432 |

| 2,900 | | Amazon.com, Inc.(a) | | | 225,330 |

| 2,420 | | CyberSource Corp.(a) | | | 40,535 |

| 1,140 | | Digital River, Inc.(a) | | | 42,750 |

| 4,350 | | eBay, Inc.(a) | | | 116,972 |

| 370 | | Equinix, Inc.(a) | | | 27,946 |

| 4,400 | | Expedia, Inc.(a) | | | 101,288 |

| 1,198 | | Google, Inc. (Class A Stock)(a) | | | 676,031 |

| 3,877 | | Internet Brands, Inc. (Class A Stock)(a) | | | 29,930 |

| 2,500 | | j2 Global Communications, Inc.(a) | | | 54,775 |

| 6,410 | | NaviSite, Inc.(a) | | | 28,845 |

| 2,380 | | NIC, Inc. | | | 17,017 |

| 1,270 | | NutriSystem, Inc.(a) | | | 36,347 |

| 990 | | Shutterly, Inc.(a) | | | 19,256 |

| 13,700 | | Symantec Corp.(a) | | | 245,641 |

| 2,270 | | Trizetto Group, Inc.(a) | | | 44,310 |

| 800 | | VeriSign, Inc.(a) | | | 27,136 |

| 475 | | Yahoo!, Inc.(a) | | | 9,111 |

| | | | | |

| | | | | 1,766,652 |

See Notes to Financial Statements.

| | |

| 20 | | Visit our website at www.prudential.com |

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

IT Services 0.2% | | | |

| 14,700 | | Electronic Data Systems Corp. | | $ | 295,470 |

| |

Leisure Equipment | | | |

| 750 | | Brunswick Corp. | | | 14,243 |

| |

Machinery 0.5% | | | |

| 625 | | Actuant Corp. (Class A Stock) | | | 17,081 |

| 3,700 | | AGCO Corp.(a) | | | 222,814 |

| 4,500 | | Caterpillar, Inc. | | | 320,130 |

| 1,000 | | Crane Co. | | | 40,870 |

| 1,455 | | Deere & Co. | | | 127,691 |

| 2,000 | | Dover Corp. | | | 80,720 |

| 500 | | Lincoln Electric Holdings, Inc. | | | 30,825 |

| 400 | | Nordson Corp. | | | 19,952 |

| 1,300 | | SPX Corp. | | | 130,780 |

| | | | | |

| | | | | 990,863 |

| |

Machinery & Equipment | | | |

| 1,250 | | Rockwell Automation, Inc. | | | 71,275 |

| |

Manufacturing 0.1% | | | |

| 550 | | Danaher Corp. | | | 40,947 |

| 750 | | Eaton Corp. | | | 62,070 |

| 500 | | Harsco Corp. | | | 28,460 |

| 1,100 | | Hexcel Corp.(a) | | | 24,013 |

| | | | | |

| | | | | 155,490 |

| |

Media 0.9% | | | |

| 18,850 | | CBS Corp. (Class B Stock) | | | 474,831 |

| 2,140 | | DG FastChannel, Inc.(a) | | | 45,304 |

| 5,786 | | DIRECTV Group, Inc. (The)(a) | | | 130,648 |

| 500 | | Dish Network Corp. (Class A Stock)(a) | | | 14,120 |

| 7,500 | | Idearc, Inc. | | | 121,950 |

| 7,100 | | News Corp. (Class A Stock) | | | 134,190 |

| 17,450 | | Time Warner, Inc. | | | 274,663 |

| 13,250 | | Walt Disney Co. (The) | | | 396,573 |

| | | | | |

| | | | | 1,592,279 |

| |

Medical Supplies & Equipment 0.5% | | | |

| 950 | | Boston Scientific Corp.(a) | | | 11,523 |

| 350 | | C.R. Bard, Inc. | | | 33,799 |

| 200 | | Edwards Lifesciences Corp.(a) | | | 9,254 |

See Notes to Financial Statements.

| | |

| Target Asset Allocation Funds/Target Conservative Allocation Fund | | 21 |

Portfolio of Investments

as of January 31, 2008 (Unaudited) continued

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Medical Supplies & Equipment (continued) | | | |

| 520 | | Immucor, Inc.(a) | | $ | 14,997 |

| 600 | | Invitrogen Corp.(a) | | | 51,402 |

| 6,250 | | Johnson & Johnson | | | 395,375 |

| 1,000 | | Medtronic, Inc. | | | 46,570 |

| 2,290 | | Micrus Endovascular Corp.(a) | | | 43,991 |

| 410 | | Myriad Genetics, Inc.(a) | | | 17,634 |

| 4,560 | | NovaMed, Inc.(a) | | | 18,012 |

| 980 | | NuVasive, Inc.(a) | | | 38,622 |

| 300 | | Sepracor, Inc.(a) | | | 8,472 |

| 3,460 | | Spectranetics Corp. (The)(a) | | | 43,181 |

| 2,600 | | St. Jude Medical, Inc.(a) | | | 105,326 |

| 770 | | Wright Medical Group, Inc.(a) | | | 21,021 |

| 600 | | Zoll Medical Corp.(a) | | | 15,996 |

| | | | | |

| | | | | 875,175 |

| |

Metals & Mining 1.0% | | | |

| 7,000 | | Alcoa, Inc. | | | 231,700 |

| 770 | | Bucyrus International, Inc. (Class A Stock) | | | 71,387 |

| 150 | | Century Aluminum Co.(a) | | | 7,798 |

| 175 | | Cleveland-Cliffs, Inc. | | | 17,822 |

| 520 | | Dynamic Materials Corp. | | | 27,862 |

| 3,400 | | Freeport-McMoRan Copper & Gold, Inc. (Class B Stock) | | | 302,702 |

| 550 | | Joy Global, Inc. | | | 34,677 |

| 910 | | Ladish Co., Inc.(a) | | | 32,296 |

| 100 | | Newmont Mining Corp. | | | 5,434 |

| 1,900 | | Nucor Corp. | | | 109,820 |

| 1,000 | | Southern Copper Corp. | | | 93,840 |

| 600 | | Timken Co. | | | 18,138 |

| 5,567 | | Transocean, Inc.(a) | | | 682,514 |

| 1,200 | | United States Steel Corp. | | | 122,532 |

| | | | | |

| | | | | 1,758,522 |

| |

Multi-Line Retail | | | |

| 1,400 | | J.C. Penney Co., Inc. | | | 66,374 |

| 50 | | Macy’s, Inc. | | | 1,382 |

| | | | | |

| | | | | 67,756 |

| |

Multi-Utilities | | | |

| 1,200 | | Vectren Corp. | | | 32,940 |

| |

Multimedia | | | |

| 1,200 | | Viacom, Inc. (Class B Stock)(a) | | | 46,512 |

See Notes to Financial Statements.

| | |

| 22 | | Visit our website at www.prudential.com |

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Office Equipment 0.1% | | | |

| 300 | | School Specialty, Inc.(a) | | $ | 9,738 |

| 12,200 | | Xerox Corp. | | | 187,880 |

| | | | | |

| | | | | 197,618 |

| |

Oil & Gas Exploration/Production | | | |

| 270 | | Core Laboratories NV (Netherlands)(a) | | | 30,429 |

| |

Oil, Gas & Consumable Fuels 3.5% | | | |

| 3,300 | | Anadarko Petroleum Corp. | | | 193,347 |

| 3,650 | | Apache Corp. | | | 348,356 |

| 1,280 | | Arena Resources, Inc.(a) | | | 45,530 |

| 800 | | Ashland, Inc. | | | 36,424 |

| 1,100 | | Cabot Oil & Gas Corp. | | | 42,559 |

| 3,500 | | Chevron Corp. | | | 295,750 |

| 1,175 | | Concho Resources, Inc.(a) | | | 23,852 |

| 9,250 | | ConocoPhillips | | | 742,960 |

| 1,025 | | Continental Resources, Inc.(a) | | | 25,533 |

| 2,550 | | Devon Energy Corp. | | | 216,699 |

| 800 | | Dresser-Rand Group, Inc.(a) | | | 25,360 |

| 15,200 | | Exxon Mobil Corp. | | | 1,313,280 |

| 7,700 | | Global Industry Ltd.(a) | | | 135,982 |

| 1,275 | | Gulfport Energy Corp.(a) | | | 19,316 |

| 2,360 | | Hess Corp. | | | 214,359 |

| 8,375 | | Marathon Oil Corp. | | | 392,369 |

| 900 | | Nabors Industries Ltd. (Bermuda)(a) | | | 24,498 |

| 3,150 | | Occidental Petroleum Corp. | | | 213,790 |

| 400 | | ONEOK, Inc. | | | 18,800 |

| 3,850 | | Patterson-UTI Energy, Inc. | | | 75,383 |

| 1,000 | | Petrohawk Energy Corp.(a) | | | 15,750 |

| 5,699 | | Petroleo Brasileiro SA, ADR (Brazil) | | | 633,387 |

| 1,550 | | Petroquest Energy, Inc.(a) | | | 20,026 |

| 500 | | Pioneer Natural Resources Co. | | | 20,950 |

| 2,100 | | Royal Dutch Shell PLC (Class B Stock), ADR (United Kingdom) | | | 145,215 |

| 7,495 | | Schlumberger Ltd. (Netherlands) | | | 565,573 |

| 500 | | St. Mary Land & Exploration Co. | | | 17,615 |

| 1,750 | | Sunoco, Inc. | | | 108,850 |

| 400 | | Swift Energy Co.(a) | | | 17,260 |

| 5,200 | | Valero Energy Corp. | | | 307,788 |

| 400 | | W&T Offshore, Inc. | | | 11,316 |

| 2,500 | | XTO Energy, Inc. | | | 129,850 |

| | | | | |

| | | | | 6,397,727 |

See Notes to Financial Statements.

| | |

| Target Asset Allocation Funds/Target Conservative Allocation Fund | | 23 |

Portfolio of Investments

as of January 31, 2008 (Unaudited) continued

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Paper & Forest Products 0.1% | | | |

| 7,850 | | Domtar Corp.(a) | | $ | 63,350 |

| 3,300 | | International Paper Co. | | | 106,425 |

| 200 | | Owens Illinois, Inc.(a) | | | 10,080 |

| 200 | | Weyerhaeuser Co. | | | 13,544 |

| | | | | |

| | | | | 193,399 |

| |

Pharmaceuticals 2.2% | | | |

| 2,850 | | Abbott Laboratories | | | 160,455 |

| 6,297 | | Amylin Pharmaceuticals, Inc.(a) | | | 186,706 |

| 2,200 | | AstraZeneca PLC, ADR (United Kingdom) | | | 92,070 |

| 200 | | Barr Pharmaceuticals, Inc.(a) | | | 10,438 |

| 1,900 | | Bristol-Meyers Squibb Co. | | | 44,061 |

| 450 | | Celgene Corp.(a) | | | 25,249 |

| 7,400 | | Eli Lilly & Co. | | | 381,248 |

| 3,000 | | Express Scripts, Inc.(a) | | | 202,470 |

| 5,900 | | Gilead Sciences, Inc.(a) | | | 269,571 |

| 2,300 | | K-V Pharmaceutical Co. (Class A Stock)(a) | | | 59,754 |

| 6,720 | | LeMaitre Vascular, Inc.(a) | | | 36,960 |

| 6,200 | | Medco Health Solutions, Inc.(a) | | | 310,496 |

| 22,838 | | Merck & Co., Inc. | | | 1,056,943 |

| 39,125 | | Pfizer, Inc. | | | 915,134 |

| 8,000 | | Schering-Plough Corp. | | | 156,560 |

| 1,890 | | Sciele Pharma, Inc.(a) | | | 45,209 |

| 700 | | Watson Pharmaceuticals, Inc.(a) | | | 18,277 |

| 4,600 | | Wyeth | | | 183,080 |

| | | | | |

| | | | | 4,154,681 |

| |

Real Estate 0.1% | | | |

| 1,600 | | Jones Lang LaSalle, Inc. | | | 124,480 |

| |

Real Estate Investment Trusts 0.6% | | | |

| 200 | | Alexandria Real Estate Equities, Inc. | | | 19,646 |

| 700 | | AMB Property Corp. | | | 35,420 |

| 1,500 | | Apartment Investment & Management Co. (Class A Stock) | | | 59,460 |

| 750 | | Chimera Investment Corp. | | | 14,363 |

| 2,200 | | Douglas Emmett, Inc. | | | 50,270 |

| 2,050 | | Duke Realty Corp. | | | 48,462 |

| 2,350 | | Hospitality Properties Trust | | | 79,782 |

| 2,000 | | Host Hotels & Resorts, Inc. | | | 33,480 |

| 450 | | Liberty Property Trust | | | 14,450 |

| 300 | | Macerich Co. (The) | | | 20,511 |

| 8,050 | | ProLogis | | | 477,767 |

See Notes to Financial Statements.

| | |

| 24 | | Visit our website at www.prudential.com |

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Real Estate Investment Trusts (continued) | | | |

| 650 | | Public Storage, Inc. | | $ | 50,862 |

| 200 | | Regency Centers Corp. | | | 12,286 |

| 1,100 | | Simon Property Group, Inc. | | | 96,063 |

| 200 | | SL Green Realty Corp. | | | 18,562 |

| 350 | | UDR, Inc. | | | 7,991 |

| 900 | | Ventas, Inc. | | | 39,780 |

| | | | | |

| | | | | 1,079,155 |

| |

Retail | | | |

| 1,250 | | Family Dollar Stores, Inc. | | | 26,288 |

| |

Retail & Merchandising 1.2% | | | |

| 200 | | Abercrombie & Fitch Co. (Class A Stock) | | | 15,938 |

| 2,700 | | Best Buy Co., Inc. | | | 131,787 |

| 1,600 | | BJ’s Wholesale Club, Inc.(a) | | | 51,904 |

| 500 | | Brinker International, Inc. | | | 9,305 |

| 9,998 | | CVS Corp. | | | 390,622 |

| 1,900 | | GameStop Corp. (Class A Stock)(a) | | | 98,287 |

| 1,222 | | Jos. A. Bank Clothiers, Inc.(a) | | | 33,287 |

| 350 | | Kohl’s Corp.(a) | | | 15,974 |

| 13,865 | | Lowe’s Cos., Inc. | | | 366,591 |

| 500 | | Lululemon Athletica, Inc. (Canada)(a) | | | 16,945 |

| 550 | | Ross Stores, Inc. | | | 16,033 |

| 2,925 | | Safeway, Inc. | | | 90,646 |

| 600 | | Sonic Corp.(a) | | | 13,308 |

| 1,025 | | Staples, Inc. | | | 24,538 |

| 20,556 | | Tesco PLC (United Kingdom) | | | 171,839 |

| 6,900 | | Wal-Mart Stores, Inc. | | | 351,072 |

| 13,834 | | Yum! Brands, Inc. | | | 472,569 |

| | | | | |

| | | | | 2,270,645 |

| |

Semiconductors 0.7% | | | |

| 800 | | Analog Devices, Inc. | | | 22,688 |

| 600 | | ATMI, Inc.(a) | | | 15,780 |

| 800 | | Broadcom Corp. (Class A Stock)(a) | | | 17,664 |

| 1,600 | | Brooks Automation, Inc.(a) | | | 19,664 |

| 32,451 | | Intel Corp. | | | 687,961 |

| 900 | | MEMC Electronic Materials, Inc.(a) | | | 64,314 |

| 1,125 | | Microsemi Corp.(a) | | | 25,560 |

| 900 | | National Semiconductor Corp. | | | 16,587 |

| 2,100 | | O2Micro International Ltd., ADR (Cayman Islands)(a) | | | 16,737 |

| 10,500 | | Texas Instruments, Inc. | | | 324,765 |

See Notes to Financial Statements.

| | |

| Target Asset Allocation Funds/Target Conservative Allocation Fund | | 25 |

Portfolio of Investments

as of January 31, 2008 (Unaudited) continued

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Semiconductors (continued) | | | |

| 1,250 | | Ultra Clean Holdings, Inc.(a) | | $ | 12,238 |

| 1,700 | | Xilinx, Inc. | | | 37,179 |

| | | | | |

| | | | | 1,261,137 |

| |

Semiconductors & Semiconductor Equipment 0.1% | | | |

| 5,850 | | NVIDIA Corp.(a) | | | 143,851 |

| 550 | | Varian Semiconductor Equipment Associates, Inc.(a) | | | 17,716 |

| | | | | |

| | | | | 161,567 |

| |

Software 2.0% | | | |

| 3,000 | | Adobe Systems, Inc.(a) | | | 104,790 |

| 4,100 | | BMC Software, Inc.(a) | | | 131,364 |

| 16,364 | | CA, Inc. | | | 360,499 |

| 3,100 | | Fair Isaac Corp. | | | 79,050 |

| 500 | | Global Payments, Inc. | | | 18,700 |

| 4,836 | | Mastercard, Inc. (Class A Stock) | | | 1,001,052 |

| 57,339 | | Microsoft Corp. | | | 1,869,251 |

| 600 | | MoneyGram International, Inc. | | | 3,204 |

| 1,070 | | Phase Forward, Inc.(a) | | | 18,458 |

| 1,800 | | PROS Holdings, Inc.(a) | | | 27,630 |

| 1,375 | | Sybase, Inc.(a) | | | 38,802 |

| 1,400 | | Tyler Technologies, Inc.(a) | | | 18,732 |

| | | | | |

| | | | | 3,671,532 |

| |

Specialty Retail 0.3% | | | |

| 1,765 | | Aaron Rents, Inc. | | | 33,747 |

| 200 | | AutoZone, Inc.(a) | | | 24,176 |

| 10,952 | | Home Depot, Inc. (The) | | | 335,898 |

| 3,500 | | Limited Brands, Inc. | | | 66,815 |

| 510 | | Monro Muffler Brake, Inc. | | | 9,435 |

| 6,600 | | RadioShack Corp. | | | 114,510 |

| | | | | |

| | | | | 584,581 |

| |

Telecommunication 2.5% | | | |

| 9,169 | | America Movil SAB de CV (Class L Stock), ADR (Mexico) | | | 549,315 |

| 4,200 | | AmerisourceBergen Corp. | | | 195,930 |

| 35,626 | | AT&T, Inc. | | | 1,371,245 |

| 820 | | Cbeyond, Inc.(a) | | | 27,667 |

| 1,700 | | CenturyTel, Inc. | | | 62,747 |

| 39,000 | | China Mobile Ltd. (Hong Kong) | | | 574,985 |

| 18,851 | | Cisco Systems, Inc.(a) | | | 461,849 |

| 2,300 | | Corning, Inc. | | | 55,361 |

See Notes to Financial Statements.

| | |

| 26 | | Visit our website at www.prudential.com |

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Telecommunication (continued) | | | |

| 125 | | Crown Castle International Corp.(a) | | $ | 4,524 |

| 930 | | GeoEye, Inc.(a) | | | 32,513 |

| 9,150 | | Juniper Networks, Inc.(a) | | | 248,422 |

| 125 | | Motorola, Inc. | | | 1,441 |

| 3,733 | | QUALCOMM, Inc. | | | 158,354 |

| 24,017 | | Sprint Nextel Corp. | | | 252,899 |

| 400 | | Telephone & Data Systems, Inc. | | | 21,096 |

| 14,900 | | Verizon Communications, Inc. | | | 578,716 |

| | | | | |

| | | | | 4,597,064 |

| |

Textiles, Apparel & Luxury Goods 0.1% | | | |

| 5,700 | | Jones Apparel Group, Inc. | | | 95,760 |

| |

Thrifts & Mortgage Finance 0.4% | | | |

| 2,325 | | Countrywide Financial Corp. | | | 16,182 |

| 7,900 | | Federal Home Loan Mortgage Corp. | | | 240,081 |

| 3,700 | | Federal National Mortgage Assoc. | | | 125,282 |

| 20,100 | | Washington Mutual, Inc. | | | 400,392 |

| | | | | |

| | | | | 781,937 |

| |

Tobacco Products 0.1% | | | |

| 300 | | Universal Corp. | | | 14,943 |

| 4,500 | | UST, Inc. | | | 233,820 |

| | | | | |

| | | | | 248,763 |

| |

Trading Companies & Distributors | | | |

| 200 | | Watsco, Inc. | | | 7,376 |

| |

Transportation 0.6% | | | |

| 1,200 | | Burlington Northern Santa Fe Corp. | | | 103,824 |

| 675 | | Forward Air Corp. | | | 20,925 |

| 4,600 | | J.B. Hunt Transport Services, Inc. | | | 143,060 |

| 4,923 | | Norfolk Southern Corp. | | | 267,762 |

| 300 | | Overseas Shipholding Group, Inc. | | | 19,566 |

| 800 | | Ryder System, Inc. | | | 41,648 |

| 4,330 | | Union Pacific Corp. | | | 541,380 |

| 900 | | United Parcel Service, Inc. (Class B Stock) | | | 65,844 |

| | | | | |

| | | | | 1,204,009 |

| |

Utilities 0.6% | | | |

| 4,150 | | American Electric Power Co., Inc. | | | 177,744 |

| 5,900 | | CMS Energy Corp. | | | 92,453 |

| 2,000 | | Dominion Resources, Inc. | | | 86,000 |

See Notes to Financial Statements.

| | |

| Target Asset Allocation Funds/Target Conservative Allocation Fund | | 27 |

Portfolio of Investments

as of January 31, 2008 (Unaudited) continued

| | | | | | | | |

| Shares | | | | Description | | Value (Note 1) |

| | | | | | | | |

| COMMON STOCKS (Continued) | | | |

| |

| Utilities (continued) | | | |

| 1,300 | | | | | DTE Energy Co. | | $ | 55,445 |

| 800 | | | | | Duke Energy Corp. | | | 14,928 |

| 7,050 | | | | | Edison International | | | 367,728 |

| 601 | | | | | Headwaters, Inc.(a) | | | 6,773 |

| 750 | | | | | Illinois Tool Works, Inc. | | | 37,800 |

| 2,250 | | | | | Northeast Utilities | | | 62,370 |

| 125 | | | | | PG&E Corp. | | | 5,130 |

| 50 | | | | | Pinnacle West Capital Corp. | | | 1,921 |

| 500 | | | | | PNM Resources, Inc. | | | 9,660 |

| 950 | | | | | SCANA Corp. | | | 35,426 |

| 1,075 | | | | | Westar Energy, Inc. | | | 26,187 |

| 675 | | | | | Wisconsin Energy Corp. | | | 30,733 |

| 4,650 | | | | | Xcel Energy, Inc. | | | 96,674 |

| | | | | | | | |

| | | | | | | | 1,106,972 |

| | | | | | | | |

| | | | | TOTAL COMMON STOCKS

(cost $67,248,290) | | | 73,388,330 |

| | | | | | | | |

| | | |

Moody’s(†)

Ratings | | Principal

Amount (000)# | | | | |

| |

| ASSET-BACKED SECURITIES 1.7% | | | |

| Aaa | | $ | 7 | | Aames Mortgage Investment Trust, Series 2006-1, Class A1

3.436%(b), 04/25/36 | | | 6,868 |

| AAA(c) | | | 305 | | Asset Backed Funding Certificates, Series 2004-OPT5, Class A1

3.726%(b), 06/25/34 | | | 270,907 |

| Aaa | | | 500 | | Bank One Issuance Trust,

Series 2003-A3, Class A3

4.346%(b), 12/15/10 | | | 499,844 |

| Aaa | | | 147 | | Countrywide Asset-Backed Certificates,

Series 2006-11, Class 3AV1

3.436%(b), 06/29/36 | | | 145,429 |

| Aaa | | | 344 | | First Franklin Mortgage Loan Asset-Backed Certificates,

Series 2006-FF15, Class A3 3.426%(b), 11/25/36 | | | 333,665 |

| Aaa | | | 116 | | Fremont Home Loan Trust,

Series 2005-E, Class 2A2 3.546%(b), 01/25/36 | | | 115,565 |

| Aaa | | | 100 | | JPMorgan Mortgage Acquisition Corp., Series 2006-WMC1, Class A2

3.446%(b), 03/25/36 | | | 99,917 |

See Notes to Financial Statements.

| | |

| 28 | | Visit our website at www.prudential.com |

| | | | | | | | |

Moody’s(†)

Ratings | | Principal

Amount (000)# | | Description | | Value (Note 1) |

| | | | | | | | |

| ASSET-BACKED SECURITIES (continued) | | | |

| Aaa | | $ | 500 | | MBNA Master Credit Card Trust,

Series 1998-E, Class A

4.403%(b), 09/15/10 | | $ | 501,280 |

| Aaa | | | 324 | | Merrill Lynch Mortgage Investors, Inc.,

Series 2006-RM5, Class A2A 3.436%(b), 10/25/37 | | | 303,038 |

| Aaa | | | 265 | | Morgan Stanley ABS Capital I,

Series 2006-HE7, Class A2A

3.426%(b), 09/25/36 | | | 260,397 |

| Aaa | | | 296 | | Soundview Home Equity Loan Trust,

(original cost $295,651; purchased 10/13/06) Series 2006-NLC1,

Class A1, 144A(j)(k)

3.436%(b), 11/25/36 | | | 291,124 |

| Aaa | | | 292 | | Structured Asset Securities Corp.,

Series 2006-BC3, Class A2 3.426%(b), 10/25/36 | | | 287,142 |

| | | | | | | | |

| | | | | TOTAL ASSET-BACKED SECURITIES

(cost $3,202,851) | | | 3,115,176 |

| | | | | | | | |

| COLLATERALIZED MORTGAGE OBLIGATIONS 2.7% |

| Aaa | | | 219 | | American Home Mortgage Investment Trust, Series 2005-2, Class 5A2

3.526%(b), 09/25/35 | | | 219,054 |

| Aaa | | | 242 | | Bear Stearns Adjustable Rate Mortgage Trust, Series 2005-4, Class 23A2

5.368%(b), 05/25/35 | | | 238,781 |

| Aaa | | | 105 | | Federal Home Loan Mortgage Corp., Series 41, Class F

10.00%, 05/15/20 | | | 111,383 |

| Aaa | | | 108 | | Series 1565, Class G

6.00%, 08/15/08 | | | 108,148 |

| Aaa | | | 615 | | Series 2801, Class EH

4.50%, 11/15/16 | | | 620,054 |

| Aaa | | | 511 | | Series 2962, Class YC

4.50%, 09/15/14 | | | 514,242 |

| Aaa | | | 443 | | Series 3117, Class PN

5.00%, 11/15/21 | | | 446,737 |

| Aaa | | | 25 | | Federal National Mortgage Assoc., Series 1992-146, Class PZ

8.00%, 08/25/22 | | | 27,545 |

See Notes to Financial Statements.

| | |

| Target Asset Allocation Funds/Target Conservative Allocation Fund | | 29 |

Portfolio of Investments

as of January 31, 2008 (Unaudited) continued

| | | | | | | | |

Moody’s(†)

Ratings | | Principal

Amount (000)# | | Description | | Value (Note 1) |

| | | | | | | | |

| COLLATERALIZED MORTGAGE OBLIGATIONS (continued) | | | |

| Aaa | | $ | 730 | | FHLMC Structured Pass-Through Securities, Series T-61, Class 1A1

6.188%(b), 07/25/44 | | $ | 736,170 |

| AAA(c) | | | 360 | | GSR Mortgage Loan Trust,

Series 2005-AR6, Class 2A1

4.539%(b), 09/25/35 | | | 352,425 |

| Aaa | | | 243 | | Harborview Mortgage Loan Trust,

Series 2006-12, Class 2A11

4.024%(b), 01/19/38 | | | 237,840 |

| NR | | | 153 | | Vendee Mortgage Trust,

Series 2001-1, Class 1A

6.814%(b), 01/15/30 | | | 159,540 |

| Aaa | | | 849 | | Washington Mutual, Inc.,

Series 2003-R1, Class A1

3.916%(b), 12/25/27 | | | 810,926 |

| Aaa | | | 407 | | Series 2006-AR15, Class 2A

6.162%(b), 11/25/46 | | | 386,913 |

| | | | | | | | |

| | | | | TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS

(cost $4,992,055) | | | 4,969,758 |

| | | | | | | | |

| CORPORATE BONDS 11.8% |

|

| Advertising 0.2% |

| Baa1 | | | 300 | | Omnicom Group, Inc., Gtd. Notes

5.90%, 04/15/16 | | | 312,014 |

|

| Automobile Manufacturers 0.1% |

| A3 | | | 200 | | DaimlerChrysler NA Holding Corp., Gtd. Notes, MTN

5.75%, 09/08/11 | | | 208,007 |

|

| Commercial Services 0.3% |

| B1 | | | 500 | | Service Corp. International,

Sr. Unsec’d. Notes

6.50%, 03/15/08 | | | 501,110 |

|

| Diversified Financial Services 1.6% |

| B1 | | | 500 | | Ford Motor Credit Co., Notes

7.00%, 10/01/13 | | | 419,160 |

| Aaa | | | 800 | | General Electric Capital Corp.,

Sr. Unsec’d. Notes, MTN

5.031%(b), 03/16/09 | | | 800,956 |

See Notes to Financial Statements.

| | |

| 30 | | Visit our website at www.prudential.com |

| | | | | | | | |

Moody’s(†)

Ratings | | Principal

Amount (000)# | | Description | | Value (Note 1) |

| | | | | | | | |

| CORPORATE BONDS (continued) | | | |

|

| Diversified Financial Services (cont’d.) |

| Aaa | | $ | 1,000 | | General Electric Capital Corp.,

Sr. Unsec’d. Notes

5.875%, 01/14/38 | | $ | 977,236 |

| A1 | | | 700 | | Goldman Sachs Group, Inc. (The),

Sub. Notes

6.75%, 10/01/37 | | | 686,735 |

| | | | | | | | |

| | | | | | | | 2,884,087 |

|

| Entertainment & Leisure 0.3% |

| NR | | | 500 | | Harrah’s Operating Co., Inc.,

(original cost $501,250; purchased 11/18/05) Notes, 144A(j)(k) 5.498%(b), 02/08/08 | | | 500,085 |

|

| Financial-Bank & Trust 3.2% |

| Aa3 | | | 2,100 | | Bank of America Corp., Notes

8.00%(b), 12/29/49 | | | 2,181,375 |

| Aa2 | | | 2,600 | | Barclays Bank PLC,

(original cost $2,582,502; purchased 12/07/07) Sub. Notes, 144A (United Kingdom)(j)(k)

6.05%, 12/04/17 | | | 2,678,941 |

| Aa2 | | | 1,000 | | Unicredito Luxembourg Finance SA,

(original cost $1,000,000; purchased 10/17/06) Gtd. Notes, 144A (Luxembourg)(j)(k)

3.768%(b), 10/24/08 | | | 998,297 |

| | | | | | | | |

| | | | | | | | 5,858,613 |

|

| Financial Services 2.6% |

| A2 | | | 1,000 | | Bear Stearns Cos., Inc. (The),

Sr. Unsec’d. Notes

7.25%, 02/01/18 | | | 999,963 |

| A1 | | | 1,000 | | Citigroup Capital XXI, Gtd. Notes

8.30%(b), 12/21/57 | | | 1,078,045 |

| Aaa | | | 900 | | General Electric Capital Corp.,

Sr. Unsec’d. Notes, MTN

3.244%(b), 10/24/08 | | | 898,612 |

| Aa1 | | | 500 | | General Electric Capital Corp.,

(original cost $999,960; purchased 08/30/07), Sub. Notes, 144A(j)(k) 6.50%(b), 09/15/47 | | | 976,903 |

See Notes to Financial Statements.

| | |

| Target Asset Allocation Funds/Target Conservative Allocation Fund | | 31 |

Portfolio of Investments

as of January 31, 2008 (Unaudited) continued

| | | | | | | | |

Moody’s(†)

Ratings | | Principal

Amount (000)# | | Description | | Value (Note 1) |

| CORPORATE BONDS (continued) | | | | | |

| | | | | | | | |

| |

| Financial Services (cont’d.) | | | |

| B1 | | $ | 500 | | General Motors Acceptance Corp.,

Sr. Unsec’d. Notes

8.00%, 11/01/31 | | $ | 414,380 |

| A1 | | | 500 | | Lehman Brothers Holdings, Inc.,

Sr. Unsec’d. Notes, MTN

5.625%, 01/24/13 | | | 506,459 |

| | | | | | | | |

| | | | | | | | 4,874,362 |

|

| Insurance 0.3% |

| Aa2 | | | 600 | | American International Group, Inc.,

Sr. Unsec’d. Notes, MTN

5.85%, 01/16/18 | | | 601,558 |

|

| Medical Supplies & Equipment 0.3% |

| B2 | | | 500 | | HCA, Inc., Sr. Sec’d. Notes

9.25%, 11/15/16 | | | 524,375 |

|

| Oil, Gas & Consumable Fuels 0.4% |

| Baa1 | | | 377 | | Petroleum Export Ltd.,

(original cost $377,418; purchased 07/14/05), Sr. Notes, 144A (Cayman Islands)(j)(k)

5.265%, 06/15/11 | | | 375,455 |

| Baa2 | | | 400 | | Transocean, Inc., Sr. Unsec’d. Notes 5.341%(b), 09/05/08 | | | 398,656 |

| | | | | | | | |

| | | | | | | | 774,111 |

|

| Pharmaceuticals 0.2% |

| Baa2 | | | 400 | | Cardinal Health, Inc.,

(original cost $400,000; purchased 09/28/06), Sr. Unsec’d. Notes, 144A(j)(k)

5.499%(b), 10/02/09 | | | 401,618 |

|

| Telecommunications 1.2% |

| A2 | | | 400 | | BellSouth Corp., Sr. Unsec’d. Notes 4.969%(b), 08/15/08 | | | 399,589 |

| Baa3 | | | 900 | | Embarq Corp., Sr. Unsec’d. Notes 6.738%, 06/01/13 | | | 923,322 |

| Ba1 | | | 1,000 | | Qwest Corp., Sr. Notes

7.625%, 06/15/15 | | | 1,007,500 |

| | | | | | | | |

| | | | | | | | 2,330,411 |

See Notes to Financial Statements.

| | |

| 32 | | Visit our website at www.prudential.com |

| | | | | | | | |

Moody’s(†)

Ratings | | Principal

Amount (000)# | | Description | | Value (Note 1) |

| | | | | | | | |

| CORPORATE BONDS (continued) | | | | | |

| Transportation 1.1% |

| Baa3 | | $ | 2,000 | | Con-Way, Inc., Sr. Unsec’d. Notes 7.25%, 01/15/18 | | $ | 2,043,668 |

| | | | | | | | |

| | | | | TOTAL CORPORATE BONDS

(cost $21,679,974) | | | 21,814,019 |

| | | | | | | | |

| FOREIGN GOVERNMENT BONDS 2.7% |

| Aaa | | EUR | 800 | | Deutsche Bundesrepublik (Germany) 6.25%, 01/04/30 | | | 1,484,085 |

| Aa2 | | JPY | 3,000 | | Federal Republic of Italy (Italy)

3.80%, 03/27/08 | | | 28,322 |

| Aaa | | EUR | 800 | | France Government Bond (France) 5.75%, 10/25/32 | | | 1,403,458 |

| Ba1 | | BRL | 1,300 | | Republic of Brazil (Brazil)

12.50%, 01/05/22 | | | 811,114 |

| Ba1 | | | 180 | | Republic of Panama (Panama)

9.625%, 02/08/11 | | | 204,750 |

| Aaa | | GBP | 300 | | United Kingdom Gilt (United Kingdom) 4.25%, 03/07/11 | | | 595,639 |

| Aaa | | GBP | 200 | | United Kingdom Gilt (United Kingdom) 5.75%, 12/07/09 | | | 407,891 |

| | | | | | | | |

| | | | | TOTAL FOREIGN GOVERNMENT BOND

(cost $4,718,555) | | | 4,935,259 |

| | | | | | | | |

| MUNICIPAL BOND 0.1% |

| Aaa | | | 200 | | Georgia State Road & Tollway Authority, Revenue Bonds

5.00%, 03/01/21

(cost $196,792) | | | 210,306 |

| | | | | | | | |

| U.S. GOVERNMENT MORTGAGE-BACKED OBLIGATIONS 39.5% |

| | | 868 | | Federal Home Loan Mortgage Corp.

5.00 %, 11/01/35 - 01/01/36 | | | 865,204 |

| | | 443 | | 5.031%(b), 03/01/36 | | | 449,755 |

| | | 1,000 | | 5.50%, TBA | | | 1,012,188 |

| | | 194 | | 6.00%, 09/01/22 | | | 200,317 |

| | | 13 | | 7.179%(b), 08/01/23 | | | 12,824 |

| | | 810 | | Federal National Mortgage Assoc.

4.00 %, 08/01/18 - 06/01/19 | | | 799,652 |

| | | 1,884 | | 4.50 %, 09/01/35 - 11/01/35 | | | 1,830,646 |

| | | 5,276 | | 5.00 %, 01/01/19 - 11/01/33 | | | 5,264,286 |

| | | 821 | | 5.089%(b), 06/01/35 | | | 837,098 |

| | | 20,747 | | 5.50 %, 09/01/33 - 12/01/37 | | | 21,030,180 |

| | | 15,000 | | 5.50%, TBA | | | 15,196,875 |

See Notes to Financial Statements.

| | |

| Target Asset Allocation Funds/Target Conservative Allocation Fund | | 33 |

Portfolio of Investments

as of January 31, 2008 (Unaudited) continued

| | | | | |

Principal

Amount (000)# | | Description | | Value (Note 1) |

| | | | | |

U.S. GOVERNMENT MORTGAGE-BACKED OBLIGATIONS (continued) | | | |

| | Federal National Mortgage Assoc. (continued) | | | |

| $ 81 | | 5.622%(b), 05/01/36 | | $ | 81,144 |

| 1,365 | | 6.00 %, 05/01/16 - 10/01/36 | | | 1,402,103 |

| 3,000 | | 6.00%, TBA | | | 3,077,814 |

| 1,425 | | 6.50 %, 01/01/16 - 10/01/37 | | | 1,479,488 |

| 167 | | 7.50%, 01/01/32 | | | 180,999 |

| 53 | | Government National Mortgage Assoc.

4.50 %, 08/15/33 - 09/15/33 | | | 51,702 |

| 6,861 | | 5.00 %, 06/15/33 - 07/15/37 | | | 6,880,305 |

| 4,937 | | 5.50 %, 07/15/37 - 09/15/37 | | | 5,035,305 |

| 8 | | 5.625%(b), 09/20/22 | | | 8,314 |

| 1,777 | | 6.00 %, 12/15/36 - 09/15/37 | | | 1,835,429 |

| 5,000 | | 6.00%, TBA | | | 5,162,500 |

| 64 | | 8.50 %, 02/20/30 - 06/15/30 | | | 70,962 |

| | | | | |

| | TOTAL U.S. GOVERNMENT MORTGAGE-BACKED OBLIGATIONS

(cost $71,169,236) | | | 72,765,090 |

| | | | | |

|

U.S. Treasury Obligations 3.5% |

| 100 | | U.S. Treasury Bonds

4.75%, 02/15/37 | | | 106,531 |

| 400 | | 12.00%, 08/15/13 | | | 420,188 |

| 900 | | U.S. Treasury Inflation Index Bonds, TIPS

1.75%, 01/15/28 | | | 910,363 |

| 900 | | 2.00%, 01/15/14 - 01/15/16 | | | 1,031,962 |

| 1,400 | | 2.375%, 04/15/11 - 01/15/25 | | | 1,688,835 |

| 190 | | 3.875%, 04/15/29 | | | 337,399 |

| 100 | | U.S. Treasury Notes

4.25%, 11/15/17 | | | 105,016 |

| 1,300 | | 4.625%, 07/31/12 | | | 1,402,476 |

| 200 | | 5.125%, 06/30/11 | | | 217,531 |

| 500 | | U.S. Treasury Strip Coupon, IO

7.25%, 02/15/22 | | | 268,066 |

| | | | | |

| | TOTAL U.S. TREASURY OBLIGATIONS

(cost $6,124,464) | | | 6,488,367 |

| | | | | |

|

Bank Notes 1.1% |

| | Chrysler Finco Term (original cost $1,895,250, purchased 11/28/07)(j)(k) | | | |

| 1,995 | | 8.99%, 08/03/12 | | | 1,785,026 |

| 300 | | TXU (Tceh) Term B3 (original cost $291,000, purchased 01/16/08)(j)(k)

8.40%, 10/10/14 | | | 276,443 |

| | | | | |

| | TOTAL BANK NOTES

(cost $2,188,673) | | | 2,061,469 |

| | | | | |

| | TOTAL LONG-TERM INVESTMENTS

(cost $181,520,890) | | | 189,747,774 |

| | | | | |

See Notes to Financial Statements.

| | |

| 34 | | Visit our website at www.prudential.com |

| | | | | |

Principal

Amount (000)# | | Description | | Value (Note 1) |

| | | | | |

SHORT-TERM INVESTMENTS 14.1% |

|

U.S. Treasury Obligations(d)(e) 0.3% |

| | U.S. Treasury Bills | | | |

| $ 30 | | 2.91%, 03/13/08 | | $ | 29,896 |

| 40 | | 2.933%, 02/28/08 | | | 39,913 |

| 540 | | 2.955%, 03/13/08 | | | 538,131 |

| 10 | | 3.04%, 03/13/08 | | | 9,965 |

| | | | | |

| | TOTAL U.S. TREASURY OBLIGATIONS

(cost $617,961) | | | 617,905 |

| | | | | |

| | |

Contracts/

Notional

Amount (000)# | | | | |

Outstanding Options Purchased(a) 1.4% | | | |

| |

Call Options 1.3% | | | |

| | 5 Year U.S. Treasury Note Futures, | | | |

| 21,000 | | expiring 02/22/2008, Strike Price $122.00 | | | 3,281 |

| | 20 Year U.S. Treasury Bond Futures, | | | |

| 12,100 | | expiring 02/22/2008, Strike Price $137.00 | | | 1,891 |

| | Currency Option USD vs. JPY, | | | |

| 4,500 | | expiring 09/16/2008 @ FX Rate 118.00 | | | 4,991 |

| 1,700 | | expiring 03/31/2010 @ FX Rate 104.65 | | | 66,055 |

| | Eurodollar Futures, | | | |

| 116,000 | | expiring 03/17/2008, Strike Price $95.00 | | | 607,550 |

| | Swap on 3 Month LIBOR, | | | |

| 6,500 | | expiring 09/19/2008 @ 4.55% | | | 189,886 |

| 16,100 | | expiring 09/26/2008 @ 4.75% | | | 525,221 |