UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-08979 |

|

Victory Variable Insurance Funds |

(Exact name of registrant as specified in charter) |

|

4900 Tiedeman Road, 4th Floor, Brooklyn, Ohio | | 44144 |

(Address of principal executive offices) | | (Zip code) |

|

Citi Fund Services Ohio, Inc., 4400 Easton Commons, Suite 200, Columbus, OH 43219 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 800-539-3863 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | December 31, 2018 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

December 31, 2018

Annual Report

Victory Variable Insurance Funds

Victory INCORE Investment Quality Bond VIP Series

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Victory Funds' shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Victory Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on www.VictoryFunds.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change, and you need not take any action.

You may elect to receive shareholder reports and other communications from the Victory Funds or your financial intermediary electronically sooner than January 1, 2021 by notifying your financial intermediary directly or, if you are a direct investor, by calling 800-539-3863 or by sending an e-mail request to TA.Processing@FISGlobal.com.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your reports. If you invest directly with the Victory Funds, you can call 800-539-3863 or send an e-mail request to TA.Processing@FISGlobal.com. Your election to receive reports in paper will apply to all Victory Funds you hold directly or through your financial intermediary.

www.vcm.com

News, Information And Education 24 Hours A Day, 7 Days A Week

The Victory Funds site gives fund shareholders, prospective shareholders, and investment professionals a convenient way to access fund information, get guidance, and track fund performance anywhere they can access the Internet. The site includes:

• Detailed performance records

• Daily share prices

• The latest fund news

• Investment resources to help you become a better investor

• A section dedicated to investment professionals

Whether you're a potential investor searching for the fund that matches your investment philosophy, a seasoned investor interested in planning tools, or an investment professional, www.vcm.com has what you seek. Visit us anytime. We're always open.

Victory Variable

Insurance Funds

Table of Contents

Shareholder Letter (Unaudited) | | | 3 | | |

Fund Review and Commentary (Unaudited) | | | 4 | | |

Financial Statements | |

Schedule of Portfolio Investments | | | 8 | | |

Statement of Assets and Liabilities | | | 15 | | |

Statement of Operations | | | 16 | | |

Statements of Changes in Net Assets | | | 17 | | |

Financial Highlights | | | 18 | | |

Notes to Financial Statements | | | 19 | | |

Report of Ernst & Young LLP, Independent

Registered Public Accounting Firm | | | 31 | | |

Supplemental Information (Unaudited) | |

Trustee and Officer Information | | | 32 | | |

Proxy Voting and Form N-Q Information | | | 35 | | |

Expense Examples | | | 35 | | |

Advisory Contract Renewal | | | 37 | | |

Privacy Policy (inside back cover) | | | |

The Fund is distributed by Victory Capital Advisers, Inc. Victory Capital Management Inc. is the investment adviser to the Fund and receives fees from the Fund for performing services for the Fund.

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus of the Fund.

For additional information about any Victory Fund, including fees, expenses, and risks, view our prospectus online at www.vcm.com or call 800-539-3863. Read it carefully before you invest or send money.

The information in this annual report is based on data obtained from recognized services and sources and is believed to be reliable. Any opinions, projections, or recommendations in this report are subject to change without notice and are not intended as individual investment advice. Past investment performance of the Fund, markets or securities mentioned herein should not be considered to be indicative of future results.

• NOT FDIC INSURED • NO BANK GUARANTEE

• MAY LOSE VALUE

Call Victory at:

800-539-FUND (800-539-3863)

Visit our website at:

www.vcm.com

1

This page is intentionally left blank.

2

Victory Funds Letter to Shareholders

Dear Shareholder,

What a difference a year makes. The year ended December 31, 2018, was marked by an abrupt return of volatility, which had largely been missing in action for years. Consider the range of highs and lows we witnessed. For the S&P 500 Index, it was a year in which we celebrated an all-time high in late summer, only to be followed by the worst December since the 2008 financial crisis. And if that wasn't enough volatility, the Dow Jones Industrial Average also registered several of its worst-ever, single-day point declines during 2018.

Through all that the S&P 500 clocked in with its first negative annual return since 2008, falling by 4.4 percent. Given the risk-off sentiment that was obvious as the year drew to a close, it's no surprise that small-cap stocks, as measured by the Russell 2000 Index, fared even worse, falling approximately 11.0 percent for the year. The challenges for equity investors were also evident around the world as the MSCI ACWI and Emerging Markets indexes declined 8.9 and 14.3 percent, respectively.

So what ushered in the renewed era of volatility and these challenging times? There were multiple culprits. For starters, trade tensions ratcheted up throughout the year as anti-global rhetoric bloomed into a series of new tariffs, which sparked concerns of a prolonged trade war with China. The Federal Reserve remained persistent in its monetary tightening, raising the benchmark interest rate four times throughout the year to a range of 2.25 to 2.5 percent. And then the year ended with a partial shutdown of the federal government. These factors conspired to elevate concerns of a possible recession here and abroad.

Yet despite the headline risks, we think it's critically important to remain focused on the data. By all accounts, the U.S. economy continued chugging along in 2018 with a real gross domestic product (GDP) rising 3.4 percent in the third quarter of 2018, the latest figures available from the Bureau of Economic Analysis. Moreover, the labor picture continues to shine with consistent monthly job growth and an unemployment rate of 3.9 percent. All this comes against a backdrop of low inflation and solid corporate earnings.

The markets, it appears, have been vacillating between the dire headlines and higher perceived risks on one hand, and the continued positive economic data on the other. Of course, no one knows where the Fed will stop raising rates, nor is there any certainty on how the trade turmoil ultimately gets resolved. For now, however, we continue to embrace our solid economic fundamentals. Moreover, we believe all of Victory Capital's independent investment franchises are well positioned to take advantage of any short-term valuation dislocations resulting from the current era of heightened volatility.

On the following pages, you will find information relating to your Victory Funds investment. If you have any questions, we encourage you to contact your financial advisor. Or, if you invest with us directly, you may call (800) 539-3863, or visit our website at www.vcm.com.

My colleagues and I sincerely appreciate the confidence you have placed in the Victory Funds, and we value the opportunity to help meet your investment goals.

Christopher K. Dyer, CFA

President,

Victory Funds

3

Victory Variable Insurance Funds

Victory INCORE Investment Quality Bond VIP Series

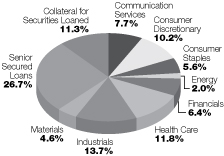

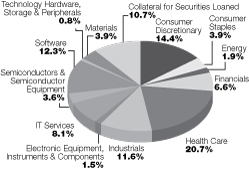

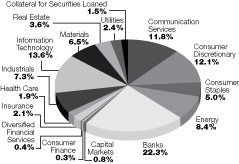

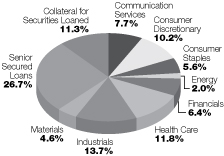

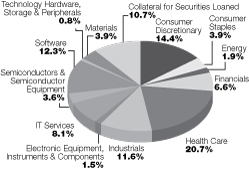

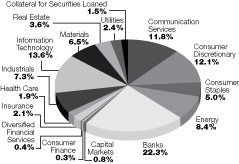

Portfolio Holdings

As a Percentage of Total Investments

Economic Perspective

As investors reflect on 2018, the old adage of coming in like a lion and going out like a lamb should resonate strongly. While financial markets were certainly more volatile through the first three quarters of the year, we entered the fourth quarter with equities at record highs, interest rates trending higher given the strong U.S. economy and credit spreads only modestly wider on the year. Clouds of uncertainty had been slowly gathering over the markets for several months and finally unleashed a significantly higher degree of volatility across global equity and fixed income markets. The CBOE Volatility (VIX) index, a market estimate of future volatility, more than doubled in the fourth quarter and closed the year at 25.42, up 130% from the end of 2017.

A plethora of factors contributed to the shift in sentiment in the fourth quarter; increasing concern for a policy error from the Federal Reserve (the Fed), further deterioration in the U.S./China trade relationship, slowing global growth, particularly in China, political chaos in Washington and the EU and the uncertain outcome of the Brexit negotiations. Despite some positive news late in the quarter — a 90-day trade truce with China, an OPEC agreement to cut oil production and a softer tone from Fed chair Powell — equity returns ended on a negative note for the year, credit spreads continued to widen and the front end of the yield curve inverted. The S&P 500 Index was down 13.97% for the quarter and down 6.24% for the year. The ICE Bank of America Merrill Lynch US Corporate Index saw its option-adjusted spread (OAS) widen 46 basis points during the quarter to end the year at 159 basis points, underperforming U.S. Treasuries by 2.84%. Perhaps one additional headwind to risk assets in 2019 will be cash as a competing asset class. Not too long-ago investors earned virtually nothing on cash balances, yet are now earning 2-2.5% with little to no duration or credit risk, which may appeal to some risk-averse investors should volatility remain elevated or increase. For perspective, 3-month Treasury bills now have a higher yield than the dividend yield on the S&P 500 Index.

Federal Reserve Chairman Powell's comments in early October suggesting monetary policy was a "long way from neutral" following three rate increases in 2018, incited fears of a Fed policy error and an increasing likelihood of an economic recession. Interest rates increased and equities began to fall following these comments. The subsequent spike in equity volatility, a sharp decline in oil prices and lack of inflationary pressure had many speculating the Fed may signal a pause in rate increases at their November meeting. The FOMC disappointed in that regard, interest rates reversed course and equity volatility moved higher. While Chairman Powell attempted to walk those comments back a bit in late November, it was too late given the committee's apparent determination to continue raising short-term rates. Further complicating the FOMC's agenda were Chairman Powell's comments following the December rate increase that the balance sheet normalization was "on autopilot." The market interpreted this such that even if the Fed did slow the pace of rate increases in 2019, the

4

Victory Variable Insurance Funds

Victory INCORE Investment Quality Bond VIP Series (continued)

shift from quantitative easing to quantitative tightening is on a preset path and the risk of policy error remains elevated. While the Fed did reduce their outlook for rate increases in 2019 from 3 to 2 moves, it was not enough to calm the financial markets. Chairman Powell again reversed course on January 4, saying the Fed would be flexible in managing the balance sheet.

The second and third quarters of 2018 were the strongest back-to back-growth quarters in the U.S. since 2014. Furthermore, the unemployment rate gradually declined throughout the year and wage growth broke above 3% on a year-over-year basis. Both the services and manufacturing sectors remained comfortably in expansionary territory and consumer and business confidence remained elevated. Combine these factors with inflation metrics near the Fed's 2% target rate and the case could be made for the Federal Open Market Committee to continue its gradual path of rate increases. While the data in hand was supportive of the move, the disconnect between the market and the Fed appeared to be the outlook given growing uncertainties. Complicating their decision-making process further was the increasing criticism of the rate increases, and Chairman Powell specifically, from President Trump. It remains an interesting question if the Fed would have increased rates in December had that dynamic not been present. We believe the public criticism left them little choice but to raise rates and demonstrate their independence and unwillingness to bow to political pressure.

In 2019, we expect economic growth to slow back towards the 2% area as the marginal benefits from fiscal stimulus (tax reform) and deregulation fade, trade uncertainty slows business investment and tighter financial conditions resulting from lower equity markets and higher interest rates impacts sentiment and spending. With that said, we do not expect to see a recession in the U.S. in 2019, but do see rising risks for 2020 if the Fed continues to raise rates on their current path and if there is not a positive resolution to the U.S. and China trade relationship soon.

Market Summary and Fund Attribution

The Victory INCORE Investment Quality Bond VIP Series ("Fund") seeks to provide a high level of current income and capital appreciation without undue risk to principal. The Fund underperformed the Bloomberg Barclays U.S. Aggregate Bond Index ("Index") for 2018, -0.41% versus 0.01%. The underperformance was driven largely by the allocation to high yield credit as spreads widened dramatically late in the year, as well as the underweight position in U.S. Treasuries. This was somewhat offset by positive allocation effects from securitized sectors, most notably agency mortgage-backed securities. Security selection was additive to performance in most sectors except for industrials in the corporate bond space. Duration and yield curve positioning contributed positively to relative performance.

Coming into 2018, many expected negative absolute returns in fixed income given the likelihood of higher interest rates resulting from continued monetary policy tightening. This rang true for most of the year, but as volatility spiked in the fourth quarter and bond investors pushed back forcefully against the Fed's forecast by driving yields lower, many fixed income indices posted positive returns for the year. The Index generated a total return of 0.01% for 2018 after having been down 2.38% through October. Interest rates did continue to rise, but when the books closed on 2018, short term rates were up two to three times those of intermediate and long-term maturities flattening the yield curve further. The spread between

5

Victory Variable Insurance Funds

Victory INCORE Investment Quality Bond VIP Series (continued)

2-year and 10-year Treasury notes declined to 19 basis points (0.19%) while the 2-year to 5-year spread ended the year at 2 basis points (0.02%). The spread relationship between 1-year and 5-year notes witnessed an inversion of 9 basis points, underscoring the market's view of the Fed heading for a policy error if they continue tightening monetary policy via rates and quantitative tightening.

Within the Index, corporate bonds were the glaring underperformer for both the quarter and the year with excess returns of -3.10% and -3.15%, respectively. Credit concerns at General Electric (GE) and the large California utilities resulting from the wild fires, coupled with heavy outflows from high grade bond funds, pressured spreads materially wider. Additionally, fears of rating downgrades and recession added to anxiety and exacerbated the underperformance. For the year, excess returns in utilities fared the worst (-3.94%), followed by industrials (-3.34%) then financials (-2.62%). In the structured sectors, agency mortgages were the weakest performer from an excess returns perspective (-0.59%), followed by commercial mortgage backed securities (-0.39%), while asset-backed securities posted positive excess returns (0.13%). Corporate bonds were the only sector to post negative absolute returns for the year, all other primary sectors were positive, led by asset-backed securities at 1.77%. Interestingly, asset-backed securities were also the only sector to post positive excess returns for the full year. High yield credit suffered a similar year as investment grade credit, only worse. This sector posted an absolute return of -2.08% for the year and underperformed U.S. Treasuries by -3.58%.

During the period, the Fund used both long and short positions in U.S. Treasury futures and U.S. Federal Funds Futures, as well as credit default swaps. The Fund entered into these transactions to more efficiently manage the Fund's total portfolio risks, in terms of duration, curve exposure and credit quality, which would be more costly and restrictive to manage by investing directly in a selection of cash bonds or ETFs. The derivatives strategy with regards to futures contributed +22 basis points to overall performance while the credit default swap strategy contributed approximately -20 basis points for the 12 months ended December 31, 2018.

Market Positioning

Our allocation to investment grade (IG) credit declined further in the fourth quarter and resulted in an underweight position in BBB-rated corporate bonds relative to the Index. Additionally, our high yield exposure ended the year well below our maximum position. Our proprietary credit momentum signal continued to reduce exposure to IG credit as the option adjusted spread (OAS) of BBB-rated corporate bonds widened significantly over the trailing three months. Given this movement in OAS, valuations are now looking more compelling relative to fundamentals, yet we remain patient and ready to add risk when appropriate. Yield curve positioning and duration will be actively-managed based upon our proprietary trading signals as well as changes in the shape of the yield curve. The market's assessment of the Fed's actions/communication, as reflected by changes in the shape of the curve, will be a focal point in the coming quarters.

6

Victory Variable Insurance Funds

Victory INCORE Investment Quality Bond VIP Series (continued)

Average Annual Return

Year Ended December 31, 2018

| | Class I | |

INCEPTION DATE | | 5/1/83 | |

| | |

Net Asset

Value | | Bloomberg

Barclays U.S.

Aggregate

Bond Index1 | |

One Year | | | –0.41 | % | | | 0.01 | % | |

Three Year | | | 2.40 | % | | | 2.06 | % | |

Five Year | | | 2.60 | % | | | 2.52 | % | |

Ten Year | | | 4.32 | % | | | 3.48 | % | |

Since Inception | | | 6.64 | % | | | N/A | | |

Expense Ratios

Gross | | | 0.61 | % | |

With Applicable Waivers | | | 0.56 | % | |

Past performance is not indicative of future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month's end, please visit www.vcm.com.

The above expense ratios are from the Fund's prospectus dated May 1, 2018. Additional information pertaining to the Fund's expense ratios as of December 31, 2018 can be found in the financial highlights.

The total return figures set forth above include all waivers of fees for various periods since inception. Without such fee waivers, the total returns would have been lower. Some fee waivers are voluntary and may be modified or terminated at any time. The total returns do not include any insurance, sales or administrative charges of variable annuity or life insurance contracts. If these charges were included, the total returns would have been lower.

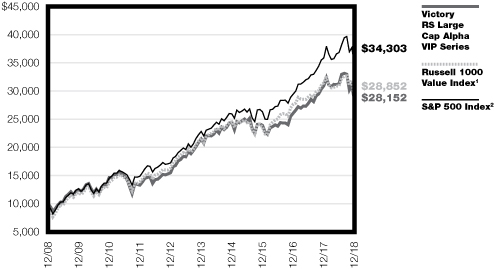

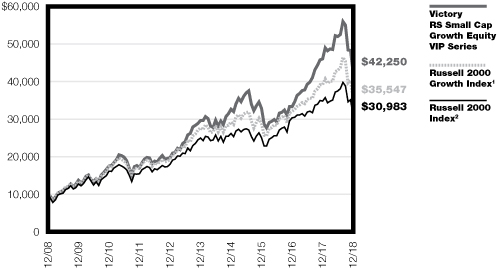

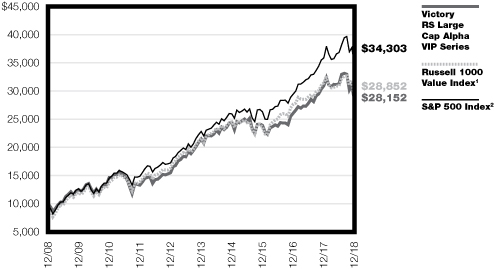

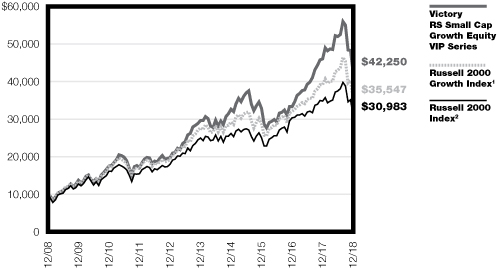

Victory INCORE Investment Quality Bond VIP Series — Growth of $10,000

1The Bloomberg Barclays U.S. Aggregate Bond Index is generally considered to be representative of U.S. bond market activity. The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index that is not available for direct investment. There are no expenses associated with the index while there are expenses associated with the Fund. It is not possible to invest directly in an index.

The graph reflects investment of growth of a hypothetical $10,000 investment in the Fund. Past performance is no guarantee of future results.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

7

Victory Variable Insurance Funds

Victory INCORE Investment Quality Bond VIP Series | | Schedule of Portfolio Investments

December 31, 2018 | |

Security Description | | Principal

Amount | | Value | |

Asset Backed Securities (4.4%) | |

AmeriCredit Automobile Receivables Trust , Series 2018-1, Class B,

3.26%, 1/18/24, Callable 1/18/22 @ 100 (a) | | $ | 1,000,000 | | | $ | 1,001,602 | | |

Avis Budget Rental Car Funding (AESOP) LLC , Series 2014-1, Class A,

2.46%, 7/20/20 (a) (b) | | | 4,000,000 | | | | 3,989,652 | | |

CarMax Auto Owner Trust , Series 2015-3, Class B,

2.28%, 4/15/21, Callable 11/15/19 @ 100 | | | 3,225,000 | | | | 3,201,158 | | |

Drive Auto Receivables Trust , Series 2017-3, Class B,

2.30%, 5/17/21, Callable 7/15/20 @ 100 | | | 928,219 | | | | 927,135 | | |

Drive Auto Receivables Trust , Series 2017-1, Class B,

2.36%, 3/15/21, Callable 7/15/20 @ 100 (a) | | | 404,749 | | | | 404,574 | | |

DT Auto Owner Trust , Series 2017-2A, Class B,

2.44%, 2/15/21, Callable 9/15/20 @ 100 (a) (b) | | | 834,111 | | | | 833,589 | | |

DT Auto Owner Trust , Series 2017-3A, Class B,

2.40%, 5/17/21, Callable 1/15/21 @ 100 (b) | | | 1,678,942 | | | | 1,675,888 | | |

Popular ABS Mortgage Pass-Through Trust , Series 2005-2, Class AV1B,

2.77% (LIBOR01M+26bps), 4/25/35, Callable 6/25/20 @ 100 (c) | | | 911,784 | | | | 906,325 | | |

Santander Drive Auto Receivables Trust , Series 2017-3, Class B,

2.19%, 3/15/22, Callable 12/15/20 @ 100 (a) | | | 3,495,000 | | | | 3,470,084 | | |

Santander Drive Auto Receivables Trust , Series 2018-2, Class B,

3.03%, 9/15/22, Callable 5/15/21 @ 100 (a) | | | 4,250,000 | | | | 4,242,019 | | |

Santander Drive Auto Receivables Trust , Series 2017-2, Class B,

2.21%, 10/15/21, Callable 6/15/20 @ 100 (a) | | | 4,123,000 | | | | 4,111,208 | | |

Santander Retail Auto Lease Trust , Series 2018-A, Class B,

3.20%, 4/20/22, Callable 3/20/21 @ 100 (a) (b) | | | 3,825,000 | | | | 3,813,862 | | |

Total Asset Backed Securities (Cost $28,649,051) | | | 28,577,096 | | |

Collateralized Mortgage Obligations (2.5%) | |

Commercial Mortgage Trust , Series 2012-CR4, Class B,

3.70%, 10/15/45 (b) | | | 4,580,000 | | | | 4,394,159 | | |

DBUBS Mortgage Trust , Series 2011-LC1A, Class A3,

5.00%, 11/10/46 (a) (b) | | | 4,500,000 | | | | 4,612,044 | | |

GS Mortgage Securities Trust , Series 2012-GC6, Class B,

5.65%, 1/10/45 (a) (b) (d) | | | 3,250,000 | | | | 3,409,015 | | |

Morgan Stanley BAML Trust , Series 2013-C13, Class A2,

2.94%, 11/15/46 (a) | | | 603,301 | | | | 601,706 | | |

WF-RBS Commercial Mortgage Trust , Series 2012-C6, Class B,

4.70%, 4/15/45 | | | 3,275,000 | | | | 3,349,789 | | |

Total Collateralized Mortgage Obligations (Cost $17,845,924) | | | 16,366,713 | | |

Residential Mortgage Backed Securities (1.0%) | |

Ameriquest Mortgage Securities, Inc. , Series 2003-5, Class A6,

4.16%, 4/25/33, Callable 1/25/19 @ 100 (a) (d) | | | 84,772 | | | | 84,594 | | |

Bear Stearns Alt-A Trust , Series 2003-3, Class 2A,

4.36%, 10/25/33, Callable 1/25/19 @ 100 (a) (d) | | | 1,136,182 | | | | 1,132,916 | | |

Countrywide Home Loans, Inc. , Series 2002-19, Class 1A1,

6.25%, 11/25/32, Callable 1/25/19 @ 100 | | | 142,696 | | | | 142,696 | | |

See notes to financial statements.

8

Victory Variable Insurance Funds

Victory INCORE Investment Quality Bond VIP Series | | Schedule of Portfolio Investments — continued

December 31, 2018 | |

Security Description | | Principal

Amount | | Value | |

Credit Suisse First Boston Mortgage Securities Corp. , Series 2002-HE16,

Class M1, 3.83% (LIBOR01M+132bps), 10/25/32,

Callable 1/25/19 @ 100 (c) | | $ | 1,012,389 | | | $ | 1,008,722 | | |

GSR Mortgage Loan Trust , Series 2004-10F, Class 6A1,

5.00%, 9/25/34, Callable 1/25/19 @ 100 (a) | | | 381,546 | | | | 381,546 | | |

JPMorgan Mortgage Trust , Series 2004-S2, Class 1A3,

4.75%, 11/25/19, Callable 5/25/19 @ 100 (a) | | | 54,431 | | | | 54,313 | | |

JPMorgan Mortgage Trust , Series 2016-4, Class A5,

3.50%, 10/25/46, Callable 8/25/37 @ 100 (a) (b) (d) | | | 1,664,953 | | | | 1,654,592 | | |

MASTR Adjustable Rate Mortgage Trust , Series 2004-13, Class 3A1,

4.44%, 11/21/34, Callable 1/21/19 @ 100 (d) | | | 804,774 | | | | 804,774 | | |

Prime Mortgage Trust , Series 2004-2, Class A3,

5.25%, 11/25/19, Callable 1/25/19 @ 100 (a) | | | 19,375 | | | | 19,375 | | |

Residential Funding Mortgage Securities I, Inc. , Series 2005-S3, Class A1,

4.75%, 3/25/20, Callable 1/25/19 @ 100 (a) | | | 58,012 | | | | 58,008 | | |

Structured Asset Securities Corp. , Series 2004-21XS, Class 2A6A,

5.24%, 12/25/34, Callable 1/25/19 @ 100 (a) (d) | | | 839 | | | | 840 | | |

Wells Fargo Mortgage Backed Securities Trust , Series 2004-Y,

Class 3A1, 4.92%, 11/25/34, Callable 1/25/19 @ 100 (a) (d) | | | 1,150,352 | | | | 1,150,352 | | |

Wells Fargo Mortgage Backed Securities Trust , Series 2005-2, Class 2A1,

4.75%, 4/25/20, Callable 1/25/19 @ 100 (a) | | | 27,247 | | | | 27,247 | | |

Total Residential Mortgage Backed Securities (Cost $6,588,757) | | | 6,519,975 | | |

Corporate Bonds (20.9%) | |

Communication Services (2.2%): | |

AT&T, Inc.

2.30%, 3/11/19 (a) | | | 9,000,000 | | | | 8,985,600 | | |

5.15%, 11/15/46, Callable 5/15/46 @ 100 (a) | | | 3,833,000 | | | | 3,568,907 | | |

SES Global Americas Holdings GP, 5.30%, 3/25/44 (b) | | | 2,475,000 | | | | 2,142,707 | | |

| | | | 14,697,214 | | |

Consumer Discretionary (1.7%): | |

Hasbro, Inc., 6.35%, 3/15/40 | | | 2,155,000 | | | | 2,265,508 | | |

Magna International, Inc., 3.63%, 6/15/24, Callable 3/15/24 @ 100 | | | 4,305,000 | | | | 4,250,413 | | |

NIKE, Inc., 3.88%, 11/1/45, Callable 5/1/45 @ 100 | | | 2,624,000 | | | | 2,512,585 | | |

Ross Stores, Inc., 3.38%, 9/15/24, Callable 6/15/24 @ 100 | | | 1,220,000 | | | | 1,204,482 | | |

| | | | 10,232,988 | | |

Consumer Staples (1.3%): | |

Estee Lauder Cos., Inc., 4.15%, 3/15/47, Callable 9/15/46 @ 100 | | | 1,000,000 | | | | 1,001,540 | | |

Mead Johnson Nutrition Co.

3.00%, 11/15/20 (e) | | | 3,000,000 | | | | 2,990,850 | | |

4.60%, 6/1/44, Callable 12/1/43 @ 100 (a) | | | 2,091,000 | | | | 2,143,191 | | |

Reynolds American, Inc., 5.70%, 8/15/35, Callable 2/15/35 @ 100 | | | 1,835,000 | | | | 1,789,529 | | |

| | | | 7,925,110 | | |

Energy (1.0%): | |

Dolphin Energy Ltd., 5.89%, 6/15/19 (b) | | | 174,400 | | | | 175,507 | | |

Exxon Mobil Corp., 4.11%, 3/1/46, Callable 9/1/45 @ 100 | | | 1,032,000 | | | | 1,047,810 | | |

Marathon Petroleum Corp.

6.50%, 3/1/41, Callable 9/1/40 @ 100 | | | 1,285,000 | | | | 1,382,519 | | |

5.85%, 12/15/45, Callable 6/15/45 @ 100 | | | 850,000 | | | | 844,365 | | |

See notes to financial statements.

9

Victory Variable Insurance Funds

Victory INCORE Investment Quality Bond VIP Series | | Schedule of Portfolio Investments — continued

December 31, 2018 | |

Security Description | | Principal

Amount | | Value | |

Statoil ASA, 3.95%, 5/15/43 | | $ | 930,000 | | | $ | 885,611 | | |

Valero Energy Corp., 6.63%, 6/15/37 | | | 2,520,000 | | | | 2,777,443 | | |

| | | | 7,113,255 | | |

Financials (8.6%): | |

Aflac, Inc.

2.88%, 10/15/26, Callable 7/15/26 @ 100 | | | 2,450,000 | | | | 2,279,407 | | |

4.75%, 1/15/49, Callable 7/15/48 @ 100 | | | 595,000 | | | | 607,132 | | |

Alleghany Corp., 4.90%, 9/15/44, Callable 3/15/44 @ 100 | | | 1,648,000 | | | | 1,654,905 | | |

Bank of America Corp.

2.33%, (LIBOR03M+63bps), 10/1/21, Callable 10/1/20 @ 100 (c) | | | 1,875,000 | | | | 1,834,688 | | |

2.50%, 10/21/22, Callable 10/21/21 @ 100, MTN | | | 3,500,000 | | | | 3,359,755 | | |

3.25%, 10/21/27, Callable 10/21/26 @ 100 | | | 1,775,000 | | | | 1,643,153 | | |

BB&T Corp., 2.75%, 4/1/22, MTN, Callable 3/1/22 @ 100 | | | 3,550,000 | | | | 3,484,431 | | |

Cincinnati Financial Corp., 6.13%, 11/1/34 | | | 2,170,000 | | | | 2,534,451 | | |

Citigroup, Inc., 3.88%(LIBOR03M+117bps), 1/24/39,

Callable 1/24/38 @ 100 (c) | | | 1,760,000 | | | | 1,573,669 | | |

HSBC Holdings PLC, 5.10%, 4/5/21 (a) | | | 5,000,000 | | | | 5,164,050 | | |

JPMorgan Chase & Co., 5.60%, 7/15/41 | | | 1,710,000 | | | | 1,932,488 | | |

KeyBank NA, 2.25%, 3/16/20 | | | 6,523,000 | | | | 6,452,290 | | |

Morgan Stanley

3.75%, 2/25/23 (a) | | | 3,000,000 | | | | 2,994,780 | | |

3.13%, 7/27/26, MTN | | | 5,500,000 | | | | 5,069,680 | | |

Newcrest Finance Pty Ltd., 5.75%, 11/15/41 (b) | | | 1,720,000 | | | | 1,703,884 | | |

The Goldman Sachs Group, Inc.

2.35%, 11/15/21, Callable 11/15/20 @ 100 | | | 4,540,000 | | | | 4,374,063 | | |

5.75%, 1/24/22 (a) | | | 2,750,000 | | | | 2,879,360 | | |

UBS Group Funding Switzerland AG, 2.95%, 9/24/20 (a) (b) | | | 3,750,000 | | | | 3,710,138 | | |

Wells Fargo & Co., 4.90%, 11/17/45 (a) | | | 1,850,000 | | | | 1,801,919 | | |

| | | | 55,054,243 | | |

Health Care (1.9%): | |

Amgen, Inc., 4.40%, 5/1/45, Callable 11/1/44 @ 100 | | | 1,825,000 | | | | 1,709,916 | | |

Express Scripts Holding Co., 2.25%, 6/15/19 (a) | | | 3,102,000 | | | | 3,088,413 | | |

Gilead Sciences, Inc.

4.40%, 12/1/21, Callable 9/1/21 @ 100 (a) | | | 6,150,000 | | | | 6,342,494 | | |

4.80%, 4/1/44, Callable 10/1/43 @ 100 | | | 1,285,000 | | | | 1,282,957 | | |

| | | | 12,423,780 | | |

Industrials (1.5%): | |

AerCap Ireland Capital Ltd., 3.75%, 5/15/19 (a) | | | 2,900,000 | | | | 2,899,536 | | |

Canadian National Railway Co., 3.20%, 8/2/46, Callable 2/2/46 @ 100 | | | 825,000 | | | | 705,771 | | |

Kansas City Southern, 4.95%, 8/15/45, Callable 2/15/45 @ 100 | | | 1,440,000 | | | | 1,453,176 | | |

Rockwell Automation, Inc., 6.25%, 12/1/37 | | | 1,151,000 | | | | 1,387,312 | | |

Snap-on, Inc., 4.10%, 3/1/48, Callable 9/1/47 @ 100 | | | 1,100,000 | | | | 1,066,428 | | |

Valmont Industries, Inc., 5.00%, 10/1/44, Callable 4/1/44 @ 100 (a) | | | 2,603,000 | | | | 2,292,384 | | |

| | | | 9,804,607 | | |

Information Technology (0.7%): | |

Apple, Inc., 4.65%, 2/23/46, Callable 8/23/45 @ 100 | | | 1,569,000 | | | | 1,658,904 | | |

NVIDIA Corp., 2.20%, 9/16/21, Callable 8/16/21 @ 100 (e) | | | 1,230,000 | | | | 1,201,624 | | |

Texas Instruments, Inc., 4.15%, 5/15/48, Callable 11/15/47 @ 100 | | | 1,512,000 | | | | 1,509,520 | | |

| | | | 4,370,048 | | |

See notes to financial statements.

10

Victory Variable Insurance Funds

Victory INCORE Investment Quality Bond VIP Series | | Schedule of Portfolio Investments — continued

December 31, 2018 | |

Security Description | | Principal

Amount | | Value | |

Materials (0.6%): | |

LyondellBasell Industries NV, 5.00%, 4/15/19, Callable 2/7/19 @ 100 (a) | | $ | 1,800,000 | | | $ | 1,801,170 | | |

Rio Tinto Finance USA Ltd.

3.75%, 6/15/25, Callable 3/15/25 @ 100 | | | 1,415,000 | | | | 1,418,183 | | |

5.20%, 11/2/40 (e) | | | 723,000 | | | | 799,848 | | |

| | | | 4,019,201 | | |

Utilities (1.4%): | |

Arizona Public Service Co., 2.95%, 9/15/27, Callable 6/15/27 @ 100 | | | 1,800,000 | | | | 1,691,082 | | |

Consolidated Edison, Inc., 6.30%, 8/15/37 | | | 1,870,000 | | | | 2,284,504 | | |

Iberdrola International BV

6.75%, 9/15/33 | | | 373,000 | | | | 429,129 | | |

6.75%, 7/15/36 (e) | | | 783,000 | | | | 935,481 | | |

Nevada Power Co., 6.65%, 4/1/36 (a) | | | 600,000 | | | | 767,742 | | |

Oklahoma G&E Co., 5.25%, 5/15/41, Callable 11/15/40 @ 100 | | | 1,546,000 | | | | 1,702,285 | | |

Public Service Enterprise Group, Inc., 4.00%, 6/1/44,

Callable 12/1/43 @ 100 | | | 1,289,000 | | | | 1,238,587 | | |

| | | | 9,048,810 | | |

Total Corporate Bonds (Cost $139,919,786) | | | 134,689,256 | | |

U.S. Government Mortgage Backed Agencies (62.1%) | |

Federal Home Loan Mortgage Corp.

5.00%, 6/15/23 – 7/1/39 (a) | | | 2,043,268 | | | | 2,163,136 | | |

Series 4139, Class DA, 1.25%, 12/15/27 (a) | | | 7,884,802 | | | | 7,472,041 | | |

Series 4395, Class PA, 2.50%, 4/15/37 (a) | | | 3,049,119 | | | | 2,963,296 | | |

7.00%, 9/1/38 (a) | | | 77,650 | | | | 88,552 | | |

Series 4290, Class CA, 3.50%, 12/15/38 – 3/1/48 (a) | | | 30,806,409 | | | | 30,945,872 | | |

Series 3713, Class PA, 2.00%, 2/15/40 – 3/15/40 (a) | | | 9,382,652 | | | | 9,094,192 | | |

4.00%, 1/1/41 (a) | | | 2,024,751 | | | | 2,084,703 | | |

4.50%, 1/1/41 – 5/1/47 (a) | | | 12,495,629 | | | | 13,026,453 | | |

Series 4049, Class AB, 2.75%, 12/15/41 (a) | | | 1,524,368 | | | | 1,510,601 | | |

Series 4494, Class JA, 3.75%, 5/15/42 (a) | | | 6,099,258 | | | | 6,227,855 | | |

| | | | 75,576,701 | | |

Federal National Mortgage Association

6.00%, 8/1/21 – 2/1/37 (a) | | | 2,881,957 | | | | 3,188,520 | | |

5.00%, 4/1/23 – 12/1/39 (a) | | | 1,416,745 | | | | 1,504,451 | | |

7.50%, 12/1/29 (a) | | | 46,931 | | | | 53,677 | | |

8.00%, 1/1/30 – 9/1/30 (a) | | | 24,195 | | | | 27,828 | | |

7.00%, 2/1/32 – 6/1/32 (a) | | | 38,746 | | | | 44,148 | | |

4.63%(LIBOR12M+166bps), 12/1/36 (a) (c) | | | 137,945 | | | | 140,706 | | |

5.50%, 1/1/38 – 2/1/39 (a) | | | 902,495 | | | | 973,151 | | |

4.50%, 12/1/38 – 6/1/40 (a) | | | 9,713,951 | | | | 10,069,667 | | |

Series 2013-33, Class UD, 2.50%, 4/25/39 – 12/25/47 (a) | | | 9,286,424 | | | | 9,040,121 | | |

Series 2013-137, Class A, 3.50%, 3/25/40 – 12/25/50 (a) (f) | | | 115,540,716 | | | | 115,804,972 | | |

4.00%, 9/1/40 – 1/25/49 (a) (f) | | | 73,808,589 | | | | 75,452,406 | | |

Series 2011-101, Class LA, 3.00%, 10/25/40 – 1/25/49 (a) (f) | | | 85,968,130 | | | | 84,085,178 | | |

Series 2013-81, Class KA, 2.75%, 9/25/42 | | | 6,070,611 | | | | 5,935,384 | | |

Series 2013-44, Class PB, 1.75%, 1/25/43 | | | 6,503,444 | | | | 6,049,673 | | |

| | | | 312,369,882 | | |

See notes to financial statements.

11

Victory Variable Insurance Funds

Victory INCORE Investment Quality Bond VIP Series | | Schedule of Portfolio Investments — continued

December 31, 2018 | |

Security Description | | Shares or

Principal

Amount | | Value | |

Government National Mortgage Association

6.00%, 10/15/32 (a) | | $ | 103,800 | | | $ | 114,676 | | |

Series 2014-42, Class AD, 2.50%, 7/16/41 | | | 522,412 | | | | 511,327 | | |

Series 2016-116, Class GA, 1.75%, 11/20/44 | | | 12,028,027 | | | | 11,300,784 | | |

| | | | 11,926,787 | | |

Multi-family (0.0%): (g) | |

Collateralized Mortgage Obligations (0.0%): (g) | |

Government National Mortgage Association

6.00%, 12/15/33 (a) | | | 35,131 | | | | 39,298 | | |

Total U.S. Government Mortgage Backed Agencies (Cost $402,652,080) | | | 399,912,668 | | |

U.S. Treasury Obligations (25.3%) | |

U.S. Treasury Bonds

2.88%, 5/15/43 (a) | | | 11,646,000 | | | | 11,369,959 | | |

3.63%, 2/15/44 (a) | | | 9,638,000 | | | | 10,677,204 | | |

3.00%, 2/15/48 | | | 20,760,000 | | | | 20,650,850 | | |

U.S. Treasury Notes

2.75%, 9/30/20 | | | 9,400,000 | | | | 9,435,637 | | |

2.75%, 4/30/23 (a) | | | 16,008,000 | | | | 16,176,010 | | |

2.75%, 8/31/23 | | | 38,191,000 | | | | 38,622,301 | | |

2.88%, 10/31/23 | | | 7,000,000 | | | | 7,117,393 | | |

2.00%, 8/15/25 (a) | | | 16,219,000 | | | | 15,638,862 | | |

2.75%, 2/15/28 (a) | | | 30,450,000 | | | | 30,608,782 | | |

2.88%, 8/15/28 | | | 2,902,000 | | | | 2,946,903 | | |

Total U.S. Treasury Obligations (Cost $158,058,375) | | | 163,243,901 | | |

Collateral for Securities Loaned^ (0.3%) | |

BlackRock Liquidity Funds TempFund Portfolio, Institutional

Class, 2.49% (h) | | | 372,175 | | | | 372,175 | | |

Fidelity Investments Money Market Government Portfolio,

Class I, 2.28% (h) | | | 537,775 | | | | 537,775 | | |

Fidelity Investments Prime Money Market Portfolio,

Class I, 2.46% (h) | | | 16,606 | | | | 16,606 | | |

Goldman Sachs Financial Square Prime Obligations Fund, Institutional

Class, 2.55% (h) | | | 206,766 | | | | 206,766 | | |

JPMorgan Prime Money Market Fund, Capital Class,

2.49% (h) | | | 330,805 | | | | 330,805 | | |

Morgan Stanley Institutional Liquidity Prime Portfolio, Institutional

Class, 2.58% (h) | | | 496,239 | | | | 496,239 | | |

Total Collateral for Securities Loaned (Cost $1,960,366) | | | 1,960,366 | | |

Total Investments (Cost $755,674,339) — 116.5% | | | 751,269,975 | | |

Liabilities in excess of other assets — (16.5)% | | | (106,268,538 | ) | |

NET ASSETS — 100.00% | | $ | 645,001,437 | | |

^ Purchased with cash collateral from securities on loan.

(a) All or a portion of this security has been segregated as collateral for derivative instruments.

See notes to financial statements.

12

Victory Variable Insurance Funds

Victory INCORE Investment Quality Bond VIP Series | | Schedule of Portfolio Investments — continued

December 31, 2018 | |

(b) Rule 144A security or other security that is restricted as to resale to institutional investors. The Fund's Adviser has deemed this security to be liquid based upon procedures approved by the Board of Trustees. As of December 31, 2018, the fair value of these securities was $32,115,037 and amounted to 4.9% of net assets.

(c) Variable or Floating-Rate Security. Rate disclosed is as of December 31, 2018.

(d) The rate for certain asset backed and mortgage backed securities may vary based on factors relating to the pool of assets underlying the security. The rate disclosed is the rate in effect at December 31, 2018.

(e) All or a portion of this security is on loan.

(f) Security purchased on a when-issued basis.

(g) Amount represents less than 0.05% of net assets.

(h) Rate disclosed is the daily yield on December 31, 2018.

bps — Basis points

LIBOR — London InterBank Offered Rate

LIBOR01M — 1 Month US Dollar LIBOR, rate disclosed as of December 31, 2018, based on the last reset date of the security

LIBOR03M — 3 Month US Dollar LIBOR, rate disclosed as of December 31, 2018, based on the last reset date of the security

LIBOR12M — 12 Month US Dollar LIBOR, rate disclosed as of December 31, 2018, based on the last reset date of the security

LLC — Limited Liability Company

MTN — Medium Term Note

PLC — Public Limited Company

Futures Contracts Purchased

| | | Number of

Contracts | | Expiration

Date | | Notional

Amount | | Value | | Unrealized

Appreciation

(Depreciation) | |

5-Year U.S. Treasury Note Future | | | 175 | | | 3/29/19 | | $ | 19,842,598 | | | $ | 20,070,313 | | | $ | 227,715 | | |

Futures Contracts Sold

| | | Number of

Contracts | | Expiration

Date | | Notional

Amount | | Value | | Unrealized

Appreciation

(Depreciation) | |

10-Year U.S. Treasury Note Future | | | 317 | | | 3/20/19 | | $ | 38,108,778 | | | $ | 38,678,946 | | | $ | (570,168 | ) | |

2-Year U.S.Treasury Note Future | | | 145 | | | 3/29/19 | | | 30,585,834 | | | | 30,785,327 | | | | (199,493 | ) | |

30-Year U.S. Treasury Bond Future | | | 128 | | | 3/20/19 | | | 17,905,683 | | | | 18,688,000 | | | | (782,317 | ) | |

| | | | | | | | | | | $ | (1,551,978 | ) | |

Total unrealized appreciation | | | | | | | | | | $ | 227,715 | | |

Total unrealized depreciation | | | | | | | | | | | (1,551,978 | ) | |

Total net unrealized appreciation(depreciation) | | | | | | | | | | $ | (1,324,263 | ) | |

See notes to financial statements.

13

Victory Variable Insurance Funds

Victory INCORE Investment Quality Bond VIP Series | | Schedule of Portfolio Investments — continued

December 31, 2018 | |

Credit Default Swap Agreements — Sell Protection (a)

Underlying

Instrument | | Fixed

Deal

Received

Rate | | Expiration

Date | | Payment

Frequency | | Implied

Credit

Spread at

December 31,

2018 (b) | | Notional

Amount (c) | | Value | | Premiums

Paid

(Received) | | Unrealized

Appreciation

(Depreciation) | |

CDX North

America

High Yield

Index;

Series 31 | | | 5.00 | % | | 12/20/23 | | Daily | | | 4.46 | % | | $ | 60,800,000 | | | $ | 1,241,851 | | | $ | 4,407,260 | | | $ | (3,165,409 | ) | |

| | | $ | 1,241,851 | | | $ | 4,407,260 | | | $ | (3,165,409 | ) | |

(a) When a credit event occurs as defined under the terms of the swap agreement, the Fund as a seller of credit protection will either (i) pay to the buyer of protection an amount equal to the par value of the defaulted reference entity and take delivery of the reference entity or (ii) pay a net amount equal to the par value of the defaulted reference entity less its recovery value.

(b) Implied credit spread, represented in absolute terms, utilized in determining the value of the credit default swap agreements as of period end will serve as an indicator of the current status of the payment/performance risk and represent the likelihood or risk of default for the credit derivative. The implied credit spread of a referenced entity reflects the cost of buying/selling protection and may include payments required to be made to enter into the agreement. Generally, wider credit spreads represent a perceived deterioration of the referenced entity's credit soundness and a greater likelihood or risk of default or other credit event occurring as defined under the terms of the swap agreement.

(c) The notional amount represents the maximum potential amount the Fund could be required to pay as a seller of credit protection if a credit event occurs, as defined under the terms of the swap agreement, for each security included in the CDX North America High Yield Index.

See notes to financial statements.

14

Victory Variable Insurance Funds | | Statement of Assets and Liabilities

December 31, 2018 | |

| | | Victory INCORE

Investment Quality

Bond VIP Series | |

ASSETS: | |

Investments, at value (Cost $755,674,339) | | $ | 751,269,975 | (a) | |

Cash and cash equivalents | | | 10,801,618 | | |

Deposits with brokers for futures contracts | | | 817,949 | | |

Deposits with brokers for swap agreements | | | 4,318,538 | | |

Interest and dividends receivable | | | 3,523,041 | | |

Receivable for capital shares issued | | | 13,503 | | |

Receivable for investments sold | | | 1,330,574 | | |

Variation margin receivable on open futures contracts | | | 43,750 | | |

Variation margin receivable on open swap agreements | | | 74,308 | | |

Receivable from Adviser | | | 186,847 | | |

Total Assets | | | 772,380,103 | | |

LIABILITIES: | |

Payables: | |

Collateral received on loaned securities | | | 1,960,366 | | |

Investments purchased | | | 124,641,125 | | |

Capital shares redeemed | | | 94,550 | | |

Variation margin on open futures contracts | | | 204,230 | | |

Accrued expenses and other payables: | |

Investment advisory fees | | | 274,382 | | |

Administration fees | | | 33,674 | | |

Custodian fees | | | 7,920 | | |

Transfer agent fees | | | 72,928 | | |

Chief Compliance Officer fees | | | 1,228 | | |

Trustees' fees | | | 628 | | |

Other accrued expenses | | | 87,635 | | |

Total Liabilities | | | 127,378,666 | | |

NET ASSETS: | |

Capital | | | 649,062,734 | | |

Total distributable earnings/(loss) | | | (4,061,297 | ) | |

Net Assets | | $ | 645,001,437 | | |

Shares Outstanding (unlimited shares authorized, with a par value

of $0.001 per share): | | | 53,966,829 | | |

Net asset value: | | $ | 11.95 | | |

(a) Includes $1,900,810 of securities on loan.

See notes to financial statements.

15

Victory Variable Insurance Funds | | Statement of Operations

For the Year Ended December 31, 2018 | |

| | | Victory INCORE

Investment Quality

Bond VIP Series | |

Investment Income: | |

Interest | | $ | 21,343,031 | | |

Securities lending (net of fees) | | | 15,762 | | |

Total Income | | | 21,358,793 | | |

Expenses: | |

Investment advisory fees | | | 3,462,863 | | |

Administration fees | | | 413,829 | | |

Custodian fees | | | 33,004 | | |

Transfer agent fees | | | 146,671 | | |

Trustees' fees | | | 56,873 | | |

Chief Compliance Officer fees | | | 6,008 | | |

Legal and audit fees | | | 94,036 | | |

Interest expense on interfund lending | | | 29 | | |

Other expenses | | | 105,307 | | |

Total Expenses | | | 4,318,620 | | |

Expenses waived/reimbursed by Adviser | | | (441,458 | ) | |

Net Expenses | | | 3,877,162 | | |

Net Investment Income (Loss) | | | 17,481,631 | | |

Realized/Unrealized Gains (Losses) from Investment Transactions: | |

Net realized gains (losses) from investment transactions | | | (10,355,978 | ) | |

Net realized gains (losses) from futures transactions | | | (2,898,933 | ) | |

Net realized gains (losses) from swap transactions | | | 2,246,399 | | |

Net change in unrealized appreciation/depreciation on investments | | | (6,335,521 | ) | |

Net change in unrealized appreciation/depreciation on futures transactions | | | (1,125,053 | ) | |

Net change in unrealized appreciation/depreciation on swap transactions | | | (3,373,041 | ) | |

Net realized/unrealized gains (losses) on investments | | | (21,842,127 | ) | |

Change in net assets resulting from operations | | $ | (4,360,496 | ) | |

See notes to financial statements.

16

Victory Variable Insurance Funds | | Statements of Changes in Net Assets | |

| | | Victory INCORE Investment

Quality Bond VIP Series | |

| | | Year

Ended

December 31,

2018 | | Year

Ended

December 31,

2017 | |

From Investment Activities: | |

Operations: | |

Net investment income (loss) | | $ | 17,481,631 | | | $ | 16,911,088 | | |

Net realized gains (losses) from investment transactions | | | (11,008,512 | ) | | | 4,641,216 | | |

Net change in unrealized appreciation (depreciation)

on investments | | | (10,833,615 | ) | | | 8,760,833 | | |

Change in net assets resulting from operations | | | (4,360,496 | ) | | | 30,313,137 | | |

Distributions to Shareholders: (a) | |

Change in net assets resulting from distributions to shareholders | | | (4,289,680 | ) | | | (17,209,084 | ) | |

Change in net assets resulting from capital transactions | | | (73,069,861 | ) | | | (2,674,726 | ) | |

Change in net assets | | | (81,720,037 | ) | | | 10,429,327 | | |

Net Assets: | |

Beginning of period | | | 726,721,474 | | | | 716,292,147 | | |

End of period | | $ | 645,001,437 | | | $ | 726,721,474 | | |

Capital Transactions: | |

Proceeds from shares issued | | $ | 47,220,231 | | | $ | 84,023,731 | | |

Distributions reinvested | | | 4,289,680 | | | | 17,209,084 | | |

Cost of shares redeemed | | | (124,579,772 | ) | | | (103,907,541 | ) | |

Change in net assets resulting from capital transactions | | $ | (73,069,861 | ) | | $ | (2,674,726 | ) | |

Share Transactions: | |

Issued | | | 3,953,299 | | | | 6,961,615 | | |

Reinvested | | | 360,968 | | | | 1,429,326 | | |

Redeemed | | | (10,495,215 | ) | | | (8,518,824 | ) | |

Change in Shares | | | (6,180,948 | ) | | | (127,883 | ) | |

(a) Current and prior year distributions to shareholders have been reclassified and conform to amended GAAP presentation under Regulation S-X (See Item 10 in the Notes to Financial Statements).

See notes to financial statements.

17

Victory Variable Insurance Funds | | Financial Highlights | |

For a Share Outstanding Throughout Each Period

| | | Victory INCORE Investment Quality Bond VIP Series | |

| | | Year

Ended

December 31,

2018 | | Year

Ended

December 31,

2017 | | Year

Ended

December 31,

2016 | | Year

Ended

December 31,

2015 | | Year

Ended

December 31,

2014 | |

Net Asset Value, Beginning of Period | | $ | 12.08 | | | $ | 11.88 | | | $ | 11.98 | | | $ | 12.38 | | | $ | 12.18 | | |

Investment Activities: | |

Net investment income (loss) | | | 0.30 | (a) | | | 0.28 | (a) | | | 0.27 | (a) | | | 0.31 | (a) | | | 0.38 | | |

Net realized and unrealized gains

(losses) on investments | | | (0.35 | ) | | | 0.21 | | | | 0.15 | | | | (0.27 | ) | | | 0.30 | | |

Total from Investment

Activities | | | (0.05 | ) | | | 0.49 | | | | 0.42 | | | | 0.04 | | | | 0.68 | | |

Distributions to Shareholders: | |

Net investment income | | | (0.08 | ) | | | (0.29 | ) | | | (0.30 | ) | | | (0.32 | ) | | | (0.38 | ) | |

Net realized gains from investments | | | — | (b) | | | — | | | | (0.22 | ) | | | (0.12 | ) | | | (0.10 | ) | |

Total Distributions to

Shareholders | | | (0.08 | ) | | | (0.29 | ) | | | (0.52 | ) | | | (0.44 | ) | | | (0.48 | ) | |

Capital Contributions from Prior

Custodian, Net (See Note 8) | | | — | | | | — | | | | — | (b) | | | — | | | | — | | |

Net Asset Value, End of Period | | $ | 11.95 | | | $ | 12.08 | | | $ | 11.88 | | | $ | 11.98 | | | $ | 12.38 | | |

Total Return (c) | | | (0.41 | )% | | | 4.15 | % | | | 3.53 | %(d) | | | 0.33 | % | | | 5.55 | % | |

Ratios/Supplemental Data: | |

Net Assets at end of period (000) | | $ | 645,001 | | | $ | 726,721 | | | $ | 716,292 | | | $ | 755,696 | | | $ | 802,377 | | |

Ratio of net expenses to average net assets | | | 0.56 | % | | | 0.56 | % | | | 0.55 | % | | | 0.56 | % | | | 0.56 | % | |

Ratio of net investment income (loss) to

average net assets | | | 2.52 | % | | | 2.28 | % | | | 2.17 | % | | | 2.47 | % | | | 2.93 | % | |

Ratio of gross expenses to average net assets | | | 0.62 | %(e) | | | 0.61 | %(e) | | | 0.55 | % | | | 0.56 | % | | | 0.56 | % | |

Portfolio turnover | | | 109 | % | | | 83 | % | | | 142 | % | | | 41 | % | | | 47 | % | |

(a) Per share net investment income (loss) has been calculated using the average daily shares method.

(b) Amount is less than $0.005 per share.

(c) Total returns do not reflect the effects of charges deducted pursuant to the terms of The Guardian Insurance & Annuity Company, Inc's variable contracts. Inclusion of such charges would reduce the total returns for all periods shown.

(d) The Fund received monies related to a nonrecurring refund from the prior Custodian. The corresponding impact to the total return was less than 0.01% for the period shown. (See Note 8)

(e) During the period, certain fees were reduced and/or reimbursed. If such fee reductions and/or reimbursements had not occurred, the ratios would have been as indicated.

See notes to financial statements.

18

Victory Variable Insurance Funds | | Notes to Financial Statements

December 31, 2018 | |

1. Organization:

Victory Variable Insurance Funds (the "Trust") was organized on February 11, 1998 as a Delaware statutory trust. The Trust is registered under the Investment Company Act of 1940, as amended (the "1940 Act"), as a diversified open-end investment company. The Trust is comprised of nine funds and is authorized to issue an unlimited number of shares, which are units of beneficial interest with a par value of $0.001 per share.

The accompanying financial statements are those of the Victory INCORE Investment Quality Bond VIP Series (the "Fund"). The Fund offers a single class of shares: Class I Shares. Sales of shares of the Fund may only be made to certain separate accounts of The Guardian Insurance & Annuity Company, Inc. ("GIAC") that fund certain variable annuity and variable life insurance contracts issued by GIAC. GIAC is a wholly owned subsidiary of The Guardian Life Insurance Company of America ("Guardian Life").

Under the Trust's organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund enters into contracts with its vendors and others that provide for general indemnifications. The Fund's maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund. However, based on experience, the Fund expects that risk of loss to be remote.

2. Significant Accounting Policies:

The following is a summary of significant accounting policies followed by the Trust in the preparation of its financial statements. The policies are in conformity with accounting principles generally accepted in the United States of America ("GAAP"). The preparation of financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the period. Actual results could differ from those estimates. The Fund follows the specialized accounting and reporting requirements under GAAP that are applicable to investment companies.

Investment Valuation:

The Fund records investments at fair value. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

The valuation techniques described below maximize the use of observable inputs and minimize the use of unobservable inputs in determining fair value. The inputs used for valuing the Fund's investments are summarized in the three broad levels listed below:

• Level 1 — quoted prices in active markets for identical securities

• Level 2 — other significant observable inputs (including quoted prices for similar securities or interest rates applicable to those securities, etc.)

• Level 3 — significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments)

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The inputs or methodologies used for valuation techniques are not necessarily an indication of the risk associated with entering into those investments.

Portfolio securities listed or traded on securities exchanges, including American Depositary Receipts ("ADRs") and Rights, are valued at the closing price on the exchange or system where the security is principally traded, if available, or at the Nasdaq Official Closing Price. If there have been no sales for that day on the exchange or system, then a security is valued at the last available bid quotation on the exchange or system where the security is principally traded. In each of these situations, valuations are typically categorized as Level 1 in the fair value hierarchy.

19

Victory Variable Insurance Funds | | Notes to Financial Statements — continued

December 31, 2018 | |

Futures contracts are valued at the settlement price established each day by the board of trade or an exchange on which they are traded. These valuations are typically categorized as Level 1 in the fair value hierarchy.

Swap agreements are valued at the mean between the current bid and ask prices. These valuations are typically categorized as Level 2 in the fair value hierarchy.

Debt securities of United States ("U.S.") issuers (other than short-term investments maturing in 60 days or less), including corporate and municipal securities, are valued on the basis of bid valuations provided by dealers or an independent pricing service approved by the Trust's Board of Trustees (the "Board"). Short-term investments maturing in 60 days or less may be valued at amortized cost, which approximates market value. Under the amortized cost method, premium or discount, if any, is amortized or accreted, respectively, on a constant basis to the maturity of the security. In each of these situations, valuations are typically categorized as Level 2 in the fair value hierarchy.

Investments for which there are no such quotations, or for which quotations do not appear reliable, are valued at fair value in accordance with procedures established by and under the general supervision and responsibility of the Board. These valuations are typically categorized as Level 2 or Level 3 in the fair value hierarchy, based on the observability of inputs used to determine the fair value.

A summary of the valuations as of December 31, 2018, based upon the three levels defined above, is included in the table below while the breakdown, by category, of investments is disclosed in the Schedule of Portfolio Investments:

| | | LEVEL 1 —

Quoted Prices | | LEVEL 2 —

Other Significant

Observable Inputs | | Total | |

| | | Investments

in

Securities | | Other

Financial

Investments^ | | Investments

in

Securities | | Other

Financial

Investments^ | | Investments

in

Securities | | Other

Financial

Investments^ | |

Asset Backed Securities | | $ | — | | | $ | — | | | $ | 28,577,096 | | | $ | — | | | $ | 28,577,096 | | | $ | — | | |

Collateralized Mortgage Obligations | | | — | | | | — | | | | 16,366,713 | | | | — | | | | 16,366,713 | | | | — | | |

Residential Mortgage Backed Securities | | | — | | | | — | | | | 6,519,975 | | | | — | | | | 6,519,975 | | | | — | | |

Corporate Bonds | | | — | | | | — | | | | 134,689,256 | | | | — | | | | 134,689,256 | | | | — | | |

U.S. Government Mortgage Backed Agencies | | | — | | | | — | | | | 399,912,668 | | | | — | | | | 399,912,668 | | | | — | | |

U.S. Treasury Obligations | | | — | | | | — | | | | 163,243,901 | | | | — | | | | 163,243,901 | | | | — | | |

Collateral for Securities Loaned | | | 1,960,366 | | | | — | | | | — | | | | — | | | | 1,960,366 | | | | — | | |

Futures Contracts | | | — | | | | (1,324,263 | ) | | | — | | | | — | | | | — | | | | (1,324,263 | ) | |

Credit Default Swap Agreements | | | — | | | | — | | | | — | | | | (3,165,409 | ) | | | — | | | | (3,165,409 | ) | |

Total | | $ | 1,960,366 | | | $ | (1,324,263 | ) | | $ | 749,309,609 | | | $ | (3,165,409 | ) | | $ | 751,269,975 | | | $ | (4,489,672 | ) | |

^ Other Financial instruments include any derivative instruments not reflected in the Schedule of Portfolio Investments as investment securities, such as futures contracts and swap agreements. These instruments are generally recorded in the financial statements at the unrealized gain or loss on the investment.

For the year ended December 31, 2018, there were no Level 3 investments for which significant unobservable inputs were used to determine fair value.

Securities Purchased on a When-Issued Basis:

The Fund may purchase securities on a when-issued basis. When-issued securities are securities purchased for delivery beyond normal settlement periods at a stated price and/or yield, thereby involving the risk that the price and/or yield obtained may be more or less than those available in the market when delivery takes place. At the time the Fund makes the commitment to purchase a security on a when-issued basis, the Fund records the transaction and reflects the value of the security in determining net asset value. No interest accrues to the Fund until the transaction settles and payment takes place. Normally, the settlement date occurs within one month of the purchase. A segregated

20

Victory Variable Insurance Funds | | Notes to Financial Statements — continued

December 31, 2018 | |

account is established and the Fund maintains cash and/or marketable securities at least equal in value to commitments for when-issued securities. If the Fund owns when-issued securities, these values are included in "Payable for investments purchased" on the accompanying Statements of Assets and Liabilities. As of December 31, 2018, the Fund had no outstanding when-issued purchase commitments.

Loans:

Floating rate loans in which the Fund invests are primarily "senior" loans. Senior floating rate loans typically hold a senior position in the capital structure of the borrower, are typically secured by specific collateral, and have a claim on the assets and/or stock of the borrower that is senior to that held by subordinated debtholders and stockholders of the borrower. While these protections may reduce risk, these investments still present significant credit risk. A significant portion of the Fund's floating rate investments may be issued in connection with highly leveraged transactions such as leveraged buyouts, leveraged recapitalization loans, and other types of acquisition financing. Obligations in these types of transactions are subject to greater credit risk (including default and bankruptcy) than many other investments and may be, or become, illiquid. See the note below regarding below investment grade securities.

The Fund may purchase second lien loans (secured loans with a claim on collateral subordinate to a senior lender's claim on such collateral), fixed rate loans, unsecured loans, and other debt obligations.

Transactions in loans often settle on a delayed basis, and the Fund may not receive the proceeds from the sale of a loan or pay for a loan purchase for a substantial period of time after entering into the transactions.

Below Investment Grade Securities:

The Fund may invest in below investment grade securities (i.e. lower-quality, "junk" debt), which are subject to various risks. Lower-quality debt is considered to be speculative because it is less certain that the issuer will be able to pay interest or repay the principal than in the case of investment grade debt. These securities can involve a substantially greater risk of default than higher-rated securities, and their values can decline significantly over short periods of time. Lower-quality debt securities tend to be more sensitive to adverse news about their issuers, the market and the economy in general, than higher-quality debt securities. The market for these securities can be less liquid, especially during periods of recession or general market decline.

Investment Companies:

The Fund may invest in portfolios of open-end investment companies. These investment companies value securities in their portfolios for which market quotations are readily available at their market values (generally the last reported sale price) and all other securities and assets at their fair value by the methods established by the board of directors of the underlying fund.

Derivative Instruments:

Futures Contracts:

The Fund may enter into contracts for the future delivery of securities or foreign currencies and futures contracts based on a specific security, class of securities, foreign currency or an index, and purchase or sell options on any such futures contracts. A futures contract on a securities index is an agreement obligating either party to pay, and entitling the other party to receive, while the contract is outstanding, cash payments based on the level of a specified securities index. No physical delivery of the underlying asset is made. The Fund may enter into futures contracts in an effort to hedge against market risks. The acquisition of put and call options on futures contracts will give the Fund the right (but not the obligation), for a specified price, to sell or to purchase the underlying futures contract, upon exercise of the option, at any time during the option period. Futures transactions involve brokerage costs and require the Fund to segregate assets to cover contracts that would require it to purchase securities or

21

Victory Variable Insurance Funds | | Notes to Financial Statements — continued

December 31, 2018 | |

currencies. A good faith margin deposit, known as initial margin, of cash or government securities with a broker or custodian is required to initiate and maintain open positions in futures contracts. Subsequent payments, known as variation margin, are made or received by the Fund based on the change in the market value of the position and are recorded as unrealized appreciation or depreciation until the contract is closed out, at which time the gain or loss is realized. The Fund may lose the expected benefit of futures transactions if interest rates, exchange rates or securities prices change in an unanticipated manner. Such unanticipated changes may also result in lower overall performance than if the Fund had not entered into any futures transactions. In addition, the value of the Fund's futures positions may not prove to be perfectly or even highly correlated with the value of its portfolio securities or foreign currencies, limiting the Fund's ability to hedge effectively against interest rate, exchange rate and/or market risk and giving rise to additional risks. There is no assurance of liquidity in the secondary market for purposes of closing out futures positions. The collateral held by the Fund is presented on the Statement of Assets and Liabilities under Deposits with brokers for futures contracts.

As of December 31, 2018, the Fund entered into Futures Contracts primarily for the strategy of hedging or other purposes, including but not limited to, providing liquidity and equitizing cash.

Credit Derivatives:

The Fund may enter into credit derivatives, including centrally-cleared credit default swaps on individual obligations or credit indices. The Fund may use these investments (i) as alternatives to direct long or short investment in a particular security or securities, (ii) to adjust the Fund's asset allocation or risk exposure, or (iii) for hedging purposes. The use by the Fund of credit default swaps may have the effect of creating a short position in a security. Credit derivatives can create investment leverage and may create additional investment risks that may subject the Fund to greater volatility than investments in more traditional securities, as described in the Fund's Statement of Additional Information.

Credit default swap ("CDS") agreements on credit indices involve one party making a stream of payments (referred to as the buyer of protection) to another party (the seller of protection) in exchange for the right to receive a specified return in the event of a write-down, principal shortfall, interest shortfall or default of all or part of the referenced entities comprising the credit index. A credit index is a basket of credit instruments or exposures designed to be representative of a specific sector of the credit market as a whole. These indices are made up of reference credits that are judged by a poll of dealers to be the most liquid entities in the CDS.

The counterparty risk for cleared swap agreements is generally lower than uncleared over-the-counter swap agreements because generally a clearing organization becomes substituted for each counterparty to a cleared swap agreement and, in effect, guarantees each party's performance under the contract as each party to a trade looks only to the clearing organization for performance of financial obligations. However, there can be no assurance that the clearing organization, or its members, will satisfy its obligations to the Fund.

The Fund may enter into CDS agreements either as a buyer or seller. The Fund may buy protection under a CDS to attempt to mitigate the risk of default or credit quality deterioration in one or more individual holdings or in a segment of the fixed income securities market. The Fund may sell protection under a CDS in an attempt to gain exposure to an underlying issuer's credit quality characteristics without investing directly in that issuer. For swaps entered with an individual counterparty, the Fund bears the risk of loss of the uncollateralized amount expected to be received under a CDS agreement in the event of the default or bankruptcy of the counterparty. CDS agreements are generally valued at a price at which the counterparty to such agreement would terminate the agreement. The Fund may also enter into cleared swaps.

Upon entering into a cleared CDS, the Fund may be required to deposit with the broker an amount of cash or cash equivalents in the range of approximately 3% to 6% of the notional amount for CDS on high yield debt issuers (this amount is subject to change by the clearing organization that clears the trade). This amount, known as "initial margin," is in the nature of a performance bond or good faith deposit on the CDS and is returned to a Fund upon termination of the CDS, assuming all contractual obligations have been satisfied. Subsequent payments, known as "variation margin," to and from the

22

Victory Variable Insurance Funds | | Notes to Financial Statements — continued

December 31, 2018 | |

broker will be made daily as the price of the CDS fluctuates, making the long and short positions in the CDS contract more or less valuable, a process known as "marking-to-market." The premium (discount) payments are built into the daily price of the CDS and thus are amortized through the variation margin. The variation margin payment also includes the daily portion of the periodic payment stream.

The maximum potential amount of future payments (undiscounted) that the Fund as a seller of protection could be required to make under a CDS agreement equals the notional amount of the agreement. Notional amounts of each individual CDS agreement outstanding as of period end for which the Fund is the seller of protection are disclosed on the Schedule of Portfolio Investments. These potential amounts would be partially offset by any recovery values of the respective referenced obligations, upfront payments received upon entering into the agreement, periodic interest payments, or net amounts received from the settlement of buy protection CDS agreements entered into by the Fund for the same referenced entity or entities.

As of December 31, 2018, the Fund entered into centrally cleared CDS agreements primarily for the strategy of asset allocation and risk exposure management.

Summary of Derivative Instruments:

The following table presents the effect of derivative instruments on the Statement of Assets and Liabilities, categorized by risk exposure, as of December 31, 2018.

| | | Assets | | Liabilities | |

| | | Variation

Margin

Receivable

on Open

Futures

Contracts* | | Variation

Margin

Receivable

on Open

Swap

Agreements* | | Variation

Margin

Payable on

Open

Futures

Contracts* | | Variation

Margin

Payable on

Open

Swap

Agreements* | |

Credit Risk Exposure | | $ | — | | | $ | — | | | $ | — | | | $ | 3,165,409 | | |

Interest Rate Risk Exposure | | | 227,715 | | | | — | | | | 1,551,978 | | | | — | | |

* Includes cumulative appreciation (depreciation) of futures contracts and centrally cleared swap agreements as reported in the Schedule of Investments. Only current day's variation margin is reported within the Statement of Assets and Liabilities.

The following table presents the effect of derivative instruments on the Statement of Operations, categorized by risk exposure, for the year ended December 31, 2018.

| | | Net Realized Gains (Losses) on

Derivatives Recognized as

a Result from Operations | | Net Change in Unrealized

Appreciation/Depreciation

on Derivatives Recognized

as a Result of Operations | |

| | | Net Realized

Gains (Losses)

from Futures

Transactions | | Net Realized

Gains (Losses)

from Swap

Transactions | | Net Change in

Unrealized

Appreciation/

Depreciation

on Futures

Transactions | | Change in Net

Unrealized

Appreciation/

Depreciation

on Swap

Transactions | |

Credit Risk Exposure | | $ | — | | | $ | 2,246,399 | | | $ | — | | | $ | (3,373,041 | ) | |

Interest Rate Risk Exposure | | | (2,898,933 | ) | | | — | | | | (1,125,053 | ) | | | — | | |

All open derivative positions at period end are reflected on the Fund's Schedule of Portfolio Investments. The underlying face value of open derivative positions relative to the Fund's net assets at period end is generally representative of the notional amount of open positions to net assets throughout the period.

Investment Transactions and Related Income:

Changes in holdings of investments are accounted for no later than one business day following the trade date. For financial reporting purposes, however, investment transactions are accounted for on

23

Victory Variable Insurance Funds | | Notes to Financial Statements — continued

December 31, 2018 | |

trade date on the last business day of the reporting period. Interest income is recognized on an accrual basis and includes, where applicable, the amortization of premiums or accretion of discounts. Dividend income is recorded on the ex-dividend date. Gains or losses realized on sales of securities are determined by comparing the identified cost of the security lot sold with the net sales proceeds.

The Fund may receive other income from investment in loan assignments and/or unfunded commitments, including amendment fees, consent fees and commitment fees. These fees are recorded as income when received by the Fund. These amounts are included in Interest Income in the Statement of Operations.

Withholding taxes on interest, dividends and gains as a result of certain investments in ADRs by the Fund have been provided for in accordance with each investment's applicable country's tax rules and rates.

Securities Lending:

The Trust has entered into a Master Securities Lending Agreement ("MSLA") with Citibank, N.A. ("Citibank" or the "Agent"). Under the terms of the MSLA, the Fund may lend securities to certain broker-dealers and banks in exchange for collateral in the amount of at least 102% of the value of U.S. securities loaned or at least 105% of the value of non-U.S. securities loaned, marked-to-market daily. Any collateral shortfalls associated with increases in the valuation of the securities loaned are adjusted the next business day. The collateral can be received in the form of cash collateral and/or non-cash collateral. Non-cash collateral can include U.S. Government Securities, letters of credit and certificates of deposit. The cash collateral is invested in short-term instruments or cash equivalents as noted on the Fund's Schedule of Portfolio Investments. The Trust does not have effective control of the non-cash collateral and therefore it is not disclosed in the Fund's Schedule of Portfolio Investments. The Fund continues to benefit from interest or dividends on the securities loaned and may also earn a return from the collateral. The Fund pays various fees in connection with the investment of cash collateral. The Fund pays the Agent fees based on the investment income received from securities lending activities. Securities lending income is disclosed in the Fund's Statement of Operations. Although risk is mitigated by the collateral, the Fund could experience a delay in recovering its securities and possible loss of income or value if the borrower fails to return them.

Securities lending transactions are entered into by the Fund under the MSLA, which permits the Fund, under certain circumstances such as an event of default, to offset amounts payable by the Fund to the same counterparty against amounts receivable from the counterparty to create a net payment due to or from the Fund.

The following table is a summary of the Fund's securities lending transactions which are subject to offset under the MSLA as of December 31, 2018. These transactions are accounted for as secured borrowings with an overnight and continuous contractual maturity for cash collateral, and greater than overnight and continuous contractual maturity for non-cash collateral.

Gross

Amount of

Recognized

Assets

(Value of | | Value of

Cash | | Value of Non-cash Collateral

Received by Maturity | | | |