Performance for the Third Quarter ended December 31, 2004

Nandan M. Nilekani

Chief Executive Officer, President and Managing Director

S. Gopalakrishnan

Chief Operating Officer and Deputy Managing Director

© Infosys Technologies Limited 2004-2005

Safe Harbour

Certain statements in this release concerning our future growth prospects are forward-looking statements, which involve a number of risks and uncertainties that could cause actual results to differ materially from those in such forward-looking statements. The risks and uncertainties relating to these statements include, but are not limited to, risks and uncertainties regarding fluctuations in earnings, our ability to manage growth, intense competition in IT services including those factors which may affect our cost advantage, wage increases in India, our ability to attract and retain highly skilled professionals, time and cost overruns on fixed-price, fixed-time frame contracts, client concentration, restrictions on immigration, industry segment concentration, our ability to manage our international operations, reduced demand for technology in our key focus areas, disruptions in telecommunication networks or system failures, our ability to successfully complete and integrate potential acquisitions, liability for damages on our service contracts, the success of the companies in which Infosys has made strategic investments, withdrawal of governmental fiscal incentives, political instability and regional conflicts, legal restrictions on raising capital or acquiring companies outside India, and unauthorized use of our intellectual property and general economic conditions affecting our industry. Additional risks that could affect our future operating results are more fully described in our United States Securities and Exchange Commission filings including our Annual Report on Form 20-F for the fiscal year ended March 31, 2004, Quarterly Report on Form 6-K for the quarters ended June 30, 2004 and September 30, 2004 and Registration Statement on Form F-3 filed on December 20, 2004. These filings are available at www.sec.gov. Infosys may, from time to time, make additional written and oral forward looking statements, including statements contained in the company’s filings with the Securities and Exchange Commission and our reports to shareholders. The company does not undertake to update any forward-looking statement that may be made from time to time by or on behalf of the company.

© Infosys Technologies Limited 2004-2005 Slide 2

Agenda

Financial Performance Operational Performance

Client Acquisition & Expansion of Services Human Resources Capex and Infrastructure Outlook for the Future Summary

© Infosys Technologies Limited 2004-2005 Slide 3

Financial Performance

© Infosys Technologies Limited 2004-2005

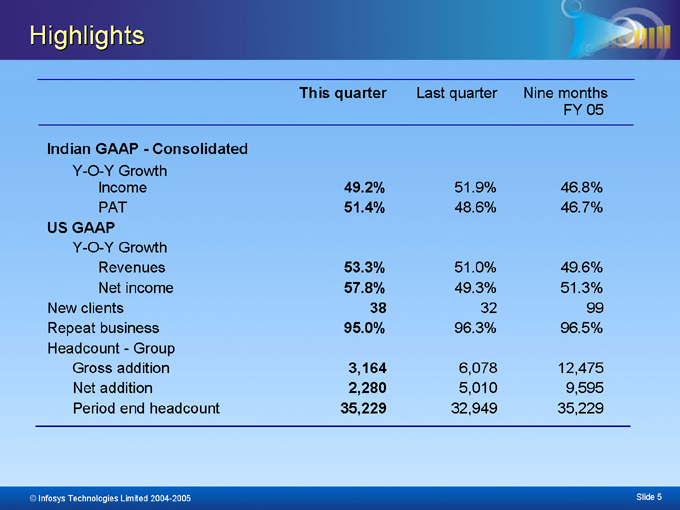

Highlights

This quarter Last quarter Nine months FY 05

Indian GAAP - Consolidated

Y-O-Y Growth

Income 49.2% 51.9% 46.8%

PAT 51.4% 48.6% 46.7%

US GAAP

Y-O-Y Growth

Revenues 53.3% 51.0% 49.6%

Net income 57.8% 49.3% 51.3%

New clients 38 32 99

Repeat business 95.0% 96.3% 96.5%

Headcount - Group

Gross addition 3,164 6,078 12,475

Net addition 2,280 5,010 9,595

Period end headcount 35,229 32,949 35,229

© Infosys Technologies Limited 2004-2005 Slide 5

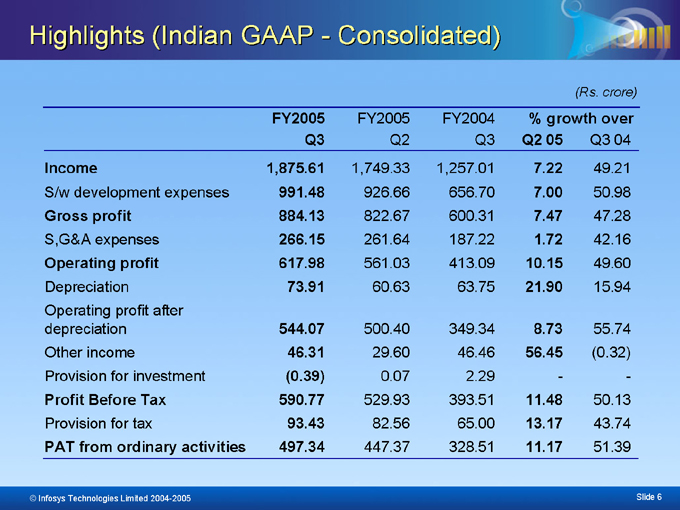

Highlights (Indian GAAP - Consolidated)

(Rs. crore)

FY2005 Q3 FY2005 Q2 FY2004 Q3 % growth over Q2 05 Q3 04

Income 1,875.61 1,749.33 1,257.01 7.22 49.21

S/w development expenses 991.48 926.66 656.70 7.00 50.98

Gross profit 884.13 822.67 600.31 7.47 47.28

S,G&A expenses 266.15 261.64 187.22 1.72 42.16

Operating profit 617.98 561.03 413.09 10.15 49.60

Depreciation 73.91 60.63 63.75 21.90 15.94

Operating profit after depreciation 544.07 500.40 349.34 8.73 55.74

Other income 46.31 29.60 46.46 56.45 (0.32)

Provision for investment (0.39) 0.07 2.29 - -

Profit Before Tax 590.77 529.93 393.51 11.48 50.13

Provision for tax 93.43 82.56 65.00 13.17 43.74

PAT from ordinary activities 497.34 447.37 328.51 11.17 51.39

© Infosys Technologies Limited 2004-2005 Slide 6

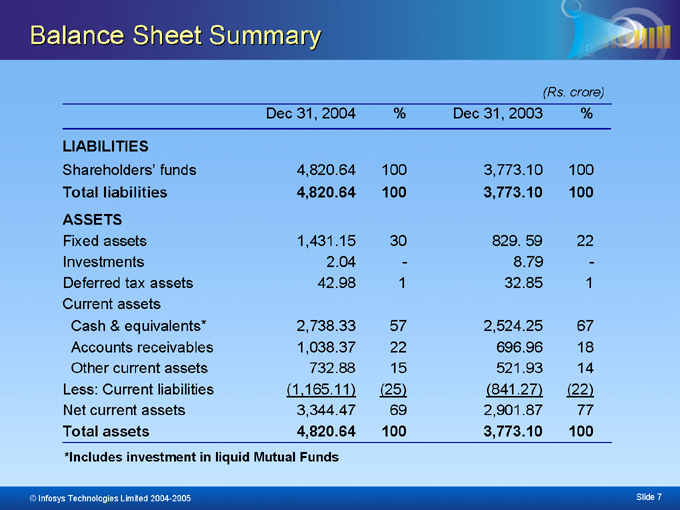

Balance Sheet Summary

(Rs. crore)

Dec 31, 2004 % Dec 31, 2003 %

LIABILITIES

Shareholders’ funds 4,820.64 100 3,773.10 100

Total liabilities 4,820.64 100 3,773.10 100

ASSETS

Fixed assets 1,431.15 30 829. 59 22

Investments 2.04 - 8.79 -

Deferred tax assets 42.98 1 32.85 1

Current assets

Cash & equivalents* 2,738.33 57 2,524.25 67

Accounts receivables 1,038.37 22 696.96 18

Other current assets 732.88 15 521.93 14

Less: Current liabilities (1,165.11) (25) (841.27) (22)

Net current assets 3,344.47 69 2,901.87 77

Total assets 4,820.64 100 3,773.10 100

*Includes investment in liquid Mutual Funds

© Infosys Technologies Limited 2004-2005 Slide 7

Operational Performance

© Infosys Technologies Limited 2004-2005

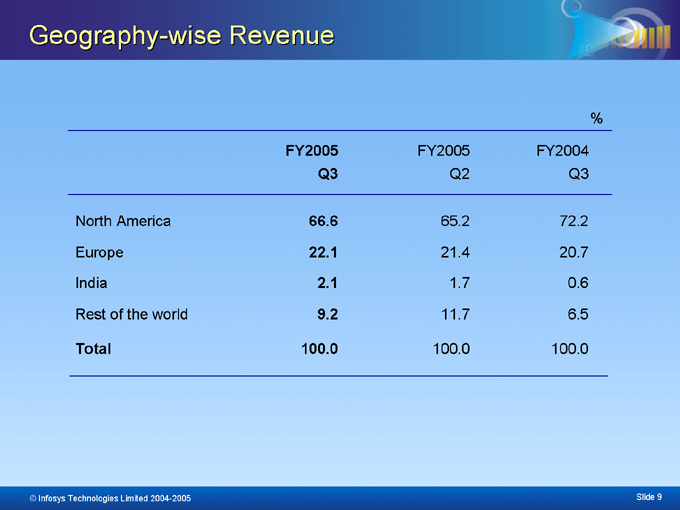

Geography-wise Revenue

%

FY2005 Q3 FY2005 Q2 FY2004 Q3

North America 66.6 65.2 72.2

Europe 22.1 21.4 20.7

India 2.1 1.7 0.6

Rest of the world 9.2 11.7 6.5

Total 100.0 100.0 100.0

© Infosys Technologies Limited 2004-2005 Slide 9

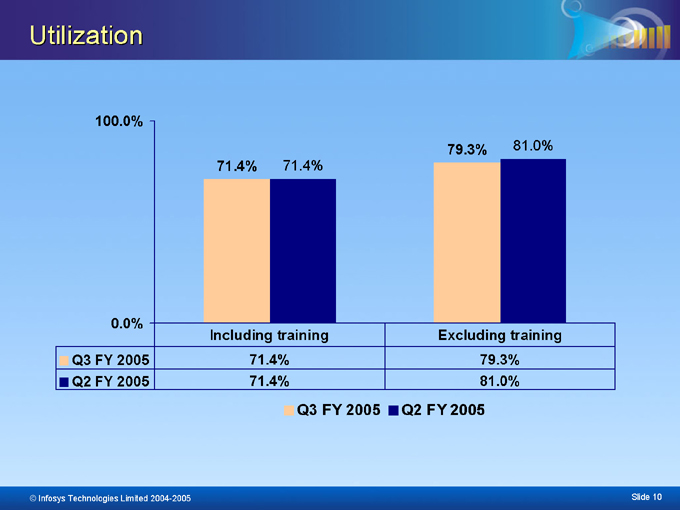

Utilization

100.0%

0.0%

Q3 FY 2005 Q2 FY 2005

79.3% 81.0% 71.4% 71.4%

Including training Excluding training

71.4% 79.3%

71.4% 81.0%

Q3 FY 2005 Q2 FY 2005

© Infosys Technologies Limited 2004-2005 Slide 10

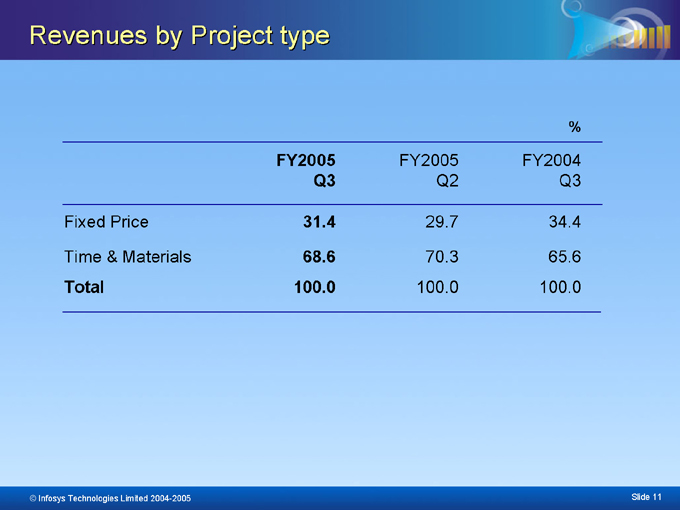

Revenues by Project type

%

FY2005 Q3 FY2005 Q2 FY2004 Q3

Fixed Price 31.4 29.7 34.4

Time & Materials 68.6 70.3 65.6

Total 100.0 100.0 100.0

© Infosys Technologies Limited 2004-2005 Slide 11

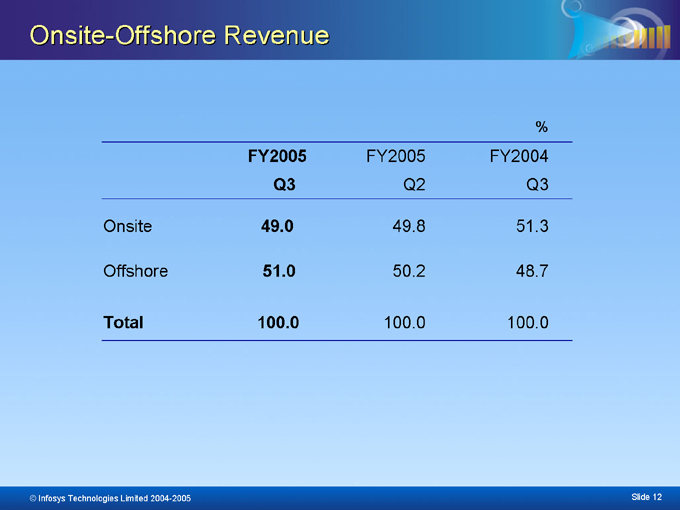

Onsite-Offshore Revenue

%

FY2005 Q3 FY2005 Q2 FY2004 Q3

Onsite 49.0 49.8 51.3

Offshore 51.0 50.2 48.7

Total 100.0 100.0 100.0

© Infosys Technologies Limited 2004-2005 Slide 12

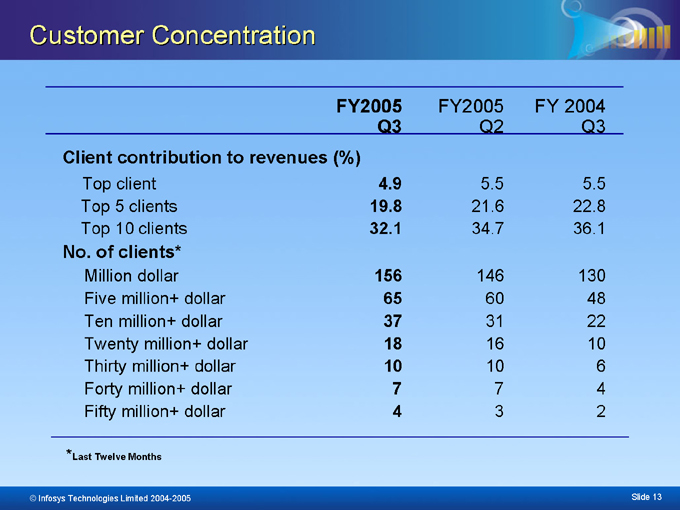

Customer Concentration

FY2005 Q3 FY2005 Q2 FY 2004 Q3

Client contribution to revenues (%)

Top client 4.9 5.5 5.5

Top 5 clients 19.8 21.6 22.8

Top 10 clients 32.1 34.7 36.1

No. of clients*

Million dollar 156 146 130

Five million+ dollar 65 60 48

Ten million+ dollar 37 31 22

Twenty million+ dollar 18 16 10

Thirty million+ dollar 10 10 6

Forty million+ dollar 7 7 4

Fifty million+ dollar 4 3 2

* Last Twelve Months

© Infosys Technologies Limited 2004-2005 Slide 13

Client Acquisition & Expansion of Services

© Infosys Technologies Limited 2004-2005

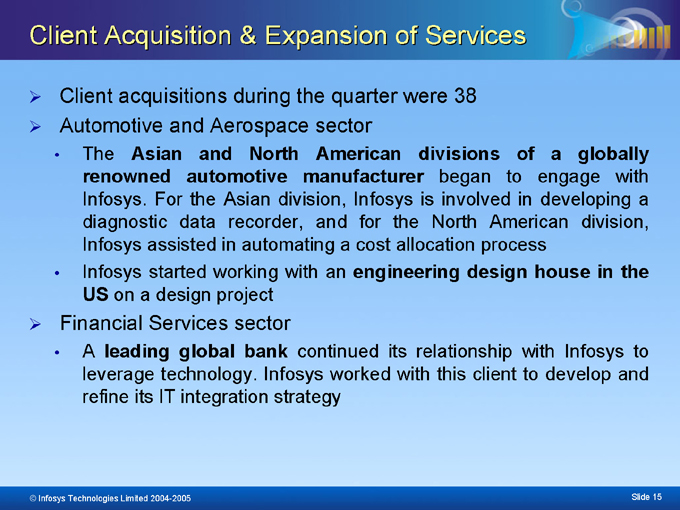

Client Acquisition & Expansion of Services

Client acquisitions during the quarter were 38 Automotive and Aerospace sector

The Asian and North American divisions of a globally renowned automotive manufacturer began to engage with Infosys. For the Asian division, Infosys is involved in developing a diagnostic data recorder, and for the North American division, Infosys assisted in automating a cost allocation process Infosys started working with an engineering design house in the US on a design project

Financial Services sector

A leading global bank continued its relationship with Infosys to leverage technology. Infosys worked with this client to develop and refine its IT integration strategy

© Infosys Technologies Limited 2004-2005 Slide 15

Client Acquisition & Expansion of Services

Insurance and Healthcare industries

Infosys is working with a premier US-based wellness company and a provider of tools, applications and healthcare content to analyze, design and implement new systems that strengthen their internal processes In a mission-critical assignment, the most distinguished preferred provider organization (PPO) network in the US selected Infosys to rewrite its core system Infosys developed an enterprise-wide road map for content management strategy for one of the largest insurance companies in the US

Other new wins this quarter include one of the world’s fastest growing pharmaceutical companies and a claim adjudication company

© Infosys Technologies Limited 2004-2005 Slide 16

Client Acquisition & Expansion of Services

Retail industry

A US supermarket giant used Infosys’ services to address process improvement initiatives and program management issues Infosys also completed a large end-to-end business process re-engineering initiative for a leading corporation in the food distribution business A premier apparel marketer in the US partnered with Infosys for a business consulting engagement

Europe

An integrated data services and technology provider signed up Infosys for assistance in developing software tools for its clients A UK utilities business engaged Infosys to convert its software platform

© Infosys Technologies Limited 2004-2005 Slide 17

Client Acquisition & Expansion of Services

China

Infosys started working with a recognized global leader in power and automation technologies to revamp its IT systems

Others

A global leader in product safety and certification testing and a leading global provider of information technology solutions for the air transport industry were added to Infosys’ client portfolio

© Infosys Technologies Limited 2004-2005 Slide 18

Banking Products

A reputed bank based in the United Arab Emirates has selected Finacle® Universal Banking Solution to power its end-to-end banking requirements. The bank will deploy Finacle® core banking, treasury and e-banking solutions across 11 branches

A leading building society based in Zimbabwe selected Finacle® Universal Banking Solution to deploy across its 52 branches. It will implement Finacle® core banking and treasury solutions

A premier bank based in Taiwan went live on Finacle® core banking, CRM and consumer internet banking solutions

A leading Japanese bank also went live on upgraded versions of Finacle® treasury solution

© Infosys Technologies Limited 2004-2005 Slide 19

Human Resources

© Infosys Technologies Limited 2004-2005

Human Resources

Total employee strength at 35,229 as on December 31, 2004, up from 32,949 as on September 30, 2004 33,051 software professionals as on December 31, 2004, up from 30,922 as on September 30, 2004 Of these software professionals, 1,125 belong to the Banking Business Unit Gross addition of employees during the quarter was 3,164, out of which 865 were laterals Net addition of 2,280 employees during the quarter as compared to 5,010 during the quarter ended September 30, 2004

© Infosys Technologies Limited 2004-2005 Slide 21

Capex and Infrastructure

© Infosys Technologies Limited 2004-2005

Capex and Infrastructure

Capital expenditure of Rs. 256.07 crores was incurred during the quarter As on December 31, 2004, the company had 65,15,250* sq. ft of space capable of accommodating 30,633 professionals; and 32,15,600* sq. ft under completion capable of accommodating 15,215 professionals

* Excluding subsidiaries

© Infosys Technologies Limited 2004-2005 Slide 23

Outlook for the Future

© Infosys Technologies Limited 2004-2005

Indian GAAP—Consolidated

Quarter ending March 31, 2005 *

Income is expected to be between Rs. 1,956 crore and Rs. 1,964 crore; YOY growth of 45% Earnings per share is expected to be Rs. 18.90; YOY growth of 50%

Fiscal year ending March 31, 2005

Income is expected to be between Rs. 7,098 crore and Rs. 7,107 crore; growth of 46% Earnings per share is expected to be Rs. 68.70; growth of 47%

*conversion 1 US$ = Rs. 43.27

© Infosys Technologies Limited 2004-2005 Slide 25

Summary

© Infosys Technologies Limited 2004-2005

Summary

Guidance for FY 2005 revised upwards in USD terms Another quarter of robust growth Demand for offshore outsourcing continued to be strong

Clients have responded favourably to the combination of our consulting services and offshore delivery Our focus on creating synergies has enhanced our competitiveness We have been able to maintain our operating margins despite the appreciation of rupee

© Infosys Technologies Limited 2004-2005 Slide 27

Thank You

© Infosys Technologies Limited 2004-2005