SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Private Media Group, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which the transaction applies: |

| | (2) | Aggregate number of securities to which the transaction applies: |

| | (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of the transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

3230 Flamingo Road, Suite 156

Las Vegas, Nevada 89121 USA

October 31, 2008

Dear Fellow Shareholder:

You are cordially invited to attend the Annual Meeting of Shareholders to be held on Monday, December 15, 2008, at 10:00 a.m., at Calle de la Marina 16-18, 08005 Barcelona, Spain.

The Notice of Annual Meeting and Proxy Statement which follow describe the business to be conducted at the meeting.

Whether or not you plan to attend the meeting in person, it is important that your shares be represented and voted. After reading the enclosed Notice of Annual Meeting and Proxy Statement, I urge you to promptly complete, sign, date and return the enclosed proxy card in the envelope provided.

Your vote is very important, and we will appreciate a prompt return of your signed Proxy card. If your shares are held in the name of a bank, broker or other holder of record, you will receive instructions from the holder of record for you to follow in order to vote your shares. We hope to see you at the meeting.

|

| Cordially, |

|

|

| Berth H. Milton |

| Chairman of the Board |

PRIVATE MEDIA GROUP, INC.

3230 Flamingo Road, Suite 156

Las Vegas, Nevada 89121 USA

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MONDAY, DECEMBER 15, 2008

To the Shareholders of PRIVATE MEDIA GROUP, INC.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of Private Media Group, Inc. will be held on Monday, December 15, 2008, at 10:00 a.m., at Calle de la Marina 16-18, 08005 Barcelona, Spain, for the following purposes:

| | 1. | To elect five (5) directors to hold office until the next Annual Meeting of Shareholders and until their respective successors have been duly elected and qualified; and |

| | 2. | To transact such other business as may properly come before the meeting or any adjournments thereof. |

Only shareholders of record at the close of business on October 20, 2008, are entitled to notice of and to vote at the Annual Meeting or any adjournment thereof.

| | | | | | |

| | | | | | By Order of the Board of Directors |

| | | |

| | | | | |  |

| | | | | | Johan Gillborg |

| October 31, 2008 | | | | | | Corporate Secretary |

All shareholders are cordially invited to attend the meeting in person. Whether or not you expect to attend the meeting, PLEASE COMPLETE AND SIGN THE ENCLOSED PROXY AND RETURN IT PROMPTLY IN THE ENCLOSED ENVELOPE. If your shares are held in the name of a bank, broker or other holder of record, you will receive instructions from the holder of record for you to follow in order to vote your shares. The giving of your Proxy will not affect your right to vote in person should you later decide to attend the meeting.

PRIVATE MEDIA GROUP, INC.

3230 Flamingo Road, Suite 156

Las Vegas, Nevada 89121 USA

PROXY STATEMENT

General Information

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Private Media Group, Inc. (the “Company” or “Private”) for the Annual Meeting of Shareholders to be held on December 15, 2008 (the “Annual Meeting”) and any postponements or adjournments thereof. Any shareholder giving a Proxy may revoke it before or at the meeting by providing a proxy bearing a later date or by attending the meeting and expressing a desire to vote in person. All proxies will be voted as directed by the shareholder on the Proxy card; and, if no choice is specified, they will be voted (1) “FOR” the five directors nominated by the Board of Directors, and (2) in the discretion of the persons acting as Proxies, for any other matters.

Your cooperation in promptly returning the enclosed Proxy will reduce the Company’s expenses and enable its management and employees to continue their normal duties for your benefit with minimum interruption for follow-up proxy solicitation.

Only shareholders of record at the close of business on October 20, 2008, are entitled to receive notice of and to vote at the meeting. On that date, the Company had outstanding 53,580,494 shares of Common Stock. The shares of Common Stock vote as a single class. Holders of shares of Common Stock on the record date are entitled to one vote for each share held. The presence at the Annual Meeting, either in person or by proxy, of the holders of one-third of the shares of Common Stock issued, outstanding and entitled to vote is necessary to constitute a quorum for the transaction of business.

A plurality of votes by the holders of the Common Stock is required for the election of directors. In accordance with Nevada law, abstentions and “broker non-votes” (i.e. proxies from brokers or nominees indicating that such persons have not received instructions from the beneficial owners or other persons entitled to vote shares as to a matter with respect to which brokers or nominees do not have discretionary power to vote) will be treated as present for purposes of determining the presence of a quorum. For purposes of determining approval of a matter presented at the meeting, abstentions will be deemed present and entitled to vote and will, therefore, have the same legal effect as a vote “against” a matter presented at the meeting. Broker non-votes will be deemed not entitled to vote on the matter as to which the non-vote is indicated and will, therefore, have no legal effect on the vote on such matter.

This Proxy Statement and the accompanying Notice of Annual Meeting and form of Proxy are being mailed or delivered to shareholders on or about October 31, 2008.

In the event that sufficient votes in favor of the proposals are not received by the date of the Annual Meeting, the persons named as proxies may propose one or more adjournments of the Annual Meeting to permit further solicitations of proxies. Any such adjournment will require the affirmative vote of the holders of a majority of the shares of Common Stock present in person or by proxy at the Annual Meeting. The persons named as proxies will vote in favor of such adjournment or adjournments.

The cost of preparing, assembling, printing, and mailing the materials, the Notice and the enclosed form of Proxy, as well as the cost of soliciting proxies relating to the Annual Meeting, will be borne by the Company. The Company will request banks, brokers, dealers, and voting trustees or other nominees to

1

forward solicitation materials to their customers who are beneficial owners of shares, and will reimburse them for the reasonable out-of-pocket expenses of such solicitations. The original solicitation of Proxies by mail may be supplemented by telephone, telegram, personal solicitation or other means by officers and other regular employees or agents of the Company, but no additional compensation will be paid to such individuals on account of such activities.

PLEASE MARK, DATE AND SIGN THE ENCLOSED PROXY AND RETURN IT AT AN EARLY DATE IN THE ENCLOSED POSTAGE PREPAID RETURN ENVELOPE SO THAT, IF YOU ARE UNABLE TO ATTEND THE ANNUAL MEETING, YOUR SHARES MAY BE VOTED. IF YOUR SHARES ARE HELD IN THE NAME OF A BANK, BROKER OR OTHER HOLDER OF RECORD, PLEASE FOLLOW THE INSTRUCTIONS FROM THE HOLDER OF RECORD IN ORDER TO VOTE YOUR SHARES.

2

PROPOSAL NO. 1

ELECTION OF FIVE NOMINEES FOR DIRECTOR

Nominees and Voting

The Bylaws of the Company authorize a Board of Directors of five directors. Consequently, at the Annual Meeting five directors will be elected to serve until the next Annual Meeting and until their successors are elected and qualified. Proxies may not be voted for more than five persons. The Company has nominated for election as directors the five persons named below. Each of these nominees has indicated that they are able and willing to serve as directors.

Under Nevada law and the Company’s Articles of Incorporation, shareholders of record on the record date will be entitled to one vote for each share held when voting for directors.

Unless otherwise instructed, the Company’s Proxy holders intend to vote the shares of Common Stock represented by the Proxies in favor of the election of these nominees. If for any reason any of these nominees will be unable or unwilling to serve, the shares represented by the enclosed Proxy will be voted for the election of the balance of those named and such other person or persons as the Board of Directors may recommend. The Board of Directors has no reason to believe that any such nominee will be unable or unwilling to serve. Directors are elected by a plurality of the votes cast.

The Company’s nominees and directors are listed below, together with their ages, offices with the Company and year in which each became a director of the Company.

THE BOARD OF DIRECTORS OF THE COMPANY RECOMMENDS THAT THE SHAREHOLDERS VOTE “FOR” THE ELECTION OF THE FIVE NOMINEES FOR DIRECTOR.

| | | | | | |

Name | | Age | | Position | | Director Since |

| Berth H. Milton | | 53 | | Chairman of the Board, | | 1998 |

| | | | Chief Executive Officer, | | |

| | | | President | | |

| Bo Rodebrant | | 55 | | Director | | 1998 |

| Lluis Torralba | | 39 | | Director | | 2005 |

| Johan G. Carlberg | | 49 | | Director | | 2004 |

| Daniel Sánchez | | 39 | | Director | | 2004 |

Business Experience of Directors and Nominees During the Past Five Years

Berth H. Milton was appointed to the Board of Directors of the Company in February 1998 and was the Corporate Secretary from June 1998 until February 1999. In February 1999 Mr. Milton was appointed Chairman of the Board and Chief Executive Officer of Private, and served as Chief Executive Officer until

3

May 2002. In November 2003 Mr. Milton was reappointed President and Chief Executive Officer of the Company. Mr. Milton has been Administrator of Milcap Media Group from its inception until June 2000 and has been acting as an advisor to the Milcap Group since 1991. Mr. Milton is also active in several international industry and real estate projects and developments.

Bo Rodebrant was appointed as a Director of the Company in August 1998. Mr. Rodebrant has operated his own accountancy and management consulting services, R&S Ekonomiservice, since 1986. Prior thereto he co-founded an ice cream business, Hemglass, which was the largest of its kind in Stockholm, Sweden. The business was sold by Mr. Rodebrant in 1986. Mr. Rodebrant holds a degree in construction engineering which he received in 1974.

Johan G. Carlberg was appointed to the Board of Directors in October 2004. Mr. Carlberg has operated his own import, trading and consulting business in the textile and fashion industry since the seventies. Mr. Carlberg holds a Degree in Business from the Stockholm Institute of Business.

Daniel Sánchez was appointed to the Board of Directors in October 2004. Since January 2004, Mr. Sánchez has been promoting, as a founding partner, the launching of a new private venture capital firm. Prior to entering the venture capital field, he held the position as Deputy Managing Director at Electrodomésticos Taurus, a consumer electronics company, from 2002 to 2004. Between 1995 and 2002 he worked as a Manager in the field of mergers and acquisitions at Alpha Corporate, a well known international consultancy firm. Mr. Sánchez holds a Master’s Degree in Business Administration from the University of Chicago.

Lluis Torralbawas appointed to the Board of Directors in June 2005. Mr. Torralba is a founding partner of Meriden IPM, an international portfolio management company, where he currently is managing private clients. From 1997 to 2004 he was responsible for the company’s IT systems. Prior to 1997, he worked as an IT manager in Andorra. Mr. Torralba holds a Degree in Information Technology from Escola D’informàtica d’Andorra.

Meetings and Committees of the Board of Directors

The Board of Directors currently has two committees: (i) an Audit Committee, and (ii) a Compensation Committee. The Board of Directors does not have a formal nominating committee, and all decisions regarding director nominations are addressed by the entire Board of Directors.

Under applicable Nasdaq listing rules the Company is a “controlled company” as Berth Milton beneficially owns more than 50% of the Company’s Common Stock. Therefore, the Company is exempt from Nasdaq Marketplace Rules which require that (i) compensation of executive officers be determined by either a majority of the independent directors or a compensation committee comprised solely of independent directors, and (ii) nomination of directors be made by either a majority of independent directors or a committee comprised solely of independent directors.

The Company’s Board of Directors met five times during 2007 (including actions by unanimous written consent). No director attended less than 75% of the aggregate of all meetings of the Board of Directors and all Committees on which he served during the 2007 fiscal year.

All of the members of the Board of Directors are “independent” as defined in Nasdaq Marketplace Rule 4200 other than Berth Milton, who is the Company’s Chief Executive Officer.

The Audit Committee is currently comprised of Lluis Torralba, Johan Carlberg and Daniel Sánchez. All of the members of the Audit Committee are “independent” as defined in applicable Nasdaq listing requirements and SEC regulations, and each of them is able to read and understand fundamental financial statements. The Board has determined that Daniel Sánchez is an “audit committee financial expert” as defined under applicable SEC regulations. The Audit Committee reviews and recommends to the Board, as it deems

4

necessary, the internal accounting and financial controls for the Company and the accounting principles and auditing practices and procedures to be employed in preparation and review of financial statements of the Company. The Audit Committee makes recommendations to the Board concerning the engagement of independent public accountants and the scope of the audit to be undertaken by such accountants. The Audit Committee has adopted a written Audit Committee Charter. The Audit Committee met five times during 2007.

The Compensation Committee is currently comprised of Berth Milton. The Compensation Committee reviews and, as it deems appropriate, recommends to the Board policies, practices and procedures relating to the compensation of the officers and other managerial employees and the establishment and administration of employee benefit plans. It exercises all authority under any employee stock option plans of the Company as the Committee therein specified, subject to the review and approval of the Board of Directors, and advises and consults with the officers of the Company as may be requested regarding managerial personnel policies. The Compensation Committee also has such additional powers as may be conferred upon it from time to time by the Board. The Compensation Committee met twice during 2007.

The Board has not established a formal nominating committee, nor has the Board adopted a nominating committee charter. Therefore, decisions relating to the nomination of directors are addressed by the entire Board of Directors. The Board has not established any specific minimum qualifications that must be met for recommendation for a position on the Board. Instead, in considering candidates for director, the Board will generally consider all relevant factors, including among others the candidate’s applicable expertise and demonstrated excellence in his or her field, the usefulness of such expertise to the Company, the availability of the candidate to devote sufficient time and attention to the affairs of the Company, the candidate’s reputation for personal integrity and ethics and the candidate’s ability to exercise sound business judgment. Other relevant factors, including diversity, age and skills, will also be considered. Candidates for director are reviewed in the context of the existing membership of the Board (including the qualities and skills of the existing directors), the operating requirements of the Company and the long-term interests of its shareholders. The Board uses its network of contacts when compiling a list of potential director candidates and may also engage outside consultants (such as professional search firms). At this time, the Board does not consider director candidates recommended by shareholders. The Board believes that it is in the best position to identify, review, evaluate and select qualified candidates for Board membership. All of the Company’s nominees for director at the 2008 Annual Meeting were approved by the entire Board of Directors.

Shareholder Communications with the Board of Directors

A shareholder may contact one or more of the members of the Board of Directors in writing by sending such communication to the Secretary at the Company’s address. The Secretary will forward shareholder communications to the appropriate director or directors for review. Anyone who has a concern about the conduct of the Company or the Company’s accounting, internal accounting controls or auditing matters, may communicate that concern to the Secretary, the Chairman of the Board or any member of the Board of Directors at the Company’s address. The Company encourages individual directors to attend the Annual Meeting. At the Company’s 2007 Annual Meeting none of the Company’s directors was in attendance. We believe the Company’s responsiveness to shareholder communications to the Board has been adequate.

5

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table presents certain information as of October 27, 2008, regarding the beneficial ownership of our common stock by (i) each of our directors and executive officers individually, (ii) all persons known by us to be beneficial owners of five percent or more of our common stock, and (iii) all of our directors and executive officers as a group. Unless otherwise noted, the persons listed below have sole voting and investment power and beneficial ownership with respect to such shares.

| | | | | |

Name and Address | | Number of Shares

Beneficially Owned (1) | | Percent

Beneficially

Owned (1) | |

Berth H. Milton (2) | | 31,282,985 | | 58.2 | % |

Javier Sánchez (3) | | 760,000 | | 1.4 | % |

Johan Gillborg (4) | | 327,500 | | * | |

Bo Rodebrant (5) | | 72,000 | | * | |

Daniel Sánchez (6) | | 40,000 | | * | |

Philip Christmas (7) | | 15,000 | | * | |

Johan G. Carlberg (8) | | 12,000 | | * | |

Lluis Torralba (9) | | 8,000 | | — | |

Peter T. Cohen (10) | | — | | — | |

All Executive Officers and Directors

as a group (9 people) (11) | | 32,517,485 | | 59.3 | % |

| (1) | Beneficial ownership is determined in accordance with rules of the U.S. Securities and Exchange Commission. The calculation of the percentage of beneficial ownership is based upon 53,580,494 shares of common stock outstanding on October 27, 2008. In computing the number of shares beneficially owned by any shareholder and the percentage ownership of such shareholder, shares of common stock which may be acquired by a such shareholder upon exercise or conversion of warrants or options which are currently exercisable or exercisable within 60 days of October 27, 2008, are deemed to be exercised and outstanding. Such shares, however, are not deemed outstanding for computing the beneficial ownership percentage of any other person. Except as indicated by footnote, to our knowledge, the persons named in the table above have the sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them. |

| (2) | Includes 4,950,000 shares of common stock owned by Slingsby Enterprises Limited, of which Mr. Milton is the sole shareholder. These shares are pledged to a third party to secure payment of a loan from the third party to us. Also includes 180,000 shares issuable upon exercise of Options issued under the Employee Stock Option Plan. His address is c/o Private Media Group, Inc., Calle de la Marina 14-16, Floor 18, Suite D, 08005 Barcelona, Spain. |

| (3) | Includes 730,000 shares issuable upon exercise of Options issued under the Employee Stock Option Plan. His address is c/o Private Media Group, Inc., Calle de la Marina 14-16, Floor 18, Suite D, 08005 Barcelona, Spain. |

| (4) | Includes 222,500 shares issuable upon exercise of Options issued under the Employee Stock Option Plan owned by Mr. Gillborg. His address is c/o Private Media Group, Inc., Calle de la Marina 14-16, Floor 18, Suite D, 08005 Barcelona, Spain. |

6

| (5) | Includes 72,000 shares issuable upon exercise of Options issued under the Employee Stock Option Plan owned by Mr. Rodebrant. His address is c/o Private Media Group, Inc., Calle de la Marina 14-16, Floor 18, Suite D, 08005 Barcelona, Spain. |

| (6) | Includes 40,000 shares issuable upon exercise of Options issued under the Employee Stock Option Plan owned by Mr. D. Sánchez. His address is c/o Private Media Group, Inc., Calle de la Marina 14-16, Floor 18, Suite D, 08005 Barcelona, Spain. |

| (7) | Includes 15,000 shares issuable upon exercise of Options issued under the Employee Stock Option Plan owned by Mr. Christmas. His address is c/o Private Media Group, Inc., Calle de la Marina 14-16, Floor 18, Suite D, 08005 Barcelona, Spain. |

| (8) | Includes 12,000 shares issuable upon exercise of Options issued under the Employee Stock Option Plan owned by Mr. Carlberg. His address is c/o Private Media Group, Inc., Calle de la Marina 14-16, Floor 18, Suite D, 08005 Barcelona, Spain. |

| (9) | Includes 8,000 shares issuable upon exercise of Options issued under the Employee Stock Option Plan owned by Mr. Torralba. His address is c/o Private Media Group, Inc., Calle de la Marina 14-16, Floor 18, Suite D, 08005 Barcelona, Spain. |

| (10) | His address is c/o Private Media Group, Inc., Calle de la Marina 14-16, Floor 18, Suite D, 08005 Barcelona, Spain. |

| (11) | Includes 1,279,500 shares issuable upon exercise of outstanding Options under the Employee Stock Option Plan. |

7

MANAGEMENT

Listed below are executive officers and key employees of the Company who are not directors or nominees.

Peter T. Cohen, age 52, was appointed Chief Operating Officer of Private Media Group in November 2006. From 2003 to 2006 he was a Managing Partner of MPP Ventures LLC, a consultancy firm providing services to major entertainment companies with respect to strategies for digital content production and distribution on multi-media platforms. From 2001 to 2002 he served as Senior Executive Vice President of Media and Entertainment for BillboardLive. From 1997 to 2001 he held the position as Senior Vice President of Programming for The Box Music Network, a state of the art interactive music video channel distributed throughout the US and select international territories. Prior to this, Mr. Cohen held several senior executive positions at various other media/entertainment companies including HBO, CNN International, MuchMusic and ACTV Inc. Mr. Cohen has a Bachelor’s degree in Human Ecology from The College of the Atlantic, Bar Harbor, Maine, USA.

Johan Gillborg,age 46, was appointed as Chief Financial Officer of Private Media Group, Inc. in August 1998 and has been the Chairman and Managing Director of Milcap Publishing Group AB from 1994 until January 2000. Mr. Gillborg joined the group in 1992 as Marketing Consultant. From 1991 to 1992 he operated his own business which acted as sub-contracting sales force for Securitas Direct of Sweden (together with Mr. Kull). From 1988 to 1990, Mr. Gillborg served as General Manager in the hotel business in the United Kingdom and Portugal. Mr. Gillborg holds a Bachelor’s Degree in Business Administration from Schiller International University in London.

Javier Sánchez,age 47, was appointed Executive Vice President, Production and Operations of Milcap Media Group in November 2006. From August 1998 to November 2006, he held the position as Chief Operating Officer of Private Media Group, Inc. He has also been the General Manager of Milcap Media Group between 1991 and 1997 and has been a member of the Board of Milcap Media Group and Private France S.A. He has been a member of the Board of Milcap Publishing Group AB since its incorporation in 1994 until 1997. From 1988 to 1991 he was the Operations Director of a mid-size printing company near Barcelona. From 1984 to 1987 he was the Production Manager of a major printing company in Barcelona.

Philip Christmas,age 47, was appointed Chief Financial Officer of Milcap Media Group in August 2001. Prior to August 2001 Mr. Christmas was employed by PricewaterhouseCoopers and its predecessor firm, Coopers & Lybrand, since 1988. While employed by PricewaterhouseCoopers he was responsible for carrying out audits of multinational and local companies and, more recently, he provided transaction services to clients acquiring businesses in Spain. Mr. Christmas is a member of the Institute of Chartered Accountants of England and Wales and of ROAC (Official Register of Auditors) in Spain.

No director or executive officer serves pursuant to any arrangement or understanding between him and any other person.

8

EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

Executive Compensation Policy and Objectives

Our policy in compensating executive officers, including the executive officers named in the Summary Compensation Table appearing below (the “named executive officers”), is to establish methods and levels of compensation that will

| | • | | attract and retain highly qualified personnel |

| | • | | provide meaningful incentives to promote profitability and growth and reward superior performance. |

To achieve these policies Private follows the basic principles that annual compensation should be competitive with similar companies and long term compensation should generally be linked to Private’s return to shareholders. Private also believes that compensation for individual executives should be aligned to the performance of areas of the business over which the executive has the most control.

Executive compensation policies are implemented through a combination of annual and long-term methods of compensation. Compensation for the named executive officers includes

| | • | | eligibility to receive annual cash bonuses, and |

| | • | | stock-based compensation in the form of stock options under the employee stock option plan. |

These primary components are available for flexible use by Private in a manner that will effectively implement our stated objectives with respect to compensation arrangements for each of the executive officers. Each of these components is discussed in more detail below. When setting the compensation arrangements for each executive officer, the Compensation Committee considers these components individually, as well as on an aggregate (total compensation) basis. There is no pre-determined relationship between base salary of our executives and any of the other principal components of compensation. Each element of compensation is considered both individually and in terms of total overall compensation.

Primary Components of Executive Compensation.

Base Salary

The base salaries of our executive officers are set by the Compensation Committee (and in the case of the CEO, ratified by the independent directors) after consideration of a number of factors, including the executive’s position, level of responsibility, tenure and performance. The Compensation Committee also considers the compensation levels of executives in comparable companies, along with the executive compensation recommendations made by our chief executive officer. In addition, the Compensation Committee evaluates whether the base salary levels of our executives are appropriate relative to our size and financial performance compared with the other companies reviewed. Relying primarily on these factors, the Compensation Committee sets the base salaries of our executive officers at levels designed to meet its objective of attracting and retaining highly qualified individuals. The Compensation Committee also believes that the continuity of leadership derived from the retention of well qualified executive officers is in the best interests of our shareholders. The base salaries of our executive officers are not set at any specific level as compared to the compensation levels of companies reviewed and the Compensation Committee does not assign relative weights or importance to any specific measure of the company’s financial performance. During 2006 and 2007 base salary accounted for all the named executive officers’ direct cash compensation.

9

Effective September 2007 we increased Mr. Cohen’s base compensation from USD $200,000 to EUR 200,000 per year, effectively resulting in an increase in Mr. Cohen’s base compensation based upon current exchange rates. The increase was intended to reflect both the decrease in the value of the dollar against the euro and to adjust his compensation to reflect market conditions. There were modest increases in base compensation to other named executive officers to reflect increased cost of living.

Annual Cash Incentive Payment

The Compensation Committee considers the use of annual performance bonuses from time to time where appropriate, to motivate participants to achieve company growth and enhance shareholder value. The incentive bonus plan permits plan participants to receive a cash bonus that is tied to the company’s financial performance during a specified fiscal year. We do not presently have in effect an annual cash bonus plan in effect with respect to any of the named executive officers other than for our Chief Operating Officer, Peter Cohen. Under the terms of his employment agreement, Mr. Cohen is eligible to receive an annual performance bonus, upon the achievement of specified goals in each fiscal year, commencing in 2007, based upon the amount of increase in annual operating income after 2006. The agreement provides for an annual bonus of between EUR 20,000 – 100,000, depending upon the amount of increase in operating income in the applicable fiscal year. No bonus was paid or accrued for 2007, as the financial targets were not achieved. Information regarding this bonus plan is contained below under the heading “Employment Contracts, Termination of Employment Contracts and Change in Control Arrangements.”

Long-Term Equity Based Compensation Awards

To date we have relied upon cash flow from operations as our principal source of working capital. As a result, we have placed special emphasis on equity-based compensation, in the form of options, to preserve our cash for operations. Long-term equity based compensation awards are granted to our executive officers pursuant to our employee stock option plan. The Compensation Committee believes that long-term equity based compensation awards are an effective incentive for senior management to increase the long-term value of the company’s common stock as well as aiding the company in attracting and retaining senior management. These objectives are accomplished by making awards under the plan, thereby providing senior management with a proprietary interest in the continued growth and performance of the company and more closely aligning their interests with those of our shareholders. In addition, because options generally terminate within 90 days after the date an executive leaves the company (other than because of disability or retirement at age 65 or older), we believe that options are a useful incentive in promoting the retention of executives.

All determinations regarding the granting of options, including the amount, exercise price and terms of vesting, are made by the Compensation Committee after seeking input from management, subject to the approval of the full Board of Directors acting as the option committee under the employee stock option plan. The Compensation Committee makes long-term equity based compensation awards after a review of a number of factors, including length of service, the performance of the company, the relative levels of responsibility of the executive and his or her contributions to the business, including recommendations of supervisors, and prior option grants received by the executive. Awards may be granted to the same executive on more than one occasion.

Stock option grants may be subject to a vesting period based upon continued employment during the option term or may fully vest upon grant. The Compensation Committee may make grants at any particular time during the year, and the full board of directors approves such grants. The exercise price of the options must be at least equal to the fair market value of such shares on the date the stock option is granted or such later date as the option committee specifies.

No options were granted to any of the named executive officers in 2006 or 2007, as their current levels of overall compensation were considered adequate.

10

Other Benefits

We provide all eligible employees, including executive officers, with certain benefits, including paid time off and paid holiday programs. We do not presently maintain any deferred compensation or retirement plans.

Employment Agreements. We do not have long-term employment agreements with our executive officers.

Severance Agreements. We generally do not enter into severance agreements or similar agreements providing for payments upon termination of employment or change-in-control. Such agreements, when entered into, are negotiated on a case-by-case basis. Other than our agreement with Peter Cohen providing for up to three months of severance benefits, we have not entered into any severance agreements or termination agreements with any of the named executive officers. Information regarding our agreement with Mr. Cohen is contained below under the heading “Employment Contracts, Termination of Employment Contracts and Change in Control Arrangements.”

11

The following table summarizes all compensation paid to (i) our Chief Executive Officer and Chief Financial Officer serving during 2007, and (ii) our other most highly compensated executive officers who were serving in such capacity at the end of 2007, other than the Chief Executive Officer and Chief Financial Officer, whose total compensation exceeded $100,000 in 2007, for services rendered in all capacities to Private Media Group for the two fiscal years ended December 31, 2006, and December 31, 2007. No other executive officer earned compensation in excess of $100,000 in 2007.

2007 Summary Compensation Table

| | | | | | | | | |

Name and Principal Position During Fiscal 2007 | | Fiscal

Year | | Salary

($)(1) | | All Other

Compensation

($) | | | Total

($)(1) |

Berth H. Milton, President and CEO (2) | | 2007 | | 141,000 | | | | | 141,000 |

Director, Chairman of the Board | | 2006 | | 118,144 | | | | | 118,144 |

Johan Gillborg (3) | | 2007 | | 191,000 | | | | | 191,000 |

Chief Financial Officer and Secretary, Private Media | | 2006 | | 165,000 | | | | | 165,000 |

Group, Inc.; Chairman, Private France S.A.; Chairman, | | | | | | | | | |

Private Benelux; Administrator, Milcap Media Group | | | | | | | | | |

Peter T. Cohen (4) | | 2007 | | 225,000 | | 27,000 | (5) | | 252,000 |

Chief Operating Officer, Private Media Group, Inc. | | 2006 | | 50,000 | | 5,000 | (5) | | 55,000 |

Javier Sánchez (6) | | 2007 | | 225,000 | | | | | 225,000 |

EVP, Production and Operations, Milcap Media Group | | 2006 | | 205,000 | | | | | 205,000 |

Philip Christmas (7) | | 2007 | | 137,000 | | | | | 137,000 |

Chief Financial Officer, Milcap Media Group | | 2006 | | 117,500 | | | | | 117,500 |

| (1) | Salary amounts received in non-US currency have been converted into dollars using the average exchange rate for the applicable year. |

| (2) | Salary received in non-US currency, 102,500 euro in 2007 and 94,515 euro in 2006. Mr. Milton agreed to waive director fees for 2006 and 2007. Therefore, the amounts for 2006 and 2007 reflect only salary received for services as President and CEO. |

| (3) | Salary received in non-US currency, 139,000 euro in 2007 and 132,000 euro in 2006. |

| (4) | Mr. Cohen was retained as a consultant in September 2006 and was appointed Chief Operating Officer in November 2006. Compensation for 2006 reflects compensation as consultant and Chief Operating Officer. Salary received in non-US currency, 67,000 euro in 2007. |

| (5) | In accordance with Mr. Cohen’s employment agreement he received a 2,000 euro ($2,667) monthly relocation allowance for 12 months commencing in November 2006. |

| (6) | Mr. Sánchez served as Chief Operating Officer of Private Media Group, Inc. from 1998 until November 2006, when Mr. Sánchez was appointed as Executive Vice President, Production and Operations of Milcap Media Group. Salary received in non-US currency, 164,000 euro in 2007 and 164,000 euro in 2006. |

| (7) | Salary received in non-US currency, 100,000 euro in 2007 and 94,000 euro in 2006. |

No bonuses, stock options or stock awards were granted to any of the named executive officers in 2007.

12

Compensation Committee Interlocks and Insider Participation

During the last fiscal year Mr. Milton has acted as the Compensation Committee. Mr. Milton served as our Chief Executive Officer during 2007. During the last fiscal year, none of our executive officers served on our Board of Directors or Compensation Committee of any other entity whose officers served either on our Board of Directors or Compensation Committee.

Grants of Plan-Based Awards in the Last Fiscal Year

There were no plan-based awards granted to the individuals named in the Summary Compensation Table above for the year ended December 31, 2007.

Outstanding Equity Awards at 2007 Fiscal Year-End

The following table summarizes certain information regarding the number and value of all options to purchase common stock of Private Media Group, Inc. held by the individuals named in the Summary Compensation Table at December 31, 2007. No stock awards or equity incentive plan awards were issued or outstanding during fiscal 2007.

2007 OUTSTANDING EQUITY AWARDS AT FISCAL YEAR END

| | | | | | | | | | |

| | | Option Awards |

| | | Number of

Securities

Underlying

Unexercised

Options

(#) | | Number of

Securities

Underlying

Unexercised

Options

(#) | | Equity

Incentive

Plan Awards

:

Number of

Securities

Underlying

Unexercised

Unearned

Options

(#) | | Option

Exercise

Price

($) | | Option

Expiration

Date |

Name | | Exercisable | | Unexercisable | | | |

Berth H. Milton | | 180,000 | | | | — | | 4.75 | | Mar 1, 2009 |

Javier Sánchez | | 180,000 | | | | — | | 4.75 | | Mar 1, 2009 |

Johan Gillborg | | 172,500 | | | | — | | 4.77 | | Mar 1, 2009 |

Javier Sánchez | | 500,000 | | | | — | | 5.00 | | Oct 7, 2009 |

Javier Sánchez | | 50,000 | | | | — | | 6.00 | | Dec 19, 2008 |

Johan Gillborg | | 50,000 | | | | — | | 6.00 | | Dec 19, 2008 |

Philip Christmas | | 15,000 | | | | — | | 6.00 | | Dec 19, 2008 |

Peter T. Cohen | | — | | — | | — | | — | | — |

Option Exercises and Stock Vesting During 2007

No stock options were exercised during 2007 by the individuals named in the Summary Compensation Table. No stock awards were issued or outstanding during fiscal 2007.

Employment Contracts, Termination of Employment Contracts and Change in Control Arrangements

We generally do not enter into long-term employment agreements with our executive officers. We generally do not enter into severance agreements or similar agreements providing for payments upon termination of employment or change-in-control. Such agreements, when entered into, are negotiated on a

13

case-by-case basis. We have not entered into any severance agreements or termination agreements with any of the named executive officers other than with Peter Cohen, pursuant to an agreement negotiated with him in connection with his commencement of employment in 2006.

Effective November 2006, we entered into an employment agreement with Peter Cohen in connection with his employment by Private as its Chief Operating Officer. Mr. Cohen’s employment is terminable upon not more than 30 days notice. We agreed to pay him a salary of $200,000 per annum plus certain relocation costs of up to EUR 24,000. Effective September 2007 his base salary of $200,000 per annum was increased to EUR 200,000 per annum. Mr. Cohen is also eligible to receive an annual performance bonus, upon the achievement of specified goals in each fiscal year, commencing in 2007, based upon the amount of increase in annual operating income after 2006. The agreement provides for an annual bonus of between EUR 20,000 – 100,000, depending upon the amount of increase in operating income in the applicable fiscal year. No bonus was paid or accrued for 2007, as the financial targets were not achieved. If Mr. Cohen is terminated by Private other than for cause, he is entitled to a severance payment equal to one month of salary if terminated prior to October 30, 2007, and three months of salary if terminated at any time thereafter.

Director Compensation During 2007

The following table summarizes all compensation paid to our non-employee directors during 2007.

2007 DIRECTOR COMPENSATION TABLE

| | | | | | | | | | | | |

Name | | Fees

Earned

or Paid

in Cash

($)(1) | | Stock

Awards

($) | | Option

Awards

($) (2)(6) | | Non-Equity

Incentive Plan

Compensation

($) | | All Other

Compensation

($) | | Total

($)(1) |

Bo Rodebrant | | — | | — | | — | | — | | — | | — |

Lluis Torralba (3) | | 10,959 | | — | | 4,128 | | — | | — | | 15,087 |

Johan G. Carlberg (4) | | 5,479 | | — | | 3,922 | | — | | — | | 9,401 |

Daniel Sánchez (5) | | 10,959 | | — | | 13,072 | | — | | — | | 24,031 |

| (1) | Fee earned in non-US currency have been converted into dollars using the average exchange rate for the applicable year. |

| (2) | Reflects the amount recognized for financial statement reporting purposes for fiscal year 2007 in accordance with FAS 123(R) using the assumptions set forth in footnote 16 to the financial statements included in the 2007 Annual Report for stock option awards granted during and prior to 2007, assuming no forfeitures. |

| (3) | The director earned 8,000 euro in non-US currency and, as of December 31, 2007, the director had 8,000 options outstanding. |

| (4) | The director earned 4,000 euro in non-US currency and, as of December 31, 2007, the director had 12,000 options outstanding. |

| (5) | The director earned 8,000 euro in non-US currency and, as of December 31, 2007, the director had 40,000 options outstanding. |

| (6) | In 2007 Messrs. Sánchez, Torralba and Carlberg were each granted options to acquire 10,000, 8,000 and 3,000 shares, respectively, of Private’s common stock at an exercise price of $3.43, $2.26 and $3.43 per share, respectively, being the fair market value of our common stock on the date of grant, which options vest in October 2008 and expire in October 2011. The fair market value of these options at the time of grant, computed in accordance with FAS 123(R), were $12,165, $6,851 and $3,649 respectively. |

Our Board of Directors may, at its discretion, compensate directors for attending board and committee meetings and reimburse the directors for out-of-pocket expenses incurred in connection with attending such meetings.

14

We have agreed to pay Daniel Sánchez and Lluis Torralba a fee of EUR 2,000, and Johan Carlberg a fee of EUR 1,000, for each board and committee meeting attended. Our directors are also eligible to receive stock option grants under our employee stock option plan.

COMPENSATION COMMITTEE REPORT

The Compensation Committee has reviewed and discussed with management the “Compensation Discussion and Analysis” section included in this Proxy Statement. Based on this review and discussion, the Compensation Committee recommended to the board of directors that the “Compensation Discussion and Analysis” section be included in this Proxy Statement and annual report for the year ended December 31, 2007.

The Compensation Committee:

Berth H. Milton

AUDIT COMMITTEE REPORT

The Company maintains an Audit Committee (the “Audit Committee”), consisting entirely of outside Directors who are not employees or former employees of the Company and are independent under applicable Nasdaq and SEC regulations. The Audit Committee has, in the course of its duties, reviewed and discussed with management the audited financial statements, and has discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61. The Audit Committee has also received the appropriate auditors disclosures regarding the auditors’ independence as required by Independence Standards Board Standard No. 1 and discussed with them its independence. Based on the foregoing, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K as filed with the Commission for fiscal 2007.

Audit Committee Members

Daniel Sánchez, Johan G. Carlberg and Lluis Torralba

INDEPENDENT AUDITORS’ FEES

The following table represents aggregate fees billed to the Company for fiscal years ended December 31, 2006 and December 31, 2007, by BDO Audiberia, the Company’s independent auditors.

| | | | | | |

| | | Years Ended

December 31, |

| | | 2006 | | 2007 |

Audit Fees | | $ | 159,000 | | $ | 170,000 |

Audit-Related Fees | | | — | | | — |

Tax Fees | | | — | | | — |

All Other Fees | | | — | | | — |

| | | | | | |

TOTAL | | $ | 159,000 | | $ | 170,000 |

| | | | | | |

Fees for audit services in 2006 and 2007 included fees associated with the annual audit and reviews of the Company’s quarterly reports. All fees described above were approved by the Audit Committee.

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditors

The Audit Committee pre-approves all audit and permissible non-audit services provided by the Company’s independent auditors. These services may include audit services, audit-related services, tax and

15

other services. Pre-approval is generally provided for up to one year, and any pre-approval is detailed as to the particular service or category of services and is generally subject to a specific budget. The independent auditors and management are required to periodically report to the Audit Committee regarding the extent of services provided by the independent auditors in accordance with this pre-approval, and the fees for the services performed to date. The Audit Committee may also pre-approve particular services on a case-by-case basis. During 2006 and 2007, all services provided by BDO Audiberia were pre-approved by the Audit Committee in accordance with this policy.

CERTAIN RELATIONSHIPS AND RELATED PARTY MATTERS

Certain Relationships

No Director or executive officer of Private Media Group is related to any other Director or executive officer. None of our officers or Directors holds any directorships in any other public entity. There are currently four outside directors on our Board of Directors.

Related Transactions

Following is a description of transactions involving more than $120,000 since January 1, 2007, between us and our directors, nominees, executive officers, or members of their immediate family.

In December 2001 we borrowed $ 4.0 million from Commerzbank AG pursuant to a Note originally due on December 20, 2002. The Note bore interest at an annual rate of 7%, payable quarterly, with the entire principal amount and accrued interest originally due on December 20, 2002. The Note is guaranteed by Slingsby Enterprises Limited, an affiliate of Berth Milton, Private’s Chairman, Chief Executive Officer and principal shareholder, and the guaranty is secured by 4,950,000 shares of Private Media Group, Inc. Common Stock. In December 2002 Commerzbank AG agreed to extend the maturity date of the Note to March 20, 2003. In April 2003 the Note was acquired by Consipio Holding b.v. from Commerzbank AG, and Consipio and Private reached an agreement-in-principle with Consipio to extend the maturity of the Note for five years, until April 2008, with interest on the Note being increased to 9.9% per annum. However, Consipio and Private were unable to reach final agreement on other terms and conditions relating to the restructured Note. Accordingly, in December 2003 Consipio notified Private and Slingsby Enterprises that Private was in default under the Note, and demanded $3.4 million as payment in full of all outstanding principal and interest under the Note. The Company continued to make regular payments on the Note, including accrued interest, but remained unable to reach agreement on the restructuring of the Note. In April 2008 Consipio requested Private to pay the remaining balance of the Note, without indicating the amount due. Private in turn requested that Consipio provide a statement of the amount due and the basis for its calculation. In response, Consipio demanded payment of $3,194,000 as settlement in full of the Note, to be received by May 9, 2008. This calculation was made using an interest rate of 9.9%, as opposed to the 7% rate provided under the original terms of the Note. Consipio also advised that if payment was not received on such date it would institute litigation, in which event Consipio would claim that the amount due under the Note should be denominated in Euro, rather than U.S. dollars. In August 2008 Consipio notified Private that the Note was in default and that it intended to exercise its rights under the Note and the pledge of shares by Slingsby of Private Common Stock. Private believes that the amount due under the Note at May 9, 2008, including accrued interest, is no more than $2.4 million, utilizing an interest rate of 7%. Private also believes it has valid claims and defenses against Consipio and its affiliates which may ultimately reduce all or a portion of its obligations relating to the Note. However, there are no assurances that either Private will be able to reach agreement with Consipio or that Private will ultimately prevail on its claims and defenses. In any event, the Company does not believe that the Note obligations will have a material adverse effect on the liquidity of the Company, as the Note is fully collateralized by 4,950,000 shares of Private Media Group, Inc. Common Stock pursuant to the guaranty agreement from Slingsby Enterprises Limited to the holder of the Note.

16

We have short-term loans to Slingsby Enterprises Limited, an entity controlled by Mr. Milton. The loans bear interest at the rate of EURIBOR+1% per annum and have no maturity date. During 2007 the highest amount outstanding was EUR 6.7 million. As of December 31, 2007, EUR 6.7 million remained outstanding on these loans, including interest.

In May 2003 EUR 1.65 million of a related party note payable was re-financed by an institutional lender at the same interest rate as on the note payable, EURIBOR + 1%. The loan is repayable in equal monthly installments over a four year period starting June 29, 2004. The loan is guaranteed by the Company’s principal shareholder and affiliates of the Company’s principal shareholder.

In December 2007 the Company’s principal shareholder and affiliates of the Company’s principal shareholder agreed to guarantee a bank line of credit agreement of EUR 1.0 million entered into by one of the Company’s European subsidiaries.

The foregoing transactions are believed to be on terms no less favorable to us than we could obtain from unaffiliated third parties on an arms-length basis.

Review and Approval of Related Party Transactions

Our Audit Committee is responsible for the review and approval of all related party transactions required to be disclosed to the public under SEC rules. This procedure, which is contained in the written charter of our Audit Committee, has been established by our Board of Directors in order to both meet the requirements of applicable Nasdaq rules requiring review and approval of related party transactions, and to serve the interests of our shareholders. In addition, we maintain a written Code of Ethics which requires all employees, including our officers, to disclose to the Audit Committee any material relationship or transaction that could reasonably be expected to give rise to a personal conflict of interest. Related party transactions are reviewed and approved by the Audit Committee on a case-by-case basis. Under existing, unwritten policy no related party transaction can be approved by the Audit Committee unless it is first determined that the terms of such transaction is on terms no less favorable to us than could be obtained from an unaffiliated third party on an arms-length basis and is otherwise in our best interest.

CODE OF ETHICS

The Company has adopted a code of ethics that applies to our principal executive officer, principal financial officer, principal accounting officer and persons performing similar functions. The code of ethics is filed as Exhibit 14.1 to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2003. The Company intends to satisfy the disclosure requirements under Form 8-K regarding an amendment to or waiver from our code of ethics, by posting the required information on our corporate Internet website at www.prvt.com or as otherwise permitted under applicable law.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Based solely upon a review of Forms 3, 4 and 5 furnished to the Company covering its 2007 fiscal year filed under Section 16(a) of the Securities Exchange Act of 1934, the Company’s officers and directors complied with the reporting requirements under Section 16(a) for the 2007 fiscal year except for Messrs. Sánchez, Torralba and Carlberg, who did not file a Form 4 to report options granted to each of them by Private in 2007.

17

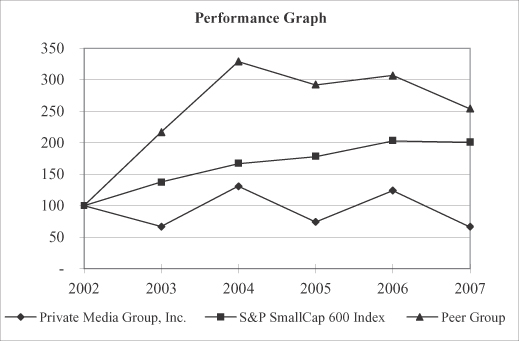

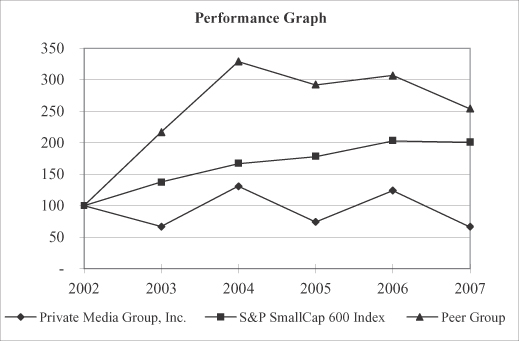

PERFORMANCE MEASUREMENT COMPARISON OF SHAREHOLDER RETURNS

The following graph compares on a cumulative basis the yearly percentage change, assuming dividend reinvestment, over the five fiscal years in (a) the total shareholder return on common stock of Private Media Group, Inc. with (b) the total return on the Standard & Poors SmallCap 600 index and (c) the total return on a peer group. The Standard & Poor’s SmallCap 600 index covers approximately 3% of the US domestic equities market and includes a total of 600 companies with a market capitalization ranging from $60 million to $4.9 billion. The average market capitalization per company is approximately $880 million. The peer group is an index weighted by the relative market capitalization of the following two companies, which were selected for being in an industry related to that of Private Media Group, Inc. (provider of adult content). The companies are Playboy and New Frontier Media. The comparisons in the graph are required by the SEC and are not intended to forecast or be indicative of possible future performance of Private Media Group, Inc. common stock.

Comparison of Five Year Cumulative Total Return (*)

| | | | | | | | | | | | |

| | | 2002 | | 2003 | | 2004 | | 2005 | | 2006 | | 2007 |

Private Media Group, Inc. | | 100 | | 67 | | 131 | | 74 | | 124 | | 66 |

S&P SmallCap 600 Index | | 100 | | 138 | | 167 | | 178 | | 203 | | 201 |

Peer Group | | 100 | | 217 | | 329 | | 292 | | 307 | | 254 |

| (*) | $ 100 invested on December 31, 2002 in stock or index, including reinvestment of dividends. Fiscal year ending December 31. |

18

MISCELLANEOUS

Independent Certified Public Accountants

BDO Audiberia has audited and reported upon the financial statements of the Company for the fiscal year ended December 31, 2007, and has been selected to serve as the Company’s independent auditors for the fiscal year ending December 31, 2008. A representative of BDO Audiberia is not expected to be present at the 2008 Annual Meeting.

Shareholder Proposals

Shareholder proposals complying with the applicable rules under the Securities Exchange Act of 1934 intended to be presented at the 2009 Annual Meeting of Shareholders must be received at the offices of the Company by July 15, 2009, to be considered by the Company for inclusion in the Company’s proxy statement and form of proxy relating to that meeting. Such proposals should be directed to the attention of the Corporate Secretary, Private Media Group, Inc., Calle de la Marina 14-16, Floor 18, Suite D, 08005 Barcelona, Spain. SEC rules provide that if the date of our 2009 Annual Meeting is advanced or delayed more than 30 days from the date of the 2008 Annual Meeting, shareholder proposals intended to be included in the proxy materials for the 2009 Annual Meeting must be received by us within a reasonable time before we begin to print and mail the proxy materials for the 2009 Annual Meeting. Upon determination by Private that the date of the 2009 Annual Meeting will be advanced or delayed by more than 30 days from the date of the 2008 Annual Meeting, we will disclose that change in the earliest possible Quarterly Report on Form 10-Q or as otherwise permitted by the SEC rules.

Shareholders wishing to submit proposals, including director nominations, that are not to be included in such proxy materials must notify the Corporate Secretary of the Company in writing at the previously mentioned address of the Company not less than 45 or more than 75 days prior to the first anniversary (the “Anniversary”) of the date on which the Company first mailed its proxy materials for this year’s annual meeting. If the date of next year’s annual meeting is advanced more than 30 days prior to or delayed by more than 30 days after the anniversary of this year’s annual meeting, notice by the shareholder must be so delivered not later than the close of business on the later of (i) the 90th day prior to such annual meeting or (ii) the 10th day following the day on which public announcement of the date of such meeting is first made. Shareholders are also advised to review the Company’s Bylaws, which contain additional requirements with respect to advance notice of shareholder proposals and director nominations.

Other Matters

Neither the Company nor any of the persons named as proxies knows of matters other than those above stated to be voted on at the Annual Meeting. However, if any other matters are properly presented at the meeting, it is the intention of the persons named as proxies to vote in accordance with their judgment on such matters, subject to direction by the Board of Directors.

The 2007 Annual Report to Shareholders accompanies this Proxy Statement, but is not to be deemed a part of the proxy soliciting material.

WHILE YOU HAVE THE MATTER IN MIND, PLEASE COMPLETE, SIGN AND RETURN THE ENCLOSED PROXY CARD PROMPTLY.IF YOUR SHARES ARE HELD IN THE NAME OF A BANK, BROKER OR OTHER HOLDER OF RECORD, PLEASE FOLLOW THE INSTRUCTIONS FROM THE HOLDER OF RECORD IN ORDER TO VOTE YOUR SHARES.

19

| | | | | | | | | | | | | | | | | | |

| | | PRIVATE MEDIA GROUP, INC. THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON DECEMBER 15, 2008 The shareholder(s) hereby appoint(s) Berth H. Milton and Johan Gillborg, or either of them, as proxies, each with full power of substitution in each of them, and hereby authorizes them to represent and to vote, as designated on the reverse side of this ballot, all of the shares of Common Stock of Private Media Group, Inc. that the shareholder(s) is/are entitled to vote at the Annual Meeting of Shareholders to be held at 10:00 a.m., Central European Time, on December 15, 2008, at Calle de la Marina 16-18, 08005 Barcelona, Spain, and any adjournment |

| | | THISPROXY,WHENPROPERLYEXECUTED,WILLBEVOTEDASDIRECTEDBYTHESHAREHOLDER(S).IFNOSUCHDIRECTIONSAREMADE,THISPROXYWILLBEVOTEDFORTHEELECTIONOFTHENOMINEESLISTEDONTHEREVERSESIDEFORTHEBOARDOFDIRECTORSANDFOREACHPROPOSAL. PLEASE MARK, SIGN, DATE AND RETURN THIS PROXY CARD PROMPTLY USING THE ENCLOSED REPLY ENVELOPE |

| | | | | | | | | |

| | | | | | | | | | | | | Address Changes/Comments: | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

(If you noted any Address Changes/Comments above, please mark corresponding box on the reverse side.) CONTINUED AND TO BE SIGNED ON REVERSE SIDE |

| | | | | | | | | | | | |

PRIVATE MEDIA GROUP, INC. C/O PROXY SERVICES P.O. BOX 9142 FARMINGDALE, NY 11735 | | VOTE BY INTERNET -www.proxyvote.com Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form. ELECTRONIC DELIVERY OF FUTURE SHAREHOLDER COMMUNICATIONS If you would like to reduce the costs incurred by Private Media Group, Inc. in mailing proxy materials, you can consent to receiving all future proxy statements, proxy cards and annual reports electronically via e- mail or the Internet. To sign up for electronic delivery, please follow the instructions above to vote using the Internet and, when prompted, indicate that you agree to receive or access shareholder communications electronically in future years. VOTE BY PHONE - 1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you call and then follow the instructions. VOTE BY MAIL Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Private Media Group, Inc., c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. |

| | |

| TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: | | KEEP THIS PORTION FOR YOUR RECORDS |

| THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. | | DETACH AND RETURN THIS PORTION ONLY |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

PRIVATE MEDIA GROUP, INC. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | THE BOARD OF DIRECTORS RECOMMEND A VOTE | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | “FOR” ITEM 1. | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | For | | Withhold | | For All | | | | To withhold authority to vote for any individual nominee(s), mark “For All Except” and write the number(s) of the nominee(s) on the line below. | | | | |

| | | | | | | | | | | All | | All | | Except | | | | | | | |

| | | Vote on Directors | | | | | | | | | | | | | | | | | |

| | | 1. | | ELECTION OF DIRECTORS | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Nominees: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | 01) Berth H. Milton 02) Bo Rodebrandt 03) Lluis Torralba | | 04) Johan G. Carlberg 05) Daniel Sanchez | | | | | | | | | | | | | | ¨ | | ¨ | | ¨ | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Vote on Proposals | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | In their discretion, the proxies named on the reverse side are authorized to vote upon such other matters that may properly come before the meeting or any adjournment or adjournments thereof. | | | | | | | | |

| | | The shares represented by this proxy when properly executed will be voted in the manner directed herein by the undersigned Shareholder(s).Ifnodirectionismade,thisproxywillbevotedFORitem 1.If any other matters properly come before the meeting the person named in this proxy will vote in their discretion. | | | | | | | | |

| | | For address changes and/or comments, please check this box

and write them on the back where indicated. | | ¨ | | | | Please sign your name exactly as it appears hereon. When signing as attorney, executor, administrator, trustee or guardian, please add your title as such. When signing as joint tenants, all parties in the joint tenancy must sign. If a signer is a corporation, please sign in full corporate name by duly authorized officer. | | | | | | | | | | |

| | | | | | | | | | | | | Yes | | No | | | | | | | | | | | | | | | |

| | | Please indicate if you plan to attend this meeting. | | | | ¨ | | ¨ | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Signature [PLEASE SIGN WITHIN BOX] | | Date | | | | | | | | | | | | | | Signature (Joint Owners) | | | | Date | | | | | | | | | | | | |