UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Private Media Group

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which the transaction applies: |

| | (2) | Aggregate number of securities to which the transaction applies: |

| | (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of the transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

3230 Flamingo Road, Suite 156

Las Vegas, Nevada 89121 USA

November 21, 2006

Dear Fellow Shareholder:

You are cordially invited to attend the Annual Meeting of Shareholders to be held on Monday, December 18, 2006, at 10:00 a.m., at Sant Cugat Hotel and Restaurante, C/César Martinell, 2 (Rambla del Celler), Sant Cugat del Vallès, Barcelona, Spain.

The Notice of Annual Meeting and Proxy Statement which follow describe the business to be conducted at the meeting.

Whether or not you plan to attend the meeting in person, it is important that your shares be represented and voted. After reading the enclosed Notice of Annual Meeting and Proxy Statement, I urge you to promptly complete, sign, date and return the enclosed proxy card in the envelope provided.

Your vote is very important, and we will appreciate a prompt return of your signed Proxy card. We hope to see you at the meeting.

|

Cordially, |

|

|

Berth H. Milton Chairman of the Board |

PRIVATE MEDIA GROUP, INC.

3230 Flamingo Road, Suite 156

Las Vegas, Nevada 89121 USA

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MONDAY, DECEMBER 18, 2006

To the Shareholders of PRIVATE MEDIA GROUP, INC.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of Private Media Group, Inc. will be held on Monday, December 18, 2006, at 10:00 a.m., at Sant Cugat Hotel and Restaurante, C/César Martinell, 2 (Rambla del Celler), Sant Cugat del Vallès, Barcelona, Spain, for the following purposes:

| | 1. | To elect five (5) directors to hold office until the next Annual Meeting of Shareholders and until their respective successors have been duly elected and qualified; and |

| | 2. | To transact such other business as may properly come before the meeting or any adjournments thereof. |

Only shareholders of record at the close of business on November 10, 2006, are entitled to notice of and to vote at the Annual Meeting or any adjournment thereof.

| | | | | | | | |

| | | | By Order of the Board of Directors |

| | | |

| | | | | |  |

November 21, 2006 | | | | Johan Gillborg Corporate Secretary |

All shareholders are cordially invited to attend the meeting in person. Whether or not you expect to attend the meeting, PLEASE COMPLETE AND SIGN THE ENCLOSED PROXY AND RETURN IT PROMPTLY IN THE ENCLOSED ENVELOPE. The giving of your Proxy will not affect your right to vote in person should you later decide to attend the meeting.

PRIVATE MEDIA GROUP, INC.

3230 Flamingo Road, Suite 156

Las Vegas, Nevada 89121 USA

PROXY STATEMENT

General Information

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Private Media Group, Inc. (the “Company” or “Private”) for the Annual Meeting of Shareholders to be held on December 18, 2006 (the “Annual Meeting”) and any postponements or adjournments thereof. Any shareholder giving a Proxy may revoke it before or at the meeting by providing a proxy bearing a later date or by attending the meeting and expressing a desire to vote in person. All proxies will be voted as directed by the shareholder on the Proxy card; and, if no choice is specified, they will be voted (1) “FOR” the five directors nominated by the Board of Directors, and (2) in the discretion of the persons acting as Proxies, for any other matters.

Your cooperation in promptly returning the enclosed Proxy will reduce the Company’s expenses and enable its management and employees to continue their normal duties for your benefit with minimum interruption for follow-up proxy solicitation.

Only shareholders of record at the close of business on November 10, 2006, are entitled to receive notice of and to vote at the meeting. On that date, the Company had outstanding 53,148,165 shares of Common Stock. The shares of Common Stock vote as a single class. Holders of shares of Common Stock on the record date are entitled to one vote for each share held. The presence at the Annual Meeting, either in person or by proxy, of the holders of one-third of the shares of Common Stock issued, outstanding and entitled to vote is necessary to constitute a quorum for the transaction of business.

A plurality of votes by the holders of the Common Stock is required for the election of directors. In accordance with Nevada law, abstentions and “broker non-votes” (i.e. proxies from brokers or nominees indicating that such persons have not received instructions from the beneficial owners or other persons entitled to vote shares as to a matter with respect to which brokers or nominees do not have discretionary power to vote) will be treated as present for purposes of determining the presence of a quorum. For purposes of determining approval of a matter presented at the meeting, abstentions will be deemed present and entitled to vote and will, therefore, have the same legal effect as a vote “against” a matter presented at the meeting. Broker non-votes will be deemed not entitled to vote on the matter as to which the non-vote is indicated and will, therefore, have no legal effect on the vote on such matter.

This Proxy Statement and the accompanying Notice of Annual Meeting and form of Proxy are being mailed or delivered to shareholders on or about November 27, 2006.

In the event that sufficient votes in favor of the proposals are not received by the date of the Annual Meeting, the persons named as proxies may propose one or more adjournments of the Annual Meeting to permit further solicitations of proxies. Any such adjournment will require the affirmative vote of the holders of a majority of the shares of Common Stock present in person or by proxy at the Annual Meeting. The persons named as proxies will vote in favor of such adjournment or adjournments.

The cost of preparing, assembling, printing, and mailing the materials, the Notice and the enclosed form of Proxy, as well as the cost of soliciting proxies relating to the Annual Meeting, will be borne by the Company. The Company will request banks, brokers, dealers, and voting trustees or other nominees to

1

forward solicitation materials to their customers who are beneficial owners of shares, and will reimburse them for the reasonable out-of-pocket expenses of such solicitations. The original solicitation of Proxies by mail may be supplemented by telephone, telegram, personal solicitation or other means by officers and other regular employees or agents of the Company, but no additional compensation will be paid to such individuals on account of such activities.

PLEASE MARK, DATE AND SIGN THE ENCLOSED PROXY AND RETURN IT AT AN EARLY DATE IN THE ENCLOSED POSTAGE PREPAID RETURN ENVELOPE SO THAT, IF YOU ARE UNABLE TO ATTEND THE ANNUAL MEETING, YOUR SHARES MAY BE VOTED.

2

PROPOSAL NO. 1

ELECTION OF FIVE NOMINEES FOR DIRECTOR

Nominees and Voting

The Bylaws of the Company authorize a Board of Directors of five directors. Consequently, at the Annual Meeting five directors will be elected to serve until the next Annual Meeting and until their successors are elected and qualified. Proxies may not be voted for more than five persons. The Company has nominated for election as directors the five persons named below. Each of these nominees has indicated that they are able and willing to serve as directors.

Under Nevada law and the Company’s Articles of Incorporation, shareholders of record on the record date will be entitled to one vote for each share held when voting for directors.

Unless otherwise instructed, the Company’s Proxy holders intend to vote the shares of Common Stock represented by the Proxies in favor of the election of these nominees. If for any reason any of these nominees will be unable or unwilling to serve, the shares represented by the enclosed Proxy will be voted for the election of the balance of those named and such other person or persons as the Board of Directors may recommend. The Board of Directors has no reason to believe that any such nominee will be unable or unwilling to serve. Directors are elected by a plurality of the votes cast.

The Company’s nominees and directors are listed below, together with their ages, offices with the Company and year in which each became a director of the Company.

THE BOARD OF DIRECTORS OF THE COMPANY RECOMMENDS THAT THE SHAREHOLDERS VOTE “FOR” THE ELECTION OF THE FIVE NOMINEES FOR DIRECTOR.

| | | | | | |

Name | | Age | | Position | | Director Since |

Berth H. Milton | | 51 | | Chairman of the Board,

Chief Executive Officer,

President | | 1998 |

Bo Rodebrant | | 53 | | Director | | 1998 |

Lluis Torralba | | 37 | | Director | | 2005 |

Johan G. Carlberg | | 46 | | Director | | 2004 |

Daniel Sánchez | | 36 | | Director | | 2004 |

Business Experience of Directors and Nominees During the Past Five Years

Berth H. Milton was appointed to the Board of Directors of the Company in February 1998 and was the Corporate Secretary from June 1998 until February 1999. In February 1999 Mr. Milton was appointed Chairman of the Board and Chief Executive Officer of Private, and served as Chief Executive Officer until

3

May 2002. In November 2003 Mr. Milton was reappointed President and Chief Executive Officer of the Company. Mr. Milton has been Administrator of Milcap Media Group from its inception until June 2000 and has been acting as an advisor to the Milcap Group since 1991. Mr. Milton is also active in several international industry and real estate projects and developments.

Bo Rodebrant was appointed as a Director of the Company in August 1998. Mr. Rodebrant has operated his own accountancy and management consulting services, R&S Ekonomiservice, since 1986. Prior thereto he co-founded an ice cream business, Hemglass, which was the largest of its kind in Stockholm, Sweden. The business was sold by Mr. Rodebrant in 1986. Mr. Rodebrant holds a degree in construction engineering which he received in 1974.

Johan G. Carlberg was appointed to the Board of Directors in October 2004. Mr. Carlberg has operated his own import, trading and consulting business in the textile and fashion industry since the seventies. Mr. Carlberg holds a Degree in Business from the Stockholm Institute of Business.

Daniel Sánchez was appointed to the Board of Directors in October 2004. Since January 2004, Mr. Sánchez has been promoting, as a founding partner, the launching of a new private venture capital firm. Prior to entering the venture capital field, he held the position as Deputy Managing Director at Electrodomésticos Taurus, a consumer electronics company, from 2002 to 2004. Between 1995 and 2002 he worked as a Manager in the field of mergers and acquisitions at Alpha Corporate, a well known international consultancy firm. Mr. Sánchez holds a Master’s Degree in Business Administration from the University of Chicago.

Lluis Torralbawas appointed to the Board of Directors in June 2005. Mr. Torralba is a founding partner of Meriden IPM, an international portfolio management company, where he currently is managing private clients. From 1997 to 2004 he was responsible for the company’s IT systems. Prior to 1997, he worked as an IT manager in Andorra. Mr. Torralba holds a Degree in Information Technology from Escola D’informàtica d’Andorra.

Meetings and Committees of the Board of Directors

The Board of Directors currently has three committees: (i) an Audit Committee, (ii) a Compensation Committee, and (iii) an Executive Committee. The Board of Directors does not have a formal nominating committee, and all decisions regarding director nominations are addressed by the entire Board of Directors.

Under applicable Nasdaq listing rules the Company is a “controlled company” as Berth Milton beneficially owns more than 50% of the Company’s Common Stock. Therefore, the Company is exempt from Nasdaq Marketplace Rules which require that (i) compensation of executive officers be determined by either a majority of the independent directors or a compensation committee comprised solely of independent directors, and (ii) nomination of directors be made by either a majority of independent directors or a committee comprised solely of independent directors.

The Company’s Board of Directors met five times during 2005 (including actions by unanimous written consent). No director attended less than 75% of the aggregate of all meetings of the Board of Directors and all Committees on which he served during the 2005 fiscal year.

All of the members of the Board of Directors are “independent” as defined in Nasdaq Marketplace Rule 4200 other than Berth Milton, who is the Company’s Chief Executive Officer.

The Audit Committee is currently comprised of Lluis Torralba, Johan Carlberg and Daniel Sánchez. All of the members of the Audit Committee are “independent” as defined in applicable Nasdaq listing requirements and SEC regulations, and each of them is able to read and understand fundamental financial statements. The Board has determined that Daniel Sánchez is an “audit committee financial expert” as defined

4

under applicable SEC regulations. The Audit Committee reviews and recommends to the Board, as it deems necessary, the internal accounting and financial controls for the Company and the accounting principles and auditing practices and procedures to be employed in preparation and review of financial statements of the Company. The Audit Committee makes recommendations to the Board concerning the engagement of independent public accountants and the scope of the audit to be undertaken by such accountants. The Audit Committee has adopted a written Audit Committee Charter. The Audit Committee met four times during 2005.

The Compensation Committee is currently comprised of Berth Milton and Javier Sánchez. The Compensation Committee reviews and, as it deems appropriate, recommends to the Board policies, practices and procedures relating to the compensation of the officers and other managerial employees and the establishment and administration of employee benefit plans. It exercises all authority under any employee stock option plans of the Company as the Committee therein specified, subject to the review and approval of the Board of Directors, and advises and consults with the officers of the Company as may be requested regarding managerial personnel policies. The Compensation Committee also has such additional powers as may be conferred upon it from time to time by the Board. The Compensation Committee met twice during 2005.

The Executive Committee is comprised of Messrs. Milton, Kull and Javier Sánchez. The Executive Committee is authorized, subject to certain limitations, to exercise all of the powers of the Board of Directors during periods between Board meetings. The Executive Committee met five times during 2005.

The Board has not established a formal nominating committee, nor has the Board adopted a nominating committee charter. Therefore, decisions relating to the nomination of directors are addressed by the entire Board of Directors. The Board has not established any specific minimum qualifications that must be met for recommendation for a position on the Board. Instead, in considering candidates for director, the Board will generally consider all relevant factors, including among others the candidate’s applicable expertise and demonstrated excellence in his or her field, the usefulness of such expertise to the Company, the availability of the candidate to devote sufficient time and attention to the affairs of the Company, the candidate’s reputation for personal integrity and ethics and the candidate’s ability to exercise sound business judgment. Other relevant factors, including diversity, age and skills, will also be considered. Candidates for director are reviewed in the context of the existing membership of the Board (including the qualities and skills of the existing directors), the operating requirements of the Company and the long-term interests of its shareholders. The Board uses its network of contacts when compiling a list of potential director candidates and may also engage outside consultants (such as professional search firms). At this time, the Board does not consider director candidates recommended by shareholders. The Board believes that it is in the best position to identify, review, evaluate and select qualified candidates for Board membership. All of the Company’s nominees for director at the 2006 Annual Meeting were approved by the entire Board of Directors.

Compensation of Directors

Our Board of Directors may, at its discretion, compensate directors for attending Board and Committee meetings and reimburse the directors for out-of-pocket expenses incurred in connection with attending such meetings.

The Company has agreed to pay Daniel Sánchez and Lluis Torralba a fee of EUR 2,000, and Johan Carlberg a fee of EUR 1,000, for each Board and Committee meeting attended. Our directors are also eligible to receive stock option grants under its Stock Option Plan. In 2004 Messrs. Sánchez and Carlberg were each granted options to acquire 10,000 and 3,000 shares, respectively, of the Company’s Common Stock at an exercise price of $2.53 per share, which options vested in October 2005 and expire in October 2008; and in 2005 Messrs. Sánchez and Carlberg were each granted options to acquire 10,000 and 3,000 shares,

5

respectively, of the Company’s Common Stock at an exercise price of $2.17 per share, which options vested in October 2006 and expire in October 2009 In 2005 Mr. Torralba was granted options to acquire 8,000 shares of the Company’s Common Stock at an exercise price of $2.74 per share, which options vested in May 2006 and expire in May 2009.

6

Shareholder Communications with the Board of Directors

A shareholder may contact one or more of the members of the Board of Directors in writing by sending such communication to the Secretary at the Company’s address. The Secretary will forward shareholder communications to the appropriate director or directors for review. Anyone who has a concern about the conduct of the Company or the Company’s accounting, internal accounting controls or auditing matters, may communicate that concern to the Secretary, the Chairman of the Board or any member of the Board of Directors at the Company’s address. The Company encourages individual directors to attend the Annual Meeting. At the Company’s 2005 Annual Meeting one of the Company’s directors, Berth Milton, was in attendance. We believe the Company’s responsiveness to shareholder communications to the Board has been adequate.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table presents certain information as of November 1, 2006, regarding the beneficial ownership of our common stock by (i) each of our directors and executive officers individually, (ii) all persons known by us to be beneficial owners of five percent or more of our common stock, and (iii) all of our directors and executive officers as a group. Unless otherwise noted, the persons listed below have sole voting and investment power and beneficial ownership with respect to such shares.

| | | | | |

Name and Address | | Number of Shares Beneficially

Owned (1) | | Percent

Beneficially

Owned (1) | |

Berth H. Milton (2) | | 27,282,985 | | 51.2 | % |

Fidelity Investments International (UK) Ltd. (3) 25 Canon Street, London, UK | | 4,253,029 | | 8.0 | % |

Javier Sánchez (4) | | 760,000 | | 1.4 | % |

Johan Gillborg (5) | | 327,500 | | * | |

Mårten Kull (6) | | 222,500 | | * | |

Bo Rodebrant (7) | | 72,000 | | * | |

Daniel Sánchez (8) | | 20,000 | | * | |

Philip Christmas (9) | | 15,000 | | * | |

Johan G. Carlberg (10) | | 6,000 | | * | |

Lluis Torralba (11) | | 8,000 | | * | |

Peter T. Cohen (12) | | — | | * | |

Richard Polding (13) | | — | | * | |

All Executive Officers and Directors as a group (11 people) (14) | | 28,713,985 | | 52.6 | % |

| (1) | Beneficial ownership is determined in accordance with rules of the U.S. Securities and Exchange Commission, and includes generally voting power and/or investment power with respect to securities. Shares of Common Stock which may be acquired by a beneficial owner upon exercise or conversion of warrants or options which are currently exercisable or exercisable within 60 days of November 1, 2006, are included in the Table as shares beneficially owned and are deemed outstanding for purposes of computing the beneficial ownership percentage of the person holding such securities but are not deemed outstanding for computing the beneficial ownership percentage of any other person. Except as indicated by footnote, to the knowledge of the Company, the persons named in the table above have the sole voting and investment power with respect to all shares of Common Stock shown as beneficially owned by them. |

7

| (2) | Includes 22,296,909 shares of Common Stock owned by Slingsby Enterprises Limited, of which Mr. Milton is the sole shareholder. 4,950,000 of these shares are pledged to a third party to secure payment of a loan from the third party to the Company. See “Management – Related Transactions.” Also includes (i) 2,785,076 shares of Common Stock owned by Bajari Properties Limited, of which Mr. Milton is the sole shareholder, and (ii) 180,000 shares issuable upon exercise of Options issued under the Employee Stock Option Plan. His address is c/o the Company, Carretera de Rubì 22, 08173 Sant Cugat del Vallès, Barcelona, Spain. |

| (3) | Based upon information reported by the Nasdaq Stock Market as of November 1, 2006. Includes 174,200 and 28,680 shares of Common Stock owned by Fidelity Investments Japan Ltd. and Fidelity Investments SA, respectively, which companies are believed to be affiliates of Fidelity Investments International (UK) Ltd. |

| (4) | Includes 780,000 shares issuable upon exercise of Options issued under the Employee Stock Option Plan. Mr. J. Sànchez address is c/o the Company, Carretera de Rubì 22, 08173 Sant Cugat del Vallès, Barcelona, Spain. |

| (5) | Includes 222,500 shares issuable upon exercise of Options issued under the Employee Stock Option Plan owned by Mr. Gillborg. His address is c/o the Company, Carretera de Rubì 22, 08173 Sant Cugat del Vallès, Barcelona, Spain. |

| (6) | Includes 222,500 shares issuable upon exercise of Options issued under the Employee Stock Option Plan owned by Mr. Kull. His address is c/o the Company, Carretera de Rubì 22, 08173 Sant Cugat del Vallès, Barcelona, Spain. |

| (7) | Includes 72,000 shares issuable upon exercise of Options issued under the Employee Stock Option Plan owned by Mr. Rodebrant. His address is c/o the Company, Carretera de Rubì 22, 08173 Sant Cugat del Vallès, Barcelona, Spain. |

| (8) | Includes 20,000 shares issuable upon exercise of Options issued under the Employee Stock Option Plan owned by Mr. D. Sánchez. His address is c/o the Company, Carretera de Rubì 22, 08173 Sant Cugat del Vallès, Barcelona, Spain. |

| (9) | Includes 15,000 shares issuable upon exercise of Options issued under the Employee Stock Option Plan owned by Mr. Christmas. His address is c/o the Company, Carretera de Rubì 22, 08173 Sant Cugat del Vallès, Barcelona, Spain. |

| (10) | Includes 6,000 shares issuable upon exercise of Options issued under the Employee Stock Option Plan owned by Mr. Carlberg. His address is c/o the Company, Carretera de Rubì 22, 08173 Sant Cugat del Vallès, Barcelona, Spain. |

| (11) | Includes 8,000 shares issuable upon exercise of Options issued under the Employee Stock Option Plan owned by Mr. Torralba. His address is c/o the Company, Carretera de Rubì 22, 08173 Sant Cugat del Vallès, Barcelona, Spain. |

| (12) | His address is c/o the Company, Carretera de Rubì 22, 08173 Sant Cugat del Vallès, Barcelona, Spain. |

| (13) | His address is c/o the Company, Carretera de Rubì 22, 08173 Sant Cugat del Vallès, Barcelona, Spain. |

| (14) | Includes 1,476,000 shares issuable upon exercise of outstanding Options under the Stock Option Plan. |

8

MANAGEMENT

Listed below are executive officers and key employees of the Company who are not directors or nominees.

Peter T. Cohen, age 50, was appointed Chief Operating Officer of Private Media Group in November 2006. From 2003 to 2006 he was a Managing Partner of MPP Ventures LLC, a consultancy firm providing services to major entertainment companies with respect to strategies for digital content production and distribution on multi-media platforms. From 2001 to 2002 he served as Senior Executive Vice President of Media and Entertainment for BillboardLive. From 1997 to 2001 he held the position as Senior Vice President of Programming for The Box Music Network, a state of the art interactive music video channel distributed throughout the US and select international territories. Prior to this, Mr. Cohen held several senior executive positions at various other media/entertainment companies including HBO, CNN International, MuchMusic and ACTV Inc. Mr. Cohen has a Bachelor’s degree in Human Ecology from The College of the Atlantic, Bar Harbor, Maine, USA.

Claes Henrik Mårten Kull,age 41, joined the Milcap Media Group in 1992 as a sales manager, has been Milcap Media Group’s Marketing Manager since 1993, and was appointed Chief Marketing Officer of Private Media Group, Inc. in August 1998, with his main responsibilities being to identify and open up new markets and negotiate with distributors. Since he began working for the Milcap Media Group in 1992, approximately 25 new countries have been opened up. From 1991 to 1992 he operated his own business (his business partner was Johan Gillborg) which acted as a sub-contracted sales force for Securitas Direct of Sweden. From 1988 to 1991 he managed a private import and trading corporation, which became the start of his career as an entrepreneur and sales professional.

Johan Gillborg,age 44, was appointed as Chief Financial Officer of Private Media Group, Inc. in August 1998 and has been the Chairman and Managing Director of Milcap Publishing Group AB from 1994 until January 2000. Mr. Gillborg joined the group in 1992 as Marketing Consultant. From 1991 to 1992 he operated his own business which acted as sub-contracting sales force for Securitas Direct of Sweden (together with Mr. Kull). From 1988 to 1990, Mr. Gillborg served as General Manager in the hotel business in the United Kingdom and Portugal. Mr. Gillborg holds a Bachelor’s Degree in Business Administration from Schiller International University in London.

Javier Sánchez,age 45, was appointed Executive Vice President, Production and Operations of Milcap Media Group in November 2006. From August 1998 to November 2006, he held the position as Chief Operating Officer of Private Media Group, Inc. He has also been the General Manager of Milcap Media Group between 1991 and 1997 and has been a member of the Board of Milcap Media Group and Private France S.A. He is a minority shareholder of Milcap Media Group since its incorporation in 1991. He has been a member of the Board of Milcap Publishing Group AB since its incorporation in 1994 until 1997. From 1988 to 1991 he was the Operations Director of a mid-size printing company near Barcelona. From 1984 to 1987 he was the Production Manager of a major printing company in Barcelona.

Philip Christmas,age 45, was appointed Vice President of Private Media Group and Chief Financial Officer of Milcap Media Group in August 2001. Prior to August 2001 Mr. Christmas was employed by PricewaterhouseCoopers and its predecessor firm, Coopers & Lybrand, since 1988. While employed by PricewaterhouseCoopers he was responsible for carrying out audits of multinational and local companies and, more recently, he provided transaction services to clients acquiring businesses in Spain. Mr. Christmas is a member of the Institute of Chartered Accountants of England and Wales and of ROAC (Official Register of Auditors) in Spain.

9

Richard Polding,age 43, was appointed as General Counsel of Private Media Group, Inc. in September 2005. Mr. Polding´s first in house position as a legal advisor was with The Burton Group PLC from which he moved to Sony Music Entertainment (UK) Ltd in 1992. In 1996 he joined the Virgin Group as a founding member and Director of Legal and Business Affairs of the V2 Record label which Sir Richard Branson launched following the sale of Virgin Records to EMI. Mr. Polding has a Bachelor’s Degree in Law from Liverpool University and is qualified as a barrister at the Bar of England and Wales.

No director or executive officer serves pursuant to any arrangement or understanding between him and any other person.

10

Executive Compensation

The following table summarizes all compensation paid to our Chief Executive Officer serving during 2005 and to our other most highly compensated executive officers other than the Chief Executive Officers whose total annual salary and bonus exceeded $100,000 (the “Named Executive Officers”), for services rendered in all capacities to Private Media Group during the fiscal years ended December 31, 2005, 2004, and 2003. No other executive officer earned compensation in excess of $100,000 in each of these periods.

Summary Compensation Table

| | | | | | |

Name and Principal Position During Fiscal 2005 | | Fiscal

Year | | Annual

Compensation Salary ($) | | Long-Term

Compensation/

Securities

Underlying

Options/SAR |

Berth H. Milton, President and CEO (1)

Director, Chairman of the Board | | 2005

2004

2003 | | 573,000

455,000

393,000 | | —

—

2,000,000 |

Javier Sánchez

Chief Operating Officer, Private Media Group, Inc.

General Manager, Milcap Media Group | | 2005

2004

2003 | | 207,000

207,000

188,000 | | 500,000

500,000

50,000 |

Mårten Kull

Chief Marketing Officer, Private Media Group, Inc.;

Marketing Manager, Milcap Media Group | | 2005

2004

2003 | | 177,000

177,000

148,000 | | —

—

50,000 |

Johan Gillborg

Secretary and Chief Financial Officer, Private Media

Group, Inc.; Chairman, Private France S.A.; Chairman,

Private Benelux; Administrator, Milcap Media Group | | 2005

2004

2003 | | 165,000

165,000

137,000 | | —

—

50,000 |

Phil Christmas

Chief Financial Officer, Milcap Media Group | | 2005

2004

2003 | | 119,000

119,000

108,000 | | —

—

— |

| (1) | Mr. Milton was appointed as the President and CEO of Private Media Group, Inc. in February 1999 and served in such capacity until May 2002. Mr. Milton was reappointed as the President and CEO of Private Media Group, Inc. in November 2003. His compensation in 2003 reflects $215,000 in directors fee. |

11

Option Grants in the Last Fiscal Year

The following table sets forth certain information at December 31, 2005, and for the year then ended, with respect to stock options granted to the individuals named in the Summary Compensation Table above. No options have been granted at an option price below the fair market value of the Common Stock on the date of grant.

OPTION/SAR GRANTS IN LAST FISCAL YEAR

| | | | | | | | | | |

Name | | Number of

Securities

Underlying

Options/SARs Granted(#) | | % of Total Options/ SARs Granted to Employees In Fiscal

Year | | Exercise

or Base Price($/Sh) | | Expiration

Date | | Potential Realized Value at

Assumed Annual Rates of

Stock Price Appreciation for Option Term at 5% and 10% Respectively |

Berth H. Milton | | — | | — | | — | | — | | — |

Javier Sànchez | | — | | — | | — | | — | | — |

Mårten Kull | | — | | — | | — | | — | | — |

Johan Gillborg | | — | | — | | — | | — | | — |

Phil Christmas | | — | | — | | — | | — | | — |

The following table summarizes certain information regarding the number and value of all options to purchase Common Stock of Private Media Group, Inc. held by the individuals named in the Summary Compensation Table as of December 31, 2005.

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR-END OPTION VALUES

| | | | | | | | | | | | |

Name | | Shares

Acquired

On

Exercise | | Value

Realized ($) | | Number of Securities

Underlying

Unexercised

Options/SARs

At Fiscal Year End Exercisable/ Unexercisable | | Value of Unexercised In-the-Money Options/SARs At Fiscal Year

End($)* Exercisable/ Unexercisable |

Berth H. Milton | | 2,000,000 | | 6,540,000 | | 180,000 | | — | | 8,588 | | — |

Javier Sánchez | | — | | — | | 730,000 | | — | | 8,588 | | — |

Mårten Kull | | — | | — | | 222,500 | | — | | 8,588 | | — |

Johan Gillborg | | — | | — | | 222,500 | | — | | 8,588 | | — |

Phil Christmas | | — | | — | | 15,000 | | — | | 8,588 | | — |

| (*) | Based on the closing price of our common stock on the last trading day of the fiscal year ended December 31, 2005. |

12

Compensation Committee Report

The Company maintains a Compensation Committee, which currently consists of one Director, Berth Milton, and Javier Sánchez. The Compensation Committee approves salary practices for the Chief Executive Officer, and sets performance objectives and establishes the compensation of the Chief Executive Officer, subject to the review and approval of the Board of Directors’ outside independent directors. The compensation of other executive officers is reviewed and set by the Chief Executive Officer, after review and consultation with the other members of the Compensation Committee.

The Company’s policy in compensating executive officers is to establish methods and levels of compensation that will provide strong incentives to promote its profitability and growth and reward superior performance. Compensation of executive officers includes salary as well as stock-based compensation in the form of stock options under the Company’s Employee Stock Option Plan. During 2005, salary accounted for all the executive officers’ direct cash compensation. No new option grants were made to executive officers during 2005. The Company believes that the existing compensation of its executive officers should be sufficient to attract and retain highly qualified personnel and also provide meaningful incentives for measurably superior performance.

To date the Company has relied upon cash flow from operations as its principal source of working capital. As a result, the Company has placed special emphasis on equity-based compensation, in the form of options, to preserve its cash for operations. This approach also serves to match the interests of the Company’s executive officers with the interest of its shareholders. The Company seeks to reward achievement by its executive officers of long and short-term performance goals, which are measured by factors including improvements in revenue and profitability, and successfully developing new products and markets.

Included in the factors considered by the Compensation Committee in setting the compensation of the Company’s Chief Executive Officer during 2005 were progress made towards improving operating efficiency and refocusing the Company’s business on its core markets. During 2005, under the leadership of Berth Milton, the Company continued to make significant progress in connection with its efforts to reduce costs, eliminate operational inefficiencies and reposition the Company’s business activities to focus on its core markets.

Compensation Committee Members

Berth Milton Javier Sánchez

Compensation Committee Interlocks and Insider Participation

The Compensation Committee is currently comprised of Messrs. Milton and Sánchez, who are the Company’s Chairman and Chief Operating officer, respectively, and served in these capacities during the 2005 fiscal year. During the last fiscal year, none of the Company’s executive officers served on the board of directors or compensation committee of any other entity whose officers served either the Company’s Board of Directors or Compensation Committee.

Audit Committee Report

The Company maintains an Audit Committee (the “Audit Committee”), consisting entirely of outside Directors who are not employees or former employees of the Company and are independent under applicable Nasdaq and SEC regulations. The Audit Committee has, in the course of its duties, reviewed and discussed with management the audited financial statements, and has discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61. The Audit Committee has also received the appropriate auditors disclosures regarding the auditors’ independence as required by Independence Standards Board Standard No. 1 and discussed with them its independence. Based on the foregoing, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K as filed with the Commission for Fiscal 2005.

13

Audit Committee Members

Daniel Sánchez, Johan G. Carlberg and Lluis Torralba

Independent Auditors’ Fees

The following table represents aggregate fees billed to the Company for fiscal years ended December 31, 2004 and December 31, 2005, by BDO Audiberia, the Company’s independent auditors.

| | | | | | |

| | | Years Ended

December 31, |

| | | 2004 | | 2005 |

Audit Fees | | $ | 145,000 | | $ | 150,000 |

Audit-Related Fees | | | — | | | — |

Tax Fees | | | — | | | — |

All Other Fees | | | — | | | — |

| | | | | | |

TOTAL | | $ | 145,000 | | $ | 150,000 |

| | | | | | |

Fees for audit services in 2004 and 2005 included fees associated with the annual audit and reviews of the Company’s quarterly reports. All fees described above were approved by the Audit Committee.

Certain Relationships

No Director or executive officer of Private Media Group is related to any other Director or executive officer. None of our officers or Directors holds any directorships in any other public entity. There are currently four outside directors on our Board of Directors.

Related Transactions

Following is a description of transactions involving more than $60,000 since January 1, 2005, between us and our directors, nominees, executive officers, or members of their immediate family.

In December 2001 Private borrowed $4.0 million from Commerzbank AG pursuant to a Note originally due December 20, 2002 in order to expand the Company’s product portfolio. Subsequently the maturity of the Note was extended to March 2003. The Note bears interest at an annual rate of 7%, payable quarterly, with the entire principal amount and accrued interest due on maturity. The Note is prepayable in full upon the sale of equity by the Company. Upon the Note becoming prepayable, the Company is required to repay the entire principal amount of the Note together with the greater of (1) accrued interest payable on the Note or (2) a prepayment premium equal to $200,000. The Note is secured by a guaranty from Slingsby Enterprises and a pledge by Slingsby Enterprises of 4,950,000 shares of Common Stock. The lender and Slingsby Enterprises have also agreed that if the Note remains unpaid at maturity, Commerzbank may elect to exchange the Note for Common Stock owned by Slingsby Enterprises with a value of $5.0 million. In April 2003 the Note was acquired by Consipio Holding b.v. from Commerzbank AG, and Consipio and Private reached an agreement-in-principle with Consipio to extend the maturity of the Note for five years, with interest on the Note being increased to 9.9% per annum. However, Consipio and Private have been unable to reach final agreement on other terms and conditions relating to the restructured Note. Accordingly, in December 2003 Consipio notified Private and Slingsby Enterprises that Private was in default under the Note, and demanded immediate payment of the outstanding principal under the Note. The Company continues to make all regularly scheduled interest payments on the Note and believes that it has valid defenses to the demand for

14

immediate repayment of the Note, should Consipio seek to enforce immediate repayment. The Company continues to engage in discussions with Consipio with a view towards reaching final agreement on a restructured Note. As of December 31, 2005 the outstanding principal under the Note was $2.9 million (or EUR 2.5 million). In any event, the Company does not believe that the acceleration of the Note by Consipio, if not rescinded, will have a material adverse effect on the Company, as the Note is fully collateralized by 4,950,000 shares of Private Media Group, Inc. Common Stock pursuant to the guaranty agreement from Slingsby. Slingsby Enterprises is beneficially owned by Berth H. Milton, Chairman of the Board of Directors.

Effective December 31, 2002, the Company completed the purchase of all of the outstanding stock of Barbuda B.V., from companies indirectly beneficially owned by Berth Milton. The principal asset of Barbuda B.V. was an approximately 6,300 square meter office facility and additional parking under construction, located in Barcelona, Spain. Construction was completed in September 2004. The purpose of this transaction was to acquire this property as the Company’s European headquarters. Since the acquisition, the Company reevaluated its need for additional space and as of February 2005 no longer owned the property.

The consideration paid by Private’s subsidiary to the seller for the Barbuda B.V. stock was EUR 9,956,950. The fair market value of the principal asset of Barbuda B.V., the real estate, was based upon independent appraisals. The consideration payable to the seller consisted of EUR 3,387,581 cash, paid in December 2002, and a note payable in the amount of EUR 6,569,369 (the “Barbuda Note”). The Barbuda Note bears interest at a rate of EURIBOR+1% payable annually and was originally due and payable on December 31, 2004. The amount payable on the Barbuda Note at December 31, 2004 was EUR 0.7 million. In January 2005, the Company and the seller agreed to a EUR 2.2 million reduction of the purchase price of the Barbuda B.V. stock based upon an adjustment to the fair market value of the real estate following completion of construction. Of this EUR 2.2 million adjustment, EUR 0.7 million was applied as an offset to retire the Barbuda Note and the remaining EUR 1.5 million was reflected as an increase in the related party receivable, described below.

The Company has short-term loans to an entity controlled by Mr. Milton in the amount of EUR 4.2 million and 5.9 million at December 31, 2004 and 2005, respectively. The loans bear interest at the rate of EURIBOR+1% per annum and have no maturity date. During 2004 and 2005 the highest amounts outstanding were EUR 4.2 million and EUR 5.9 million, respectively. Advances and repayments since June 30, 2002 are related to the acquisition of the Barbuda B.V. stock from an entity controlled by Mr. Milton, discussed above. In January 2005 the amount of the receivable was increased by EUR 1.5 million to reflect an adjustment in the purchase price of the Barbuda B.V. stock, as described above. As of September 30, 2006, EUR 6.0 million remained outstanding on these loans, including interest.

In May 2003 EUR 1.65 million of a related party note payable was re-financed by an institutional lender at the same interest rate as on the Note Payable, EURIBOR + 1%. The loan is repayable in equal monthly installments over a four year period starting June 29, 2004. The loan is guaranteed by the Company’s principal shareholder and affiliates of the Company’s principal shareholder.

The foregoing transactions were approved by a majority of our disinterested directors and are believed to be on terms no less favorable to us than could be obtained from unaffiliated third parties on an arms-length basis.

Code of Ethics

The Company has adopted a code of ethics that applies to our principal executive officer, principal financial officer, principal accounting officer and persons performing similar functions. The code of ethics is filed as Exhibit 14.1 to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2003. The Company intends to satisfy the disclosure requirements under Form 8-K regarding an amendment to or waiver from our code of ethics, by posting the required information on our corporate Internet website at www.prvt.com or as otherwise permitted under applicable law.

15

Section 16(a) Beneficial Ownership Reporting Compliance

Based solely upon a review of Forms 3, 4 and 5 furnished to the Company covering its 2005 fiscal year filed under Section 16(a) of the Securities Exchange Act of 1934, the Company’s officers and directors complied with the reporting requirements under Section 16(a) for the 2005 fiscal year except for Messrs. Torralba and Polding, who each failed to file an initial Form 3 in 2005, and Mr. Torralba, Sánchez and Carlberg who failed to file a single Form 4 in 2005 reflecting their receipt of options under the Company’s Stock Option Plan.

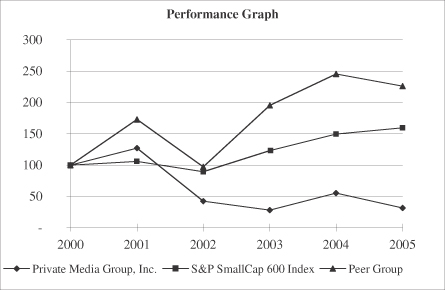

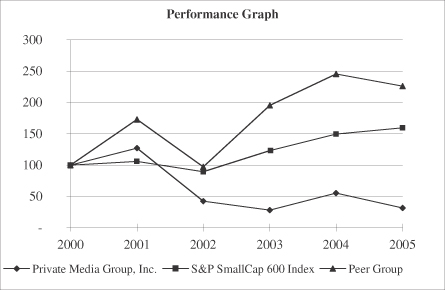

Performance Graph

The following graph compares on a cumulative basis the yearly percentage change, assuming dividend reinvestment, over the five fiscal years in (a) the total shareholder return on common stock of Private Media Group, Inc. with (b) the total return on the Standard & Poors SmallCap 600 index and (c) the total return on a peer group. The Standard & Poor’s SmallCap 600 index covers approximately 3% of the US domestic equities market and includes a total of 600 companies with a market capitalization ranging from $60 million to $4.6 billion. The average market capitalization per company is approximately $ 0.97 billion. The peer group is an index weighted by the relative market capitalization of the following two companies, which were selected for being in an industry related to that of Private Media Group, Inc. (provider of adult content). The companies are Playboy and New Frontier Media. The comparisons in the graph are required by the SEC and are not intended to forecast or be indicative of possible future performance of Private Media Group, Inc. common stock.

COMPARISON OF FIVE YEAR CUMULATIVE TOTAL RETURN (*)

| | | | | | | | | | | | |

| | | 2000 | | 2001 | | 2002 | | 2003 | | 2004 | | 2005 |

Private Media Group, Inc. | | 100 | | 127 | | 42 | | 28 | | 55 | | 31 |

S&P SmallCap 600 Index | | 100 | | 106 | | 90 | | 123 | | 150 | | 160 |

Peer Group | | 100 | | 173 | | 97 | | 196 | | 246 | | 226 |

| (*) | $ 100 invested on December 31, 2000 in stock or index, including reinvestment of dividends. Fiscal year ending December 31. |

16

MISCELLANEOUS

Independent Certified Public Accountants

BDO Audiberia has audited and reported upon the financial statements of the Company for the fiscal year ended December 31, 2005, and has been selected to serve as the Company’s independent auditors for the fiscal year ending December 31, 2006. A representative of BDO Audiberia is not expected to be present at the 2006 Annual Meeting.

Shareholder Proposals

Shareholder proposals complying with the applicable rules under the Securities Exchange Act of 1934 intended to be presented at the 2007 Annual Meeting of Shareholders must be received at the offices of the Company by January 2, 2007, to be considered by the Company for inclusion in the Company’s proxy statement and form of proxy relating to that meeting. Such proposals should be directed to the attention of the Corporate Secretary, Private Media Group, Inc., Carrettera de Rubì 22, 08173 Sant Cugat del Vallès, Barcelona, Spain. Shareholders wishing to submit proposals or director nominations that are not to be included in such proxy materials must notify the Corporate Secretary of the Company in writing at the previously mentioned address not less than 45 or more than 75 days prior to the first anniversary (the “Anniversary”) of the date on which the Company first mailed its proxy materials for this year’s annual meeting. If the date of next year’s annual meeting is advanced more than 30 days prior to or delayed by more than 30 days after the anniversary of this year’s annual meeting, notice by the shareholder must be so delivered not later than the close of business on the later of (i) the 90th day prior to such annual meeting or (ii) the 10th day following the day on which public announcement of the date of such meeting is first made. Shareholders are also advised to review the Company’s Bylaws, which contain additional requirements with respect to advance notice of shareholder proposals and director nominations.

Other Matters

Neither the Company nor any of the persons named as proxies knows of matters other than those above stated to be voted on at the Annual Meeting. However, if any other matters are properly presented at the meeting, it is the intention of the persons named as proxies to vote in accordance with their judgment on such matters, subject to direction by the Board of Directors.

The 2005 Annual Report to Shareholders accompanies this Proxy Statement, but is not to be deemed a part of the proxy soliciting material.

WHILE YOU HAVE THE MATTER IN MIND, PLEASE COMPLETE, SIGN AND RETURN THE ENCLOSED PROXY CARD PROMPTLY.

17

PRIVATE MEDIA GROUP, INC.

3230 Flamingo Road, Suite 156

Las Vegas, Nevada 89121

PROXY FOR ANNUAL MEETING OF SHAREHOLDERS TO BE HELD DECEMBER 18, 2006

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned hereby appoints Berth H. Milton and Johan Gillborg, and each of them, Proxies, with full power of substitution in each of them, in the name, place and stead of the undersigned, to vote at the Annual Meeting of Shareholders of Private Media Group, Inc. on Monday, December 18, 2006, at 10:00 a.m. at Sant Cugat Hotel and Restaurante, C/César Martinell, 2 (Rambla del Celler), Sant Cugat del Vallès, Barcelona, Spain or at any adjournment or adjournments thereof, according to the number of votes that the undersigned would be entitled to vote if personally present, upon the following matters:

| | |

FOR all nominees listed below | | WITHHOLD AUTHORITY |

(except as marked to the contrary below). | | to vote for all nominees listed below. |

Berth H. Milton, Bo Rodebrant, Lluis Torralba, Johan G. Carlberg, Daniel Sánchez

(Instruction: To withhold authority to vote for any individual nominee, write the nominee’s name in the space below.)

In their discretion, the Proxies are authorized to vote upon such other business as may properly come before the meeting.

(Continued on the reverse side)

THIS PROXY WILL BE VOTED IN ACCORDANCE WITH THE INSTRUCTIONS GIVEN ABOVE. IF NO INSTRUCTIONS ARE GIVEN, THIS PROXY WILL BE VOTED FOR THOSE NOMINEES AND THE PROPOSALS LISTED ABOVE.

|

DATED: , 2006 Please sign exactly as name appears hereon. When shares are held by joint tenants, both should sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If a corporation, please sign in full corporate name by President or other authorized officer. If a partnership, please sign in partnership name by authorized person. |

|

| |

Signature |

|

| |

Signature if held jointly |

Please mark, sign, date and return this proxy card promptly using the enclosed envelope.